Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FedNat Holding Co | form8k.htm |

Exhibit 99.1

NASDAQ: FNHC INVESTOR PRESENTATIONQ2-2017

SAFE HARBOR statement 2 Safe harbor statement under the Private Securities Litigation Reform Act of 1995: Statements that are not historical fact are forward-looking statements that are subject to certain risks and uncertainties that could cause actual events and results to differ materially from those discussed herein. Without limiting the generality of the foregoing, words such as “anticipate,” “believe,” “budget,” “contemplate,” “continue,” “could,” “envision,” “estimate,” “expect,” “guidance,” “indicate,” “intend,” “may,” “might,” “plan,” “possibly,” “potential,” “predict,” “probably,” “pro-forma,” “project,” “seek,” “should,” “target,” or “will” or the negative thereof or other variations thereon and similar words or phrases or comparable terminology are intended to identify forward-looking statements. Forward-looking statements might also include, but are not limited to, one or more of the following:Projections of revenues, income, earnings per share, dividends, capital structure or other financial items or measures;Descriptions of plans or objectives of management for future operations, insurance products/or services; Forecasts of future insurable events, economic performance, liquidity, need for funding and income; andDescriptions of assumptions or estimates underlying or relating to any of the foregoing. The risks and uncertainties include, without limitation, risks and uncertainties related to estimates, assumptions and projections generally; the nature of the Company’s business; the adequacy of its reserves for losses and loss adjustment expense; claims experience; weather conditions (including the severity and frequency of storms, hurricanes, tornadoes and hail) and other catastrophic losses; reinsurance costs and the ability of reinsurers to indemnify the Company; raising additional capital and our potential failure to meet minimum capital and surplus requirements; potential assessments that support property and casualty insurance pools and associations; the effectiveness of internal financial controls; the effectiveness of our underwriting, pricing and related loss limitation methods; changes in loss trends, including as a result of insureds’ assignment of benefits; court decisions and trends in litigation; our potential failure to pay claims accurately; ability to obtain regulatory approval applications for requested rate increases, or to underwrite in additional jurisdictions, and the timing thereof; the impact that the results of the Monarch joint venture may have on our results of operations; inflation and other changes in economic conditions (including changes in interest rates and financial markets); pricing competition and other initiatives by competitors; legislative and regulatory developments; the outcome of litigation pending against the Company, and any settlement thereof; dependence on investment income and the composition of the Company’s investment portfolio; insurance agents; ratings by industry services; the reliability and security of our information technology systems; reliance on key personnel; acts of war and terrorist activities; and other matters described from time to time by the Company in releases and publications, and in periodic reports and other documents filed with the United States Securities and Exchange Commission. In addition, investors should be aware that generally accepted accounting principles prescribe when a company may reserve for particular risks, including claims and litigation exposures. Accordingly, results for a given reporting period could be significantly affected if and when a reserve is established for a contingency. Reported results may therefore appear to be volatile in certain accounting periods. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We do not undertake any obligation to update publicly or revise any forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made.

FNHC Snapshot and quick facts Federated National Holding Company (as of 6/30/2017, except where noted) 3 NASDAQ: FNHCHeadquarters: Sunrise, FL (Ft. Lauderdale)Core Market: FL Homeowners’ P&C insurance IPO Year: 1998Financial Stability Rating: Cash and Investments: $534 MMTotal Shareholders’ Equity: $222 MM excluding non-controlling interestCommon Shares Outstanding: 13.1 MMBook Value Per Common Share: $16.97 Excluding non-controlling interestClosing Market Price on August 31 of $15.54 represents an 8.4% discount to BV * Market data as of March 31, 2017

Our distinguishing characteristics and track record 4 Generate profitable growth by:Continued market share growth in FloridaOngoing expansion into other StatesDeveloping additional affinity relationshipsLooking for strategic acquisitions and/or joint venturesMaintaining our commitment to delivering quality products, services, and customer satisfaction We are a well-regarded employer that is mindful of the well-being of our employees, allowing all employees to develop their individual capabilities in an impartial, challenging, rewarding and cooperative environment and offering them the opportunity for career development. We value experienced insurance professionals who share our dedication to exceptional customer service. We seek individuals who are qualified, highly motivated and demonstrate our principles of professionalism, cooperation, communication, accountability, innovation and respect. We strive for total customer satisfaction. Our intent is to attract and retain customers for their insurance needs by providing outstanding customer service, quality and value in all our products and services at the lowest possible cost. LEADING TO Our Customers Our Strategy Our Team

