Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - SITE Centers Corp. | d430910dex991.htm |

| 8-K - FORM 8-K - SITE Centers Corp. | d430910d8k.htm |

Exhibit 99.2

DDR CORP.

2Q17

CONFERENCE CALL

DDR considers portions of this information to be forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, both as amended, with respect to the Company’s expectations for future periods. Although the Company believes that the expectations

reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved. For this purpose, any statements contained herein that are not historical fact may be deemed to be

forward-looking statements. There are a number of important factors that could cause our results to differ materially from those indicated by such forward-looking statements, including among other factors, local conditions such as supply of space or

a reduction in demand for real estate in the area; competition from other available space; dependence on rental income from real property; the loss of, significant downsizing of or bankruptcy of a major tenant; redevelopment and construction

activities may not achieve a desired return on investment; our ability to buy or sell assets on commercially reasonable terms; our ability to complete acquisitions or dispositions of assets under contract; our ability to secure equity or debt

financing on commercially acceptable terms or at all; our ability to enter into definitive agreements with regard to our financing and joint venture arrangements or our failure to satisfy conditions to the completion of these arrangements; the

success of our deleveraging strategy; any impact or results from the Company’s portfolio transition or any change in strategy; and the finalization of the financial statements for the period ended June 30, 2017. For additional factors that

could cause the results of the Company to differ materially from these indicated in the forward-looking statements, please refer to the Company’s Form 10-K for the year ended December 31, 2016. The

Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof.

In

addition, this presentation includes certain non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP

measures can be found in the Company’s earnings press release and supplement issued today. This release and the

Company’s quarterly financial supplement

are available on the website at www.ddr.com.

2 SAFE HARBOR STATEMENT

2Q17 SUMMARY

+ 2Q17

RESULTS COMMENTARY & LEASING UPDATE 4

+ FIVE-MONTH PROGRESS REPORT 6

+ BALANCE SHEET & GUIDANCE UPDATE 10

+ PORTFOLIO REVIEW CONCLUSIONS

13

3

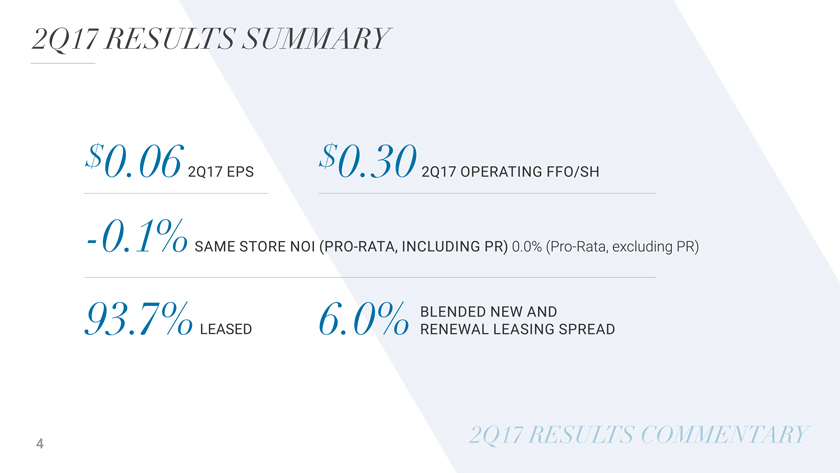

2Q17 RESULTS SUMMARY

$0.06 $

2Q17 EPS 0.302Q17 OPERATING FFO/SH

-0.1% SAME STORE NOI (PRO-RATA, INCLUDING PR) 0.0% (Pro-Rata, excluding PR) BLENDED NEW AND

