Attached files

| file | filename |

|---|---|

| EX-10.3 - LOAN AGREEMENT - flooidCX Corp. | flcx_ex103.htm |

| EX-10.2 - PROMISSORY NOTE - flooidCX Corp. | flcx_ex102.htm |

| EX-32.1 - CERTIFICATION - flooidCX Corp. | flcx_ex321.htm |

| EX-31.1 - CERTIFICATION - flooidCX Corp. | flcx_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended February 28, 2021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

0-55965

(Commission File Number)

| flooidCX Corp. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

| 35-2511643 |

| (State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

|

| 1282 A Cornwall Road Oakville, Ontario Canada |

| L6J 7W5 |

| (Address of principal executive offices) |

| (Zip Code) |

Registrant’s telephone number, including area code: (855) 535-6643

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class |

| Trading symbol(s) |

| Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ YES ☒ NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ YES ☒ NO

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ YES ☐ NO

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ YES ☐ NO

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

|

|

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ YES ☒ NO

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold as of August 31, 2020 was $2,088,396.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 1,952,689 shares of common stock are outstanding as of June 16, 2021.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K into which the document is incorporated: None

| 2 |

| Table of Contents |

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

Information included in this Form 10-K contains forward-looking statements. This information may involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of flooidCX Corp. (the “Company”), to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe future plans, strategies and expectations of the Company, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. These forward-looking statements are based on assumptions that may be incorrect, and there can be no assurance that these projections included in these forward-looking statements will come to pass. Actual results of the Company could differ materially from those expressed or implied by the forward-looking statements as a result of various factors. Except as required by applicable laws, the Company has no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

| 3 |

| Table of Contents |

In this report, unless the context requires otherwise, references to the “Company”, “flooidCX”, “we”, “us” and “our” are to flooidCX Corp.

CORPORATE HISTORY

flooidCX Corp. was incorporated on January 7, 2014 in the State of Nevada as Baixo Relocation Services, Inc. We changed our name to “Gripevine Inc.” in December 2016 and also changed our trading symbol to “GRPV” on February 1, 2017.

Acquisition of MBE Holdings Inc.

Effective February 28, 2017, we entered into a share exchange agreement (the “MBE Exchange Agreement”) with MBE Holdings Inc., a private corporation organized under the laws of Delaware (“MBE”) and the shareholders of MBE (the “MBE Shareholders”). In accordance with the terms and provisions of the MBE Exchange Agreement, an aggregate of 5,248,626 (pre-reverse stock split) shares of our restricted common stock were issued to the MBE Shareholders in exchange for all of the issued and outstanding shares of MBE, thus making MBE our wholly-owned subsidiary. Our Board of Directors deemed it in the best interests of the respective shareholders to enter into the MBE Exchange Agreement pursuant to which we acquired all the technology and assets and assumed all liabilities of MBE. This resulted in a change in overall business operations of the Company bringing potential value to our shareholders.

2019 Name Change

Effective March 18, 2019, we changed our name to flooidCX Corp. pursuant to Certificate of Amendment to our Articles of Incorporation filed with the Nevada Secretary of State. The new CUSIP number for the Company’s common stock is 33974L 106, and the new trading symbol is FLCX. The name of the Company was changed as part of its rebranding, which better reflects its new business direction into the customer care and feedback solutions space – offering easy to adapt customer care and feedback solutions to enterprises of all sizes.

Acquisition of Resolution 1, Inc.

On May 17, 2019, we entered into a Share Exchange Agreement (the “R1 Exchange Agreement”) with the stockholders of Resolution 1, Inc., a Delaware corporation (“R1”), to acquire all of the outstanding shares of R1 in exchange for 10,000,000 restricted shares of our common stock (the “Acquisition”). R1 has developed a comprehensive customer care and feedback management platform, which is delivered as a cloud-based, software as a service solution. R1 was founded in August 2012 by Richard Hue, the CEO and a director of our Company. The Acquisition was approved by the independent members of the board of directors of the Company.

Reverse Stock Split

On January 27, 2021, the Company’s common stock began trading on a 1-for-85 reverse stock split basis. The new CUSIP number for the Company’s common stock following the reverse stock split is 33974L205.

CURRENT BUSINESS OPERATIONS

General

Our mission is to help businesses bring back the conversation with customers with innovative, simple to use solutions that empower both the businesses and customers to communicate and create positive outcomes. With the consummation of the R1 Exchange Agreement resulting in R1 being our subsidiary, we now offer a suite of customer relationship management (CRM) solutions that enhances and builds upon our initial offering, “GripeVine.”

| 4 |

| Table of Contents |

Market Opportunity

The CRM industry is based on the premise that existing customers can drive the success of a business. According to the Harvard Business Review, acquiring a new customer is anywhere from 5 to 25 times more expensive than retaining an existing one. Further, the book, Marketing Metrics, states that businesses have a 60% to 70% chance of selling to an existing customer while the probability of selling to a new prospect is only 5% to 20%. Statistics from Gartner Group support the assertion that 80% of a company’s future revenue will come from just 20% of its existing customers. The CRM market is estimated at $200 billion, which alone includes approximately 270 billion contact center conversations.

Products

Resolution1 offers a unified communications and collaboration online via its simplified CRM solutions while GripeVine offers a platform for businesses to build trust through transparency in the consumer ratings and review space. In 2002, customers overwhelmingly chose voice calling to contact businesses, as compared to direct messaging. In 2017, contact via voice calling (16.1%) has largely been replaced by direct messaging (24.7%) and social media (34.5%).

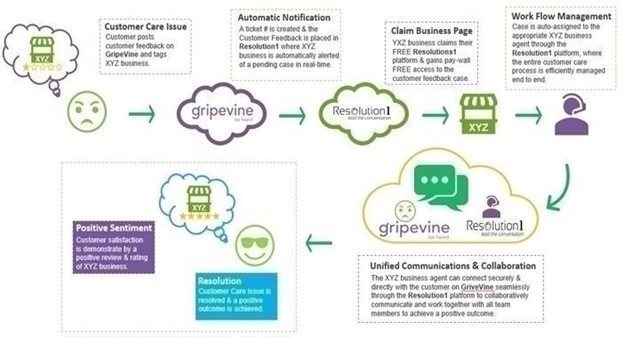

The following illustrates how these solutions work together:

__________

1 http://hbr.org/2014/10/the-value-of-keeping-the-right-customers

2 http://www.forbes.com/sites/patrickhull/2013/12/06/tools-for-entrepreneurs-to-retain-clients/#4c499ca62443 quoting P. Farris, N. Bendle, P. Pfeifer & D. Reibstein, Marketing Metrics: The Manager’s Guide to Measuring Marketing Performance.

