Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Forest City Realty Trust, Inc. | a8kinvestorpresentationaug.htm |

August 2017

Investor

Presentation

Exhibit 99.1

Disclosure Information

INFORMATION RELATED TO FORWARD-LOOKING STATEMENTS

Statements made in this presentation that state the Company’s or management's intentions, hopes, beliefs, expectations

or predictions of the future are forward-looking statements. It is important to note that the Company's future events and

actual results, financial or otherwise, could differ materially from those projected in such forward-looking statements.

Additional information concerning factors that could cause future events or actual results to differ materially from those in

the forward-looking statements are included in the “Risk Factors” section of the Company's SEC filings, including, but not

limited to, the Company's Annual Report and quarterly reports. You are cautioned not to place undue reliance on such

forward-looking statements.

USE OF NON-GAAP MEASURES

We frequently use the non‐GAAP measures at total company ownership of funds from operations (“FFO”), Operating FFO,

Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”), Adjusted EBITDA, Net Debt to Adjusted

EBITDA, net operating income (“NOI”), net asset value (“NAV”) and comparable NOI to explain operating performance and

assist investors in evaluating our business. For a more thorough discussion of FFO, Operating FFO, EBITDA, Adjusted

EBITDA, Net Debt to Adjusted EBITDA, NOI, Comparable NOI, and NAV, including how we reconcile these measures to

their GAAP counterparts, please refer to the supplemental package for the quarter-ended June 30, 2017, furnished to the

SEC on Form 8‐K on August 3, 2017 and the supplemental package for the year-ended December 31, 2016, furnished to

the SEC on Form 8‐K on February 27, 2017. Copies of our quarterly and annual supplemental packages can be found on

our website at www.forestcity.net, or on the SEC’s website at www.sec.gov.

Please note: We periodically post updated investor presentations on the Investors page of our website at

www.forestcity.net. It is possible the periodic updates may include information deemed to be material. Therefore, we

encourage investors, the media, and other interested parties to review the Investors page of our website at

www.forestcity.net for the most recent investor presentation.

Pictures shown on cover from left to right are Twelve12, the New York Times building and 88 Sidney Street.

Section Page #

Our Company 1

Our Portfolio 6

Near-Term Priorities and Long-Term Strategy 8

Capital Structure Overview 13

Property Margins and Overhead 15

Corporate Responsibility and ESG 19

Appendix: Additional Financial Information 21

Table of Contents

1

2

3

4

5

A

6

Premier assets in core, high-barrier-to-entry urban markets

Scale and focus within core markets; top 10 assets comprise ~61% of NOI(1)

Outsized growth opportunities from existing JV buyouts, in-process developments

and entitled pipeline in attractive core markets

Identified margin enhancements resulting in ~400-500bps of adjusted EBITDA

margin expansion

Effective, seasoned management team averaging ~20 years of experience at Forest

City; successfully executed key strategic goals in the Company‟s evolution(2)

Substantial upside in dividend; anticipated to more than double by 2019

- 1 -

Value Proposition 1

High-quality assets concentrated in core, urban markets with strong growth

profiles and operated by an experienced, proven management team

(1) Reflects portfolio pro forma for pending retail and FAH dispositions. Percentage based on Q2 2017 estimated annualized stabilized NOI.

(2) Average represents top senior executives excluding Ketan Patel who joined Forest City as General Counsel in 2017.

NAV per Share

Trading Gap

FFO per Share NAV per Share Stockholder Returns

Commitment to Outperformance

Guiding Principles

- 2 -

1

(1) Core markets include Boston, Dallas, Denver and Los Angeles as well as the Greater New York City, San Francisco and Washington, D.C.

metropolitan areas. Reflective of portfolio pro forma for pending retail and FAH dispositions.

Focused Placemaking

Premier national portfolio of

high-quality office and

multifamily assets

Concentrated exposure in

seven leading core markets(1)

Pursue development at

attractive risk-adjusted

returns

Sustainable Growth

Operate within well-defined

capital allocation parameters

Tailored capital structure for

future growth opportunities

Disciplined approach to

activating development

pipeline

Exceptional Performance

Streamlined operations for

“best-in-class” performance

Reduced exposure to non-

core assets and markets

Accountability through

transparency in governance

Focus on core markets

Refine portfolio

Deliver in-process

developments

Portfolio Optimization Earnings Enhancements

Reduce cost of capital

Improve margins

Stabilize accretive

developments

Growth Opportunities

Existing development

entitlements

Opportunistic JV buyouts

Targeted acquisitions

Key Factors As of 2011 Today Target

S

tra

te

g

ic

G

o

a

ls

Core Asset

Focus

Non-Core

Markets

82.2% NOI from 9 Markets(1) 88.4% NOI from 9 Markets(1) >90.0% NOI from 7 Core Markets(2)

Development 16.7%

2011 Development Ratio

7.6%

Q2 2017 Development Ratio

Target development ratio less than ~7.5%

and deliver NAV and FFO growth from

existing projects

Fina

n

cia

l

Margin

Improvement

44.4%

Adjusted EBITDA Margin

49.9% Q2 2017 Adj. EBITDA Margin

(rolling 12-months)

~400-500bps

of upside from identified cost savings

JV Exposure Majority of NOI from JVs

University Park at MIT, QIC

and Madison JV transactions

Opportunity for partner buy-outs

from captive deal pipeline reduces JV exposure

Leverage 13.1x

Net Debt / Adj. EBITDA

8.2x Net Debt / Adj. EBITDA (rolling 12-months

as of 06/30/2017) with a target of 7-8x by

YE2017

6.5x

Long Term Net Debt / Adj. EBITDA

Dividend

Policy

None

$0.09

Quarterly Dividend More than Double by 2019

C

orp

o

ra

te

G

o

v

ern

a

n

c

e

Other

Corporate

Governance

Items

6/15 Independent Board Members

2/6 Independent Board Members with

less than 10 years tenure

21.5 yrs Avg. Board Tenure

Executive Chairman

8/13 Independent Board Members

6/8 Independent Board Members with less

than 10 years tenure

12.2 yrs Avg. Board Tenure

Non-Executive Chairman

Predominantly Independent

Board

Majority Voting standard in uncontested

elections

Ongoing Board Refreshment

(1) Nine markets include Boston, Chicago, Dallas, Denver, Los Angeles and Philadelphia, as well as the Greater New York City, San Francisco and Washington,

D.C. metropolitan areas.

(2) Core markets include Boston, Dallas, Denver and Los Angeles as well as the Greater New York City, San Francisco and Washington, D.C. metropolitan areas.

