Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - 12 Retech Corp | devago_ex321.htm |

| EX-31.1 - CERTIFICATION - 12 Retech Corp | devago_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

|

For the fiscal year ended November 30, 2016 |

|

|

|

|

¨ |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

|

For the transition period from ______________ to ______________ |

Commission file number 333-201319

|

Devago, Inc. |

|

(Exact name of registrant as specified in its charter) |

|

Nevada |

38-3954047 | |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

Calle Dr. Heriberto Nunez #11A, Edificio Apt. 104, Dominican Republic |

| |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 809-994-4443

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange On Which Registered |

|

N/A |

|

N/A |

Securities registered pursuant to Section 12(g) of the Act:

N/A

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-K (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

¨ |

Accelerated filer |

¨ |

|

Non-accelerated filer |

¨ |

Smaller reporting company |

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes x No ¨

The aggregate market value of Common Stock held by non-affiliates of the Registrant on May 31, 2016, was $Nil based on a $Nil average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. (There was no bid or ask price of our common shares during this year).

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date.

24,582,004 common shares as of March 3, 2017.

DOCUMENTS INCORPORATED BY REFERENCE

None.

PART I

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this current report and unless otherwise indicated, the terms “we”, “us”, “our” and “Devago” mean Devago Inc., unless otherwise indicated.

General Overview

We were incorporated under the laws of the State of Nevada on September 8, 2014. We are in the business of acquiring, developing, marketing and selling mobile application software.

We have not generated revenues and have limited cash on hand. We have sustained losses since inception and have relied upon loans from our sole director and officer and the sale of our securities for funding. We have never declared bankruptcy, been in receivership, or involved in any kind of legal proceeding.

Our Current Business

We are a development stage company in the business of acquiring, developing, marketing and selling mobile application software. Our operations, to date, have been devoted primarily to startup and development activities, which include the following:

|

|

· | Formation of the company; |

|

|

|

|

|

|

· | Development of our business plan; |

|

|

|

|

|

|

· | Building an online presence; |

|

|

|

|

|

|

· | Design and development of our initial mobile application |

Currently, we have no fully-developed revenue generating mobile applications. We intend to build a harmonious portfolio of apps that will service a wide range of industries and consumers. We currently have one application (Hotchek) in our portfolio. Hotchek is a multi-use customizable application designed to enable users to easily engage their network audience with the use of highly interactive polls and surveys.

| 3 |

| Table of Contents |

We expect that Apple and Android online App stores will be the primary distribution, marketing, promotion and payment platform for our mobile Apps. Operations will also take place through our company website “devagoinc.com,” which intends to serve as a multipurpose marketplace for the sale of our mobile applications.

Our planned website, devagoinc.com, is in the development stage. In addition, our product offering is also in the development stage. We have only recently begun operations, have no sales or revenues, and therefore rely upon the sale of our securities or debt financing to fund our operations. We have a going concern uncertainty as of the date of our most recent financial statements.

We intend to meet our cash requirements for the next 12 months by generating revenue and through a combination of debt financing and equity financing. We currently do not have any arrangements or commitments in place to complete any private placement financings and there is no assurance that we will be successful in completing any such financings on terms that will be acceptable to us.

As we did not raise the $105,000 budget that we require to implement our business plan as anticipated, we will scale our business development in line with available capital. Our primary priority will be to retain our reporting status with the SEC which means that we will first ensure that we have sufficient capital to cover our corporate, legal and accounting expenses. We will likely not expend funds on the remainder of our planned activities unless we have the required capital.

We will prioritize our corporate activities as chronologically laid out below as these activities need to be undertaken as a prerequisite for future operations.

Market Trends and Opportunity

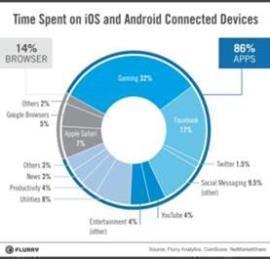

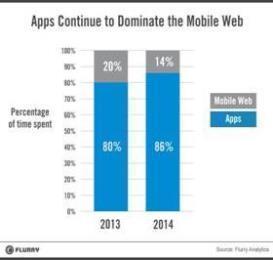

It is still too early to predict the trajectory that apps will take; however, it is becoming clear - the mobile browser is taking a back seat to mobile apps. Analytics firm Flurry has published data on mobile usage by US consumers during Q1 2014. While users are spending more time on their devices (an average of 2 hours and 42 minutes per day, up four minutes on the same period last year), how they use that time has changed as well. Only 22 minutes per day are spent in the browser, with the balance of time focused on applications. This is a reality that enterprises around the world are now taking on in the development of their marketing and business strategies.

|

|

|

| 4 |

| Table of Contents |

Devago believes the mobile channel is opening up new ways for companies to nurture customer relationships in ways not possible in the past. Via the deployment of strategic apps, mobile presents businesses with a unique opportunity to engage customers with a product or service anytime, anywhere, in a manner that is specifically tuned to their individual needs. The mobile experience also delivers a rich set of analytics that provides hard-to-come-by insights into everything from a customer’s buying behavior to his or her actual physical location, allowing companies to custom tailor the conversation while also setting the stage for interaction that is all about intention.

Mobile opens up a world of data that no other channel can provide, with access to a user’s on-the-go lifestyle, consumption habits, social, transactions and is the fabric to connecting to the world around us – it truly tells marketers who their consumer is. We believe that we have the expertise and keen eye for applications that facilitate mobile relationship marketing (MRM) as a critical area for companies to gain competency and competitive advantage. We endeavor to become one of leading mobile applications providers within the space of mobile relationship marketing.

