Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - LiveXLive Media, Inc. | f10k2017ex32ii_lotoncorp.htm |

| EX-32.1 - CERTIFICATION - LiveXLive Media, Inc. | f10k2017ex32i_lotoncorp.htm |

| EX-31.2 - CERTIFICATION - LiveXLive Media, Inc. | f10k2017ex31ii_lotoncorp.htm |

| EX-31.1 - CERTIFICATION - LiveXLive Media, Inc. | f10k2017ex31i_lotoncorp.htm |

| EX-21.1 - LIST OF SUBSIDIARIES OF THE REGISTRANT - LiveXLive Media, Inc. | f10k2017ex21i_lotoncorp.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2017

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File No. 333-167219

LOTON, CORP

(Exact name of registrant as specified in its charter)

| Nevada | 98-0657263 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

269 South Beverly Drive, Suite #1450 Beverly Hills, California |

90212 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (310) 601-2500

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☒ No ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§223.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter ended September 30, 2016, was approximately $93,544,000. For the sole purpose of making this calculation, (i) the term “non-affiliate” has been interpreted to exclude directors, executive officers and holders of 10% or more of the registrant’s common stock, and (ii) in light of the very limited trading of the registrant’s common stock, such aggregate market value was determined based on the then most recent price per share at which the registrant last sold its common stock in a private placement during the six months ended September 30, 2016.

As of June 9, 2017, the registrant had outstanding 108,082,599 shares of common stock, $0.001 par value.

TABLE OF CONTENTS

Cautionary Statement Regarding Forward-Looking Statements

This Annual Report on Form 10-K (this “Annual Report”) contains forward-looking statements within the meaning of the U.S. federal securities laws, which involve substantial risks and uncertainties. The forward-looking statements are contained principally in the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors.”

In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. These statements include, but are not limited to, statements regarding:

| ● | our ability to identify, acquire, secure and develop live music and music-related video content from Content Providers (as defined below) and to distribute or otherwise exploit such content on our platform; | |

| ● | our ability to attract and retain users through our content and platform engagement strategies and ultimately establish a subscription-based revenue stream; | |

| ● | our ability to continue to expand and develop our content and platform, including through future acquisitions of businesses or assets; | |

| ● | our ability to utilize our technology and the LXL App to stream our content and leverage other aspects of our operations; | |

| ● | our ability to integrate certain operating assets of Wantickets (as defined below) and other companies we may acquire in the future; | |

| ● | our belief that our management team’s relationships with Content Providers and Industry Stakeholders (as defined below) provide us a competitive advantage; | |

| ● | our belief that the costs of acquiring our content will be at substantially lower, cost-effective price points relative to other content; | |

| ● | our belief that the demand for live music and music-related video content and the global music community will grow substantially and quickly; | |

| ● | our ability to produce original programming in-house through LXL Studios and future acquisitions; and | |

| ● | our ability to execute our monetization strategies, including subscriptions, advertising, sponsorships and e-commerce. |

Forward-looking statements reflect our current views with respect to future events and are based on assumptions and are subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this Annual Report. You should read this Annual Report and the documents that we filed as exhibits to this Annual Report, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements by these cautionary statements.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Use of Market and Industry Data

This Annual Report includes market and industry data that we have obtained from third-party sources, including industry publications, as well as industry data prepared by our management on the basis of its knowledge of and experience in the industries in which we operate (including our management’s estimates and assumptions relating to such industries based on that knowledge). Management has developed its knowledge of such industries through its experience and participation in these industries. While our management believes the third-party sources referred to in this Annual Report are reliable, neither we nor our management have independently verified any of the data from such sources referred to in this Annual Report or ascertained the underlying economic assumptions relied upon by such sources. Furthermore, references in this Annual Report to any publications, reports, surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report, survey or article is not incorporated by reference in this Annual Report.

Forecasts and other forward-looking information obtained from these sources involve risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors,” “Cautionary Statement Regarding Forward-Looking Statements,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report.

Trademarks, Service Marks and Trade Names

This Annual Report contains references to our trademarks, service marks and trade names and to trademarks, service marks and trade names belonging to other entities. Solely for convenience, trademarks, service marks and trade names referred to in this Annual Report, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend our use or display of other companies’ trade names, service marks or trademarks or any artists’ or other individuals’ names to imply a relationship with, or endorsement or sponsorship of us by, any other companies or persons.

PART I

| Item 1. | Business |

Unless the context requires otherwise or unless otherwise stated, references to “our Company,” “Loton,” “LXL,” “LiveXLive,” “we,” “us,” “our” and similar references refer to Loton, Corp and its consolidated subsidiaries, including LiveXLive, Corp., our wholly-owned subsidiary (“LXL”), and LiveXLive Tickets, Inc., our wholly-owned subsidiary (“LXL Tickets”), in each case giving effect to our recently completed acquisition (the “Wantickets Acquisition”) of certain operating assets of Wantickets RDM, LLC (“Wantickets”), which occurred on May 5, 2017.

Our Company Overview

We are one of the world’s only premium internet networks devoted to live music and music-related video content. We intend to fill a market void by becoming a central content, information and transaction hub for music consumers and industry stakeholders, including agents, managers, distributors, producers, labels, publishers, advertisers, and social influencers (collectively, “Industry Stakeholders”), around the world. We are geared for the digital generation, and our mission is to bring the experience of live music and entertainment to internet users by delivering live streamed and on demand content to nearly any internet-connected screen. Our goal is to become a leading destination for premium music video content on the internet by continuing to aggregate and create our content, including through strategic acquisitions. We are also building a proprietary engagement platform that we believe will attract and retain users, which we believe will allow us to collect valuable user data and monetize our growing content library through subscriptions, advertising, sponsorships and e-commerce.

Since our launch in 2015, we have sought to become the singular online destination for music fans to enjoy premium live performances from music venues and leading music festivals around the world as well as premium original content, artist exclusives and industry interviews. We have live streamed music festivals such as Rock in Rio, Outside Lands Music and Arts Festival (“Outside Lands”) and Hangout Music Festival, and our platform has featured performances and content from over 170 of the most popular artists in various music genres, including Rihanna, Katy Perry, Metallica, Duran Duran, Radiohead, Chance The Rapper, Bruce Springsteen, Major Lazer and Maroon 5. We have successfully distributed such content through our online platform and major third-party distributors such as MTV International, AOL and Complex Media.

Our content strategy includes continuing to aggregate live and on demand performance (e.g., on stage sets) and non-performance (e.g., behind the scenes, interviews) music-related video content from festivals, clubs, events, concerts, artists, promoters, venues, music labels and publishers (“Content Providers”); acquiring and producing original music-related video content; and curating existing online premium content. In addition to acquiring and/or partnering with third-party Content Providers, our digital studio, LXL Studios, will develop and produce original music-related video content, including digital magazine-style news programming and original-concept digital pilots and documentaries.

Our platform engagement strategy is to build a compelling online experience for our users, anchored by a pioneering website and our custom mobile application, the “LXL App”. Our platform engagement strategy is to build a compelling online experience for our users, anchored by a pioneering website and our custom LXL App. The LiveXLive platform will offer access to some of the world’s leading music festivals and events with multi-day and simultaneous multi-stage coverage, unique concerts, intimate performances and premium programming. It will be fueled by our custom LXL App, which we believe will drive 24/7/365 user engagement and data that we will be able to convert to earnings and cash flow through multiple potential revenue streams. We intend to initially release the first version of the LXL App during summer 2017 on the iOS operating system in anticipation of Rock in Rio 2017. We plan to release the Android version of the LXL App and Apple TV, Roku and Amazon Fire TV LiveXLive applications later in 2017.