3 http://www.forbes.com/sites/alexlawrence/2012/11/01/five-customer-retention-tips-for-entrepreneurs/?hstc=32807841.12fdf7f0d9e1a4e4127eacd91e9e7015.1420565079181.1420565079181.1420565079181.1&__hssc=32807841.1.1420565079181&__hsfp=111348769#227ab25f5e8d

4 IBM, April 2018; The US Contact Center Decision-Makers Guide 2018-2019.

5 http://websitebuilder.org.uk/blog/rise-social-media-customer-care/

| 5 |

| Table of Contents |

Significantly, GripeVine’s platform creates an incredibly strong search engine optimization (SEO) presence. Once there are multiple posts about a business (usually 5 or more) from consumers who want to connect to companies, the GripeVine platform automatically creates a strong SEO with the key words, “[company] headquarters,” which consumers usually use to search for a company when they have a customer care or feedback issue. This then triggers GripeVine’s proprietary auto-notification platform that advises the businesses that (1) their customers are waiting to hear back from them on GripeVine with regards to customer care and feedback issues and (2) they can claim their page and directly connect with the customer “pay-wall” free.

GripeVine. GripeVine is a consumer-to-business platform that helps build a customer feedback-minded community, focused on transparency, mutual respect and open communications among like-minded customers and businesses – all working together – to facilitate positive outcomes. It allows for private messaging between customers and businesses for positive resolutions, so that businesses are not forced to communicate via the comments section. While functioning as a social customer experience platform for social customer service and consumer reviews, GripeVine differentiates itself in the following ways:

|

| · | Pay-Wall Free – Rather than taking businesses hostage like other rating and review sites, GripeVine connects business directly with their customers without the worries of having to pay for such access. |

|

|

|

|

|

| · | Transparent – With a focus on sincerity, respect and open communications to build trust through transparency, GripeVine is the “go to” consumer-to-business platform, for many Fortune 1000 brands. |

Resolution1. Resolution1 (“R1”) functions as a cloud-based customer experience workflow management solution, where businesses can manage the entire logistics of customer care, feedback or inquiries throughout their entire organizations seamlessly. Businesses can respond quickly and accurately to customers, while keeping track of every customer interaction. The R1 solution offers customization features right out-of-the box and is designed to grow and scale, so that businesses of all sizes, from small to medium-size enterprises (SMEs) to large enterprises, can use this cloud-based customer experience management system without incurring significant customization costs.

The Resolution1 platform offers the following features and advantages:

|

| · | Leads from GripeVine – As GripeVine’s back-end customer care solution, Resolution1 has the capability to receive sales leads from GripeVine. |

|

|

|

|

|

| · | AI-powered sentiment analysis and process automation – Resolution1 uses artificial intelligence and natural language processing to automate standard repeatable tasks, enable more impactful use of data, and create tools that boost agent productivity and decision making. |

|

|

|

|

|

| · | Auto-Ticketing and Auto-Routing – Once a customer makes contact a ticket is automatically assigned to a case that is auto-routed to the pre-determined team member or department. Every ticket is tracked and monitored until it’s completed. |

|

|

|

|

|

| · | Reporting and analytics – Resolution1 offers robust analytics and the ability to build custom reports. This reporting also uses sentiment analysis on a business’s social sites, so that a business can quickly view how it is perceived on all social platforms. |

|

|

|

|

|

| · | Case management – Resolution1 can ticket and track all incoming feedback, conversations and/or inquiries so that businesses can immediately see all commentary or social posts and track the case management and resolution process. This enables businesses to prioritize, categorize and assign cases to the right department and agent. |

|

|

|

|

|

| · | Omni-channel support – This feature allows a business to enter feedback manually, as well as staying on top of conversations about the business in its social channels. A business can aggregate customer feedback and respond to social commentary through its multiple social channels, in addition to creating cases and messages directly from its social feeds into Resolution1’s case manager. |

| 6 |

| Table of Contents |

|

| · | Build watchlist – The watchlist allows a user/agent to pin posts of interest from social sites for later review or to aggregate them for lead generation and/or other marketing opportunities. Users/agents can tag notes and share watchlist posts internally with other departments and team members, create custom notes and generate cases as required. |

|

|

|

|

|

| · | Team collaboration – Resolution1 allows for collaboration across an organization’s teams and/or departments. People from beyond the immediate support team can be brought in to help resolve or join in the customer conversation all under a single application. |

|

|

|

|

|

| · | Auto Review Generator – This feature allows businesses to solicit ratings and reviews from their customers, without them having to first register to do so. |

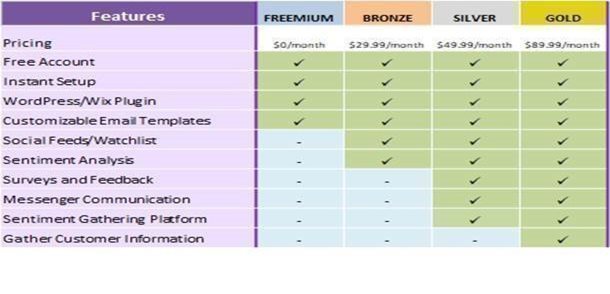

Pricing. Once companies claim their free Resolution1 platform, access is granted to their proprietary dashboard where they can communicate publicly or privately with consumers, keep accurate track of reviews, see their current ratings, launch resolution offers, and manage their overall online customer service channels across other social platforms.

We will also offer paid company accounts, which will allow companies to access a more robust social customer service management system utilizing unique and proprietary features allowing them to scale the use of the system to suit their organizational needs. The paid accounts will also allow the respective company to have more control over its presence on the site and be provided access to tools for gaining market share within their industries thus expanding the channels through which they will receive and manage customer service feedback. Management intends that paid accounts will offer companies access to the customer commentary and sentiment on social media. Whether a company is large or small, there is tremendous value in being able to monitor social customer service conversations about its brand across multi-platforms under one dashboard.

Currently, Resolution1’s basic free subscription option is much more robust than other comparable paid solutions. Resolution1 offers bronze, silver and gold plans, which are currently priced at $29.99, $49.99 and $89.99 per month, respectively, which offer features comparable to much more expensive competitor packages.

| 7 |

| Table of Contents |

Marketing Strategies

We are utilizing the freemium model approach - offering a robust “free” plan (a “freemium”) that allows small businesses to use the basic features of GripeVine and Resolution1. Management believes that this will allow the Company to rapidly gain market share, create brand awareness and increase conversion of the users to its tiered paid plans.