93.7%LEASED 6.0% RENEWAL LEASING SPREAD

4 2Q17 RESULTS COMMENTARY

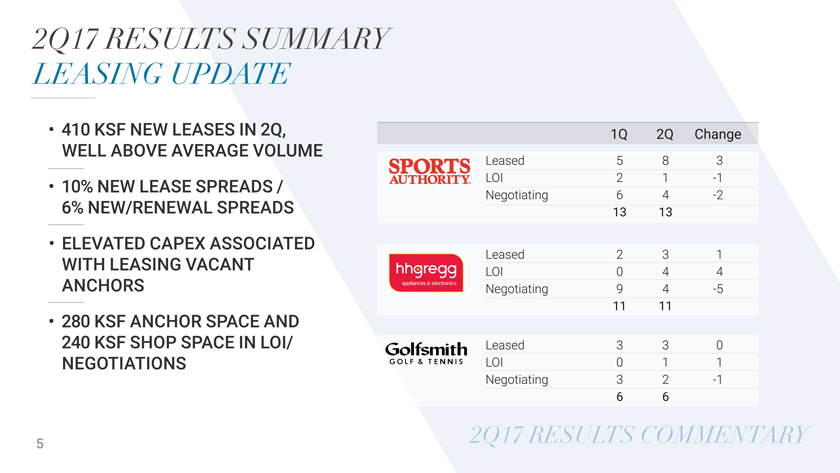

2Q17 RESULTS SUMMARY LEASING UPDATE

• 410 KSF NEW LEASES IN 2Q, 1Q 2Q Change WELL ABOVE AVERAGE VOLUME

Leased 5 8 3

• 10% NEW LEASE SPREADS / LOI 2 1 -1

Negotiating 6 4 -2

6% NEW/RENEWAL SPREADS 13 13

• ELEVATED CAPEX ASSOCIATED

WITH LEASING VACANT Leased 2 3 1

LOI 0 4 4 ANCHORS Negotiating 9 4 -5

11 11

• 280 KSF ANCHOR SPACE AND

240 KSF SHOP SPACE IN LOI/ Leased 3 3 0 NEGOTIATIONS LOI 0 1 1

Negotiating 3

2 -1

6 6

5 2Q17 RESULTS COMMENTARY

FIVE-MONTH PROGRESS REPORT

• MONTH 1: ORGANIZATIONAL STREAMLINING

•Right-sized organization: 12% head count reduction, $6MM annualized G&A reduction

