Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BROADWIND, INC. | exh_991.htm |

| 8-K - FORM 8-K - BROADWIND, INC. | f8k_080117.htm |

EXHIBIT 99.2

Q2 2017 Earnings Call August 1, 2017

Industry Data and Forward - Looking Statements Disclaimer ▪ Broadwind obtained the industry and market data used throughout this presentation from our own research, internal surveys and st udies conducted by third parties, independent industry associations or general publications and other publicly available informatio n. Independent industry publications and surveys generally state that they have obtained information from sources believed to be reliable, but do not gu arantee the accuracy or completeness of such information. Forecasts are particularly likely to be inaccurate, especially over long periods of time. W e a re not aware of any misstatements in the industry data we have presented herein, but estimates involve risks and uncertainties and a re subject to change based on various factors beyond our control. ▪ This presentation contains “forward - looking statements ”, as defined in Section 21E of the Securities Exchange Act of 1934, as amended. Forward - looking statements include any statement that does not directly relate to a current or historical fact. Our forward - look ing statements may include or relate to our beliefs, expectations, plans and/or assumptions with respect to the following: (i ) state, local and federal regulatory frameworks affecting the industries in which we compete, including the wind energy industry, and the related extension, conti nua tion or renewal of federal tax incentives and grants and state renewable portfolio standards; (ii) our customer relationships and efforts to div ers ify our customer base and sector focus and leverage customer relationships across business units; (iii) our ability to continue to grow our busines s o rganically and through acquisitions; (iv) the sufficiency of our liquidity and alternate sources of funding, if necessary; (v) our ability t o r ealize revenue from customer orders and backlog; (vi) our ability to operate our business efficiently, manage capital expenditures and costs effe cti vely, and generate cash flow; (vii) the economy and the potential impact it may have on our business, including our customers; (viii) the state of the wind energy market and other energy and industrial markets generally and the impact of competition and economic volatility in those marke ts; (ix) the effects of market disruptions and regular market volatility, including fluctuations in the price of oil, gas and other commodities; (x) the effects of the recent change of administrations in the U.S. federal government; (xi) our ability to successfully integrate and operate the business of Red Wolf Company, LLC and to identify, negotiate and execute future acquisitions; and (xii) the potential loss of tax benefits if we experience an “ownership change” under Section 382 of the Internal Revenue Code of 1986, as amended. These statements are based on information currently available to us and are subject to various risks, uncertainties and other factors. We are under no duty to update any of these statements. You sh oul d not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties or other factors that could cause our c urr ent beliefs, expectations, plans and/or assumptions to change. ▪ This presentation contains non - GAAP financial information. We believe that certain non - GAAP financial measures may provide users of this financial information with meaningful comparisons between current results and results in prior operating periods. We believe tha t these non - GAAP financial measures can provide additional meaningful reflection of underlying trends of the business because they provide a c omp arison of historical information that excludes certain infrequently occurring or non - operational items that impact the overall comparabili ty. Non - GAAP financial measures should be viewed in addition to, and not as an alternative to, our reported results prepared in accordance wi th GAAP. Please see our earnings release dated August 1, 2017 for a reconciliation of certain non - GAAP measures presented in this presentation. August 1, 2017 2

Highlights August 1, 2017 ▪ Jason Bonfigt named Chief Financial Officer and Treasurer ▪ Q2 results consistent with guidance ▪ Q2 revenue flat compared to prior year – lower tower sales volumes offset by added Red Wolf sales ▪ Tower manufacturing productivity gains and cost efficiencies drive higher segment earnings despite lower near - term demand ▪ BWEN markets mixed: ▪ Diversification/growth strategy gaining traction 3 BWEN Markets Trend Comments Towers lull after PTC qualification, medium term strong Gears oil & gas recovery, mining trending higher Gas Turbines down modestly CNG remains weak

Orders and Backlog Orders – $M ▪ No tower orders in Q2 – soft near - term demand ▪ Strong Gearing orders from oil & gas and industrial customers ▪ Process Systems includes Red Wolf and CNG Backlog – $M ▪ 6/30/17 backlog $156M ▪ Industry slowdown in new order intake after PTC qualification boom August 1, 2017 - 50 100 150 200 250 300 350 Q1 12 Q4 12 Q3 13 Q2 14 Q1 15 Q4 15 Q3 16 Q2 17 Millions Q2 2016 Q2 2017 YTD 2016 YTD 2017 YTD 2017 Book: Bill Towers & Weldments 170.6 1.5 206.1 30.6 .37 Gearing 5.6 11.6 9.1 19.0 1.91 Process Systems n/a 4.4 n/a 8.1 1.29 Total 176.2 17.6 215.2 57.6 .58 4

