Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Great Elm Capital Corp. | gecc-ex991_6.htm |

| 8-K - 14 AUG 17 8-K - Great Elm Capital Corp. | gecc-8k_20170814.htm |

Great Elm Capital Corp. (NASDAQ: GECC) Investor Presentation – Quarter Ended June 30, 2017 Exhibit 99.2 © 2017 Great Elm Capital Corp. August 14, 2017

© 2017 Great Elm Capital Corp. Disclaimer Statements in this communication that are not historical facts are “forward-looking” statements within the meaning of the federal securities laws. These statements are often, but not always, made through the use of words or phrases such as “believe,” “expect,” “anticipate,” “should,” “planned,” “will,” “may,” “intend,” “estimated,” “aim,” “target,” “opportunity,” “sustained,” “positioning,” “designed,” “create,” “seek,” “would,” “could”, “potential,” “continue,” “ongoing,” “upside,” “increases,” and “potential,” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed in the statements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are the following: conditions in the credit markets, the price of GECC common stock, performance of GECC’s portfolio and investment manager. Additional information concerning these and other factors can be found in GECC’s Form 10-K and other reports filed with the SEC. GECC assumes no obligation to, and expressly disclaims any duty to, update any forward-looking statements contained in this communication or to conform prior statements to actual results or revised expectations except as required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. You should consider the investment objective, risks, charges and expenses of GECC carefully before investing. GECC’s filings with the SEC contain this and other information about GECC and are available by contacting GECC at the phone number and address at the end of this presentation. These documents should be read and considered carefully before investing. The performance, distribution and financial data contained herein represent past performance, distributions and results and neither guarantees nor is indicative of future performance, distributions or results. Investment return and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than the original cost. GECC’s market price and net asset value will fluctuate with market conditions. Current performance may be lower or higher than the performance data quoted. All information and data, including portfolio holdings and performance characteristics, is as of June 30, 2017, unless otherwise noted, and is subject to change. This presentation does not constitute an offer of any securities for sale.

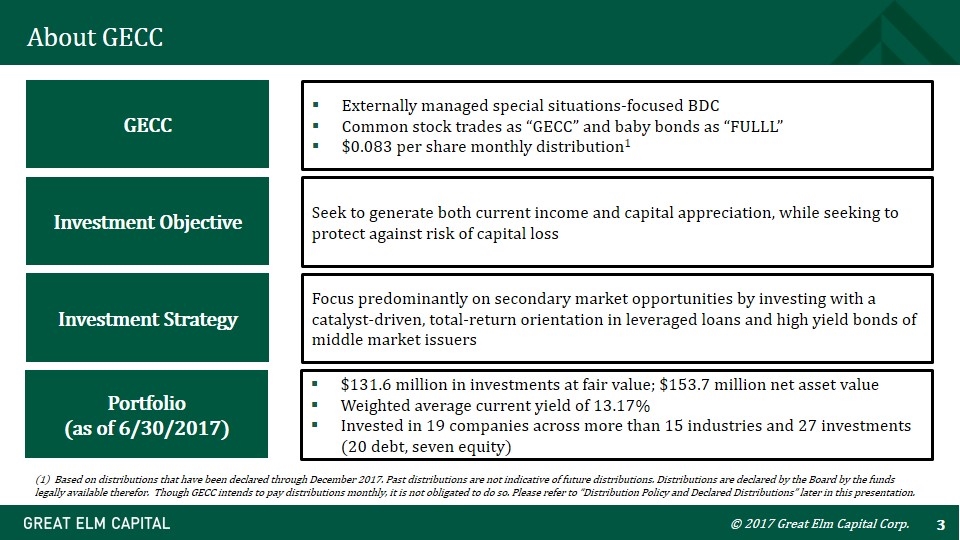

© 2017 Great Elm Capital Corp. About GECC GECC Investment Objective Investment Strategy Externally managed special situations-focused BDC Common stock trades as “GECC” and baby bonds as “FULLL” $0.083 per share monthly distribution1 Seek to generate both current income and capital appreciation, while seeking to protect against risk of capital loss Focus predominantly on secondary market opportunities by investing with a catalyst-driven, total-return orientation in leveraged loans and high yield bonds of middle market issuers Portfolio (as of 6/30/2017) $131.6 million in investments at fair value; $153.7 million net asset value Weighted average current yield of 13.17% Invested in 19 companies across more than 15 industries and 27 investments (20 debt, seven equity) (1) Based on distributions that have been declared through December 2017. Past distributions are not indicative of future distributions. Distributions are declared by the Board by the funds legally available therefor. Though GECC intends to pay distributions monthly, it is not obligated to do so. Please refer to “Distribution Policy and Declared Distributions” later in this presentation.

© 2017 Great Elm Capital Corp. Realized Investments (through August 11, 2017) Past performance is not indicative of future results. It should not be assumed that the realization of other positions will be profitable or equal the performance of the positions realized in the quarter ended June 30, 2017 and the partial quarter reported through August 11, 2017. Because we focus on a catalyst-driven, special situations investment approach, results will vary from period to period and it should not be assumed that results attained in any one period will be replicated. Please refer to “Disclaimer” at the beginning of this presentation.

