Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TELEFLEX INC | exhibit991to5-4x20178xkxq1.htm |

| 8-K - 8-K - TELEFLEX INC | a5-4x20178xkreq12017earnin.htm |

1

Teleflex Incorporated

First Quarter 2017

Earnings Conference Call

2

Conference Call Logistics

The release, accompanying slides, and replay webcast are available online at

www.teleflex.com (click on “Investors”)

Telephone replay available by dialing 855-859-2056 or for international calls, 404-

537-3406, pass code number 12639722

3

Introductions

Benson Smith

Chairman and CEO

Liam Kelly

President and COO

Thomas Powell

Executive Vice President and CFO

Jake Elguicze

Treasurer and Vice President of Investor Relations

4

Note on Forward-Looking Statements

This presentation and our discussion contain forward-looking information and statements including, but not limited

to, forecasted 2017 GAAP and constant currency revenue growth, GAAP and adjusted gross and operating margins

and adjusted earnings per share and the items that are expected to impact each of those forecasted results;

estimated pre-tax charges we expect to incur and annualized pre-tax savings we expect to realize in connection with

our restructuring programs; our expectations with respect to when we will begin to realize savings from our

restructuring programs and when those programs will be substantially completed; our expectation with respect to

estimated annual increases in our revenue related to improved pricing with respect to certain of our kits; and other

matters which inherently involve risks and uncertainties which could cause actual results to differ from those

projected or implied in the forward–looking statements. These risks and uncertainties are addressed in our SEC

filings, including our most recent Form 10-K.

Note on Non-GAAP Financial Measures

This presentation refers to certain non-GAAP financial measures, including, but not limited to, constant currency

revenue growth, adjusted diluted earnings per share, adjusted gross and operating margins and adjusted tax rate.

These non-GAAP financial measures should not be considered replacements for, and should be read together with,

the most comparable GAAP financial measures. Tables reconciling these non-GAAP financial measures to the most

comparable GAAP financial measures are contained within the appendices to this presentation.

Additional Notes

Unless otherwise noted, the following slides reflect continuing operations.

5

Executive Summary

First quarter 2017 revenue of $487.9 million

• Up 14.8% vs. prior year period on an as-reported basis

• Up 16.0% vs. prior year period on a constant currency basis

• Q1’17 results include a partial quarter of contribution from Vascular Solutions which

added approximately 5% towards revenue growth during the quarter

First quarter 2017 Earnings Per Share

• GAAP EPS of $0.87, down 17.1% vs. prior year period

• Adjusted EPS of $1.80, up 18.4% vs. prior year period

2017 Full Year Financial Guidance

• Reaffirmed GAAP revenue growth range of 10.0% - 11.5%

• Reaffirmed constant currency revenue growth range of 12.5% - 14.0%

• Raised GAAP EPS range from $5.04 - $5.08 to $5.59 - $5.66

• Raised adjusted EPS range from $8.00 - $8.15 to $8.05 to $8.23

Note: See appendices for reconciliations of non-GAAP information

6

First Quarter Highlights

First quarter 2017 constant currency revenue growth of 16.0%

• Sales volume of existing products contributed 7.8% of constant currency growth,

including impact of five additional selling days in the quarter which contributed

approximately 6%

• Acquisitions contributed 5.8% of constant currency revenue growth, including

Vascular Solutions which contributed 5.1% and Cartika which contributed 0.7%

• Sales volume of new products contributed 1.8% of constant currency growth

• Pricing increases contributed 0.6% of constant currency growth

Note: See appendices for reconciliations of non-GAAP information

7

Segment Revenue Review

Q1’17 Q1’16

Constant Currency Revenue Commentary

Vascular N.A.: $93.8 million, up 14.8% Anesthesia N.A.: $48.2 million, up 4.7%

Surgical N.A.: $46.0 million, up 17.7% EMEA: $130.7 million, up 10.9%

Asia: $49.0 million, down 0.4% OEM: $43.3 million, up 28.4%

All Other: $76.9 million, up 45.0%

Note: Increases and decreases in revenue referred to above are as compared to results for the first quarter of 2016. See

appendices for reconciliations of non-GAAP information.

19%

9%

10%

27%

10%

9%

16%

Vascular North America Surgical North America

Anesthesia North America EMEA

Asia OEM

All Other

19%

9%

11%

29%

12%

8%

12%

Vascular North America Surgical North America

Anesthesia North America EMEA

Asia OEM

All Other

8

Group Purchasing Organization and IDN Review

Track record of expansion of contractual agreements continues in Q1’17

Group Purchasing Organization Update

• 9 renewed agreements

• 1 new agreement

• 1 existing agreement not renewed

IDN Update

• 7 renewed agreements

• 13 new agreements

9

Product Introductions and Regulatory Approvals

Spectre™ Guidewire

PRODUCT DESCRIPTION

Recently received FDA 510(k) clearance and

initiated U.S. commercial launch of the Spectre™

Guidewire, which is designed for premium

performance in coronary and peripheral

interventions with enhanced trackability and

torque control.

The Spectre™ Guidewire is engineered with a

smooth stainless steel-to-nitinol dual-core

transition that balances strength and agility.

The Spectre™ is a 0.014” guidewire available in

190 cm and 300 cm lengths with a distal

hydrophilic coating and a proximal PTFE coating.

Approximately 70% of guidewires used in

percutaneous coronary interventions (PCI) are

considered workhorse wires and are used to

deliver catheters, balloons, stents, and other

diagnostic and therapeutic devices. As a

workhorse wire, the Spectre™ Guidewire was

designed to be applicable to the majority of PCIs.

10

Product Introductions and Regulatory Approvals

Twin-Pass® Torque Dual Access Catheter

PRODUCT DESCRIPTION

Recently received FDA 510(k) clearance and

initiated both U.S. and international

commercial launch of the Twin-Pass® Torque

Dual Access Catheter.

The Twin-Pass® Torque Dual Access Catheter

contains both a rapid-exchange (RX) lumen

and an over-the-wire (OTW) lumen. With a

0.014” guidewire deployed through the RX

lumen into the main branch, the OTW lumen

can be used for guidewire exchange,

subsequent delivery of a second guidewire

into the side branch, or fluid injection to a

desired distal vessel segment.