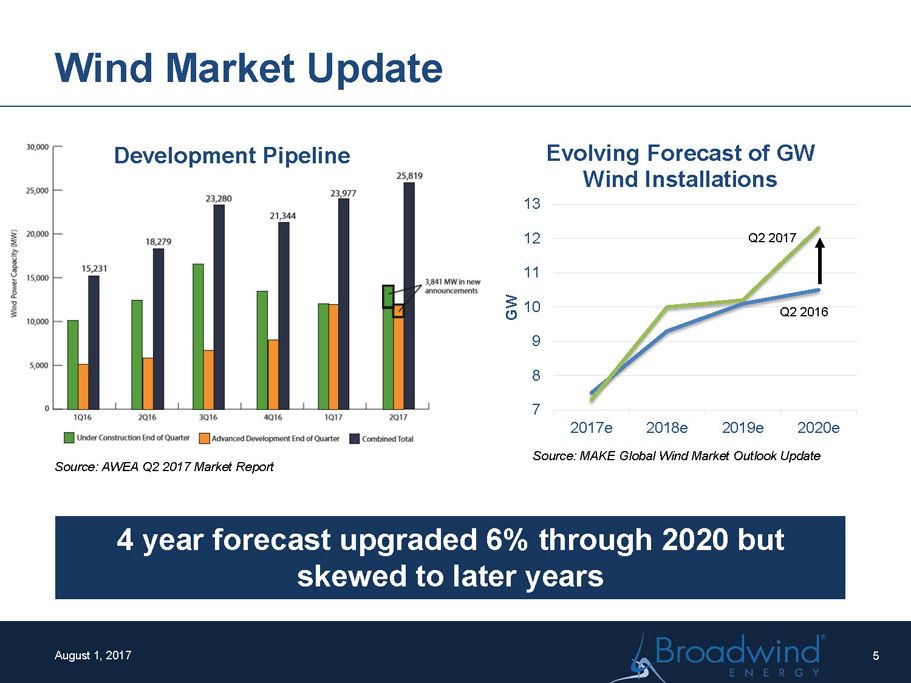

Wind Market Update August 1, 2017 7 8 9 10 11 12 13 2017e 2018e 2019e 2020e GW Evolving Forecast of GW Wind Installations Q2 2017 Q2 2016 Source: MAKE Global Wind Market Outlook Update 4 year forecast upgraded 6% through 2020 but skewed to later years Development Pipeline Source: AWEA Q2 2017 Market Report 5

$0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 2012 2013 2014 2015 2016 2017E $ M *Excluding automotive 6 U.S. Gearing Production ▪ American Gear Manufacturers Association raised their forecast for second consecutive reporting period in April ▪ Outlook reflects recovery in U.S. oil & gas market and weaker USD ▪ Early signs of recovery in mining markets should support 2H order growth Sources: AGMA & IHS ~+6%

7 © 2017 Broadwind Energy, Inc. All rights reserved. Natural Gas Market Indicators 2017 # of Units Capacity (GWs) Q1 53 7 Q2 YTD 53 7 2017 # of CNG Stations Built Q1 19 Q2 18 YTD 37 Source: McCoy Power Reports Source: U.S. Dept. of Energy ▪ Red Wolf starting to see recovery in orders for gas turbine aftermarket – expect stronger 2H order intake ▪ Declining price spread between diesel and natural gas has resulted in less CNG station builds ▪ BWEN Process Systems has gained some traction in virtual CNG pipeline business

BWEN Consolidated Financial Results August 1, 2017 ▪ Q2 17 sales even with Q1 17; Towers and Weldments - 10%, Gearing +13%, Process Systems added 7% ▪ Gross Margin, profit and EBITDA all slightly lower due mainly to Process Systems operating loss ▪ EPS loss of $.05 due to addition of amortization expenses associated with acquisition of Red Wolf 8