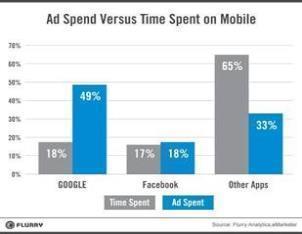

The Graph above is a breakdown of the overall mobile advertising revenues spent versus time spent on Mobile. Google accounts for 18% of time spent on Mobile and has a high market share in terms of ad revenues at 49.3% of advertising spent. The rest of the apps, including gaming apps, are simply not getting their fair share of advertising spent. The “other” apps command 65.3% of time spent but only receive 32% of ad revenues. We believe this represents a massive opportunity for applications to monetize through advertising. Globally ad spend jumped by 105% in 2013. eMarketer also projects that the mobile ad market will grow 75% in 2014 for a total of $31.5 billion, making the opportunity even bigger. Please note, while the foregoing industry predictions are based on publicly available third party industry reports, there are wide ranging variations in the predictions regarding the size of the future mobile applications market and undue reliance should not be placed on these statistics.

Current Product

Our primary products will be mobile applications. We plan to develop internal mobile applications and also to acquire existing mobile applications (“apps”) that are complementary to our existing business and the breadth of our offerings. We intend to build a harmonious portfolio of apps that will service a wide range of industries and consumers.

| 5 |

| Table of Contents |

Currently, we have not fully-developed revenue generating mobile applications. We currently have one application (Hotchek) in our portfolio. Hotchek is a multi-use customizable application designed to enable users to easily engage their network audience with the use of highly interactive polls and surveys.

Hotchek is currently in its second phase of the final stage of development. To date, we have paid Softaddicts $15,000 to help develop the Hotcheck application. Softaddicts is no longer being used for development of our software as the development team has changed as the project migrated into the second phase.

During the first phase of development the following services were provided:

| 1. | Application and form design; |

|

|

|

| 2. | Database design and architecture; |

|

|

|

| 3. | Programmatic code to connect the forms to the database; and |

|

|

|

| 4. | Compile iOS and Android applications. |

There were no statements of work in connection the above services.

Mr. Crespo oversaw the development work by Softaddicts, made modifications as needed and tested the source imagery and marketing content for the messaging. The services provided by Softaddicts and Mr. Crespo resulted in a working prototype of the application and information page about its functions. This information page is found at http://wwha.softaddicts.com/public-campaigns. Our sole officer and director loaned us $15,000 to pay Softaddicts under an 8% demand promissory note dated February 5, 2015. We no longer use the services of Softaddicts as their scope of work has concluded.

We have planned for three releases associated with the Hotchek app, with the following features and costs:

| 1. | During Phase 1 we developed release one where approximately 70% of the prototype was completed. |

|

|

|

| 2. | Release two will require an additional $15,000 and take 30-60 additional days to complete. |

|

|

|

| 3. | Release three will be based on the feedback from customers using released versions of release one and two. The time period and budget is unknown until we receive feedback and have a better understanding of the amount of development work required. |

We have completed release one and continue to work on release two of the Hotchek app and hope to have it ready for commercial sale during the 3rd quarter of 2017.

We expect to complete releases one and two of the Hotchek app and have it ready for commercial sale in 2017.

The completion of releases two and three are contingent on the company receiving adequate funding.

During the period from September to November, 2015, the Company performed design and implementation of the Chrome extension, iOS, and Android Apps for Hotchek. A framework was completed to solidify short and long term goals of the product. Unit testing was also completed, and functionality of the extension was tested. Scalability of the projects have been considered during design of the applications.

During the period from December, 2015, to February, 2016, the UAT of the chrome extension was completed, and the product was tested across different versions, screen resolutions, and operating systems. Customer feedback was sought on the usability of the extension, and changes were made to incorporate customer suggestions. The application was made ready for live deployment. Work was completed on the coding of the mobile apps for Andriod and iOS. Unit testing of the mobile apps was completed during this period, involving testing on various versions of the operating systems and hardware.

Aside from our internal applications, we plan to acquire Apps that are currently in development, as well as apps that are ready to be presented to the public. We plan to specialize in apps that are used to increase the customer connection, often with a social aspect; enable self-service; and obtain better information on customer preferences.

| 6 |

| Table of Contents |

Revenue Generation

We plan to derive revenue by way of the sale of our developed and acquired mobile applications as well as through advertisement integration. We plan to use advertising integration in the free versions of our mobile applications that are downloaded by consumers/end users. We will also look to generate revenue from clients by sale of premium subscription packages that offer greater levels of usage or access to advanced features within the application.

We are engaged in the monetization of mobile application software or “Apps” through four revenue generating platforms: (i) development of customized Apps for third parties to monetize their particular intellectual property, persona or brand, (ii) incubation of Apps in partnership with third parties, (iii) sale of advertising and sponsorship opportunities directly to brands via mobile advertising networks and (iv) acquisition of Apps from other developers and use of a proprietary application programming interface, or API, to make Apps recommendations for our user base.

Marketing

Awareness of the services, competitive advantages and revenue potential that we are able to provide through our mobile applications, is expected to be delivered through the implementation of a number of marketing initiatives including search engine optimization, website completion, hosted video demonstrations, third party service contacts, product reviews, tradeshow attendance, as well as blogging and other forms of social media which are driven by technology and mobile flexibility. These efforts and the resulting awareness will be key drivers behind the success of our revenue producing operations.