Retail FAH

Office Apartment

- 3 -

Focus on Continued Execution

Office Apartment

Mixed-Use

1

Retail FAH

Office Apartment

Hotels

Military

Housing

Land Team / Arena

- 4 -

Recent Steps & Accomplishments… 1

Management and the Board have a proven track record of achieving their stated goals and

are focused on continuing successful execution of the Company‟s strategy

Increased Focus

Narrowing focus to two property types, apartment and office, from eight in 2011

Pending disposition of the majority of our retail portfolio through the sale of 11 regional malls

and 12 New York shopping center assets to our existing partners, QIC and Madison International,

for a combined ~5% cap rate (represents $2.2Bn valuation and $1.2Bn NAV)(1)

Currently generate 88.4% of NOI from nine markets compared to 82.2% in 2011(2)

2017 Guidance 2017 Operating FFO Guidance : $1.50 - $1.55 per share

Expanded Margins Adjusted EBITDA margin has expanded from 44.4% in 2011 to 49.9% as of Q2 2017 (rolling 12-months)

Improved Corporate

Governance

Eliminated dual-class structure, implemented majority voting, established a predominately

independent Board and committed to ongoing Board refreshment

Initiated Dividend Re-initiated dividend in 2016 and increased dividend by 50% in 2017

Reduced Leverage Steadily decreased leverage from 13.1x Net Debt / Adj. EBITDA in 2011 to 8.4x at year-end 2016

Enhanced Disclosure Changed fiscal year-end to Dec. 31, disclosed new segment level data, added detailed margin and

overhead information and currently provide annualized NOI and NAV components

Outperformed Peers(3)

Outperformed our proxy peers on a 1, 3 and 5 year basis by ~12%, ~7% and ~30%, respectively

Outperformed MSCI US REIT Index on a 1, 3 and 5 year basis by ~9%, ~2% and ~22%,

respectively

Source: FactSet, SNL Financial.

(1) See pages 28–29 for additional disclosure.

(2) Nine markets include Boston, Chicago, Dallas, Denver, Los Angeles and Philadelphia, as well as the Greater New York City, San Francisco and Washington,

D.C. metropolitan areas.

(3) On an equity market cap-weighted, total returns basis as of 07/31/2017; proxy peers include ARE, AIV, AVB, BXP, CBL, DDR, DRE, EQR, FRT, KIM, MAC,

SLG, UDR and VNO.

(7.5%)

(4.6%)

4.4%

(30%)

(25%)

(20%)

(15%)

(10%)

(5%)

--

5%

10%

07/29/16 10/10/16 12/22/16 03/06/17 05/18/17 07/31/17

23.1%

28.1%

30.2%

(20%)

(10%)

--

10%

20%

30%

40%

07/3 /14 03/ 7/15 10/12/15 05/18/ 6 12/23/16 07/31/17

47.8%

55.5%

77.0%

(20%)

--

20%

40%

60%

80%

100%

07/31/12 07/31/13 07/31/14 07/31/15 0 /30/16 07/31/17

31%

(1%)

6%

14%

(7%)

6%

2

(11%)

(1%)

111%

34%

47%

- 5 -

…Have Yielded Strong Results 1

1 Year Total Return 3 Year Total Return 5 Year Total Return

Source: FactSet, SNL Financial.

(1) Peers are proxy peers.

(2) On an equity market cap-weighted, total returns basis as of 07/31/2017; proxy peers include ARE, AIV, AVB, BXP, CBL, DDR, DRE, EQR, FRT, KIM, MAC,

SLG, UDR and VNO.

Forest City Proxy Peers(2) MSCI US REIT Index (RMZ)

Total Returns Since Key Strategic Milestones

Start of Strategic Plan Converted to a REIT

Reclassification

Announcement

Announcement of REIT

Conversion / Strategic Plan

01/01/2012 01/13/2015 01/04/2016 12/06/2016

Total returns have outperformed peers both over a 1, 3 and 5 year basis,

and since key strategic milestones(1)

Near-Term Strategic Priorities

- 6 -

Objective Near-Term Impact

Execute Sale of Retail Portfolio

Reduces retail exposure, with ~94% of pro forma NOI from

office and multifamily assets

Margin Improvement

~400-500bps of identified adjusted EBITDA margin

improvement

Increase Dividend

More than double current quarterly dividend of $0.09/share

by 2019

Reduce Leverage

~6.5x Net Debt / Adj. EBITDA by year-end 2018 from 8.2x

as of 6/30/2017 (rolling 12-months)(1)

Deliver Near-Term

Developments

Near-term incremental FFO contribution of $0.06 – $0.08

per share from 2017 and 2018 openings upon stabilization

Navigate “BIG” Period

Minimize built-in gains (“BIG”) recognition, resulting from

REIT conversion, while retail and other non-core asset

sales are executed

“BIG” period lasts until 12/31/2020(2)

(1) See page 16 for current capital structure.

(2) See page 25 for additional detail.

2

Forest City has identified six key near-term strategic priorities intended to

simplify & focus the portfolio, increase cash flow and drive stockholder returns

4

3

2

1

5

6

Long-Term Strategy

- 7 -

2

Portfolio Optimization

Focus investing in top tier core markets (inventory of

opportunity: NYC, D.C., San Francisco and Denver)

Deliver ongoing “power of place” developments into

stabilized core portfolio

Continue to evaluate the merit of the long-term

ownership of non-core and remaining retail

Growth Opportunities

Disciplined development targeting 6% – 7% yield on

cost or 150-200bps spread to stabilized cap rates

Opportunistic acquisitions from captive pipeline of

JV partner interests

Targeting development ratio less than ~7.5%

Value creation potential from development pipeline

Earnings Enhancements

Reduce cost of capital

Strengthen balance sheet

Efficient organizational structure of continuous

improvement mindset

Significant FFO from delivery of current developments

Maximize

Stockholder

Value

Portfolio Composition

- 8 -

Total Operating Portfolio Office (% of Total NOI)(2)

Apartment (% of Total NOI)(3)

~$278MM

NOI

~$190MM

NOI

3

(1)

Note: NOI data as presented is at Company share.

(1) Reflects portfolio pro forma for pending retail and FAH dispositions. Percentages based on Q2 2017 estimated annualized stabilized NOI.

(2) CBD includes assets located in the central business districts of Pittsburgh, PA, Richmond, VA, Cleveland, OH and San Francisco, CA. Other includes

assets located in suburban areas of Alexandria, VA, Beachwood, OH, Richmond, VA and Albuquerque, NM. Other Life Science includes an asset in

Philadelphia, PA and an asset in Baltimore, MD.

(3) Core markets include Boston, Chicago, Dallas, Denver, Los Angeles and Philadelphia as well as the Greater New York City, San Francisco and

Washington, D.C. metropolitan areas. Non-Core markets include Cleveland, OH, Cumberland, RI, Haverhill, MA, New Haven, CT, San Diego, CA,

Orange, CA and Stratford, CT.

AMERICAN CIGAR LOFTS | RICHMOND, VA

40 LANDSDOWNE ST | CAMBRIDGE, MA

FOUNDRY LOFTS | WASHINGTON, D.C.

~$501MM

NOI

Atlantic Terminal

Office

Top Ten Assets

- 9 -

3

Pro forma for pending retail portfolio dispositions, Forest City‟s portfolio is concentrated in a

select number of high-quality assets with the top ten assets comprising ~61% of total NOI

Note: Reflects portfolio pro forma for pending retail and FAH asset dispositions. NOI reflects Q2 2017 estimated annualized stabilized NOI. GLA as of 6/30/2017.

Note: NOI and GLA data as presented is at Company share.

(1) Includes Arris, an apartment building that was not stabilized as of Q2 2017. Arris is excluded in other NOI calculations or percentages.

