Attached files

| file | filename |

|---|---|

| S-1/A - AMENDMENT NO. 3 TO FORM S-1 - Ovid Therapeutics Inc. | d286200ds1a.htm |

| EX-23.1 - EX-23.1 - Ovid Therapeutics Inc. | d286200dex231.htm |

| EX-3.1 - EX-3.1 - Ovid Therapeutics Inc. | d286200dex31.htm |

Exhibit 10.16

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

LICENSE AGREEMENT

BETWEEN

H. LUNDBECK A/S

AND

OVID THERAPEUTICS INC.

Table of Contents

| Page | ||||||

| List of Schedules |

3 | |||||

| 1. |

DEFINITIONS |

4 | ||||

| 2. |

LICENSE GRANT AND RETENTION OF RIGHTS |

15 | ||||

| 3. |

DOCUMENTS; TECHNOLOGY TRANSFER |

17 | ||||

| 4. |

FINANCIAL PROVISIONS |

17 | ||||

| 5. |

DEVELOPMENT |

24 | ||||

| 6. |

COMMERCIALISATION |

26 | ||||

| 7. |

INTELLECTUAL PROPERTY |

26 | ||||

| 8. |

MAINTENANCE, PROSECUTION AND DEFENCE OF PATENT RIGHTS |

27 | ||||

| 9. |

NON-COMPETE |

30 | ||||

| 10. |

CONFIDENTIALITY AND NON-DISCLOSE |

31 | ||||

| 11. |

WARRANTIES AND UNDERTAKINGS |

33 | ||||

| 12. |

INDEMNIFICATION |

35 | ||||

| 13. |

LIABILITY |

36 | ||||

| 14. |

TERM AND TERMINATION |

36 | ||||

| 15. |

CONSEQUENCES OF TERMINATION |

37 | ||||

| 16. |

ACCRUED RIGHTS AND OBLIGATIONS; SURVIVAL |

38 | ||||

| 17. |

FORCE MAJEURE |

38 | ||||

| 18. |

ASSIGNMENT |

39 | ||||

| 19. |

GOVERNING LAW AND JURISDICTION |

40 | ||||

| 20. |

CODE OF CONDUCT |

40 | ||||

| 21. |

NOTICES |

40 | ||||

| 22. |

RELATIONSHIP OF THE PARTIES |

41 | ||||

| 23. |

ENTIRE AGREEMENT AND SEVERABILITY |

41 | ||||

| 24. |

AMENDMENT |

42 | ||||

| 25. |

WAIVER AND NON-EXCLUSION OF REMEDIES |

42 | ||||

| 26. |

NO BENEFIT TO THIRD PARTIES |

42 | ||||

| 27. |

FURTHER ASSURANCE |

42 | ||||

| 28. |

COMPLIANCE WITH LAWS |

42 | ||||

| 29. |

EXPENSES |

43 | ||||

| 30. |

COUNTERPARTS |

43 | ||||

Page 2 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

Table of Contents

(continued)

Page

LIST OF SCHEDULES

| A: Lundbeck Current Patent Rights |

||||

| B: Description of Compound |

||||

| C: Third Party Agreements |

||||

| D: Form of Joint Press Release |

||||

| E: Definition of Fully Burdened Cost |

||||

| F: Compound Specification |

||||

| G: List of Document Types to be Disclosed by Lundbeck |

||||

| H: Knowledge People |

||||

Page 3 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

LICENSE AGREEMENT

This License Agreement is made as of the 25th day of March, 2015 (the “Effective Date”), by and between H. Lundbeck A/S, a corporation organized and existing under the laws of Denmark and having its principal place of business at Ottiliavej 9, DK 2500 Valby, Denmark (hereinafter referred to as “Lundbeck”), and Ovid Therapeutics Inc., a Delaware corporation having its principal place of business at 205 East 42nd Street, Suite 15-048, New York, New York 10017, United States of America (hereinafter referred to as “Ovid”). Lundbeck and Ovid may also be referred to herein individually as a “Party” and collectively as the “Parties.”