By executing the above strategies, we are creating a platform that is dedicated to live music and has the breadth and depth of content to reach and be relevant to a global audience of all ages.

| 1 |

Our Opportunity

We believe there is significant unmet demand for experiencing live music, musical performance video on demand and related content online. For example, there is a large market for live music events worldwide with an estimated $19.6 billion in live music industry revenue in 2016 (IBISWorld), with more than 2,000 music festivals worldwide, and over 10 million people attending ten of the top festivals in 2016 alone. In 2015 and 2016, on average almost 80,000 people attended each day of the Rock in Rio music festivals in Rio de Janeiro and Lisbon. In addition to festivals, there are thousands of live music performances that occur nightly in large and small venues such as arenas, theatres, clubs, bars and lounges. Due in part to a combination of costs, logistics, event capacity and publicity, the attendance at any one festival or live event is a fraction of the total potential audience for that content. For example, while almost 100,000 people attended Coachella in 2016, the live stream garnered over 9 million views. This demonstrates the potential demand for online viewership of live music events. We believe there is currently no centralized platform dedicated to online streaming of live music and music-related video content. We intend to fill this market void by executing each component of our business approach.

Our Growth Strategy

We intend to pursue the following core growth strategies:

| ● | Grow Our Live and On Demand Content Library. In order to continue to grow our content base, we will strategically acquire the digital rights to live music events, concerts, and festivals, acquire existing content, partner with Content Providers and create custom premium content. Most recently in March 2017, we entered in to a content license agreement to broadcast and distribute JBTV’s extensive content library, and in April 2017, we acquired the exclusive broadcast and distribution rights to Hangout Music Festival’s live broadcast. JBTV is a leading source of music programming for the past 30 years, which includes over 2,500 hours of Emmy and Billboard award winning music and media content. Hangout Music Festival is an annual three-day music festival in Gulf Shores, Alabama, which was held in May of this year and had approximately 45,000 people in attendance per day. We will seek to acquire and/or license existing libraries of live content in order to capitalize on underutilized existing live content assets. We intend to collaborate with Content Providers to provide our users with access to ever-growing new and relevant premium content. Our recently launched LXL Studios will also create synergistic, complementary, short-form original content that will further enhance our user experience and deepen our relationship with our users and Content Providers. | |

| ● | Pursue Strategic Acquisitions. We intend to continue expanding our business in part through strategic acquisitions in markets where we see opportunities to grow our brand and revenues, which will ultimately expand the reach of our network. We have an active program for identifying and pursuing potential acquisitions of companies and content. We will continue to utilize a “buy and build” strategy and to use the operations of LiveXLive and our talented management team as the overall infrastructure to which we will add more companies and assets. For example, in May 2017, we acquired certain operating assets of Wantickets, a branded leading online nightlife, electronic dance music and event ticketing company in North America that is designed to promote ticket sales for live events. This acquisition will allow us to expand the reach of our content and build our subscription model by utilizing Wantickets’ large database of ticket buyers to live music events. Similar to our acquisition of Wantickets, we will continue to identify businesses and assets that we believe will accelerate the growth of our vertical markets through strategic acquisitions. | |

| ● | Expand our Reach. We will continue to identify distribution partners in territories across the world that will benefit from sharing our programming on mutually beneficial terms. We will also seek to exploit the potential of previously under-monetized live music content and underexposed genres of music beyond the most popular through online distribution. We will also continue to expand our global footprint through partnerships and organic growth in markets where we see opportunities to grow revenues and expand the reach of our network. | |

| ● | Programming Premium Content. We believe users value personalized offerings of both premium existing and new content. We believe that the following three components will drive our programming success: (1) investment in original content and gaining a stronger foothold in production; (2) building scale and aggregating content to maintain a differentiated way for our users to access live music; and (3) utilizing data analytics to complement editorial approaches. We will utilize programming and curation as a driver for our platform as great programming is valuable to both our users and our financial performance. |

| 2 |

| ● | Expand Our Monetization Opportunities. The growth of digital formats and the expansion of our user base will continue to produce new means for the monetization of our increasing premium and unique content. We believe that our network will deliver large-scale audiences and engagement, while concurrently providing a monetization model that is commercially viable and scalable. We anticipate being capable of increasingly realizing the value of our various revenue streams across our distribution, partnerships, advertising, sponsorship, e-commerce merchandising and ticketing opportunities. Potential revenue streams include but are not limited to the following: |

| ● | Subscription, SVoD and PPV: Various types of premium content will lend themselves to different monetization opportunities. We plan to take advantage of our growing premium content by offering different methods of user access, such as subscription-only content, subscription video on demand (“SVoD”) across our entire platform, pay-per-view (“PPV”) for special events or groups with strong fan bases and virtual reality for certain premium content. We also plan to launch a number of LiveXLive proprietary concepts such as digital festivals and digital residencies. See below under “Business — Our Approach and Business — Content Aggregation — LXL Studios and Original Content — LiveXLive Original Live Events.” | |

| ● | Advertising and Sponsorship: We believe that the ability to monetize our growing content library will improve over time as we drive users and engagement across current and emerging distribution channels. We will also continue to drive growth in our sponsorship and advertisings relationships, together with our focus on expanding existing partnerships, to provide them with targeted strategic programs, leveraging our increasing user base. | |

| ● | E-Commerce: Through our LiveXLive ecosystem, we plan to sell artist merchandise, tickets to upcoming shows, VIP packages, fan club access and more, all of which will be focused on a global captive audience of music fans on our platform. | |

| ● | Data: We expect to capitalize on an expansive user database we will build as our content offerings and user base grow. For example, our recent acquisition of Wantickets provides the opportunity to expand the reach of our content and build our subscription model by utilizing Wantickets’ large database of ticket buyers who consume live music events. |

Through the combination of these monetization strategies and acquisitions, we hope to create a music network with the breadth and depth of content to have global relevance, fueled by our LXL App, to drive user engagement and data that we can convert to earnings and cash flow through the multiple revenue opportunities.

Our Approach and Business

We are a global media company focused on producing and distributing live music and music-related video content around the world. Our approach is rooted in satisfying what we believe is a growing worldwide appetite for a centralized portal for such content. Live music and music-related video content is offered through myriad platforms, brands and forms. As a significant portion of consumers increasingly move from traditional platforms to digital and online platforms for consumption of pre-recorded music, sports and film and television, we believe the same shift will occur with respect to live music and music-related video content. Industry Stakeholders are continuously seeking avenues to expand their audience and generate additional revenue. We believe we are at the nascent stage of a revolution in live music content consumption that will mirror the growth of live sports consumption, and we aim to be at the very center of that revolution by offering a centralized hub of live music and music-related video content, available on nearly any internet-connected device, with subscription, advertising, sponsorship and e-commerce opportunities.