Fnhc organizational structure Public Shareholders Federated National Holding Company FedNat Underwriters, Inc. (MGA) Century Risk Insurance Services, Inc. Insure-Link, Inc. d.b.a. Preferred Link (Agency) Southeast Catastrophe Consulting Company, LLC(Catastrophe Claims Adjusting) Federated National Insurance Company (FNIC) Monarch Delaware Holdings LLC(a Delaware limited liability company) Monarch National Holding Company(a Florida corporation) Monarch National Insurance Company(a Florida corporation) Transatlantic Reinsurance Company(a New York corporation) Crosswinds Investor Monarch L.P. 100% 33.3% 100% ownershipInterest 100% ownershipInterest 15.2% ownership interest (100% of Class B Units) 42.4% ownership interest (50% of Class A Units) 42.4% ownership interest (50% of Class A Units) 5 100% 100% 100% 100%

fnhc and Market timeline 2009 1992 & 1993 2004 & 2005 2006 & 2007 6 Timeline continues to next page… The early years… 2011 Hurricane Andrew Emergence of Citizen’s predecessor, Florida’s property residual market National carriers begin to intentionally reduce their share within the Florida property market Creation of the Florida Hurricane Catastrophe Fund Hurricane seasons bring four Florida hurricanes in year 2004 and four in year 2005 Windstorm mitigation credit overhaul Citizens becomes a competitor to the private market Citizens establishes “glide path” to actuarial sound rates Joined BBB and earned A+ rating “Cost Driver” bill to expedite rate filings, increase surplus requirements and reform sinkhole claims National carriers further accelerate their desire not to compete within the Florida property market

fnhc and Market timeline 2015 2016 2012 2013 2015 7 Recent developments… Citizens reduces potential assessment Citizens Clearinghouse established Monarch National approved by Florida Office of Insurance Regulation Lloyd’s of London appoints FedNat Underwriters (FNU) as Coverholders Sun Sentinel honors FNHC as one of the 2016 Top Workplaces in South Florida Changed name from 21st Century Holding Company to Federated National Holding Company Federated National Insurance Company – Allstate relationship (Ivantage Select Agency Inc.) FNIC named Fortune “Fastest Growing Companies” FNIC appointed to Citizens Market Accountability Advisory BoardFNIC named Forbes “America’s 50 Most Trustworthy Financial Companies” FNU entered into an Authorization and Appointment Agreement with GEICO Insurance Agency, Inc.

Federated National’s approach to the Florida market Utilize innovative point of sale software providing agent “ease of use”Deliver instantaneous quoting and binding capabilitiesProvide agents with access to numerous key data points essential to assessing risk factors Reduce geographic concentration in the Tri-County / South Florida area and expand in other counties in FloridaEnhance underwriting results and reduce our risk exposure via greater diversificationExpand into other coastal states Focus on higher value propertiesEmphasize properties which typically have more advanced wind / hurricane mitigation features and lower All Other Peril (non-catastrophe) losses, all of which mitigate expected lossesUnderwrite every risk to maintain our quality book of business 8 GeographicDiversification UnderwritingStandards Agent Experience

Lines of Business Homeowners – Consists of our homeowners property and casualty insurance business, which currently operates in Florida, Alabama, Texas, Louisiana and South Carolina90% of total 2Q17 net earned premiums and 82% of total revenue.9.9% Florida statewide-average rate increase taking effect beginning August 1, 2017Core reinsurance structure for all states totals approximately $2.19 billion of aggregate coverage with a maximum single event coverage of $1.56 billion, with automatic reinstatement premium protection in place. See p.16 for further details.Automobile – Consists of our nonstandard personal automobile insurance business which currently operates in Georgia, Texas, Alabama, and Florida6% of total 2Q17 net earned premiums and 8% of total revenue.Three active programs with three more programs in run-off.Less than 5% of FNIC’s statutory surplus is required to back our Automobile operations.Other – Consists primarily of our commercial general liability and federal flood businesses, along with our in-house insurance agency and corporate and investment operations5% of total 2Q17 net earned premiums and 10% of total revenue (in part due to realized investment gains in the quarter).Includes all net investment income and realized investment gains and losses. 9

FEDERATED NATIONAL GROWING MARKET SHARE 10 Premiums/Policies In -Force at Quarter End OIR = Office of Insurance Regulation% Market share per OIR for Q1 and Q2-17 unavailable as of 8/17/2017.

