Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Presbia PLC | lens-8k_20170531.htm |

Jefferies Healthcare Conference **Confidential** June 2017 CAUTION - Investigational Device. Limited by Federal (or United States) law to investigational use. Exhibit 99.1

Disclosure To the extent statements contained in this presentation are not descriptions of historical facts regarding Presbia PLC and its subsidiaries (collectively “Presbia,” “we,” “us,” or “our”), they are forward-looking statements reflecting management’s current beliefs and expectations. Forward-looking statements are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance, or achievements to be materially different from those anticipated by such statements. You can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “intends,” or “continue,” or the negative of these terms or other comparable terminology. Forward-looking statements contained in this presentation include, but are not limited to, statements regarding: (i) the initiation, timing, progress and results of our clinical trials, our regulatory submissions and our research and development programs; (ii) our ability to advance our products into, and successfully complete, clinical trials; (iii) our ability to obtain pre-market approvals; (iv) the commercialization of our products; (v) the implementation of our business model, strategic plans for our business, products and technology; (vi) the scope of protection we are able to establish and maintain for intellectual property rights covering our products and technology; (vii) estimates of our expenses, future revenues, growth of operations, capital requirements and our needs for additional financing; (viii) the timing or likelihood of regulatory filings and approvals; (ix) our financial performance; (x) developments relating to our competitors and our industry; and (xi) statements regarding our markets, including the estimated size and anticipated growth in those markets. Various factors may cause differences between our expectations and actual results, including those risks discussed under “Risk Factors” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 29, 2017 and those risks discussed under “Risk Factors” in other reports we may file with the Securities and Exchange Commission. Except as required by law, we assume no obligation to update these forward-looking statements publicly or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future.

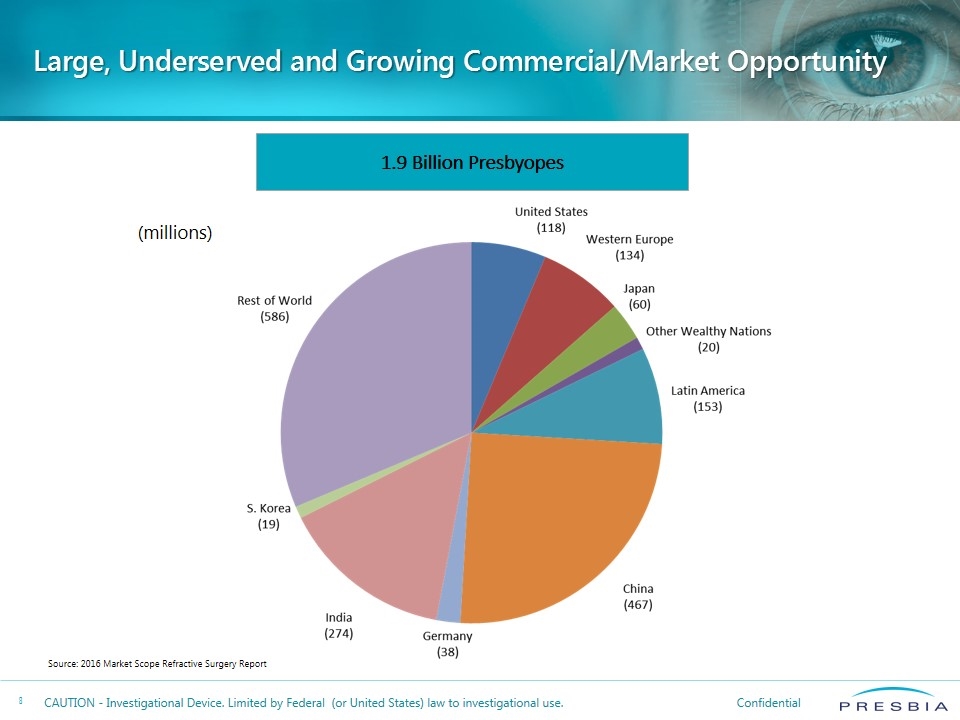

Business Highlights 118 million presbyopes in the U.S.; 1.9 billion presbyopes worldwide (2016)* Large, Underserved Presbyopia Opportunity Best-in-Class Microlens Technology Strong Leadership and Compelling Business Model Refractive corneal inlay restores reading vision—on average 5 lines of improvement which is the highest reported UNVA change‡ Wide range of lens size refractive powers to offer patients a customized therapy—competitors offer single size Compatible with additional diagnostic and surgical procedures (e.g. cataract surgery)—competitors are not§ Senior ophthalmic and global medical device experience; major KOLs worldwide supporting Presbia Compelling surgery center economics: 100% private pay, ~10 minute procedure time, leverage large installed base of femtosecond lasers Irish domicile FDA Pathway Developed Ophthalmic Surgery Market Over 4,000 global ophthalmic surgery centers with no effective treatment of presbyopia† We believe ophthalmic surgeons are highly motivated to develop this market to replace lost LASIK volumes and utilize installed base of expensive femtosecond lasers CE-marked, 1000+ lenses implanted globally Ongoing U.S. pivotal trial targeting FDA approval Q3 2018 *Source: Market Scope 2016 †Source: Market Scope 2013 ‡FDA Submission data §OUS Data non-concurrent