• MONTH 2: INITIAL PORTFOLIO REVIEW & STRATEGY PLANNING

•Assessed/sustained

disposition pipeline; began in-depth portfolio analysis

• MONTH 3: BALANCE SHEET EXECUTION & DISPOSITION

PLANNING

•Debt transactions lengthen average maturities; finalized disposition list

• MONTH 4—5: TRANSACTION EXECUTION & PORTFOLIO REVIEW COMPLETION

•Recapitalized DDRM/Manatee JV

•Disposed $238MM of assets,

including 2 in Puerto Rico

•Completed portfolio review

6 2Q17 RESULTS

COMMENTARY

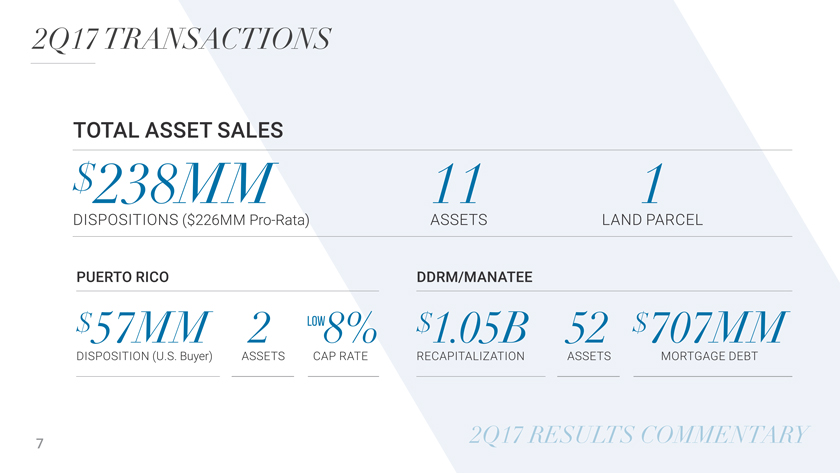

2Q17 TRANSACTIONS

TOTAL

ASSET SALES

$238MM 11 1

DISPOSITIONS ($226MM

Pro-Rata) ASSETS LAND PARCEL

PUERTO RICO DDRM/MANATEE

$57MM 2 LOW8% $1.05B 52 $707MM

DISPOSITION (U.S. Buyer) ASSETS CAP RATE RECAPITALIZATION

ASSETS MORTGAGE DEBT

7 2Q17 RESULTS COMMENTARY

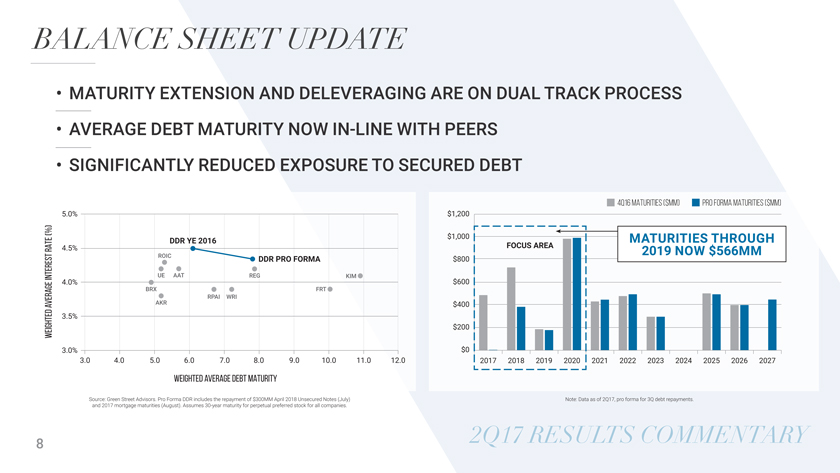

BALANCE SHEET UPDATE

• MATURITY EXTENSION AND DELEVERAGING ARE ON DUAL TRACK PROCESS

•

AVERAGE DEBT MATURITY NOW IN-LINE WITH PEERS

• SIGNIFICANTLY REDUCED EXPOSURE TO SECURED DEBT

4Q16 MATURITIES ($MM) PRO FORMA MATURITIES ($MM)

5.0% $1,200

(%) $1,000 MATURITIES THROUGH

DDR YE 2016

RATE 4.5% FOCUS AREA

ROIC DDR PRO FORMA $800 2019 NOW $566MM

INTEREST UE AAT REG KIM

4.0% $600

BRX FRT RPAI WRI

AVERAGE AKR $400

3.5%

WEIGHTED $200

3.0% $0

3.0 4.05.0 6.07.0 8.09.0 10.0 11.0 12.0 2017 2018 2019 2020 2021 2022 2023 2024 2025

2026 2027

WEIGHTED AVERAGE DEBT MATURITY

Source: Green Street Advisors. Pro

Forma DDR includes the repayment of $300MM April 2018 Unsecured Notes (July) Note: Data as of 2Q17, pro forma for 3Q debt repayments. and 2017 mortgage maturities (August). Assumes 30-year maturity for

perpetual preferred stock for all companies.

8 2Q17 RESULTS COMMENTARY

2017 GUIDANCE AND LEVERAGE OUTLOOK REITERATING PRIOR GUIDANCE SSNOI: -1.5% - 0% (Pro-rata,

including PR) SSNOI: -1.0% - +.5% (Pro-rata, excluding PR) Leased Rate: 93% - 93.5% at YE 2017 G&A Expense: $72 - 75MM Fees: $30 - 33MM Interest Income: $26 - 29MM LEVERAGE OUTLOOK Target: 6X net Debt/EBITDA (Pro-rata), excluding perpetual

preferred stock Sources: $900MM of proceeds from dispositions, including $226MM of proceeds in 2Q Estimated Uses: - - Secured 2017/2018 term mortgage loan maturities - $200MM of $400MM unsecured term loan - $82MM 2018 unsecured notes - $100MM of

additional mortgage maturities Additional Sources of Potential Equity: - JV asset sales - $318MM preferred equity repayment 9