Florida Market provides continued growth Note: Includes personal residential and excludes commercial residential business. The Florida Office of Insurance Regulation's QUASR next generation database excludes State Farm Florida Insurance Company in its dataset as of March 31, 2017.FNIC rank based on Florida residential homeowners’ insurance premiums written per Florida Office of Insurance Regulation (FL OIR)Market data for June-17 unavailable as of 8/31/2017. Federated National Insurance Company (FNIC) is predominantly a homeowners’ insurer in Florida with controlled expansion in LA, AL, SC and TX.All new policies are generated on a voluntary basisOne of a few selected Florida homeowners’ insurance companies appointed to write voluntary business through Allstate & GEICO Florida agentsOpportunity to increase FNIC’s market share through partnership with 2,500+ agentsOpportunity to further increase our market presence through Monarch National insurance productsFNIC’s ranking increased to 4th largest insurance company in Florida as of March 31, 2017FNIC has achieved its growth by winning the business at the point of sale when our partner insurance agents decide which carrier to entrust with their clients 11

Diversification in Florida 12 Total Florida Policies In Force for Homeowners as of June 30, 2017 = 271,159 Federated National Insurance Company - Florida Market for Homeowners Panhandle11.4% North FL5.6% Treasure Coast8.2% Tampa / St. Pete13.0% SW FL22.0% Tri-County / South Florida25.1% Central FL14.7%

diversification 13 Federated National Insurance Company Market Florida 306.4k Policies81.1% Alabama3.8k Policies1.0% Louisiana15.1k Policies4.0% South Carolina4.7k Policies1.2% Georgia17.5k Policies4.6% Texas30.2k Policies8.0% Total Polices In Force for all Lines of Business as of June 30, 2017 = 377,647

Quality Growth in FLORIDA Homeowners’ Portfolio 1-in-100 Year Probable Maximum Loss/ In-Force Premium Note: Probable Maximum Loss modeled using average of RMS and AIR combined and assuming LT, NoSS and NoLA. FNIC Total Insured Value and Policies In-Force 14 PIF (Thousands) TIV ($ Billions)

Robust claims capabilities and tenured staff 40 field adjusters covering the state of Florida and 60 onsite (desk) adjusters; 40 claims Directors, Managers and Supervisors; in-house Director of Litigation Management supported by three Litigation Managers and twelve Litigation Adjusters; all of whom are fully licensed in all of the states in which we write businessAverage experience is over 10 yearsLong tenure with Federated National; many of our homeowners’ management team and adjusting staff served the company during the storms of 2004 and 2005Training and knowledge is promoted and enhanced through on and off-site education 24/7 new claims reporting capacity with immediate emergency response available when warrantedLong-standing relationships with water remediation companies, emergency services providers and loss causation analysts that provide rapid mitigation of damages and exceptional customer service Owns 1/3 of Southeast Catastrophe Consulting Company, an independent catastrophe claims adjusterDedicated catastrophe adjusters available to Federated National & Monarch National as neededAll data and systems functionality are integrated and backed-up through a remote cloud-based computing system 15 In-House ClaimsAdjuster Strategic AllianceWith CatastropheAdjuster Efficient ClaimsResponse

Strong Catastrophe reinsurance 2017 – 2018 Excess of Loss Catastrophe Reinsurance HighlightsApproximately $2.19 billion of aggregate coverage with maximum single event coverage of approximately $1.56 billion with a per occurrence retention of $18 million. 80+ reinsurance partners, all of which are rated “A-” or higher by A.M. Best or fully collateralized. New ex-named storm quota share of 10% with Swiss Re.Additional Multiple year protection of $89 million was obtained for the period 7/1/17 – 6/30/19. The amount of multiple year protection varies by layer of excess of loss protection, but the total multiple year protection in place is roughly $245 million.All private market layers have prepaid automatic reinstatement premium protection (“RPP”) and a cascading, drop down feature excess of $25.1 million.A non-Florida first event retention of $13 million which lowers to $2 million for the second event for hurricane losses only.The ex-named storm property per risk treaty affords $5 million of loss coverage in excess of $1 million. 16 Federated National has full indemnity reinsurance with highly rated reinsurers, and has maintained a business relationship with many of them for numerous years