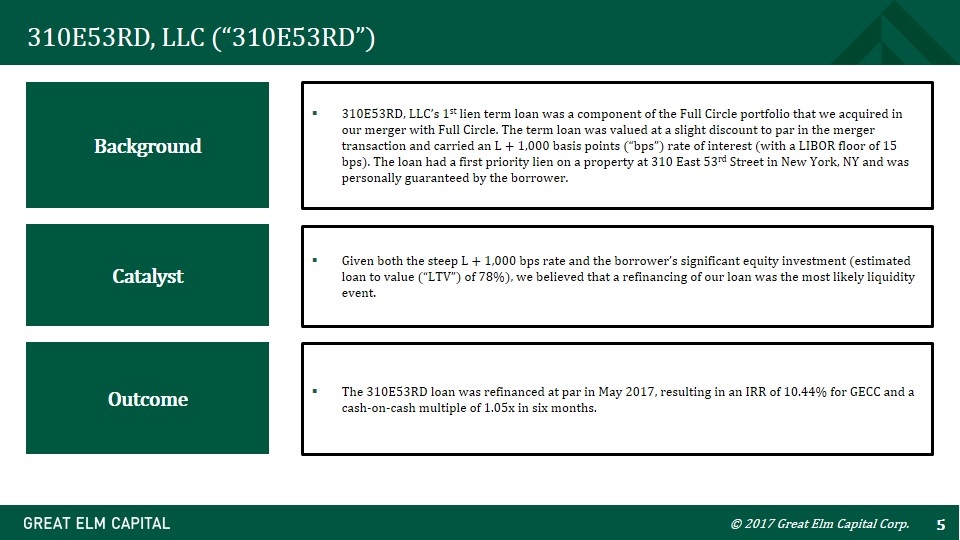

© 2017 Great Elm Capital Corp. Background Catalyst Outcome 310E53RD, LLC’s 1st lien term loan was a component of the Full Circle portfolio that we acquired in our merger with Full Circle. The term loan was valued at a slight discount to par in the merger transaction and carried an L + 1,000 basis points (“bps”) rate of interest (with a LIBOR floor of 15 bps). The loan had a first priority lien on a property at 310 East 53rd Street in New York, NY and was personally guaranteed by the borrower. Given both the steep L + 1,000 bps rate and the borrower’s significant equity investment (estimated loan to value (“LTV”) of 78%), we believed that a refinancing of our loan was the most likely liquidity event. The 310E53RD loan was refinanced at par in May 2017, resulting in an IRR of 10.44% for GECC and a cash-on-cash multiple of 1.05x in six months. 310E53RD, LLC (“310E53RD”)

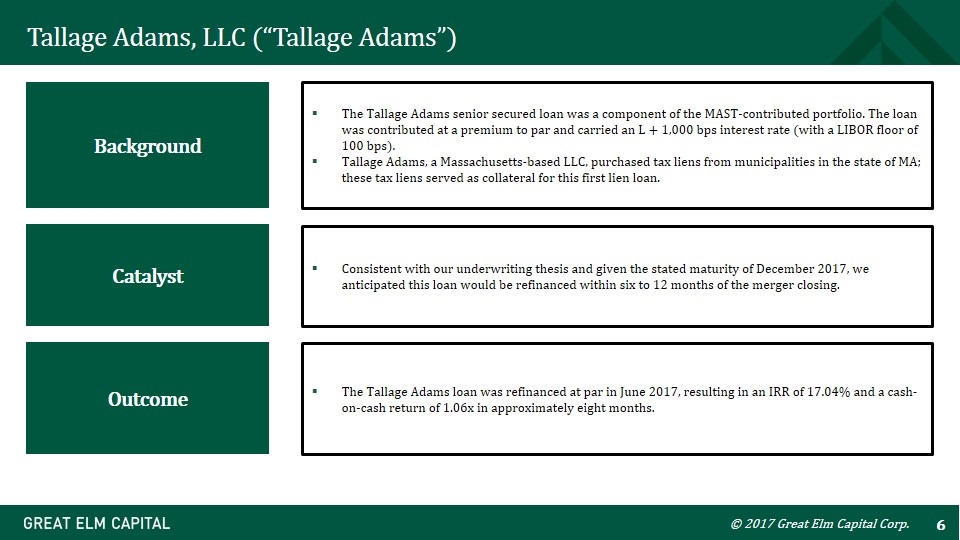

© 2017 Great Elm Capital Corp. Outcome The Tallage Adams senior secured loan was a component of the MAST-contributed portfolio. The loan was contributed at a premium to par and carried an L + 1,000 bps interest rate (with a LIBOR floor of 100 bps). Tallage Adams, a Massachusetts-based LLC, purchased tax liens from municipalities in the state of MA; these tax liens served as collateral for this first lien loan. Consistent with our underwriting thesis and given the stated maturity of December 2017, we anticipated this loan would be refinanced within six to 12 months of the merger closing. The Tallage Adams loan was refinanced at par in June 2017, resulting in an IRR of 17.04% and a cash-on-cash return of 1.06x in approximately eight months. Tallage Adams, LLC (“Tallage Adams”) Catalyst Background

© 2017 Great Elm Capital Corp. Financial & Portfolio Review (Quarter Ended 6/30/2017)

