Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - NUMEREX CORP /PA/ | t1701443_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - NUMEREX CORP /PA/ | t1701443_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - NUMEREX CORP /PA/ | t1701443_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - NUMEREX CORP /PA/ | t1701443_ex31-1.htm |

| EX-10.3 - EXHIBIT 10.3 - NUMEREX CORP /PA/ | t1701443_ex10-3.htm |

| 10-Q - FORM 10-Q - NUMEREX CORP /PA/ | t1701443-10q.htm |

Exhibit 10.1

EXECUTION VERSION

THIRD AMENDMENT TO TERM LOAN AGREEMENT AND LIMITED WAIVER

This THIRD AMENDMENT to TERM LOAN AGREEMENT AND LIMITED WAIVER, dated as of March 31, 2017 (this “Third Amendment”), by and among Numerex Corp., a Pennsylvania corporation (the “Lead Borrower”), the other Persons party hereto designated as “Borrowers” (each a “Borrower” and, together with the Lead Borrower, the “Borrowers”), the other Persons party hereto designated as “Guarantors” (the “Guarantors”, and, together with the Borrowers, the “Credit Parties”), Crystal Financial LLC, a Delaware limited liability company, as administrative agent and collateral agent (in such capacities, the “Term Agent”) for the financial institutions from time to time party to the Term Loan Agreement (collectively, the “Term Lenders” and individually each a “Term Lender”) and for itself and the other Secured Parties.

W I T N E S S E T H:

WHEREAS, the Borrowers, the Guarantors, the Term Agent and the Term Lenders are party to that certain Term Loan Agreement dated as of March 9, 2016, as amended by the First Amendment to Term Loan Agreement dated as of July 29, 2016, as further amended by the Second Amendment to Term Loan Agreement dated as of November 3, 2016 (as further amended, restated, supplemented or otherwise modified from time to time in accordance with the terms thereof, the “Term Loan Agreement”), pursuant to which the Term Lenders agreed, subject to the terms and conditions contained therein, to extend credit to the Borrowers;

WHEREAS, the Credit Parties have requested that the Term Agent and the Term Lenders effect certain amendments to the Term Loan Agreement as more specifically set forth herein, and the Term Agent and the Term Lenders are willing to effect such amendments to the Term Loan Agreement on the terms and conditions hereinafter set forth;

WHEREAS, certain Events of Default (the “Specified Events of Default”) have occurred and are continuing under:

(i) Section 6.1(c) of the Term Loan Agreement as a result of the Credit Parties’ failure to comply with Sections 5.23(a), 5.23(b), 5.23(c) and 5.23(d) of the Term Loan Agreement for the period ended December 31, 2016;

(ii) Section 6.1(c) of the Term Loan Agreement as a result of the Credit Parties’ failure to notify the Term Agent, as required under Section 5.3 of the Term Loan Agreement, of the dissolution of a non-Credit Party Subsidiary of the Lead Borrower;

(iii) Section 6.1(d) of the Term Loan Agreement as a result of the Credit Parties’ failure to notify the Term Agent, as required under Section 4.3(c) of the Term Loan Agreement, of the letter, dated as of April 27, 2016, received by the Lead Borrower from a Governmental Authority;

(iv) Section 6.1(d) of the Term Loan Agreement as a result of the Credit Parties’ failure to notify the Term Agent, as required under Section 4.3(d) of the Term Loan Agreement, regarding the commencement of certain litigation in which the amount of damages claimed exceeds $250,000 and regarding material developments in certain other litigation affecting the Credit Parties;

(v) Section 6.1(b) of the Term Loan Agreement as a result of the inaccuracy of the Credit Parties’ representations in Section 3.19 of the Term Loan Agreement due to the Credit Parties’ omission of outstanding options in Schedule 3.19 to the Term Loan Agreement;

(vi) Section 6.1(b) of the Term Loan Agreement as a result of the Credit Parties’ failure to disclose, in the Compliance Certificates delivered to the Term Agent pursuant to Section 4.2(b) of the Term Loan Agreement, changes in the information provided in Schedule 3.16 to the Term Loan Agreement;

(vii) Section 6.1(b) of the Term Loan Agreement, as a result of the inaccuracy of the Credit Parties’ representations in Loan Documents delivered after the date of the Term Loan Agreement due to the Credit Parties’ failure to update the information set forth in Schedules 3.5, 3.16, 3.19, 3.20 and 3.21 to the Term Loan Agreement;

(viii) Section 6.1(c) of the Term Loan Agreement as a result of the Credit Parties’ failure to notify the Term Agent, as required under Section 4.3(a) of the Term Loan Agreement, of the occurrence of the Events of Default described in clauses (ii), (iii), (iv), (v), (vi) and (vii) above, and this clause (viii); and

(ix) Section 6.1(b) of the Term Loan Agreement as a result of the inaccuracy of the Credit Parties’ representations in Loan Documents delivered after the date of the Term Loan Agreement due to the existence of the Events of Default described in clauses (ii), (iii), (iv), (v), (vi), (vii) and (viii) above and this clause (ix); and

WHEREAS, the Credit Parties have requested that the Term Agent and the Term Lenders agree to waive the Specified Events of Default, and the Term Agent and the Term Lenders are willing to waive the Specified Events of Default on the terms and conditions hereinafter set forth.

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants herein contained, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties signatory hereto agree as follows:

| 1. | Defined Terms. Except as otherwise defined in this Third Amendment, terms defined in the Term Loan Agreement are used herein as defined therein. |

| 2. | Amendments to Term Loan Agreement. Subject to the satisfaction of the conditions precedent specified in Section 6 below, the following amendments shall be incorporated into the Term Loan Agreement: |

| (a) | The following subsection (e) shall be added to Section 1.6 of the Term Loan Agreement: |

“(e) June 1, 2017 Prepayment. On June 1, 2017, unless the Credit Parties have entered into Planned Refinancing Transaction Documentation in respect of a Planned Refinancing Transaction of the nature described in clause (i) of the definition of Planned Refinancing Transaction Documentation, the Borrowers shall prepay the outstanding principal balance of the Term Loans (notwithstanding the application of payments provisions set forth in Section 1.8(c)) in an amount equal to $2,000,000 funded with the proceeds of equity or Subordinated Indebtedness upon terms and conditions acceptable to the Term Agent, which prepayment shall be subject to the Prepayment Premium; provided, that such Prepayment Premium in an amount equal to $40,000 shall be fully earned and due on June 1, 2017, but not payable until the earlier of

| 2 |

(i) the payment in full in cash of the Obligations, (ii) the occurrence of an Event of Default, and (iii) August 1, 2017.”

| (b) | The following Section 4.21 shall be added to Article 4 of the Term Loan Agreement: |

“4.21 Planned Refinancing Transaction Documentation; Investment Banker. No later than June 1, 2017 or such later date as agreed by the Term Agent in its sole discretion, the Credit Parties shall have either (i) entered into Planned Refinancing Transaction Documentation, or (ii) entered into, upon terms and conditions reasonably acceptable to the Term Agent, an engagement letter (the “Engagement Letter”) with an investment banker or other similar consultant reasonably acceptable to the Term Agent (the “Investment Banker”) to advise and assist the Credit Parties in entering into a Planned Refinancing Transaction. The Credit Parties shall retain the Investment Banker at all times until the closing of a Planned Refinancing Transaction (including the payment in full in cash of the Obligations) or as otherwise agreed by the Term Agent. Each Credit Party acknowledges and agrees that the Term Agent shall have the right to communicate directly with the Investment Banker, provided that the Lead Borrower is provided an opportunity to be present on all calls and copied on all emails and other correspondence. Subject to the preceding sentence, the Engagement Letter shall authorize and direct the Investment Banker to communicate directly with the Term Agent, participate in required weekly status calls with the Term Agent and furnish the Term Agent with such information as the Term Agent may request, in form and substance acceptable to the Term Agent. The Investment Banker shall provide the Term Agent periodic updates, and, if requested by the Term Agent, interim updates, regarding the status of its efforts, including, without limitation, the status of any sale efforts, and copies of any notices, reports and other communications delivered by the Investment Banker to the Credit Parties. The Credit Parties shall continue to retain the Investment Banker as and when required in this Section, and shall provide the Investment Banker with all information and reports necessary for the Investment Banker to perform its duties under the Engagement Letter and otherwise cooperate with the Investment Banker.

| (c) | Section 4.2 of the Term Loan Agreement is hereby amended by adding the following clauses (k) and (l) thereto: |

“(k) promptly upon receipt thereof, copies of any notices, reports and other communications delivered to the Credit Parties by the Investment Banker; and

(l) promptly upon receipt thereof, copies of any expressions of interest, offers and letters of intent with respect to any Planned Refinancing Transaction.”

| (d) | Section 5.23(a) of the Term Loan Agreement is hereby amended by deleting the grid contained therein in its entirety and substituting the following in its stead: |

| Quarter | Minimum Adjusted EBITDA |

| March 31, 2017 | $1,900,000 |

| June 30, 2017 | $2,250,000 |

| September 30, 2017 | $3,250,000 |

| December 31, 2017, and the last day of each fiscal quarter thereafter | $6,000,000 |

| 3 |

| (e) | Section 5.23(b) of the Term Loan Agreement is hereby amended by deleting the grid contained therein in its entirety and substituting the following in its stead: |

| Quarter |

Minimum Consolidated Fixed Charge Coverage Ratio |

| March 31, 2017 | 0.35 : 1.00 |

| June 30, 2017 | 0.40 : 1.00 |

| September 30, 2017 | 0.50 : 1.00 |

| December 31, 2017, and the last day of each fiscal quarter thereafter | 1.00 : 1.00 |

| (f) | Section 5.23(c) of the Term Loan Agreement is hereby amended by deleting the grid contained therein in its entirety and substituting the following in its stead: |

| Quarter |

Maximum Consolidated Total Net Leverage |

| March 31, 2017 | 3.00 : 1.00 |

| June 30, 2017 | 2.50 : 1.00 |

| September 30, 2017 | 2.00 : 1.00 |

|

December 31, 2017 and the last day of each fiscal quarter thereafter |

1.50 : 1.00 |

| (g) | Section 5.23(d) of the Term Loan Agreement is hereby amended by deleting the grid contained therein in its entirety and substituting the following in its stead: |

| Quarter | Churn |

| March 31, 2017 | -7.5% |

| June 30, 2017 and the last day of each fiscal quarter thereafter | -2.5% |

| (h) | Section 6.1(c) of the Term Loan Agreement shall be amended by adding a failure to perform or observe any term, covenant or agreement contained in Section 4.21 of the Term Loan Agreement to the list of specific Defaults set forth in such section 6.1(c). |

| (i) | Section 10.1 of the Term Loan Agreement is hereby amended by deleting the definition of “Adjusted EBITDA” in its entirety and substituting the following in its stead: |

