Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VEECO INSTRUMENTS INC | a17-13180_18k.htm |

Exhibit 99.1

Ultratech and Veeco Employee Meeting May, 2017

Agenda Rational for the Combination of Veeco and Ultratech Integration Plans and Priorities Looking Forward Q&A

Veeco & Ultratech’s Technologies LED Lighting, Display & Power Electronics Advanced Packaging, RF & MEMS Front End Semi Scientific, Industrial & Data Storage MOCVD AP Litho PSP LSA ADE 3D Inspection MBE ALD

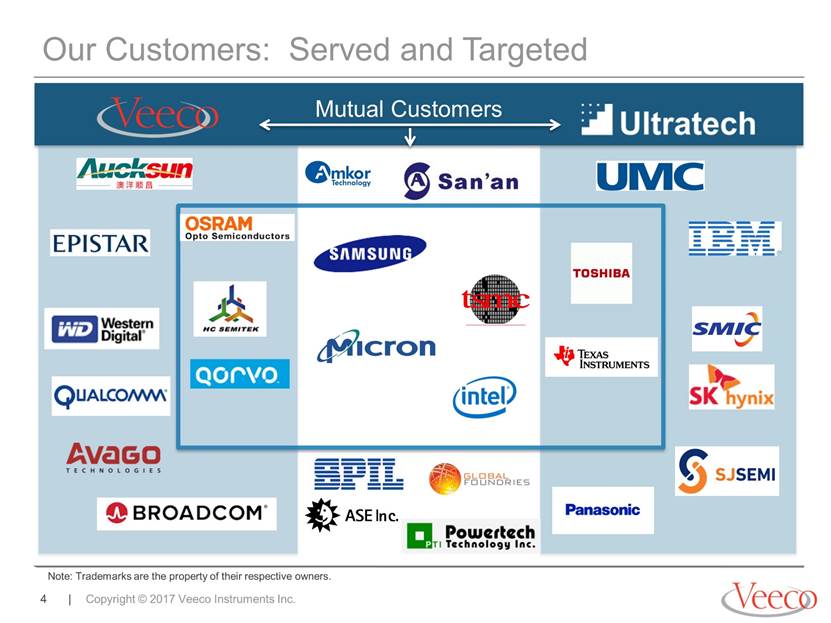

Mutual Customers Our Customers

Veeco & Ultratech Locations Fremont, CA Plainview, NY St. Paul, MN Somerset, NJ Munich, Germany Shanghai, China Hsinchu City, Taiwan Penang, Malaysia Bundang-gu, Korea Singapore Philippines Bangkok, Thailand Tokyo, Japan Horsham, PA San Jose, CA Waltham, MA Dresden, Germany Ultratech Locations Veeco Locations Hwaseong-si, Korea

A Compelling Combination for All Stakeholders Diversified revenue for improved stability Similar cultures with focus on innovation Increased scale provides opportunities for advancement and professional growth Increased scale and better positioned to address customers’ critical needs Increased sales and service presence Complementary skills to deliver innovative and cost-effective solutions Expanded Leadership in Advanced Packaging, RF & MEMS Increased critical mass in Front-End Semi and Scientific segments Better positioned for long term growth and profitability Expected to be strongly accretive to non-GAAP EPS Employees Customers Stockholders

Integration Plans and Priorities

The Ultratech Division Business Units Lithography Business Unit – Rezwan Lateef LSA Business Unit – Scott Zafiropoulo 3D Inspection – Eric Bouche Functional Groups Engineering, Operations and Supply Chain – Tammy Landon CTO & Technology – Andy Hawryluk

Ultratech Manufacturing, Supply Chain and Quality Focus on meeting or exceeding customer’s expectations for performance Adopt common processes and metrics to drive effective execution Increase Focus on Cost Reduction to Combat Low Cost Competitors Collaboration between Ultratech and existing Veeco supply chain groups Leverage purchasing volume to reduce material and contract manufacturer cost Create competition between our suppliers Execute common strategy for basic commodities like sheet metal, cables, etc. Adopt common / best practices Mission: Deliver High Quality Products, On Time, at a Competitive Cost Quality and Customer Satisfaction

Sales and Services Outsell the competition to grow market share and profit in each business Cross sell Veeco and Ultratech products to accelerate growth Expand the service portfolio to create growth opportunities Over time, cross train services personnel to provide flexibility and individual growth Consolidate sales offices and infrastructure to reduce expenses Unify parts depots and logistics to improve cost and customer satisfaction Opportunities Stronger Veeco presence in OSATs, IDMs and foundries Stronger Ultratech presence in LED, RF & Scientific Customers Better critical mass and global coverage Become more cost effective Mission and Strategies Ultratech Sales and Services - Dave Ghosh

Integration Plans Things we plan to do: Integrate Ultratech Finance, HR and IT functions into respective Veeco groups Convert Ultratech from Manman to SAP Leverage best practices in both directions 12 Integration teams have been formed to integrate functions and processes Financial processes Naming and branding Benefits IT Strategic Planning, and many other functions Things we do not plan to do: We do not plan to reduce salaries We do not plan to move out of the Zanker Road facility We will work through organizational decisions carefully Many things will not change Some decisions will be made at close and others will only be made after we have a much deeper understanding of the situation and strategy

