Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K 5.22.17 - FORWARD AIR CORP | form8-k52217.htm |

NASDAQ:FWRD

www.ForwardAirCorp.com

Investor Presentation

Today’s presentation and discussion will contain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expects,”

“anticipates,” “intends,” “estimates,” or similar expressions are intended to identify these

forward-looking statements. These statements, which include statements regarding our

competitive advantages, synergies, and scalable platform, and future technology

investments are based on Forward Air’s current plans and expectations and involve risks

and uncertainties that could cause future activities and results of operations to be

materially different from those set forth in the forward-looking statements. For further

information, please refer to Forward Air’s reports and filings with the Securities and

Exchange Commission.

To supplement the financial measures prepared in accordance with generally accepted

accounting principles in the United States (“GAAP”), we have included the following non-

GAAP financial information in this presentation: adjusted EBITDA, adjusted EBITDA margin,

adjusted operating margin and adjusted EPS. The reconciliations of these non-GAAP

measures to the most directly comparable financial measures calculated and presented in

accordance with GAAP can be found in the Appendix to this presentation. Because these

non-GAAP financial measures exclude certain items as described herein, they may not be

indicative of the results that the Company expects to recognize for future periods. As a

result, these non-GAAP financial measures should be considered in addition to, and not a

substitute for, financial information prepared in accordance with GAAP.

2

Forward Looking Statements Disclosure

3

Asset-Light Freight & Logistics Company

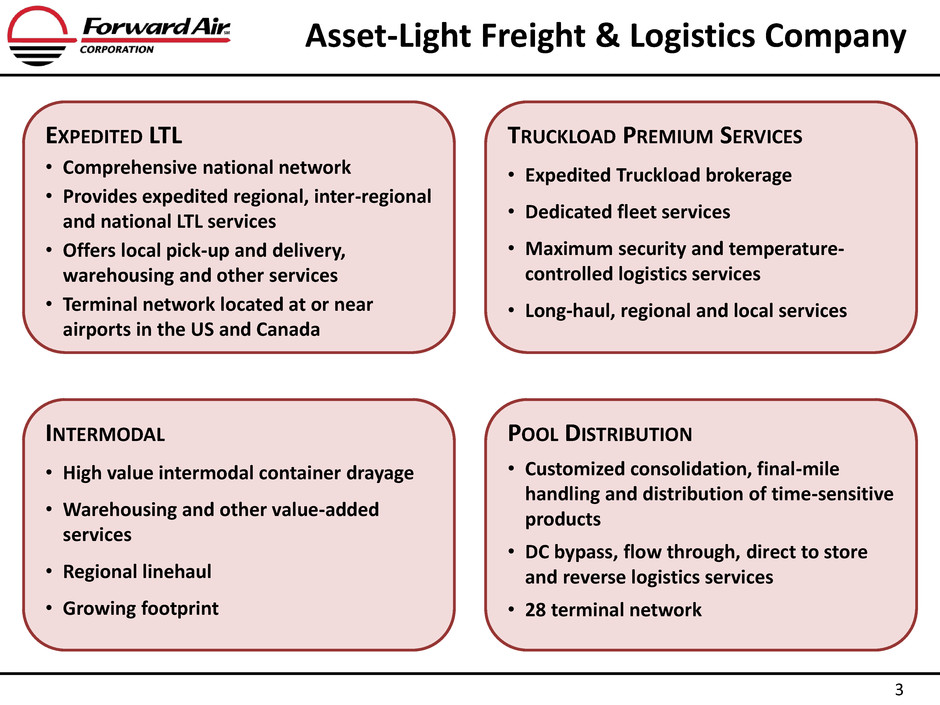

EXPEDITED LTL

• Comprehensive national network

• Provides expedited regional, inter-regional

and national LTL services

• Offers local pick-up and delivery,

warehousing and other services

• Terminal network located at or near

airports in the US and Canada

TRUCKLOAD PREMIUM SERVICES

• Expedited Truckload brokerage

• Dedicated fleet services

• Maximum security and temperature-

controlled logistics services

• Long-haul, regional and local services

INTERMODAL

• High value intermodal container drayage

• Warehousing and other value-added

services

• Regional linehaul

• Growing footprint

POOL DISTRIBUTION

• Customized consolidation, final-mile

handling and distribution of time-sensitive

products

• DC bypass, flow through, direct to store

and reverse logistics services

• 28 terminal network

4

Key Attributes

Deliver premium solutions: expedited, time-definite, service-sensitive

Most comprehensive provider of wholesale transportation services in North

America, serving Freight Forwarders, Airlines, 3PLs, etc.