“Adjusted EBITDA” means, for any period, for the Lead Borrower and its Subsidiaries on a Consolidated basis, an amount equal to Consolidated Net Income for such period plus (a) without duplication, the following to the extent deducted in calculating such Consolidated Net Income: (i) Consolidated Interest Expense for such period, (ii) the provision for federal, state, local and foreign income taxes payable by the Lead Borrower and its Subsidiaries for such period, (iii) depreciation and amortization expense for such period, (iv) non-cash equity-based

| 4 |

compensation, (v) non-recurring, non-cash expenses which are deemed acceptable to the Term Agent, (vi) the fees, costs, and expenses payable by the Borrowers in connection with the closing of the transactions contemplated by the Loan Documents, (vii) fees and expenses paid in connection with field examinations and wind-down analyses in accordance with Section 4.9(c), (viii) the non-cash write-off of fixed assets during the second Fiscal Quarter of 2016 relating to the Atlanta Sublease in an amount not to exceed $377,000, (ix) the impairment charge taken during the second Fiscal Quarter of 2016 relating to the Atlanta Sublease in an amount not to exceed $889,000, (x) third party broker fees incurred during the second Fiscal Quarter of 2016 relating to the Atlanta Sublease not to exceed $460,000, (xi) severance paid during the second Fiscal Quarter of 2016 in an amount not to exceed $415,000, (xii) inventory reserves taken during second Fiscal Quarter of 2016 in an amount not to exceed $435,000, (xiii) goodwill impairment charges taken during the second Fiscal Quarter of 2016 in an amount not to exceed $7,000,000, (xiv) cash severance paid during July and August of 2016 in an amount not to exceed $253,000, (xv) cash costs and expenses paid in connection with relocating to a temporary headquarters at 400 Interstate North Parkway SE, Atlanta, Georgia in July of 2016 in an amount not to exceed $25,000; (xvi) goodwill impairment charges taken during the fourth Fiscal Quarter of 2016 in an amount not to exceed $7,833,000; (xvii) severance paid during the fourth Fiscal Quarter of 2016 in an amount not to exceed $311,598 and severance paid during the first Fiscal Quarter of 2017 in an amount not to exceed $398,821; (xviii) third party professional fees for transaction related activities in the fourth Fiscal Quarter of 2016 in an amount not to exceed $111,136 and fees related to debt refinancing and amendment in the first Fiscal Quarter of 2017 to not exceed in amount of $775,000; (xix) one-time consulting costs for Inventory MRP system not to exceed $75,000 and one-time moving expenses to a new 3PL not to exceed $20,000; and (xx) one-time costs related to turn down of network for 2G ATT in an amount not to exceed $25,000; and minus (b) the following to the extent included in calculating such Consolidated Net Income: (i) federal, state, local and foreign income tax credits of the Lead Borrower and its Subsidiaries for such period, (ii) extraordinary gains for such period and (iii) all non-cash, non-recurring items increasing Consolidated Net Income for such period. For quarterly periods prior to the closing date, “Adjusted EBITDA” shall be as follows: quarter ended December 31, 2015 - $1,963,000, quarter ended September 30, 2015 - $1,664,000 and quarter ended June 30, 2015 - $3,410,000.”

| (j) | Section 10.1 of the Term Loan Agreement is hereby amended by deleting the definition of “Applicable Margin” in its entirety and substituting the following in its stead: |

“Applicable Margin” means, (a) at any time prior to January 1, 2017, eight and one-half percent (8.50%) per annum, and (b) at any time on or after January 1, 2017, ten and one-half percent (10.5%).

| (k) | Section 10.1 of the Term Loan Agreement is hereby amended by adding the following definition of “Planned Refinancing Transaction Documentation” to such Section in the proper alphabetical order: |

“Planned Refinancing Transaction Documentation” means, (i) definitive documentation providing for a the sale of all or substantially all of the Credit Parties’ assets or the equity interests of the Lead Borrower, or a merger of the Lead Borrower with another Person, or (ii) a binding commitment letter for the refinancing of the Obligations, in each case, in form and substance acceptable to the Term Agent and subject only to completion of the definitive legal documentation, approvals required by applicable law and other customary ministerial closing conditions, that will result in the payment in full in cash of the Obligations on or before August 1, 2017 (each transaction of the nature described above, a “Planned Refinancing Transaction”).

| 5 |

| (l) | Exhibit 4.2(b) to the Term Loan Agreement (Form of Compliance Certificate) is hereby replaced in its entirety with Exhibit 4.2(b) attached hereto. |

| (m) | Schedule 3.5 (Litigation) to the Term Loan Agreement is hereby replaced in its entirety with Schedule 3.5 attached hereto. |

| (n) | Schedule 3.16 (Intellectual Property) to the Term Loan Agreement is hereby replaced in its entirety with Schedule 3.16 attached hereto. |

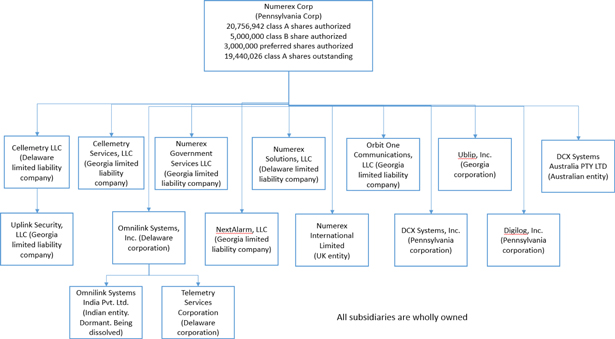

| (o) | Schedule 3.19 (Ventures, Subsidiaries and Affiliates; Outstanding Stock) to the Term Loan Agreement is hereby replaced in its entirety with Schedule 3.19 attached hereto. |

| (p) | Schedule 3.20 (Jurisdiction of Organization; Chief Executive Office) to the Term Loan Agreement is hereby replaced in its entirety with Schedule 3.20 attached hereto. |

| (q) | Schedule 3.21 (Locations of Inventory, Equipment and Books and Records) to the Term Loan Agreement is hereby replaced in its entirety with Schedule 3.21 attached hereto. |

| 3. | Limited Waiver. The Credit Parties acknowledge that the Specified Events of Default have occurred and are continuing, and represent and warrant that as of the date hereof, no Defaults or Events of Default have occurred and are continuing other than the Specified Events of Default. Subject to the satisfaction of the conditions set forth in Section 6 below, and in reliance on the representations and warranties contained in Section 5 below, the Term Agent and the Term Lenders hereby waive the Specified Events of Default. The Term Agent hereby acknowledges that the Subordinated Lender (as defined below) may be considered an Affiliate of a Borrower for purposes of Section 5.6 of the Term Loan Agreement and hereby agrees that the transactions contemplated by the Subordinated Note and the Warrant to Purchase Stock (the “Warrant”) issued to the Subordinated Lender on the date hereof, which shall be exercised by way of cashless exercise, shall not be prohibited by Section 5.6 of the Term Loan Agreement. This is a limited waiver and shall not be deemed to (a) waive, release, modify or limit any Credit Party’s obligations to otherwise comply with all terms and conditions of the Term Loan Agreement and the other Loan Documents, (b) waive any other existing or future Default or Event of Default, or (c) prejudice any right or remedy that the Term Agent or any Term Lender may have presently or in the future under or in connection with the Term Loan Agreement or any other Loan Document (all of which rights and remedies are expressly reserved), except as expressly provided herein. |

| 4. | Acknowledgment Regarding Huron Consulting Services. Each Credit Party hereby acknowledges that the Term Agent has engaged Huron Consulting Services LLC to review and assess certain financial results and projections with respect to the Credit Parties, and each Credit Party hereby agrees to pay or reimburse the Term Agent for all costs and expenses incurred by the Term Agent in connection with such engagement. |

| 5. | Representations and Warranties. Each Credit Party hereby represents and warrants that: |

| (a) | After giving effect to this Third Amendment, no Default or Event of Default has occurred and is continuing; |

| (b) | the execution, delivery and performance of this Third Amendment by each Credit Party are all within such Credit Party’s corporate powers, will not contravene any Requirement of Law or the terms of such Credit Party’s Organization Documents, or any Material |

| 6 |

| Contract to which such Credit Party is a party or by which such Credit Party or its property is bound, and shall not result in the creation or imposition of any lien, claim, charge or encumbrance upon any of the Collateral, except in favor of Term Agent and Term Lenders pursuant to the Term Loan Agreement and the other Loan Documents as amended hereby; |

| (c) | this Third Amendment and each other agreement or instrument to be executed and delivered by the Credit Parties in connection herewith have been duly authorized, executed and delivered by all necessary action on the part of such Credit Party and, if necessary, its stockholders, as the case may be, and the agreements and obligations of each Credit Party contained herein and therein constitute the legal, valid and binding obligations of such Credit Party, enforceable against it in accordance with their terms, except as enforceability is limited by bankruptcy, insolvency, reorganization, receivership, moratorium or other laws affecting creditor’s rights generally and by general principles of equity; and |

| (d) | after giving effect to this Third Amendment, and other than as disclosed on the Schedules to this Third Amendment, all representations and warranties contained in the Term Loan Agreement and each other Loan Document are true and correct in all material respects on and as of the date hereof, except (i) to the extent that such representations and warranties refer to an earlier date, in which case they shall be true and correct as of such earlier date, and (ii) in the case of any representation and warranty qualified by materiality, in which case they shall be true and correct in all respects. |

| 6. | Conditions to Effectiveness. This Third Amendment shall not be effective until each of the following conditions precedent have been fulfilled to the satisfaction of the Term Agent (such date referred to herein as, the “Effective Date”): |

| (a) | the Term Agent shall have received this Third Amendment, duly executed by each of the parties hereto; |

| (b) | after giving effect to this Third Amendment, no Default or Event of Default shall have occurred and be continuing; |

