Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Protea Biosciences Group, Inc. | v474079_ex23-1.htm |

| EX-21.1 - EXHIBIT 21.1 - Protea Biosciences Group, Inc. | v474079_ex21-1.htm |

| EX-10.85 - EXHIBIT 10.85 - Protea Biosciences Group, Inc. | v474079_ex10-85.htm |

| EX-10.84 - EXHIBIT 10.84 - Protea Biosciences Group, Inc. | v474079_ex10-84.htm |

| EX-4.40 - EXHIBIT 4.40 - Protea Biosciences Group, Inc. | v474079_ex4-40.htm |

| EX-4.38 - EXHIBIT 4.38 - Protea Biosciences Group, Inc. | v474079_ex4-38.htm |

As filed with the Securities and Exchange Commission on August 29, 2017

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PROTEA BIOSCIENCES GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 20-2903252 | ||

|

(State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

1311 Pineview Drive, Suite 501

Morgantown, West Virginia 26505

1-304-292-2226

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Stephen Turner

Chief Executive Officer

Protea Biosciences Group, Inc.

1311 Pineview Drive, Suite 501

Morgantown, West Virginia 26505

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Stephen A. Weiss, Esq. Megan J. Penick, Esq. CKR Law LLP 12100 Wilshire Boulevard, Suite 480 Los Angeles, California 90025 Tel: (310) 312-1860 Fax: (310) 477-3481 |

Harvey Kesner, Esq. Avital Perlman, Esq. Sichenzia Ross Ference Kesner LLP 61 Broadway, 32nd Floor New York, New York 10006 Telephone: (212) 930-9700 Facsimile: (212) 930-9725 |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| Emerging growth company | x |

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price (1) | Amount of Registration Fee | ||||||

| Common stock, par value $0.0001 per share (2)(3) | $ | 17,250,000 | $ | 2,000 | ||||

| Common stock underlying representative’s common stock purchase warrants (2)(4) | $ | 1,155,000 | $ | 134 | ||||

| Total | $ | 18,405,000 | $ | 2,134 | ||||

| (1) | Gives retroactive effect to a 1-for-50 reverse stock split to be effected prior to the effective date of this Registration Statement and assumes an initial public offering price of $5.00 per share. The proposed maximum aggregate offering price assumes an offering of 3,000,000 shares of common stock for the account of the Registrant and the full exercise of the underwriters’ over-allotment option to purchase up to an additional 450,000 shares, and is estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. Includes the offering price of additional shares that the underwriters have the option to purchase to cover over-allotments. |

| (2) | Pursuant to Rule 416, there are also being registered such indeterminable additional securities as may be issued to prevent dilution as a result of stock splits, stock dividends or similar transactions. |

| (3) | Includes shares which may be issued upon exercise of a 45-day option granted to the underwriters to cover over-allotments, if any (up to 15% of the offering amount). |

| (4) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. The warrants are exercisable at a per share exercise price equal to 110% of the public offering price. As estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act, the proposed maximum aggregate offering price of the representatives’ warrants is equal to 110% of $1,150,000 (7% of $15,000,000). |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated August 29, 2017

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION

Protea Biosciences Group, Inc.

Shares of Common Stock

We are offering for sale a total of shares of our common stock, $0.0001 par value per share.

Our common stock is currently quoted on the OTCQB under the symbol “PRGB.” We intend to apply to have our common stock listed on The NASDAQ Capital Market under the symbol [PRGB]. On August 22, 2017 the last reported sale price of our common stock as reported on the OTCQB was $0.065. In order to obtain NASDAQ listing approval we intend to effect a reverse split of our common stock; the exact amount of which shall be determined by our board of directors immediately prior to the date of this prospectus. In this prospectus, we assume that the price per share in this offering, on a post-split basis, will be in the range of $4.00 to $6.00, and we have used the $5.00 per share (the midpoint of such range) for the assumptions set forth herein.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 9 of this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, and we have elected to comply with certain reduced public company reporting requirements.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (1) | ||||||||

| Proceeds to us, before expenses | $ | $ | ||||||

| (1) | The underwriters will receive compensation in addition to the underwriting discounts and commissions. See “Underwriting” for a description of compensation payable to the underwriters. |

We have granted the underwriters a 45 day option, exercisable by the underwriters, in whole or in part, to purchase up to an additional shares of common stock, at the public offering price, less underwriting discounts and commissions, solely to cover over-allotments, if any. If the underwriters exercise the option in full, the total discount and commissions will be $ , and the total proceeds, before expenses, to us will be $ .

The underwriters expect to deliver our securities to investors on or about , 2017.

Except as otherwise indicated, all share and per share amounts in this prospectus assume and give retroactive effect to a 1-for-50 reverse stock split of our outstanding shares of common stock, which will occur prior to or upon the effective date of this prospectus. However, based upon our pre-offering closing market price at August 22, 2017 of $0.065 per share, a 1-for-50 ratio of the reverse stock split may be insufficient in order to offer our shares of common stock within the price range referred to above and list our shares on the Nasdaq Capital Market or other national securities exchange. Accordingly, prior to the effective date of this registration statement of which this prospectus is a part, we may be required to obtain another approval from our stockholders to increase a reverse stock split ratio in excess of 1-for-50.

LAIDLAW & COMPANY (UK) LTD.

The date of this prospectus is _______, 2017

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment. We have not authorized any other person to provide you with information that is different from, or adds to, that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should assume that the information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of any securities in any jurisdiction.

TABLE OF CONTENTS

Neither we nor the underwriters have authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. When you make a decision about whether to invest in our securities, you should not rely upon any information other than the information in this prospectus or in any free writing prospectus that we may authorize to be delivered or made available to you. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus or any free writing prospectus is correct after the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Our management estimates have not been verified by any independent source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors”. These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements”.

Throughout this prospectus, unless otherwise designated or the context suggests otherwise,

| · | all references to the “Company,” the “registrant,” “Protea,” “we,” “our,” or “us” in this prospectus mean Protea Biosciences Group, Inc. and its consolidated subsidiaries; |

| · | all shares, common stock, and per share data assumes and gives pro forma retroactive effect to a one-for-50 reverse stock split of Protea’s outstanding capital stock that will be consummated prior to the effective date of the registration statement of which this prospectus is a part; |

| · | assumes a public offering price of our common stock (after giving effect to such reverse stock split) of $5.00 per share, the mid-range of the estimated $4.00 to $6.00 initial offering price per share; |

| · | “year” or “fiscal year” mean the year ending December 31; |

| · | all dollar or $ references when used in this prospectus refer to United States dollars. |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements.” Forward-looking statements reflect the current view about future events. When used in this prospectus, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. Such statements, include, but are not limited to, statements contained in this prospectus relating to our business strategy, our future operating results and liquidity and capital resources outlook. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation:

| · | the results of clinical trials and the regulatory approval process; |

| · | our ability to raise capital to fund continuing operations; |

| · | market acceptance of any products that may be approved for commercialization; |

| · | our ability to protect our intellectual property rights; |

| · | the impact of any infringement actions or other litigation brought against us; |

| · | competition from other providers and products; our ability to develop and commercialize new and improved products and services; |

| · | changes in government regulation; |

| · | our ability to complete capital raising transactions; and |

| · | other factors (including the risks contained in the section of this prospectus entitled “Risk Factors”) relating to our industry, our operations and results of operations. |

Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

| 1 |

This summary provides a brief overview of the key aspects of our business and our securities. The reader should read the entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors.” Some of the statements contained in this prospectus, including statements under “Summary” and “Risk Factors” as well as those noted in the documents incorporated herein by reference, are forward-looking statements and may involve a number of risks and uncertainties. Our actual results and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus.