Company Website – We believe that using the internet is a great marketing tool not only for providing information on our company, but also for providing current information on our upcoming apps as well as industry related information regarding new technology and device updates. We have developed our preliminary website, and are in the process of developing a more advanced site where we can provide more detailed information regarding our apps designs and features. We have not yet recognized revenues from the website nor is there any indication that we ever will recognize direct revenues from our website. We are currently in the process of updating our website.

App Landing Page - Apart from the app page within the app store, a dedicated website for our application is necessary to harness the potential of search engines. Apart from the major ASO factors, search engines and SEO can also be used as a potential route to app discovery. If our app gathers enough traction and momentum, it will attract positive ratings and would rank better for a relevant search query in the app stores as well.

Integration into our clients’ existing advertising and marketing strategies -We will focus a significant portion of our marketing and public relations efforts towards soliciting corporations or organizations to use our Hotchek mobile application within their online advertising and marketing campaigns.

We anticipate expansive growth of our subscriber base as enlisted enterprises reach out to their customers or end users to download and use our mobile application as a means to completing their interactive survey or questionnaire. We will focus its sales and promotional efforts towards organizations that have a high business to consumer component and want to deliver their brand via the mobile application space but do so in a more cost effective and time efficient manner. Focused efforts will be placed on entities with large established contact lists that are seeking innovative ways to engage their customers or end users.

Our eventual aim is to have a large enough subscriber base to attract integrated advertising revenue from big brand companies.

| 7 |

| Table of Contents |

Customers

We currently have no customers. We are focused on several commercial enterprise markets.

For commercial use of our applications, a typical prospective customer would include;

·

Travel Agencies

·

Model/Talent Agencies

·

Product retailer

·

Service providers

·

Bars & Restaurants

·

Film Industry

·

Auto Dealers

·

Music Industry

We plan to identify and address additional target categories and industries for our products based on market research and feedback from our customers.

Competition

The app development market is very competitive, with many companies developing apps worldwide.

There are many companies who compete directly with our products and services. These companies may already have an established market in our industry. Most of these companies have significantly greater financial and other resources than us and have been developing their products and services longer than we have been developing ours. Additionally, there are not significant barriers to entry in our industry and new companies may be created that will compete with us and other, more established companies who do not now directly compete with us, may choose to enter our markets and compete with us in the future.

The business in which we operate is highly competitive. Continued evolution in the industry, as well as technological advancements, is opening up the market to increased competition. Other key competitive factors include: industry consolidation; price; availability of financing; product and system performance; product quality, availability and warranty; the quality and availability of service; company reputation; and time-to-market.

Intellectual Property, Proprietary Rights, Patents and Trademarks

We currently have no patents or trademarks on our brand name and have not and do not intend to seek protection for our brand name or our mobile applications at this time; however, as business develops and operations continue, we may seek such protection. Despite efforts to protect our proprietary rights, such as our brand and service names, since we have no patent or trademark rights unauthorized persons may attempt to copy aspects of our business, including our web site design, services, product information and sales mechanics or to obtain and use information that we regards as proprietary. Any encroachment upon our proprietary information, including the unauthorized use of our brand name, the use of a similar name by a competing company or a lawsuit initiated against us for infringement upon another company’s proprietary information or improper use of their trademark, may affect our ability to create brand name recognition, cause customer confusion and/or have a detrimental effect on our business. Litigation or proceedings before the U.S. or International Patent and Trademark Offices may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets and domain name and/or to determine the validity and scope of the proprietary rights of others. Any such litigation or adverse proceeding could result in substantial costs and diversion of resources and could seriously harm our business operations and/or results of operations.

Government and Industry Regulation

We will be subject to local and international laws and regulations that relate directly or indirectly to our operations. We will also be subject to common business and tax rules and regulations pertaining to the operation of our business. We believe that the effects of existing or probable governmental regulations will be additional responsibilities of the management of the Company to ensure that we are in compliance with securities regulations as they apply to our products as well as ensuring that the company does not infringe on any proprietary rights of others with respect to its products. We will also need to maintain accurate financial records in order to remain complaint with securities regulations as well as any corporate tax liability we incur.

| 8 |

| Table of Contents |

Employees and Employment Agreements

With the majority of our back office operational costs outsourced and variable, we are able to maintain a small employee base focused on income producing activities. Currently, we have one employee, which is our sole officer and director.

We currently do not have any employment agreements with our officers or directors.

Seasonality

We do not have a seasonal business cycle.

Research and Development

We have incurred $Nil in research and development expenditures over the last two fiscal years.

Item 1A. Risk Factors

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 1B. Unresolved Staff Comments

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Currently, we do not own any real estate. We are leasing our corporate offices, which are located at Calle Dr. Heriberto Nunez #11A, Edificio Apt. 104, Dominican Republic. Mr. Jose, supplies this office space on a rent-free basis. We do not expect this arrangement to be changed during the next 12 months.

We know of no material pending legal proceedings to which our company is a party or of which any of our properties, or the properties of our subsidiaries, is the subject. In addition, we do not know of any such proceedings contemplated by any governmental authorities.

We know of no material proceedings in which any of our directors, officers or affiliates, or any registered or beneficial stockholder is a party adverse to our company or has a material interest adverse to our company or our subsidiaries.

Item 4. Mine Safety Disclosures

Not applicable.

Our shares of common stock were listed for quotation on the OTCPink of the OTC Markets on September 25, 2015 under the symbol “DVGG”. To date, no trades of our common stock have occurred.

