Attached files

| file | filename |

|---|---|

| EX-95.1 - EXHIBIT 95.1 - MINE SAFETY DISCLOSURE - KLONDEX MINES LTD | exhibit951-minesafetydiscl.htm |

| EX-32.1 - EXHIBIT 32.1 - CERTIFICATION OF PEO AND PFO - KLONDEX MINES LTD | exhibit321-certificationof.htm |

| EX-31.2 - EXHIBIT 31.2 - CERTIFICATION OF PRINCIPAL FINANCIAL OFFICER - KLONDEX MINES LTD | exhibit312-certificationof.htm |

| EX-31.1 - EXHIBIT 31.1 - CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER - KLONDEX MINES LTD | exhibit311-certificationof.htm |

| EX-23.1 - EXHIBIT 23.1 - CONSENT OF BRIAN MORRIS - KLONDEX MINES LTD | exhibit231-consentofbrianm.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2017

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to

Commission file number: 001-37563

KLONDEX MINES LTD.

(Exact name of registrant as specified in its charter)

British Columbia | 98-1153397 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

6110 Plumas Street Suite A Reno, Nevada | 89519 | |

(Address of principal executive offices) | (Zip Code) | |

(775) 284-5757

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | o | Accelerated filer | ý | |||

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o | |||

Emerging growth company | ý | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 7(a)(2)(B) of the Securities Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

On May 2, 2017, there were 177,319,560 shares of the registrant's common stock with no par value per share, outstanding.

KLONDEX MINES LTD.

FORM 10-Q

For the Quarter Ended March 31, 2017

INDEX

Page | ||||

Cautionary statement regarding forward-looking statements

This Quarterly Report on Form 10-Q contains forward-looking information within the meaning of Canadian securities laws and forward-looking statements within th meaning of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the "Securities Act") (collectively, "forward-looking statements"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and are intended to be covered by the safe harbors provided by these regulations. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, identified by words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “potential”, “possible” or variations thereof or stating that certain actions, events, conditions or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements. Our forward-looking statements may include, without limitation, statements with respect to:

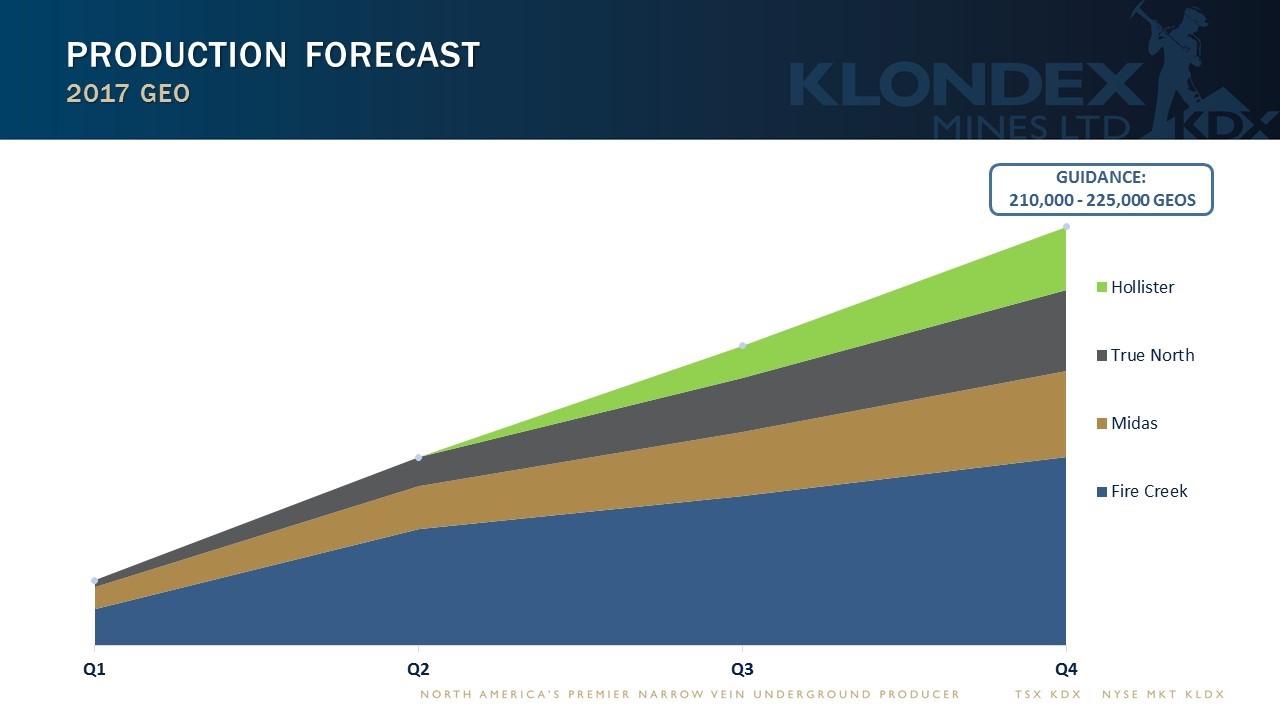

• | statements, tables and graphs under the headings "2017 full year outlook" and "Production forecast"; |

• | estimates of future mineral production, mining activities and sales (including graphs or other visual representations of future production forecasts); |

• | estimates of future production costs and other expenses for specific operations and on a consolidated basis; |

• | estimates of future capital expenditures, construction or production activities and other cash needs, for specific operations and on a consolidated basis, and expectations as to the funding or timing thereof; |

• | estimates as to the projected development of certain mineral projects, such as Hollister (as defined herein), including the timing of such development, the costs of such development and other capital costs, financing plans for these deposits and expected production commencement dates; |

• | estimates of mineral reserves and mineral resources, timing of updated studies and statements regarding future exploration; |

• | statements regarding the availability of, and, terms and costs related to, future borrowing and financing; |

• | estimates regarding future exploration expenditures, results and reserves; |

• | estimates regarding potential cost savings, productivity and operating performance; |

• | expectations regarding the start-up time, design, mine life, mill availability, production and costs applicable to sales and exploration potential of our mines and projects; |

• | statements regarding future transactions; and |

• | statements regarding the impacts of changes in the legal and regulatory environment in which we operate. |

Forward-looking statements have been based upon our current business and operating plans, as approved by our Board of Directors; our cash and other funding requirements and timing and sources thereof; results of pre-feasibility and technical reports; mineral resource and reserve estimates; exploration activities; any required permitting processes; and current market conditions and project development plans. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation:

• | the prices of gold, silver, and other metals and commodities; |

• | the cost of operations; |

• | currency fluctuations; |

• | inflation or deflation; |

• | geological and metallurgical assumptions; |

• | risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of our mineral deposits; |

• | operating performance of equipment, processes and facilities; including the impact of weather on such operating performance; |

• | timing of receipt of necessary governmental permits or approvals; |

• | domestic and foreign laws or regulations, particularly relating to the environment, mining and processing; |

• | changes in tax laws; |

• | domestic and international economic and political conditions; |

• | our ability to obtain or maintain necessary financing; |

• | other risks and hazards associated with mining operations; |

• | uncertainty of estimates of capital costs, operating costs, production and economic returns; |

1

• | uncertainty related to inferred mineral resources; |

• | labor relations and our need and/or ability to attract and retain qualified management and technical personnel; and |

• | increased regulatory compliance costs relating to the Dodd-Frank Wall Street Reform and Consumer Protection Act |

The foregoing list is not exhaustive of the factors that may affect any of our forward-looking statements. Forward-looking statements are statements about the future and are inherently uncertain, and our actual achievements or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in this Quarterly Report on Form 10-Q under the heading “Risk Factors” and in our Annual Report on Form 10-K.

Our forward-looking statements contained in this Quarterly Report on Form 10-Q are based on the beliefs, expectations and opinions of management as of the date of this report. We do not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change, except as required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

Cautionary note to U.S. investors regarding estimates of measured, indicated and inferred resources and proven and probable reserves

As used in this Quarterly Report on Form 10-Q, the terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101-Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (CIM)-CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (“CIM Definition Standards”).

These definitions differ from the definitions in the U.S. Securities and Exchange Commission's ("SEC") Industry Guide 7 (“SEC Industry Guide 7”) under the Exchange Act.

The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in, and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that all or any part of a mineral deposit in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all, or any part, of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable.

Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report in place tonnage and grade without reference to unit measures for mineralization that does not constitute “reserves” by SEC standards. Accordingly, information contained in this report and the documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

The term “mineralized material” as used in this Quarterly Report on Form 10-Q, although permissible under SEC Industry Guide 7, does not indicate “reserves” by SEC Industry Guide 7 standards. We cannot be certain that any part of the mineralized material will ever be confirmed or converted into SEC Industry Guide 7 compliant “reserves”. Investors are cautioned not to assume that all or any part of the mineralized material will ever be confirmed or converted into reserves or that mineralized material can be economically or legally extracted. Brian Morris, our Vice President, Exploration and Geological Services (who is a "qualified person" for purposes of NI 43-101), has approved the disclosure of all the scientific and technical information contained in this Quarterly Report on Form 10-Q.

2

Table of Contents

PART I - FINANCIAL INFORMATION Item 1. Financial Statements |

KLONDEX MINES LTD. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) (US dollars in thousands) |

Note | March 31, 2017 | December 31, 2016 | ||||||||

Assets | ||||||||||

Current assets | ||||||||||

Cash and cash equivalents | $ | 29,554 | $ | 47,636 | ||||||

Inventories | 3 | 31,511 | 21,310 | |||||||

Prepaid expenses and other | 4 | 5,834 | 4,678 | |||||||

Derivative assets | 9 | 644 | 1,247 | |||||||

Total current assets | 67,543 | 74,871 | ||||||||

Mineral properties, plant and equipment, net | 5 | 280,460 | 276,223 | |||||||

Derivative assets | 9 | 582 | 1,545 | |||||||

Restricted cash | 10,055 | 10,055 | ||||||||

Deferred tax assets | 16,852 | 17,284 | ||||||||

Total assets | $ | 375,492 | $ | 379,978 | ||||||

Liabilities | ||||||||||

Current liabilities | ||||||||||

Accounts payable | $ | 26,255 | $ | 23,774 | ||||||

Accrued compensation and benefits | 4,458 | 4,672 | ||||||||

Derivative liabilities | 9 | 1,506 | 1,721 | |||||||

Debt | 6 | 8,951 | 8,502 | |||||||

Interest payable | — | 23 | ||||||||

Provision for legal settlement | 17 | 3,000 | 3,000 | |||||||

Income taxes payable | 633 | — | ||||||||

Total current liabilities | 44,803 | 41,692 | ||||||||

Derivative liabilities | 9 | — | 331 | |||||||

Debt | 6 | 19,198 | 21,689 | |||||||

Deferred share units liability | 8 | 728 | 812 | |||||||

Asset retirement obligations | 7 | 25,829 | 25,436 | |||||||

Deferred tax liabilities | 11,772 | 11,964 | ||||||||

Total liabilities | 102,330 | 101,924 | ||||||||

Shareholders' Equity | ||||||||||

Unlimited common shares authorized, no par value; 177,312,560 and 175,251,538 issued and outstanding at March 31, 2017 and December 31, 2016, respectively | — | — | ||||||||

Additional paid-in capital | 367,824 | 363,899 | ||||||||

Accumulated deficit | (68,507 | ) | (58,280 | ) | ||||||

Accumulated other comprehensive loss | (26,155 | ) | (27,565 | ) | ||||||

Total shareholders' equity | 273,162 | 278,054 | ||||||||

Total liabilities and shareholders' equity | $ | 375,492 | $ | 379,978 | ||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

3

Table of Contents

KLONDEX MINES LTD. CONDENSED CONSOLIDATED STATEMENTS OF (LOSS) INCOME (Unaudited) (US dollars in thousands, except per share amounts) |

Three months ended March 31, | ||||||||||

Note | 2017 | 2016 | ||||||||

Revenues | $ | 41,710 | $ | 36,441 | ||||||

Cost of sales | ||||||||||

Production costs | 26,229 | 20,331 | ||||||||

Depreciation and depletion | 7,728 | 5,803 | ||||||||

Write-down of production inventories | 3 | 3,680 | — | |||||||

4,073 | 10,307 | |||||||||

Other operating expenses | ||||||||||

General and administrative | 4,488 | 3,418 | ||||||||

Exploration | 127 | 1,612 | ||||||||

Development and projects costs | 5,505 | 766 | ||||||||

Asset retirement and accretion | 381 | 247 | ||||||||

Business acquisition costs | — | 709 | ||||||||

Loss on equipment disposal | 116 | — | ||||||||

Income (loss) from operations | (6,544 | ) | 3,555 | |||||||

Other income (expense) | ||||||||||

(Loss) on derivatives, net | 9 | (2,144 | ) | (5,644 | ) | |||||

Interest (expense), net | 6 | (1,158 | ) | (1,387 | ) | |||||

Foreign currency (loss), net | (1,021 | ) | (2,554 | ) | ||||||

Interest income and other, net | 17 | 51 | ||||||||

Income before tax | (10,850 | ) | (5,979 | ) | ||||||

Income tax (expense) benefit | 13 | 623 | (684 | ) | ||||||

Net (loss) | $ | (10,227 | ) | $ | (6,663 | ) | ||||

Net (loss) per share | ||||||||||

Basic | 14 | $ | (0.06 | ) | $ | (0.05 | ) | |||

Diluted | 14 | $ | (0.06 | ) | $ | (0.05 | ) | |||

The accompanying notes are an integral part of the condensed consolidated financial statements.

4

Table of Contents

KLONDEX MINES LTD. CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME (Unaudited) (US dollars in thousands) |

Three months ended March 31, | ||||||||

2017 | 2016 | |||||||

Net (loss) | $ | (10,227 | ) | $ | (6,663 | ) | ||

Other comprehensive (loss) income, net of tax | ||||||||

Foreign currency translation adjustments, net of tax (expense) of ($495) and ($2,247) for the three months ended March 31, 2017 and 2016, respectively. | 1,410 | 6,396 | ||||||

Comprehensive (loss) | $ | (8,817 | ) | $ | (267 | ) | ||

The accompanying notes are an integral part of the condensed consolidated financial statements.

5

Table of Contents

KLONDEX MINES LTD. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) (US dollars in thousands) |

Three months ended March 31, | ||||||||||

Note | 2017 | 2016 | ||||||||

Operating activities | ||||||||||

Net (loss) | $ | (10,227 | ) | $ | (6,663 | ) | ||||

Significant items not involving cash | ||||||||||

Depreciation and depletion | 7,890 | 5,749 | ||||||||

Asset retirement and accretion | 381 | 247 | ||||||||

Derivative fair value adjustments | 1,052 | 4,078 | ||||||||

Write-down of production inventories | 3 | 1,446 | — | |||||||

Foreign exchange, net | 899 | 2,156 | ||||||||

Deferred tax expense (benefit) | 240 | 229 | ||||||||

Share-based compensation | 12 | 716 | 455 | |||||||

Deliveries under Gold Purchase Agreement(1) | (1,860 | ) | (1,238 | ) | ||||||

Loss on equipment disposal | 116 | — | ||||||||

Deferred share unit expense | 8 | (91 | ) | — | ||||||

Non-cash interest expense | 153 | — | ||||||||

715 | 5,013 | |||||||||

Changes in non-cash working capital | ||||||||||

Trade receivables | — | (38 | ) | |||||||

Inventories | (6,414 | ) | (825 | ) | ||||||

Prepaid expenses and other | (1,148 | ) | (5,164 | ) | ||||||

Accounts payable | 2,443 | 2,319 | ||||||||

Accrued compensation and benefits | (219 | ) | 335 | |||||||

Interest payable | (23 | ) | — | |||||||

Income taxes payable | 633 | — | ||||||||

Net cash (used) provided by operating activities | (4,013 | ) | 1,640 | |||||||

Investing activities | ||||||||||

Expenditures on mineral properties, plant and equipment | (17,008 | ) | (11,929 | ) | ||||||

Cash paid for acquisitions | — | (20,000 | ) | |||||||

Net cash used in investing activities | (17,008 | ) | (31,929 | ) | ||||||

Financing activities | ||||||||||

Cash received from option and warrant exercises | 3,209 | 2,286 | ||||||||

Repayment of capital lease obligations | (112 | ) | (127 | ) | ||||||

Payment of debt issuance costs | (217 | ) | (768 | ) | ||||||

Net cash provided by financing activities | 2,880 | 1,391 | ||||||||

Effect of foreign exchange on cash balances | 59 | 655 | ||||||||

Net (decrease) in cash | (18,082 | ) | (28,243 | ) | ||||||

Cash, beginning of period | 47,636 | 59,097 | ||||||||

Cash, end of period | $ | 29,554 | $ | 30,854 | ||||||

(1) Represents Revenue less Interest Expense attributable to the Gold Purchase Agreement (as defined herein). | ||||||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

6

Table of Contents

KLONDEX MINES LTD. CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (Unaudited) (US dollars in thousands, except shares) |

Note | Common shares | Additional paid-in capital | Accumulated deficit | Accumulated other comprehensive loss | Total | ||||||||||||||||

Balance at December 31, 2016 | 175,251,538 | $ | 363,899 | $ | (58,280 | ) | $ | (27,565 | ) | $ | 278,054 | ||||||||||

Share-based compensation expense | 12 | — | 716 | — | — | 716 | |||||||||||||||

Option exercises | 12 | 920,222 | 1,528 | — | — | 1,528 | |||||||||||||||

Warrant exercises | 11 | 1,140,800 | 1,681 | — | — | 1,681 | |||||||||||||||

Net (loss) | — | — | (10,227 | ) | — | (10,227 | ) | ||||||||||||||

Foreign currency translation adjustments | — | — | — | 1,410 | 1,410 | ||||||||||||||||

Balance at March 31, 2017 | 177,312,560 | $ | 367,824 | $ | (68,507 | ) | $ | (26,155 | ) | $ | 273,162 | ||||||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

7

Klondex Mines Ltd.