| (c) | all orders, permissions, consents, approvals, licenses, authorizations and validations of, and filings, recordings and registrations with, and exemptions by, any Governmental Authority, or any other Person required to authorize or otherwise required in connection with the execution, delivery and performance by each Credit Party of this Third Amendment and the transactions contemplated hereby, shall have been obtained and shall be in full force and effect; |

| (d) | the Credit Parties shall have (i) delivered to the Term Agent, (A) evidence, in form acceptable to the Term Agent, of the closing of the transactions contemplated by the Senior Subordinated Promissory Note, dated as of the date hereof (the “Subordinated Note”), executed and delivered by the Lead Borrower to Kenneth Rainin Foundation (the “Subordinated Lender”), and (B) duly-executed copies of the Subordinated Note and all related documentation, including without limitation, the Warrant, as required by the Term Agent in its sole discretion, in each case, in form and substance acceptable to the Term Agent, and (ii) received $5,000,000 in Subordinated Indebtedness proceeds from the Subordinated Lender pursuant to the Subordinated Note, and shall have used such |

| 7 |

| proceeds to prepay the outstanding principal balance of the Term Loans (notwithstanding the application of payments provisions set forth in Section 1.8(c) of the Term Loan Agreement), which prepayment shall be subject to the Prepayment Premium; provided, that such Prepayment Premium in an amount equal to $100,000 shall be fully earned and due on the date hereof, but not payable until the earlier of (A) the payment in full in cash of the Obligations, (B) the occurrence of an Event of Default, and (C) August 1, 2017; and |

| (e) | the Credit Parties shall have paid in full (i) all invoiced Credit Party expenses in connection with the preparation, execution, delivery and administration of this Third Amendment and the other instruments and documents to be delivered hereunder, (ii) the Amendment Fee First Installment (as defined below), and (iii) all unpaid interest on the Term Loans due and payable under the Term Loan Agreement as of the date hereof (including, without limitation, any additional interest resulting from the amendment to the definition of Applicable Margin set forth herein; provided, that any such additional interest shall be fully earned and due on the date hereof, but not payable until the earlier of (A) the payment in full in cash of the Obligations, (B) the occurrence of an Event of Default, and (C) April 3, 2017). The amounts to be paid by the Credit Parties set forth in this Section 6(e) shall be fully earned and due as of the date hereof, and no portion thereof when paid shall be refunded or returned to the Credit Parties under any circumstances. |

| 7. | Amendment Fee. In consideration of the agreements contained in this Third Amendment, the Credit Parties shall pay to the Term Agent an amendment fee equal to $200,000, which shall be fully earned and due as of the date hereof, and payable as follows: (a) $100,000 on the date hereof (the “Amendment Fee First Installment”), and (b) $100,000 (the “Amendment Fee Second Installment”) on the earlier of (i) the occurrence of an Event of Default, and (ii) June 1, 2017; provided that the payment of the Amendment Fee Second Installment shall be waived if no Default or Event of Default has occurred and is continuing and a Planned Refinancing Transaction closes prior to June 1, 2017 (including the payment in full in cash of the Obligations). |

| 8. | Effect on Loan Documents. The Term Loan Agreement and the other Loan Documents, after giving effect to this Third Amendment, shall be and remain in full force and effect in accordance with their terms and hereby are ratified and confirmed in all respects. Except as expressly set forth herein, the execution, delivery, and performance of this Third Amendment shall not operate as a waiver of any right, power, or remedy of the Term Agent or any other Secured Party under the Term Loan Agreement or any other Loan Document, as in effect prior to the date hereof. Each Credit Party hereby ratifies and confirms in all respects all of its obligations under the Loan Documents to which it is a party and each Credit Party hereby ratifies and confirms in all respects any prior grant of a security interest under the Loan Documents to which it is party. |

| 9. | Further Assurances. Each Credit Party shall execute and deliver all agreements, documents and instruments, each in form and substance satisfactory to the Term Agent, and take all actions as the Term Agent may reasonably request from time to time, to perfect and maintain the perfection and priority of the security interest in the Collateral held by the Term Agent and to fully consummate the transactions contemplated under this Third Amendment and the Term Loan Agreement, as modified hereby. |

| 10. | Release. Each Credit Party hereby remises, releases, acquits, satisfies and forever discharges Term Agent and the Term Lenders, their agents, employees, officers, directors, predecessors, |

| 8 |

| attorneys and all others acting on behalf of or at the direction of Term Agent or the Term Lenders, of and from any and all manner of actions, causes of action, suit, debts, accounts, covenants, contracts, controversies, agreements, variances, damages, judgments, claims and demands whatsoever, in law or in equity, which any of such parties ever had, or now has, to the extent arising from or in connection with any act, omission or state of facts taken or existing on or prior to the Effective Date, against Term Agent and the Term Lenders, their agents, employees, officers, directors, attorneys and all persons acting on behalf of or at the direction of Term Agent or the Term Lenders (“Releasees”), for, upon or by reason of any matter, cause or thing whatsoever arising under, or in connection with, or otherwise related to, the Loan Documents through the Effective Date. Without limiting the generality of the foregoing, each Credit Party waives and affirmatively agrees not to allege or otherwise pursue any defenses, affirmative defenses, counterclaims, claims, causes of action, setoffs or other rights they have or may have under, or in connection with, or otherwise related to, the Loan Documents as of the Effective Date, including, but not limited to, the rights to contest any conduct of Term Agent, the Term Lenders or other Releasees on or prior to the Effective Date. |

| 11. | No Novation; Entire Agreement. This Third Amendment evidences solely the amendment of certain specified terms and obligations of the Credit Parties under the Term Loan Agreement and is not a novation or discharge of any of the other obligations of the Credit Parties under the Term Loan Agreement. There are no other understandings, express or implied, among the Credit Parties, the Term Agent and the Term Lenders regarding the subject matter hereof or thereof. |

| 12. | Choice of Law. THIS THIRD AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK, WITHOUT GIVING EFFECT TO THE CONFLICTS OF LAWS PRINCIPLES THEREOF, BUT INCLUDING SECTION 5-1401 OF THE NEW YORK GENERAL OBLIGATIONS LAW. |

| 13. | Counterparts; Facsimile Execution. This Third Amendment may be executed in any number of counterparts and by different parties and separate counterparts, each of which when so executed and delivered shall be deemed an original, and all of which, when taken together, shall constitute one and the same instrument. Delivery of an executed counterpart of a signature page to this Third Amendment by facsimile (or other electronic transmission) shall be as effective as delivery of a manually executed counterpart of this Third Amendment. Any party delivering an executed counterpart of this Third Amendment by facsimile (or other electronic transmission) also shall deliver a manually executed counterpart of this Third Amendment but the failure to deliver a manually executed counterpart shall not affect the validity, enforceability, and binding effect of this Third Amendment. |

| 14. | Construction. This Third Amendment is a Loan Document. This Third Amendment and the Term Loan Agreement shall be construed collectively and in the event that any term, provision or condition of any of such documents is inconsistent with or contradictory to any term, provision or condition of any other such document, the terms, provisions and conditions of this Third Amendment shall supersede and control the terms, provisions and conditions of the Term Loan Agreement. |

| 15. | Miscellaneous. The terms and provisions hereof shall be binding upon and inure to the benefit of the parties hereto and their successors and assigns. |

| 9 |

[Signature Pages Follow]

| 10 |

IN WITNESS WHEREOF, the parties hereto have caused this Third Amendment to be duly executed and delivered by their duly authorized officers of the date first above written.

| Numerex Corp., as the Lead Borrower and a Borrower | ||

| By: | /s/ Kenneth Gayron | |

| Name: | Kenneth Gayron | |

| Title: | Chief Financial Officer | |

| Cellemetry LLC, as a Borrower | ||

| By: | /s/ Kenneth Gayron | |

| Name: | Kenneth Gayron | |

| Title: | Treasurer | |

| Cellemetry Services, LLC, as a Borrower | ||

| By: | /s/ Kenneth Gayron | |

| Name: | Kenneth Gayron | |

| Title: | Treasurer | |

| NEXTALARM, LLC, as a Borrower | ||

| By: | /s/ Kenneth Gayron | |

| Name: | Kenneth Gayron | |

| Title: | Treasurer | |

| NUMEREX GOVERNMENT SERVICES LLC, as a Borrower | ||

| By: | /s/ Kenneth Gayron | |

| Name: | Kenneth Gayron | |

| Title: | Treasurer | |

[Signature Page to Third Amendment to Term Loan Agreement and Limited Waiver]

| NUMEREX SOLUTIONS, LLC, as a Borrower | ||

| By: | /s/ Kenneth Gayron | |

| Name: | Kenneth Gayron | |

| Title: | Treasurer | |

| OMNILINK SYSTEMS INC., as a Borrower | ||

| By: | /s/ Kenneth Gayron | |

| Name: | Kenneth Gayron | |

| Title: | Chief Financial Officer | |

| ORBIT ONE COMMUNICATIONS, LLC, as a Borrower | ||

| By: | /s/ Kenneth Gayron | |

| Name: | Kenneth Gayron | |

| Title: | Treasurer | |

| TELEMETRY SERVICES CORPORATION, as a Borrower | ||

| By: | /s/ Kenneth Gayron | |

| Name: | Kenneth Gayron | |

| Title: | Chief Financial Officer | |

| UBLIP, INC., as a Borrower | ||

| By: | /s/ Kenneth Gayron | |

| Name: | Kenneth Gayron | |

| Title: | Chief Financial Officer | |

| UPLINK SECURITY, LLC, as a Borrower | ||

| By: | /s/ Kenneth Gayron | |

| Name: | Kenneth Gayron | |

| Title: | Treasurer | |

[Signature Page to Third Amendment to Term Loan Agreement and Limited Waiver]

| CRYSTAL FINANCIAL LLC, as Term Agent | ||

| By: | /s/ Christopher A. Arnold | |

| Name: | Christopher A. Arnold | |

| Title: | Senior Managing Director | |

| CRYSTAL FINANCIAL SPV LLC, as Term Lender | ||

| By: | /s/ Christopher A. Arnold | |

| Name: | Christopher A. Arnold | |

| Title: | Senior Managing Director | |

[Signature Page to Third Amendment to Term Loan Agreement and Limited Waiver]

EXHIBIT 4.2(b)

FORM OF COMPLIANCE CERTIFICATE

| To: | Crystal Financial LLC | Date: _____________________ |

| Two International Place, 17th Floor | ||

| Boston, MA 02110 |

Re: Term Loan Agreement dated as of March 9, 2016 (as amended, modified, supplemented or restated hereafter, the “Term Loan Agreement”) by and among (i) Numerex Corp., a Pennsylvania corporation (the “Lead Borrower”), (ii) the other Borrowers party thereto from time to time (together with the Lead Borrower, the “Borrowers”), (iii) the Guarantors party thereto from time to time, (iv) the Term Lenders party thereto from time to time party, and (v) Crystal Financial LLC, as term agent (the “Term Agent”). All capitalized terms used herein and not otherwise defined shall have the same meaning herein as in the Term Loan Agreement.

