Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Wendy's Co | d377001d8k.htm |

First Quarter 2017 Conference Call May 10, 2017 © Quality Is Our Recipe, LLC Exhibit 99.1

Peter Koumas Director – Investor Relations © Quality Is Our Recipe, LLC

Forward-Looking Statements and Non-GAAP Financial Measures This presentation, and certain information that management may discuss in connection with this presentation, contains certain statements that are not historical facts, including information concerning possible or assumed future results of our operations. Those statements constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (The “Reform Act”). For all forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Reform Act. Many important factors could affect our future results and could cause those results to differ materially from those expressed in or implied by our forward-looking statements. Such factors, all of which are difficult or impossible to predict accurately, and many of which are beyond our control, include but are not limited to those identified under the caption “Forward-Looking Statements” in our news release issued on May 10, 2017 and in the “Special Note Regarding Forward-Looking Statements and Projections” and “Risk Factors” sections of our most recent Form 10-K / Form 10-Qs. In addition, this presentation and certain information management may discuss in connection with this presentation reference non-GAAP financial measures (i.e., adjusted EBITDA, adjusted EBITDA margin, adjusted earnings per share, adjusted tax rate, free cash flow and systemwide sales). These non-GAAP financial measures exclude certain expenses and benefits. Reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures are provided in the Appendix to this presentation, and are included in our news release issued on May 10, 2017 and posted on www.aboutwendys.com. As used in this presentation, the terms adjusted EBITDA and adjusted earnings per share refer to adjusted EBITDA from continuing operations and adjusted earnings per share from continuing operations, respectively. THE WENDY'S COMPANY |