Our marketing strategy includes the following:

|

| · | Channel Partners – We plan to create joint ventures with non-traditional channels to showcase and offer our free version of our products. |

|

|

|

|

|

| · | Application Programming Interfaces (APIs) – Our innovative “drag and drop” APIs that easily integrates with popular applications such as WordPress (over 4 million websites) and WIX (over 150 million users) will allow us to broaden our reach and attract a strong user base quickly. |

|

|

|

|

|

| · | Affiliate Marketing - Once business users are on board, we plan to launch our Affiliate Marketing platform to direct-sell to SMEs. Management believes that this sales strategy, coupled with our freemium model approach, can be a very effective low cost strategy, eliminating the need to create an expensive sales infrastructure. |

|

|

|

|

|

| · | Value Added Resellers (VARs) – Through our partner program, we plan to offer trusted partners the ability to attract new customers and provide additional value to existing ones. By introducing the flooidCX suite of products to existing and prospective clients, our VARs will allow us to gain additional exposure to both SMEs and enterprise clients. |

EMPLOYEES

We have two full-time employees, and we engage approximately 10 individuals as independent contractors. The Company also has its President/Chief Executive Officer, Richard Hue, and its Chief Technology Officer, Mark Vange. These individuals are primarily responsible for all of the Corporation’s day-to-day operations. Other services may be provided by outsourcing and consultant and special purpose contracts.

RESEARCH AND DEVELOPMENT ACTIVITIES

We have incurred $1,002,639 and $1,873,152 during the fiscal years ended February 28, 2021 and February 29, 2020, respectively, on research and development for the Company. None of these research or development costs were borne by the customer.

INTELLECTUAL PROPERTY

Patent

On February 15, 2019, patent applications were filed in the United States and Canada for “Complaint Resolution System” – US 16/325,828 and CA 3034118. The applications, which are pending, claimed the benefit of U.S. Provisional Application No. 62/375,027, filed on August 15, 2016, and U.S. Provisional Application No. 62/475,447, filed on March 23, 2017, for the “System and Method for Determining Metrics,” as well as International application PCT/CA2017/050965 filed on August 17, 2017.

Trademarks

We have trademarked certain of our logos and names. On October 16, 2012, the United States Patent and Trademark Office issued a trademark for “Gripevine”, Registration No. 4,227,471, for classes 35 and 42, which primarily is for business data analysis and electronic data collection and use of online non-downloadable proprietary software for business purposes for third parties featuring the use of such proprietary software to collect, evaluate and analyze consumer complaints and assist third parties in the resolution of such complaints.

We rely on federal, state, common law and international rights, as well as contractual restrictions, to protect our intellectual property. We control access to our proprietary technology and algorithms by entering into confidentiality and agreements with our employees and contractors and confidentiality agreements with third parties.

| 8 |

| Table of Contents |

In addition to these contractual arrangements, we also rely on a combination of patent pending applications, trade secrets, copyrights, trademarks, service marks and domain names to protect our intellectual property. We will pursue the registration of our patents, copyrights, trademarks, service marks and domain names in North America and in certain locations outside the United States. We believe that our registration efforts will focus on gaining protection of our trademark “Gripevine” name and logos among others. These marks are material to our business as they enable others to easily identify us as the source of the services offered under these marks and are essential to our brand identity.

Circumstances outside our control could pose a threat to our intellectual property rights. For example, effective intellectual property protection may not be available in the North America or other countries in which we operate. Also, the efforts we have taken to protect our proprietary rights may not be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to compete. Also, protecting our intellectual property rights is costly and time-consuming. Any unauthorized disclosure or use of our intellectual property could make it more expensive to do business and harm our operating results.

Companies in the Internet, media and other industries may own large numbers of patents, copyrights and trademarks and may frequently request license agreements, threaten litigation or file suit against us based on allegations of infringement or other violations of intellectual property rights. We are currently subject to, and expect to face in the future, allegations that we have infringed the trademarks, copyrights, patents and other intellectual property rights of third parties, including our competitors and non-practicing entities. As we face increasing competition and as our business grows, we may likely face claims of infringement.

COMPETITION

There are a number of established and emerging competitors in the broad market of customer engagement software. This market is fragmented, rapidly evolving, and highly competitive, with relatively low barriers to entry in some segments. We consider the principal competitive differentiators in our market to include:

|

| · | Ease-of-deployment and use; |

|

| · | Time to value realization; |

|

| · | Enablement of customer communications across channels; |

|

| · | Availability of self-service options; |

|

| · | Data analytics and performance recommendations; |

|

| · | Mobile and multi-device capabilities; |

|

| · | Proactive outreach tools; |

|

| · | Customization and integration with third-party applications; |

|

| · | Brand recognition and thought leadership; and |

|

| · | Total cost of ownership for the customer (including software updates, ongoing maintenance, and consulting and system integration fees). |

Given the large number, disparate sizes, and varying areas of focus of other companies with which we compete in the provision of customer engagement software, we may not always compare favorably with respect to some or all of the foregoing factors. Most, if not all, of our competitors have greater financial and personnel resources than our Company, as well as greater name recognition, longer operating histories, and larger marketing budgets. Our competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards, or customer requirements. With the introduction of new technologies, the evolution of our products, and new market entrants, we expect competition to intensify in the future. Pricing pressures and increased competition generally could result in reduced sales, reduced margins, losses, or the failure of our suite of products to achieve significant market acceptance, any of which could harm our business. In order to improve our competitive position in the market, we must remain focused in our development, operations, and sales and marketing efforts on the evolving customer service needs of all organizations.

| 9 |

| Table of Contents |

You should carefully consider the risks, uncertainties and other factors described below because they could materially and adversely affect our business, financial condition, operating results and prospects and could negatively affect the market price of our common stock. Also, you should be aware that the risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties that we do not yet know of, or that we currently believe are immaterial, may also impair our business operations and financial results. Our business, financial condition or results of operations could be harmed by any of these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

In assessing these risks, you should also refer to the other information contained in or incorporated by reference to this Annual Report on Form 10-K, including our financial statements and the related notes.

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

If we fail to manage our growth effectively, our brand, results of operations and business could be harmed.

We anticipate experiencing rapid growth in our operations, which places substantial demands on management and our operational infrastructure. Most of our contractors have been with us for fewer than three years and to manage the expected growth of our operations, we will need to continue to increase the productivity of our current contractors and may hire, train and manage employees. In particular, we intend to continue to make substantial investments in our developer, engineering, technical support, sales and marketing and social community management organizations. As a result, we must effectively integrate, develop and motivate a large number of new contractors, including contractors in international markets and from any acquired businesses, while maintaining the beneficial aspects of our company culture.

As our business matures, we may make periodic changes and adjustments to our organization in response to various internal and external considerations, including market opportunities, the competitive landscape, new and enhanced products, acquisitions, sales performance, increases in headcount and cost levels. In some instances, these changes have resulted in a temporary lack of focus and reduced productivity, which may occur again in connection with any future changes to our organization and may negatively affect our results of operations. Similarly, any significant changes to the way we structure compensation of our sales organization may be disruptive and may affect our ability to generate revenue.

