Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - KELLY SERVICES INC | kelya-201711xexh322.htm |

| EX-32.1 - EXHIBIT 32.1 - KELLY SERVICES INC | kelya-201711xexh321.htm |

| EX-31.2 - EXHIBIT 31.2 - KELLY SERVICES INC | kelya-201711xexh312.htm |

| EX-31.1 - EXHIBIT 31.1 - KELLY SERVICES INC | kelya-201711xexh311.htm |

| EX-24 - EXHIBIT 24 - KELLY SERVICES INC | kelya-201711x10xkexhibit24.htm |

| EX-23 - EXHIBIT 23 - KELLY SERVICES INC | kelya-201711x10xkexhibit23.htm |

| EX-21 - EXHIBIT 21 - KELLY SERVICES INC | kelya-201711x10xkexhibit21.htm |

| EX-14 - EXHIBIT 14 - KELLY SERVICES INC | kelya-201711x10xkexhibit14.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934 For the fiscal year ended January 1, 2017

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from _________ to __________

Commission file number 0-1088

KELLY SERVICES, INC. | ||

(Exact Name of Registrant as specified in its Charter) | ||

Delaware | 38-1510762 | |||

(State or other jurisdiction of | (IRS Employer Identification Number) | |||

incorporation or organization) | ||||

999 West Big Beaver Road, Troy, Michigan | 48084 | |

(Address of Principal Executive Office) | (Zip Code) | |

(248) 362-4444 | ||

(Registrant’s Telephone Number, Including Area Code) | ||

Securities Registered Pursuant to Section 12(b) of the Act: | ||||

Title of each class | Name of each exchange on which registered | |||

Class A Common | NASDAQ Global Market | |||

Class B Common | NASDAQ Global Market | |||

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No[ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] | Accelerated filer [X] |

Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $560,567,627.

Registrant had 34,806,309 shares of Class A and 3,437,643 of Class B common stock, par value $1.00, outstanding as of February 5, 2017.

Documents Incorporated by Reference

The proxy statement of the registrant with respect to its 2017 Annual Meeting of Stockholders is incorporated by reference in Part III.

2

PART I

Unless the context otherwise requires, throughout this Annual Report on Form 10-K the words “Kelly,” “Kelly Services,” “the Company,” “we,” “us” and “our” refer to Kelly Services, Inc. and its consolidated subsidiaries.

ITEM 1. BUSINESS.

History and Development of Business

Founded by William R. Kelly in 1946, Kelly Services® has developed innovative workforce solutions for customers in a variety of industries throughout our 70-year history. Our range of solutions has grown steadily over the years to match the changing needs of our customers and to reflect the changing nature of our work.

We have evolved from a United States-based company concentrating primarily on traditional office staffing into a global workforce solutions leader offering a full breadth of specialty services. While ranking as one of the world’s largest scientific staffing providers, we also place professional and technical employees at all levels in engineering, IT, law, healthcare and finance. These specialty services complement our expertise in office services, education, contact center, light industrial and electronic assembly staffing. As the human capital arena has become more complex, we have also developed a talent supply chain management approach to help many of the world’s largest companies plan for and manage their workforce. Innovative solutions supporting this approach span outsourcing, consulting, recruitment, career transition and vendor management services.

Geographic Breadth of Services

Headquartered in Troy, Michigan, Kelly provides workforce solutions to a diversified group of customers in three regions: the Americas; Europe, the Middle East, and Africa (“EMEA”); and Asia Pacific (“APAC”). Our customer base spans a variety of industries and includes 95 of the Fortune 100™ companies.

In 2016, we assigned nearly 500,000 temporary employees to a variety of customers around the globe.

Description of Business Segments

Our operations are divided into seven principal business segments: Americas Commercial, Americas Professional and Technical (“Americas PT”), EMEA Commercial, EMEA Professional and Technical (“EMEA PT”), APAC Commercial, APAC Professional and Technical (“APAC PT”) and Outsourcing and Consulting Group (“OCG”). In July 2016, we transferred our APAC Commercial and APAC PT staffing operations to TS Kelly Asia Pacific, an expanded joint venture with our long-time partner, Temp Holdings. Kelly retains a 49% ownership interest in TS Kelly Asia Pacific. OCG in the APAC region remains wholly Kelly-owned and continues to provide holistic workforce solutions throughout the APAC region.

Americas Commercial

Our Americas Commercial segment specialties include: Office, providing trained employees for data entry, clerical and administrative support roles across numerous industries; Contact Center, providing staff for contact centers, technical support hotlines and telemarketing units; Education, supplying schools nationwide with instructional and non-instructional employees; Marketing, providing support staff for seminars, sales and trade shows; Electronic Assembly, providing assemblers, quality control inspectors and technicians; and Light Industrial, placing maintenance workers, material handlers and assemblers. We also offer a temporary-to-hire service that provides customers and temporary staff the opportunity to evaluate their relationship before making a full-time employment decision, as well as a direct-hire placement service and vendor on-site management.

Americas PT

Our Americas PT segment includes a number of specialty staffing services: Science, providing all levels of scientists and scientific and clinical research workforce solutions; Engineering, supplying engineering professionals across all disciplines, including aeronautical, chemical, civil/structural, electrical/instrumentation, environmental, industrial, mechanical, petroleum, pharmaceutical, quality and telecommunications; Information Technology, placing IT specialists across all disciplines; Creative Services, placing creative talent in the spectrum of creative services positions; Finance and Accounting, serving the needs of corporate finance departments, accounting firms and financial institutions with all levels of financial professionals; Healthcare, providing all levels of healthcare specialists and professionals; and Law, placing legal professionals including attorneys, paralegals, contract administrators, compliance specialists and legal administrators. Our temporary-to-hire service, direct-hire placement service and vendor on-site management are also offered in this segment.

3

EMEA Commercial

Our EMEA Commercial segment provides a similar range of staffing services as described for our Americas Commercial segment above, including: Office, Contact Center and our temporary-to-hire service. Additional service areas include: Catering and Hospitality, providing chefs, porters and hospitality representatives; and Industrial, supplying manual workers to semi-skilled professionals in a variety of trade, non-trade and operational positions.

EMEA PT

Our EMEA PT segment provides many of the same services as described for our Americas PT segment, including: Engineering, Finance and Accounting, Healthcare, IT and Science.

APAC Commercial

Our APAC Commercial segment offered a similar range of commercial staffing services as described for our Americas and EMEA Commercial segments above, through staffing solutions that included permanent placement, temporary staffing and temporary to full-time staffing. The operations of this segment were transferred to TS Kelly Asia Pacific in July 2016.

APAC PT

Our APAC PT segment provided many of the same services as described for our Americas and EMEA PT segments, including: Engineering, IT and Science. The operations of this segment were transferred to TS Kelly Asia Pacific in July 2016.

OCG

Our OCG segment delivers integrated talent management solutions to meet customer needs across multiple regions, skill sets and the entire spectrum of talent categories. Using talent supply chain strategies, we help customers manage their full-time and contingent labor spend, and gain access to service providers and quality talent at competitive rates with minimized risk. Services in this segment include: Contingent Workforce Outsourcing (“CWO”), providing globally managed service solutions that integrate supplier and vendor management technology partners to optimize contingent workforce spend; Business Process Outsourcing (“BPO”), offering full staffing and operational management of non-core functions or departments; Recruitment Process Outsourcing (“RPO”), offering end-to-end talent acquisition solutions, including customized recruitment projects; Independent Contractor Solutions, delivering evaluation, classification and risk management services that enable safe access to this critical talent pool; Payroll Process Outsourcing (“PPO”), providing centralized payroll processing solutions globally for our customers; and Career Transition and Executive Coaching and Development, providing leadership in executive placement in various regions throughout the world.

