Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - UGI CORP /PA/ | ugimar2017ex991.htm |

| 8-K - 8-K - UGI CORP /PA/ | ugimar2017er8k.htm |

1

Fiscal 2017

Second Quarter Results

John Walsh

President & CEO, UGI

Kirk Oliver

Chief Financial Officer, UGI

Jerry Sheridan

President & CEO, AmeriGas

2

About This Presentation

This presentation contains certain forward-looking statements that management believes to be

reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties

that are difficult to predict and many of which are beyond management’s control. You should read UGI’s

Annual Report on Form 10-K for a more extensive list of factors that could affect results. Among them are

adverse weather conditions, cost volatility and availability of all energy products, including propane,

natural gas, electricity and fuel oil, increased customer conservation measures, the impact of pending and

future legal proceedings, liability for uninsured claims and for claims in excess of insurance coverage,

domestic and international political, regulatory and economic conditions in the United States and in

foreign countries, including the current conflicts in the Middle East, and foreign currency exchange rate

fluctuations (particularly the euro), changes in Marcellus Shale gas production, the availability, timing and

success of our acquisitions, commercial initiatives and investments to grow our business, our ability to

successfully integrate acquired businesses and achieve anticipated synergies, and the interruption,

disruption, failure, malfunction, or breach of our information technology systems, including due to cyber-

attack. UGI undertakes no obligation to release revisions to its forward-looking statements to reflect

events or circumstances occurring after today. In addition, this presentation uses certain non-GAAP

financial measures. Please see the appendix for reconciliations of these measures to the most comparable

GAAP financial measure.

UGI Corporation | Fiscal 2017 Second Quarter Results

3

Second Quarter Recap

John Walsh

President & CEO, UGI

4

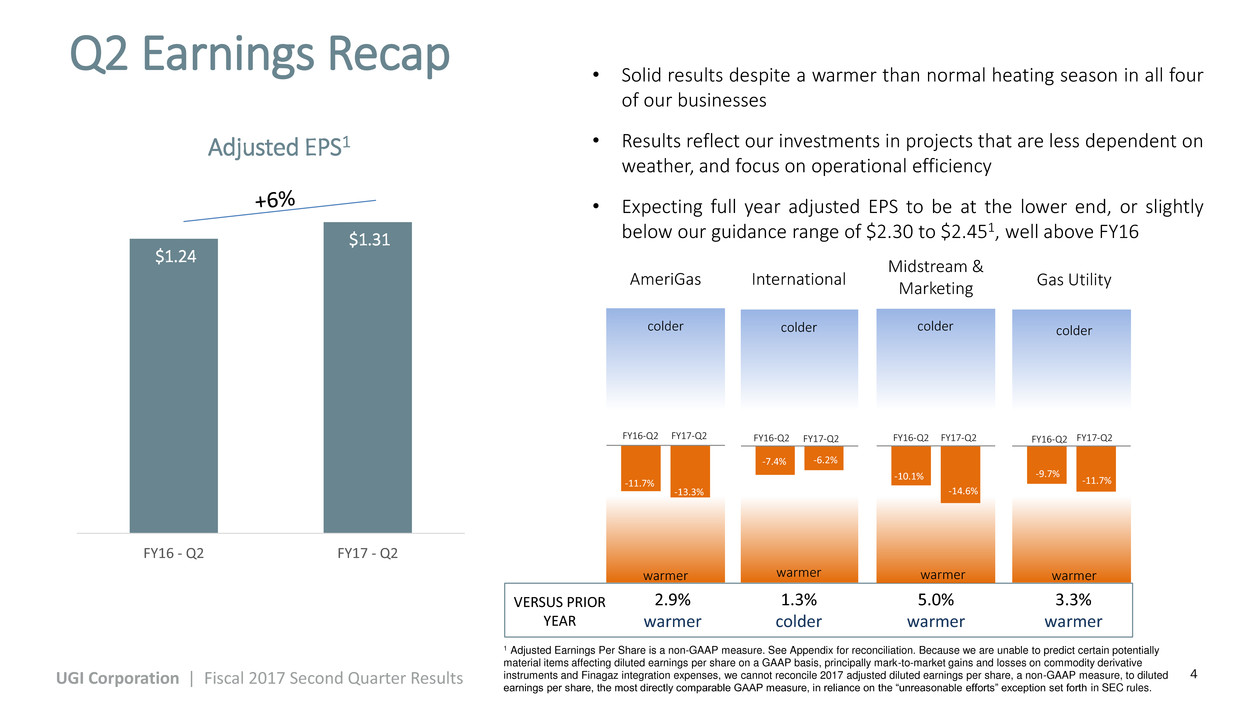

Q2 Earnings Recap

• Solid results despite a warmer than normal heating season in all four

of our businesses

• Results reflect our investments in projects that are less dependent on

weather, and focus on operational efficiency

• Expecting full year adjusted EPS to be at the lower end, or slightly

below our guidance range of $2.30 to $2.451, well above FY16

FY17-Q2 FY16-Q2 FY16-Q2 FY17-Q2 FY16-Q2

International AmeriGas

Midstream &

Marketing Gas Utility

colder

warmer

colder

warmer

colder

warmer

colder

warmer

-13.3%

-11.7%

-6.2% -7.4%

-30.0%

-10.7%

-11.7%

-9.7%

5.0%

warmer

3.3%

warmer

1.3%

colder

2.9%

warmer

VERSUS PRIOR

YEAR

FY17-Q2

-10.1%

-14.6%

FY17-Q2 FY16-Q2

warmer

colder

$1.24

$1.31

FY16 - Q2 FY17 - Q2

Adjusted EPS1

UGI Corporation | Fiscal 2017 Second Quarter Results

1 Adjusted Earnings Per Share is a non-GAAP measure. See Appendix for reconciliation. Because we are unable to predict certain potentially

material items affecting diluted earnings per share on a GAAP basis, principally mark-to-market gains and losses on commodity derivative

instruments and Finagaz integration expenses, we cannot reconcile 2017 adjusted diluted earnings per share, a non-GAAP measure, to diluted

earnings per share, the most directly comparable GAAP measure, in reliance on the “unreasonable efforts” exception set forth in SEC rules.

