Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ELAH Holdings, Inc. | rely-ex991_16.htm |

| 8-K - Q-1 EARNINGS RELEASE AND EARNINGS PRESENTATION - ELAH Holdings, Inc. | rely-8k_20170510.htm |

1Q 2017 earnings presentation may 10, 2017 Exhibit 99.2

Cautions about forward-looking statements and other notices Cautionary Statement Regarding Forward-Looking Statements. This presentation contains forward-looking statements, which are based on our current expectations, estimates, and projections about Real Industry, Inc. and its subsidiaries’ (the “Company”) businesses and prospects, as well as management’s beliefs, and certain assumptions made by management. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “may,” “should,” “will” and variations of these words are intended to identify forward-looking statements. Such statements speak only as of the date hereof and are subject to change. The Company undertakes no obligation to revise or update publicly any forward-looking statements for any reason. These statements include, but are not limited to, statements about: our financial results, including for the fiscal first quarter of 2017, as well as our expectations for future financial trends and performance of our business and our strategy in future periods including during fiscal 2017; our ability to take advantage of opportunities to acquire assets with tremendous upside; the expected benefits to the Company of the integration of Beck Aluminum Alloys into Real Alloy; future opportunistic investments; our evaluation of other potential M&A opportunities; our long-term outlook; our preparation for future market conditions; and any statements or assumptions underlying any of the foregoing. Such statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict. Accordingly, actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors. Important factors that may cause such a difference include, but are not limited to, changes in domestic and international demand for recycled aluminum; the cyclical nature and general health of the aluminum industry and related industries; commodity and scrap price fluctuations and our ability to enter into effective commodity derivatives or arrangements to effectively manage our exposure to such commodity price fluctuations; inventory risks, commodity price risks, and energy risks associated with Real Alloy’s buy/sell business model; the impact of tariffs and trade regulations on our operations; the impact of any changes in U.S. or non-U.S. tax laws on our operations or the value of our NOLs; our ability to service, and the high leverage associated with, our indebtedness, and compliance with the terms of the indebtedness, including the restrictive covenants that constrain the operation of our business and the businesses of our subsidiaries; our ability to successfully identify, acquire and integrate additional companies and businesses that perform and meet expectations after completion of such acquisitions; our ability to achieve future profitability; our ability to control operating costs and other expenses; that general economic conditions may be worse than expected; that competition may increase significantly; changes in laws or government regulations or policies affecting our current business operations and/or our legacy businesses, as well as those risks and uncertainties disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Real Industry, Inc.’s Form 10-Q filed with the Securities and Exchange Commission (“SEC”) on May 10, 2017 and Form 10-K filed with the SEC on March 13, 2017, and similar disclosures in subsequent reports filed with the SEC, which are available on our website at www.realindustryinc.com and on the SEC website at https://www.sec.gov. Use of Non-GAAP Financial Measures. This presentation includes references to the non-GAAP financial measures of segment earnings before interest, taxes, depreciation and amortization and, with certain additional adjustments (“Segment Adjusted EBITDA”). Management believes that Segment Adjusted EBITDA enhances the understanding of the financial performance of the operations of Real Alloy (and prior to its acquisition, the former Global Recycling and Specification Alloys business of Aleris Corporation) by investors and lenders. As a complement to financial measures recognized under GAAP, management believes that Segment Adjusted EBITDA assists investors who follow the practice of some investment analysts who adjust GAAP financial measures to exclude items that may obscure underlying performance and distort comparability. Because Segment Adjusted EBITDA is not a measure recognized under GAAP, it is not intended to be presented herein as a substitute for net earnings (loss) as an indicator of operating performance. Segment Adjusted EBITDA is the primary performance measurement used by our senior management and Board of Directors to evaluate segment operating results. A reconciliation to the GAAP equivalent of Segment Adjusted EBITDA, net earnings (loss), is provided herein, in our Form 10-Q filed with the SEC on May 10, 2017, on our Form 10-K filed on March 13, 2017, and prior reports filed on Forms 10-Q, 10-K and 8-K.