THE WENDY'S COMPANY | Agenda CEO Update Financial Update Q&A

Todd Penegor President & Chief Executive Officer © Quality Is Our Recipe, LLC

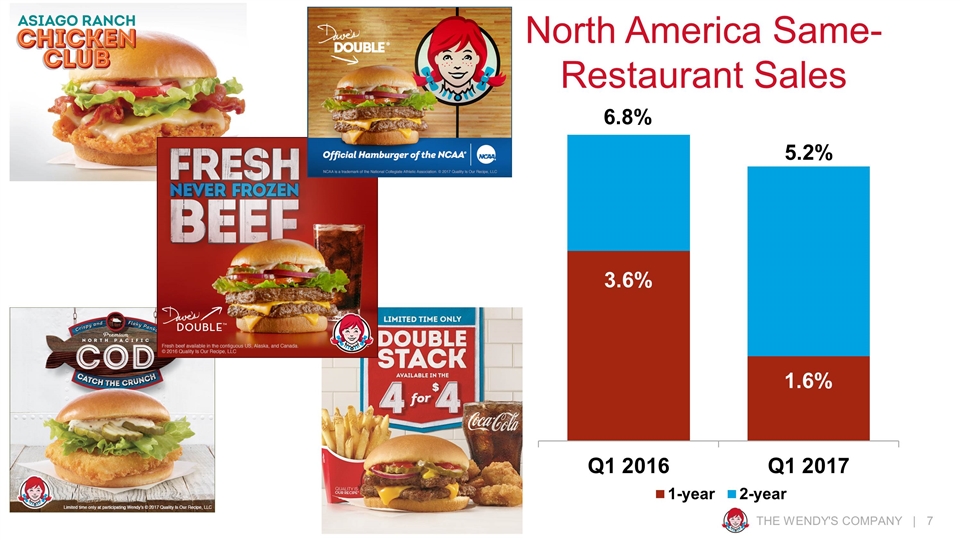

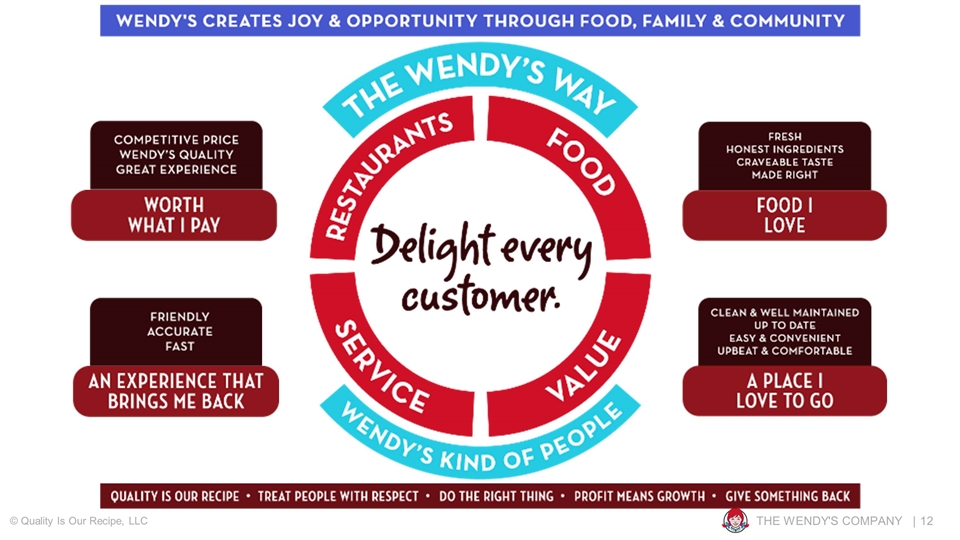

THE WENDY'S COMPANY | Q1 Highlights * See reconciliation of non-GAAP financial measures in the Appendix. 17th consecutive quarter of positive NA SRS NA SRS increase 1.6%; 5.2% on a two-year basis Global expansion momentum continues; 33 global restaurant openings in Q1 Improvement of 530bps in adj. EBITDA margin to 31.2%* Company finalizes G&A initiative plans; expects approx. three-quarters of ~$35 million in savings to be achieved by end of 2018 Company increases 2017 adj. EBITDA guidance*

THE WENDY'S COMPANY | North America Same-Restaurant Sales 6.8% 5.2%

Global Footprint Expansion Continues THE WENDY'S COMPANY | 0.08% North America Restaurant Openings International Restaurant Openings ’17 Net New Growth Rate Goal of ~12.5% (~55) ’17E Net New Growth Rate ~1% (~60) 113 ’17 Net New Growth Rate Goal of ~12.5% (~55) ’17E Net New Growth Rate ~12.5% (~55)

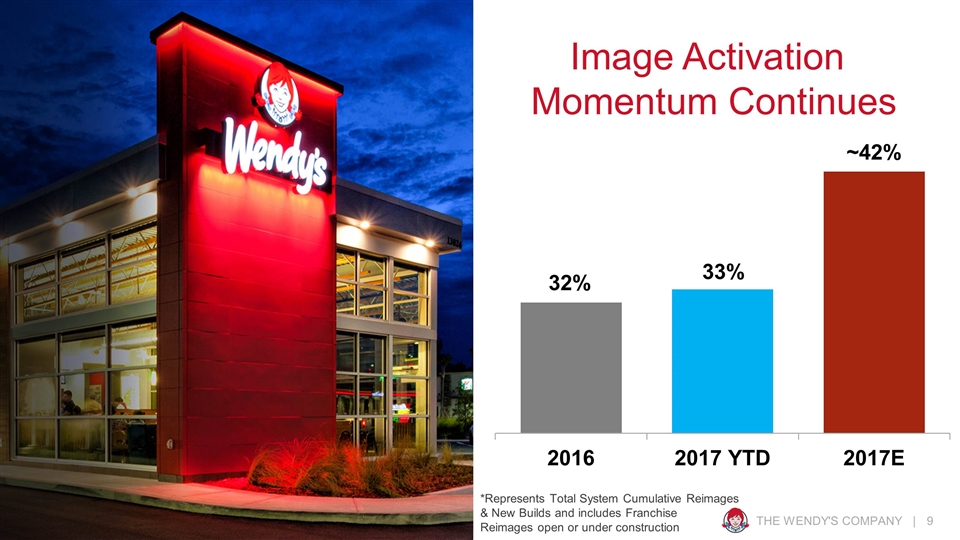

THE WENDY'S COMPANY | Image Activation Momentum Continues *Represents Total System Cumulative Reimages & New Builds and includes Franchise Reimages open or under construction 118 Buy & Flip transactions completed in Q1. On track to achieve target of 400 ~42% 33%

