Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Urban Edge Properties | exhibit322certofceoandcfo-.htm |

| EX-32.1 - EXHIBIT 32.1 - Urban Edge Properties | exhibit321certofceoandcfo-.htm |

| EX-31.4 - EXHIBIT 31.4 - Urban Edge Properties | exhibit314certofcfo-sox302.htm |

| EX-31.3 - EXHIBIT 31.3 - Urban Edge Properties | exhibit313certofceo-sox302.htm |

| EX-31.2 - EXHIBIT 31.2 - Urban Edge Properties | exhibit312certofcfo-sox302.htm |

| EX-31.1 - EXHIBIT 31.1 - Urban Edge Properties | exhibit311certofceo-sox302.htm |

| EX-10.2 - EXHIBIT 10.2 - Urban Edge Properties | exhibit102ackermancontribu.htm |

| 10-Q - 10-Q - Urban Edge Properties | ue-6302017x10q.htm |

EXHIBIT 10.1

TAX PROTECTION AGREEMENT

This Tax Protection Agreement (this “Agreement”) is entered into as of May 24, 2017, by and among Urban Edge Properties LP, a Delaware limited partnership (the “Partnership”); Urban Edge Properties, a Maryland real estate investment trust (the “REIT”); Acklinis Yonkers Realty, L.L.C., a New York limited liability company; Acklinis Realty Holding, LLC, a New York limited liability company; Acklinis Original Building, L.L.C., a New York limited liability company; Ackrik Associates, L.P., a New York limited partnership; A & R Woodbridge Shopping Center, L.L.C., a Delaware limited liability company; A & R Millburn Associates, L.P., a New Jersey limited partnership; and A & R Manchester, LLC, a Missouri limited liability company (each of the foregoing seven entities, a “Contributor”); 211 West 61st Street Associates, L.P., a Delaware limited partnership; Acklinis Associates, L.P., a New York limited partnership; A & R Woodbridge Associates II, L.P., a New Jersey limited partnership; each Initial Unitholder and each Protected Partner other than the Initial Unitholders, all as identified on Annex A hereto, as amended from time to time; and the respective representatives of the Initial Unitholders as set forth on Annex A hereto, in each case solely in his or her capacity as representative of the designated Initial Unitholder(s) and any Protected Partner that becomes a beneficiary of this Agreement with respect to the OP Units received by the designated Initial Unitholder(s) (each, a “Representative”).

WHEREAS, pursuant to the Contribution Agreement (the “Contribution Agreement”) between each of the parties designated as a “Contributor” on Exhibit A-1 thereto, the REIT and the Partnership dated as of April 7, 2017, the Contributors shall contribute their interests in each property set forth on Annex B hereto to the Partnership on the Closing Date in exchange for a combination of OP Units, cash and the assumption of existing debt (each, a “Contribution”);

WHEREAS, in consideration for the agreement of the relevant Contributors to make the Contributions of the Protected Properties, the parties hereto desire to enter into this Agreement;

NOW, THEREFORE, in consideration of the promises and mutual agreements contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

Section 1.Definitions. Capitalized terms employed herein and not otherwise defined shall have the meaning assigned to them in the Contribution Agreement. References to “Closing Date” in this Agreement shall be deemed to include reference to the Woodbridge Closing Date, as appropriate.

(a) “Accounting Firm” shall have the meaning set forth in Section 4(e)(ii).

(b) “Agreement” shall have the meaning set forth in the Preamble.

(c) “Applicable Tax Liability” shall mean:

{00441945-2}

(i) with respect to each Protected Partner that is allocated gain under Code Section 704(c) with respect to a particular Protected Property as a result of a breach of Section 2(a), an amount equal to the product of (A) the amount of Built-In Gain allocated to such Protected Partner under Code Section 704(c) with respect to such Protected Property and the applicable Contribution as a result of such breach (taking into account any adjustments under Code Section 743 or 734 to which such Protected Partner is entitled or that would be available if any applicable intermediate entity classified as a partnership for U.S. federal income tax purposes had made an election under Code Section 754) multiplied by (B) the Effective Tax Rate;

(ii) with respect to each Protected Partner that recognizes gain resulting from a disposition of the OP Units of such Protected Partner in a Fundamental Transaction as a result of a breach of Section 2(a), an amount equal to the product of (A) the lesser of (x) the aggregate Built-In Gain for each Protected Partner with respect to all of the Protected Properties as of the date hereof (or May 25, 2017, with respect to the Woodbridge Property) and (y) the amount of gain recognized by such Protected Partner from such Fundamental Transaction multiplied by (B) the Effective Tax Rate, provided, however, that if Built-In Gain has previously been taken into account under clause (i) of this definition of Applicable Tax Liability or in a prior Fundamental Transaction with respect to the Protected Partner, or if such Fundamental Transaction also results in an allocation of Built-In Gain to the Protected Partner described in clause (i) of this definition, the amount of Built-In Gain taken into account for purposes of subclause (A)(x) of this clause (ii) with respect to such Fundamental Transaction shall be reduced by the amount taken into account under clause (i) of this definition prior to or as a result of the Fundamental Transaction or as a result of any prior Fundamental Transaction (and this proviso shall be interpreted and applied so as to avoid double counting of Built-In Gain when calculating any Applicable Tax Liability resulting from a Fundamental Transaction);

(iii) with respect to each Protected Partner that recognizes gain under Code Section 731 as a result of a breach of Section 3 with respect to a Protected Property, an amount equal to the product of (A) the amount of gain recognized under Code Section 731 by such Protected Partner by reason of such breach multiplied by (B) the Effective Tax Rate.

For purposes of calculating the amount of Built-In Gain allocated to a Protected Partner under Code Section 704(c) with respect to a particular Protected Property, (i) any “reverse Section 704(c) gain” allocated to such Protected Partner pursuant to Treasury Regulations Section 1.704-3(a)(6) shall not be taken into account and (ii) any Built-In Gain recognized by such Protected Partner pursuant to Code Section 704(c)(1)(B) (i.e., as a result of the distribution of such Protected Property by the Partnership to a partner of the Partnership other than the Protected Partner) and Code Section 737 (i.e., as a result of an in-kind

{00441945-2}

distribution made by the Partnership to the Protected Partner) shall be taken into account.

(d) “BBA” shall have the meaning set forth in Section 5(h).

(e) “Built-In Gain” shall mean, with respect to any Protected Partner and a Protected Property at any time, the gain that is allocable to such Protected Partner pursuant to Code Section 704(c) with respect to such Protected Property (or, for purposes of clause (ii) of the definition of Applicable Tax Liability prior to any adjustment pursuant to the proviso of such clause (ii), the gain that would be allocable to such Protected Partner under Code Section 704(c) with respect to such Protected Property if such Protected Property were sold by the Partnership in a taxable sale for fair market value as of the date hereof (or, as of May 25, 2017, with respect to the Woodbridge Property). The initial Built-In Gain for each Initial Unitholder with respect to each Protected Property is set forth on Annex B hereto. For the avoidance of doubt and notwithstanding the foregoing, the parties acknowledge that any Applicable Tax Liability is calculated with reference to the Built-In Gain for the applicable Protected Partner and Protected Property immediately prior to the breach (to the extent recognized as a result of the breach) and the initial Built-In Gain for a Protected Property will be reduced over time to the extent required under Treasury Regulations Section 1.704-3.

(f) “Code” means the Internal Revenue Code of 1986, as amended.

(g) “Contribution” shall have the meaning set forth in the Recitals.

(h) “Contribution Agreement” shall have the meaning set forth in the Recitals.

(i) “Contributor” shall have the meaning set forth in the Preamble.

(j) “Effective Tax Rate” shall mean, with respect to a Protected Partner who is entitled to receive a payment under Section 4(a), the highest combined individual U.S. federal, state and local income tax rate (applicable to individuals in the city and state in which the Protected Partner is resident for state and local income tax purposes) in respect of the income or gain that gave rise to such payment, taking into account the character and type of the income recognized in the hands of the Protected Partner for the taxable year in which the transaction giving rise to such taxes occurred, the varying tax rates applicable to different categories of taxable income and gain and to different taxable years in which taxable income or gain is recognized, and assuming (absent a change in law) the deductibility of state and local taxes for U.S. federal income tax purposes, provided, however, that in the case of a Protected Partner that is a C corporation for U.S. federal income tax purposes, the Effective Tax Rate shall be based on the combined U.S. federal, state and local corporate income tax rate in respect of the income or gain that gave rise to such payment, taking into account any of the assumptions described above as are applicable to such entity.