We have focused on the most well-known, premium live music events around the world. Our online platform offers access on nearly any internet-connected screens to some of the world’s leading music festivals and live music events, with multi-day, multi-stage coverage, unique concerts, intimate performances and cutting-edge programming. We feature all popular genres of music, including rock, pop, indie, alternative, hip-hop, R&B, electronic dance music and country, as well as less popular genres, and performances from both headliners and emerging artists from around the world. We deliver content through a strategic relationship with Verizon Digital Media Services (“VDMS”) and have contracted with major distributors to help build the LiveXLive brand and user audience. We believe the power of music touches nearly every person on the planet; we have successfully streamed high definition quality live feeds of performances from over 170 of the biggest artists in the world to fans in more than 100 countries. As of March 1, 2017, views of LiveXLive content were in the tens of millions.

| 3 |

As we establish the key components of our premium live music and music-related video network, we plan to execute all stages of a full network life-cycle, including aggregating, producing, directing, promoting, curating and distributing music and music-related video and live music “lifestyle” content that we will distribute on our online platform. We also intend to acquire and/or produce, along with our Content Providers, curated original programming and original-concept pilots for music-related content. We believe this will further engage our user base and allow us to collect and analyze data instrumental to further monetization and generation of additional revenue streams.

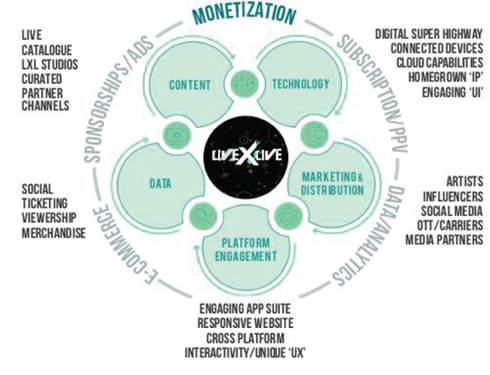

To become a centralized hub for live music and music-related video content, we plan to execute the following interconnected components of our business as shown below: Content Aggregation; Technology Development; Marketing and Distribution; Platform Engagement; and Data Collection.

Content Aggregation

We operate on the basis that “Content Is King” and seek to aggregate thousands of hours of premium, professionally produced, curated, innovative, immersive and experiential music-related video content that can be enjoyed live and on demand around the world. Some of our most compelling content is performance content captured at the world’s leading music festivals, clubs, events, concerts and venues. Furthermore, each of these music events presents opportunities to capture unique non-performance content that showcases the culture surrounding live music events, including fashion, food, and lifestyle from local, national and/or international vantage points such as on the red carpet, in dressing rooms or from other places customarily off-limits to anyone but VIPs are artists. We will feature performance and non-performance content side-by-side with original content produced by LXL Studios, which programming will cover news, comedy, reality, drama and more.

Live music and music-related video content can be acquired and/or produced at costs lower than that required for comparable exclusive premium video content in other genres. For example, during one day of a music festival, participating artists perform at a single venue, allowing us to produce the live performance content at marginal costs; a single day should provide over eight hours of live performance music content per stage. When artists are not performing during the music festival, we intend to capture artist interviews and other premium non-performance content in a cost-efficient manner. Furthermore, at music clubs and indoor venues, we will be able to deliver additional performance and non-performance content at a low cost on a daily basis using the Venue Production Studio System. In addition, we will have the capability to curate free content provided by third-party sources such as talk shows and artists and host such content on our platform. When our performance content, non-performance content and original programming are combined, we believe our content costs will be at a substantially lower, cost-effective price point to provide a competitive advantage versus other providers of premium content.

| 4 |

We have devised a content aggregation and development strategy focused on the following types and sources of content: Live Events (e.g., performance and non-performance), Catalog, LXL Studios (original), Co-branded/Partner Channel programming, and Curated.

Live Events

| ● | Festivals. We aim to partner with leading music festival brands in the live music industry and have partnered with several of the leading music festival brands, including Rock in Rio, Outside Lands and Hangout Music Festival. Thousands of music festivals and live music events are held each year. We will continue to actively identify and partner with a diverse group of festival Content Providers to maintain consistent levels of both performance and non-performance content throughout the year. Generally, we aim to enter into long-term agreements with the festival organizers, ranging anywhere between one to five years, depending on popularity, fan appeal and other factors. |

A sample of our most popular festivals include:

| ● | Rock in Rio (Rio de Janeiro, Lisbon, Las Vegas) — We entered into a distribution agreement in 2015 with Rock in Rio, one of the largest, most prominent music festivals in the world having been in existence for over 30 years. For 2017 and 2018, we possess the exclusive digital distribution rights, including live streaming and VoD, throughout the world, excluding China, Brazil and the host country of that particular iteration of Rock in Rio. We will also serve as Rock in Rio’s media partner for all third-party requests for cable, television broadcast, digital, satellite, radio, virtual reality, VoD and live streaming requests. A sample of artists that we have streamed from Rock in Rio events include: Katy Perry, Rihanna, Metallica, Bruce Springsteen, Maroon 5, Elton John, Rod Stewart, Avicii, One Republic and John Legend. In partnership with Rock in Rio, we also broadcasted the Amazonia Live concert from the Amazon Rainforest’s Rio Negro on August 27, 2016. As part of the viewing experience, we directed viewers to donate funds to the reforestation effort to aid Rock in Rio in their successful goal of planting one million new trees in the rainforest. | |

| ● | Outside Lands Music and Arts Festival (San Francisco) — We entered into an agreement with OSL Partnerships, LLC (“OSL”) granting us the exclusive right to broadcast, distribute and promote Outside Lands via live stream, as well as broadcast video on demand and television broadcast rights, which OSL may sell if they procure a deal prior to us broadcasting on television. We have the right to distribute created content on our network, as well as the right to sub-license to third-party sites. Outside Lands is a music festival located in Golden Gate Park in San Francisco, CA, which will take place in August 2017. The festival features all genres of music with the 2017 lineup to be headlined by The Who, Metallica, Gorillaz, Lorde and A Tribe Called Quest, among others. LiveXLive has streamed from Outside Lands include performances from Radiohead, Duran Duran, Chance the Rapper, Third Eye Blind, Lionel Richie, LCD Soundsystem, Major Lazer and Mike Snow among many others. | |

| ● | Hangout Music Festival (Gulf Shores, Alabama) — In April 2017, we entered into an agreement for the exclusive broadcast and distribution rights across virtually all platforms to one of the summer’s major music festivals. Founded in 2009, the Hangout Music Festival (commonly referred to as Hangout Fest or Hangout) is an annual three-day music festival held at the public beaches of Gulf Shores, Alabama. Previous headliners included Foo Fighters, Zac Brown Band, Beck, The Black Keys, The Killers, OutKast, Kings of Leon, Tom Petty & The Heartbreakers, Stevie Wonder, Jack White, Red Hot Chili Peppers, and Dave Matthews Band. The May 2017 event will be headlined by Frank Ocean, Mumford & Sons, Chance The Rapper and Twenty One Pilots. |

| ● | Clubs and Venues. We are able to stream live performances around the world on our platform on a daily basis from popular nightclubs and concert venues. We have entered into content licensing, broadcasting and/or distribution agreements with elite nightclubs and concert venues, including many of the industry’s leading properties. These nightclubs and concert venues could yield a substantial amount of raw performance content in a single year. In addition, we plan to install our Venue Production Studio System at similar nightclubs and concert venues to enable us to capture this content and share it with our users at relatively low costs to us. Generally, we aim to enter into long-term agreements with the owners of the nightclubs and other concert venues, ranging anywhere between one to five years depending on the popularity and other factors. |

| 5 |

A sample of our clubs and venues include:

| ● | TAO Group — We own the exclusive rights to broadcast live performances from Marquee, TAO and Lavo Nightclubs in Las Vegas, for a period of 5 years. These include rights to film, broadcast and distribute footage from musical and special events, DJ shows, concerts, behind the scenes footage and promotions and events series produced by the TAO Group in Las Vegas. The TAO Group will provide production infrastructure in venue as well as transmission and encoding services to deliver the broadcast signal and feed for distribution on our platform. The TAO Group operates some of the most iconic nightclubs in Las Vegas and have been home to some of the most popular and successful electronic dance music (“EDM”) artist performances and residencies. | |

| ● | E11EVEN — We own production and streaming rights from 11 USA Group, the owners of E11EVEN, a popular nightclub located in Miami, Florida, to live-stream select concerts, DJ shows, and other lifestyle events from the club’s 25,000 square foot venue. We also own the rights to live stream 11 USA Group’s events across the globe. E11EVEN hosts performances from top acts in pop, electronic and hip-hop music, including Nicki Minaj, Drake, and Miguel, among many others. | |

| ● | Exchange LA — Pursuant to our agreement with Exchange LA, a 25,000 square foot nightclub comprising a four floor building in downtown Los Angeles home to widely recognized EDM artists, we will assist Exchange LA to produce and distribute select live music performances on our network. We have also collaborated with the management of Exchange LA to both lead the expansion of our EDM Club Network (an EDM-specific channel within our network), as well as to create a permanent, turnkey, replicable and scalable production and streaming technology solution to be installed at venues within our network based on Exchange LA’s proprietary infrastructure at its club in Los Angeles. |

| ● | Artist Tours. We will identify and partner with concerts and/or tours featuring both popular and emerging artists who wish to extend the experience of their brand and content to viewers across markets or in markets such tours may never reach. | |

| ● | Companion to Live Music Events. We plan to produce additional content ancillary to the content customarily captured from live events that we feel would resonate with our users, including: |

| ● | Highlighting various important social causes relating to music (e.g., deforestation in the Amazon rainforest for Rock in Rio) |

| ● | Behind the scenes |

| ● | Lifestyle and culture |

| ● | Tour/venue information |

| ● | Video “podcast” featuring news, artist interviews, editorial commentary and local events |

| ● | Award Shows. We will identify music award shows that are seeking to extend the reach of their content. These shows feature increasingly popular performances and sometimes pair major artists together to create unique performances that cannot be seen or heard outside the award show format. Aside from attracting high-profile artists for such performances, award shows are prime for social media events and similarly generate publicity and marketing across news media, which contribute to our overall marketing and content goals. |

Catalog Content

We have acquired, and plan to acquire in the future, distribution rights to certain libraries consisting of classic archived content, including concert footage, festival footage, interviews and documentaries as evidenced by the recent JBTV transaction, which has not only increased our overall content offerings, but also allows us to target-market users already using our online platform for their favorite live music video content, deepening and engaging our user base.

LXL Studios and Original Content

Our LXL Studios will produce scripted and unscripted programs, as well as branded entertainment campaigns focused on a variety aspects of live music event culture, including art, food, fashion, film, sports, politics and travel. We believe there is currently no network in place that is dedicated to providing these stories from a raw, live, experiential and global perspective. As the market for this type of content in the digital content space grows, we will continue to invest in LXL Studios and the creation of original content programming. We aim to create compelling, high-quality LXL Studios programming that will be distributed through our network and eventually exclusively on the LiveXLive platform, which we believe will increase subscriptions and user retention.

| 6 |

We expect to launch and strategically position our music magazine-style live news show similar to popular sports and entertainment daily news shows, tentatively titled “LiveZone”. LiveZone will act as the flagship for the LiveXLive platform and feature as-it-happens coverage, news on live music events and in-depth artist bios and interviews, as well as music-related “lifestyle” topics. LiveZone’s anchors and on-location correspondents from major cities and events around the world and will include social media influencers and popular music programming hosts whose respective fan bases will bolster overall viewership and user engagement with the LiveXLive platform. We intend LiveZone to be a guide to the world of live music one segment at a time. Ultimately, we expect LiveZone to fuel the daily viewership of the platform similar to the way other daily sports and entertainment news shows have anchored their respective network’s daily programming.

We plan to produce the following content within our LXL Studios division in collaboration with our production partner Big Boots, one of the first studios dedicated to incubating, launching and monetizing engagement platforms:

| ● | Scripted and Unscripted Shows. Our slate of expected original content web series shows includes content in news, comedy, reality and more. We expect to produce 10 to 12 shows each year. In 2017, we are currently developing and producing original pilots and documentary series with the slate expanding in 2018 and beyond. The following titles and are currently entering pre-production: |

| ● | Scripted: |

| ● | Pawn Shop: a show about two girls, starring Amanda Cerny, who manage a pawn shop full of musical instruments and regularly break into song with their customers. |

| ● | Sycamore: a show about a band which moves into a Hollywood apartment complex populated with eccentric hopefuls; the band quickly discovers that the mysticism, glamour and magic of the complex is not only in their heads. |

| ● | Unscripted: |

| ● | MainStagers: a show taking music fans inside the biggest music festivals through the eyes of a group of superfans. |

| ● | Autotune: A Love Story: an in-depth documentary on the origins, usage, and pervasive nature of auto-tune in song recordings and live performance. |

| ● | Acquired Content. In addition to producing original content, LXL Studios will look to acquire new and existing third-party-produced content that will appeal to our users, including third-party development ideas for new content. We plan to acquire content within the following categories, among others: scripted, reality, music and performance, interviews and behind the scenes, films and documentaries, and user generated content. |

| ● | LiveXLive Original Live Events. We plan to produce and develop original live performance content created uniquely for LiveXLive, including the following: |

| ● | Digital Festival. The Digital Festival will reinvent the traditional music-festival model by removing the physical boundaries of the venue and extending the experience to a global audience. Similar to the way the 2005 “Live 8” series of live performances and concerts were broadcast on traditional media across the globe in a single day, the Digital Festival will allow users to experience a multi-artist, venue-agnostic, digital concert experience available on any internet-connected screen. This will remove substantial logistical costs associated with physical festival budgets, including production and infrastructure. Thanks to modern streaming technology, we can engage artists to perform from most venue types or even from their personal residences, which we can schedule in sequence to create a festival-type experience. |

| ● | Digital Residency. Artists who may not have the desire to embark on a large-scale tour are sometimes intrigued by the concept of a localized residency. Residencies appeal to artists, both big and small, who want to stay relevant to their fans, but may not have the ability, financing or desire to perform on tour. We will offer artists a “Digital Residency” at a digital venue, the LiveXLive digital platform, which offers artists the opportunity to generate additional revenue from existing fan bases by performing live to fans all around the world at the convenience of the artist. This is a blank canvas for artists to create new and exciting ways to connect with their fans in real-time, whether through live performance, rehearsal coverage, inside looks on the songwriting or live question-and-answer sessions. |

| 7 |

Partner and Co-Branded Channels:

Using our technology and the strength of our LiveXLive brand and outreach, we plan to offer Industry Stakeholders the opportunity to host their entire content library on our platform in the form of individual co-branded channels, thereby offering them a fully-serviced digital asset. We believe Industry Stakeholders can benefit and monetize a substantial portion of their existing live music video content by distributing such content on branded channels on the LiveXLive platform. We intend to provide artists and labels a new revenue opportunity similar to what Spotify and Pandora have done for audio rights. In addition, we believe this strategy will ensure that potential key Industry Stakeholders do not view us as a direct competitor, but rather as a trusted partner. We will also continue to look to find other creative ways to incentivize distribution of third-party content on our network.