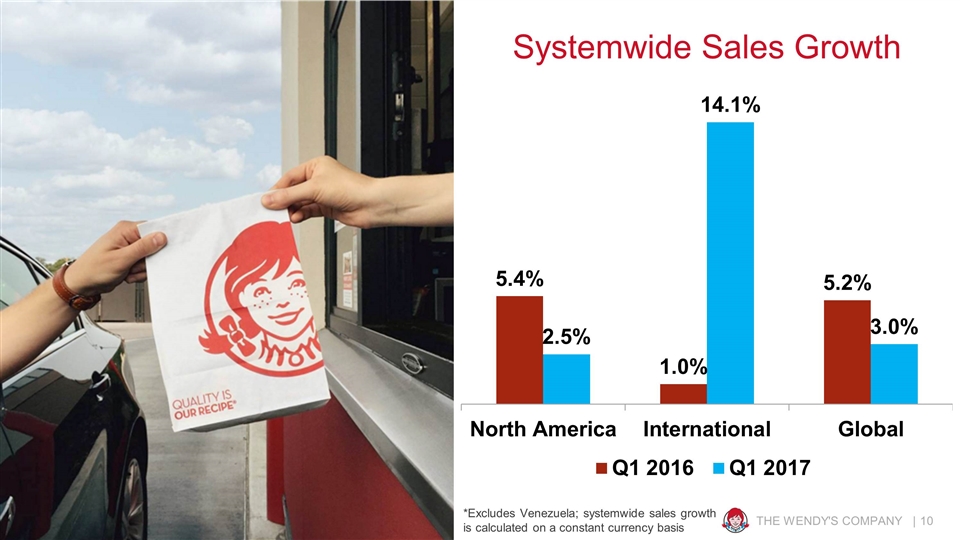

Systemwide Sales Growth THE WENDY'S COMPANY | *Excludes Venezuela; systemwide sales growth is calculated on a constant currency basis

Transforming Our Franchise System Through Buy & Flips THE WENDY'S COMPANY | ~34% of Global System Image Activated at the end of Q1 2017 113

THE WENDY'S COMPANY |

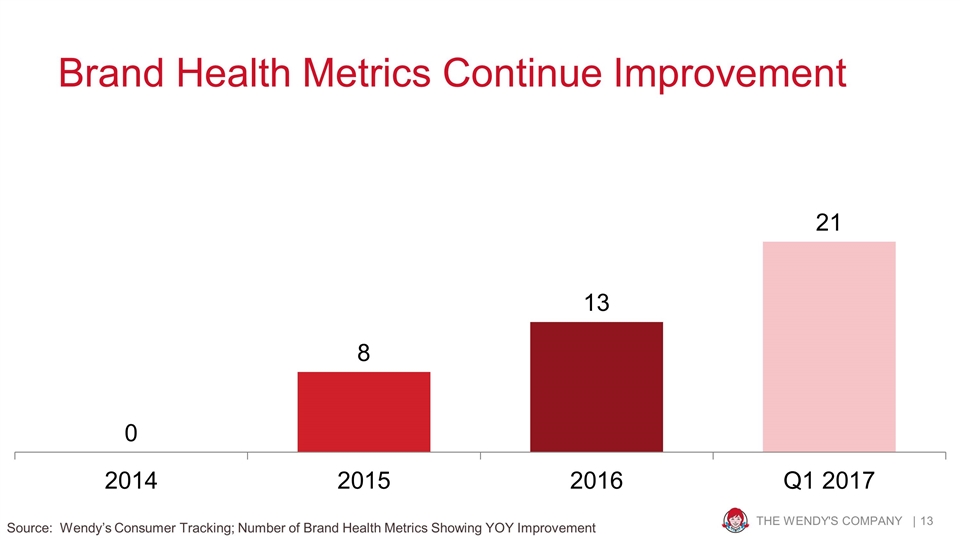

Brand Health Metrics Continue Improvement THE WENDY'S COMPANY | Source: Wendy’s Consumer Tracking; Number of Brand Health Metrics Showing YOY Improvement

