Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - GAIN Capital Holdings, Inc. | ex9916-30x17earningsrelease.htm |

| 8-K - 8-K - GAIN Capital Holdings, Inc. | form8-kq22017earnings.htm |

Q2 and First Half 2017 Results

1

August 2017

SAFE HARBOR STATEMENT

2

Forward Looking Statements

In addition to historical information, this earnings presentation contains "forward-looking" statements that reflect management's expectations for the future. A variety of

important factors could cause results to differ materially from such statements.. These factors are noted throughout GAIN Capital's annual report on Form 10-K for the

year ended December 31, 2016, as filed with the Securities and Exchange Commission on March 15, 2017, and include, but are not limited to, the actions of both current

and potential new competitors, fluctuations in market trading volumes, financial market volatility, evolving industry regulations, errors or malfunctions in GAIN Capital’s

systems or technology, rapid changes in technology, effects of inflation, customer trading patterns, the success of our products and service offerings, our ability to

continue to innovate and meet the demands of our customers for new or enhanced products, our ability to successfully integrate assets and companies we have acquired,

our ability to effectively compete, changes in tax policy or accounting rules, fluctuations in foreign exchange rates and commodity prices, adverse changes or volatility in

interest rates, as well as general economic, business, credit and financial market conditions, internationally or nationally, and our ability to continue paying a quarterly

dividend in light of future financial performance and financing needs. The forward-looking statements included herein represent GAIN Capital’s views as of the date of this

release. GAIN Capital undertakes no obligation to revise or update publicly any forward-looking statement for any reason unless required by law.

Non-GAAP Financial Measures

This presentation contains various non-GAAP financial measures, including adjusted EBITDA, adjusted net income, adjusted EPS and various “pro forma” non-GAAP

measures. These non-GAAP financial measures have certain limitations, including that they do not have a standardized meaning and, therefore, our definitions may be

different from similar non-GAAP financial measures used by other companies and/or analysts. Thus, it may be more difficult to compare our financial performance to that

of other companies. We believe our reporting of these non-GAAP financial measures assists investors in evaluating our historical and expected operating performance.

However, because these are not measures of financial performance calculated in accordance with GAAP, such measures should be considered in addition to, but not as a

substitute for, other measures of our financial performance reported in accordance with GAAP, such as net income.

SECOND QUARTER AND FIRST HALF 2017 REVIEW

3

• Q2 2017 GAAP net income of $13.9 million; GAAP EPS of $0.31

• Adjusted EPS of $0.25, compared to $0.27 in Q2 2016

• Adjusted EBITDA and margins remained stable year-over-year due to cost reductions, despite a decrease in revenue for the same period

• Q2 operating expenses decreased 11% year-over-year; 12% decrease for the first half of 2017

• Remain on target for $15 million in fixed cost savings in 2017 and $20 million run rate for 2018

• Revenue per million of $122, in line with Q2 2016

• Performance driven by widening of average trading ranges

• TTM revenue per million of $106, in line with TTM ended Q2 2016

• Continued to return capital to investors via share buyback program

• Repurchased 761,262 shares at an average share price of $6.24 in Q2 2017

• Approximately $15.1 million authorized and remaining for additional repurchases

• Returned a total of $15.2 million to shareholders in the first half of 2017 through stock repurchases and dividends

BALANCED GROWTH STRATEGY:

ORGANIC INITIATIVES, COMPLEMENTED BY STRATEGIC M&A

4

Strategic Acquisitions

to Accelerate Growth

• Focused on acquisition opportunities that would:

• Expand our product set

• Provide additional distribution channels

• Expand our geographic reach and scale

• Regulatory change and market dislocation continue to

produce corporate development opportunities

• Remain well-positioned to capitalize on opportunistic

growth prospects

Positioned to Invest in

Organic Growth

• Organic growth initiatives focused on client acquisition

and retention

• Grow share in markets where we operate

• Introduce new products and services to diversify

into new markets and new client bases

• Focus on customer experience, including

support, trading ideas and education

Expansion into Digital

Advisory

• Developing new products

for clients seeking

personalized trading

advice

• Innovative mobile-only

trade signals app rolling

out in Q4

ORGANIC GROWTH INITIATIVES PROGRESS UNDERWAY

5

Investing in product enhancements and marketing to drive increased client retention and acquisition

Redesigned Trading

Experience

• New City Index UK &

FOREX.com UK website

experiences launched

• Upgrade of mobile trading

apps in early June

• FOREX.com Active Trader

Program global rollout

Automated and

Streamlined Account

Opening

• Enhanced mobile

application and

onboarding process

• New mobile funding

options for APAC

customers

• Automated KYC checks for

instantaneous approval

Global, Cross-Brand

Affiliate Marketing

Program

• Introduction of the pilot

program in UK market in

Q1

• Rolling out across other

regions in Q3/Q4

Complement Our

Existing Products and

Services

• Adding new business lines

that are complementary

to our core offerings

• “Acqui-hire” transactions

to add talent

STRATEGIC ACQUISITIONS TO ACCELERATE GROWTH

6

We have a strong pipeline of M&A opportunities that are being reviewed, focused on achieving the following objectives