Designed for procedures that call for the

delivery of two interventional guidewires from

a single catheter in clinical situations where

catheter delivery and torsional control are

paramount.

11

Product Introductions and Regulatory Approvals

TrapLiner™ Catheter

PRODUCT DESCRIPTION

Recently received FDA 510(k) clearance and

initiated U.S. commercial launch of the

TrapLiner™ Catheter.

The TrapLiner™ Catheter is similar in design

to Vascular Solutions’ popular GuideLiner

Guide Extension Catheter, with the added

feature of an integrated balloon for trapping a

standard 0.014” guidewire within a guide

catheter.

The TrapLiner™ Catheter can be used as an

alternative method to the trapping technique

that requires the use of a PTCA balloon to

exchange an existing over-the-wire catheter

while maintaining guidewire position. The

technique of guidewire trapping for catheter

exchange is most commonly performed in

complex interventional procedures.

12

Product Introductions and Regulatory Approvals

Arrow® AC3 Optimus™ Intra-Aortic Balloon Pump

PRODUCT DESCRIPTION

Recently received FDA 510(k) clearance for the AC3 Optimus™ Intra-Aortic

Balloon Pump (IABP).

This device helps a weakened heart pump blood and can deliver IABP

therapy to a broad range of patients, even those not previously considered

candidates for IABP therapy. Clinicians may use the pump on patients with

the most severe arrhythmias or with heart rates as high as 200 beats per

minute.1,2

The AC3 Optimus™ IABP has a third-generation AutoPilot Mode, which

uses proprietary algorithms to address key clinical challenges and to

simplify the delivery of IABP therapy.3 In AutoPilot Mode, the AC3

Optimus™ IABP automatically adjusts timing and triggering parameters,

freeing clinicians to focus on the patient rather than the pump. In addition,

the AC3 Optimus™ IABP includes several exclusive algorithms, such as

WAVE Inflation Timing, Deflation Timing Management, and Best Signal

Analysis, which optimize key functions of the IABP to deliver therapy to

the most challenging patients.

1. Schreuder J, Castiglioni A, Donelli A, et al. Automatic intraaortic balloon pump timing using an intra beat

dicrotic notch prediction algorithm. Ann Thorac Surg. 2005;79(3):1017-1022. Study sponsored by Teleflex.

2. Donelli A, Jansen JRC, Hoeksel B, et al. Performance of a real-time dicrotic notch detection and prediction

algorithm in arrhythmic human aortic pressure signals. J Clin Monit. 2002;17(3-4):181-185. Study sponsored

by Teleflex.

3. Torracca, L. Overcoming electro-surgical inference in IABP therapy with the combined use of AutoPilot and

FiberOptix IAB sensor signal. 2007. (case report, data on file). Study sponsored by Teleflex.

13

Acquisition Update

Completed acquisition of Pyng Medical

• Pyng Medical commercializes trauma and resuscitation products for front-line

critical care and emergency medical personnel

• Product portfolio includes a variety of innovative, lifesaving tools, including

intraosseous infusion, pelvic stabilization, hemorrhage control and emergency

airway management

• All-cash transaction, which is accretive on a Non-GAAP basis, completed in April

2017 enhances Teleflex product offerings for the military and civilian trauma markets

and builds upon previous acquisitions in the emergency medicine field (i.e. Vidacare

and LMA)

14

Restructuring Update

2017 Vascular Solutions Integration Program

During the first quarter 2017, we committed to a restructuring program related to the integration of Vascular

Solutions' operations with our operations. We initiated the program in the first quarter 2017 and expect the

program to be substantially completed by the end of the second quarter 2018. We estimate that we will

record aggregate pretax restructuring charges of $6.0 million to $7.5 million related to this program, of which

$4.5 million to $5.3 million will constitute termination benefits, and $1.5 million to $2.2 million will relate to

other exit costs, including employee relocation and outplacement costs. Additionally, we expect to incur

$2.5 million to $3.0 million of restructuring related charges consisting primarily of retention bonuses offered

to certain employees expected to remain with the Company after completion of the program. All of these

charges will result in future cash outlays.

We began realizing program-related synergies in the first quarter 2017 and expect to achieve annualized pre-

tax synergies of $20 million to $25 million once the program is fully implemented.

2017 EMEA Restructuring Program

During the first quarter 2017, we committed to a restructuring program to centralize certain administrative

functions in Europe. The program will commence in the second quarter 2017 and is expected to be

substantially completed by the end of 2018. We estimate that we will record aggregate pre-tax restructuring

charges of $7.1 million to $8.5 million related to this program, almost all of which constitute termination

benefits, and all of which will result in future cash outlays.

We expect to achieve annualized pre-tax savings of $2.7 million to $3.3 million once the program is fully

implemented and expect to begin realizing plan related savings in the first quarter 2018.

15

Restructuring Update

In addition to the restructuring programs initiated during the first quarter 2017, we have other ongoing

restructuring programs related to the consolidation of our manufacturing operations (referred to as

our 2016 and 2014 footprint realignment plans) as well as restructuring programs designed to

improve operating efficiencies and reduce costs. With respect to our restructuring plans and

programs, the following table summarizes (1) the estimated total cost and estimated annual pre-tax

savings once the programs are completed; (2) the costs incurred and estimated pre-tax savings

realized through December 31, 2016; and (3) the costs expected to be incurred and estimated

incremental pre-tax savings estimated to be realized for these programs from January 1, 2017 through

the anticipated completion dates:

Dollars

in Millions

Estimated

Total

Through

December 31, 2016

Estimated remaining from

January 1, 2017 through

December 31, 2021 2

Restructuring charges $51 to $60 $33 $18 to $27

Restructuring related charges 1 $53 to $65 $30 $23 to $35

Total charges $104 to $125 $63 $41 to $62

Pre-tax savings 3 $60 to $71 $31 $29 to $40

Vascular Solutions integration

program - synergies

$20 to $25 ̶ $20 to $25

1. Restructuring related charges principally constitute accelerated depreciation and other costs primarily related to the transfer of manufacturing operations to new locations and are expected to be recognized

primarily in cost of goods sold.