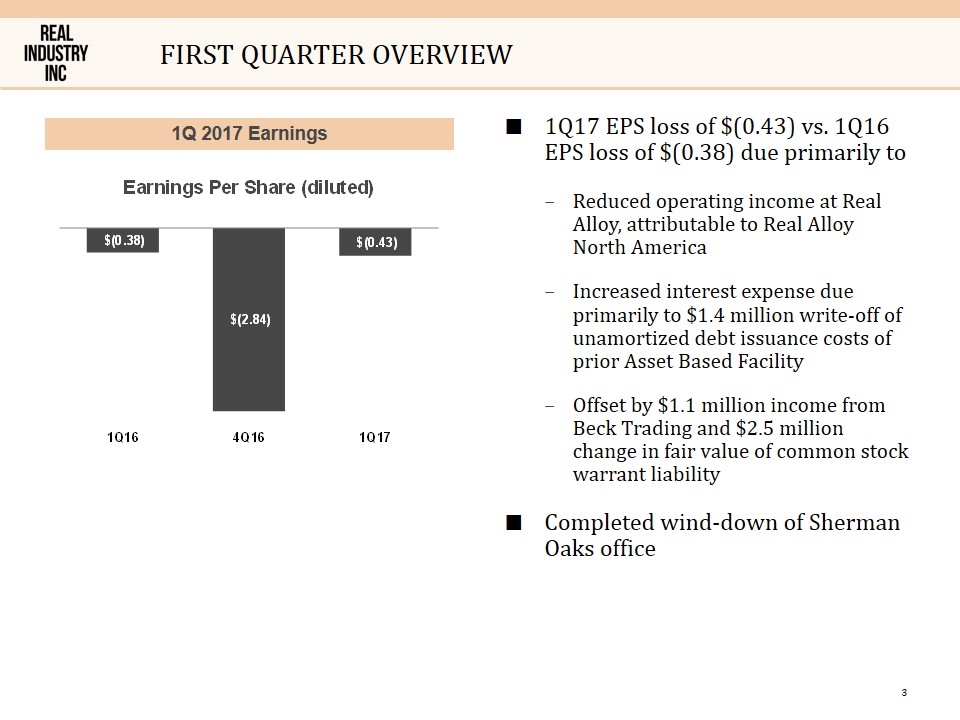

First quarter overview 1Q17 EPS loss of $(0.43) vs. 1Q16 EPS loss of $(0.38) due primarily to Reduced operating income at Real Alloy, attributable to Real Alloy North America Increased interest expense due primarily to $1.4 million write-off of unamortized debt issuance costs of prior Asset Based Facility Offset by $1.1 million income from Beck Trading and $2.5 million change in fair value of common stock warrant liability Completed wind-down of Sherman Oaks office 1Q 2017 Earnings

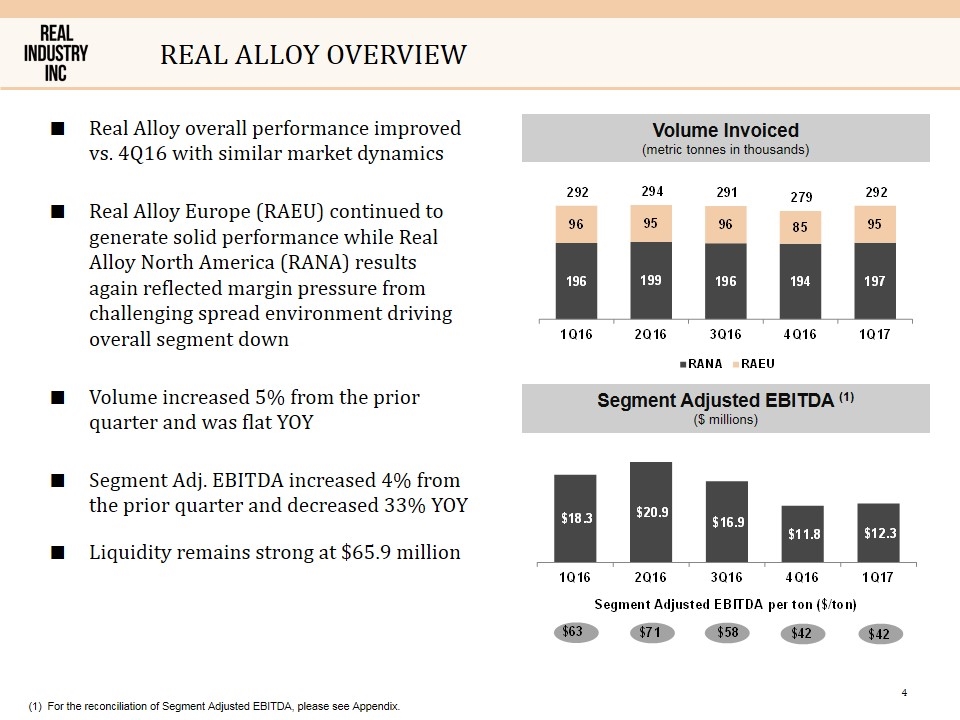

Real alloy overview Real Alloy overall performance improved vs. 4Q16 with similar market dynamics Real Alloy Europe (RAEU) continued to generate solid performance while Real Alloy North America (RANA) results again reflected margin pressure from challenging spread environment driving overall segment down Volume increased 5% from the prior quarter and was flat YOY Segment Adj. EBITDA increased 4% from the prior quarter and decreased 33% YOY Liquidity remains strong at $65.9 million Volume Invoiced (metric tonnes in thousands) Segment Adjusted EBITDA (1) ($ millions) (1) For the reconciliation of Segment Adjusted EBITDA, please see Appendix.