Financial information regarding our industry segments is included in the Segment Disclosures note to our consolidated financial statements presented in Part II, Item 8 of this report.

Business Objectives

Kelly’s philosophy is rooted in our conviction that our business can and does make a difference on a daily basis — for our customers, in the lives of our employees, in the local communities we serve and in our industry. Our vision is “to provide the world’s best workforce solutions.” We aspire to be a strategic business partner to our customers and strive to assist them in operating more efficient and profitable organizations. Our solutions are customized to benefit any scope or scale customers require.

As the use of contingent labor, consultants and independent contractors becomes more prevalent and critical to the ongoing success of our customer base, our core competencies are refined to help them realize their respective business objectives. Kelly offers a comprehensive array of outsourcing and consulting services, as well as world-class staffing on a temporary, temporary-to-hire and direct placement basis. Kelly will continue to deliver the strategic expertise our customers need to transform their workforce challenges into opportunities.

4

Business Operations

Service Marks

We own numerous service marks that are registered with the United States Patent and Trademark Office, the European Union Community Trademark Office and numerous individual country trademark offices.

Seasonality

Our quarterly operating results are affected by the seasonality of our customers’ businesses. Demand for staffing services historically has been lower during the first quarter, and typically increases during the remainder of the year.

Working Capital

Our working capital requirements are primarily generated from temporary employee payroll and customer accounts receivable. Since receipts from customers generally lag payroll to temporary employees, working capital requirements increase substantially in periods of growth.

Customers

We are not dependent on any single customer or a limited segment of customers. In 2016, an estimated 51% of total Company revenue was attributed to 100 large customers. Our largest single customer accounted for approximately five percent of total revenue in 2016.

Government Contracts

Although we conduct business under various federal, state, and local government contracts, no single one accounts for more than three percent of total Company revenue in 2016.

Competition

The worldwide temporary staffing industry is competitive and highly fragmented. In the United States, approximately 100 competitors operate nationally, and approximately 10,000 smaller companies compete in varying degrees at local levels. Additionally, several similar staffing companies compete globally. In 2016, our largest competitors were Adecco S.A., Randstad Holding N.V., ManpowerGroup Inc., Allegis Group and Recruit Holdings.

Key factors that influence our success are quality of service, price and breadth of service.

Quality of service is highly dependent on the availability of qualified, competent talent, and our ability to recruit, screen, train, retain and manage a pool of employees who match the skills required by particular customers. During an economic downturn, we must balance competitive pricing pressures with the need to retain a qualified workforce. Price competition in the staffing industry is intense, particularly for office clerical and light industrial personnel, and pricing pressure from customers and competitors continues to be significant.

Breadth of service, or ability to manage staffing suppliers, has become more critical as customers seek a single supplier to manage all their staffing needs. Kelly’s talent supply chain management approach seeks to address this requirement for our larger customers, enabling us to deliver talent wherever and whenever they need it around the world.

Environmental Concerns

Because we are involved in a service business, federal, state or local laws that regulate the discharge of materials into the environment do not materially impact us.

Employees

We employ approximately 1,100 people at our corporate headquarters in Troy, Michigan, and approximately 6,400 staff members in our U.S. and international network of branch offices. In 2016, we assigned nearly 500,000 temporary employees to a variety of customers around the globe.

While services may be provided inside the facilities of customers, we remain the employer of record for our temporary employees. We retain responsibility for employee assignments, the employer’s share of all applicable payroll taxes and the administration of the employee’s share of these taxes.

5

Foreign Operations

For information regarding sales, earnings from operations and long-lived assets by domestic and foreign operations, please refer to the information presented in the Segment Disclosures note to our consolidated financial statements, presented in Part II, Item 8 of this report.

Access to Company Information

We electronically file our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports with the Securities and Exchange Commission (“SEC”). The public may read and copy any of the reports that are filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically.

We make available, free of charge, through our website, and by responding to requests addressed to our vice president of investor relations, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports. These reports are available as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. Our website address is: www.kellyservices.com. The information contained on our website, or on other websites linked to our website, is not part of this report.

6

ITEM 1A. RISK FACTORS.

We operate in a highly competitive industry with low barriers to entry and may be unable to compete successfully against existing or new competitors.

The worldwide staffing services market is highly competitive with limited barriers to entry. We compete in global, national, regional and local markets with full-service and specialized temporary staffing and consulting companies. While the majority of our competitors are significantly smaller than us, several competitors, including Adecco S.A., Randstad Holding N.V., ManpowerGroup Inc., Allegis Group and Recruit Holdings, are considerably larger than we are and have more substantial marketing and financial resources. Additionally, the emergence of online staffing platforms or other forms of disintermediation may pose a competitive threat to our services, which operate under a more traditional staffing business model. Price competition in the staffing industry is intense, particularly for the provision of office clerical and light industrial personnel. We expect that the level of competition will remain high, which could limit our ability to maintain or increase our market share or profitability.

The number of customers distributing their staffing service purchases among a broader group of competitors continues to increase which, in some cases, may make it more difficult for us to obtain new customers, or to retain or maintain our current share of business, with existing customers. We also face the risk that our current or prospective customers may decide to provide similar services internally. As a result, there can be no assurance that we will not encounter increased competition in the future.

Our business is significantly affected by fluctuations in general economic conditions.

Demand for staffing services is significantly affected by the general level of economic activity and employment in the United States and the other countries in which we operate. When economic activity increases, temporary employees are often added before full-time employees are hired. As economic activity slows, however, many companies reduce their use of temporary employees before laying off full-time employees. Significant swings in economic activity historically have had a disproportionate impact on staffing industry volumes. We may also experience more competitive pricing pressure during periods of economic downturn. A substantial portion of our revenues and earnings are generated by our business operations in the United States. Any significant economic downturn in the United States or certain other countries in which we operate could have a material adverse effect on our business, financial condition and results of operations.

Technological advances may significantly disrupt the labor market and weaken demand for human capital at a rapid rate.

Our success is directly dependent on our customers’ demands for talent. As technology continues to evolve, more tasks currently performed by people may be replaced by automation, robotics, machine learning, artificial intelligence and other technological advances outside of our control. This trend poses a risk to the staffing industry as a whole, particularly in lower-skill job categories that may be more susceptible to such replacement.

We may not achieve the intended effects of our business strategy.

Our business strategy focuses on driving growth in higher margin specialties in our OCG segment and in Americas PT. We have made targeted investments, adjusted our operating models and increased the resources necessary for driving sustainable growth within our targeted higher-margin solutions. If we are unsuccessful in executing our strategy, we may not achieve either our stated goal of strong revenue growth or the intended productivity improvements, which could negatively impact profitability.

We are at risk of damage to our brand, which is important to our success.