9

PORTFOLIO REVIEW

10

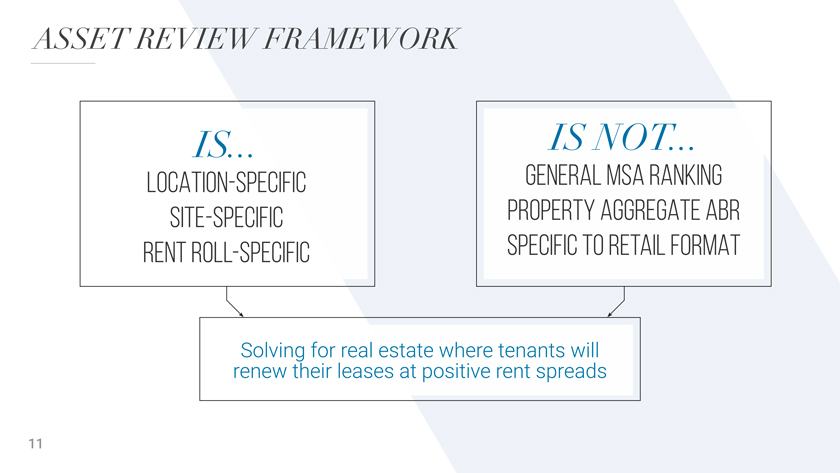

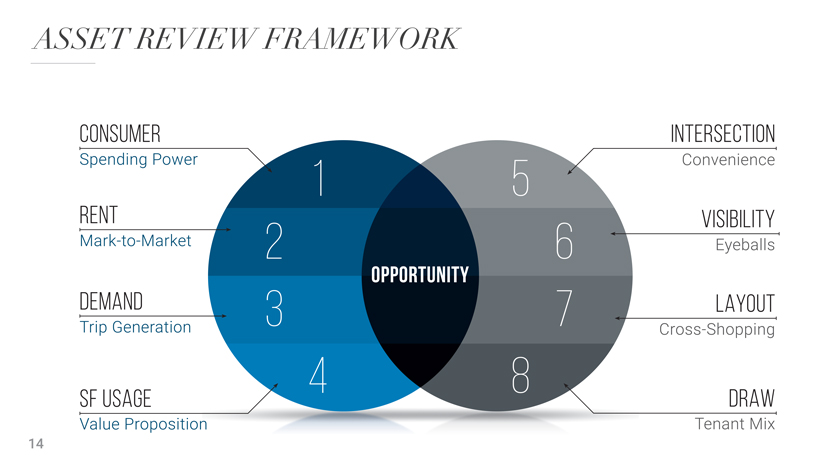

ASSET REVIEW FRAMEWORK

IS... IS NOT

LOCATION-SPECIFIC GENERAL MSA RANKING SITE-SPECIFIC PROPERTY

AGGREGATE ABR RENT ROLL-SPECIFIC SPECIFIC TO RETAIL FORMAT

Solving for real estate where tenants will renew their leases at positive rent spreads