There is currently no active trading market for our securities. There is no assurance that a regular trading market will develop, or if developed, that it will be sustained. Therefore, a shareholder may be unable to resell his securities in our company.

| 9 |

| Table of Contents |

Our shares are issued in registered form. Action Stock Transfer Corporation, 2469 E. Fort Union Blvd., Suite 214, Salt Lake City, Utah, 84121 (Telephone: (801) 274-1088; Facsimile: (801) 274-1099 is the registrar and transfer agent for our common shares.

On November 30, 2016, the shareholders’ list showed 34 registered shareholders with 24,582,004 shares of common stock outstanding.

Penny Stock

The Securities Exchange Commission has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the Commission, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;(b) contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities’ laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price;(d) contains a toll-free telephone number for inquiries on disciplinary actions;(e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and;(f) contains such other information and is in such form, including language, type, size and format, as the Commission shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with; (a) bid and offer quotations for the penny stock;(b) the compensation of the broker-dealer and its salesperson in the transaction;(c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statements showing the market value of each penny stock held in the customer’s account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock if it becomes subject to these penny stock rules. Therefore, because our common stock is subject to the penny stock rules, stockholders may have difficulty selling those securities.

Dividend Policy

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

|

|

1. | we would not be able to pay our debts as they become due in the usual course of business, or; |

|

|

|

|

|

|

2. | our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. |

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

| 10 |

| Table of Contents |

Equity Compensation Plan Information

We do not have any equity compensation plans.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

We did not sell any equity securities which were not registered under the Securities Act during the year ended November 30, 2016 that were not otherwise disclosed on our quarterly reports on Form 10-Q or our current reports on Form 8-K filed during the year ended November 30, 2016.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fourth quarter of our fiscal year ended November 30, 2016.

Item 6. Selected Financial Data

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with our consolidated audited financial statements and the related notes that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this annual report.

Our consolidated audited financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

Plan of Operations and Cash Requirements

We anticipate that we will meet our ongoing cash requirements through equity or debt financing. We estimate that our expenses over the next 12 months will be approximately $105,000 as described in the table below. These estimates may change significantly depending on the nature of our future business activities and our ability to raise capital from shareholders or other sources.

|

Description |

|

Estimated Completion Date |

|

Estimated |

| |

|

Offering expenses |

|

Current |

|

$ | 20,000 |

|

|

Legal and accounting fees |

|

12 months |

|

$ | 25,000 |

|

|

Product Development |

|

12 months |

|

$ | 25,000 |

|

|

Website Development |

|

12 months |

|

$ | 10,000 |

|

|

Sales and Marketing |

|

12 months |

|

$ | 25,000 |

|

|

Working Capital |

|

12 months |

|

$ | 20,000 |

|

|

Total |

|

|

|

$ | 105,000 |

|

We expect that we will require additional capital to meet our long term operating requirements. We are currently looking to secure additional financing to focus on completing phases two and three of Hotchek app and for updating our website, product development and sales and marketing activities.

| 11 |

| Table of Contents |

Results of Operations

The following summary of our results of operations should be read in conjunction with our financial statements for the year ended November 30, 2016, which are included herein.

Our operating results for the twelve months ended November 30, 2016, for the twelve months ended November 30, 2015 and the changes between those periods for the respective items are summarized as follows:

|

|

|

Twelve Month Period Ended November 30, 2016 |

|

|

Twelve Month Period Ended November 30, 2015 |

|

|

Change Between Twelve Month Periods Ended November 30, 2016 and November 30, 2015 |

| |||

|

|

|

$ |

Nil |

|

|

$ |

Nil |

|

|

$ |

- |

|

|

General and administrative expenses |

|

|

16,498 |

|

|

|

1,205 |

|

|

|

15,293 |

|

|

Professional fees |

|

|

25,865 |

|

|

|

38,345 |

|

|

|

(12,480 | ) |

|

Depreciation and amortization |

|

|

2,160 |

|

|

|

1,755 |

|

|

|

405 |

|

|

Operating expenses |

|

$ | (44,523 | ) |

|

$ | (41,305 | ) |

|

$ | (3,218 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

$ | (1,196 | ) |

|

$ | (945 | ) |

|

$ | (251 | ) |

|

Gain (loss) on foreign exchange |

|

|

34 |

|

|

|

(231) |

|

|

|

265 |

|

|

Net Loss |

|

$ | (45,685 | ) |

|

$ | (42,481 | ) |

|

$ | (3,204 | ) |

Our financial statements report a net loss of $45,685 for the twelve month period ended November 30, 2016 compared to a net loss of $42,481 for the twelve month period ended November 30, 2015. Our losses have increased by $3,204, primarily as a result of an increase of general and administrative expenses of $15,293, offset by a decrease in professional fees of $12,480.

Our operating expenses for the year ended November 30, 2016 were $44,523 compared to $41,305 as of November 30, 2015.

Liquidity and Financial Condition

Working Capital

|

|

|

At November 30, 2016 |

|

|

At November 30, 2015 |

| ||

|

Current assets |

|

$ | 23 |

|

|

$ | 4,914 |

|

|

Current liabilities |

|

|

40,859 |

|

|

|

17,225 |

|

|

Working capital (deficit) |

|

$ | (40,836 | ) |

|

$ | (12,311 | ) |

Cash Flows

|

|

|

Year Ended |

| |||||

|

|

|

November 30 |

| |||||

|

|

|

2016 |

|

|

2015 |

| ||

|

Net cash (used in) operating activities |

|

$ | (16,480 | ) |

|

$ | (39,270 | ) |

|

Net cash (used in) investing activities |

|

|

- |

|

|

|

(15,000 | ) |

|

Net cash from (used in) financing activities |

|

|

11,589 |

|

|

|

44,184 |

|

|

Net increase (decrease) in cash during period |

|

$ | (4,891 | ) |

|

$ | (10,086 | ) |

| 12 |

| Table of Contents |

Our total current liabilities as of November 30, 2016 were $40,858 as compared to total current liabilities of $17,225 as of November 30, 2015. The increase was primarily due to an increase of amounts due to related party, which were incurred through expenses paid by a related party on behalf of the Company.

