Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Impax Laboratories, LLC | ipxl-8x9x2017ex991.htm |

| 8-K - 8-K - Impax Laboratories, LLC | ipxl-8x9x2017x8k.htm |

1

Second Quarter 2017 Results

and Business Update

August 9, 2017

2

Impax Cautionary Statement Regarding

Forward Looking Statements

"Safe Harbor" statement under the Private Securities Litigation Reform Act of 1995:

To the extent any statements made in this presentation contain information that is not historical; these statements are forward-looking in nature

and express the beliefs and expectations of management. Such statements are based on current expectations and involve a number of known

and unknown risks and uncertainties that could cause the Company’s future results, performance, or achievements to differ significantly from

the results, performance, or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties include, but

are not limited to, fluctuations in the Company’s operating results and financial condition, the volatility of the market price of the Company’s

common stock, the Company’s ability to successfully develop and commercialize pharmaceutical products in a timely manner, the impact of

competition, the effect of any manufacturing or quality control problems, the Company’s ability to manage its growth, risks related to

acquisitions of or investments in technologies, products or businesses, the risks related to the sale or closure of the Company’s Taiwan

manufacturing facility, effects from fluctuations in currency exchange rates between the U.S. dollar and the Taiwan dollar, risks relating to

goodwill and intangibles, the reduction or loss of business with any significant customer, the substantial portion of the Company’s total revenues

derived from sales of a limited number of products, the impact of consolidation of the Company’s customer base, the Company’s ability to

sustain profitability and positive cash flows, the impact of any valuation allowance on the Company’s deferred tax assets, the restrictions

imposed by the Company’s credit facility and indenture, the Company’s level of indebtedness and liabilities and the potential impact on cash

flow available for operations, the availability of additional funds in the future, any delays or unanticipated expenses in connection with the

operation of the Company’s manufacturing facilities, the effect of foreign economic, political, legal and other risks on the Company’s operations

abroad, the uncertainty of patent litigation and other legal proceedings, the increased government scrutiny on the Company’s agreements to

settle patent litigations, product development risks and the difficulty of predicting FDA filings and approvals, consumer acceptance and demand

for new pharmaceutical products, the impact of market perceptions of the Company and the safety and quality of the Company’s products, the

Company’s determinations to discontinue the manufacture and distribution of certain products, the Company’s ability to achieve returns on its

investments in research and development activities, changes to FDA approval requirements, the Company’s ability to successfully conduct

clinical trials, the Company’s reliance on third parties to conduct clinical trials and testing, the Company’s lack of a license partner for

commercialization of Numient® (IPX066) outside of the United States, impact of illegal distribution and sale by third parties of counterfeits or

stolen products, the availability of raw materials and impact of interruptions in the Company’s supply chain, the Company’s policies regarding

returns, rebates, allowances and chargebacks, the use of controlled substances in the Company’s products, the effect of current economic

conditions on the Company’s industry, business, results of operations and financial condition, disruptions or failures in the Company’s

information technology systems and network infrastructure caused by third party breaches or other events, the Company’s reliance on alliance

and collaboration agreements, the Company’s reliance on licenses to proprietary technologies, the Company’s dependence on certain

employees, the Company’s ability to comply with legal and regulatory requirements governing the healthcare industry, the regulatory

environment, the effect of certain provisions in the Company’s government contracts, the Company’s ability to protect its intellectual property,

exposure to product liability claims, changes in tax regulations, uncertainties involved in the preparation of the Company’s financial statements,

the Company’s ability to maintain an effective system of internal control over financial reporting, the effect of terrorist attacks on the Company’s

business, the location of the Company’s manufacturing and research and development facilities near earthquake fault lines, expansion of social

media platforms and other risks described in the Company’s periodic reports filed with the Securities and Exchange Commission. Forward-

looking statements speak only as to the date on which they are made, and the Company undertakes no obligation to update publicly or revise

any forward-looking statement, regardless of whether new information becomes available, future developments occur or otherwise.

