Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - MICT, Inc. | f8k052217_micronetenertec.htm |

| EX-99.1 - PRESS RELEASE DATED MAY 22, 2017 - MICT, Inc. | f8k052217ex99i_micronet.htm |

Exhibit 99.2

1Q 17 Financial Results Conference Call

Forward Looking Statement 2 This presentation contains express or implied forward - looking statements within the Private Securities Litigation Reform Act of 1995 and other U.S. Federal securities laws. These forward - looking statements include, but are not limited to those statements regarding expected new opportunities and anticipated orders and growth resulting from the ELD mandate, Enertec being positioned for growth based on its strong reputation and an expected increase in military spending, the strengthening of the Aerospace and Defense deal pipeline as Enertec builds its reputation as a dependable and innovation defense systems provider, our future revenue growth, increased volumes and demand in the markets in which we operate, our product offerings and future market opportunities and the expected benefits from our spinoff of the Aerospace and Defense division, including whether such spinoff will be completed. Such forward - looking statements and their implications involve known and unknown risks, uncertainties and other factors that may cause actual results or performance to differ materially from those projected. Such forward - looking statements and their implications involve known and unknown risks, uncertainties and other factors that may cause actual results or performance to differ materially from those projected. The forward - looking statements contained in this presentation are subject to other risks and uncertainties, including those discussed in the "Risk Factors" section and elsewhere in the Company's annual report on Form 10 - K for the year ended December 31, 2016 and in subsequent filings with the Securities and Exchange Commission. Except as otherwise required by law, the Company is under no obligation to (and expressly disclaims any such obligation to) update or alter its forward - looking statements whether as a result of new information, future events or otherwise. .

3 1 st Quarter Overview ▪ Contracts totaling $5.6 million awarded to Company during Q1 ▪ Combined backlog in both Micronet and Enertec businesses remain robust at $15.4 million ▪ Positioned for growth in Enertec business based on our strong reputation and increase in military spending ▪ Potential significant sector growth expected in 2017 for Micronet as electronic logging device (ELD) mandate requirement deadline nears and additional new MRM products are introduced by Micronet

Sales of TREQ® - 317 and TREQ - r 5 4 ▪ Expect additional orders in 2017 pursuant to implementation of final ELD mandate ▪ Strong pipeline with growing amount of customers evaluating products in the field ▪ TREQ® - 317 ▪ $800,000 order for the all - in - one TREQ® - 317 rugged Android tablet from a leading American school bus fleet management solutions provider ▪ $2,100,000 order from a current customer for the TREQ® - 317 ▪ TREQr - 5 (OBC) ▪ $1,060,000 worth of TREQr - 5 received on May 1 ▪ Orders for 16,000 units received as of May 15 ▪ Backlog for Micronet is $7.3 M and $9.3 M of March 31, 2017 and May 15, 2017 respectively

5 Multiple Contracts Awarded to Enertec $250,000 continuous order for a mobile command and control center for used in rugged and difficult terrains for the control and monitoring of advanced weapons systems $470,000 order for the development of a computer - based test and simulation system to ensure the combat readiness of a critical missile system $500,000 in orders for the development of a rugged diagnosis and simulation system for Unmanned Aerial Vehicles (UAVs). $460,000 continuous order for the development of a diagnosis and simulation system for a specific missile system $1,000,000 in contracts for the development and production of advanced automated testing equipment used to automatically diagnose and test faults in integrated circuits, chips, wafers and other electronic components used for mission - critical aerospace & defense applications A&D Deal Pipeline Strengthening as Enertec Builds Reputation as Dependable and Innovative Defense Systems Provider

Positive Outlook 6 MRM ▪ Local fleet market and the ELD expected to be the growth engines of the company ▪ The All In One line of new developed tablets becoming the Company’s leading product with wider market acceptance ▪ ELD mandate is driving increased pipeline for All In One products ▪ Broadening product portfolio to target the additional segments in the MRM market Aerospace/Defense ▪ Continued reliance on missile defense systems supports demand for our missile defense offerings ▪ Expect significant demand for new Mobile Command & Control Centers Trends