(2) Includes One Pierrepont Plaza.

Cambridge Life

Science Portfolio

Boston, MA

1.5MM SF GLA

$80.8MM NOI

2

NYC San Francisco

San Francisco, CA

388K SF GLA

$19.0MM NOI

Westfield SF

Centre

4

Bayside Village

San Francisco, CA

431 Units

$11.5MM NOI

Brooklyn, NY

400K SF GLA

$11.4MM NOI

New York, NY

735K SF GLA

$50.7MM NOI

New York Times

3

East River Plaza

New York, NY

262K SF GLA

$12.1MM NOI

6

8 Spruce Street

New York, NY

234 Units

$9.9MM NOI

9

Brooklyn, NY

3.2MM SF GLA

$87.3MM NOI

Metrotech

Portfolio(2)

1

Boston

Retail

Office

Apartment

Mixed-Use

Top 10 Asset NOI Contribution

Property Type Key

# Denotes ranking by NOI

Greater Washington, D.C.

276K SF GLA

$9.6MM NOI

Johns Hopkins

8

Washington, D.C.

71K SF GLA / 485 Units

$13.8MM NOI

The Yards(1)

10

Top 10

61%

Remaining

39%

~$501MM

NOI

Washington, D.C.

7

5

New

York

55%

Boston

29%

Washing

ton, D.C.

4%

San

Francisc

o

2%

Philadel

phia

2%

Other

8%

Key Office Stats

New

York

Life

Science

Other

Rent PSF: $52.57 $64.91 $24.54

Occupancy: 98.4% 99.8% 82.8%

Total GLA: 4,823 2,126 2,558

Company GLA: 4,463 1,855 2,250

% Total NOI(1): 31% 19% 6%

Allocated Debt: $408MM $607MM $217MM

Office Segment Overview

- 10 -

Top Office Assets (% of NOI)

Property Location

GLA

(000s)

Rent

PSF Occ‟y

% Office

NOI(1)

Metrotech(2)(3) Brooklyn, NY 3,181 $45.07 98.4% 31%

Cambridge Life

Science(2)

Cambridge, MA 1,457 $70.23 100.0% 29%

New York Times(2) Manhattan, NY 735 $92.39 100.0% 18%

Remaining Core 1,944 $42.61 92.5% 17%

Non-Core(4) 1,251 $20.23 78.6% 5%

Total / Wtd. Avg. 8,568 $48.41 94.5% 100%

33 properties encompassing 8.6MM SF primarily located in core-urban markets

21 traditional office properties (6.7MM SF) and 12 life science properties (1.9MM SF)

3

Geographic Overview (% of Office NOI)(1)

Note: All figures shown at Company share as of 06/30/2017.

(1) Based on Q2 2017 estimated annualized stabilized NOI.

(2) Subject to a ground lease. Additional disclosure on page 22.

(3) Includes One Pierrepont Plaza.

(4) Includes assets located in Beachwood, OH, Albuquerque, NM, Cleveland, OH and Pittsburgh, PA.

(5) Includes Greater Washington, D.C. and Richmond, VA.

300 MASSACHUSETTS AVE | CAMBRIDGE, MA TWELVE METROTECH CENTER | BROOKLYN, NY

(5)

~$278MM

NOI

(4)

Top Apartment Assets (% of NOI)(1)

Property Location Units

Rent /

Unit(2)

Economic

Occ‟y

% Apt.

NOI

Bayside Village San Francisco, CA 431 $3,010 92.5% 6%

8 Spruce Street Manhattan, NY 234 $4,862 95.3% 5%

Pavilion Chicago, IL 1,058 $1,187 94.2% 5%

Remaining Core 7,211 $1,984 94.9% 59%

Non-Core(3) 7,853 $997 92.6% 25%

Total / Wtd. Avg. 16,787 $1,531 94.1% 100%

Apartment Segment Overview

- 11 -

69 total properties; 23,212 total leasable units (16,787 at Company share)(1)

75% of apartment NOI comes from core assets

Note: All figures shown at Company share as of 6/30/2017 and NOI reflects Q2 2017 estimated annualized stabilized NOI.

(1) Pro forma for FAH disposition.

(2) Reflects monthly rent based on comparable unit data as of 6/30/2017.

(3) Core markets include Boston, Chicago, Dallas, Denver, Los Angeles and Philadelphia as well as the Greater New York City, San Francisco and

Washington, D.C. metropolitan areas. Non-Core markets include Cleveland, OH, Cumberland, RI, Haverhill, MA, New Haven, CT, San Diego, CA,

Orange, CA and Stratford, CT.

(4) Includes Richmond, VA.

3

Sky55 | CHICAGO BAYSIDE VILLAGE | SAN FRANCISCO, CA 8 SPRUCE STREET | NEW YORK, NY

(3)

Key Apartment Stats(1)

Core Non-Core

Rent per Unit: $2,015 $997

Occupancy: 94.7% 92.6%

Total Units: 12,322 10,890

Company Units: 8,934 7,853

Avg. Units / Property: 293 407

% of Total NOI: 29% 9%

Allocated Debt: $1.38Bn $328MM

Geographic Overview (% of Apt. NOI)(1)

(4)

~$190MM

NOI

Year

Opening

# of

Projects

Net Cost

($MM)

NOI Range

($MM)

Yield Range

2017 5 298.0$ $15.8 - $17.3 5.7% - 6.2%

2018 3 73.6 4.8 - 5.2 6.5% - 7.0%

2019 2 97.9 6.7 - 7.3 6.9% - 7.4%

10 469.5$ $27.3 - $29.8 5.7% - 6.2%

Property

Type

# of

Projects

Net Cost

($MM)

NOI Range

($MM)

Yield Range

Apartment 8 421.5$ $24.0 - $26.2 5.6% - 6.1%

Retail 2 48.0 3.3 - 3.6 6.7% - 7.2%

10 469.5$ $27.3 - $29.8 5.7% - 6.2%

By Year

By Property Type

Name Location $MM Office Apt. Retail Other Total

Stapleton Denver, CO $0.0 3.1 2.0 0.2 0.2 5.6

The Yards Washington, D.C. 70.4 1.8 2.0 0.3 0.5 4.6

Pier 70 San Francisco, CA 36.2 1.2 0.9 0.4 0.8 3.2

Hudson Exchange Jersey City, NJ 12.5 - 3.0 0.2 - 3.2

Pacific Park Brooklyn, NY 40.9 0.3 1.2 - 0.3 1.8

Waterfront Station Washington, D.C. 10.4 - 0.3 0.0 - 0.3

5M San Francisco, CA 30.8 0.1 0.0 0.0 0.1 0.3

Operating Properties 23.1 - - - - -

Other 5.7 0.1 0.5 0.2 - 0.8

Non-Core Markets 53.4 1.6 0.4 0.1 - 2.1

Total $283.5 8.3 10.2 1.3 1.9 21.7

Square Feet

- 12 -

3

Near-Term Growth(1) Long-Term Growth(2)

Summary of Potential Growth

(1) Reflects projects under construction. See page 24 for additional detail. Dollar amounts represent cost at Company share.