5

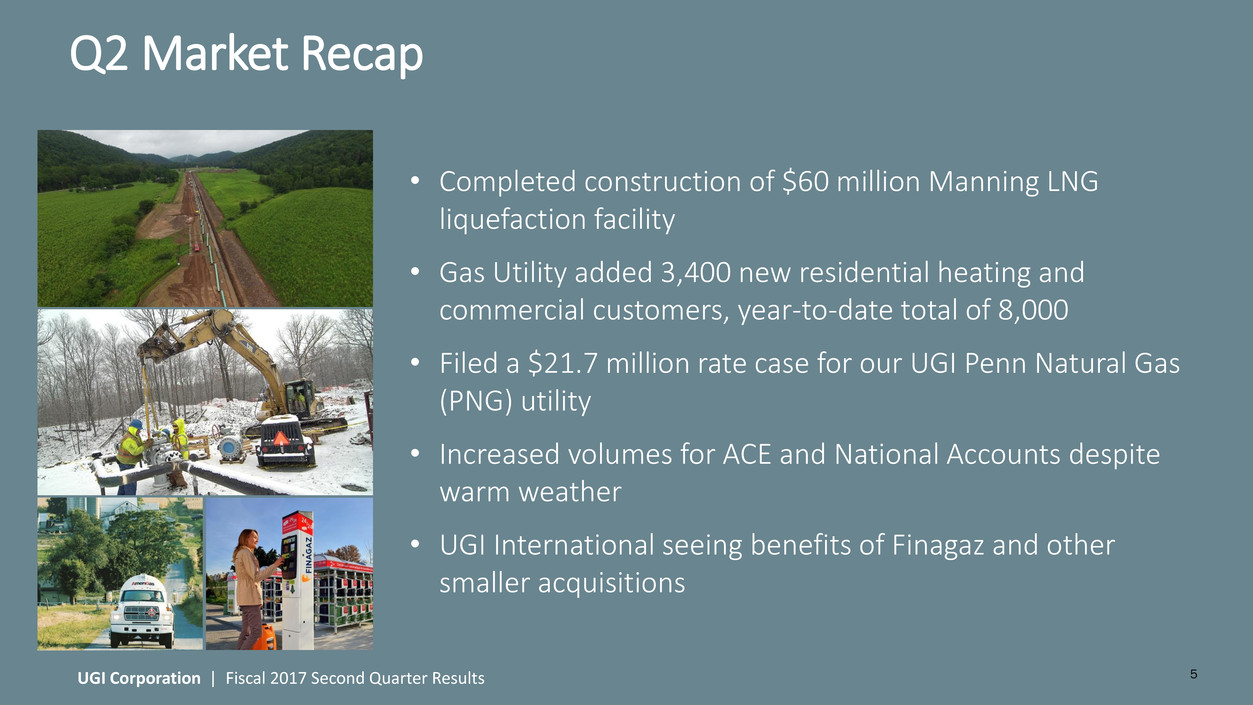

Q2 Market Recap

UGI Corporation | Fiscal 2017 Second Quarter Results

• Completed construction of $60 million Manning LNG

liquefaction facility

• Gas Utility added 3,400 new residential heating and

commercial customers, year-to-date total of 8,000

• Filed a $21.7 million rate case for our UGI Penn Natural Gas

(PNG) utility

• Increased volumes for ACE and National Accounts despite

warm weather

• UGI International seeing benefits of Finagaz and other

smaller acquisitions

6

Second Quarter Financial Review

Kirk Oliver

Chief Financial Officer, UGI

7

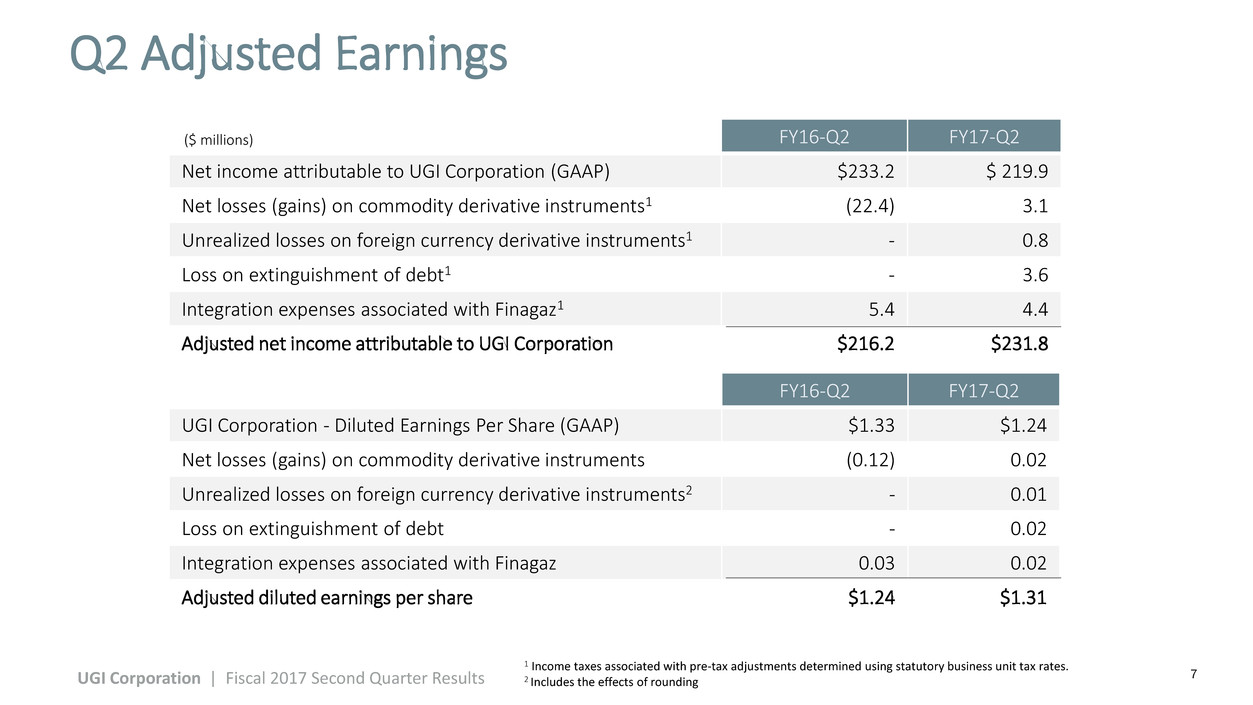

FY16-Q2 FY17-Q2

Net income attributable to UGI Corporation (GAAP) $233.2 $ 219.9

Net losses (gains) on commodity derivative instruments1 (22.4) 3.1

Unrealized losses on foreign currency derivative instruments1 - 0.8

Loss on extinguishment of debt1 - 3.6

Integration expenses associated with Finagaz1 5.4 4.4

Adjusted net income attributable to UGI Corporation $216.2 $231.8

Q2 Adjusted Earnings

FY16-Q2 FY17-Q2

UGI Corporation - Diluted Earnings Per Share (GAAP) $1.33 $1.24

Net losses (gains) on commodity derivative instruments (0.12) 0.02

Unrealized losses on foreign currency derivative instruments2 - 0.01

Loss on extinguishment of debt - 0.02

Integration expenses associated with Finagaz 0.03 0.02

Adjusted diluted earnings per share $1.24 $1.31

1 Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates.

2 Includes the effects of rounding

($ millions)

UGI Corporation | Fiscal 2017 Second Quarter Results

8

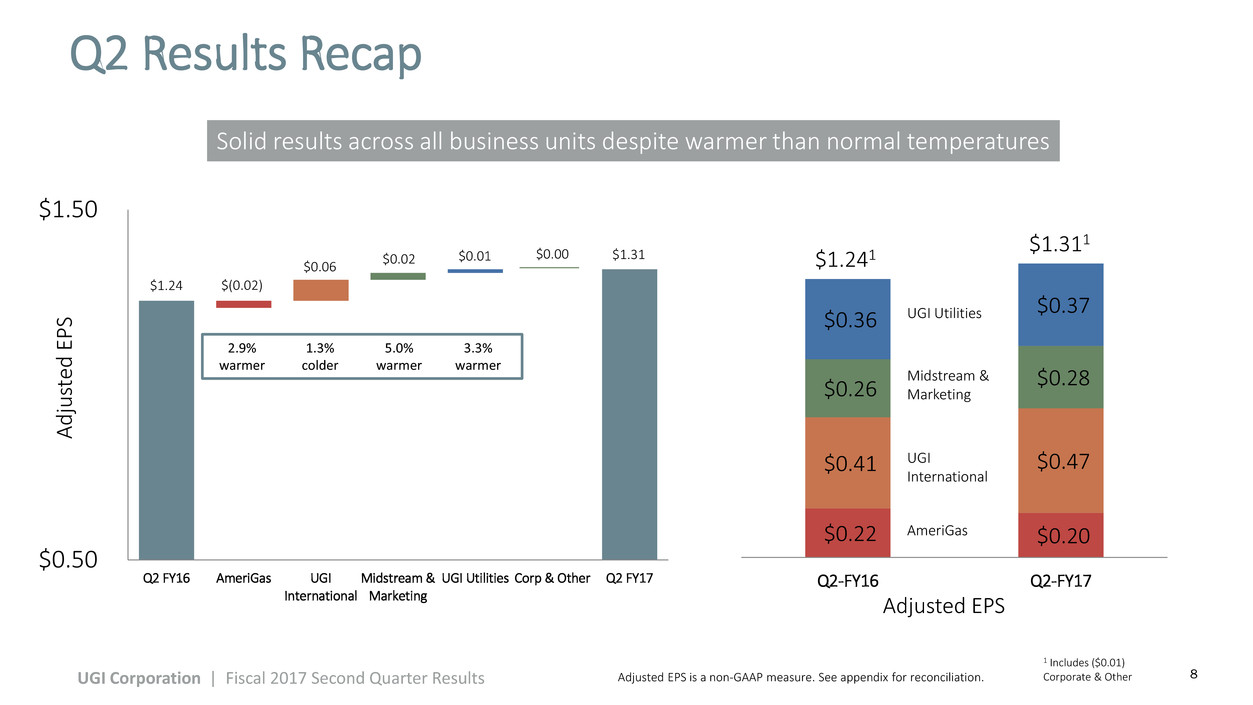

$0.50

$1.50

Q2 FY16 AmeriGas UGI

International

Midstream &

Marketing

UGI Utilities Corp & Other Q2 FY17

$1.24 $(0.02)