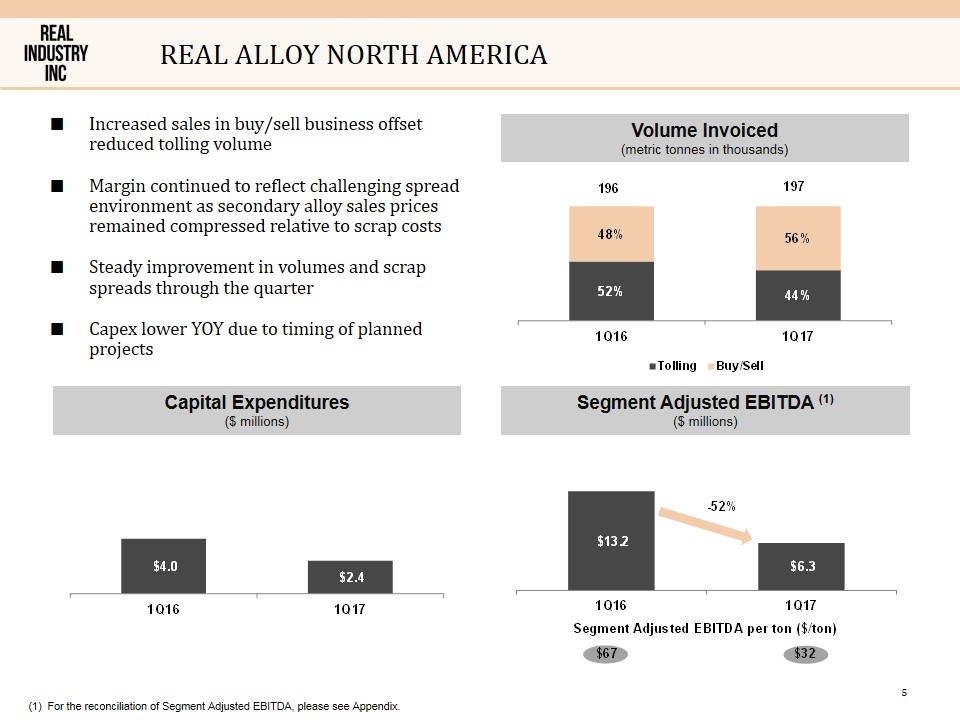

Real alloy north America Increased sales in buy/sell business offset reduced tolling volume Margin continued to reflect challenging spread environment as secondary alloy sales prices remained compressed relative to scrap costs Steady improvement in volumes and scrap spreads through the quarter Capex lower YOY due to timing of planned projects Volume Invoiced (metric tonnes in thousands) Segment Adjusted EBITDA (1) ($ millions) Capital Expenditures ($ millions) (1) For the reconciliation of Segment Adjusted EBITDA, please see Appendix.

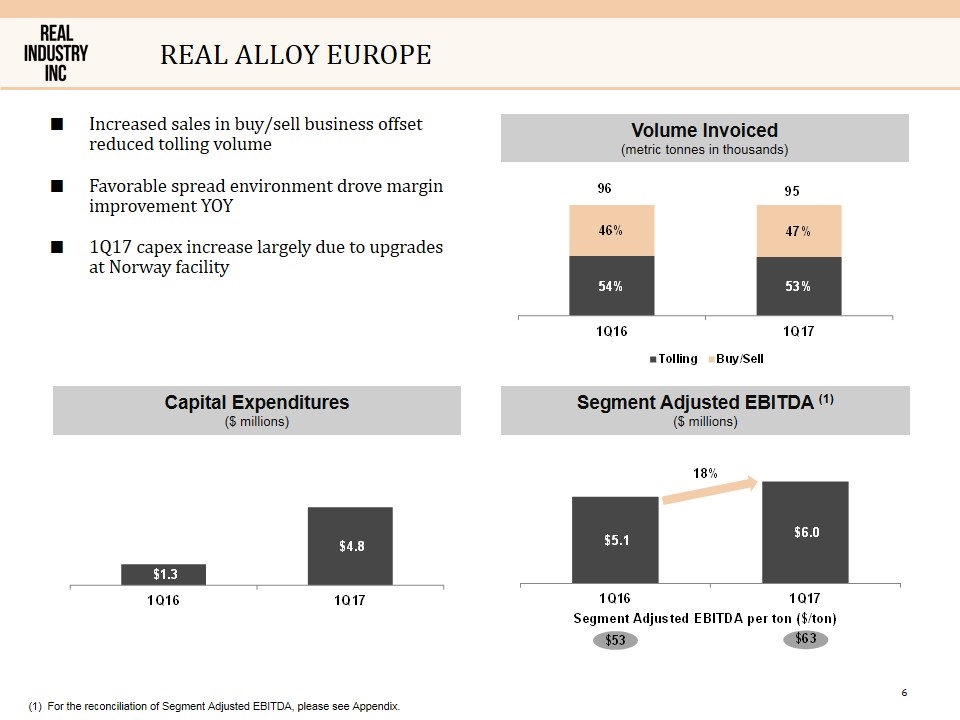

Real alloy Europe Increased sales in buy/sell business offset reduced tolling volume Favorable spread environment drove margin improvement YOY 1Q17 capex increase largely due to upgrades at Norway facility Volume Invoiced (metric tonnes in thousands) Segment Adjusted EBITDA (1) ($ millions) Capital Expenditures ($ millions) (1) For the reconciliation of Segment Adjusted EBITDA, please see Appendix.