Operating Activities

Net cash used in operating activities was $16,480 for the year ended November 30, 2016 compared with net cash used in operating activities of $39,270 in the same period in 2015. Net cash used in operating activities during 2016 were comprised of a net loss of $45,685, amortization expense of $2,160, increase in accounts payable of $10,844, and accrued interest expense of $1,200. Net cash used in operating activities during the year ended November 30, 2015 was comprised of a net loss of $42,481, amortization expense of $1,755, increase in accounts payable of $247and accrued interest expense of $977.

Investing Activities

Net cash used in investing activities was $0 for the year ended November 30, 2016 compared to net cash used in investing activities of $15,000 in the same period in 2015. The net cash used in investing activities for the year ended November 30, 2015 was due to acquisition of property plant and equipment.

Financing Activities

Net cash from financing activities was $11,589 for the year ended November 30, 2016 compared to $44,184 provided by financing activities in the same period in 2015. Financing activities for the year ended November 30, 2016 comprised of an increase in due to related party of $11,589. Financing activities for the year ended November 30, 2015 comprised of an increase in due to related party of $16,000 and issuance of common stock for $28,124.

Contractual Obligations

As a “smaller reporting company”, we are not required to provide tabular disclosure obligations.

Going Concern

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an on-going business for the next twelve months. Our ability to continue as a going concern is dependent upon our ability to generate future profitable operations and/or obtain the necessary financing to meet our obligations and repay our liabilities arising from normal business operations when they become due. We intend to finance operating costs over the next twelve months through continued financial support from our shareholders and private placements of common stock.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Emerging Growth Company

We are an emerging growth company as defined in Section 2(a)(19) of the Securities Act. We will continue to be an emerging growth company until: (i) the last day of our fiscal year during which we had total annual gross revenues of $1,000,000,000 or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act; (iii) the date on which we have, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or (iv) the date on which we are deemed to be a large accelerated filer, as defined in Section 12b-2 of the Exchange Act.

| 13 |

| Table of Contents |

As an emerging growth company, we are exempt from:

|

|

· | Sections 14A(a) and (b) of the Exchange Act, which require companies to hold stockholder advisory votes on executive compensation and golden parachute compensation; |

|

|

|

|

|

|

· | The requirement to provide, in any registration statement, periodic report or other report to be filed with the Securities and Exchange Commission (the “Commission” or “SEC”), certain modified executive compensation disclosure under Item 402 of Regulation S-K or selected financial data under Item 301 of Regulation S-K for any period before the earliest audited period presented in our initial registration statement; |

|

|

|

|

|

|

· | Compliance with new or revised accounting standards until those standards are applicable to private companies; |

|

|

|

|

|

|

· | The requirement under Section 404(b) of the Sarbanes-Oxley Act of 2002 to provide auditor attestation of our internal controls and procedures; and |

|

|

|

|

|

|

· | Any Public Company Accounting Oversight Board (“PCAOB”) rules regarding mandatory audit firm rotation or an expanded auditor report, and any other PCAOB rules subsequently adopted unless the Commission determines the new rules are necessary for protecting the public. |

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the Jumpstart Our Business Startups Act.

We are also a smaller reporting company as defined in Rule 12b-2 of the Exchange Act. As a smaller reporting company, we are not required to provide selected financial data pursuant to Item 301 of Regulation S-K, nor are we required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002. We are also permitted to provide certain modified executive compensation disclosure under Item 402 of Regulation S-K.

Critical Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. We regularly evaluate estimates and assumptions related to deferred income tax asset valuation allowances. We base our estimates and assumptions on current facts, historical experience and various other factors that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by us may differ materially and adversely from our estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

Revenue Recognition

Revenue from the sale of goods is recognized when the following conditions are satisfied:

|

|

· | We have transferred to the buyer the significant risks and rewards of ownership of the goods; |

|

|

|

|

|

|

· | We retain neither continuing managerial involvement to the degree usually associated with ownership nor effective control over the goods sold; |

|

|

|

|

|

|

· | The amount of revenue can be measured reliably; |

|

|

|

|

|

|

· | It is probable that the economic benefits associated with the transaction will flow to the entity; and |

|

|

|

|

|

|

· | The costs incurred or to be incurred in respect of the transaction can be measured reliably. |

Recently Issued Accounting Pronouncements

We do not expect the adoption of any recently issued accounting pronouncements to have a significant impact on our results of operations, financial position or cash flow.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

As a “smaller reporting company”, we are not required to provide the information required by this Item.

| 14 |

| Table of Contents |

Item 8. Financial Statements and Supplementary Data

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Stockholders Devago, Inc.

We have audited the accompanying balance sheets of Devago, Inc. as of November 30, 2016 and 2015 and the related statements of operations, stockholders’ deficit, and cash flows for the years ended November 30, 2016 and 2015. Devago, Inc.’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Devago, Inc. as of November 30, 2016 and 2015, the results of their operations, and their cash flows, for the years ended November 30, 2016 and 2015, in conformity with accounting principles generally accepted in the United States of America.

As discussed in Note 2 to the financial statements, the Company has suffered recurring losses since inception which raises substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments relating to the recoverability and classification of asset carrying amounts or the amount and classification of liabilities that might result should the Company be unable to continue as a going concern.