(k) “Existing Property Debt” shall mean, for each Protected Property, the indebtedness secured by such Protected Property (or, in the case of a Yonkers Pledged Property, the indebtedness secured by the Yonkers Pledged Properties) at the time of the Contribution of

{00441945-2}

such Protected Property, as set forth on Exhibit I of the Contribution Agreement, and, for the avoidance of doubt, shall not include the Acklinis-Ackrik Debt or the Woodbridge-Manchester Debt.

(l) “Final Determination” means (i) a decision, judgment, decree or other order by any court of competent jurisdiction, which decision, judgment, decree or other order has become final after all allowable appeals by either party to the action have been exhausted or after the time for filing such appeals has expired, (ii) a binding settlement agreement entered into in connection with an administrative or judicial proceeding, (iii) the expiration of the time for instituting a claim for a refund or adjustment, or if such a claim was filed, the expiration of the time for instituting suit with respect thereto or (iv) the expiration of the time for instituting suit with respect to a claimed deficiency or adjustment.

(m) “Fundamental Transaction” means a merger, consolidation or other combination of the Partnership with or into any other entity, a transfer of all or substantially all of the assets of the Partnership, any reclassification, recapitalization or change of the outstanding equity interests of the Partnership, a conversion of the Partnership into another form of entity, or any other strategic transaction undertaken by the Partnership pursuant to which the OP Units of a Protected Partner are required to be exchanged for cash or equity in any other entity. Notwithstanding the above, a Fundamental Transaction shall not include (i) any transaction to the extent that as part of such transaction a Protected Partner is offered (whether or not such offer is accepted) consideration that would not result in the recognition of Built-In Gain by such Protected Partner (if the consideration were accepted by the Protected Partner) or (ii) a redemption of OP Units pursuant to Section 8.6 of the OP Agreement or other voluntary conversion of OP Units into cash or REIT Shares by a Protected Partner.

(n) “Government Entity” means any nation or government, any state, province or other political subdivision thereof, and any agency, authority, department, board, tribunal, commission or instrumentality thereof, and any person exercising executive, legislative, judicial, regulatory or administration functions of or pertaining to any of the foregoing.

(o) “Initial Notice” shall have the meaning set forth in Section 6(a).

(p) “Initial Unitholder” shall mean the persons designated on Annex A hereto as receiving OP Units on the date hereof and/or May 25, 2017.

(q) “Minimum Debt Amount” shall mean, with respect to each Protected Property other than a Yonkers Pledged Property, the amount equal to the outstanding principal balance of the Existing Property Debt secured by such Protected Property as of the Closing Date (or, in the case of the Yonkers Pledged Properties, the outstanding principal balance of the Existing Property Debt secured by the Yonkers Pledged Properties as of the Closing Date) minus any scheduled amortization payments that are required to be paid under the terms of such Existing Property Debt prior to the maturity of the Existing Property Debt. For clarity, there will be no Minimum Debt Amount (i) with respect to the Woodbridge-Manchester Debt or (ii) with respect to the Acklinis-Ackrik Debt. The Minimum Debt Amount with respect to each Protected Property is set forth on Annex C hereto.

{00441945-2}

(r) “Nonrecourse Indebtedness” shall mean, with respect to a Protected Property, indebtedness that is a “nonrecourse liability” of the Partnership within the meaning of Treasury Regulations Section 1.752-1(a)(2) and to which the Protected Property is subject for purposes of Treasury Regulations Section 1.752-3.

(s) “OP Units” means (i) the limited partnership interests in the Partnership that were received by the Contributors on account of the Contribution and immediately distributed (or deemed distributed for U.S. federal income tax purposes) to the Initial Unitholders and (ii) equity interests in an entity treated as a partnership for U.S. federal income tax purposes received by any Protected Partner in exchange for OP Units pursuant to a Fundamental Transaction with respect to which the Protected Partner’s tax basis in such equity interests is determined in whole or in part with reference to the Protected Partner’s tax basis in such OP Units.

(t) “Partnership” shall have the meaning set forth in the Preamble.

(u) “Pass Through Entity” means a partnership, disregarded entity, grantor trust or S corporation for U.S. federal income tax purposes.

(v) “Permitted Disposition” means a sale, exchange or other disposition of OP Units (i) by a Protected Partner: (a) to such Protected Partner’s children, spouse or issue; (b) to a trust for such Protected Partner or such Protected Partner’s children (including adopted children), spouse or issue; (c) in the case of a trust that is a Protected Partner, to its beneficiaries, or any of them, whether current or remainder beneficiaries, or to any successor trust or trusts for the benefit of the same beneficiaries; (d) to a revocable inter vivos trust of which such Protected Partner is a trustee; (e) in the case of any partnership or limited liability company that is a Protected Partner, to its partners or members; and/or (f) in the case of any corporation that is a Protected Partner, to its shareholders, and (ii) by a party described in clauses (a), (b), (c), (d), (e), or (f) to a partnership, limited liability company or corporation of which the only partners, members or shareholders, as applicable, are parties described in clauses (a), (b), (c), (d), (e), or (f).

(w) “Permitted Transferee” means a Person that is a permitted transferee for purposes of a transaction qualifying as a Permitted Disposition.

(x) “Person” means an individual, partnership, corporation (including a business trust), limited liability company, joint stock company, trust, unincorporated association, joint venture or other entity, or a government or any political subdivision or agency thereof.

(y) “Proceeding” shall have the meaning set forth in Section 5(d).

(z) “Protected Partner” shall mean (i) each Initial Unitholder; (ii) any Person who holds OP Units and who acquired such OP Units from an Initial Unitholder or another Protected Partner in a Permitted Disposition in which such Person’s adjusted basis in such OP Units, as determined for U.S. federal income tax purposes, is determined, in whole or in part, by reference to the adjusted basis of the Initial Unitholder or other Protected Partner in such OP

{00441945-2}

Units and who has notified the Partnership of its status as a Protected Partner, provided all documentation reasonably requested by the Partnership to verify such status, and become a signatory to, and agreed to the terms and conditions of, this Agreement; and (iii) with respect to a Protected Partner that is a Pass Through Entity, and solely for purposes of computing the amount to be paid under Section 4(a) with respect to such Protected Partner and without duplication of any amount otherwise payable to such Protected Partner under Section 4(a), any Person who (x) holds an interest in such Protected Partner, either directly or through one or more Pass Through Entities, and (y) is required to include all or a portion of the income of such Protected Partner in its own gross income.

(aa) “Protected Period” shall mean the period commencing on the Closing Date and ending on the fifteenth anniversary of the Closing Date; provided, however, that such period shall end prior to the fifteenth anniversary of the Closing Date with respect to the OP Units received on the Closing Date by any Initial Unitholder (whether then held by such Initial Unitholder or any other Protected Partner), and with respect to any equity interests attributable thereto that are treated as OP Units under clause (ii) of the definition of “OP Units,” (i) to the extent that there is a Final Determination that no portion of the applicable Contribution qualified for tax-deferred treatment under Code Section 721 or (ii) to the extent that, on any date after the Closing Date and prior to the fifteenth anniversary of the Closing Date, such Initial Unitholder owns less than 15% of the OP Units that were originally owned by the Initial Unitholder on the date hereof (with any OP Units that are transferred pursuant to a Permitted Disposition considered to be owned by the Initial Unitholder that received such OP Units on the date hereof and/or May 25, 2017 for purposes of this clause (ii) unless and until there has been a transfer of such OP Units by a Permitted Transferee that is not another Permitted Disposition).

(bb) “Protected Property” shall mean the interests in each property set forth on Annex B transferred to the Partnership by a Contributor in the Contributions, and any property acquired by the Partnership in a transaction pursuant to which the tax basis of such property is determined in whole or in part by reference to the tax basis of such Protected Property.