2. We expect to incur substantially all of the costs prior to the end of 2018, and to have realized substantially all of the estimated annual pre-tax savings and synergies by the year ended December 31, 2019.

3. Approximately 65% of the savings is expected to result in reductions to cost of goods sold. During 2016, in connection with our execution of the 2014 footprint realignment plan, we implemented changes to

medication delivery devices included in certain of our kits, which are expected to result in increased product costs (and therefore reduce the annual savings that were estimated at the inception of the program).

However, we also expect to achieve improved pricing on these kits to offset the cost, which is expected to result in estimated annual increased revenues of $5 million to $6 million. We expect to begin realizing

the benefits of this incremental pricing in 2017. Savings generated from restructuring programs are difficult to estimate, given the nature and timing of the restructuring activities and the possibility that

unanticipated expenditures may be required as the program progresses. Moreover, predictions of revenues related to increased pricing are particularly uncertain and can be affected by a number of factors,

including customer resistance to price increases and competition.

16

First Quarter Financial Review

Revenue of $487.9 million

• Up 14.8% vs. prior year period on an as-reported basis

• Up 16.0% vs. prior year period on a constant currency basis

Gross Margin

• GAAP gross margin of 52.4%, down 60 bps vs. prior year period

• Adjusted gross margin of 54.7%, up 110 bps vs. prior year period

Operating Margin

• GAAP operating margin of 12.5%, down 340 bps vs. prior year period

• Adjusted operating margin of 23.4%, up 100 bps vs. prior year period

Tax Rate

• GAAP tax rate of (7.1%), down 1,200 bps vs. prior year period

• Adjusted tax rate of 16.1%, down 290 bps vs. prior year period

Earnings Per Share

• GAAP EPS of $0.87, down 17.1% vs. prior year period

• Adjusted EPS of $1.80, up 18.4% vs. prior year period

Note: See appendices for reconciliations of non-GAAP information

17

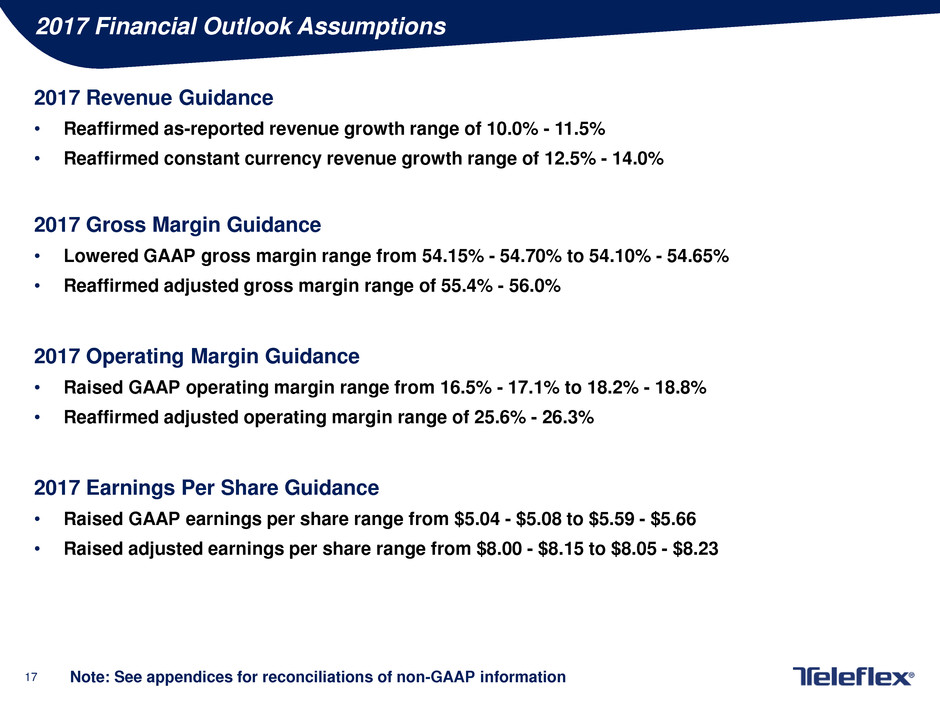

2017 Financial Outlook Assumptions

2017 Revenue Guidance

• Reaffirmed as-reported revenue growth range of 10.0% - 11.5%

• Reaffirmed constant currency revenue growth range of 12.5% - 14.0%

2017 Gross Margin Guidance

• Lowered GAAP gross margin range from 54.15% - 54.70% to 54.10% - 54.65%

• Reaffirmed adjusted gross margin range of 55.4% - 56.0%

2017 Operating Margin Guidance

• Raised GAAP operating margin range from 16.5% - 17.1% to 18.2% - 18.8%

• Reaffirmed adjusted operating margin range of 25.6% - 26.3%

2017 Earnings Per Share Guidance

• Raised GAAP earnings per share range from $5.04 - $5.08 to $5.59 - $5.66

• Raised adjusted earnings per share range from $8.00 - $8.15 to $8.05 - $8.23

Note: See appendices for reconciliations of non-GAAP information

18

Any Questions?