Looking Forward

Veeco + Ultratech Growth Opportunities 34% 13% 18% Pro Forma 2017 Revenue Forecast Advanced Packaging, MEMs & RF Key Technologies Lithography Single wafer etch and clean Ion Beam Etch Opportunities Veeco Sales into AP Customers Ultratech Sales into RF & MEMS Key Technologies MBE ALD IBE & IBD PVD DLC Opportunities Increase sales to research community Scientific, Industrial & Data Storage Lighting, Display & Power Electronics Key Technologies MOCVD Single wafer etch and clean Lithography Opportunities LED Lighting MicroLEDs Front-End Semiconductor Key Technologies LSA 3D Inspection IBE & PVD encapsulation MOCVD Opportunities China semi fabs Melt STT RAM Superfast Inspection 35%

Veeco’s Operating Principles Speed is a vital competitive weapon Our people drive our success Promote a results-oriented, high performance environment Be passionate about technology & product leadership Customers are our reason for being Exemplify integrity in our words and our actions

Other Important Veeco Values Teamwork across organizations and Business Units Transparency shine light on good and (especially) bad news we deal with bad news better than surprises Demonstrate respect and fairness to others No politics. Period.

How You Can Help Focus on doing a great job for our customers Work through integration challenges Make our company more cost effective Innovate and create new solutions for our customers

Employee Focus Work Locations Important to Everyone Staying where we are for now Reviewing both Company’s office locations Evaluating consolidation opportunities Employees, Customers and Suppliers will factor heavily into future decisions Ultratech Employment Agreements As indicated in Welcome Letters, the terms of Employment Agreements will continue unchanged following closing: T’s & C’s; Title; Manager; Salary; Hire Date (Ultratech service counts 100%) Ultratech Payroll; Vacation; Benefits No changes for 2017 maybe longer Reviewing each Company’s processes and programs Evaluating approaches for future consolidation plenty of notice provided

Q&A

Cautionary Statements, Additional Info, Solicitation Forward-looking Statements This written communication contains forward-looking statements that involve risks and uncertainties concerning the proposed acquisition by Veeco Instruments Inc., (“Veeco” or the “Company), of Ultratech, Inc. (“Ultratech”), Ultratech’s and the Company’s expected financial performance, as well as Ultratech’s and the Company’s strategic and operational plans. Actual events or results may differ materially from those described in this written communication due to a number of risks and uncertainties. The potential risks and uncertainties include, among others, the possibility that Ultratech may be unable to obtain required stockholder approval or that other conditions to closing the transaction may not be satisfied, such that the transaction will not close or that the closing may be delayed; the reaction of customers to the transaction; general economic conditions; the transaction may involve unexpected costs, liabilities or delays; risks that the transaction disrupts current plans and operations of the parties to the transaction; the ability to recognize the benefits of the transaction; the amount of the costs, fees, expenses and charges related to the transaction and the actual terms of any financings that will be obtained for the transaction; the outcome of any legal proceedings related to the transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction agreement. In addition, please refer to the documents that the Company and Ultratech file with the SEC on Forms 10-K, 10-Q and 8-K. The filings by the Company and Ultratech identify and address other important factors that could cause its financial and operational results to differ materially from those contained in the forward-looking statements set forth in this written communication. All forward-looking statements speak only as of the date of this written communication or, in the case of any document incorporated by reference, the date of that document. Neither the Company nor Ultratech is under any duty to update any of the forward-looking statements after the date of this written communication to conform to actual results. Additional Information and Where to Find It In connection with the proposed acquisition of Ultratech by Veeco pursuant to the Agreement and Plan of Merger by and among Ultratech, Veeco and Ulysses Acquisition Subsidiary Corp., Veeco filed with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4 on April 24, 2017, which contains a proxy statement of Ultratech and a prospectus of Veeco, which proxy statement/prospectus was mailed or otherwise disseminated to Ultratech’s stockholders on April 24, 2017. Investors are urged to read the proxy statement/prospectus (including all amendments and supplements) because they contain important information. Investors may obtain free copies of the proxy statement/prospectus, as well as other filings containing information about Veeco and Ultratech, without charge, at the SEC’s Internet site (www.sec.gov). Copies of these documents may also be obtained for free from the companies’ web sites at www.Veeco.com or www.Ultratech.com. Participants in Solicitation Veeco, Ultratech and their respective officers and directors may be deemed to be participants in the solicitation of proxies from the stockholders of Ultratech in connection with the proposed transaction. Information about Veeco’s executive officers and directors is set forth in its Annual Report on Form 10-K, which was filed with the SEC on February 22, 2017, and its proxy statement for its 2017 annual meeting of stockholders, which was filed with the SEC on March 17, 2017. Information about Ultratech’s executive officers and directors is set forth in its Annual Report on Form 10-K, which was filed with the SEC on March 1, 2017, and the amendment to its Annual Report on Form 10-K/A, which was filed with the SEC on April 20, 2017. Investors may obtain more detailed information regarding the direct and indirect interests of Veeco, Ultratech and their respective executive officers and directors in the acquisition by reading the proxy statement/prospectus regarding the transaction, which has been filed with the SEC.