11

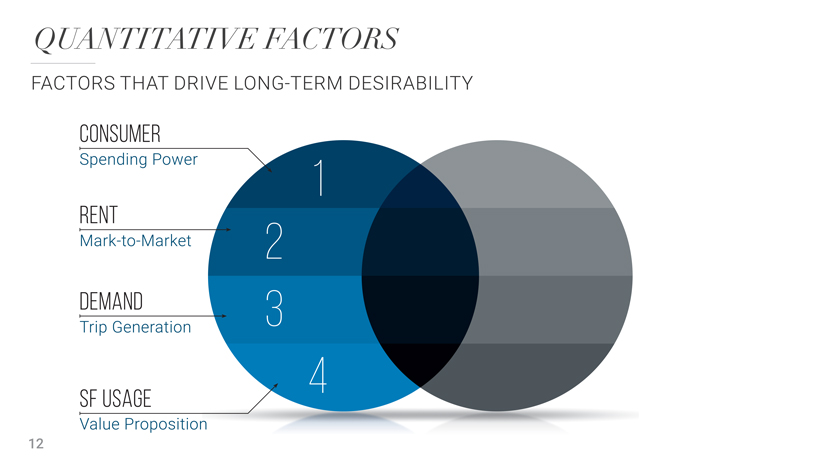

QUANTITATIVE FACTORS

FACTORS THAT DRIVE LONG-TERM DESIRABILITY

CONSUMER

Spending Power 1

RENT

Mark-to-Market 2

DEMAND 3

Trip Generation

4

SF USAGE

Value Proposition

12

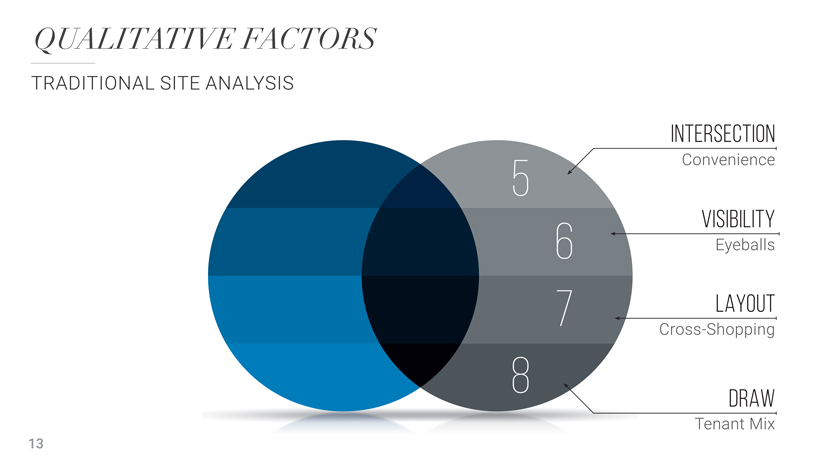

QUALITATIVE FACTORS

TRADITIONAL SITE ANALYSIS

INTERSECTION

5 Convenience

VISIBILITY

6 Eyeballs

7 LAYOUT

Cross-Shopping

8

DRAW

Tenant Mix

13

ASSET REVIEW FRAMEWORK

CONSUMER INTERSECTION

Spending Power 1 5 Convenience

RENT VISIBILITY

Mark-to-Market 2 6 Eyeballs

OPPORTUNITY

DEMAND 3 7 LAYOUT

Trip Generation Cross-Shopping

4 8

SF USAGE DRAW

Value Proposition Tenant Mix

14

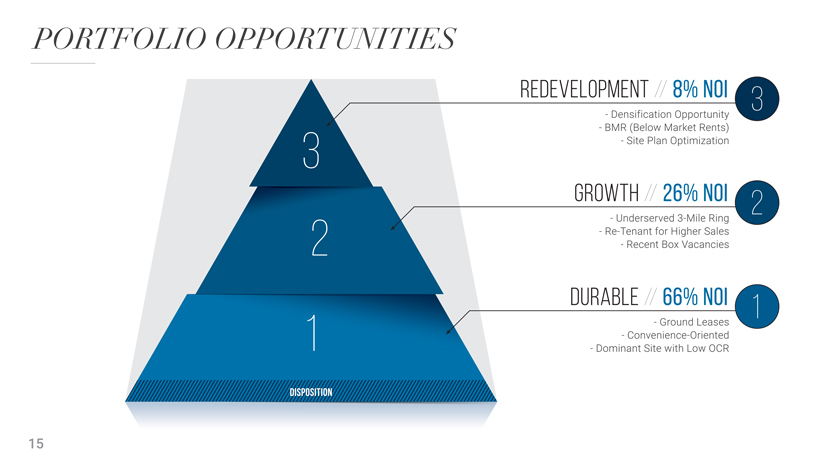

PORTFOLIO OPPORTUNITIES

REDEVELOPMENT // 8% NOI 3

- Densification Opportunity

- BMR (Below Market Rents)