Expand Our

Product Set

• Adding new products

within existing business

lines by partnering with

start-ups or other fintech

companies to leverage

their innovation

Provide Additional

Distribution Channels

• Accessing new platforms

or other technology

favored by select

customer groups

Expand Our

Geographic Reach and

Scale

• Accessing markets where

we do not have expertise,

personnel or required

regulatory permissions

• Acquiring strong local

brands

COST INITIATIVES TO DRIVE MARGIN ENHANCEMENT

7

• Remain on target for $15 million in fixed cost savings in 2017 and $20 million run rate for 2018

• Will continue to identify areas for savings over the next two years as we seek to further lower

our operating expenses and grow margins

• Targeting 35% adjusted EBITDA margin

• Disciplined capital expenditures of $3 -$4 million per quarter

These initiatives will generate significant additional free cash flow

Financial Review

8

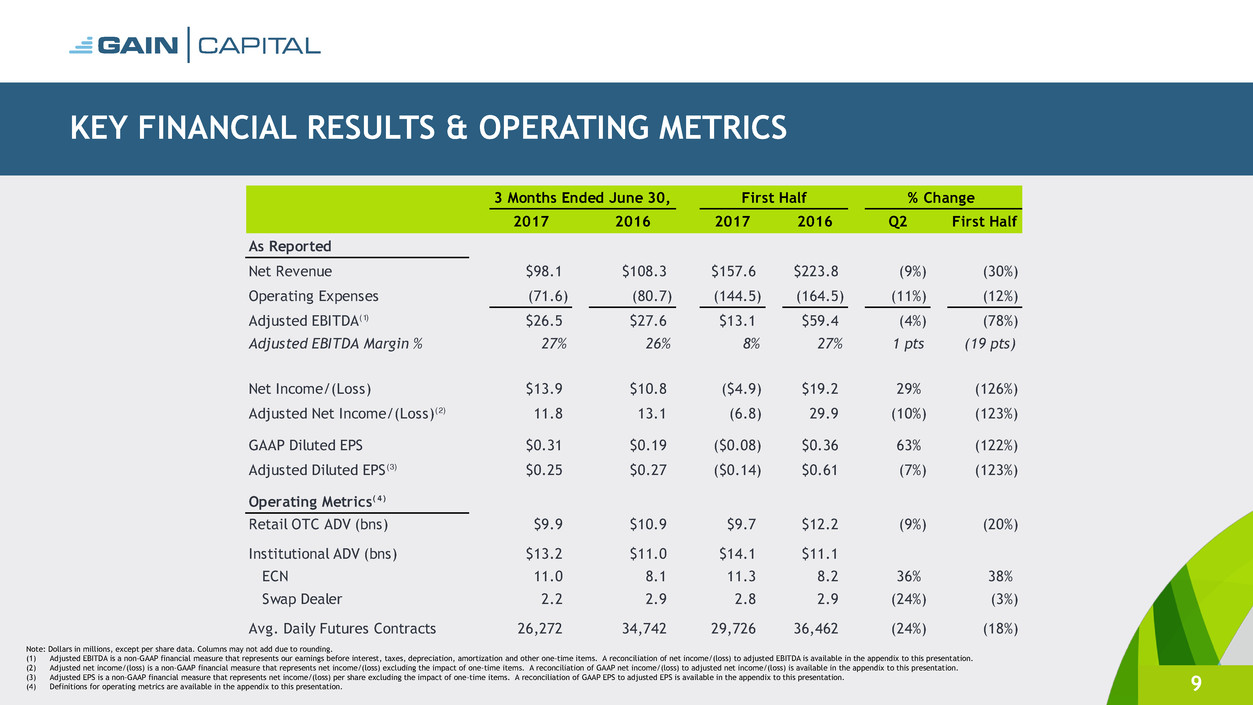

KEY FINANCIAL RESULTS & OPERATING METRICS

9

Note: Dollars in millions, except per share data. Columns may not add due to rounding.

(1) Adjusted EBITDA is a non-GAAP financial measure that represents our earnings before interest, taxes, depreciation, amortization and other one-time items. A reconciliation of net income/(loss) to adjusted EBITDA is available in the appendix to this presentation.

(2) Adjusted net income/(loss) is a non-GAAP financial measure that represents net income/(loss) excluding the impact of one-time items. A reconciliation of GAAP net income/(loss) to adjusted net income/(loss) is available in the appendix to this presentation.

(3) Adjusted EPS is a non-GAAP financial measure that represents net income/(loss) per share excluding the impact of one-time items. A reconciliation of GAAP EPS to adjusted EPS is available in the appendix to this presentation.