Our success depends, in part, on the goodwill associated with our brand. Because we assign employees to work under the direction and supervision of our customer at work locations not under Kelly’s control, we are at risk of our employees engaging in unauthorized conduct that could harm our reputation. Our Kelly Educational Staffing product is particularly susceptible to this exposure. An occurrence that damages Kelly’s reputation could cause the loss of current and future customers, additional regulatory scrutiny and liability to third parties.

Our intellectual property assets could be infringed upon or compromised, and there are limitations to our ability to protect against such events.

Our success is dependent in part on our proprietary business processes, our intellectual property and our thought leadership. To protect those rights, we depend upon protections afforded by the laws of the various countries in which we operate, as well as

7

contractual language and our own enforcement initiatives. These defenses may not be sufficient to fully protect us or to deter infringement or other misappropriation of our trade secrets and other intellectual property. In addition, third parties may challenge the validity or enforceability of our intellectual property rights. We also face the risk that third parties may allege that the operation of our business infringes or otherwise misappropriates intellectual property rights that they own or license. Losses or claims of this nature could cause us to incur significant expense, harm our reputation, reduce our competitive advantages or prevent us from offering certain services or solutions. The remedies available to us may be limited or leave us without full compensation.

If we fail to successfully develop new service offerings, we may be unable to retain our current customers and gain new customers and our revenues would decline.

The process of developing new service offerings requires accurate anticipation of customers’ changing needs and emerging technological trends. This may require that we make long-term investments and commit significant resources before knowing whether these investments will eventually result in service offerings that achieve customer acceptance and generate the revenues required to provide desired returns. If we fail to accurately anticipate and meet our customers’ needs through the development of new service offerings, our competitive position could be weakened and that could materially adversely affect our results of operations and financial condition.

As we increasingly offer services outside the realm of traditional staffing, including business process outsourcing, we are exposed to additional risks which could have a material adverse effect on our business.

Our business strategy focuses on growing our outsourcing and consulting business, including business process outsourcing, where we provide operational management of our customers’ non-core functions or departments. This could expose us to certain risks unique to that business, including product liability or product recalls. Although we have internal vetting processes intended to control such risks, there is no assurance that these processes will be effective. Additionally, while we maintain insurance in types and amounts we believe are appropriate in light of the aforementioned exposures, there can also be no assurance that such insurance policies will remain available on reasonable terms or be sufficient in amount or scope of coverage.

We are increasingly dependent on third parties for the execution of critical functions.

We do not maintain our own vendor management technology, and we have outsourced certain other critical applications or business processes to external providers, including cloud-based services. We have elected to enter into supplier partnerships rather than establishing or maintaining our own operations in some of the territories where our customers require our services. We do not maintain a controlling interest in our expanded staffing joint venture in Asia Pacific (TS Kelly Asia Pacific) and have elected to rely on the joint venture to provide certain back office and administrative services to our OCG operations in the region. The failure or inability to perform on the part of one or more of these critical suppliers or partners could cause significant disruptions and increased costs.

Past and future acquisitions may not be successful.

From time to time, we acquire and invest in companies throughout the world. Acquisitions involve a number of risks, including the diversion of management’s attention from its existing operations, the failure to retain key personnel or customers of an acquired business, the failure to realize anticipated benefits such as cost savings and revenue enhancements, the potentially substantial transaction costs associated with acquisitions, the assumption of unknown liabilities of the acquired business and the inability to successfully integrate the business into our operations. Potential impairment losses could result if we overpay for an acquisition. There can be no assurance that any past or future acquired businesses will generate anticipated revenues or earnings.

Investments in equity affiliates expose us to additional risks and uncertainties.

We participate, or may participate in the future, in certain investments in equity affiliates, such as joint ventures or other equity investments with strategic partners, including TS Kelly Asia Pacific. These arrangements expose us to a number of risks, including the risk that the management of the combined venture may not be able to fulfill their performance obligations under the management agreements or that the joint venture parties may be incapable of providing the required financial support. Additionally, improper, illegal or unethical actions by the venture management could have a negative impact on the reputation of the venture and our company.

8

A loss of major customers or a change in such customers’ buying behavior could have a material adverse effect on our business.

Our business strategy is focused on serving large corporate customers through high volume global service agreements. While our strategy is intended to enable us to increase our revenues and earnings from our major corporate customers, the strategy also exposes us to increased risks arising from the possible loss of major customer accounts. The deterioration of the financial condition or business prospects of these customers could reduce their need for staffing and OCG services and result in a significant decrease in the revenues and earnings we derive from these customers. Continuing merger and acquisition activity involving our large corporate customers could put existing business at risk or impose additional pricing pressures. Since receipts from customers generally lag payroll to temporary employees, the bankruptcy of a major customer could have a material adverse impact on our ability to meet our working capital requirements. Additionally, most of our customer contracts can be terminated by the customer on short notice without penalty. This creates uncertainty with respect to the revenues and earnings we may recognize with respect to our customer contracts.

Our business with large customer accounts reflects a market-driven shift in buying behaviors in which reliance on a small number of staffing partners has shifted to reliance upon outsourced workforce solutions. The movement from single-sourced to competitively sourced staffing contracts may also substantially reduce our future revenues from such customers. While Kelly has sought to address this trend with the adoption of talent supply chain strategies, including providing CWO services within our OCG segment, we may not be selected or retained as the CWO service provider by our large customers. This may result in a material decrease in the revenue we derive from providing staffing services to such customers.

Our business with the federal government and government contractors presents additional risk considerations. We must comply with laws and regulations relating to the formation, administration and performance of federal government contracts. Failure to meet these obligations could result in civil penalties, fines, suspension of payments, reputational damage, disqualification from doing business with government agencies and other sanctions or adverse consequences. Government procurement practices may change in ways that impose additional costs or risks upon us or pose a competitive disadvantage. Our employees may be unable to obtain or retain the security clearances necessary to conduct business under certain contracts, or we could lose or be unable to secure or retain a necessary facility clearance. Government agencies may temporarily or permanently lose funding for awarded contracts, or there could be delays in the start-up of projects already awarded and funded.

We conduct a significant portion of our operations outside of the United States and we are subject to risks relating to our international business activities, including fluctuations in currency exchange rates and numerous legal and regulatory requirements.

We conduct our business in most major staffing markets throughout the world. Our operations outside the United States are subject to risks inherent in international business activities, including:

• | fluctuations in currency exchange rates; |

• | restrictions or limitations on the transfer of funds; |

• | government intrusions including asset seizures, expropriations or de facto control; |

• | varying economic and political conditions; |

• | differences in cultures and business practices; |

• | differences in employment and tax laws and regulations; |

• | differences in accounting and reporting requirements; |

• | differences in labor and market conditions; |

• | changing and, in some cases, complex or ambiguous laws and regulations; |

• | violations of U.S. Foreign Corrupt Practices Act and similar anti-corruption laws; and |

• | litigation and claims. |

Our operations outside the United States are reported in the applicable local currencies and then translated into U.S. dollars at the applicable currency exchange rates for inclusion in our consolidated financial statements. Exchange rates for currencies of these countries may fluctuate in relation to the U.S. dollar and these fluctuations may have an adverse or favorable effect on our operating results when translating foreign currencies into U.S. dollars.

We depend on our ability to attract, develop and retain qualified permanent full-time employees to lead complex talent supply chain sales solutions.

