Attached files

| file | filename |

|---|---|

| 8-K - 8-K SMARTFINANCIAL INC. EARNINGS RELEASE 2Q2017 - SMARTFINANCIAL INC. | a2017q2earningsreleasecover.htm |

| EX-99.1 - EXHIBIT 99.1 - SMARTFINANCIAL INC. | a2017q2earningsrelease-ex9.htm |

Second Quarter 2017 Earnings Call

July 26, 2017

Important Information

Forward Looking Statements

This presentation contains forward-looking statements. SmartFinancial cautions you that a number of important factors could cause actual results to

differ materially from those currently anticipated in any forward-looking statement. Such factors include, but are not limited to: the expected

revenue synergies and cost savings from the proposed merger with Capstone may not be fully realized or may take longer than anticipated to be

realized; the disruption from the proposed Capstone merger with customers, suppliers or employees or other business partners’ relationships; the

risk of successful integration of our business with that of Capstone after consummation of the proposed merger; the failure of SmartFinancial’s or

Capstone’s shareholders to approve the merger agreement; changes in management’s plans for the future, prevailing economic and political

conditions, particularly in our market area; credit risk associated with our lending activities; changes in interest rates, loan demand, real estate values

and competition; changes in accounting principles, policies, and guidelines; changes in any applicable law, rule, regulation or practice with respect to

tax or legal issues; and other economic, competitive, governmental, regulatory and technological factors affecting our operations, pricing, products

and services and other factors that may be described in our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q as filed with the

Securities and Exchange Commission from time to time. The forward-looking statements are made as of the date of this presentation, and, except as

may be required by applicable law or regulation, SmartFinancial assumes no obligation to update the forward-looking statements or to update the

reasons why actual results could differ from those projected in the forward-looking statements.

Non-GAAP Measures

Statements included in this presentation include non-GAAP financial measures and should be read along with the accompanying tables, which

provide a reconciliation of non-GAAP financial measures to GAAP financial measures. SmartFinancial management uses non-GAAP financial

measures, including: (i) net operating earnings available to common shareholders; (ii) operating efficiency ratio; and (iii) tangible common equity, in

its analysis of the company's performance. Net operating earnings available to common shareholders excludes the following from net income

available to common shareholders: securities gains and losses, merger and conversion costs, OREO gain and losses, and the income tax effect of

adjustments. The operating efficiency ratio excludes securities gains and losses, merger and conversion costs, and adjustment for OREO gains and

losses from the efficiency ratio. Adjusted allowance for loan losses adds net acquisition accounting fair value discounts to the allowance for loan

losses. Tangible common equity excludes total preferred stock, preferred stock paid in capital, goodwill, and other intangible assets. Management

believes that non-GAAP financial measures provide additional useful information that allows readers to evaluate the ongoing performance of the

company and provide meaningful comparisons to its peers. Non-GAAP financial measures should not be considered as an alternative to any measure

of performance or financial condition as promulgated under GAAP, and investors should consider SmartFinancial's performance and financial

condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the company. Non-

GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the

results or financial condition as reported under GAAP.

2

Important Information

Important Information for Investors and Shareholders

In connection with the proposed merger, SmartFinancial has filed with the Securities and Exchange Commission (“SEC”) a registration statement on

Form S-4 containing a joint proxy statement/prospectus of Capstone Bancshares, Inc. and SmartFinancial. A definitive joint proxy

statement/prospectus will be mailed to shareholders of both SmartFinancial and Capstone. Shareholders of SmartFinancial and Capstone are urged

to read the joint proxy statement/prospectus and other documents filed with the SEC carefully and in their entirety because they contain important

information. Shareholders may obtain free copies of the registration statement and the joint proxy statement/prospectus and other documents filed

with the SEC by SmartFinancial through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by

SmartFinancial are also available free of charge on SmartFinancial’s website at www.smartfinancialinc.com or by contacting SmartFinancial’s Investor

Relations Department at (423) 385-3009.

SmartFinancial, Capstone, their directors and executive officers, and other members of management and employees may be considered participants

in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of SmartFinancial is

set forth in SmartFinancial’s proxy statement for its 2017 annual shareholders meeting. Other information regarding the participants in the proxy

solicitations and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the joint proxy

statement/prospectus and other relevant materials filed with the SEC.