We have estimated that the initial offering price of our common stock will range between $4.00 and $6.00 per share and have assumed an initial offering price of $5.00, representing the mid-point of such range.

Except as otherwise indicated, all share and per share amounts in this prospectus assumes and gives retroactive effect to a 1-for-50 reverse stock split of our outstanding shares of common stock, which will occur prior to or upon the effective date of this prospectus. Our Board of Directors has discretionary authority to determine the exact ratio of the reverse stock split (up to 1-for-50) based upon the market price of our common stock on the date of such determination and with such reverse stock split to be effective at such time and date, if at all, as determined by the Board in its sole discretion. On August 25, 2017, our Board of Directors authorized a 1-for-50 reverse stock split. However, based on our pre-offering closing market price at August 22, 2017 of $0.065 per share, a 1-for-50 ratio of the reverse stock split may be insufficient in order to offer our shares of common stock within the price range referred to above and list our shares on the Nasdaq Capital Market or other national securities exchange. Accordingly, prior to the effective date of this registration statement of which this prospectus is a part, we may be required to obtain another approval from our stockholders to increase a reverse stock split ratio in excess of 1-for-50.

About Our Business

We provide bioanalytical services that support the development of new pharmaceuticals and other products by providing detailed molecular information as requested by our clients. Our services and technology address the molecular information needs of immunotherapy and therapeutic protein drug development, which has been the source of all of our historical revenues. We can provide both visual and analytical evaluation of therapeutic efficacy and the analysis of drug target tissues and tumor microenvironments. Our clients include pharmaceutical, chemical and biotechnology companies, as well as academic and government laboratories, both under contracts and on an ad-hoc basis.

Protea is an emerging growth, bioanalytical technology company that has developed proprietary technology which enables the rapid and direct identification, mapping and display of the molecules present in living cells and tissue samples, thereby providing “molecular information” that is of value to the pharmaceutical, diagnostic and life science industries.

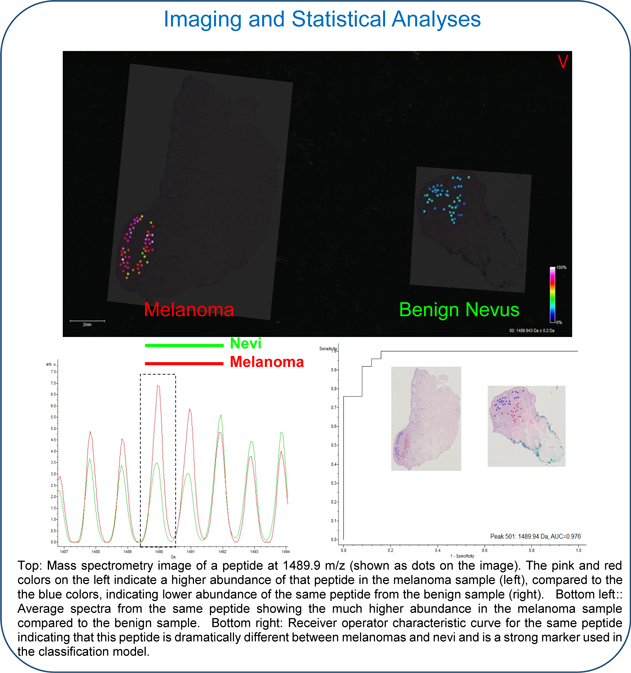

We are applying our proprietary technology to create a new class of molecular tests for the improved diagnosis and management of cancer. We have established a collaborative research initiative with The Yale University School of Medicine that employs our technology for the definitive diagnosis of malignant melanoma. We anticipate the commercial availability of our first cancer diagnostic test sometime in 2018. In July 2017, we entered into a Collaborative Research Agreement with the Massachusetts General Hospital (MGH) for the joint development of new medical diagnostic technology in the fields of oncology and wound healing. Additional collaborations are in development.

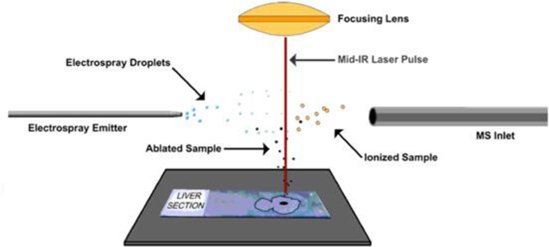

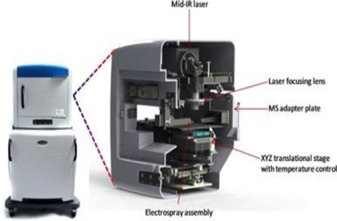

We have completed the development of a proprietary bioanalytical technology that enables the rapid and direct analysis and visualization of molecules in cells. Known as LAESI®, under an exclusive licensed from The George Washington University. This technology is covered under twelve issued patents and has been the subject of over 50 peer-reviewed publications. LAESI technology couples with “mass spectrometers,” which are instruments that detect, characterize, and identify molecules. LAESI enables rapid speed (providing data results in seconds to minutes vs. days) and the generation of large molecular datasets. Based on our tests and actual usage of our LAESI® technology, more than 1,000 molecules can be directly identified in a single analysis.

“Bioanalytics” and “molecular information” as referenced herein refer to the identification and characterization of the proteins, metabolites, lipids and other biologically active molecules that are produced by all living cells and life forms, and the use of proprietary machine learning algorithms (AI) to analyze these very large data sets.

In summary, we are pursuing our vision of developing and applying next generation bioanalytical technology to support a new era of medical research and disease diagnosis, where the molecular networks of human cellular processes can be clearly defined, with data rapidly available, thereby accelerating pharmaceutical development, and revolutionizing cancer diagnosis and treatment.

| 2 |

Our Business Strategy

Protea is developing two primary business areas, bioanalytical services and bioanalytical diagnostics, which are described in more detail below.