As we aim to expand the number of clients adopting a talent supply chain management approach in order to support our OCG growth strategy, we are highly reliant on individuals who possess specialized knowledge and skills to lead complex talent supply chain sales and operations. There can be no assurance that qualified personnel will continue to be available. Our success is increasingly dependent on our ability to attract, develop and retain these experts.

9

We depend on our ability to attract and retain qualified temporary personnel (employed directly by us or through third-party suppliers).

We depend on our ability to attract qualified temporary personnel who possess the skills and experience necessary to meet the staffing requirements of our customers. We must continually evaluate our base of available qualified personnel to keep pace with changing customer needs. Competition for individuals with proven professional skills is intense, and demand for these individuals is expected to remain strong for the foreseeable future. There can be no assurance that qualified personnel will continue to be available in sufficient numbers and on terms of employment acceptable to us and our customers. Our success is substantially dependent on our ability to recruit and retain qualified temporary personnel.

We may be exposed to employment-related claims and losses, including class action lawsuits and collective actions, which could have a material adverse effect on our business.

We employ and assign personnel in the workplaces of other businesses. The risks of these activities include possible claims relating to:

• | discrimination and harassment; |

• | wrongful termination or retaliation; |

• | violations of employment rights related to employment screening or privacy issues; |

• | apportionment between us and our customer of legal obligations as an employer of temporary employees; |

• | classification of workers as employees or independent contractors; |

• | employment of unauthorized workers; |

• | violations of wage and hour requirements; |

• | retroactive entitlement to employee benefits, including health insurance; |

• | failure to comply with leave policy requirements; and |

• | errors and omissions by our temporary employees, particularly for the actions of professionals such as attorneys, accountants, teachers and scientists. |

We are also subject to potential risks relating to misuse of customer proprietary information, misappropriation of funds, death or injury to our employees, damage to customer facilities due to negligence of temporary employees, criminal activity and other similar occurrences. We may incur fines and other losses or negative publicity with respect to these risks. In addition, these occurrences may give rise to litigation, which could be time-consuming and expensive. In the U.S. and certain other countries in which we operate, new employment and labor laws and regulations have been proposed or adopted that may increase the potential exposure of employers to employment-related claims and litigation. In addition, such laws and regulations are arising with increasing frequency at the state and local level in the U.S and the resulting inconsistency in such laws and regulations results in additional complexity. There can be no assurance that the corporate policies and practices we have in place to help reduce our exposure to these risks will be effective or that we will not experience losses as a result of these risks. Although we maintain insurance in types and amounts we believe are appropriate in light of the aforementioned exposures, there can also be no assurance that such insurance policies will remain available on reasonable terms or be sufficient in amount or scope of coverage. Additionally, should we have a material inability to produce records as a consequence of litigation or a government investigation, the cost or consequences of such matters could become much greater.

A failure to maintain the privacy of information entrusted to us could have significant adverse consequences.

In the normal course of business we control, we process or have access to personal information regarding our own employees or employment candidates, as well as that of many of our customers or managed suppliers. Information concerning our employees and candidates may also reside in systems controlled by third parties for purposes such as employee benefits and payroll administration. The legal and regulatory environment concerning data privacy is becoming more complex and challenging, and the potential consequences of non-compliance have become more severe. Any failure to protect such personal information from inappropriate access or disclosure, whether through social engineering or by accident or other cause, could have severe consequences including fines, litigation, regulatory sanctions including loss of our status as a subscriber to the EU-U.S. Privacy Shield Framework, reputational damage and loss of customers or employees. Although we have a program designed to preserve the privacy of the personal data that we control or process, as well as personal data that we entrust to third parties, there can be no assurance that our program will meet all current and future regulatory requirements, anticipate all potential methods of unauthorized access, or prevent all inappropriate disclosures. Our insurance coverage may not be sufficient to cover all such costs or consequences, and there can be no assurance that any insurance that we now maintain will remain available under acceptable terms.

10

Cyber attacks or other breaches of network or information technology security could have an adverse effect on our systems, services, reputation and financial results.

We rely upon multiple information technology systems and networks, some of which are web-based or managed by third parties, to process, transmit and store electronic information and to manage or support a variety of critical business processes and activities. Our networks and applications are increasingly accessed from locations and by devices not within our physical control, and the specifics of our technology systems and networks may vary by geographic region. In the course of ordinary business, we may store or process proprietary or confidential information concerning our business and financial performance and current, past or prospective employees, customers, vendors and managed suppliers. The secure and consistent operation of these systems, networks and processes is critical to our business operations. Moreover, our temporary employees may be exposed to, or have access to, similar information in the course of their customer assignments. We routinely experience cyber attacks, which may include the use of malware, computer viruses, social engineering schemes and other means of attempted disruption or unauthorized access.

The actions we take to reduce the risk of impairments to our operations or systems and breaches of confidential or proprietary data may not be sufficient to prevent or repel future cyber events or other impairments of our networks or information technologies. An event involving the destruction, modification, accidental or unauthorized release, or theft of sensitive information from systems related to our business, or an attack that results in damage to or unavailability of our key technology systems or those of critical vendors, could result in damage to our reputation, fines, regulatory sanctions or interventions, contractual or financial liabilities, additional compliance and remediation costs, loss of employees or customers, loss of payment card network privileges, operational disruptions and other forms of costs, losses or reimbursements, any of which could materially adversely affect our operations or financial condition. Our cyber security and business continuity plans may not be effective in anticipating, preventing and effectively responding to all potential cyber risk exposures. Our insurance coverage may not be sufficient to cover all such costs or consequences, and there can be no assurance that any insurance that we now maintain will remain available under acceptable terms.

Damage to our key data centers could affect our ability to sustain critical business applications.

Many business processes critical to our continued operation are housed in our data center situated within the corporate headquarters complex as well as regional data centers in Asia-Pacific and Europe. Those processes include, but are not limited to, payroll, customer reporting and order management. While we have taken steps to protect these operations and have developed remote recovery capabilities, the loss of a data center would create a substantial risk of business interruption which could have a material adverse effect on our business, financial condition and results of operations.

Our information technology projects may not yield their intended results.

We have a number of information technology projects in process or in the planning stages, including improvements to applicant onboarding and tracking systems, order management, and improvements to financial processes such as billing and accounts payable through system consolidation and upgrades. Although the technology is intended to increase productivity and operating efficiencies, these projects may not yield their intended results. Any delays in completing, or an inability to successfully complete, these technology initiatives or an inability to achieve the anticipated efficiencies could adversely affect our operations, liquidity and financial condition. In addition, our information technology investments and strategy may not provide the ability to keep up with evolving industry trends and customer expectations which could weaken our competitive position. We also do not currently utilize a single enterprise resource planning system, which limits our ability and increases the amount of investment and effort necessary to provide global service integration to our customers.

Failure to maintain adequate financial and management processes and controls could lead to errors in our financial reporting.

Failure to maintain adequate financial and management processes and controls could lead to errors in our financial reporting. If our management is unable to certify the effectiveness of our internal controls or if our independent registered public accounting firm cannot render an opinion on the effectiveness of our internal controls over financial reporting, or if material weaknesses in our internal controls are identified, we could be subject to regulatory scrutiny and a loss of public confidence. In addition, if we do not maintain adequate financial and management personnel, processes and controls, we may not be able to accurately report our financial performance on a timely basis, which could have a negative effect on our stock price.