To manage our growth, we may need to improve our operational, financial and management systems and processes, which may require significant capital expenditures and allocation of valuable management and employee resources, as well as subject us to the risk of over-expanding our operating infrastructure. However, if we fail to scale our operations successfully and increase productivity, the quality of our platform and efficiency of our operations could suffer, which could harm our brand, results of operations and business.

If the demand for information regarding local businesses does not develop as we expect, or if we fail to address the needs of this demand, our business will be harmed. We may not be able to address successfully these risks and difficulties or others, including those described elsewhere in these risk factors. Failure to address these risks and difficulties adequately could harm our business and cause our operating results to suffer.

We may incur significant operating losses and may not be able to generate sufficient revenue to gain profitability. A failure to maintain an adequate growth rate will adversely affect our business and results of operations.

We have incurred significant operating losses since inception and, as of February 28, 2021, had an accumulated deficit of $56,165,383, a substantial amount of which was incurred due to the value of preferred stock recorded for stock compensation expense. We have generated only limited revenues. Additionally, our costs may continue to exceed revenues each year as we continue to expend substantial financial resources on: (i) sales and marketing; (ii) our technology infrastructure; (iii) product and feature development; (iv) domestic and international expansion efforts; (iv) strategic opportunities, including commercial relationships and acquisitions; and (v) general administration, including legal and accounting expenses related to being a public company.

| 10 |

| Table of Contents |

Proposed investments may not result in increased revenue or growth in our business. Our costs may also increase as we hire additional employees, particularly as a result of the significant competition that we face to attract and retain technical talent. Our expenses may grow faster than our revenue and may be greater than we anticipate in a particular period or over time. If we are unable to maintain adequate revenue growth and to manage our expenses, we may continue to incur significant losses in the future and may not be able to regain profitability.

We have a limited operating history in an evolving industry, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful.

We have a limited operating history in an evolving industry. As a result, our historical operating results may not be indicative of our future operating results, making it difficult to assess our future prospects. You should consider our business and prospects in light of the risks and difficulties we may encounter in this rapidly evolving industry, which we may not be able to address successfully. These risks and difficulties include our ability to, among other things: (i) increase the number of users of our CRM solutions; (ii) attract and retain new business clients, many of which may have limited or no online CRM experience; (iii) forecast revenue, which may be more difficult as we engage more company paid accounts, as well as appropriately estimate and plan our expenses; (iv) continue to earn and preserve a reputation for providing effective CRM solutions; (v) successfully compete with other companies that are currently in, or may in the future enter, the CRM industry; (vi) successfully manage our growth, including in international markets; (vii) successfully develop and deploy new features and products; (viii) manage and integrate successfully any acquisitions of businesses, solutions or technologies; (ix) avoid interruptions or disruptions in our service or slower than expected load times (x) develop a scalable, high-performance technology infrastructure that can efficiently and reliably handle increased usage globally, as well as the deployment of new features and products; (xi) hire, integrate and retain talented sales and other personnel; (xii) effectively manage rapid growth in our sales force, other personnel and operations; and (xiii) effectively identify, engage and manage third-party partners and service providers.

We expect a number of factors to cause our operating results to fluctuate on a quarterly and annual basis, which may make it difficult to predict our future performance.

Our operating results could vary significantly from period to period as a result of a variety of factors, many of which may be outside of our control. This volatility increases the difficulty in predicting our future performance and means comparing our operating results on a period-to-period basis may not be meaningful. In addition to the other risk factors discussed in this section, factors that may contribute to the volatility of our operating results include: (i) changes in our pricing policies and terms of contracts, whether initiated by us or as a result of competition; (ii) cyclicality; (iii) the effects of changes in search engine placement and prominence; (iv) the adoption of any laws or regulations that adversely affect the growth, popularity or use of the Internet, such as laws impacting Internet neutrality; (v) the success of our sales and marketing efforts; (vi) costs associated with defending intellectual property infringement and other claims and related judgments or settlements; (vii) interruptions in service and any related impact on our reputation; (viii) the impact of fluctuations in currency exchange rates; (ix) changes in consumer behavior; (ix) changes in our tax rates or exposure to additional tax liabilities; (x) the impact of worldwide economic conditions; and; (xi) the effects of natural or man-made catastrophic events.

We will likely require additional capital to support business growth, and such capital might not be available on acceptable terms, if at all.

We intend to continue to invest in our business and will likely require or otherwise seek additional funds to respond to business challenges, including the need to develop new features and products, enhance our existing services, improve our operating infrastructure and acquire complementary businesses and technologies. As a result, we may need to engage in equity or debt financings to secure additional funds. If we raise additional funds through future issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of our common stock. Any future debt financing we secure could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions. We may not be able to obtain additional financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth and respond to business challenges could be significantly impaired, and our business may be harmed.

| 11 |

| Table of Contents |

If our marketing strategies prove to be ineffective, we will be unable to increase our customer base and achieve significant market acceptance of our products.

Increasing our customer base and achieving significant market acceptance of our products will depend on the effectiveness of our marketing strategies. We have developed these strategies to leverage our limited financial resources. If these strategies prove to be ineffective and we are unable to expand our customer base and generate revenues, our business will be harmed. Specifically, we will be utilizing the freemium model and offering a free basic version of our Resolution1 solution. Many early users never convert from the free version of a product to a paid version with enhanced features. Further, we may be dependent upon individuals within an organization who initiate the trial or free usage of our products being able to convince decision makers within their organization to convert to a paid version. To the extent to these users do not become, or are unable to convince others to become, paying customers, we will not realize the intended benefits of this marketing strategy and our ability to grow our revenue will be adversely affected.

If we are unable to increase traffic to our website, or user engagement on our platform declines, our revenue, business and operating results may be harmed.