Presbia Restores Near Vision Presbia has developed a solution for presbyopia, an age related condition affecting people from approximately 40 years of age, to help restore near vision Safe, effective and minimally invasive surgical procedure Currently marketed in certain markets outside the United States Marketed to people with presbyopia who need reading glasses or contact lenses

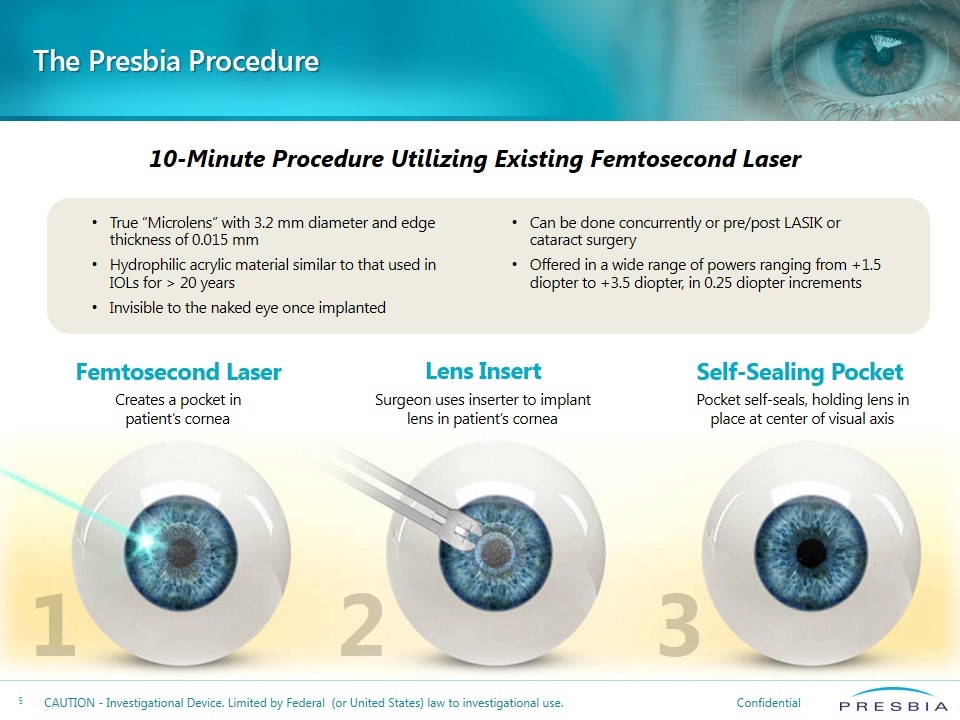

True “Microlens” with 3.2 mm diameter and edge thickness of 0.015 mm Hydrophilic acrylic material similar to that used in IOLs for > 20 years Invisible to the naked eye once implanted Can be done concurrently or pre/post LASIK or cataract surgery Offered in a wide range of powers ranging from +1.5 diopter to +3.5 diopter, in 0.25 diopter increments The Presbia Procedure 10-Minute Procedure Utilizing Existing Femtosecond Laser Femtosecond Laser 1 Creates a pocket in patient’s cornea 3 2 Lens Insert Surgeon uses inserter to implant lens in patient’s cornea Self-Sealing Pocket Pocket self-seals, holding lens in place at center of visual axis

The Presbia Flexivue MicrolensTM The Presbia Flexivue Microlens™ is a best in class treatment option for presbyopia A powered corneal inlay is implanted in the non-dominant eye, with minimal impact to binocular distance vision Presbia has unique competitive advantages A refractive lens like reading glasses Designed to be removable The only option that is adjustable as you age (replace to a higher power) Can easily be done before or after LASIK or cataract surgery

Competitive Landscape AcuFocus - KAMRA Non-powered “disc” implanted in the non-dominant eye Utilizes the “pinhole effect” to focus light to enhance near vision The disc is visible to naked eye in light colored eyes Difficult for patient in low light environments Obstructs the view of the retina in diagnostic exams and cataract surgery Requires capital outlay from physician for “centration” equipment Revision Optics - Raindrop Hydrogel placed under a LASIK-like flap in the non dominant eye Changes the curvature of the cornea by adding volume under the flap Non-powered Challenging to remove Corneal inlays are an exciting surgical treatment for presbyopia There are two primary competitors in the corneal inlay space