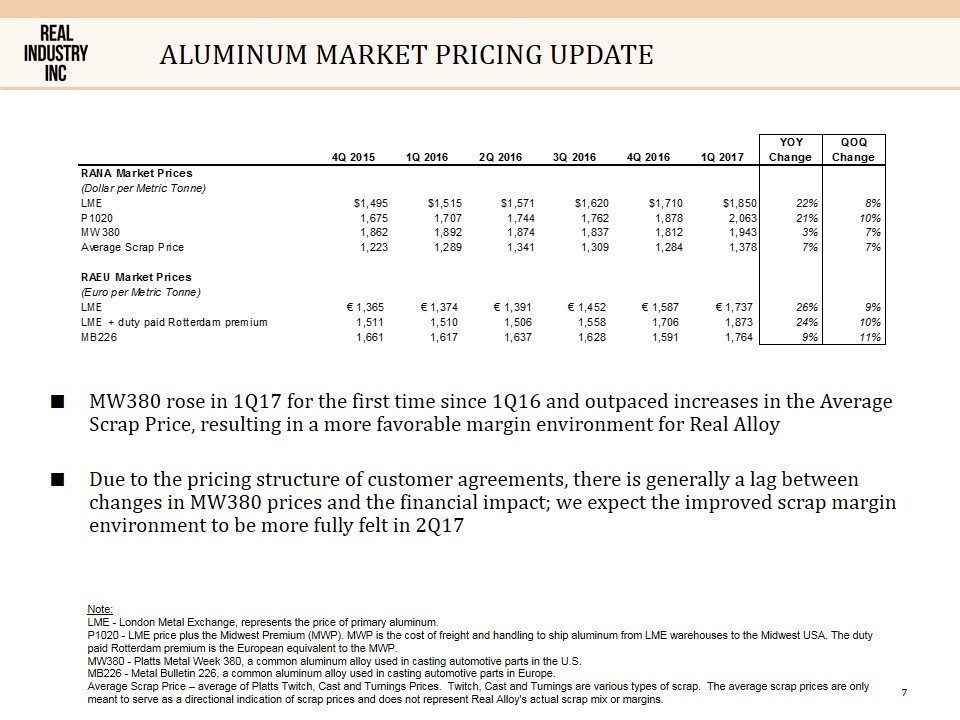

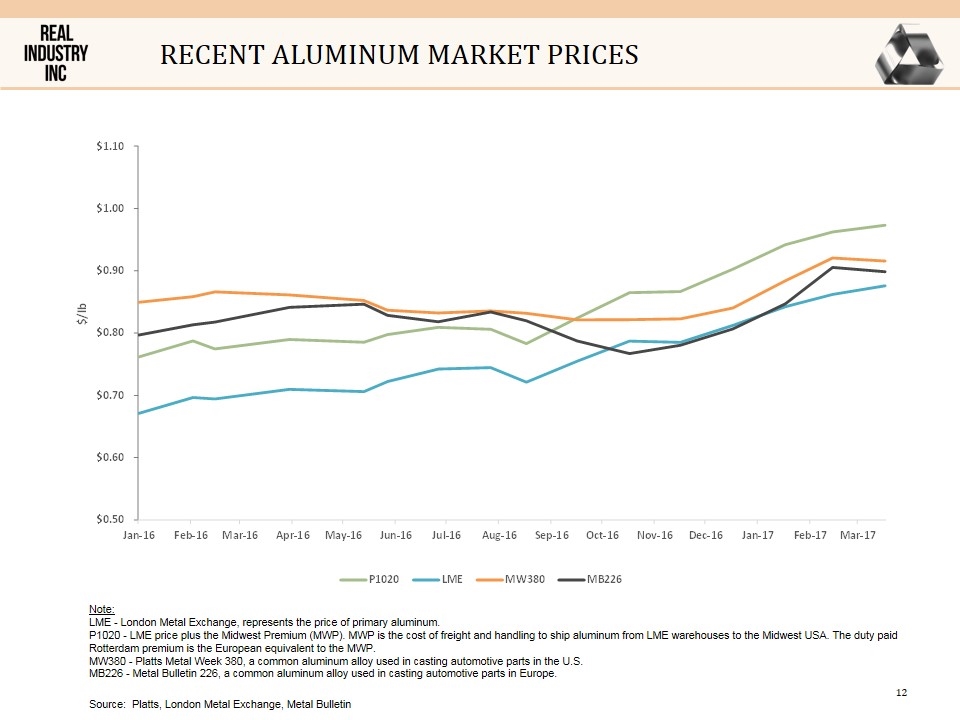

Aluminum market pricing update MW380 rose in 1Q17 for the first time since 1Q16 and outpaced increases in the Average Scrap Price, resulting in a more favorable margin environment for Real Alloy Due to the pricing structure of customer agreements, there is generally a lag between changes in MW380 prices and the financial impact; we expect the improved scrap margin environment to be more fully felt in 2Q17 Note: LME - London Metal Exchange, represents the price of primary aluminum. P1020 - LME price plus the Midwest Premium (MWP). MWP is the cost of freight and handling to ship aluminum from LME warehouses to the Midwest USA. The duty paid Rotterdam premium is the European equivalent to the MWP. MW380 - Platts Metal Week 380, a common aluminum alloy used in casting automotive parts in the U.S. MB226 - Metal Bulletin 226, a common aluminum alloy used in casting automotive parts in Europe. Average Scrap Price – average of Platts Twitch, Cast and Turnings Prices. Twitch, Cast and Turnings are various types of scrap. The average scrap prices are only meant to serve as a directional indication of scrap prices and does not represent Real Alloy's actual scrap mix or margins.

