Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TESCO CORP | d442041d8k.htm |

| EX-99.4 - EX-99.4 - TESCO CORP | d442041dex994.htm |

| EX-99.3 - EX-99.3 - TESCO CORP | d442041dex993.htm |

| EX-99.1 - EX-99.1 - TESCO CORP | d442041dex991.htm |

| EX-2.1 - EX-2.1 - TESCO CORP | d442041dex21.htm |

August 14, 2017 Combining TESCO with Nabors Exhibit 99.2

Disclaimer Forward-Looking Statements Statements included in this presentation regarding the proposed transaction, benefits, expected synergies and other expense savings and operational and administrative efficiencies, opportunities, timing, expense and effects of the transaction, financial performance, accretion to discounted cash flows, revenue growth, future dividend levels, credit ratings or other attributes of Nabors Industries Ltd. (“Nabors”) following the completion of the transaction and other statements that are not historical facts, are forward-looking statements (including within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended) and Canadian securities laws. Forward-looking statements include words or phrases such as "anticipate," "believe," “contemplate,” "estimate," "expect," "intend," "plan," "project," "could," "may," "might," "should," "will" and words and phrases of similar import. These statements involve risks and uncertainties including, but not limited to, actions by regulatory authorities, rating agencies or other third parties, actions by the respective companies’ security holders, costs and difficulties related to integration of Tesco Corporation (“TESCO”), delays, costs and difficulties related to the transaction, market conditions, and Nabors’ financial results and performance following the completion of the transaction, satisfaction of closing conditions, ability to repay debt and timing thereof, availability and terms of any financing and other factors detailed in the risk factors section and elsewhere in Nabors’ and TESCO’s Annual Report on Form 10-K for the year ended December 31, 2016, and their respective other filings with the Securities and Exchange Commission (the "SEC"), which are available on the SEC’s website at www.sec.gov (and www.sedar.com in the case of TESCO). Should one or more of these risks or uncertainties materialize (or the other consequences of such a development worsen), or should underlying assumptions prove incorrect, actual outcomes may vary materially from those forecasted or expected. All information in this presentation is as of today. Except as required by law, both Nabors and TESCO disclaim any intention or obligation to update publicly or revise such statements, whether as a result of new information, future events or otherwise. Important Additional Information Regarding the Proposed Transaction This release does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of a vote or proxy. The proposed Transaction anticipates that the sale of Nabors shares will be exempt from registration under the Securities Act, pursuant to Section 3(a)(10) of the Securities Act. Consequently, the Nabors shares will not be registered under the Securities Act or any state securities laws. In connection with the proposed transactions, TESCO intends to file with the SEC a proxy statement in respect of the meeting of its shareholders to approve the Arrangement, and other relevant documents to be mailed by TESCO to its shareholders in connection with the Arrangement. TESCO’s proxy statement will also be filed with the Canadian securities regulators. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE PROXY STATEMENT AND ANY OTHER DOCUMENTS RELATED TO THE TRANSACTION WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION about TESCO, Nabors, and the proposed transactions. Investors and security holders will be able to obtain these materials (when they are available) and other documents filed with the SEC and the Canadian securities regulators free of charge at the SEC’s website, www.sec.gov and at the System for Electronic Document Analysis and Retrieval (SEDAR) maintained by the Canadian Securities Administrators at www.sedar.com. In addition, a copy of TESCO’s proxy statement (when it becomes available) may be obtained free of charge from TESCO’s investor relations website at http://www.tescocorp.com. Investors and security holders may also read and copy any reports, statements and other information filed by TESCO, with the SEC, at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room. Participants in the Solicitation TESCO and its directors, executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies for its security holder approvals to be obtained for the Transaction. Information regarding TESCO’s directors and executive officers is available in its proxy statement filed with the SEC by TESCO on March 27, 2017 in connection with its 2017 annual meeting of shareholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC and the Canadian securities regulators when they become available. This release shall not constitute an offer to sell or the solicitation of any offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