We will derive substantially all of our revenue from the paid company accounts of businesses, offering business access to a robust social customer service management system. Because traffic to our platform will have an influence on its popularity and the number of businesses we are able to show, we believe this will affect the value of our services provided to businesses and influence the content creation that drives further traffic. Slower traffic growth rates may harm our business and financial results. As a result, our ability to grow our business depends on our ability to increase traffic to and user engagement on our platform. Our traffic could be adversely affected by factors including:

|

| · | Reliance on Internet Search Engines. We rely on Internet search engines to drive traffic to our platform. However, the display, including rankings, of unpaid search results can be affected by a number of factors, many of which are not in our direct control, and may change frequently. For example, a search engine may change its ranking algorithms, methodologies or design layouts. As a result, links to our platform may not be prominent enough to drive traffic to our platform, and we may not be in a position to influence the results. Although internet search engine results have allowed us to attract a significant audience with low organic traffic acquisition costs to date, if they fail to drive sufficient traffic to our platform in the future, we may need to increase our marketing expenses, which could harm our operating results. |

|

|

|

|

|

| · | Increasing Competition. The market for online consumer review and social customer service space is intensely competitive and rapidly changing. If the popularity, usefulness, ease of use, performance and reliability of our services do not compare favorably to those of our competitors, traffic may decline. |

|

|

|

|

|

| · | Our Automated Artificial Intelligence (AI) Suggestion Engine. If our automated AI engine does not suggest helpful content or recommends unhelpful content, consumers may reduce or stop their use of our online consumer review platform. While we have designed our technology to avoid suggesting content that we believe to be unreliable or otherwise unhelpful, we cannot guarantee that our efforts will be successful. |

|

|

|

|

|

| · | Content Scraping. Other companies may attempt to copy information from our platform without our permission, through website scraping, robots or other means, and publish or aggregate it with other information for their own benefit. This may make them more competitive and may decrease the likelihood that consumers will visit our platform to find the local businesses and information they seek. Though we will strive to detect and prevent this third-party conduct, we may not be able to detect it in a timely manner and, even if we could, may not be able to prevent it. In some cases, particularly in the case of third parties operating outside of the United States, our available remedies may be inadequate to protect us against such conduct. |

|

|

|

|

|

| · | Macroeconomic Conditions. Consumer purchases of discretionary items generally decline during recessions and other periods in which disposable income is adversely affected. As a result, adverse economic conditions may impact consumer spending, particularly with respect to local businesses, which in turn could adversely impact the number of consumers visiting our online consumer review platform. |

|

|

|

|

|

| · | Internet Access. The adoption of any laws or regulations that adversely affect the growth, popularity or use of the internet, including laws impacting Internet Neutrality, could decrease the demand for our services. Similarly, any actions by companies that provide Internet access that degrade, disrupt or increase the cost of user access to our platform could undermine our operations and result in the loss of traffic. |

| 12 |

| Table of Contents |

We also anticipate that our traffic growth rate may slow over time, and potentially decrease in certain periods, as our business matures and we achieve higher penetration rates. In particular, the number of major geographic markets, especially within North America, that we have not yet entered completely and may decline and further expansion in smaller markets may not yield similar results or sustain our growth. That our traffic growth may slow even as we expand our operations. As our traffic growth rate slows, our success may become increasingly dependent on our ability to increase levels of user engagement on our platform. This dependence may increase as the portion of our revenue derived from company accounts increases. A number of factors may negatively affect our user engagement, including if: (i) users engage with other services or activities as an alternative to our platform; (ii) there is a decrease in the perceived quality of the content contributed by our users; (iii) we fail to introduce new and improved features or we introduce new features that do not effectively address consumer concerns or needs or otherwise alienate consumers; (iv) technical or other problems negatively impact the availability and reliability of our platform or otherwise affect the user experience; (v) users have difficulty installing, updating or otherwise accessing our platform as a result of actions by us or third parties; (vi) users believe that their experience is diminished as a result of the decisions we make with respect to the frequency, relevance and prominence of the business and content we display; and (vii) we do not maintain our brand image or our reputation is damaged.

If we fail to maintain and expand our base of company accounts, our revenue and our business will be harmed.

Our ability to grow our business depends on our ability to maintain and expand our base of company accounts. To do so, we must convince prospective companies that our services offer a material benefit and can generate a competitive return relative to other alternatives. Our ability to do so depends on certain factors.

|

| · | Traffic Quality. The success of our online consumer review and social customer service program depends on delivering positive results to our clients. Low-quality or invalid traffic, such as robots, spiders and the mechanical automation of clicking, may be detrimental to our relationships with advertisers and could adversely affect our advertising pricing and revenue. If we fail to detect and prevent click fraud, the affected companies may experience or perceive a reduced return on their investment, which could lead to dissatisfaction with our service, refusals to pay, refund demands or withdrawal of future business. |

|

|

|

|

|

| · | Perception of Our Platform. Our ability to compete effectively for a company’s budget depends on our reputation and perceptions regarding our consumer review platform. For example, we may face challenges expanding our company base in certain businesses and shopping categories if businesses believe that consumers perceive the utility of our platform to be limited to finding businesses in these categories. The ratings and reviews that businesses receive from our users may also affect their advertising decisions. Favorable ratings and reviews, on the one hand, could be perceived as obviating the need to advertise. Unfavorable ratings and reviews, on the other, could discourage businesses from advertising to an audience that they perceive as hostile or cause them to form a negative opinion of our products and user base. |

|

|

|

|

|

| · | Macroeconomic Conditions. Adverse macroeconomic conditions can have a negative impact on the demand for consumer review particularly with respect to online review sites. We may rely heavily on small and medium-sized businesses, which often have limited budgets and may be disproportionately affected by economic downturns. In addition, such business may view online consumer review forums as a low priority. |

As is typical in our industry, businesses generally do not have long-term obligations to purchase our services. Their decisions to renew depend on the degree of satisfaction with our services as well as a number of factors that are outside of our control, including their ability to continue their operations and spending levels. Small and medium-sized local businesses in particular have historically experienced high failure rates. As a result, we may experience attrition in our advertisers in the ordinary course of business resulting from several factors, including losses to competitors, declining budgets, closures and bankruptcies. To grow our business, we must continually add new company accounts to replace company accounts who choose not to renew their listing or who go out of business or otherwise fail to fulfill any contracts with us, which we may not be able to do.

| 13 |

| Table of Contents |

If we fail to further develop our markets effectively, including international markets where we may have limited operating experience and may be subject to increased risks, our revenue and business will be harmed.

We intend to further develop our operations both domestically and abroad. Our current and future plans will require significant resources and management attention, and the returns on such investments may not be achieved for several years, or at all. Our communities in many of the largest markets in North America are in a relatively late stage of development, and further development of smaller markets may not yield similar results. As a result, our continued growth depends on our ability to successfully develop potential international communities and operations. We have no operating history in international markets, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful. If we are not able to develop our international markets as we expect, or if we fail to address the needs of those markets, our business will be negatively impacted.