The undersigned, a duly authorized and acting Responsible Officer of the Lead Borrower, hereby certifies to you as follows:

| 1. | No Default; Representations and Warranties. |

| a. | To the knowledge of the undersigned Responsible Officer, except as set forth in Appendix I, no Default or Event of Default has occurred and is continuing. |

| b. | If a Default or Event of Default has occurred and is continuing, the Lead Borrower and its Subsidiaries propose to take action as set forth in Appendix I with respect to such Default or Event of Default. |

| c. | Each of the representations and warranties set forth in the Term Loan Agreement is true and correct in all material respects as of the date hereof (without duplication of any materiality qualifier contained therein). |

| 2. | Financial Calculations. Attached hereto as Appendix II are reasonably detailed calculations of the following, each as of the Fiscal [Month/Year] ending [_____]1: |

| a. | Adjusted EBITDA; |

| b. | Consolidated Fixed Charge Coverage Ratio; |

| c. | Consolidated Total Net Leverage; |

| d. | Churn; and |

| e. | Liquidity. |

1 Note: All calculations to be included regardless of whether compliance with any particular covenant is required for a given reporting period under the Term Loan Agreement.

| 3. | No Material Accounting Changes, Etc. The financial statements furnished to the Term Agent for the Fiscal [Month/Year] ending [_____] are complete, correct, and fairly present, in all material respects, in accordance with GAAP, the consolidated financial position and the results of operations of the Lead Borrower and its Subsidiaries on a consolidated basis at the close of, and the results of the Lead Borrower and its Subsidiaries’ operations and cash flows for, the period(s) covered, subject to, with respect to the monthly financial statements, normal year-end adjustments and the absence of footnotes. There has been no change in GAAP or the application thereof since the date of the audited financial statements furnished to the Term Agent for the year ending [_____], other than the material accounting changes as disclosed on Appendix III hereto. |

| 4. | Intellectual Property. Except as set forth on Appendix IV hereto, there has been no change to the information provided in Schedule 3.16 to the Term Loan Agreement since the date of the most recently delivered compliance certificate. |

| 5. | Commercial Tort Claims. Except as set forth on Appendix V hereto, there has been no change to the information provided in Schedule 1 to the Guaranty and Security Agreement since the date of the most recently delivered compliance certificate. |

[Signature Page Follows]

IN WITNESS WHEREOF, I have executed this certificate as of the date first written above.

| By:_______________________________ | |

| Responsible Officer of Lead Borrower | |

| Name:_____________________________ | |

| Title:______________________________ |

Appendix I

Except as set forth below, no Default or Event of Default presently exists. [If a Default or Event of Default exists, the following describes the nature of the Default or Event of Default in reasonable detail and the steps being taken or contemplated by the Lead Borrower and its Subsidiaries to be taken on account thereof.]

Appendix II

A. Calculation of Adjusted EBITDA2

| 1. | Consolidated Net Income: | $______________ |

| plus, without duplication, the following to the extent deducted in calculating such Consolidated Net Income: | ||

| 2. | Consolidated Interest Expense: | $______________ |

| 3. | the provision for federal, state, local and foreign income taxes payable by the Lead Borrower and its Subsidiaries: | $______________ |

| 4. | depreciation and amortization expense: | $______________ |

| 5. | non-cash equity-based compensation: | $ |

| 6. | non-recurring, non-cash expenses which are deemed acceptable to the Term Agent: | $______________ |

| 7. | the fees, costs and expenses payable by the Borrowers in connection with the closing of the transactions contemplated by the Loan Documents: | $______________ |

| 8. | fees and expenses paid in connection with field examinations and wind-down analyses in accordance with Section 4.9(c) of the Term Loan Agreement: | $______________ |

| 9. | the non-cash write-off of fixed assets during the second Fiscal Quarter of 2016 relating to the Atlanta Sublease in an amount not to exceed $377,000: | $______________ |

| 10. | the impairment charge taken during the second Fiscal Quarter of 2016 relating to the Atlanta Sublease in an amount not to exceed $889,000: | $______________ |

| 11. | third party broker fees incurred during the second Fiscal Quarter of 2016 relating to the Atlanta Sublease not to exceed $460,000: | $______________ |

| 12. | severance paid during the second Fiscal Quarter of 2016 in an amount not to exceed $415,000: | $______________ |

| 13. | inventory reserves taken during second Fiscal Quarter of 2016 in an amount not to exceed $435,000: | $______________ |

| 14. | goodwill impairment charges taken during the second Fiscal |

2 For quarterly periods prior to the Closing Date, “Adjusted EBITDA” shall be as follows: quarter ended December 31, 2015 - $1,963,000, quarter ended September 30, 2015 - $1,664,000 and quarter ended June 30, 2015 - $3,410,000.

| Quarter of 2016 in an amount not to exceed $7,000,000: | $______________ | |

| 15. | cash severance paid during July and August of 2016 in an amount not to exceed $253,000: | $______________ |

| 16. | cash costs and expenses paid in connection with relocating to a temporary headquarters at 400 Interstate North Parkway SE, Atlanta, Georgia in July of 2016 in an amount not to exceed $25,000: | $______________ |

| 17. | goodwill impairment charges taken during the fourth Fiscal Quarter of 2016 in an amount not to exceed $7,833,000: | $______________ |

| 18. | severance paid during the fourth Fiscal Quarter of 2016 in an amount not to exceed $311,598 and severance paid during the first Fiscal Quarter of 2017 in an amount not to exceed $398,821: | $______________ |

| 19. | third party professional fees for transaction related activities in the fourth Fiscal Quarter of 2016 in an amount not to exceed $111,136 and fees related to debt refinancing and amendment in the first Fiscal Quarter of 2017 to not exceed in amount of $775,000: | $______________ |

| 20. | one-time consulting costs for Inventory MRP system not to exceed $75,000 and one-time moving expenses to a new 3PL not to exceed $20,000: | $______________ |

| 21. | one-time costs related to turn down of network for 2G ATT in an amount not to exceed $25,000: | $______________ |

| minus the following to the extent included in calculating such Consolidated Net Income: | ||

| 22. | federal, state, local and foreign income tax credits of the Lead Borrower and its Subsidiaries: | $______________ |

| 23. | extraordinary gains for such period: | $______________ |

| 24. | all non-cash, non-recurring items increasing Consolidated Net Income: | $______________ |

| 25. | the sum of lines A-2 through A-21: | $______________ |

| 26. | the sum of lines A-22 through A-24: | $______________ |

| 27. | Adjusted EBITDA (line A-1 plus line A-25 minus line A-26): | $______________ |

| In compliance with minimum Adjusted EBITDA covenant, pursuant to Section 5.23 of the Term Loan Agreement (applicable only for calculations as of the end of a Fiscal Quarter): | [Yes/No/NA] |

B. Calculation of Consolidated Fixed Charge Coverage Ratio

| 1. | Adjusted EBITDA (line A-27): | $______________ |

| 2. | Capital Expenditures paid in cash: | $______________ |

| plus: | ||

| 3. | the aggregate amount (but not less than $0) of federal, state, local and foreign income taxes paid in cash: | $______________ |

| 4. | Debt Service Charges paid in cash: | |

| a. Consolidated Interest Expense3: | $______________ | |

| b. All scheduled principal payments made or required to be made on account of Indebtedness for borrowed money (including, without limitation, principal payments in accordance with Section 1.6(a)(i) of the Term Loan Agreement and obligations with respect to Capital Leases for such period (excluding, for the avoidance of doubt, all voluntary and mandatory prepayments): | $______________ | |

| c. the sum of lines B-4-a and B-4-b: | $______________ | |

| 5. | Restricted Payments paid in cash: | $______________ |

| 6. | the sum of lines B-2, B-3, B-4-c and B-5: | $______________ |

| 7. | Consolidated Fixed Charge Coverage Ratio (the ratio of line B-1 to line B-6): | [__] : [__] |

| In compliance with minimum Consolidated Fixed Charge Coverage Ratio covenant, pursuant to Section 5.23 of the Term Loan Agreement (applicable only for calculations as of the end of a Fiscal Quarter): | [Yes/No/NA] |

3 With respect to the calculation of the amounts set forth in line B-4-a above, for each of the quarters ending on March 31, 2016, June 30, 2016, September 30, 2016 and December 30, 2016, such amounts shall be calculated by: (i) determining the actual amount thereof from the Closing Date through such date of determination, (ii) dividing such amount by the number of days that have elapsed from the Closing Date through such date of determination, and (iii) multiplying the result by 365.

C. Calculation of Consolidated Total Net Leverage

| 1. | Net Debt: | $______________ |

| 2. | Consolidated Total Net Leverage (the ratio of line C-1 to Adjusted EBITDA (line A-27)): | [__] : [__] |

| In compliance with maximum Consolidated Total Net Leverage covenant, pursuant to Section 5.23 of the Term Loan Agreement (applicable only for Calculations as of the end of a Fiscal Quarter): | [Yes/No/NA] |

D. Calculation of Churn

| 1. | Aggregate number of subscribers at the end of the period: | [__] |

| minus | ||

| 2. | Aggregate number of subscribers at the end of the prior period: | [__] |

| 3. | Subscriber disconnect (line D-1 minus line D-2): | [__] |

| 4. | Churn (line D-3 divided by line D-2): | [__] |

| In compliance with subscriber Churn covenant, pursuant to Section 5.23 of the Term Loan Agreement (applicable only for calculations as of the end of a Fiscal Quarter): | [Yes/No/NA] |

E. Minimum Liquidity

| Liquidity: | $ |

| Minimum Liquidity: | $5,000,000 |

| In compliance with minimum Liquidity covenant, pursuant to Section 5.23 of the Term Loan Agreement: | [Yes/No] |

Appendix III

Except as set forth below, no material changes in GAAP or the application thereof have occurred since [the date of the most recently delivered financial statements to the Term Agent prior to the date of this certificate]. [If material changes in GAAP or in application thereof have occurred, the following describes the nature of the changes in reasonable detail and the effect, if any, of each such material change in GAAP or in application thereof in the calculation of the financial covenants described in the Term Loan Agreement].