WHEREAS, Lundbeck has performed research and development activities relating to Gaboxadol for which Lundbeck has obtained certain patents and know how; and

WHEREAS, Ovid desires to obtain a license from Lundbeck to further develop and to commercialise Gaboxadol, subject to the terms and conditions set forth in this Agreement.

NOW THEREFORE, in consideration of the covenants and obligations expressed herein, and intending to be legally bound, the Parties hereby agree as follows:

| 1. | DEFINITIONS |

In this Agreement the following definitions shall apply unless the context requires otherwise:

| 1.1 | “Affiliate” - any Person which controls, is controlled by or is under common control with either Party. For the purposes of this definition only, “control” refers to any of the following: (a) the possession, directly or indirectly, of the power to direct the management or policies of an entity, whether through ownership of voting securities, by contract or otherwise; (b) ownership of fifty percent (50%) or more of the voting securities entitled to vote for the election of directors in the case of a corporation, or of fifty percent (50%) or more of the equity interest in the case of any other type of legal entity; (c) status as a general partner in any partnership, or any other arrangement whereby a Party controls or has the right to control the board of directors or equivalent governing body of a corporation or other entity. |

| 1.2 | “Agreement” - this document, including any and all Schedules, appendices and other addenda to it as may be added and/or amended from time to time in accordance with the provisions of this document. |

| 1.3 | “Applicable Law” - any law, regulation, directive, guideline instruction, direction or rule of any Competent Authority or Regulatory Authority, including any amendment, extension or replacement thereof, which is from time to time in force during the Term and applicable to a particular activity hereunder. |

| 1.4 | “Asian Major Markets” - China, Japan and South Korea. |

| 1.5 | “Business Day” - 9.00am to 5.00pm local time on a day other than a Saturday, Sunday or bank or other public holiday in New York, New York or Copenhagen, Denmark. |

| 1.6 | “Calendar Year” - a period of twelve (12) consecutive months commencing on 1 January and ending on 31 December. |

Page 4 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| 1.7 | “Change of Control” - a transaction or a series of related transactions in which any of the following events occurs with respect to a Party: (a) a Third Party (or a group of Third Parties acting in concert) becomes the beneficial owner, directly or indirectly, of more than fifty percent (50%) of the total voting power of the stock then outstanding of such Party normally entitled to vote in elections of directors; (b) such Party consolidates with or merges into a Third Party or any Third Party consolidates with or merges into such Party, in either event pursuant to a transaction in which more than fifty percent (50%) of the total voting power of the stock outstanding of the surviving entity normally entitled to vote in elections of directors is not held by the Persons holding at least fifty percent (50%) of the total outstanding shares of such Party preceding such consolidation or merger; provided, that a Change of Control shall not include a bona fide equity financing, even if a Party’s current investors’ interests are diluted to the extent that such investors have less than a fifty percent (50%) interest after the close of that round of financing. |

| 1.8 | “Clinical Study” - any human clinical trial on a Product including, without limitation, any study carried out in order to obtain a Regulatory Approval, any study carried out in order to obtain a label expansion or other new Regulatory Approval for a Product, and any study carried out with the intention that the results will be used for marketing purposes. |

| 1.9 | “Combination Product” - any pharmaceutical product containing the Compound as an active pharmaceutical ingredient in combination with one or more other therapeutically active ingredients, in any and all forms, presentations, dosages, and formulations. |

| 1.10 | “Commercialisation”, “Commercialising”, or “Commercialise” - all activities relating to manufacturing, importing, exporting, advertising, promoting and other marketing, pricing and reimbursement, detailing, distributing, storing, handling, packaging, offering for sale and selling, customer service and support, post-marketing authorisation Clinical Studies, and regulatory activities of a Product. |

| 1.11 | “Competent Authority” - any national or local agency, authority, Regulatory Authority, department, inspectorate, minister, ministry official, parliament or public or statutory person (whether autonomous or not) of any government of any country having jurisdiction over any of the activities contemplated by this Agreement or the Parties. |

| 1.12 | “Competing Product” – any pharmaceutical product, [*], containing [*] or [*] or [*] or [*] and [*]. For clarity, Product that is Developed and/or Commercialized by Ovid under this Agreement is not a Competing Product. |

