Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CenterState Bank Corp | csfl-8k_20170731.htm |

2nd Quarter 2017 Investor Presentation Exhibit 99.1

Forward Looking Statement This presentation contains forward-looking statements, within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. These statements related to future events, other future financial and operating performance, costs, revenues, economic conditions in our markets, loan performance, credit risks, collateral values and credit conditions, or business strategies, including expansion and acquisition activities and may be identified by terminology such as “may,” “will,” “should,” “expects,” “scheduled,” “plans,” “intends,” “anticipates,” “believes,” “estimates,” “potential,” or “continue” or the negative of such terms or other comparable terminology. Actual events or results may differ materially. In evaluating these statements, you should specifically consider the factors described throughout this report. We cannot assure you that future results, levels of activity, performance or goals will be achieved, and actual results may differ from those set forth in the forward looking statements. Forward-looking statements, with respect to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the actual results, performance or achievements of CenterState to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. You should not expect us to update any forward-looking statements. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in our annual report on Form 10-K for the year ended December 31, 2016, and otherwise in our SEC reports and filings.

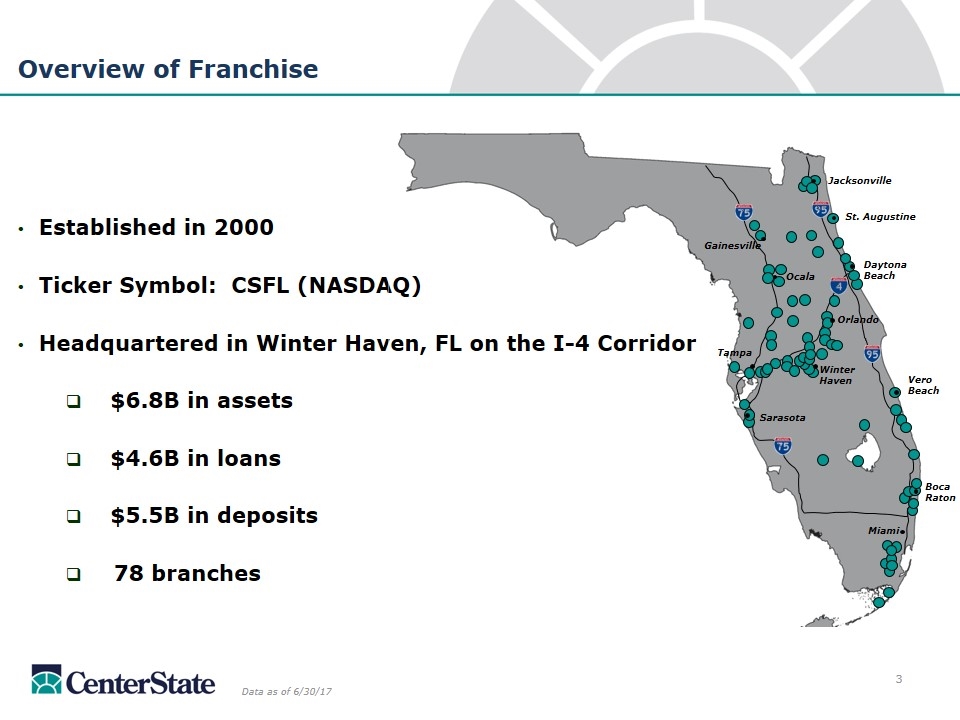

Overview of Franchise Established in 2000 Ticker Symbol: CSFL (NASDAQ) Headquartered in Winter Haven, FL on the I-4 Corridor $6.8B in assets $4.6B in loans $5.5B in deposits 78 branches Data as of 6/30/17 Tampa Jacksonville Orlando Winter Haven Miami Ocala Gainesville Sarasota Daytona Beach St. Augustine Vero Beach Boca Raton

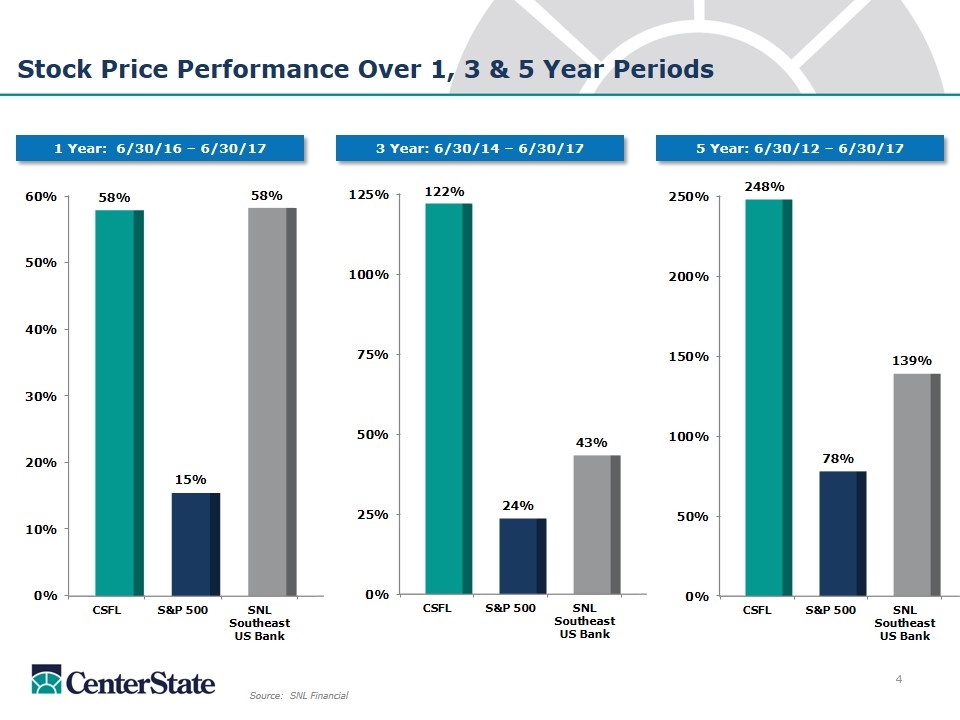

Stock Price Performance Over 1, 3 & 5 Year Periods Source: SNL Financial 1 Year: 6/30/16 – 6/30/17 3 Year: 6/30/14 – 6/30/17 5 Year: 6/30/12 – 6/30/17

Current Focus 1. Improve earning asset mix with a target loan to deposit ratio of 85% Recruiting commercial lending teams 2. Invest in non-interest income lines of business Mortgage SBA ARC interest rate swap product 3. M&A Core competency after 14 completed acquisitions since 2009 Ample opportunities Preparations for crossing $10 billion in assets are ongoing