Appendix IV

Except as set forth below, there has been no change to the information provided in Schedule 3.16 (Intellectual Property)_to the Term Loan Agreement since the date of the most recently delivered compliance certificate.

Appendix V

Except as set forth below, there has been no change to the information provided in Schedule 1 (Commercial Tort Claims) to the Guaranty and Security Agreement since the date of the most recently delivered compliance certificate.

SCHEDULE 3.5

LITIGATION

Actions, suits and proceedings:

In re: Liperial “Savon” Easterling v. Aretz , et al., 16 CV 1617 (Montgomery Ct, Tenn).

This action was filed on August 8, 2016 against Omnilink and multiple other defendants related to the death of Mr. Easterling, the plaintiff’s son. The claims arise from the alleged murder of Mr. Easterling by Mr. Aretz, an individual that was released on bail and ordered to wear a GPS tracking device bracelet provided by Omnilink.

The claims were tendered to Omnilink’s insurance carrier, and the insurance carrier agreed to defend Omnilink. On October 4, 2016, Omnilink filed a motion to dismiss the complaint based on lack of personal jurisdiction and failure to state a claim. On December 2, 2016, the judge continued the motion and granted plaintiff ninety days to conduct discovery to support plaintiff’s opposition of the motion.

The complaint requests that the plaintiff be awarded $20,000,000 in compensatory damages and $10,000,000 in punitive damages. Numerex believes the complaint is without merit.

Cen Com, Inc. v. Numerex Corp, et al., 16-2-31077-0 SEA (Sup. Ct WA)

Cen Com, a former supplier of alarm monitoring services for NextAlarm, brought an action claiming that NextAlarm allowed Amcest, the current provider of the services, to improperly gather information owned by Cen Com to service NextAlarm’s customers.

The complaint does not specify the amount of damages being sought by the plaintiff. Numerex believes that its potential liability in the event of an unfavorable outcome with respect to this matter is likely to be less than $250,000.

Jeff Smith v. Numerex

Jeff Smith, the former Chief Technology and Innovation Officer of Numerex, brought an action seeking reimbursement of approximately $54K in expenses that Mr. Smith claims to have incurred while at Numerex but for which no expense reports were submitted.

Marc Zionts

Numerex received a letter from an attorney representing Marc Zionts (former CEO) regarding his termination from Numerex on January 10, 2017. On March 29, 2017 Numerex was advised by Mr. Zionts’ counsel that, unless Numerex begins settlement discussions, Mr. Zionts may submit a request for arbitration in accordance with the terms of his employment agreement. At this preliminary stage, Numerex does not know whether Mr. Zionts will submit a request for arbitration or what his claims might be and cannot form a judgment as to the likelihood of an unfavorable outcome or the amount or range of potential loss, if any.

Governmental audits, reviews and investigations:

SEC

On April 27, 2016, Numerex received a document preservation notice from the Atlanta regional Office of the Securities & Exchange Commission in connection with an investigation by the staff. The SEC inquired about the departure of executive officers of Numerex, Grant Thornton’s decision not to stand for reappointment after completion of audit services for FY2015, and the material weaknesses reported in Numerex’s annual report for the year ended December 31, 2015. The chair of the audit committee responded to questions from the SEC staff and since that time, there have been no additional contact or requests for more information.

OFCCP

The Office of Federal Contract Compliance Programs (“OFCCP”) conducted a routine audit of Numerex Corp.’s affirmative action policies. Numerex Corp. provided information requested by the OFCCP. The OFCCP did not find any discriminatory practices but did find deficiencies in the hiring process, namely that Numerex failed to maintain records of the gender, race, and ethnicity of all applicants and to list all openings in the state workforce job bank. Numerex entered into a conciliation agreement under which Numerex agreed to correct such practices.

SCHEDULE 3.16

INTELLECTUAL PROPERTY

| 1. | Patents |

| Country | Application No. | Patent No | Filing Date | Issue Date | Title | Registrant |

| US | 09/666,042 | 6,718,177 | 9/20/2000 | 4/6/2004 | System for Communicating Messages Via a Forward Overhead Control Channel for a Programmable Logic Control Device | Numerex Corp. |

| US | 10/038,089 | 6,882,843 | 1/2/2002 | 4/19/2005 | Multiple Wireless Data Transport Transceiver System | Numerex Corp. |

| US | 09/083,079 | 6,311,060 | 5/21/1998 | 10/30/2001 | Method and System for Registering the Location of a Mobile Cellular Communications Device | Numerex Corp. |

| US | 10/008,100 | 7,225,459 | 11/13/2001 | 5/29/2007 | Methods and Systems for Dynamically Adjusting Video Bit Rates | Numerex Corp. |

| US | 08/769,142 | 5,873,043 | 12/18/1996 | 2/16/1999 | System for Communicating Messages Via a Forward Overhead Control Channel | Numerex Corp. |

| US | 09/699,312 | 6,856,808 | 10/27/2000 | 2/15/2005 | Interconnect System and Method for Multiple Protocol Short Message Services | Numerex Corp. |

| US | 10/262,372 | 6,718,237 | 9/30/2002 | 4/6/2004 | Communications Device for Conveying Geographic Location Information Over Capacity Constrained Wireless Systems | Numerex Corp. |

| US | 09/549,761 | 6,738,647 | 4/14/2000 | 5/18/2004 | Method and System for Expanding the Data Payload of Data Messages Transported Via a Cellular Network Control Channel | Numerex Corp. |

| US | 09/082,694 | 6,311,056 | 5/21/1998 | 10/30/2001 | Method and System for Expanding the Data Capacity of a Cellular Network Control Channel | Numerex Corp. |

| US | 10/773,692 | 7,272,494 | 2/6/2004 | 9/18/2007 | Communication Device for Conveying Geographic Location Information Over Capacity Constrained Wireless Systems | Numerex Corp. |

| US | 10/770,326 | 7,151,943 | 2/2/2004 | 12/19/2006 | System for Communicating Messages Via a Forward Overhead Control Channel for a Programmable Logic Control Device | Numerex Corp. |

| US | 10/885,445 | 7,245,928 | 7/6/2004 | 7/17/2007 | Method and System for Improved Short Message Services | Numerex Corp. |

| US | 10/952,710 | 7,233,802 | 9/29/2004 | 6/19/2007 | Interconnect System and Method for Multiple Protocol Short Message Services | Numerex Corp. |

| US | 11/811,855 | 7,680,505 | 6/12/2007 | 3/16/2010 | Telemetry Gateway | Numerex Corp. |

| US | 12/704,290 | 8,060,067 | 2/11/2010 | 11/15/2011 | Method and System for Efficiently Routing Messages | Numerex Corp. |

| US | 13/247,316 | 8,543,146 | 9/28/2011 | 9/24/2013 | Method and System for Efficiently Routing Messages | Numerex Corp. |

| US | 13/848,804 | 8,903,437 | 3/22/2013 | 12/2/2014 | Method and System for Efficiently Routing Messages | Numerex Corp. |

| US | 10/959,809 | 7,783,508 | 10/6/2004 | 8/24/2010 | Method and System for Refining Vending Operations Based on Wireless Data | Numerex Corp. |

| US | 10/877,354 | 7,650,285 | 6/25/2004 | 1/19/2010 | Method and System for Adjusting Digital Audio Playback Sampling Rate | Numerex Corp. |

| US | 12/012,848 | 8,265,605 | 2/6/2008 | 9/11/2012 | Service escrowed transportable wireless event reporting system | Numerex Corp. |

| US | 13/568,559 | 8,543,097 | 8/7/2012 | 9/24/2013 | Service escrowed transportable wireless event reporting system | Numerex Corp. |

| US | 13/971,935 | 8,855,716 | 8/21/2013 | 10/7/2014 | Service escrowed transportable wireless event reporting system | Numerex Corp. |

| US | 12/002,215 | 7,880,599 | 12/14/2007 | 2/1/2011 | Method and System for Remotely Monitoring the Operations of a Vehicle | Numerex Corp. |

| US | 12/002,091 | 7,936,256 | 12/14/2007 | 5/3/2011 | Method and System for Interacting with a Vehicle over a Mobile Radiotelephone Network | Numerex Corp. |

| US | 12/290,048 | 8,738,046 | 10/27/2008 | 5/27/2014 | Intelligent Short Message Delivery System and Method | Numerex Corp. |

| US | 12/713,916 | 8,041,383 | 2/26/2010 | 10/18/2011 | Digital Upgrade System and Method | Numerex Corp. |

| US | 13/234,712 | 8,483,748 | 9/16/2011 | 7/9/2013 | Digital Upgrade System and Method | Numerex Corp. |

| US | 13/911,554 | 8,868,059 | 6/6/2013 | 10/21/2014 | Digital Upgrade System and Method | Numerex Corp. |

| US | 12/640,688 | 8,112,285 | 12/17/2009 | 2/7/2012 | Method and System for Improving Real-Time Data Communications | Numerex Corp. |

| US | 12/985,989 | 8,126,764 | 1/6/2011 | 2/28/2012 | Communication of Managing Vending Operations Based on Wireless Data | Numerex Corp. |

| US | 12/860,231 | 8,214,247 | 8/20/2010 | 7/3/2012 | Method and System for Refining Vending Operations Based on Wireless Data | Numerex Corp. |

| US | 13/491,079 | 8,484,070 | 6/7/2012 | 7/9/2013 | Method and System for Managing Vending Operations Based on Wireless Data | Numerex Corp. |

| US | 12/985,975 | 8,269,618 | 1/6/2011 | 9/18/2012 | Method and System for Remotely Monitoring the Location of a Vehicle | Numerex Corp. |

| US | 13/040,563 | 8,253,549 | 3/4/2011 | 8/28/2012 | Method and System for Interacting with a Vehicle over a Mobile Radiotelephone Network | Numerex Corp. |