Provide our customers with safe, superior service

Operate an asset-light model utilizing independent owner-operators

Expanding into new areas organically and through acquisitions

Leading technology lowers operating cost & improves customer service

Superior service & operating flexibility regardless of economic cycle

5

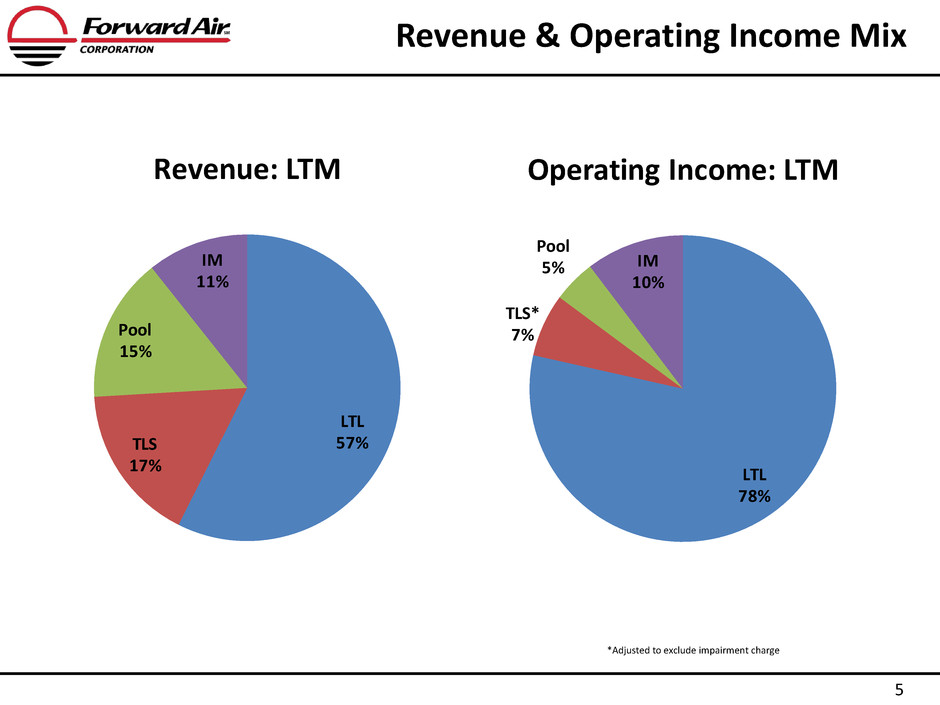

Revenue & Operating Income Mix

*Adjusted to exclude impairment charge

LTL

57%TLS

17%

Pool

15%

IM

11%

Revenue: LTM

LTL

78%

TLS*

7%

Pool

5% IM

10%

Op rating Income: LTM

6

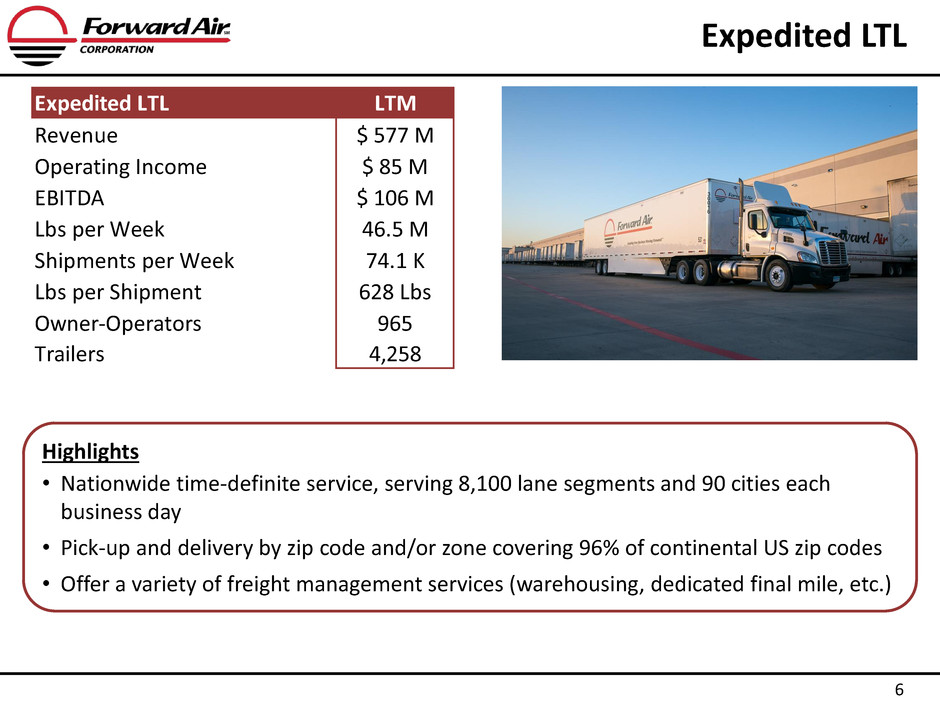

Expedited LTL

Highlights

• Nationwide time-definite service, serving 8,100 lane segments and 90 cities each

business day

• Pick-up and delivery by zip code and/or zone covering 96% of continental US zip codes

• Offer a variety of freight management services (warehousing, dedicated final mile, etc.)

