Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE ISSUED AUGUST 10, 2017 - INTERSECTIONS INC | p17-0165_ex991.htm |

| 8-K - CURRENT REPORT - INTERSECTIONS INC | p17-0165_8k.htm |

Exhibit 99.2

Second Quarter 2017 Investor Update

Forward-Looking Statements Statements in this release relating to future plans, results, performance, expectations, achievements and the like are considered “forward-looking statements” under the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,'' “plan,” “intend,” “believe,” “may,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. Those forward-looking statements involve known and unknown risks and uncertainties and are subject to change based on various factors and uncertainties that may cause actual results to differ materially from those expressed or implied by those statements, including the success of our strategic objectives; our ability to generate revenue from our partner sales strategy and business development pipeline with our distribution partners; the impact of shutting down and then divesting our Pet Health Monitoring segment; the timing and success of new product launches and other growth initiatives, including our new Identity Guard® with Watson™ product; the continuing impact of the regulatory environment on our business; the continued dependence on a small number of financial institutions for a majority of our revenue and to service our U.S. financial institution customer base; our ability to execute our strategy and previously announced transformation plan; our incurring additional restructuring charges; our incurring additional charges for non-income business taxes or otherwise, or impairment costs or charges on goodwill and/or other assets; our ability to control costs; our expectations about marketing and investment expenditures; our ability to maintain sufficient liquidity and produce sufficient cash flow to fund our business, growth strategy and debt service obligations; and our needs for additional capital to grow our business, including our ability to maintain compliance with the covenants under our term loan or seek additional sources of debt and/or equity financing. Factors and uncertainties that may cause actual results to differ include but are not limited to the risks disclosed under “Forward-Looking Statements,” “Item 1. Business—Government Regulation” and “Item 1A. Risk Factors” in the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and in its recent other filings with the U.S. Securities and Exchange Commission. The Company undertakes no obligation to revise or update any forward-looking statements unless required by applicable law. Please see the company’s release and website at www.intersections.com for additional details on quarterly results. 2

About Intersections Inc. YEAR ESTABLISHED1996 2016 REVENUE ...........................................................$176 MILLION PUBLICLY TRADED ON NASDAQ SINCE 2004 INTX CONSUMERS PROTECTED TO DATE47 MILLION Intersections Inc. provides innovative, information based solutions that help consumers manage risks and make better informed life decisions. Under its IDENTITY GUARD® brand and other brands, the company helps consumers monitor, manage and protect against the risks associated with their identities and personal information. HEADQUARTERS: Chantilly, Virginiawww.intersections.com. 3

Second Quarter Results 4

Revenue The 3.9% Identity Guard® revenue increase from the first quarter of 2017 was driven by growth in subscribers acquired during the first quarter of 2017. The decrease of 3.4% compared to the second quarter of 2016 was due to the loss of revenue from one of our partners, Costco, that is no longer marketing our products.Revenue from U.S. financial institution clients decreased at an average monthly rate of 0.8% per month in the second quarter ended June 30, 2017, which the Company believes is representative of normal attrition given the discontinuation of marketing and retention efforts for this subscriber population.Note (1): We periodically refine the criteria used to calculate and report our subscriber data. In the six months ended June 30, 2017, we determined that certain subscribers who receive our breach response services should no longer be included in the presentation of Identity Guard® subscribers or revenue due to the nonrecurring nature of our breach response services. For comparability, all periods presented have been recast to reflect this change in subscribers and revenue. 5

Subscribers The Identity Guard® subscriber base increased 3.8% in the first half of 2017 primarily in its direct to consumer channel. Subscribers acquired through our Canadian business marketing relationship were relatively consistent with the base as of March 31, 2017 and December 31, 2016.U.S. financial institution subscribers declined approximately 1% per month on average since December 31, 2016, a rate we believe continues to represent normal attrition.Note (1): We periodically refine the criteria used to calculate and report our subscriber data. In the six months ended June 30, 2017, we determined that certain subscribers who receive our breach response services should no longer be included in the presentation of Identity Guard® subscribers or revenue due to the nonrecurring nature of our breach response services. For comparability, all periods presented have been recast to reflect this change in subscribers and revenue. 6

Note (a): “Core Business” comprises all the business of Intersections Inc. with the exception of its Voyce business.Note (b): Adjusted EBITDA (loss) refers to adjusted EBITDA (loss) before share related compensation and non-cash impairment charges. See reconciliation of non-GAAP financial measures on slide 10 of this presentation. Financial Highlights Core Business income before income taxes was negatively impacted during the second quarter of 2017 by a $1.5 million non-cash loss on extinguishment of debt as a result of the term loan refinancing, and an increase of $1.0 million in the estimated liability for non-income business taxes and interest.Core Business Adjusted EBITDA for the quarter ended June 30, 2017 was negatively impacted by $800 thousand of the increase in the estimated liability for non-income business taxes. The decrease compared to the second quarter of 2016 is additionally caused by the negative impact of lower revenue primarily from our U.S. financial institution clients. 7