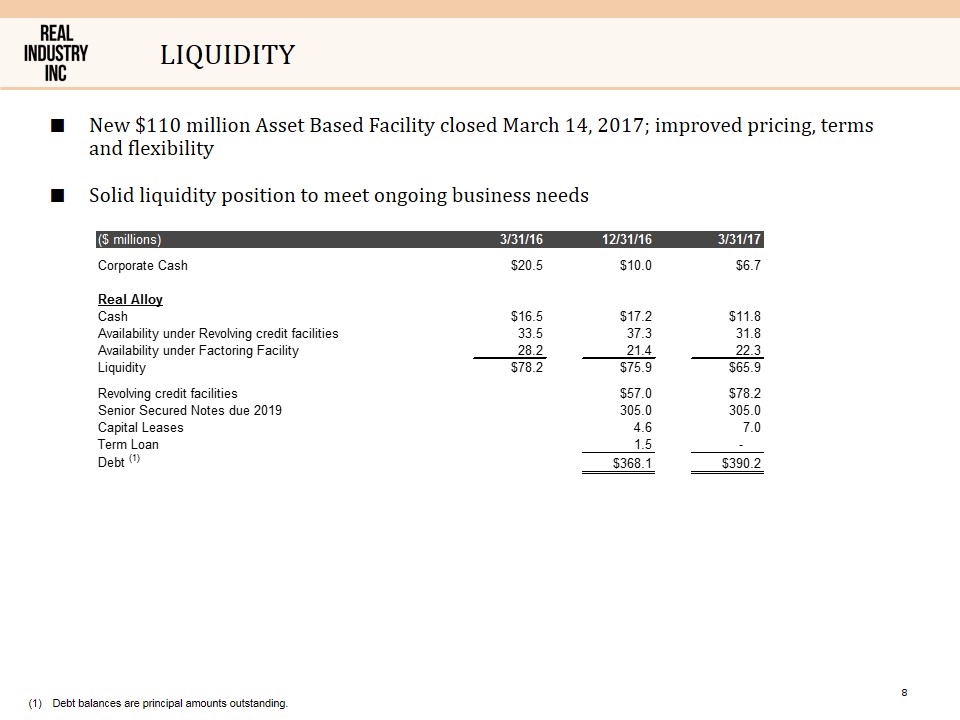

liquidity New $110 million Asset Based Facility closed March 14, 2017; improved pricing, terms and flexibility Solid liquidity position to meet ongoing business needs Debt balances are principal amounts outstanding.

M&A strategy Continued effort on executable opportunities Maintain disciplined approach to value and structure using a risk-adjusted return model Focus on diversifying cash flow, driving toward sustainable profitability, and improving free cash flow conversion Prospective target’s financial profile more important than size or industry Drive stockholder value by focusing on per share earnings growth over time Utilize tax assets to increase free cash flow Allocate additional capital to existing businesses to the extent risk-adjusted returns exceed new M&A opportunities Targeting creative financing structures to best optimize long term common stock value, particularly under current market conditions E.g. Preferred stock, earn out provisions, seller financing and equity roll-over, joint ventures, minority equity

outlook Focused on executable investment opportunities at RELY and Real Alloy that maximize stockholder value Signs of improved scrap spread environment in North America expected to result in improved 2Q17 performance for RANA Strong customer demand and a stable spread environment in Europe expected to drive continued strong performance for RAEU in 2Q17 and beyond Initiating plans to identify refinance options for Senior Secured Notes due 2019

appendix IR Contacts Real Industry, Inc. Jeehae Shin (212) 201-4126 investor.relations@realindustryinc.com The Equity Group, Inc. Adam Prior, Senior Vice President (212) 836-9606 aprior@equityny.com Carolyne Y. Sohn, Senior Associate (415) 568-2255 csohn@equityny.com

Recent Aluminum Market prices Source: Platts, London Metal Exchange, Metal Bulletin Note: LME - London Metal Exchange, represents the price of primary aluminum. P1020 - LME price plus the Midwest Premium (MWP). MWP is the cost of freight and handling to ship aluminum from LME warehouses to the Midwest USA. The duty paid Rotterdam premium is the European equivalent to the MWP. MW380 - Platts Metal Week 380, a common aluminum alloy used in casting automotive parts in the U.S. MB226 - Metal Bulletin 226, a common aluminum alloy used in casting automotive parts in Europe.