19

Thank You

20

Appendices

21

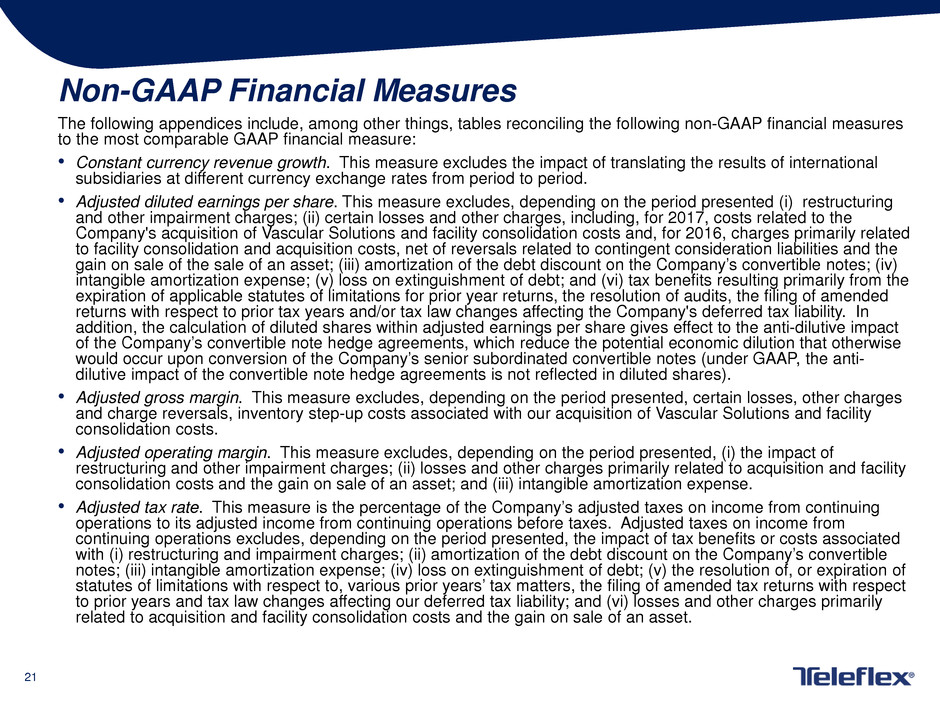

Non-GAAP Financial Measures

The following appendices include, among other things, tables reconciling the following non-GAAP financial measures

to the most comparable GAAP financial measure:

• Constant currency revenue growth. This measure excludes the impact of translating the results of international

subsidiaries at different currency exchange rates from period to period.

• Adjusted diluted earnings per share. This measure excludes, depending on the period presented (i) restructuring

and other impairment charges; (ii) certain losses and other charges, including, for 2017, costs related to the

Company's acquisition of Vascular Solutions and facility consolidation costs and, for 2016, charges primarily related

to facility consolidation and acquisition costs, net of reversals related to contingent consideration liabilities and the

gain on sale of the sale of an asset; (iii) amortization of the debt discount on the Company’s convertible notes; (iv)

intangible amortization expense; (v) loss on extinguishment of debt; and (vi) tax benefits resulting primarily from the

expiration of applicable statutes of limitations for prior year returns, the resolution of audits, the filing of amended

returns with respect to prior tax years and/or tax law changes affecting the Company's deferred tax liability. In

addition, the calculation of diluted shares within adjusted earnings per share gives effect to the anti-dilutive impact

of the Company’s convertible note hedge agreements, which reduce the potential economic dilution that otherwise

would occur upon conversion of the Company’s senior subordinated convertible notes (under GAAP, the anti-

dilutive impact of the convertible note hedge agreements is not reflected in diluted shares).

• Adjusted gross margin. This measure excludes, depending on the period presented, certain losses, other charges

and charge reversals, inventory step-up costs associated with our acquisition of Vascular Solutions and facility

consolidation costs.

• Adjusted operating margin. This measure excludes, depending on the period presented, (i) the impact of

restructuring and other impairment charges; (ii) losses and other charges primarily related to acquisition and facility

consolidation costs and the gain on sale of an asset; and (iii) intangible amortization expense.

• Adjusted tax rate. This measure is the percentage of the Company’s adjusted taxes on income from continuing

operations to its adjusted income from continuing operations before taxes. Adjusted taxes on income from

continuing operations excludes, depending on the period presented, the impact of tax benefits or costs associated

with (i) restructuring and impairment charges; (ii) amortization of the debt discount on the Company’s convertible

notes; (iii) intangible amortization expense; (iv) loss on extinguishment of debt; (v) the resolution of, or expiration of

statutes of limitations with respect to, various prior years’ tax matters, the filing of amended tax returns with respect

to prior years and tax law changes affecting our deferred tax liability; and (vi) losses and other charges primarily

related to acquisition and facility consolidation costs and the gain on sale of an asset.

22

APPENDIX A –

RECONCILIATION OF CONSTANT CURRENCY REVENUE GROWTH

DOLLARS IN MILLIONS

April 2, 2017 March 27, 2016 Constant Currency Currency Total

Vascular North America 93.8$ 81.5$ 14.8% 0.2% 15.0%

Anesthesia North America 48.2 46.0 4.7% 0.2% 4.9%

Surgical North America 46.0 38.9 17.7% 0.3% 18.0%

EMEA 130.7 122.1 10.9% (3.8%) 7.1%

Asia 49.0 49.2 (0.4%) 0.0% (0.4%)

OEM 43.3 34.0 28.4% (0.8%) 27.6%

All Other 76.9 53.2 45.0% (0.5%) 44.5%

Net Revenues 487.9$ 424.9$ 16.0% (1.2%) 14.8%

Three Months Ended % Increase / (Decrease)