Banking the Sunshine State

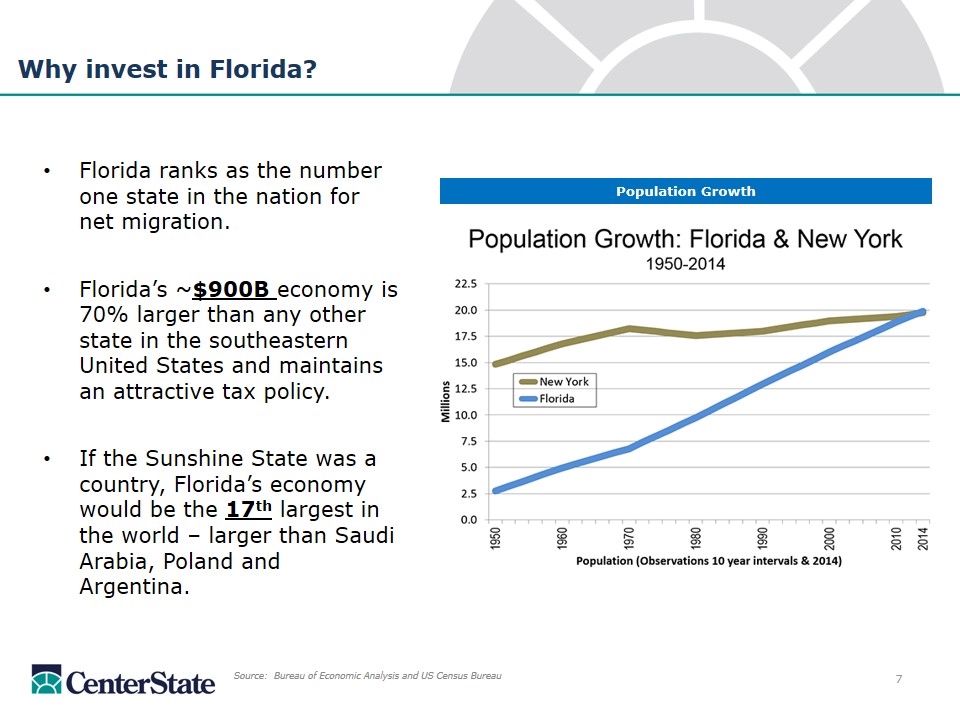

Florida ranks as the number one state in the nation for net migration. Florida’s ~$900B economy is 70% larger than any other state in the southeastern United States and maintains an attractive tax policy. If the Sunshine State was a country, Florida’s economy would be the 17th largest in the world – larger than Saudi Arabia, Poland and Argentina. Why invest in Florida? Source: Bureau of Economic Analysis and US Census Bureau Population Growth

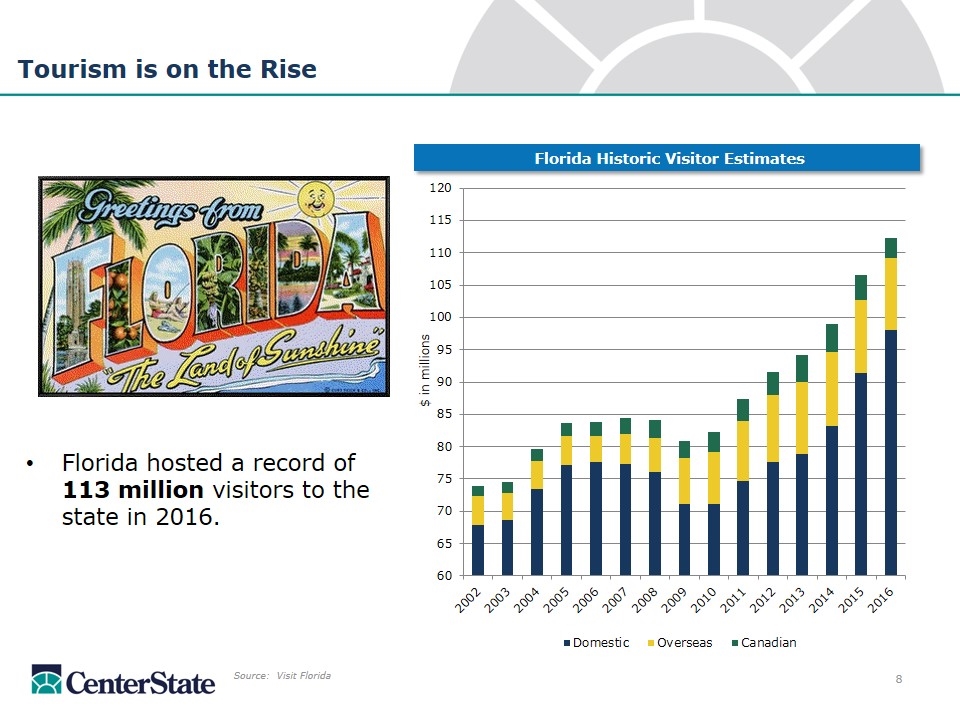

Florida hosted a record of 113 million visitors to the state in 2016. Tourism is on the Rise Source: Visit Florida Florida Historic Visitor Estimates

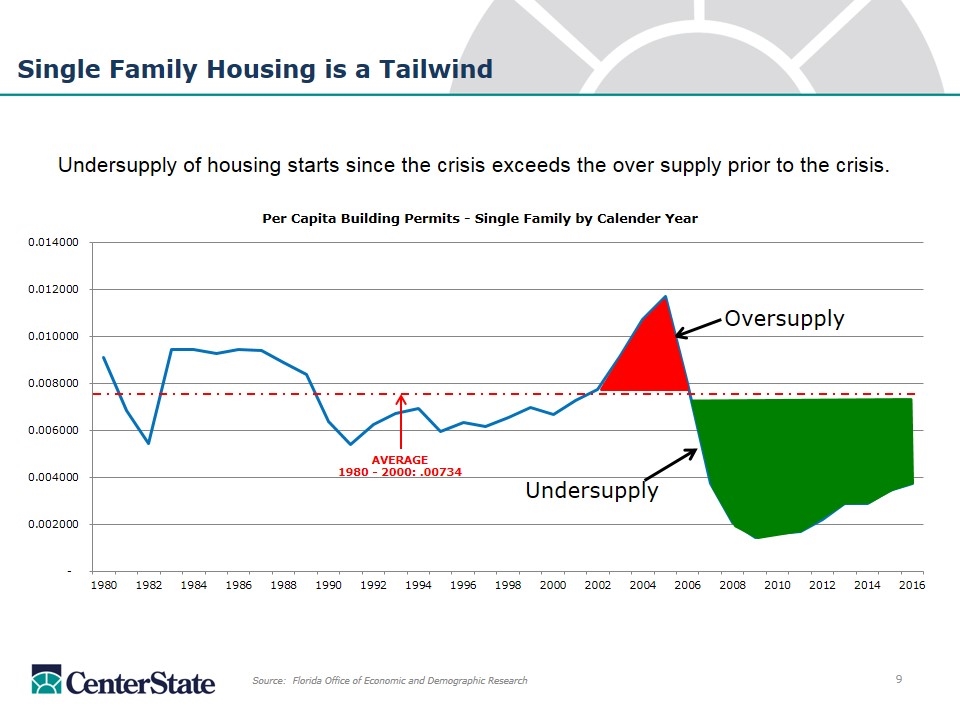

AVERAGE 1980 - 2000: .00734 Single Family Housing is a Tailwind Undersupply of housing starts since the crisis exceeds the over supply prior to the crisis. Source: Florida Office of Economic and Demographic Research Oversupply Undersupply

