Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - OFFICE PROPERTIES INCOME TRUST | gov_063017xexhibitx991.htm |

| 8-K - 8-K - OFFICE PROPERTIES INCOME TRUST | a8-kcoverpage_063017.htm |

Fourth Quarter 2016

Supplemental Operating and Financial Data

All amounts in this report are unaudited.

Government Properties Income Trust Exhibit 99.2Exhibit 99.2Exhibit 99.2

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

TABLE OF CONTENT

S

2

TABLE OF CONTENTS

CORPORATE INFORMATION PAGE/EXHIBIT

Company Profile 6

Investor Information 7

Research Coverage 8

FINANCIALS

Key Financial Data 10

Condensed Consolidated Balance Sheets 11

Condensed Consolidated Statements of Income 12

Condensed Consolidated Statements of Cash Flows 13

Debt Summary 14

Debt Maturity Schedule 15

Leverage Ratios, Coverage Ratios and Public Debt Covenants 16

Summary of Capital Expenditures 17

Property Acquisition and Disposition Information Since January 1, 2017 18

Calculation of Property Net Operating Income (NOI) and Cash Basis NOI 19

Calculation of Same Property NOI and Cash Basis NOI 20

Calculation of EBITDA and Adjusted EBITDA 21

Calculation of Funds from Operations (FFO) and Normalized FFO 22

Non-GAAP Financial Measures Definitions 23

PORTFOLIO INFORMATION

Portfolio Summary 25

Summary Consolidated and Same Property Results 26

Occupancy and Leasing Summary 28

Leasing Analysis by Tenant Type 29

Tenant List 30

Lease Expiration Schedule 31

EXHIBIT

Property Detail A

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

W

ARNING CONCERNING FO

RW

ARD LOOKING S

TA

TEMENT

S

3

WARNING CONCERNING FORWARD LOOKING STATEMENTS

THIS PRESENTATION OF SUPPLEMENTAL OPERATING AND FINANCIAL DATA CONTAINS STATEMENTS THAT CONSTITUTE FORWARD LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995 AND OTHER SECURITIES LAWS. ALSO, WHENEVER WE USE WORDS SUCH AS “BELIEVE”, “EXPECT”, “ANTICIPATE”, “INTEND”, “PLAN”, “ESTIMATE”, “WILL”, “MAY” AND NEGATIVES OR DERIVATIVES OF

THESE OR SIMILAR EXPRESSIONS, WE ARE MAKING FORWARD LOOKING STATEMENTS. THESE FORWARD LOOKING STATEMENTS ARE BASED UPON OUR PRESENT INTENT, BELIEFS OR EXPECTATIONS, BUT FORWARD

LOOKING STATEMENTS ARE NOT GUARANTEED TO OCCUR AND MAY NOT OCCUR. FORWARD LOOKING STATEMENTS IN THIS REPORT RELATE TO VARIOUS ASPECTS OF OUR BUSINESS, INCLUDING:

• OUR ACQUISITIONS AND SALES OF PROPERTIES,

• OUR ABILITY TO COMPETE FOR ACQUISITIONS AND TENANCIES EFFECTIVELY,

• THE LIKELIHOOD THAT OUR TENANTS WILL PAY RENT OR BE NEGATIVELY AFFECTED BY CYCLICAL ECONOMIC CONDITIONS OR GOVERNMENT BUDGET CONSTRAINTS,

• THE LIKELIHOOD THAT OUR TENANTS WILL RENEW OR EXTEND THEIR LEASES AND NOT EXERCISE EARLY TERMINATION OPTIONS PURSUANT TO THEIR LEASES OR THAT WE WILL OBTAIN REPLACEMENT TENANTS,

• OUR ABILITY TO PAY DISTRIBUTIONS TO OUR SHAREHOLDERS AND THE AMOUNT OF SUCH DISTRIBUTIONS,

• OUR EXPECTATION THAT WE BENEFIT FINANCIALLY FROM OUR OWNERSHIP INTEREST IN SELECT INCOME REIT, OR SIR,

• OUR POLICIES AND PLANS REGARDING INVESTMENTS, FINANCINGS AND DISPOSITIONS,

• THE FUTURE AVAILABILITY OF BORROWINGS UNDER OUR REVOLVING CREDIT FACILITY,

• OUR EXPECTATION THAT THERE WILL BE OPPORTUNITIES FOR US TO ACQUIRE, AND THAT WE WILL ACQUIRE, ADDITIONAL PROPERTIES IN THE METROPOLITAN WASHINGTON, D.C. MARKET AREA OR ELSEWHERE THAT ARE

MAJORITY LEASED TO GOVERNMENT TENANTS OR GOVERNMENT CONTRACTOR TENANTS,

• OUR EXPECTATIONS REGARDING DEMAND FOR LEASED SPACE BY THE U.S. GOVERNMENT AND STATE AND LOCAL GOVERNMENTS,

• OUR ABILITY TO RAISE EQUITY OR DEBT CAPITAL,

• OUR ABILITY TO PAY INTEREST ON AND PRINCIPAL OF OUR DEBT,

• OUR ABILITY TO APPROPRIATELY BALANCE OUR USE OF DEBT AND EQUITY CAPITAL,

• OUR CREDIT RATINGS,

• OUR EXPECTATION THAT WE BENEFIT FROM OUR OWNERSHIP OF THE RMR GROUP INC., OR RMR INC.,

• OUR EXPECTATION THAT WE BENEFIT FROM OUR OWNERSHIP OF AFFILIATES INSURANCE COMPANY, OR AIC, AND FROM OUR PARTICIPATION IN INSURANCE PROGRAMS ARRANGED BY AIC,

• THE CREDIT QUALITIES OF OUR TENANTS,

• OUR QUALIFICATION FOR TAXATION AS A REAL ESTATE INVESTMENT TRUST, OR REIT, AND

• OTHER MATTERS.

OUR ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE CONTAINED IN OR IMPLIED BY OUR FORWARD LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS. FACTORS THAT COULD HAVE A MATERIAL ADVERSE EFFECT ON

OUR FORWARD LOOKING STATEMENTS AND UPON OUR BUSINESS, RESULTS OF OPERATIONS, FINANCIAL CONDITION, FUNDS FROM OPERATIONS, OR FFO, NORMALIZED FUNDS FROM OPERATIONS, OR NORMALIZED FFO, NET

OPERATING INCOME, OR NOI, CASH BASIS NOI, EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION, OR EBITDA, EBITDA AS ADJUSTED, OR ADJUSTED EBITDA, CASH FLOWS, LIQUIDITY AND PROSPECTS INCLUDE,

BUT ARE NOT LIMITED TO:

• THE IMPACT OF CHANGES IN THE ECONOMY AND THE CAPITAL MARKETS ON US AND OUR TENANTS,

• COMPETITION WITHIN THE REAL ESTATE INDUSTRY, PARTICULARLY WITH RESPECT TO THOSE MARKETS IN WHICH OUR PROPERTIES ARE LOCATED AND WITH RESPECT TO GOVERNMENT TENANCIES,

• THE IMPACT OF CHANGES IN THE REAL ESTATE NEEDS AND FINANCIAL CONDITIONS OF THE U.S. GOVERNMENT AND STATE AND LOCAL GOVERNMENTS,

• COMPLIANCE WITH, AND CHANGES TO, FEDERAL, STATE AND LOCAL LAWS AND REGULATIONS, ACCOUNTING RULES, TAX LAWS AND SIMILAR MATTERS,

• ACTUAL AND POTENTIAL CONFLICTS OF INTEREST WITH OUR RELATED PARTIES, INCLUDING OUR MANAGING TRUSTEES, THE RMR GROUP LLC, OR RMR LLC, RMR INC., SIR, AIC AND OTHERS AFFILIATED WITH THEM,

• LIMITATIONS IMPOSED ON OUR BUSINESS AND OUR ABILITY TO SATISFY COMPLEX RULES IN ORDER FOR US TO QUALIFY FOR TAXATION AS A REIT FOR U.S. FEDERAL INCOME TAX PURPOSES, AND

• ACTS OF TERRORISM, OUTBREAKS OF SO CALLED PANDEMICS OR OTHER MANMADE OR NATURAL DISASTERS BEYOND OUR CONTROL.

FOR EXAMPLE:

• OUR ABILITY TO MAKE FUTURE DISTRIBUTIONS TO OUR SHAREHOLDERS AND TO MAKE PAYMENTS OF PRINCIPAL AND INTEREST ON OUR INDEBTEDNESS DEPENDS UPON A NUMBER OF FACTORS, INCLUDING OUR FUTURE

EARNINGS, THE CAPITAL COSTS WE INCUR TO LEASE OUR PROPERTIES, OUR WORKING CAPITAL REQUIREMENTS AND OUR RECEIPT OF DISTRIBUTIONS FROM SIR. WE MAY BE UNABLE TO PAY OUR DEBT OBLIGATIONS OR TO

MAINTAIN OUR CURRENT RATE OF DISTRIBUTIONS ON OUR COMMON SHARES AND FUTURE DISTRIBUTIONS MAY BE REDUCED OR ELIMINATED,

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017W

ARNING CONCERNING FO

RW

ARD LOOKING S

TA

TEMENTS (continued

)

4

• OUR ABILITY TO GROW OUR BUSINESS AND INCREASE DISTRIBUTIONS TO OUR SHAREHOLDERS DEPENDS IN LARGE PART UPON OUR ABILITY TO BUY PROPERTIES AND LEASE THEM FOR RENTS, LESS OUR

PROPERTY OPERATING EXPENSES, THAT EXCEED OUR CAPITAL COSTS. WE MAY BE UNABLE TO IDENTIFY PROPERTIES THAT WE WANT TO ACQUIRE OR TO NEGOTIATE ACCEPTABLE PURCHASE PRICES,

ACQUISITION FINANCING OR LEASE TERMS FOR NEW PROPERTIES,

• SOME OF OUR TENANTS MAY NOT RENEW EXPIRING LEASES, AND WE MAY BE UNABLE TO OBTAIN NEW TENANTS TO MAINTAIN OR INCREASE THE HISTORICAL OCCUPANCY RATES OF, OR RENTS FROM, OUR

PROPERTIES,

• SOME GOVERNMENT TENANTS MAY EXERCISE THEIR RIGHTS TO VACATE THEIR SPACE BEFORE THE STATED EXPIRATION OF THEIR LEASES, AND WE MAY BE UNABLE TO OBTAIN NEW TENANTS TO MAINTAIN