Trademarks referenced herein are the property of their respective owners.

©2017 Impax Laboratories, Inc. All Rights Reserved.

3

Presentation Overview

Paul Bisaro – President & Chief Executive Officer

2Q 2017 Results

Business Update

Bryan Reasons – Senior Vice President, Chief Financial Officer

2Q 2017 Financial Review

Paul Bisaro

2017 Financial Guidance

Path Forward

4

Paul Bisaro

President & CEO

5

Solid Second Quarter 2017 Performance

$173

$184

$202

2Q16 1Q17 2Q17

$41

$32

$39

2Q16 1Q17 2Q17

$0.21

$0.11

$0.18

2Q16 1Q17 2Q17

Revenues

$ millions

Adjusted EBITDA

$ millions

Adjusted EPS

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results

• Revenue growth of 17% over 2Q16

• Sequential revenue growth of 10% over 1Q17

› Adjusted EBITDA up 23%

› Adjusted EPS up 64%

• Focused on improving profitability and earnings

6

Generics Business Second Quarter Highlights

Second Quarter

• Approved and launched first-to-market generic Vytorin®

› Captured more than 40% share on launch

• Continued growth of epinephrine auto-injector

› 11% revenue growth over 2Q16

› 46% revenue growth over 1Q17

Post Second Quarter Events

• Generic product approvals

› AB-rated generic Concerta® - securing API quota, targeting late 4Q17 launch

› Additional strengths of Generic Focalin® XR – launched immediately

• Settled Opana® ER litigation with Endo Pharmaceuticals

7

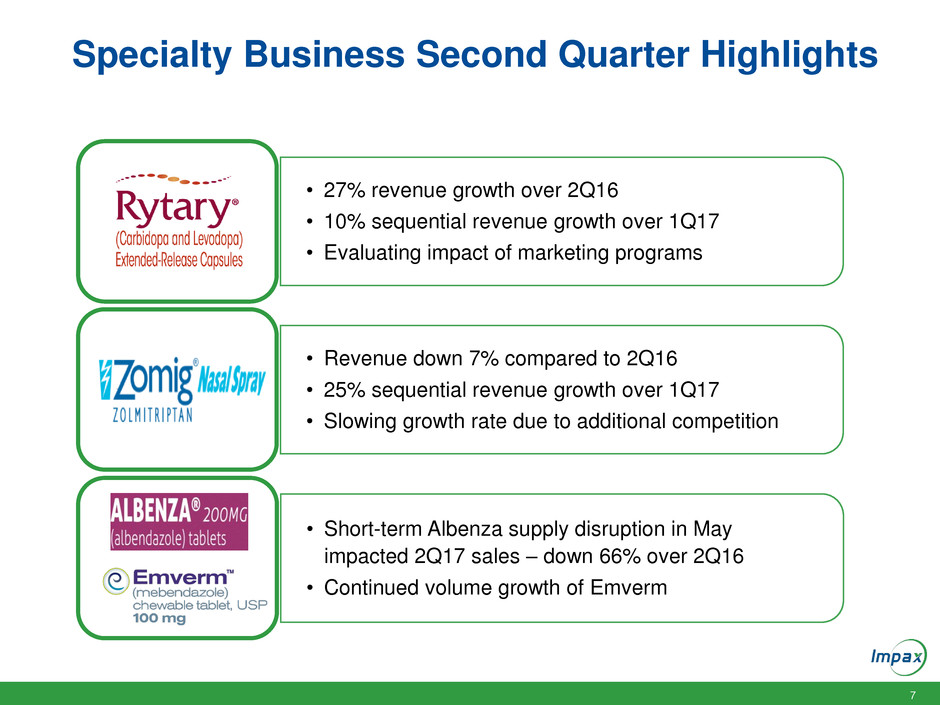

• 27% revenue growth over 2Q16

• 10% sequential revenue growth over 1Q17

• Evaluating impact of marketing programs

• Revenue down 7% compared to 2Q16

• 25% sequential revenue growth over 1Q17

• Slowing growth rate due to additional competition

• Short-term Albenza supply disruption in May

impacted 2Q17 sales – down 66% over 2Q16

• Continued volume growth of Emverm

Specialty Business Second Quarter Highlights

8

Pre-2017 Announced Initiatives

Achieved Initiatives Completed

Closure of Middlesex manufacturing site Mid-2017

Closure of Philadelphia packaging facility 2016

Restructure Technical Operations and R&D 2015

Delivering on plan designed to improve efficiencies and profitability;