11

Impairment charges relating to our goodwill and long-lived assets could adversely affect our results of operations.

We regularly monitor our goodwill and long-lived assets for impairment indicators. In conducting our goodwill impairment testing, we compare the fair value of each of our reporting units with goodwill to the related net book value. In conducting our impairment analysis of long-lived assets, we compare the undiscounted cash flows expected to be generated from the long-lived assets to the related net book values. Changes in economic or operating conditions impacting our estimates and assumptions could result in the impairment of our goodwill or long-lived assets. In the event that we determine that our goodwill or long-lived assets are impaired, we may be required to record a significant non-cash charge to earnings that could adversely affect our results of operations.

Unexpected changes in claim trends on our workers’ compensation, unemployment, disability and medical benefit plans may negatively impact our financial condition.

We self-insure, or otherwise bear financial responsibility for, a significant portion of expected losses under our workers’ compensation program, disability and medical benefits claims. Unexpected changes in claim trends, including the severity and frequency of claims, actuarial estimates and medical cost inflation, could result in costs that are significantly different than initially reported. If future claims-related liabilities increase due to unforeseen circumstances, or if we must make unfavorable adjustments to accruals for prior accident years, our costs could increase significantly. In addition, unemployment insurance costs are dependent on benefit claims experience from employees which may vary from current levels and result in increased costs. There can be no assurance that we will be able to increase the fees charged to our customers in a timely manner and in a sufficient amount to cover increased costs as a result of any changes in claims-related liabilities.

Our business is subject to extensive government regulation, which may restrict the types of employment services we are permitted to offer or result in additional or increased taxes, including payroll taxes or other costs that reduce our revenues and earnings.

The temporary employment industry is heavily regulated in many of the countries in which we operate. Changes in laws or government regulations may result in prohibition or restriction of certain types of employment services we are permitted to offer or the imposition of new or additional benefit, licensing or tax requirements that could reduce our revenues and earnings. In particular, we are subject to state unemployment taxes in the U.S., which typically increase during periods of increased levels of unemployment. We also receive benefits, such as the work opportunity income tax credit in the U.S., that regularly expire and may not be reinstated. There can be no assurance that we will be able to increase the fees charged to our customers in a timely manner and in a sufficient amount to fully cover increased costs as a result of any changes in laws or government regulations. Any future changes in laws or government regulations, or interpretations thereof, including additional laws and regulations enacted at a local level may make it more difficult or expensive for us to provide staffing services and could have a material adverse effect on our business, financial condition and results of operations.

We may have additional tax or unclaimed property liabilities that exceed our estimates.

We are subject to a multitude of federal, state and local taxes in the jurisdictions we operate in, including the tax provisions of the U.S. Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010. We are also subject to unclaimed or abandoned property (escheat) laws. Our tax expense could be materially impacted by changes in tax laws in these jurisdictions, changes in the valuation of deferred tax assets and liabilities or changes in the mix of income by country. The demographics of our workforce and the visibility of our industry may make it more likely we become a target of government investigations, and we are regularly subject to audit by tax authorities. Although we believe our tax and unclaimed property estimates are reasonable, the final determination of audits and any related litigation could be materially different from our historical tax provisions and accruals. The results of an audit or litigation could materially harm our business.

Failure to maintain specified financial covenants in our bank credit facilities, or credit market events beyond our control, could adversely restrict our financial and operating flexibility and subject us to other risks, including risk of loss of access to capital markets.

Our bank credit facilities contain covenants that require us to maintain specified financial ratios and satisfy other financial conditions. During 2016, we met all of the covenant requirements. Our ability to continue to meet these financial covenants, particularly with respect to interest coverage (see Debt footnote in the notes to our consolidated financial statements), may not be assured. If we default under this or any other of these requirements, the lenders could declare all outstanding borrowings, accrued interest and fees to be due and payable or significantly increase the cost of the facility. In these circumstances, there can be no assurance that we would have sufficient liquidity to repay or refinance this indebtedness at favorable rates or at all. Events beyond our control could result in the failure of one or more of our banks, reducing our access to liquidity and potentially resulting in reduced financial and operating flexibility. If broader credit markets were to experience dislocation, our potential access to other funding sources would be limited.

12

Our controlling stockholder exercises voting control over our company and has the ability to elect or remove from office all of our directors.

Terence E. Adderley, the Executive Chairman and Chairman of the Board of our board of directors, and certain trusts with respect to which he acts as trustee or co-trustee, control approximately 93% of the outstanding shares of Kelly Class B common stock, which is the only class of our common stock entitled to voting rights. Mr. Adderley is therefore able to exercise voting control with respect to all matters requiring stockholder approval, including the election or removal from office of all members of the Board of Directors.

We are not subject to certain of the listing standards that normally apply to companies whose shares are quoted on the NASDAQ Global Market.

Our Class A and Class B common stock are quoted on the NASDAQ Global Market. Under the listing standards of the NASDAQ Global Market, we are deemed to be a “controlled company” by virtue of the fact that Terence E. Adderley, the Executive Chairman and Chairman of the Board of our board of directors, and certain trusts of which he acts as trustee or co-trustee have voting power with respect to more than fifty percent of our outstanding voting stock. A controlled company is not required to have a majority of its board of directors comprised of independent directors. Director nominees are not required to be selected or recommended for the board’s selection by a majority of independent directors or a nominations committee comprised solely of independent directors, nor do the NASDAQ Global Market listing standards require a controlled company to certify the adoption of a formal written charter or board resolution, as applicable, addressing the nominations process. A controlled company is also exempt from NASDAQ Global Market’s requirements regarding the determination of officer compensation by a majority of independent directors or a compensation committee comprised solely of independent directors. A controlled company is required to have an audit committee composed of at least three directors who are independent as defined under the rules of both the Securities and Exchange Commission and the NASDAQ Global Market. The NASDAQ Global Market further requires that all members of the audit committee have the ability to read and understand fundamental financial statements and that at least one member of the audit committee possess financial sophistication. The independent directors must also meet at least twice a year in meetings at which only they are present.

We currently comply with certain of the listing standards of the NASDAQ Global Market that do not apply to controlled companies. Our compliance is voluntary, however, and there can be no assurance that we will continue to comply with these standards in the future.

Provisions in our certificate of incorporation and bylaws and Delaware law may delay or prevent an acquisition of our company.

Our restated certificate of incorporation and bylaws contain provisions that could make it harder for a third party to acquire us without the consent of our board of directors. For example, if a potential acquirer were to make a hostile bid for us, the acquirer would not be able to call a special meeting of stockholders to remove our board of directors or act by written consent without a meeting. The acquirer would also be required to provide advance notice of its proposal to replace directors at any annual meeting, and would not be able to cumulate votes at a meeting, which would require the acquirer to hold more shares to gain representation on the board of directors than if cumulative voting were permitted.

Our board of directors also has the ability to issue additional shares of common stock which could significantly dilute the ownership of a hostile acquirer. In addition, Section 203 of the Delaware General Corporation Law limits mergers and other business combination transactions involving 15 percent or greater stockholders of Delaware corporations unless certain board or stockholder approval requirements are satisfied. These provisions and other similar provisions make it more difficult for a third party to acquire us without negotiation.