Gunther Plosch Chief Financial Officer © Quality Is Our Recipe, LLC

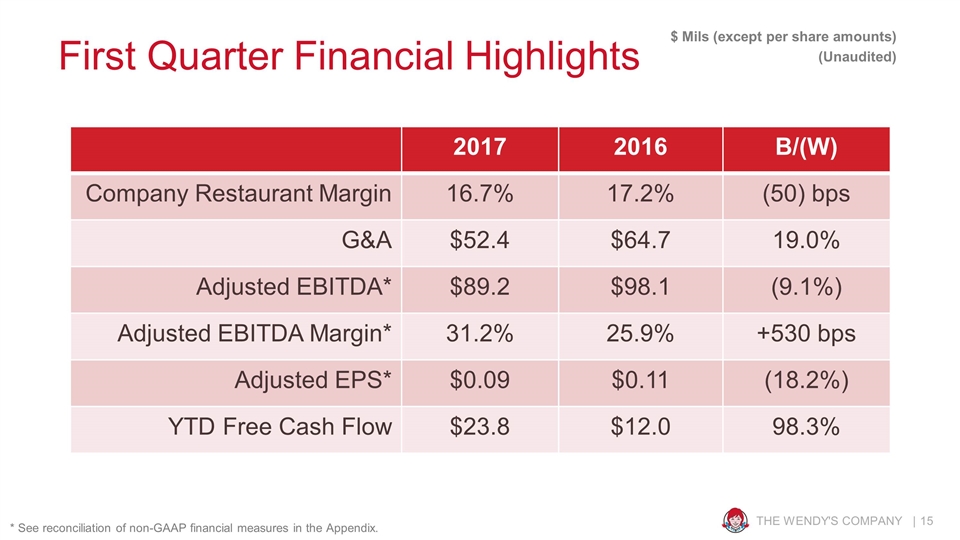

First Quarter Financial Highlights THE WENDY'S COMPANY | 2017 2016 B/(W) Company Restaurant Margin 16.7% 17.2% (50) bps G&A $52.4 $64.7 19.0% Adjusted EBITDA* $89.2 $98.1 (9.1%) Adjusted EBITDA Margin* 31.2% 25.9% +530 bps Adjusted EPS* $0.09 $0.11 (18.2%) YTD Free Cash Flow $23.8 $12.0 98.3% $ Mils (except per share amounts) (Unaudited) * See reconciliation of non-GAAP financial measures in the Appendix.

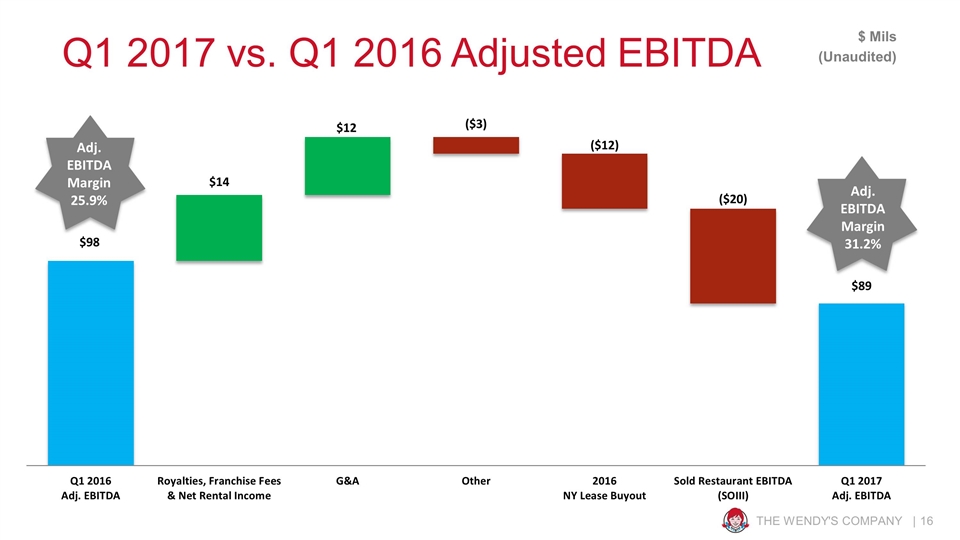

THE WENDY'S COMPANY | Q1 2017 vs. Q1 2016 Adjusted EBITDA $ Mils (Unaudited)

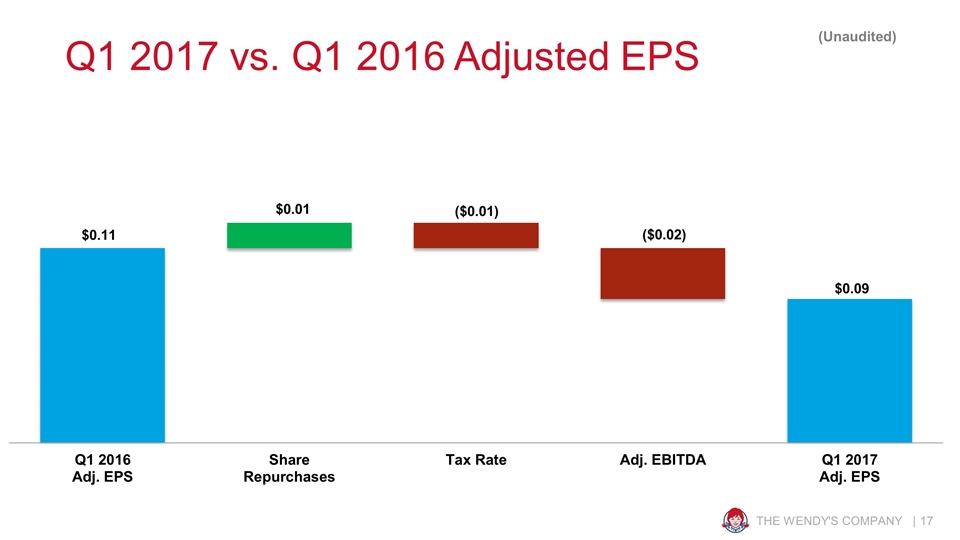

THE WENDY'S COMPANY | Q1 2017 vs. Q1 2016 Adjusted EPS (Unaudited)