23

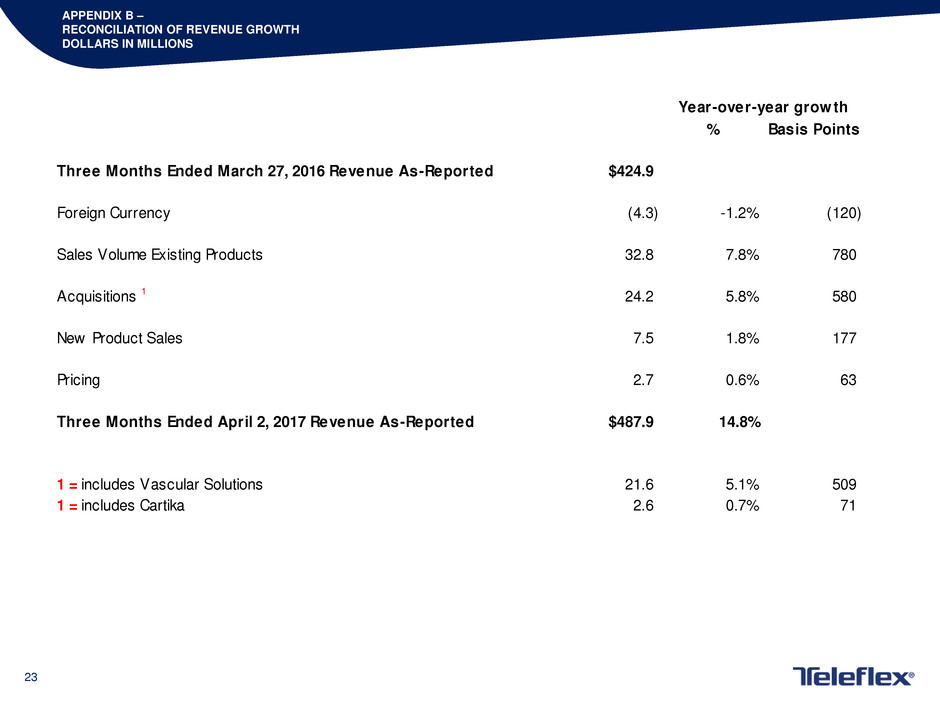

APPENDIX B –

RECONCILIATION OF REVENUE GROWTH

DOLLARS IN MILLIONS

% Basis Points

Three Months Ended March 27, 2016 Revenue As-Reported $424.9

Foreign Currency (4.3) -1.2% (120)

Sales Volume Existing Products 32.8 7.8% 780

Acquisitions 1 24.2 5.8% 580

New Product Sales 7.5 1.8% 177

Pricing 2.7 0.6% 63

Three Months Ended April 2, 2017 Revenue As-Reported $487.9 14.8%

1 = includes Vascular Solutions 21.6 5.1% 509

1 = includes Cartika 2.6 0.7% 71

Year-over-year growth

24

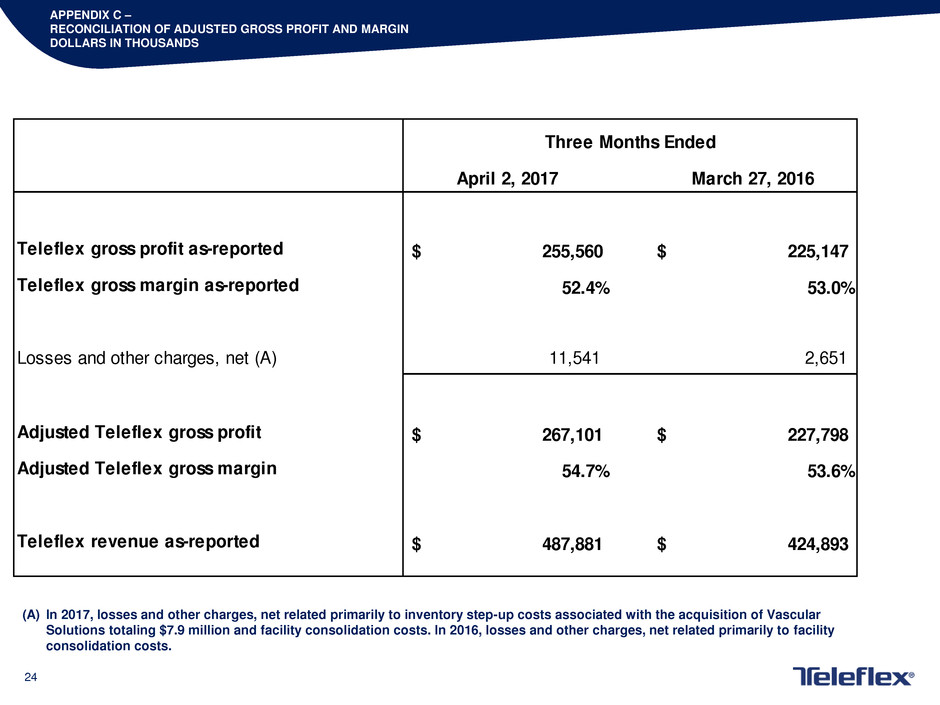

APPENDIX C –

RECONCILIATION OF ADJUSTED GROSS PROFIT AND MARGIN

DOLLARS IN THOUSANDS

April 2, 2017 March 27, 2016

Teleflex gross profit as-reported 255,560$ 225,147$

Teleflex gross margin as-reported 52.4% 53.0%

Losses and other charges, net (A) 11,541 2,651

Adjusted Teleflex gross profit 267,101$ 227,798$

Adjusted Teleflex gross margin 54.7% 53.6%

Teleflex revenue as-reported 487,881$ 424,893$

Three Months Ended

(A) In 2017, losses and other charges, net related primarily to inventory step-up costs associated with the acquisition of Vascular

Solutions totaling $7.9 million and facility consolidation costs. In 2016, losses and other charges, net related primarily to facility

consolidation costs.

25

APPENDIX D –

RECONCILIATION OF ADJUSTED OPERATING PROFIT AND MARGIN

DOLLARS IN THOUSANDS

(A) In 2017, losses and other charges, net related primarily to costs associated with the acquisition of Vascular Solutions and facility consolidation

costs. In 2016, losses and other charges, net related primarily to facility consolidation costs and the gain on sale of an asset.

April 2, 2017 March 27, 2016

Teleflex income from continuing operations before interest and taxes 60,819$ 67,497$

Teleflex income from continuing operations before interest and taxes margin 12.5% 15.9%