Expanding our international operations may also subject us to risks that we have not faced before or that increase our exposure to risks that we currently face, including risks associated with: (i) operating a rapidly growing business in an environment of multiple languages, cultures, customs, legal systems, regulatory systems and commercial infrastructures; (ii) recruiting and retaining qualified, multi-lingual employees, including sales personnel; (iii) increased competition from local websites and guides, and potential preferences by local populations for local providers; (iv) potentially lower levels of demand and user engagement; (v) our ability to achieve prominent display of our content in unpaid search results, which may be more difficult in newer markets where we may have less content and more competitors than in more established markets; (vi) providing solutions in different languages for different cultures, which may require that we modify our solutions and features to ensure that they are culturally relevant in different countries; (vii) compliance with applicable foreign laws and regulations, including different privacy, censorship and liability standards; (viii) the enforceability of our intellectual property rights; (ix) credit risk and higher levels of payment fraud; (x) currency exchange rate fluctuations; (xi) compliance with anti-bribery laws, including but not limited to the Foreign Corrupt Practices Act and the U.K. Bribery Act; (xii) foreign exchange controls that might prevent us from repatriating cash earned outside the United States; (xiii) political and economic instability in some countries; (xiv) double taxation of our international earnings and potential adverse tax consequences due to changes in the tax laws of the United States or foreign jurisdictions in which we operate; and (xv) higher costs of doing business internationally.

We may rely on third-party service providers and strategic partners for many aspects of our business, and any failure to maintain these relationships could harm our business.

We may rely on relationships with various third parties to grow our business, including strategic partners and technology and content providers. For example, we may rely on third parties for data about local businesses, mapping functionality, payment processing and administrative software solutions. Identifying, negotiating and maintaining relationships with third parties require significant time and resources, as does integrating their data, services and technologies onto our platform. It is possible that these third parties may not be able to devote the resources we expect to the relationships. We may also have competing interests and obligations with respect to our partners in particular, which may make it difficult to maintain, grow or maximize the benefit for each partnership.

If our relationships with our partners and providers deteriorate, we could suffer increased costs and delays in our ability to provide consumers with content or similar services. We may have disagreements or disputes with our partners about our respective contractual obligations, which could result in legal proceedings or negatively affect our brand and reputation. In addition, we will exercise limited control over our third-party partners and vendors, which makes us vulnerable to any errors, interruptions or delays in their operations. If these third parties experience any service disruptions, financial distress or other business disruption, or difficulties meeting our requirements or standards, it could make it difficult for us to operate some aspects of our business. Any disruption or problems with a supplier or its services could have an adverse effect on our reputation, results of operations and financial results. Similarly, upon expiration or termination of any of our agreements with third-party providers, we may not be able to replace the services provided to us in a timely manner or on terms that are favorable to us, if at all, and a transition from one partner or provider to another could subject us to operational delays and inefficiencies.

| 14 |

| Table of Contents |

Our business depends on strong branding, and any failure to maintain, protect and/or enhance our brand would hurt our ability to retain and expand our base of users and advertisers, as well as our ability to increase the frequency with which they use our platform.

We are in the early process of developing a strong brand that we believe will contribute significantly to the success of our business. Maintaining, protecting and enhancing the “flooidCX,” “Resolution1” and “Gripevine” brands are critical to expanding our base of users and increasing the frequency with which they will use our solutions. Our ability to do so will depend largely on our ability to maintain consumer trust in our platform and in the quality and integrity of the user content and other information found on our site, which we may not do successfully, and which may also affect our ability to create advertising revenues. We plan on dedicating significant resources to these goals, primarily through our artificial intelligence (AI) suggestion software, sting operations targeting the buying and selling of reviews, our consumer alerts program, coordination with consumer protection agencies and law enforcement, and, in certain egregious cases, taking legal action against business we believe to be engaged in deceptive practices. We also endeavor to remove content from our platform that violates our terms of service.

Despite these efforts, we cannot guarantee that each of the proposed numerous reviews on our platform have been recommended and are useful or reliable or that consumers will trust the integrity of our content. For example, if our AI suggestion software does not recommend helpful content or recommends unhelpful content, consumers and businesses alike may stop or reduce their use of our platform and products. Some consumers and businesses may express concern that our technology either recommends too many reviews, thereby recommending some reviews that may not be legitimate, or too few reviews, thereby not recommending some reviews that may be legitimate. If consumers do not believe our recommended reviews to be useful and reliable, they may seek other services to obtain the information for which they are looking and may not return to our platform as often in the future, or at all. This would negatively impact our ability to retain and attract users and advertisers and the frequency with which they use our platform.

Consumers may also believe that the reviews, photos and other user content contributed by our company clients or other employees are influenced by any contractual relationships or are otherwise biased. Although we will take steps to prevent this from occurring, we may not be successful in our efforts to maintain consumer trust. Similarly, the actions of any future partners may affect our brand if users do not have a positive experience on the flooidCX and Gripevine Platforms. If others misuse our brand or pass themselves off as being endorsed or affiliated with us, it could harm our reputation and our business could suffer. Our website and mobile app also serve as a platform for expression by our users, and third parties or the public at large may also attribute the political or other sentiments expressed by users on our platform to us, which could harm our reputation.

Maintaining and enhancing our brand may also require us to make substantial investments, and these investments may not be successful. For example, our trademarks are an important element of our brand. We may face in the future oppositions from third parties to our applications to register key trademarks in foreign jurisdictions in which we expect to expand our presence. If we are unsuccessful in defending against these oppositions, our trademark applications may be denied. Whether or not our trademark applications are denied, third parties may claim that our trademarks infringe their rights. As a result, we could be forced to pay significant settlement costs or cease the use of these trademarks and associated elements of our brand in certain jurisdictions. Doing so could harm our brand recognition and adversely affect our business. If we fail to maintain and enhance our brand successfully, or if we incur excessive expenses in this effort, our business and financial results may be adversely affected.

The customer experience is our highest priority. Our dedication to making decisions based primarily on the best interests of customers may cause us to forgo short-term gains and advertising revenue.

We base many of our decisions on the best interests of the businesses and consumers who use or may use our platform. We may in the future forgo, certain expansion or revenue opportunities that we do not believe are in the best interests of these users, even if such decisions negatively impact our results of operations in the short term. Our approach of putting our customers first may negatively impact our relationship with others, such as prospective advertisers. For example, unless we believe that a review violates our terms of service, such as reviews that contain hate speech or bigotry, we will allow the review to remain on our platform, even if the business disputes its accuracy. However, consumers must respond to any business that is proactive in engaging in order to come to an amicable resolution with any negative review the consumer has posted and if there is no response by the consumer then the business has an option to “flag as fake” any review it deems as inaccurate or fake. This initiative is only activated if the consumer refuses to connect with the company in order to try and resolve a negative review. Even with our flag as fake option, certain advertisers may still perceive us as an impediment to their success as a result of negative reviews and ratings. This practice could result in a loss of advertisers, which in turn could harm our results of operations. However, we believe that this approach has been essential to our success in attracting users and increasing the frequency with which they use our platform. As a result, we believe this balanced approach will served the long-term interests of our company and our stakeholders and will continue to do so in the future.

| 15 |

| Table of Contents |

We rely on the performance of highly skilled personnel, and if we are unable to attract, retain and motivate well-qualified team members, our business could be harmed.