Bioanalytical Services

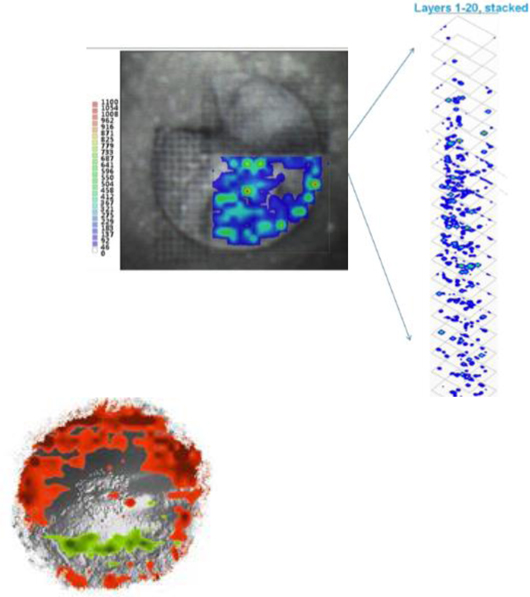

We provide bioanalytical services that support the development of new pharmaceuticals by providing detailed molecular information as requested by our clients. Employing our proprietary technology and methods, we can provide integrated proteomics, metabolomics, protein characterization and imaging solutions. Our mass spec imaging methods can identify biologically-active molecules produced by cells, then instantly spatially-display the molecules (both two- and three-dimensional) in tissue (histology) sections.

We continue to develop new bioanalytics technology to improve the availability, comprehensiveness, and usefulness of molecular information to address the needs of our clients.

We are growing our list of platform extending partnerships to bundle our services with theirs and expand our total available services market opportunities.

Bioanalytical Diagnostics

We are creating a new class of bioanalytics-based molecular tests for the improved diagnosis and management of cancer. We believe our proprietary bioanalytics technology will provide more accurate and unambiguous results for use in the diagnosis and management of cancer. We employ proprietary “machine learning algorithms” on tissue, targeting data generated from our proprietary workflows to provide a statistically supportive diagnostic decision.

Our test methodology has been developed and now applied to our first cancer test, for the differential diagnosis of malignant melanoma.

To advance the development of a broad range of new tests, we are developing partnerships with top tier medical research institutions that combine our expertise with the institutions’ medical knowledge and resources.

Risk Factors

Our business is subject to a number of risks. You should be aware of these risks before making an investment decision. As such, these risks are discussed in more detail in the section of this prospectus entitled “Risk Factors,” which begins on page 9 of this prospectus and includes the following sections:

| · | We have a history of losses; |

| · | We may be required to raise additional financing; |

| · | We have a significant amount of indebtedness and have defaulted in the payment of many debt obligations; |

| · | We may be unable to protect our intellectual property; |

| · | Market acceptance of our products is still uncertain; |

| · | We face significant competition; and |

| · | Investors in this offering will incur substantial dilution. |

Our Reverse Stock Split

On April 28, 2017, we obtained shareholder approval to increase the number of shares of our authorized common stock, $0.0001 par value per share, from 500,000,000 shares to 750,000,000 shares. In addition, and in order to seek to qualify the listing of our shares of common stock on the Nasdaq Capital Market or another national securities exchange, on April 28, 2017, we obtained shareholder approval to seek discretionary authority to effect a reverse stock split of our issued and outstanding shares of common stock of up to one-for-50, as determined at the discretion of our Board to be in our best interests without further approval from our stockholders

We intend to consummate a reverse stock split immediately prior to the effective date of the registration statement of which this prospectus is a part. Thus far, the Company has obtained authorization from our stockholders to consummate a reverse stock split of up to 1:50 and our Board of Directors approved the 1:50 reverse stock split on August 25, 2017, with the effective date of the reverse stock split to be such time as the officers of the Company deem appropriate. For the reasons set forth below, prior to the effective date of this prospectus, we intend to seek stockholder approval to effectuate an additional increase in the authorized range of such reverse stock split from a minimum of 1:50 to a maximum of 1:125. No fractional shares of common stock will be issued in connection with the reverse stock split, and all such fractional interests will be rounded down to the nearest whole number. Issued and outstanding stock options, convertible notes and warrants will be split on the same basis and exercise prices will be adjusted accordingly.

Unless otherwise indicated, all information presented in this prospectus gives retroactive effect to such 1-for-50 reverse stock split and all share price, per share, convertible note conversion prices and stock option and warrant exercise price data set forth in this prospectus has been adjusted to give effect to the 1-for-50 reverse stock split.

As of December 31, 2016 and August 21, 2017, on a pre-split basis, we had issued and outstanding a total of (i) 162,471,373 and 398,633,940 shares of our common stock, respectively, and (ii) warrants to purchase a total of 122,475,881 and 221,611,629 shares of our common stock, respectively, at certain exercise prices ranging from $0.075 to $2.25 per share.

| 3 |

As a result of the proposed 1-for-50 reverse stock split, we will have (i) 750,000,000 shares of common stock authorized, of which (ii) all outstanding 398,633,940 shares of our common stock, prior to the consummation of such reverse stock split, will be reduced to 7,972,679 shares, (iii) all 108,167,947 shares of our common stock issuable upon conversion of $6,107,068 principal amount of convertible notes and debentures, would be reduced to 2,163,364 shares with a corresponding increase in the conversion price of such convertible securities ranging from $0.50 to $25.00 per share, and (iv) all 221,661,629 shares of our common stock issuable upon exercise of outstanding warrants, prior to the consummation of the reverse stock split, will be reduced to 4,432,233 shares with a corresponding increase in the exercise prices of such warrants to prices ranging from $3.75 to $112.50 per share.

Notwithstanding the above, based on our current pre-offering closing market price on the OTCQB at August 22, 2017 of $0.065 per share, in order to offer our shares of common stock within a price range of between $4.00 and $6.00 per share and meet the requirements to list our shares on the Nasdaq Capital Market or other national securities exchange, prior to the effective date of the registration statement of which this prospectus is a part, we will need to obtain another approval from our stockholders to complete a reverse split ratio in excess of 1-for-50. We therefore will likely be required to seek approval from the holders of a majority of our outstanding shares of common stock to (i) effect a reverse split within a range of between 1-for-50 to 1-for-125, (ii) grant our Board discretionary authority to determine the exact ratio of the reverse stock split based upon the market price of our common stock on the date of such determination and (iii) cause such reverse stock split to be effective at such time and date, if at all, as determined by the Board in its sole discretion. There can be no assurance that such stockholder approval will be obtained. See the section entitled “Risk Factors” beginning on page 9 of this prospectus.

Additional information regarding our issued and outstanding securities may be found in the section of this prospectus entitled “Description of Securities.”

