Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - PERDOCEO EDUCATION Corp | ceco-ex991_6.htm |

| 8-K - CECO-8K-201703 - PERDOCEO EDUCATION Corp | ceco-8k_20170503.htm |

CAREER EDUCATION CORPORATION FIRST quarter 2017 investor conference call MAY 3, 2017 A.J. Cederoth Senior Vice President & Chief Financial Officer Ashish Ghia Vice President, Finance Todd Nelson President & Chief Executive Officer Exhibit 99.2

This presentation contains “forward-looking statements,” as defined in Section 21E of the Securities Exchange Act of 1934, as amended, that reflect our current expectations regarding our future growth, results of operations, cash flows, performance and business prospects and opportunities, as well as assumptions made by (see, for example, slide 6), and information currently available to, our management. We have tried to identify forward-looking statements by using words such as “believe,” “should,” “will,” “expect,” “estimate,” “continue to,” “outlook,” “trend” and similar expressions, but these words are not the exclusive means of identifying forward-looking statements. These statements are based on information currently available to us and are subject to various risks, uncertainties, and other factors, including, but not limited to, those discussed in Item 1A,“Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2016 and our subsequent filings with the Securities and Exchange Commission that could cause our actual growth, results of operations, financial condition, cash flows, performance and business prospects and opportunities to differ materially from those expressed in, or implied by, these statements. Except as expressly required by the federal securities laws, we undertake no obligation to update such factors or any of the forward-looking statements to reflect future events, developments, or changed circumstances or for any other reason. Certain financial information is presented on a non-GAAP basis. The Company believes it is useful to present non-GAAP financial measures which exclude certain significant items as a means to understand the performance of its operations. As a general matter, the Company uses non-GAAP financial measures in conjunction with results presented in accordance with GAAP to help analyze the performance of its core business, assist with preparing the annual operating plan, and measure performance for some forms of compensation. In addition, the Company believes that non-GAAP financial information is used by analysts and others in the investment community to analyze the Company's historical results and to provide estimates of future performance. The most directly comparable GAAP information and a reconciliation between the non-GAAP and GAAP figures are provided at the end of this presentation, and this presentation (including the reconciliation) has been posted to our website. Cautionary Statements & Disclosures