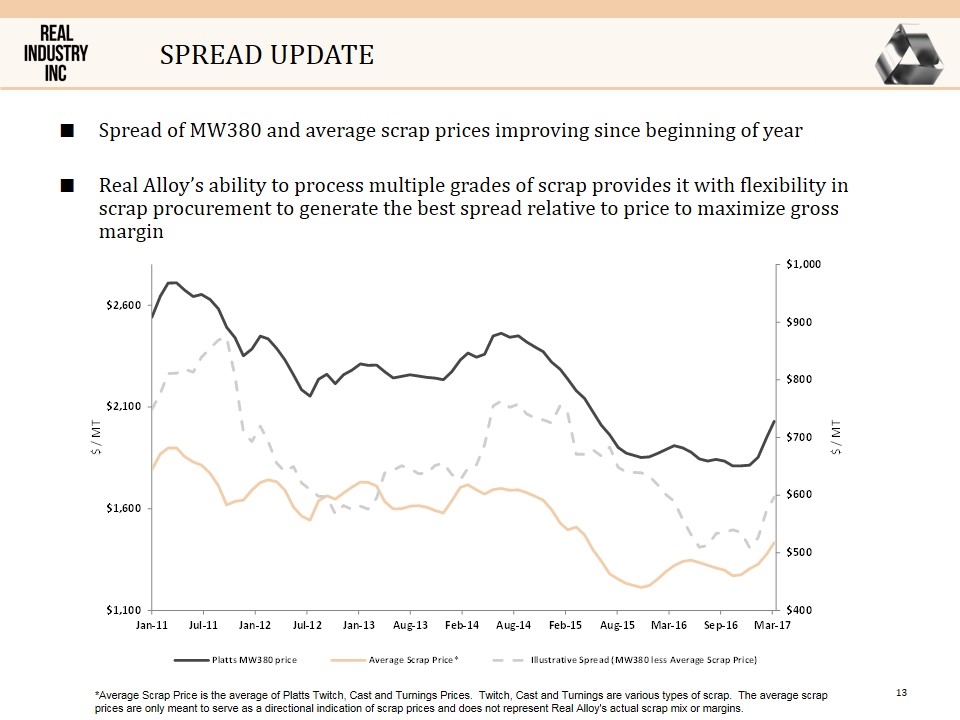

Spread update *Average Scrap Price is the average of Platts Twitch, Cast and Turnings Prices. Twitch, Cast and Turnings are various types of scrap. The average scrap prices are only meant to serve as a directional indication of scrap prices and does not represent Real Alloy's actual scrap mix or margins. Spread of MW380 and average scrap prices improving since beginning of year Real Alloy’s ability to process multiple grades of scrap provides it with flexibility in scrap procurement to generate the best spread relative to price to maximize gross margin