(2) Reflects development pipeline. Dollar amounts and square feet are at Company share. May not sum to totals as presented due to rounding.

(3) $469.5MM reflects cost net of subsidies. Gross cost is $489.4MM.

(4) Dollar amounts reflect projects under development at Company Share.

(5) Completed Projects include: Foundry Lofts, Boilermaker Shops, Lumbershed, Arris, Twelve12; Projects Underway include The Guild and District Winery.

(6) Value of NOI less cost. Assumes 4.5% blended cap rate for residential and office (Source: CoStar as of Q1 2017).

Robust growth pipeline of ~$489MM of projects currently under construction and

a development pipeline of ~20MM entitled SF in core markets

(3)

The Yards Development

(3)

Phase 1 Value Created(6) = $205MM - $230MM

Cash on Cost Return = 6.6% - 7.1%

Cash on Cost spread to Cap Rate = 210-260 bps

Completed

Projects(5)

Projects

Underway Total Phase I

Total

Investment

$198MM ~$212MM - $232MM ~$410MM - $430MM

Total NOI $15MM ~$13MM - $15MM ~$28MM - $30MM

THE BRIDGE AT CORNELL TECH | NEW YORK, NY

Total/Wtd. Avg.

Total/Wtd. Avg.

(4)

Company Share Net Debt / TEV 44%

Fixed Charge Coverage Ratio 2.1x

Net Debt / Adj. EBITDA 8.2x

Total Liquidity: 780.1$

Cash and Cash Equivalents 223.1$

Revolver Capacity 557.0

Secured Debt $ Amt Rate $ Amt Rate

Fixed-rate Mortgage Debt 1,907.3$ 4.38% 3,642.2$ 4.37%

Variable-rate Mortgage Debt 668.5 3.32% 753.4 4.06%

Tax-Exempt Notes Payable 618.1 1.87% 679.9 1.97%

Total Secured Debt 3,193.9$ 5,075.6$

Net unamortized mortgage procurement costs (35.6) (49.9)

Total Secured Debt, Net 3,158.3$ 3.68% 5,025.7$ 4.00%

Unsecured Debt

Revolving Credit Facility L+ 125bps L+ 125bps

May 2021 Term Loan, Net 333.5$ L+ 145bps 333.5$ L+ 145bps

Convertible Senior Debt

4.250 Notes due 2018 73.2 4.25% 73.2 4.25%

3.625% Notes due 2020 40.0 3.63% 40.0 3.63%

Net unamortized mortgage procurement costs (0.8) (0.8)

Total Unsecured Debt 445.9$ 445.9$ 2.54%

Total Debt 3,604.2$ 5,471.6$ 3.92%

Less: Cash and Cash Equivalents (172.3) (223.1)

Net Debt 3,431.8$ 5,248.4$

Common Equity ($24.38 per share as of 7/31/2017) (3) 6,667.9$ 6,667.9$

Noncontrolling interest 480.4 -

Total Enterprise Value 11,916.3$

Consolidated Company's Share

Common Equity

Secured Debt

Term Loan

Convertible Senior Debt

Capital Structure Overview

- 13 -

Capitalization(1) Capitalization (%)(1)(2)

Leverage Metrics & Liquidity(1)

4

(1) All figures shown at Company share unless noted. Balance sheet as of 06/30/2017 and share price as of 07/31/2017.

(2) Does not include $223.1MM of cash and cash equivalents or $0.8MM of net unamortized mortgage procurement costs.

(3) Based on 273.5MM shares outstanding.

(4) Rolling 12-months ended 06/30/2017.

Key

Dollars in millions

Dollars in millions

(4)

Illustrative Deleveraging Plan

- 14 -

Leverage target of ~6.5x by year-end 2018 as the Company continues its focus on

enhancing the balance sheet profile and builds equity in stabilized assets

4

Note: The 2017 and 2018 information is illustrative. It is based on a number of significant assumptions any or all which may turn out to be untrue. You

should not place undue reliance on this forward-looking information. There can be no assurance that these plans will be implemented, or if

implemented, that will be effective in achieving our strategic goals.

13.1x

10.7x

9.5x

8.4x

~7.5x

~6.5x

YE 2011 YE 2014 YE 2015 YE 2016 YE 2017

Target

YE 2018

Run Rate

Key Drivers of Further Deleveraging:

Debt Reduction:

Disposition of FAH portfolio

Disposition of retail assets

Use proceeds from dispositions to pay down

debt

Key Drivers of Further Deleveraging:

EBITDA Growth:

Strong continued free cash flow generation

from operating assets

Additional ~400–500bps in adj. EBITDA

margin improvement from identified cost

savings

NOI contributions from New Property

Openings

Key Drivers of Further Deleveraging from 2017 to 2018:

49.7%

~125bps

~150bps

~225bps

~275bps

~50bps 53.7%

~75bps

54.7%

Year-End 2016 Property NOI Corporate G&A and

Other Operations NOI

Development Overhead Year-End 2018

Adjusted EBITDA Margin Expansion

- 15 -

5

Identified cost savings are expected to provide ~400-500bps of additional

margin improvements by year-end 2018

Illustrative Adjusted EBITDA Margin Enhancement Bridge

Note: Diagonal lines on bridge are reflective of the range of potential enhancements.

Office NOI Margins

- 16 -

Total Office

5

Our New York and Life Science assets have adjusted property margins in line

with top-quartile performing peers

New York (55% of Office NOI) Life Science (34% of Office NOI)

Other (11% of Office NOI)

Note: Margin figures from the six months ended June 30, 2016. NOI and GLA figures shown at Company share. NOI dollar amounts based on Q2 2017

estimated annualized stabilized NOI. GLA as of 06/30/2017.

$95MM NOI

1.9MM GLA

$279MM NOI

8.6MM GLA

$29MM NOI

2.2MM GLA

$154MM NOI

4.5MM GLA

Apartment NOI Margins

- 17 -

Total Apartment

5

Our apartment portfolio has adjusted property margins which are generally in

line with peers operating in the respective markets

Core Markets (75% of Apartment NOI)(1) Non-Core (25% of Apartment NOI)(2)

Note: Margin figures from the year-ended Dec. 31, 2016. NOI and GLA figures shown at Company share. NOI is Q2 2017 estimated annualized

stabilized NOI. Units as of 06/30/2017. Apartment peers normally exclude management fees.

(1) Core markets include Boston, Chicago, Dallas, Denver, Los Angeles and Philadelphia as well as the Greater New York City, San Francisco and

Washington, D.C. metropolitan areas.

(2) Non-Core markets include Cleveland, OH, Cumberland, RI, Haverhill, MA, New Haven, CT, San Diego, CA, Orange, CA and Stratford, CT.

$191MM NOI

16,787 Units

$47MM NOI

7,853 Units

$143MM NOI

8,934 Units

Corporate Overhead

- 18 -

5

Forest City is focused on improving efficiency to align its corporate overhead

with best-in-class peers

G&A as a % of Revenue(1)

Note: Revenue and G&A data as of fiscal year-end 2016 for Forest City.

(1) Forest City revenue is pro rata for JVs, minority interests and discontinued operations.