Financial Highlights Cash flows provided by (used in) operations for first and second quarters of 2017 include approximately $(1.4) million and $(500) thousand, respectively, to fund the wind down of the Voyce business.The Company began expanding its business development capabilities in 2016 to address market channel and distribution opportunities and continued the expansion of this team in the first six months of 2017. As a result, cash used in operating activities for the six month period includes approximately $2.4 million for Identity Guard business development activities, the significant majority of which is personnel cost. The Company expects to continue its spending on business development activities at approximately the same level for the remainder of 2017.Cash used in operating activities included $4.0 million and $1.3 million in the first and second quarters of 2017, respectively, for deferred subscription and solicitation costs related to our direct to consumer marketing, for a total of $5.3 million for the six month period. The Company implemented changes beginning in the second quarter to reduce the cash marketing spending in this channel and expects the use of cash for this purpose to continue to decline for the remainder of 2017.The Company continued to develop new product features primarily for the Identity Guard® with Watson™ platform during the six month period ended June 30, 2017. As a result, the Company invested approximately $1.6 million in internally developed capitalized software for the six month period. The Company expects to continue its investments in product development at approximately the same level for the remainder of 2017. 8

Outlook We will not recommence providing revenue and earnings guidance at this time, however, we offer the following comments regarding our view of directional indicators designed to achieve meaningful improvement in our financial results through 2018:We expect the run-off of our financial institution revenue to continue at approximately 1% per month through the end of 2017 and 2018.We expect revenue from our Identity Guard, Canadian, and Breach business lines to grow at a rate such that the total revenue generated by our identity theft protection services in the fourth quarter of 2017 will be consistent with our first quarter 2017 revenue, and begin to produce net growth in revenue during 2018.As a result of the changes made in how we market and acquire subscribers in our direct to consumer channels, we expect marketing expense to continue to decrease and be over $1.0 million lower in the fourth quarter of 2017 compared to the first quarter of 2017. We expect these changes to reduce our overall marketing expense in 2018 by approximately $6 million compared to 2017.We will continue to pursue cost control in our general and administrative expenses and expect to achieve modest overall reductions through 2018 while continuing to spend on business development activities at approximately the same level as the first six months of 2017 for at least the remainder of 2017. 9 These indicators are “forward-looking statements” under the Private Securities Litigation Reform Act of 1995, and speak only as of the date of this Investor Update. See “Forward-Looking Statements” on page 2 of this Investor Update and the other factors and risks disclosed in our SEC filings.

Reconciliation of Non-GAAP Financial Measures Please see notes on following page.Please see the company’s release and website at www.intersections.com for additional details on quarterly results. Reconciliation of consolidated adjusted EBITDA (loss) before share related compensation and non-cash impairment charges (“Adjusted EBITDA”)($ in thousands): 10