Towers and Weldments Q2 2016 Q2 2017 YTD 2016 YTD 2017 Orders ($M) 170.6 1.5 206.1 30.6 Towers Sold (#) 108 88 226 221 Revenue ($M) 38.0 34.3 80.0 83.2 Operating Income ($M) 2.7 2.8 6.0 8.6 - % of Sales 7.2% 8.2% 7.5% 10.4% EBITDA* ($M) 3.9 3.9 8.1 10.9 - % of Sales 10.2% 11.2% 10.2% 13.1% Q2 Results ▪ Orders down significantly – Q2 16 included multi - year framework agreement ▪ Towers sold - 19% vs. Q2 16 – slowdown in new orders after PTC qualification boom in Q4 16 ▪ Operating income slightly higher on lower revenue – improved production mix, high labor productivity and successful cost reduction initiatives ▪ YTD EBITDA margin 13.1% 2017 Objectives ▪ Aggressive cost management in response to soft demand ▪ Complete capital investments to provide better production flexibility ▪ Diversify Tower customer base August 1, 2017 * Reconciliation to non - GAAP measure included in Appendix 9 0 500 1,000 1,500 2,000 2,500 IA TX MN ND NM NE SD CO KS Wind Power Capacity in Advanced Development - MW Midwest 50% Mountain West 14% Texas 14% Source: AWEA 2Q 2017 Market Report

Gearing Q2 2016 Q2 2017 YTD 2016 YTD 2017 Orders ($M) 5.6 11.6 9.1 19.0 Revenue ($M) 5.4 6.1 10.2 9.9 Operating Loss ($M) (1.2) (0.6) (2.4) (2.2) EBITDA* ($M) (0.5) 0.0 (1.0) (0.9) Q2 Results ▪ Orders up significantly – oil & gas and industrial ▪ Revenue up 13% - strong sales to oil & gas customers ▪ Operating loss cut in half – increased volume, productivity and absence of severance ▪ EBITDA positive August 1, 2017 2017 Objectives ▪ Leverage expanded sales resources to improve capacity utilization ▪ Continue cross - training to improve labor productivity ▪ Continue aggressive cost management ▪ Positive EBITDA for 2017 — trending to positive Operating Income ▪ Continue rationalization of manufacturing footprint * Reconciliation to non - GAAP measure included in Appendix - 5.0 10.0 15.0 20.0 Q1 14 Q4 14 Q3 15 Q2 16 Q1 17 Gearing Order History 10

August 1, 2017 Process Systems Q2 2016 Q2 2017 YTD 2016 YTD 2017 Orders ($M) n/a 4.4 n/a 8.1 Revenue ($M) n/a 3.0 n/a 6.3 Operating Loss ($M) n/a (1.1) n/a (1.9) EBITDA* ($M) n/a (0.6) n/a (1.1) * Reconciliation to non - GAAP measure included in Appendix Q2 Results ▪ Process Systems includes Abilene - based CNG, and Red Wolf as of Feb 1, 2017 ▪ Q2 Orders predominantly Red Wolf $4.1M ▪ Revenue reflects $1M customer imposed shipping curtailments at quarter - end ▪ No CNG units completed in Q2 2017 Objectives ▪ Seamless integration of Red Wolf into BWEN ▪ Build momentum on CNG business ▪ Grow Red Wolf business by expanding customer base and entering new markets 11

Operating Working Capital (OWC) August 1, 2017 ▪ Q2 OWC back in “normal” range -- $.13/ dollar sales ▪ OWC increase driven by roll - off of customer deposits and timing of receipts ▪ 2H 17 OWC expected to decrease as receivables and inventory decrease related to lower tower production, partially offset by Gearing and Red Wolf * Operating Working Capital = Trade A/R + Inventories – Trade Payables – Customer Deposits 12/31/16 3/31/17 6/30/17 DSO 22 39 45 Inv. Turns 8.2 7.7 7.4 DPO 33 36 34 Cash Conv. (days) 0 28 50 $- $0.02 $0.04 $0.06 $0.08 $0.10 $0.12 $0.14 $0.16 $0.18 $0.20 OWC* Historical Trend – cents/$ sales OWC* Managemen t 12

Balance Sheet and Capital Expenditures August 1, 2017 1.4% 1.1% 1.8% 1.5% 2.0% 2.3% 4.8% 5.4% 5.8% 2.4% Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16 Q4 16 Q1 17 Q2 17 Cap Ex - % of Revenue Typically ~ 2% of revenue Abilene Expansion and Coatings Improvements ▪ PrivateBank $25M line of credit had $13.7M drawn at quarter - end ▪ Capex declines as Abilene expansion and other tower plant improvements complete ▪ FY capex estimate ~$7M - 8M 12/31/2016 3/31/2017 6/30/2017 Cash Assets 21.9$ 0.3$ 0.2$ Accounts Receivable 11.9 23.7 21.5 Inventory 21.2 25.8 21.3 PPE 54.6 56.0 57.4 Other 8.1 25.9 24.6 Total Assets 117.7 131.7 125.0 Accounts Payable 15.9 19.5 14.6 Customer Deposits 18.0 13.6 5.2 Debt + Cap. Leases 4.1 10.5 19.1 Other 11.1 13.0 11.5 Total Liabilities 49.1 56.6 50.4 Equity 68.6 75.1 74.6 (In Millions) 13