(2) Adjustments include Apartment segment service and management fees and corporate allocations, which were removed from the Apartment

segment comparable NOI margin bridges shown previously in the supplemental package. Additionally the remaining Apartment segment

service and management company overhead (reflected in Apartment segment “other NOI” in the NOI Detail section of this supplemental

package) is included in these adjustments.

Annual G&A

Expense: $63MM ~$98MM ~$73MM–$83MM

Expected range of 5.75% - 6.50%

pro forma for achieving identified

cost savings of ~$15MM-$25MM

~Q3 2018

(2)

Green Building Performance

2016 LEED Multi-Family Developer of the Year

Recognized by Dept. of Energy as part of the Better Building Alliance Interior Lighting Campaign

Achieved an 11.1% energy reduction since 2010 and 7.3% water use reduction since 2013

Developing a long-term GHG Emissions Reduction target to be implemented in 2017

ESG Ratings & Rankings

“A” rating from MSCI

Green Star Recognition from Global Real Estate Sustainability Benchmark for 2nd straight year

Participation in Global Reporting Initiative framework annually

Submitting performance to CDP Climate Change in 2017

Diversity

Only U.S. REIT on Equileap’s 2017 Top 200 Gender Equality Global Report and Ranking

2020 Women on Boards Winning „W‟ Company for 2016

10.25% spend with minority, women and/or veteran business enterprises in 2016, exceeding

Enterprise-Wide Diverse Supplier Spend goal

Corporate Responsibility and ESG 6

Forest City creates thriving, mixed-use developments that address both the

environmental and social needs of our core markets

- 19 -

Addressing Key Risks Proactively 6

- 20 -

Reducing energy and water use and GHG emissions by improving efficiency through

robust data tracking and reporting

Investing in innovation: developing and incorporating smart building technology and

pursuing the development of green-building certifications and standards

Remediation and responsible land use in operations, development and demolition

Embracing affordable housing and strategically locating properties in dense

environments, aided by careful planning and a focus on transit-oriented design

Sustainable design criteria adheres to standards that exceed local air quality regulations

Implementing strict standards on contractors during all construction/renovation projects

Proactive approach to cybersecurity that accounts for security at connected entities

Cybersecurity committee establishes cyber risk priority areas and implements

enhancements to the security of company and customer data

Energy and Emissions

Cybersecurity

Land Management

and Urban Access

Tenant Health/Safety

Lobbying targeted toward driving economic vitality in the markets served

4 areas of philanthropic focus are economic development, workforce

preparedness, educational attainment and diversity and inclusion efforts

Government and

Community Engagement

Appendix

THE NEW YORK TIMES BUILDING | NEW YORK, NY

Development Detail

- 21 -

Project Name

Property

Type Ownership(3) Units / SF(4)

Cost

Incurred(MM)(4)

Expected

Cost(MM)(4)

Anticipated

Stabilization

2017 Phased Openings

550 Vanderbilt Condominiums 30% 83 106.7 116.4 n/a

Pacific Park Parking Parking 30% n/a 1.2 4.1 Q3 2017

Projects Under Construction

Axis Apartment 30% 116 45.1 41.8 Q1 2019

Ardan Apartment 30% 115 20.8 36.2 Q3 2019

38 Sixth Ave Apartment 30% 91 40.1 50.1 Q3 2018

Mint Town Center Apartment 95% 379 65.4 88.4 Q1 2019

VYV Apartment 50% 211 93.1 107.1 Q1 2019

Ballston Quarter Residential Apartment 51% 207 23.8 92.9 Q3 2020

The Yards – The Guild Apartment 0% 0 0.0 0.0 Q3 2019

Capper 769 Apartment 25% 45 3.7 18.1 Q1 2020

The Yards – The District Winery Retail 100% 16,150 9.1 10.6 Q4 2017

Ballston Quarter Redevelopment Retail 51% 156,570 23.0 44.2 Q3 2018

Total Projects Under Construction $324.1 $489.4

Total (Includes 2017 Openings) $432.0 $609.9

(1) Represent phased openings.

(2) Pacific Park Parking costs include garages that are open/under construction as well as garages not yet under construction.

(3) The Company invests in certain real estate projects through joint ventures and, at times, may provide funding at percentages that differ from the

Company’s legal ownership.

(4) Figures shown at Company share.

(5) Opening date.

A

(5)

(1)

(1)(2)

(1)

(1)

(1)

(1)

(1)

(1)

Summary of Stapleton

- 22 -

Plans for Stapleton include more than 12,000 homes and apartments, 3MM SF of

retail and 10MM SF feet of office, research, development and industrial space

# of Lots Sold to Homebuilders

Completed Project Summary as of 6/30/2017

Completed Retail GLA: 2.5MM SF

Completed Office GLA: 393k SF

Completed Other Commercial GLA: 2.5MM SF

Completed Apartment Units: 1,608

Apartment Units Under Construction: 399

Owned Land: 468 Acres

Land Controlled via Option: 408 Acres

Located in Denver, CO, Stapleton is one of the largest

urban in-fill redevelopment projects in U.S. history

Future entitlements in-place for apartment, retail, office

and single family uses

Upon completion, Stapleton is expected to be home to

30,000 residents and 35,000 workers

Stapleton exemplifies Forest City’s excellence in urban

placemaking

Over the past few years Stapleton land sales have

contributed ~$40MM annually to FFO, which is expected

to continue in the near-term

ASTER TOWN CENTER | DENVER, CO

A

(1) As of 06/30/2017.

501

650

522 [VALUE]

251

12/31/2013* 12/31/2014 12/31/2015 12/31/2016 6/30/2017†

*Represents 11 months ended 12/31/2013

†Represents YTD sales as of 6/30/2017

The Yards Development Case Study

- 23 -

At full build-out, The Yards is expected to include up to 3,000 residential units,

1.8MM SF of office space and approximately 400k SF of retail and dining space

ARRIS | WASHINGTON, D.C.

A

FOUNDRY LOFTS | WASHINGTON, D.C.

Phase 1 Value Created(2) = $205MM - $230MM

Cash on Cost Return = 6.6% - 7.1%

Cash on Cost spread to Cap Rate = 210-260 bps

Completed

Projects(1)

Projects

Underway Total Phase I

Total

Investment

$198MM ~$212MM - $232MM ~$410MM - $430MM

Total NOI $15MM ~$13MM - $15MM ~$28MM - $30MM

Source: CoStar as of Q2 2017.

(1) Completed Projects include: Foundry Lofts, Boilermaker Shops, Lumbershed, Arris, Twelve12; Projects Underway include The Guild and

District Winery.

(2) Value of NOI less cost. Assumes 4.5% blended cap rate for residential and office.

The Yards Project Summary The Yards Geographic Overview

H:\! GRAPHICS\! MAPINFO\Porter Carbajal\2017-06-29\Yards Development.wor

Downtown

Capitol Riverfront

The White House

Washington Monument The Capitol

Nationals Park

E

N

W

S

Washington D.C.