3

SMBK at-a-glance

• Core franchise in East Tennessee – SmartBank founded in 2007

• Corporate Headquarters – Knoxville, Tennessee

• 14 Branch Offices located in Knoxville, Pigeon Forge/Gatlinburg and Chattanooga/Cleveland

regions in TN with FL offices in Pensacola, Destin and Panama City.

• SmartBank $1B+ platform was created through an East TN Merger of Equals completed in

2016.

• Business Strategy

• Create a valuable Southeastern banking franchise through organic growth in strong markets coupled with an

acquisition model positioning our company as a partner of choice for banks our region.

• Continually improve earnings and efficiency metrics as we build out our model.

• Disciplined growth strategy with a focus on strong credit metrics.

• Build a solid franchise in all of our markets focusing on strong core deposit growth.

• Create a strong, consistent culture with an environment where top performers want to work.

• Notable planned acquisition of Alabama-based company that creates scale in our Southern

region and allows leverage to our infrastructure.

4

SmartFinancial Strategic Focus

• Core franchise in

East Tennessee.

• Cleveland branch

acquisition fills gap

between Knoxville

and Chattanooga.

• Geography

provides multiple

opportunities to fill

in between

Tennessee and

Florida.

• Strong capital

position and

management team

provide the means

to execute.

5

SmartFinancial Strategic Focus

6

2007 20162012

1/8/2007

SmartBank

opened first office

in Pigeon Forge,

Tennessee

2015

8/31/2015

Merger with

Cornerstone

Bancshares

completed, pushing

SMBK past $1.0B

asset mark

10/19/2012

FDIC-assisted

acquisition of

GulfSouth Private

Bank completed

($159M assets at

closure)

12/17/2015

SMBK

listed on

Nasdaq

Capital

Market

2/29/2016

Charter

combination of

SmartBank and

Cornerstone

Community

Bank

completed

1/13/2017

Announced

lift-out of

Cleveland-

based

banking

team

12/9/2016

Announced

pending

acquisition of

Cleveland, TN

/ Bradley

County branch

($32M loans to

be acquired)

2017

1/31/2017

$33MM

common

stock

capital

raise

completed

5/23/2017

SmartFinancial

announced

definitive

agreement with

Capstone

Bancshares

Second Quarter 2017 Highlights

• Net income available to common shareholders of $1.6 million during 2Q17 compared to

$0.9 million during 2Q16.

• Net operating earnings (Non-GAAP) available to common shareholders of $1.6 increased

over 170% year over year.

• Gross loan growth of $58 million for the quarter included over $35 million in organic

growth.

• Closed acquisition of Cleveland, Tennessee, branch with book value of over $24 million

in both loans and deposits with about $1 million of intangible assets.

• Increased net interest margin, taxable equivalent, during the quarter to 4.15 percent.

• Asset quality outstanding with nonperforming assets to total assets of just 0.31%.

7

Summary Results

0.00%

0.20%

0.40%

0.60%

0.80%

ROAA

3.70%

3.75%

3.80%

3.85%

3.90%

Net interest income / average assets

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

Noninterest income / average assets

2.80%

3.00%

3.20%

3.40%

3.60%

Noninterest expense / average assets

8

Earnings Profile – Second Quarter 2017

• Net income increased 38% year

over year.

• Net interest income up over 7%

year over year primarily due to

average loan balances that were up

11%.

• Provision up due to loan growth.

• Increases non-interest income

compared to prior periods primarily

due to gains from higher sales

volumes of SBA and mortgage

loans.

2Q17 1Q17 2Q16

Total interest income 11,517$ 10,949$ 10,669$

Total interest expense 1,269 1,129 1,057

Net interest income 10,249 9,820 9,612

Provision for loan losses 298 12 218

Net interest income after provision for loan losses 9,951 9,808 9,394

Total noninterest income 1,253 927 961

Total noninterest expense 8,829 8,145 8,472

Earnings before income taxes 2,374 2,590 1,883

Income tax expense 726 946 691

Net income 1,648 1,644 1,192

Dividends on preferred stock — 195 270

Net income available to common shareholders 1,648$ 1,449$ 922$

Net income per common share

Basic 0.20$ 0.19$ 0.16$

Diluted 0.20 0.19 0.15

9

Net Interest Income

• Net interest margin, taxable equivalent, increased

quarter to quarter due to higher loan balances and

higher yields on securities, and reductions in FHLB

advances and other borrowings.

• Compared to a year ago earning asset yields are up

4bps while cost of interest bearing liabilities are up

9bps.