• THE HISTORICAL OCCUPANCY RATES OF, OR RENTS FROM, OUR PROPERTIES,

• RENTS THAT WE CAN CHARGE AT OUR PROPERTIES MAY DECLINE BECAUSE OF CHANGING MARKET CONDITIONS OR OTHERWISE,

• CONTINGENCIES IN OUR ACQUISITION AND SALE AGREEMENTS MAY NOT BE SATISFIED AND OUR PENDING ACQUISITIONS AND SALES MAY NOT OCCUR, MAY BE DELAYED OR THE TERMS OF SUCH TRANSACTIONS MAY CHANGE,

• CONTINUED AVAILABILITY OF BORROWINGS UNDER OUR REVOLVING CREDIT FACILITY IS SUBJECT TO OUR SATISFYING CERTAIN FINANCIAL COVENANTS AND OTHER CREDIT FACILITY CONDITIONS THAT WE MAY BE UNABLE TO

SATISFY,

• ACTUAL COSTS UNDER OUR REVOLVING CREDIT FACILITY OR OTHER FLOATING RATE CREDIT FACILITIES WILL BE HIGHER THAN LIBOR PLUS A PREMIUM BECAUSE OF FEES AND EXPENSES ASSOCIATED WITH SUCH FACILITIES,

• THE INTEREST RATES PAYABLE UNDER OUR FLOATING RATE DEBT OBLIGATIONS DEPEND UPON OUR CREDIT RATINGS. BOTH MOODY'S INVESTORS SEVICE, OR MOODY'S, AND STANDARD & POOR'S RATINGS SERVICES, OR S&P,

HAVE RECENTLY UPDATED OUR RATING OUTLOOK TO NEGATIVE, WHICH MAY IMPLY THAT OUR CREDIT RATINGS MAY BE DOWNGRADED. IF OUR CREDIT RATINGS ARE DOWNGRADED, OUR BORROWING COSTS WILL INCREASE,

• OUR ABILITY TO ACCESS DEBT CAPITAL AND THE COST OF OUR DEBT CAPITAL WILL DEPEND IN PART ON OUR CREDIT RATINGS. BOTH MOODY'S AND S&P HAVE RECENTLY UPDATED OUR RATING OUTLOOK TO NEGATIVE, WHICH

MAY IMPLY THAT OUR CREDIT RATINGS MAY BE DOWNGRADED. IF OUR CREDIT RATINGS ARE DOWNGRADED, WE MAY NOT BE ABLE TO ACCESS DEBT CAPITAL OR THE DEBT CAPITAL WE CAN ACCESS MAY BE EXPENSIVE,

• WE MAY BE UNABLE TO REPAY OUR DEBT OBLIGATIONS WHEN THEY BECOME DUE,

• THE MAXIMUM BORROWING AVAILABILITY UNDER OUR REVOLVING CREDIT FACILITY AND TERM LOANS MAY BE INCREASED TO UP TO $2.5 BILLION ON A COMBINED BASIS IN CERTAIN CIRCUMSTANCES; HOWEVER, INCREASING THE

MAXIMUM BORROWING AVAILABILITY UNDER OUR REVOLVING CREDIT FACILITY AND TERM LOANS IS SUBJECT TO OUR OBTAINING ADDITIONAL COMMITMENTS FROM LENDERS, WHICH MAY NOT OCCUR,

• WE HAVE THE OPTION TO EXTEND THE MATURITY DATE OF OUR REVOLVING CREDIT FACILITY UPON PAYMENT OF A FEE AND MEETING OTHER CONDITIONS; HOWEVER, THE APPLICABLE CONDITIONS MAY NOT BE MET,

• THE BUSINESS AND PROPERTY MANAGEMENT AGREEMENTS BETWEEN US AND RMR LLC HAVE CONTINUING 20 YEAR TERMS. HOWEVER, THOSE AGREEMENTS PERMIT EARLY TERMINATION IN CERTAIN CIRCUMSTANCES.

ACCORDINGLY, WE CANNOT BE SURE THAT THESE AGREEMENTS WILL REMAIN IN EFFECT FOR CONTINUING 20 YEAR TERMS,

• WE BELIEVE THAT OUR RELATIONSHIPS WITH OUR RELATED PARTIES, INCLUDING RMR LLC, RMR INC., SIR, AIC AND OTHERS AFFILIATED WITH THEM MAY BENEFIT US AND PROVIDE US WITH COMPETITIVE ADVANTAGES IN

OPERATING AND GROWING OUR BUSINESS. HOWEVER, THE ADVANTAGES WE BELIEVE WE MAY REALIZE FROM THESE RELATIONSHIPS MAY NOT MATERIALIZE,

• SIR MAY REDUCE THE AMOUNT OF ITS DISTRIBUTIONS TO ITS SHAREHOLDERS, INCLUDING US,

• RMR INC. MAY REDUCE THE AMOUNT OF ITS DISTRIBUTION TO ITS SHAREHOLDERS, INCLUDING US,

• WE MAY BE UNABLE TO SELL OUR SIR COMMON SHARES FOR AN AMOUNT EQUAL TO OUR CARRYING VALUE OF THOSE SHARES AND ANY SUCH SALE MAY BE AT A DISCOUNT TO MARKET PRICE BECAUSE OF THE LARGE SIZE OF

OUR SIR HOLDINGS OR OTHERWISE; WE MAY REALIZE A LOSS ON OUR INVESTMENT IN OUR SIR SHARES,

• WE CURRENTLY EXPECT TO SPEND, AS OF JUNE 30, 2017, AN ADDITIONAL $5.5 MILLION TO COMPLETE THE REDEVELOPMENT AND EXPANSION OF A PROPERTY WE OWN PRIOR TO THE COMMENCEMENT OF THE LEASE FOR THAT

PROPERTY. IN ADDITION, AS OF JUNE 30, 2017, WE HAVE ESTIMATED UNSPENT LEASING RELATED OBLIGATIONS OF $24.9 MILLION, EXCLUDING THE ESTIMATED DEVELOPMENT COSTS NOTED IN THE PRECEDING SENTENCE. IT IS

DIFFICULT TO ACCURATELY ESTIMATE DEVELOPMENT AND TENANT SPACE PREPARATION COSTS. THIS DEVELOPMENT PROJECT AND OUR UNSPENT LEASING RELATED OBLIGATIONS MAY COST MORE OR LESS AND MAY TAKE

LONGER TO COMPLETE THAN WE CURRENTLY EXPECT, AND WE MAY INCUR INCREASING AMOUNTS FOR THESE AND SIMILAR PURPOSES IN THE FUTURE,

• WE HAVE AGREED TO ACQUIRE FPO AND EXPECT THE FPO TRANSACTION TO BE CONSUMMATED PRIOR TO DECEMBER 31, 2017. THE CONSUMMATION OF THE FPO TRANSACTION IS SUBJECT TO CUSTOMARY CONDITIONS,

INCLUDING APPROVAL BY THE HOLDERS OF AT LEAST A MAJORITY OF FPO’S OUTSTANDING COMMON SHARES. WE CANNOT BE SURE THAT SUCH CONDITIONS WILL BE SATISFIED. ACCORDINGLY, THE FPO TRANSACTION MAY NOT

CLOSE PRIOR TO DECEMBER 31, 2017 OR AT ALL, OR THE TERMS OF THE FPO TRANSACTION MAY CHANGE,

• THE APPROVAL OF THE FPO TRANSACTION BY THE HOLDERS OF AT LEAST A MAJORITY OF FPO’S OUTSTANDING COMMON SHARES MAY BE SOLICITED BY A PROXY STATEMENT WHICH MUST BE FILED WITH THE SEC. THE

PROCESS OF PREPARING THE PROXY STATEMENT IS TIME CONSUMING. ACCORDINGLY, WE CANNOT BE SURE THAT THE FPO TRANSACTION WILL BE CONSUMMATED WITHIN A SPECIFIED TIME PERIOD OR AT ALL, AND

• WE CURRENTLY EXPECT THE PROCEEDS FROM OUR RECENT COMMON SHARE AND SENIOR NOTES OFFERINGS TO BE USED (DIRECTLY OR INDIRECTLY BY REPAYMENTS AND DRAWINGS UNDER OUR REVOLVING CREDIT FACILITY)

TO PARTIALLY FINANCE THE FPO TRANSACTION. IN THE EVENT THE FPO TRANSACTION IS NOT CONSUMMATED, WE EXPECT TO USE THE NET PROCEEDS FROM THE COMMON SHARE OFFERING FOR GENERAL BUSINESS

PURPOSES. IF THE FPO TRANSACTION IS NOT CONSUMMATED ON OR PRIOR TO DECEMBER 31, 2017, OR THE MERGER AGREEMENT IS TERMINATED ON OR AT ANY TIME PRIOR TO THAT DATE, WE WILL BE REQUIRED TO REDEEM

THE NOTES ISSUED PURSUANT TO OUR RECENT NOTES OFFERING AT 101% OF THE PRINCIPAL AMOUNT OUTSTANDING PLUS ACCRUED AND UNPAID INTEREST.

CURRENTLY UNEXPECTED RESULTS COULD OCCUR DUE TO MANY DIFFERENT CIRCUMSTANCES, SOME OF WHICH ARE BEYOND OUR CONTROL, SUCH AS CHANGES IN GOVERNMENT TENANTS’ NEEDS FOR LEASED SPACE, ACTS OF

TERRORISM, NATURAL DISASTERS OR CHANGES IN CAPITAL MARKETS OR THE ECONOMY GENERALLY.

THE INFORMATION CONTAINED IN OUR FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION, OR SEC, INCLUDING UNDER THE CAPTION "RISK FACTORS" IN OUR PERIODIC REPORTS, OR INCORPORATED THEREIN, IDENTIFIES

OTHER IMPORTANT FACTORS THAT COULD CAUSE DIFFERENCES FROM OUR FORWARD LOOKING STATEMENTS. OUR FILINGS WITH THE SEC ARE AVAILABLE ON THE SEC’S WEBSITE AT WWW.SEC.GOV.

YOU SHOULD NOT PLACE UNDUE RELIANCE UPON OUR FORWARD LOOKING STATEMENTS.

EXCEPT AS REQUIRED BY LAW, WE DO NOT INTEND TO UPDATE OR CHANGE ANY FORWARD LOOKING STATEMENTS AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE.