(4) Definitions for operating metrics are available in the appendix to this presentation.

3 Months Ended June 30, First Half % Change

2017 2016 2017 2016 Q2 First Half

As Reported

Net Revenue $98.1 $108.3 $157.6 $223.8 (9%) (30%)

Operating Expenses (71.6) (80.7) (144.5) (164.5) (11%) (12%)

Adjusted EBITDA(1) $26.5 $27.6 $13.1 $59.4 (4%) (78%)

Adjusted EBITDA Margin % 27% 26% 8% 27% 1 pts (19 pts)

Net Income/(Loss) $13.9 $10.8 ($4.9) $19.2 29% (126%)

Adjusted Net Income/(Loss)(2) 11.8 13.1 (6.8) 29.9 (10%) (123%)

GAAP Diluted EPS $0.31 $0.19 ($0.08) $0.36 63% (122%)

Adjusted Diluted EPS (3) $0.25 $0.27 ($0.14) $0.61 (7%) (123%)

Operating Metrics( 4 )

Retail OTC ADV (bns) $9.9 $10.9 $9.7 $12.2 (9%) (20%)

Institutional ADV (bns) $13.2 $11.0 $14.1 $11.1

ECN 11.0 8.1 11.3 8.2 36% 38%

Swap Dealer 2.2 2.9 2.8 2.9 (24%) (3%)

Avg. Daily Futures Contracts 26,272 34,742 29,726 36,462 (24%) (18%)

OPERATING SEGMENT RESULTS: RETAIL

10 Note: Dollars in millions, except where noted otherwise. Columns may not add due to rounding.

• Cost reduction strategy improving margins with Q2

2017 profit margin of 38%, up from 35% in Q2 2016,

amid minimal change in profit

• Client assets increased 14% year-over-year, helped in

part by the integration of FXCM accounts

• Q2 revenue per million of $122; TTM revenue per

million of $106, in line with TTM ended Q2 2016

• Direct active accounts up 23% year-over-year

• Direct volume up 20% quarter-over-quarter and 11%

year-over-year

3 Months Ended June 30, First Half

2017 2016 2017 2016 TTM 6/30/17

Trading Revenue $79.1 $88.1 $118.0 $182.8 $265.9

Other Retail Revenue 1.5 1.3 2.7 3.3 5.0

Total Revenue $80.6 $89.4 $120.7 $186.1 $270.9

Employee Comp & Ben 16.6 16.9 32.0 33.6 60.8

Marketing 7.2 6.5 16.1 12.7 31.1

Referral Fees 9.8 13.7 22.1 30.3 46.9

Other Operating Exp. 16.0 20.8 30.5 41.7 64.3

Segment Profit $30.9 $31.5 $20.0 $67.8 $67.8

% Margin 38% 35% 17% 36% 25%

Operating Metrics

ADV (bns) $9.9 $10.9 $9.7 $12.2 $9.6

Active Accounts 134,120 135,369 134,120 135,369 134,120

Client Assets $732.9 $641.3 $732.9 $641.3 $732.9

PnL/mm $122 $124 $93 $116 $106

Retail Financial & Operating Results

OPERATING SEGMENT RESULTS: INSTITUTIONAL & FUTURES

11 Note: Dollars in millions, except where noted otherwise. Columns may not add due to rounding.

• Q2 ECN average daily volume increased 36% year-

over-year, above the TTM average of $10 billion

• Swap dealer volume declined due to customer mix

• For ECN, we expect revenue capture rates to

stabilize

3 Months Ended June 30, First Half

2017 2016 2017 2016 TTM 6/30/17

ECN $6.1 $5.3 $12.2 $10.1 $22.7

Swap Dealer 1.6 2.2 4.1 4.5 9.2

Total Revenue $7.7 $7.5 $16.3 $14.6 $31.9

Employee Comp & Ben 3.6 3.5 7.6 6.7 15.3

Other Operating Exp. 2.9 2.6 6.2 5.0 11.6

Segment Profit $1.2 $1.4 $2.5 $2.9 $5.0

% Margin 16% 20% 15% 20% 16%

Operating Metrics

ECN ADV (bns) $11.0 $8.1 $11.3 $8.2 $10.0

Swap Dealer ADV (bns) 2.2 $2.9 2.8 2.9 3.0

Insitutional Financial & Operating Results

3 Months Ended June 30, First Half

2017 2016 2017 2016 TTM 6/30/17

Revenue $10.0 $12.9 $21.0 $25.1 $44.0

Employee Comp & Ben 2.5 3.1 5.0 6.1 10.9

Marketing 0.2 0.2 0.5 0.4 1.1

Referral Fees 3.5 3.9 7.6 8.0 15.3

Other Operating Exp 3.2 3.9 7.0 7.9 13.9

Segment Profit $0.6 $1.8 $0.9 $2.7 $2.8

% Margin 6% 14% 4% 1 % 6%

Operating Metrics

Avg. Daily Contracts 26,272 34,742 29,726 36,462 29,613

Active Accounts 7,885 8,822 7,885 8,822 7,885

Client Assets $214.4 $419.5 $214.4 $419.5 $214.4

Revenue/Contract $6.05 $5.80 $5.65 $5.51 $5.89

Futures Financial & Operating Results

• VIX declined year-over-year for both Q2 and first

half of 2017

• Low fixed cost base:

• H1 2017 expenses of $20.1 million down 10% from H1 2016

• Q2 2017 expenses of $9.4 million down 15% from Q2 2016

STRONG LIQUIDITY POSITION

12

Required Liquidity

Reserves

Strategic

Acquisitions

Quarterly Dividends

Buyback Program

Conservatively retain excess capital over regulatory requirements

Obtained $50 million revolving credit facility

Successfully integrated 10 acquisitions over the last 5 years

Well positioned for future opportunities

Quarterly dividend of $0.06 per share approved

Record date: September 12, 2017

Payment date: September 19, 2017

Repurchased 761,262 shares at an average share price of $6.24 in

Q2 2017

Approximately $15.1 million authorized and remaining for

additional repurchases

1. Liquidity table available in appendix to this presentation.

POSITIONED TO DELIVER LONG-TERM VALUE

13

Proven Leader in a Large, Attractive and Growing Market

Optimized Capital Allocation to Drive Shareholder Value

Future Growth Driven by Balanced Focus on Customer-

Facing Technology Enhancements and Strategic M&A

Highly Diverse and Scalable Business Model

$

Appendix

14

CONSOLIDATED STATEMENT OF OPERATIONS

15 Note: Dollars in millions, except share and per share data. Columns may not add due to rounding. (1) Earnings per share includes an adjustment for the redemption value of the NCI put option.

Three Months Ended Six Months Ended

June 30, June 30,

2017 2016 2017 2016

Revenue

Retail revenue 79.1$ 88.1$ 118.0$ 183.1$

Institutional revenue 7.4 7.2 15.8 13.9

Futures revenue 9.6 12.7 20.1 24.8

Interest & Other revenue 2.0 0.2 3.7 2.0

Net revenue 98.1$ 108.3$ 157.6$ 223.8$

Expenses

Employee compensation and benefits 26.3 26.6 50.5 53.0

Selling and marketing 7.5 6.8 16.8 13.2

Referral Fees 13.3 17.6 29.8 38.2

Trading expenses 7.2 7.8 15.2 16.2

General and administrative 17.2 21.9 32.2 43.9

Depreciation and amortization 8.7 7.4 16.3 14.5

One-Time Expenses - 1.1 - 12.1

Total expenses 80.2 89.1 160.8 191.0

Operating profit/(loss) 17.8$ 19.2$ (3.2)$ 32.8$

Interest expense on long term borrowings 2.7 2.6 5.4 5.2

Income/(loss) before income tax expense/(benefit) 15.1$ 16.6$ (8.5)$ 27.7$

Income tax expense/(benefit) 1.0 5.0 (3.9) 7.4

Net income/(loss) 14.1$ 11.6$ (4.7)$ 20.3$

Net income attributable to non-controlling interests 0.2 0.7 0.2 1.1

Net income/(loss) applicable to Gain Capital Holdings Inc. 13.9$ 10.8$ (4.9)$ 19.2$

Earnings/(loss) per common share(1)

Basic $0.31 $0.19 ($0.08) $0.36

Diluted $0.31 $0.19 ($0.08) $0.36

Weighted average common shares outstanding used

in computing earnings/(loss) per common share:

Basic 47,687,214 48,546,253 47,790,307 48,584,534

Diluted 47,894,648 48,737,188 47,790,307 48,860,533

CONSOLIDATED BALANCE SHEET

16 Note: Dollars in millions. Columns may not add due to rounding.

As of

6/30/2017 12/31/2016

ASSETS:

Cash and cash equivalents 193.1$ 234.8$

Cash and securities held for customers 947.3 945.5

Receivables from brokers 80.7 61.1

Property and equipment - net of accumulated depreciation 39.7 36.5

Intangible assets, net 68.7 67.4

Goodwill 32.7 32.1

Other assets 53.8 52.8

Total assets 1,415.9$ 1,430.1$

LIABILITIES AND SHAREHOLDERS' EQUITY:

Payables to customers 947.3$ 945.5$

Accrued compensation & benefits 8.9 13.6

Accrued expenses and other liabilities 36.5 41.5

Income tax payable 0.4 4.0

Convertible senior notes 127.3 124.8

Total liabilities 1,120.4$ 1,129.3$

Non-controlling interest 5.0$ 6.6$

Shareholders' Equity 290.5 294.2

Total liabilities and shareholders' equity 1,415.9$ 1,430.1$

LIQUIDITY

17

Note: Dollars in millions. Columns may not add due to rounding.