Expedited LTL LTM

Revenue $ 577 M

Operating Income $ 85 M

EBITDA $ 106 M

Lbs per Week 46.5 M

Shipments per Week 74.1 K

Lbs per Shipment 628 Lbs

Owner-Operators 965

Trailers 4,258

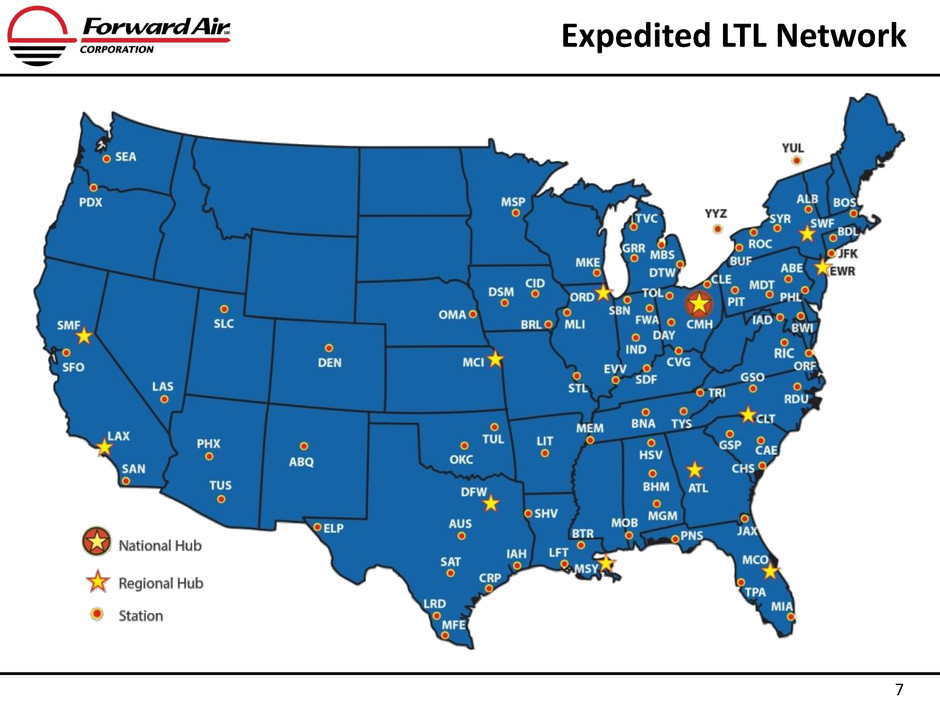

7

Expedited LTL Network

8

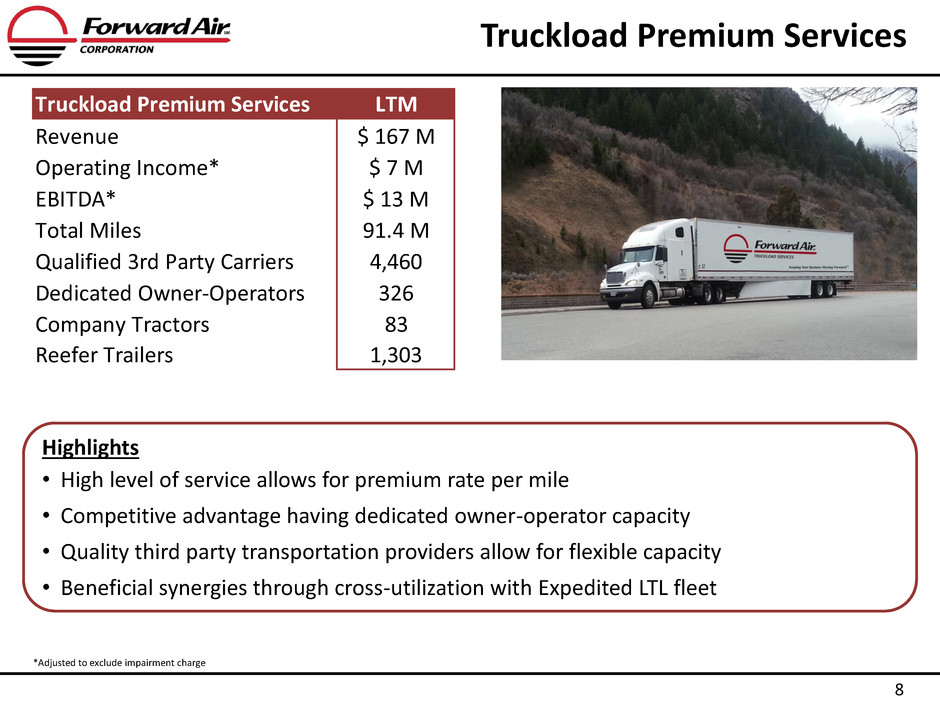

Truckload Premium Services

Highlights

• High level of service allows for premium rate per mile

• Competitive advantage having dedicated owner-operator capacity

• Quality third party transportation providers allow for flexible capacity

• Beneficial synergies through cross-utilization with Expedited LTL fleet

*Adjusted to exclude impairment charge

Truckload Premium Services LTM

Revenue $ 167 M

Operating Income* $ 7 M

EBITDA* $ 13 M

Total Miles 91.4 M

Qualified 3rd Party Carriers 4,460

Dedicated Owner-Operators 326

Company Tractors 83

Reefer Trailers 1,303

9

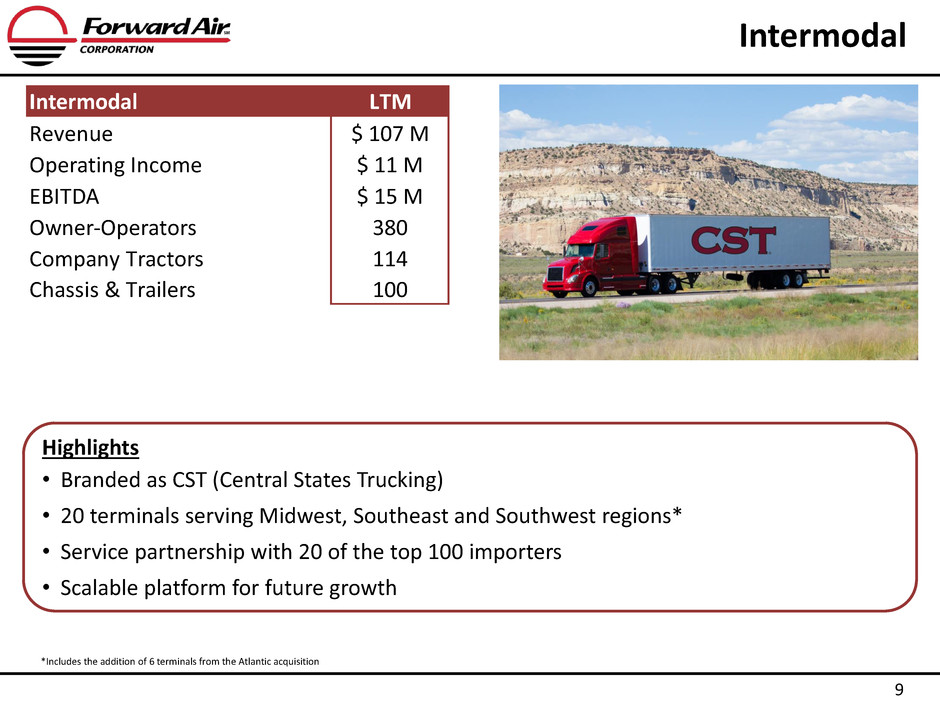

Intermodal

Highlights

• Branded as CST (Central States Trucking)

• 20 terminals serving Midwest, Southeast and Southwest regions*

• Service partnership with 20 of the top 100 importers

• Scalable platform for future growth

Intermodal LTM

Revenue $ 107 M

Operating Income $ 11 M

EBITDA $ 15 M

Owner-Operators 380

Company Tractors 114

Chassis & Trailers 100

*Includes the addition of 6 terminals from the Atlantic acquisition

10

Pool Distribution

Highlights

• Branded as Forward Air Solutions

• Terminal and service locations in 28 states

• Leverages core competencies of Expedited LTL business

• Current customer base is primarily specialty retail; pursuing customers in other verticals

Pool Distribution LTM

Revenue $ 153 M

Operating Income $ 5 M

EBITDA $ 11 M

Owner-Operators 226

Company Straight Trucks 218

Company Tractors 94

11

Technology

• Advanced technology is a cornerstone of every Forward Air business operation

• Our technology priorities include:

‒ End-to-end customer visibility to every shipment we handle in every

business unit

‒ Secure real-time transactions with customers and service providers using

APIs and EDI

‒ Web-based technologies and mobile applications for customers, drivers

and service providers

• Forward Air is committed to making long-term, on-going investments in

technology to provide high level service and security

Financial Overview

13

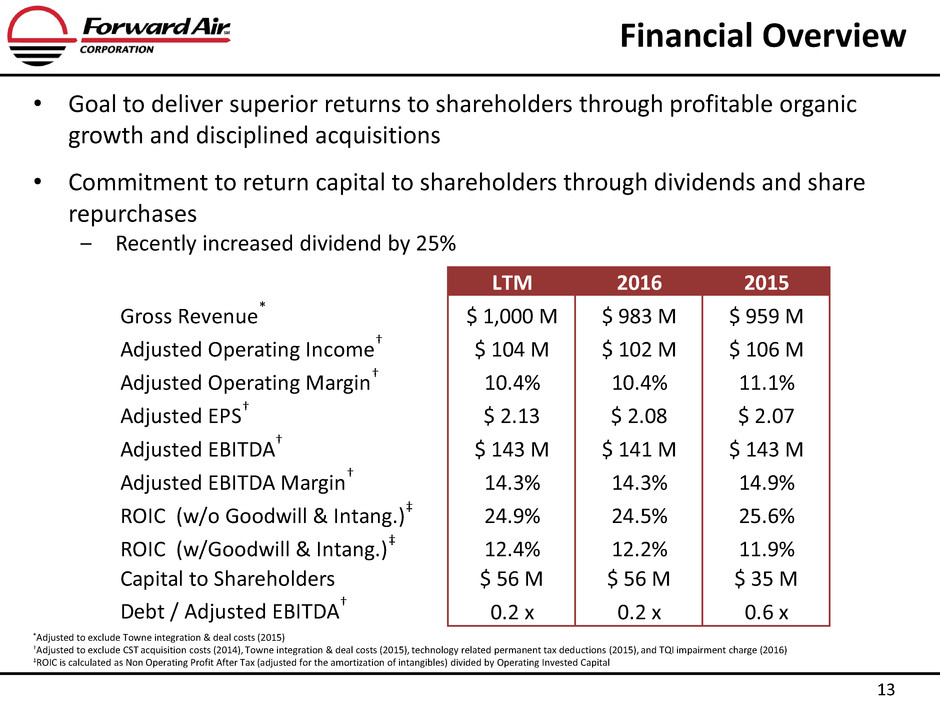

Financial Overview

• Goal to deliver superior returns to shareholders through profitable organic

growth and disciplined acquisitions

• Commitment to return capital to shareholders through dividends and share

repurchases

‒ Recently increased dividend by 25%

*Adjusted to exclude Towne integration & deal costs (2015)

†Adjusted to exclude CST acquisition costs (2014), Towne integration & deal costs (2015), technology related permanent tax deductions (2015), and TQI impairment charge (2016)

‡ROIC is calculated as Non Operating Profit After Tax (adjusted for the amortization of intangibles) divided by Operating Invested Capital

LTM 2016 2015

Gross Revenue

*

$ 1,000 M $ 983 M $ 959 M

Adjusted Operating Income

†

$ 104 M $ 102 M $ 106 M

Adjusted Operating Margin

†

10.4% 10.4% 11.1%

Adjusted EPS

†

$ 2.13 $ 2.08 $ 2.07

Adjusted EBITDA

†

$ 143 M $ 141 M $ 143 M

Adjusted EBITDA Margin† 14.3% 14.3% 14.9%

ROIC (w/o Goodwill & Intang.)‡ 24.9% 24.5% 25.6%

ROIC (w/Goodwill & Intang.)

‡

12.4% 12.2% 11.9%

Capital to Shareholders $ 56 M $ 56 M $ 35 M

Debt / Adjusted EBITDA

†

0.2 x 0.2 x 0.6 x

14

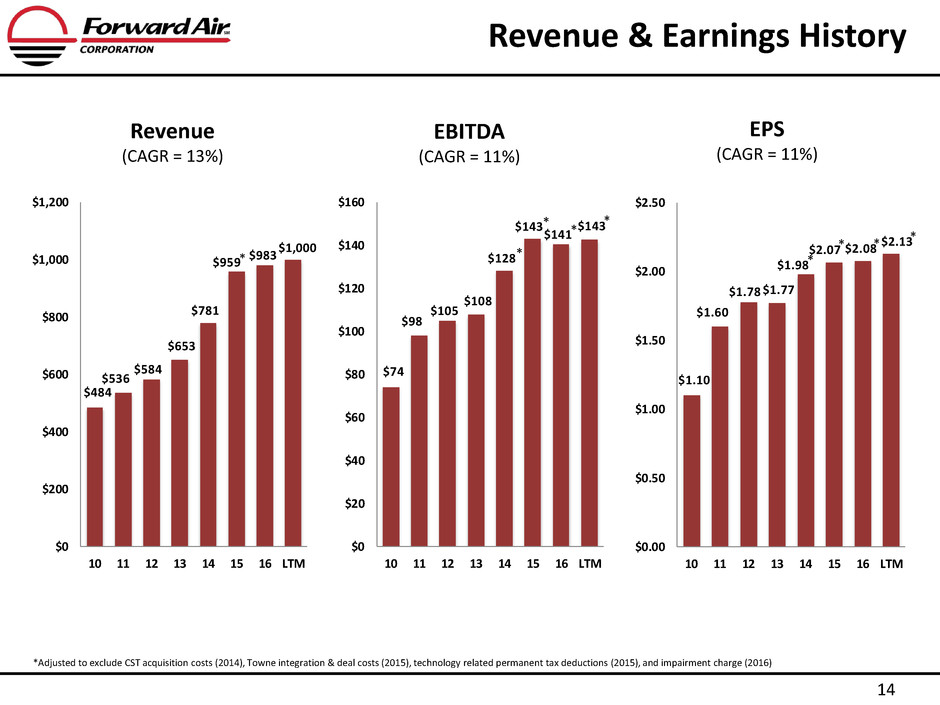

Revenue & Earnings History

Revenue

(CAGR = 13%)