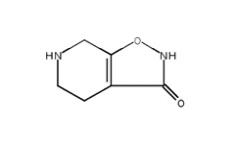

| 1.13 | “Compound” - the compound known as Gaboxadol (INN) with the chemical name, structural formula and CAS Registry Number set forth in Schedule B. |

| 1.14 | “Confidential Information” - the following information exchanged in connection with this Agreement, subject to the exceptions set forth in Section 10.2: (a) the terms and conditions of this Agreement, for which each Party will be considered a Disclosing Party; (b) Know How Controlled by either Party (including non-public Clinical Study data) for which the Party disclosing such Know How will be considered the Disclosing Party; and (c) any other non-public information, whether or not patentable, disclosed or provided by one Party to the other Party in connection with this Agreement, including, without limitation, information regarding such Party’s objectives, research, technology, products and business information, including any non-public data relating to Development or Commercialisation of any Product and other information of the type |

Page 5 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| that is customarily considered to be confidential information by parties engaged in activities that are substantially similar to the activities being engaged in by the Parties under this Agreement, for which the Party making such disclosure will be considered the Disclosing Party. |

| 1.15 | “Control” or “Controlled” - with respect to any Know How or Patent Rights, possession of the right, whether directly or indirectly, and whether by ownership, license or otherwise, to assign, or grant a license, sub-license or other right to or under such Know How or Patent as provided for herein without violating the terms of any agreement or other arrangement with any Third Party. When used as a verb, “Controlled” shall mean to exercise Control. |

| 1.16 | “Co-promotion Partnership” – means, on a country-by-country basis in the Territory, the engagement of a Third Party sales force by Ovid to co-promote the Product with Ovid. For clarity, a Co-Promotion Partnership shall not include (i) any license or sublicense grant to a Third Party, other than to sell or have sold Product or to Ovid’s trademarks, provided that Ovid is engaging such Third Party’s sales force or (ii) the recognition of Product sales by a Third Party. |

| 1.17 | “Current Compound Inventory” – the kilograms of Compound that Lundbeck as of the Effective Date holds in inventory. |

| 1.18 | “Development” or “Develop” - all preclinical development activities and all clinical drug development and regulatory activities regarding Compound or Product. Development shall include, without limitation, all preclinical testing, test method development and stability testing, toxicology, formulation, process development, manufacturing scale-up, qualification and validation, quality assurance/quality control, Clinical Studies, manufacturing clinical supplies, regulatory affairs, statistical analysis and report writing. When used as a verb, “Develop” shall mean to engage in Development. |

| 1.19 | “DMF” - the Drug Master File(s) filed (or to be filed) by Lundbeck with the FDA for Compound, as amended from time to time. |

| 1.20 | “Documents” - analyses, books, CD-ROMs, charts, comments, computations, designs, discs, diskettes, files, graphs, ledgers, notebooks, papers, photographs, plans, records, recordings, reports, memoranda, research notes, tapes and any other graphic or written data or other media on which Know How is permanently stored and other computer information storage means, and advertising and promotional materials of any nature whatsoever including preparatory materials for the same. |

| 1.21 | “EMA” - European Medicines Agency and any successor agency thereto. |

| 1.22 | “European Union” or “EU” – all countries that are officially recognized as member states of the European Union at any particular time during the Term. |

| 1.23 | “Exclusivity Period” - the period [*]. |

| 1.24 | “FDA” - the United States Food and Drug Administration and any successor agency thereto. |