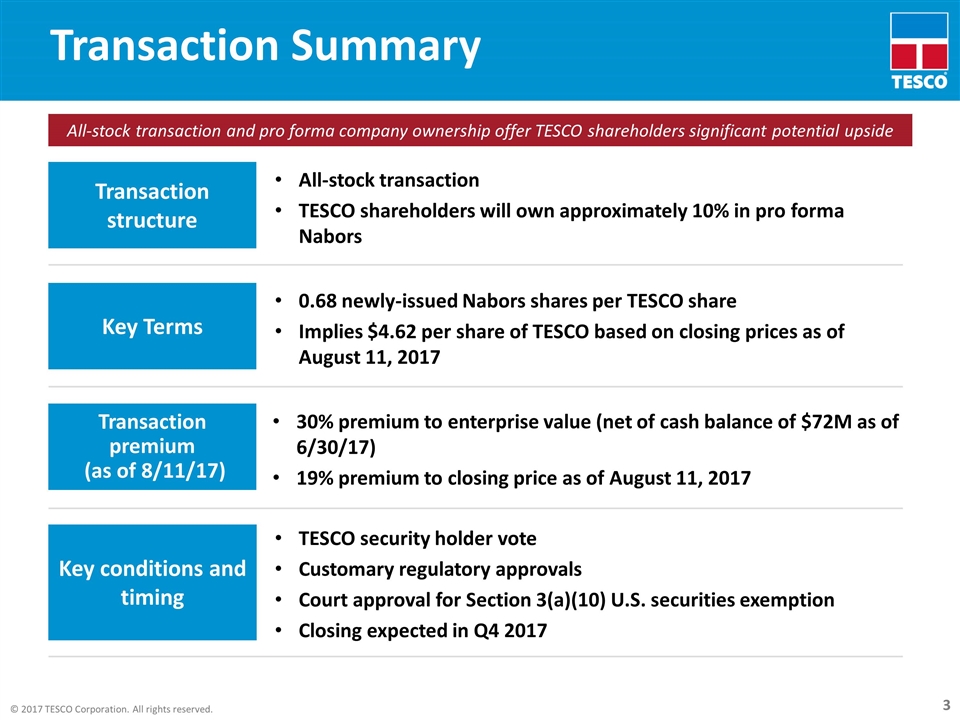

Transaction Summary All-stock transaction TESCO shareholders will own approximately 10% in pro forma Nabors Transaction structure 0.68 newly-issued Nabors shares per TESCO share Implies $4.62 per share of TESCO based on closing prices as of August 11, 2017 Key Terms 30% premium to enterprise value (net of cash balance of $72M as of 6/30/17) 19% premium to closing price as of August 11, 2017 Transaction premium (as of 8/11/17) Key conditions and timing TESCO security holder vote Customary regulatory approvals Court approval for Section 3(a)(10) U.S. securities exemption Closing expected in Q4 2017 All-stock transaction and pro forma company ownership offer TESCO shareholders significant potential upside