Our board of directors could choose not to negotiate with an acquirer that it did not believe was in our strategic interests. If an acquirer is discouraged from offering to acquire us or prevented from successfully completing a hostile acquisition by these or other measures, our shareholders could lose the opportunity to sell their shares at a favorable price.

The holders of shares of our Class A common stock are not entitled to voting rights.

Under our certificate of incorporation, the holders of shares of our Class A common stock are not entitled to voting rights, except as otherwise required by Delaware law. As a result, Class A common stock holders do not have the right to vote for the election of directors or in connection with most other matters submitted for the vote of our stockholders.

13

Our stock price may be subject to significant volatility and could suffer a decline in value.

The market price of our common stock may be subject to significant volatility. We believe that many factors, including several which are beyond our control, have a significant effect on the market price of our common stock. These include:

• | actual or anticipated variations in our quarterly operating results; |

• | announcements of new services by us or our competitors; |

• | announcements relating to strategic relationships or acquisitions; |

• | changes in financial estimates by securities analysts; |

• | changes in general economic conditions; |

• | actual or anticipated changes in laws and government regulations; |

• | commencement of, or involvement in, litigation; |

• | any major change in our board or management; |

• | changes in industry trends or conditions; and |

• | sales of significant amounts of our common stock or other securities in the market. |

In addition, the stock market in general, and the NASDAQ Global Market in particular, have experienced significant price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of listed companies. These broad market and industry factors may seriously harm the market price of our common stock, regardless of our operating performance. In the past, securities class action litigation has often been instituted following periods of volatility in the market price of a company’s securities. A securities class action suit against us could result in substantial costs, potential liabilities and the diversion of our management’s attention and resources. Further, our operating results may be below the expectations of securities analysts or investors. In such event, the price of our common stock may decline.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

14

ITEM 2. PROPERTIES.

We own our headquarters in Troy, Michigan, where corporate, subsidiary and divisional offices are currently located. The original headquarters building was purchased in 1977. Headquarters operations were expanded into additional buildings purchased in 1991, 1997 and 2001.

The combined usable floor space in the headquarters complex is approximately 345,000 square feet. Our buildings are in good condition and are currently adequate for their intended purpose and use. We also own undeveloped land in Troy and northern Oakland County, Michigan.

Branch office business is conducted in leased premises with the majority of leases being fixed for terms of generally three to five years in the U.S. and Canada and five to ten years outside the U.S. and Canada. We own virtually all of the office furniture and the equipment used in our corporate headquarters and branch offices.

ITEM 3. LEGAL PROCEEDINGS.

The Company is a party to a pending nationwide class action lawsuit entitled Hillson et.al. v Kelly Services. The suit alleges that current and former temporary employees of Kelly Services are entitled to monetary damages for violation of the Fair Credit Reporting Act requirement that the notice and disclosure form provided to employees for purposes of conducting a background screening be a standalone document. On April 20, 2016, the parties entered into a formal settlement agreement. The parties still must secure court approval of the settlement. In light of amounts previously expensed and anticipated recoveries from third parties, Kelly recorded an accrual in the fourth quarter of 2015 of $4.1 million (in accounts payable and accrued liabilities on the consolidated balance sheet) to reflect the expected cost of the tentative settlement.

The Company is continuously engaged in litigation arising in the ordinary course of its business, such as matters alleging employment discrimination, alleging wage and hour violations or enforcing the restrictive covenants in the Company’s employment agreements. The Company has recently experienced an increase in its litigation volume, including cases where claimants seek class action certification. While there is no expectation that any of these matters will have a material adverse effect on the Company’s results of operations, financial position or cash flows, litigation is always subject to inherent uncertainty and the Company is not able to reasonably predict if any matter will be resolved in a manner that is materially adverse to the Company.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

15

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Information and Dividends

Our Class A and Class B common stock is traded on the NASDAQ Global Market under the symbols “KELYA” and “KELYB,” respectively. The high and low selling prices for our Class A common stock and Class B common stock as quoted by the NASDAQ Global Market and the dividends paid on the common stock for each quarterly period in the last two fiscal years are reported in the table below. Our ability to pay dividends is subject to compliance with certain financial covenants contained in our debt facilities, as described in the Debt footnote in the notes to our consolidated financial statements.

Per share amounts (in dollars) | |||||||||||||||||||

First Quarter | Second Quarter | Third Quarter | Fourth Quarter | Year | |||||||||||||||

2016 | |||||||||||||||||||

Class A common | |||||||||||||||||||

High | $ | 19.73 | $ | 20.15 | $ | 20.98 | $ | 23.61 | $ | 23.61 | |||||||||

Low | 14.63 | 17.81 | 18.01 | 18.06 | 14.63 | ||||||||||||||

Class B common | |||||||||||||||||||

High | 18.04 | 20.00 | 21.60 | 27.80 | 27.80 | ||||||||||||||

Low | 15.43 | 15.04 | 17.23 | 17.75 | 15.04 | ||||||||||||||

Dividends | 0.05 | 0.075 | 0.075 | 0.075 | 0.275 | ||||||||||||||

2015 | |||||||||||||||||||

Class A common | |||||||||||||||||||

High | $ | 18.22 | $ | 17.86 | $ | 15.82 | $ | 17.51 | $ | 18.22 | |||||||||

Low | 15.10 | 14.66 | 13.47 | 13.67 | 13.47 | ||||||||||||||

Class B common | |||||||||||||||||||

High | 17.96 | N/A | (1) | 15.38 | 17.42 | 17.96 | |||||||||||||

Low | 15.85 | N/A | (1) | 13.20 | 12.24 | 12.24 | |||||||||||||

Dividends | 0.05 | 0.05 | 0.05 | 0.05 | 0.20 | ||||||||||||||

(1) No trading in the Company’s Class B common shares was reported for the applicable period.

Holders

The number of holders of record of our Class A and Class B common stock were approximately 4,000 and 200, respectively, as of February 3, 2017.

Recent Sales of Unregistered Securities

None.

16

Issuer Purchases of Equity Securities

During the fourth quarter of 2016, we reacquired shares of our Class A common stock as follows:

Period | Total Number of Shares (or Units) Purchased | Average Price Paid per Share (or Unit) | Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs | Maximum Number (or Approximate Dollar Value) of Shares (or Units) That May Yet Be Purchased Under the Plans or Programs | ||||||||||

(in millions of dollars) | ||||||||||||||

October 3, 2016 through November 6, 2016 | 237 | $ | 18.32 | — | $ | — | ||||||||

November 7, 2016 through December 4, 2016 | 196 | 20.24 | — | — | ||||||||||

December 5, 2016 through January 1, 2017 | — | — | — | — | ||||||||||

Total | 433 | $ | 19.19 | — | ||||||||||

We may reacquire shares sold to cover taxes due upon the vesting of restricted stock held by employees. Accordingly, 433 shares were reacquired during the Company’s fourth quarter.