| 1.25 | “Field” - all human therapeutic diseases. |

Page 6 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| 1.26 | “First Commercial Sale” - with respect to any Product, the first sale for which revenue has been invoiced by Ovid or its sublicensees, respectively, for use or consumption by the general public of such Product in any country in the Territory after all required Regulatory Approvals have been granted in such country. For clarity: Compound sold under a compassionate use program or similar shall not constitute a First Commercial Sale. |

| 1.27 | “Force Majeure” - in relation to either Party, any event or circumstance which is beyond the reasonable control of that Party that results in or causes the failure of that Party to perform any or all of its obligations under this Agreement, including acts of God, lightning, fire, storm, flood, earthquake, accumulation of snow or ice, lack of water arising from weather or environmental problems, strike, lockout or other industrial or student disturbance, act of the public enemy, war declared or undeclared, threat of war, terrorist act, blockade, revolution, riot, insurrection, civil commotion, public demonstration, sabotage, act of vandalism, prevention from or hindrance in obtaining in any way materials, energy or other supplies, explosion, fault or failure of plant or machinery (which could not have been prevented by good industry practice), or Applicable Law governing either Party, provided that lack of funds shall not be interpreted as a cause beyond the reasonable control of that Party. |

| 1.28 | “Generic Product” - as to any Product which has received Regulatory Approval by or on behalf of Ovid in the applicable country, a version of that Product with the same active pharmaceutical ingredient, or any other pharmaceutical product, approved under an Abbreviated New Drug Application, or ANDA, in the United States, under Section 505(b)(2) of the Food Drug and Cosmetic Act, or similar regulatory pathways outside of the U.S., in any case, with the Product as the reference product. |

| 1.29 | “Generic Product Competition” - with respect to a Product, on a country-by-country basis, Generic Product Competition shall exist if during any [*] in such country there are one or more Generic Products Commercialized by one or more Third Parties being sold in such country and the sales of such Generic Product(s) account for [*] or more of the sales revenue of the Product and its Generic Product(s) in the given country during such [*] as determined by reference to applicable sales data obtained from IMS Health, Verispan or from such other reasonable source for such sales data as may be used and relied upon by Ovid from time to time, provided however if sale of such Generic Product(s) falls below [*] of the sales revenue of the Product and its Generic Products for more than [*], Generic Product Competition shall be deemed no longer to exist. |

| 1.30 | “Good Manufacturing Practice” or “GMP” - manufacture in accordance with: |

| 1.30.1 | the rules governing medicinal products in the European Union, volume 4 EU Guidelines to Good Manufacturing Practice medicinal Products for human and veterinary use including all annexes; |

| 1.30.2 | the current good manufacturing standards, practices and procedures promulgated or endorsed by the FDA relating to manufacturing and set forth in 21 C.F.R. Parts 210 and 211, and all analogous guidelines promulgated by any Regulatory Authority (including the EMA and under the ICH); and |

| 1.30.3 | the equivalent Applicable Law in any country in which Compound and/or Product is manufactured. |

| 1.31 | “Gulf Major Markets” – collectively Kuwait, Saudi Arabia and the United Arab Emirates. |

Page 7 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| 1.32 | “Headline Results” – with respect to any Phase III Clinical Trial, following study database release for such Clinical Study as set forth in the statistical analysis plan, a presentation consisting of the principal results of such Clinical Study, including the following information: (a) demographics, disposition and baseline characteristics; (b) whether the Clinical Study met its primary endpoints or secondary endpoints as set forth in the protocol for the Clinical Study; and (c) safety parameters. |

| 1.33 | “ICH” – the International Conference on Harmonisation of Technical Requirements for Registration of Pharmaceuticals for Human Use or any successor organisation thereto. |

| 1.34 | “IND” - any investigational new drug application filed with the FDA pursuant to Part 312 of Title 21 of the U.S. Code of Federal Regulations prior to beginning clinical trials in humans in the United States or any comparable application filed with any Regulatory Authority outside of the United States. |