provide resources to support growth initiatives

Consolidation and Improvement Plan

~$45M Run-Rate Savings Expected in 2018

2016

Realized ~$20M of total

run-rate savings

2017

~$12M of savings by year-end

2018

Full run-rate savings of ~$45M

9

2017 Announced Initiatives

Ongoing Initiatives Completion Timing

Consolidation of all generic R&D to Hayward, CA Completed mid-2017

Closure of Middlesex packaging site Completion by 1Q18

Rationalizing generic portfolio to eliminate low-value products Completion by 1Q18

Strategic alternatives for Taiwan manufacturing site TBD

Reorganizing certain functions including quality, engineering and

supply chain operations

TBD

Efforts designed to improve efficiencies are well underway…strong

momentum toward achieving targeted efficiencies

Consolidation and Improvement Plan

Additional ~$85M Run-Rate Savings Expected by Year-End 2019**

2017

Limited savings impact

End of 2018

Approximately half of total

run-rate savings

End of 2019

Full run-rate savings of ~$85M

** Total run-rate savings and timing dependent on Taiwan strategic alternatives

10

Continuing to Expand Pipeline Opportunities

Generic R&D Specialty Pharma R&D

IPX203 Carbidopa-Levodopa

Phase 2b study

Multiple dose study in patients with

advanced Parkinson’s disease

Readout of Phase 2b expected during

the third quarter of 2017

Evaluating additional internal and

external pipeline opportunities

Advancing pipeline lays the foundation for growth

Source of sales data: IMS NSP June 2017; *U.S. Brand/Generic market sales; Pipeline data as of August 2, 2017

6 4

13

14

Pending

at FDA

$16B

Under

Development

$4B

19 18

Portfolio of 37 Products

Current U.S. Brand/Generic Market of $20B

10 15

# of Potential

Products FTF or FTM

Solid Oral Dose

Alternative Dose

2017 ANDAs Approved

Aspirin/Dipyridamole ER Cap

(Aggrenox®)

Naftifine Cream 2%

Olopatadine Nasal Spray

(Patanase®)

Dexmethylphenidate

Hydrochloride ER Capsules

(Focalin XR®) 25 mg and 35 mg

Ezetimibe/Simvastatin Tablet

(Vytorin®)

Methylphenidate Hydrochloride

ER Tablet (Concerta®)

