Attached files

| file | filename |

|---|---|

| 8-K - 8-K - First Internet Bancorp | inbk-2017annualmeetingpres.htm |

Annual Meeting

of Shareholders

May 15, 2017

Exhibit 99.1

PROPOSALS

2

Election of Directors

Proposal 1

3

Advisory Vote to Approve

Executive Compensation

Proposal 2

4

Ratification of Appointment

of Independent Registered

Public Accounting Firm

Proposal 3

5

VOTING

6

Company Update

May 15, 2017

This presentation may contain forward-looking statements with respect to the

financial condition, results of operations, plans, objectives, future performance

or business of the Company. Forward-looking statements are generally

identifiable by the use of words such as “believe,” “expect,” “anticipate,” “plan,”

“intend,” “estimate,” “consider,” “may,” “will,” “would,” “could,” “should” or other

similar expressions. Forward-looking statements are not a guarantee of future

performance or results, are based on information available at the time the

statements are made and involve known and unknown risks, uncertainties and

other factors that could cause actual results to differ materially from the

information in the forward-looking statements. Factors that may cause such

differences include: failures of or interruptions in the communications and

information systems on which we rely to conduct our business; failure of our

plans to grow our commercial real estate, commercial and industrial, and public

finance loan portfolios; competition with national, regional and community

financial institutions; the loss of any key members of senior management;

fluctuations in interest rates; general economic conditions; risks relating to the

regulation of financial institutions; and other factors identified in reports we file

with the U.S. Securities and Exchange Commission. All statements in this

presentation, including forward-looking statements, speak only as of the date

they are made, and the Company undertakes no obligation to update any

statement in light of new information or future events.

Safe Harbor

8

Who We Are

First Internet Bank launched in 1999

First state-chartered, FDIC-insured Internet bank

Industry pioneer in branchless delivery of

consumer and commercial banking services

Headquartered in Fishers, IN with a loan

production office in Phoenix, AZ

Experienced management team

9

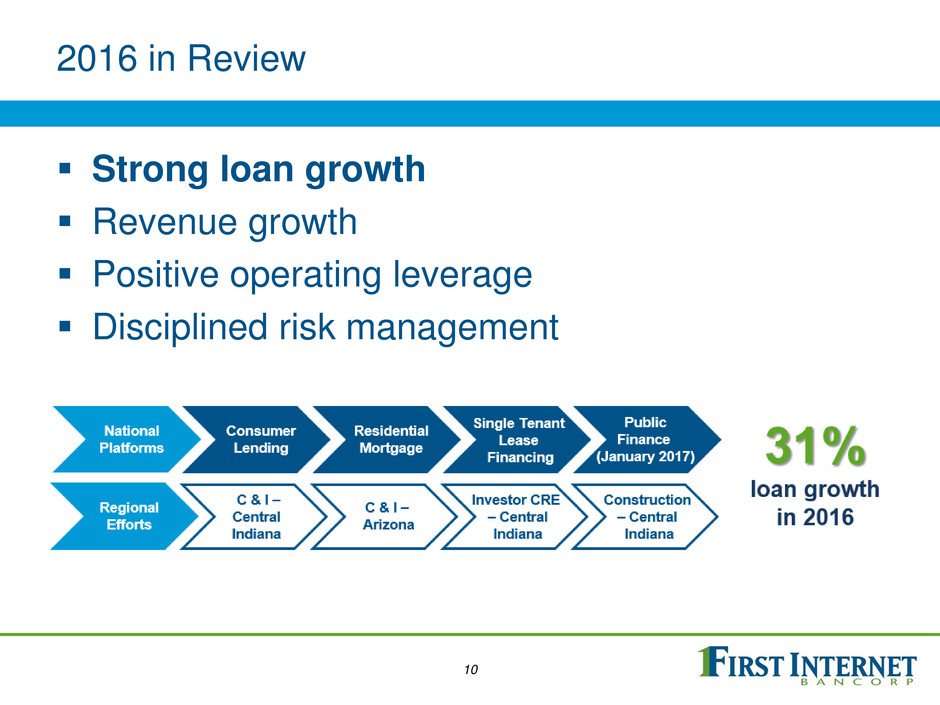

2016 in Review

Strong loan growth

Revenue growth

Positive operating leverage

Disciplined risk management

10

2016 in Review

Strong loan growth

Revenue growth

Positive operating leverage

Disciplined risk management

$53.8 million

Revenue in 2016

32%

Increase over prior year

11

2016 in Review

Strong loan growth

Revenue growth

Positive operating leverage

Disciplined risk management

$22.3 million

1

Pre-provision, pre-tax income

43%

Increase over prior year

12

1 Non-GAAP financial measure; reconciled as follows: full year 2016 net income of $12.1

million plus full year 2016 income tax provision of $5.9 million plus full year 2016 provision for

loan losses of $4.3 million. For further information on the full year amounts, see the

Consolidated Statements of Income on page F-4 of the Company’s Annual Report on 10-K

for the year ended December 31, 2016.