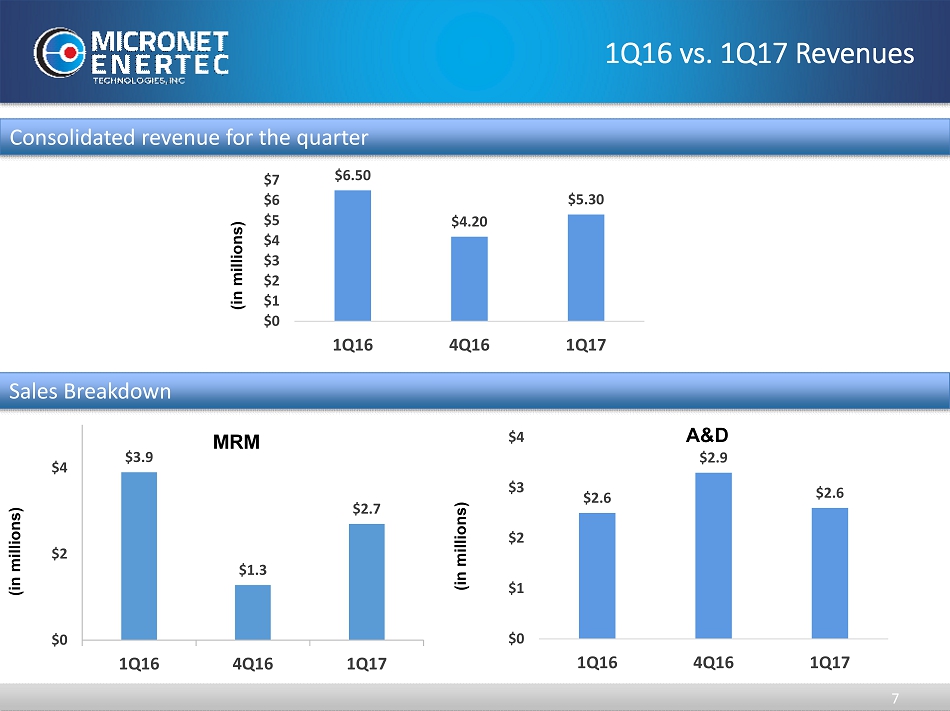

1Q16 vs. 1Q17 Revenues 7 (in millions) $2.6 $2.9 $2.6 $0 $1 $2 $3 $4 1Q16 4Q16 1Q17 A&D MRM $6.50 $4.20 $5.30 $0 $1 $2 $3 $4 $5 $6 $7 1Q16 4Q16 1Q17 (in millions) (in millions) Sales Breakdown Consolidated revenue for the quarter $3.9 $1.3 $2.7 $0 $2 $4 1Q16 4Q16 1Q17

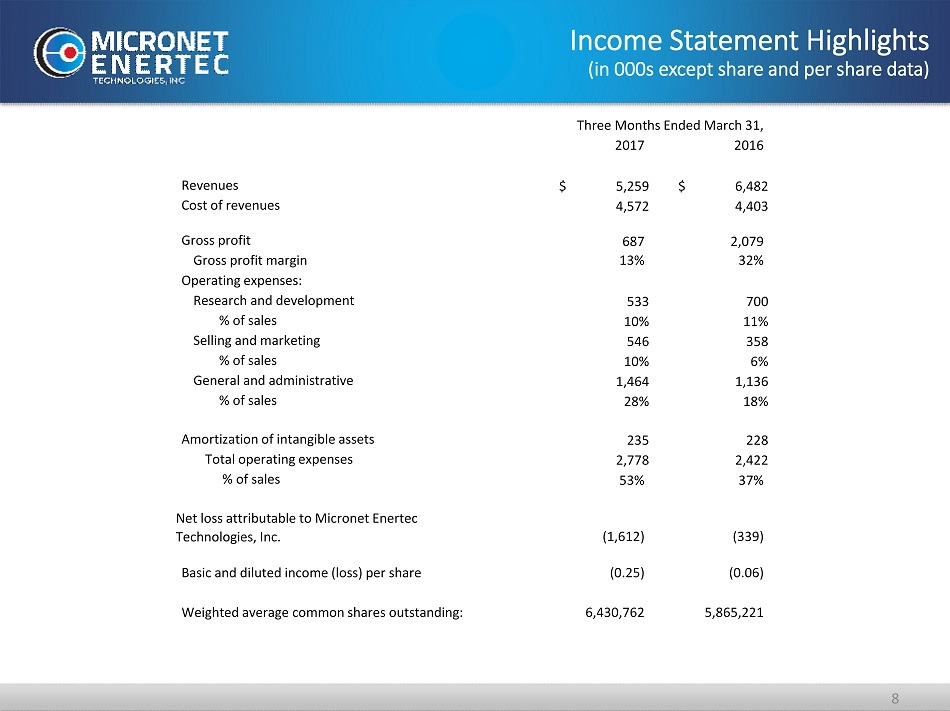

8 Income Statement Highlights (in 000s except share and per share data) Three Months Ended March 31, 2017 2016 Revenues $ 5,259 $ 6,482 Cost of revenues 4,572 4,403 Gross profit 687 2,079 Gross profit margin 13% 32% Operating expenses: Research and development 533 700 % of sales 10% 11% Selling and marketing 546 358 % of sales 10% 6% General and administrative 1,464 1,136 % of sales 28% 18% Amortization of intangible assets 235 228 Total operating expenses 2,778 2,422 % of sales 53% 37% Net loss attributable to Micronet Enertec Technologies, Inc. (1,612) (339) Basic and diluted income (loss) per share (0.25) (0.06) Weighted average common shares outstanding: 6,430,762 5,865,221 Total non - GAAP net income (loss) attributed to MICT (1,448) (116)