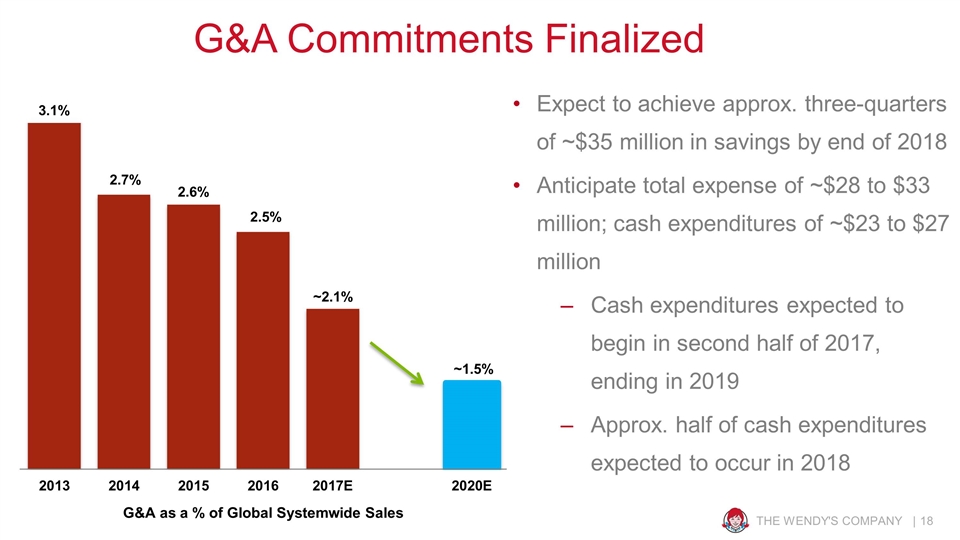

THE WENDY'S COMPANY | G&A Commitments Finalized Expect to achieve approx. three-quarters of ~$35 million in savings by end of 2018 Anticipate total expense of ~$28 to $33 million; cash expenditures of ~$23 to $27 million Cash expenditures expected to begin in second half of 2017, ending in 2019 Approx. half of cash expenditures expected to occur in 2018 G&A as a % of Global Systemwide Sales

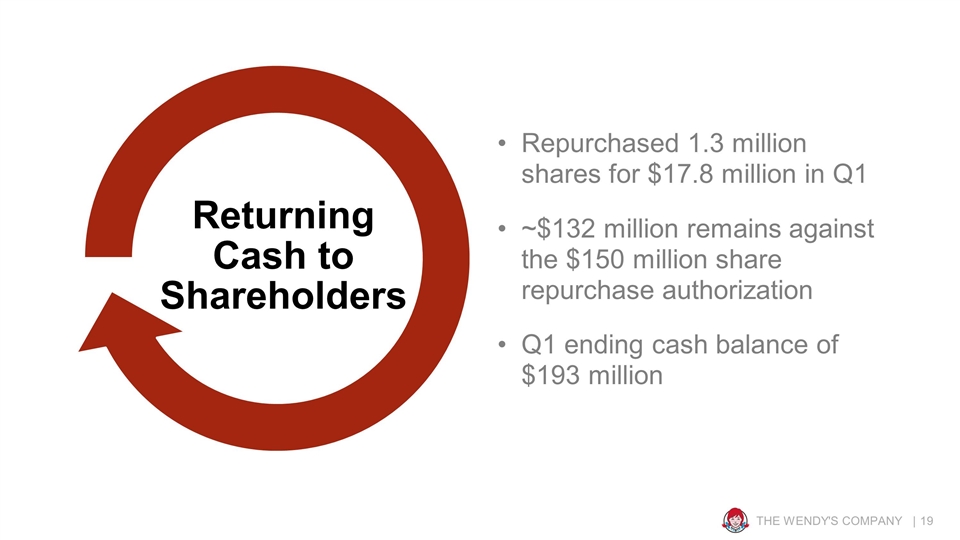

THE WENDY'S COMPANY | Returning Cash to Shareholders Repurchased 1.3 million shares for $17.8 million in Q1 ~$132 million remains against the $150 million share repurchase authorization Q1 ending cash balance of $193 million