Recent Sales of Securities

Between November 2016 through March 2017, we received an aggregate of $2,095,430 in gross cash proceeds from 71 accredited investors in connection with the sale of approximately 209.54 units of securities (each a “Unit” and collectively, the “Units”) pursuant to the terms and conditions of subscription agreements (the “Subscription Agreements”) by and among the Company and each of the purchasers thereto. The Units were offered at a price of $10,000 per Unit and consisted of up to (a) 2,667 shares of common stock, (b) 18-month warrants to purchase 2,667 shares of common stock at an exercise price of $4.50 per share (the “Class A Warrants”), and (c) five-year warrants to purchase 2,667 shares of common stock at an exercise price of $5.63 per share (the “Class B Warrants” and, together with the Class A Warrants, the “Investor Warrants”). The offering terminated on March 31, 2017, and we issued an aggregate of 552,115 shares of common stock at $3.75 per share, Class A Warrants to purchase 552,115 shares of common stock at an exercise price of $4.50 per share, and Class B Warrants to purchase 552,115 shares of common stock at an exercise price of $5.63 per share.

In connection with the Unit offering, the Company paid to Laidlaw & Company (UK) Ltd., as placement agent, an aggregate of $258,092 in cash compensation, representing fees and an expense allowance, and issued a warrant to the placement agent to purchase an aggregate of 149,274 shares of common stock, with an exercise price of $3.75 per share and a term of three years. The Company also issued one Unit to the placement agent’s legal counsel for services rendered in connection with the Closing.

The sales of common stock from November 2016 through March 2017 (see above) at a unit price of $3.75 per share triggered the anti-dilution provisions contained in certain financial instruments we had previously issued between 2013 and 2016. As a result, to satisfy our obligations under such provisions, we were required to issue 1,714,500 additional shares of common stock, issue 504,887 Warrants to purchase shares of common stock, reduce the conversion rate of certain outstanding notes to $3.75 per share and reduce the exercise price of 989,191 outstanding warrants.

In April 2017, we received a loan of $500,000 from Summit Resources, Inc., an affiliate of one of our directors, under a 15% maximum $1,750,000 secured installment convertible note that matures in March 2020, and is convertible at the option of the holder into shares of our common stock at a price equal to the lower of 85% of the per share offering price in this prospectus or $0.075 ($3.75, as adjusted for the contemplated reverse stock split. In connection with such financing, we issued to the note holder a warrant to purchase 400,000 shares of our common stock at an exercise price equal to the conversion price of the note.

In June 2017, we received the sum of $1,000,000 from the issuance of a 20% original issue discount debenture in $1,200,000 face amount to Andreas Wawrla. The debenture is due and payable on the earlier of November 30, 2017 or from the net proceeds of our sale of $5,000,000 or more of our securities in any public or private offering. The debenture is convertible to our common stock at a conversion price of $3.75 per share. We also issued to the debenture holder a three-year warrant to purchase additional shares of our common stock equal to 100% of the shares issuable upon conversion of the debenture at an exercise price of $3.75 per share.

In July 2017, the Company issued a $360,000 note to PPLL, LLC under a two-year advisory agreement that was entered into in connection with the Company’s collaboration and research agreement with MGH. The note is convertible into 720,000 shares of the Company’s common stock at any time after January 28, 2018 at the option of the holder and may be paid by the Company by the issuance of such shares of common stock in exchange for cancellation of the note. For further information, see “Certain Relationships and Related Transactions” on page 56 of this prospectus.

| 4 |

In August 2017, we received a loan agreement in the amount of $440,000 from Summit Resources under a maximum 10% $500,000 note payable on the earlier of (a) December 31, 2017, (b) our receipt of $2,500,000 or more from any subsequent private placement of securities consummated prior to December 31, 2017, or (c) the completion of the offering contemplated by this prospectus. In consideration of its making of the Loan, and in addition to interest and any other charges to be paid pursuant to this Note, the Borrower hereby grants to the Lender or its designees a seven (7) year warrant to purchase, for an initial exercise price of $3.75 per share, 1,200,000 shares of the common stock, $0.0001 par value per share.

In addition to the above financings, and in order to provide it with funds necessary to continue to operate its business, prior to the effective date of the registration statement of which this prospectus is a part, the Company intends to engage in one or more private placements of convertible notes and warrants to accredited investors and seek to raise up to $5,550,000 (the “Interim Financings”). However, as of August 25, 2017, on a pre-split basis, based on 398,633,940 outstanding shares of our common stock and up to 329,779,576 additional shares that would be issuable upon conversion of currently outstanding convertible notes and debentures and exercise of currently outstanding warrants, we would not have enough shares authorized under our certificate of incorporation to issue shares of common stock or reserve shares of common stock for subsequent issuance to prospective investors in such Interim Financings.

On August 25, 2017, we entered into an agreement with PPLL and Summit, who each agreed that until January 15, 2018, they

| · | would not convert any convertible notes held by them or exercise any warrants issued to Summit unless and until the Company has, in addition to all shares of common stock issued and issuable to connection with the proposed Interim Financings, a sufficient number of shares of authorized common stock available to be issued to PPLL and Summit upon full conversion or exercise of their securities; and’ |

| · | would waive the covenants of our Company to reserve up 139,333,333 shares of our common stock otherwise potentially issuable to PPLL and Summit. |

In connection with such agreement, we committed that by no later than January 15, 2018, the Company would either consummate a reverse stock split or obtain stockholder approval to increase the 750,000,000 shares of common stock under our certificate of incorporation to provide for a sufficient number of authorized but unissued shares of common stock to accommodate the full conversion and exercise of all convertible notes and warrants held by PPLL and Summit. Failure to effectuate the reverse split or amendment to our certificate of incorporation would be an event of default under the notes.

There can be no assurance that we will be able to obtain any Interim Financing or that we will be able to provide an adequate number of shares of our common stock to comply with the terms of all of our outstanding convertible securities and warrants. See “Risk Factors” on page 9 of this prospectus.

Our Exchange Offers

As of August 21, 2017, we were in default on the payment of approximately $2,085,400 of outstanding notes and debentures.

In addition, the anti-dilution provisions contained in many of our outstanding securities between 2013 and 2017 has created significant derivative liabilities for our Company. As of December 31, 2016, such derivative liability has been calculated to be in excess of $3,100,000 and increases as we sell additional warrants with anti-dilution provisions. Such derivative liability directly impacts and reduces our stockholders’ equity, which could materially and adversely affect our ability to qualify to list our common stock for trading on the Nasdaq Capital Market or other comparable national securities exchange.