(1) Reflects cash that would be received from brokers following the close-out of all open positions.

(2) Relates to regulatory capital requirements or capital charges, depending upon regulatory jurisdiction.

6/30/2017 3/31/2017 12/31/2016 9/30/2016 6/30/2016

Cash and cash equivalents $193.1 $183.7 $234.8 $235.7 $89.4

Receivable from brokers (1) 80.7 75.9 61.1 52.3 218.1

Less: Payable to brokers - - - - (4.8)

Less: Regulatory capital requirements/charges (2) (138.0) (124.6) (113.0) (117.0) (123.3)

Liquidity $135.8 $134.9 $182.9 $171.0 $179.4

Regulatory Capital Requirements/Charges

US $36.2 $36.1 $28.7 $29.4 $28.6

UK 97.2 83.0 78.9 79.9 89.2

Other jurisdictions 4.6 5.5 5.4 7.7 5.5

Total Regulatory Capital Requirements/Charges(2) $138.0 $124.6 $113.0 $117.0 $123.3

As of

ADJUSTED EBITDA & MARGIN RECONCILIATION

18

Note: Dollars in millions. Columns may not add due to rounding.

(1) Adjusted EBITDA margin is calculated as adjusted EBITDA divided by net revenue.

3 Months Ended June 30, First Half

2017 2016 2017 2016

Net Revenue 98.1$ 108.3$ 157.6$ 223.8$

Net Income/(Loss) 13.9 10.8 (4.9) 19.2

Net Income/(Loss) Margin % 14% 10% (3%) 9%

Net (Loss)/Income 13.9$ 10.8$ (4.9)$ 19.2$

Depreciation & amortization 4.3 3.6 8.4 6.7

Purchase intangible amortization 4.4 3.8 8.0 7.8

Interest expense on long term borrowings 2.7 2.6 5.4 5.2

Income tax (benefit)/expense 1.0 5.0 (3.9) 7.4

Restructuring - - - 0.8

Integration costs - 1.0 - 1.9

Legal settlement - - - 9.4

Net income attributable to non-controlling interest 0.2 0.7 0.2 1.1

Adjusted EBITDA 26.5$ 27.6$ 13.1$ 59.4$

Adjusted EBITDA Margin % (1) 27% 26% 8% 27%

ADJUSTED NET INCOME AND EPS RECONCILIATION

19

Note: Dollars in millions, except per share and share data. Columns may not add due to rounding.

(1) Assumes 21% tax rate following reduction in corporation tax rates in the UK from April 6 2017.

3 Months Ended June 30, First Half

2017 2016 2017 2016

Net Income/(Loss) $13.9 $10.8 ($4.9) $19.2

Income Tax Expense/(Benefit) 1.0 5.0 (3.9) 7.4

Non-controlling Interest 0.2 0.7 0.2 1.1

Pre-Tax Income/(Loss) $15.1 $16.6 ($8.5) $27.7

Plus: Adjustments - 1.1 - 12.1

Adjusted Pre-Tax Income/(Loss) $15.1 $17.7 ($8.5) $39.8

Normalized Income Tax(1) (3.2) (3.9) 1.8 (8.7)

Non-controlling interest (0.2) (0.7) (0.2) (1.1)

Adjusted Net Income/(Loss) $11.8 $13.1 ($6.8) $29.9

Adjusted Earnings/(Loss) per Common Share:

Basic 0.25$ $0.27 ($0.14) $0.62

Diluted 0.25$ $0.27 ($0.14) $0.61

Weighted average common shares outstanding used

in computing earnings/(loss) per common share:

Basic 47,687,214 48,546,253 47,790,307 48,584,534

Diluted 47,894,648 48,737,188 47,790,307 48,860,533

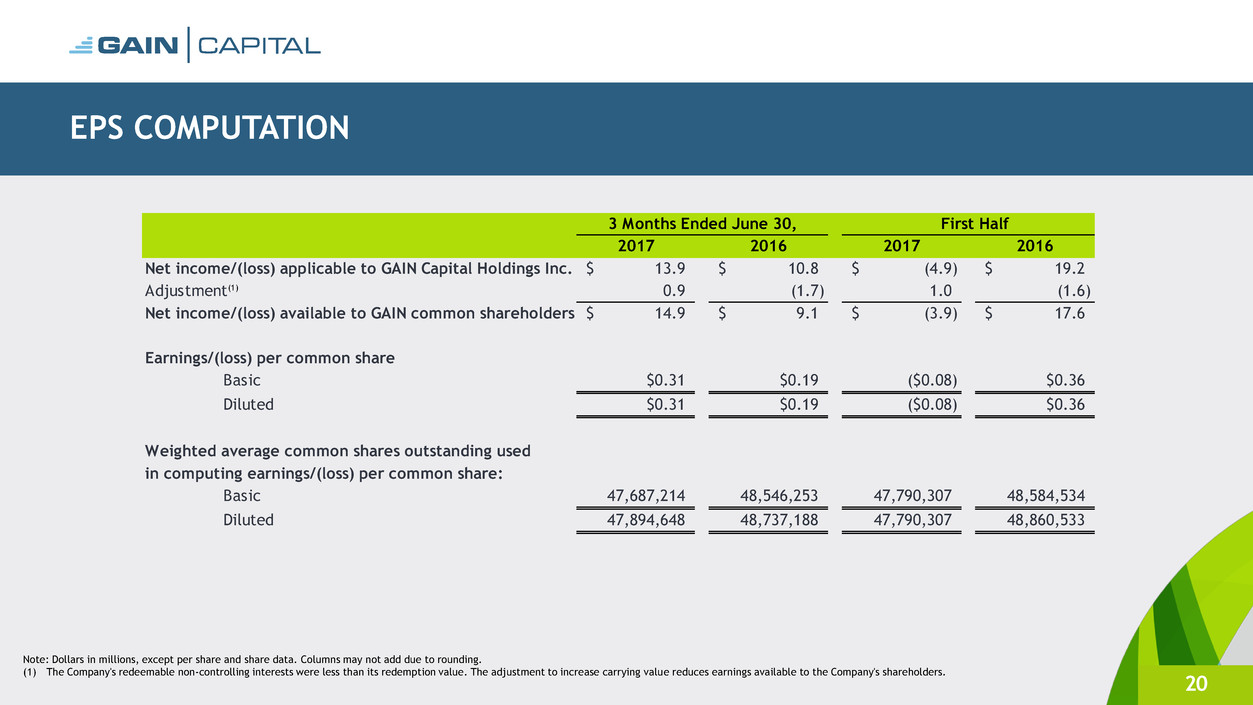

EPS COMPUTATION

20

Note: Dollars in millions, except per share and share data. Columns may not add due to rounding.

(1) The Company's redeemable non-controlling interests were less than its redemption value. The adjustment to increase carrying value reduces earnings available to the Company's shareholders.

3 Months Ended June 30, First Half

2017 2016 2017 2016

Net income/(loss) applicable to GAIN Capital Holdings Inc. 13.9$ 10.8$ (4.9)$ 19.2$

Adjustment(1) 0.9 (1.7) 1.0 (1.6)

Net income/(loss) available to GAIN common shareholders 14.9$ 9.1$ (3.9)$ 17.6$

Earnings/(loss) per common share

Basic $0.31 $0.19 ($0.08) $0.36

Diluted $0.31 $0.19 ($0.08) $0.36

Weighted average common shares outstanding used

in computing earnings/(loss) per common share:

Basic 47,687,214 48,546,253 47,790,307 48,584,534

Diluted 47,894,648 48,737,188 47,790,307 48,860,533

RECONCILIATION OF SEGMENT PROFIT TO INCOME BEFORE INCOME TAX EXPENSE

21 Note: Dollars in millions. Columns may not add due to rounding.

3 Months Ended June 30, First Half

2017 2016 2017 2016

Retail segment $30.9 $31.5 $20.0 $67.8

Institutional segment 1.2 1.4 2.5 2.9

Futures segment 0.6 1.8 0.9 2.7

Corporate and other (6.2) (7.1) (10.2) (14.0)