2Q17 1Q17 2Q16

Loans 5.17% 5.11% 5.32%

Investment securities and interest-bearing due

from banks 2.04% 1.70% 1.59%

Federal funds and other 1.69% 4.47% 3.51%

Earning Asset Yields 4.66% 4.54% 4.62%

Total interest-bearing deposits 0.65% 0.60% 0.56%

Securities sold under agreement to repurchase 0.32% 0.35% 0.30%

Federal Home Loan Bank advances and other

borrowings 1.27% 0.82% 1.03%

Total interest-bearing liabilities 0.65% 0.60% 0.56%

Net interest margin 4.15% 4.07% 4.16%

Cost of Funds 0.54% 0.49% 0.46%

Average Yields and Rates

3.50%

3.75%

4.00%

4.25%

2Q16 3Q16 4Q16 1Q17 2Q17

Net Interest Margin

Net interest margin, TEY

Net interest margin, TEY- ex purchase acct. adj

2Q17 1Q17 2Q16

Net intere t income 10,249$ 9,820$ 9,612$

Average Earning Assets 992,133 979,535 928,670

10

Noninterest Income

• 2Q17 Noninterest income was all core, undistorted by gains on securities or gains on the sale of

foreclosed assets.

• Quarterly recurring core noninterest income of service charges, gains on the sale of loans, and other

noninterest income has trended higher over the last four quarters from approximately $866

thousand in 2Q16 over $1.2 million in 2Q17.

$0

$200,000

$400,000

$600,000

$800,000

$1,000,000

$1,200,000

$1,400,000

2Q16 3Q16 4Q16 1Q17 2Q17

Noninterest Income

Gain (loss) on sale of foreclosed assets

Gain on securites

Other non-interest income

Gain on sale of loans and other assets

Service charges on deposit accounts

Core Recurring Trend

11

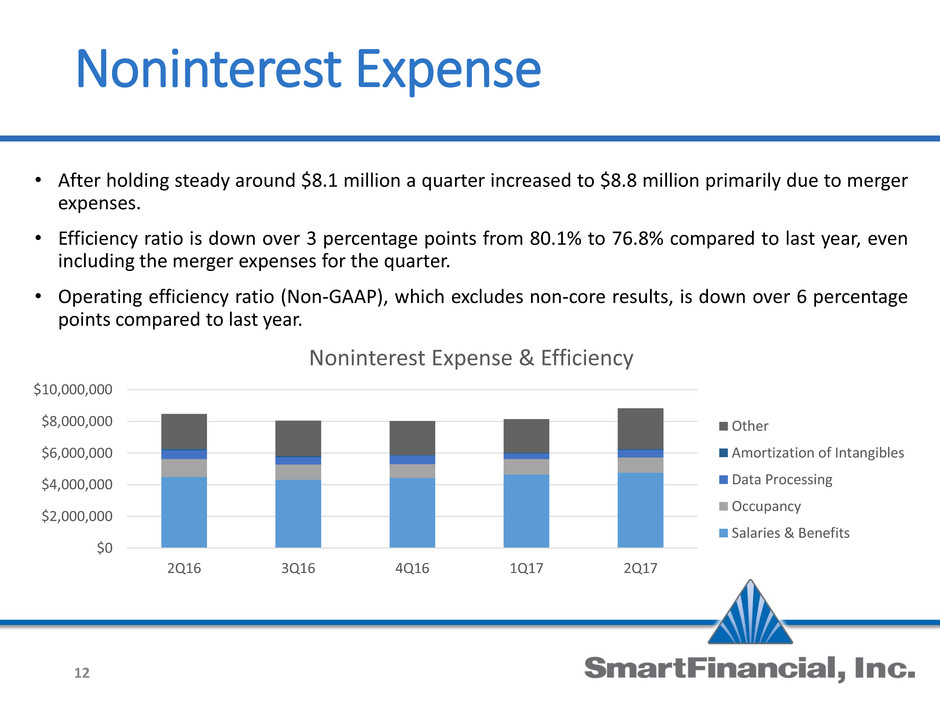

Noninterest Expense

• After holding steady around $8.1 million a quarter increased to $8.8 million primarily due to merger

expenses.

• Efficiency ratio is down over 3 percentage points from 80.1% to 76.8% compared to last year, even

including the merger expenses for the quarter.

• Operating efficiency ratio (Non-GAAP), which excludes non-core results, is down over 6 percentage

points compared to last year.

