Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - KELLY SERVICES INC | a20171qearningsreleaseform.htm |

| 8-K - 8-K - KELLY SERVICES INC | form8-k2017firstquarter.htm |

Kelly Services, Inc.

First Quarter

May 11, 2017

Exhibit 99.2

Safe Harbor Statement

This release contains statements that are forward looking in nature and, accordingly, are subject to risks and

uncertainties. These factors include, but are not limited to, competitive market pressures including pricing and

technology introductions, changing market and economic conditions, our ability to achieve our business strategy,

the risk of damage to our brand, the risk our intellectual assets could be infringed upon or compromised, our

ability to successfully develop new service offerings, our exposure to risks associated with services outside

traditional staffing, including business process outsourcing, our increasing dependency on third parties for the

execution of critical functions, the risks associated with past and future acquisitions, exposure to risks associated

with investments in equity affiliates, material changes in demand from or loss of large corporate customers, risks

associated with conducting business in foreign countries, including foreign currency fluctuations, availability of

full-time employees to lead complex talent supply chain sales and operations, availability of temporary workers

with appropriate skills required by customers, liabilities for employment-related claims and losses, including class

action lawsuits and collective actions, the risk of cyber attacks or other breaches of network or information

technology security as well as risks associated with compliance on data privacy, our ability to sustain critical

business applications through our key data centers, our ability to effectively implement and manage our

information technology programs, our ability to maintain adequate financial and management processes and

controls, impairment charges triggered by adverse industry developments or operational circumstances,

unexpected changes in claim trends on workers’ compensation, disability and medical benefit plans, the impact of

the Patient Protection and Affordable Care Act on our business, the impact of changes in laws and regulations

(including federal, state and international tax laws ), the risk of additional tax or unclaimed property liabilities in

excess of our estimates, our ability to maintain specified financial covenants in our bank facilities to continue to

access credit markets, and other risks, uncertainties and factors discussed in this release and in the Company’s

filings with the Securities and Exchange Commission. Actual results may differ materially from any forward looking

statements contained herein, and we have no intention to update these statements.

2

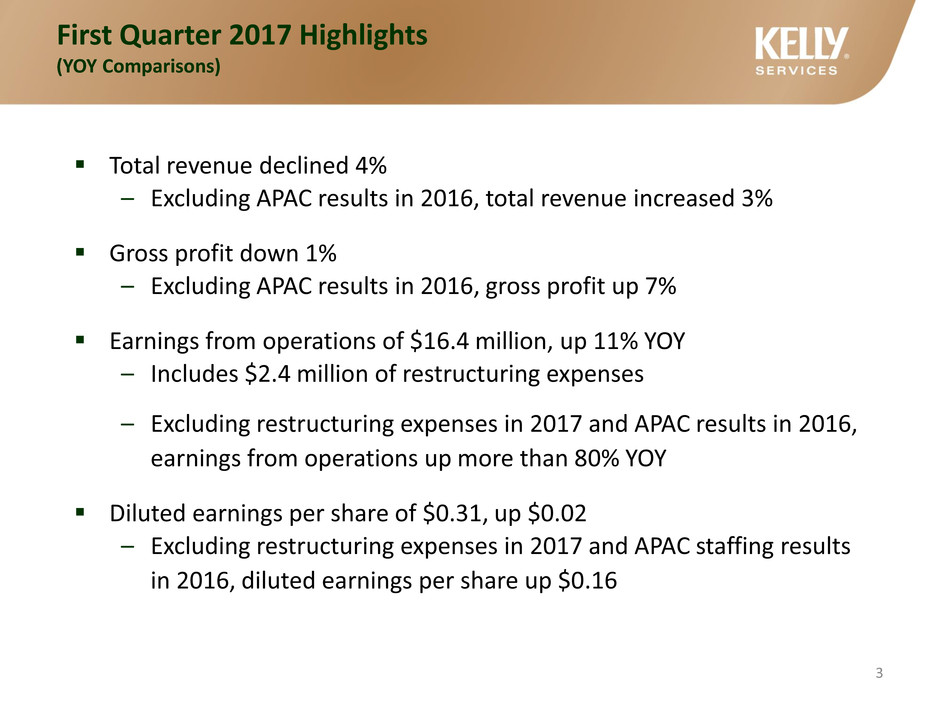

First Quarter 2017 Highlights

(YOY Comparisons)