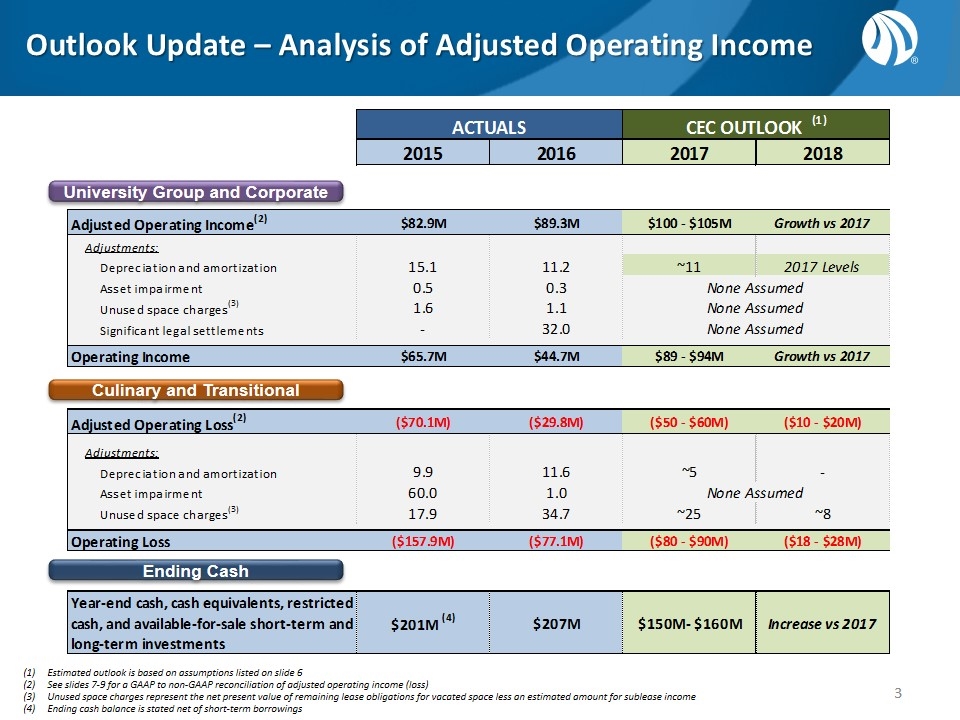

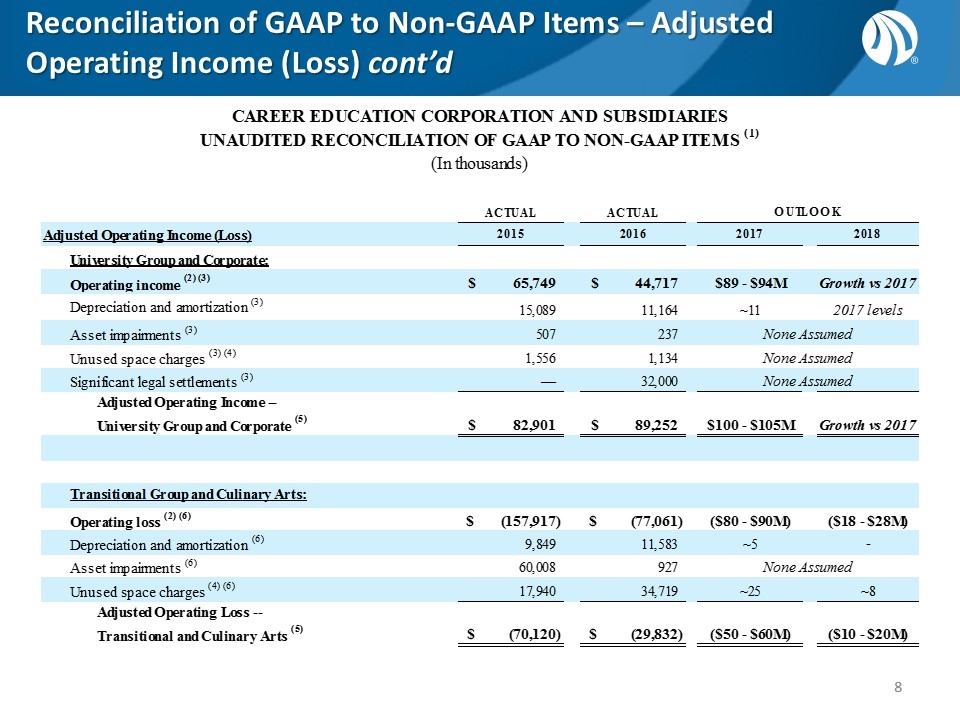

Outlook Update – Analysis of Adjusted Operating Income Estimated outlook is based on assumptions listed on slide 6 See slides 7-9 for a GAAP to non-GAAP reconciliation of adjusted operating income (loss) Unused space charges represent the net present value of remaining lease obligations for vacated space less an estimated amount for sublease income Ending cash balance is stated net of short-term borrowings University Group and Corporate Culinary and Transitional Ending Cash ACTUALS CEC OUTLOOK (1) 2015 2016 2017 2018 Adjusted Operating Income(2) $82,900,000 $89,300,000 $100 - $105M Growth vs 2017 Adjustments: Depreciation and amortization 15.1 11.2 ~11 2017 Levels Asset impairment 0.5 0.3 None Assumed Unused space charges(3) 1.6 1.1000000000000001 None Assumed Significant legal settlements 0 32 None Assumed Operating Income $65,700,000 $44,700,000 $89 - $94M Growth vs 2017 Adjusted Operating Loss(2) $,-70,120,000 $,-29,832,000 ($50 - $60M) ($10 - $20M) Adjustments: Depreciation and amortization 9.9 11.6 ~5 0 Asset impairment 60 1 None Assumed Unused space charges(3) 17.899999999999999 34.700000000000003 ~25 ~8 Operating Loss $-,157,917,000 $,-77,061,000 ($80 - $90M) ($18 - $28M) Year-end cash, cash equivalents, restricted cash, and available-for-sale short-term and long-term investments $201M (4) $207M $150M- $160M Increase vs 2017

