Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - BeiGene, Ltd. | a17-19943_1ex99d4.htm |

| 8-K - 8-K - BeiGene, Ltd. | a17-19943_18k.htm |

| EX-99.2 - EX-99.2 - BeiGene, Ltd. | a17-19943_1ex99d2.htm |

| EX-99.1 - EX-99.1 - BeiGene, Ltd. | a17-19943_1ex99d1.htm |

Exhibit 99.3

Company Overview

We are a globally focused, clinical-stage biopharmaceutical company dedicated to becoming a leader in the discovery, development and commercialization of innovative, molecularly targeted and immuno-oncology drugs for the treatment of cancer. We believe the next generation of cancer treatment will utilize therapeutics both as monotherapies and in combination to attack multiple underlying mechanisms of cancer cell growth and survival. We further believe that discovery of next-generation cancer therapies requires new research tools. To that end, we have developed a proprietary cancer biology platform that addresses the importance of tumor-immune system interactions and the value of primary biopsies in developing new models to support our drug discovery effort.

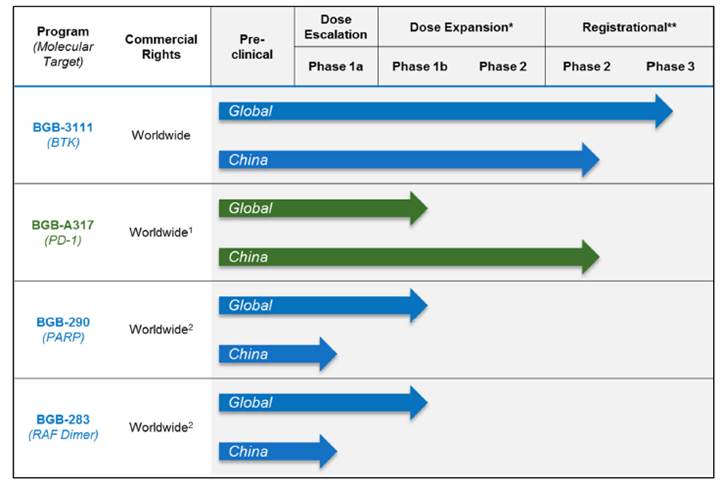

Our strategy is to develop a pipeline of drug candidates with the potential to be best-in-class monotherapies and also important components of multiple-agent combination regimens. Over the last six years, using our cancer biology platform, we have developed clinical-stage drug candidates that inhibit the important oncology targets Bruton’s tyrosine kinase, or BTK, RAF dimer protein complex and PARP family of proteins, and an immuno-oncology agent that inhibits the immune checkpoint protein receptor PD-1. For each of our molecularly targeted drug candidates, we have achieved proof-of-concept by observing objective responses in defined patient populations. Globally outside China, our BTK inhibitor is currently in a pivotal clinical trial in the United States, Europe, and Australia. Our PD-1, PARP and RAF dimer inhibitors are currently in the dose-expansion phases of their respective clinical trials. In China, our BTK inhibitor and our PD-1 inhibitor have each entered two pivotal clinical trials. As of July 26, 2017, trials of our four clinical-stage drug candidates, as monotherapies and in combination, have enrolled a total of over 1,400 patients and healthy adults. We have Investigational New Drug, or IND, applications in effect for our BTK, PD-1 and PARP inhibitors with the U.S. Food and Drug Administration, or FDA. All four of our drug candidates are in the clinic in China. We believe that each of our clinical-stage drug candidates is the first in their respective classes being developed in China under the Category 1.1 domestic regulatory pathway to enter into human testing and to present clinical data.

Our research operations are in China, which we believe confers several advantages including access to a deep scientific talent pool and proximity to extensive preclinical study and clinical trial resources through collaborations with leading cancer hospitals in China. Beyond the substantial market opportunities we expect to have globally, we believe our location in China provides us the opportunity to bring best-in-class and/or first-in-class monotherapies and combination therapeutics to our home market where many global standard-of-care therapies are not currently approved or available. In addition to research and development operations, we are also building small molecule and biologic manufacturing facilities by taking advantage of local funding sources available in China. We have established global clinical development capabilities with a significant presence in the United States and Australia that allow us to advance our clinical candidates globally as well as provide us with access to the global talent pool. We have assembled a team of over 400 employees in China, the United States, and Australia with deep scientific talent and extensive global pharmaceutical experience who are deeply committed to advancing our mission to become a global leader in next-generation cancer therapies.

The following table summarizes the status of our clinical pipeline globally and in China as of the date hereof:

*Some indications will not require a non-registrational Phase 2 clinical trial prior to beginning registrational Phase 2 or 3 clinical trials.

**Confirmatory clinical trials post approval are required for accelerated approvals.

(1) Entered into a collaboration with Celgene, that has not yet closed, to grant Celgene the rights to develop and commercialize in solid tumors in the United States, European Union, Japan and the rest-of-world outside of Asia. See “—Recent Developments—Strategic Collaboration with Celgene.”

(2) Limited collaboration with Merck KGaA.

The following table summarizes the status of our combination therapy pipeline as of the date hereof:

*Some indications will not require a non-registrational Phase 2 clinical trial prior to beginning registrational Phase 2 or 3 clinical trials.

**Confirmatory clinical trials post approval are required for accelerated approvals.

Recent Developments

Strategic Collaboration with Celgene

On July 5, 2017, we announced a strategic collaboration with Celgene pursuant to which Celgene will have the exclusive right to develop and commercialize our investigational PD-1 inhibitor, BGB-A317, in patients with solid tumor cancers in the United States, Europe, Japan and the rest of world outside Asia. We will retain exclusive rights for the development and commercialization of BGB-A317 for hematological cancers globally and for solid tumors in China and the rest of Asia, other than Japan. In addition, we retain the right to develop BGB-A317 in combination therapies with our portfolio compounds, and Celgene has a right of first negotiation for any proposed license, grant or other transfer of rights relating to BGB-A317, including development and commercialization rights, in our territory and in the hematology field in Celgene’s territory, subject to certain conditions. Upon closing, we will receive $263 million in upfront license fees and issue and sell to Celgene Switzerland LLC $150 million of our ordinary shares, consisting of 32,746,416 ordinary shares, or approximately 5.9% of our outstanding shares as of July 5, 2017, at a price per share equal to $4.58, or $59.55 per ADS, which represents a 35% premium over the 11-day volume weighted average price of our ADSs on The NASDAQ Global Select Market during the period from June 16, 2017 through June 30, 2017. We will also be eligible to receive up to $980 million in development, regulatory and sales milestone payments and royalties in the low-double digit to mid-twenty percentages on any future sales of BGB-A317, based on specified terms.

In connection with the BGB-A317 collaboration, we also announced that we will acquire Celgene’s commercial operations and sales force in China, excluding Hong Kong, Macau and Taiwan, and gain an exclusive license in that territory to commercialize Celgene’s approved cancer therapies, ABRAXANE®, REVLIMID®, and VIDAZA®, and its investigational agent CC-122 in clinical development.

The transactions have been approved by the boards of directors of both companies and are expected to close in the third quarter of 2017, subject to the expiration or termination of applicable waiting periods under all applicable

antitrust laws and satisfaction of other customary closing conditions. The principal agreements for the transactions are further summarized in our Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission on July 6, 2017.