In order to cure our defaults in payment of our debt securities and to reduce, if not eliminate, the derivative liability, we:

| · | Offered to the holder(s) of all $2,270,688 of 20% original issue discount debentures issued in 2016 an opportunity under Section 3(a)(9) of the Securities Act of 1933, as amended, to exchange their debentures for a new 20% original issued discount convertible debenture due September 30, 2017, plus one share of our common stock for each $1.00 outstanding principal amount of the new 20% OID convertible debenture issued to them. As proposed, the contemplated restated 20% OID convertible debenture would be in face amount equal to 100% of the outstanding principal of and accrued interest on the earlier convertible debentures and, upon consummation of any subsequent public offering of our common stock that is registered under the Securities Act prior to the new maturity date, would be subject to mandatory conversion at a 20% discount to the initial public offering price of our common stock (the “OID Convertible Debenture Exchange Offer”). As of the date of this prospectus, an aggregate of $2,254,281 of the 2016 20% OID Debentures were exchanged for $2,366,995 of new 20% OID Debentures due September 30, 2017, and the parties to the exchange offer received an additional 49,779 shares of our common stock. The remaining $16,406 of our 20% original discount debentures that were not exchanged for new 20% OID Debentures are currently in default and there can be no assurance that the three holders of such defaulted debentures will agree to accept our exchange offer. |

| 5 |

| · | Offered to the 156 holders of our common stock and warrants issued in the 2013 offering, an opportunity under Section 3(a)(9) of the Securities Act, to (a) waive for all purposes the “make whole” provisions in their subscription agreement in exchange for one-quarter of a warrant exercisable at $4.50 per share for each of the 2,069,952 shares of Common Stock issued and issuable to them in the 2013 Offering (approximately 517,488 additional warrants) which would contain no weighted average or full ratchet anti-dilution provisions, plus (b) exchange all of the outstanding 2013 B Warrants issued in the 2013 offering (approximately 155,246 warrants) for one additional share of our common stock (the “2013 Exchange Offer”). As of the date of this prospectus, 116 of the purchasers of our securities in the 2013 offering accepted the exchange offer, resulting in the issuance of 123,251 additional shares of common stock and warrants to purchase 410,838 shares of common stock. |

| · | Offered to the 72 holders of our common stock and warrants issued in the 2016-17 offering, an opportunity under Section 3(a)(9) of the Securities Act of 1933, as amended, to exchange all of their 2016-17 Class A Warrants and 2016-17 Class B Warrants for 1.5 shares of Common Stock for each 2016-17 Class A Warrant and 2016-17 Class B Warrant (the “2016-17 Exchange Offer”). Accordingly, each $10,000 Unit that represented 2,667 shares of common stock, plus 2,667 of 2016-17 Class A Warrants and 2,667 of 2016-17 Class B Warrants would be exchanged for 1,403,620 shares of Common Stock, representing (a) 561,448 shares of Common Stock, plus (ii) 842,172 additional shares of common stock issued in lieu of the 2016-17 Class A Warrants and 2016-17 Class B Warrants. As of the date of this prospectus, 70 of the purchasers of our securities in the 2016-17 offering accepted the exchange offer resulting in the issuance of 822,172 additional shares of common stock. |

| · | Entered into agreements with certain related parties, including members of our board of directors, to convert approximately $2,651,719 of our indebtedness and accrued interest of $92,319 owed to such individuals into 738,410 shares of our common stock and 738,410 Class A Warrants to purchase shares of our common stock at an exercise price of 4.50 per share, and 738,410 Class B Warrants to purchase shares of our common stock at an exercise price of $5.63 per share, all upon the same terms as the Units of equity securities offered in our 2016-17 Offering. In July 2017, these related parties accepted the terms of the 2016-2017 Exchange Offer referred to above, as a result of which they were issued an aggregate of 1,097,615 additional shares of common stock in lieu of their Class A Warrants and Class B Warrants. As of the date of this prospectus, the balance of the related party debt is $2,068,994. |

As a result of the acceptances we received in the above exchange offers, we believe that we will be able to significantly reduce our derivative liability. In such connection, we intend to engage an outside consulting firm to calculate the amount of such derivative liability reduction based upon and following the issuance of our unaudited June 30, 2017 balance sheet.

Related Party Indebtedness

In 2017, related parties, including members of our board of directors, converted a total of $2,646,719 principal amount of notes we owed to such persons and accrued interest of $92,319 into units of our securities consisting of (a)730,410 shares of our common stock (a conversion price of $3.75 per share) plus (b) an eighteen-month warrant to purchase an additional 730,410 shares of common stock at an exercise price of $4.50 per share and (c) a five-year warrant to purchase an additional 730,410 shares of common stock at an exercise price of $5.63 per share containing identical terms to the units of equity securities which we sold in our private placement to unaffiliated accredited investors between November 2016 and June 30, 2017. In July 2017, these related parties accepted the terms of the 2016-2017 Exchange Offer referred to above, as a result of which they were issued an aggregate of 1,097,615 additional shares of common stock in lieu of their Class A Warrants and Class B Warrants.

On April 7, 2017, we received a loan of $1,750,000 from Summit Resources, Inc. (“Summit”), one of our principal stockholders and an affiliate of Steve Antoline, one of our directors. The loaned amount includes $500,000 previously advanced by Summit and an additional $1,250,000 will be advanced to us from April 2017 through August 2017. We issued to Summit our senior secured promissory note in the principal amount of up to $1,750,000 that is payable in monthly installments over a period of 36 months. In addition, the Company granted a seven-year warrant to purchase 400,000 shares of the Company’s common stock at an exercise price of $3.75 per share.

Of the loan proceeds, we intend to apply $1,250,000 to purchase two new mass spectrometers and the balance of the loan for working capital. The company is presently evaluating the different mass spectrometers on the market prior to making its purchase and is working with Summit to amend the note agreement to best reflect these plans. We have agreed to apply 30% of the net proceeds (after commissions and offering expenses) we receive from any equity or equity type financing to reduce and prepay the $500,000 working capital portion of the loan. In addition, the entire loan is subject to mandatory prepayment in the event and to the extent that we receive gross proceeds of $5,000,000 or more from any subsequent public offering of our securities.

Commencing 30 days after installation of the state-of-the-art mass spectrometer we will pay monthly installments of principal and accrued interest in the amount equal to the greater of (a) $62,030.86 (representing 36 monthly installments of principal and accrued interest at the rate of 15% per annum), or (b) 20% of the cash proceeds we receive from customers who request services from the Company using the new mass spectrometer equipment. We also agreed to establish a special lock box to deposit cash proceeds we receive from use of such equipment.

The note is convertible into shares of our common stock, at the option of the holder at a conversion price equal to the lower of $3.75 per share (as adjusted by the contemplated the reverse stock split), or (b) 85% of the offering price per share of the common stock in any subsequent public offering of our common stock. Based on our initial per share offering price in this offering, the conversion price of the note will be $3.75 per share.

| 6 |

The loan is secured by a first lien and security interest on all of our assets and properties, including the purchased equipment and all purchase orders we receive in connection therewith.

In a related development on April 21, 2017, we entered into an agreement with Summit under which Summit agreed to waive its security interest in our accounts receivable and inventory until such time as we retire a $301,578 obligation to an unaffiliated third party, subject to our agreement to reaffirm Summit’s senior priority lien and security interest on all of our assets and properties, other than the specific accounts receivable and related collateral granted to such third party. On June 28, 2017, we satisfied our obligation to the unaffiliated third party and the waiver is no longer applicable.