$0.06

$0.02 $0.01 $0.00 $1.31

Q2 Results Recap

Solid results across all business units despite warmer than normal temperatures

A

d

ju

st

ed

E

P

S

Adjusted EPS is a non-GAAP measure. See appendix for reconciliation. UGI Corporation | Fiscal 2017 Second Quarter Results

1 Includes ($0.01)

Corporate & Other

$0.22 $0.20

$0.41 $0.47

$0.26 $0.28

$0.36

$0.37

Q2-FY16 Q2-FY17

$1.311

$1.241

AmeriGas

UGI

International

Midstream &

Marketing

UGI Utilities

1.3%

colder

2.9%

warmer

5.0%

warmer

3.3%

warmer

Adjusted EPS

9

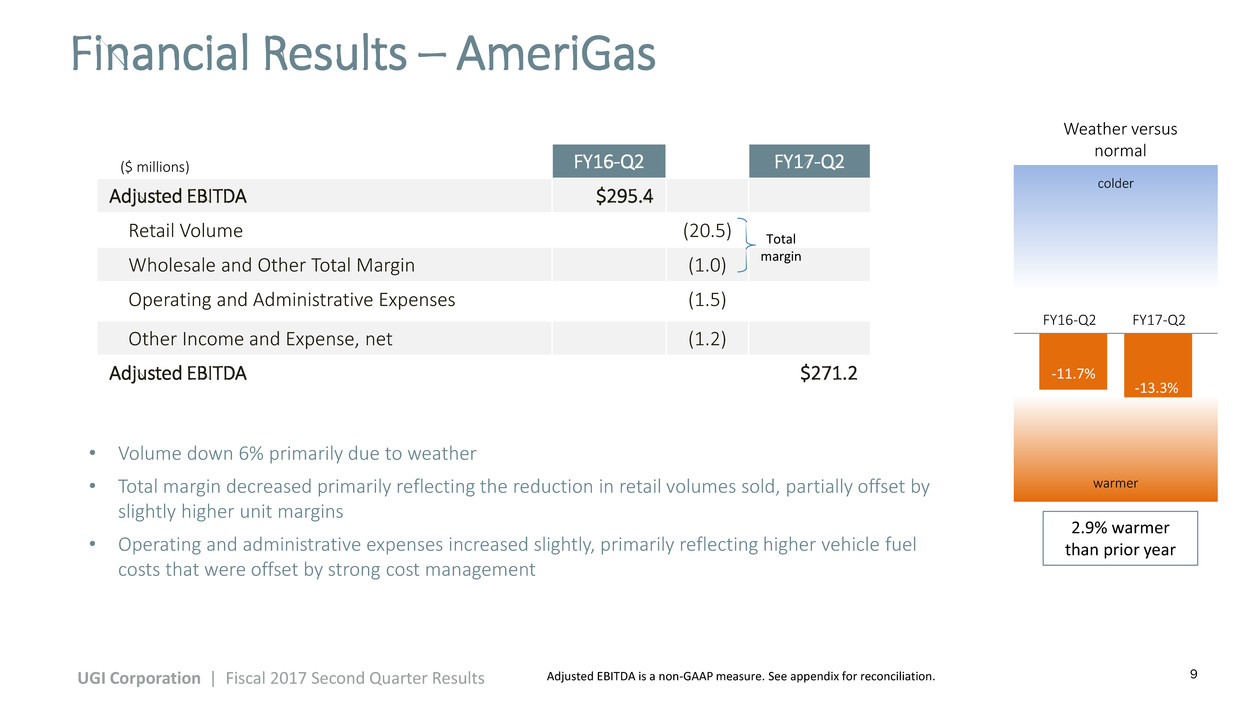

FY16-Q2 FY17-Q2

Adjusted EBITDA $295.4

Retail Volume (20.5)

Wholesale and Other Total Margin (1.0)

Operating and Administrative Expenses (1.5)

Other Income and Expense, net (1.2)

Adjusted EBITDA $271.2

• Volume down 6% primarily due to weather

• Total margin decreased primarily reflecting the reduction in retail volumes sold, partially offset by

slightly higher unit margins

• Operating and administrative expenses increased slightly, primarily reflecting higher vehicle fuel

costs that were offset by strong cost management

Financial Results – AmeriGas

FY16-Q2 FY17-Q2

colder

warmer

-13.3%

-11.7%

Weather versus

normal

2.9% warmer

than prior year

Adjusted EBITDA is a non-GAAP measure. See appendix for reconciliation.

($ millions)

Total

margin

UGI Corporation | Fiscal 2017 Second Quarter Results

10

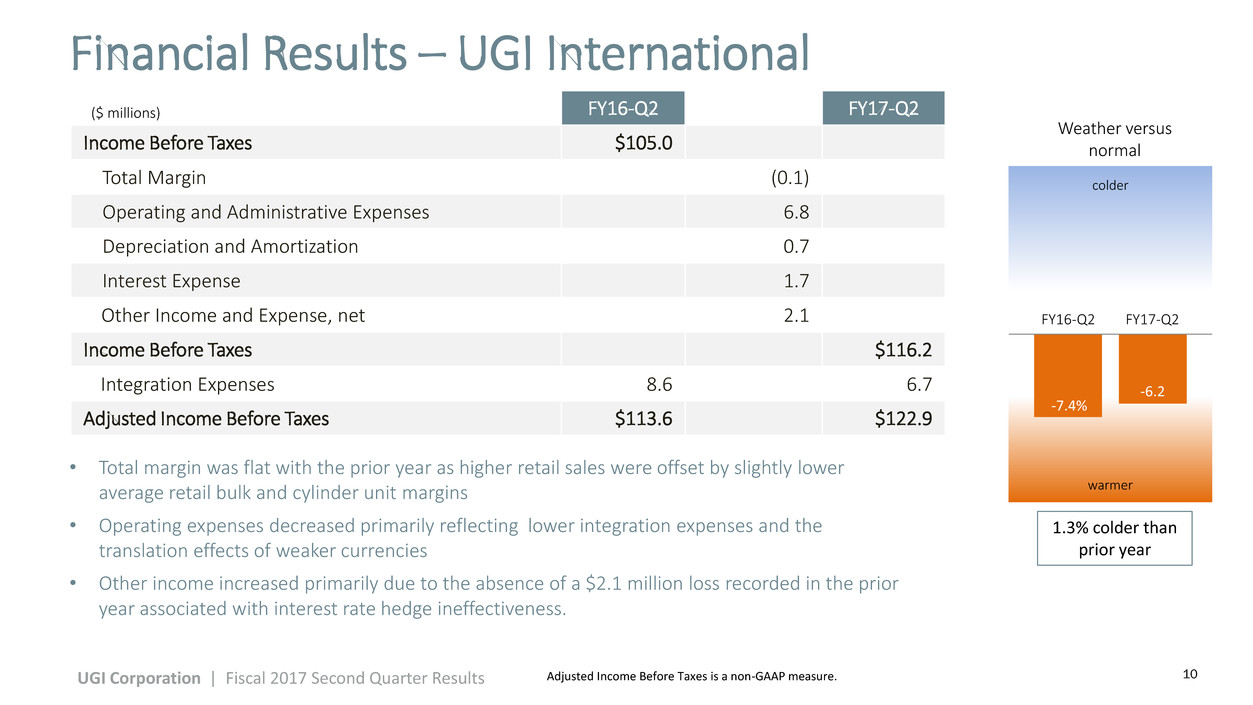

FY16-Q2 FY17-Q2

Income Before Taxes $105.0

Total Margin (0.1)

Operating and Administrative Expenses 6.8

Depreciation and Amortization 0.7

Interest Expense 1.7

Other Income and Expense, net 2.1

Income Before Taxes $116.2

Integration Expenses 8.6 6.7

Adjusted Income Before Taxes $113.6 $122.9

• Total margin was flat with the prior year as higher retail sales were offset by slightly lower

average retail bulk and cylinder unit margins

• Operating expenses decreased primarily reflecting lower integration expenses and the

translation effects of weaker currencies

• Other income increased primarily due to the absence of a $2.1 million loss recorded in the prior

year associated with interest rate hedge ineffectiveness.