/s/ KLJ & Associates, LLP

KLJ & Associates, LLP

Edina, MN

May 23, 2017

| 15 |

| Table of Contents |

DEVAGO INC.

Balance Sheets

|

|

|

November 30, |

|

|

November 30, |

| ||

|

|

|

2016 |

|

|

2015 |

| ||

|

|

|

|

|

|

|

| ||

|

ASSETS |

| |||||||

|

Current Assets |

|

|

|

|

|

| ||

|

Cash and cash equivalents |

|

$ | 23 |

|

|

$ | 4,914 |

|

|

Total Current Assets |

|

|

23 |

|

|

|

4,914 |

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net of accumulated depreciation of $3,915 and $0, respectively |

|

|

11,085 |

|

|

|

13,245 |

|

|

TOTAL ASSETS |

|

$ | 11,108 |

|

|

$ | 18,159 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’S DEFICIT |

|

| ||||||

|

Current Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ | 11,093 |

|

|

$ | 248 |

|

|

Accrued expenses |

|

|

2,177 |

|

|

|

977 |

|

|

Due to related party |

|

|

27,589 |

|

|

|

16,000 |

|

|

Total Current Liabilities |

|

|

40,859 |

|

|

|

17,225 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

|

40,859 |

|

|

|

17,225 |

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’s Deficit |

|

|

|

|

|

|

|

|

|

Preferred stock: 100,000,000 authorized; $0.00001 par value No shares issued and outstanding |

|

|

- |

|

|

|

- |

|

|

Common stock: 100,000,000 authorized; $0.00001 par value 24,582,004 and 24,082,004 shares issued and outstanding, respectively |

|

|

246 |

|

|

|

241 |

|

|

Additional paid in capital |

|

|

63,169 |

|

|

|

48,174 |

|

|

Accumulated deficit |

|

|

(93,166 | ) |

|

|

(47,481 | ) |

|

Total Stockholders’s Deficit |

|

|

(29,751 | ) |

|

|

934 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’S DEFICIT |

|

$ | 11,108 |

|

|

$ | 18,159 |

|

The accompanying notes are an integral part of these financial statements

DEVAGO INC.

Statement of Operations

|

|

|

Year Ended |

|

|

Year Ended |

| ||

|

|

|

November 30, |

|

|

November 30, |

| ||

|

|

|

2016 |

|

|

2015 |

| ||

|

|

|

|

|

|

|

| ||

|

Operating Expenses |

|

|

|

|

|

| ||

|

General and administrative |

|

|

16,498 |

|

|

|

1,205 |

|

|

Professional fees |

|

|

25,865 |

|

|

|

38,345 |

|

|

Depreciation and amortization |

|

|

2,160 |

|

|

|

1,755 |

|

|

Total Operating Expenses |

|

|

44,523 |

|

|

|

41,305 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from operations |

|

|

(44,523 | ) |

|

|

(41,305 | ) |

|

|

|

|

|

|

|

|

|

|

|

Other Income and Expense |

|

|

|

|

|

|

|

|

|

Interest (expense) |

|

|

(1,196 | ) |

|

|

(945 | ) |

|

Gain (Loss) on Foreign Exchange |

|

|

34 |

|

|

|

(231 | ) |

|

Total other income (expense) |

|

|

(1,162 | ) |

|

|

(1,176 | ) |

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ | (45,685 | ) |

|

|

(42,481 | ) |

|

|

|

|

|

|

|

|

|

|

|

Basic and dilutive loss per common share |

|

$ | (0.00 | ) |

|

$ | (0.00 | ) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding |

|

|

24,143,648 |

|

|

|

22,163,307 |

|

The accompanying notes are an integral part of these financial statements

DEVAGO INC.

Statements of Changes in Stockholders’ Equity

|

|

|

Common Stock |

|

|

Additional |

|

|

|

|

|

Total |

| ||||||||

|

|

|

Number of Shares |

|

|

Amount |

|

|

Paid in Capital |

|

|

Accumulated Deficit |

|

|

Stockholder’s Equity (Deficit) |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Balance as of September November 30, 2014 |

|

|

20,000,000 |

|

|

$ | 200 |

|

|

$ | 19,800 |

|

|

$ | (5,000 | ) |

|

$ | 15,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issued for cash |

|

|

4,082,004 |

|

|

|

41 |

|

|

|

28,374 |

|

|

|

- |

|

|

|

28,415 |

|

|

Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(42,481 | ) |

|

|

(42,481 | ) |

|

Balance - November 30, 2015 |

|

|

24,082,004 |

|

|

$ | 241 |

|

|

$ | 48,174 |

|

|

$ | (47,481 | ) |

|

$ | 934 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(45,685 | ) |

|

|

(45,685 | ) |

|

Common stock issued to settle debt |

|

|

500,000 |

|

|

$ | 5 |

|

|

|

14,995 |

|

|

$ | - |

|

|

|

15,000 |

|

|

Balance - November 30, 2016 |

|

|

24,582,004 |

|

|

$ | 246 |

|

|

$ | 63,169 |

|

|

$ | (93,166 | ) |

|

$ | (29,751 | ) |

The accompanying notes are an integral part of these financial statements

DEVAGO INC.