695

295

395

295

395

1 mile

The Yards

Arlington, VA

Summary of Retail Transaction

- 24 -

A

QIC Madison Forest City

Westfield San Francisco Centre

Ballston Quarter (redevelopment)

East River Plaza

Station Square

The Yards:

- Boilermaker Shops

- Lumber Shed

- Twelve12

Likely Dispositions:

- Boulevard Mall

- Atlantic Center Site V

- Brooklyn Commons

Atlantic Center

Atlantic Terminal

Castle Center

Columbia Park Center

Forest Avenue

Harlem Center

Queens Place

Shops at Gun Hill Road

Shops at Northern Boulevard

Shops at Richmond Avenue

The Heights

42nd Street(1)

Outright Sales:

Antelope Valley Mall

Charleston Town Center

Mall at Robinson

Shops at Northfield Stapleton

Shops at Wiregrass

South Bay Galleria

Westchester’s Ridge Hill

Galleria at Sunset

Short Pump Town Center

Promenade Temecula

Victoria Gardens

Cap Rate 5.0%

Valuation $2.2 Bn

QIC Madison

~$1.6B ~$600M

Debt - $1.0 Bn ~700M ~300M

NAV - $1.2 Bn ~900M ~300M

$110.0MM

2016 NOI

(1) 42nd Street will close after resolution of the ground lease rate reset dispute with the city.

NAV Components (as of June 30, 2017)

- 25 -

A

Q2 2017 Net Stabilized Stabilized Annualized Nonrecourse

(Dollars in millions at company's share) NOI ( 1) Adjustments ( 2) NOI Stabilized NOI ( 3) Debt, net ( 4)

Operations A B =A+B

Office Real Estate

Life Science

Cambridge $ 21.9 $ (1.7) $ 20.2 80.8$ (505.1)$

Other Life Science 3.7 (0.1) 3.6 14.4 (101.4)

New York

Manhattan 14.6 (0.7) 13.9 55.6 -

Brooklyn 24.7 - 24.7 98.8 (408.0)

Other Office 7.2 - 7.2 28.8 (217.1)

Subtotal Office $ 72.1 $ (2.5) $ 69.6 278.4$ (1,231.6)$

Apartment Real Estate

Apartments, Core-Markets 35.7 - 35.7 142.8 (1,376.1)

Apartments, Non-Core Markets 11.9 - 11.9 47.6 (327.9)

Subtotal Apartment Product Type $ 47.6 $ - $ 47.6 190.4$ (1,704.0)$

Federally Assisted Housing (5) 4.0 (2.3) 1.7 6.8 (67.3)

Subtotal Apartments 51.6 (2.3) 49.3 197.2 (1,771.3)

Retail Real Estate

Regional Malls 26.3 (2.1) 24.2 96.8 (930.5)

Specialty Retail Centers 12.7 0.1 12.8 51.2 (472.2)

Subtotal Retail $ 39.0 $ (2.0) $ 37.0 148.0$ (1,402.7)$

Subtotal $ 162.7 $ (6.8) $ 155.9 $ 623.6 $ (4,405.6)

Straight-line rent adjustments 3.8 - 3.8 15.2 -

Other operations (1.5) - (1.5) (6.0) -

Total Operations $ 165.0 $ (6.8) $ 158.2 $ 632.8 $ (4,405.6)

Development

Recently-Opened Properties/Redevelopment $ 0.7 $ 5.7 $ 6.4 25.6$ (129.8)$

Straight-line rent adjustments 0.1 - 0.1 0.4 -

Other Development (7.1) - (7.1) (28.4) -

Total Development $ (6.3) $ 5.7 $ (0.6) $ (2.4) $ (129.8)

NAV Components (as of June 30, 2017)

- 26 -

A

(Dollars in millions at company's share) Nonrecourse

Development Book Value ( 4) Debt, net ( 4)

Projects under construction (6) 519.8$ (211.7)$

Projects under development 283.5$ (187.4)$

Land inventory

Stapleton 49.6$ —$

Commercial Outlots 19.7$ —$

Other Tangible Assets

Cash and equivalents 223.1$

Restricted cash 227.0$

Accounts receivable, net (7) 257.1$

Notes Receivable 446.2$

Net investments and advances to unconsolidated entities 41.7$

Prepaid expenses and other deferred costs, net 87.9$

Recourse Debt and Other Liabilities

Revolving credit facility —$

Term loan, net (333.5)$

Convertible senior debt, net (112.4)$

Less: convertible debt 112.4$

Construction payables (110.1)$

Operating accounts payable and accrued expenses (8) (657.9)$

Share Data (in millions)

Diluted weighted average number of shares for the three months ended June 30, 2017 268.8

1) Q2 2017 Earnings Before Income Taxes reconciled to NOI for the three months ended June 30, 2017 in the Supplemental Operating Information section

of the supplemental package, furnished to the SEC on form 8-K on August 3, 2017.

2) The net stabilized adjustments column represents adjustments assumed to arrive at an estimated annualized stabilized NOI. We include stabilization

adjustments to the Q2 2017 NOI as follows:

a) We have removed Q2 2017 lease termination income from our Cambridge Life Science and Manhattan office portfolios.

b) Due to quarterly fluctuations of NOI as a result of distribution restrictions from our limited-distribution federally assisted housing

properties, we have included a stabilization adjustment to the Q2 2017 NOI to arrive at our estimate of stabilized NOI. Our estimate of

stabilized NOI is based on the 2016 annual NOI of $6.8 million, which excludes NOI related to 22 properties in this portfolio that were sold

during the six months ended June 30, 2017.

c) Partial period NOI for recently sold properties has been removed in the Operations Segments.

d) Due to the planned transfer of Boulevard Mall (Regional Malls) to the lender in a deed-in-lieu transaction during 2017, we have removed

NOI and nonrecourse debt, net, related to this property.

e) For recently-opened properties currently in initial lease-up periods included in the Development Segment, NOI is reflected at 5% of the

company ownership cost. This assumption does not reflect our anticipated NOI, but rather is used in order to establish a hypothetical

basis for an estimated valuation of leased-up properties. The following properties are currently in their initial lease-up periods:

NOI attributable to Kapolei Lofts, an apartment community on land in which we lease, is not included in NOI from lease-up properties.

We consolidate the land lessor, who is entitled to a preferred return that currently exceeds anticipated operating cash flow of the project, and

therefore, this project is reflected at 0% for company-share purposes. In accordance with the waterfall provisions of the distribution agreement,

we expect to share in the net proceeds upon a sale of the project, which is not currently reflected on the NAV component schedule.

- 27 -

NAV Components-Footnotes (as of June 30, 2017) A

Property Cost at 100%

Cost at Company

Share

Lease Commitment % as of

July 23, 2017

Office:

1812 A hland Ave (Life Science) 61.2$ 61.2$ 75%

Apartments:

535 Carlton (Core Market) 168.1$ 41.7$ 36%

Eli t on 4th (C r Market) 143.7$ 44.2$ 39%

NorthxNorthwest (Core Market) 115.0$ 33.5$ 24%

461 Dean Street (Core Market) 195.6$ 195.6$ 77%

The Bixby (Core Market) 59.2$ 11.8$ 99%

Blossom Plaza (Core Market) 100.6$ 29.9$ 95%

The Yards - Arris (Core Market) 143.2$ 42.9$ 94%

986.6$ 460.8$

(in millions)

NAV Components-Footnotes (as of June 30, 2017)

- 28 -

f) Due to the redevelopment of Ballston Quarter (Development Segment; Recently-Opened Properties/Redevelopment), we have

included a stabilization adjustment to the Q2 2017 NOI to arrive at $2.6 million, our estimate of annualized stabilized NOI prior to

the commencement of our current redevelopment.