2017-2018 REINSURANCE STRUCTURE 17

2017-2018 REINSURANCE STRUCTURESecond Event Structure after a 100 Year Florida Event 18

Consistently innovating 19

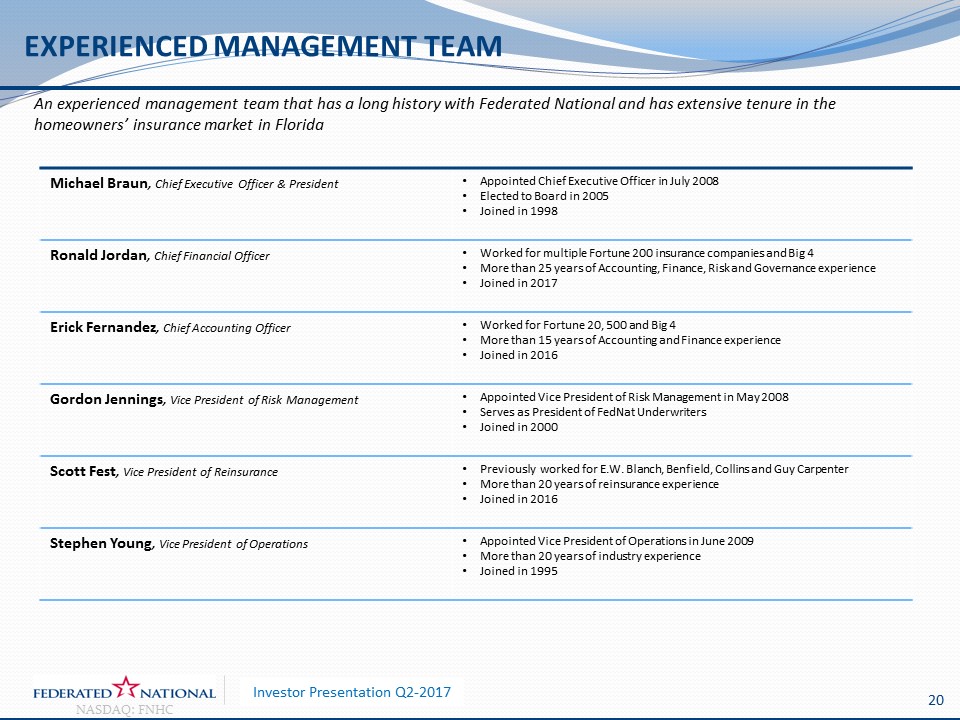

Experienced MANAGEMENT TEAM An experienced management team that has a long history with Federated National and has extensive tenure in the homeowners’ insurance market in Florida Michael Braun, Chief Executive Officer & President Appointed Chief Executive Officer in July 2008Elected to Board in 2005Joined in 1998 Ronald Jordan, Chief Financial Officer Worked for multiple Fortune 200 insurance companies and Big 4More than 25 years of Accounting, Finance, Risk and Governance experienceJoined in 2017 Erick Fernandez, Chief Accounting Officer Worked for Fortune 20, 500 and Big 4 More than 15 years of Accounting and Finance experienceJoined in 2016 Gordon Jennings, Vice President of Risk Management Appointed Vice President of Risk Management in May 2008 Serves as President of FedNat UnderwritersJoined in 2000 Scott Fest, Vice President of Reinsurance Previously worked for E.W. Blanch, Benfield, Collins and Guy CarpenterMore than 20 years of reinsurance experienceJoined in 2016 Stephen Young, Vice President of Operations Appointed Vice President of Operations in June 2009 More than 20 years of industry experienceJoined in 1995 20