Financial Results – UGI International

Weather versus

normal

-6.2% -7.4%

1.3% colder than

prior year

($ millions)

Adjusted Income Before Taxes is a non-GAAP measure. UGI Corporation | Fiscal 2017 Second Quarter Results

FY16-Q2 FY17-Q2

colder

warmer

-7.4%

-6.2

11

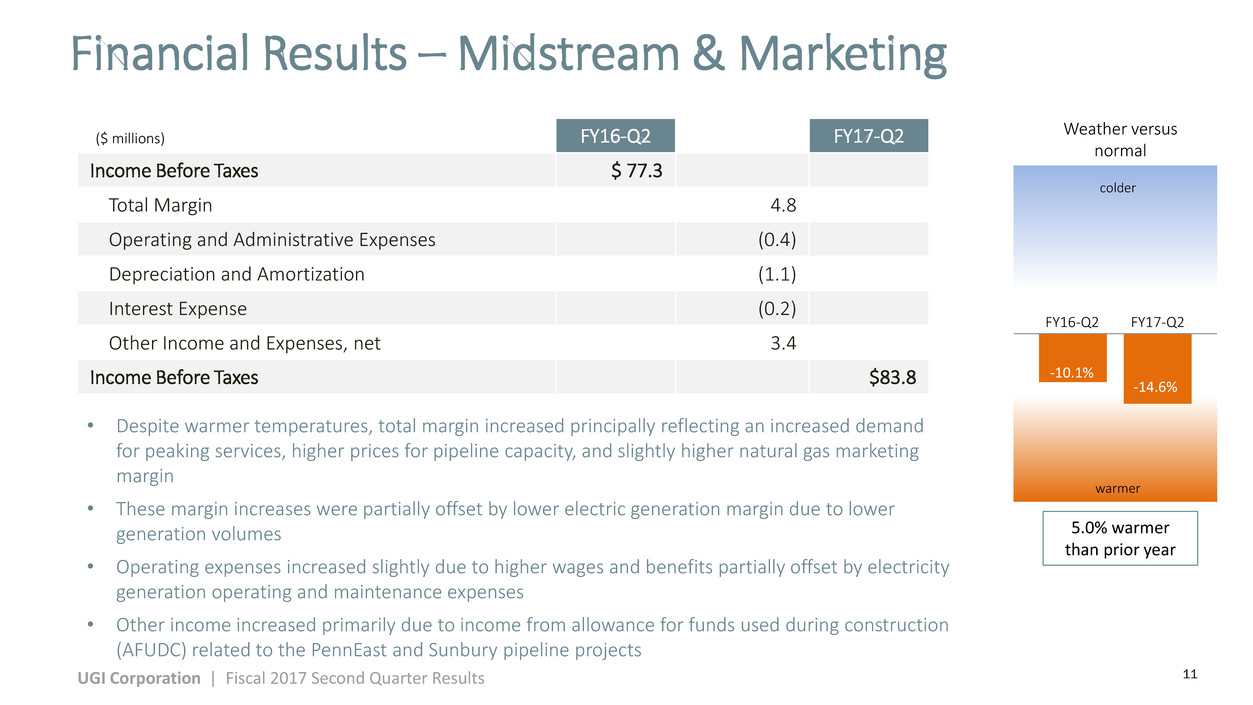

FY16-Q2 FY17-Q2

Income Before Taxes $ 77.3

Total Margin 4.8

Operating and Administrative Expenses (0.4)

Depreciation and Amortization (1.1)

Interest Expense (0.2)

Other Income and Expenses, net 3.4

Income Before Taxes $83.8

• Despite warmer temperatures, total margin increased principally reflecting an increased demand

for peaking services, higher prices for pipeline capacity, and slightly higher natural gas marketing

margin

• These margin increases were partially offset by lower electric generation margin due to lower

generation volumes

• Operating expenses increased slightly due to higher wages and benefits partially offset by electricity

generation operating and maintenance expenses

• Other income increased primarily due to income from allowance for funds used during construction

(AFUDC) related to the PennEast and Sunbury pipeline projects

Financial Results – Midstream & Marketing

FY16-Q2 FY17-Q2

colder

warmer

-10.1%

-14.6%

Weather versus

normal

5.0% warmer

than prior year

($ millions)

UGI Corporation | Fiscal 2017 Second Quarter Results

12

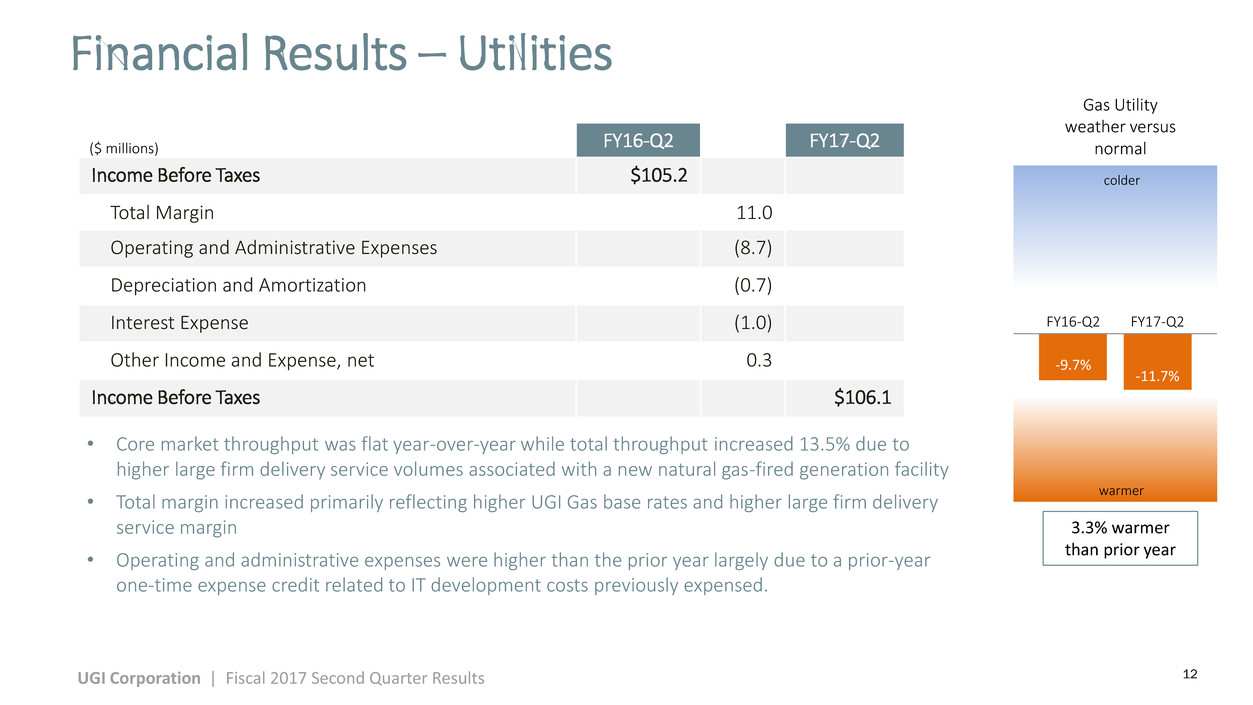

FY16-Q2 FY17-Q2

Income Before Taxes $105.2

Total Margin 11.0

Operating and Administrative Expenses (8.7)

Depreciation and Amortization (0.7)

Interest Expense (1.0)

Other Income and Expense, net 0.3

Income Before Taxes $106.1

Financial Results – Utilities

FY16-Q2 FY17-Q2

colder

warmer

-11.7%

-9.7%

Gas Utility

weather versus

normal

3.3% warmer

than prior year

($ millions)

• Core market throughput was flat year-over-year while total throughput increased 13.5% due to

higher large firm delivery service volumes associated with a new natural gas-fired generation facility

• Total margin increased primarily reflecting higher UGI Gas base rates and higher large firm delivery

service margin

• Operating and administrative expenses were higher than the prior year largely due to a prior-year

one-time expense credit related to IT development costs previously expensed.