17

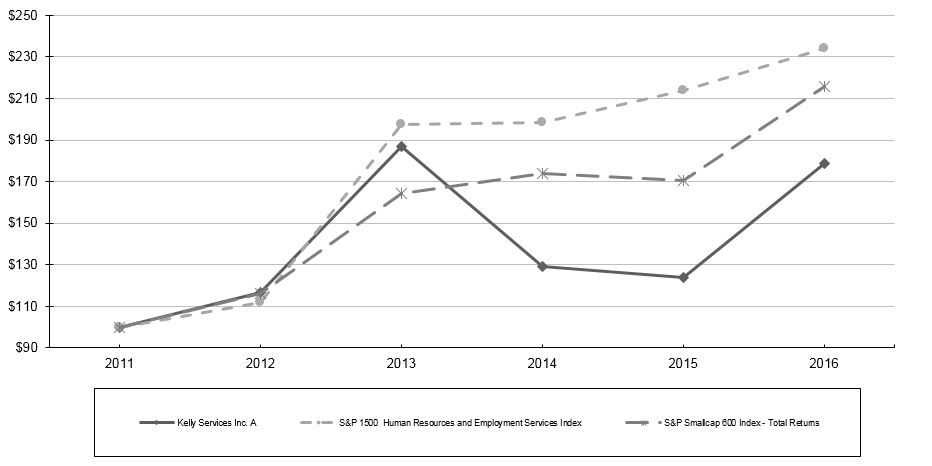

Performance Graph

The following graph compares the cumulative total return of our Class A common stock with that of the S&P 600 SmallCap Index and the S&P 1500 Human Resources and Employment Services Index for the five years ended December 31, 2016. The graph assumes an investment of $100 on December 31, 2011 and that all dividends were reinvested.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Assumes Initial Investment of $100

December 31, 2011 – December 31, 2016

2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |||||||||||||

Kelly Services, Inc. | $ | 100.00 | $ | 116.77 | $ | 187.04 | $ | 129.07 | $ | 123.98 | $ | 178.64 | ||||||

S&P SmallCap 600 Index | $ | 100.00 | $ | 116.33 | $ | 164.38 | $ | 173.84 | $ | 170.41 | $ | 215.67 | ||||||

S&P 1500 Human Resources and Employment Services Index | $ | 100.00 | $ | 111.95 | $ | 197.57 | $ | 198.28 | $ | 214.06 | $ | 234.28 | ||||||

18

ITEM 6. SELECTED FINANCIAL DATA.

The following table summarizes selected financial information of Kelly Services, Inc. and its subsidiaries for each of the most recent five fiscal years. This table should be read in conjunction with the other financial information, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements included elsewhere in this report. The statement of earnings data for the 2013 and 2012 fiscal years as well as the balance sheet data as of 2014, 2013 and 2012 are derived from consolidated financial statements previously on file with the SEC.

(In millions except per share amounts) | 2016 | 2015 (1) | 2014 | 2013 | 2012 | |||||||||||||||

Revenue from services | $ | 5,276.8 | $ | 5,518.2 | $ | 5,562.7 | $ | 5,413.1 | $ | 5,450.5 | ||||||||||

Earnings from continuing operations (2) | 63.2 | 53.8 | 23.7 | 58.9 | 49.7 | |||||||||||||||

Gain on investment in TS Kelly Asia Pacific (3) | 87.2 | — | — | — | — | |||||||||||||||

Earnings (loss) from discontinued operations, net of tax (4) | — | — | — | — | 0.4 | |||||||||||||||

Net earnings | 120.8 | 53.8 | 23.7 | 58.9 | 50.1 | |||||||||||||||

Basic earnings per share: | ||||||||||||||||||||

Earnings from continuing operations | 3.10 | 1.39 | 0.61 | 1.54 | 1.31 | |||||||||||||||

Earnings (loss) from discontinued operations | — | — | — | — | 0.01 | |||||||||||||||

Net earnings | 3.10 | 1.39 | 0.61 | 1.54 | 1.32 | |||||||||||||||

Diluted earnings per share: | ||||||||||||||||||||

Earnings from continuing operations | 3.08 | 1.39 | 0.61 | 1.54 | 1.31 | |||||||||||||||

Earnings (loss) from discontinued operations | — | — | — | — | 0.01 | |||||||||||||||

Net earnings | 3.08 | 1.39 | 0.61 | 1.54 | 1.32 | |||||||||||||||

Dividends per share | ||||||||||||||||||||

Classes A and B common | 0.275 | 0.20 | 0.20 | 0.20 | 0.20 | |||||||||||||||

Working capital (5) | 443.5 | 411.3 | 428.1 | 474.5 | 470.3 | |||||||||||||||

Total assets | 2,028.1 | 1,939.6 | 1,917.9 | 1,798.6 | 1,635.7 | |||||||||||||||

Total noncurrent liabilities | 245.0 | 228.4 | 224.1 | 214.0 | 172.4 | |||||||||||||||

(1) | Fiscal year included 53 weeks. |

(2) | Included in results of continuing operations are asset impairments of $1.7 million in 2013 and $3.1 million in 2012. |

(3) | Represents the fair value of the Company’s investment in TS Kelly Asia Pacific in addition to the cash received less the carrying value of assets transferred to the joint venture. |

(4) | Discontinued operations represent adjustments to assets and liabilities retained from the 2007 sale of Kelly Home Care. |

(5) | Working capital is calculated as current assets minus current liabilities. |

19

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Executive Overview

The Workforce Solutions Industry

The staffing industry has changed dramatically over the last decade — transformed by globalization, competitive consolidation and secular shifts in labor supply and demand. Global employment trends are reshaping and redefining traditional employment models, sourcing strategies and human resource capability requirements. In response, the industry has accelerated its evolution from commercial into professional/technical and outsourced solutions.

The broader workforce solutions industry has continued to evolve to meet businesses’ growing demand for total workforce or talent supply chain management (“TSCM”) solutions. As clients’ workforce solutions strategies move up the maturity model, the TSCM concept seeks to manage all categories of talent (temporary, project-based, outsourced and full-time) and thus represents significant market potential.

Strategic clients are increasingly looking for global, flexible and holistic talent solutions that encompass all worker categories, driving adoption of our TSCM approach covering temporary staffing, Contingent Workforce Outsourcing (“CWO”), Recruitment Process Outsourcing (“RPO”), Business Process Outsourcing (“BPO”), independent contractor management, strategic workforce planning and more.

Across all regions, the structural shifts toward higher-skilled, project-based professional/technical talent continue to represent long-term opportunities for the industry. In fact, professional/technical staffing is projected to increase as a percent of the global market, with demand for specialty staffing projected to outpace commercial.

Our Business

Kelly Services is a global workforce solutions company, serving customers of all sizes in a variety of industries. Our staffing operations are divided into three regions (Americas, EMEA and APAC), with commercial and professional/technical staffing businesses in each region. As the human capital arena has become more complex, we have also developed a suite of innovative solutions within our global Outsourcing & Consulting Group (OCG). OCG delivers integrated talent management solutions to meet customer needs across the entire spectrum of talent categories. Using talent supply chain strategies, we help customers plan for and manage their acquisition of contingent and full-time labor, and gain access to service providers and quality talent at competitive rates with minimized risk. In July 2016, we transferred our APAC Commercial and APAC PT staffing operations to TS Kelly Asia Pacific, an expanded joint venture with our long-time partner, Temp Holdings. OCG in the APAC region remains wholly Kelly-owned and continues to provide holistic workforce solutions throughout the APAC region.

We earn revenues from the hourly sales of services by our temporary employees to customers, as a result of recruiting permanent employees for our customers, and through our outsourcing activities. Our working capital requirements are primarily generated from temporary employee payroll and customer accounts receivable. The nature of our business is such that trade accounts receivable are our most significant asset. Average days sales outstanding varies within and outside the U.S., but is 53 days on a global basis as of the 2016 year end. Since receipts from customers generally lag temporary employee payroll, working capital requirements increase substantially in periods of growth.