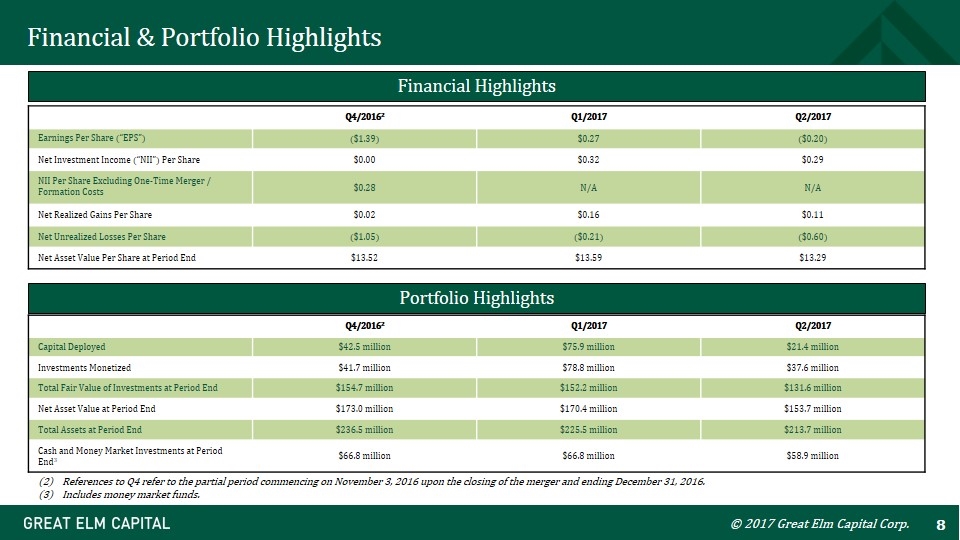

© 2017 Great Elm Capital Corp. Financial & Portfolio Highlights Q4/20162 Q1/2017 Q2/2017 Earnings Per Share (“EPS”) ($1.39) $0.27 ($0.20) Net Investment Income (“NII”) Per Share $0.00 $0.32 $0.29 NII Per Share Excluding One-Time Merger / Formation Costs $0.28 N/A N/A Net Realized Gains Per Share $0.02 $0.16 $0.11 Net Unrealized Losses Per Share ($1.05) ($0.21) ($0.60) Net Asset Value Per Share at Period End $13.52 $13.59 $13.29 Financial Highlights Q4/20162 Q1/2017 Q2/2017 Capital Deployed $42.5 million $75.9 million $21.4 million Investments Monetized $41.7 million $78.8 million $37.6 million Total Fair Value of Investments at Period End $154.7 million $152.2 million $131.6 million Net Asset Value at Period End $173.0 million $170.4 million $153.7 million Total Assets at Period End $236.5 million $225.5 million $213.7 million Cash and Money Market Investments at Period End3 $66.8 million $66.8 million $58.9 million Portfolio Highlights References to Q4 refer to the partial period commencing on November 3, 2016 upon the closing of the merger and ending December 31, 2016. Includes money market funds.

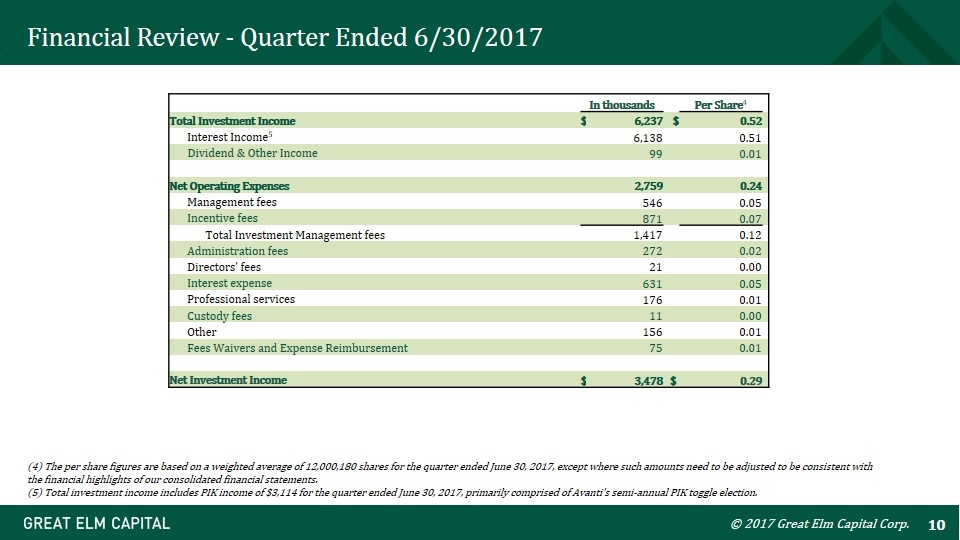

© 2017 Great Elm Capital Corp. Financial Review Total investment income for the quarter ended June 30, 2017 was approximately $6.2 million, or $0.52 per share Net expenses for the quarter ended June 30, 2017 were approximately $2.8 million, or $0.24 per share Net investment income for the quarter ended June 30, 2017 was approximately $3.5 million, or $0.29 per share Net realized gains for the quarter ended June 30, 2017 were approximately $1.4 million, or $0.11 per share Net unrealized depreciation of investments for the quarter ended June 30, 2017 was approximately ($7.3) million, or ($0.60) per share

© 2017 Great Elm Capital Corp. Financial Review - Quarter Ended 6/30/2017 In thousands Per Share4 Total Investment Income $ 6,237 $ 0.52 Interest Income5 6,138 0.51 Dividend & Other Income 99 0.01 Net Operating Expenses 2,759 0.24 Management fees 546 0.05 Incentive fees 871 0.07 Total Investment Management fees 1,417 0.12 Administration fees 272 0.02 Directors’ fees 21 0.00 Interest expense 631 0.05 Professional services 176 0.01 Custody fees 11 0.00 Other 156 0.01 Fees Waivers and Expense Reimbursement 75 0.01 Net Investment Income $ 3,478 $ 0.29 (4) The per share figures are based on a weighted average of 12,000,180 shares for the quarter ended June 30, 2017, except where such amounts need to be adjusted to be consistent with the financial highlights of our consolidated financial statements. (5) Total investment income includes PIK income of $3,114 for the quarter ended June 30, 2017, primarily comprised of Avanti’s semi-annual PIK toggle election.