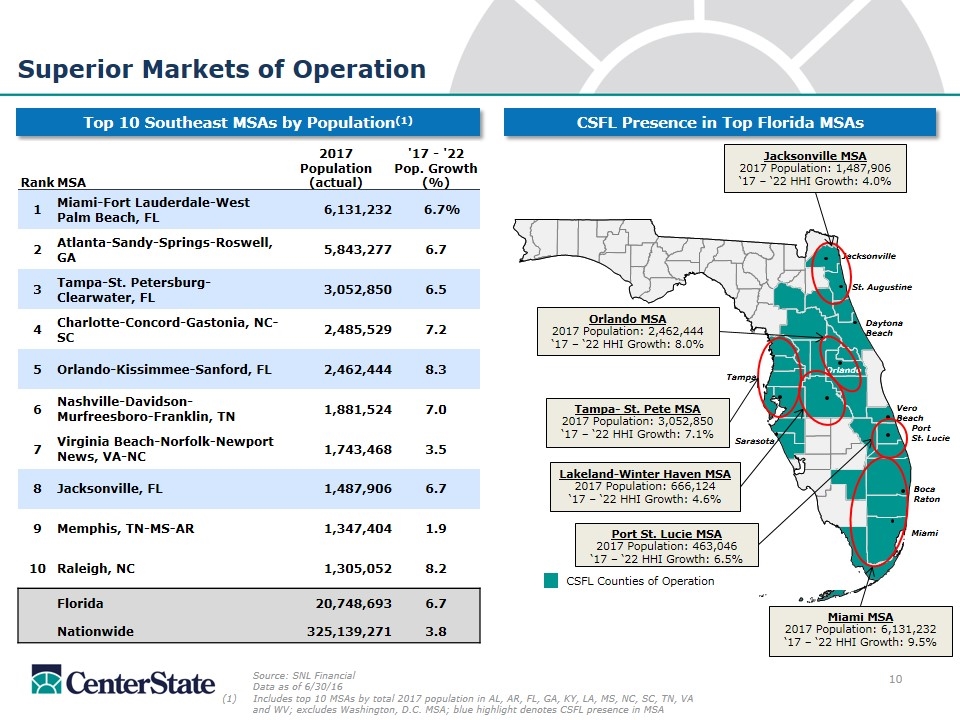

Source: SNL Financial Data as of 6/30/16 (1) Includes top 10 MSAs by total 2017 population in AL, AR, FL, GA, KY, LA, MS, NC, SC, TN, VA and WV; excludes Washington, D.C. MSA; blue highlight denotes CSFL presence in MSA Jacksonville Miami Daytona Beach St. Augustine Vero Beach Boca Raton Sarasota Superior Markets of Operation Top 10 Southeast MSAs by Population(1) CSFL Presence in Top Florida MSAs Orlando MSA 2017 Population: 2,462,444 ‘17 – ‘22 HHI Growth: 8.0% Tampa- St. Pete MSA 2017 Population: 3,052,850 ‘17 – ‘22 HHI Growth: 7.1% Miami MSA 2017 Population: 6,131,232 ‘17 – ‘22 HHI Growth: 9.5% Jacksonville MSA 2017 Population: 1,487,906 ‘17 – ‘22 HHI Growth: 4.0% Orlando Tampa CSFL Counties of Operation 2017 '17 - '22 Population Pop. Growth Rank MSA (actual) (%) 1 Miami-Fort Lauderdale-West Palm Beach, FL 6,131,232 6.7% 2 Atlanta-Sandy-Springs-Roswell, GA 5,843,277 6.7 3 Tampa-St. Petersburg-Clearwater, FL 3,052,850 6.5 4 Charlotte-Concord-Gastonia, NC-SC 2,485,529 7.2 5 Orlando-Kissimmee-Sanford, FL 2,462,444 8.3 6 Nashville-Davidson-Murfreesboro-Franklin, TN 1,881,524 7.0 7 Virginia Beach-Norfolk-Newport News, VA-NC 1,743,468 3.5 8 Jacksonville, FL 1,487,906 6.7 9 Memphis, TN-MS-AR 1,347,404 1.9 10 Raleigh, NC 1,305,052 8.2 Florida 20,748,693 6.7 Nationwide 325,139,271 3.8 Lakeland-Winter Haven MSA 2017 Population: 666,124 ‘17 – ‘22 HHI Growth: 4.6% Port St. Lucie MSA 2017 Population: 463,046 ‘17 – ‘22 HHI Growth: 6.5% Port St. Lucie

Capital Management

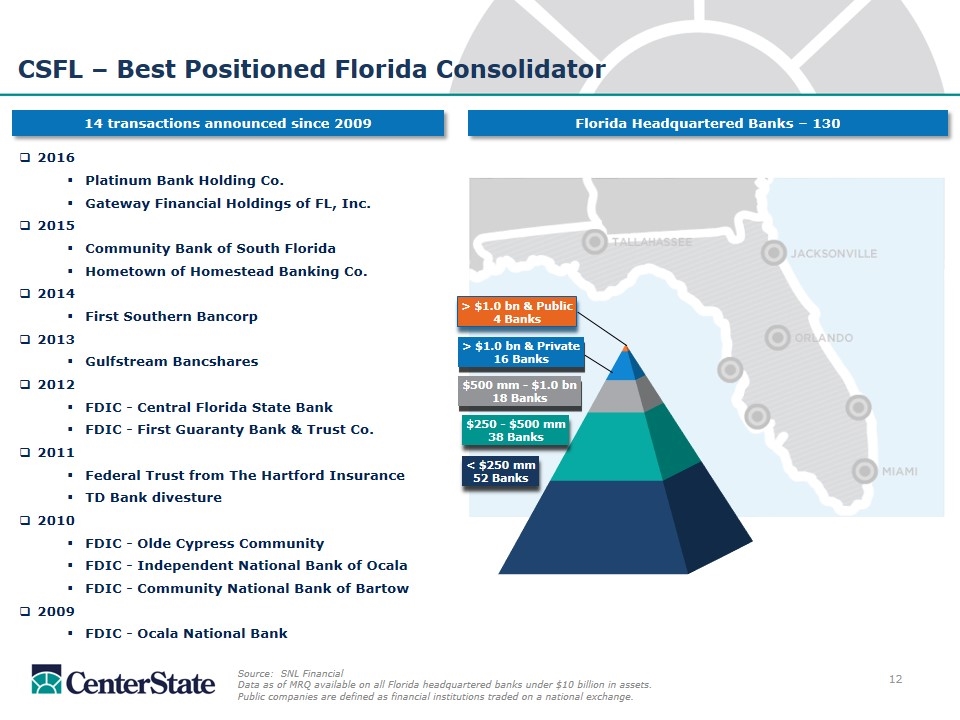

18 CSFL – Best Positioned Florida Consolidator Source: SNL Financial Data as of MRQ available on all Florida headquartered banks under $10 billion in assets. Public companies are defined as financial institutions traded on a national exchange. 2016 Platinum Bank Holding Co. Gateway Financial Holdings of FL, Inc. 2015 Community Bank of South Florida Hometown of Homestead Banking Co. 2014 First Southern Bancorp 2013 Gulfstream Bancshares 2012 FDIC - Central Florida State Bank FDIC - First Guaranty Bank & Trust Co. 2011 Federal Trust from The Hartford Insurance TD Bank divesture 2010 FDIC - Olde Cypress Community FDIC - Independent National Bank of Ocala FDIC - Community National Bank of Bartow 2009 FDIC - Ocala National Bank 14 transactions announced since 2009 Florida Headquartered Banks – 130