Our Strategy and Outlook

Our long-term strategic objective is to create shareholder value by delivering a competitive profit from the best workforce solutions and talent in the industry. To achieve this, we are focused on the following key areas:

• | Maintain our core strengths in commercial staffing in key markets; |

• | Grow our professional and technical solutions; |

• | Enhance our position as a market-leading provider of talent supply chain management in our OCG segment; and |

• | Lower our costs through deployment of efficient service delivery models. |

2016 was a year of progress as we pursued this strategy. Even in the face of slowing revenue, we improved on several important key performance indicators, including improving our conversion rate and free cash flow. In addition, we raised the cash dividend for our shareholders based on our confidence in our execution and completed the expansion of our joint venture with Temp Holdings, forming one of the largest workforce solutions companies in the Asia-Pacific region, TS Kelly Asia Pacific. We are running our staffing operations more tightly in line with growth expectations, and we took actions during the

20

second quarter of 2016 in the Americas and EMEA to increase operational efficiency. In OCG, we continued to expand our global client portfolio even as we invest for future growth.

Our 2016 results confirm our growth strategy:

• | Earnings from operations for the full year of 2016 totaled $63.2 million, or $66.6 million excluding restructuring expenses, compared to $66.7 million in 2015. |

• | Our OCG segment delivered gross profit growth of nearly 12% and we continued to add resources in line with the increased market demand for outsourced solutions with tempered earnings growth in 2016. OCG earned a full-year operating profit of $25.9 million, compared to $28.5 million last year. |

• | Conversion rate, or return on gross profit, continues to be a key metric to measure our drive for profitable growth. Our 2016 conversion rate was 7.0%, or 7.4% excluding restructuring expenses, compared to 7.2% in 2015 |

• | Cash from operating activities and free cash flow generation increased year over year and we ended the year with no outstanding debt. |

Kelly remains focused on executing our strategy with increased speed and precision, making the necessary investments and adjustments to advance that strategy. We have set our sights on becoming an even more focused, consultative and profitable company, and we are reshaping our business to make that vision a reality. We will continue to rebalance our resources to align with our goals for growth, intentionally focusing more of our workforce in roles that drive increased revenue and gross profit for the Company. We will primarily measure our progress against gross profit growth and an improved conversion rate. The goals we have established are based on the current economic and business environment, and may change as conditions warrant:

• | We expect to grow PT and OCG revenue, creating a more balanced portfolio that yields benefits from an improved mix. |

• | We expect Commercial to remain a core component of our strategy. |

• | We expect to exercise strict control over our cost base, delivering structural improvements that create strong operating leverage. |

• | And, as a result, we expect our conversion rate to continue to improve. |

Looking ahead, we are keeping a watchful eye on demand levels in the U.S. labor market while anticipating an increasing demand for skilled workers. Despite uncertainties, we know that companies are relying more heavily on the use of flexible staffing models; there is growing acceptance of free agents and contractual employment by companies and talent alike; and companies are seeking more comprehensive workforce management solutions that lend themselves to Kelly’s talent supply chain management approach. This shift in demand for contingent labor and strategic solutions plays to our strengths and experience — particularly serving large companies whose needs span the globe and cross multiple labor categories.

21

Financial Measures

The constant currency (“CC”) change amounts in the following tables refer to the year-over-year percentage changes resulting from translating 2016 financial data into U.S. dollars using the same foreign currency exchange rates used to translate financial data for 2015. We believe that CC measurements are a useful measure, indicating the actual trends of our operations without distortion due to currency fluctuations. We use CC results when analyzing the performance of our segments and measuring our results against that of our competitors. Additionally, substantially all of our foreign subsidiaries derive revenues and incur cost of services and selling, general and administrative expenses (“SG&A”) within a single country and currency which, as a result, provide a natural hedge against currency risks in connection with their normal business operations.

CC measures are non-GAAP (Generally Accepted Accounting Principles) measures and are used to supplement measures in accordance with GAAP. Our non-GAAP measures may be calculated differently from those provided by other companies, limiting their usefulness for comparison purposes. Non-GAAP measures should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP.

Return on sales (earnings from operations divided by revenue from services) and conversion rate (earnings from operations divided by gross profit) in the following tables are ratios used to measure the Company’s operating efficiency.

Days sales outstanding (“DSO”) represents the numbers days that sales remain unpaid for the period being reported. DSO is calculated by dividing average net sales per day (net sales excluding secondary supplier expense for a rolling three-month period) into trade accounts receivable, net at the period end.

Free cash flow measures the Company’s ability to generate the cash flow in excess of that used to maintain operations. Free cash flow is calculated by subtracting capital expenditures from cash flows from operating activities.

Staffing Fee-Based Income

Staffing fee-based income, which is included in revenue from services in the following tables, has a significant impact on gross profit rates. There are very low direct costs of services associated with staffing fee-based income. Therefore, increases or decreases in staffing fee-based income can have a disproportionate impact on gross profit rates.

22

Results of Operations

2016 versus 2015

Total Company

(Dollars in millions)

2016 (52 Weeks) | 2015 (53 Weeks) | Change | CC Change | |||||||||||

Revenue from services | $ | 5,276.8 | $ | 5,518.2 | (4.4 | )% | (3.2 | )% | ||||||

Staffing fee-based income | 58.5 | 65.3 | (10.3 | ) | (8.3 | ) | ||||||||

Gross profit | 906.3 | 920.3 | (1.5 | ) | (0.5 | ) | ||||||||

SG&A expenses excluding restructuring charges | 839.7 | 853.6 | (1.6 | ) | (0.7 | ) | ||||||||

Restructuring charges | 3.4 | — | NM | NM | ||||||||||

Total SG&A expenses | 843.1 | 853.6 | (1.2 | ) | (0.3 | ) | ||||||||

Earnings from operations | 63.2 | 66.7 | (5.2 | ) | ||||||||||

Gross profit rate | 17.2 | % | 16.7 | % | 0.5 | pts. | ||||||||

Expense rates (excluding restructuring charges): | ||||||||||||||

% of revenue | 15.9 | 15.5 | 0.4 | |||||||||||

% of gross profit | 92.6 | 92.8 | (0.2 | ) | ||||||||||

Return on sales | 1.2 | 1.2 | — | |||||||||||

Conversion rate | 7.0 | 7.2 | (0.2 | ) | ||||||||||

Total Company results of operations for 2016 were impacted by the transfer of APAC staffing and certain APAC OCG businesses to the TS Kelly Asia Pacific joint venture in the third quarter of 2016. Accordingly, separate APAC results for 2016 and 2015 are not presented in the following discussions due to the lack of comparability between the periods.

Total Company revenue from services for 2016 was down 4.4% in comparison to the prior year on a reported basis, and down 3.2% on a CC basis due, in part, to the transfer of the APAC operations and as more fully described in the following discussions. See Segment Disclosures footnote in the notes to our consolidated financial statements for the impact of this transfer on year-over-year segment results. In addition, the 2015 fiscal year included a 53rd week. This fiscal leap year occurs every five or six years and is necessary to align the fiscal and calendar periods. The 53rd week added approximately 1% to 2015 revenue.