Notes to Condensed Consolidated Financial Statements (Unaudited)

1. Basis of presentation

The accompanying unaudited Condensed Consolidated Financial Statements of Klondex Mines Ltd. and its wholly-owned subsidiaries (the "Company") have been prepared in accordance with United States generally accepted accounting principles ("GAAP") and applicable rules and regulations of the Securities and Exchange Commission ("SEC"). Certain information and note disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations of the SEC. Therefore, the information included in this Quarterly Report on Form 10-Q should be read in conjunction with the audited Consolidated Financial Statements and related note disclosures of the Company's Annual Report on Form 10-K for the year ended December 31, 2016. In the opinion of management, all adjustments and disclosures necessary to fairly present the interim financial information set forth herein have been included. These interim financial statements, with the exception of any recently adopted accounting pronouncements described in Note 2. Recent accounting pronouncements, follow the same significant accounting policies disclosed in the Company's most recent Annual Report on Form 10-K. .

The results reported in these Condensed Consolidated Financial Statements are not necessarily indicative of the results that may be expected for the entire year or for future years.

All amounts are expressed and presented in thousands of United States dollars (unless otherwise noted) and references to "CDN$" refer to Canadian dollars.

2. Recent accounting pronouncements

Recently adopted

In March 2016, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2016-09, "Compensation - Stock Compensation - Improvements to Employee Share-Based Payment Accounting." ASU No. 2016-09 simplifies several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, an accounting policy election for forfeitures, and classification on the statement of cash flows. ASU No. 2016-09 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2016, which for the Company means the first quarter of the year ending December 31, 2017. The Company has adopted ASU 2016-09, which other than presentation and disclosure changes, did not have a material impact on its financial statements.

Recently issued

In May 2014, the FASB issued ASU No. 2014-09, “Revenue from Contracts with Customers”, which has been amended several times. The new standard provides a five-step approach to be applied to all contracts with customers and also requires expanded disclosures surrounding revenue recognition. ASU No. 2014-09 is effective for fiscal years, and interim periods within those years, beginning on or after December 15, 2017, which for the Company means the first quarter of the year ending December 31, 2018. The Company has evaluated the potential impacts of ASU No. 2014-09 and does not expect it will have a material impact on its financial statements.

In February 2016, the FASB issued ASU No. 2016-02, "Leases." ASU No. 2016-02 requires lessees to recognize assets and liabilities on the balance sheet for the rights and obligations resulting from leases. ASU No. 2016-02 is effective for fiscal years beginning after December 15, 2018 and for interim periods within those fiscal years, which for the Company means the first quarter of the year ending December 31, 2019. The Company is currently evaluating the impact that ASU No. 2016-02 will have on its financial Statements.

In August 2016, the FASB issued ASU No. 2016-15, "Statement of Cash Flows - Classification of Certain Cash Receipts and Cash Payments." ASU No. 2016-15 addresses eight specific cash flow issues with the objective of reducing the diversity in practice in how certain cash receipts and cash payments are presented and classified in the statement of cash flows. ASU No. 2016-15 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017, which for the Company means the first quarter of the year ending December 31, 2018. The Company is currently evaluating the impact that ASU No. 2016-15 will have on its financial Statements.

In November 2016, the FASB issued ASU No. 2016-18, "Statement of Cash Flows - Restricted Cash." ASU No. 2016-18 requires that restricted cash or restricted cash equivalents be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. ASU No. 2016-18 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017, which for the Company means the first quarter of the year ending December 31, 2018. The Company is currently evaluating the impact that ASU No. 2016-18 will have on its financial statements.

In January 2017, the FASB issued ASU No. 2017-01, "Business Combinations." ASU No. 2017-01 clarifies the definition of a business and adds guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions or disposals of assets or businesses. ASU No. 2017-01 is effective for fiscal years, and interim periods within those fiscal years, beginning after December

8

15, 2017, which for the Company means the first quarter of the year ending December 31, 2018. The Company is currently evaluating the impact that ASU No. 2017-01 will have on its financial statements.

3. Inventories

The following table provides the components of Inventories (in thousands):

March 31, 2017 | December 31, 2016 | |||||||

Supplies | $ | 6,565 | $ | 5,541 | ||||

Production related inventories: | ||||||||

Stockpiles | 14,334 | 6,604 | ||||||

In-process | 8,726 | 7,316 | ||||||

Doré finished goods | 1,886 | 1,849 | ||||||

$ | 31,511 | $ | 21,310 | |||||

As of March 31, 2017 and December 31, 2016, the Company's stockpiles, in-process, and doré finished goods inventories included approximately $5.8 million and $2.0 million, respectively, of capitalized non-cash depreciation and depletion costs.

The period-end market value of the Company's production-related inventories is determined in part by using the period-end prices (per ounces) of gold and silver and is sensitive to these inputs. Write-downs have resulted solely from the Company's application of its lower of average cost or net realizable value accounting policy and were unrelated to any ounce adjustments or changes to recovery rates. Write-downs for the three months ended March 31, 2017 were related to Midas and True North (both as defined herein).

The following table provides information about the Company's write-downs (in thousands, except per ounce amounts):

Three months ended March 31, | ||||||||

Type of previously incurred cost | 2017 | 2016 | ||||||

Cash production costs | $ | 2,234 | $ | — | ||||

Allocated depreciation and depletion | 1,446 | — | ||||||

Write-down of production inventories | $ | 3,680 | $ | — | ||||

Period-end prices used in write-down calculation | ||||||||

Price per gold ounce | $ | 1,242 | $ | 1,234 | ||||

Price per silver ounce | $ | 18.06 | $ | 15.38 | ||||

Further declines from March 31, 2017 metal price levels and/or future production costs greater than the March 31, 2017 carrying value included in Inventories could result in, or contribute to, additional future write-downs of production-related inventories.

4. Prepaid expenses and other

The following table provides the components of Prepaid expenses and other (in thousands):

March 31, 2017 | December 31, 2016 | |||||||

Prepaid taxes | $ | 2,882 | $ | 1,390 | ||||

Vendor prepayments | 779 | 315 | ||||||

Prepaid claim maintenance and land holding costs | 541 | 909 | ||||||

Prepaid insurance | 499 | 518 | ||||||

Utilities, rent, and service deposits | 158 | 178 | ||||||

Software maintenance | 129 | 60 | ||||||

Royalties | 49 | 82 | ||||||

Other | 797 | 1,226 | ||||||

$ | 5,834 | $ | 4,678 | |||||

9

5. Mineral properties, plant and equipment, net

The following table provides the components of Mineral properties, plant and equipment, net (in thousands):

March 31, 2017 | December 31, 2016 | |||||||

Mineral properties | $ | 163,204 | $ | 163,012 | ||||

Facilities and equipment | 101,176 | 97,054 | ||||||

Mine development | 68,953 | 54,070 | ||||||

Land | 3,835 | 3,828 | ||||||

Asset retirement cost assets(1) | 3,191 | 2,887 | ||||||

Construction in progress | 14,312 | 16,472 | ||||||

354,671 | 337,323 | |||||||

Less: accumulated depreciation and depletion | (74,211 | ) | (61,100 | ) | ||||

$ | 280,460 | $ | 276,223 | |||||

(1)Asset retirement cost assets relate to increases in asset retirement obligations at sites with proven and probable reserves. | ||||||||

Facilities and equipment included $1.5 million and $1.5 million at March 31, 2017 and December 31, 2016, respectively, for the gross amount of mobile mine equipment acquired under capital lease obligations. Accumulated depreciation on such mobile mine equipment totaled $0.6 million and $0.5 million at March 31, 2017 and December 31, 2016, respectively.

At March 31, 2017, construction in progress of $14.3 million included $8.7 million related to facilities and equipment, $4.7 million of mine development, $0.6 million of mineral properties, and $0.3 million of other.