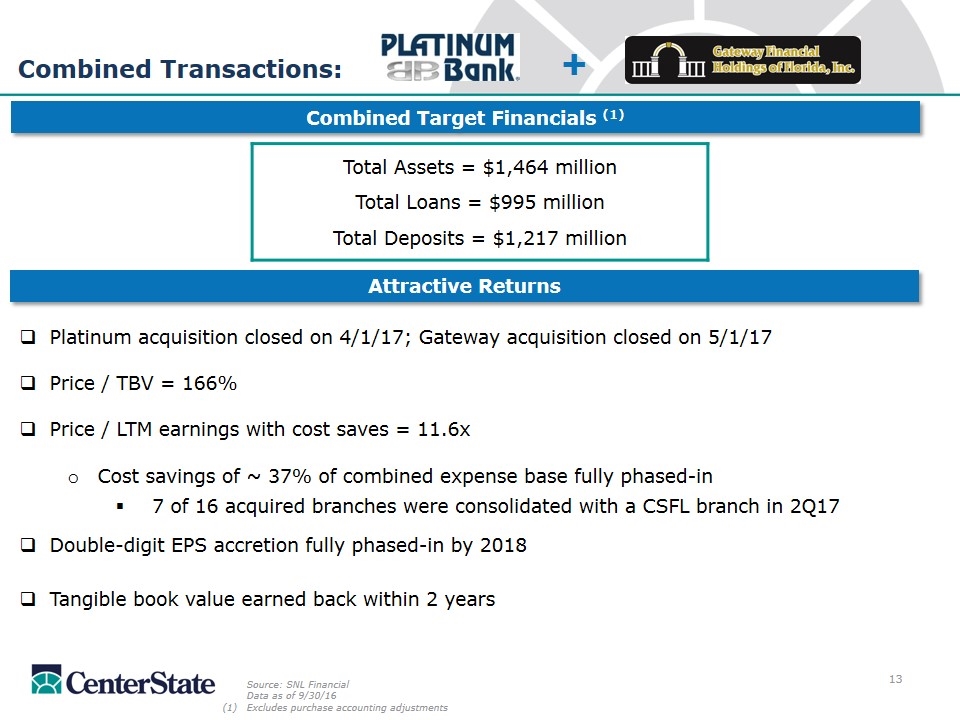

Combined Transactions: Total Assets = $1,464 million Total Loans = $995 million Total Deposits = $1,217 million Combined Target Financials (1) + Attractive Returns Source: SNL Financial Data as of 9/30/16 Excludes purchase accounting adjustments Platinum acquisition closed on 4/1/17; Gateway acquisition closed on 5/1/17 Price / TBV = 166% Price / LTM earnings with cost saves = 11.6x Cost savings of ~ 37% of combined expense base fully phased-in 7 of 16 acquired branches were consolidated with a CSFL branch in 2Q17 Double-digit EPS accretion fully phased-in by 2018 Tangible book value earned back within 2 years

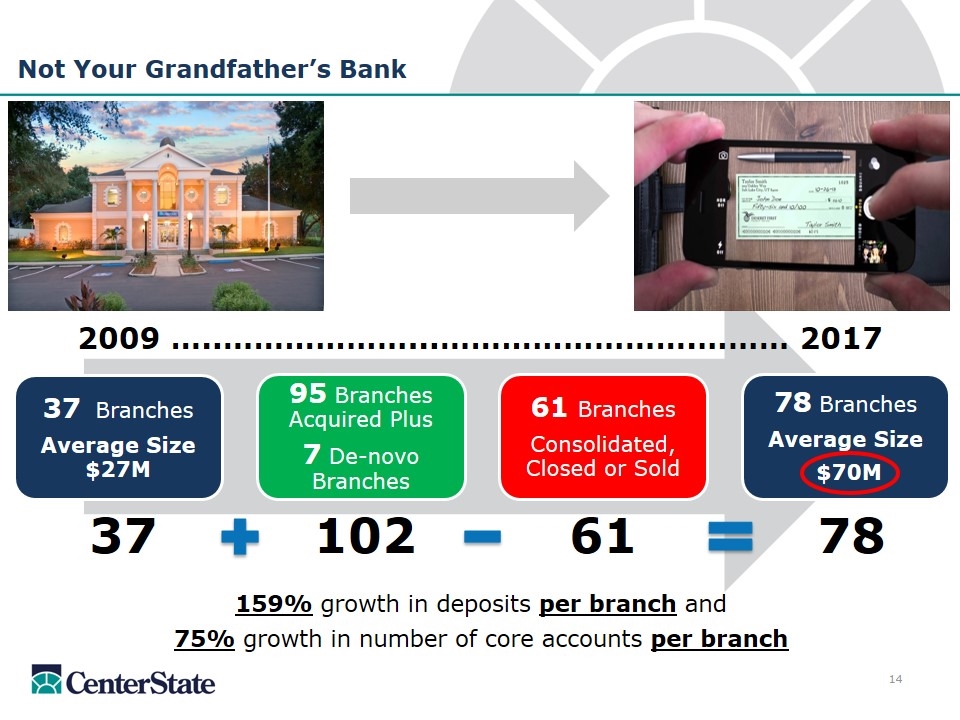

Not Your Grandfather’s Bank 159% growth in deposits per branch and 75% growth in number of core accounts per branch 37 102 61 78 2009 …..………………...…………………….……… 2017 37 Branches Average Size $27M 95 Branches Acquired Plus 7 De-novo Branches 61 Branches Consolidated, Closed or Sold 78 Branches Average Size $70M

Planning for “$10 Billion and Beyond” Asset Threshold Enhancing corporate governance: Established an independent Board Risk committee in April 2017 Enhancing risk management: Chief Risk Officer in place since 2010 General Counsel hired in 2016 Bank Risk Committee in place since 2011 ERM program formalized and enhanced in 2016-2017 Implementing rigorous stress testing: Top down and bottom up stress testing using outside resources since 2014 Planning toward developing and implementing a DFAST compliant stress test model by 2018 Investing in IT and Infrastructure Implementing formal project plan with 30 work streams Overseen by General Counsel Active project management office support

Operating Performance

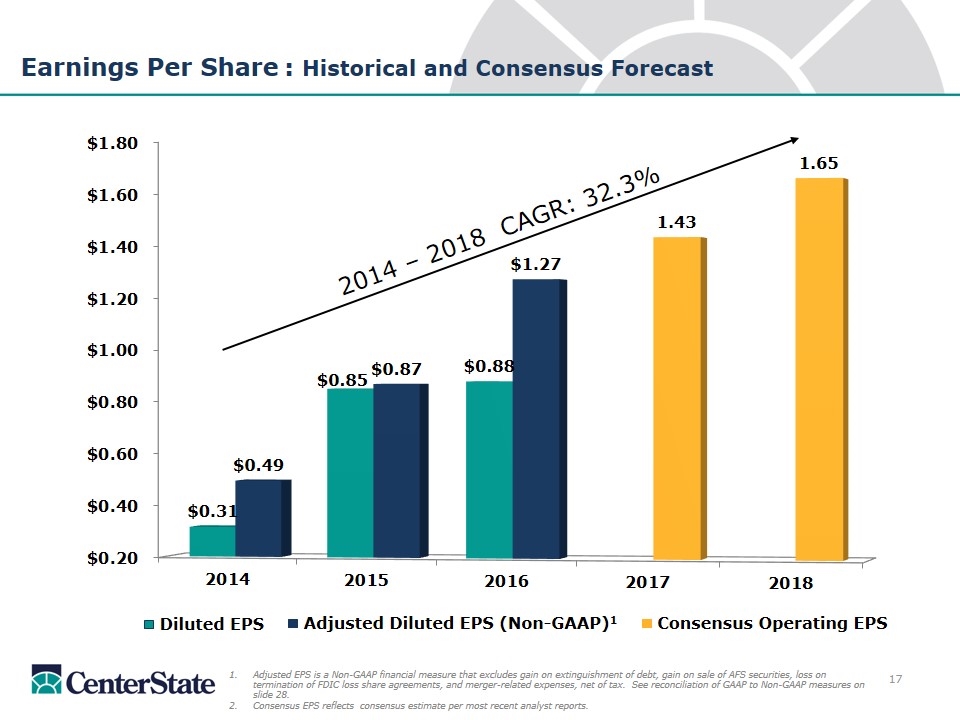

Earnings Per Share : Historical and Consensus Forecast 2014 – 2018 CAGR: 32.3% Adjusted EPS is a Non-GAAP financial measure that excludes gain on extinguishment of debt, gain on sale of AFS securities, loss on termination of FDIC loss share agreements, and merger-related expenses, net of tax. See reconciliation of GAAP to Non-GAAP measures on slide 28. Consensus EPS reflects consensus estimate per most recent analyst reports. Consensus Operating EPS Adjusted Diluted EPS (Non-GAAP)1 Diluted EPS