(cc) “REIT” shall have the meaning set forth in the Preamble.

(dd) “Representative” shall have the meaning set forth in the Preamble.

(ee) “Selling Partner” shall have the meaning set forth in Section 5(a)(ii)(B).

(ff) “Tax Claim” shall have the meaning set forth in Section 5(d).

(gg) “Tax Protection Period Transfer” shall have the meaning set forth in Section 2(a).

(hh) “Taxpayer Contributor” means, with respect to each Contributor, the Contributor or, if the Contributor is disregarded as a separate entity from its direct or indirect owner for U.S. federal income tax purposes, such owner.

{00441945-2}

(ii) “Treasury Regulations” means the income tax regulations under the Code, whether such regulations are in proposed, temporary or final form, as such regulations may be amended from time to time (including corresponding provisions of succeeding regulations).

(jj) “Yonkers Contributors” means (collectively) Acklinis Yonkers Realty, L.L.C., Acklinis Realty Holding, LLC, and Acklinis Original Building, L.L.C.

(kk) “Yonkers Pledged Property” means each of the “Ground Lease” (as defined in the Contribution Agreement) and the fee interest in Yonkers Gateway Center that is being contributed to the Partnership by Acklinis Realty Holding, LLC

(ll) “Yonkers Protected Property” shall have the meaning set forth in Section 3(b).

Section 2. Restrictions on Dispositions of Protected Properties.

(a) Except as otherwise provided in this Section 2 and subject to Section 4, during the Protected Period, neither the Partnership nor any entity in which the Partnership holds a direct or indirect interest will consummate (i) a sale, transfer, exchange, or other disposition of any Protected Property or any interest therein held by the Partnership directly or indirectly in a transaction that results in an allocation to any Protected Partner of all or any portion of its Built-In Gain with respect to such Protected Property under Code Section 704(c) (including any portion thereof recognized under Code Section 704(c)(1)(B)), (ii) a distribution by the Partnership to a Protected Partner that results in the recognition of all or any portion of the Protected Partner’s Built-In Gain with respect to a Protected Property under Code Section 737, or (iii) any Fundamental Transaction that would result in the recognition of gain by any Protected Partner (any such disposition under clause (i), distribution under clause (ii) or Fundamental Transaction under clause (iii) taking place during the Protected Period, a “Tax Protection Period Transfer”), provided however, that if a Representative (in his or her capacity as such) expressly consents to such Tax Protection Period Transfer in writing, the Partnership shall not be deemed to be in breach of its obligations hereunder with respect to any Protected Partner represented by such Representative, and no payment shall be due under Section 4(a) as a result of such Tax Protection Period Transfer with respect any Protected Partner represented by such Representative.

(b) Section 2(a) shall not apply to any Tax Protection Period Transfer in a transaction in which no gain is allocated to or required to be recognized by a Protected Partner, including a transaction qualifying under Code Section 1031, Code Section 351 or Code Section 721 (or any successor statutes) if no gain is allocated to or required to be recognized by a Protected Partner in such transaction.

(c) Section 2(a) shall not apply to any Tax Protection Period Transfer as a result of the condemnation or other taking of the Protected Property by a Government Entity in an eminent domain or condemnation proceeding or otherwise, provided that the Partnership shall use commercially reasonable best efforts to structure such condemnation or other taking as either a tax-free like-kind exchange under Code Section 1031 or a tax-free reinvestment of proceeds

{00441945-2}

under Code Section 1033, provided further that in no event shall the Partnership be obligated to acquire or invest in any property that it otherwise would not have acquired or invested in.

Section 3. Obligation to Maintain Nonrecourse Indebtedness.

(a) Except as otherwise provided in this Section 3 and subject to Section 4, during the Protected Period, with respect to each Protected Property (other than the Manchester Property) then held by the Partnership, the Partnership shall maintain, directly or indirectly, an amount of Nonrecourse Indebtedness secured by such Protected Property or to which the Protected Property is otherwise subject for purposes of Treasury Regulations Section 1.752-3(a) (and which is not secured by any other property and to which no other property is subject for purposes of Treasury Regulations Section 1.752-3(a)) not less than the Minimum Debt Amount with respect to such Protected Property.

(b) For purposes of Section 3(a), Section 3(c), and Section 3(d), all interest in the project commonly known as “Yonkers Gateway Center” that is contributed by the Yonkers Contributors to the Partnership shall be treated as a single Protected Property (also referred to as the “Yonkers Protected Property”). For purposes of determining whether a Nonrecourse Indebtedness with respect to a Protected Property is secured by other property (or whether other property is subject to such Nonrecourse Indebtedness), (i) the following shall be disregarded: (A) cash accounts, reserves, assignments of rents, personal property associated with the Protected Property and other similar items with respect to the Protected Property, (B) reasonable “nonrecourse carveouts” and environmental indemnities, and (C) any other items that are customarily included in nonrecourse financings of properties such as the Protected Property, and (ii) solely with respect to the Yonkers Protected Property, any interest (including associated personal property) in the project commonly known as “Yonkers Gateway Center” shall be disregarded in connection with a refinancing of such project if an amount of Nonrecourse Indebtedness equal to the lesser of (x) the fair market value of the Yonkers Protected Property at the time of such refinancing or (y) the Minimum Debt Amount for the Yonkers Protected Property is allocated to such Yonkers Protected Property for purposes of Treasury Regulations Sections 1.752-3(a)(2) and 1.752-3(b).

(c) The Partnership shall be permitted to make any payments required under the terms of each Existing Property Debt prior to the maturity thereof, and notwithstanding any other provision of this Agreement, the Partnership shall be deemed to satisfy its obligations under Section 3(a) and under Section 3(d) with respect to a Protected Property for so long and to the extent that it maintains the Existing Property Debt for such Protected Property (other than scheduled amortization pursuant to the terms of such Existing Property Debt).

(d) Except as otherwise provided in this Section 3, and subject to Section 4, prior to the maturity date of the Existing Property Debt for a Protected Property the Partnership may, and no later than the maturity date of such Existing Property Debt for a Protected Property the Partnership shall, refinance such Existing Property Debt with Nonrecourse Indebtedness secured by the applicable Protected Property (and not secured by any other property) having an outstanding balance that will remain at an amount that is at least equal to the Minimum Debt Amount for such Protected Property.

{00441945-2}

(e) Notwithstanding anything to the contrary herein, but subject to Section 4, the Partnership shall have the right to refinance the Existing Property Debt for any Protected Property with Nonrecourse Indebtedness not described in Section 3(d), but only if the amount of Nonrecourse Indebtedness that is allocated to the Protected Partners with respect to such Protected Property under Treasury Regulations Section 1.752-3 is not less than the amount of Nonrecourse Indebtedness that would have been allocated to such Protected Partners under Treasury Regulations Section 1.752-3 if the Partnership had maintained an amount of Nonrecourse Indebtedness secured by such Protected Property (and not secured by any other property) not less than the Minimum Debt Amount with respect to such Protected Property.

(f) The Protected Partners hereby acknowledge and agree that they expressly allow for the Partnership to provide any guarantee or indemnity that was previously provided to a lender by Irwin Ackerman if required by a lender in respect of any Existing Property Debt that is being assumed in connection with a Contribution.