11

Bryan Reasons

Chief Financial Officer

12

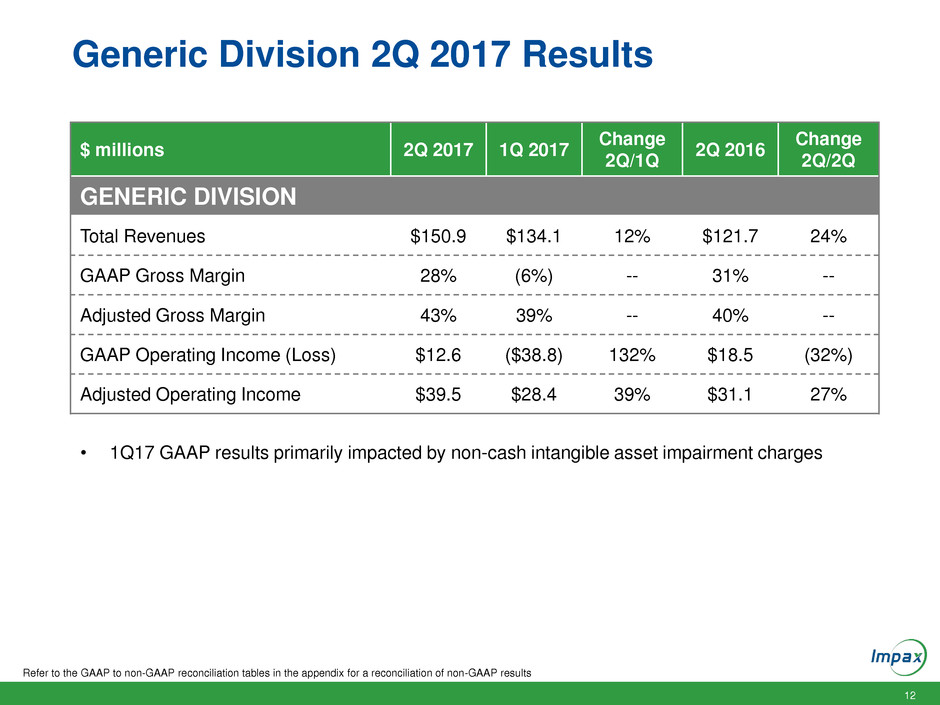

Generic Division 2Q 2017 Results

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results

$ millions 2Q 2017 1Q 2017

Change

2Q/1Q

2Q 2016

Change

2Q/2Q

GENERIC DIVISION

Total Revenues $150.9 $134.1 12% $121.7 24%

GAAP Gross Margin 28% (6%) -- 31% --

Adjusted Gross Margin 43% 39% -- 40% --

GAAP Operating Income (Loss) $12.6 ($38.8) 132% $18.5 (32%)

Adjusted Operating Income $39.5 $28.4 39% $31.1 27%

• 1Q17 GAAP results primarily impacted by non-cash intangible asset impairment charges

13

Specialty Pharma Division 2Q 2017 Results

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results

$ millions 2Q 2017 1Q 2017

Change

2Q/1Q

2Q 2016

Change

2Q/2Q

SPECIALTY PHARMA DIVISION

Total Revenues $51.2 $50.3 2% $50.9 1%

GAAP Gross Margin 59% 66% -- 70% --

Adjusted Gross Margin 71% 74% -- 85% --

GAAP Operating Income $6.9 $11.2 (38%) $13.1 (47%)

Adjusted Operating Income $12.7 $15.1 (16%) $20.5 (38%)

14

Consolidated 2Q 2017 Results

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results

$ millions, except per share

amounts

2Q 2017 1Q 2017

Change

2Q/1Q

2Q 2016

Change

2Q/2Q

EBITDA $16.6 ($30.2) 155% $23.4 (29%)

Adjusted EBITDA $39.2 $31.9 23% $40.7 (4%)

GAAP Loss Per Share ($0.28) ($1.37) 80% ($0.04) (600%)

Adjusted Diluted EPS $0.18 $0.11 64% $0.21 (14%)

GAAP Tax Rate 3% (46%) -- 32% --

Adjusted Tax Rate 31% 31% -- 34% --

• 1Q17 GAAP results primarily impacted by non-cash intangible asset impairment charges