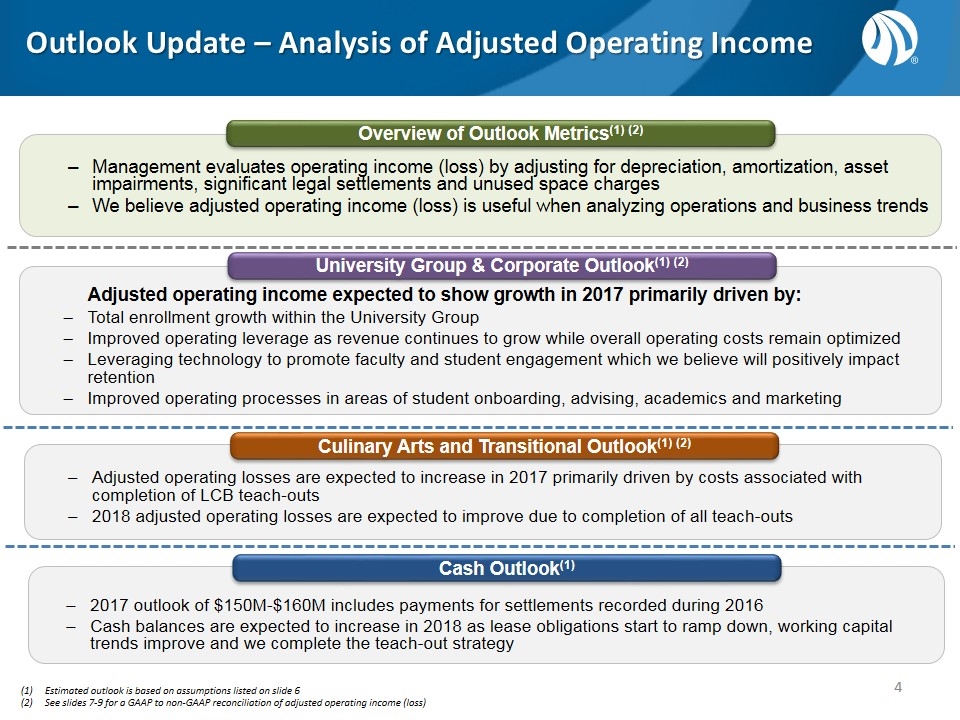

2017 outlook of $150M-$160M includes payments for settlements recorded during 2016 Cash balances are expected to increase in 2018 as lease obligations start to ramp down, working capital trends improve and we complete the teach-out strategy Outlook Update – Analysis of Adjusted Operating Income Estimated outlook is based on assumptions listed on slide 6 See slides 7-9 for a GAAP to non-GAAP reconciliation of adjusted operating income (loss) Adjusted operating income expected to show growth in 2017 primarily driven by: Total enrollment growth within the University Group Improved operating leverage as revenue continues to grow while overall operating costs remain optimized Leveraging technology to promote faculty and student engagement which we believe will positively impact retention Improved operating processes in areas of student onboarding, advising, academics and marketing Adjusted operating losses are expected to increase in 2017 primarily driven by costs associated with completion of LCB teach-outs 2018 adjusted operating losses are expected to improve due to completion of all teach-outs University Group & Corporate Outlook(1) (2) Culinary Arts and Transitional Outlook(1) (2) Management evaluates operating income (loss) by adjusting for depreciation, amortization, asset impairments, significant legal settlements and unused space charges We believe adjusted operating income (loss) is useful when analyzing operations and business trends Overview of Outlook Metrics(1) (2) Cash Outlook(1)