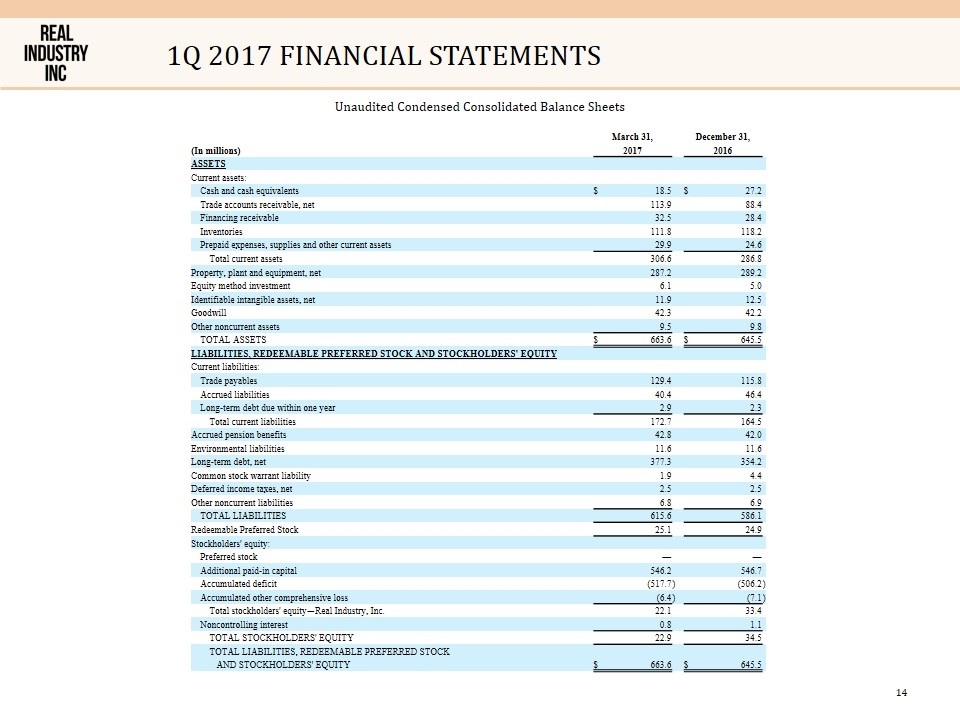

1Q 2017 Financial statements Unaudited Condensed Consolidated Balance Sheets March 31, December 31, (In millions) 2017 2016 ASSETS Current assets: Cash and cash equivalents $ 18.5 $ 27.2 Trade accounts receivable, net 113.9 88.4 Financing receivable 32.5 28.4 Inventories 111.8 118.2 Prepaid expenses, supplies and other current assets 29.9 24.6 Total current assets 306.6 286.8 Property, plant and equipment, net 287.2 289.2 Equity method investment 6.1 5.0 Identifiable intangible assets, net 11.9 12.5 Goodwill 42.3 42.2 Other noncurrent assets 9.5 9.8 TOTAL ASSETS $ 663.6 $ 645.5 LIABILITIES, REDEEMABLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY Current liabilities: Trade payables 129.4 115.8 Accrued liabilities 40.4 46.4 Long-term debt due within one year 2.9 2.3 Total current liabilities 172.7 164.5 Accrued pension benefits 42.8 42.0 Environmental liabilities 11.6 11.6 Long-term debt, net 377.3 354.2 Common stock warrant liability 1.9 4.4 Deferred income taxes, net 2.5 2.5 Other noncurrent liabilities 6.8 6.9 TOTAL LIABILITIES 615.6 586.1 Redeemable Preferred Stock 25.1 24.9 Stockholders' equity: Preferred stock — — Additional paid-in capital 546.2 546.7 Accumulated deficit (517.7 ) (506.2 ) Accumulated other comprehensive loss (6.4 ) (7.1 ) Total stockholders' equity—Real Industry, Inc. 22.1 33.4 Noncontrolling interest 0.8 1.1 TOTAL STOCKHOLDERS' EQUITY 22.9 34.5 TOTAL LIABILITIES, REDEEMABLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY $ 663.6 $ 645.5

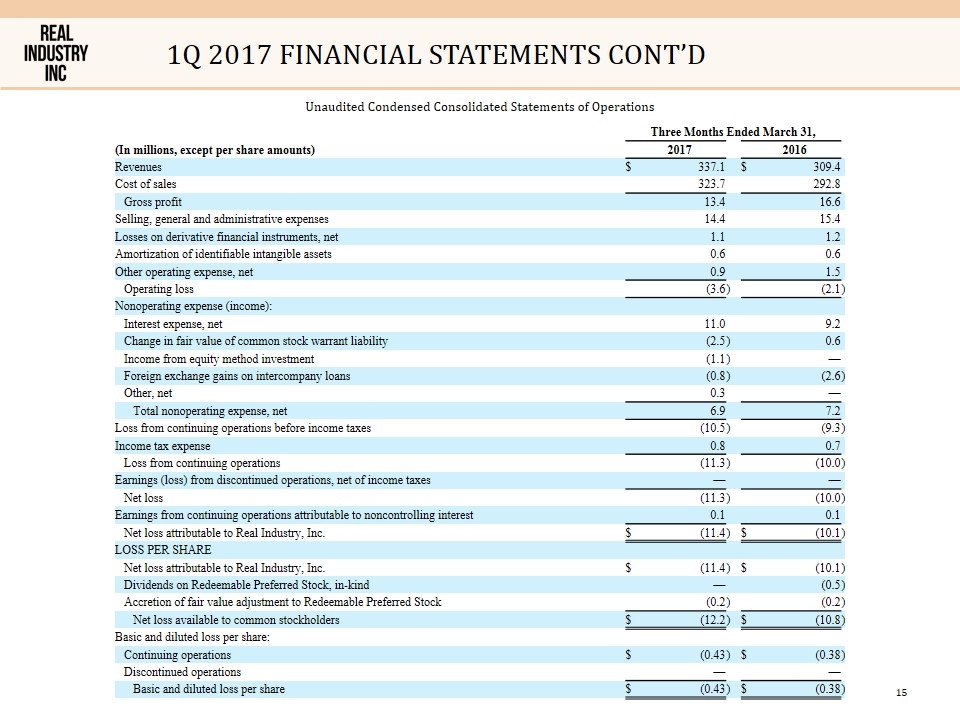

1Q 2017 Financial statements cont’d Unaudited Condensed Consolidated Statements of Operations Three Months Ended March 31, (In millions, except per share amounts) 2017 2016 Revenues $ 337.1 $ 309.4 Cost of sales 323.7 292.8 Gross profit 13.4 16.6 Selling, general and administrative expenses 14.4 15.4 Losses on derivative financial instruments, net 1.1 1.2 Amortization of identifiable intangible assets 0.6 0.6 Other operating expense, net 0.9 1.5 Operating loss (3.6 ) (2.1 ) Nonoperating expense (income): Interest expense, net 11.0 9.2 Change in fair value of common stock warrant liability (2.5 ) 0.6 Income from equity method investment (1.1 ) — Foreign exchange gains on intercompany loans (0.8 ) (2.6 ) Other, net 0.3 — Total nonoperating expense, net 6.9 7.2 Loss from continuing operations before income taxes (10.5 ) (9.3 ) Income tax expense 0.8 0.7 Loss from continuing operations (11.3 ) (10.0 ) Earnings (loss) from discontinued operations, net of income taxes — — Net loss (11.3 ) (10.0 ) Earnings from continuing operations attributable to noncontrolling interest 0.1 0.1 Net loss attributable to Real Industry, Inc. $ (11.4 ) $ (10.1 ) LOSS PER SHARE Net loss attributable to Real Industry, Inc. $ (11.4 ) $ (10.1 ) Dividends on Redeemable Preferred Stock, in-kind — (0.5 ) Accretion of fair value adjustment to Redeemable Preferred Stock (0.2 ) (0.2 ) Net loss available to common stockholders $ (12.2 ) $ (10.8 ) Basic and diluted loss per share: Continuing operations $ (0.43 ) $ (0.38 ) Discontinued operations — — Basic and diluted loss per share $ (0.43 ) $ (0.38 )