2017 Guidance and Priorities August 1, 2017 ▪ Q3 Guidance: Revenue $30M, EBITDA $1M, EPS ($.15 - .17) ▪ Q4 outlook highly uncertain due to changes in tower procurement and engineering practices Second Half Priorities ▪ Navigate through the impact of near - term tower inventory correction ▪ Progress growth/diversification strategy ▪ Commission Abilene plant expansion ▪ Add machining capabilities for weldments ▪ Red Wolf market expansion initiatives ▪ Controlled Gearing revenue growth to achieve profitability ▪ Evaluate bolt - on acquisitions 14

Appendix August 1, 2017 15 Consolidated 2017 2016 2017 2016 Net Income/(Loss) from continuing operations……………………………. (688)$ 42$ 5,794$ (316)$ Interest Expense…………………………………. 217 152 356 306 Income Tax Provision/(Benefit)……………………………… (16) (8) (5,034) (16) Depreciation and Amortization………………………………………………………………2,203 1,787 4,304 3,443 Share-based Compensation and Other Stock Payments………………………………………………………………241 174 462 433 Restructuring Expense…………………………………………………... - - - - Adjusted EBITDA (Non-GAAP)………………… 1,957$ 2,147$ 5,882$ 3,850$ Three Months Ended June 30, Six Months Ended June 30, Towers and Weldments Segment 2017 2016 2017 2016 Net Income…...……………………………. 2,024$ 1,801$ 6,028$ 3,941$ Interest Expense/(Benefit)…………………………………. 20 6 35 16 Income Tax Provision/(Benefit)……………………………… 772 923 2,603 2,027 Depreciation and Amortization………………………………………………………………1,070 1,094 2,162 2,060 Share-based Compensation and Other Stock Payments………………………………………………………………58 37 115 75 Adjusted EBITDA (Non-GAAP)…………………. 3,944$ 3,861$ 10,943$ 8,119$ Three Months Ended June 30, Six Months Ended June 30, Gearing Segment 2017 2016 2017 2016 Net Loss……………………………. (638)$ (1,194)$ (2,175)$ (2,401)$ Interest Expense…………………………………. 2 3 6 7 Income Tax Provision/(Benefit)……………………………… 2 1 4 2 Depreciation and Amortization………………………………………………………………612 641 1,238 1,280 Share-based Compensation and Other Stock Payments………………………………………………………………23 25 41 72 Adjusted EBITDA (Non-GAAP)…………………. 1$ (524)$ (886)$ (1,040)$ Three Months Ended June 30, Six Months Ended June 30, Process Systems 2017 2016 2017 2016 Net Income/(Loss)……………………………. (1,103)$ -$ (5,769)$ -$ Interest Expense…………………………………. 1 - 3 - Income Tax Provision/(Benefit)……………………………… - - 3,841 - Depreciation and Amortization………………………………………………………………467 - 801 - Share-based Compensation and Other Stock Payments………………………………………………………………10 - 15 - Adjusted EBITDA (Non-GAAP)…………………. (625)$ -$ (1,109)$ -$ Three Months Ended June 30, Six Months Ended June 30, Corporate and Other 2017 2016 2017 2016 Net Income/(Loss)……………………………. (971)$ (565)$ 7,710$ (1,856)$ Interest Expense…………………………………. 194 143 312 283 Income Tax Provision/(Benefit)……………………………… (790) (932) (11,482) (2,045) Depreciation and Amortization………………………………………………………………54 52 103 103 Share-based Compensation and Other Stock Payments………………………………………………………………150 112 291 286 Adjusted EBITDA (Non-GAAP)…………………. (1,363)$ (1,190)$ (3,066)$ (3,229)$ Three Months Ended June 30, Six Months Ended June 30,

Broadwind Energy is a precision manufacturer of structures, equipment & components for clean tech and other specialized applications . www.BWEN.com August 1, 2017 16