| 1.35 | “Invention” - any improvement, enhancement or modification of Product and/or Compound by a Party or their respective Affiliates or subcontractors, whether patentable or not. |

| 1.36 | “Insolvency Event” - in relation to either Party, means any one of the following: |

| 1.36.1 | a notice shall have been issued to convene a meeting for the purpose of passing a resolution to wind up that Party, or such a resolution shall have been passed other than a resolution for the solvent reconstruction or reorganisation of that Party; |

| 1.36.2 | a resolution shall have been passed by that Party’s directors to seek a winding up or a petition for a winding up shall have been presented against that Party which, in the case of a petition presented against a Party, shall not have been appealed within seven (7) days of having been lodged or such an order shall have been made and shall not have been dismissed within thirty (30) days thereafter; |

| 1.36.3 | a receiver, administrative receiver, receiver and manager, interim receiver, custodian, sequestrator or similar officer is appointed in respect of that Party or an encumbrancer takes steps to enforce or enforces its security against such Party which shall not have been dismissed by a court of competent jurisdiction within thirty (30) days thereafter; |

| 1.36.4 | (a) a resolution shall have been passed by that Party or that Party’s directors to make an application for an administration order or to appoint an administrator, or (b) an application for an administration order shall have been made to the court or a notice of appointment of an administrator shall have been filed at the court in respect of that Party, which in the case of such an application made to the court or notice filed with the court, shall not have been appealed within seven (7) days of having been made or filed or such an order or appointment shall have been dismissed within thirty (30) days thereafter; |

| 1.36.5 | any other step or event shall have been taken or arisen in the jurisdiction in which a Party shall be incorporated or organized, in respect of such Party, which is similar or analogous to any of the steps or events set forth in Subsections 1.36.1 through 1.36.4 above (including under the relevant laws of Copenhagen, Denmark or the State of Delaware, as applicable) which, in the case of a filing made against a party, shall not have been appealed within seven (7) days of having been lodged or such an order shall have been made and dismissed within thirty (30) days thereafter; or |

Page 8 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| 1.36.6 | that Party proposes or makes any general assignment, composition or arrangement with or for the benefit of all or some of that Party’s creditors or makes or suspends or threatens to suspend making payments to all or some of that Party’s creditors or the Party submits to any similar type of voluntary arrangement with its creditors. |

| 1.37 | “International Financial Reporting Standards” or “IFRS” - the International Financial Reporting Standards established by the International Accounting Standards Board, as amended from to time. |

| 1.38 | “Know How” - proprietary information, within the Field, of a Party, relating to Compound and/or Product, which is not in the public domain, including information comprising or relating to concepts, discoveries, data, designs, formulae, ideas, Inventions, methods, models, assays, reagents, research plans, procedures, designs for experiments and tests, results of experimentation and testing (including results of research or development), processes (including manufacturing processes, specifications and techniques), laboratory records, chemical, pharmacological, toxicological, clinical, analytical and quality control data, clinical and non-clinical trial data, case report forms, data analyses, reports, manufacturing data or summaries and information contained in submissions to and information from ethical committees and Regulatory Authorities. Know How includes Documents containing Know How, including but not limited to any rights including trade secrets, copyright, database or design rights protecting such Know How. The fact that an item is known to the public shall not be taken to preclude the possibility that a compilation including the item, and/or a development relating to the item, is not known to the public. |

| 1.39 | “Knowledge” - with respect to the Party to which such term is attributed, the actual knowledge of the persons listed in Schedule H and employed by such Party as of the Effective Date. |

| 1.40 | “Licensed IP” - (a) Lundbeck Current Know How, (b) Lundbeck Current Patent Rights, (c) Lundbeck Future Patent Rights, (d) Lundbeck Future Know How and (e) and Lundbeck Non Exclusive Patent Rights and Know How. |