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017CORPORATE INFORMATION 5

One Memphis Place, Memphis, TN

Square Feet: 204,694

Primary Agency Occupant: U.S. Courts

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

COM

PAN

Y PROFIL

E

6

COMPANY PROFILE

The Company:

Government Properties Income Trust, or GOV, we or us, is a real estate investment trust, or REIT, which

primarily owns properties located throughout the United States that are majority leased to government

tenants. The majority of our properties are office buildings. As of June 30, 2017, we also own 24.9 million

common shares, or approximately 27.9% of the then outstanding common shares, of Select Income REIT

(Nasdaq: SIR), or SIR, a REIT which owns properties that are primarily leased to single tenants. We have

been investment grade rated since 2010, and we are included in the S&P Small Cap 600 Index, the Russell

2000® index and the MSCI US REIT index.

Management:

GOV is managed by The RMR Group LLC, the operating subsidiary of The RMR Group Inc. (Nasdaq: RMR).

RMR is an alternative asset management company that was founded in 1986 to manage real estate

companies and related businesses. RMR primarily provides management services to four publicly owned

REITs and three real estate related operating businesses. In addition to managing GOV, RMR manages

Hospitality Properties Trust, a REIT that owns hotels and travel centers, Senior Housing Properties Trust, a

REIT that primarily owns healthcare, senior living and medical office buildings, and SIR, a REIT which owns

properties that are primarily leased to single tenants. RMR also provides management services to

TravelCenters of America LLC, a publicly traded operator of travel centers along the U.S. Interstate Highway

System, convenience stores and restaurants, Five Star Senior Living Inc., a publicly traded operator of senior

living communities, and Sonesta International Hotels Corporation, a privately owned franchisor and operator

of hotels and cruise ships. RMR also manages publicly traded securities of real estate companies and private

commercial real estate debt funds through wholly owned SEC registered investment advisory subsidiaries.

As of June 30, 2017, RMR had $27.9 billion of real estate assets under management and the combined

RMR managed companies had approximately $11 billion of annual revenues, over 1,400 properties and

approximately 53,000 employees. We believe that being managed by RMR is a competitive advantage for

GOV because of RMR’s depth of management and experience in the real estate industry. We also believe

RMR provides management services to us at costs that are lower than we would have to pay for similar

quality services.

Corporate Headquarters:

Two Newton Place

255 Washington Street, Suite 300

Newton, MA 02458-1634

(t) (617) 219-1440

(f) (617) 219-1441

Stock Exchange Listing:

Nasdaq

Trading Symbols:

Common Shares: GOV

Senior Unsecured Notes due 2046: GOVNI

Issuer Ratings:

Moody’s: Baa3

Standard & Poor’s: BBB-

(1) Excludes one property (one building) classified as discontinued

operations as of June 30, 2017.

(2) See page 22 for the calculation of Normalized FFO and a

reconciliation of net income determined in accordance with U.S.

generally accepted accounting principles, or GAAP, to this

amount.

Total Properties 74 (96 buildings)

Total sq. ft. 11,516

Percent Leased 95.0%

Q2 2017 Total Rental Income $69,887

Q2 2017 Net Income $11,677

Q2 2017 Normalized FFO (2) $42,412

Key data (as of 6/30/2017)(1):

(dollars and sq. ft. in 000s)

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

INVES

TOR INFORM

ATIO

N

7

INVESTOR INFORMATION

Board of Trustees

Barbara D. Gilmore John L. Harrington Elena Poptodorova

Independent Trustee Independent Trustee Independent Trustee

Adam D. Portnoy Barry M. Portnoy Jeffrey P. Somers

Managing Trustee Managing Trustee Independent Trustee

Senior Management

David M. Blackman Mark L. Kleifges

President and Chief Operating Officer Chief Financial Officer and Treasurer

Contact Information

Investor Relations Inquiries

Government Properties Income Trust Financial inquiries should be directed to Mark L. Kleifges,

Two Newton Place Chief Financial Officer and Treasurer, at (617) 219-1440

255 Washington Street, Suite 300 or mkleifges@rmrgroup.com.

Newton, MA 02458-1634

(t) (617) 219-1440 Investor and media inquiries should be directed to

(f) (617) 796-8267 Christopher Ranjitkar, Director, Investor Relations, at (617) 219-1473 or

(e-mail) info@govreit.com cranjitkar@rmrgroup.com.

(website) www.govreit.com

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

RESEARCH COVERAG

E

8

RESEARCH COVERAGE

Equity Research Coverage

Bank of America Merrill Lynch Research FBR & Co.

James Feldman Bryan Maher

James.Feldman@baml.com bmaher@fbr.com

(646) 855-5808 (646) 885-5423

Jeffries & Company, Inc. JMP Securities

Jonathan Petersen Mitch Germain

jpetersen@jefferies.com mgermain@jmpsecurities.com

(212) 284-1705 (212) 906-3546

Morgan Stanley RBC Capital Markets

Sumit Sharma Mike Carroll

Sumit.Sharma@morganstanley.com Michael.Carroll@rbccm.com

(212) 761-7567 (440) 715-2649

Rating Agencies

Moody’s Investors Service Standard & Poor’s

Lori Marks Sarah Sherman

Lori.marks@moodys.com sarah.sherman@standardandpoors.com

(212) 553-1653 (212) 438-3550

GOV is followed by the analysts and its credit is rated by the rating agencies listed above. Please note that any opinions, estimates

or forecasts regarding GOV’s performance made by these analysts or agencies do not represent opinions, forecasts or predictions

of GOV or its management. GOV does not by its reference above imply its endorsement of or concurrence with any information,

conclusions or recommendations provided by any of these analysts or agencies.

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

FINANCIALS

9960 Maryland Drive, Richmond, VA

Square Feet: 173,932

Agency Occupant: The Commonwealth of Virginia

9

625 Indiana Avenue, Washington, DC

Square Feet: 160,897

Primary Agency Occupant: U.S. Courts 9

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

KE

Y FINANCIA

L D

AT

A

10

KEY FINANCIAL DATA

(dollar and share amounts in thousands, except per share data)

(1) Total gross assets is total assets plus accumulated depreciation.

(2) See page 19 for the calculation of NOI and a reconciliation of net income determined in accordance with GAAP to that amount.

(3) See page 21 for the calculation of Adjusted EBITDA and a reconciliation of net income determined in accordance with GAAP to that amount.

(4) See page 22 for the calculation of FFO and Normalized FFO and a reconciliation of net income determined in accordance with GAAP to those amounts.

(5) Annualized distribution yield is the annualized distribution paid during the period divided by the closing price of our common shares at the end of the period.

As of and for the Three Months Ended

6/30/2017 3/31/2017 12/31/2016 9/30/2016 6/30/2016

Selected Balance Sheet Data:

Total gross assets (1) $ 2,685,114 $ 2,685,291 $ 2,681,870 $ 2,551,044 $ 2,526,611

Total assets $ 2,365,109 $ 2,377,050 $ 2,385,066 $ 2,265,070 $ 2,251,210

Total liabilities $ 1,456,430 $ 1,448,480 $ 1,450,062 $ 1,314,330 $ 1,293,998

Total shareholders' equity $ 908,679 $ 928,570 $ 935,004 $ 950,740 $ 957,212

Selected Income Statement Data:

Rental income $ 69,887 $ 69,296 $ 66,030 $ 64,478 $ 64,061

Net income $ 11,677 $ 7,415 $ 12,065 $ 11,578 $ 16,813

NOI (2) $ 42,587 $ 42,521 $ 39,939 $ 37,550 $ 39,556

Adjusted EBITDA (3) $ 52,160 $ 51,893 $ 49,424 $ 47,122 $ 48,949

FFO (4) $ 41,282 $ 37,713 $ 40,637 $ 38,512 $ 43,302

Normalized FFO (4) $ 42,412 $ 39,899 $ 41,533 $ 38,590 $ 43,350

Per Share Data (basic and diluted):

Net income $ 0.16 $ 0.10 $ 0.17 $ 0.16 $ 0.24

FFO (4) $ 0.58 $ 0.53 $ 0.57 $ 0.54 $ 0.61

Normalized FFO (4) $ 0.60 $ 0.56 $ 0.58 $ 0.54 $ 0.61

Dividends:

Annualized distributions paid per share during period $ 1.72 $ 1.72 $ 1.72 $ 1.72 $ 1.72

Annualized distribution yield (at end of period) (5) 9.4% 8.2% 9.0% 7.6% 7.5%

Normalized FFO payout ratio (4) (5) 71.7% 76.8% 74.1% 79.6% 70.5%

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

CONDENSED CONSOLID

ATED BALANCE SHEET

S

11

CONDENSED CONSOLIDATED BALANCE SHEETS

(amounts in thousands, except share data)

June 30, December 31,

2017 2016

ASSETS

Real estate properties:

Land $ 269,410 $ 267,855

Buildings and improvements 1,652,535 1,620,905

Total real estate properties, gross 1,921,945 1,888,760

Accumulated depreciation (320,005) (296,804)

Total real estate properties, net 1,601,940 1,591,956

Equity investment in Select Income REIT 477,233 487,708

Assets of discontinued operations 12,534 12,541

Acquired real estate leases, net 108,927 124,848

Cash and cash equivalents 12,907 29,941

Restricted cash 344 530

Rents receivable, net 47,717 48,458

Deferred leasing costs, net 21,251 21,079

Other assets, net 82,256 68,005

Total assets $ 2,365,109 $ 2,385,066

LIABILITIES AND SHAREHOLDERS’ EQUITY

Unsecured revolving credit facility $ 155,000 $ 160,000

Unsecured term loans, net 547,511 547,171

Senior unsecured notes, net 647,584 646,844

Mortgage notes payable, net 26,991 27,837

Liabilities of discontinued operations 81 45

Accounts payable and other liabilities 64,479 54,019

Due to related persons 5,361 3,520

Assumed real estate lease obligations, net 9,423 10,626

Total liabilities 1,456,430 1,450,062

Commitments and contingencies

Shareholders’ equity:

Common shares of beneficial interest, $.01 par value: 150,000,000 and 100,000,000 shares

authorized, respectively, 71,195,178 and 71,177,906 shares issued and outstanding, respectively 712 712

Additional paid in capital 1,473,936 1,473,533

Cumulative net income 115,420 96,329

Cumulative other comprehensive income 42,350 26,957

Cumulative common distributions (723,739) (662,527)

Total shareholders’ equity 908,679 935,004

Total liabilities and shareholders’ equity $ 2,365,109 $ 2,385,066

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

CONDENSED CONSOLID

ATED S

TA

TEMENTS OF INCOME

12

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(dollars and share amounts in thousands, except per share data)

(1) General and administrative expenses include estimated business management incentive fee expense of $893 for both the three and six months ended June 30, 2017.