6. Debt

The following table summarizes the components of Debt (in thousands):

March 31, 2017 | December 31, 2016 | |||||||

Debt, current: | ||||||||

Gold Purchase Agreement | $ | 8,455 | $ | 8,023 | ||||

Capital lease obligations | 496 | 479 | ||||||

$ | 8,951 | $ | 8,502 | |||||

Debt, non-current: | ||||||||

Revolver(1) | $ | 11,095 | $ | 11,165 | ||||

Gold Purchase Agreement | 7,643 | 9,935 | ||||||

Capital lease obligations | 460 | 589 | ||||||

$ | 19,198 | $ | 21,689 | |||||

(1) Net of unamortized issuance costs of $0.9 million. | ||||||||

The following table summarizes the components of Interest (expense), net (in thousands):

Three months ended March 31, | ||||||||

2017 | 2016 | |||||||

Gold Purchase Agreement | $ | 783 | $ | 1,126 | ||||

Promissory Note | — | 180 | ||||||

Revolver interest and stand-by fees | 334 | — | ||||||

Capital lease obligations | 9 | 17 | ||||||

Other | 32 | 64 | ||||||

$ | 1,158 | $ | 1,387 | |||||

10

Revolver

On March 23, 2016, the Company, as borrower, and Investec Bank PLC ("Investec"), as lender and security agent, entered into a $25.0 million secured revolving facility agreement (the "Revolver"). The Revolver was amended on October 27, 2016 to increase the borrowing capacity by $10.0 million to $35.0 million. During the year ended December 31, 2016, the Company drew $12.0 million from the Revolver to retire the Promissory Note (as defined herein) related to the acquisition of True North (as defined herein). Borrowings under the Revolver bear interest per annum at LIBOR plus Margin plus Risk Premium, as such terms are defined in the Revolver. Margin is determined by the Company's Gearing Ratio (a measure of debt to EBITDA) and ranges from 2.75%-4.00% per annum and the Risk Premium is 0.35% per annum, until the Gold Purchase Agreement balance is less than $10.0 million, at which time the Risk Premium is no longer applicable (as such terms are defined in the Revolver). Revolver borrowings may be utilized by the Company for working capital requirements, general corporate purposes, and capital investments and expenditures.

On March 31, 2017, pursuant to an amendment, the Revolver's maturity date was extended from March 23, 2018 to December 31, 2019, unless otherwise extended by the parties, and the reserves and resources required to be maintained by the Company under the Revolver were amended. The Revolver is secured by all of the Company's assets on a pari passu basis with the Gold Purchase Agreement.

Gold Purchase Agreement

The Company's February 2014 gold purchase agreement with a subsidiary of Franco-Nevada Corporation (the "Gold Purchase Agreement") requires physical gold deliveries to be made at the end of each month, each of which reduces the Gold Purchase Agreement balance and accrued interest. The repayment amortization schedule was established on the transaction date and incorporates then current forward gold prices (ranging from $1,290 to $1,388) and an effective interest rate of approximately 18.3%. Gold deliveries will cease on December 31, 2018 following the delivery of 38,250 gold ounces. The Gold Purchase Agreement is secured by all the Company's assets on a pari passu basis with the Revolver.

During the three months ended March 31, 2017 and 2016, the Company delivered 2,000 gold ounces for each period under the Gold Purchase Agreement. The Company is required to deliver 2,000 gold ounces per quarter (8,000 gold ounces per year) during fiscal years 2017 and 2018.

Capital lease obligations

The Company's capital lease obligations are for the purchase of mobile mine equipment and passenger vehicles, bear interest at approximately 4.0% per annum, and carry 36-month terms. The Company's capital lease obligations are secured by the underlying assets financed.

Secured Promissory Note

In conjunction with its January 22, 2016 acquisition of True North, the Company entered into a $12.0 million promissory note to the vendor with an annual interest rate of 4.0% ("Promissory Note"). The Promissory Note required principal repayments of $4.0 million in each of the succeeding three years on the anniversary of the closing date. Interest payments were due monthly. In the fourth quarter of 2016, the Company repaid the entire principal amount of the Promissory Note without penalty and recorded a $0.5 million Loss on debt extinguishment for the unamortized issuance discount.

Debt covenants

The Company's debt agreements contain certain representations and warranties, restrictions, events of default, and covenants that are customary for agreements of these types. Additionally, the Revolver contains financial covenants which require the Company to maintain a Tangible Net Worth not less than $100.0 million, a Gearing Ratio (a measure of debt to EBITDA) not greater than 4.00:1, a Cash Balance not less than $10.0 million, and a Current Ratio not less than 1.10:1 (as such terms are defined in the Revolver). The Company was in compliance with all debt covenants as of March 31, 2017 and December 31, 2016.

11

7. Asset retirement obligations

The Company’s asset retirement obligations are related to its mining operations, projects, and exploration activities. The Company's asset retirement obligations are estimated based upon present value techniques using market participant assumptions of expected cash flows, estimates of inflation, and a credit adjusted risk-free discount rate. The following table provides a summary of changes in the asset retirement obligation (in thousands):

March 31, 2017 | December 31, 2016 | |||||||

Balance, beginning of period | $ | 25,436 | $ | 12,387 | ||||

Changes in estimates | — | 2,866 | ||||||

Accretion expense | 381 | 1,122 | ||||||

Additions resulting from Hollister Acquisition - Hollister | — | 4,481 | ||||||

Additions resulting from Hollister Acquisition - Aurora | — | 2,677 | ||||||

Additions resulting from True North Acquisition | — | 1,793 | ||||||

Effect of foreign currency | 12 | 110 | ||||||

Balance, end of period | $ | 25,829 | $ | 25,436 | ||||

As of March 31, 2017, the Company's asset retirement obligations were secured by surety bonds totaling $48.2 million, which were partially collateralized by Restricted cash totaling $10.0 million. During the three months ended March 31, 2017, the amount of restricted cash collateralizing the surety bonds remained unchanged.

The following table provides a listing of the Company's asset retirement obligations by property (in thousands):

March 31, 2017 | December 31, 2016 | |||||||

Midas | $ | 12,792 | $ | 12,616 | ||||

Hollister | 6,206 | 6,110 | ||||||

Aurora | 2,783 | 2,741 | ||||||

Fire Creek | 2,339 | 2,303 | ||||||

True North | 1,709 | 1,666 | ||||||

$ | 25,829 | $ | 25,436 | |||||

8. Deferred share units liability

In May 2016, the Board of Directors adopted the Deferred Share Unit Plan (the "DSU Plan") to: (1) assist the Company in the recruitment and retention of qualified non-employee directors and (2) further align the interests of directors with shareholders. The DSU Plan is administered by the Compensation and Governance Committee of the Board of Directors of the Company. Under the DSU Plan, non-employee directors may receive a portion of their annual compensation in the form of Deferred Share Units ("DSUs"). The value of a DSU is determined as the weighted average closing price of the Company's common shares for the five days preceding such valuation date (the "DSU Value"). DSUs are fully vested at the time of grant and are retained until a director is separated or terminated from the Board of Directors of the Company, at which time the number of DSUs credited to such director's account multiplied by the DSU Value is to be paid out in cash. In the event the Company pays cash dividends, additional DSUs are to be credited to each director's account in an amount equal to the cash value that would have been received by the directors had the DSUs been held as common shares of the Company divided by the DSU Value. DSUs have no voting rights.

The fair value of DSUs granted each year, together with the change in fair value of all outstanding DSUs, is recorded within General and administrative and totaled $(0.1) million during the three months ended March 31, 2017.