| 1.41 | “Litigable Matter” – a Dispute to the extent relating to (a) the validity or enforceability of Patent Rights, or (b) the non-disclosure, non-use and maintenance of Confidential Information. |

| 1.42 | “Losses” - any and all liabilities, damages, losses and expenses (including reasonable lawyers’ fees and disbursements). In calculating “Losses”, the duty to mitigate on the part of the Party suffering the Losses shall be taken into account. |

| 1.43 | “Lundbeck Current Know How” - the Know How Controlled by Lundbeck or its Affiliates as of the Effective Date relating to Compound and/or Product and which is necessary to Develop or Commercialise Compound and/or Product. |

| 1.44 | “Lundbeck Current Patent Rights” - any Patent Rights Controlled by Lundbeck or its Affiliates as of the Effective Date that claim or cover the researching, Developing, making, having made, using, having used, Commercialising and having Commercialised Compound and/or Product in the Field set out in Schedule A. |

Page 9 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| 1.45 | “Lundbeck Future Know How” - Know How that, subject to Section 7.2.1, becomes Controlled by Lundbeck or its Affiliates during the Term relating to Compound and/or Product. |

| 1.46 | “Lundbeck Future Patent Rights” – any Patent Rights that, subject to Section 7.2.1, become Controlled by Lundbeck or its Affiliates during the Term that claim or cover the researching, Developing, making, using and Commercialising Compound and/or Product. |

| 1.47 | “MAA” - regulatory application filed with the EMA seeking to obtain Regulatory Approval for a pharmaceutical product (including all additions, supplements, extensions and modifications thereto). |

| 1.48 | “Major Markets” – collectively, the Asian Major Markets, South American Major Markets, the EU, Russia, Australia, the Gulf Major Markets, Turkey and North America. |

| 1.49 | “Major Market” – any of the Major Markets, as applicable. |

| 1.50 | “Manufacturing Information” – Know How proprietary to Lundbeck relating to manufacturing of Compound. |

| 1.51 | “NDA” - a new drug application filed with the FDA pursuant to Part 314 of Title 21 of the U.S. Code of Federal Regulations seeking to obtain Regulatory Approval for Compound and/or Product (including all additions, supplements, extensions, and modifications thereto), or any equivalent new drug license under Applicable Law in any other country in the Territory where Compound and/or Product is Commercialised. |

| 1.52 | “Net Sales” - with respect to any Compound or Product, the gross invoiced sales price of such Compound or Product sold by Ovid, its Affiliates or Sub-licensees (the “Selling Party”), in bulk form or finished product form in arm’s-length transactions to Third Parties, less deductions allowed to the Third Party customer by the Selling Party, to the extent actually taken by such Third Party customer, on such sales for: |

| 1.52.1 | transportation charges relating to Product to the extent actually invoiced to Ovid’s customers, including handling charges and insurance premiums relating thereto; |

| 1.52.2 | sales taxes, excise taxes, use taxes, VAT and duties paid by the Selling Party in relation to Product and any other equivalent governmental charges imposed on the importation, use or sale of Product; |

| 1.52.3 | government-mandated and other rebates (such as those in respect of any state or federal Medicare, Medicaid or similar programs) or fees; |

| 1.52.4 | customary trade, quantity and cash discounts allowed on Product; |

| 1.52.5 | allowances or credits to customers on account of retrospective price reductions affecting Product; |

| 1.52.6 | customary rebates and charge-backs, including those granted to managed care or similar organizations; |

| 1.52.7 | uncollectible amounts on previously sold products, provided that Ovid shall use Reasonable Best Efforts to collect such amounts before they are deductible under this Section 1.52.7; and |

| 1.52.8 | the portion of any fees payable by Ovid or its Affiliates pursuant to the Affordable Care Act as a result of the sale of Product. |

Page 10 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

The transfer of Product by Ovid or one of its Affiliates to another Affiliate shall not be considered a sale unless the Affiliate is a bona fide purchaser at fair market value for resale (e.g., if the Affiliate is a wholesaler). If the Affiliate is not an end user, Net Sales shall be determined based on the invoiced sale price by the Affiliate to the first Third Party trade purchaser, less the deductions allowed under this Subsection. Disposal of Product for or use of Product in Clinical Studies or as free samples in quantities common in the industry for this sort of Product shall not give rise to any deemed sale under this definition.