| US | 13/561,313 | 8,547,212 | 7/30/2012 | 10/1/2013 | Method and System for Interacting with a Vehicle over a Mobile Radiotelephone Network | Numerex Corp. |

| US | 14/043,363 | 9,084,197 | 10/1/2013 | 7/14/2015 | Method and System for Interacting with a Vehicle over a Mobile Radiotelephone Network | Numerex Corp. |

| US | 13/345,018 | 8,412,186 | 1/6/2012 | 4/2/2013 | Method and system for managing subscriber identity modules on wireless networks for machine to-machine applications | Numerex Corp. |

| US | 13/681,460 | 8,611,891 | 11/20/2012 | 12/17/2013 | Method and system for managing subscriber identity modules on wireless networks for machine to-machine applications | Numerex Corp. |

| US | 14/079,936 | 9,414,240 | 11/14/2013 | 8/9/2016 | Method and system for managing subscriber identity modules on wireless networks for machine to-machine applications | Numerex Corp. |

| US | 13/456,662 | 8,705,716 | 4/26/2012 | 4/22/2014 | Interactive Control of Alarm Systems by Telephone Interface Using an Intermediate Gateway | Numerex Corp. |

| US | 13/413,333 | 8,705,704 | 3/6/2012 | 4/22/2014 | Delivery of Alarm System Event Data and Audio Over Hybrid Network | Numerex Corp. |

| US | 13/438,941 | 8,798,260 | 4/4/2012 | 8/5/2014 | Delivery of Alarm System Event Data and Audio | Numerex Corp. |

| US | 14/450,787 | 9,462,135 | 8/4/2014 | 10/4/2016 | Delivery of Alarm System Event Data and Audio | Numerex Corp. |

| US | 14/013,637 | 9,153,124 | 8/29/2013 | 10/6/2015 | Alarm Sensor Supporting Long-Range Wireless Communication | Numerex Corp. |

| US | 14/039,573 | 9,177,464 | 9/27/2013 | 11/3/2015 | Method and system for untethered two-way voice communication for an alarm system | Numerex Corp. |

| US | 10/462,708 | 7,245,703 | 6/17/2003 | 7/17/2007 | Alarm Signal Interceptor, Middleware Processor, and Re-Transmitter Using Caller ID | Numerex Corp. |

| US | 10/861,790 | 7,440,554 | 6/7/2004 | 10/21/2008 | Alarm Signal Interceptor, Middleware Processor, and Re-Transmitter | Numerex Corp. |

| US | 11/226,857 | 7,593,512 | 9/14/2005 | 9/22/2009 | Private VOIP network for Security System Monitoring | Numerex Corp. |

| US | 11/348,291 | 7,734,020 | 2/6/2006 | 6/8/2010 | Two-way Voice and Voice over IP receivers for Alarm Systems | Numerex Corp. |

| US | 11/517,025 | 7,613,278 | 9/7/2006 | 11/3/2009 | Alarm System Activation Platform | Numerex Corp. |

| US | 12/018,724 | 8,369,487 | 1/23/2008 | 2/5/2013 | Enhanced 911 notification for Internet Enabled Alarm Systems | Numerex Corp. |

| US | 12/504,709 | 9,131,040 | 7/17/2009 | 9/8/2015 | Alarm System for use over Satellite Broadband | Numerex Corp. |

| US | 13/004,917 | 8,509,391 | 1/12/2011 | 8/13/2013 | Wireless VoIP Network for Security System Monitoring | Numerex Corp. |

| US | 13/939,460 | 9,094,410 | 7/11/2013 | 7/28/2015 | Wireless VoIP Network for Security System Monitoring | Numerex Corp. |

| US | 13/194,912 | 9,054,893 | 7/30/2011 | 6/9/2015 | Alarm System IP Network with PSTN Output | Numerex Corp. |

| US | 14/598,737 | 9,356,798 | 1/16/2015 | 5/31/2016 | Alarm System IP Network with PSTN Output | Numerex Corp. |

| US | 14/075,467 | 9,235,855 | 11/8/2013 | 1/12/2016 | Delivery of Security Solutions Based on Demand | Numerex Corp. |

| US | 14/272,709 | 9,510,180 | 5/8/2014 | 11/29/2016 | Mobile Management Message Distribution and Active On-Network Determination | Numerex Corp. |

| US | 14/862,701 | 9/23/2015 | Mobile Management Message Distribution and Active On-Network Determination | Numerex Corp | ||

| US | 14/185,209 | 9,350,871 | 2/20/2014 | 5/24/2016 | Delivery of Alarm System Event Data and Audio Over Hybrid Network | Numerex Corp |

| US | 14/332,794 | 9,183,730 | 7/16/2014 | 11/10/2015 | Method and System for Mitigating Invasion Risk Associated with Stranger Interactions in a Security System Environment | Numerex Corp |

| US | 14/559,190 | 12/3/2014 | Method and System for Managing a Location Detector | Numerex Corp | ||

| US | 14/525,808 | 10/28/2014 | Method and System for Generating Geofences for Managing Offender Movement | Numerex Corp | ||

| US | 14/534,746 | 9,582,982 | 11/6/2014 | 2/28/2017 | Method and System for Energy Managed of an Offender Monitor | Numerex Corp |

| US | 14/524,232 | 10/27/2014 | Offender Monitor with Managed Rate of Location Reading | Numerex Corp | ||

| US | 14/525,786 | 9,401,082 | 10/28/2014 | 7/26/2016 | Offender Monitor with Orientation Based Monitoring | Numerex Corp |

| US | 14/522,965 | 9,449,497 | 10/24/2014 | 9/20/2016 | Method and System for Detecting Alarm System Tampering | Numerex Corp |

| US | 11/040,636 | 7,323,970 | 1/21/2005 | 1/29/2008 | Method and System for Remote Interaction with a Vehicle via Wireless Communication | Numerex Corp |

| US | 14/789,085 | 7/1/2015 | Method and System for Locating a Wireless Tracking Device | Numerex Corp | ||

| US | 14/789,089 | 9,503,848 | 7/1/2015 | 11/22/2016 | Method and System for Locating a Wireless Tracking Device Associated with a Network of Alarm Panels | Numerex Corp |

| US | 13/081,954 | 9,119,013 | 4/7/2011 | 8/25/2015 | Satellite Based Tracking and Data Device with Multi-Function Radio Frequency Interface | Numerex Corp |

| US | 13/092,652 | 4/22/2011 | Analytical Scoring Engine for Remote Device Data | Numerex Corp | ||

| US | 13/209,536 | 8,769,111 | 8/15/2011 | 7/1/2014 | IP Network Service Redirector Device and Method | Numerex Corp |

| US | 13/435,231 | 8,990,915 | 3/30/2012 | 3/24/2015 | Local Data Appliance for Collecting and Storing Remote Sensor Data | Numerex Corp |

| US | 13/484,973 | 9,214,082 | 5/31/2012 | 12/15/2015 | System and Method for Alarm System Tamper Detection and Reporting | Numerex Corp |

| US | 13/485,030 | 9,325,814 | 5/31/2012 | 8/9/2016 | Wireless SNMP Agent Gateway | Numerex Corp |

| US | 13/607,955 | 8,761,795 | 9/10/2012 | 6/24/2014 | Dynamic Reverse Geofencing | Numerex Corp |

| US | 14/312,037 | 6/23/2014 | Dynamic Reverse Geofencing | Numerex Corp | ||

| US | 13/644,001 | 8,970,364 | 10/3/2012 | 3/3/2015 | Method and System for Remote Coupling Security System Control | Numerex Corp |

| US | 13/734,352 | 9,207,331 | 1/4/2013 | 12/8/2015 | Using Statistical Analysis to Infer an Accurate GPS Location for Use in Tracking Devices | Numerex Corp |

| US | 13/865,601 | 9,041,527 | 4/18/2013 | 5/26/2015 | System and Method for Using Alarm System Zones for Remote or Mobile Objects | Numerex Corp |

| US | 14/721,472 | 5/26/2015 | System and Method for Using Alarm System Zones for Remote or Mobile Objects | Numerex Corp | ||

| US | 14/538,569 | 11/11/2014 | System and Method for Employing Base Stations to Track Mobile Devices | Numerex Corp | ||

| US | 14/552,768 | 11/25/2014 | System and Method for Interfacing 2G Applications with a 3G/4G Cellular Radio Network | Numerex Corp | ||

| US | 14/794,586 | 7/8/2015 | Depletion Mode MOSFET Power Supply | Numerex Corp | ||

| US | 14/794,602 | 7/8/2015 | System and Method for Camera Registration | Numerex Corp | ||

| US | 14/830,574 | 8/19/2015 | Motor Fault Detection System and Method | Numerex Corp | ||

| US | 14/872,780 | 10/1/2015 | Coordination of Gas Pump with Tank Level Sensors for Fraud Detection | Numerex Corp | ||

| US | 14/872,997 | 10/1/2015 | Closed Tank Fill Level Sensor | Numerex Corp | ||

| US | 11/804,199 | 7,680,471 | 5/17/2007 | 3/16/2010 | System and method for prolonging wireless data product's life | Numerex Corp |

| US | 13/750,205 | 9,215,578 | 1/25/2013 | 12/15/2015 | Monitoring Systems and Methods | Omnilink Systems Inc. |

| US | 12/112,695 | 8,115,621 | 4/30/2008 | 2/14/2012 | Device for Tracking the Movement of Individuals or Objects | Omnilink Systems Inc. |

| US | 11/935,858 | 8,547,222 | 11/6/2007 | 10/1/2013 | System and Method of Tracking the Movement of Individuals and Assets | Omnilink Systems Inc. |

| US | 11/935,833 | 7,518,500 | 11/6/2007 | 4/14/2009 | System and Method for Monitoring Alarms and Responding to the Movement of Individuals and Assets | Omnilink Systems Inc. |

| US | 12/350,678 | 7,864,047 | 1/8/2009 | 1/4/2011 | System and Method for Monitoring Alarms and Responding to the Movement of Individuals and Assets | Omnilink Systems Inc. |

| US | 13/937,941 | 9,373,241 | 7/9/2013 | 6/21/2016 | System and Method of Tracking the Movement of Individuals and Assets | Omnilink Systems Inc. |

| US | 12/794,500 | 8,489,113 | 6/4/2010 | 7/16/2013 | Method and System for Tracking, Monitoring and/or Changing Tracking Devices including Wireless Energy Transfer Features | Omnilink Systems Inc. |