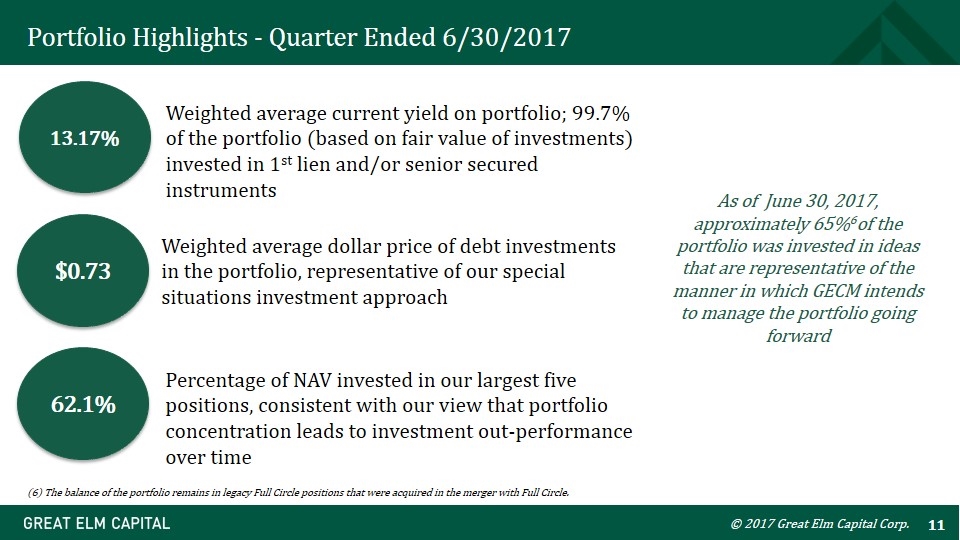

© 2017 Great Elm Capital Corp. Portfolio Highlights - Quarter Ended 6/30/2017 13.17% Weighted average current yield on portfolio; 99.7% of the portfolio (based on fair value of investments) invested in 1st lien and/or senior secured instruments 62.1% Percentage of NAV invested in our largest five positions, consistent with our view that portfolio concentration leads to investment out-performance over time $0.73 Weighted average dollar price of debt investments in the portfolio, representative of our special situations investment approach As of June 30, 2017, approximately 65%6of the portfolio was invested in ideas that are representative of the manner in which GECM intends to manage the portfolio going forward (6) The balance of the portfolio remains in legacy Full Circle positions that were acquired in the merger with Full Circle.