(g) A failure to comply with Section 3(a)-(e) shall not be a breach under this Agreement and shall not entitle a Protected Partner to a payment under Section 4(a) to the extent that (i) the failure does not reduce the amount of Nonrecourse Indebtedness that is allocated to the Protected Partner under Treasury Regulations Section 1.752-3, (ii) the failure arises as a result of the condemnation or other taking of the Protected Property by a Government Entity in an eminent domain or condemnation proceeding or otherwise, (iii) the failure results from an obligation to perform under a guarantee described in Section 3(f) that was caused by a pre-existing condition with respect to the Protected Property, or (iv) the failure arises as a result of a casualty event prior to the Closing Date with respect to a Protected Property in connection with which a lender requires any insurance proceeds or other related awards be applied to any loan secured by the applicable Protected Property thereby reducing the amount of Nonrecourse Indebtedness allocable to one or more Protected Partners with respect to such Protected Property

(h) With respect to each (and any) Nonrecourse Indebtedness described in Section 3(a) with respect to a Protected Property, pursuant to the fifth sentence of Treasury Regulations Section 1.752-3(a)(3), the Partnership shall first allocate any portion of such Nonrecourse Indebtedness that is an “excess nonrecourse liability” (within the meaning of Treasury Regulations Section 1.752-3(a)(3)) to the Protected Partners up to the aggregate amount of Built-In Gain with respect to such Protected Property as of the date of determination that is allocable to such Protected Partners with respect to such Protected Property, to the extent that such Built-In Gain exceeds the gain described in Treasury Regulations Section 1.752-3(a)(2) with respect to such Protected Property as of the date of determination (with the aggregate amount of such excess nonrecourse liability so allocated to the Protected Partners with respect to such Protected Property further allocated among such Protected Partners pro rata based on their respective shares of such Built-In Gain with respect to such Protected Property as of such date).

Section 4. Indemnification; Liability.

(a) Payment for Breach. Except as otherwise provided in this Agreement:

{00441945-2}

(i) In the event of a Tax Protection Period Transfer described in Section 2(a), the Partnership shall pay to such Protected Partner an amount equal to the sum of (w) the Applicable Tax Liability (if any) attributable to such Tax Protection Period Transfer, plus (x) an estimated amount equal to the aggregate federal, state, and local income taxes payable by the Protected Partner as a result of the receipt of any payment required under the preceding clause (w) and this clause (x), calculated by applying the Effective Tax Rate that applies with respect to any such additional income.

(ii) In the event of a breach of Section 3 that causes a Protected Partner to recognize gain under Code section 731, the Partnership shall pay to such Protected Partner an amount equal to the sum of (y) the Applicable Tax Liability (if any) attributable to such breach, plus (z) an estimated amount equal to the aggregate federal, state, and local income taxes payable by the Protected Partner as a result of the receipt of any payment required under the preceding clause (y) and this clause (z), calculated by applying the Effective Tax Rate that applies with respect to any such additional income.

Any payments due under this Section 4(a) shall be paid in accordance with Section 4(d).

(b) Exclusive Remedy. The parties hereto agree and acknowledge that the payment obligations of the Partnership pursuant to Section 4(a) hereof shall constitute liquidated damages for any breach by the Partnership of this Agreement, and shall be the sole and exclusive remedy of the Protected Partners for any such breach of this Agreement. No Protected Partner shall bring any claim for specific performance under this Agreement for any breach of this Agreement, other than a claim for performance of the payment obligations set forth in this Section 4, or bring a claim against any Person that acquires a Protected Property from the Partnership in violation of Section 2(a).

(c) Limitations.

(i) For the avoidance of doubt, the Partnership shall not be liable to any Protected Partner for any income or gain (A) allocated to such Protected Partner with respect to OP Units that is not the result of a breach by the Partnership of its obligations or agreements under this Agreement or (B) resulting from distributions by the Partnership made with respect to the class of limited partnership units in the Partnership that includes the OP Units that are made to all holders of units of such class.

(ii) No officer, director, limited partner or employee of the Partnership or any of its affiliates (other than the general partner of the Partnership) shall have any liability for any breach of the obligations and agreements of the Partnership under this Agreement.

{00441945-2}

(iii) Except to the extent arising as a result of the Partnership’s breach of its obligations under Section 2, Section 3, or Section 5(a)(iv) of this Agreement, the Protected Partners shall not be entitled to indemnification from the Partnership for any tax liabilities incurred as result of any tax authority treating any portion of the Contribution intended to be a tax-deferred contribution as a taxable exchange (rather than a tax-deferred contribution) for purposes of any tax laws (and notwithstanding Section 5(a)).

(iv) Intentionally Deleted.

(v) To the extent an imputed underpayment under Code Section 6225 is assessed against the Partnership and such assessment implicates the terms of, or payments that have been made or that could be required to be made pursuant to, this Agreement, the parties hereto shall reasonably cooperate as necessary to preserve the economic arrangement intended by the terms of this Agreement to the maximum extent possible, and the parties hereto (and any successor to a party hereto) acknowledge and agree that the preservation of the intended economic arrangement includes, without limitation, preventing any party from receiving a windfall or from having to pay duplicate damages and ensuring that, except as required by Section 4(c)(iii) above, the Partnership does not bear any cost, expense or liability associated with a challenge of the tax treatment described in Section 5(a).

(vi) In the event that (A) a Protected Partner holds equity received in a Fundamental Transaction in which the Protected Partner recognizes gain but such equity is treated as OP Units by reason of clause (ii) of the definition of “OP Units” (e.g. in a partially taxable Fundamental Transaction) or (B) a property is treated as Protected Property by reason of being acquired in a transaction pursuant to which the tax basis of such property is determined in whole or in part by reference to the tax basis of Protected Property (e.g. in a partially taxable transaction), appropriate adjustments shall be made to any payments required under this Agreement so that the Partnership is not required to pay duplicate damages with respect to such OP Units or Protected Property.

(d) Procedural Matters.

(i) The Contributors have provided the Partnership with an estimated computation of: (A) the initial Built-In Gain amount with respect to each Protected Property in Annex B hereto, (B) each Contributor’s adjusted tax basis in the applicable Protected Property as of December 31, 2016 and as of the Closing Date in Annex B hereto, (C) the Minimum Debt Amount based on the scheduled amortization payments required to be paid under the terms of the Existing Property Debt with respect to each Protected Property prior to the maturity of such Existing Property Debt in Annex C hereto, (D) each Initial Unitholder’s share of the aggregate Built-In Gain with respect to each Protected Property in Annex B hereto, (E) each Initial Unitholder’s initial tax capital

{00441945-2}

account in the OP Units received by such Initial Unitholder with respect to each Protected Property in Annex B hereto, and (F) the amount of any adjustments under Section 734 or 743 that could impact the calculation of an Applicable Tax Liability as of December 31, 2016 and as of the Closing Date in Annex B hereto. Within thirty (30) days after the Closing Date, the Representatives shall provide the Partnership with a schedule showing updated Annexes providing the actual information that was estimated in such Annexes. The Representatives shall cooperate with all reasonable requests for documentation supporting the adjusted tax basis amounts of the Protected Properties and the Protected Partners’ respective shares of Built-In Gain, and the Representatives shall cause any information reasonably requested by the Partnership to be provided as promptly as possible, including, without limitation, the following information regarding each of the fixed assets (depreciable and non-depreciable) comprising the Protected Property to the extent not already provided to the Partnership: (A) cost and additions from inception, (B) accumulated depreciation, (C) depreciation method used and (D) useful life remaining. If a Representative fails to satisfy its obligations under this Section 4(d)(i), then to the extent such failure to comply directly results in a recognition of income or gain by a Protected Partner that otherwise would not have occurred but for such failure, the Partnership and the REIT shall not be required to comply with or otherwise satisfy the other provisions of this Section 4 with respect to such recognized income or gain resulting from such failure by the Representatives.

(ii) In the event that there has been a breach by the Partnership of any of its obligations under this Agreement during the Protected Period for which payment is required under Section 4(a), the Partnership shall provide to each Representative notice of the breach as soon as reasonably practicable thereafter. As soon as reasonably practicable after giving notice described in the preceding sentence (subject to delay pending the receipt of any information requested pursuant to the penultimate sentence of this Section 4(d)(ii)), the Partnership shall be obligated to (i) provide each Representative with a detailed calculation of the amount due under Section 4(a) with respect to such breach for each of the Protected Partners, and (ii) provide each Representative with such evidence or verification as such Representative may reasonably require as to the items necessary to confirm the calculation of such amounts. The Protected Partners and the Representatives agree to cooperate with the Partnership and to provide any information reasonably requested by the Partnership in order to assist the Partnership in making the calculations required under this Section 4(d) with respect to each breach, including without limitation information relating to adjustments under Code Sections 743 and 734, and information relating to the computation of the Effective Tax Rate, and, subject to obtaining such cooperation, the Partnership shall finalize the calculation of the amount due to each Protected Partner with respect to the breach as soon as reasonably practicable, provided, however, that to the extent the Protected Partners and Representatives fail to provide information, the Partnership may make any good faith assumptions with

{00441945-2}

respect to matters for which it does not have adequate information as a result of such failure. Once such amounts have been finalized in accordance with this Section 4(d)(ii), the Partnership shall promptly pay the amounts so due with respect to the breach to the relevant Protected Partners.