12

The following table provides a summary of the Company's outstanding DSUs:

Three months ended March 31, 2017 | |||

Outstanding at beginning of period | 180,183 | ||

Granted | — | ||

Redeemed | — | ||

Outstanding at end of period | 180,183 | ||

9. Derivatives

The following table provides a listing of the Company's derivative instruments (in thousands):

Description | Recorded Within | March 31, 2017 | December 31, 2016 | |||||||

Gold Purchase Agreement embedded derivative | Derivative assets, current | $ | 644 | $ | 1,247 | |||||

Gold Purchase Agreement embedded derivative | Derivative assets, non-current | 582 | 1,545 | |||||||

$ | 1,226 | $ | 2,792 | |||||||

Gold Offering Agreement | Derivative liabilities, current | $ | 1,448 | $ | 1,721 | |||||

Forward metal sales | Derivative liabilities, current | 58 | — | |||||||

Gold Offering Agreement | Derivative liabilities, non-current | — | 331 | |||||||

$ | 1,506 | $ | 2,052 | |||||||

The following table lists the net amounts recorded for (Loss) on derivatives, net (in thousands):

Three months ended March 31, | ||||||||

2017 | 2016 | |||||||

Gold Purchase Agreement embedded derivative | (1,407 | ) | (3,386 | ) | ||||

Gold Offering Agreement | (342 | ) | (1,171 | ) | ||||

Forward metal sales(1) | (395 | ) | (1,087 | ) | ||||

$ | (2,144 | ) | $ | (5,644 | ) | |||

(1) Loss (gain) on settlement of forward metal sales derivative instruments, which was determined by the difference in the fixed forward price received by the Company and the spot price on the applicable delivery date. See Forward Metal Sales discussed below. | ||||||||

Gold Purchase Agreement embedded derivative

The Company's Gold Purchase Agreement (as defined and discussed in Note 6. Debt) contains an embedded compound derivative for: 1) the prepayment option, which is at the discretion of the Company, and 2) the forward sales component, which was established on the transaction date and incorporates the then current forward gold prices. In addition to recurring fair value adjustments, gains and losses on the Gold Purchase Agreement's embedded derivative relate to the difference in the forward gold price received by the Company and the spot price of gold on each delivery date. The following table summarizes information about past and future gold deliveries under the Gold Purchase Agreement:

Outstanding Future Deliveries | Three months ended March 31, | ||||||||||||||

2018 | 2017 | 2017 | 2016 | ||||||||||||

Gold ounces | 8,000 | 6,000 | 2,000 | 2,000 | |||||||||||

Average forward gold price | $ | 1,369 | $ | 1,336 | $ | 1,322 | $ | 1,302 | |||||||

Average gold spot price on delivery date | n/a | n/a | $ | 1,238 | $ | 1,195 | |||||||||

Gold Offering Agreement

In March 2011, the Company entered into a gold offering agreement, as amended in October 2011 (the "Gold Offering Agreement"), which granted the counterparty the right to purchase, on a monthly basis, the refined gold produced from the Fire Creek mine ("Fire Creek") for a five-year period which began in February 2013 and ends in February 2018. When/if the counterparty elects to purchase

13

the refined gold, the purchase price is calculated as the average PM settlement price per gold ounce on the London Bullion Market Association for the 30 trading days immediately preceding the relevant purchase election date. A 1.0% discount was applicable through February 29, 2016 and no longer exists. In addition to recurring fair value adjustments, gains and losses on the Gold Offering Agreement relate to: 1) the difference in the gold price paid to the Company from the counterparty and the spot price of gold on the applicable delivery date, and 2) losses incurred by the Company to net cash settle any obligations arising from the Gold Offering Agreement. The following table summarizes information about gold purchased under the Gold Offering Agreement:

Three months ended March 31, | ||||||||

2017 | 2016 | |||||||

Gold ounces purchased by counterparty | 22,040 | 19,583 | ||||||

Average gold price paid to the Company | $ | 1,206 | $ | 1,100 | ||||

Average gold spot price on delivery date | $ | 1,250 | $ | 1,150 | ||||

Forward metal sales

In order to increase the certainty of expected future cash flows, from time to time, the Company enters into fixed forward spot trades for a portion of its projected gold and silver sales. These agreements are considered derivative financial instruments. The following table summarizes information about the Company's forward trades:

Three months ended March 31, | ||||||||

2017 | 2016 | |||||||

Gold ounces covered | 48,558 | 27,270 | ||||||

Average price per gold ounce | $ | 1,236 | $ | 1,186 | ||||

Silver ounces covered | 287,000 | 524,616 | ||||||

Average price per silver ounce | $ | 17.88 | $ | 15.21 | ||||

The balances as of March 31, 2017, are scheduled to be delivered in 2017.

10. Fair value measurements

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Financial assets and liabilities recorded at fair value in the Condensed Consolidated Financial Statements are classified using a fair value hierarchy that reflects the significance of the inputs used in making the fair value measurements. The fair value hierarchy has the following levels:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities at the measurement date;

Level 2 – Quoted prices in markets that are not active, or inputs that are observable, either directly or indirectly, for the full term of the asset or liability; and

Level 3 – Prices or valuation techniques that require inputs that are both significant to the fair value measurement and are not observable.

14

Financial assets and liabilities are classified in their entirety based upon the lowest level of input that is significant to the fair value measurement. There were no transfers between fair value hierarchy levels during the three months ended March 31, 2017. The following table provides a listing (by level) of the Company's financial assets and liabilities which are measured at fair value on a recurring basis (in thousands):

March 31, 2017 | December 31, 2016 | |||||||||||||||||||||||||

Assets: | Note | Level 1 | Level 2 | Level 3 | Level 1 | Level 2 | Level 3 | |||||||||||||||||||

Gold Purchase Agreement embedded derivative | 9 | $ | — | $ | 1,226 | $ | — | $ | — | $ | 2,792 | $ | — | |||||||||||||

$ | — | $ | 1,226 | $ | — | $ | — | $ | 2,792 | $ | — | |||||||||||||||

Liabilities: | ||||||||||||||||||||||||||

Deferred share units liability | 8 | $ | — | $ | 728 | $ | — | $ | — | $ | 812 | $ | — | |||||||||||||

Gold Offering Agreement | 9 | — | — | 1,448 | — | — | 2,052 | |||||||||||||||||||

Forward metal sales | 9 | — | 58 | — | — | — | — | |||||||||||||||||||

$ | — | $ | 786 | $ | 1,448 | $ | — | $ | 812 | $ | 2,052 | |||||||||||||||

Gold Purchase Agreement embedded derivative - This asset was valued by a third-party consultant (and reviewed by the Company) using observable inputs, including period-end forward gold prices and historic forward gold prices from the Gold Purchase Agreement's February 2014 transaction date and, as such, is classified within Level 2 of the fair value hierarchy.

Deferred share unit liability - This liability was valued using the number of outstanding DSUs and quoted closing prices of the Company’s common shares, which are traded in active markets, and as such is classified within Level 2 of the fair value hierarchy. The fair value was calculated as the number of DSUs outstanding multiplied by the period end DSU Value.

Gold Offering Agreement - This liability was valued by a third-party consultant (and reviewed by the Company) using a simulation-based pricing model and is classified within level 3 of the fair value hierarchy as it incorporates an estimate of the Company's future gold production from Fire Creek, which is not an observable input, as well as quoted prices from active markets and certain observable inputs, such as, forward gold prices and the volatility of such prices. The Company's 2017 gold production from Fire Creek is estimated to range from 97,000 - 100,000 ounces, the amounts of which were incorporated into the March 31, 2017 valuation.

Forward metal sales - Forward metal sales are valued using observable inputs, which are forward metal prices. Such instruments are classified within Level 2 of the fair value hierarchy.

Items disclosed at fair value - Other than the above, the carrying values of financial assets and liabilities approximate their fair values, other than Debt, which is carried at amortized cost. As of March 31, 2017, the fair value of the Gold Purchase Agreement, including the embedded features, was approximately $16.9 million.

Level 3 information

The following table provides additional detail for the Company's Level 3 financial liability (in thousands):

Gold Offering Agreement liability: | March 31, 2017 | |||

Balance at beginning of the period | $ | 2,052 | ||

Gain from change in fair value | (604 | ) | ||

Balance at end of the period | $ | 1,448 | ||

(Loss) gain on derivative, net: | ||||

Settlement losses | $ | (946 | ) | |

Gain from change in fair value | 604 | |||

$ | (342 | ) | ||

11. Share capital

Common shares

The authorized share capital of the Company is comprised of an unlimited number of common shares with no par value. Common shares are typically issued in conjunction with corporate financing efforts, the exercise of warrants (discussed below), and pursuant to share-based compensation arrangements (see Note 12. Share-based compensation).

15

Share Purchase Warrants

The Company has previously issued share purchase warrants in conjunction with its acquisition of Hollister and Midas (both as defined herein) in 2016 and 2014, respectively, and other past debt and equity financing transactions. The following table summarizes activity of the Company's warrant activity:

March 31, 2017 | |||||||

Warrants | Number of Warrants | Weighted Average Exercise Price - CDN$ | |||||

Outstanding, beginning of period | 11,140,800 | $ | 3.86 | ||||

Exercised | (1,140,800 | ) | 1.95 | ||||

Outstanding, end of period | 10,000,000 | $ | 4.08 | ||||

Exercisable, end of period | 5,000,000 | $ | 2.15 | ||||

The following table provides a summary of the Company's outstanding warrants:

March 31, 2017 | |||||||||

Exercise price per share - CDN$ | Number outstanding | Weighted average remaining life (years) | Weighted average exercise price - CDN$ | ||||||

$2.00 - $2.49 | 5,000,000 | 11.87 | 2.15 | ||||||

$6.00 | 5,000,000 | 15.00 | 6.00 | ||||||

10,000,000 | 13.44 | $ | 4.08 | ||||||

12. Share-based compensation

The Company has a Share Option and Restricted Share Unit Plan ("New Share Plan") to compensate eligible participants, which can include directors, officers, employees, and service providers to the Company. The New Share Plan is administered by the Board of Directors of the Company and is subject to conditions and restrictions over award terms, grant limits, and grant prices. The New Share Plan was approved at the June 15, 2016 annual and special meeting of shareholders. Subject to certain adjustments, the maximum number of common shares available for grant under the New Share Plan is equal to 8.9% of the common shares then outstanding less the aggregate number of common shares reserved for issuance under all of the Company's other share-based compensation plans. Additionally, the maximum number of common shares available for issuance pursuant to grants under the restricted share unit portion of the New Share Plan is subject to a sub-cap and cannot exceed 4.0% of the total number of common shares outstanding at the time of grant of the applicable award.