(2) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also includes expense reimbursements, tax escalations, parking

revenues, service income and other fixed and variable charges paid to us by our tenants, as well as the net effect of non-cash amortization of intangible lease assets and liabilities.

(3) We recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price we paid for our investment in RMR common stock in June 2015. This liability is being amortized on a straight line basis through

December 31, 2035 as an allocated reduction to business management fees and property management fees, which are included in general and administrative and other operating expenses, respectively.

Three Months Ended June 30, Six Months Ended June 30,

2017 2016 2017 2016

Rental income $ 69,887 $ 64,061 $ 139,183 $ 127,672

Expenses:

Real estate taxes 7,941 7,566 16,118 15,219

Utility expenses 4,172 3,673 8,778 7,847

Other operating expenses 15,187 13,266 29,179 26,177

Depreciation and amortization 20,663 17,985 41,168 36,309

Acquisition related costs — 64 — 216

General and administrative (1) 5,086 4,008 9,048 7,534

Total expenses 53,049 46,562 104,291 93,302

Operating income 16,838 17,499 34,892 34,370

Dividend income 303 363 607 363

Interest income 67 10 128 16

Interest expense (including net amortization of debt premiums and discounts

and debt issuance costs of $808, $747, $1,615 and $1,219, respectively) (13,963) (10,314) (27,544) (19,678)

Gain on early extinguishment of debt — — — 104

Gain on issuance of shares by Select Income REIT 21 16 21 16

Income from continuing operations before income taxes

and equity in earnings of investees 3,266 7,574 8,104 15,191

Income tax expense (25) (35) (43) (50)

Equity in earnings of investees 8,581 9,400 11,320 19,334

Income from continuing operations 11,822 16,939 19,381 34,475

Loss from discontinued operations (145) (126) (289) (275)

Net income $ 11,677 $ 16,813 $ 19,092 $ 34,200

Weighted average common shares outstanding (basic) 71,088 71,038 71,083 71,034

Weighted average common shares outstanding (diluted) 71,119 71,061 71,109 71,046

Per common share amounts (basic and diluted):

Income from continuing operations $ 0.17 $ 0.24 $ 0.27 $ 0.49

Loss from discontinued operations $ — $ — $ — $ —

Net income $ 0.16 $ 0.24 $ 0.27 $ 0.48

Additional Data:

General and administrative expenses / rental income 7.28% 6.26% 6.50% 5.90%

General and administrative expenses / total assets (at end of period) 0.22% 0.18% 0.38% 0.33%

Non-cash straight line rent adjustments (2) $ 1,104 $ 435 $ 2,404 $ 584

Lease value amortization included in rental income (2) $ (617) $ (425) $ (1,244) $ (732)

Non-cash amortization included in other operating expenses (3) $ 121 $ 121 $ 242 $ 242

Non-cash amortization included in general and administrative expenses (3) $ 151 $ 151 $ 302 $ 302

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

CONDENSED CONSOLID

ATED S

TA

TEMENTS OF CASH FLOW

S

13

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollar amounts in thousands)

For the Six Months Ended June 30,

2017 2016

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income $ 19,092 $ 34,200

Adjustments to reconcile net income to cash provided by operating activities:

Depreciation 23,398 20,781

Net amortization of debt premiums and discounts and debt issuance costs 1,615 1,219

Gain on early extinguishment of debt — (104)

Straight line rental income (2,404) (584)

Amortization of acquired real estate leases 17,209 14,842

Amortization of deferred leasing costs 1,797 1,475

Other non-cash expenses (income), net 193 302

Equity in earnings of investees (11,320) (19,334)

Gain on issuance of shares by Select Income REIT (21) (16)

Distributions of earnings from Select Income REIT 9,345 17,760

Change in assets and liabilities:

Restricted cash 186 678

Deferred leasing costs (2,087) (3,409)

Rents receivable 2,872 1,428

Other assets (3,071) 1,120

Accounts payable and accrued expenses 9,871 971

Due to related persons 1,841 692

Net cash provided by operating activities 68,516 72,021

CASH FLOWS FROM INVESTING ACTIVITIES:

Real estate acquisitions and deposits (12,648) (79,285)

Real estate improvements (21,996) (14,149)

Distributions in excess of earnings from Select Income REIT 16,072 7,158

Net cash used in investing activities (18,572) (86,276)

CASH FLOWS FROM FINANCING ACTIVITIES:

Repayment of mortgage notes payable (761) (107,202)

Proceeds from issuance of senior notes — 310,000

Borrowings on unsecured revolving credit facility 45,000 229,000

Repayments on unsecured revolving credit facility (50,000) (346,000)

Payment of debt issuance costs — (10,138)

Repurchase of common shares (5) —

Distributions to common shareholders (61,212) (61,169)

Net cash (used in) provided by financing activities (66,978) 14,491

Increase (decrease) in cash and cash equivalents (17,034) 236

Cash and cash equivalents at beginning of period 29,941 8,785

Cash and cash equivalents at end of period $ 12,907 $ 9,021

Supplemental cash flow information:

Interest paid $ 25,747 $ 17,343

Income taxes paid $ 82 $ 76

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

DEBT SUMMA

RY

14

DEBT SUMMARY

(dollars in thousands)

As of June 30, 2017

(1) Principal balances exclude unamortized premiums, discounts and issuance costs related to these debts. Total debt outstanding as of June 30, 2017, net of unamortized premiums and discounts and

certain issuance costs totaling $14,661, was $1,377,086.

(2) We are required to pay interest on borrowings under our $750,000 revolving credit facility at an annual rate of LIBOR plus a premium of 125 basis points. We also pay a facility fee of 25 basis points

per annum on the total amount of lending commitments. Both the interest rate premium and facility fee are subject to adjustment based upon changes to our credit ratings. The coupon rate and

interest rate listed above are as of June 30, 2017. Subject to meeting certain conditions and payment of a fee, we may extend the maturity date to January 31, 2020.

(3) We are required to pay interest on the amounts outstanding under our $300,000 unsecured term loan at an annual rate of LIBOR plus a premium of 140 basis points, subject to adjustment based on

changes to our credit ratings. The coupon rate and interest rate listed above are as of June 30, 2017. Our $300,000 unsecured term loan is prepayable without penalty at any time.

(4) We are required to pay interest on the amounts outstanding under our $250,000 unsecured term loan at an annual rate of LIBOR plus a premium of 180 basis points, subject to adjustment based on

changes to our credit ratings. The coupon rate and interest rate listed above are as of June 30, 2017. Our $250,000 unsecured term loan is prepayable without penalty at any time.

(5) The maximum aggregate borrowing availability under the credit agreement governing our revolving credit facility and term loans may be increased to up to $2,500,000 on a combined basis in certain

circumstances.

(6) In July 2017, we sold $300,000 in aggregate principal amount of 4.00% senior unsecured notes due 2022. These notes are not included in the above table.

Coupon Interest Principal Maturity Due at Years to

Rate Rate Balance (1) Date Maturity Maturity

Unsecured Floating Rate Debt:

$750,000 unsecured revolving credit facility (2) (5) 2.436% 2.436% $ 155,000 1/31/2019 $ 155,000 1.6

$300,000 unsecured term loan (3) (5) 2.626% 2.626% 300,000 3/31/2020 300,000 2.8

$250,000 unsecured term loan (4) (5) 3.026% 3.026% 250,000 3/31/2022 250,000 4.8

Total / weighted average 2.726% 2.726% 705,000 705,000 3.2

Unsecured Fixed Rate Debt: (6)

Senior unsecured notes due 2019 3.750% 3.930% 350,000 8/15/2019 350,000 2.1

Senior unsecured notes due 2046 5.875% 5.875% 310,000 5/1/2046 310,000 28.9

Total / weighted average 4.748% 4.844% 660,000 660,000 14.7

Secured Fixed Rate Debt:

Mortgage debt - One building in Fairfax, VA 5.877% 5.877% 13,815 8/11/2021 12,702 4.1

Mortgage debt - One building in Tampa, FL 7.000% 5.150% 8,354 3/1/2019 7,890 1.7

Mortgage debt - One building in Lakewood, CO 8.150% 6.150% 4,578 3/1/2021 — 3.7

Total / weighted average 6.617% 5.697% 26,747 20,592 3.3

Total / weighted average 3.760% 3.787% $ 1,391,747 $ 1,385,592 8.7

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

DEBT M

ATURIT

Y SCHEDUL

E

15

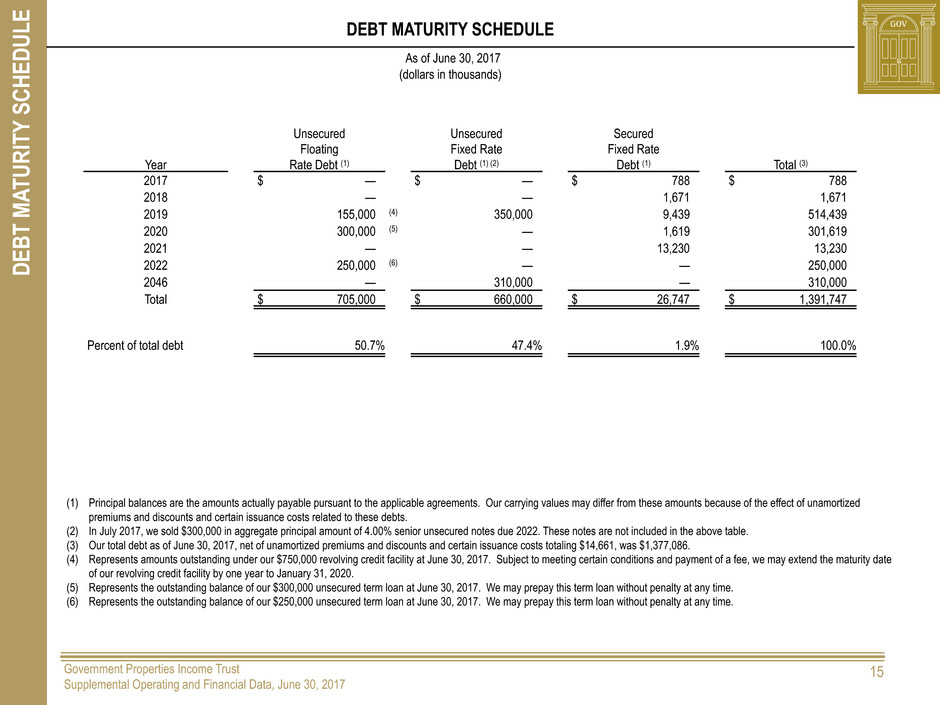

DEBT MATURITY SCHEDULE

(dollars in thousands)

As of June 30, 2017

(1) Principal balances are the amounts actually payable pursuant to the applicable agreements. Our carrying values may differ from these amounts because of the effect of unamortized

premiums and discounts and certain issuance costs related to these debts.