3 - Site Plan Optimization

GROWTH // 26% NOI 2

- Underserved 3-Mile Ring

- Re-Tenant for Higher Sales

2 -

Recent Box Vacancies

DURABLE // 66% NOI 1

- Ground Leases

1 - Convenience-Oriented

- Dominant Site with Low OCR

DISPOSITION

15

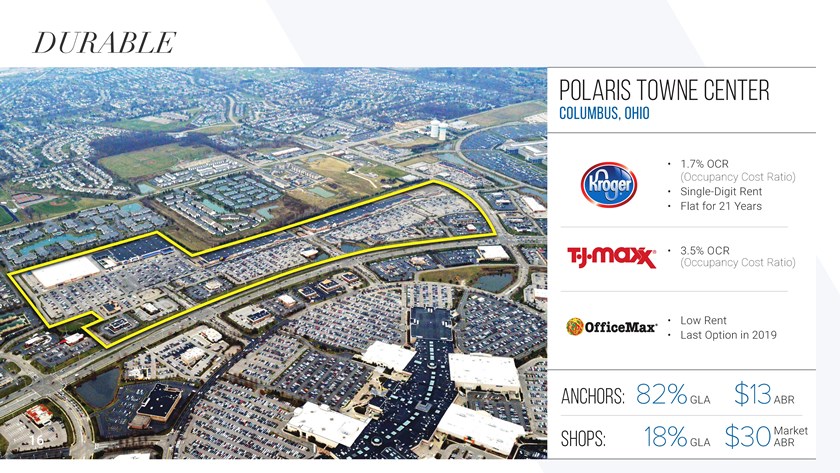

DURABLE

POLARIS TOWNE

CENTER

COLUMBUS, OHIO

• 1.7%

OCR

(Occupancy Cost Ratio)

• Single-Digit Rent

• Flat for 21 Years

• (Occupancy 3.5% OCR Cost Ratio)

• Low Rent

• Last Option in 2019

ANCHORS: 82% GLA $13ABR

Market

16 SHOPS: 18% GLA $30ABR

GROWTH

TANASBOURNE TOWN

CENTER

PORTLAND, OREGON

DEMAND DRIVERS

RE-TENANTING MOMENTUM

ANCHORS: 80% GLA $13ABR

17 SHOPS: 20% GLA $36ABR Market

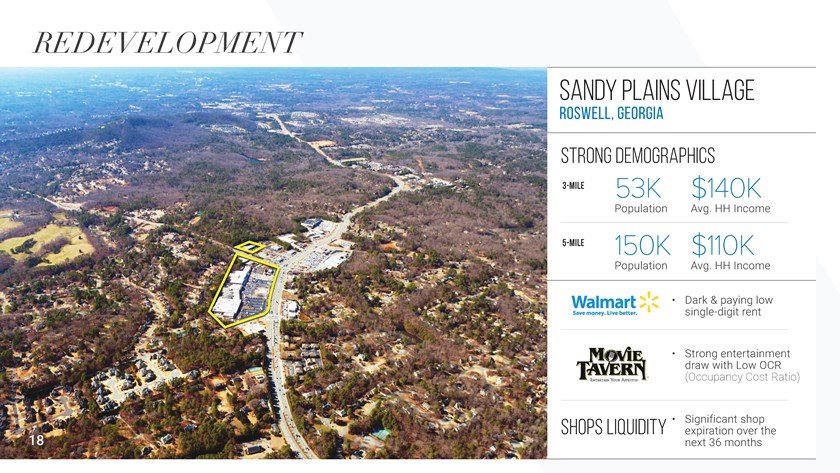

REDEVELOPMENT

SANDY

PLAINS VILLAGE

ROSWELL, GEORGIA

STRONG DEMOGRAPHICS

3-MILE 53K $140K

Population Avg. HH Income

5-MILE 150K $110K

Population Avg. HH Income

• Dark single-digit & paying rent low

• draw Strong with entertainment Low OCR

(Occupancy Cost Ratio)

SHOPS LIQUIDITY • Significant expiration over

shop the 18 next 36 months