Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Carbonite Inc | ex991-q22017pressrelease.htm |

| 8-K - 8-K - Carbonite Inc | a8-kq22017earningsrelease.htm |

carbonite.com 1

Carbonite, Inc.

Q2 2017 Financial Results

August 3, 2017

carbonite.com 2

Safe Harbor Statement

Certain matters discussed in these slides and accompanying oral presentation have "forward-looking statements" intended to qualify for the safe

harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements may generally be

identified as such because the context of such statements will include words such as "anticipate," "believe," "could," "estimate," "expect," "intend,"

"may," "plan," "potential," "predict," "project," "should," "will," "would" or words of similar import. Similarly, statements that describe the

Company's future plans, objectives or goals are also forward-looking statements. Forward-looking statements are subject to a number of risks and

uncertainties, many of which involve factors or circumstances that are beyond the Company's control. The Company's actual results could differ

materially from those stated or implied in forward-looking statements due to a number of factors, including, but not limited to, economic conditions

and markets (including current financial conditions), exchange rate fluctuations, risks associated with debt prepayment, stock repurchases or

acquisitions in lieu of retaining such cash for future needs, and changes in regulatory conditions or other trends affecting the Internet and the

information technology industry. These and other important risk factors are discussed under the heading "Risk Factors" in our Annual Report on

Form 10-K for the fiscal year ended December 31, 2016 filed with the Securities and Exchange Commission (the "SEC"), which is available on

www.sec.gov, and elsewhere in any subsequent periodic or current reports filed by us with the SEC. Except as required by applicable law, we do not

undertake any obligation to update our forward-looking statements to reflect future events, new information or circumstances.

This presentation contains non-GAAP financial measures including, but not limited to, Bookings, non-GAAP Revenue, non-GAAP Gross Margin,

non-GAAP Net Income and non-GAAP Net Income Per Share, and Adjusted Free Cash Flow. A reconciliation to GAAP can be found in the financial

schedules included in our most recent earnings press release located on Carbonite’s website, http://investor.carbonite.com, in the Company’s filings

or with the SEC at www.sec.gov. The presentation of non-GAAP financial information should not be considered in isolation or as a substitute for, or

superior to, the financial information prepared and presented in accordance with GAAP.

carbonite.com 3

Financial Results Conference Call Details

What: Carbonite Q2 2017 Financial Results Conference Call

When: Thursday, August 3, 2017

Time: 5:30 p.m. ET

Live Call: 877-303-1393 (U.S.)

315-625-3228 (International)

Conference ID: 48381962

Live and Recorded Webcast: http://investor.carbonite.com

carbonite.com 4

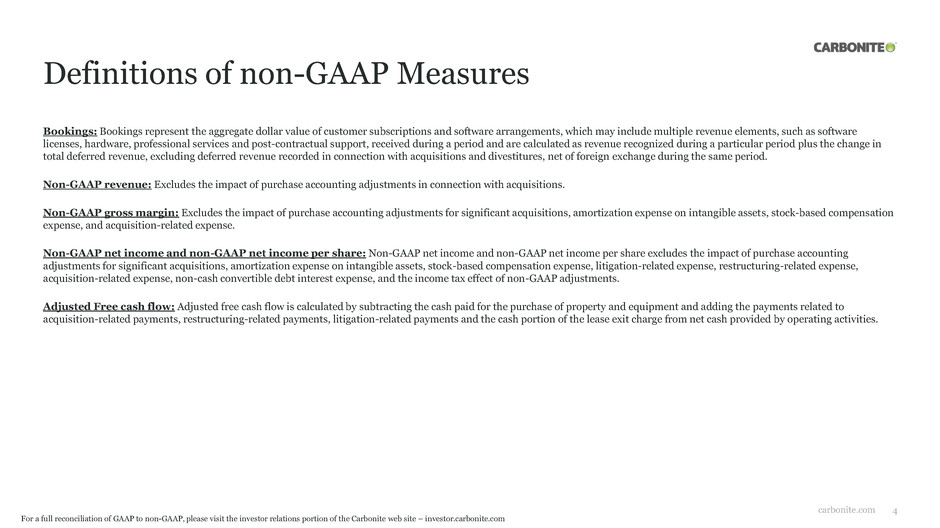

Definitions of non-GAAP Measures

Bookings: Bookings represent the aggregate dollar value of customer subscriptions and software arrangements, which may include multiple revenue elements, such as software

licenses, hardware, professional services and post-contractual support, received during a period and are calculated as revenue recognized during a particular period plus the change in

total deferred revenue, excluding deferred revenue recorded in connection with acquisitions and divestitures, net of foreign exchange during the same period.