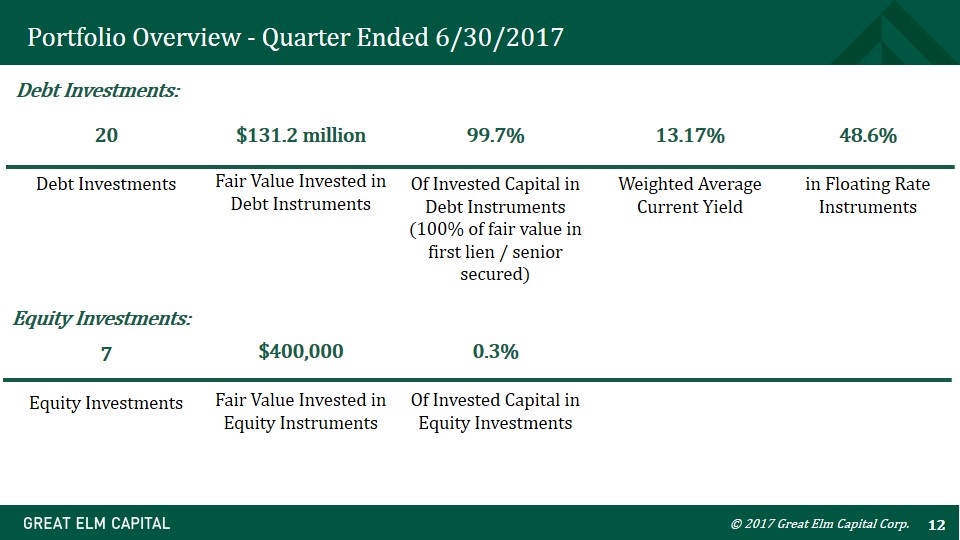

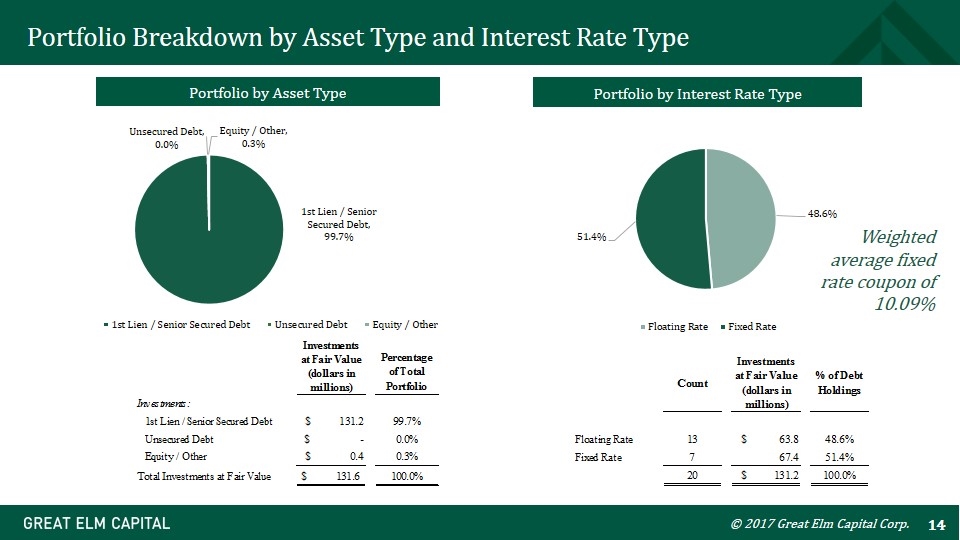

© 2017 Great Elm Capital Corp. Portfolio Overview - Quarter Ended 6/30/2017 20 Debt Investments $131.2 million Fair Value Invested in Debt Instruments 48.6% in Floating Rate Instruments 13.17% Weighted Average Current Yield 99.7% Of Invested Capital in Debt Instruments (100% of fair value in first lien / senior secured) 7 Equity Investments $400,000 Fair Value Invested in Equity Instruments Debt Investments: Equity Investments: 0.3% Of Invested Capital in Equity Investments

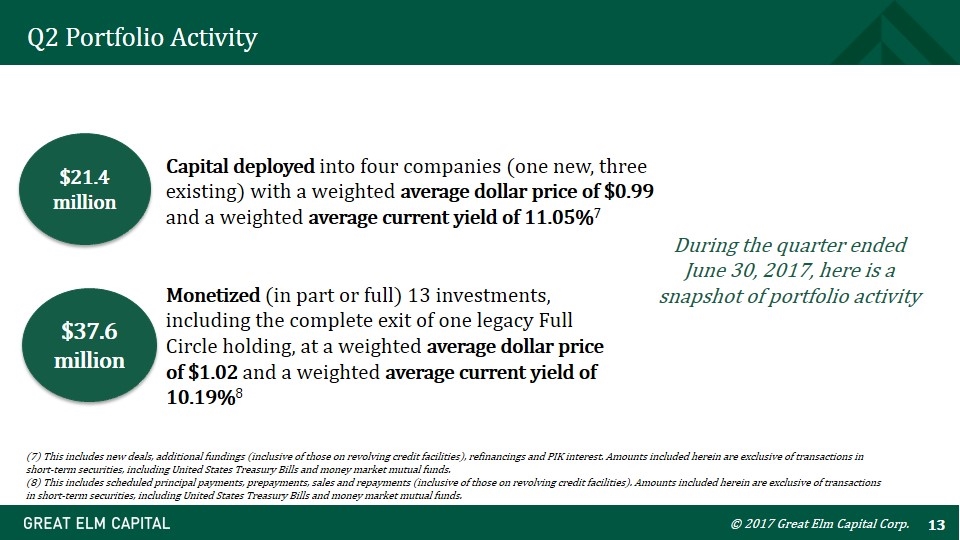

© 2017 Great Elm Capital Corp. Q2 Portfolio Activity $21.4 million Capital deployed into four companies (one new, three existing) with a weighted average dollar price of $0.99 and a weighted average current yield of 11.05%7 $37.6 million Monetized (in part or full) 13 investments, including the complete exit of one legacy Full Circle holding, at a weighted average dollar price of $1.02 and a weighted average current yield of 10.19%8 During the quarter ended June 30, 2017, here is a snapshot of portfolio activity (7) This includes new deals, additional fundings (inclusive of those on revolving credit facilities), refinancings and PIK interest. Amounts included herein are exclusive of transactions in short-term securities, including United States Treasury Bills and money market mutual funds. (8) This includes scheduled principal payments, prepayments, sales and repayments (inclusive of those on revolving credit facilities). Amounts included herein are exclusive of transactions in short-term securities, including United States Treasury Bills and money market mutual funds.

© 2017 Great Elm Capital Corp. Portfolio Breakdown by Asset Type and Interest Rate Type Portfolio by Asset Type Portfolio by Interest Rate Type Weighted average fixed rate coupon of 10.09%