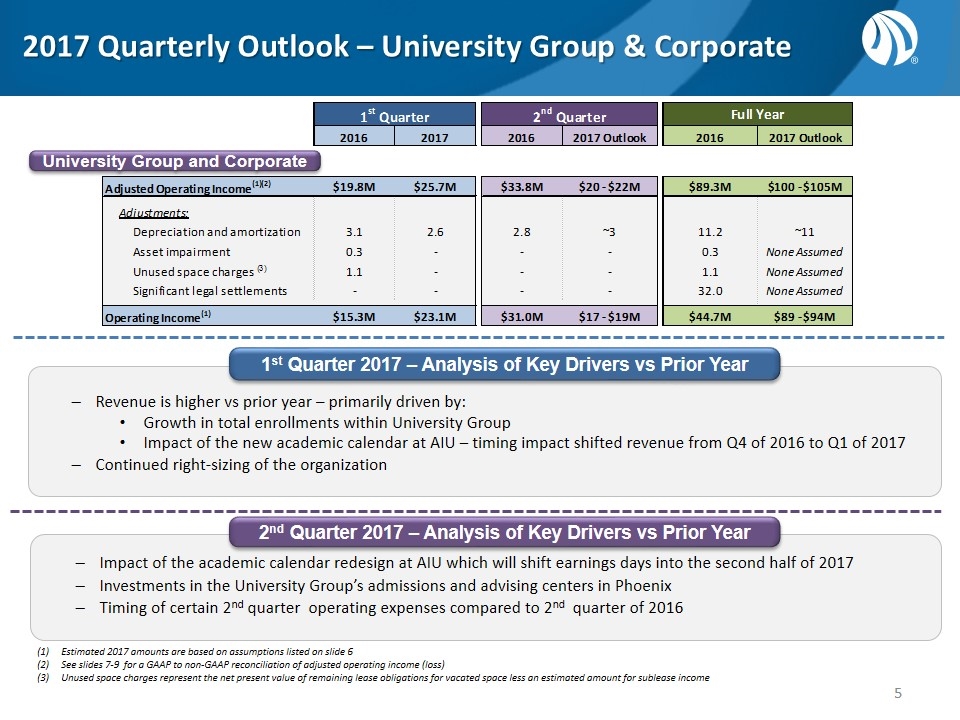

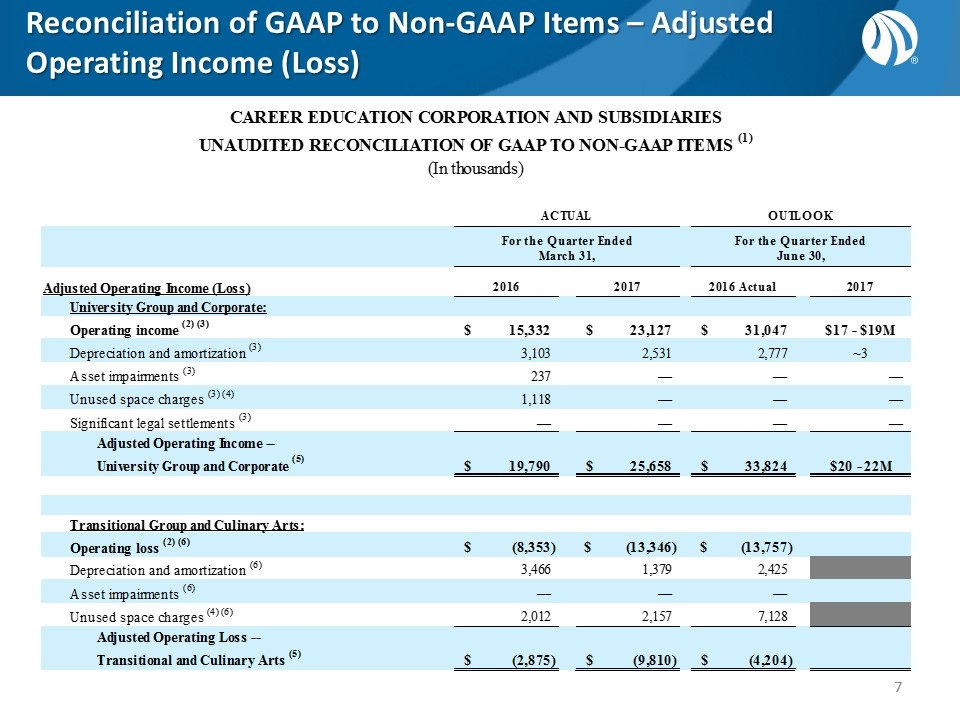

2017 Quarterly Outlook – University Group & Corporate Revenue is higher vs prior year – primarily driven by: Growth in total enrollments within University Group Impact of the new academic calendar at AIU – timing impact shifted revenue from Q4 of 2016 to Q1 of 2017 Continued right-sizing of the organization 1st Quarter 2017 – Analysis of Key Drivers vs Prior Year Impact of the academic calendar redesign at AIU which will shift earnings days into the second half of 2017 Investments in the University Group’s admissions and advising centers in Phoenix Timing of certain 2nd quarter operating expenses compared to 2nd quarter of 2016 2nd Quarter 2017 – Analysis of Key Drivers vs Prior Year Estimated 2017 amounts are based on assumptions listed on slide 6 See slides 7-9 for a GAAP to non-GAAP reconciliation of adjusted operating income (loss) Unused space charges represent the net present value of remaining lease obligations for vacated space less an estimated amount for sublease income University Group and Corporate 1st Quarter 2nd Quarter Full Year 2016 2017 2016 2017 Outlook 2016 2017 Outlook Adjusted Operating Income(1)(2) $19,790,000 $25,658,000 $33,824,000 $20 - $22M $89,300,000 $100 - $105M Adjustments: Depreciation and amortization 3.1 2.6 2.8 ~3 11.2 ~11 Asset impairment 0.3 0 0 0 0.3 None Assumed Unused space charges (3) 1.1000000000000001 0 0 0 1.1000000000000001 None Assumed Significant legal settlements 0 0 0 0 32 None Assumed Operating Income(1) $15,332,000 $23,127,000 $31,047,000 $17 - $19M $44,700,000 $89 - $94M

Outlook Assumptions Achievement of the outlook included within these slides is based on the following key assumptions and factors, among others: Modest total enrollment growth within the University Group while achieving the intended University Group efficiencies Teach-outs to progress as expected and performance consistent with current trends Achievement of recovery rates for our real estate obligations and timing of any associated lease termination payments consistent with our historical experiences Continued right-sizing of our Corporate expense structure to serve primarily online institutions No material changes in the current legal or regulatory environment and excludes legal and regulatory liabilities which are not probable and estimable at this time, and any impact of new or proposed regulations, including the new “borrower