(e) Dispute Resolution.

(i) If the Partnership has breached or violated any of the covenants set forth in this Agreement (or a Protected Partner asserts that the Partnership has breached or violated any of the covenants set forth in this Agreement), the Partnership and the Representative for such Protected Partner agree to negotiate in good faith to resolve any disagreements regarding any such breach or violation and the amount of damages, if any, payable to the Protected Partners under Section 4(a). If the Partnership and the applicable Representative agree as to a breach or covenant violation but disagree as to the amount of damages payable under Section 4(a), and such disagreement cannot be resolved through such negotiations, the Partnership shall consult with its accountants to determine a reasonable calculation of the amount of damages payable, which determination shall be binding absent a determination to the contrary by the Accounting Firm (as defined below) in accordance with this Section 4(e) that the Partnership acted unreasonably.

(ii) If any disagreement between the Partnership and one or more Protected Partners as to whether the Partnership breached or violated any covenant in this Agreement with respect to such Protected Partners, or any allegation that the Partnership’s determination of damages with respect to such Protected Partners was not reasonable cannot be resolved within sixty (60) days after the receipt of a notice of disagreement from the aggrieved party, the Partnership and the applicable Representatives for such Protected Partners shall jointly retain an accounting firm (an “Accounting Firm”) selected by the Partnership from a list prepared by the applicable Representatives within thirty (30) days following expiration of such sixty (60) day period of five independent accounting firms. Each accounting firm on such list must be comprised of at least one hundred fifty (150) certified public accountants, and two of the accounting firms on such list must be “Big Four” accounting firms; provided, however, that (i) the requirement for such list to include two Big Four accounting firms shall only apply to the extent that at least two of Big Four accounting firms are not then representing, and have not in the three years prior to the due date of such list represented, the Partnership and/or the REIT with respect to income tax return preparation or the audit of financial statements, (ii) the Partnership shall inform the Representatives of which of the Big Four accounting firms is providing or has during such period provided such representation, and (iii) if the applicable Representatives do not provide a list meeting the requirements of this sentence within such thirty (30) day period the Partnership may select any nationally recognized accounting firm to serve as the Accounting Firm for the relevant

{00441945-2}

disputes. The Accounting Firm will act as an arbitrator to resolve as expeditiously as possible all points of any such disagreement (including, without limitation, whether a breach of any of the covenants set forth in this Agreement has occurred and, if so, whether the Partnership’s determination of the amount of damages to which the Protected Partner is entitled as a result thereof under Section 4(a) was reasonable). All determinations made by the Accounting Firm with respect to the resolution of any breach or violation of any of the covenants set forth in this Agreement and the reasonableness of the amount of damages payable to the Protected Partners under Section 4(a) shall be final, conclusive and binding on the Partnership and the Protected Partners. If the Accounting Firm determines that the Partnership’s calculation of damages was not reasonable, the Accounting Firm shall calculate the proper amount required to be paid. The fees and expenses of any Accounting Firm incurred in connection with any such determination shall be borne by the party that loses the dispute.

Section 5. Tax Treatment and Reporting; Tax Proceedings; Imputed Underpayments.

(a) Tax Treatment of Transaction

(i) The parties hereto agree that, for U.S. federal income tax purposes (and, as applicable under corresponding provisions, for state and local income tax purposes), the transfer of the Manchester Property to the Partnership will be treated as a tax-deferred contribution under Code Section 721 of such Protected Property to the Partnership for OP Units.

(ii) The parties hereto agree that, for U.S. federal income tax purposes (and, as applicable under corresponding provisions, for state and local income tax purposes), the following describes the characterization of the transfer of each of the Protected Properties other than the Manchester Property to the Partnership:

(A) The transfer of each such Protected Property will be made pursuant to a transaction that constitutes an “assets over” partnership merger within the meaning of Treasury Regulations Section 1.708-1(c) of the applicable Taxpayer Contributor and the Partnership, in which the Taxpayer Contributor is terminated and the Partnership is treated as the “continuing partnership” for income tax purposes. Each Taxpayer Contributor shall be deemed to distribute the OP Units it is deemed to receive in connection with the applicable contribution contemplated herein to such Taxpayer Contributor’s respective partners other than its Selling Partners, as set forth on Annex D hereto, promptly upon such contribution and shall liquidate contemporaneously with each Closing.

(B) Immediately before each such partnership merger, the Partnership will be treated as purchasing interests in the applicable Taxpayer Contributor from certain partners of the Taxpayer Contributor as set forth on Annex D hereto (the “Selling Partners”) in exchange for cash as provided for in

{00441945-2}

Annex D hereto, in accordance with Treasury Regulations Section 1.708-1(c)(4) and Example 5 of Treasury Regulations Section 1.708-1(c)(5). Each such Selling Partner hereby consents to treat the transaction as a sale of their interests in such Taxpayer Contributor. In accordance with Treasury Regulations Section 1.708-1(c)(4) and Example 5 of Treasury Regulations Section 1.708-1(c)(5), that portion of the transfer of a Protected Property to the Partnership treated as a tax-deferred contribution under Code Section 721 of an undivided interest in the Protected Property in exchange for OP Units shall not include that portion corresponding to the interests in the Taxpayer Contributor treated as purchased for cash under such Treasury Regulations.

(iii) Notwithstanding anything herein to the contrary, if any Protected Property is transferred to the Partnership in exchange for any cash (other than cash used to reimburse a Contributor for cash escrows that are transferred to the Partnership) that is not treated as being transferred to a Selling Partner pursuant to Section 5(a)(ii) (e.g., where cash is used by the applicable Taxpayer Contributor to pay expenses relating to the applicable Contribution), then the applicable Taxpayer Contributor shall be treated as selling an undivided interest in the applicable Protected Property to the Partnership in exchange for such cash.

(iv) No party hereto shall take any position in any U.S. federal, state, or local income tax returns or for any income tax purposes that is contrary to the characterization described in this Section 5(a), unless such position is otherwise required by a change in applicable tax law, a change in interpretation of applicable tax law, or a change in facts, or pursuant to a Final Determination.

(v) The Partnership shall not be allocated any item of income, gain, loss or deduction from any Taxpayer Contributor for any period in connection with the Contribution transactions contemplated herein.

(b) Tax Advice. Each party hereto acknowledges and agrees that it has not received and is not relying upon tax advice from any other party hereto, and that it has and will continue to consult its own tax advisors. Section 5(a) notwithstanding, the Partnership makes no representation or warranty as to the proper treatment of the Contribution, or the consequences of the transactions and elections contemplated by the Agreement, for U.S. federal income tax purposes or any other tax purposes.

(c) 704(c) Elections. The Partnership shall elect to use the “traditional method” pursuant to Treasury Regulations Section 1.704-3(b) for purposes of making allocations under Code Section 704(c) with respect to the Built-In Gain with respect to the contributed portion (as determined under Section 5(a)) of each Protected Property.

(d) Tax Audits. If any claim, demand, assessment (including a notice of proposed assessment) or other assertion is made with respect to taxes against any Protected Partner the calculation of which involves a matter covered in this Agreement (“Tax Claim”) or if a Protected Partner receives any notice from any jurisdiction with respect to any current or future

{00441945-2}

audit, examination, investigation or other proceeding (“Proceeding”) involving the Protected Partners that otherwise could involve a matter covered in this Agreement, then the Protected Partners, as applicable, shall promptly notify the Partnership of such Tax Claim or Proceeding. Notwithstanding anything to the contrary herein, if any Tax Claim or Proceeding causes a change in the amount owed by the Partnership to any Protected Partner pursuant to this Agreement, then (i) if there is an increase in the amount owed by the Partnership to such Protected Partner, the Partnership shall pay to such Protected Partner any incremental amount of damages resulting from such increase, or (ii) if there is a decrease in the amount owed by the Partnership to such Protected Partner, such Protected Partner shall pay to the Partnership any incremental decrease in the amount of damages previously paid to such Protected Partner, in each case as calculated pursuant to Section 4(a); provided, however, that if (x) a Protected Partner fails to provide notice to the Partnership of such Tax Claim or Proceeding where it is reasonably expected to potentially increase the amount owed by the Partnership to any Protected Partner or (y) the Protected Partners breach any of their obligations under Section 5(e), then the amount of any such increase in the amount owed by the Partnership to the Protected Partner shall not be taken into account and shall not be paid by the Partnership to the Protected Partner.