Curated Content:

We consider there to be a substantial amount of live music-related video content available on the internet that is not currently well-marketed or monetized by their creators. The LiveXLive platform will feature publicly available performance and non-performance content created by third-party sources, carefully curated by LiveXLive. The constant flow of new and exciting content will ensure the network is continually fresh and current with music trends. We believe there are substantial opportunities for curated content given the sheer volume of content generated and uploaded to the internet every day.

Technology Development

Technology is a key component of the LiveXLive network that brings our ecosystem to life for both users and our Content Providers. We currently deliver our viewer experience through an HTML-based website compatible with most major web browsers (e.g., Chrome, Safari, Internet Explorer) and operating systems (e.g., Windows, MacOS, iOS, Android). LiveXLive, in conjunction with third-party technology developers, is building a pioneering technology stack for delivering our content to users on nearly any internet-connected screen. Our developers bring extensive experience building technology solutions for the leading media companies of the world, including the design of live and VoD workflows, the video content management system and delivery of content on mobile, over-the-top (“OTT”) and desktop clients.

We intend to deliver a user experience that will be platform and operating system agnostic and available on nearly any internet-connected screen. We are currently developing the LXL App, which we intend to release initially on the iOS operating system in the summer 2017 in anticipation of Rock in Rio 2017. We plan to release the Android version of the LXL App and Apple TV, Roku and Amazon Fire TV LiveXLive applications later in 2017. We are also in the process of finalizing our OTT strategy, which we expect will result in the release of a custom OTT application that will be available on all OTT platforms and consoles. We believe our full-service, delivery-to-distribution back-end will allow us to capitalize on monetization opportunities and is the first step in creating a digital supply chain for live music and music-related video content.

We have also contracted with VDMS to provide us with software, encoding, streaming, cloud storage and delivery services. VDMS’s digital media platform is a single, end-to-end solution that can prepare, deliver, display and enable the monetization of online content. VDMS takes our digital content and helps turn it into instantly gratifying experiences. VDMS brings together world-class technology to prepare, deliver and display content, so our users can watch and enjoy our content on their terms. VDMS’s next-generation platform helps us reduce the challenges and pressures of meeting today’s user expectations of instantaneous, always-on, seamless and secure digital experiences by taking care of our infrastructure and workflow needs.

The Wantickets system is hosted on Amazon Web Services, which provides flexibility we need to handle traffic spikes and the simplifies our IT management and disaster recovery tasks. In load testing, the system has been able to handle approximately 10,000 orders per minute.

| 8 |

Marketing and Distribution

Our brand and content marketing and distribution efforts will focus on third-party distributors, individual artist and social media promotion, traditional media outlets and social-viral events. Given that our content appeals to a diverse user demographic spanning a variety of music genres, we plan to customize our campaigns to best suit the need of our Content Providers and potential advertising partners. We will also continue to share our own, music-related video content and updates with our users, together with targeted posts on our social media networks on Snapchat, Facebook, Instagram and Twitter.

Marketing and distribution of our content and brand will be integral to our business and the execution of our platform engagement, data collection and monetization strategies. We believe we can achieve this initially by leveraging the reach of major distribution platforms in a way similar to our success with past distribution through major third parties such as MTV International, Complex Media and AOL. For example, our co-distribution agreement with AOL for Rock in Rio 2015 resulted in a total of nearly 180 million social impressions, which does not include any social impressions following the live broadcast. We believe we will continue to reach a substantial number of consumers through these and other distribution partners utilizing their platforms. We will also partner with major mobile carriers and web and broadcast distributors to drive distribution and viewership of LiveXLive and LXL Studios branded content.

We have engaged artists and social influencers to conduct marketing on their own social media and other marketing platforms. For example, individual artists such as Rihanna at Rock in Rio 2015 and Avicii at Rock in Rio 2016 promoted our live stream to their massive and dedicated fan bases. We have also partnered with three prominent social media influencers: Amanda Cerny, Andrew B. Bachelor (also known as “King Bach”) and Jake Paul. These social media influencers feature a combined audience of over 70 million followers who are engaged and interested in music. In May 2017, Amanda Cerny launched her first LXL Studios series of comedy shorts with King Bach as a guest star. The three-episode series promoting LiveXLive in advance of Hangout Music Festival and the summer festival season garnered nearly 900,000 views on LiveXLive’s Instagram. In May 2017, Amanda Cerny’s daily Instastories (short-form temporary videos on Instagram) drove over 75,000 unique viewers to the LiveXLive platform to view Hangout Music Festival. In June 2017, we live streamed on our platform the exclusive broadcast of the first ever live on-stage performance of Jake Paul’s hit hip-hop song “It’s Everyday, Bro,” which debuted at #2 on iTunes. Exchange LA, our venue partner, hosted the surprise sold-out performance. Amanda Cerny, King Bach and Jake Paul have recently collaborated on social media-based promotions designed to drive fan participation, including offering fans to join the three of them on a private jet from Los Angeles to San Francisco to enjoy Outside Lands. We believe this type of direct marketing is invaluable as we continue to expand our brand.

Furthermore, as a result of our acquisition of certain operating assets of Wantickets, we will utilize its large engaged social following, with more than 170,000 followers focused on the nightlife category and over 135,000 unique emails in its marketing database. Wantickets builds relationships between leading social media influencers and everyday users to evoke authentic marketing while working towards automating a personalized experience.

We will also employ advertising across traditional media outlets. For example, under our agreement with KAOS Connect, we will receive advertisement placements in select theaters within Screenvision’s network of approximately 14,500 screens. This up-front-and-center advertising will reach captive theater patrons viewing marquee films, in advance of an exclusive theatrical event highlighting LiveXLive and our premium content.

Finally, content captured at live events can also become viral and provide unique marketing opportunities for our brand. For instance, while performing at Rock in Rio 2015, Katy Perry brought on stage an overly affectionate fan from the audience. The resulting exchange became international news, garnering placement on popular entertainment news shows and the upload of videos related to the incident on YouTube in the tens of millions. These videos depict our LiveXLive logo with over 10 million views on YouTube. This incident illustrates the power that live content has to create free, self-perpetuating and potentially profitable forms of marketing.

Platform Engagement

We are designing our custom platform with interactive features that will enhance the live music experience and, when combined with our platform’s functionality and unique features, will create an immersive digital experience in and of itself. We believe the combination of the intuitive, modern LiveXLive user interface and cross-platform capabilities will be instrumental in creating a deeply engaging, personally-tailored central hub for live music and music-related video content, particularly for those users who are otherwise unable to attend live events in person. Our aim is to also include options for artist fan club membership, merchandise, ticketing, VIP packages and other offerings to further solidify users’ affinity toward our platform and their interests.