15

Paul Bisaro

President & CEO

16

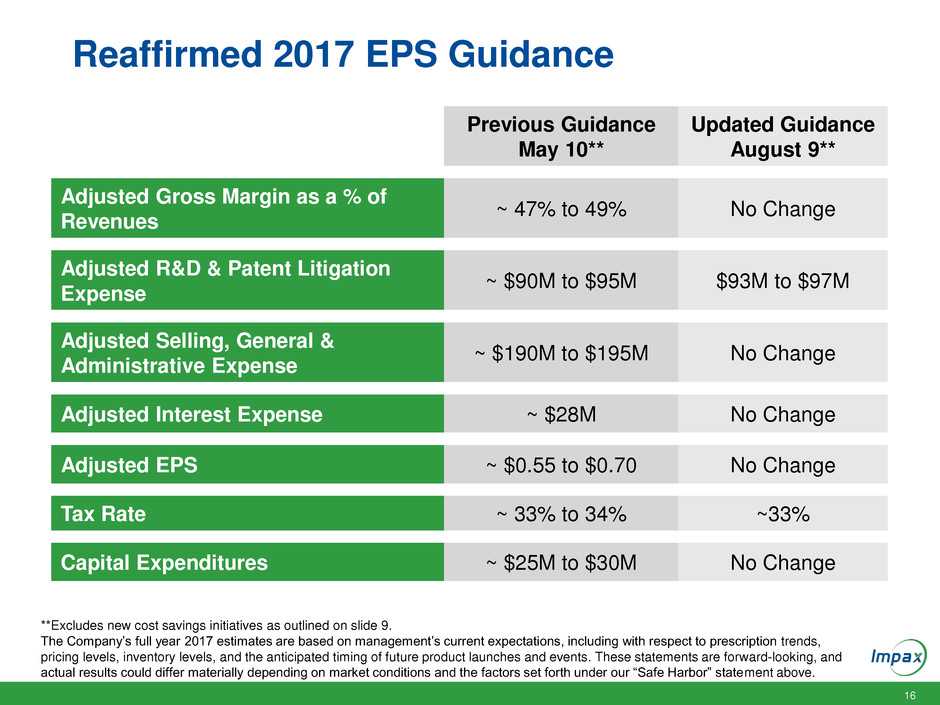

Reaffirmed 2017 EPS Guidance

**Excludes new cost savings initiatives as outlined on slide 9.

The Company’s full year 2017 estimates are based on management’s current expectations, including with respect to prescription trends,

pricing levels, inventory levels, and the anticipated timing of future product launches and events. These statements are forward-looking, and

actual results could differ materially depending on market conditions and the factors set forth under our “Safe Harbor” statement above.

Previous Guidance

May 10**

Updated Guidance

August 9**

Adjusted Gross Margin as a % of

Revenues

~ 47% to 49% No Change

Adjusted R&D & Patent Litigation

Expense

~ $90M to $95M $93M to $97M

Adjusted Selling, General &

Administrative Expense

~ $190M to $195M No Change

Adjusted Interest Expense ~ $28M No Change

Adjusted EPS ~ $0.55 to $0.70 No Change

Tax Rate ~ 33% to 34% ~33%

Capital Expenditures ~ $25M to $30M No Change

17

Path Forward

• Generics: Continuing internal R&D investment and external R&D license efforts

• Specialty: Continuing focus on Movement Disorders pipeline and opportunistically

in-license external opportunities

Invest in

Organic

Growth

• Maintain high level of Quality and Compliance

• Achieve superior service levels

• Deliver differentiated products to our customers

Maintain

Customer

Focus

• Achieve consolidation targets without business disruption

• Continue to explore additional cost savings opportunities

Achieve

“CIP” Target

• Strengthen Generic and Specialty franchises

Pursue

Creative

Business

Development

Position Impax for Sustainable Long-Term Growth

18

Second Quarter 2017 Results

and Business Update

Q&A Session

August 9, 2017

19

ANDA Pipeline Includes Several Potential High-Value

First-to-Market Opportunities

Source of sales data: IMS NPS June 2017; Pipeline data as of August 2, 2017

1 Launched authorized generic in April 2016

Disclosed Pending ANDAs

Generic Product Name Brand

IMS

Sales

Potential Launch

Timing

FTM

Opportunity

Apixaban IR tablet Eliquis® $4.0B Pending litigation

Dimethyl Fumarate DR Cap Tecfidera® $3.6B Pending litigation

Oxycodone ER tablet (new formulation) 1 OxyContin® $2.1B Settled, not disclosed

Sevelamer Carbonate IR tablet Renvela® $1.9B Approval

Teriflunomide IR tablet Aubagio® $1.2B Settled, not disclosed

Colesevelam IR tablet Welchol® $597M Approval

Oxymorphone ER tablet (new

formulation)