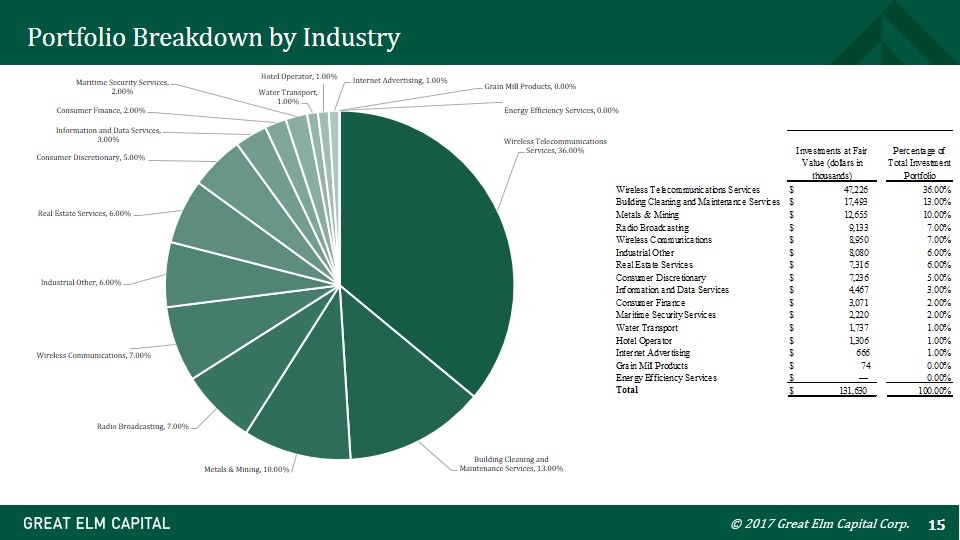

© 2017 Great Elm Capital Corp. Portfolio Breakdown by Industry

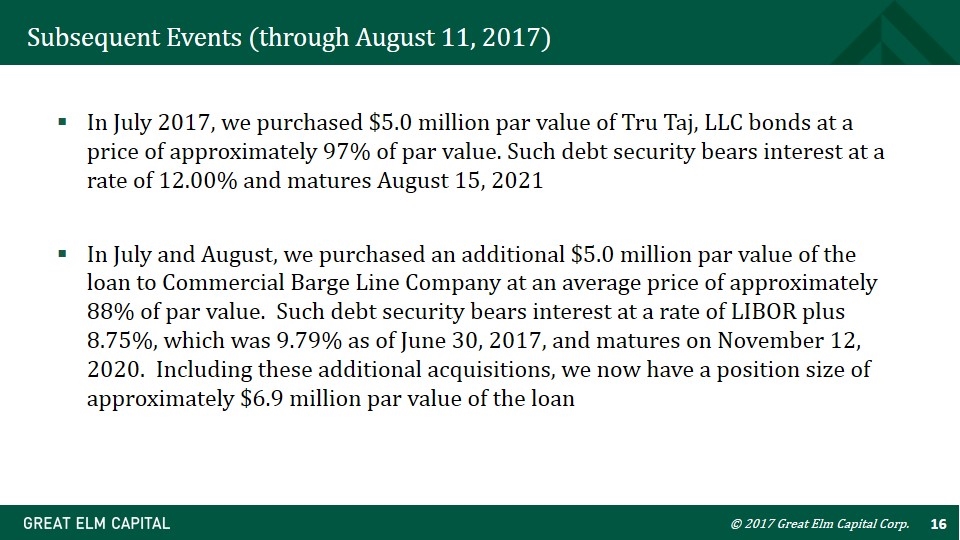

Subsequent Events (through August 11, 2017) In July 2017, we purchased $5.0 million par value of Tru Taj, LLC bonds at a price of approximately 97% of par value. Such debt security bears interest at a rate of 12.00% and matures August 15, 2021 In July and August, we purchased an additional $5.0 million par value of the loan to Commercial Barge Line Company at an average price of approximately 88% of par value. Such debt security bears interest at a rate of LIBOR plus 8.75%, which was 9.79% as of June 30, 2017, and matures on November 12, 2020. Including these additional acquisitions, we now have a position size of approximately $6.9 million par value of the loan © 2017 Great Elm Capital Corp.

© 2017 Great Elm Capital Corp. Capital Activity

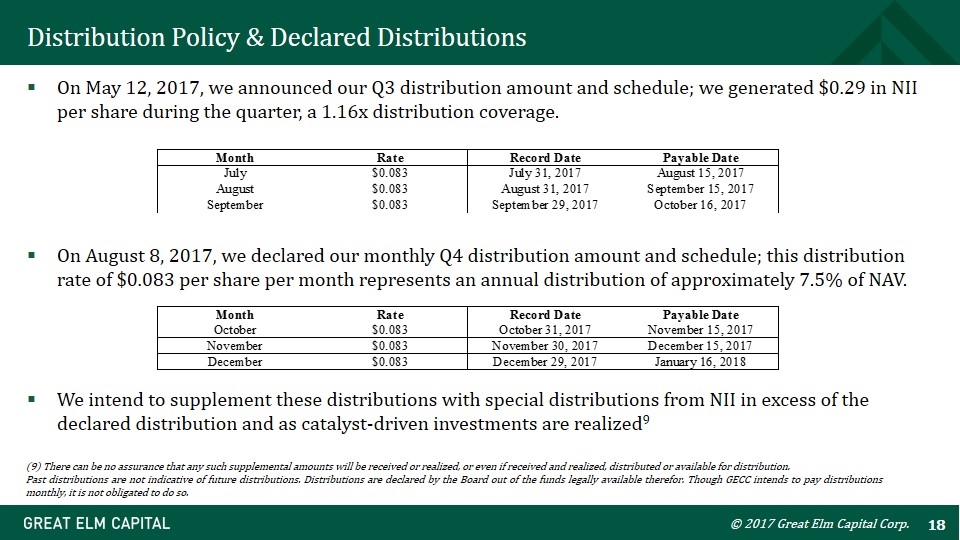

© 2017 Great Elm Capital Corp. Distribution Policy & Declared Distributions On May 12, 2017, we announced our Q3 distribution amount and schedule; we generated $0.29 in NII per share during the quarter, a 1.16x distribution coverage. On August 8, 2017, we declared our monthly Q4 distribution amount and schedule; this distribution rate of $0.083 per share per month represents an annual distribution of approximately 7.5% of NAV. We intend to supplement these distributions with special distributions from NII in excess of the declared distribution and as catalyst-driven investments are realized9 (9) There can be no assurance that any such supplemental amounts will be received or realized, or even if received and realized, distributed or available for distribution. Past distributions are not indicative of future distributions. Distributions are declared by the Board out of the funds legally available therefor. Though GECC intends to pay distributions monthly, it is not obligated to do so.