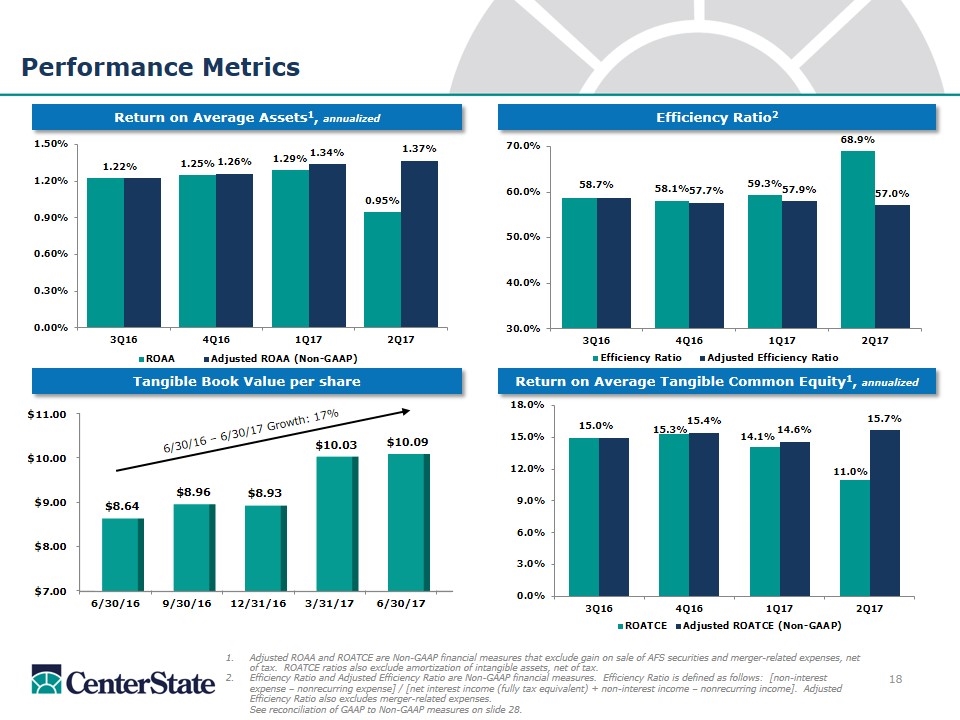

Efficiency Ratio2 Performance Metrics Adjusted ROAA and ROATCE are Non-GAAP financial measures that exclude gain on sale of AFS securities and merger-related expenses, net of tax. ROATCE ratios also exclude amortization of intangible assets, net of tax. Efficiency Ratio and Adjusted Efficiency Ratio are Non-GAAP financial measures. Efficiency Ratio is defined as follows: [non-interest expense – nonrecurring expense] / [net interest income (fully tax equivalent) + non-interest income – nonrecurring income]. Adjusted Efficiency Ratio also excludes merger-related expenses. See reconciliation of GAAP to Non-GAAP measures on slide 28. Tangible Book Value per share Return on Average Tangible Common Equity1, annualized Return on Average Assets1, annualized 6/30/16 – 6/30/17 Growth: 17%

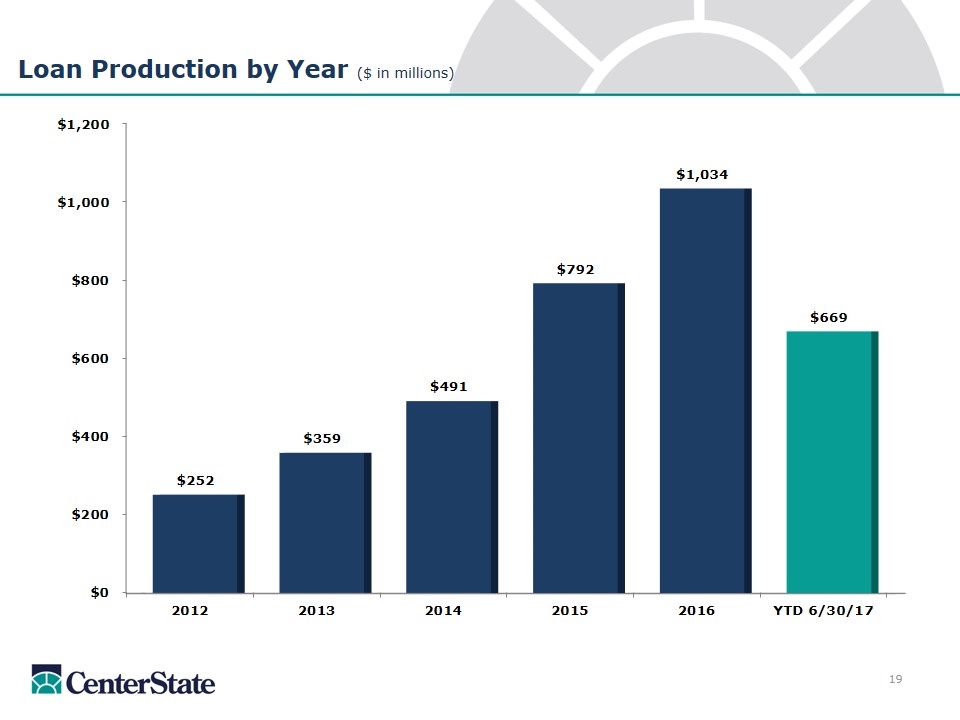

Loan Production by Year ($ in millions)