Non-GAAP revenue: Excludes the impact of purchase accounting adjustments in connection with acquisitions.

Non-GAAP gross margin: Excludes the impact of purchase accounting adjustments for significant acquisitions, amortization expense on intangible assets, stock-based compensation

expense, and acquisition-related expense.

Non-GAAP net income and non-GAAP net income per share: Non-GAAP net income and non-GAAP net income per share excludes the impact of purchase accounting

adjustments for significant acquisitions, amortization expense on intangible assets, stock-based compensation expense, litigation-related expense, restructuring-related expense,

acquisition-related expense, non-cash convertible debt interest expense, and the income tax effect of non-GAAP adjustments.

Adjusted Free cash flow: Adjusted free cash flow is calculated by subtracting the cash paid for the purchase of property and equipment and adding the payments related to

acquisition-related payments, restructuring-related payments, litigation-related payments and the cash portion of the lease exit charge from net cash provided by operating activities.

For a full reconciliation of GAAP to non-GAAP, please visit the investor relations portion of the Carbonite web site – investor.carbonite.com

carbonite.com 5

Recent Financial and Operating Highlights

Consistent financial

performance

Proven acquisition

growth strategy

Steady growth and

improving margins

Strong team

executing well

Carbonite surpassed $1 Billion in lifetime company bookings

carbonite.com 6

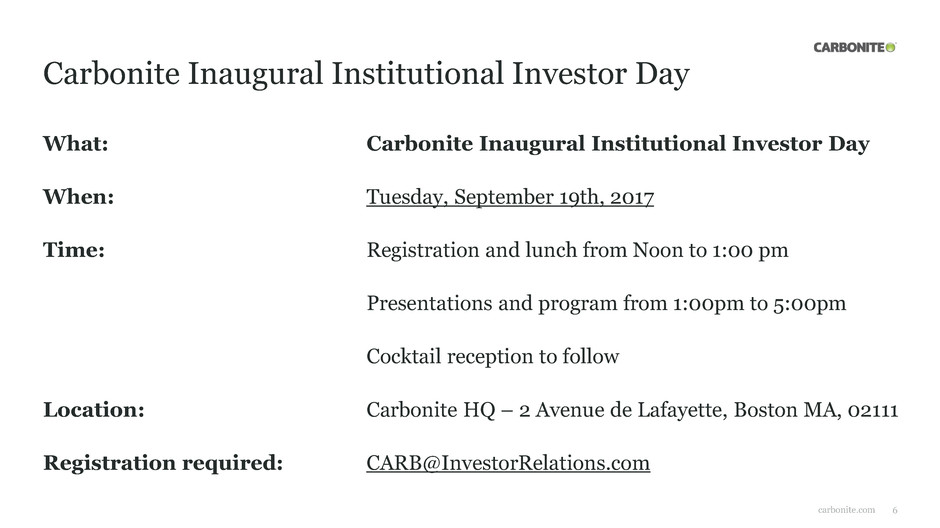

Carbonite Inaugural Institutional Investor Day

What: Carbonite Inaugural Institutional Investor Day

When: Tuesday, September 19th, 2017

Time: Registration and lunch from Noon to 1:00 pm

Presentations and program from 1:00pm to 5:00pm

Cocktail reception to follow

Location: Carbonite HQ – 2 Avenue de Lafayette, Boston MA, 02111

Registration required: CARB@InvestorRelations.com

carbonite.com 7

Ransomware

Backup is one of the only reliable means of protection

• $1 Billion

It was estimated that $ 1 Billion in potential

ransoms would be paid in 2016*

• 230,000

Number of computers infected by WannaCry

ransomware*

• 10,000+

Number of customers Carbonite customer support

recovered from ransomware in last 24 months

• Carbonite is a leader in ransomware

recovery

$1B

Ransom paid in 2016*

Source: http://fortune.com/2017/05/15/ransomware-wannacry-virus-microsoft-patch-cyber-attack-bug/;