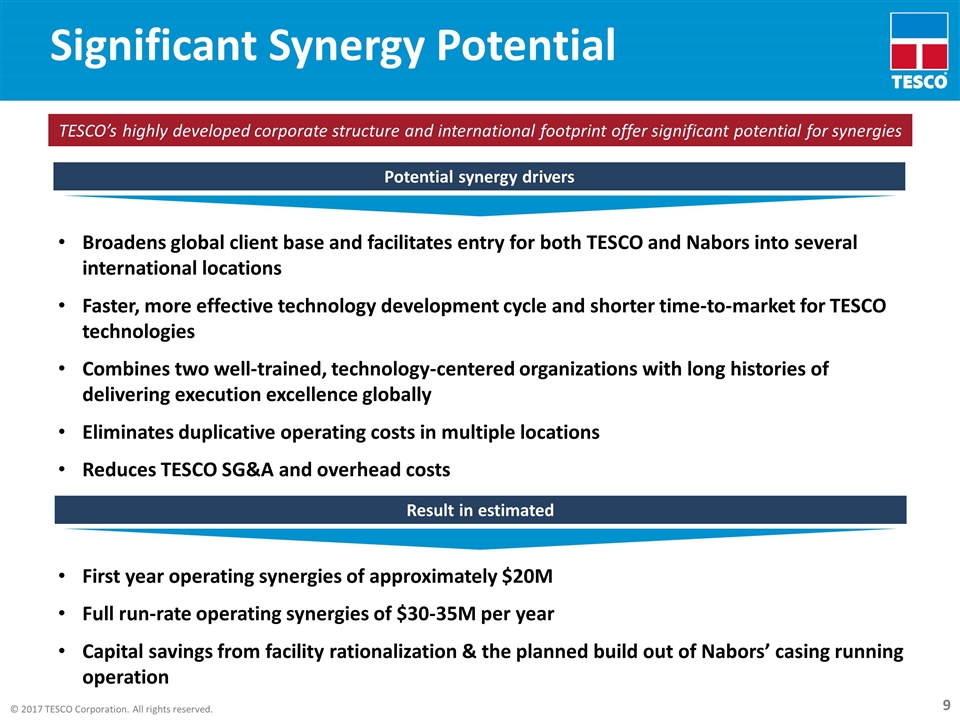

Compelling Rationale Creates a leading rig equipment and drilling automation provider Combines TESCO's rig equipment manufacturing, rental and aftermarket service business with Canrig, Nabors' rig equipment subsidiary Integrates TESCO's automated tubular services technologies into Nabors’ rigs and NDS service platform Results in the most complete drilling automation package in the industry Significant synergy potential Broadens global client base and facilitates entry for both TESCO and Nabors into several international locations Faster, more effective technology development cycle and shorter time-to-market for TESCO technologies Combines two well-trained, technology-centered organizations with long histories of delivering execution excellence globally Eliminates duplicative operating costs in multiple locations Reduces TESCO SG&A and overhead costs TESCO shareholders participate in the benefits of a larger platform and more integrated offering suite TESCO shareholders will have a meaningful ownership position in Nabors and continued exposure to an industry recovery Nabors’ large infrastructure provides TESCO with instant scale and speed