The New Share Plan replaced the Company's Share Incentive Plan (the "Legacy SIP"), which permitted the granting of share options and common share awards. Awards outstanding under the Legacy SIP will continue to vest in accordance with their grant terms and reduce the number of shares available for issuance under the New Share Plan (discussed above).

Share-based compensation costs

The following table summarizes the Company's share-based compensation cost by award type (in thousands):

Three months ended March 31, | ||||||||

Share-based compensation cost by award | 2017 | 2016 | ||||||

Share options | $ | 173 | $ | 412 | ||||

Restricted share units - time vesting criteria | 444 | 71 | ||||||

Restricted share units - performance vesting criteria | 92 | — | ||||||

Common share awards | 7 | (28 | ) | |||||

$ | 716 | $ | 455 | |||||

16

The following table summarizes activity of the Company's share-based compensation for restricted share units ("RSUs"), common share awards, and share options:

Three months ended March 31, 2017 | ||||||||||||

Restricted share units - time-based vesting(1) | Restricted share units - performance-based vesting | Common share awards | Share options | |||||||||

Outstanding, beginning of period | 948,038 | 212,243 | 56,665 | 5,233,105 | ||||||||

Granted | 27,124 | (4) | — | — | — | |||||||

Forfeited | (56,102 | ) | — | — | (73,333 | ) | ||||||

Exercised(3) | — | — | — | (920,222 | ) | |||||||

Outstanding, end of period | 919,060 | 212,243 | 56,665 | 4,239,550 | ||||||||

(1) Includes awards with comparable terms and characteristics of RSUs, even if such awards are not called "RSUs" under the plan they were granted. | ||||||||||||

(2) Not applicable to Share options. | ||||||||||||

(3) Only applicable to Share options. | ||||||||||||

(4) The weighted average grant-date fair value of time-based RSUs granted during the three months ended March 31, 2017 was CDN$5.39. | ||||||||||||

13. Income taxes

Major components of our income tax (expense) benefit for the three months ended March 31, 2017 and 2016 are as follows (in thousands):

Three months ended March 31, | ||||||||

2017 | 2016 | |||||||

Current: | ||||||||

Canada | $ | — | $ | — | ||||

United States | 864 | (455 | ) | |||||

Total current income tax (expense) benefit | 864 | (455 | ) | |||||

Deferred: | ||||||||

Canada | — | — | ||||||

United States | (241 | ) | (229 | ) | ||||

Total deferred income tax (expense) | (241 | ) | (229 | ) | ||||

Total income tax (expense) benefit | $ | 623 | $ | (684 | ) | |||

17

14. Net (loss) income per share

Basic net income (loss) per share is calculated by dividing net income by the weighted average number of shares outstanding for the period. Diluted net income (loss) per share reflects the potential dilution that would occur if outstanding share-based instruments were executed. The following table provides computations of the Company's basic and diluted net income (loss) per share (in thousands, except per share amounts):

Three months ended March 31, | ||||||||

2017 | 2016 | |||||||

Net (loss) | $ | (10,227 | ) | $ | (6,663 | ) | ||

Weighted average common shares: | ||||||||

Basic | 175,570,592 | 140,248,413 | ||||||

Effect of: | ||||||||

Share options | — | — | ||||||

Warrants | — | — | ||||||

Common share awards | — | — | ||||||

Diluted | 175,570,592 | 140,248,413 | ||||||

Net (loss) per share | ||||||||

Basic | $ | (0.06 | ) | $ | (0.05 | ) | ||

Diluted | $ | (0.06 | ) | $ | (0.05 | ) | ||

Diluted net income per share excludes common share-based instruments in periods where inclusion would be anti-dilutive. During the three months ended March 31, 2017, the Company's basic weighted average common shares and diluted weighted average common shares were the same because the effects of potential execution was anti-dilutive due to the Company's net loss. Had the Company generated net income, during the three months ended March 31, 2017, the effects from executing 3,878,026 warrants, 2,595,078 share options, and 546,196 RSUs would have been included in the diluted weighted average common shares calculation.

15. Segment information

The Company's reportable segments are comprised of operating units which have revenues, earnings or losses, or assets exceeding 10% of the respective consolidated totals, each of which is reviewed by the Company’s Chief Executive Officer to make decisions about resources to be allocated to the segments and to assess their performance. The table below summarizes segment information:

Three months ended March 31, 2017 | Fire Creek | Midas | True North | Hollister | Aurora | Corporate and other | Total | ||||||||||||||||||||

Revenues | $ | 20,451 | $ | 15,789 | $ | 5,470 | $ | — | $ | — | $ | — | $ | 41,710 | |||||||||||||

Cost of sales | |||||||||||||||||||||||||||

Production costs | 6,781 | 12,542 | 6,906 | — | — | — | 26,229 | ||||||||||||||||||||

Depreciation and depletion | 1,657 | 4,536 | 1,535 | — | — | — | 7,728 | ||||||||||||||||||||

Write-down of production inventories | — | 951 | 2,729 | — | — | — | 3,680 | ||||||||||||||||||||

12,013 | (2,240 | ) | (5,700 | ) | — | — | — | 4,073 | |||||||||||||||||||

Other operating expenses | |||||||||||||||||||||||||||

General and administrative | 191 | 156 | 253 | — | — | 3,888 | 4,488 | ||||||||||||||||||||

Exploration | 127 | — | — | — | — | — | 127 | ||||||||||||||||||||

Development and projects costs | — | — | — | 5,505 | — | — | 5,505 | ||||||||||||||||||||

Asset retirement and accretion | 36 | 177 | 30 | 96 | 42 | — | 381 | ||||||||||||||||||||

Loss on equipment disposal | 36 | 80 | — | — | — | — | 116 | ||||||||||||||||||||

Income (loss) from operations | $ | 11,623 | $ | (2,653 | ) | $ | (5,983 | ) | $ | (5,601 | ) | $ | (42 | ) | $ | (3,888 | ) | $ | (6,544 | ) | |||||||

Capital expenditures | $ | 6,804 | $ | 5,544 | $ | 3,458 | $ | 298 | $ | 615 | $ | 289 | $ | 17,008 | |||||||||||||

Total assets | $ | 55,664 | $ | 109,636 | $ | 49,179 | $ | 116,340 | $ | 16,199 | $ | 28,474 | $ | 375,492 | |||||||||||||

18

Three months ended March 31, 2016 | Fire Creek | Midas | True North | Hollister | Aurora | Corporate and other | Total | ||||||||||||||||||||

Revenues | $ | 21,934 | $ | 14,507 | $ | — | $ | — | $ | — | $ | — | $ | 36,441 | |||||||||||||

Cost of sales | |||||||||||||||||||||||||||

Production costs | 8,657 | 11,674 | — | — | — | — | 20,331 | ||||||||||||||||||||

Depreciation and depletion | 1,914 | 3,889 | — | — | — | — | 5,803 | ||||||||||||||||||||

Write-down of production inventories | — | — | — | — | — | — | — | ||||||||||||||||||||

11,363 | (1,056 | ) | — | — | — | — | 10,307 | ||||||||||||||||||||

Other operating expenses | |||||||||||||||||||||||||||

General and administrative | 161 | 161 | — | — | — | 3,096 | 3,418 | ||||||||||||||||||||

Exploration | 1,503 | 109 | — | — | — | — | 1,612 | ||||||||||||||||||||

Development and projects costs | — | — | 766 | — | — | — | 766 | ||||||||||||||||||||

Asset retirement and accretion | 41 | 176 | 30 | — | — | — | 247 | ||||||||||||||||||||

Business acquisition costs | — | — | 709 | — | — | — | 709 | ||||||||||||||||||||

Income (loss) from operations | $ | 9,658 | $ | (1,502 | ) | $ | (1,505 | ) | $ | — | $ | — | $ | (3,096 | ) | $ | 3,555 | ||||||||||

Capital expenditures | $ | 5,456 | $ | 4,991 | $ | 1,172 | $ | — | $ | — | $ | 310 | $ | 11,929 | |||||||||||||

Total assets | $ | 41,919 | $ | 103,124 | $ | 38,817 | $ | — | $ | 36,461 | $ | — | $ | 220,321 | |||||||||||||

16. Supplemental cash flow information

The following table provides a summary of significant supplemental cash flow information:

Three months ended March 31, | ||||||||

2017 | 2016 | |||||||

Cash paid for federal and state income taxes | $ | — | $ | 1,904 | ||||

Mineral properties, plant and equipment acquired through Promissory Note | — | 12,000 | ||||||

17. Commitments and contingencies

Provision for legal settlement

In 2012, three former directors and/or employees of the Company resigned or were terminated for cause and because the Company believed that each individual breached certain duties, no amounts for severance benefits and/or the receipt of previously granted share-based compensation awards were initially accrued. The individuals filed claims against the Company for such compensation benefits and other claims and as of the date of these Condensed Consolidated Financial Statements, two of the three individuals had entered into agreements with the Company to dismiss such claims without the ability to refile a claim in the future.