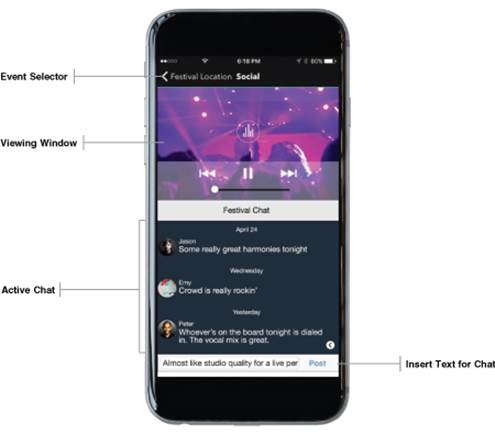

On our platform, users will be immediately greeted with a main viewing window featuring the most current content and multiple sub-windows that highlight additional stages, venues, events and our other content. Users will be able to move seamlessly, at the swipe of a finger, from stage to stage and venue to venue, to enjoy our content, creating a personalized viewing environment. By creating this free-flowing user experience, the platform will encourage users to connect with others to share their individual experience, further deepening social interaction and platform engagement.

| 9 |

LiveXLive currently runs on a responsive HTML-based website that has been developed to work across browsers on nearly any internet-connected screen. The website’s landing page includes a featured playback window used for the most relevant content. The remainder of the page features video content that is updated regularly and covers a full spectrum of music genres. As our content library and user data grows, this featured playback window will be individually tailored to a user’s preferences and interests. We intend to add video, display and other advertising to the website to generate additional revenue. We will work with our developers to continue to add and tweak features based on internal and external feedback.

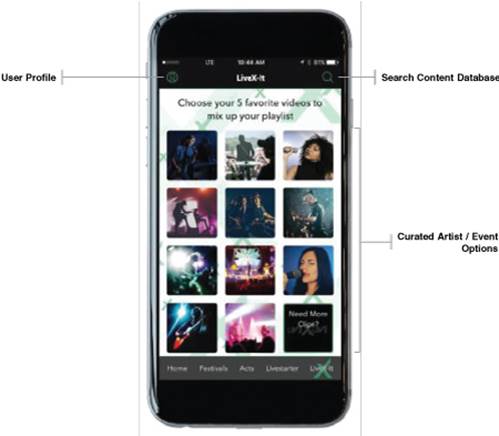

The LXL App will include live video streaming, VoD, push notifications, festival-, venue- and original content-specific functionality, Google Ads capability, digital rights management (e.g., geo-blocking), capability to display time-shifted content and enhanced functionality that will support social media sharing and user community. The main landing page of the LXL App will include a graphic depicting a featured performance at the top of the screen and options for viewing concurrent programming located below the graphic. The LXL App will also include a “Festivals” tab dedicated to ongoing and past festivals. We plan for this tab to allow users to view multiple stages of a single festival broadcasting live simultaneously. We believe this fun and simple interface layout, together with LiveZone, will highlight key content and encourage users to also discover our other content offerings.

| 10 |

In addition to the standard features, the LXL App will showcase several features that we believe will encourage and facilitate user engagement and interactivity, including:

LiveX-It — The feature allows users to compile select artist performance clips and share them across any chosen outlet in the form of a live performance “mixtape.”

Chat — In our endeavor to enhance the live event experience digitally, we will feature an integrated user chat system so users can connect, share and comment regarding the live content. The integrated chat will allow users to connect, comment and share, all without leaving the LXL App.

| 11 |

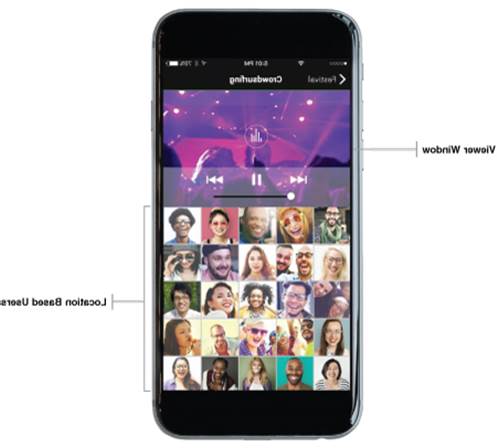

Crowdsurfing — Modeled after location based meet-up apps, the LXL App will have crowdsurfing capability to allow users to find and meet up at live events and connect with digital viewers. We want to take the integrated chat and bring it to the real world.

| 12 |

Livestarter — Users will be able to participate in by crowdfunding special music events and experiences for social causes and charitable purpose featuring artists and performers of the user’s choice. In addition to enjoying the resulting performance, users will receive an “event producer credit” memorializing the user’s role in the production of the event.

Data Collection

As a result of our acquisition of certain operating assets of Wantickets, we have taken an important first step in our data collection efforts. Wantickets’ database boasts over 2.7 million lifetime unique customers, over 300,000 unique customers in 2016, and over 70,000 unique customers thus far in 2017. As we continue to aggregate premium content offerings and grow our user base, we will gain valuable insights on users’ viewing habits, trends and preferences based upon specific clicks on viewing windows, music genre trends and popularity, duration of user engagement, social networks activity and geographical data. This data, paired with general demographic data supplied via integration of users’ social media, Google and/or Spotify accounts, will provide a rich, nuanced understanding of our user base.

We expect data collection will provide valuable information for each of our monetization strategies, including advertising, e-commerce, ticketing, distribution, sponsorships, subscription, SVoD and PPV. Our platform will support advertising for our Content Provider brands, music-related merchandise and ticketing services. We plan to use data mining to analyze the efficacy of these strategies and our broader marketing and distribution and content selection strategies. This data will inform how we can better price individual streams or subscription plans. We will be able to identify specific music genres, geographic markets and content programming most conducive to the success of our business. We aim to provide targeted e-commerce opportunities for music fans, including offering artist merchandise, tickets to upcoming live music events, fan club access and more. We also plan to implement rating or other review features to obtain direct user feedback on our content, the LXL App, e-commerce merchandise and our other platform features.

Our Leadership

Our leadership team, consisting of our Named Executive Officers (as defined below), executive management and our Advisory Board, collectively brings a wealth of industry relationships and expertise in the fields of programming, promotion, marketing, sales, distribution, web, digital, linear, mobile, legal and finance. The members of our active Advisory Board are renowned in their respective fields, are considered thought leaders in the entertainment industry by their peers, further enhance our credibility and provide strategic guidance to our business.

| 13 |

Many of the members of our leadership team have built businesses as entrepreneurs and/or have been executives at Fortune 500 companies. The team includes seasoned Wall Street executives that have collectively been involved in mergers and acquisitions of approximately $15 billion dollars’ worth of transactions in the live event, recorded music, music publishing, fashion, technology and other media and entertainment businesses. Our leadership team provides the knowledge to source, analyze, negotiate and complete acquisition transactions, partnerships and other business combinations. See Item 10. Directors, Executive Officers and Corporate Governance.

Our Industries

Our addressable markets include live music, digital music streaming and online video streaming. These three markets are experiencing significant growth and now represent the majority of the music industry’s overall revenue, as physical and digital record sales have steadily declined. We both capitalize on these trends and provide Industry Stakeholders with additional lucrative revenue streams.

Live Music Industry

The live music industry is a large, growing market that creates, manages and promotes live performances and events, ranging from festivals to concerts in stadiums, arenas, and other smaller venues. In the U.S. alone, the live music industry is expected to have generated approximately $19.6 billion of revenue in 2016, representing 1% growth over 2015 and 11% growth over 2014 (IBIS World, March 2017) and over $5.5 billion in live music sponsorship for the same periods. Live events and festivals have become an increasingly important cultural phenomenon as seen by more than 2,000 music festivals worldwide. Each festival can attract hundreds of thousands of people with attendance at the largest festival in the United States estimated at 125,000 people per day. Rock in Rio, for instance, attracted a combined attendance of over 1,000,000 people in 2015 and 2016 in Lisbon and Rio. The most popular festivals based on attendance include Coachella, Electric Daisy Carnival, Glastonbury, Outside Lands Music and Arts Festival, Rock Werchter, Rock in Rio, Roskilde, Tomorrowland and Ultra Music Festival. The live event industry is a global market with only a fraction of the leading live music events located in the U.S. In addition to festivals, there are thousands of live music performances that occur nightly in large and small venues such as arenas, theatres, clubs, bars and lounges.