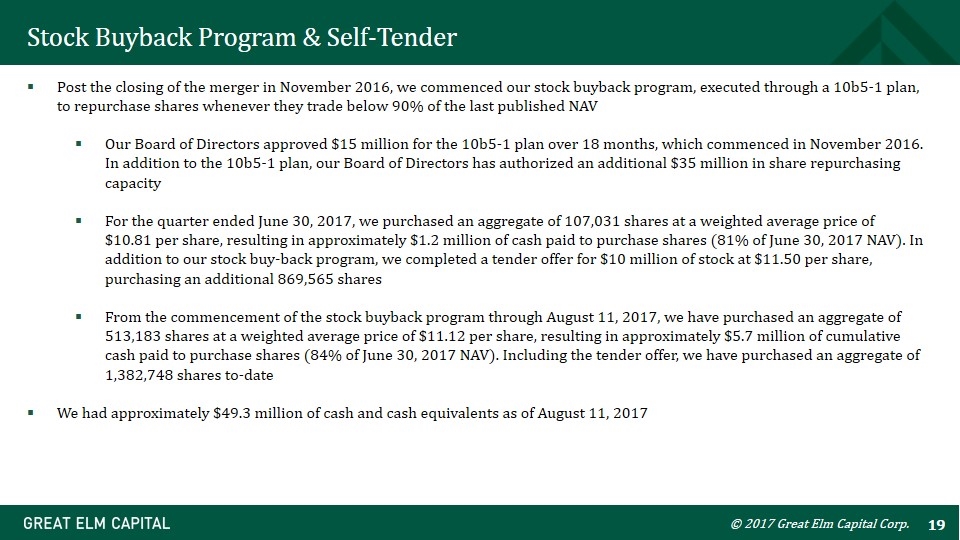

© 2017 Great Elm Capital Corp. Stock Buyback Program & Self-Tender Post the closing of the merger in November 2016, we commenced our stock buyback program, executed through a 10b5-1 plan, to repurchase shares whenever they trade below 90% of the last published NAV Our Board of Directors approved $15 million for the 10b5-1 plan over 18 months, which commenced in November 2016. In addition to the 10b5-1 plan, our Board of Directors has authorized an additional $35 million in share repurchasing capacity For the quarter ended June 30, 2017, we purchased an aggregate of 107,031 shares at a weighted average price of $10.81 per share, resulting in approximately $1.2 million of cash paid to purchase shares (81% of June 30, 2017 NAV). In addition to our stock buy-back program, we completed a tender offer for $10 million of stock at $11.50 per share, purchasing an additional 869,565 shares From the commencement of the stock buyback program through August 11, 2017, we have purchased an aggregate of 513,183 shares at a weighted average price of $11.12 per share, resulting in approximately $5.7 million of cumulative cash paid to purchase shares (84% of June 30, 2017 NAV). Including the tender offer, we have purchased an aggregate of 1,382,748 shares to-date We had approximately $49.3 million of cash and cash equivalents as of August 11, 2017

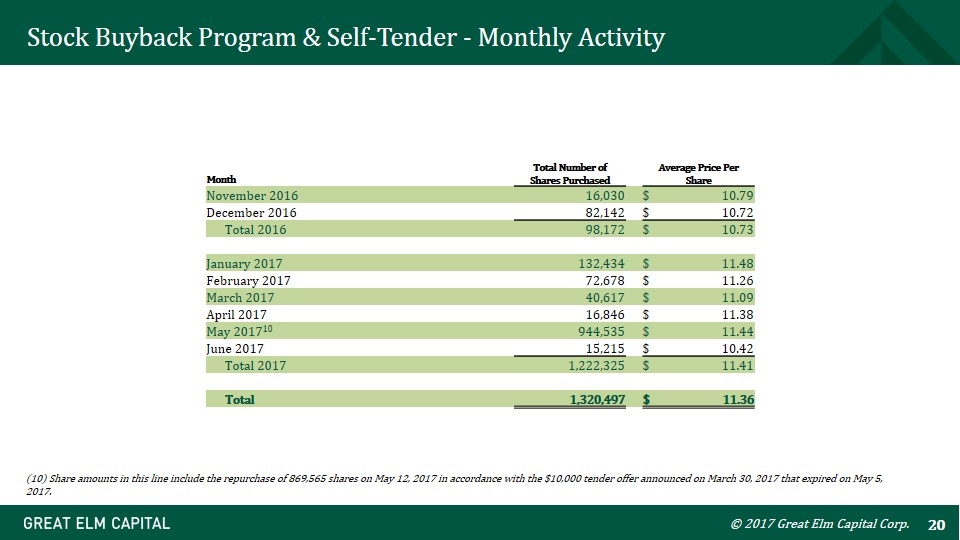

© 2017 Great Elm Capital Corp. Stock Buyback Program & Self-Tender - Monthly Activity Month Total Number of Shares Purchased Average Price Per Share November 2016 16,030 $ 10.79 December 2016 82,142 $ 10.72 Total 2016 98,172 $ 10.73 January 2017 132,434 $ 11.48 February 2017 72,678 $ 11.26 March 2017 40,617 $ 11.09 April 2017 16,846 $ 11.38 May 201710 944,535 $ 11.44 June 2017 15,215 $ 10.42 Total 2017 1,222,325 $ 11.41 Total 1,320,497 $ 11.36 (10) Share amounts in this line include the repurchase of 869,565 shares on May 12, 2017 in accordance with the $10,000 tender offer announced on March 30, 2017 that expired on May 5, 2017.