Experienced MANAGEMENT TEAM (cont.) An experienced management team that has a long history with Federated National and has extensive tenure in the homeowners’ insurance market in Florida C. Brian Turnau, Vice President of Claims Worked for private practice insurance defense litigation law firms for 15 yearsMore than 18 years of industry experienceJoined in 2000 Tracy Wiggan, Vice President of Human Resources Appointed as Director of Human Resources in July 2008More than 20 years experience in human resourcesJoined in 2005 Anthony Prete, Vice President of Strategy More than 15 years of industry experiencePreviously worked at Kemper, The Hartford, Travelers, and SafecoJoined in 2015 Christopher Clouse, Vice President of Personal Lines Underwriting Appointed Underwriting Manager in June 2010More than 25 years of industry experienceJoined in 2008 Larry Hufschmid, Vice President of Information Technology Previously was CIO at Hull & Company Inc.28 years of industry experience and 38 years of IT experienceJoined in 2012 21

Financial Overview

Premiums - FNHC 23 Q2-17 reflects market share growth in HO-FL, HO non-FL and Auto lines of business as well as a HO-FL statewide-average rate increase of 5.6%, which became effective on August 1, 2016.Effective August 1, 2017, a HO-FL statewide-average rate increase of 9.9% took effect, which will earn into our results over the next four quarters.Breakouts for Homeowners and Automobile are provided from 1Q16 forward.

Revenue and Expenses - FNHC 24 Starting in Q3-16 total expenses (excluding Losses/LAE and taxes) increased due to: (1) the unwinding of the Florida homeowners’ 30% quota share reinsurance treaty, and (2) growth in private passenger automobile and non-Florida homeowners’, both of which embody higher commission rates than Florida homeowners’.

Net income bridge 25 Q2-17 net income equated to 24¢ per average diluted share and 5.7% annualized ROE, excluding realized investment gains.Q2-17 losses and LAE included $2.8M, pre-tax-tax, from severe weather events.

2Q17 Results by line of business - FNHC 26 See page 9 for definitions of our lines of business (LOB).Homeowners and Automobile are presented on an underwriting results basis, i.e. all net investment income and net realized investment gains are presented in Other.In conjunction with our launch of LOB reporting, 2Q17 results by LOB were impacted by the reclassification of $3.5 million (pre-tax) of net loss reserves from Other to Homeowners as a result of reassessing our reserves at an LOB level. While this reclassification had no impact on our results on a consolidated basis, it increased net income in Other and decreased net income in Homeowners by approximately $2.2 million, respectively.

Losses and lae 27 * Includes the impact of severe weather events (Hurricane Matthew, Tornados, Tropical Storm Colin, Hurricane Hermine) * Beginning Q4-15, we have experienced increased loss and LAE costs associated with claims in our Florida homeowners book of business due to Assignment of Benefits (“AOB”). AOB has resulted in a rate increase effective August 2016, with an additional 9.9% Florida statewide-average increase taking effect August 2017. *

BALANCE SHEET STRENGTH 28 *Conservative Capital Structure *Reinsurance Strategy *Low risk investment portfolio “Our commitment to protecting our policyholders and our shareholders” $ in Millions (1) 2016 Statutory surplus includes $25M surplus infusion(2) FNHC Shareholders’ Equity excludes non-controlling interest (1) (2)

Shareholder value creation 29 Source: Company Filings and SNL FinancialNote: Based on GAAP financial information BVPS excluding Non-Controlling Interest

Investment Portfolio Holdings Federated National Investments and Cash* As of June 30, 2017$491.4 Million 30 Designed to preserve capital, maximize after-tax investment income, maintain liquidity and minimize riskUtilize outside investment managers for the fixed income and equity portfoliosAs of June 30, 2017, 99.83% of the Company’s fixed income portfolio was rated investment gradeAverage duration: 3.884 yearsComposite rating: A (S&P)Average yield: 2.211%Historical total returns on cash and investments as of June 30, 20171 Year: 1.39%2 Years: 2.40%

INVESTMENT OPPORTUNITY 31

CONTACT US Company ContactsMichael Braun, Chief Executive Officer & PresidentEmail: mbraun@FedNat.com Phone: 954-308-1322Ronald Jordan, Chief Financial OfficerEmail: rjordan@FedNat.com Phone: 954-308-1363Erick Fernandez, Chief Accounting OfficerEmail: eafernandez@FedNat.com Phone: 954-308-1341Rebecca Sanchez, Director of Corporate Affairs & Corporate SecretaryEmail: bsanchez@FedNat.com Phone: 954-308-1257 Federated National Holding Company14050 N.W. 14th StreetSuite 180Sunrise, FL 33323Tel. (954) 581-9993 / (800) 293-2532www.FedNat.com 32