As a result of the popularity of live music performances, there has been a growing interest in experiencing live events and performances via online streaming distribution. For example, in 2016, there were 9 million livestream views of the Coachella festival (Eventbrite Blog, August 22, 2016).

Additionally, the growth of the live music industry benefits ancillary verticals, such as merchandise and primary/secondary ticket marketplaces. Merchandise includes the retail sales of licensed music-related goods and is estimated to be larger than $2 billion as of 2014. Primary/secondary ticket marketplaces consist of online retailers that sell tickets to live events and online ticket resellers. This market generated revenue of over $5 billion in 2016, representing 2% growth over 2015.

| 14 |

Digital Music Streaming Industry

The addressable market for paid digital music streaming is large and growing and has surpassed physical music sales. The digital music streaming industry was expected to generate approximately $5.4 billion of revenue in 2016, representing 33% growth over 2015 and 89% growth over 2014 (PwC Global Entertainment and Media Outlook).

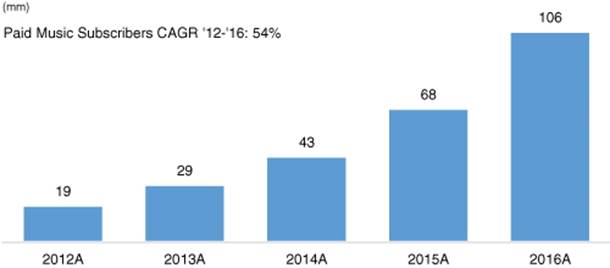

At the end of 2016, worldwide paid subscribers to music streaming services surpassed 100 million for the first time, representing 57% growth over 2015 (MIDiA Research).

These same fans are increasingly engaging digitally on their mobile devices. With over 2.1 billion smartphone users globally in 2016 (eMarketer, November 2016), we expect that mobile will continue to represent a significant opportunity for streaming live music and music-related content. More than 50% of smartphone users in the U.S. listened to music through direct download or live stream at least once per month from services such as Apple Music and iTunes, Pandora, iHeartRadio, Deezer and Spotify (eMarketer, August 2016).

We believe that the demand for live music and music-related content that is optimized for internet-connected devices will continue to grow with the further development of mobile devices and increases in mobile carrier bandwidth. We intend to continue to extend our global reach by executing deals with new partners and strengthening our business model to enable us to further monetize the content offered on our network across these devices.

Online Video Streaming Industry

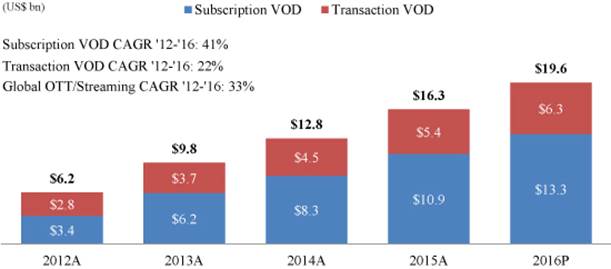

The addressable market for online video streaming is large and growing. The online video streaming industry was expected to generate approximately $19.6 billion of revenue in 2016, representing 19.9% growth over 2015 and 52.9% growth over 2014 (PwC Global Entertainment and Media Outlook). Over 49 million U.S. households or 53% of U.S. Wi-Fi connected homes accessed at least one OTT service in December 2016 (comScore, April 2017). According to comScore, these subscribers are heavily engaged, viewing OTT content an average of 19 days per month and 2.2 hours per day.

| 15 |

Additionally, an important subset of the growing online video streaming market is live video streaming. According to Facebook Live, users watch live video three times longer and comment ten times more than recorded footage (Eventbrite Blog, August 22, 2016). We aim to capitalize on what we believe is an increasing trend in user engagement with live video content.

Monetization

We expect to generate revenue from distribution, sponsorship, advertising and e-commerce. Once we aggregate enough premium content, we anticipate adding a monthly SVoD fee and PPV fees. Once an SVoD model is established, we will maintain a free tier with limited content that is supported by advertising revenue. Our diversified and growing portfolio of content will enable us to appeal to a broad range of consumers, not just the millennial demographic often desired by new media companies. This diversified user base will make it easier for us to generate substantial revenue from multiple streams. These revenue streams should be sufficient to pay for the total costs of operations, including production, rights, marketing, administrative and travel.

| ● | Wantickets — In May 2017, we acquired certain operating assets of Wantickets. Wantickets is a leading online nightlife, EDM and event ticketing company in North America, promoting ticket sales for live events. Its enhanced ticketing solution reaches an average of one million unique visitors on a monthly basis. Its extensive network of more than 1.5 million registered users, coupled with in-house social marketing engineering, provides a focused reach to music fans around the world. Wantickets features some of the best online tools for the ticketing experience on the business-to-business side as well, inclusive of real time reporting, accounting, and event management. Its strong marketing and ticketing capabilities combined with LiveXLive’s live music streaming network will allow us to take advantage of synergies in the emerging digital music market. We believe the acquisition of Wantickets presents an ideal opportunity to expand content reach and build LiveXLive’s subscription model by utilizing Wantickets’ significant database of live music ticket buyers. |

| ● | One Live Media — We have entered into an agreement with One Live Media (“OneLive”) to build and manage, as well as to help populate what we intend to be a LiveXLive store for merchandise and other e-commerce. The LiveXLive store will sell merchandise from the artists that have or will perform at the festivals, nightclubs and other concert venues with which we have entered into agreements. Additionally, we plan to sell travel packages, music and related lifestyle merchandise through the LiveXLive store. Our payments to OneLive for its services will vary depending on the nature of the services provided. OneLive is a diversified entertainment e-commerce company focused on providing commerce software platforms, fan club, event ticketing and merchandise fulfillment to over 500 well-known sports and music organizations. OneLive’s clients include Bon Jovi, Carrie Underwood, Radiohead, Guns N’ Roses, The Who, Sony Music, Warner Music Group, Jeff Gordon and Formula 1 Racing. |

| 16 |

Competition

While the broader market for live entertainment remains highly competitive, the digital distribution of live and music-related video content is still a nascent market. We believe live streamed music video content is the only remaining media genre without a dominant brand. We believe there is a tremendous amount of high quality live music content available to be captured and produced but without a singular home for distribution and access by the public at large.

We expect to compete for the time and attention of our users with other Content Providers based on a number of factors, including: quality of experience, relevance, acceptance and diversity of content, ease of use, price, accessibility, perceptions of advertisement load, brand awareness and reputation. We also expect to compete for the time and attention of users based on the presence and/or visibility of the LiveXLive platform as compared with other platforms and Content Providers that deliver content through internet-connected screens.