(e) Participation in Tax Proceedings.

(i) The Partnership shall have the right to participate, at its own expense, in any Tax Claims or Proceedings that relate to a matter that is covered by this Agreement, and the Protected Partners (as applicable) shall not settle or otherwise resolve any such matter without the Partnership’s prior written consent, which consent shall not be unreasonably withheld or delayed. The Protected Partners (as applicable) shall keep the Partnership reasonably informed of the details and status of any such Tax Claims and Proceedings (including providing the Partnership with copies of all written correspondence that they receive regarding such matter).

(ii) The Partnership shall notify the applicable Representatives of any Proceeding against the Partnership in which the applicable tax authority challenges the tax treatment provided for under Section 5(a). The Partnership shall keep the applicable Representatives reasonably informed as to the status of such Proceeding to the extent (and only to the extent) that the Proceeding relates to the tax treatment provided for under Section 5(a) (including providing each applicable Representative with copies of all material written correspondence that it receives regarding such tax treatment), and the Partnership shall consult in good faith with the applicable Representatives before it settles or otherwise resolves any such matter relating to the tax treatment provided for under Section 5(a); provided that in no event shall the Partnership be required to delay any such settlement or resolution.

(f) Book Depreciation. For any asset with a tax basis of zero that is treated as being contributed to the Partnership pursuant to Code Section 721 as part of the Contribution, the Partnership shall calculate the “book depreciation” for such asset pursuant to Treasury Regulations Section 1.704-1(b)(2)(iv)(g)(3) as if such asset were purchased on the date hereof

{00441945-2}

(or May 25, 2017, with respect to the Woodbridge Property) for cash equal to its initial book value.

(g) Yonkers Contribution. The Yonkers Contributors hereby represent and warrant that they are the owners of the Yonkers Gateway Center building (excluding the portion leased to Burlington Coat Factory) for income tax purposes, and the Partnership hereby represents and warrants that the only portion of the Yonkers Gateway Center building that it owns for income tax purposes is the portion leased to Burlington Coat Factory. Based on the foregoing, the parties hereto agree that, absent a change in applicable law or facts, for income tax purposes (i) the transfers by the Yonkers Contributors to the Partnership will be treated as including the transfer of the Yonkers Gateway Center building (excluding the portion leased to Burlington Coat Factory) to the Partnership and (ii) the interest in the Yonkers Gateway Center building that is treated as being contributed to the Partnership pursuant to Section 5(a)(ii) will be “section 704(c) property” (within the meaning of Treasury Regulations Section 1.704-3(a)(3)(i)) in the hands of the Partnership after the Contribution.

(h) The Partnership has not made, and will not make, an election, pursuant to Section 1101(g)(4) of the Bipartisan Budget Act of 2015 (the “BBA”), to have the amendments made by Section 1101 of the BBA (other than the election under Code Section 6221(b), as added by the BBA) to apply to any return of the Partnership filed for any partnership taxable year beginning after November 2, 2015 and before January 1, 2018.

Section 6. Miscellaneous.

(a) Appointment/Replacement of Representative. Each Initial Unitholder agrees as a condition to becoming a beneficiary to this Agreement that it will be represented by the Representative shown next to such Initial Unitholder’s name on Annex A, and agrees that such Representative alone will represent and act on behalf of such Initial Unitholder and any successor in interest to the OP Units received by such Initial Unitholder on the date hereof and/or May 25, 2017 or to equity attributable to such OP Units and treated as OP Units under clause (ii) of the definition thereof (and each hereby irrevocably appoints or shall be deemed to irrevocably appoint the applicable Representative as his, her, or its representative) for the purpose of receiving any notice or giving any notice, consent, approval or waiver required or contemplated in this Agreement, and each agrees that the Partnership shall be fully entitled to rely conclusively on any such notice, consent, approval, waiver or other determination by the applicable Representative as an action by the appointed and authorized representative of the applicable Protected Partners. If a Representative dies, resigns as Representative or otherwise ceases to serve as Representative, the Partnership shall be notified in writing (such notification, the “Initial Notice”), and the holders of a majority of the OP Units issued to the applicable Initial Unitholder that are then issued and outstanding shall have the power to designate an individual to serve as the replacement Representative for the Protected Partners represented by such Representative. The Partnership shall be notified in writing of such designation, provided that if the Partnership has not received notice of a replacement Representative designation within thirty (30) days of the receipt of the Initial Notice, the Partnership shall designate a Protected Partner that was previously represented by such Representative as the Representative for the Protected Partners represented by such Representative and shall provide written notice to all then Protected Partners

{00441945-2}

represented by such Representative of such designation, which shall be effective immediately upon delivery of such notice to such Protected Partners.

(b) Assignment. No Protected Partner shall assign this Agreement or its rights hereunder to any Person without the prior written consent of the Partnership, which consent shall not be unreasonably withheld, conditioned or delayed, provided that any such assignment undertaken without such consent shall be null and void. For the avoidance of doubt, any transfer of OP Units by a Protected Partner shall be governed by the terms of the OP Agreement as amended by the Admission Amendment.

(c) Integration, Waiver. This Agreement (including any Annex hereto) and the Contribution Agreement embody and constitute the entire understanding among the parties hereto with respect to the subject matter hereof and supersede all prior agreements, understandings, representations and statements, whether oral or written. Neither this Agreement nor any provision hereof may be waived, modified, amended, discharged or terminated except by an instrument signed by the party against whom the enforcement of such waiver, modification, amendment, discharge or termination is sought, and then only to the extent set forth in such instrument. No waiver by a party hereto of any failure or refusal by any other party to comply with its obligations hereunder shall be deemed a waiver of any other or subsequent failure or refusal to so comply.

(d) Governing Law. This Agreement shall be governed by, and construed in accordance with, the law of the State of New York, without regard to principles of conflicts of laws.

(e) Captions Not Binding; Annexes. The captions in this Agreement are inserted for reference only and in no way define, describe or limit the scope or intent of this Agreement or of any of the provisions hereof. All Annexes attached hereto shall be incorporated by reference as if set out herein in full.

(f) Binding Effect. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and permitted assigns.

(g) Severability. If any term or provision of this Agreement or the application thereof to any Persons or circumstances shall, to any extent, be invalid or unenforceable, the remainder of this Agreement or the application of such term or provision to Persons or circumstances other than those as to which it is held invalid or unenforceable shall not be affected thereby, and each term and provision of this Agreement shall be valid and enforced to the fullest extent permitted by law.

(h) No Rights as Stockholders. Nothing contained in this Agreement shall be construed as conferring upon the holders of the OP Units any rights whatsoever as stockholders of the REIT, including, without limitation, any right to receive dividends or other distributions made to stockholders of the REIT or to vote or to consent or to receive notice as stockholders in respect of any meeting of stockholders for the election of directors of the REIT or any other matter.

{00441945-2}

(i) Notices. Any notice to be given hereunder by any party to the other shall be given in writing by either (i) personal delivery, or (ii) registered or certified mail, postage prepaid, return receipt requested, and any such notice shall be deemed communicated as of the date of delivery (including delivery by overnight courier, or certified mail). Mailed notices shall be addressed as set forth below, but any party may change the address set forth below by written notice to other parties in accordance with this paragraph.