defense to repayment” regulations and the gainful employment regulation Consistent working capital movements in line with historical operating trends and potential impact of teach-out campuses on working capital in line with expectations Although these estimates and assumptions are based upon management’s good faith beliefs regarding current events and actions that we may undertake in the future, actual results could differ materially from estimates.

Reconciliation of GAAP to Non-GAAP Items – Adjusted Operating Income (Loss) CAREER EDUCATION CORPORATION AND SUBSIDIARIES **should match the exhibits table UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ITEMS (1) (In thousands) ACTUAL OUTLOOK For the Quarter Ended March 31, For the Quarter Ended June 30, Adjusted Operating Income (Loss) 2016 2017 2016 Actual 2017 University Group and Corporate: Operating income (2) (3) $15,332 $23,127 $31,047 $17 - $19M Depreciation and amortization (3) 3,103 2,531 2,777 ~3 Asset impairments (3) 237 0 0 0 Unused space charges (3) (4) 1,118 0 0 0 Significant legal settlements (3) 0 0 0 0 Adjusted Operating Income --University Group and Corporate (5) $19,790 $25,658 $33,824 $20 - 22M Transitional Group and Culinary Arts: Operating loss (2) (6) $-8,353 $,-13,346 $,-13,757 Depreciation and amortization (6) 3,466 1,379 2,425 Asset impairments (6) 0 0 0 Unused space charges (4) (6) 2,012 2,157 7,128 Adjusted Operating Loss --Transitional and Culinary Arts (5) $-2,875 $-9,810 $-4,204 CAREER EDUCATION CORPORATION AND SUBSIDIARIES UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ITEMS (1) (In thousands) ACTUAL ACTUAL OUTLOOK Adjusted Operating Income (Loss) 2015 2016 2017 2018 University Group and Corporate: Operating income (2) (3) $65,749 $44,717 $89 - $94M Growth vs 2017 Depreciation and amortization (3) 15,089 11,164 ~11 2017 levels Asset impairments (3) 507 237 None Assumed Unused space charges (3) (4) 1,556 1,134 None Assumed Significant legal settlements (3) 0 32,000 None Assumed Adjusted Operating Income --University Group and Corporate (5) $82,901 $89,252 $100 - $105M Growth vs 2017 Transitional Group and Culinary Arts: Operating loss (2) (6) $-,157,917 $,-77,061 ($80 - $90M) ($18 - $28M) Depreciation and amortization (6) 9,849 11,583 ~5 - Asset impairments (6) 60,008 927 None Assumed Unused space charges (4) (6) 17,940 34,719 ~25 ~8 Adjusted Operating Loss --Transitional and Culinary Arts (5) $,-70,120 $,-29,832 ($50 - $60M) ($10 - $20M)