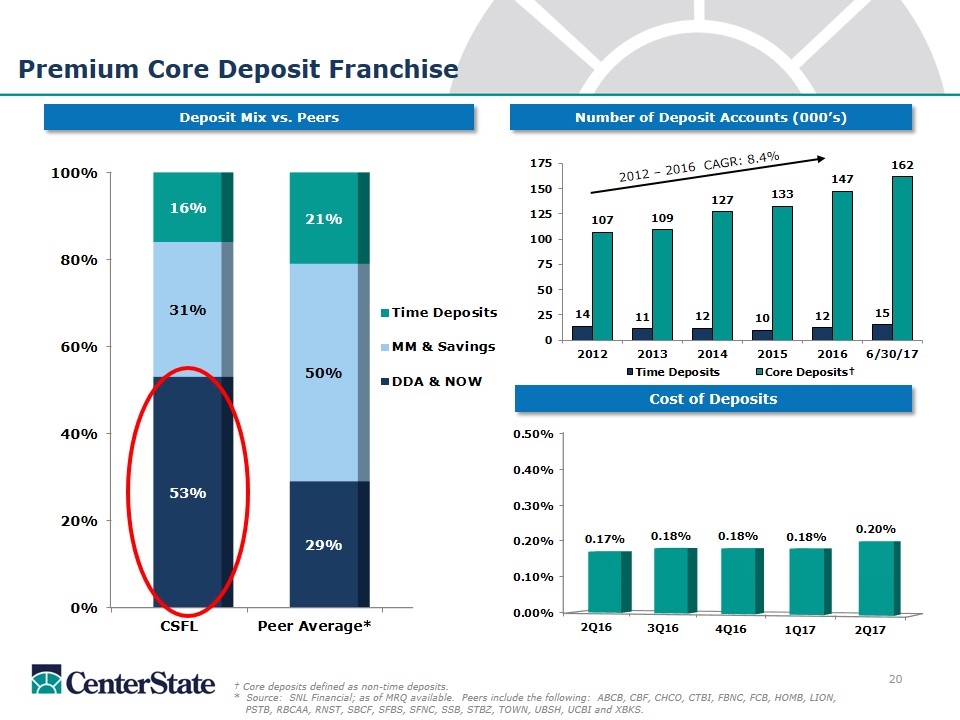

Number of Deposit Accounts (000’s) Premium Core Deposit Franchise Cost of Deposits 2012 – 2016 CAGR: 8.4% Deposit Mix vs. Peers † Core deposits defined as non-time deposits. * Source: SNL Financial; as of MRQ available. Peers include the following: ABCB, CBF, CHCO, CTBI, FBNC, FCB, HOMB, LION, PSTB, RBCAA, RNST, SBCF, SFBS, SFNC, SSB, STBZ, TOWN, UBSH, UCBI and XBKS.

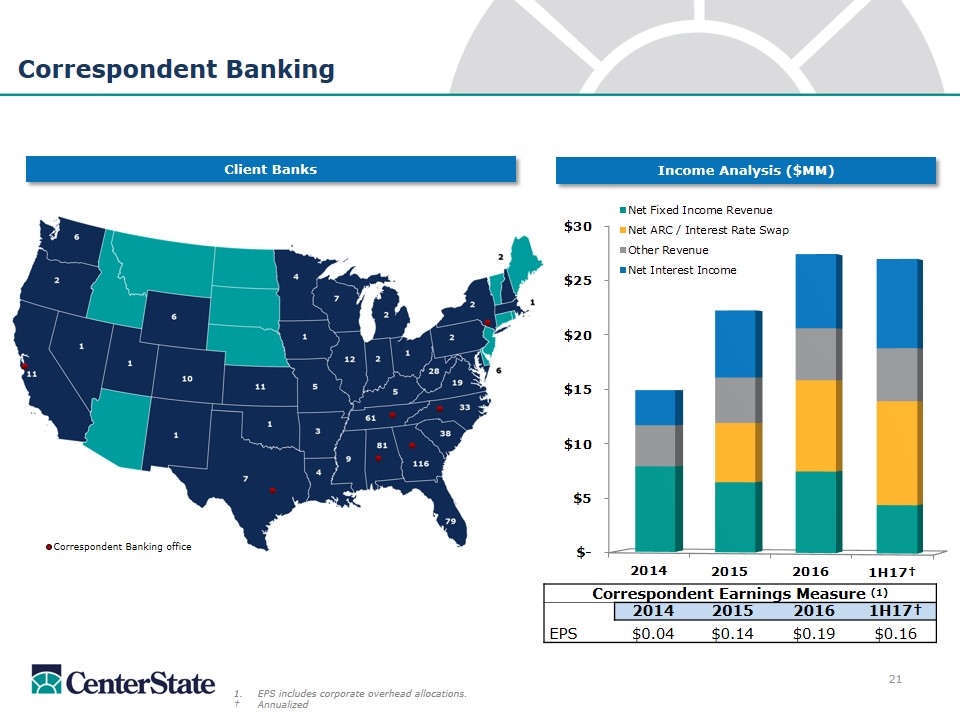

EPS includes corporate overhead allocations. †Annualized Correspondent Banking Income Analysis ($MM) Client Banks Correspondent Banking office Correspondent Earnings Measure (1) 2014 2015 2016 1H17† EPS $0.04 $0.14 $0.19 $0.16

Investment Thesis Based on strong operating results, CSFL shares outperformed the banking index over a 1, 3 & 5 year horizon. Florida is an economic powerhouse and leads the nation in net migration. With $6.8 billion in assets, CSFL ranks as the 2nd largest community bank headquartered in Florida. Investments are currently underway to accelerate organic growth and build shareholder value.

Supplemental

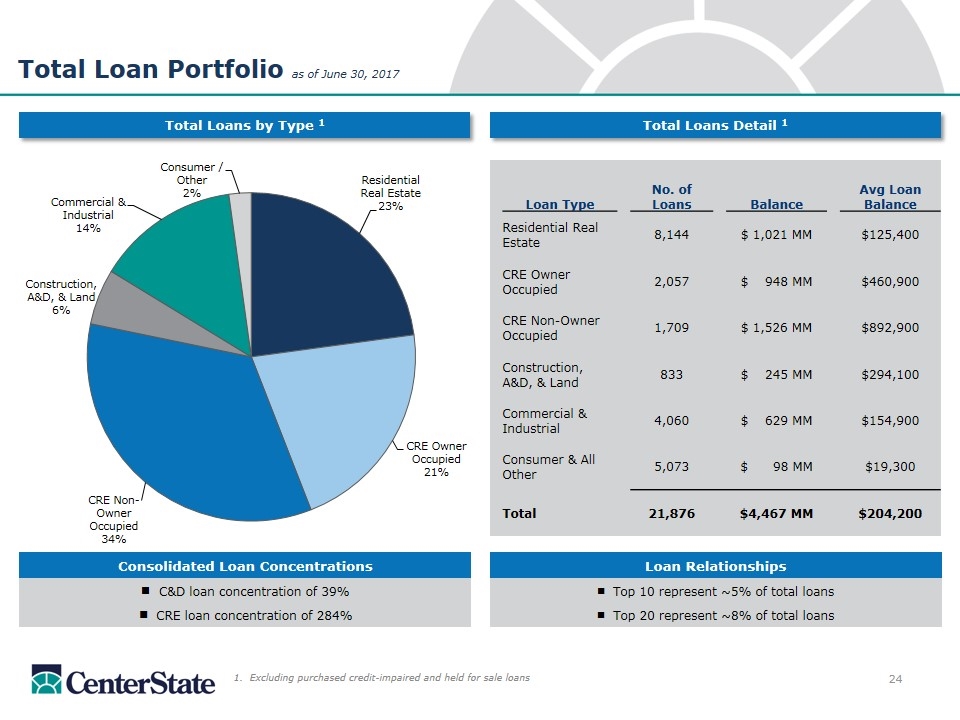

Loan Type No. of Loans Balance Avg Loan Balance Residential Real Estate 8,144 $ 1,021 MM $125,400 CRE Owner Occupied 2,057 $ 948 MM $460,900 CRE Non-Owner Occupied 1,709 $ 1,526 MM $892,900 Construction, A&D, & Land 833 $ 245 MM $294,100 Commercial & Industrial 4,060 $ 629 MM $154,900 Consumer & All Other 5,073 $ 98 MM $19,300 Total 21,876 $4,467 MM $204,200 Total Loan Portfolio as of June 30, 2017 Total Loans by Type 1 Total Loans Detail 1 1. Excluding purchased credit-impaired and held for sale loans Loan Relationships n Top 10 represent ~5% of total loans n Top 20 represent ~8% of total loans Consolidated Loan Concentrations C&D loan concentration of 39% CRE loan concentration of 284%