Large, Underserved and Growing Commercial/Market Opportunity 1.9 Billion Presbyopes Source: 2016 Market Scope Refractive Surgery Report (millions)

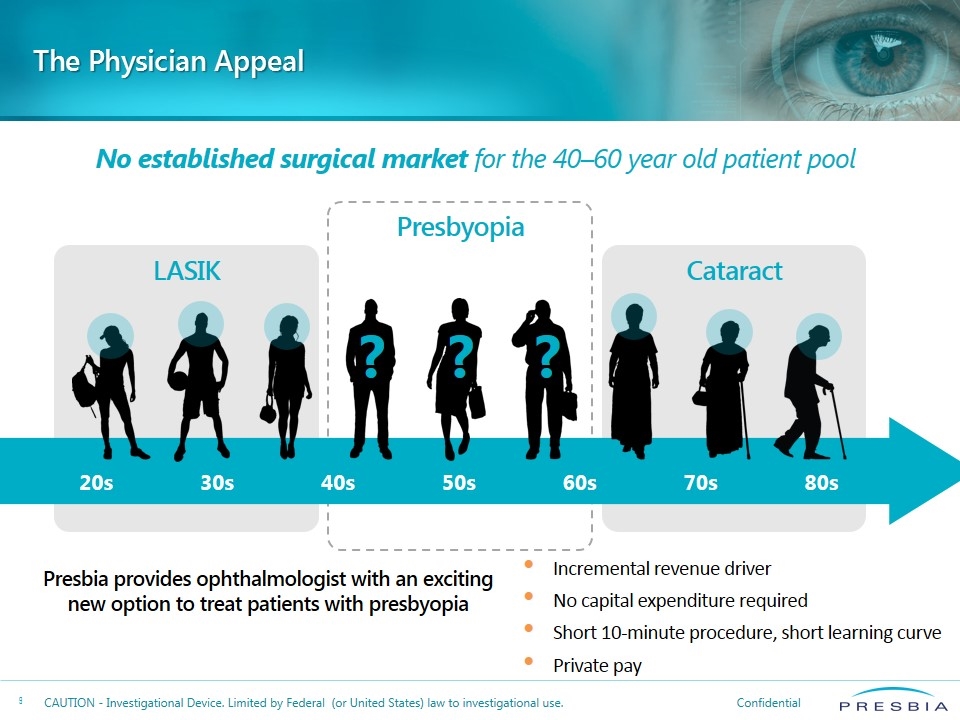

The Physician Appeal LASIK Cataract Presbyopia No established surgical market for the 40–60 year old patient pool 20s 30s 40s 50s 60s 70s 80s ? ? ? Presbia provides ophthalmologist with an exciting new option to treat patients with presbyopia Incremental revenue driver No capital expenditure required Short 10-minute procedure, short learning curve Private pay

Commercial Opportunity - LASIK as a Market Benchmark * Market Scope, 2014 Corneal inlay has the potential to impact the Presbyopia market similar to LASIK’s impact on vision correction in younger patients Presbia Flexivue Microlens™ requires a less invasive procedure About 1.6x more people suffer from presbyopia than the conditions that LASIK treats (myopia, astigmatism, and hyperopia) Rapid commercial acceptance of cash pay medical procedure to eliminate glasses Serves early adult demographic, which is now approaching the age at which near vision deteriorates Grew 1230% in the first 5 years of US commercialization – to over 1.2 million procedures annually Steady state is about 2.8 million* procedures per year in North America, Europe and Asia Internal survey of 143 LASIK patients indicate 75% would use a surgical solution to eliminate reading glasses Positive takeaways from LASIK market: 75

Focused Commercial Strategy Build global KOL acceptance carrying momentum into US commercial launch Registered to commercialize in 42 different countries Clinics implanting in South Korea, Germany, Ireland, UK, Netherlands, Australia/NZ, and Canada Gain FDA approval and begin marketing in the United States Adjust marketing strategy to differentiate Presbia Flexivue Microlens™ from corneal inlay competitors