The net stabilized adjustments are not comparable to any GAAP measure and therefore do not have a reconciliation to the nearest

comparable GAAP measure.

3) Company ownership annualized stabilized NOI is calculated by taking the Q2 2017 stabilized NOI times a multiple of four.

4) Amounts represent the company’s share of each respective balance sheet line item as of June 30, 2017 and may be calculated using the financial

information contained in the Appendix of the supplemental package furnished to the SEC on form 8-K on August 3, 2017. Due to the planned

transfer of Boulevard Mall to the lender, we have removed nonrecourse debt, net, of $91.1 million related to this property.

5) Represents the remaining 25 federally assisted housing apartment communities. We recently signed a master purchase and sale agreement to

dispose of this portfolio and expect to receive net proceeds of approximately $65 million. As of June 30, 2017, 22 properties have closed,

representing $53.5 million in net proceeds.

6) We have removed $23.0 million of assets from projects under construction, which represents the costs on the balance sheet associated with the

ongoing redevelopment of Ballston Quarter. NOI for each of this is stabilized under Recently-Opened Properties/Redevelopment.

7) Includes $149.9 million of straight-line rent receivable (net of $9.1 million of allowance for doubtful accounts).

8) Includes $62.2 million of straight-line rent payable.

A

Definitions of non-GAAP measures

EBITDA

EBITDA, a non-GAAP measure, is defined as net earnings excluding the following items at our company share: i) non-cash charges for depreciation and

amortization; ii) interest expense; iii) amortization of mortgage procurement costs; and iv) income taxes. EBITDA may not be directly comparable to

similarly-titled measures reported by other companies. We use EBITDA as the starting point in order to calculate Adjusted EBITDA as described below.

Adjusted EBITDA

We define Adjusted EBITDA, a non-GAAP measure, as EBITDA adjusted to exclude: i) impairment of real estate; ii) gains or losses from extinguishment

of debt; iii) gain (loss) on full or partial disposition of rental properties, development projects and other investments; iv) gains or losses on change in

control of interests; v) other transactional items, including organizational transformation and termination benefits; and vi) the Nets pre-tax EBITDA. We

believe EBITDA, Adjusted EBITDA and net debt to Adjusted EBITDA provide additional information in evaluating our credit and ability to service our debt

obligations. Adjusted EBITDA is used by the chief operating decision maker and management to assess operating performance and resource allocations

by segment and on a consolidated basis. Management believes Adjusted EBITDA gives the investment community a further understanding of the

Company’s operating results, including the impact of general and administrative expenses and acquisition-related expenses, before the impact of

investing and financing transactions and facilitates comparisons with competitors. However, Adjusted EBITDA should not be viewed as an alternative

measure of the Company’s operating performance since it excludes financing costs as well as depreciation and amortization costs which are significant

economic costs that could materially impact the Company’s results of operations and liquidity. Other REITs may use different methodologies for

calculating Adjusted EBITDA and, accordingly, the Company’s Adjusted EBITDA may not be comparable to other REITs.

Net Debt to Adjusted EBITDA

Net Debt to Adjusted EBITDA, a non-GAAP measure, is defined as total debt, net at our company share (total debt includes outstanding borrowings on

our revolving credit facility, our term loan facility, convertible senior debt, net, nonrecourse mortgages and notes payable, net) less cash and

equivalents, at our company share, divided by Adjusted EBITDA. Net Debt to Adjusted EBITDA is a supplemental measure derived from non-GAAP

financial measures that the Company uses to evaluate its capital structure and the magnitude of its debt against its operating performance. The

Company believes that investors use versions of this ratio in a similar manner. The Company’s method of calculating the ratio may be different from

methods used by other REITs and, accordingly, may not be comparable to other REITs.

Net Asset Value Components

We disclose components of our business relevant to calculate NAV, a non-GAAP measure. There is no directly comparable GAAP financial measure to

NAV. We consider NAV to be a useful supplemental measure which assists both management and investors to estimate the fair value of our Company.

The calculation of NAV involves significant estimates and can be calculated using various methods. Each individual investor must determine the specific

methodology, assumptions and estimates to use to arrive at an estimated NAV of the Company. NAV components are shown at our total company

ownership. We believe disclosing the components at total company ownership is essential to estimate NAV, as they represent our estimated

proportionate amount of assets and liabilities the Company is entitled to.

The components of NAV do not consider the potential changes in rental and fee income streams or development platform. The components include

non-GAAP financial measures, such as NOI, and information related to our rental properties business at the Company’s share. Although these measures

are not presented in accordance with GAAP, investors can use these non-GAAP measures as supplementary information to evaluate our business.

- 29 -

A

Definitions of non-GAAP measures(cont’d)

NOI

NOI, a non-GAAP measure, reflects our share of the core operations of our rental real estate portfolio, prior to any financing activity. NOI is

defined as revenues less operating expenses at our ownership within our Office, Apartments, Retail, and Development segments, except for

revenues and cost of sales associated with sales of land held in these segments. The activities of our Corporate and Other segments do not involve

the operations of our rental property portfolio and therefore are not included in NOI.

We believe NOI provides important information about our core operations and, along with earnings before income taxes, is necessary to

understand our business and operating results. Because NOI excludes general and administrative expenses, interest expense, depreciation and

amortization, revenues and cost of sales associated with sales of land, other non-property income and losses, and gains and losses from property

dispositions, it provides a performance measure that, when compared year over year, reflects the revenues and expenses directly associated with

owning and operating office, apartment and retail real estate and the impact to operations from trends in occupancy rates, rental rates, and

operating costs, providing a perspective on operations not immediately apparent from net income. We use NOI to evaluate our operating

performance on a portfolio basis since NOI allows us to evaluate the impact that factors such as occupancy levels, lease structure, rental rates, and

tenant mix have on our financial results. Investors can use NOI as supplementary information to evaluate our business. In addition, management

believes NOI provides useful information to the investment community about our financial and operating performance when compared to other

REITs since NOI is generally recognized as a standard measure of performance in the real estate industry. NOI is not intended to be a performance

measure that should be regarded as an alternative to, or more meaningful than, our GAAP measures, and may not be directly comparable to

similarly-titled measures reported by other companies.

- 30 -

A

Reconciliation of non-GAAP measures

(1)-(3) See page 29 in the supplemental package furnished to the SEC for the three and six months ended June 30, 2017 for footnotes. Additionally, see page 25 in the

supplemental package furnished to the SEC for the year-ended December 31, 2016 for footnotes.