(2) In July 2017, we sold $300,000 in aggregate principal amount of 4.00% senior unsecured notes due 2022. These notes are not included in the above table.

(3) Our total debt as of June 30, 2017, net of unamortized premiums and discounts and certain issuance costs totaling $14,661, was $1,377,086.

(4) Represents amounts outstanding under our $750,000 revolving credit facility at June 30, 2017. Subject to meeting certain conditions and payment of a fee, we may extend the maturity date

of our revolving credit facility by one year to January 31, 2020.

(5) Represents the outstanding balance of our $300,000 unsecured term loan at June 30, 2017. We may prepay this term loan without penalty at any time.

(6) Represents the outstanding balance of our $250,000 unsecured term loan at June 30, 2017. We may prepay this term loan without penalty at any time.

Unsecured Unsecured Secured

Floating Fixed Rate Fixed Rate

Year Rate Debt (1) Debt (1) (2) Debt (1) Total (3)

2017 $ — $ — $ 788 $ 788

2018 — — 1,671 1,671

2019 155,000 (4) 350,000 9,439 514,439

2020 300,000 (5) — 1,619 301,619

2021 — — 13,230 13,230

2022 250,000 (6) — — 250,000

2046 — 310,000 — 310,000

Total $ 705,000 $ 660,000 $ 26,747 $ 1,391,747

Percent of total debt 50.7% 47.4% 1.9% 100.0%

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

LEVERAGE R

ATIOS, COVERAGE R

ATIOS

AND PUBLIC DEBT COVENANT

S

16

LEVERAGE RATIOS, COVERAGE RATIOS AND PUBLIC DEBT COVENANTS

(1) Debt amounts are net of unamortized premiums, discounts and certain issuance costs.

(2) Total gross assets is total assets plus accumulated depreciation.

(3) Gross book value of real estate assets is real estate properties, at cost, before purchase price allocations, less impairment writedowns, if any, and excludes properties classified as held for sale or discontinued operations.

(4) As of June 30, 2017, we owned 24,918,421 common shares of SIR. The closing price of SIR's common shares on The Nasdaq Stock Market LLC on June 30, 2017 was $24.03 per share.

(5) Total market capitalization is total debt plus the market value of our common shares at the end of each period.

(6) See page 21 for the calculation of EBITDA and Adjusted EBITDA and a reconciliation of net income determined in accordance with GAAP to those amounts.

(7) Adjusted total assets and total unencumbered assets include original cost of real estate assets calculated in accordance with GAAP before impairment writedowns, if any, the lower of cost or market value of our investment

in SIR and exclude depreciation and amortization, accounts receivable and intangible assets.

(8) Consolidated income available for debt service is earnings from operations excluding interest expense, depreciation and amortization, loss on asset impairment, unrealized appreciation on assets held for sale, gains and

losses on early extinguishment of debt, gains and losses on sales of property, gains or losses on equity issuance by SIR and equity earnings in SIR and including distributions received from SIR.

As of and for the Three Months Ended

6/30/2017 3/31/2017 12/31/2016 9/30/2016 6/30/2016

Leverage Ratios:

Total debt (book value) (1) / total gross assets (2) 51.3% 51.5% 51.5% 48.9% 48.4%

Total debt (book value) (1) / gross book value of real estate assets (3) and

market value of SIR common shares (4) 49.6% 49.2% 49.9% 46.4% 46.1%

Total debt (book value) (1) / total market capitalization (5) 51.4% 48.1% 50.4% 43.6% 42.7%

Secured debt (book value) (1) / total assets 1.1% 1.2% 1.2% 1.2% 1.3%

Variable rate debt (book value) (1) / total debt (book value) (1) 51.0% 51.2% 51.2% 45.9% 44.8%

Coverage Ratios:

Adjusted EBITDA (6) / interest expense 3.7x 3.8x 3.9x 3.7x 4.7x

Total debt (book value) (1) / Annualized Adjusted EBITDA (6) 6.6x 6.7x 7.0x 6.6x 6.2x

Public Debt Covenants:

Total debt / adjusted total assets (7) - allowable maximum 60.0% 47.9% 47.6% 48.2% 45.1% 45.1%

Secured debt / adjusted total assets (7) - allowable maximum 40.0% 0.9% 0.9% 1.0% 1.0% 1.0%

Consolidated income available for debt service (8) / debt service - required minimum 1.50x 4.0x 4.1x 4.2x 3.9x 3.9x

Total unencumbered assets (7) to unsecured debt - required minimum 150.0% 208.2% 209.4% 207.2% 221.7% 221.9%

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

SUMMA

RY

OF CAPI

TA

L EXPENDITURE

S

17

SUMMARY OF CAPITAL EXPENDITURES (1)

(dollars and sq. ft. in thousands, except per sq. ft. data)

(1) Amounts exclude one property (one building) classified as discontinued operations.

(2) Tenant improvements include capital expenditures used to improve tenants' space or amounts paid directly to tenants to improve their space.

(3) Leasing costs include leasing related costs, such as brokerage commissions and tenant inducements.

(4) Building improvements generally include expenditures to replace obsolete building components and expenditures that extend the useful life of existing assets.

(5) Development, redevelopment and other activities generally include (i) capital expenditures that are identified at the time of a property acquisition and incurred within a short

time period after acquiring the property, and (ii) capital expenditure projects that reposition a property or result in new sources of revenue.

(6) Rentable square footage is subject to changes when space is re-measured or re-configured for tenants.

For the Three Months Ended

6/30/2017 3/31/2017 12/31/2016 9/30/2016 6/30/2016

Tenant improvements (2) $ 1,076 $ 2,403 $ 3,550 $ 5,636 $ 4,681

Leasing costs (3) 971 1,087 1,947 655 3,035

Building improvements (4) 4,465 1,778 2,570 3,009 2,649

Recurring capital expenditures 6,512 5,268 8,067 9,300 10,365

Development, redevelopment and other activities (5) 6,949 6,281 3,597 1,292 2,161

Total capital expenditures $ 13,461 $ 11,549 $ 11,664 $ 10,592 $ 12,526

Average sq. ft. during period (6) 11,514 11,477 11,196 10,968 10,986

Building improvements per average sq. ft. during period $ 0.39 $ 0.15 $ 0.23 $ 0.27 $ 0.24

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

PROPERT

Y

ACQUISITION

AND DISPOSITION INFORM

ATION SINCE JANUA

RY

1, 201

7

18

PROPERTY ACQUISITION AND DISPOSITION INFORMATION SINCE JANUARY 1, 2017

(dollars and sq. ft. in thousands, except per sq. ft. data)

Acquisitions: Weighted

Average

Purchase Remaining

Date Number of Number of Purchase Price (1) / Cap Lease Percent

Acquired City and State Properties Buildings Sq. Ft. Price (1) Sq. Ft. Rate (2) Term (3) Leased (4) Major Tenant

1/3/2017 Manassas, VA 1 1 69 $ 12,620 $ 183 8.6% 9.1 100.0% Prince William County

(1) Represents the purchase price, including assumed debt, if any, and excludes acquisition costs, amounts necessary to adjust assumed liabilities to their fair values and purchase

price allocations to intangibles.

(2) Represents the ratio of (x) annual straight line rental income, excluding the impact of above and below market lease amortization, based on existing leases at the acquisition date,

less estimated annual property operating expenses as of the date of acquisition, excluding depreciation and amortization expense, to (y) the acquisition purchase price, including

the principal amount of assumed debt, if any, and excluding acquisition related costs.

(3) Average remaining lease term in years weighted based on rental income as of the date of acquisition.

(4) Percent leased as of the date of acquisition.

Dispositions:

There were no property dispositions since January 1, 2017.

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

CALCUL

ATION OF PROPERT

Y NET OPER

ATING INCOME (NOI)

AND CASH BASIS NOI

19

CALCULATION OF PROPERTY NET OPERATING INCOME (NOI) AND CASH BASIS NOI (1)

(dollars in thousands)

(1) See Definitions of Certain Non-GAAP Financial Measures on page 23 for the definitions of NOI and Cash Basis NOI, a description of why we believe they are appropriate supplemental measures and a description of how we

use these measures.

(2) Excludes one property (one building) classified as discontinued operations.

(3) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also includes expense reimbursements, tax

escalations, parking revenues, service income and other fixed and variable charges paid to us by our tenants, as well as the net effect of non-cash amortization of intangible lease assets and liabilities.

(4) We recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price we paid for our investment in RMR common stock in June 2015. A portion of this liability is being amortized

on a straight line basis through December 31, 2035 as a reduction to property management fees, which are included in property operating expenses.