$0

$2,000,000

$4,000,000

$6,000,000

$8,000,000

$10,000,000

2Q16 3Q16 4Q16 1Q17 2Q17

Noninterest Expense & Efficiency

Other

Amortization of Intangibles

Data Processing

Occupancy

Salaries & Benefits

12

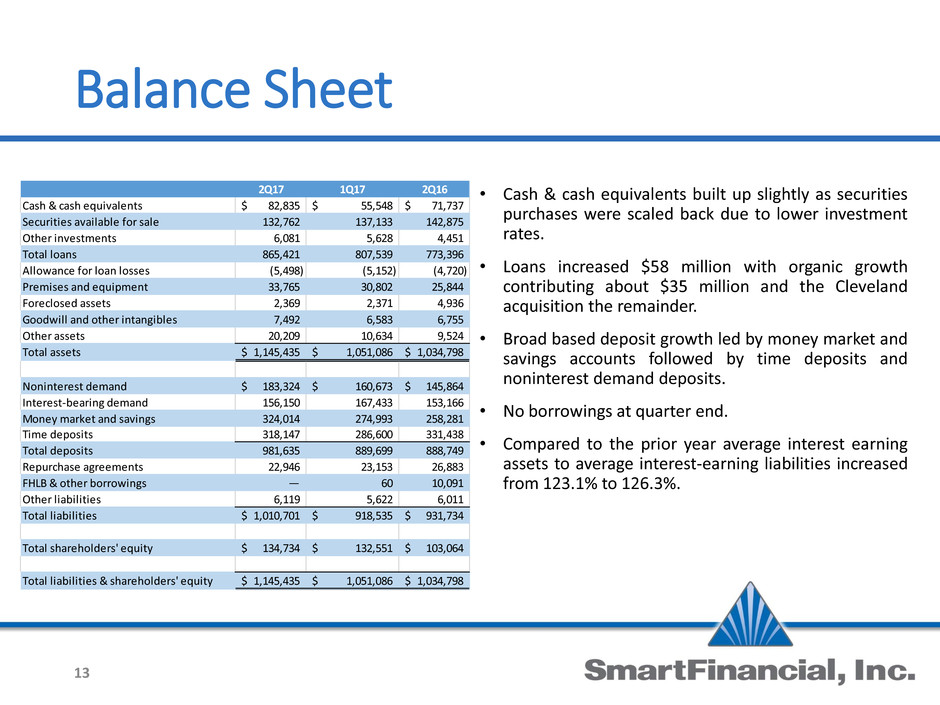

Balance Sheet

• Cash & cash equivalents built up slightly as securities

purchases were scaled back due to lower investment

rates.

• Loans increased $58 million with organic growth

contributing about $35 million and the Cleveland

acquisition the remainder.

• Broad based deposit growth led by money market and

savings accounts followed by time deposits and

noninterest demand deposits.

• No borrowings at quarter end.

• Compared to the prior year average interest earning

assets to average interest-earning liabilities increased

from 123.1% to 126.3%.

2Q17 1Q17 2Q16

Cash & cash equivalents 82,835$ 55,548$ 71,737$

Securities available for sale 132,762 137,133 142,875

Other investments 6,081 5,628 4,451

Total loans 865,421 807,539 773,396

Allowance for loan losses (5,498) (5,152) (4,720)

Premises and equipment 33,765 30,802 25,844

Foreclosed assets 2,369 2,371 4,936

Goodwill and other intangibles 7,492 6,583 6,755

Other assets 20,209 10,634 9,524

Total assets 1,145,435$ 1,051,086$ 1,034,798$

Noninterest demand 183,324$ 160,673$ 145,864$

Interest-bearing demand 156,150 167,433 153,166

Money market and savings 324,014 274,993 258,281

Time deposits 318,147 286,600 331,438

Total deposits 981,635 889,699 888,749

Repurchase agreements 22,946 23,153 26,883

FHLB & other borrowings — 60 10,091

Other liabilities 6,119 5,622 6,011

Total liabilities 1,010,701$ 918,535$ 931,734$

Total shareholders' quity 134,734$ 132,551$ 103,064$

Total liabilities & shareholders' equity 1,145,435$ 1,051,086$ 1,034,798$

13

Loan Portfolio

• Loan growth of over $90 million year over year, about 12%.

• Growth over the last year has been broad based with increases in C&I, CRE, and Consumer RE.