We believe our success will depend on the efforts and talents of our team members, including our senior management team, software engineers, marketing professionals and advertising sales team. At present, all our officers and team members are at-will contractors, which means they may terminate their business relationship with us at any time, and their knowledge of our business and industry could be extremely difficult to replace. Any changes in our senior management team in particular may be disruptive to our business. If our senior management team, including any new hires that we may make, fails to work together effectively or execute our plans and strategies on a timely basis, our business could be harmed.

Our future also depends on our continuing ability to attract, develop, motivate and retain highly qualified and skilled team members. Identifying, recruiting, training and integrating new hires will require significant time, expense and attention, and qualified individuals are in high demand; as a result, we may incur significant costs to attract them before we can validate their productivity. Volatility in the price of our common stock may make it more difficult or costly in the future to use equity compensation to motivate, incentivize and retain our team members or future employees. If we fail to manage our hiring needs effectively, our efficiency and ability to meet our forecasts, as well as team member morale, productivity and retention, could suffer, and our business and operating results could be adversely affected.

If our goodwill or intangible assets become impaired, we may be required to record a significant charge to earnings.

Under accounting principles generally accepted in the United States, or GAAP, we will review our intangible assets for impairment when events or changes in circumstances indicate the carrying value of our goodwill and other intangible assets may not be recoverable. Goodwill is required to be tested for impairment at least annually. Factors that may be considered include declines in our stock price, market capitalization and future cash flow projections. If future acquisitions do not yield expected returns, our stock price declines or any other adverse change in market conditions occurs, a change to the estimation of fair value could result. Any such change could result in an impairment charge to our goodwill and intangible assets, particularly if such change impacts any of our critical assumptions or estimates, and may have a negative impact on our financial position and operating results.

Changes in tax laws or tax rulings, or the examination of our tax positions, could materially affect our financial position and results of operations.

Tax laws are dynamic and subject to change as new laws are passed and new interpretations of the law are issued or applied. Our existing corporate structure and wholly-owned subsidiary have been implemented in a manner we believe is in compliance with current prevailing tax laws. However, the tax benefits that we intend to eventually derive could be undermined due to changing tax laws. In particular, the current U.S. administration and key members of Congress have made public statements indicating that tax reform is a priority, resulting in uncertainty not only with respect to the future corporate tax rate, but also the U.S. tax consequences of income derived from income related to intellectual property earned overseas in low tax jurisdictions. Certain changes to U.S. tax laws, including limitations on the ability to defer U.S. taxation on earnings outside of the United States until those earnings are repatriated to the United States, as well as changes to U.S. tax laws that may be enacted in the future, could affect the tax treatment of our foreign earnings. In addition, many countries in the European Union, as well as a number of other countries and organizations such as the Organization for Economic Cooperation and Development, are actively considering changes to existing tax laws that, if enacted, could increase our tax obligations in many countries where we do business. Due to the expanding scale of our international business activities, any changes in the taxation of such activities may increase our worldwide effective tax rate and harm our financial position and results of operations.

In addition, the taxing authorities in the United States and other jurisdictions where we do business regularly examine our income and other tax returns. The ultimate outcome of these examinations cannot be predicted with certainty. Should the IRS or other taxing authorities assess additional taxes as a result of examinations, we may be required to record charges to our operations, which could harm our business, operating results and financial condition.

| 16 |

| Table of Contents |

RISKS RELATED TO OUR TECHNOLOGY

Our business is dependent on the uninterrupted and proper operation of our technology and network infrastructure. Any significant disruption in our service could damage our reputation, result in a potential loss of users and engagement and adversely affect our results of operations.

It is important to our success that users in all geographies be able to access our platform at all times. We may experience in the future service disruptions, outages and other performance problems. Such performance problems may be due to a variety of factors, including infrastructure changes, human or software errors and capacity constraints due to an overwhelming number of users accessing our platform simultaneously. Our platform and services are highly technical and complex, and may contain errors or vulnerabilities that could result in unanticipated downtime for our platform and harm to our reputation and business. Users may also use our products in unanticipated ways that may cause a disruption in service for other users attempting to access our platform. We may encounter such difficulties more frequently as we acquire companies and incorporate their technologies into our service. It may also become increasingly difficult to maintain and improve the availability of our platform, especially during peak usage times, as our products become more complex and our user traffic increases.

In some instances, we may not be able to identify the cause or causes of these performance problems within an acceptable period of time. If our platform is unavailable when users attempt to access it, or it does not load as quickly as they expect, users may seek other services to obtain the information for which they are looking and may not return to our platform as often in the future, or at all. This would negatively impact our ability to attract users and advertisers and increase the frequency with which they use our platform. We expect to continue to make significant investments to maintain and improve the availability of our platform and to enable rapid releases of new features and products. To the extent that we do not effectively address capacity constraints, upgrade our systems as needed and continually develop our technology and network architecture to accommodate actual and anticipated changes in technology, our business and operating results may be harmed.

Although the majority of our infrastructures and platform are cloud based hosted, our systems are still vulnerable to damage or interruption from catastrophic occurrences such as earthquakes, fires, floods, power losses, telecommunications failures, cyber or terrorist attacks and similar events. Acts of terrorism, which may be targeted at metropolitan areas that have higher population densities than rural areas where our infrastructures are hosted, could cause disruptions within our infrastructures or our advertisers’ businesses or the economy as a whole. We may not have sufficient protection or recovery plans in certain circumstances, such as natural disasters affecting the New York City, New York and/or Oakville, Ontario area, and our business interruption insurance may be insufficient to compensate us for losses that may occur. Our disaster recovery program both internal and cloud based will contemplate transitioning our platform and data to a backup center in the event of a catastrophe. Although this program is not yet functional, if our primary data center shuts down, there will be a period of time that our services will remain shut down while the transition to the back-up data center takes place. During this time, our platform may be unavailable in whole or in part to our users.

If our security measures are compromised, or if our platform is subject to cyber security attacks that degrade or deny the ability of users to access our content, users may curtail or stop use of our platform.