UGI Corporation | Fiscal 2017 Second Quarter Results

13

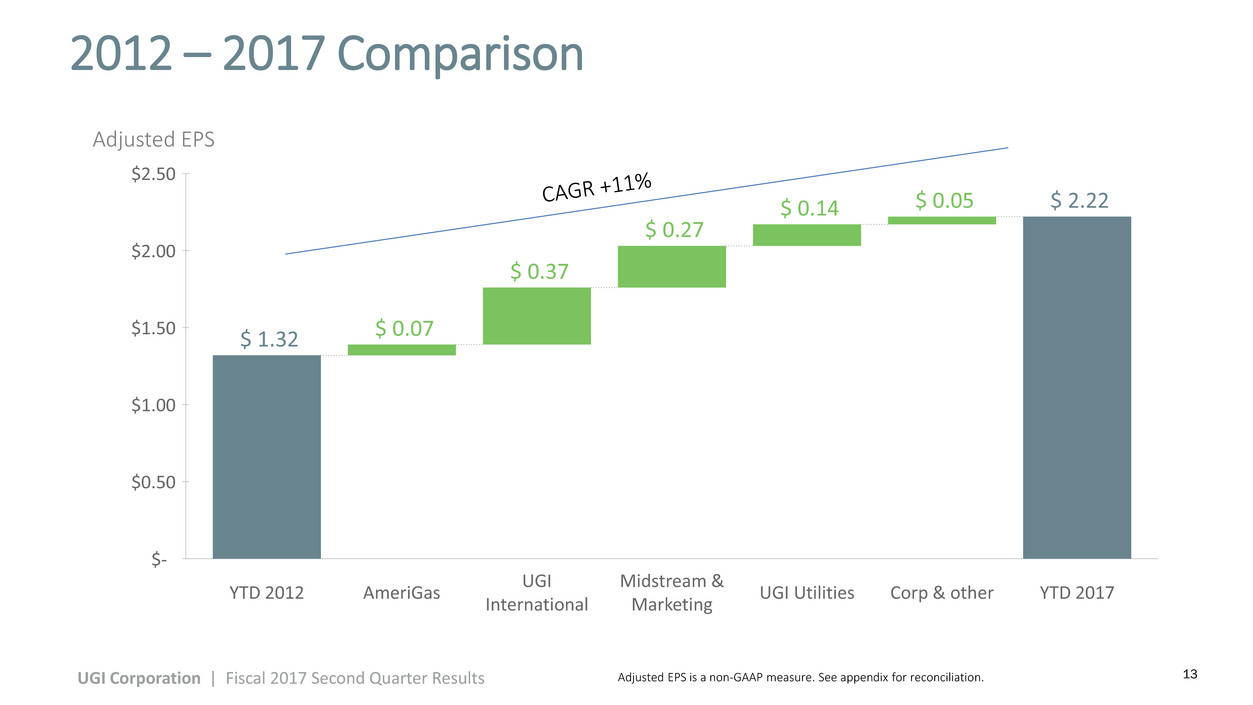

2012 – 2017 Comparison

UGI Corporation | Fiscal 2017 Second Quarter Results

$ 1.32 $ 0.07

$ 0.37

$ 0.27

$ 0.14 $ 0.05 $ 2.22

YTD 2012 AmeriGas

UGI

International

Midstream &

Marketing

UGI Utilities Corp & other YTD 2017

$2.50

$2.00

$1.50

$1.00

$0.50

$-

Adjusted EPS

Adjusted EPS is a non-GAAP measure. See appendix for reconciliation.

A

me

riGa

s

Second Quarter Recap

Jerry Sheridan

President & CEO, AmeriGas

15

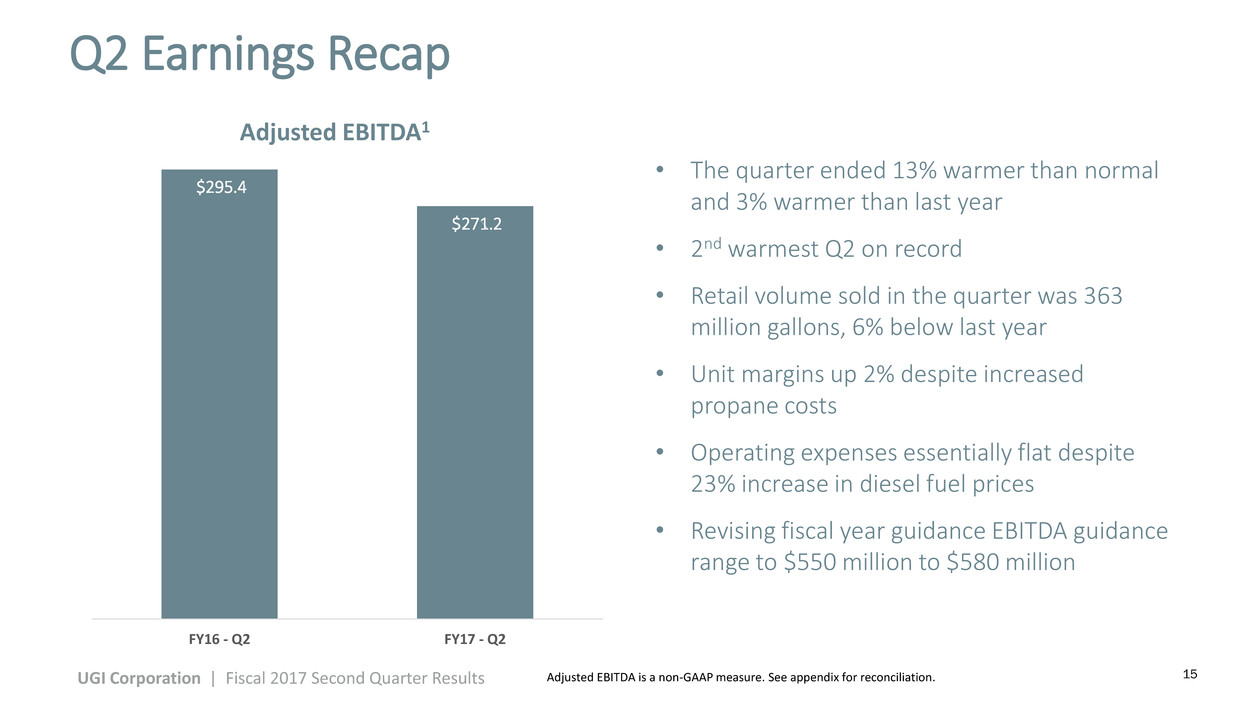

• The quarter ended 13% warmer than normal

and 3% warmer than last year

• 2nd warmest Q2 on record

• Retail volume sold in the quarter was 363

million gallons, 6% below last year

• Unit margins up 2% despite increased

propane costs

• Operating expenses essentially flat despite

23% increase in diesel fuel prices

• Revising fiscal year guidance EBITDA guidance

range to $550 million to $580 million

Adjusted EBITDA is a non-GAAP measure. See appendix for reconciliation.