Total revenue declined 4%

– Excluding APAC results in 2016, total revenue increased 3%

Gross profit down 1%

– Excluding APAC results in 2016, gross profit up 7%

Earnings from operations of $16.4 million, up 11% YOY

– Includes $2.4 million of restructuring expenses

– Excluding restructuring expenses in 2017 and APAC results in 2016,

earnings from operations up more than 80% YOY

Diluted earnings per share of $0.31, up $0.02

– Excluding restructuring expenses in 2017 and APAC staffing results

in 2016, diluted earnings per share up $0.16

3

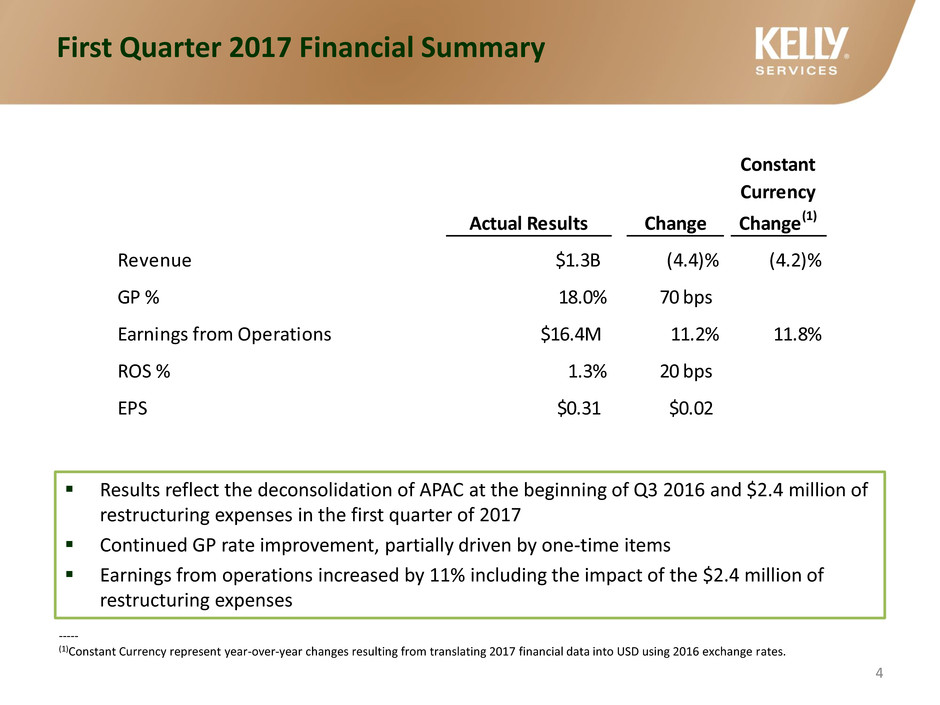

Results reflect the deconsolidation of APAC at the beginning of Q3 2016 and $2.4 million of

restructuring expenses in the first quarter of 2017

Continued GP rate improvement, partially driven by one-time items

Earnings from operations increased by 11% including the impact of the $2.4 million of

restructuring expenses

-----

(1)Constant Currency represent year-over-year changes resulting from translating 2017 financial data into USD using 2016 exchange rates.

First Quarter 2017 Financial Summary

4

Actual Results Change

Constant

Currency

Change(1)