Our platform involves the storage and transmission of user and business information, some of which may be private, and security breaches could expose us to a risk of loss of this information, which could result in potential liability and litigation. Security breaches such as cyber-attacks, computer viruses, break-ins, malware, phishing attacks, attempts to overload servers with denial-of-service or other attacks and similar disruptions from unauthorized use of computer systems have become more prevalent in our industry, have occurred on our systems in the past and are expected to occur periodically on our systems in the future. We may be a particularly compelling target for such attacks as a result of our brand recognition. User and business owner accounts and listing pages could be hacked, hijacked, altered or otherwise claimed or controlled by unauthorized persons. For example, we enable businesses to create online accounts and each of their business locations. Although we take steps to confirm that the person setting up the account is affiliated with the business, our verification systems could fail to confirm that such person is an authorized representative of the business, or mistakenly allow an unauthorized person to claim the business’s listing page. In addition, we face risks associated with security breaches affecting our third-party partners and service providers. A security breach at any such third party could be perceived by consumers as a security breach of our systems and result in negative publicity, damage to our reputation and expose us to other losses.

| 17 |

| Table of Contents |

Future disruptions could lead to interruptions, delays or website shutdowns, causing loss of critical data or the unauthorized disclosure or use of personally identifiable or other confidential information. Even if we experience no significant shutdown or no critical data is lost, obtained or misused in connection with an attack, the occurrence of such attack or the perception that we are vulnerable to such attacks may harm our reputation, our ability to retain existing users and our ability to attract new users. Although we will develop systems and processes that are designed to protect our data and prevent data loss and other security breaches, the techniques used to obtain unauthorized access, disable or degrade service or sabotage systems change frequently, often are not recognized until launched against a target or long after, and may originate from less regulated and more remote areas around the world. As a result, these preventative measures may not be adequate and we cannot provide assurances that they will provide absolute security.

Any or all of these issues could negatively impact our ability to attract new users, deter current users from returning to our platform, cause potential advertisers to cancel their contracts or subject us to third-party lawsuits or other liabilities. For example, we will work with a third-party vendor to process credit card payments and are subject to payment card association operating rules. Compliance with applicable operating rules will not necessarily prevent illegal or improper use of our payment systems, or the theft, loss or misuse of payment information, however. If our security measures fail to prevent fraudulent credit card transactions and protect payment information adequately as a result of employee error, malfeasance or otherwise, or we fail to comply with the applicable operating rules, we could be liable to the users and businesses for their losses, as well as the vendor under our agreement with it, and be subject to fines and higher transaction fees. In addition, government authorities could also initiate legal or regulatory actions against us in connection with such incidents, which could cause us to incur significant expense and liability or result in orders or consent decrees forcing us to modify our business practices.

Some of our features may contain open source software, which may pose particular risks to our proprietary software and solutions.

We may use open source software in our services, presently and in the future. From time to time, we may face claims from third parties claiming ownership of, or demanding release of, the open source software or derivative works that we developed using such software (which could include our proprietary source code), or otherwise seeking to enforce the terms of the applicable open source license. These claims could result in litigation and could require us to purchase a costly license or cease offering the implicated solutions unless and until we can re-engineer them to avoid infringement. This re-engineering process could require significant additional research and development resources. In addition to risks related to license requirements, use of certain open source software can lead to greater risks than use of third-party commercial software because open source licensors generally do not provide warranties or controls on the origin of the software. Any of these risks could be difficult to eliminate or manage, and, if not addressed, could have a negative effect on our business and operating results.

We may rely on data from both internal tools and third parties to calculate certain performance metrics. Real or perceived inaccuracies in such metrics may harm our reputation and negatively affect our business.

We intend to implement and track certain performance metrics – including the number of unique devices accessing our mobile app in a given period, page views and calls and clicks for directions and map views – with internal tools, which are not independently verified by any third party. Our internal tools may have a number of limitations and our methodologies for tracking these metrics may change over time, which could result in unexpected changes to our metrics, including key metrics that we report. For example, our metrics may be affected by mobile applications that automatically contact our servers for regular updates with no discernable user action involved; this activity can cause our system to count the device associated with the app as a unique app device in a given period. If the internal tools we use to track these metrics over- or under-count performance or contain algorithm or other technical errors, the data we report may not be accurate. In addition, limitations or errors with respect to how we measure data may affect our understanding of certain details of our business, which could affect our longer-term strategies.

| 18 |

| Table of Contents |

In addition, certain of our key metrics – the number of our desktop unique visitors and mobile website unique visitors – maybe calculated relying on data from third parties. While these numbers might be based on what we believe to be reasonable calculations for the applicable periods of measurement, our third-party providers may periodically encounter difficulties in providing accurate data for such metrics as a result of a variety of factors, including human and software errors. We expect these challenges to continue to occur, and potentially to increase as our traffic grows.

There may also be inherent challenges in measuring usage across our future user base around the world. For example, because these metrics are based on users with unique cookies, an individual who accesses our website from multiple devices with different cookies may be counted as multiple unique visitors, and multiple individuals who access our website from a shared device with a single cookie may be counted as a single unique visitor. In addition, although we will be implementing technology designed to block low-quality traffic, such as robots, spiders and other software, we may not be able to prevent all such traffic. For these and other reasons, the present and/or future calculations of our desktop unique visitors and mobile website unique visitors may not accurately reflect the number of people actually using our platform.

Our measures of traffic and other key metrics may differ from estimates published by third parties (other than those whose data we use to calculate our key metrics) or from similar metrics of our competitors. We will be continually seeking ways to improve our ability to measure these key metrics, and regularly review our processes to assess potential improvements to their accuracy. However, if our users, advertisers, partners and stockholders do not perceive our metrics to be accurate representations, or if we discover material inaccuracies in our metrics, our reputation may be harmed.

RISKS RELATED TO REGULATORY COMPLIANCE AND LEGAL MATTERS

We are, and may be in the future, subject to disputes and assertions by third parties that we violate their rights. These disputes may be costly to defend and could harm our business and operating results.

We may face from time to time in the future, allegations that we have violated the rights of third parties, including patent, trademark, copyright and other intellectual property rights, and the rights of current and former team members and/or future employees, users and business owners. The nature of our business also exposes us to claims relating to the information posted on our platform, including claims for defamation, libel, negligence and copyright or trademark infringement, among others. Businesses may in the future claim that we are responsible for the defamatory reviews posted by our users. We expect claims like these to potentially increase in proportion to the amount of content on our platform. In some instances, we may elect or be compelled to remove the content that is the subject of such claims or may be forced to pay substantial damages if we are unsuccessful in our efforts to defend against these claims. If we elect or are compelled to remove content from our platform, our products and services may become less useful to consumers and our traffic may decline, which would have a negative impact on our business.

We are also regularly exposed to claims based on allegations of infringement or other violations of intellectual property rights. Companies in the Internet, technology and media industries own large numbers of patent and other intellectual property rights, and frequently enter into litigation. Various “non-practicing entities” that own patents and other intellectual property rights also often aggressively attempt to assert their rights in order to extract value from technology companies. From time to time, we may receive notice letters from patent holders alleging that certain of our products and services infringe their patent rights. While we intend to pursue patent applications, we do not currently have any issued patents, and the contractual restrictions and trade secrets that protect our proprietary technology provide only limited safeguards against infringement. This may make it more difficult to defend certain of our intellectual property rights, particularly related to our core business.