• The bank’s Commercial Real Estate 100 & 300 ratios dropped even further.

$0

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

$800,000

$900,000

$1,000,000

2Q16 3Q16 4Q16 1Q17 2Q17

Portfolio Composition

Other

Consumer RE

CRE, non-owner occupied

CRE, owner occupied

C&D

C&I

14

Asset Quality

• Excellent asset quality with nonperforming assets at just 0.31% of total assets.

• Nonperforming assets down over 50% year over year.

• Purchase accounting discounts are significantly higher than ALLL.

0.00%

0.20%

0.40%

0.60%

0.80%

$0

$2,000

$4,000

$6,000

$8,000

2Q16 3Q16 4Q16 1Q17 2Q17

Nonperforming Assets

Foreclosed assets

Nonperforming loans

Nonperforming assets to total assets

15

0.50%

0.55%

0.60%

0.65%

0.70%

0.75%

$0

$4,000

$8,000

$12,000

2Q16 3Q16 4Q16 1Q17 2Q17

Loan Discounts

Allowance for loan losses (GAAP)

Net acquisition accounting fair value discounts to loans

Allowance for loan losses to loans

Deposits

• Well diversified deposit mix with growth of money market, savings, and noninterest demand

replacing mostly wholesale time deposits.

• After keeping cost of funds steady for three quarters cost of funds starting to creep up driven by

isolated money market accounts and floating rate municipal demand deposit accounts.

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

$-

$200,000

$400,000

$600,000

$800,000

$1,000,000

$1,200,000

2Q16 3Q16 4Q16 1Q17 2Q17

Deposit Composition

Time deposits

Money market and savings

Interest-bearing demand

Noninterest demand

Cost of Funds

Fed Funds Target

16

Capstone Summary Transaction Terms

17

Acquiror: SmartFinancial, Inc.

Target: Tuscaloosa, AL based Capstone Bancshares, Inc.

Transaction Value(1): $84.8 million

Consideration Mix: Approximately $69.0 million in stock(1)

(2,899,107 SMBK shares issued) and $15.8

million in cash

Valuation

Multiples(1)(2):

159% of Tangible Book Value

22.0x LTM Earnings

New Board Seats: 2 (Steven B. Tucker and J. Beau Wicks)

Required Approvals: Customary regulatory approvals, SmartFinancial

shareholders and Capstone shareholders

Expected Closing: Q4 2017

Transaction

Terms

(1) Based on 4,263,393 Capstone shares, 262,324 Capstone options (weighted average strike price of

$10.00), and SMBK’s closing price of $22.70 on May 19, 2017

(2) Based on Capstone Bancshares, Inc. financials as of March 31, 2017

Deal Assumptions and Impact

18

Cost Savings: 25%, with 85% phased-in in 2018 and 100%

thereafter

Merger Related

Expenses:

$5.0 million after-tax

Significant Purch.

Acct. Mark:

$9.3 million loan credit mark down

$2.3 million loan fair value adjustment

Core Deposit

Intangible:

$4.2 million

Earnings Accretion: +25% in each of the first two years (excl.

merger charges)

TBV Dilution: ~7.5%, earned back over ~3 years (crossover)

Deal

Assumptions

Estimated

Financial

Impact

Pro Forma Branch Map

19

SMBK (14)

Capstone (8)

• Capstone brings the

vibrant Tuscaloosa

market to

complement existing

Tennessee and

Florida markets.

• Capstone’s CEO,

Robert Kuhn, will be

the Regional

President for

Alabama and the

Florida Panhandle

which will enhance

SmartBank’s

geographic profile.

• Pro forma footprint

allows for additional

opportunities for

market expansion.

Tuscaloosa Market Highlights

20

Tuscaloosa Market Overview Companies with Presence in Western Alabama

SMBK Chairman Miller Welborn was raised in

Tuscaloosa and has strong ties to the area

Tuscaloosa, AL is home to the flagship campus of the

University of Alabama, one of the largest universities in

the country

• Over 37,000 students

In 1993, Mercedes-Benz selected Tuscaloosa as the

headquarters for its U.S.-based manufacturing

operations

• Located approximately 20 miles from

downtown Tuscaloosa

• ~3,600 employees

DCH Regional Medical center opened in Tuscaloosa in

1923 and today serves as one of West Alabama’s

premier hospitals

• +500 bed facility

• Over 3,600 employees

21

SmartBank Named Top Workplace

Conclusions

• Second quarter net income increased 38% compared to a year ago.