For further information, see “Certain Relationships and Related Transactions” elsewhere in this prospectus.

Organizational History

We were incorporated as SRKP 5, Inc., in Delaware on May 24, 2005. Prior to the Reverse Merger (as defined below) and split-off (as described below), our business was to provide software solutions to deliver geo-location targeted coupon advertising to mobile internet devices.

On September 2, 2011, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Protea Biosciences, Inc., a Delaware corporation (“PBI”), and we formed our wholly-owned subsidiary to complete the merger. Under the terms of the Merger Agreement, our subsidiary merged with and into PBI, as a result of which PBI became our wholly owned subsidiary (the “Reverse Merger”). In the Reverse Merger, each share of PBI common stock was automatically converted into one share of our common stock, all shares of PBI common stock in treasury were canceled and we assumed all of PBI’s rights and obligations for outstanding convertible securities and warrants. Upon the Reverse Merger, we discontinued our prior business and our business became the business of PBI and its subsidiaries.

Corporate Information

Our principal executive office is located at 1311 Pineview Drive, Suite 501, Morgantown, West Virginia 26505. Our telephone number is 1-304-292-2226 and our web address is http://proteabio.com. Information included on our website is not a part of this prospectus.

Implications of Being an Emerging Growth Company

We are an "emerging growth company," as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier of (i) December 31, 2019, the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act; (ii) the last day of the fiscal year in which we have total annual gross revenues of $1 billion or more; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under applicable SEC rules. We expect that we will remain an emerging growth company for the foreseeable future, but cannot retain our emerging growth company status indefinitely and will no longer qualify as an emerging growth company on or before December 31, 2019. We refer to the Jumpstart Our Business Startups Act of 2012 herein as the "JOBS Act," and references herein to "emerging growth company" have the meaning associated with it in the JOBS Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are applicable to other public companies that are not emerging growth companies.

These exemptions available to us as a result of being an emerging growth company include:

| · | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced "Management's Discussion and Analysis of Financial Condition and Results of Operations" disclosure; |

| · | not being required to comply with the requirement of auditor attestation of our internal controls over financial reporting; |

| · | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements; |

| · | reduced disclosure obligations regarding executive compensation; and |

| · | not being required to hold a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

For as long as we continue to be an emerging growth company, we expect that we will take advantage of the reduced disclosure obligations available to us as a result of that classification. We have taken advantage of certain of those reduced reporting burdens in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

| 7 |

An emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves of this extended transition period and, as a result, we will not be required to adopt new or revised accounting standards on the dates on which adoption of such standards is required for other public reporting companies.

We are also a "smaller reporting company" as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies.

THE OFFERING

| Common stock outstanding prior to the offering | 7,972,679 shares (1) |

| Common stock offered by the Company | shares | |

| Over-allotment option | The underwriters have an option for a period of 45 days to purchase up to additional shares of our common stock to cover over-allotments, if any. | |

| Use of proceeds | We estimate that the net proceeds to us from this offering will be approximately $13,000,000 or approximately $15,000,000 if the underwriters exercise their option to purchase additional shares in full, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds of this offering to fund research and development of new products, for development of the Melanoma Diagnostic Pilot Lab and commercialization efforts, to increase our sales and marketing efforts, to build infrastructure, including hiring of additional personnel, to reduce certain indebtedness and accounts payable, and for working capital and other general corporate purposes. For additional information, please refer to the section entitled “Use of Proceeds” on page 21 of this prospectus. | |

| Proposed Nasdaq Stock Market symbol: | PRGB. Our common stock is currently quoted on the OTCQB under the symbol “PRGB.” | |

| Risk Factors | You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 9 of this prospectus before deciding whether or not to invest in shares of our common stock. |

| (1) | Represents shares of our common stock outstanding as of August 21, 2017 and does not include the following: |

| · | 255,702 shares of common stock issuable upon the exercise of outstanding stock options, at a weighted average exercise price of $24.33 per share; |

| · | 4,227,933 shares of common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $10.42 per share; |

| · | 20,900 shares of common stock issuable upon conversion of $400,000 of convertible notes, 635,793 shares of common stock issuable upon conversion of $2,384,267 of convertible notes issued in the second and third quarter of 2016, 320,000 shares of common stock upon conversion of $1,200,000 of convertible 20% OID issued in 2017 and 466,667 shares of common stock upon conversion of $1,750,000 convertible promissory note; |

| · | 204,299 shares of common stock issuable upon the exercise of outstanding warrants issued to Laidlaw & Co. (UK) Ltd. or its assigns in connection with acting as placement agent in private placements of our securities consisting of (i) warrants to purchase up to 14,820 shares of common stock at $10.00 per share, (ii) warrants to purchase up to 9,825 shares of common stock at exercise price of $10.00 per share, (iii) warrants to purchase up to 30,380 shares of common stock at an exercise price of $10.00 per share and (iv) warrants to purchase up to 149,274 shares of common stock at an exercise price of $3.75; and |

| · | 720,000 shares of common stock issuable to PPLL, LLC in payment of, or upon conversion of, a $360,000 note due June 30, 2019 that was issued under a business advisory agreement entered into in July 2017. |

Except as otherwise indicated, all information in this prospectus assumes and gives effect to (a) a 1-for-50 reverse split of our common stock, which will occur prior to the effectiveness of the registration statement of which this prospectus is a part; and (b) no exercise by the underwriters of their option to purchase up to an additional 450,000 shares of our common stock.

| 8 |

Our business is subject to many risks and uncertainties, which may affect our future financial performance. If any of the events or circumstances described below occur, our business and financial performance could be adversely affected, our actual results could differ materially from our expectations, and the price of our stock could decline. The risks and uncertainties discussed below are not the only ones we face. There may be additional risks and uncertainties not currently known to us or that we currently do not believe are material that may adversely affect our business and financial performance. You should carefully consider the risks described below, together with all other information included in this prospectus including our financial statements and related notes, before making an investment decision. The statements contained in this prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and investors in our securities may lose all or part of their investment.

Risks Related to Our Business

Our independent registered public accounting firm has issued a “going concern” opinion.

Our ability to continue as a going concern is dependent upon our ability to generate profitable operations in the future and/or obtain the necessary financing we need to meet our obligations and repay our liabilities arising from normal business operations when they come due. We plan to continue to provide for our capital requirements that are not met by income from our operations by issuing additional equity or debt securities. No assurance can be given that additional capital will be available when required or on terms acceptable to us. We also cannot give assurance that we will achieve sufficient revenues in the future to achieve profitability and cash flow positive operations. The outcome of these matters cannot be predicted at this time and there is no assurance that, if achieved, we will have sufficient funds to execute our business plan or to generate positive operating results. We believe that that these matters, among others, raise substantial doubt about our ability to continue as a going concern.

