Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - flooidCX Corp. | grpv_8k.htm |

EXHIBIT 3.2

| 1 |

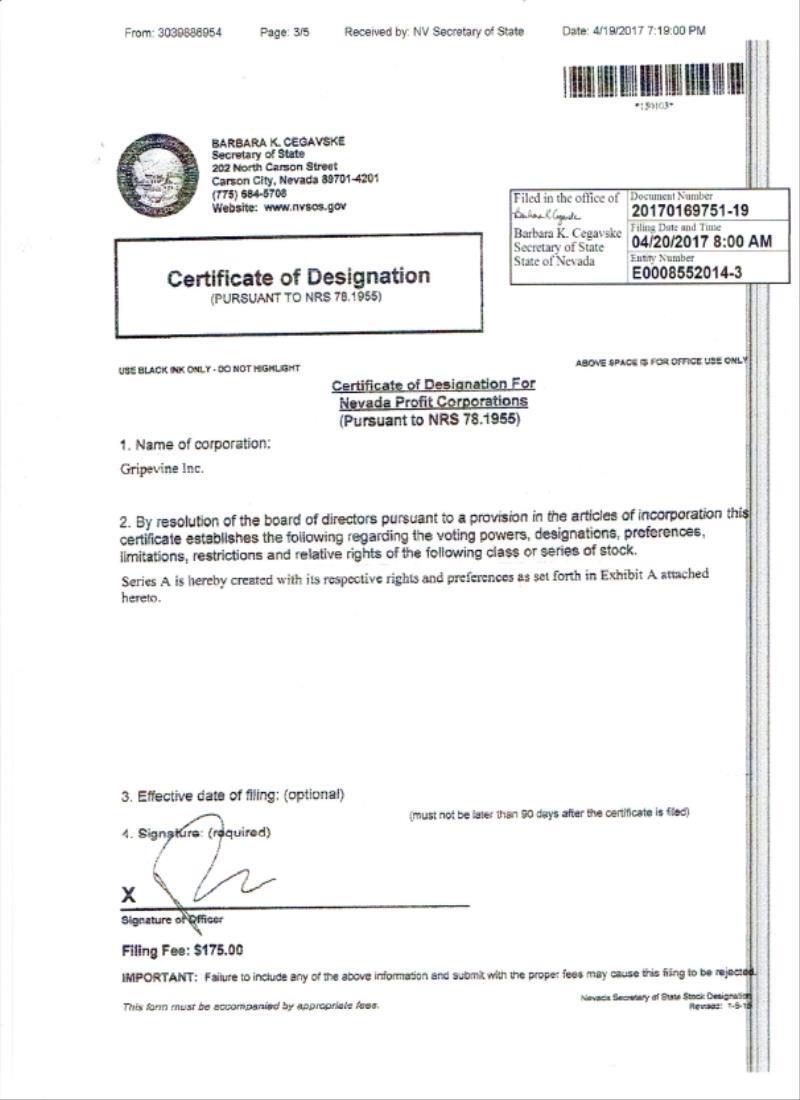

CERTIFICATE OF DESIGNATION

OF

SERIES A PREFERRED STOCK

This Certificate of Designation is filed with the Nevada Secretary of State on April 20, 2017 regarding the designation of 1,000,000 shares as Series A preferred stock and setting forth its respective rights, preferences and limitations.

1. DESIGNATION. This class of stock of this Corporation shall be named and designated “Series A Preferred Stock”. It shall have 1,000,000 shares authorized at $0.001 par value per share.

2. PRICE.

(a) The initial price of each share of Series A Preferred Stock shall be $0.001.

(b) The price of each share of Series A Preferred Stock may be changed either through a majority vote of the Board of Directors through a resolution at a meeting of the Board, or through a resolution passed at an Action Without Meeting of the unanimous Board.

3. DIVIDENDS. Upon approval by the Board of Directors the Corporation may elect to pay an annual dividend. The annual percentage of such dividend will be established by the Board of Directors upon the performance of the Corporation. If elected to pay such dividends, the Board of Directors may elect to make such dividends payable in the form of shares of common stock rather than a cash dividend.

4. LIQUIDATION RIGHTS. Upon any liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, before any distribution or payment shall be made to the holders of any stock ranking junior to the Series A Preferred Stock, the holders of the Series A Preferred Stock shall be entitled to receive in cash out of the asset of the Corporation, whether from capital or from earnings available for distribution to its stockholders, before any amount shall be paid to the holders of common stock, the sum of $0.001 per share.

Notwithstanding the above, in the event of any acquisition of the Corporation or its assets, either through a merger or share exchange, by way of cash and/or shares, the holder of the shares of Series A Preferred Stock shall receive Twenty Percent (20%) of the aggregate valuation of such merger or share exchange in the form of cash and/or shares, before any distributions are made to shareholders of any other class (the “Merger Acquisition Right”). The Merger Acquisition Right may be assigned by the holder of the Series A Preferred Stock upon notice to the Corporation of such assignment.

| 2 |

5. CONVERSION

(a) The holder of the Series A Preferred Stock shall at their option convert each share of Series A Preferred Stock into one hundred shares of common stock (a one for one hundred basis).

(c) Promptly upon conversion, the Corporation shall issue and deliver to such holder a certificate or certificates for the number of full shares of common stock issuable to the holder pursuant to the holder’s conversion of Series A Preferred Shares in accordance with the provisions of this Section. The stock certificate(s) evidencing the common stock shall be issued with a restrictive legend indicating that it was issued in a transaction exempt from registration under the Securities Act, and that it cannot be transferred unless it is so registered, or an exemption from registration is available, in the opinion of counsel to the Corporation. The common stock shall be issued in the same name as the person who is the holder of the Series A Preferred Stock unless, in the opinion of counsel to the Corporation, such transfer can be made in compliance with applicable securities laws. The person in whose name the certificate(s) of common stock are so registered shall be treated as a holder of shares of common stock of the Corporation on the date the common stock certificate(s) are so issued.

All shares of common stock delivered upon conversion of the Series A Preferred Shares as provided herein shall be duly and validly issued and fully paid and non-assessable. Effective as of the Conversion Date, such converted Series A Preferred Shares shall no longer be deemed to be outstanding and all rights of the holder with respect to such shares shall immediately terminate except the right to receive the shares of Common Stock issuable upon such conversion.

(d) Shares of Series A Preferred Stock are anti-dilutive to reverse splits, and therefore in the case of a reverse split, are convertible to the number of common shares after the reverse split as would have been equal to the Conversion Rate established prior to the reverse split.

7. REDEMPTION. The Corporation may by providing a five day notice to the holder of the Series A Preferred Shares redeem such Series A Preferred Shares at a redemption price of $0.001 (the "Notice of Redemption"). In the event of receipt of the Notice of Redemption by the holder of the Series A Preferred Shares, the holder shall have five business days from date of receipt to convert into shares of common stock in accordance with Section 5 above irrespective of Section 5(a).

6. VOTING RIGHTS. Each holder of outstanding shares of Series A Preferred Stock shall be entitled to cast 200 votes for each Series A Preferred Stock held of record.

7. ASSIGNMENT. The shares of Series A Preferred Stock may be assigned or transferred by the holder thereof in whole or in part.

|

3 |