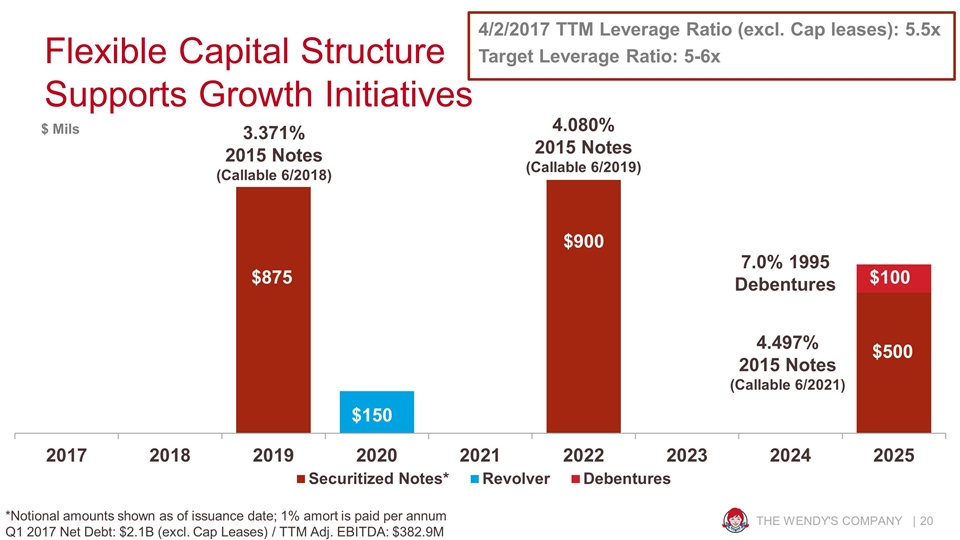

Flexible Capital Structure Supports Growth Initiatives THE WENDY'S COMPANY | 4/2/2017 TTM Leverage Ratio (excl. Cap leases): 5.5x Target Leverage Ratio: 5-6x $875 $900 $500 $100 *Notional amounts shown as of issuance date; 1% amort is paid per annum Q1 2017 Net Debt: $2.1B (excl. Cap Leases) / TTM Adj. EBITDA: $382.9M 3.371% 2015 Notes (Callable 6/2018) 4.080% 2015 Notes (Callable 6/2019) 4.497% 2015 Notes (Callable 6/2021) 7.0% 1995 Debentures $ Mils

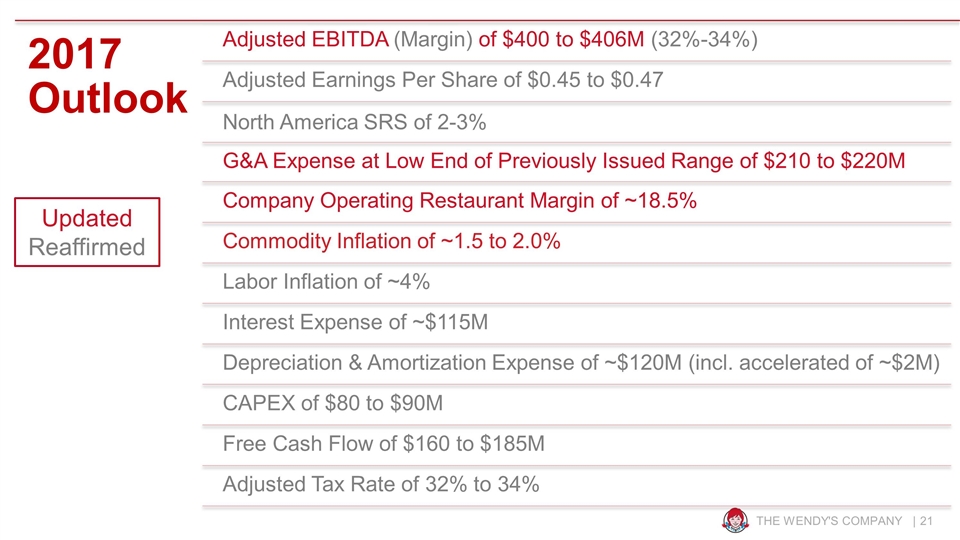

THE WENDY'S COMPANY | Updated Reaffirmed North America SRS of 2-3% 2017 Outlook G&A Expense at Low End of Previously Issued Range of $210 to $220M Commodity Inflation of ~1.5 to 2.0% Labor Inflation of ~4% Interest Expense of ~$115M Depreciation & Amortization Expense of ~$120M (incl. accelerated of ~$2M) CAPEX of $80 to $90M Free Cash Flow of $160 to $185M Adjusted Tax Rate of 32% to 34% Adjusted EBITDA (Margin) of $400 to $406M (32%-34%) Adjusted Earnings Per Share of $0.45 to $0.47 Company Operating Restaurant Margin of ~18.5%