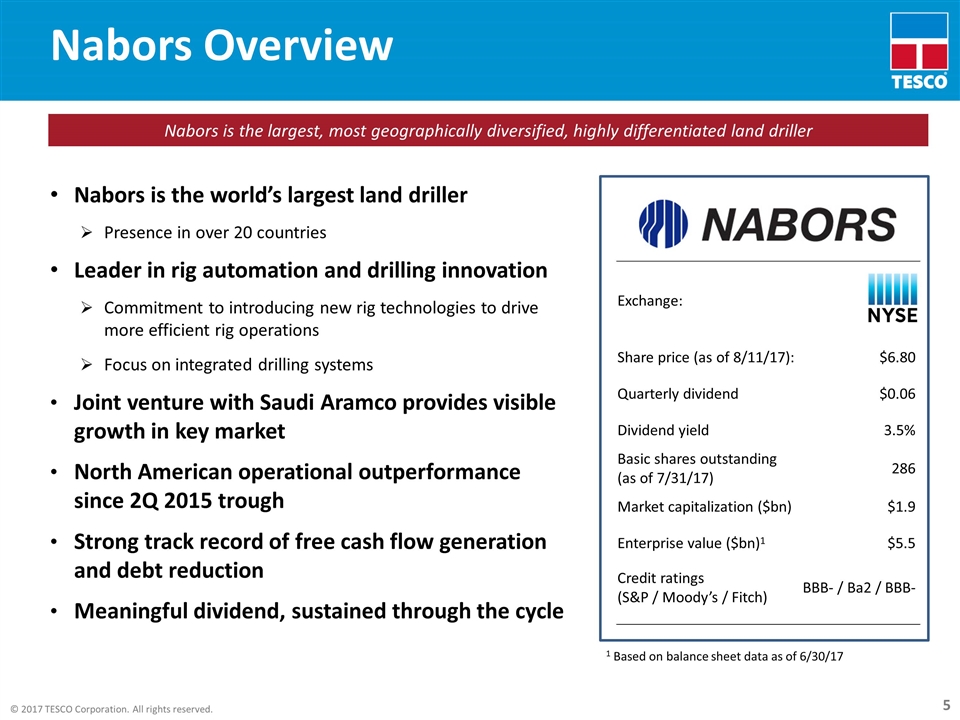

Exchange: Share price (as of 8/11/17): $6.80 Quarterly dividend $0.06 Dividend yield 3.5% Basic shares outstanding (as of 7/31/17) 286 Market capitalization ($bn) $1.9 Enterprise value ($bn)1 $5.5 Credit ratings (S&P / Moody’s / Fitch) BBB- / Ba2 / BBB- Nabors Overview Nabors is the world’s largest land driller Presence in over 20 countries Leader in rig automation and drilling innovation Commitment to introducing new rig technologies to drive more efficient rig operations Focus on integrated drilling systems Joint venture with Saudi Aramco provides visible growth in key market North American operational outperformance since 2Q 2015 trough Strong track record of free cash flow generation and debt reduction Meaningful dividend, sustained through the cycle Nabors is the largest, most geographically diversified, highly differentiated land driller 1 Based on balance sheet data as of 6/30/17

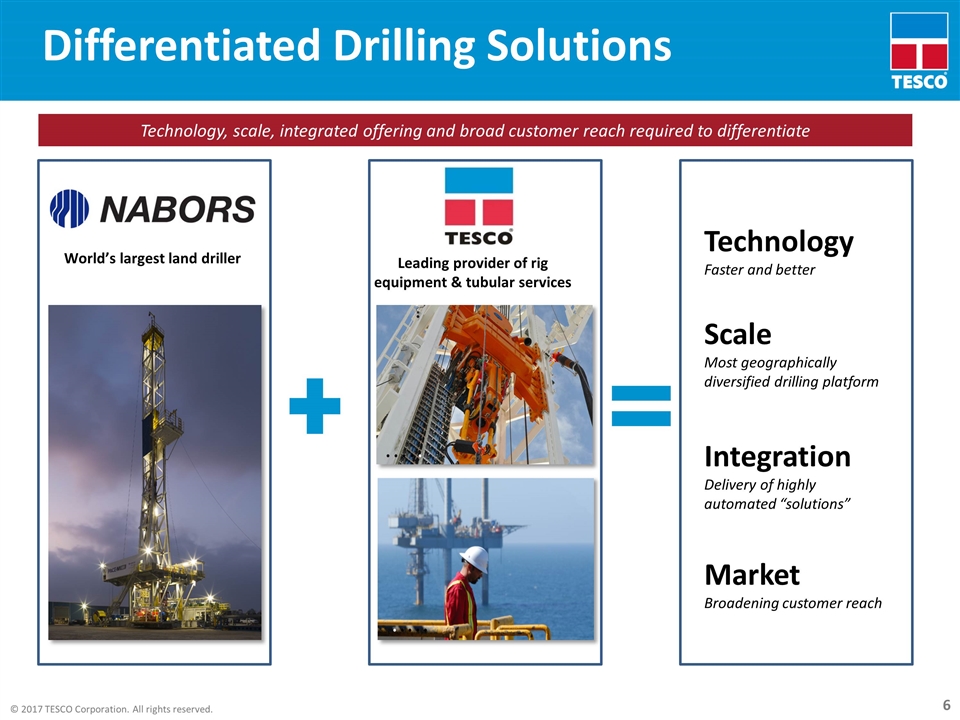

= Differentiated Drilling Solutions World’s largest land driller Technology Faster and better Scale Most geographically diversified drilling platform Integration Delivery of highly automated “solutions” Market Broadening customer reach Leading provider of rig equipment & tubular services Technology, scale, integrated offering and broad customer reach required to differentiate