We are an emerging growth company with a limited operating history and limited sales to date.

The Company is subject to all of the risks inherent in the establishment of an emerging growth company including the absence of an operating history and the risk that we may be unable to successfully develop, manufacture and sell our products. There can be no assurance that the Company will be able to execute its business plan, including without limitation the Company’s plans to develop, then manufacture, market and sell its technologies, products and services. The Company has engaged in limited manufacturing operations to date and although the Company believes that its plans to conduct manufacturing of its products internally will work, there is no assurance that this will be the case. The Company began to sell products and services in the fourth quarter of 2007 and sales to date are limited. There can be no assurance that the Company’s sales projections and marketing plans will be achieved as anticipated and planned. It is likely that losses will be incurred during the early stages of operations. The Company believes that its future success will depend on its ability to develop and introduce its instruments and services for mass spec molecular imaging, to meet a wide range of customer needs and achieve market acceptance. The Company cannot assure prospective investors that it will be able to successfully develop and market its products or that it will recover the initial investment that must be made to develop and market such products.

We have incurred net losses since inception.

We incurred a net loss of $11,365,977 for the six months ended June 30, 2017, $15,647,922 for the year ended December 31, 2016 and $9,574,434 for the year ended December 31, 2015. The Company has a net loss of $ 106,611,507 since inception. Our independent registered public accountants issued an opinion on our audited financial statements as of and for the year ended December 31, 2016 that contains an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent upon raising capital from financing transactions. To stay in business, we will need to raise additional capital through public or private sales of our securities, debt financing or short-term bank loans, or a combination of the foregoing.

We are in default in payments of approximately $2,085,400 of our outstanding notes and debentures.

As of August 21, 2017, approximately $2,068,994 of our Loans Payable to Stockholders, advances from related parties and all $16,406 of our 20% original issued discount (“OID”) Convertible Debentures have matured and are currently in default. Although we are attempting to obtain extensions of the maturity date of these debt obligations, there is no assurance that we will be successful in such endeavors. Even if we are able to renegotiate the terms of such debt obligations and extend their maturity dates to September 30, 2017, there is no assurance that we will have the funds available by September 30, 2017 to pay our obligations, if required. In the event that all or substantially all of such creditors do not agree upon an extension of our defaulted debt securities, or we are unable to pay such debts by September 30, 2017, assuming we are able to obtain extensions of the current maturity dates, the holders of such notes and debentures could accelerate the indebtedness evidenced thereby in which event we may be forced to cease operations or be required to seek protection under the United States Bankruptcy Act.

| 9 |

We may be required to raise significant additional capital.

We have been operating at a loss since inception and our working capital requirements continue to be significant. We have been supporting our business through the sale of debt and equity since inception. We will need additional funding for developing products and services, increasing our sales and marketing capabilities, technologies and assets, as well as for working capital requirements and other operating and general corporate purposes. Our working capital requirements depend and will continue to depend on numerous factors including the timing of revenues, the expense involved in development of our products, and capital improvements. If we are unable to generate sufficient revenue and cash flow from operations, we will need to seek additional equity or debt financing to provide the capital required to maintain or expand our operations, which may have the effect of diluting our existing stockholders or restricting our ability to run our business.

We plan to meet our working capital requirements by raising additional funds from the sale of equity or debt securities, the sale of certain assets, and possibly developing corporate development partnerships to advance our molecular information technology development activities by sharing the costs of development and commercialization with our partners.

Although we believe that the net proceeds of this offering will be sufficient to enable us to develop our business, increase our revenues and sustain our working capital requirements for the next 18 months, we may have to raise additional capital during such period or thereafter. We can provide no assurance as to whether our capital raising efforts will be successful or when, or if, we will ever be profitable in the future. Even if we are able to achieve profitability, we may not be able to sustain such profitability.

There can be no assurance that we will be able to raise sufficient additional capital on acceptable terms, or at all. If such financing is not available on satisfactory terms or is not available at all, we may be required to delay, scale back or eliminate the development of business opportunities and our operations and our financial condition may be materially adversely affected. Debt financing, if obtained, may involve agreements that include covenants limiting or restricting our ability to take specific actions such as incurring additional debt and could increase our expenses and require that our assets be provided as a security for such debt. Debt financing would also be required to be repaid regardless of our operating results. Equity financing, if obtained, could result in additional dilution to our then existing stockholders.

We depend on the pharmaceutical and biotechnology industries.

Over the past several years, some areas of our business have grown significantly as a result of an increase in the sales of our bioanalytical instrument platform known as “LAESI®” and the increase in pharmaceutical, academic and clinical research laboratory outsourcing of their clinical drug research support activities. We believe that due to the significant investment in facilities and personnel required to support drug development, pharmaceutical, academic and clinical research laboratories look to purchase our bioanalytical instrument platforms and solutions technology to meet and administer their drug research requirements. Our revenues depend greatly on the expenditures made by these pharmaceutical and academic or clinical research laboratory companies in research and development. In some instances, companies in these industries are reliant on their ability to raise capital in order to fund their research and development projects. Accordingly, economic factors and industry trends that affect our clients in these industries also affect our business. If companies in these industries were to reduce the number of research and development projects they conduct or outsource, our business could be materially adversely affected.

Changes in government regulation or in practices relating to the pharmaceutical industry could change the need for the services we provide.

Governmental agencies throughout the world, but particularly in the United States, strictly regulate the drug development process. Changes in regulation, such as regulatory submissions to meet the internal research and development standards of pharmaceutical research, a relaxation in existing regulatory requirements, the introduction of simplified drug approval procedures or an increase in regulatory requirements that we may have difficulty satisfying or that make our services less competitive, could substantially change the demand for our services. Also, if the government increases efforts to contain drug costs and pharmaceutical companies profits from new drugs, our customers may spend less, or reduce their growth in spending on research and development.

We may be affected by health care reform.

In March 2010, the United States Congress enacted the Patient Protection and Affordable Care Act (“PPACA”) which is intended over time to expand health insurance coverage and impose health industry cost containment measures. PPACA legislation and the accompanying regulations may significantly impact the pharmaceutical and biotechnology industries as it is implemented over the next several years. In addition, the U.S. Congress, various state legislatures and European and Asian governments may consider various types of health care reform in order to control growing health care costs. We are unable to predict what legislative proposals will be adopted in the future, if any.

Implementation of health care reform legislation may have certain benefits but also may contain costs that could limit the profits that can be made from the development of new drugs. This could adversely affect research and development expenditures by pharmaceutical and biotechnology companies, which could in turn decrease the business opportunities available to us both in the United States and abroad. In addition, new laws or regulations may create a risk of liability, increase our costs or limit our service offerings.