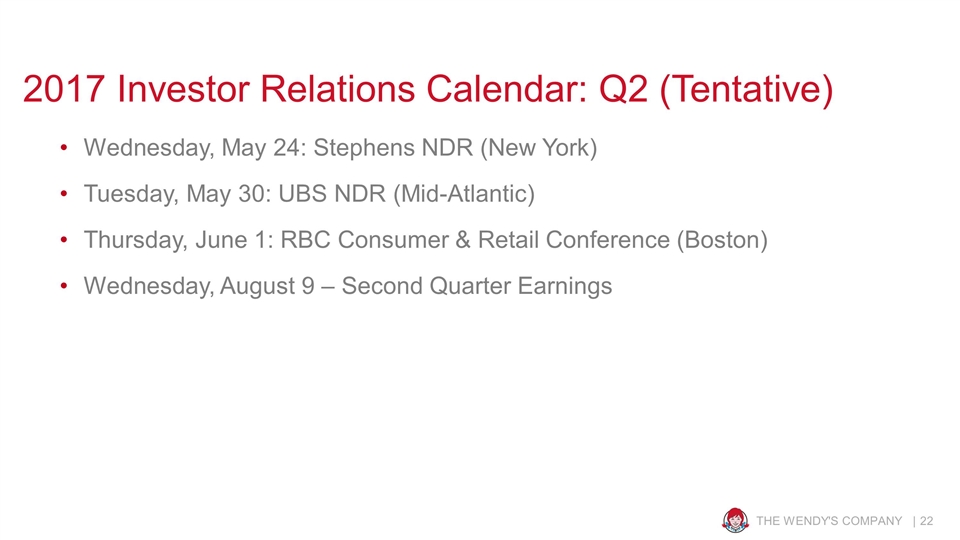

2017 Investor Relations Calendar: Q2 (Tentative) Wednesday, May 24: Stephens NDR (New York) Tuesday, May 30: UBS NDR (Mid-Atlantic) Thursday, June 1: RBC Consumer & Retail Conference (Boston) Wednesday, August 9 – Second Quarter Earnings THE WENDY'S COMPANY |