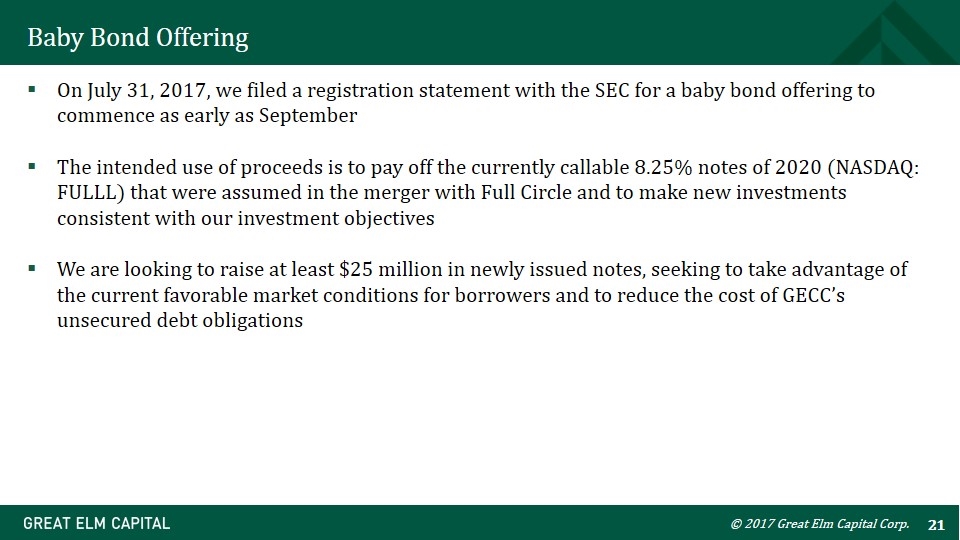

© 2017 Great Elm Capital Corp. Baby Bond Offering On July 31, 2017, we filed a registration statement with the SEC for a baby bond offering to commence as early as September The intended use of proceeds is to pay off the currently callable 8.25% notes of 2020 (NASDAQ: FULLL) that were assumed in the merger with Full Circle and to make new investments consistent with our investment objectives We are looking to raise at least $25 million in newly issued notes, seeking to take advantage of the current favorable market conditions for borrowers and to reduce the cost of GECC’s unsecured debt obligations

Contact Information © 2017 Great Elm Capital Corp. Investor Relations Meaghan K. Mahoney Senior Vice President 800 South Street, Suite 230 Waltham, MA 02453 Phone: +1 (617) 375-3006 investorrelations@greatelmcap.com

© 2017 Great Elm Capital Corp. Appendix: General Risks Debt instruments are subject to credit and interest rate risks. Credit risk refers to the likelihood that an obligor will default in the payment of principal or interest on an instrument. Financial strength and solvency of an obligor are the primary factors influencing credit risk. In addition, lack or inadequacy of collateral or credit enhancement for a debt instrument may affect its credit risk. Credit risk may change over the life of an instrument and debt instrument that are rated by rating agencies are often reviewed and may be subject to downgrade. Our debt investments either are, or if rated would be, rated below investment grade by independent rating agencies. These “junk bonds” and “leveraged loans” are regarded as having predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may be illiquid and difficult to value and typically do not require repayment of principal before maturity, which potentially heightens the risk that we may lose all or part of our investment. Interest rate risk refers to the risks associated with market changes in interest rates. Interest rate changes may affect the value of a debt instrument indirectly (especially in the case of fixed rate obligations) or directly (especially in the case of instrument whose rates are adjustable). In general, rising interest rates will negatively impact the price of a fixed rate debt instrument and falling interest rates will have a positive effect on price. Adjustable rate instruments also react to interest rate changes in a similar manner although generally to a lesser degree (depending, however, on the characteristics of the reset terms, including the index chosen, frequency of reset and reset caps or floors, among other factors). GECC utilizes leverage to seek to enhance the yield and net asset value of its common stock. These objectives will not necessarily be achieved in all interest rate environments. The use of leverage involves risk, including the potential for higher volatility and greater declines of GECC’s net asset value, fluctuations of dividends and other distributions paid by GECC and the market price of GECC’s common stock, among others. The amount of leverage that GECC may employ at any particular time will depend on, among other things, our Board’s and our adviser’s assessment of market and other factors at the time of any proposed borrowing. As part of our lending activities, we may purchase notes or make loans to companies that are experiencing significant financial or business difficulties, including companies involved in bankruptcy or other reorganization and liquidation proceedings. Although the terms of such financings may result in significant financial returns to us, they involve a substantial degree of risk. The level of analytical sophistication, both financial and legal, necessary for successful financing to companies experiencing significant business and financial difficulties is unusually high. We cannot assure you that we will correctly evaluate the value of the assets collateralizing our investments or the prospects for a successful reorganization or similar action. In any reorganization or liquidation proceeding relating to a portfolio company, we may lose all or part of the amounts advanced to the borrower or may be required to accept collateral with a value less than the amount of the investment advanced by us to the borrower.