- 31 -

A

2017 2016

Earnings ( loss) before income taxes (GAAP) 58,245$ (454,173)$

Earnings from unconsolidated entities (41,514) 263,533

Earnings (loss) before income taxes and earnings from unconsolidated entities 16,731 (190,640)

Land sales (17,762) (48,078)

Cost of land sales 7,694 13,661

Other land development revenues (1,862) (10,183)

Other land development expenses 2,034 8,923

Corporate general and administrative expenses 14,018 62,683

Organizational transformation and termination benefits 6,863 31,708

Depreciation and amortization 65,747 250,848

Write-offs of abandoned development projects and demolition costs 1,596 10,348

Impairment of real estate — 156,825

Interest and other income (9,896) (46,229)

Interest expense 28,901 131,441

Interest rate swap breakage fee — 24,635

Am rtization of mortgage procurement costs 1,507 5,719

Loss on extinguishment of debt — 32,960

NOI related to unconsolidated entities(1) 53,629 223,592

NOI related to noncontrolling interest(2) (10,483) (37,221)

NOI related to discontinued operations(3) — 1,198

Net Operating Income (Non-GAAP) 158,717$ 622,190$

Three Months

Ended June 30,

Year Ended

December 31,

Reconciliation of Earnings (Loss) Before Income Taxes (GAAP) to Net Operating Income (non-GAAP)

(in thousands)

Reconciliation of non-GAAP measures(cont’d)

(1) See page 35 in the supplemental package furnished to the SEC for the quarter ended June 30, 2017 for footnotes. Additionally, see page 32 in the supplemental

package furnished to the SEC for the year-ended December 31, 2016 for footnotes.

- 32 -

A

Reconciliation of Net Earnings (GAAP) to EBITDA (non-GAAP)

Three Months

Ended June 30,

2017 2016

Net earnings attributable to Forest C ity Realty Trust, Inc. (GAAP) 56,753$ (158,402)$

Depreciation and amortization 82,089 321,749

Interest Expense(1) 48,857 221,812

Interest rate swap breakage fee — 24,635

Amortization of mortgage procurement costs 1,909 8,680

Income tax expense 4,654 85,105

EBITDA attributable to Forest C ity Realty Trust, Inc. (Non-GAAP) 194,262$ 503,579$

Impairment of real estate — 463,225

Net loss on extinguishment of debt 2 33,863

Net gain on disposition of interest in development project — (136,687)

Net gain on disposition of partial interest in other investment - Nets — (136,247)

Net gain on disposition of full or partial interests in rental properties (39,314) (129,367)

Nets pre-tax EBITDA — 1,400

Organizational transformation and termination benefits 6,863 31,708

Adjusted EBITDA attributable to Forest C ity Realty Trust, Inc. (Non-GAAP) 161,813$ 631,474$

2017 2016

Nonrecourse mortgage debt and notes payable, net, at company share 5,025,661$ 5,063,175$

Revolving credit facility — —

Term loan, net 333,468 333,268

Convertible ior debt, net 112,410 112,181

Total debt 5,471,539$ 5,508,624

Less cash and equivalents (223,141) (221,478)

Net Debt 5,248,398$ 5,287,146$

Net Debt to Adjusted EBITDA (Annualized) 8.1x 8 .4x

As of June 30, As of Dec 31,

(in thousands)

Year Ended

December 31,

(in thousands)

2017 Guidance

- 33 -

A

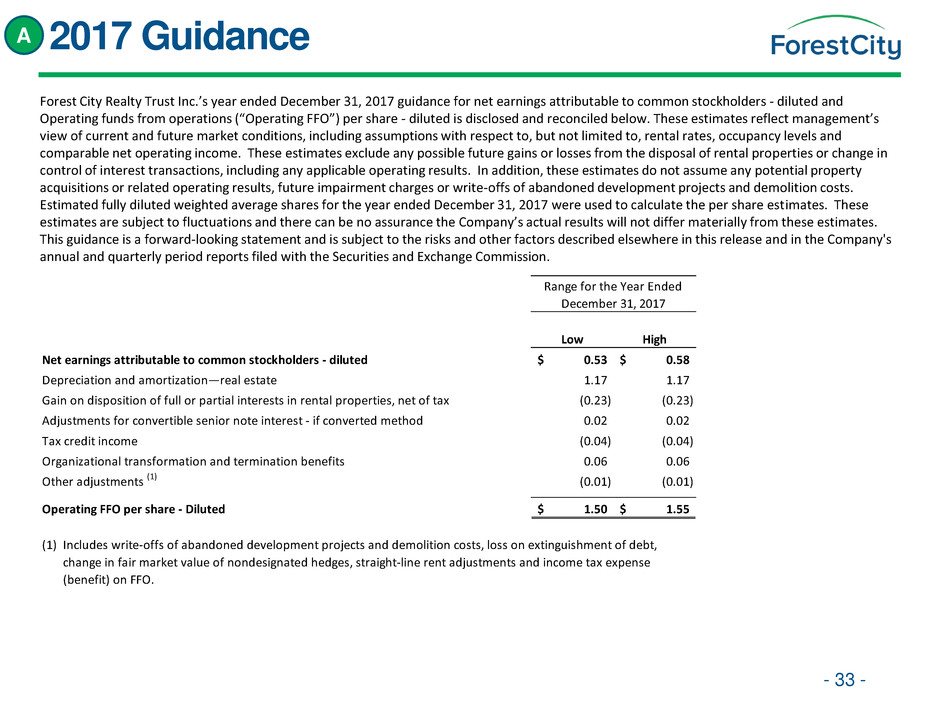

Forest City Realty Trust Inc.’s year ended December 31, 2017 guidance for net earnings attributable to common stockholders - diluted and

Operating funds from operations (“Operating FFO”) per share - diluted is disclosed and reconciled below. These estimates reflect management’s

view of current and future market conditions, including assumptions with respect to, but not limited to, rental rates, occupancy levels and

comparable net operating income. These estimates exclude any possible future gains or losses from the disposal of rental properties or change in

control of interest transactions, including any applicable operating results. In addition, these estimates do not assume any potential property

acquisitions or related operating results, future impairment charges or write-offs of abandoned development projects and demolition costs.

Estimated fully diluted weighted average shares for the year ended December 31, 2017 were used to calculate the per share estimates. These

estimates are subject to fluctuations and there can be no assurance the Company’s actual results will not differ materially from these estimates.

This guidance is a forward-looking statement and is subject to the risks and other factors described elsewhere in this release and in the Company's

annual and quarterly period reports filed with the Securities and Exchange Commission.

Low High

Net earnings attributable to common stockholders - diluted 0.53$ 0.58$

Depreciation and amortization—real estate 1.17 1.17

Gain on disposition of full or partial interests in rental properties, net of tax (0.23) (0.23)

Adjustments for convertible senior note interest - if converted method 0.02 0.02

Tax credit income (0.04) (0.04)

Orga zatio al tr nsformation and termination benefits 0.06 0.06

Oth r adjustments

(1)

(0.01) (0.01)

Operating FFO per share - Diluted 1.50$ 1.55$

(1)

Range for the Year Ended

December 31, 2017

Includes write-offs of abandoned development projects and demolition costs, loss on extinguishment of debt,

change in fair market value of nondesignated hedges, straight-line rent adjustments and income tax expense

(benefit) on FFO.