http://www.nbcnews.com/tech/security/ransomware-now-billion-dollar-year-crime-growing-n704646

carbonite.com 8

Unified Partner Program

• The Carbonite Partner Program consists of

solutions, tools, incentives and support, including:

sales, pre-sales engineering and marketing support

• Relaunched and redesigned Partner Portal helps

manage all customer accounts while support teams

sell, deploy and support any Carbonite data

protection solution

• Programs include up-front deal registration, sales

incentive programs, and incumbent renewal, rebate

and marketing programs

carbonite.com 9

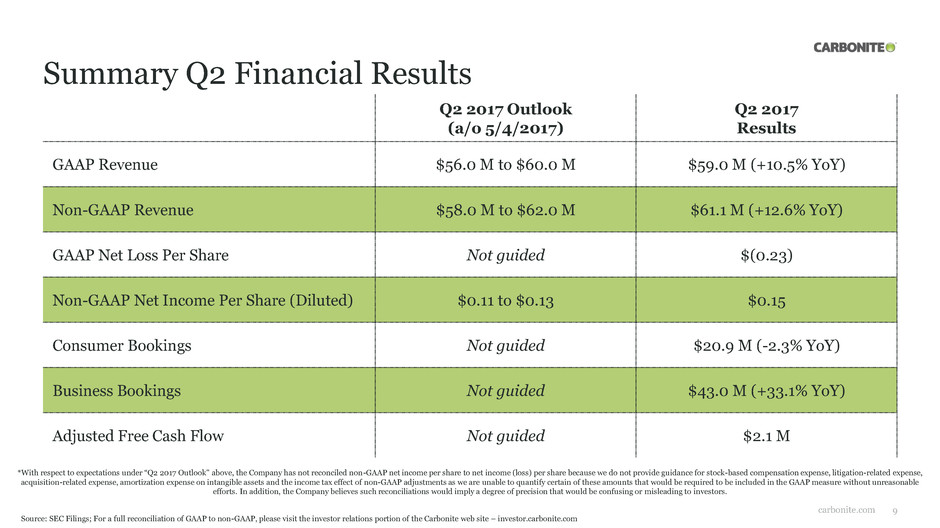

Summary Q2 Financial Results

Q2 2017 Outlook

(a/o 5/4/2017)

Q2 2017

Results

GAAP Revenue $56.0 M to $60.0 M $59.0 M (+10.5% YoY)

Non-GAAP Revenue $58.0 M to $62.0 M $61.1 M (+12.6% YoY)

GAAP Net Loss Per Share Not guided $(0.23)

Non-GAAP Net Income Per Share (Diluted) $0.11 to $0.13 $0.15

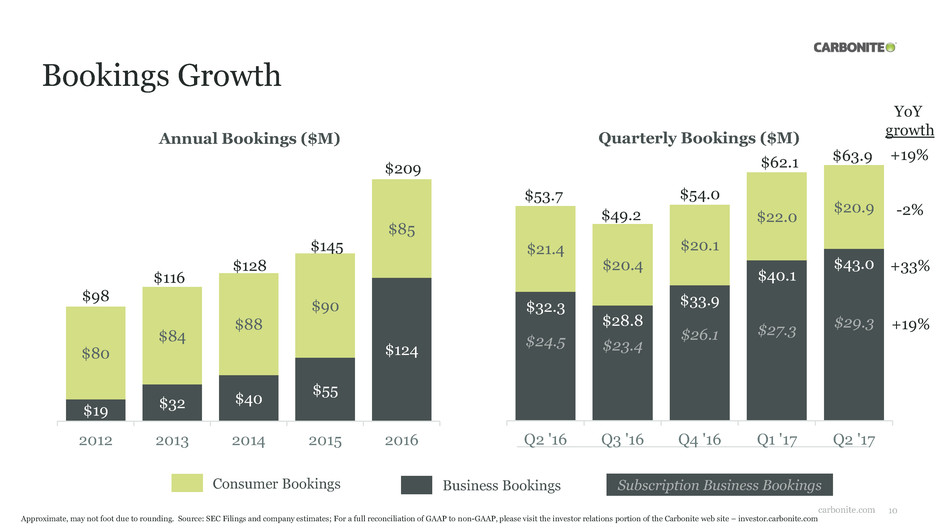

Consumer Bookings Not guided $20.9 M (-2.3% YoY)