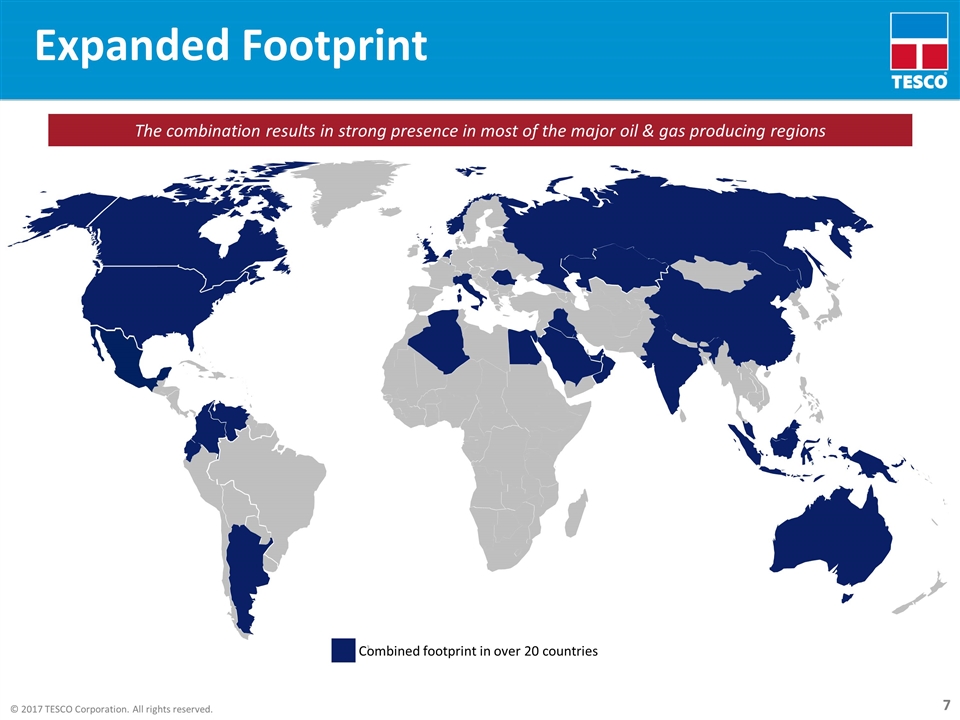

Expanded Footprint Combined footprint in over 20 countries The combination results in strong presence in most of the major oil & gas producing regions

Increased Customer Reach Select Nabors Customers Select TESCO Customers Utilize customer relationships to: Offer broader, more differentiated drilling solutions Sell additional products and services to existing customers Enhance customer technical and commercial support High quality clients with little overlap provide significantly expanded access to market

Significant Synergy Potential Broadens global client base and facilitates entry for both TESCO and Nabors into several international locations Faster, more effective technology development cycle and shorter time-to-market for TESCO technologies Combines two well-trained, technology-centered organizations with long histories of delivering execution excellence globally Eliminates duplicative operating costs in multiple locations Reduces TESCO SG&A and overhead costs Potential synergy drivers First year operating synergies of approximately $20M Full run-rate operating synergies of $30-35M per year Capital savings from facility rationalization & the planned build out of Nabors’ casing running operation TESCO’s highly developed corporate structure and international footprint offer significant potential for synergies Result in estimated

Next Steps Regulatory Required anti-trust filings Customary regulatory approvals Court approval for Section 3(a)(10) U.S. securities exemption TESCO security holder vote Anticipated closing: Q4 2017

Combining TESCO with Nabors