Through a mediation process, during the first quarter of 2017 the Company reached what it believes is a final settlement regarding the case for the remaining third individual which calls for a $3.0 million cash payment and, accordingly, during the year ended December 31, 2016, the Company accrued a Provision for legal settlement for this amount. As of March 31, 2017, the Company remained obligated for the associated settlement payment. Subsequent to the end of March 31, 2017, the payment was made with no further obligation from the Company.

Royalty commitments

Certain patented and unpatented mining claims at all mine sites are subject to lease and royalty agreements that require payments to holders based on minimum annual payment schedules and/or a percentage of the mineral values produced from, or transported through, the royalty claims. Amounts due pursuant to royalty agreements are not recorded in the Condensed Consolidated Financial Statements until such time when the amounts are actually payable. The primary type of royalty agreement applicable to the mine sites is a net smelter return ("NSR") royalty. Under an NSR royalty, the amount paid by the Company to the royalty holder is generally calculated as the royalty percentage multiplied by the market value of the minerals produced less charges and costs for milling, smelting, refining, and transportation. During the three months ended March 31, 2017 and 2016, the Company did not make any payments related to minimum and advance royalty payments.

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

This Management's Discussion & Analysis of Financial Condition and Results of Operations ("MD&A") contains forward-looking statements (as previously defined) which are subject to numerous risks and uncertainties, as more fully described in the Cautionary

19

statement regarding forward-looking statements section of this Quarterly Report on Form 10-Q. This MD&A provides a discussion and analysis of the financial condition and results of operations of the Company and includes the Company's subsidiaries. This MD&A should be read in conjunction with our other reports filed with the U.S. Securities and Exchange Commission (the "SEC") as well as our interim unaudited Condensed Consolidated Financial Statements and notes thereto included in this Quarterly Report on form 10-Q and our audited financial statements and notes thereto included ion our Annual Report on Form 10-K for the year ended December 31, 2016 . The following discussion has been prepared based on information available to us as of May 4, 2017. All dollar amounts included in this MD&A are expressed in thousands of United States dollars unless otherwise noted. References to CDN$ refer to Canadian dollars. References to "Notes" refer to the notes to Condensed Consolidated Financial Statements.

In this MD&A, we use the non-GAAP performance measures "Production cash costs per gold equivalent ounce sold" and "All-in costs per gold ounce sold", which should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. See the Non-GAAP performance measures section of this MD&A for additional detail.

Introduction and strategy

We are a well–capitalized, junior–tier gold and silver mining company focused on exploration, development, and production in a safe, environmentally responsible, and cost–effective manner. As of March 31, 2017, we had 100% interests in three producing mines: (1) the Fire Creek mine ("Fire Creek") and (2) the Midas mine and ore milling facility ("Midas"), both of which are located in the state of Nevada, USA, and (3) the True North gold mine and mill in Manitoba, Canada ("True North", formerly known as the Rice Lake mine). The Company also has 100% interests in two recently acquired projects: (1) the Hollister mine ("Hollister") and (2) the Aurora mine and ore milling facility ("Aurora", formerly known as Esmeralda), both of which are also located in Nevada, USA.

Prior to February 2014, our only mine was Fire Creek, and since that time, we have experienced growth in our annual gold and silver production, total assets, and workforce largely due to the acquisitions of Midas (February 2014), True North (January 2016), and Hollister and Aurora (October 2016).

Gold and silver sales represent 100% of our revenues, and the market prices of gold and silver significantly impact our financial position, operating results, and cash flows. Our primary strategy is to increase shareholder value by responsibly achieving our production, cost, and capital targets while attempting to extend our mine lives through development and exploration programs. We also consider acquisitions or other arrangements in the normal course which strategically fit our future growth objectives. We have an experienced management team, a strong financial position, a low-cost production profile, and high-quality assets located in mining-friendly jurisdictions.

Executive summary

Our 2017 highlights included the following, which are discussed in further detail throughout this MD&A or elsewhere in this Quarterly Report on Form 10-Q:

• | Health, safety, and environmental - We remained committed to our most important core values by operating in an environmentally-responsible manner while protecting the health and safety of our employees and contractors. No lost-time injuries occurred at our properties during the quarter and as of March 31, 2017, we had operated 1,629 days (~4.5 years) at Fire Creek, 905 days (~2.5 years) at Midas, 434 days (~1.2 years) at True North, and 179 days (~0.5 years) at Hollister and Aurora, without a lost-time injury. |

• | Consolidated performance - We mined a total of 57,633 gold equivalent ounces ("GEOs"), in line with management’s expectations, and produced a total of 34,454 GEOs. Mined ounces are calculated using tons hauled to surface multiplied by the assays from production sampling. |

• | Nevada performance -In Nevada, ore from Fire Creek was stockpiled due to heavy snowfall limiting our ability to transport ore to the Midas mill. At Fire Creek and Midas, the Company mined 71,883 ore tons in the first quarter at an average mined head grade of 0.72 gold equivalent ounces per ton. The Company's mining activity performed as planned, which resulted in an estimated 51,670 gold equivalent ounces mined. The Company built a significant stockpile in Nevada of 30,890 tons at an average grade of 0.94 gold equivalent ounces per ton containing an estimated 29,142 gold equivalent ounces. Production cash costs per gold equivalent ounce sold in Nevada was $659 which is below our 2017 expected range of $680 to $710. |

• | Nevada performance, April 2017 - The Company produced approximately 25,000 gold equivalent ounces from Fire Creek and Midas in April as the Midas mill ran near full capacity. |

• | Hollister project development - The Company completed a significant amount of project development activities at Hollister, including the rehab of approximately 4,000 feet of underground workings in the main zone, 4,000 feet of air and water lines, repairing underground support systems, and advancing approximately 1,025 feet and 2,600 feet of waste and ore development in the Gloria zone, respectively. |

• | True North performance - We continued to ramp up True North in Canada towards full production. |

20

• | Ounces sold and financial results - We sold 33,737 gold equivalent ounces, consisting of 29,559 gold ounces and 287,000 silver ounces. Revenue was $41.71 million from average realized selling prices per gold and silver ounce of $1,237 and $18.00, respectively. Net loss was $10.2 million (or $0.06 per share - basic). |

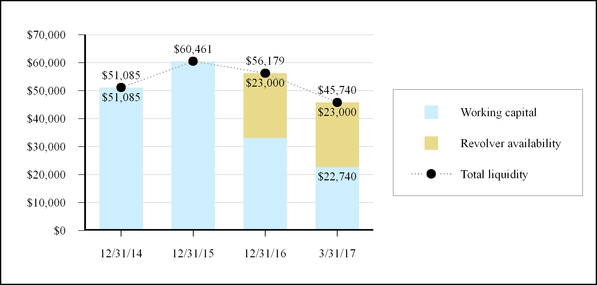

• | Cash flows and liquidity - We maintained our strong financial position and liquidity. Our ending cash balance was $29.6 million after $4.0 million of operating cash outflows, $17.0 million used in investing activities, and $2.9 million provided by financing activities. Ending working capital was $22.7 million and total liquidity was $45.7 million when including the $23.0 million of Revolver availability. We expect an increase in operating cash flow in the second quarter as the ounces contained in stockpiles in Nevada are processed through the Midas mill. |

• | Spending - Capital, exploration, and development spending totaled $6.9 million at Fire Creek, $5.5 million at Midas, $3.5 million at True North, $5.8 million at Hollister, $0.6 million at Aurora, and $0.3 million at corporate for total capital, exploration and development spending of $22.6 million. |

2017 full year outlook

The following statements are based on our current expectations for fiscal year 2017 results. The statements are forward-looking and actual results may differ materially.