Statements of Cash Flows

|

|

|

Year Ended |

|

|

Year Ended |

| ||

|

|

|

November 30, |

|

|

November 30, |

| ||

|

|

|

2016 |

|

|

2015 |

| ||

|

|

|

|

|

|

|

| ||

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

| ||

|

Net loss |

|

$ | (45,685 | ) |

|

$ | (42,481 | ) |

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

|

Amortization expense |

|

|

2,160 |

|

|

|

1,755 |

|

|

Gain (loss) on foreign exchange |

|

|

- |

|

|

|

232 |

|

|

Accounts payable |

|

|

25,845 |

|

|

|

247 |

|

|

Accrued expenses |

|

|

1,200 |

|

|

|

977 |

|

|

|

|

|

|

|

|

|

|

|

|

Net Cash used in Operating Activities |

|

|

(16,480 | ) |

|

|

(39,270 | ) |

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Acquisition of property and equipment |

|

|

- |

|

|

|

(15,000 | ) |

|

Net Cash used in Investing Activities |

|

|

- |

|

|

|

(15,000 | ) |

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Due to Related Party |

|

|

11,589 |

|

|

|

16,000 |

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock |

|

|

- |

|

|

|

28,184 |

|

|

Net Cash provided by Financing Activities |

|

|

11,589 |

|

|

|

44,184 |

|

|

|

|

|

|

|

|

|

|

|

|

Net increase in cash and cash equivalents |

|

|

(4,891 | ) |

|

|

(10,086 | ) |

|

Cash and cash equivalents, beginning of period |

|

|

4,914 |

|

|

|

15,000 |

|

|

Cash and cash equivalents, end of period |

|

$ | 23 |

|

|

$ | 4,914 |

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash financing activities |

|

|

|

|

|

|

|

|

|

Common shares issued to settle debt |

|

$ | 15,000 |

|

|

$ | - |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow information |

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ | - |

|

|

$ | - |

|

|

Cash paid for taxes |

|

$ | - |

|

|

$ | - |

|

The accompanying notes are an integral part of these financial statements

DEVAGO INC.

Notes to the Financial Statements

NOTE 1. NATURE OF BUSINESS AND CONTINUANCE OF OPERATIONS

DEVAGO INC. (“we”, “us”, “our” or the “Company”) was formed on September 8, 2014 in Nevada. We are a start-up stage company and engaged in the creation of mobile software applications, or “Apps.” Our strategic initiative includes developing and marketing our current mobile application, as well as expanding our mobile application portfolio through the acquisition of third party mobile applications and mobile application development companies.

NOTE 2. GOING CONCERN

These financial statements have been prepared on a going concern basis which assumes the Company will continue to realize it assets and discharge its liabilities in the normal course of business. As of November 30, 2016, the Company has incurred losses totaling $93,166 since inception, has not yet generated revenue from operations, and will require additional funds to maintain our operations. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. The Company’s ability to continue as a going concern is dependent upon its ability to generate future profitable operations and/or obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they become due. The Company intends to finance operating costs over the next twelve months through continued financial support from its shareholders and private placements of common stock. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

NOTE 3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

|

a) | Basis of Presentation |

|

|

|

|

|

|

These financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States and are expressed in US dollars. The Company’s year-end is November 30. | |

|

|

|

|

|

|

b) | Estimates and Assumptions |

|

|

|

|

|

|

The preparation of financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to deferred income tax asset valuation allowances. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected. | |

|

|

|

|

|

|

c) | Cash and Cash Equivalents |

|

|

|

|

|

|

The Company considers all highly liquid instruments with maturity of six months or less at the time of issuance to be cash equivalents. |

| 20 |

| Table of Contents |

|

|

d) | Foreign Currency Transactions |

|

|

|

|

|

|

The Company’s planned operations are outside of the United States, which results in exposure to market risks from changes in foreign currency exchange rates. The financial risk is the risk to the Company’s operations that arise from fluctuations in foreign exchange rates and the degree of volatility of these rates. Currently, the Company does not use derivative instruments to reduce its exposure to foreign currency risk. Nonmonetary assets and liabilities are translated at historical rates and monetary assets and liabilities are translated at exchange rates in effect at the end of the year. Revenues and expenses are translated at average rates for the year. Gains and losses from translation of foreign currency financial statements into U.S. dollars are included in current results of operations. | |

|

|

|

|

|

|

e) | Income Taxes |

|

|

|

|

|

|

Potential benefits of income tax losses are not recognized in the accounts until realization is more likely than not. The Company computes tax asset benefits for net operating losses carried forward. The potential benefits of net operating losses have not been recognized in these financial statements because the Company cannot be assured it is more likely than not it will utilize the net operating losses carried forward in future years. | |

|

|

|

|

|

|

f) | Website |

|

|

|

|

|

|

Website is carried at cost, with amortization provided on a straight-line basis over its estimated useful lives of seven years. Total amortization of $2,160 was booked for the year ending November 30, 2016. | |

|

|

|

|

|

|

h) | Earnings (Loss) Per Common Share |

|

|

|

|

|

|

Basic EPS is computed by dividing net income (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing Diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti-dilutive. At November 30, 2016, the Company has no potentially dilutive securities outstanding. | |

|

|

|

|

|

|

i) | Stock-Based Compensation |

|

|

|

|

|

|

Compensation costs attributable to stock options or similar equity instruments granted are measured at the fair value at the grant date, and expensed over the expected vesting period. We did not grant any stock options during the period ended November 30, 2016. | |

|

|

|

|

|

|

j) | Income Taxes |

|

|

|

|

|

|

The Company accounts for income taxes using the asset and liability method. The asset and liability method provides that deferred tax assets and liabilities are recognized for the expected future tax consequences of temporary differences between the financial reporting and tax bases of assets and liabilities, and for operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using the currently enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company records a valuation allowance to reduce deferred tax assets to the amount that is believed more likely than not to be realized. | |

|

|

|

|

|

|

k) | New Accounting Pronouncements |

|

|

|

|

|

|

We have reviewed all the recently issued, but not yet effective, accounting pronouncements and we do not believe any of these pronouncements will have a material impact on the Company. |

| 21 |

| Table of Contents |

NOTE 4. RELATED PARTY TRANSACTIONS

On February 5, 2015, the Company entered into a promissory note with its sole officer and director for $15,000. The note accrues interest at 8% annually and is due on demand. As of November 30, 2016, $2,177 has been accrued for interest.