Reve ue $1.3B (4.4)% (4.2)%

GP % 18.0% 70 bps

Earnings from Operations $16.4M 11.2% 11.8%

ROS % 1.3% 20 bps

EPS $0.31 $0.02

-----

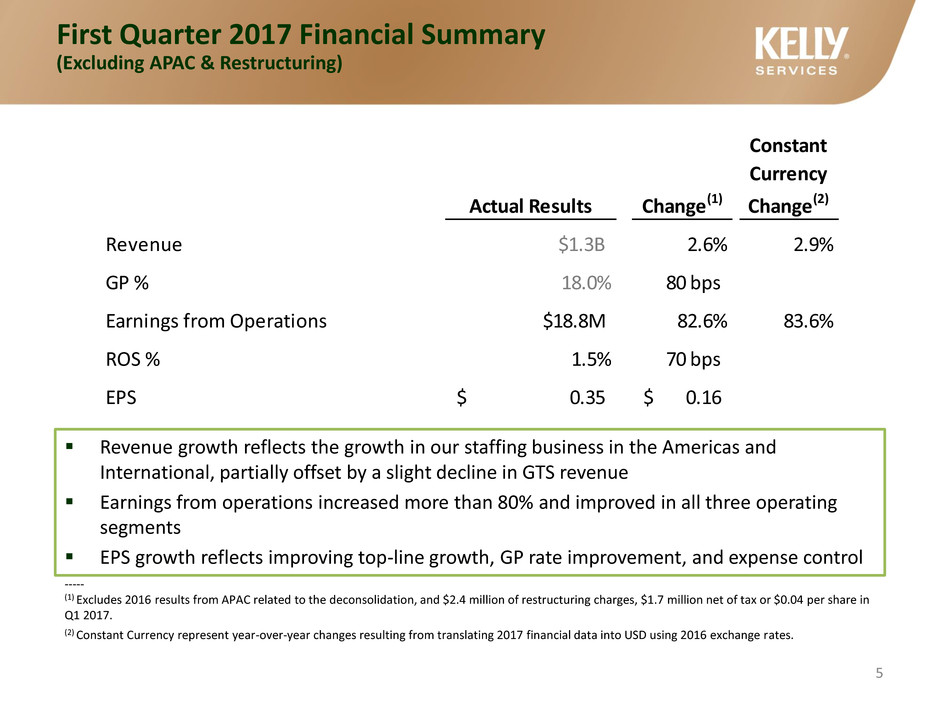

(1) Excludes 2016 results from APAC related to the deconsolidation, and $2.4 million of restructuring charges, $1.7 million net of tax or $0.04 per share in

Q1 2017.

(2) Constant Currency represent year-over-year changes resulting from translating 2017 financial data into USD using 2016 exchange rates.

Revenue growth reflects the growth in our staffing business in the Americas and

International, partially offset by a slight decline in GTS revenue

Earnings from operations increased more than 80% and improved in all three operating

segments

EPS growth reflects improving top-line growth, GP rate improvement, and expense control

First Quarter 2017 Financial Summary

(Excluding APAC & Restructuring)

5

Actual Results Change(1)

Constant

Currency

Change(2)

Revenue $1.3B 2.6% 2.9%

GP % 18.0% 80 bps

Earnings from Operations $18.8M 82.6% 83.6%

ROS % 1.5% 70 bps

EPS 0.35$ 0.16$

Americas staffing revenues reflect a return to top-line growth

International staffing is impacted by the deconsolidation of APAC staffing at the end