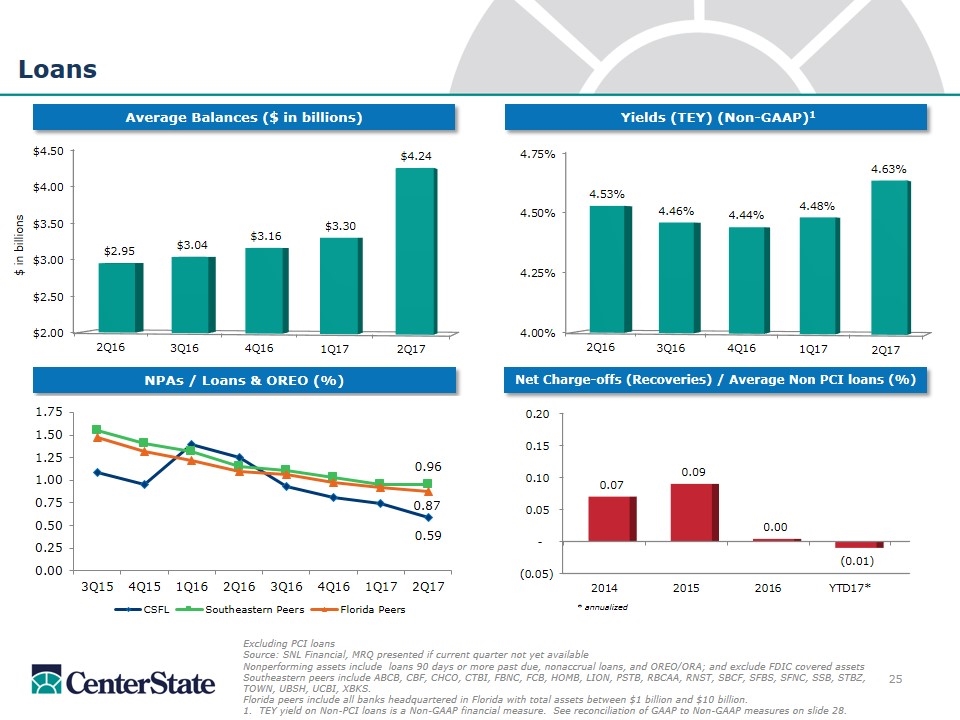

Loans Yields (TEY) (Non-GAAP)1 Average Balances ($ in billions) Excluding PCI loans Source: SNL Financial, MRQ presented if current quarter not yet available Nonperforming assets include loans 90 days or more past due, nonaccrual loans, and OREO/ORA; and exclude FDIC covered assets Southeastern peers include ABCB, CBF, CHCO, CTBI, FBNC, FCB, HOMB, LION, PSTB, RBCAA, RNST, SBCF, SFBS, SFNC, SSB, STBZ, TOWN, UBSH, UCBI, XBKS. Florida peers include all banks headquartered in Florida with total assets between $1 billion and $10 billion. 1. TEY yield on Non-PCI loans is a Non-GAAP financial measure. See reconciliation of GAAP to Non-GAAP measures on slide 28. NPAs / Loans & OREO (%) Net Charge-offs (Recoveries) / Average Non PCI loans (%) * annualized

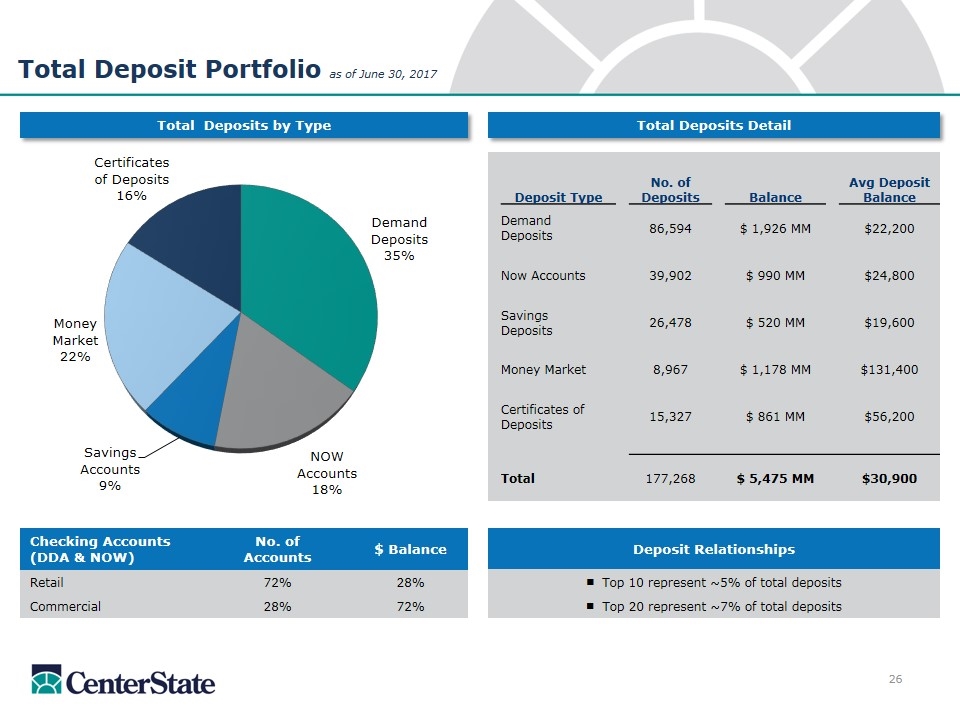

Deposit Relationships n Top 10 represent ~5% of total deposits n Top 20 represent ~7% of total deposits Total Deposits by Type Total Deposits Detail 23 Total Deposit Portfolio as of June 30, 2017 Deposit Type No. of Deposits Balance Avg Deposit Balance Demand Deposits 86,594 $ 1,926 MM $22,200 Now Accounts 39,902 $ 990 MM $24,800 Savings Deposits 26,478 $ 520 MM $19,600 Money Market 8,967 $ 1,178 MM $131,400 Certificates of Deposits 15,327 $ 861 MM $56,200 Total 177,268 $ 5,475 MM $30,900 Checking Accounts (DDA & NOW) No. of Accounts $ Balance Retail 72% 28% Commercial 28% 72%