For the Three Months Ended For the Six Months Ended

6/30/2017 3/31/2017 12/31/2016 9/30/2016 6/30/2016 6/30/2017 6/30/2016

Calculation of NOI and Cash Basis NOI (2):

Rental income (3) $ 69,887 $ 69,296 $ 66,030 $ 64,478 $ 64,061 $ 139,183 $ 127,672

Property operating expenses (27,300) (26,775) (26,091) (26,928) (24,505) (54,075) (49,243)

Property net operating income (NOI) 42,587 42,521 39,939 37,550 39,556 85,108 78,429

Non-cash straight line rent adjustments included in rental income (3) (1,104) (1,300) (902) (1,205) (435) (2,404) (584)

Lease value amortization included in rental income (3) 617 627 355 370 425 1,244 732

Non-cash amortization included in property operating expenses (4) (121) (121) (121) (121) (121) (242) (242)

Cash Basis NOI $ 41,979 $ 41,727 $ 39,271 $ 36,594 $ 39,425 $ 83,706 $ 78,335

Reconciliation of Net Income to NOI and Cash Basis NOI:

Net income $ 11,677 $ 7,415 $ 12,065 $ 11,578 $ 16,813 $ 19,092 —$ 34,200

Gain on sale of property — — — (79) — — —

Income before gain on sale of property 11,677 7,415 12,065 11,499 16,813 19,092 34,200

Loss from discontinued operations 145 144 160 154 126 289 275

Income from continuing operations 11,822 7,559 12,225 11,653 16,939 19,381 34,475

Equity in earnings of investees (8,581) (2,739) (7,516) (8,668) (9,400) (11,320) (19,334)

Income tax expense 25 18 38 13 35 43 50

Net (gain) loss on issuance of shares by SIR (21) — 2 (72) (16) (21) (16)

Gain on early extinguishment of debt — — — — — — (104)

Interest expense 13,963 13,581 12,774 12,608 10,314 27,544 19,678

Interest income (67) (61) (95) (47) (10) (128) (16)

Dividend income (303) (304) (304) (304) (363) (607) (363)

Operating income 16,838 18,054 17,124 15,183 17,499 34,892 34,370

General and administrative 5,086 3,962 3,547 3,816 4,008 9,048 7,534

Acquisition related costs — — 828 147 64 — 216

Depreciation and amortization 20,663 20,505 18,440 18,404 17,985 41,168 36,309

NOI 42,587 42,521 39,939 37,550 39,556 85,108 78,429

Non-cash amortization included in property operating expenses (4) (121) (121) (121) (121) (121) (242) (242)

Lease value amortization included in rental income (3) 617 627 355 370 425 1,244 732

Non-cash straight line rent adjustments included in rental income (3) (1,104) (1,300) (902) (1,205) (435) (2,404) (584)

Cash Basis NOI $ 41,979 $ 41,727 $ 39,271 $ 36,594 $ 39,425 $ 83,706 $ 78,335

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

CALCUL

ATION OF SAME PROPERT

Y NOI

AND CASH BASIS NOI

20

CALCULATION OF SAME PROPERTY NOI AND CASH BASIS NOI (1)

(dollars in thousands)

(1) See Definitions of Certain Non-GAAP Financial Measures on page 23 for the definitions of NOI and Cash Basis NOI, a description of why we believe they are appropriate

supplemental measures and a description of how we use these measures.

(2) Based on properties we owned as of June 30, 2017 and which we owned continuously since April 1, 2016, excluding one property (one building) classified as discontinued

operations.

(3) Based on properties we owned as of June 30, 2017 and which we owned continuously since January 1, 2016, excluding one property (one building) classified as discontinued

operations.

(4) Excludes one property (one building) classified as discontinued operations.

(5) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income

also includes expense reimbursements, tax escalations, parking revenues, service income and other fixed and variable charges paid to us by our tenants, as well as the net effect of

non-cash amortization of intangible lease assets and liabilities.

(6) We recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price we paid for our investment in RMR common stock in June 2015.

A portion of this liability is being amortized on a straight line basis through December 31, 2035 as a reduction to property management fees, which are included in property operating

expenses.

For the Three Months Ended (2) For the Six Months Ended (3)

6/30/2017 6/30/2016 6/30/2017 6/30/2016

Reconciliation of Property NOI to Same Property NOI: (4)

Rental income $ 69,887 $ 64,061 $ 139,183 $ 127,672

Property operating expenses (27,300) (24,505) (54,075) (49,243)

Property NOI 42,587 39,556 85,108 78,429

Add (less): NOI of properties not included in same property results (2,635) 54 (8,693) (2,182)

Same property NOI $ 39,952 $ 39,610 $ 76,415 $ 76,247

Calculation of Same Property Cash Basis NOI:

Same property NOI $ 39,952 $ 39,610 $ 76,415 $ 76,247

Add: Lease value amortization included in rental income (5) 391 426 849 732

Less: Non-cash straight line rent adjustments included in rental income (5) (933) (436) (1,844) (469)

Non-cash amortization included in property operating expenses (6) (121) (121) (242) (242)

Same property Cash Basis NOI $ 39,289 $ 39,479 $ 75,178 $ 76,268

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

CALCUL

ATION OF EBITD

A

AND

ADJUSTED EBITD

A

21

CALCULATION OF EBITDA AND ADJUSTED EBITDA (1)

(dollars in thousands)

(1) See Definitions of Certain Non-GAAP Financial Measures on page 23 for the definitions of EBITDA and Adjusted EBITDA and a description of why we believe they are

appropriate supplemental measures.

(2) Amounts represent equity compensation awarded to our trustees, officers and certain other employees of RMR’s operating subsidiary, The RMR Group LLC.

(3) Amount represents estimated incentive fees under our business management agreement calculated based on common share total return, as defined. In

calculating net income in accordance with GAAP, we recognize estimated business management incentive fee expense, if any, in the first, second and third quarters. Although

we recognize this expense, if any, in the first, second and third quarters for purposes of calculating net income, we do not include such expense in the calculation of Adjusted

EBITDA until the fourth quarter, when the amount of the business management incentive fee expense for the calendar year, if any, is determined. Incentive fees for 2017, if any,

will be payable in cash in January 2018.

For the Three Months Ended For the Six Months Ended

6/30/2017 3/31/2017 12/31/2016 9/30/2016 6/30/2016 6/30/2017 6/30/2016

Net income $ 11,677 $ 7,415 $ 12,065 $ 11,578 $ 16,813 $ 19,092 $ 34,200

Add: Interest expense 13,963 13,581 12,774 12,608 10,314 27,544 19,678

Income tax expense 25 18 38 13 35 43 50

Depreciation and amortization 20,663 20,505 18,440 18,404 17,985 41,168 36,309

EBITDA 46,328 41,519 43,317 42,603 45,147 87,847 90,237

Add: Acquisition related costs — — 828 147 64 — 216

General and administrative expense paid in common shares (2) 459 277 55 470 678 736 845

Estimated business management incentive fees (3) 893 — — — — 893 —

Loss on issuance of shares by SIR — — 2 — — — —

Distributions received from SIR 12,708 12,708 12,708 12,708 12,459 25,416 24,918

Less: Gain on early extinguishment of debt — — — — — — (104)

Equity in earnings of SIR (8,207) (2,611) (7,486) (8,655) (9,383) (10,818) (19,240)

Gain on issuance of shares by SIR (21) — — (72) (16) (21) (16)

Gain on sale of property — — — (79) — — —

Adjusted EBITDA $ 52,160 $ 51,893 $ 49,424 $ 47,122 $ 48,949 $ 104,053 $ 96,856

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

CALCUL

ATION OF FUNDS FROM OPER

ATIONS (FFO)

AND NORMALIZED FF

O

22

CALCULATION OF FUNDS FROM OPERATIONS (FFO) AND NORMALIZED FFO (1)

(amounts in thousands, except per share data)

(1) See Definitions of Certain Non-GAAP Financial Measures on page 23 for the definitions of FFO and Normalized FFO, a description of why we believe they are appropriate supplemental measures

and a description of how we use these measures.

(2) Incentive fees under our business management agreement are payable after the end of each calendar year, are calculated based on common share total return, as defined, and are included in

general and administrative expense in our condensed consolidated statements of income. In calculating net income in accordance with GAAP, we recognize estimated business management

incentive fee expense, if any, in the first, second and third quarters. Although we recognize this expense, if any, in the first, second and third quarters for purposes of calculating net income, we do

not include such expense in the calculation of Normalized FFO until the fourth quarter, when the amount of the business management incentive fee expense for the calendar year, if any, is

determined. Normalized FFO excludes estimated business management incentive fee expense of $893 for the three and six months ended June 30, 2017.

For the Three Months Ended For the Six Months Ended

6/30/2017 3/31/2017 12/31/2016 9/30/2016 6/30/2016 6/30/2017 6/30/2016

Net income $ 11,677 $ 7,415 $ 12,065 $ 11,578 $ 16,813 $ 19,092 $ 34,200

Add: Depreciation and amortization 20,663 20,505 18,440 18,404 17,985 41,168 36,309

FFO attributable to SIR investment 17,149 12,404 17,618 17,264 17,887 29,553 36,345

Less: Equity in earnings of SIR (8,207) (2,611) (7,486) (8,655) (9,383) (10,818) (19,240)

Gain on sale of property — — — (79) — — —

FFO 41,282 37,713 40,637 38,512 43,302 78,995 87,614

Add: Acquisition related costs — — 828 147 64 — 216

Estimated business management incentive fees (2) 893 — — — — 893 —

Loss on issuance of shares by SIR — — 2 — — —

Normalized FFO attributable to SIR investment 17,407 14,590 17,684 17,267 17,887 31,997 36,362

Less: FFO attributable to SIR investment (17,149) (12,404) (17,618) (17,264) (17,887) (29,553) (36,345)

Gain on early extinguishment of debt — — — — — — (104)

Gain on issuance of shares by SIR (21) — — (72) (16) (21) (16)

Normalized FFO $ 42,412 $ 39,899 $ 41,533 $ 38,590 $ 43,350 $ 82,311 $ 87,727

Weighted average common shares outstanding (basic) 71,088 71,079 71,079 71,054 71,038 71,083 71,034

Weighted average common shares outstanding (diluted) 71,119 71,094 71,079 71,084 71,061 71,109 71,046

Per common share amounts:

Net income (basic and diluted) $ 0.16 $ 0.10 $ 0.17 $ 0.16 $ 0.24 $ 0.27 $ 0.48

FFO (basic and diluted) $ 0.58 $ 0.53 $ 0.57 $ 0.54 $ 0.61 $ 1.11 $ 1.23

Normalized FFO (basic) $ 0.60 $ 0.56 $ 0.58 $ 0.54 $ 0.61 $ 1.16 $ 1.24

Normalized FFO (diluted) $ 0.60 $ 0.56 $ 0.58 $ 0.54 $ 0.61 $ 1.16 $ 1.23

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

NON-GAA

P FINANCIA

L MEASURES DEFINITION

S

23

DEFINITIONS OF CERTAIN NON-GAAP FINANCIAL MEASURES

Definition of NOI and Cash Basis NOI

We calculate NOI and Cash Basis NOI as shown on page 19. The calculations of NOI and Cash Basis NOI exclude certain components of net income in order to provide results that are

more closely related to our property level results of operations. We define NOI as income from our rental of real estate less property operating expenses. NOI excludes

amortization of capitalized tenant improvement costs and leasing commissions because we record those amounts as depreciation and amortization. We define Cash Basis NOI as NOI

excluding non-cash straight line rent adjustments, lease value amortization and non-cash amortization included in other operating expenses. We consider NOI and Cash Basis NOI to be

appropriate supplemental measures to net income because they may help both investors and management to understand the operations of our properties. We use NOI and Cash Basis

NOI to evaluate individual and company wide property level performance, and we believe that NOI and Cash Basis NOI provide useful information to investors regarding our results of

operations because they reflect only those income and expense items that are generated and incurred at the property level and may facilitate comparisons of our operating performance

between periods and with other REITs. NOI and Cash Basis NOI do not represent cash generated by operating activities in accordance with GAAP and should not be considered as

alternatives to net income or operating income as an indicator of our operating performance or as a measure of our liquidity. These measures should be considered in conjunction with net

income and operating income as presented in our Condensed Consolidated Statements of Income. Other REITs and real estate companies may calculate NOI and Cash Basis NOI

differently than we do.