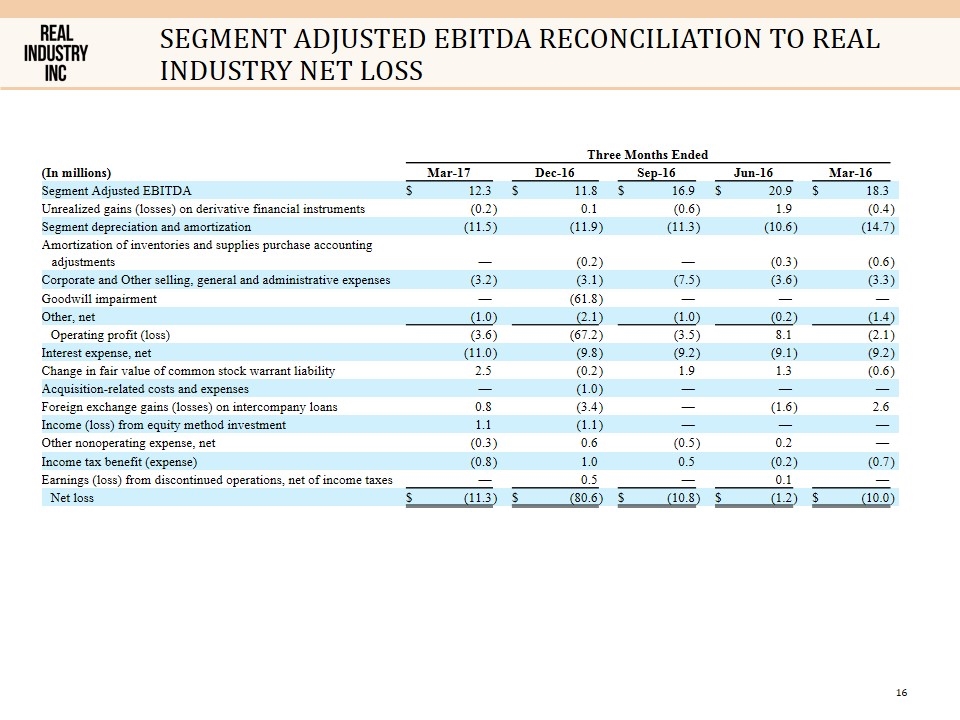

Segment adjusted ebitda reconciliation to real industry net LOSS Three Months Ended (In millions) Mar-17 Dec-16 Sep-16 Jun-16 Mar-16 Segment Adjusted EBITDA $ 12.3 $ 11.8 $ 16.9 $ 20.9 $ 18.3 Unrealized gains (losses) on derivative financial instruments (0.2 ) 0.1 (0.6 ) 1.9 (0.4 ) Segment depreciation and amortization (11.5 ) (11.9 ) (11.3 ) (10.6 ) (14.7 ) Amortization of inventories and supplies purchase accounting adjustments — (0.2 ) — (0.3 ) (0.6 ) Corporate and Other selling, general and administrative expenses (3.2 ) (3.1 ) (7.5 ) (3.6 ) (3.3 ) Goodwill impairment — (61.8 ) — — — Other, net (1.0 ) (2.1 ) (1.0 ) (0.2 ) (1.4 ) Operating profit (loss) (3.6 ) (67.2 ) (3.5 ) 8.1 (2.1 ) Interest expense, net (11.0 ) (9.8 ) (9.2 ) (9.1 ) (9.2 ) Change in fair value of common stock warrant liability 2.5 (0.2 ) 1.9 1.3 (0.6 ) Acquisition-related costs and expenses — (1.0 ) — — — Foreign exchange gains (losses) on intercompany loans 0.8 (3.4 ) — (1.6 ) 2.6 Income (loss) from equity method investment 1.1 (1.1 ) — — — Other nonoperating expense, net (0.3 ) 0.6 (0.5 ) 0.2 — Income tax benefit (expense) (0.8 ) 1.0 0.5 (0.2 ) (0.7 ) Earnings (loss) from discontinued operations, net of income taxes — 0.5 — 0.1 — Net loss $ (11.3 ) $ (80.6 ) $ (10.8 ) $ (1.2 ) $ (10.0 )