We expect to produce between 210,000 and 225,000 GEOs during 2017 at an expected production cash cost per GEO sold of $680 to $710 per GEO sold. This represents an increase in GEOs sold of approximately 37% from the prior year as we expect to benefit from bulk sampling production at Hollister in Nevada as well as higher production from True North in Canada as ramp-up continues. Fire Creek and Midas’ 2017 production is expected to be in line with the prior year.

We expect our 2017 capital expenditures to be between $57 - $62 million with an additional $3 - $5 million to be spent on regional exploration. The majority of capital is expected to be spent at Fire Creek as we continue underground expansion in the form of primary access development and advancement of a second portal. We also expect to spend $7 - $9 million at our newly acquired Hollister mine in Nevada as it continues its bulk sampling mining program and underground definition drilling in the Gloria zone.

Below are tables summarizing key 2017 operating guidance.

Gold Equivalent Ounces Produced(1) | Production Cash Costs per Gold Equivalent Ounce Sold(1) | Capital Expenditures (thousands) | ||||||||||||||||||||||

2017 full year outlook | Low | High | Low | High | Low | High | ||||||||||||||||||

Midas | 42,000 | 45,000 | $ | 925 | $ | 950 | $ | 11,000 | $ | 12,000 | ||||||||||||||

Midas Mill | — | — | — | — | 4,000 | 5,000 | ||||||||||||||||||

Fire Creek | 97,000 | 100,000 | 475 | 500 | 27,000 | 29,000 | ||||||||||||||||||

Hollister(2) | 30,000 | 35,000 | 935 | 960 | — | — | ||||||||||||||||||

Nevada Total | 169,000 | 180,000 | 670 | 700 | 42,000 | 46,000 | ||||||||||||||||||

True North(3) | 41,000 | 45,000 | 725 | 750 | 15,000 | 16,000 | ||||||||||||||||||

210,000 | 225,000 | $ | 680 | $ | 710 | $ | 57,000 | $ | 62,000 | |||||||||||||||

Low | High | |||||||||||||||||||||||

Corporate general and administrative (thousands) | $ | 15,000 | $ | 17,000 | ||||||||||||||||||||

Hollister development and project costs (thousands) | $ | 7,000 | $ | 9,000 | ||||||||||||||||||||

Regional exploration (thousands) | $ | 3,000 | $ | 5,000 | ||||||||||||||||||||

All-in costs per gold ounce sold(1) | $ | 1,070 | $ | 1,130 | ||||||||||||||||||||

(1) This is a non-GAAP measure; refer to the Non-GAAP Performance Measures section of the MD&A for additional detail. | ||||||||||||||||||||||||

(2) Hollister is an exploration stage mineral property and as such, production refers to the estimated quantities resulting from the process of extracting mineralized materials from the earth and treating that material in a mill. | ||||||||||||||||||||||||

(3) Based on an estimated CDN:US dollar exchange rate of 0.75:1. | ||||||||||||||||||||||||

Production in 2017 is expected to be weighted more heavily towards the second half of the year as True North and Hollister continue to ramp up towards full production. See the graph below.

21

We have not reconciled forward-looking 2017 full year non-GAAP performance measures contained in this Quarterly Report on Form 10-Q to their most directly comparable GAAP measures, as permitted by Item 10(e)(1)(i)(B) of Regulation S-K. Such reconciliations would require unreasonable efforts at this time to estimate and quantify, with a reasonable degree of certainty, various necessary GAAP components, including for example those related to future production costs, realized sales prices and the timing of such sales, timing and amounts of capital expenditures, metal recoveries, and corporate general and administrative amounts and timing, or others that may arise during the year. These components and other factors could materially impact the amount of the future directly comparable GAAP measures, which may differ significantly from their non-GAAP counterparts.

Critical accounting estimates

This MD&A is based on our Condensed Consolidated Financial Statements, which have been prepared in accordance with United States generally accepted accounting principles (“GAAP”). The preparation of these statements requires us to make assumptions, estimates, and judgments that affect the amounts of assets, liabilities, revenues, and expenses. For information on our most critical accounting estimates, see the Critical accounting estimates section included in Part II - Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations in our Annual Report on Form 10-K for the year ended December 31, 2016.

22

Results of operations

Three Months Ended March 31, | ||||||||||||

Revenues | 2017 | 2016 | Change | |||||||||

Gold revenue | ||||||||||||

Fire Creek | $ | 20,251 | $ | 21,402 | $ | (1,151 | ) | |||||

Midas | 10,860 | 10,168 | $ | 692 | ||||||||

True North | 5,452 | — | $ | 5,452 | ||||||||

36,563 | 31,570 | 4,993 | ||||||||||

Silver revenue | ||||||||||||

Fire Creek | 200 | 532 | (332 | ) | ||||||||

Midas | 4,929 | 4,339 | 590 | |||||||||

True North | 18 | — | 18 | |||||||||

5,147 | 4,871 | 276 | ||||||||||

$ | 41,710 | $ | 36,441 | $ | 5,269 | |||||||

Revenues increased during the first quarter of 2017 as compared to the first quarter of 2016 due to the addition of production at True North and higher average realized prices offset by less ounces milled during the quarter at the Nevada locations. Consolidated ore tons milled during the first quarter 2017 and 2016, were 89,903 and 73,755, respectively, with the increase driven by the addition of True North. See the Mining operations review section of this MD&A for additional discussion on our operating results at each mine.

Gold Revenue - The table below summarizes changes in gold revenue, ounces sold, and average realized prices (in thousands, except ounces sold and per ounce amounts):

Three Months Ended March 31, | ||||||||

2017 | 2016 | |||||||

Total gold revenue (thousands) | $ | 36,563 | $ | 31,570 | ||||

Gold ounces sold | 29,559 | 26,964 | ||||||

Average realized price (per ounce) | $ | 1,237 | $ | 1,171 | ||||

The change in gold revenue was attributable to: | Change | |||||||

Increase in ounces sold | $ | 3,042 | ||||||

Change in average realized price | 1,780 | |||||||

Effect of average realized price change on ounces sold increase | 171 | |||||||

$ | 4,993 | |||||||

Gold revenues increased during the first quarter of 2017 as compared to the first quarter 2016 largely due to an increase of 2,595 in ounces sold, partly as a result of commencing production at True North and partly from an increase of $66 (or 5.6%) in the average realized price per ounce sold compared to the first quarter of 2016.

Silver Revenue - The table below summarizes changes in silver revenue, ounces sold, and average realized prices (in thousands, except ounces sold and per ounce amounts):

Three Months Ended March 31, | ||||||||

2017 | 2016 | |||||||

Total silver revenue (thousands) | $ | 5,147 | $ | 4,871 | ||||

Silver ounces sold | 287,000 | 325,274 | ||||||

Average realized price (per ounce) | $ | 18.00 | $ | 14.98 | ||||

The change in silver revenue was attributable to: | Change | |||||||

Change in ounces sold | $ | (571 | ) | |||||

Change in average realized price | 960 | |||||||

Effect of average realized price change on ounces sold change | (113 | ) | ||||||

$ | 276 | |||||||

23

Silver revenues increased during the first quarter of 2017 as compared to the first quarter of 2016 driven by an increase of $3.02 (or 20.2%) in the average realized price per ounce sold. This increase in silver revenue was offset by a decrease in silver sold of 38,274 ounces.

Three Months Ended March 31, | ||||||||||||

Cost of sales | 2017 | 2016 | Change | |||||||||

Production costs | $ | 26,229 | $ | 20,331 | $ | 5,898 | ||||||

Depreciation and depletion | 7,728 | 5,803 | 1,925 | |||||||||

Write-down of production inventories | 3,680 | — | 3,680 | |||||||||

$ | 37,637 | $ | 26,134 | $ | 11,503 | |||||||

Cost of sales by mine | ||||||||||||

Fire Creek | $ | 8,438 | $ | 10,571 | $ | (2,133 | ) | |||||

Midas | 18,029 | 15,563 | 2,466 | |||||||||

True North | 11,170 | — | 11,170 | |||||||||

$ | 37,637 | $ | 26,134 | $ | 11,503 | |||||||

Production costs - Increases in production costs during the first quarter of 2017 as compared to the first quarter of 2016 were driven by the addition of True North and by higher depletion expense which contributed to a write down of production inventories at Midas and True North. See the Mining operations review section of this MD&A for a discussion of production costs at each mine.

Depreciation and depletion - Increases in depreciation and depletion costs increased due to increased cost base.