2016 in Review

Strong loan growth

Revenue growth

Positive operating leverage

Disciplined risk management

15 bps

Net charge-offs / average loans

46 bps

(U.S. Commercial Banks1)

1 Source: SNL Financial

13

FIRST LOOK

Focused on the Future

14

Driving to $3 Billion in Total Assets

15

With Growth, Expanded Net Interest Income

YOY Growth

1Q17 v 1Q16

16

38%

Loans

25%

Net Interest

Income

With Growth, Improved Economies of Scale

$9.4M

1Q16

$10.3M

1Q17

2.08%

1Q16

1.85%

1Q17

17

With Growth, Created Shareholder Value

1 Year 2 Year 5 Year

NASDAQ Composite Index 7.5% 13.7% 106.6%

SNL Micro Cap US Bank Index 20.7% 31.7% 130.3%

INBK 11.5% 91.2% 413.4%

18

Increased liquidity

Increased visibility

in investment

community

Upgraded listing

(NASDAQ Global

Select Market)

Our Growth: Organic

Five-year balance sheet growth rates far exceed

median rates for similar institutions

19

Source: Company data and SNL Financial; financial data as March 31, 2017; peer data

represents median value of component companies. SNL Micro Cap US Banks represent

publicly traded micro cap banks with a market capitalization of less than $250 million; peer

data based on index components as of March 31, 2017.

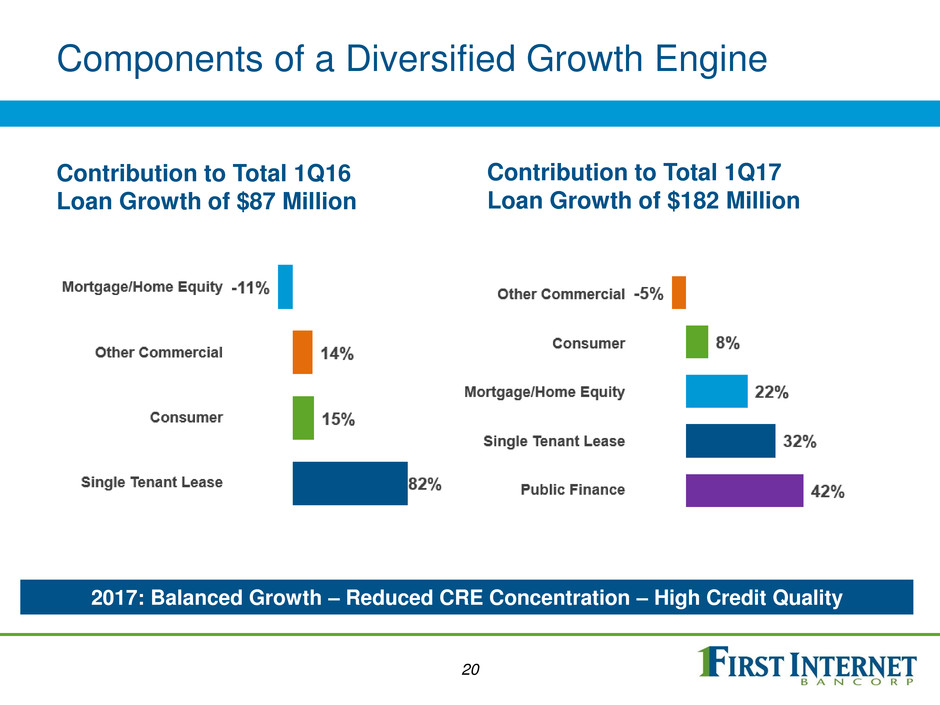

Components of a Diversified Growth Engine

Contribution to Total 1Q16

Loan Growth of $87 Million

Contribution to Total 1Q17

Loan Growth of $182 Million

2017: Balanced Growth – Reduced CRE Concentration – High Credit Quality

20

Growth Opportunities under Consideration

Marketplace lending

Healthcare or other industry-focused lending

Asset-based lending

Specialty finance (equipment, franchise,

lender, trade)

SBA lending

Other niche consumer lending

21

Execution

1 Assumes average tangible common equity/tangible assets of 7.50%.

22

Investor Relations

www.firstinternetbancorp.com

investors@firstib.com

NASDAQ: INBK

23