of 2016. Excluding APAC staffing, the segment grew revenue at 8%

First Quarter 2017 Revenue Growth

6

44%

18%

38%

Business Mix

Americas Staffing International Staffing Global Talent Solutions

-30%

-20%

-10%

0%

10%

20%

30%

Total Americas Staffing International Staffing Global Talent

Solutions

YoY Growth

Reported Constant Currency Excluding APAC in 2016

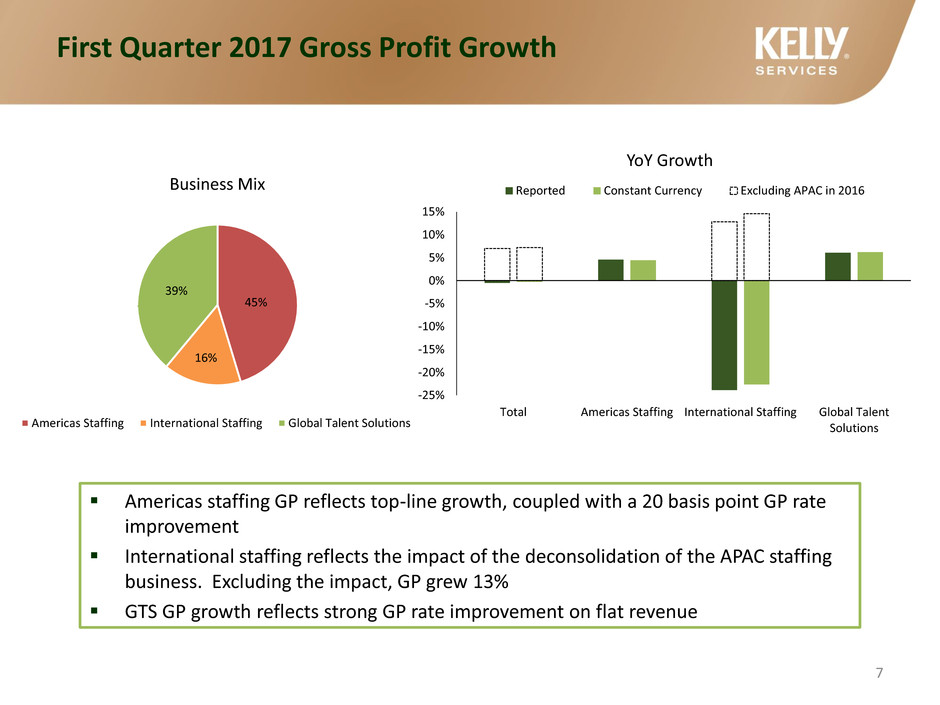

First Quarter 2017 Gross Profit Growth

Americas staffing GP reflects top-line growth, coupled with a 20 basis point GP rate

improvement

International staffing reflects the impact of the deconsolidation of the APAC staffing

business. Excluding the impact, GP grew 13%

GTS GP growth reflects strong GP rate improvement on flat revenue

7

45%

16%

39%

Business Mix

Americas Staffing International Staffing Global Talent Solutions

-25%

-20%

-15%

-10%

-5%

0%

5%

10%

15%

Total Americas Staffing International Staffing Global Talent

Solutions

YoY Growth

Reported Constant Currency Excluding APAC in 2016

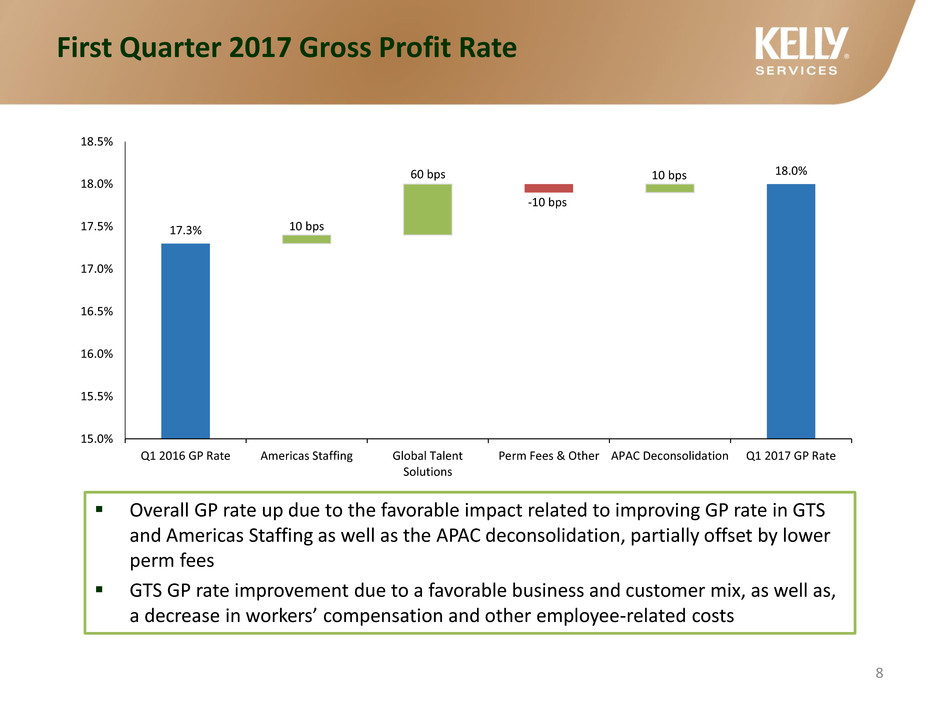

17.3%

18.0%

15.0%

15.5%

16.0%

16.5%

17.0%

17.5%

18.0%

18.5%

Q1 2016 GP Rate Americas Staffing Global Talent

Solutions

Perm Fees & Other APAC Deconsolidation Q1 2017 GP Rate

First Quarter 2017 Gross Profit Rate

Overall GP rate up due to the favorable impact related to improving GP rate in GTS

and Americas Staffing as well as the APAC deconsolidation, partially offset by lower

perm fees

GTS GP rate improvement due to a favorable business and customer mix, as well as,