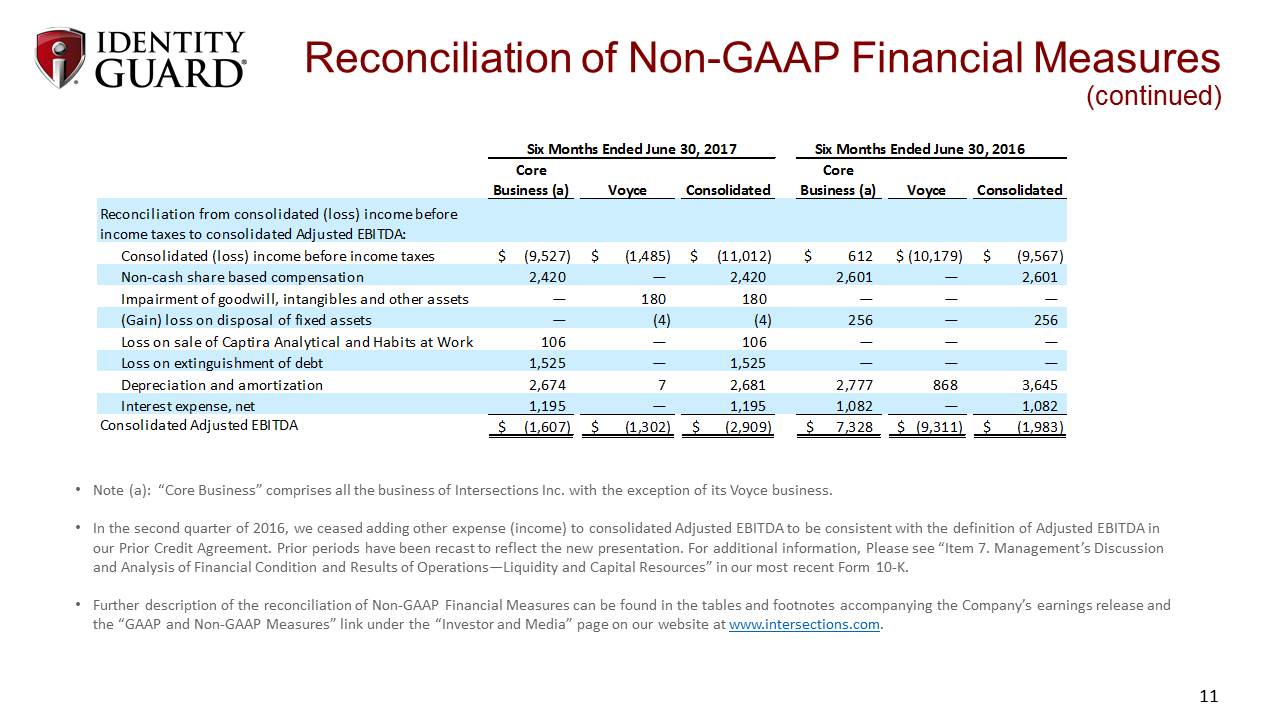

Reconciliation of Non-GAAP Financial Measures(continued) Note (a): “Core Business” comprises all the business of Intersections Inc. with the exception of its Voyce business.In the second quarter of 2016, we ceased adding other expense (income) to consolidated Adjusted EBITDA to be consistent with the definition of Adjusted EBITDA in our Prior Credit Agreement. Prior periods have been recast to reflect the new presentation. For additional information, Please see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources” in our most recent Form 10-K.Further description of the reconciliation of Non-GAAP Financial Measures can be found in the tables and footnotes accompanying the Company’s earnings release and the “GAAP and Non-GAAP Measures” link under the “Investor and Media” page on our website at www.intersections.com. 11

OVERVIEW The Market OpportunityThe Competition’s DNAA Distinctive Value PropositionA Tailored Value Chain 12

THE MARKET OPPORTUNITY 13

US DATA BREACHES ARE EXPLODING BREACHES SECURITY SPENDING PHISHING BILLION BILLION BILLIONESTIMATED 2016: 56% 2015:38% 1,093 14

DOUBLE-DIGIT INCREASES IN 2016 16millionvictimsin the USA 16%increaseover 2015 $16billoncost toconsumers 15

SOCIAL MEDIA VOLUME AND PENETRATION U.S. INTERNET USERSON FACEBOOK: 89%ON INSTAGRAM: 32% 3 Every minute on Facebook we collectively send over millionmessages 16

WHY SOCIAL AND CYBER BULLYING MONITORING MATTERS? Banks are using Alternate Scorecards with social media profiles for lending decisions Colleges are making admissions decisions based on social media Employers are hiring decisions based on social media profiles of applicants Suicide is 2nd ranking cause of death for individuals 15-24 years of age 1 2 3 4 Drapeau & McIntosh 2015- American Association of Suicidology (AAS) Study 17