| US | 12/639,524 | 8,831,627 | 12/16/2009 | 9/9/2014 | System and Method for Tracking Monitoring, Collecting, Reporting and Communicating with the Movement of Individuals | Omnilink Systems Inc. |

| US | 29/279,448 | D578,918 | 5/1/2007 | 10/21/2008 | Offender Monitor | Omnilink Systems Inc. |

| US | 08/969,146 | 6,154,648 | 11/12/1997 | 11/28/2000 | METHODS AND APPARATUS FOR COMMUNICATING DATA VIA A CELLULAR MOBILE RADIOTELEPHONE SYSTEM | Numerex Corp. |

| US | 09/160,512 | 6,108,537 | 9/24/1998 | 8/22/2000 | METHOD AND SYSTEM FOR PERFORMING A PREDETERMINED OPERATION RELATED TO A PREDETERMINED CLASS OF CELLULAR SOURCES | Numerex Corp. |

| US | 15/222,164 | 7/28/2016 | Offender Monitor Messaging System | Numerex Corp. | ||

| US | 15/158,088 | 5/18/2016 | System and Method of Using Pick-up, Drop-off Geofence for Mobile Devices | Numerex Corp. | ||

| US | 14/991,031 | 9,536,417 | 1/8/2016 | 1/2/2017 | Method and System for Hierarchical Management of Personal Emergency Response System (PERS) Devices | Numerex Corp. |

| US | 14/991,028 | 1/8/2016 | Method and System for Locating a Personal Emergency Response System (PERS) Device Based on Real Estate Lockbox Interaction | Numerex Corp. | ||

| US | 15/331,364 | 10/21/2016 | Method and System for Locating a Wireless Tracking Device Associated with a Network of Alarm Panels | Numerex Corp. |

| 2. | Trademarks |

| MARK | COUNTRY | SERIAL NO. |

FILING DATE |

REG. NO. | REG. DATE |

STATUS CODE | OWNER |

|

United States | 77894440 | 12/16/2009 | 3906542 | 1/18/2011 | REGISTERED | Numerex Corp |

|

Canada | 1463075 | 12/16/2009 | TMA815774 | 1/19/2012 | REGISTERED | Numerex Corp |

|

CTM | 8766371 | 12/17/2009 | 8766371 | 6/11/2010 | REGISTERED | Numerex Corp |

|

Mexico | 1055804 | 12/18/2009 | 1146967 | 3/5/2010 | REGISTERED | Numerex Corp |

|

Mexico | 1055805 | 12/18/2009 | 1150111 | 3/24/2010 | REGISTERED | Numerex Corp |

|

Mexico | 1055806 | 12/18/2009 | 1146300 | 3/2/2010 | REGISTERED | Numerex Corp |

| AVIDWIRELESS | United States | 85721098 | 9/5/2012 | 4378893 | 8/6/2013 | REGISTERED | Numerex Corp |

| FASTRACK | United States | 78047504 | 2/9/2001 | 2858718 | 6/29/2004 | REGISTERED | Numerex Corp |

| FASTRACK | Canada | 1663293 | 2/10/2014 | PENDING | Numerex Corp | ||

| FASTRACK | CTM | 12579652 | 2/10/2014 | 12579652 | 7/2/2014 | REGISTERED | Numerex Corp |

| FOCALPOINT | United States | 78873454 | 5/1/2006 | 3545293 | 12/9/2008 | REGISTERED | Omnilink Systems Inc. |

| MYSHIELD | United States | 86740980 | 8/28/2015 | PENDING | Numerex Corp | ||

| NEXTALARM | United States | 86187648 | 2/7/2014 | 4784209 | 8/4/2015 | REGISTERED | Numerex Corp |

| NEXTALARM | Canada | 1663294 | 2/10/2014 | PENDING | Numerex Corp | ||

| NEXTALARM | Mexico | 1502622 | 7/3/2014 | PENDING | Numerex Corp | ||

| NEXTALARM | Mexico | 1502627 | 7/3/2014 | PENDING | Numerex Corp | ||

| NEXTALARM | Mexico | 1502631 | 7/3/2014 | PENDING | Numerex Corp | ||

| NEXTALARM | Mexico | 1502632 | 7/3/2014 | PENDING | Numerex Corp | ||

| NEXTALARM | Mexico | 1502635 | 7/3/2014 | PENDING | Numerex Corp | ||

| NEXTALARM.COM | United States | 78885124 | 5/16/2006 | 3249281 | 6/5/2007 | REGISTERED | Numerex Corp |

| NEXTALARM.COM THE BROADBAND ALARM COMPANY | United States | 78929909 | 7/14/2006 | 3244717 | 5/22/2007 | REGISTERED | Numerex Corp |

| NUMEREX | United States | 77710898 | 4/9/2009 | 3736251 | 1/12/2010 | REGISTERED | Numerex Corp |

| NUMEREX | Canada | 1349945 | 6/1/2007 | TMA770553 | 6/23/2010 | REGISTERED | Numerex Corp |

| NUMEREX | Canada | 1454771 | 10/8/2009 | TMA829144 | 8/6/2012 | REGISTERED | Numerex Corp |

| NUMEREX | CTM | 8605371 | 10/9/2009 | 8605371 | 4/5/2010 | REGISTERED | Numerex Corp |

| NUMEREX | CTM | 5820519 | 4/10/2007 | 5820519 | 7/30/2009 | REGISTERED | Numerex Corp |

| NUMEREX | Mexico | 859369 | 6/5/2007 | 1011675 | 11/16/2007 | REGISTERED | Numerex Corp |

| NUMEREX | Mexico | 859366 | 6/5/2007 | 1043373 | 5/30/2008 | REGISTERED | Numerex Corp |

| NUMEREX | Mexico | 859368 | 6/5/2007 | 1104992 | 6/11/2009 | REGISTERED | Numerex Corp |

| NUMEREX | Mexico | 859367 | 6/5/2007 | 1011674 | 11/16/2007 | REGISTERED | Numerex Corp |

| NUMEREX | Mexico | 1024495 | 6/5/2007 | 1024495 | 2/20/2008 | REGISTERED | Numerex Corp |

| NUMEREX DNA | United States | 77598236 | 10/22/2008 | 3796708 | 6/1/2010 | REGISTERED | Numerex Corp |

| NUMEREX DNA | Canada | 1415685 | 10/24/2008 | TMA783445 | 11/25/2010 | REGISTERED | Numerex Corp |

| NUMEREX DNA | CTM | 8230054 | 4/21/2009 | 8230054 | 11/13/2009 | REGISTERED | Numerex Corp |

| NUMEREX DNA | Mexico | 1002255 | 4/21/2009 | 1131018 | 11/23/2009 | REGISTERED | Numerex Corp |

| NUMEREX DNA | Mexico | 1006231 | 5/14/2009 | 1127160 | 10/23/2009 | REGISTERED | Numerex Corp |

| NUMEREX DNA | Mexico | 1006232 | 5/14/2009 | 1163625 | 6/14/2010 | REGISTERED | Numerex Corp |

| NUMEREX SATELLITE FLEX | United States | 85385958 | 8/1/2011 | 4488845 | 2/25/2014 | REGISTERED | Numerex Corp |

| NUMEREX SMART DATA DELIVERED | CTM | 12704433 | 3/18/2014 | 12704433 | 8/13/2014 | REGISTERED | Numerex Corp |

| OMNILINK | United States | 78626004 | 5/9/2005 | 3156898 | 10/17/2006 | REGISTERED | Omnilink Systems Inc. |

| SMART DATA DELIVERED | United States | 86112013 | 11/6/2013 | 4680617 | 2/3/2015 | REGISTERED | Numerex Corp |

| SMART DATA DELIVERED | Canada | 1657958 | 12/27/2013 | PUBLISHED | Numerex Corp | ||

| SMART DATA DELIVERED | Mexico | 1446329 | 1/9/2014 | PENDING | Numerex Corp | ||

| SMART DATA DELIVERED | Mexico | 1446330 | 1/9/2014 | PENDING | Numerex Corp | ||

| SMARTDATADELIVERED | Canada | 1661235 | 1/27/2014 | PUBLISHED | Numerex Corp | ||

| SMARTDATADELIVERED | Mexico | 1451208 | 1/27/2014 | PENDING | Numerex Corp |

| SMARTDATADELIVERED | Mexico | 1451209 | 1/27/2014 | PENDING | Numerex Corp | ||

| THE BROADBAND ALARM COMPANY | United States | 78785181 | 1/4/2006 | 3175728 | 11/21/2006 | REGISTERED | Numerex Corp |

| UPLINK | United States | 78691601 | 8/12/2005 | 3279435 | 8/14/2007 | REGISTERED | Uplink Security, LLC |

| UPLINK | United States | 78106931 | 2/5/2002 | 4013326 | 8/16/2011 | REGISTERED | Uplink Security, LLC |

| UPLINK | United States | 86190829 | 2/11/2014 | 4683816 | 2/10/2015 | REGISTERED | Uplink Security, LLC |

| UPLINK | Canada | 1465547 | 1/12/2010 | TMA839360 | 1/11/2013 | REGISTERED | Uplink Security, LLC |

| UPLINK | CTM | 5915327 | 5/18/2007 | 5915327 | 3/16/2010 | REGISTERED | Uplink Security, LLC |

| UPLINK | Mexico | 1501264 | 6/30/2014 | PENDING | Uplink Security, LLC | ||

| UPLINK | Mexico | 1501263 | 6/30/2014 | PENDING | Uplink Security, LLC | ||

| UPLINK | Mexico | 1501262 | 6/30/2014 | PENDING | Uplink Security, LLC | ||

| UPLINK | Mexico | 1501260 | 6/30/2014 | PENDING | Uplink Security, LLC | ||

| NUMEREX INSITE | United States | 86345978 | 7/23/2014 | ABANDONED | Numerex Corp | ||

| ACCELAVIEW | United States | 85040167 | 5/17/2010 | 3932829 | 3/15/2011 | REGISTERED | Numerex Corp |

| ABBRA | United States | 78567205 | 2/14/2005 | 3076222 | 4/4/2006 | REGISTERED | Numerex Corp |

| MACHINES TRUST US | United States | 77592395 | 10/14/2008 | 3675590 | 9/1/009 | REGISTERED | Numerex Corp |