Opana ER® $274M Pending litigation

Carvedilol ER capsule Coreg CR® $217M Approval

Fentanyl Buccal IR tablet Fentora® $125M Settled, not disclosed

Risedronate Sodium DR tablet Atelvia® $23M Approval

20

GAAP to Adjusted Results Reconciliation

The following table reconciles total Company reported cost of revenues to adjusted cost of revenues, adjusted gross profit,

adjusted gross margin, adjusted research and development expenses, and adjusted selling, general and administrative expenses.

(Unaudited, In thousands)

Refer to the Second Quarter 2017 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal due to rounding.

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted gross profit divided by

total revenues.

June 30, March 31, June 30,

2017 2017 2016

Cost of revenues 129,676$ 120,232$ 98,061$

Cost of revenues impairment charges - 39,280 1,545

Adjusted to deduct:

Amortization 17,219 17,232 12,469

Intangible asset impairment charges - 39,280 1,545

Business development 49 8 -

Restructuring and severance charges 7,402 6,139 4,991

Middlesex plant closure 3,344 1,636 -

Adjusted cost of revenues 101,662$ 95,217$ 80,601$

Adjusted gross profit (a) 100,420$ 89,186$ 91,989$

Adjusted gross margin (a) 49.7% 48.4% 53.3%

Research and development expenses 26,847$ 22,489$ 20,800$

In-process research and development impairment charges - 6,079 946

Adjusted to deduct:

Intangible asset impairment charges - 6,079 946

Restructuring and severance charges 2,926 - -

Other 1,825 650 -

Adjusted research and development expenses 22,096$ 21,839$ 20,800$

Selling, general and administrative expenses 51,615$ 47,055$ 44,908$

Adjusted to deduct:

Business development expenses 50 42 1,448

Turi g legal expenses 89 (495) -

CEO transition costs 267 - -

Taiwan accelerated depreciation 4 - -

Philadelphia packaging and distribution restructuring - 31

Restructuring and severance charges 271 - 31

Adjusted selling, general and administrative expenses 51,205$ 47,508$ 43,429$

Three Months Ended

21

GAAP to Adjusted Net Income Reconciliation

The following table reconciles reported net loss to adjusted net income.

(Unaudited, In thousands, except per share and per share data)

June 30, March 31, June 30,

2017 2017 2016

Net loss (20,417)$ (98,431)$ (2,701)$

Adjusted to add (deduct):

Amortization 17,219 17,232 12,469

Non-cash interest expense 6,430 6,312 5,409

Business development expenses 99 50 1,448

Intangible asset impairment charges - 45,359 2,491

Reserve for Turing receivable 2,353 317 -

Turing legal expenses 89 (495) -

Restructuring and severance charges 10,599 6,139 5,022

Fixed asset impairment charges 1,894 - -

Gain on sale of intangible assets (11,850) - -

Gain on sale of PP&E (350) - -

Loss on debt extinguishment - 1,215 -

Middlesex plant closure 3,344 1,636 -

Legal settlements 7,900 - -

Other 2,286 931 -

Income tax effect (6,456) 27,463 (9,130)

Adjusted net income 13,140$ 7,728$ 15,008$

Adjusted net income per diluted share 0.18$ 0.11$ 0.21$

Net loss per diluted share (0.28)$ (1.37)$ (0.04)$

Diluted weighted-average common shares outstanding 71,804,585 71,600,337 71,908,623

Refer to the Second Quarter 2017 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal due to rounding.

22

GAAP to Adjusted EBITDA Reconciliation

Refer to the Second Quarter 2017 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal due to rounding.

The following table reconciles reported net loss to adjusted EBITDA.