Restructuring and other impairment charges 12,945 9,968

Losses and other charges, net (A) 21,377 2,271

Intangible amortization expense 18,785 15,357

Adjusted Teleflex income from continuing operations before interest, taxes and

intangible amortization expense 113,926$ 95,093$

Adjusted Teleflex income from continuing operations before interest, taxes and

intangible amortization expense margin 23.4% 22.4%

Teleflex revenue as-reported 487,881$ 424,893$

Three Months Ended

26

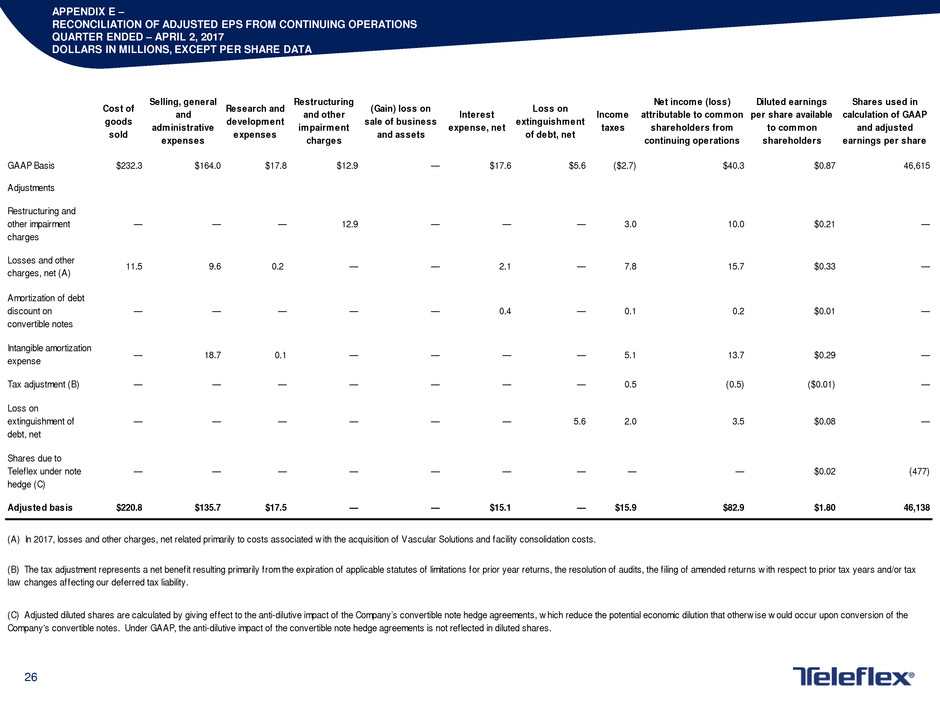

APPENDIX E –

RECONCILIATION OF ADJUSTED EPS FROM CONTINUING OPERATIONS

QUARTER ENDED – APRIL 2, 2017

DOLLARS IN MILLIONS, EXCEPT PER SHARE DATA

Cost of

goods

sold

Selling, general

and

administrative

expenses

Research and

development

expenses

Restructuring

and other

impairment

charges

(Gain) loss on

sale of business

and assets

Interest

expense, net

Loss on

extinguishment

of debt, net

Income

taxes

Net income (loss)

attributable to common

shareholders from

continuing operations

Diluted earnings

per share available

to common

shareholders

Shares used in

calculation of GAAP

and adjusted

earnings per share

GAAP Basis $232.3 $164.0 $17.8 $12.9 — $17.6 $5.6 ($2.7) $40.3 $0.87 46,615

Adjustments

Restructuring and

other impairment

charges

— — — 12.9 — — — 3.0 10.0 $0.21 —

Losses and other

charges, net (A)

11.5 9.6 0.2 — — 2.1 — 7.8 15.7 $0.33 —

Amortization of debt

discount on

convertible notes

— — — — — 0.4 — 0.1 0.2 $0.01 —

Intangible amortization

expense

— 18.7 0.1 — — — — 5.1 13.7 $0.29 —

Tax adjustment (B) — — — — — — — 0.5 (0.5) ($0.01) —

Loss on

extinguishment of

debt, net

— — — — — — 5.6 2.0 3.5 $0.08 —

Shares due to

Teleflex under note

hedge (C)

— — — — — — — — — $0.02 (477)

Adjusted basis $220.8 $135.7 $17.5 — — $15.1 — $15.9 $82.9 $1.80 46,138

(A) In 2017, losses and other charges, net related primarily to costs associated w ith the acquisition of Vascular Solutions and facility consolidation costs.

(B) The tax adjustment represents a net benefit resulting primarily from the expiration of applicable statutes of limitations for prior year returns, the resolution of audits, the f iling of amended returns w ith respect to prior tax years and/or tax

law changes affecting our deferred tax liability.

(C) Adjusted diluted shares are calculated by giving effect to the anti-dilutive impact of the Company’s convertible note hedge agreements, w hich reduce the potential economic dilution that otherw ise w ould occur upon conversion of the

Company's convertible notes. Under GAAP, the anti-dilutive impact of the convertible note hedge agreements is not reflected in diluted shares.

27

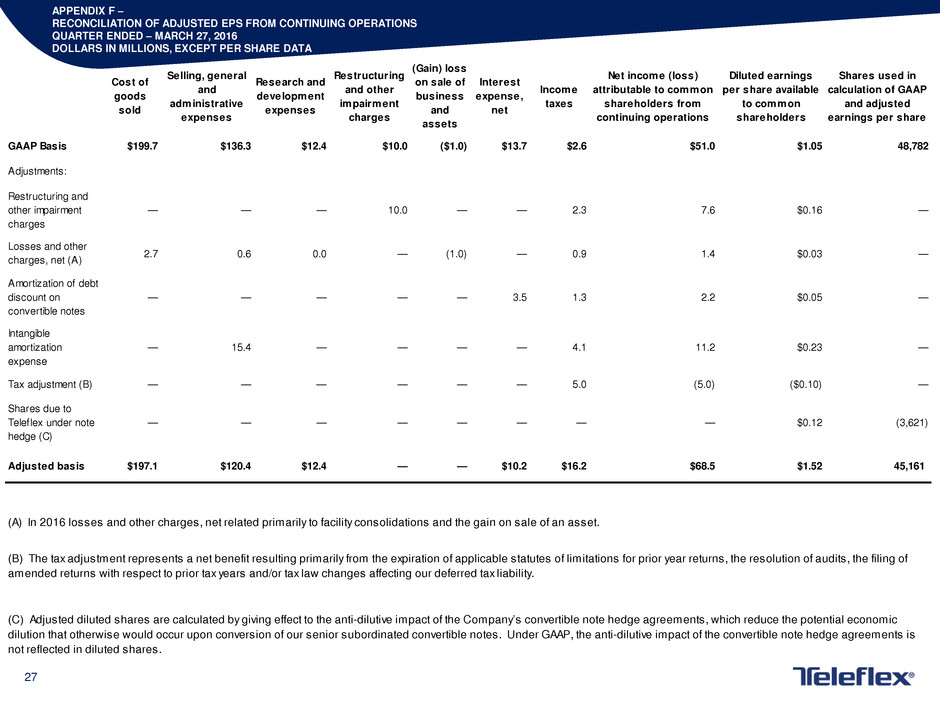

APPENDIX F –

RECONCILIATION OF ADJUSTED EPS FROM CONTINUING OPERATIONS

QUARTER ENDED – MARCH 27, 2016

DOLLARS IN MILLIONS, EXCEPT PER SHARE DATA

Cost of

goods

sold

Selling, general

and

administrative

expenses

Research and

development

expenses

Restructuring

and other

impairment

charges

(Gain) loss

on sale of

business

and

assets

Interest

expense,

net

Income

taxes

Net income (loss)

attributable to common

shareholders from

continuing operations

Diluted earnings

per share available

to common

shareholders

Shares used in

calculation of GAAP

and adjusted

earnings per share

GAAP Basis $199.7 $136.3 $12.4 $10.0 ($1.0) $13.7 $2.6 $51.0 $1.05 48,782

Adjustments:

Restructuring and

other impairment

charges

— — — 10.0 — — 2.3 7.6 $0.16 —

Losses and other

charges, net (A)

2.7 0.6 0.0 — (1.0) — 0.9 1.4 $0.03 —

Amortization of debt

discount on

convertible notes

— — — — — 3.5 1.3 2.2 $0.05 —

Intangible

amortization

expense

— 15.4 — — — — 4.1 11.2 $0.23 —

Tax adjustment (B) — — — — — — 5.0 (5.0) ($0.10) —

Shares due to

Teleflex under note

hedge (C)

— — — — — — — — $0.12 (3,621)

Adjusted basis $197.1 $120.4 $12.4 — — $10.2 $16.2 $68.5 $1.52 45,161

(A) In 2016 losses and other charges, net related primarily to facility consolidations and the gain on sale of an asset.

(B) The tax adjustment represents a net benefit resulting primarily from the expiration of applicable statutes of limitations for prior year returns, the resolution of audits, the filing of

amended returns with respect to prior tax years and/or tax law changes affecting our deferred tax liability.

(C) Adjusted diluted shares are calculated by giving effect to the anti-dilutive impact of the Company’s convertible note hedge agreements, which reduce the potential economic

dilution that otherwise would occur upon conversion of our senior subordinated convertible notes. Under GAAP, the anti-dilutive impact of the convertible note hedge agreements is

not reflected in diluted shares.

28

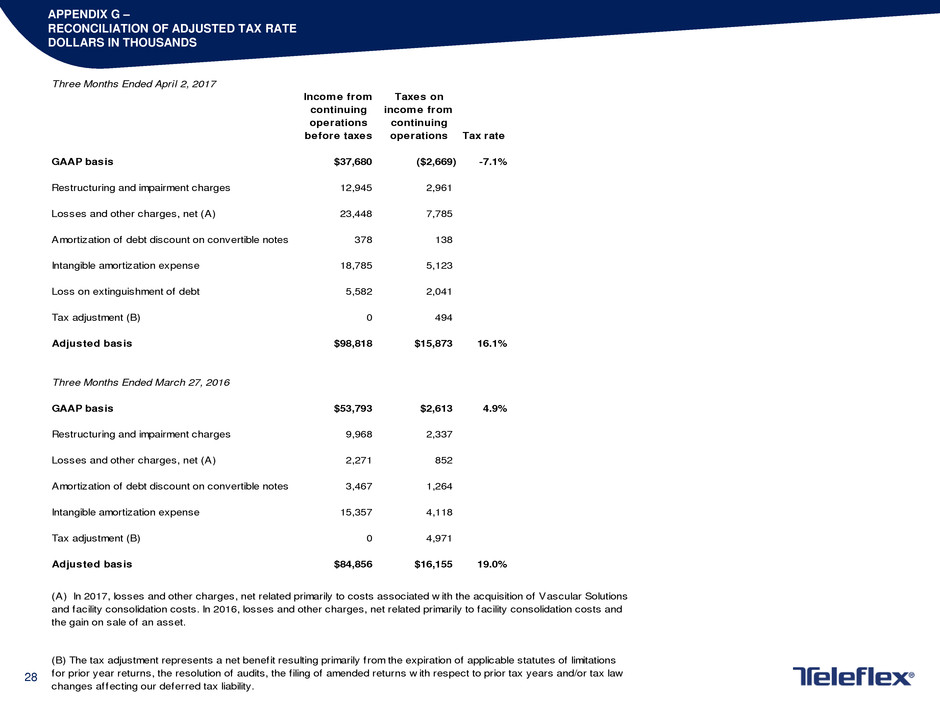

APPENDIX G –

RECONCILIATION OF ADJUSTED TAX RATE

DOLLARS IN THOUSANDS

Three Months Ended April 2, 2017

Income from

continuing

operations

before taxes

Taxes on

income from

continuing

operations Tax rate

GAAP basis $37,680 ($2,669) -7.1%

Restructuring and impairment charges 12,945 2,961

Losses and other charges, net (A) 23,448 7,785

Amortization of debt discount on convertible notes 378 138

Intangible amortization expense 18,785 5,123

Loss on extinguishment of debt 5,582 2,041

Tax adjustment (B) 0 494

Adjusted basis $98,818 $15,873 16.1%

Three Months Ended March 27, 2016

GAAP basis $53,793 $2,613 4.9%

Restructuring and impairment charges 9,968 2,337

Losses and other charges, net (A) 2,271 852

Amortization of debt discount on convertible notes 3,467 1,264

Intangible amortization expense 15,357 4,118

Tax adjustment (B) 0 4,971

Adjusted basis $84,856 $16,155 19.0%

(B) The tax adjustment represents a net benefit resulting primarily from the expiration of applicable statutes of limitations

for prior year returns, the resolution of audits, the f iling of amended returns w ith respect to prior tax years and/or tax law

changes affecting our deferred tax liability.

(A) In 2017, losses and other charges, net related primarily to costs associated w ith the acquisition of Vascular Solutions

and facility consolidation costs. In 2016, losses and other charges, net related primarily to facility consolidation costs and

the gain on sale of an asset.