Our competitors will include (i) broadcast radio providers, including terrestrial radio providers such as Clear Channel and CBS and satellite radio providers such as Sirius XM, (ii) interactive on-demand audio content and pre-recorded entertainment, such as Apple’s iTunes Music Store and Apple Music, Rhapsody, Spotify, Pandora, Tidal and Amazon Prime that allow listeners to stream music or select the audio content that they stream or purchase, (iii) other forms of entertainment, including Facebook, Instagram, Google, Twitter (including Periscope), and Yahoo, which offer a variety of internet and mobile device-based products, services and content and (iv) promoters and producers of content on mobile, online and AR/VR platforms such as Redbull TV, Live Nation TV and independent content owners. To the extent that existing or potential users choose to watch satellite or cable television, streaming video from on demand services such as Hulu, VEVO or YouTube, or play interactive video games on their home-entertainment system, computer or mobile phone rather than use the LiveXLive service, these content services pose a competitive threat.

We may also face direct competition from other large live music event competitors with regards to online distribution of live music and music-related video content, ticketing and sponsorship opportunities, including from Live Nation, Anschutz Entertainment Group, and Livestyle (formerly SFX). Furthermore, there are many smaller, regional companies that compete in the market as well.

Government Regulation

Our operations are subject to various federal, state and local laws statutes, rules, regulations, policies and procedures, both domestically and internationally, governing matters such as:

| ● | labor and employment laws; | |

| ● | the United States Foreign Corrupt Practice Act (the “FCPA”) and similar regulations and laws in other countries; | |

| ● | sales and other taxes and withholding of taxes; | |

| ● | Securities and Exchange Commission (the “SEC”) requirements; | |

| ● | privacy laws and protection of personally identifiable information; | |

| ● | marketing activities online; and | |

| ● | primary ticketing and ticket resale services. |

We believe that we are in material compliance with these laws. We are also required to comply with the laws of the countries we operate in and anti-bribery regulations under the FCPA. Such regulations make it illegal for us to pay, promise to pay, or receive money or anything of value to, or from, any government or foreign public official for the purpose of directly or indirectly obtaining or retaining business. This ban on illegal payments and bribes also applies to agents or intermediaries who use funds for purposes prohibited by the statute.

From time to time, governmental bodies have proposed legislation that could have an effect on our business. For example, some legislatures have proposed laws in the past that would impose potential liability on promoters and producers of live music events for entertainment taxes and for incidents that occur at such events, particularly incidents relating to drugs and alcohol. More recently, some jurisdictions have proposed legislation that would restrict ticketing methods and mandate ticket inventory disclosure.

| 17 |

Privacy Policy

As a company conducting business on the internet, we are subject to a number of foreign and domestic laws and regulations relating to information security, data protection and privacy, among others. Many of these laws and regulations are still evolving and could be interpreted in ways that could hurt our business. In the area of information security and data protection, the laws in several states require companies to implement specific information security controls to protect certain types of personally identifiable information. Likewise, all but a few states have laws in place requiring companies to notify users if there is a security breach that compromises certain categories of their personally identifiable information. Any failure on our part to comply with these laws may subject us to significant liabilities.

We are also subject to federal and state laws regarding privacy of listener data. Our privacy policy and terms of use describe our practices concerning the use, transmission and disclosure of listener information and are posted on our website. Any failure to comply with our posted privacy policy or privacy-related laws and regulations could result in proceedings against us by governmental authorities or others, which could harm our business. Further, any failure by us to adequately protect the privacy or security of our users’ information could result in a loss of confidence in our brand among existing and potential users, and ultimately, in a loss of users and advertising customers, which could adversely affect our business.

We will also collect and use certain types of information from our customers in accordance with the privacy policies posted on our websites. We will collect personally identifiable information directly from our platform’s users when they register to use our service, fill out their listener profiles, post comments, use our service’s social networking features, participate in polls and contests and sign up to receive email newsletters. We may also obtain information about our platform’s users from other platform users and third parties. We also collect information from customers using our other websites in order to provide ticketing services and other user support. Our policy is to use the collected information to customize and personalize our offerings for platform users and other customers and to enhance the listeners’ experience when using our service.

The sharing, use, disclosure and protection of personally identifiable information and other user data are governed by existing and evolving federal, state and international laws. We could be adversely affected if legislation or regulations are expanded to require changes in business practices or privacy policies, or if governing jurisdictions interpret or implement their legislation or regulations in ways that negatively affect our business, financial condition and results of operations. We intend to attract users from all over the world, and as we expand into new jurisdictions, the costs associated with compliance with these regulations increases. It is possible that government or industry regulation in these markets will require us to deviate from our standard processes, which will increase operational cost and risk. We intend to commit capital resources to ensure our compliance with any such regulations.

Intellectual Property

While we do not currently have a trademark on the LiveXLive name, we plan to apply to register the trademark for the name in the future, and we intend to protect our trademarks, brands, copyrights, patents and other original and acquired works, ancillary goods and services. In connection with the Wantickets acquisition, we acquired a trademark for the Wantickets name. We believe that certain trademarks and other proprietary rights that we may apply for or otherwise obtain will have significant value and will be important to our brand-building efforts and the marketing of our services. We cannot predict, however, whether steps taken by us to protect our proprietary rights will be successful or adequate to prevent misappropriation, infringement or other violation of these rights. Upon the consummation of any future acquisitions, we may acquire additional registered trademarks, as well as applied-for trademarks potentially for worldwide use.

Legal Proceedings

On March 3, 2016, Blink TV Limited and Northstar Media, Inc. (collectively, “Plaintiffs”) filed a claim in the Los Angeles County Superior Court of California against Loton and LXL, alleging breaches of two different license agreements for the live-streaming rights to “Bestival,” an annual music festival which takes place on the Isle of Wight in England. LXL and Loton demurred to the complaint on May 10, 2016, and, prior to the hearing on the demurrer, Plaintiffs amended their complaint. The amended complaint no longer states a claim against Loton and only states a single cause of action against LXL for the alleged breach of a single license agreement. Plaintiffs are seeking $300,000 in damages.

| 18 |

To date, LXL has vigorously contested Plaintiffs’ claims. In doing so, LXL filed a cross-complaint against Plaintiffs for breach of contract and breach of the implied covenant of good faith and fair dealing, on December 23, 2016. On May 11, 2017 the parties agreed to a mediation currently scheduled for June 2017, and a trial is set for March 2018.

We are currently not aware of any other pending legal proceedings. From time to time, we may become involved in various lawsuits and legal proceedings that arise in the ordinary course of business. An adverse result in these or other matters may have, individually or in the aggregate, a material adverse effect on our business, financial condition or operating results.

Employees

As of June 9, 2017, we had 24 full-time employees. We are not party to any collective bargaining agreements and have not experienced any strikes or work stoppages. We believe we enjoy strong relationships with all of our employees. In addition to our employees, we engage key consultants and utilize the services of independent contractors to perform various services on our behalf. Some of our executive officers and directors are engaged in outside business activities that we do not believe conflict with our business, and we anticipate that such officers and directors will devote limited time to our business until after the completion of our underwritten public offering pursuant to our Registration Statement on Form S-1, filed with the SEC on May 11, 2017 (the “Public Offering”).

Management Services from Trinad Management

Trinad Management LLC (“Trinad Management”), an affiliate of Mr. Ellin, our Executive Chairman and President, provides management and other services to us for a monthly cash fee of $30,000. We intend to terminate this arrangement upon completion of the Public Offering.

Going Concern

We are dependent upon the receipt of capital investment and other financing to fund our ongoing operations and to execute our business plan. If continued funding and capital resources are unavailable at reasonable terms, we may not be able to implement our plan of operations. We may be required to obtain alternative or additional financing, from financial institutions or otherwise, in order to maintain and expand our existing operations. The failure by us to obtain such financing would have a material adverse effect upon our business, financial condition and results of operations.