Segment profit $26.5 $27.6 $13.1 $59.4

Depreciation and amortization $4.3 $3.6 $8.4 $6.7

Purchased intangible amortization 4.4 3.8 8.0 7.8

Restructuring expenses - - - 0.8

Integration expenses - 1.0 - 1.9

Legal settlement - - - 9.4

Operating profit/(loss) $17.8 $19.2 (3.2) 32.8

Interest expense on long term borrowings 2.7 2.6 5.4 5.2

Income/(loss) before income tax expense/(benefit) $15.1 $16.6 ($8.5) $27.7

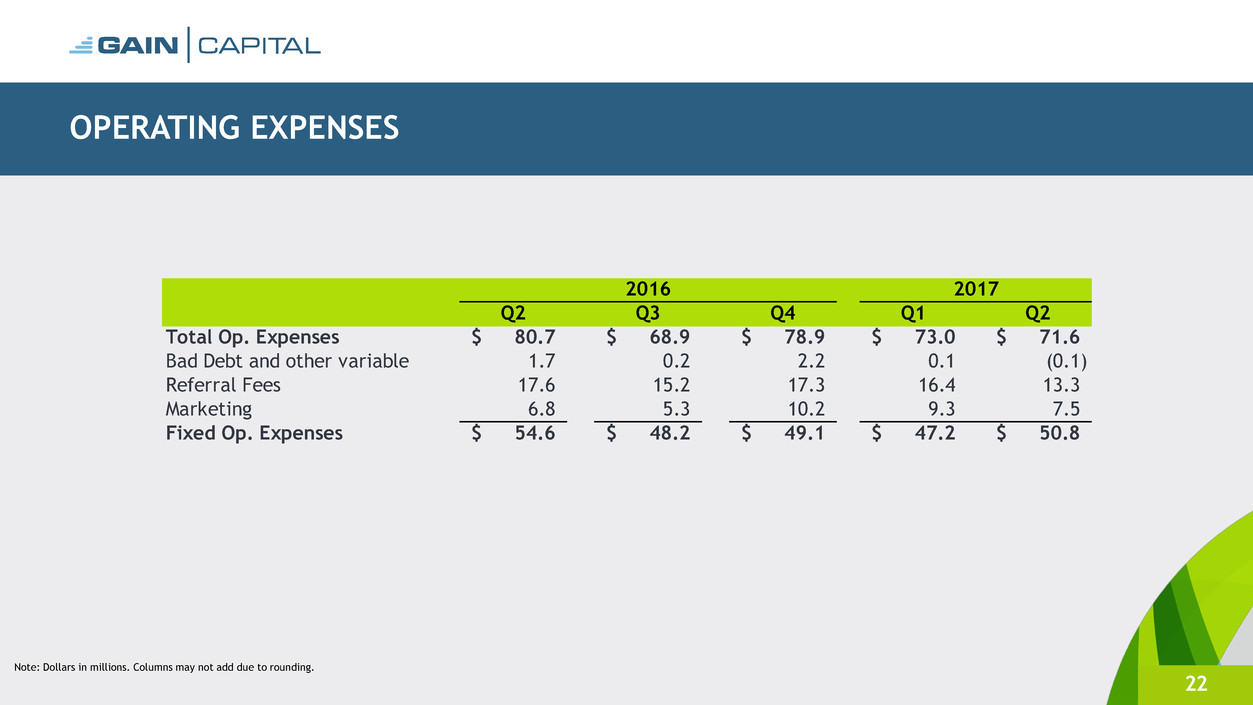

OPERATING EXPENSES

22

Note: Dollars in millions. Columns may not add due to rounding.

Q2 Q3 Q4 Q1 Q2

Total Op. Expenses 80.7$ 68.9$ 78.9$ 73.0$ 71.6$

Bad Debt and other variable 1.7 0.2 2.2 0.1 (0.1)

Referral Fees 17.6 15.2 17.3 16.4 13.3

Marketing 6.8 5.3 10.2 9.3 7.5

Fixed Op. Expenses 54.6$ 48.2$ 49.1$ 47.2$ 50.8$

2016 2017

RETAIL REVENUE PER MILLION

23

$72

$124

$122

$90

$100

$106

$106

$0

$20

$40

$60

$80

$100

$120

$140

$160

Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16 Q4 16 Q1 17 Q2 17

Quarterly Trailing 12 Months Trailing 12 Months - Pro Forma

OPERATING SEGMENT RESULTS: CORPORATE & OTHER

24 Note: Dollars in millions, except where noted otherwise. Columns may not add due to rounding.

3 Months Ended June 30, First Half

2017 2016 2017 2016 TTM 6/30/17

Revenue ($0.3) ($1.5) ($0.4) ($2.0) ($1.1)

Employee Comp & Ben 4.0 3.1 6.5 6.6 13.0

Marketing - - 0.1 - 0.1

Other Operating Exp. 1.9 2.5 3.2 5.5 7.9

Loss ($6.2) ($7.1) ($10.2) ($14.0) ($22.2)