Q2 Earnings Recap

$295.4

$271.2

FY16 - Q2 FY17 - Q2

Adjusted EBITDA1

UGI Corporation | Fiscal 2017 Second Quarter Results

16

Growth Initiatives

UGI Corporation | Fiscal 2017 Second Quarter Results

Cylinder Exchange

• Modest increase in volume despite the

warmer weather

• Over 1,250 new locations year-to-date

National Accounts

• Volume up 5% primarily due to new

accounts

Acquisitions

• Completed two small scale acquisitions and

anticipate closing on 3 additional deals in the

next few months

17 UGI Corporation | Fiscal 2017 Second Quarter Results

Refinancing

• Issued $525 million of 5.75% notes due May 2027

• Tendered for $378 million of 7.00% May 2022 notes

• Redeeming remaining $102.5 million of 7.00% May 2022 notes

• Completes refinancing of all long-term debt

• No significant debt maturities until 2024

• Average interest rates have been reduced by over 100 basis points

Distribution

• 1% increase distribution to $3.80 annually

• 13th consecutive year increasing distribution

Maintaining A Strong Balance Sheet

18

Conclusion and Q&A

John Walsh

President & CEO, UGI

19

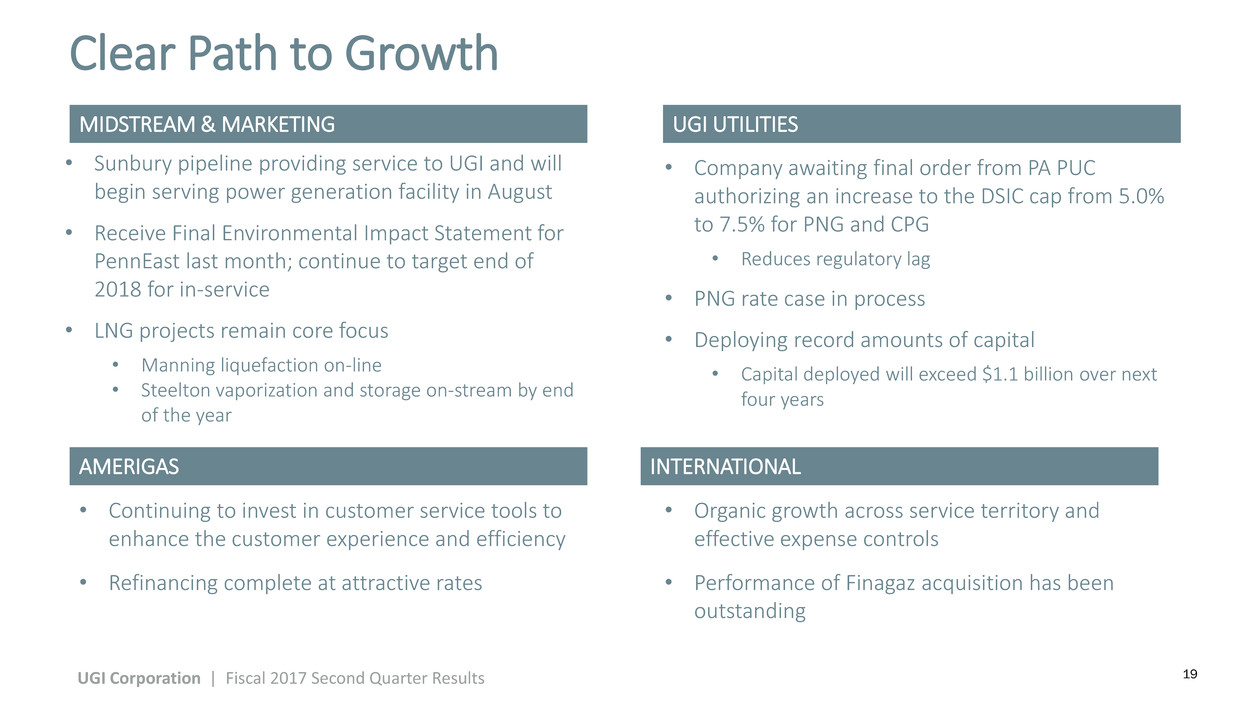

Clear Path to Growth

• Sunbury pipeline providing service to UGI and will

begin serving power generation facility in August

• Receive Final Environmental Impact Statement for

PennEast last month; continue to target end of

2018 for in-service

• LNG projects remain core focus

• Manning liquefaction on-line

• Steelton vaporization and storage on-stream by end

of the year

MIDSTREAM & MARKETING

INTERNATIONAL

• Organic growth across service territory and

effective expense controls

• Performance of Finagaz acquisition has been

outstanding

UGI UTILITIES

• Company awaiting final order from PA PUC

authorizing an increase to the DSIC cap from 5.0%

to 7.5% for PNG and CPG

• Reduces regulatory lag

• PNG rate case in process

• Deploying record amounts of capital

• Capital deployed will exceed $1.1 billion over next

four years

AMERIGAS

• Continuing to invest in customer service tools to

enhance the customer experience and efficiency

• Refinancing complete at attractive rates

UGI Corporation | Fiscal 2017 Second Quarter Results

20

APPENDIX

21

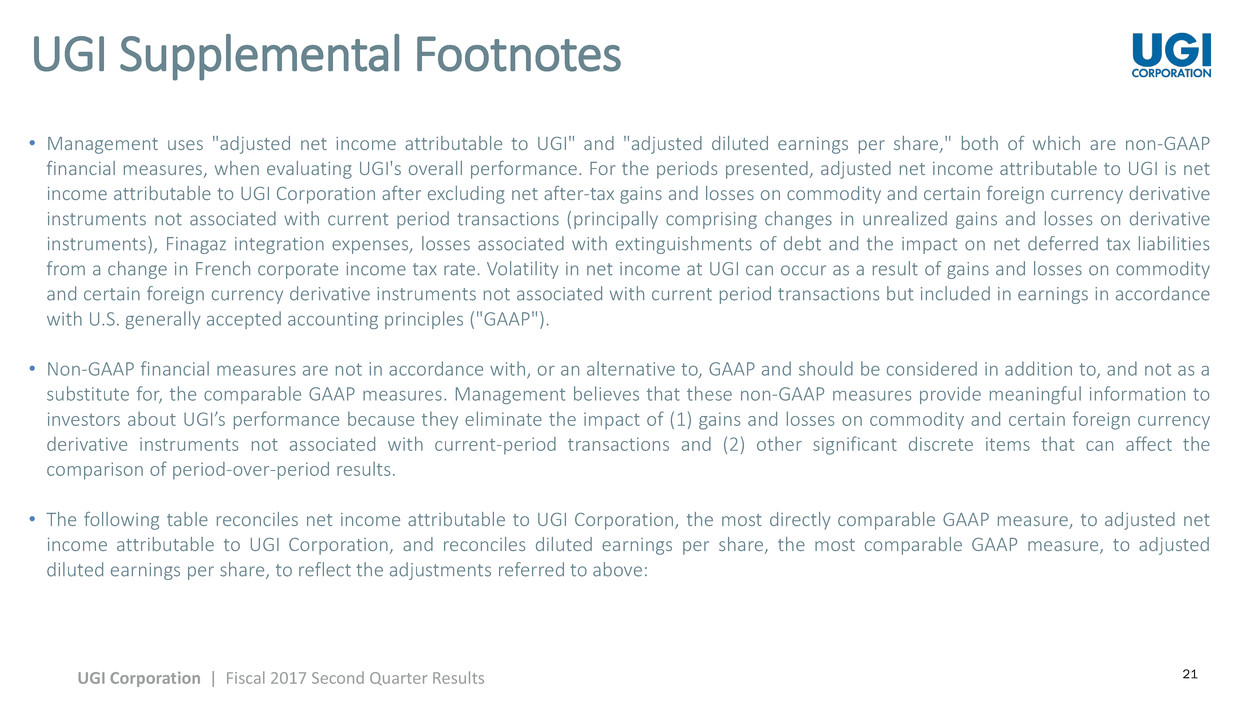

• Management uses "adjusted net income attributable to UGI" and "adjusted diluted earnings per share," both of which are non-GAAP

financial measures, when evaluating UGI's overall performance. For the periods presented, adjusted net income attributable to UGI is net

income attributable to UGI Corporation after excluding net after-tax gains and losses on commodity and certain foreign currency derivative

instruments not associated with current period transactions (principally comprising changes in unrealized gains and losses on derivative

instruments), Finagaz integration expenses, losses associated with extinguishments of debt and the impact on net deferred tax liabilities

from a change in French corporate income tax rate. Volatility in net income at UGI can occur as a result of gains and losses on commodity

and certain foreign currency derivative instruments not associated with current period transactions but included in earnings in accordance

with U.S. generally accepted accounting principles ("GAAP").

• Non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a

substitute for, the comparable GAAP measures. Management believes that these non-GAAP measures provide meaningful information to

investors about UGI’s performance because they eliminate the impact of (1) gains and losses on commodity and certain foreign currency

derivative instruments not associated with current-period transactions and (2) other significant discrete items that can affect the

comparison of period-over-period results.

• The following table reconciles net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net

income attributable to UGI Corporation, and reconciles diluted earnings per share, the most comparable GAAP measure, to adjusted

diluted earnings per share, to reflect the adjustments referred to above:

UGI Supplemental Footnotes

UGI Corporation | Fiscal 2017 Second Quarter Results

22

UGI Adjusted Net Income and EPS

UGI Corporation | Fiscal 2017 Second Quarter Results

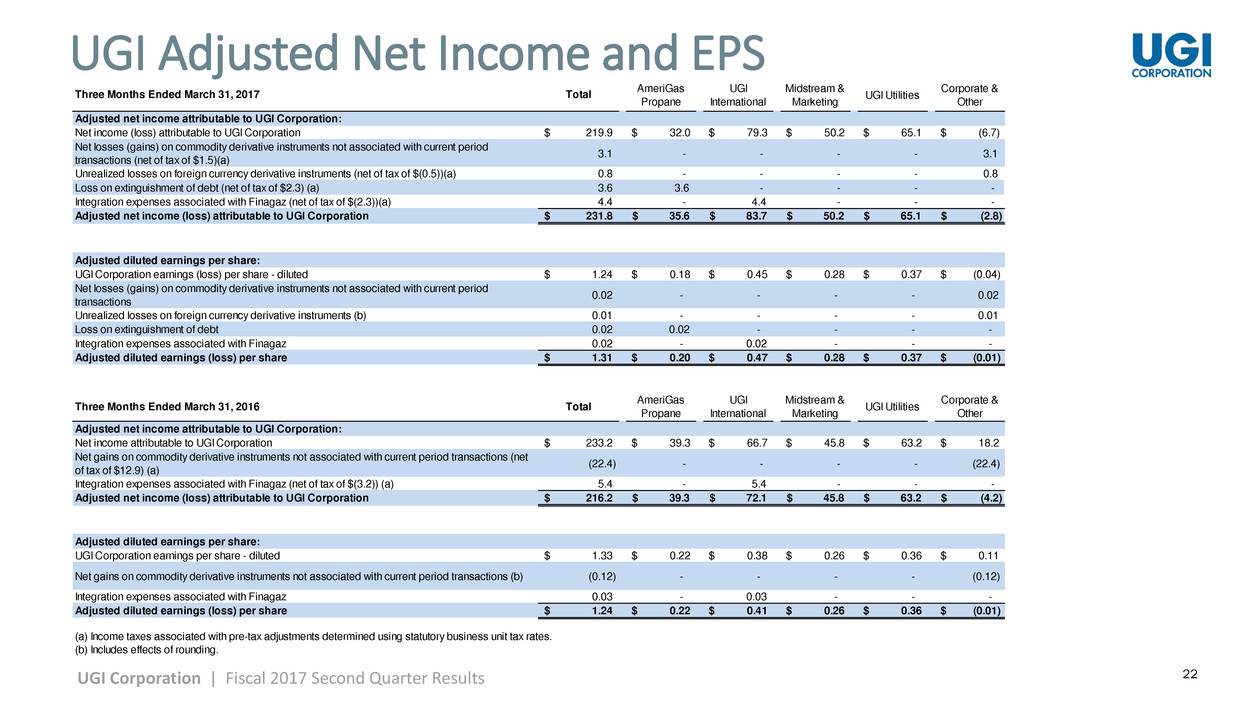

Three Months Ended March 31, 2017 Total

AmeriGas

Propane

UGI

International

Midstream &

Marketing

UGI Utilities

Corporate &

Other

Adjusted net income attributable to UGI Corporation:

Net income (loss) attributable to UGI Corporation 219.9$ $ 32.0 $ 79.3 $ 50.2 $ 65.1 $ (6.7)

Net losses (gains) on commodity derivative instruments not associated with current period

transactions (net of tax of $1.5)(a)

3.1 - - - - 3.1

Unrealized losses on foreign currency derivative instruments (net of tax of $(0.5))(a) 0.8 - - - - 0.8

Loss on extinguishment of debt (net of tax of $2.3) (a) 3.6 3.6 - - - -

Integration expenses associated with Finagaz (net of tax of $(2.3))(a) 4.4 - 4.4 - - -

Adjusted net income (loss) attributable to UGI Corporation 231.8$ 35.6$ 83.7$ 50.2$ 65.1$ (2.8)$

Adjusted diluted earnings per share:

UGI Corporation earnings (loss) per share - diluted 1.24$ $ 0.18 $ 0.45 $ 0.28 $ 0.37 $ (0.04)

Net losses (gains) on commodity derivative instruments not associated with current period

transactions

0.02 - - - - 0.02

Unrealized losses on foreign currency derivative instruments (b) 0.01 - - - - 0.01

Loss on extinguishment of debt 0.02 0.02 - - - -

Integration expenses associated with Finagaz 0.02 - 0.02 - - -

Adjusted diluted earnings (loss) per share 1.31$ $ 0.20 $ 0.47 $ 0.28 $ 0.37 $ (0.01)

Three Months Ended March 31, 2016 Total

AmeriGas

Propane

UGI

International

Midstream &

Marketing

UGI Utilities

Corporate &

Other

Adjusted net income attributable to UGI Corporation:

Net income attributable to UGI Corporation 233.2$ $ 39.3 $ 66.7 $ 45.8 $ 63.2 $ 18.2

Net gains on commodity derivative instruments not associated with current period transactions (net

of tax of $12.9) (a)

(22.4) - - - - (22.4)

Integration expenses associated with Finagaz (net of tax of $(3.2)) (a) 5.4 - 5.4 - - -

Adjusted net income (loss) attributable to UGI Corporation 216.2$ 39.3$ 72.1$ 45.8$ 63.2$ (4.2)$

Adjusted diluted earnings per share:

UGI Corporation earnings per share - diluted 1.33$ $ 0.22 $ 0.38 $ 0.26 $ 0.36 $ 0.11

Net gains on commodity derivative instruments not associated with current period transactions (b) (0.12) - - - - (0.12)

Integration expenses associated with Finagaz 0.03 - 0.03 - - -

Adjusted diluted earnings (loss) per share 1.24$ $ 0.22 $ 0.41 $ 0.26 $ 0.36 $ (0.01)

(a) Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates.

(b) Includes effects of rounding.

23

UGI Adjusted Net Income and EPS

UGI Corporation | Fiscal 2017 Second Quarter Results

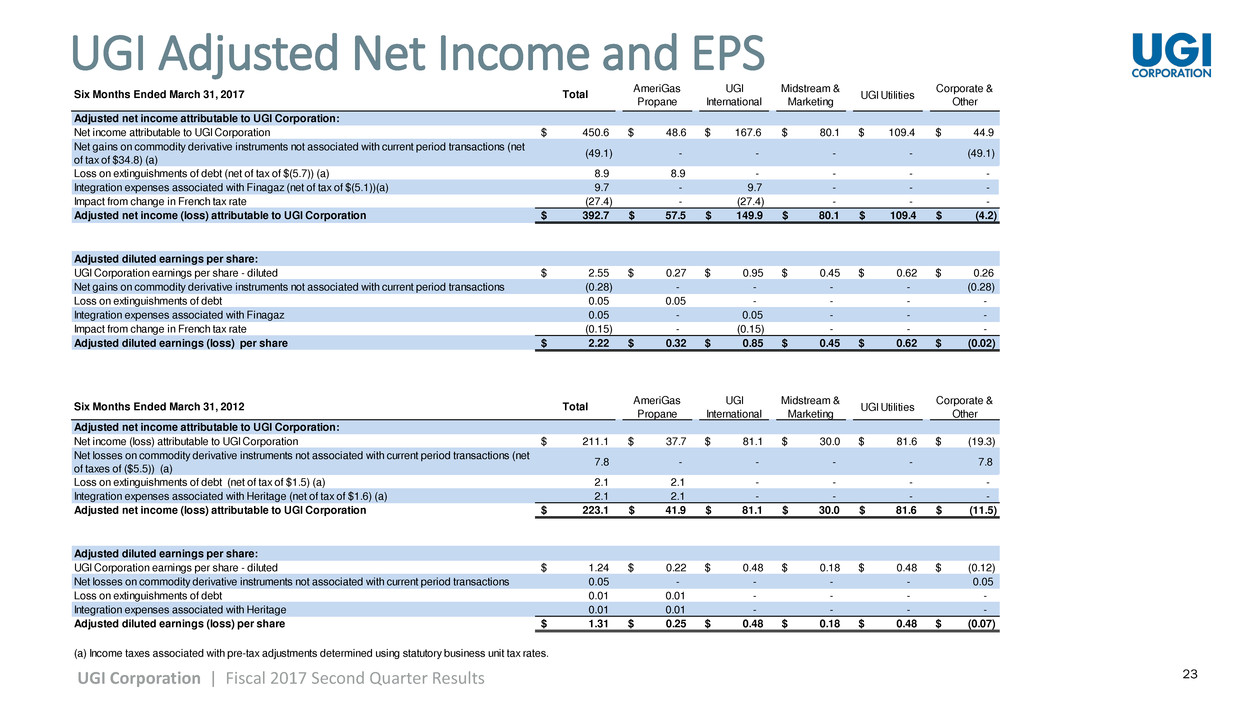

Six Months Ended March 31, 2017 Total

AmeriGas

Propane

UGI

International

Midstream &

Marketing

UGI Utilities

Corporate &

Other

Adjusted net income attributable to UGI Corporation:

Net income attributable to UGI Corporation 450.6$ $ 48.6 $ 167.6 $ 80.1 $ 109.4 $ 44.9

Net gains on commodity derivative instruments not associated with current period transactions (net

of tax of $34.8) (a)

(49.1) - - - - (49.1)

Loss on extinguishments of debt (net of tax of $(5.7)) (a) 8.9 8.9 - - - -

Integration expenses associated with Finagaz (net of tax of $(5.1))(a) 9.7 - 9.7 - - -