• Third and fourth quarter forecast:

• Loan growth driven by: Robust pipeline, New production personnel, Over $128 million in

unfunded commitments.

• Merger expenses estimated at $0.3 million a quarter.

• Lower effective tax rate should mostly offset merger expenses.

• Improved loan mix with less CRE which will allow continued growth.

• SMBK continues focus on long-term shareholder value by:

• Building the foundation for organic growth and profitability

• Exploring expansion to strategic markets

• Q&A

22

Non-GAAP Reconciliations

2Q16 3Q16 4Q16 1Q17 2Q17

Net interest income -ex purchase acct. adj.

Net interest income (GAAP) 9,612$ 9,665$ 9,856$ 9,820$ 10,248$

Taxable equivalent adjustment (463) (34) (177) 58 21

net interest income TEY 9,149 9,631 $9,679 9,878 10,269

purchase accounting adjustments (597) (450) (430) (540) (696)

Net interest income -ex purchase acct. adj. 8,552$ 9,181$ 9,249$ 9,338$ 9,573$

Loan Discount Data

Allowance for loan losses (GAAP) 4,720$ 4,964$ 5,105$ 5,152$ 5,498$

Net acqui ition accounting fair value discounts to loans 11,053 10,742 10,271 9,831 9,086

Tangible Common Equity

Shareholders' equity (GAAP) 103,064$ 105,170$ 105,240$ 132,551$ 134,734$

Less preferred stock & preferred stock paid in capital 12,000 12,000 12,000 — —

Less goodwill and other intangible assets 6,754 6,675 6,636 6,583 7,492

Tangible common equity (Non-GAAP) 84,310$ 86,495$ 86,604$ 125,968$ 127,242$

23

Non-GAAP Reconciliations

2Q16 3Q16 4Q16 1Q17 2Q17

Operating Earnings

Net income (loss) (GAAP) 1,192$ 1,611$ 1,647$ 1,644$ 1,648$

Purchased loan accounting adjustments (597) (450) (430) (540) (696)

Securities (gains) losses (98) (18) — — —

Merger and conversion costs 153 — — — 420

Foreclosed assets (gains) losses 4 (130) (6) 15 —

Income tax effect of adjustments 206 229 167 201 265

Net operating earnings (Non-GAAP) 860 1,242 1,378 1,320 1,637

Dividends on preferred stock (270) (270) (270) (195) —

Net operating earnings available to common shareholders

(Non-GAAP) 590$ 972$ 1,108$ 1,125$ 1,637$

Net operating earnings per common share:

Basic 0.11$ 0.19$ 0.24$ 0.15$ 0.20$

Diluted 0.10 0.19 0.23 0.15 0.20

Operating Efficiency Ratio

Efficiency ratio (GAAP) 80.13% 74.06% 74.29% 75.79% 76.77%

Adjustment for amortization of intangibles -1.10% -0.99% -0.49% -0.65% -0.69%

Adjustment for taxable equivalent yields -0.16% -0.18% -0.26% -0.25% -0.22%

Adjustment for purchased loan accounting adjustments1 7.05% 5.59% 5.36% 6.63% 7.88%