EBITDA

(CAGR = 11%)

EPS

(CAGR = 11%)

*Adjusted to exclude CST acquisition costs (2014), Towne integration & deal costs (2015), technology related permanent tax deductions (2015), and impairment charge (2016)

$484

$536

$584

$653

$781

$959

$983

$1,000

$0

$200

$400

$600

$800

$1,000

$1,200

10 11 12 13 14 15 16 LTM

*

$74

$98

$105

$108

$128

$143

$141

$143

$0

$20

$40

$60

$80

$100

$120

$140

$160

0 1 2 13 14 15 16 LTM

*

* *

*

$1.10

$1.60

$1.78 $1.77

$1.98

$2.07 $2.08

$2.13

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

10 11 12 13 14 15 16 LTM

*

*

* *

15

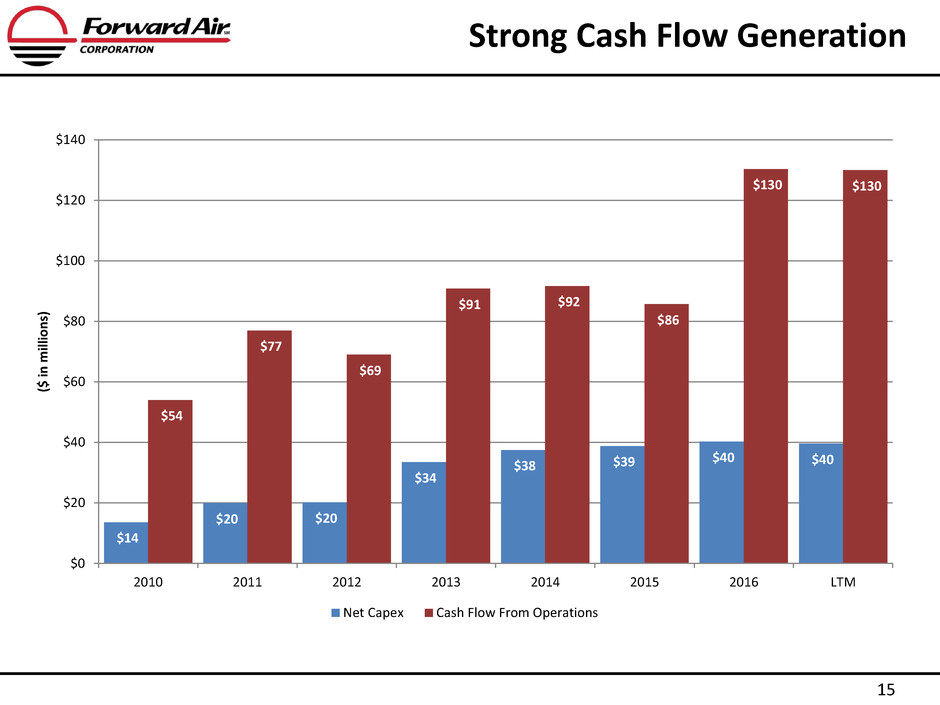

Strong Cash Flow Generation

$14

$20 $20

$34

$38 $39

$40 $40

$54

$77

$69

$91 $92

$86

$130 $130

$0

$20

$40

$60

$80

$100

$120

$140

2010 2011 2012 2013 2014 2015 2016 LTM

($

in

mi

llio

ns

)