Business Bookings Not guided $43.0 M (+33.1% YoY)

Adjusted Free Cash Flow Not guided $2.1 M

*With respect to expectations under “Q2 2017 Outlook" above, the Company has not reconciled non-GAAP net income per share to net income (loss) per share because we do not provide guidance for stock-based compensation expense, litigation-related expense,

acquisition-related expense, amortization expense on intangible assets and the income tax effect of non-GAAP adjustments as we are unable to quantify certain of these amounts that would be required to be included in the GAAP measure without unreasonable

efforts. In addition, the Company believes such reconciliations would imply a degree of precision that would be confusing or misleading to investors.

Source: SEC Filings; For a full reconciliation of GAAP to non-GAAP, please visit the investor relations portion of the Carbonite web site – investor.carbonite.com

carbonite.com 10

Subscription Business Bookings

Bookings Growth

$19 $32

$40

$55

$124$80

$84

$88

$90

$85

2012 2013 2014 2015 2016

Annual Bookings ($M)

Approximate, may not foot due to rounding. Source: SEC Filings and company estimates; For a full reconciliation of GAAP to non-GAAP, please visit the investor relations portion of the Carbonite web site – investor.carbonite.com

$98

$32.3

$28.8

$33.9

$40.1

$43.0

$21.4

$20.4

$20.1

$22.0

$20.9

$24.5 $23.4

$26.1 $27.3

$29.3

Q2 '16 Q3 '16 Q4 '16 Q1 '17 Q2 '17

Quarterly Bookings ($M)

$53.7

$63.9

$209

$116

$128

$145

$49.2

$54.0

$62.1

Business BookingsConsumer Bookings

+19%

YoY

growth

-2%

+33%

+19%

carbonite.com 11

Revenue and Gross Margin

$54.2

$52.5

$53.9

$59.1

$61.1

Q2 '16 Q3 '16 Q4 '16 Q1 '17 Q2 '17

Non-GAAP Revenue ($M)

Source: SEC Filings; For a full reconciliation of GAAP to non-GAAP, please visit the investor relations portion of the Carbonite web site – investor.carbonite.com

72.5%

72.2%

74.0%

73.8%

74.1%

Q2 '16 Q3 '16 Q4 '16 Q1 '17 Q2 '17

Non-GAAP Gross Margin (%)

carbonite.com 12

Business Outlook (as of August 3, 2017)*

Q3 2017

Outlook

FY 2017

Outlook

GAAP Revenue $59.0 M to $61.0 M $232.0 M to $244.0 M

Non-GAAP Revenue $60.5 M to $62.5 M $238.5 M to $250.5 M

Non-GAAP Net Income Per Share (Diluted) $0.19 to $0.21 $0.74 to $0.80

Business Bookings Not guided $160.6 M to $170.2 M

Consumer Bookings YoY Growth Not guided (10%) to 0% growth

Non-GAAP Gross Margin Not guided 74.0% to 75.0%

Adjusted Free Cash Flow Not guided $16.0 M to $20.0 M

*With respect to our expectations under "Business Outlook" above, the Company has not reconciled non-GAAP net income per share to net income (loss) per share because we do not provide guidance for stock-based compensation expense, litigation-related expense,

acquisition-related expense, amortization expense on intangible assets, non-cash convertible debt interest expense, and the income tax effect of non-GAAP adjustments as we are unable to quantify certain of these amounts that would be required to be included in the

GAAP measure without unreasonable efforts. In addition, the Company believes such reconciliations would imply a degree of precision that would be confusing or misleading to investors.

Source: SEC Filings; For a full reconciliation of GAAP to non-GAAP, please visit the investor relations portion of the Carbonite web site – investor.carbonite.com