29

APPENDIX H –

RECONCILIATION OF 2017 CONSTANT CURRENCY REVENUE GROWTH GUIDANCE

Low High

Forecasted GAAP Revenue Growth 10.0% 11.5%

Estimated Impact of Foreign Currency Exchange Rate Fluctuations 2.5% 2.5%

Forecasted Constant Currency Revenue Growth 12.5% 14.0%

30

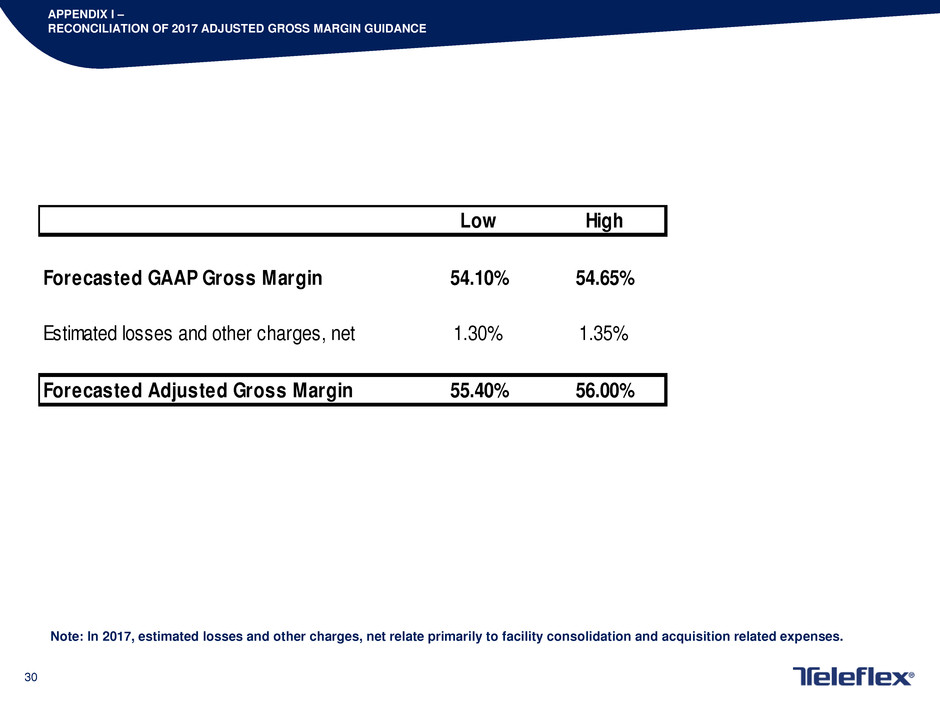

APPENDIX I –

RECONCILIATION OF 2017 ADJUSTED GROSS MARGIN GUIDANCE

Note: In 2017, estimated losses and other charges, net relate primarily to facility consolidation and acquisition related expenses.

Low High

Forecasted GAAP Gross Margin 54.10% 54.65%

Estimated losses and other charges, net 1.30% 1.35%

Forecasted Adjusted Gross Margin 55.40% 56.00%

31

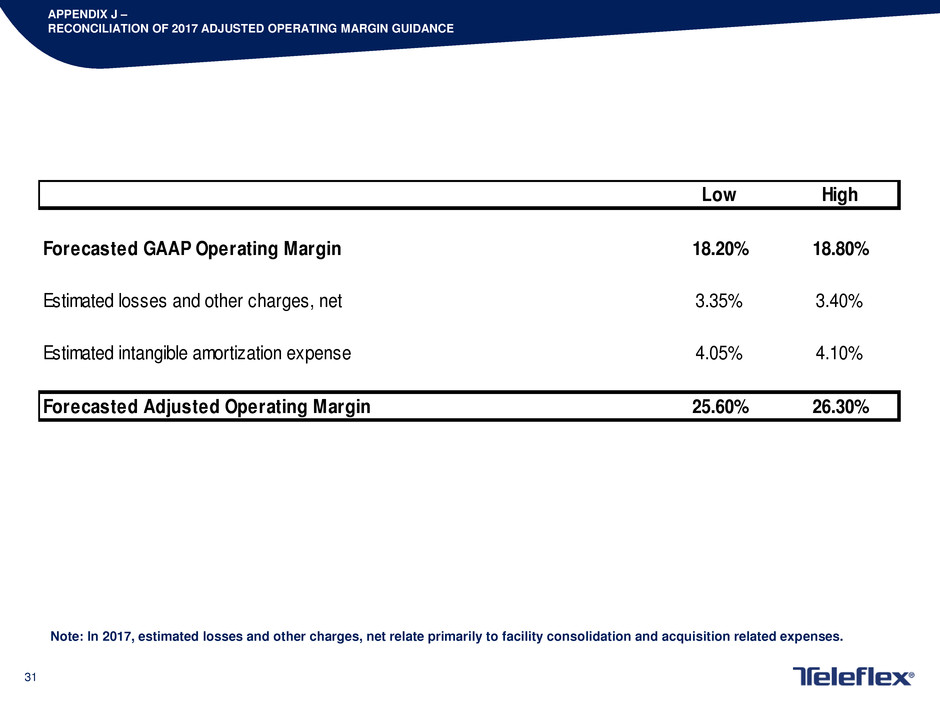

APPENDIX J –

RECONCILIATION OF 2017 ADJUSTED OPERATING MARGIN GUIDANCE

Note: In 2017, estimated losses and other charges, net relate primarily to facility consolidation and acquisition related expenses.

Low High

Forecasted GAAP Operating Margin 18.20% 18.80%

Estimated losses and other charges, net 3.35% 3.40%

Estimated intangible amortization expense 4.05% 4.10%

Forecasted Adjusted Operating Margin 25.60% 26.30%

32

APPENDIX K –

RECONCILIATION OF 2017 ADJUSTED EARNINGS PER SHARE GUIDANCE

Low High

Forecasted diluted earnings per share attributable to common shareholders $5.59 $5.66

Restructuring, impairment charges and special items, net of tax $1.15 $1.20

Intangible amortization expense, net of tax $1.30 $1.35

Amortization of debt discount on convertible notes, net of tax $0.01 $0.02

Forecasted adjusted diluted earnings per share $8.05 $8.23