Definition of EBITDA and Adjusted EBITDA

We calculate EBITDA and Adjusted EBITDA as shown on page 21. We consider EBITDA and Adjusted EBITDA to be appropriate supplemental measures of our operating performance,

along with net income and operating income. We believe that EBITDA and Adjusted EBITDA provide useful information to investors because by excluding the effects of certain historical

amounts, such as interest, depreciation and amortization expense, EBITDA and Adjusted EBITDA may facilitate a comparison of current operating performance with our past operating

performance. EBITDA and Adjusted EBITDA do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income or

operating income as an indicator of operating performance or as a measure of GOV’s liquidity. These measures should be considered in conjunction with net income and operating

income as presented in our Condensed Consolidated Statements of Income. Other REITs and real estate companies may calculate EBITDA and Adjusted EBITDA differently than we do.

Definition of FFO and Normalized FFO

We calculate FFO and Normalized FFO as shown on page 22. FFO is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or NAREIT, which is

net income, calculated in accordance with GAAP, plus real estate depreciation and amortization and the difference between FFO attributable to an equity investment and equity in

earnings of an equity investee but excluding impairment charges on real estate assets, any gain or loss on sale of properties, as well as certain other adjustments currently not applicable

to us. Our calculation of Normalized FFO differs from NAREIT's definition of FFO because we include the difference between FFO and Normalized FFO attributable to our equity

investment in SIR, we include business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as expense in accordance with GAAP

due to their quarterly volatility not necessarily being indicative of our core operating performance and the uncertainty as to whether any such business management incentive fees will be

payable when all contingencies for determining such fees are known at the end of the calendar year and we exclude acquisition related costs expensed under GAAP, gains and losses on

issuance of shares by SIR and gains on early extinguishment of debt. We consider FFO and Normalized FFO to be appropriate supplemental measures of operating performance for a

REIT, along with net income and operating income. We believe that FFO and Normalized FFO provide useful information to investors because by excluding the effects of certain historical

amounts, such as depreciation expense, FFO and Normalized FFO may facilitate a comparison of our operating performance between periods and with other REITs. FFO and Normalized

FFO are among the factors considered by our Board of Trustees when determining the amount of distributions to our shareholders. Other factors include, but are not limited to,

requirements to maintain our qualification for taxation as a REIT, limitations in our credit agreement and public debt covenants, the availability to us of debt and equity capital, our

expectation of our future capital requirements and operating performance, our receipt of distributions from SIR and our expected needs and availability of cash to pay our obligations. FFO

and Normalized FFO do not represent cash generated by operating activities in accordance with GAAP and should not be considered as alternatives to net income or operating income as

an indicator of our operating performance or as a measure of our liquidity. These measures should be considered in conjunction with net income and operating income as presented in our

Condensed Consolidated Statements of Income. Other REITs and real estate companies may calculate FFO and Normalized FFO differently than we do.

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

PORTFOLIO INFORMATION

24

Stevens Center, Richland, WA

Square Feet: 140,152

Agency Occupant: Department of Energy

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

PORTFOLIO SUMMA

RY

25

PORTFOLIO SUMMARY (1)

As of June 30, 2017

(1) Excludes one property (one building) classified as discontinued operations.

(2) Rentable square footage is subject to changes when space is re-measured or re-configured for tenants.

(3) Percent leased includes (i) space being fitted out for occupancy pursuant to our lease agreements, if any, and (ii) space which is leased, but is not occupied or is being offered for sublease by

tenants, if any, as of the measurement date.

(4) See page 19 for the calculation of NOI and Cash Basis NOI and a reconciliation of net income determined in accordance with GAAP to those amounts.

% of Total % Rental Income % NOI % Cash Basis NOI

Number of Number of Sq. Ft. Three Months Three Months Three Months

Properties Buildings Sq. Ft. (2) % Sq. Ft. % Leased (3) Leased Ended 6/30/2017 Ended 6/30/2017 (4) Ended 6/30/2017 (4)

Properties majority leased to the U.S. Government 46 60 7,212,677 62.6% 96.6% 63.7% 60.5% 62.9% 64.7%

Properties majority leased to state governments 20 26 3,018,415 26.2% 94.7% 26.1% 27.1% 25.3% 24.0%

Properties majority leased to other government tenants 3 3 446,478 3.9% 97.1% 4.0% 6.3% 6.3% 5.4%

Properties majority leased to government contractor tenants 1 3 409,478 3.6% 98.5% 3.7% 4.3% 4.7% 5.1%

Properties majority leased to other tenants 2 2 319,344 2.8% 86.7% 2.5% 1.8% 1.3% 1.5%

Other properties (currently vacant) 2 2 109,595 0.9% —% —% —% (0.5%) (0.7%)

Total / Average 74 96 11,515,987 100.0% 95.0% 100.0% 100.0% 100.0% 100.0%

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

SUMMA

RY

CONSOLID

ATED

AND SAME PROPERT

Y RESU

LT

S

26

SUMMARY CONSOLIDATED AND SAME PROPERTY RESULTS – SECOND QUARTER

(dollars and sq. ft. in thousands)

(1) Based on properties we owned as of June 30, 2017 and June 30, 2016, respectively, excluding one property (one building) classified as discontinued operations.

(2) Based on properties we owned as of June 30, 2017 and which we owned continuously since April 1, 2016, excluding one property (one building) classified as discontinued operations.

(3) Subject to changes when space is re-measured or re-configured for tenants.

(4) Percent leased includes (i) space being fitted out for occupancy pursuant to our lease agreements, if any, and (ii) space which is leased, but is not occupied or is being offered for sublease by

tenants, if any, as of the measurement date.

(5) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also includes

expense reimbursements, tax escalations, parking revenues, service income and other fixed and variable charges paid to us by our tenants, as well as the net effect of non-cash amortization of

intangible lease assets and liabilities.

(6) See page 19 for the calculation of NOI and Cash Basis NOI and a reconciliation of net income determined in accordance with GAAP to those amounts and see page 20 for a calculation and

reconciliation of same property NOI and same property Cash Basis NOI.

(7) NOI margin is defined as NOI as a percentage of rental income. Cash Basis NOI margin is defined as Cash Basis NOI as a percentage of cash basis rental income. Cash basis rental income

excludes non-cash straight line rent adjustments, non-cash amortization included in property operating expenses and the net effect of non-cash amortization of intangible lease assets and

liabilities.

Summary Consolidated Results (1) Summary Same Property Results (2)

For the Three Months Ended For the Three Months Ended

6/30/2017 6/30/2016 6/30/2017 6/30/2016

Properties (end of period) 74 72 71 71

Total sq. ft. (3) 11,516 10,985 10,954 10,950

Percent leased (4) 95.0% 94.2% 94.8% 94.5%

Rental income (5) $ 69,887 $ 64,061 $ 65,942 $ 64,061

NOI (6) $ 42,587 $ 39,556 $ 39,952 $ 39,610

Cash Basis NOI (6) $ 41,979 $ 39,425 $ 39,289 $ 39,479

NOI % margin (7) 60.9% 61.7% 60.6% 61.8%

Cash Basis NOI % margin (7) 60.5% 61.6% 60.1% 61.6%

NOI % change 7.7% — 0.9% —

Cash Basis NOI % change 6.5% — (0.5%) —

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

SUMMA

RY

CONSOLID

ATED

AND SAME PROPERT

Y RESU

LT

S

27

SUMMARY CONSOLIDATED AND SAME PROPERTY RESULTS – SIX MONTHS

(dollars and sq. ft. in thousands)

(1) Based on properties we owned as of June 30, 2017 and June 30, 2016, respectively, excluding one property (one building) classified as discontinued operations.

(2) Based on properties we owned as of June 30, 2017 and which we owned continuously since January 1, 2016, excluding one property (one building) classified as discontinued operations.

(3) Subject to changes when space is re-measured or re-configured for tenants.

(4) Percent leased includes (i) space being fitted out for occupancy pursuant to our lease agreements, if any, and (ii) space which is leased, but is not occupied or is being offered for sublease by

tenants, if any, as of the measurement date.

(5) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also includes

expense reimbursements, tax escalations, parking revenues, service income and other fixed and variable charges paid to us by our tenants, as well as the net effect of non-cash amortization of

intangible lease assets and liabilities.

(6) See page 19 for the calculation of NOI and Cash Basis NOI and a reconciliation of net income determined in accordance with GAAP to those amounts and see page 20 for a calculation and

reconciliation of same property NOI and same property Cash Basis NOI.

(7) NOI margin is defined as NOI as a percentage of rental income. Cash Basis NOI margin is defined as Cash Basis NOI as a percentage of cash basis rental income. Cash basis rental income

excludes non-cash straight line rent adjustments, non-cash amortization included in property operating expenses and the net effect of non-cash amortization of intangible lease assets and

liabilities.