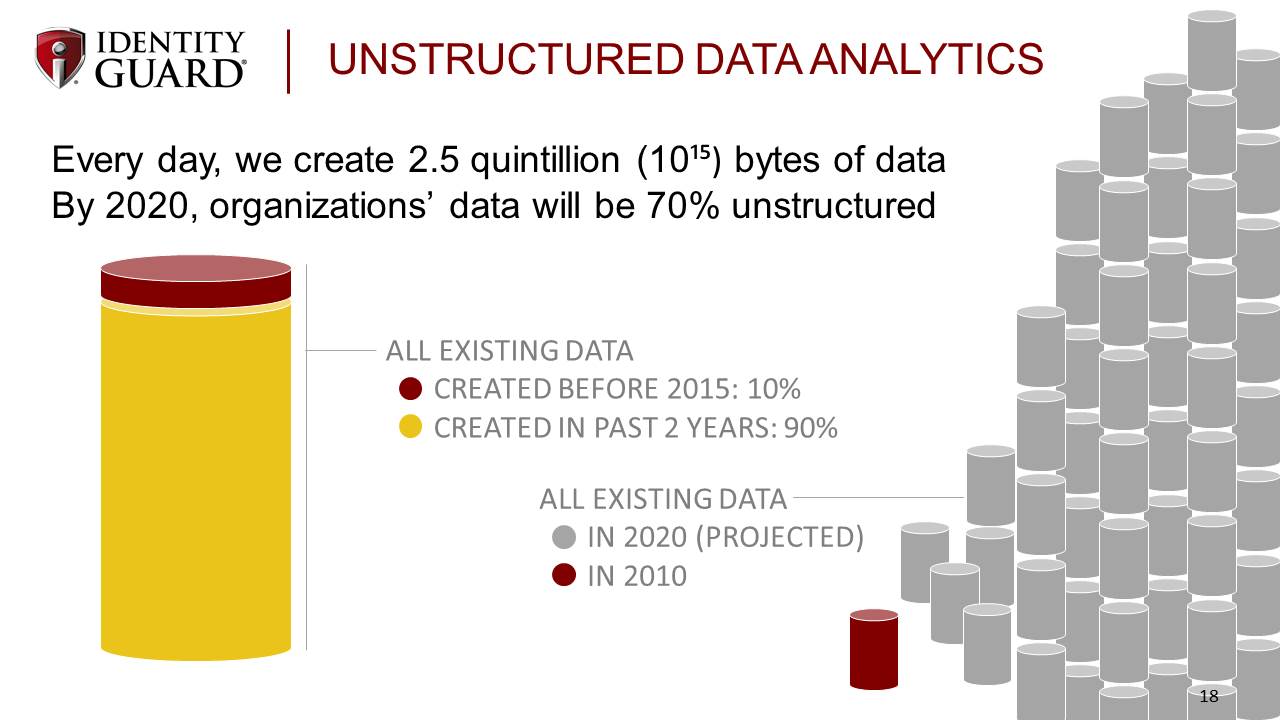

UNSTRUCTURED DATA ANALYTICS Every day, we create 2.5 quintillion (10¹⁵) bytes of dataBy 2020, organizations’ data will be 70% unstructured ALL EXISTING DATACREATED BEFORE 2015: 10%CREATED IN PAST 2 YEARS: 90% ALL EXISTING DATAIN 2020 (PROJECTED)IN 2010 18

THE COMPETITION’S DNA 19

¢ ¢ LOW-COST OPERATORExperianLimited, structured credit data analyticsFocused on Credit KarmaFree credit scoresGive away data for free HIGHLY EFFECTIVE MARKETERLifeLockBrand buildersExcessive marketing spendFocus on being acquiredSubscriber growth at all costsRestoration service with very little monitoring PRODUCT INNOVATORIdentity GuardExtensive monitoringEarly identification of fraudPrevention|Detection|Resolution 20

A DISTINCTIVE VALUE PROPOSITION 21

22

Identity Guard | With Watson Product Development Timeline Product development begins OCT2015 Public beta is launched OCT2016 JUL2017 OCT2017 V1 is launched 3 Tiers of service will be active 23

RISK ALERT TO MOBILE CONTENT ADVICE TO MEMBER AREA DATA MODEL STRUCTURED DATA FEEDS UNSTRUCTURED DATA FEEDS DARK WEBCREDIT MONITORINGBANK & FINANCE ACCOUNTSPUBLIC DATA NEWS DATASOCIAL MEDIA DATAINTERNET HISTORYGEO-LOCATION DATACYBER BEHAVIORJOB & REPUTATIONIoT DATA 24

SOCIAL INSIGHTS Connect Your Social Media activity says a lot about you. Having a Reputation Report provides a convenient way to identify potentially risky behavior so you can take action. Social Report 25

SOCIAL INSIGHTS Take Action Continuously searches for offensive or vulgar words and alerts you when found in your profile 26

CYBER BULLYING MONITORING MONITORING Actively monitors social media posts & replies. Posts alert 27

28

A TAILORED VALUE CHAIN 29

A TAILORED VALUE CHAIN Sophisticated and risk-averse consumers Fastest, most innovative, comprehensive monitoring Distribution built around large, complex partners Diversified structured and unstructured data sources World-class IT security and fulfillment compliance 30

2015 Best ID Protection Service in Kiplinger’s Personal Finance magazine’s The Best List. WE HAVE A RELENTLESS FOCUS ON DATA SECURITY 31

CONCLUDING REMARKS The market opportunity is growingThe competitive landscape is shrinkingOur new product and platform creates a distinctive value propositionOur tailored value chain is hard to copyThe opportunity to create shareholder value is measurable 32

Thank You 33 Corporate HeadquartersIntersections Inc.3901 Stonecroft BoulevardChantilly, VA 20151Toll-free: 800.695.7536www.intersections.com Investor RelationsRon Barden, CFO IR@intersections.com Tel: 703.488.6100