Net Capex Cash Flow From Operations

16

Value Proposition

Sustainable Revenue Growth

Flexible Asset-Light Model

Solid Capital Returns

Proven Operating Leverage

Strong Balance Sheet

Appendix

18

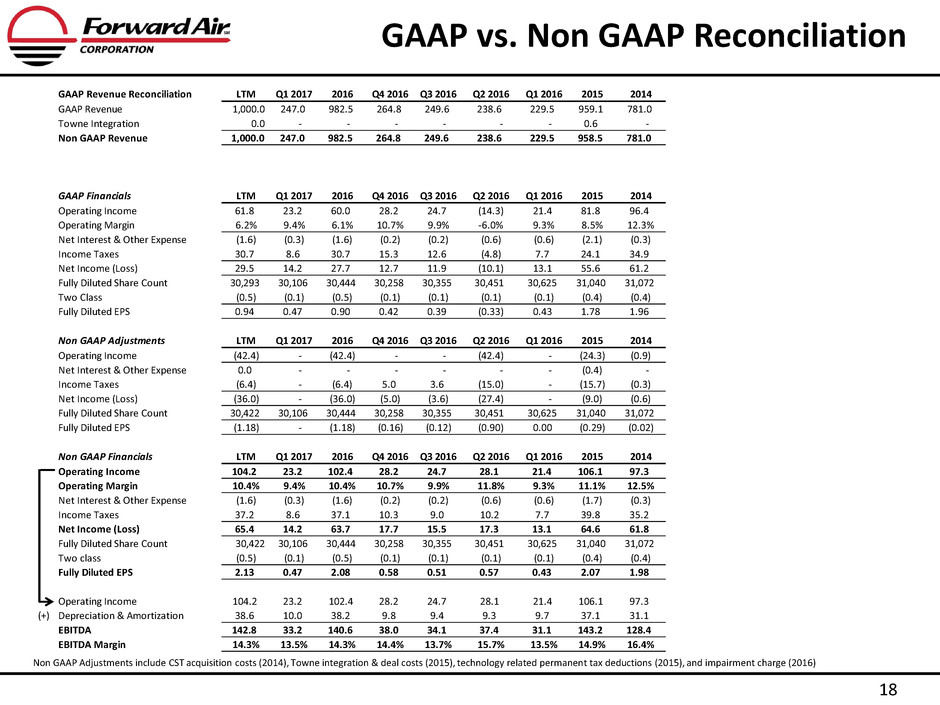

GAAP vs. Non GAAP Reconciliation

Non GAAP Adjustments include CST acquisition costs (2014), Towne integration & deal costs (2015), technology related permanent tax deductions (2015), and impairment charge (2016)

GAAP Revenue Reconciliation LTM Q1 2017 2016 Q4 2016 Q3 2016 Q2 2016 Q1 2016 2015 2014

GAAP Revenue 1,000.0 247.0 982.5 264.8 249.6 238.6 229.5 959.1 781.0

Towne Integration 0.0 - - - - - - 0.6 -

Non GAAP Revenue 1,000.0 247.0 982.5 264.8 249.6 238.6 229.5 958.5 781.0

GAAP Financials LTM Q1 2017 2016 Q4 2016 Q3 2016 Q2 2016 Q1 2016 2015 2014

Operating Income 61.8 23.2 60.0 28.2 24.7 (14.3) 21.4 81.8 96.4

Operating Margin 6.2% 9.4% 6.1% 10.7% 9.9% -6.0% 9.3% 8.5% 12.3%

Net Interest & Other Expense (1.6) (0.3) (1.6) (0.2) (0.2) (0.6) (0.6) (2.1) (0.3)

Income Taxes 30.7 8.6 30.7 15.3 12.6 (4.8) 7.7 24.1 34.9

Net Income (Loss) 29.5 14.2 27.7 12.7 11.9 (10.1) 13.1 55.6 61.2

Fully Diluted Share Count 30,293 30,106 30,444 30,258 30,355 30,451 30,625 31,040 31,072

Two Class (0.5) (0.1) (0.5) (0.1) (0.1) (0.1) (0.1) (0.4) (0.4)

Fully Diluted EPS 0.94 0.47 0.90 0.42 0.39 (0.33) 0.43 1.78 1.96

Non GAAP Adjustments LTM Q1 2017 2016 Q4 2016 Q3 2016 Q2 2016 Q1 2016 2015 2014

Operating Income (42.4) - (42.4) - - (42.4) - (24.3) (0.9)

Net Interest & Other Expense 0.0 - - - - - - (0.4) -

Income Taxes (6.4) - (6.4) 5.0 3.6 (15.0) - (15.7) (0.3)

Net Income (Loss) (36.0) - (36.0) (5.0) (3.6) (27.4) - (9.0) (0.6)

Fully Diluted Share Count 30,422 30,106 30,444 30,258 30,355 30,451 30,625 31,040 31,072

Fully Diluted EPS (1.18) - (1.18) (0.16) (0.12) (0.90) 0.00 (0.29) (0.02)

Non GAAP Financials LTM Q1 2017 2016 Q4 2016 Q3 2016 Q2 2016 Q1 2016 2015 2014

Operating Income 104.2 23.2 102.4 28.2 24.7 28.1 21.4 106.1 97.3

Operating Margin 10.4% 9.4% 10.4% 10.7% 9.9% 11.8% 9.3% 11.1% 12.5%

Net Interest & Other Expense (1.6) (0.3) (1.6) (0.2) (0.2) (0.6) (0.6) (1.7) (0.3)

Income Taxes 37.2 8.6 37.1 10.3 9.0 10.2 7.7 39.8 35.2

Net Income (Loss) 65.4 14.2 63.7 17.7 15.5 17.3 13.1 64.6 61.8

Fully Diluted Share Count 30,422 30,106 30,444 30,258 30,355 30,451 30,625 31,040 31,072

Two class (0.5) (0.1) (0.5) (0.1) (0.1) (0.1) (0.1) (0.4) (0.4)