Reconciliation of GAAP to Non-GAAP Items – Adjusted Operating Income (Loss) cont’d CAREER EDUCATION CORPORATION AND SUBSIDIARIES **should match the exhibits table UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ITEMS (1) (In thousands) ACTUAL OUTLOOK For the Quarter Ended March 31, For the Quarter Ended June 30, Adjusted Operating Income (Loss) 2016 2017 2016 Actual 2017 University Group and Corporate: Operating income (2) (3) $15,332 $23,127 $31,047 $17 - $19M Depreciation and amortization (3) 3,103 2,531 2,777 ~3 Asset impairments (3) 237 0 0 0 Unused space charges (3) (4) 1,118 0 0 0 Significant legal settlements (3) 0 0 0 0 Adjusted Operating Income --University Group and Corporate (5) $19,790 $25,658 $33,824 $20 - 22M Transitional Group and Culinary Arts: Operating loss (2) (6) $-8,353 $,-13,346 $,-13,757 Depreciation and amortization (6) 3,466 1,379 2,425 Asset impairments (6) 0 0 0 Unused space charges (4) (6) 2,012 2,157 7,128 Adjusted Operating Loss --Transitional and Culinary Arts (5) $-2,875 $-9,810 $-4,204 CAREER EDUCATION CORPORATION AND SUBSIDIARIES UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ITEMS (1) (In thousands) ACTUAL ACTUAL OUTLOOK Adjusted Operating Income (Loss) 2015 2016 2017 2018 University Group and Corporate: Operating income (2) (3) $65,749 $44,717 $89 - $94M Growth vs 2017 Depreciation and amortization (3) 15,089 11,164 ~11 2017 levels Asset impairments (3) 507 237 None Assumed Unused space charges (3) (4) 1,556 1,134 None Assumed Significant legal settlements (3) 0 32,000 None Assumed Adjusted Operating Income --University Group and Corporate (5) $82,901 $89,252 $100 - $105M Growth vs 2017 Transitional Group and Culinary Arts: Operating loss (2) (6) $-,157,917 $,-77,061 ($80 - $90M) ($18 - $28M) Depreciation and amortization (6) 9,849 11,583 ~5 - Asset impairments (6) 60,008 927 None Assumed Unused space charges (4) (6) 17,940 34,719 ~25 ~8 Adjusted Operating Loss --Transitional and Culinary Arts (5) $,-70,120 $,-29,832 ($50 - $60M) ($10 - $20M)