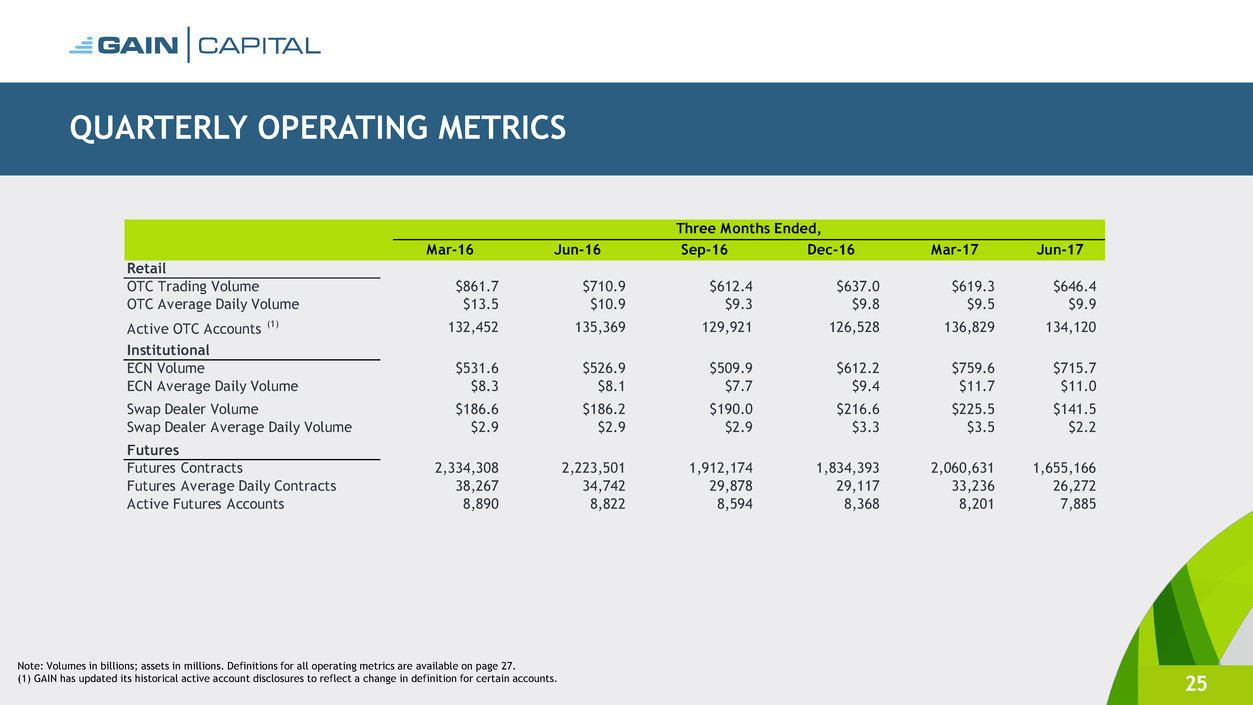

QUARTERLY OPERATING METRICS

25

Note: Volumes in billions; assets in millions. Definitions for all operating metrics are available on page 27.

(1) GAIN has updated its historical active account disclosures to reflect a change in definition for certain accounts.

Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17

Retail

OTC Trading Volume $861.7 $710.9 $612.4 $637.0 $619.3 $646.4

OTC Average Daily Volume $13.5 $10.9 $9.3 $9.8 $9.5 $9.9

Active OTC Accounts (1) 132,452 135,369 129,921 126,528 136,829 134,120

Institutional

ECN Volume $531.6 $526.9 $509.9 $612.2 $759.6 $715.7

CN Average Daily Volume $8.3 $8.1 $7.7 $9.4 $11.7 $11.0

Swap Dealer Volume $186.6 $186.2 $190.0 $216.6 $225.5 $141.5

Swap Dealer Average Daily Volume $2.9 $2.9 $2.9 $3.3 $3.5 $2.2

Futures

Futures Contracts 2,334,308 2,223,501 1,912,174 1,834,393 2,060,631 1,655,166

Futures Average Daily Contracts 38,267 34,742 29,878 29,117 33,236 26,272

Active Futures Accounts 8,890 8,822 8,594 8,368 8,201 7,885

Three Months Ended,

JULY 2017 OPERATING METRICS

26

$10.1

$8.3

$9.4 $9.1

$11.7

$8.6

$9.5

$8.5

$10.4

$9.3 $9.5

$11.0

$9.7

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

OTC Average Daily Volume ($ bns)

135.5 132.4 129.9 128.4 128.4 126.5 124.9

131.2

136.8 135.9 135.1 134.1 132.4

-

20.0

40.0

60.0

80.0

100.0

120.0

140.0

160.0

Active OTC Accounts (000s)

29.6

28.3

31.9

28.3

32.9

26.2

32.2

31.0

36.0

28.7

24.0

26.5

23.6

0.0

5.0

10.0

15.0

20.0

25.0

30.0

35.0

40.0

Futures Average Daily Contracts (000s)

$8.3

$6.5

$8.5 $8.7

$10.3

$9.2

$12.1

$11.1

$11.8 $11.5

$10.7 $10.8

$10.1

$0.0

$2.0

$4.0

$6.0

8

$10

$12

$14

ECN Average Daily Volume ($ bns)

$2.4

$3.2 $3.1

$2.8

$4.0

$3.2

$4.4

$3.1

$2.9

$2.5 $2.6

$1.5

$2.7

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

$4.0

$4.5

$5.0

Swap Dealer Average Daily Volume ($ bns)

8.7 8.6 8.6 8.5 8.5 8.4 8.3 8.2 8.2 8.1 8.0 7.9 8.0

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.

8

9.0

10.0

Active Fut res Accounts (000s)

DEFINITION OF METRICS

27

• Active Accounts: Accounts who executed a transaction within the last 12 months

• Trading Volume: Represents the U.S. dollar equivalent of notional amounts traded

• Customer Assets: Represents amounts due to clients, including customer deposits and unrealized

gains or losses arising from open positions

Q2 and First Half 2017 Results

28

August 2017