As to the Partnership: | 888 Seventh Avenue New York, New York 10019 Attention: Robert Milton, Esq. Telephone: (212) 956-0083 Email: RMilton@UEdge.com |

With a Copy to: | Goodwin Procter LLP 100 Northern Avenue Boston, MA 02210 Attention: Andrew C. Sucoff, Esq. Telephone: (617) 570-1995 Facsimile: (617) 801-8851 Email: asucoff@goodwinlaw.com |

As to Contributors, Taxpayer Contributors, and Initial Unitholders and other Protected Partners: | 187 Millburn Avenue # 6 Millburn, NJ 07041 Attention: Mr. Irwin Ackerman Telephone: 973-379-4150 Telecopy No.: 973-379-0691 E-mail: ibacker235@gmail.com and to: Each of the addresses set forth beside the Initial Unitholders and other Protected Partners on Annex A |

{00441945-2}

With a Copy to: | Meislik & Meislik 66 Park Street Montclair, New Jersey 07042 Attention: Ira Meislik Telephone: (973) 744-0288 Telecopy No.: (973) 744-5757 E-mail: imeislik@meislik.com and to: Meislik & Meislik 8325 Sugarman Drive San Diego, California 92037 Attention: Notice Department Telephone: (973) 744-0288 Telecopy No.: (973) 744-5757 E-mail: imeislik@meislik.com and to: Paul Weiss Rifkind Wharton & Garrison, LLP 1285 Avenue of the Americas New York, New York 10019-6064 Attention: Allen M. Wieder Telephone: (212) 373-3041 Telecopy No.: (212) 492-0041 E-mail: awieder@paulweiss.com and to: Milbank, Tweed, Hadley & McCloy LLP 28 Liberty Street New York, New York 10005 Attention: Kevin O’Shea Telephone: (212) 530-5254 Telecopy No.: (212) 530-5219 E-Mail: koshea@milbank.com |

(j) Counterparts. This Agreement may be executed in counterparts, each of which shall be an original and all of which counterparts taken together shall constitute one and the same agreement. The signature page of any counterpart may be detached therefrom without impairing the legal effect of the signature(s) thereon provided such signature page is attached to any other counterpart identical thereto except having additional signature pages executed by other parties to this Agreement attached thereto.

(k) Construction. The parties acknowledge that each party and its counsel have reviewed and revised this Agreement and that the normal rule of construction to the effect that any ambiguities are to be resolved against the drafting party shall not be employed in the interpretation of this Agreement or any amendment or Annex hereto.

{00441945-2}

[Signatures Commence on Following Page.]

{00441945-2}

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the Closing Date.

PARTNERSHIP:

URBAN EDGE PROPERTIES LP,

a Delaware limited partnership

By: Urban Edge Properties, its sole General Partner

By:

Name:

Title

REIT:

URBAN EDGE PROPERTIES,

a Maryland real estate investment trust

By:

Name:

Title

CONTRIBUTORS:

A & R WOODBRIDGE SHOPPING CENTER, L.L.C.,

a Delaware limited liability company

By: A&R Woodbridge Associates II, L.P.,

a New Jersey limited partnership,

its sole member

By:

Irwin Ackerman, General Partner

{00441945-2}

ACKRIK ASSOCIATES, L.P.,

a New York limited partnership

By:

Irwin Ackerman, General Partner

A & R MILLBURN ASSOCIATES, L.P.,

a New Jersey limited partnership

By: Ackerman Millburn G.P. Corp.,

a New Jersey corporation

By:

Irwin Ackerman, President

A & R MANCHESTER, LLC,

a Missouri limited liability company

By: 211 West 61st Street Associates, L.P.,

a Delaware limited partnership,

its sole member

By:

Irwin Ackerman, General Partner

{00441945-2}

ACKLINIS YONKERS REALTY, L.L.C.,

a New York limited liability company

By: | Acklinis Management LLC, a Delaware limited liability company its Manager |

By:

Irwin Ackerman, President

ACKLINIS REALTY HOLDING, LLC,

a New York limited liability company

By: Acklinis Associates, L.P.,

a New York limited partnership,

its sole member

By:

Irwin Ackerman, General Partner

ACKLINIS ORIGINAL BUILDING, L.L.C.,

a New York limited liability company

By: Acklinis Associates, L.P.,

a New York limited partnership,

its sole member

By:

Irwin Ackerman, General Partner

{00441945-2}

ADDITIONAL TAXPAYER CONTRIBUTORS

211 WEST 61ST STREET ASSOCIATES, L.P.,

a Delaware limited partnership,

By:

Irwin Ackerman, General Partner

A&R WOODBRIDGE ASSOCIATES II, L.P.,

a New Jersey limited partnership,

By:

Irwin Ackerman, General Partner

ACKLINIS ASSOCIATES, L.P.,

a New York limited partnership,

By:

Irwin Ackerman, General Partner

{00441945-2}

INITIAL UNITHOLDERS

______________________________________

IRWIN ACKERMAN

______________________________________

IRA RIKLIS

MARCIA RIKLIS

Trust under Article FIFTH of the Simona R. Ackerman Revocable Trust f/b/o Ari J. Ackerman

By:

Ari J. Ackerman, Trustee

By:

Georgiana J. Slade, Trustee

Trust under Article FIFTH of the Simona R. Ackerman Revocable Trust f/b/o Gila Ackerman Steinbock

By:

Gila Ackerman Steinbock, Trustee

By:

Georgiana J. Slade, Trustee

{00441945-2}

Trust under Article THIRD of the Simona R. Ackerman Family Trust f/b/o Ari J. Ackerman

By:

Ari J. Ackerman, Trustee

By:

Georgiana J. Slade, Trustee

Trust under Article THIRD of the Simona R. Ackerman Family Trust f/b/o Gila Ackerman Steinbock

By:

Gila Ackerman Steinbock, Trustee

By:

Georgiana J. Slade, Trustee

{00441945-2}

ANNEX A

INITIAL UNITHOLDERS, REPRESENTATIVES, OTHER PROTECTED PARTNERS

INITIAL UNITHOLDERS

Initial Unitholder | Address for Notice | Representative |

Irwin Ackerman | Irwin Ackerman 93 Sharon Road Lakeville, CT 06039 And Irwin Ackerman 107 Dolphin Road Palm Beach, FL 33480 | Irwin Ackerman |

Ira Riklis | Sutherland Capital Management 32 East 57th Street 16th Floor New York, NY 10022 Attn: Ira Riklis | Ira Riklis |

Marcia Riklis | Marcia Riklis 700 Meadow Lane Southampton, NY 11968 | Marcia Riklis |

Trust under Article FIFTH of the Simona R. Ackerman Revocable Trust f/b/o Ari J. Ackerman | Ari J. Ackerman, Trustee 65 West 13th Street, #11C New York, NY 10011 | Ari Ackerman |

Trust under Article FIFTH of the Simona R. Ackerman Revocable Trust f/b/o Gila Ackerman Steinbock | Gila Ackerman Steinbock, Trustee 2995 Heidelberg Drive Boulder, CO 80305 | Gila Steinbock |

Trust under Article THIRD of the Simona R. Ackerman Family Trust f/b/o Ari J. Ackerman | Ari J. Ackerman, Trustee 65 West 13th Street, #11C New York, NY 10011 | Ari Ackerman |

Trust under Article THIRD of the Simona R. Ackerman Family Trust f/b/o Gila Ackerman Steinbock | Gila Ackerman Steinbock, Trustee 2995 Heidelberg Drive Boulder, CO 80305 | Gila Steinbock |

OTHER PROTECTED PARTNERS

{00441945-2}

Protected Partners (Other than Initial Unitholders) | Address for Notice | Representative |

{00441945-2}

ANNEX B

PROTECTED PROPERTY, ADJUSTED BASIS, INITIAL BUILT-IN GAIN, PROTECTED PARTNERS’ SHARE OF INITIAL BUILT-IN GAIN; INITIAL TAX CAPITAL ACCOUNT IN OP UNITS

Protected Property / Contributor(s) | Allocated Value3 (A) | Adjusted Tax Basis as of 12/31/16 | Adjusted Tax Basis as of Closing Date (B) | Initial Built-In Gain (A - B) (A) – |

Yonkers Gateway Center— Acklinis Yonkers Realty, L.L.C., Acklinis Realty Holding, LLC, and Acklinis Original Building, L.L.C. | 100,687,950 | 3,953,602 | 3,938,558 | 96,749,392 |