Fully Diluted EPS 2.13 0.47 2.08 0.58 0.51 0.57 0.43 2.07 1.98

Operating Income 104.2 23.2 102.4 28.2 24.7 28.1 21.4 106.1 97.3

(+) Depreciation & Amortization 38.6 10.0 38.2 9.8 9.4 9.3 9.7 37.1 31.1

EBITDA 142.8 33.2 140.6 38.0 34.1 37.4 31.1 143.2 128.4

EBITDA Margin 14.3% 13.5% 14.3% 14.4% 13.7% 15.7% 13.5% 14.9% 16.4%

19

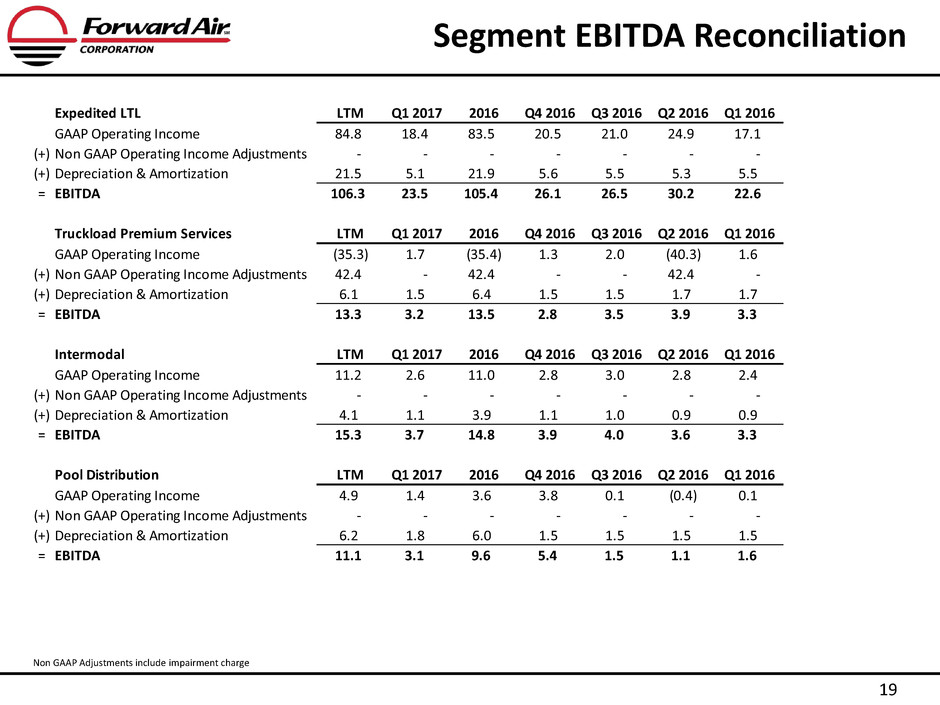

Segment EBITDA Reconciliation

Non GAAP Adjustments include impairment charge

Expedited LTL LTM Q1 2017 2016 Q4 2016 Q3 2016 Q2 2016 Q1 2016

GAAP Operating Income 84.8 18.4 83.5 20.5 21.0 24.9 17.1

(+) Non GAAP Operating Income Adjustments - - - - - - -

(+) Depreciation & Amortization 21.5 5.1 21.9 5.6 5.5 5.3 5.5

= EBITDA 106.3 23.5 105.4 26.1 26.5 30.2 22.6

Truckload Premium Services LTM Q1 2017 2016 Q4 2016 Q3 2016 Q2 2016 Q1 2016

GAAP Operating Income (35.3) 1.7 (35.4) 1.3 2.0 (40.3) 1.6

(+) Non GAAP Operating Income Adjustments 42.4 - 42.4 - - 42.4 -

(+) Depreciation & Amortization 6.1 1.5 6.4 1.5 1.5 1.7 1.7

= EBITDA 13.3 3.2 13.5 2.8 3.5 3.9 3.3

Intermodal LTM Q1 2017 2016 Q4 2016 Q3 2016 Q2 2016 Q1 2016

GAAP Operating Income 11.2 2.6 11.0 2.8 3.0 2.8 2.4

(+) Non GAAP Operating Income Adjustments - - - - - - -

(+) Depreciation & Amortization 4.1 1.1 3.9 1.1 1.0 0.9 0.9

= EBITDA 15.3 3.7 14.8 3.9 4.0 3.6 3.3

Pool Distribution LTM Q1 2017 2016 Q4 2016 Q3 2016 Q2 2016 Q1 2016

GAAP Operating Income 4.9 1.4 3.6 3.8 0.1 (0.4) 0.1

(+) Non GAAP Operating Income Adjustments - - - - - - -

(+) Depreciation & Amortization 6.2 1.8 6.0 1.5 1.5 1.5 1.5

= EBITDA 11.1 3.1 9.6 5.4 1.5 1.1 1.6

Thank You For Your Time

Investor Relations Contact:

Mike Morris, CFO & Treasurer

mmorris@forwardair.com

(404) 362-8933