During the year ended November 30, 2016, the Company repaid the sole officer and director for $1,177, and the Company was provided an additional $12,766 by the sole officer and director. As at August 31, 2016, the related party payable balance is $27,589.

NOTE 5. STOCKHOLDERS’ EQUITY

|

|

a) | The Company’s authorized capital consists of 100,000,000 shares of common stock with a par value of $0.00001 and 100,000,000 shares of preferred stock with a par value of $0.00001. |

|

|

|

|

|

|

b) | At inception on September 8, 2014, 20,000,000 shares of common stock were issued to the sole director of the Company at $0.001 per share for cash proceeds of $20,000. |

|

|

|

|

|

|

c) | During the year ended November 30, 2015, the Company issued a total of 4,082,004 shares of common shares at $0.007 per share for a total of $28,416 to unrelated parties. |

|

|

|

|

|

|

d) | On October 17, 2016, 500,000 common stock were issued to settle outstanding debt of $15,000. |

NOTE 6. INCOME TAXES

The Company is subject to United States federal income taxes at an approximate rate of 35%. The reconciliation of the provision for income taxes at the United States federal statutory rate compared to the Company’s income tax expense as reported is as follows:

|

|

|

November 30, |

|

|

November 30, |

| ||

|

Income tax expense at statutory rate |

|

$ | 16,000 |

|

|

$ | 14,900 |

|

|

Change in valuation allowance |

|

|

(16,000 | ) |

|

|

(14,900 | ) |

|

Provision for income taxes |

|

$ | - |

|

|

$ | - |

|

Significant components of the Company’s deferred tax assets and liabilities as at November 30, 2016 after applying enacted corporate income tax rates, are as follows:

|

|

|

November 30, |

|

|

November 30, |

| ||

|

Net operating loss carry forwards |

|

$ | (29,150 | ) |

|

$ | (13,150 | ) |

|

Less: Valuation allowance |

|

|

29,150 |

|

|

|

13,150 |

|

|

Net deferred tax asset |

|

$ | - |

|

|

$ | - |

|

As of November 30, 2016, the Company has unused net operating loss carry-forwards of $93,166 which will begin to expire in twenty years after incurred. The Company provided a full valuation allowance to the deferred tax asset as of November 30, 2016 because it is not presently known whether future taxable income will be sufficient to utilize the loss carry-forwards.

NOTE 7. SUBSEQUENT EVENTS

The Company evaluated all events and transactions that occurred after November 30, 2016 and through the date of this filing in accordance with FASB ASC 855, “Subsequent Events”. The Company determined that it does not have any material subsequent events to disclose.

| 22 |

| Table of Contents |

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

There were no disagreements related to accounting principles or practices, financial statement disclosure, internal controls or auditing scope or procedure during the two fiscal years and interim periods.

Item 9A. Controls and Procedures

Disclosure Controls and Procedures

As required by Rule 13a-15 under the Securities Exchange Act of 1934, we have carried out an evaluation of the effectiveness of our disclosure controls and procedures as of the end of the period covered by this annual report, being November 30, 2016. This evaluation was carried out under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer (our principal executive officer and principal accounting officer).

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include controls and procedures designed to ensure that information required to be disclosed in our company’s reports filed under the Securities Exchange Act of 1934 is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

Based upon that evaluation, including our Chief Executive Officer and Chief Financial Officer, we have concluded that our disclosure controls and procedures were ineffective as of the end of the period covered by this annual report.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rule 13a-15(f) under the Securities Exchange Act of 1934). Management has assessed the effectiveness of our internal control over financial reporting as of November 30, 2016 based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. As a result of this assessment, management concluded that, as of November 30, 2016, our internal control over financial reporting was not effective. Our management identified the following material weaknesses in our internal control over financial reporting, which are indicative of many small companies with small staff: (i) inadequate segregation of duties and effective risk assessment; and (ii) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of both US GAAP and SEC guidelines.

We plan to take steps to enhance and improve the design of our internal control over financial reporting. During the period covered by this annual report on Form 10-K, we have not been able to remediate the material weaknesses identified above. To remediate such weaknesses, we hope to implement the following changes during our fiscal year ending November 30, 2017: (i) appoint additional qualified personnel to address inadequate segregation of duties and ineffective risk management; and (ii) adopt sufficient written policies and procedures for accounting and financial reporting. The remediation efforts set out in (i) and (ii) are largely dependent upon our securing additional financing to cover the costs of implementing the changes required. If we are unsuccessful in securing such funds, remediation efforts may be adversely affected in a material manner.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to an exemption for non-accelerated filers set forth in Section 989G of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

| 23 |

| Table of Contents |

Remediation of Material Weakness

We are unable to remedy our controls related to the inadequate segregation of duties and ineffective risk management until we receive financing to hire additional employees. We are currently in the process of hiring an outsourced controller to improve the controls for accounting and financial reporting.

Changes in Internal Control Over Financial Reporting

There were no changes in the Company’s internal control over financial reporting during the quarter ended November 30, 2016 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Limitations on the Effectiveness of Internal Controls