Changes in healthcare law and implementing regulations, including government restrictions on pricing and reimbursement, as well as healthcare policy and other healthcare payor cost-containment initiatives, may negatively impact our ability to generate revenues.

The pricing and reimbursement environment for the pharmaceutical and biotechnology industries may change in the future and become more challenging due to, among other reasons, policies advanced by the current or any new presidential administration, federal agencies, new healthcare legislation passed by Congress or fiscal challenges faced by all levels of government health administration authorities. If pricing and regulatory changes pressure our customer base in the pharmaceutical and biotechnology industries our revenue generating ability may be adversely impacted.

| 10 |

A reduction in research and development budgets at pharmaceutical companies and clinical research institutions may adversely affect our business.

Our customers include researchers at pharmaceutical companies and academic or clinical research laboratory institutions. Our ability to continue to grow and win new business is dependent in large part upon the ability and willingness of the pharmaceutical and biotechnology industries to continue to spend on research and development and to outsource their product equipment and service needs. Fluctuations in the research and development budgets of these researchers and their organizations could have a significant effect on the demand for our products and services. Research and development budgets fluctuate due to changes in available resources, mergers of pharmaceutical companies and spending priorities and institutional budgetary policies of academic or clinical research organizations. Our business could be adversely affected by any significant decrease in life sciences research and development expenditures by pharmaceutical and academic or clinical research companies. Similarly, economic factors and industry trends that affect our clients in these industries also affect our business.

We rely on a limited number of key customers, the importance of which may vary dramatically from year to year, and a loss of one or more of these key customers may adversely affect our operating results.

Six customers accounted for approximately 53% of our gross revenue in fiscal 2016 and five customers accounted for approximately 52% of our gross revenues in fiscal 2015. One large pharmaceutical company (our largest customer) accounted for 22% of our gross revenue in 2016, and this customer will not continue to be a significant contributor to revenue in 2017 due to management changes within the customer laboratory. The loss of a significant amount of business from one of our major customers would materially and adversely affect our results of operations until such time, if ever, as we are able to replace the lost business. Significant clients or projects in any one period may not continue to be significant clients or projects in other periods. In any given year, there is a possibility that a single pharmaceutical, academic or clinical research laboratory company may account for 5% or more of our gross revenue or that our business may be dependent on one or more large projects. To the extent that we are dependent on any single customer, we are subject to the risks faced by that customer to the extent that such risks impede the customer's ability to stay in business and make timely payments to us.

We may bear financial risk if we underprice our contracts or overrun cost estimates.

Since some of our contracts are structured as fixed price or fee-for-service, we bear the financial risk if we initially underprice our contracts or otherwise overrun our cost estimates. Such underpricing or significant cost overruns could have a material adverse effect on our business, results of operations, financial condition, and cash flows.

A default in our credit facility could materially and adversely affect our operating results and our financial condition.

The Company has an outstanding line of credit with United Bank. This credit facility requires us to adhere to certain contractual covenants. If there were an event of default under our credit facility that was not cured or waived, the lenders of the defaulted debt could cause all amounts outstanding with respect to that debt to be due and payable immediately. We cannot assure that our assets or cash flow would be sufficient to fully repay borrowings under the credit facility, either upon maturity or if accelerated, upon an event of default, or that we would be able to refinance or restructure the payments becoming due on the credit facility. Please see Note 3 Bank Line of Credit in Part IV, Financial Statement Footnotes in this prospectus for additional detail regarding our credit facility.

We might incur expenses to develop products that are never successfully commercialized.

We have incurred and expect to continue to incur research and development and other expenses in connection with our products business. The potential products to which we devote resources might never be successfully developed or commercialized by us for numerous reasons including:

| · | inability to develop products that address our customers’ needs; |

| · | competitive products with superior performance; |

| · | patent conflicts or unenforceable intellectual property rights; |

| · | demand for the particular product; |

| · | other factors that could make the product uneconomical; and |

| · | termination of pre-existing license agreements. |

Incurring expenses for a potential product that is not successfully developed and/or commercialized could have a material adverse effect on our business, financial condition, prospects and stock price.

| 11 |

Our business uses biological and hazardous materials, which could injure people or violate laws, resulting in liability that could adversely impact our financial condition and business.

Our activities involve the controlled use of potentially harmful biological materials as well as hazardous materials and chemicals. We cannot completely eliminate the risk of accidental contamination or injury from the use, storage, handling or disposal of these materials. In the event of contamination or injury, we could be held liable for damages that result and any liability could exceed our insurance coverage and ability to pay. Any contamination or injury could also damage our reputation, which is critical to obtaining new business. In addition, we are subject to federal, state and local laws and regulations governing the use, storage, handling and disposal of these materials and specified waste products. The cost of compliance with these laws and regulations is significant and if changes are made to impose additional requirements, these costs could increase and have an adverse impact on our financial condition and results of operations.

Hardware or software failures, delays in the operations of our computer and communications systems or the failure to implement system enhancements could harm our business.

Our success depends on the efficient and uninterrupted operation of our computer and communications systems. A failure of our network or data gathering procedures could impede the processing of data, delivery of databases and services, client orders and day-to-day management of our business and could result in the corruption or loss of data. While all of our operations have disaster recovery plans in place, they might not adequately protect us. Despite any precautions we take, damage from fire, floods, hurricanes, power loss, telecommunications failures, computer viruses, break-ins and similar events at our computer facilities could result in interruptions in the flow of data to our servers and from our servers to our clients. In addition, any failure by our computer environment to provide our required data communications capacity could result in interruptions in our service. In the event of a delay in the delivery of data, we could be required to transfer our data collection operations to an alternative provider of server hosting services. Such a transfer could result in delays in our ability to deliver our products and services to our clients. Additionally, significant delays in the planned delivery of system enhancements, improvements and inadequate performance of the systems once they are completed could damage our reputation and harm our business. Finally, long-term disruptions in the infrastructure caused by events such as natural disasters, the outbreak of war, the escalation of hostilities and acts of terrorism, particularly involving cities in which we have offices, could adversely affect our businesses. Although we carry property and business interruption insurance, our coverage might not be adequate to compensate us for all losses that may occur.

We rely on third parties for important services.

We depend on third parties to provide us with services critical to our business. The failure of any of these third parties to adequately provide the needed services including, without limitation, licensed intellectual property rights, could have a material adverse effect on our business.

We license a significant portion of our intellectual property from third parties.

The Company has entered into a number of technology license agreements with various universities for the exclusive use of a significant portion of the patent-based intellectual property that the Company uses. Generally, the license agreements impose, and we expect that future license agreements will impose, various diligence, milestone payment, royalty and other obligations on us. If we fail to comply with our obligations under these agreements, or if we file for bankruptcy, we may be required to make certain payments to the licensor, we may lose the exclusivity of our license, or the licensor may have the right to terminate the license, in which event we would not be able to develop or market products covered by the license.