a decrease in workers’ compensation and other employee-related costs

10 bps

60 bps

8

10 bps

-10 bps

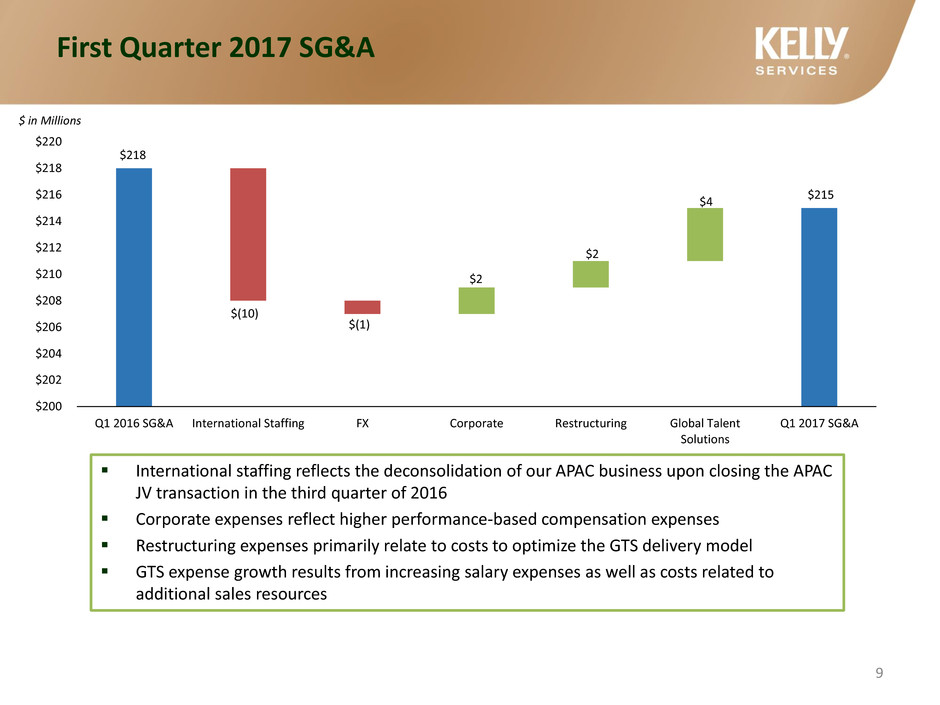

$218

$215

$200

$202

$204

$206

$208

$210

$212

$214

$216

$218

$220

Q1 2016 SG&A International Staffing FX Corporate Restructuring Global Talent

Solutions

Q1 2017 SG&A

First Quarter 2017 SG&A

International staffing reflects the deconsolidation of our APAC business upon closing the APAC

JV transaction in the third quarter of 2016

Corporate expenses reflect higher performance-based compensation expenses

Restructuring expenses primarily relate to costs to optimize the GTS delivery model

GTS expense growth results from increasing salary expenses as well as costs related to

additional sales resources

$(10)

$(1)

$2

$2

$ in Millions

$4

9

First Quarter 2017 Conversion Rate

-----

(1)Conversion rate represents earnings from operations as a percent of gross profit, or return on gross profit.

APAC results are no longer included in the international staffing or total

Company’s gross profit or earnings from operations upon closing of the APAC JV

transaction at the beginning of the third quarter of 2016

$ in Millions

10

2017 2016

Gross Earnings Conversion Gross Earnings Conversion Change

Profit from Ops Rate(1) Profit from Ops Rate(1) (bps)