The Plaza at Woodbridge (“Woodbridge”) / A & R Woodbridge Shopping Center, L.L.C. | 99,752,160 | 2,785,654 | 2,773,089 | 96,979,071 |

The Plaza at Cherry Hill (“Cherry Hill”) / Ackrik Associates, L.P. | 51,347,159 | 4,107,716 | 4,071,703 | 47,275,456 |

Millburn Gateway Center (“Millburn”) / A & R Millburn Associates, L.P. | 43,748,202 | 5,122,761 | 4,934,638 | 38,813,564 |

Manchester Plaza (“Manchester”) / A & R Manchester, LLC | 19,794,058 | 7,214,447 | 7,057,239 | 12,736,819 |

{00441945-2}

Each Initial Unitholder’s share of the initial Built-In Gain with respect to each Protected Property:

Initial Unitholder | Yonkers | Woodbridge | Cherry Hill | Millburn | Manchester | Total |

Irwin Ackerman | 14,522,084 | 24,244,768 | 2,363,773 | 9,703,391 | 3,184,205 | 54,018,220 |

Trust under Article FIFTH of the Simona R. Ackerman Revocable Trust f/b/o Ari J. Ackerman | 13,704,551 | N/A | N/A | N/A | 1,592,102 | 15,296,654 |

Trust under Article FIFTH of the Simona R. Ackerman Revocable Trust f/b/o Gila Ackerman Steinbock | 13,704,551 | N/A | N/A | N/A | 1,592,102 | 15,296,654 |

Trust under Article THIRD of the Simona R. Ackerman Family Trust f/b/o Ari J. Ackerman | N/A | 12,122,384 | N/A | 4,851,696 | N/A | 16,974,079 |

Trust under Article THIRD of the Simona R. Ackerman Family Trust f/b/o Gila Ackerman Steinbock | N/A | 12,122,384 | N/A | 4,851,696 | N/A | 16,974,079 |

Ira Riklis | N/A | N/A | N/A | N/A | 3,184,205 | 3,184,205 |

Marcia Riklis | 27,409,103 | 24,244,768 | N/A | 9,703,391 | 3,184,205 | 64,541,466 |

{00441945-2}

Each Initial Unitholder’s initial tax capital account in the OP Units received by such Initial Unitholder with respect to each Protected Property

Initial Unitholder | Yonkers | Woodbridge | Cherry Hill | Millburn | Manchester | Total |

Irwin Ackerman | -4,387,208 | -6,531,879 | -686,561 | -2,872,421 | -2,600,524 | -17,078,593 |

Trust under Article FIFTH of the Simona R. Ackerman Revocable Trust f/b/o Ari J. Ackerman | -4,140,227 | N/A | N/A | N/A | -1,300,262 | -5,440,489 |

Trust under Article FIFTH of the Simona R. Ackerman Revocable Trust f/b/o Gila Ackerman Steinbock | -4,140,227 | N/A | N/A | N/A | -1,300,262 | -5,440,489 |

Trust under Article THIRD of the Simona R. Ackerman Family Trust f/b/o Ari J. Ackerman | N/A | -3,265,940 | N/A | -1,436,210 | N/A | -4,702,150 |

Trust under Article THIRD of the Simona R. Ackerman Family Trust f/b/o Gila Ackerman Steinbock | N/A | -3,265,940 | N/A | -1,436,210 | N/A | -4,702,150 |

Ira Riklis | N/A | N/A | N/A | N/A | -2,600,524 | -2,600,524 |

Marcia Riklis | -8,280,453 | -6,531,879 | N/A | -2,872,421 | -2,600,524 | -20,285,277 |

{00441945-2}

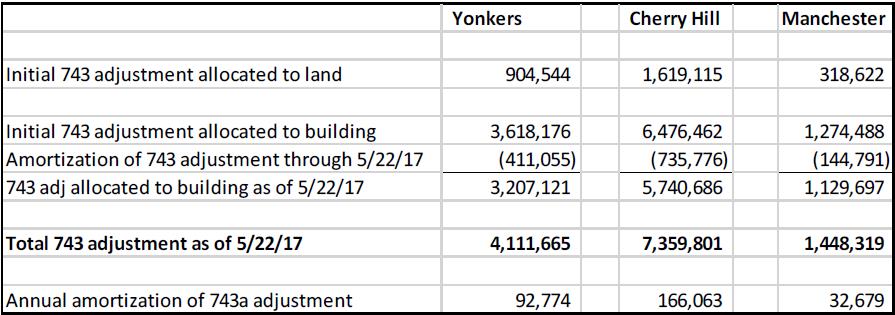

The amount of any adjustments under Code Section 734 or 743 that could impact the calculation of an Applicable Tax Liability is as follows:

{00441945-2}

ANNEX C

MINIMUM DEBT AMOUNT

The Minimum Debt Amount with respect to each Protected Property, based on the balance of the Existing Property Debt encumbering each Protected Property as of the Closing Date, reduced by the scheduled amortization prior to maturity:

Protected Property | Minimum Debt Amount |

Yonkers | 22,524,840 |

Woodbridge | 33,834,118 |

Cherry Hill | 11,151,287 |

Millburn | 11,705,736 |

{00441945-2}

ANNEX D

ALLOCATION OF NET CONSIDERATION

YONKERS GATEWAY CENTER:

Share of Net Consideration as cash (for Selling Partners) | Share of Net Consideration as OP Units | |

Irwin Ackerman | —% | 15.01% |

Trust under Article FIFTH of the Simona R. Ackerman Revocable Trust f/b/o Ari J. Ackerman | 0% | 14.165% |

Trust under Article FIFTH of the Simona R. Ackerman Revocable Trust f/b/o Gila Ackerman Steinbock | 0% | 14.165% |

Ira Riklis | 28.33% | 0% |

Marcia Riklis | —% | 28.33% |

{00441945-2}

THE PLAZA AT WOODBRIDGE:

Share of Net Consideration and Woodbridge Notes Consideration as cash (for Selling Partners) | Share of Net Consideration and Woodbridge Notes Consideration as OP Units | |

Irwin Ackerman | —% | 25% |

Trust under Article THIRD of the Simona R. Ackerman Family Trust f/b/o Ari J. Ackerman | 0% | 12.5% |

Trust under Article THIRD of the Simona R. Ackerman Family Trust f/b/o Gila Ackerman Steinbock | 0% | 12.5% |

Ira Riklis | 25% | 0% |

Marcia Riklis | —% | 25% |

{00441945-2}

THE PLAZA AT CHERRY HILL:

Share of Net Consideration as cash (for Selling Partners) | Share of Net Consideration as OP Units | |

Irwin Ackerman | 20% | 5% |

Trust under Article FIFTH of the Simona R. Ackerman Revocable Trust f/b/o Ari J. Ackerman | 12.5% | 0% |

Trust under Article FIFTH of the Simona R. Ackerman Revocable Trust f/b/o Gila Ackerman Steinbock | 12.5% | 0% |

Ira Riklis | 25% | 0% |

Marcia Riklis | 25% | 0% |

{00441945-2}

MILBURN GATEWAY CENTER:

Share of Net Consideration as cash (for Selling Partners) | Share of Net Consideration as OP Units | |

Irwin Ackerman | —% | 25% |

Trust under Article THIRD of the Simona R. Ackerman Family Trust f/b/o Ari J. Ackerman | 0% | 12.5% |

Trust under Article THIRD of the Simona R. Ackerman Family Trust f/b/o Gila Ackerman Steinbock | 0% | 12.5% |

Ira Riklis | 25% | 0% |

Marcia Riklis | —% | 25% |

{00441945-2}

MANCHESTER:

Share of Net Consideration as cash (for Selling Partners) | Share of Net Consideration as OP Units | |

Irwin Ackerman | 0% | 25% |

Trust under Article FIFTH of the Simona R. Ackerman Revocable Trust f/b/o Ari J. Ackerman | 0% | 12.5% |

Trust under Article FIFTH of the Simona R. Ackerman Revocable Trust f/b/o Gila Ackerman Steinbock | 0% | 12.5% |

Ira Riklis | 0% | 25% |

Marcia Riklis | 0% | 25% |

{00441945-2}