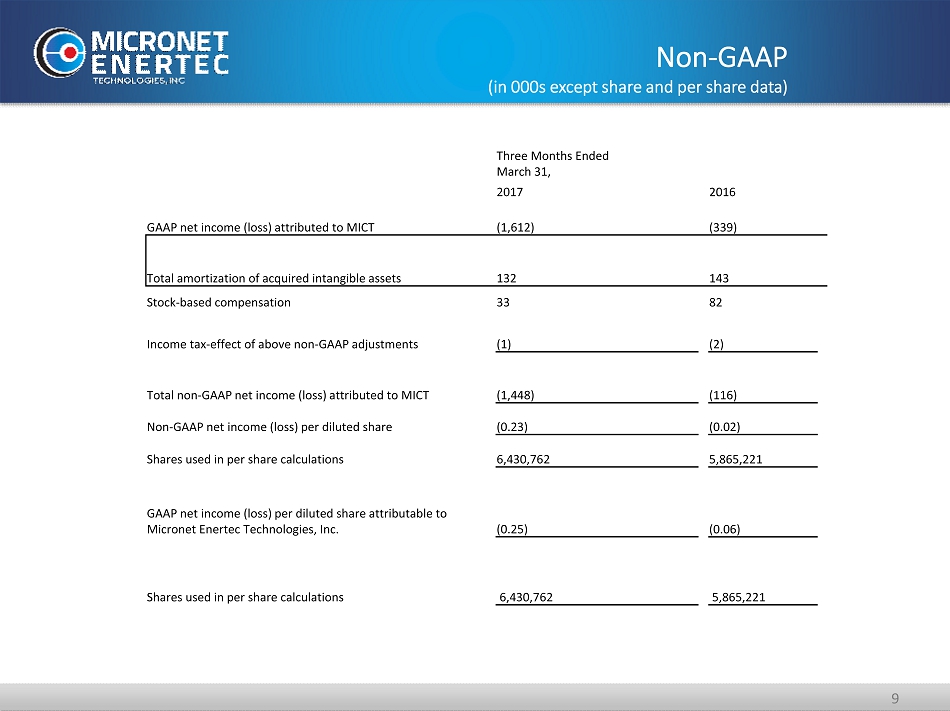

Non - GAAP (in 000s except share and per share data) 9 Three Months Ended March 31, 2017 2016 GAAP net income (loss) attributed to MICT (1,612) (339) Total amortization of acquired intangible assets 132 143 Stock - based compensation 33 82 Income tax - effect of above non - GAAP adjustments (1) (2) Total non - GAAP net income (loss) attributed to MICT (1,448) (116) Non - GAAP net income (loss) per diluted share ( 0.23) (0.02) Shares used in per share calculations 6,430,762 5,865,221 GAAP net income (loss) per diluted share attributable to Micronet Enertec Technologies, Inc. (0.25) (0.06) Shares used in per share calculations 6,430,762 5,865,221

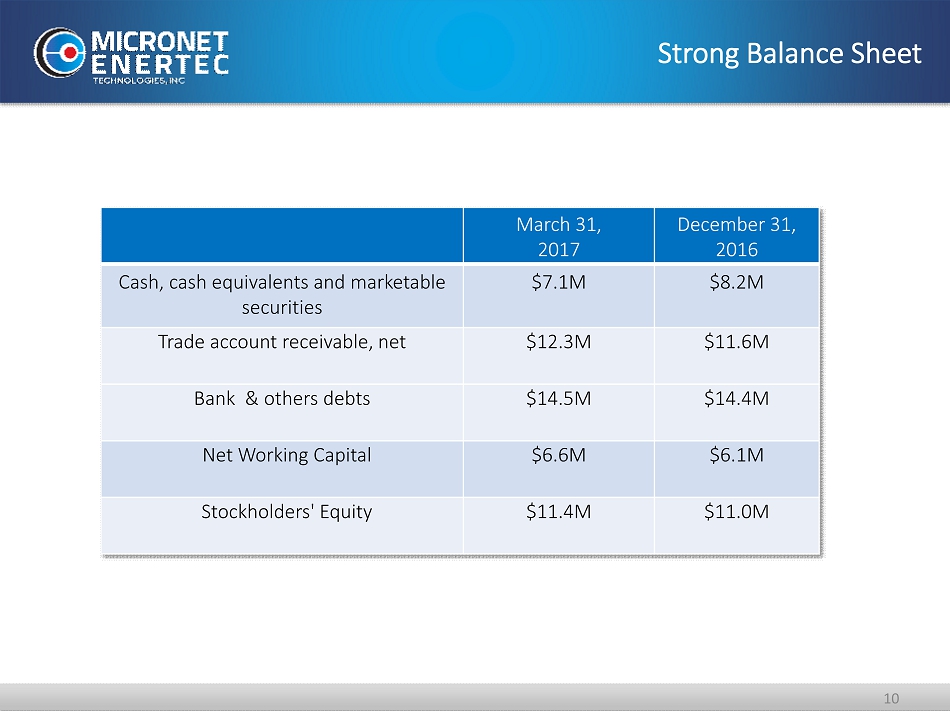

Strong Balance Sheet March 31, 2017 December 31, 2016 Cash, cash equivalents and marketable securities $7.1M $8.2M Trade account receivable, net $12.3M $11.6M Bank & others debts $14.5M $14.4M Net Working Capital $6.6M $6.1M Stockholders' Equity $11.4M $11.0M 10

Thank You 11 Q & A