Americ s Staffing 105.3$ 21.2$ 20.1% 100.7$ 17.1$ 16.9% 320

Global Talent

Solutions

90.5 15.3 16.9% 85.3 13.7 16.0% 90

International

Staffing

36.4 5.2 14.4% 47.8 6.6 14.0% 40

Total Company 231.6$ 16.4$ 7.1% 232.7$ 14.7$ 6.3% 80

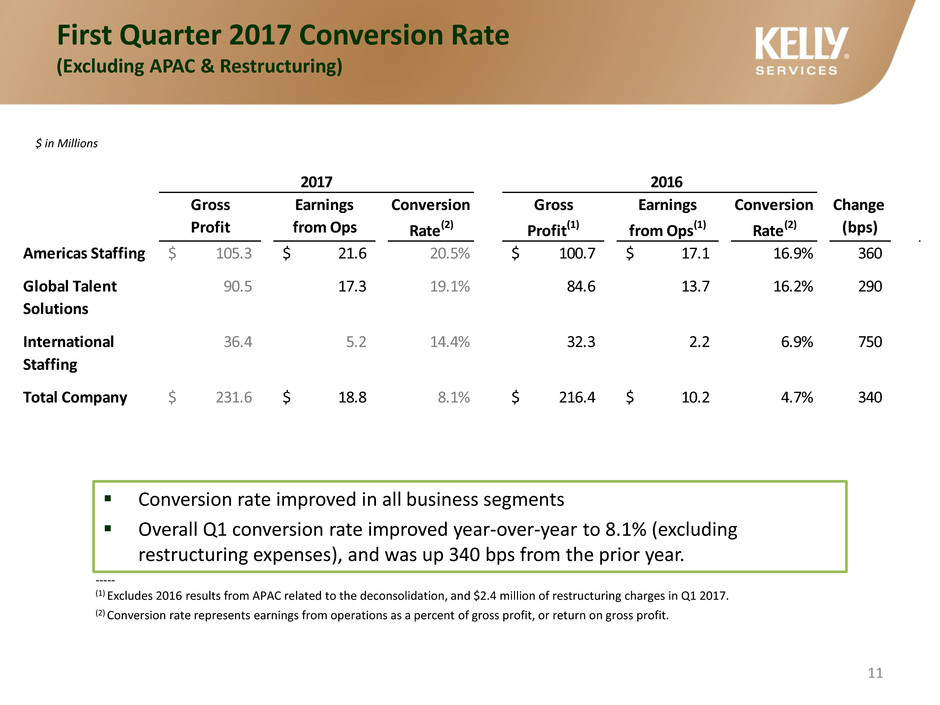

First Quarter 2017 Conversion Rate

(Excluding APAC & Restructuring)

$ in Millions

-----

(1) Excludes 2016 results from APAC related to the deconsolidation, and $2.4 million of restructuring charges in Q1 2017.

(2) Conversion rate represents earnings from operations as a percent of gross profit, or return on gross profit.

Conversion rate improved in all business segments

Overall Q1 conversion rate improved year-over-year to 8.1% (excluding

restructuring expenses), and was up 340 bps from the prior year.

11

2017 2016

Gross Earnings Conversion Gross Earnings Conversion Change

Profit from Ops Rate(2) Profit(1) from Ops(1) Rate(2) (bps)