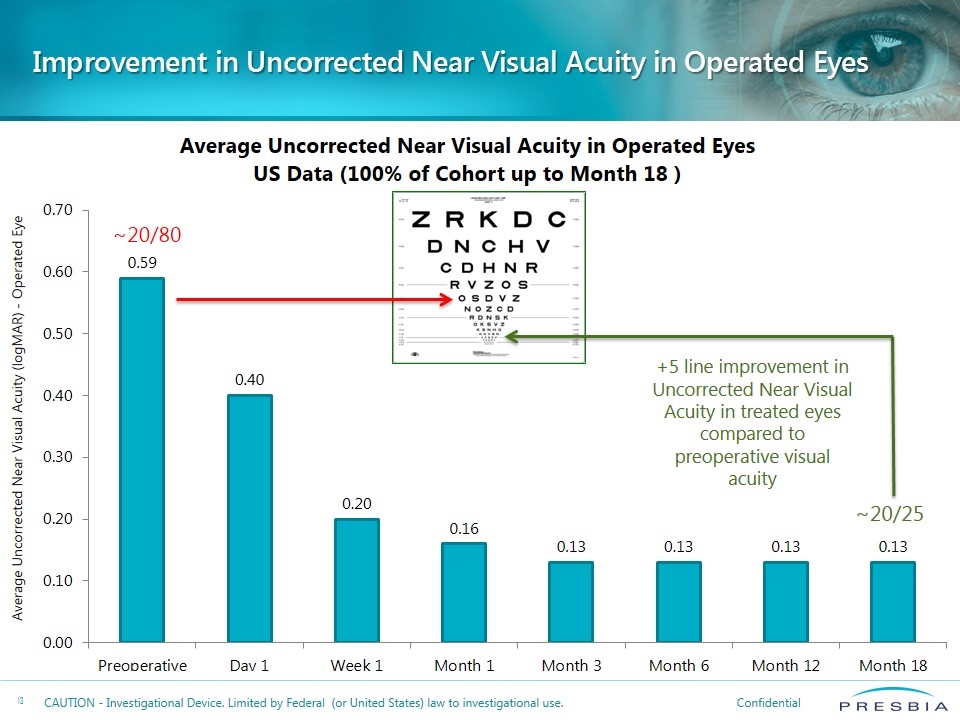

Compelling Results Subjects can perform almost all near vision tasks without glasses For example, an improvement from reading a subhead in the newspaper (12pt font) to reading the content label (4pt font) on a medicine bottle

Improvement in Uncorrected Near Visual Acuity in Operated Eyes ~20/80 ~20/25 +5 line improvement in Uncorrected Near Visual Acuity in treated eyes compared to preoperative visual acuity

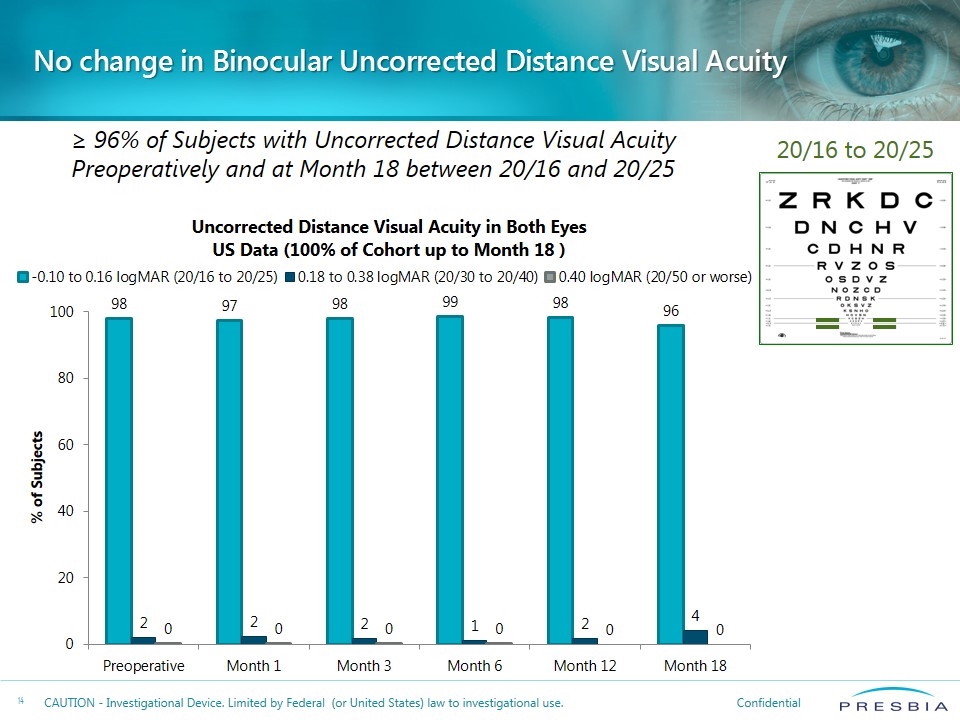

No change in Binocular Uncorrected Distance Visual Acuity 20/16 to 20/25 ≥ 96% of Subjects with Uncorrected Distance Visual Acuity Preoperatively and at Month 18 between 20/16 and 20/25