Impact from change in French tax rate (27.4) - (27.4) - - -

Adjusted net income (loss) attributable to UGI Corporation 392.7$ 57.5$ 149.9$ 80.1$ 109.4$ (4.2)$

Adjusted diluted earnings per share:

UGI Corporation earnings per share - diluted 2.55$ $ 0.27 $ 0.95 $ 0.45 $ 0.62 $ 0.26

Net gains on commodity derivative instruments not associated with current period transactions (0.28) - - - - (0.28)

Loss on extinguishments of debt 0.05 0.05 - - - -

Integration expenses associated with Finagaz 0.05 - 0.05 - - -

Impact from change in French tax rate (0.15) - (0.15) - - -

Adjusted diluted earnings (loss) per share 2.22$ $ 0.32 $ 0.85 $ 0.45 $ 0.62 $ (0.02)

Six Months Ended March 31, 2012 Total

AmeriGas

Propane

UGI

International

Midstream &

Marketing

UGI Utilities

Corporate &

Other

Adjusted net income attributable to UGI Corporation:

Net income (loss) attributable to UGI Corporation 211.1$ $ 37.7 $ 81.1 $ 30.0 $ 81.6 $ (19.3)

Net losses on commodity derivative instruments not associated with current period transactions (net

of taxes of ($5.5)) (a)

7.8 - - - - 7.8

Loss on extinguishments of debt (net of tax of $1.5) (a) 2.1 2.1 - - - -

Integration expenses associated with Heritage (net of tax of $1.6) (a) 2.1 2.1 - - - -

Adjusted net income (loss) attributable to UGI Corporation 223.1$ 41.9$ 81.1$ 30.0$ 81.6$ (11.5)$

Adjusted diluted earnings per share:

UGI Corporation earnings per share - diluted 1.24$ $ 0.22 $ 0.48 $ 0.18 $ 0.48 $ (0.12)

Net losses on commodity derivative instruments not associated with current period transactions 0.05 - - - - 0.05

Loss on extinguishments of debt 0.01 0.01 - - - -

Integration expenses associated with Heritage 0.01 0.01 - - - -

Adjusted diluted earnings (loss) per share 1.31$ $ 0.25 $ 0.48 $ 0.18 $ 0.48 $ (0.07)

(a) Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates.

24

• The enclosed supplemental information contains a reconciliation of earnings before interest expense, income taxes,

depreciation and amortization ("EBITDA") and Adjusted EBITDA to Net Income.

• EBITDA and Adjusted EBITDA are not measures of performance or financial condition under accounting principles

generally accepted in the United States ("GAAP"). Management believes EBITDA and Adjusted EBITDA are meaningful

non-GAAP financial measures used by investors to compare the Partnership's operating performance with that of other

companies within the propane industry. The Partnership's definitions of EBITDA and Adjusted EBITDA may be different

from those used by other companies.

• EBITDA and Adjusted EBITDA should not be considered as alternatives to net income (loss) attributable to AmeriGas

Partners, L.P. Management uses EBITDA to compare year-over-year profitability of the business without regard to capital

structure as well as to compare the relative performance of the Partnership to that of other master limited partnerships

without regard to their financing methods, capital structure, income taxes or historical cost basis. Management uses

Adjusted EBITDA to exclude from AmeriGas Partners’ EBITDA gains and losses that competitors do not necessarily have to

provide additional insight into the comparison of year-over-year profitability to that of other master limited partnerships.

In view of the omission of interest, income taxes, depreciation and amortization, gains and losses on commodity

derivative instruments not associated with current-period transactions, and other gains and losses that competitors do

not necessarily have from Adjusted EBITDA, management also assesses the profitability of the business by comparing net

income attributable to AmeriGas Partners, L.P. for the relevant periods. Management also uses Adjusted EBITDA to

assess the Partnership's profitability because its parent, UGI Corporation, uses the Partnership's Adjusted EBITDA to

assess the profitability of the Partnership, which is one of UGI Corporation’s business segments. UGI Corporation

discloses the Partnership's Adjusted EBITDA as the profitability measure for its domestic propane segment.

AmeriGas Supplemental Footnotes

UGI Corporation | Fiscal 2017 Second Quarter Results

25

AmeriGas EBITDA and Adjusted EBITDA

UGI Corporation | Fiscal 2017 Second Quarter Results

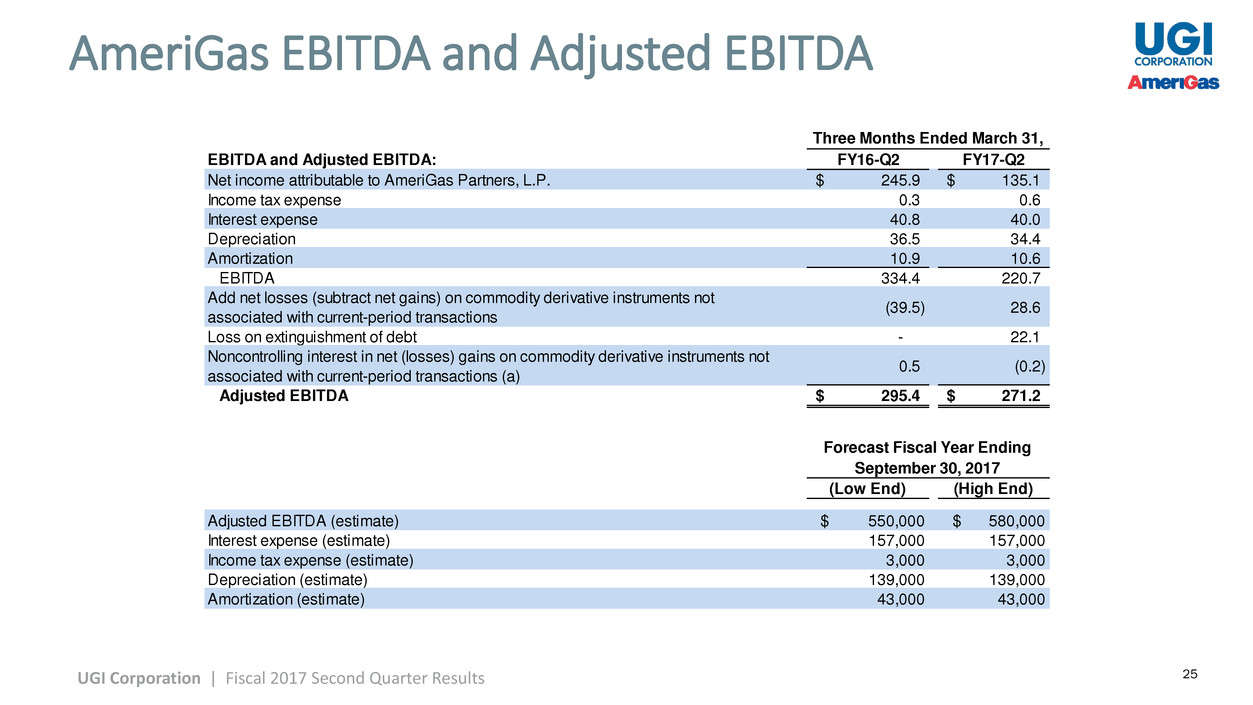

EBITDA and Adjusted EBITDA: FY16-Q2 FY17-Q2

Net income attributable to AmeriGas Partners, L.P. 245.9$ 135.1$

Income tax expense 0.3 0.6

Interest expense 40.8 40.0

Depreciation 36.5 34.4

Amortization 10.9 10.6

EBITDA 334.4 220.7

Add net losses (subtract net gains) on commodity derivative instruments not

associated with current-period transactions

(39.5) 28.6

Loss on extinguishment of debt - 22.1

Noncontrolling interest in net (losses) gains on commodity derivative instruments not

associated with current-period transactions (a)

0.5 (0.2)

Adjusted EBITDA 295.4$ 271.2$

Forecast Fiscal Year Ending

September 30, 2017

(Low End) (High End)

Adjusted EBITDA (estimate) $ 550,000 $ 580,000

Interest expense (estimate) 157,000 157,000

Income tax expense (estimate) 3,000 3,000

Depreciation (estimate) 139,000 139,000

Amortization (estimate) 43,000 43,000

Three Months Ended March 31,

26

Investor Relations:

Will Ruthrauff

610-456-6571

ruthrauffw@ugicorp.com