(Unaudited, In thousands)

June 30, March 31, June 30,

2017 2017 2016

Net loss (20,417)$ (98,431)$ (2,701)$

Adjusted to add (deduct):

Interest expense 13,369 13,380 8,454

Interest income (155) (154) (340)

Income taxes (520) 30,901 (1,249)

Depreciation and amortization 24,355 24,098 19,195

EBITDA 16,632 (30,206) 23,359

Adjusted to add (deduct):

Share-based compensation expense 6,225 6,957 8,384

Business development expenses 99 50 1,448

Intangible asset impairment charges - 45,359 2,491

Reserve for Turing receivable 2,353 317 -

Turing legal expenses 89 (495) -

Restructuring and severance charges 10,599 6,139 5,022

Fixed asset impairment charges 1,894 - -

Gain on sale of intangible assets (11,850) - -

Gain on sale of PP&E (350) - -

Loss on debt extinguishment - 1,215 -

Middlesex plant closure 3,344 1,636 -

Legal settlements 7,900 - -

Other 2,286 931 -

Adjusted EBITDA 39,221$ 31,903$ 40,704$

Three Months Ended

23

Generic Division GAAP to Adjusted

Results Reconciliation

The following tables reconcile the Impax Generics Division reported cost of revenues and income (loss) from operations to adjusted cost

of revenues, adjusted gross profit, adjusted gross margin and adjusted operating income.

(Unaudited, In thousands)

June 30, March 31, June 30,

2017 2017 2016

Cost of revenues 108,901$ 103,335$ 82,794$

Cost of revenues impairment charges - 39,280 1,545

Adjusted to deduct:

Amortization 13,385 13,398 5,053

Intangible asset impairment charges - 39,280 1,545

Restruct ri g and severance charges 5,396 6,139 4,991

Middlesex plant closure 3,344 1,636 -

Adjusted cost of revenues 86,776$ 82,162$ 72,750$

Adjusted gross profit (a) 64,113$ 51,985$ 48,945$

Adjusted gross margin (a) 42.5% 38.8% 40.2%

Three Months Ended

June 30, March 31, June 30,

2017 2017 2016

GAAP income (loss) from operations 12,640$ (38,779)$ 18,547$

to add (deduct):

Amortization 13,385 13,398 5,053

Intangible asset impairment charges - 45,359 2,491

Restructuring and severance charges 8,322 6,139 4,991

Payments for licensing agreements 1,825 650 -

Middlesex plant closure 3,344 1,636 -

Adjusted income from operations 39,516$ 28,403$ 31,082$

Refer to the Second Quarter 2017 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal due to rounding.

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted gross profit divided by

total revenues.

24

Specialty Pharma Division GAAP to

Adjusted Results Reconciliation

The following tables reconcile the Impax Specialty Pharma Division reported cost of revenues and income from operations to

adjusted cost of revenues, adjusted gross profit, adjusted gross margin and adjusted income from operations.

(Unaudited, In thousands)

Refer to the Second Quarter 2017 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal due to rounding.

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted gross profit divided by

total revenues.

June 30, March 31, June 30,

2017 2017 2016

Cost of revenues 20,775$ 16,897$ 15,267$

Cost of revenues impairment charges - - -

Adjusted to deduct:

A ortization 3,834 3,834 7,416

Restructuring and severance charges 2,006 - -

Adjusted cost of revenues 14,935$ 13,063$ 7,851$

Adjusted gross profit (a) 36,258$ 37,193$ 43,044$

Adjusted gross margin (a) 70.8% 74.0% 84.6%

Three Months Ended

June 30, March 31, June 30,

2017 2017 2016

GAAP income from operations 6,901$ 11,232$ 13,064$

Adjusted to add:

Amortization 3,834 3,834 7,416

Restructuring and severange charges 2,006 - -

Adjusted income from operations 12,741$ 15,066$ 20,480$

Three Months Ended