| ALL TERRAIN M2M | United States | 77978685 | 4/2/2008 | 3782717 | 4/27/2010 | REGISTERED | Numerex Corp |

| NUMEREX FAST | United States | 77920341 | 1/26/2010 | 3906634 | 1/18/2011 | REGISTERED | Numerex Corp |

| NUMEREX DNA DEVICE NETWORK APPLICATION | United States | 77917829 | 1/22/2010 | 3840747 | 8/31/2010 | REGISTERED | Numerex Corp |

| V-NOTIFY | United States | 77084419 | 1/17/2007 | 3333730 | 11/13/2007 | REGISTERED | Numerex Corp |

| E-NOTIFY | United States | 77084414 | 1/17/2007 | 3403769 | 3/25/2008 | REGISTERED | Numerex Corp |

| ORBITRAX | United States | 77004275 | 9/21/2006 | 3264104 | 7/17/2007 | REGISTERED | Numerex Corp |

| CELLEMETRY | United States | 74493789 | 2/23/1994 | 2004693 | 10/1/1996 | REGISTERED | Numerex Corp |

| DCX | United States | 74437904 | 9/20/1993 | 1941980 | 12/19/1995 | REGISTERED | Numerex Corp |

| DERIVED CHANNEL MULTIPLEX | United States | 74437859 | 9/20/1993 | 1937727 | 11/28/1995 | REGISTERED | Numerex Corp |

| UPLINK REMOTE | United States | 86187670 | 2/7/2014 | 4677682 | 1/27/2015 | REGISTERED | Uplink Security, LLC |

| UPLINK GPS | United States | 85818059 | 1/8/2013 | 4546091 | 6/10/2014 | REGISTERED | Uplink Security, LLC |

| U-TRAC BY UPLINK | United States | 77759381 | 6/15/2009 | 3826255 | 7/27/2010 | REGISTERED | Uplink Security, LLC |

| 3. | Copyrights |

None.

| 4. | Internet Domains |

| alzcomfortzone.com |

| comfortzonecheckin.com |

| lbsdeveloper.com |

| lbsdevelopment.com |

| lbsgateway.com |

| lbsplatform.com |

| lbsprofessionalservices.com |

| lbsproserve.com |

| m2mwirelessdevices.com |

| omnilink.com |

| omnilinkalert.com |

| omnilinkalerts.com |

| omnilinkfocalpoint.com |

| omnilinkfocalpt.com |

| omnilinkfpt.com |

| omnilinkjs.com |

| omnilinkjudicial.com |

| omnilinksafereturn.com |

| omnilinksafereturns.com |

| omnilinksoftware.com |

| omnilinksys.com |

| omnilinksystems.com |

| omnilinkve.com |

| omnilinkvirtualearth.com |

| tscgateway.com |

| tscgateway.net |

| universaltracker.com |

| virtualearthconsulting.com |

| virtualearthdevelopment.com |

| virtualearthps.com |

| ACCUTRAX.COM |

| ACCUTRAX.INFO |

| ACCUTRAX.MOBI |

| ACCUTRAX.US |

| ACCUTRAXLIVE.COM |

| ACCUTRAXLIVE.NET |

| ACCUTRAXONLINE.NET |

| ACCUTRAXWEB.COM |

| ACCUTRAXWEB.NET |

| FELIX-DATA.COM |

| FELIXADMIN.COM |

| FELIXCONTROL.COM |

| FELIXLITE.COM |

| FELIXLITE.NET |

| FELIXLIVE.COM |

| FELIXLIVE.NET |

| FELIXLOGISTICS.COM |

| FELIXMANAGER.COM |

| FELIXMAPPING.COM |

| FELIXMOBILE.COM |

| FELIXMOBILE.NET |

| FELIXTAV.COM |

| FELIXTPM.COM |

| FELIXTRACKING.COM |

| FELIXVIEW.COM |

| G-RFID.COM |

| G-RFID.INFO |

| G-RFID.NET |

| G-RFID.ORG |

| G-RFID.US |

| I-FELIX.COM |

| MYACCUTRAX.COM |

| MYACCUTRAX.NET |

| MYGLOBALTRACKING.COM |

| MYGLOBALTRACKING.NET |

| SATELLITE-RFID.COM |

| SATELLITE-RFID.INFO |

| SATELLITE-RFID.NET |

| SATELLITE-RFID.ORG |

| SATELLITE-RFID.US |

| NUMEREXDNA.COM |

| NUMEREXFAST.COM |

| UBLIP.COM |

| I3GCORP.COM |

| 4GSUNRISE.COM |

| accelaview.info |

| accelaview.net |

| accelaview.us |

| accelaviewblog.com |

| accelaviewdriver.com |

| accelaviewdriver.info |

| accelaviewdriver.net |

| accelaviewdriver.us |

| accelaviewfleet.com |

| accelaviewfleet.info |

| accelaviewfleet.net |

| accelaviewfleet.us |

| accelaviewonline.com |

| accelaviewshop.com |

| accelaviewstore.com |

| ACCUTAV.BIZ |

| ACCUTAV.COM |

| ACCUTAV.INFO |

| ACCUTAV.MOBI |

| ACCUTAV.NET |

| ACCUTAV.ORG |

| ACCUTAV.US |

| ACTIVATEUPLINK.COM |

| AIRDESK.NET |

| AIRDESKWIRELESS.COM |

| ALARMLOGIN.COM |

| ALARMLOGIN.NET |

| ALARMLOGIN.US |

| ASKUPLINK.COM |

| CELLEMETRY.COM |

| CELLEMETRY.NET |

| CELLEMETRY.ORG |

| CELLEMETRYAPPS.COM |

| CPNFORUM.COM |

| DCXSYS.COM |

| DIGILOG.COM |

| FAST-SCO.COM |

| FAST-UPLINK.COM |

| FASTRACKFLEET.COM |

| FASTRACKMOBILE.COM |

| FASTRACKXPRESS.COM |

| FTFLEET.COM |

| GOUPLINK.NET |

| GPRSXPRESS.COM |

| M2MEXCHANGE.NET |

| M2MEXCHANGE.ORG |

| M2MXCHANGE.COM |

| M2MXCHANGE.NET |

| M2MXCHANGE.ORG |

| MBLGPS.COM |

| myaccelaview.com |

| MYALARM.INFO |

| MYMOBILEFASTRACK.COM |

| MYMOBILEGUARDIAN.COM |

| MYMOBILEGUARDIAN.NET |

| MYUPLINKCONNECT.COM |

| MYUPLINKGPS.COM |

| MYUPLINKINTERACTIVE.COM |

| MYUPLINKMOBILE.COM |

| MYUPLINKREMOTE.COM |

| MYUPLINKSECURITY.COM |

| MYWIRELESSCONNECTIONS.COM |

| MYWIRELESSCONNECTIONS.NET |

| NEXTALARM.COM |

| NEXTALARM.INFO |

| NEXTALARM.NET |

| NEXTALARM.ORG |

| NEXTALARM.US |

| NEXTVIEWCAM.COM |

| NMRX.COM |

| NMRX.NET |

| NMRX.ORG |

| NUMEREX-IOT.COM |

| NUMEREX.COM |

| NUMEREX.NET |

| NUMEREX.ORG |

| NUMEREXCELLPASS.COM |

| NUMEREXCLOUDPASS.COM |

| NUMEREXCOMMPASS.COM |

| NUMEREXCOMPASS.COM |

| NUMEREXCONNECTPASS.COM |

| NUMEREXCORP.COM |

| NUMEREXCORP.NET |

| NUMEREXDATAPASS.COM |

| NUMEREXFASTPASS.COM |

| NUMEREXFASTRACK.COM |

| NUMEREXFLEX.COM |

| NUMEREXM2MSOLUTIONS.COM |

| NUMEREXMEXICO.COM |

| NUMEREXMOBILE.COM |

| NUMEREXPASSPORT.COM |

| NUMEREXPRESS.COM |

| NUMEREXSOLUTIONS.COM |

| NUMEREXSOLUTIONS.NET |

| NUMEREXVENDING.COM |

| NUMEREXVENDING.NET |

| NUMEREXWORLDPASS.COM |

| ONEHOURSECURITY.COM |

| ORBIT-ONE.COM |

| PORTABLEM2M.COM |

| PORTABLEM2M.NET |

| PORTABLEM2M.ORG |

| POWEREDBYNUMEREX.COM |

| REMOTEARM.ME |

| SATELLITEFLEX.COM |

| SATELLITEHERO.COM |

| SMARTDATADELIVERED.BIZ |

| SMARTDATADELIVERED.COM |

| SMARTDATADELIVERED.INFO |

| SMARTDATADELIVERED.MOBI |

| SMARTDATADELIVERED.NET |

| SMARTDATADELIVERED.ORG |

| SMARTDATADELIVERED.US |

| U-TARQCARGO.NET |

| U-TRAQ.COM |

| U-TRAQ.NET |

| U-TRAQASSETS.COM |

| U-TRAQASSETS.NET |

| U-TRAQAUTO.COM |

| U-TRAQAUTO.NET |

| U-TRAQAUTOPRO.COM |

| U-TRAQAUTOPRO.NET |

| U-TRAQCARGO.COM |

| U-TRAQFLEET.COM |

| U-TRAQFLEET.NET |

| U-TRAQMINI.COM |

| U-TRAQMINI.NET |

| U-TRAQMINIC.COM |

| U-TRAQMINIC.NET |

| U-TRAQPETS.COM |

| U-TRAQPETS.NET |

| UPLINK.COM |

| UPLINK2GIG.COM |

| UPLINKBILLING.COM |

| UPLINKCONNECT.COM |

| UPLINKGPS.COM |

| UPLINKINTERACTIVE.COM |

| UPLINKREMOTE.COM |

| UPLINKSECURITY.COM |

| UPLINKTRACKER.COM |

| UPLINKTRACKER.NET |

| UPLINKTRACKING.COM |

| UPLINKTRACKING.NET |

| UTRAQAUTO.COM |

| UTRAQAUTO.NET |

| UTRAQCARGO.COM |

| UTRAQCARGO.NET |

| UTRAQFLEET.COM |

| UTRAQFLEET.NET |

| UTRAQNOW.COM |

| UTRAQNOW.NET |

| UTRAQPETS.COM |

| UTRAQPETS.NET |