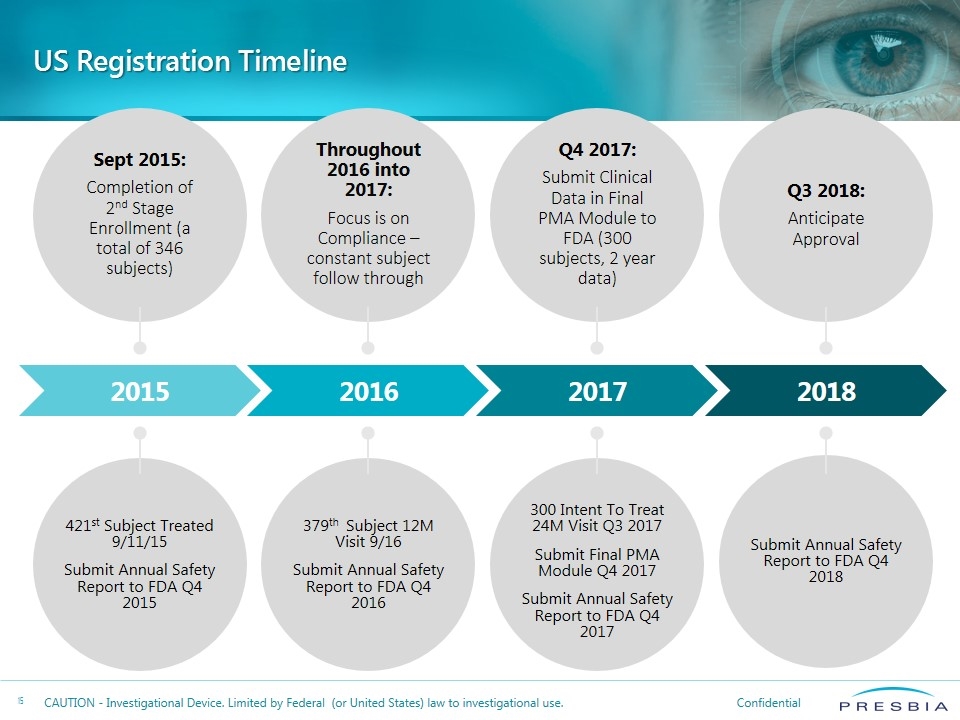

Sept 2015: Completion of 2nd Stage Enrollment (a total of 346 subjects) Throughout 2016 into 2017: Focus is on Compliance – constant subject follow through Q4 2017: Submit Clinical Data in Final PMA Module to FDA (300 subjects, 2 year data) Q3 2018: Anticipate Approval 421st Subject Treated 9/11/15 Submit Annual Safety Report to FDA Q4 2015 379th Subject 12M Visit 9/16 Submit Annual Safety Report to FDA Q4 2016 300 Intent To Treat 24M Visit Q3 2017 Submit Final PMA Module Q4 2017 Submit Annual Safety Report to FDA Q4 2017 Submit Annual Safety Report to FDA Q4 2018 US Registration Timeline 2015 2016 2017 2018

Business Highlights 118 million presbyopes in the U.S.; 1.9 billion presbyopes worldwide (2016)* Large, Underserved Presbyopia Opportunity Best-in-Class Microlens Technology Strong Leadership and Compelling Business Model Refractive corneal inlay restores reading vision—on average 5 lines of improvement which is the highest reported UNVA change‡ Wide range of lens size refractive powers to offer patients a customized therapy—competitors offer single size Compatible with additional diagnostic and surgical procedures (e.g. cataract surgery)—competitors are not§ Senior ophthalmic and global medical device experience; major KOLs worldwide supporting Presbia Compelling surgery center economics: 100% private pay, ~10 minute procedure time, leverage large installed base of femtosecond lasers Irish domicile FDA Pathway Developed Ophthalmic Surgery Market Over 4,000 global ophthalmic surgery centers with no effective treatment of presbyopia† We believe ophthalmic surgeons are highly motivated to develop this market to replace lost LASIK volumes and utilize installed base of expensive femtosecond lasers CE-marked, 1000+ lenses implanted globally Ongoing U.S. pivotal trial targeting FDA approval Q3 2018 *Source: Market Scope 2016 †Source: Market Scope 2013 ‡FDA Submission data §OUS Data non-concurrent

CAUTION - Investigational Device. Limited by Federal (or United States) law to investigational use.