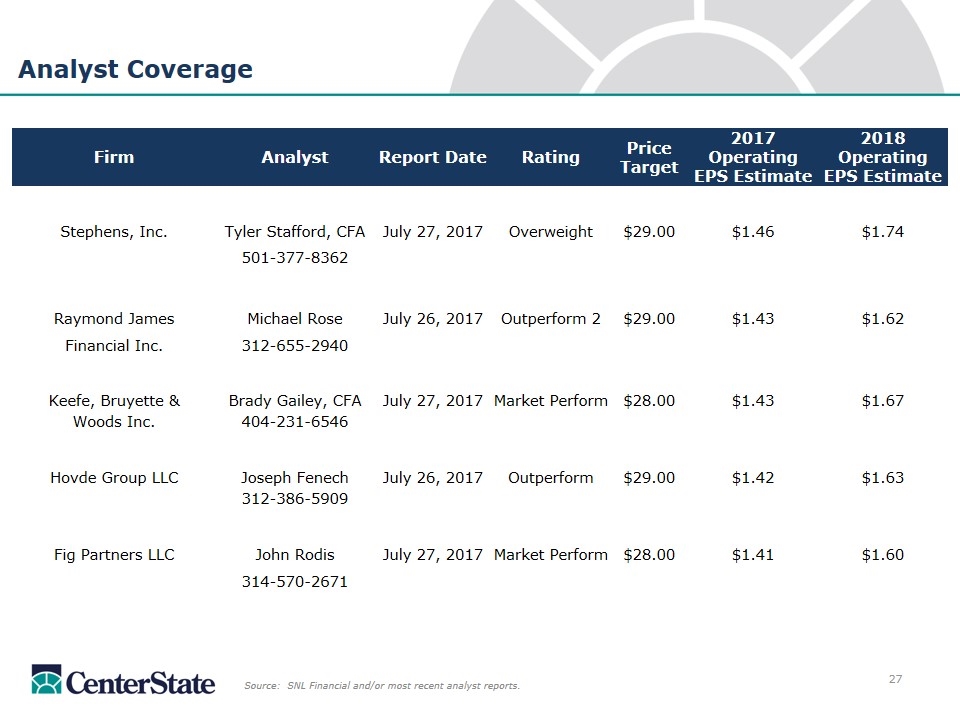

Analyst Coverage Source: SNL Financial and/or most recent analyst reports. Firm Analyst Report Date Rating Price Target 2017 Operating EPS Estimate 2018 Operating EPS Estimate Stephens, Inc. Tyler Stafford, CFA July 27, 2017 Overweight $29.00 $1.46 $1.74 501-377-8362 Raymond James Michael Rose July 26, 2017 Outperform 2 $29.00 $1.43 $1.62 Financial Inc. 312-655-2940 Keefe, Bruyette & Brady Gailey, CFA July 27, 2017 Market Perform $28.00 $1.43 $1.67 Woods Inc. 404-231-6546 Hovde Group LLC Joseph Fenech July 26, 2017 Outperform $29.00 $1.42 $1.63 312-386-5909 Fig Partners LLC John Rodis July 27, 2017 Market Perform $28.00 $1.41 $1.60 314-570-2671

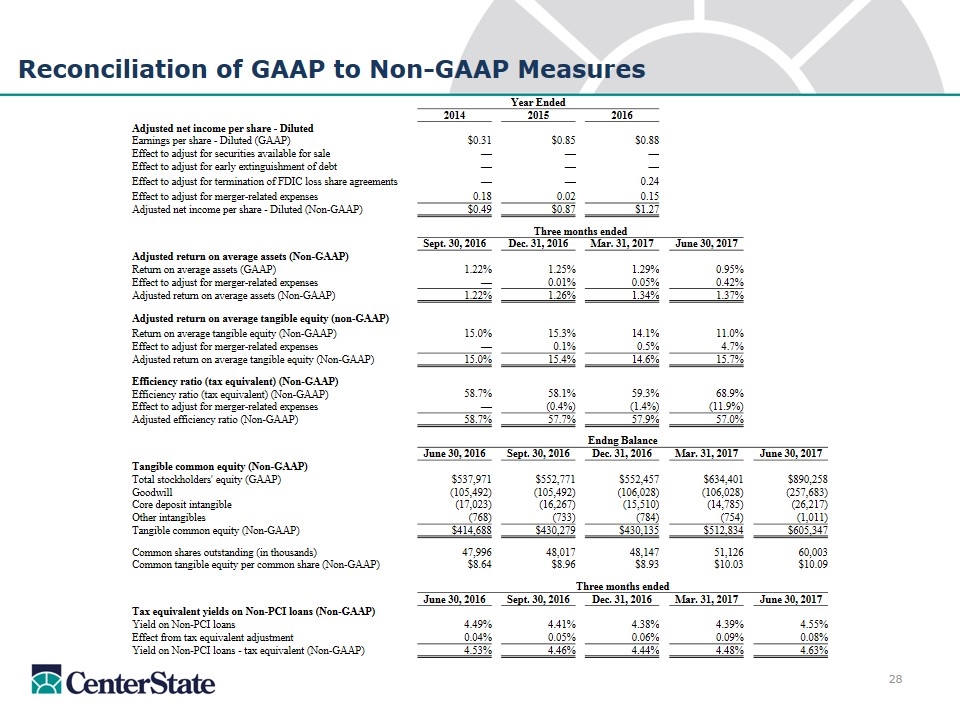

Reconciliation of GAAP to Non-GAAP Measures Year Ended 2014 2015 2016 Adjusted net income per share - Diluted Earnings per share - Diluted (GAAP) $0.31 $0.85 $0.88 Effect to adjust for securities available for sale — — — Effect to adjust for early extinguishment of debt — — — Effect to adjust for termination of FDIC loss share agreements — — 0.24 Effect to adjust for merger-related expenses 0.18 0.02 0.15 Adjusted net income per share - Diluted (Non-GAAP) $0.49 $0.87 $1.27 Three months ended Sept. 30, 2016 Dec. 31, 2016 Mar. 31, 2017 June 30, 2017 Adjusted return on average assets (Non-GAAP) Return on average assets (GAAP) 1.22% 1.25% 1.29% 0.95% Effect to adjust for merger-related expenses — 0.01% 0.05% 0.42% Adjusted return on average assets (Non-GAAP) 1.22% 1.26% 1.34% 1.37% Adjusted return on average tangible equity (non-GAAP) Return on average tangible equity (Non-GAAP) 15.0% 15.3% 14.1% 11.0% Effect to adjust for merger-related expenses — 0.1% 0.5% 4.7% Adjusted return on average tangible equity (Non-GAAP) 15.0% 15.4% 14.6% 15.7% Efficiency ratio (tax equivalent) (Non-GAAP) Efficiency ratio (tax equivalent) (Non-GAAP) 58.7% 58.1% 59.3% 68.9% Effect to adjust for merger-related expenses — (0.4%) (1.4%) (11.9%) Adjusted efficiency ratio (Non-GAAP) 58.7% 57.7% 57.9% 57.0% Endng Balance June 30, 2016 Sept. 30, 2016 Dec. 31, 2016 Mar. 31, 2017 June 30, 2017 Tangible common equity (Non-GAAP) Total stockholders' equity (GAAP) $537,971 $552,771 $552,457 $634,401 $890,258 Goodwill (105,492) (105,492) (106,028) (106,028) (257,683) Core deposit intangible (17,023) (16,267) (15,510) (14,785) (26,217) Other intangibles (768) (733) (784) (754) (1,011) Tangible common equity (Non-GAAP) $414,688 $430,279 $430,135 $512,834 $605,347 Common shares outstanding (in thousands) 47,996 48,017 48,147 51,126 60,003 Common tangible equity per common share (Non-GAAP) $8.64 $8.96 $8.93 $10.03 $10.09 Three months ended June 30, 2016 Sept. 30, 2016 Dec. 31, 2016 Mar. 31, 2017 June 30, 2017 Tax equivalent yields on Non-PCI loans (Non-GAAP) Yield on Non-PCI loans 4.49% 4.41% 4.38% 4.39% 4.55% Effect from tax equivalent adjustment 0.04% 0.05% 0.06% 0.09% 0.08% Yield on Non-PCI loans - tax equivalent (Non-GAAP) 4.53% 4.46% 4.44% 4.48% 4.63%

Investor Contacts Ernie Pinner John Corbett Executive Chairman President & Chief Executive Officer esp@centerstatebank.com jcorbett@centerstatebank.com Steve Young Jennifer Idell Chief Operating Officer Chief Financial Officer syoung@centerstatebank.com jidell@centerstatebank.com