Am ricas Staffing 105.3$ 21.6$ 20.5% 100.7$ 17.1$ 16.9% 360

Global Talent

Solutions

90.5 17.3 19.1% 84.6 13.7 16.2% 290

International

Staffing

36.4 5.2 14.4% 32.3 2.2 6.9% 750

Total Company 231.6$ 18.8$ 8.1% 216.4$ 10.2$ 4.7% 340

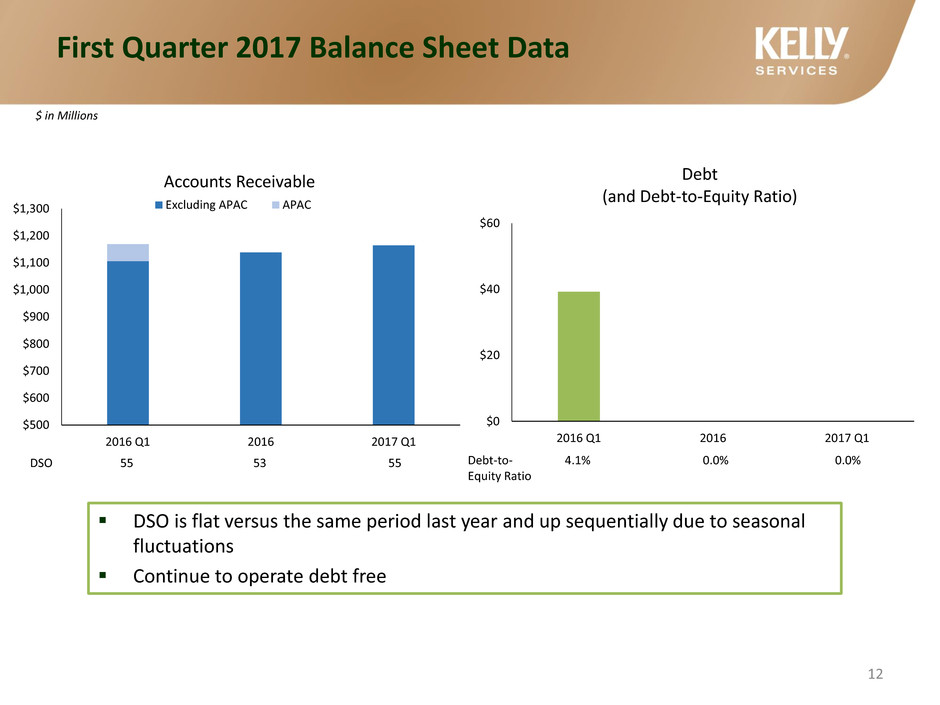

$500

$600

$700

$800

$900

$1,000

$1,100

$1,200

$1,300

2016 Q1 2016 2017 Q1

Accounts Receivable

Excluding APAC APAC

First Quarter 2017 Balance Sheet Data

12

DSO is flat versus the same period last year and up sequentially due to seasonal

fluctuations

Continue to operate debt free

$ in Millions

DSO 55 53 55 Debt-to- 4.1% 0.0% 0.0%

Equity Ratio

$0

$20

$40

$60

2016 Q1 2016 2017 Q1

Debt

(and Debt-to-Equity Ratio)

2017 Outlook – Second Quarter

Revenue down 3.5% to 4.5% YOY

– Excluding the impact of the APAC results in 2016,

revenue up 2.5% to 3.5%

Gross profit rate up YOY, but down sequentially

SG&A down 3.5% to 4.5% YOY

– Excluding APAC results in 2016, SG&A up 2.5% to 3.5%

13

2017 Outlook – Full Year

Revenue down 1% to flat YOY

– No significant foreign exchange impact expected

– Excluding the impact of the APAC results in the first half of

2016, revenue up 3.0% to 4.0%

Gross profit rate up YOY

SG&A down 1% to flat YOY

– Excluding APAC results in the first half of 2016, SG&A up 3.0%

to 4.0%

Annual tax rate in mid-20% range, including impact of Work

Opportunity Credits

14

APPENDIX:

TS KELLY ASIA PACIFIC JOINT VENTURE

Highlights – TS Kelly Asia Pacific

Joint Venture capitalizes on the strong reputation of Kelly Services as a

leading talent provider in the region and on Temp Holdings’ regional

presence

– Provides accelerated growth opportunities, larger workforce

solutions presence, and enhanced competitive positioning

– Expands on 14-year strategic partnership between Kelly and

Temp Holdings

TS Kelly Asia Pacific is expected to be one of the largest workforce

solutions companies in the Asia Pacific region

Solidifies Kelly’s focus on OCG solutions in the APAC market

– Opportunity to accelerate investment in high growth market

– Kelly’s outsourcing and consulting group, KellyOCG, is not part

of the joint venture and will continue to operate under the

complete control of Kelly

16

Expands scope from four geographies to twelve, with headquarters in

Singapore

Brings together established businesses with approximately $500 million

in revenue and 1,600 employees

– TS Kelly North Asia – China, Hong Kong, Taiwan, South Korea

– Kelly Services – Singapore, Malaysia, Australia, New Zealand,

India, Indonesia, Thailand

– Capita – Singapore and Malaysia

– First Alliances – Vietnam

– Intelligence – Indonesia, Vietnam, Singapore, Malaysia

Highlights – TS Kelly Asia Pacific

17

Closed on July 4, 2016, the JV was formed through asset transfers from Kelly and

Temp Holdings, and a $36.5 million cash payment to Kelly at closing and a $4.5

million cash true-up payment made to Kelly in Q4 2016

Temp Holdings owns 51%, Kelly owns 49%

Beginning in the third quarter, Kelly accounts for its 49% interest as an Equity

Method Investment

– APAC results are no longer included in the individual lines of

Kelly’s consolidated income statement or balance sheet

• Equity method investment asset will be reported as a single line item on the

balance sheet

• 49% share of income reflected as Income from equity method investments

(below earnings from operations), effective on the transaction closing date

» Will no longer be included as revenue, cost of service, and SG&A

expense

TS Kelly Asia Pacific – Transaction Details

18