Adjustment for securities (gains) losses 1.16% 0.23% —% —% —%

Adjustment for merger and conversion costs -1.81% —% —% —% -4.76%

Adjustment for OREO (gains) losses -0.05% 1.62% 0.08% -0.18% —%

Operating efficiency ratio (Non-GAAP) 85.22% 80.33% 78.98% 81.34% 78.98%

24

Second Quarter 2017

25

Supplemental Information

Loan & Deposit Composition 2Q17

C&I

12%

C&D

12%

CRE,

owner

occupied

24%

CRE, non-

owner

occupied

27%

Consumer

RE

24%

Other

1%

Loans

Noninteres

t demand

19%

Interest-

bearing

demand

16%

Money market

and savings

33%

Time

deposits

32%

Deposits

26

Loan Composition History 2Q17 1Q17 4Q16 3Q16 2Q16

Gross Loans

C&I 105,129$ 90,649$ 85,696$ 83,471$ 87,253$

C&D 101,151 115,675 117,748 128,727 115,385

CRE, owner occupied 211,469 197,032 181,840 172,397 177,052

CRE, non-owner occupied 233,707 210,901 233,021 222,592 212,315

Consumer RE 206,667 186,344 187,557 182,952 174,013

Other 7,298 6,938 7,515 7,263 7,377

Total Loans, gross 865,421$ 807,539$ 813,377$ 797,402$ 773,395$

27

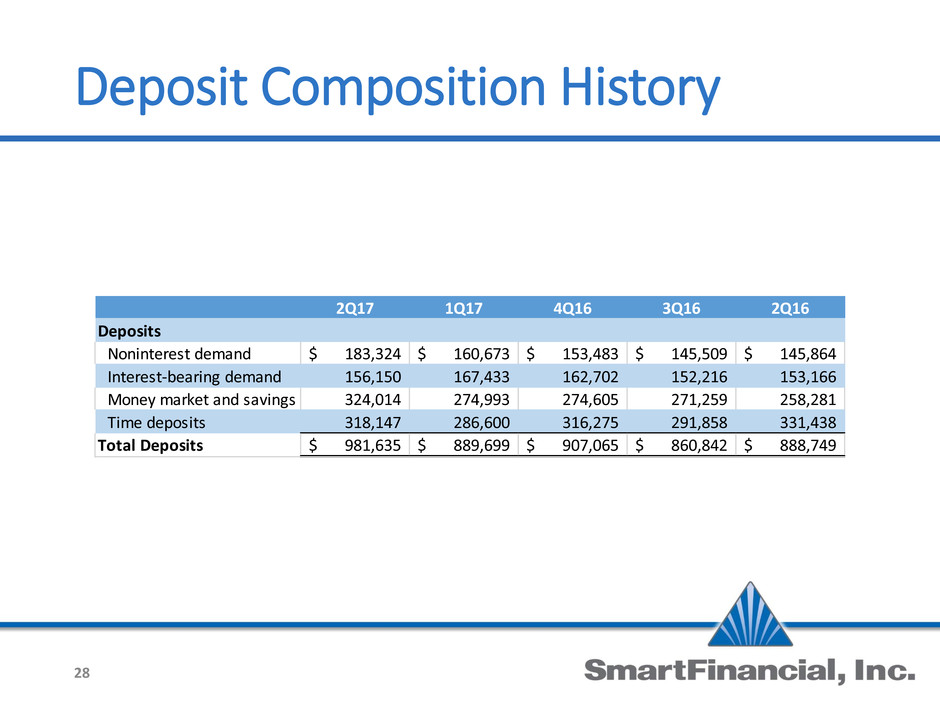

Deposit Composition History

2Q17 1Q17 4Q16 3Q16 2Q16

Deposits

Noninterest demand 183,324$ 160,673$ 153,483$ 145,509$ 145,864$

Interest-bearing demand 156,150 167,433 162,702 152,216 153,166

Money market and savings 324,014 274,993 274,605 271,259 258,281

Time deposits 318,147 286,600 316,275 291,858 331,438

Total Deposits 981,635$ 889,699$ 907,065$ 860,842$ 888,749$

28

CRE Ratios

• Declining trend in CRE ratios has been a result of targeted focus by lending teams across Bank’s

geography to primarily prospect opportunities within the owner occupied CRE and Commercial and

Industrial portfolio segments.

• This strategy was implemented to further diversify the bank’s loan portfolio by reducing existing

concentrations within the CRE segment.

50.00%

75.00%

100.00%

125.00%

150.00%

Q4

2

0

1

4

Q1

2

0

1

5

Q2

2

0

1

5

Q3

2

0

1

5

Q4

2

0

1

5

Q1

2

0

1

6

Q2

2

0

1

6

Q3

2

0

1

6

Q4

2

0

1

6

Q1

2

0

1

7

Q2

2

0

1

7

100 Ratio

29

200.00%

250.00%

300.00%

350.00%

400.00%

Q4

2

0

1

4

Q1

2

0

1

5

Q2

2

0

1

5

Q3

2

0

1

5

Q4

2

0

1

5

Q1

2

0

1

6

Q2

2

0

1

6

Q3

2

0

1

6

Q4

2

0

1

6

Q1

2

0

1

7

Q2

2

0

1

7

300 Ratio

Management Team

30

Billy Carroll

President & CEO

Miller Welborn

Chairman of the Board

C. Bryan Johnson

Chief Financial Officer

Rhett Jordan

Chief Credit Officer

Gary Petty

Chief Risk Officer

Greg Davis

Chief Lending Officer