Summary Consolidated Results (1) Summary Same Property Results (2)

For the Six Months Ended For the Six Months Ended

6/30/2017 6/30/2016 6/30/2017 6/30/2016

Properties (end of period) 74 72 70 70

Total sq. ft. (3) 11,516 10,985 10,616 10,612

Percent leased (4) 95.0% 94.2% 94.9% 94.7%

Rental income (5) $ 139,183 $ 127,672 $ 126,119 $ 124,000

NOI (6) $ 85,108 $ 78,429 $ 76,415 $ 76,247

Cash Basis NOI (6) $ 83,706 $ 78,335 $ 75,178 $ 76,268

NOI % margin (7) 61.1% 61.4% 60.6% 61.5%

Cash Basis NOI % margin (7) 60.6% 61.3% 60.1% 61.4%

NOI % change 8.5% — 0.2% —

Cash Basis NOI % change 6.9% — (1.4%) —

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

OCCU

PANC

Y

AND LEASING SUMMA

RY

28

OCCUPANCY AND LEASING SUMMARY (1)

(dollars and sq. ft. in thousands, except per sq. ft. data)

(1) Excludes one property (one building) classified as discontinued operations.

(2) Rentable square footage is subject to changes when space is re-measured or re-configured for tenants.

(3) Rentable square footage includes a 25,579 square foot expansion being constructed prior to the commencement of the lease.

(4) Percent difference in prior rents charged for same space or, in the case of space acquired vacant, market rental rates for similar space in the building at the date of acquisition. Rents include estimated recurring expense

reimbursements paid to us, exclude lease value amortization and are net of lease concessions.

(5) Includes commitments made for leasing expenditures and concessions, such as tenant improvements, leasing commissions, tenant reimbursements and free rent.

(6) Excludes the estimated aggregate cost of $19.8 million to redevelop and expand an existing property prior to the commencement of the lease.

The above leasing summary is based on leases entered into during the periods indicated.

As of and for the Three Months Ended

6/30/2017 3/31/2017 12/31/2016 9/30/2016 6/30/2016

Properties (end of period) 74 74 73 71 72

Total sq. ft. (2) 11,516 11,512 11,443 10,950 10,985

Percentage leased 95.0% 95.1% 95.1% 95.0% 94.2%

Leasing Activity (sq. ft.) (3):

Government tenants 236 324 344 62 515

Non-government tenants 52 36 43 74 52

Total 288 360 387 136 567

% Change in GAAP Rent (4):

Government tenants 15.0% 4.5% 5.7% 10.5% 4.7%

Non-government tenants 6.6% 7.1% (19.1%) (3.8%) 1.2%

Total 13.5% 5.2% 4.3% 2.0% 4.4%

Leasing Cost and Concession Commitments (5)(6):

Government tenants $ 1,611 $ 879 $ 2,107 $ 1,087 $ 10,593

Non-government tenants 854 1,362 1,348 2,341 543

Total $ 2,465 $ 2,241 $ 3,455 $ 3,428 $ 11,136

Leasing Cost and Concession Commitments per Sq. Ft. (5)(6):

Government tenants $ 6.82 $ 2.71 $ 6.13 $ 17.38 $ 20.57

Non-government tenants $ 16.33 $ 37.87 $ 31.05 $ 31.67 $ 10.50

Total $ 8.55 $ 6.22 $ 8.93 $ 25.12 $ 19.65

Weighted Average Lease Term by Sq. Ft. (years):

Government tenants 8.1 10.9 3.1 6.9 10.7

Non-government tenants 3.2 7.1 5.2 6.6 3.7

Total 7.2 10.6 3.3 6.8 10.1

Leasing Cost and Concession Commitments per Sq. Ft. per Year (3)(5)(6):

Government tenants $ 0.85 $ 0.25 $ 2.00 $ 2.50 $ 1.92

Non-government tenants $ 5.09 $ 5.36 $ 6.02 $ 4.77 $ 2.85

Total $ 1.19 $ 0.59 $ 2.70 $ 3.71 $ 1.96

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

LEASING

ANA

LYSIS B

Y TENANT TYP

E

29

LEASING ANALYSIS BY TENANT TYPE (1)

(1) Excludes one property (one building) classified as discontinued operations.

(2) Rentable sq. ft. leased is pursuant to leases existing as of the measurement date and includes (i) space being fitted out for occupancy, if any, and (ii) space which is leased, but is

not occupied or is being offered for sublease, if any, as of the measurement date. Sq. ft. measurements are subject to changes when space is re-measured or re-configured for

new tenants.

(3) Rentable square footage excludes a 25,579 square foot expansion being constructed prior to the commencement of the lease.

Sq. Ft. During the Three Months Ended 6/30/2017

Sq. Ft. Leased % of Sq. Ft. Lease New Net Sq. Ft. Leased % of Sq. Ft.

As of Leased as of Leases Renewals Leases Acquisitions/ As of Leased as of

Tenant Type 3/31/2017 (2)(3) 3/31/2017 (2)(3) Expired Executed Executed Dispositions 6/30/2017 (2)(3) 6/30/2017 (2)(3)

U.S. Government 6,703,781 61.2% (173,806) 111,380 12,216 — 6,653,571 60.8%

State Government 2,503,022 22.9% (110,500) 110,500 2,063 — 2,505,085 22.9%

Other Government 371,202 3.4% — — — — 371,202 3.4%

Government Contractor 416,369 3.8% — — — — 416,369 3.8%

Other Tenants 956,245 8.7% (17,695) 16,797 35,472 — 990,819 9.1%

10,950,619 100.0% (302,001) 238,677 49,751 — 10,937,046 100.0%

Government Properties Income Trust

Supplemental Operating and Financial Data, June 30, 2017

TENANT LIS

T

30

TENANT LIST (1)

As of June 30, 2017

(1) Amounts exclude one property (one building) classified as discontinued operations.

(2) Rentable sq. ft. is pursuant to leases existing as of June 30, 2017, and includes (i) space being fitted out for occupancy, if any, and (ii) space which is leased but is not occupied or is being offered for sublease, if any. Rentable sq. ft.

measurements are subject to changes when space is re-measured or re-configured for new tenants.

(3) Percentage of annualized rental income is calculated using annualized contractual base rents from our tenants pursuant to our lease agreements as of June 30, 2017, plus straight line rent adjustments and estimated recurring

expense reimbursements to be paid to us, and excluding lease value amortization.

(4) Agency occupant cannot be disclosed.

(5) Rentable sq. ft. excludes a 25,579 square foot expansion to be constructed prior to the commencement of the lease.

% of Total % of % of Total % of

Rentable Rentable Annualized Rentable Rentable Annualized

Tenant / Agency Sq. Ft. (2) Sq. Ft. (2) Rental Income (3) Tenant Sq. Ft. (2) Sq. Ft. (2) Rental Income (3)

U.S. Government: State Governments:

1 Citizenship and Immigration Services 448,607 3.9% 8.0% 1 State of California - nine agency occupants 755,086 6.6% 7.7%

2 Internal Revenue Service 1,041,806 9.0% 7.8% 2 Commonwealth of Massachusetts - three agency occupants 307,119 2.7% 3.5%

3 U.S. Government (4) 406,388 3.5% 4.5% 3 State of Georgia - Department of Transportation 298,223 2.6% 2.4%

4 Federal Bureau of Investigation 304,425 2.6% 3.3% 4 Commonwealth of Virginia - seven agency occupants 255,241 2.2% 2.1%

5 Department of Justice 239,417 2.1% 2.9% 5 State of New Jersey - Department of Treasury 173,189 1.5% 1.7%

6 Centers for Disease Control (5) 352,876 3.1% 2.8% 6 State of Oregon - four agency occupants 199,018 1.7% 1.7%

7 Customs and Border Protection 243,162 2.1% 2.4% 7 State of Washington - Social and Health Services 111,908 1.0% 1.0%

8 Department of Veterans Affairs 280,699 2.4% 2.3% 8 State of Arizona - Northern Arizona University 66,743 0.6% 0.5%

9 Bureau of Land Management 304,831 2.6% 2.3% 9 State of South Carolina - four agency occupants 124,238 1.1% 0.5%

10 Defense Intelligence Agency 266,000 2.3% 1.9% 10 State of Maryland - two agency occupants 84,674 0.7% 0.5%

11 Social Security Administration 189,645 1.6% 1.7% 11 State of Minnesota - Minnesota State Lottery 61,426 0.5% 0.4%

12 Bureau of Reclamation 212,996 1.8% 1.7% 12 State of New York - Department of Agriculture 64,000 0.6% 0.4%

13 National Park Service 166,745 1.4% 1.6% 13 State of Kansas - Kansas University 4,220 0.0% 0.0%

14 U.S. Courts 115,366 1.0% 1.6% Subtotal State Governments 2,505,085 21.8% 22.4%

15 Immigration and Customs Enforcement 90,688 0.8% 1.4% 4 Other Government Tenants 371,202 3.2% 5.6%

16 Drug Enforcement Agency 93,177 0.8% 1.2% 4 Government Contractor Tenants 416,369 3.6% 5.1%

17 National Archives and Record Administration 352,064 3.1% 1.1% 143 Other Tenants 990,819 8.6% 7.3%

18 Department of Health and Human Services 108,849 0.9% 1.1% Subtotal Leased Rentable Square Feet 10,937,046 95.0% 100.0%

19 Department of Energy 140,152 1.2% 1.0% Available for Lease 578,941 5.0% —%

20 Defense Nuclear Facilities Board 60,133 0.5% 1.0% Total Rentable Square Feet 11,515,987 100.0% 100.0%

21 Department of State 89,058 0.8% 0.9%

22 U.S. Postal Service 321,800 2.8% 0.9%

23 Occupational Health and Safety Administration 57,770 0.5% 0.8%

24 Bureau of the Fiscal Service 98,073 0.9% 0.7%

25 Centers for Medicare and Medicaid Services 78,361 0.7% 0.7%

26 Military Entrance Processing Station 56,931 0.5% 0.6%

27 Environmental Protection Agency 43,232 0.4% 0.6%

28 Department of the Army 228,108 2.0% 0.6%

29 Department of Housing and Urban Development 82,497 0.7% 0.6%

30 General Services Administration 20,535 0.2% 0.4%

31 Bureau of Prisons 51,138 0.4% 0.4%

32 Food and Drug Administration 33,398 0.3% 0.3%

33 Department of Defense 31,030 0.3% 0.3%

34 Equal Employment Opportunity Commission 24,516 0.2% 0.2%

35 Small Business Administration 8,575 0.1% 0.1%

36 Department of Labor 6,459 0.1% 0.0%

37 U.S. Coast Guard 4,064 0.0% 0.0%

Subtotal U.S. Government 6,653,571 57.8% 59.6%

Government Properties Income Trust