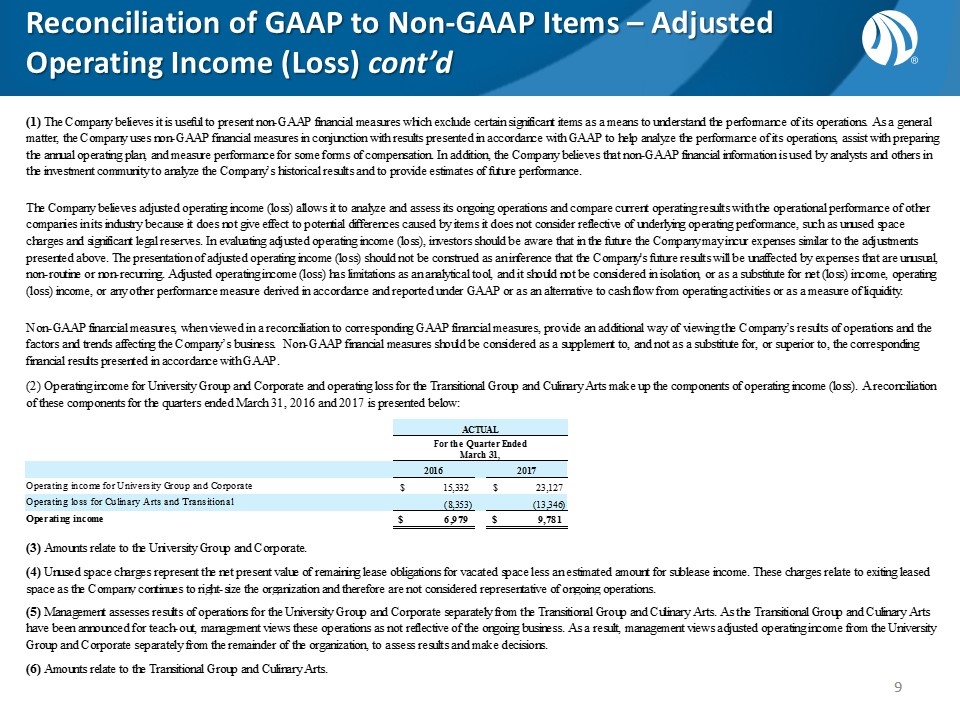

Reconciliation of GAAP to Non-GAAP Items – Adjusted Operating Income (Loss) cont’d (1) The Company believes it is useful to present non-GAAP financial measures which exclude certain significant items as a means to understand the performance of its operations. As a general matter, the Company uses non-GAAP financial measures in conjunction with results presented in accordance with GAAP to help analyze the performance of its operations, assist with preparing the annual operating plan, and measure performance for some forms of compensation. In addition, the Company believes that non-GAAP financial information is used by analysts and others in the investment community to analyze the Company’s historical results and to provide estimates of future performance. The Company believes adjusted operating income (loss) allows it to analyze and assess its ongoing operations and compare current operating results with the operational performance of other companies in its industry because it does not give effect to potential differences caused by items it does not consider reflective of underlying operating performance, such as unused space charges and significant legal reserves. In evaluating adjusted operating income (loss), investors should be aware that in the future the Company may incur expenses similar to the adjustments presented above. The presentation of adjusted operating income (loss) should not be construed as an inference that the Company's future results will be unaffected by expenses that are unusual, non-routine or non-recurring. Adjusted operating income (loss) has limitations as an analytical tool, and it should not be considered in isolation, or as a substitute for net (loss) income, operating (loss) income, or any other performance measure derived in accordance and reported under GAAP or as an alternative to cash flow from operating activities or as a measure of liquidity. Non-GAAP financial measures, when viewed in a reconciliation to corresponding GAAP financial measures, provide an additional way of viewing the Company’s results of operations and the factors and trends affecting the Company’s business. Non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the corresponding financial results presented in accordance with GAAP. (2) Operating income for University Group and Corporate and operating loss for the Transitional Group and Culinary Arts make up the components of operating income (loss). A reconciliation of these components for the quarters ended March 31, 2016 and 2017 is presented below: ACTUAL For the Quarter Ended March 31, 2016 2017 Operating income for University Group and Corporate $15,332 $23,127 Operating loss for Culinary Arts and Transitional -8,353 ,-13,346 Operating income $6,979 $9,781 (3) Amounts relate to the University Group and Corporate. (4) Unused space charges represent the net present value of remaining lease obligations for vacated space less an estimated amount for sublease income. These charges relate to exiting leased space as the Company continues to right-size the organization and therefore are not considered representative of ongoing operations. (5) Management assesses results of operations for the University Group and Corporate separately from the Transitional Group and Culinary Arts. As the Transitional Group and Culinary Arts have been announced for teach-out, management views these operations as not reflective of the ongoing business. As a result, management views adjusted operating income from the University Group and Corporate separately from the remainder of the organization, to assess results and make decisions. (6) Amounts relate to the Transitional Group and Culinary Arts.