Q&A

Appendix

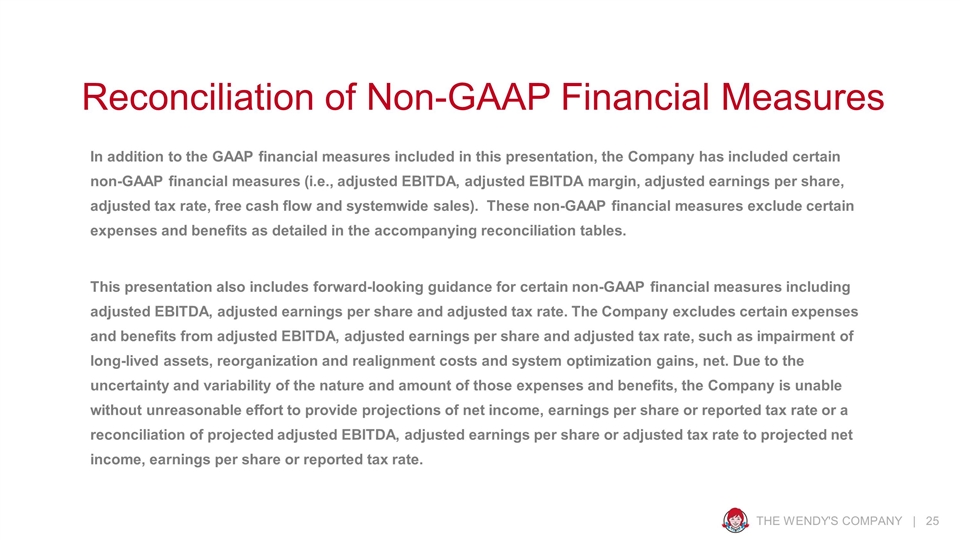

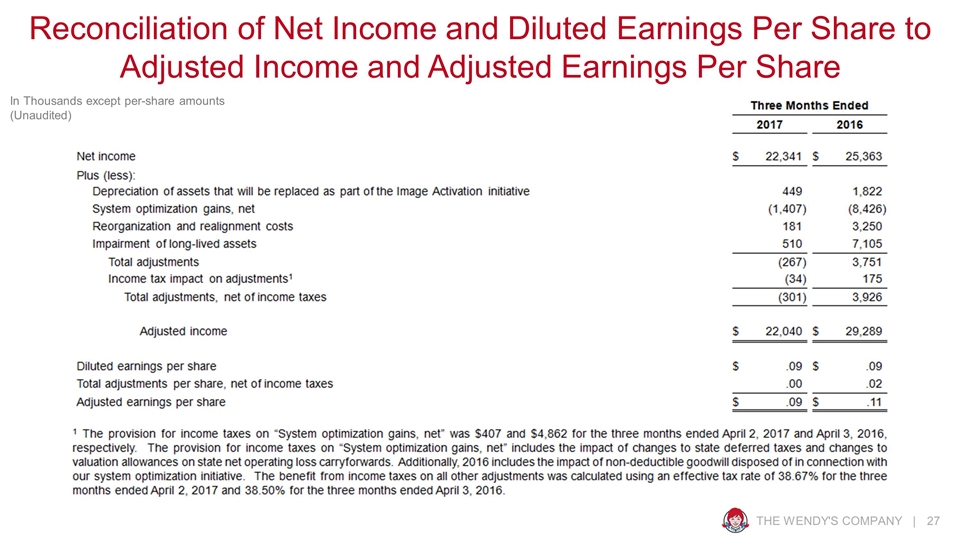

Reconciliation of Non-GAAP Financial Measures In addition to the GAAP financial measures included in this presentation, the Company has included certain non-GAAP financial measures (i.e., adjusted EBITDA, adjusted EBITDA margin, adjusted earnings per share, adjusted tax rate, free cash flow and systemwide sales). These non-GAAP financial measures exclude certain expenses and benefits as detailed in the accompanying reconciliation tables. This presentation also includes forward-looking guidance for certain non-GAAP financial measures including adjusted EBITDA, adjusted earnings per share and adjusted tax rate. The Company excludes certain expenses and benefits from adjusted EBITDA, adjusted earnings per share and adjusted tax rate, such as impairment of long-lived assets, reorganization and realignment costs and system optimization gains, net. Due to the uncertainty and variability of the nature and amount of those expenses and benefits, the Company is unable without unreasonable effort to provide projections of net income, earnings per share or reported tax rate or a reconciliation of projected adjusted EBITDA, adjusted earnings per share or adjusted tax rate to projected net income, earnings per share or reported tax rate. THE WENDY'S COMPANY |

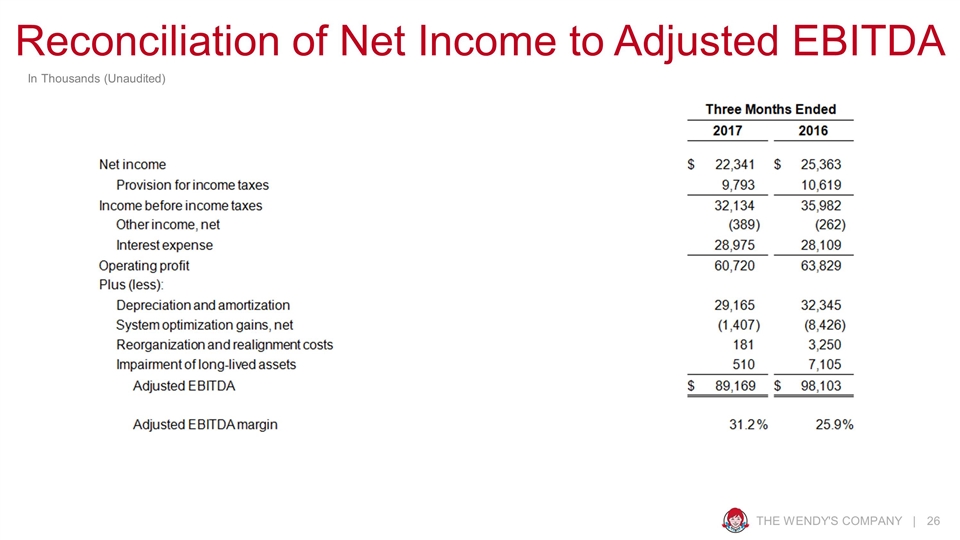

THE WENDY'S COMPANY | Reconciliation of Net Income to Adjusted EBITDA In Thousands (Unaudited)

Reconciliation of Net Income and Diluted Earnings Per Share to Adjusted Income and Adjusted Earnings Per Share In Thousands except per-share amounts (Unaudited) THE WENDY'S COMPANY |