Net Sales shall be calculated and accounted for in accordance with U.S. GAAP; provided, that if Ovid or its Affiliates change accounting standards during the Term (e.g., from U.S. GAAP to IFRS), then Net Sales hereunder may be calculated and accounted for in accordance with such different set of accounting standards, consistently applied, following such change; provided, further, that Ovid shall promptly notify Lundbeck of any such change to Ovid’s accounting standards.

If Product is sold for other than cash payment Net Sales of Product shall be deemed to be cash value of such other payment.

If Product is sold as part of a Combination Product, Net Sales of such Product shall be deemed to be an amount equal to the following:

(X divided by Y) multiplied by Z,

where “X” is the average sales price during the applicable reporting period achieved for the relevant Product in the country in which such sale occurred when the Product contains only Compound and no other active pharmaceutical ingredient;

“Y” is the sum of the average sales price as a single entity during the applicable reporting period achieved in that country (as applicable) of each product included in the Combination Product when such product is sold as a separate product and not as part of a Combination Product; and

“Z” is the single price at which the relevant Combination Product was actually sold.

In the event that no separate sale of either (a) Product comprising the Compound as the sole active pharmaceutical ingredient, or (b) a product containing the other active pharmaceutical ingredient(s) included in the Combination Product, are made during the accounting period in which the sale was made or if the price for a particular therapeutically active ingredient cannot otherwise be determined for an accounting period, Net Sales allocable to the Product shall be determined by mutual agreement of the Parties prior to the end of the accounting period in question based on an equitable method of determining the same that takes into account, in the Territory, variations in potency, the relative contribution of each therapeutically active ingredient in the Combination Product, and relative value to the end user of each therapeutically active ingredient; provided, that if the Parties cannot reach mutual agreement prior to the end of the applicable accounting period, such matter shall be resolved in accordance with Section 19. For clarity: Ovid shall only pay royalties on its sale of Product either in bulk or as finished product, whichever is sold in a Third Party transaction, but not on both.

| 1.53 | “North America” – the U.S., Canada and Mexico. |

Page 11 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| 1.54 | “Ovid IP” or “Ovid Intellectual Property” - Ovid Know How and Ovid Patent Rights. |

| 1.55 | “Ovid Know How” – the Know How that is Controlled by Ovid or its Affiliates during the Term relating to Compound and/or Product and which is necessary to Develop or Commercialise Compound and/or Product. |

| 1.56 | “Ovid Patent Rights” - any Patent Rights that become Controlled by Ovid or its Affiliates during the Term that claim or cover the researching, Developing, making, having made, using, having used, Commercialising and having Commercialised Compound and/or Product. |

| 1.57 | “Patent Right(s)” – (a) patent applications and patents in any country or supranational jurisdiction in the Territory, and (b) with respect to such patent applications and patents, any utility certificates, improvement patents and models, certificates of addition, divisional applications, refilings, renewals, re-examinations, continuations, continuations-in-part, patents of addition, extensions (including patent term extensions), reissues, substitutions, confirmations, registrations, revalidations, pipeline and administrative protections and additions, supplementary protection certificates and equivalent protection rights (e.g., in relation to paediatric extensions), and any equivalents of the foregoing. |

| 1.58 | “Partner” - a Third Party with which Ovid has entered into a Partnership. |

| 1.59 | “Partnership” - any Development or Commercialisation relationship with a Third Party where such Third Party is not a subcontractor, assignee or successor in business (i.e., where such Third Party obtains a license, sublicense or similar rights from Ovid to Develop or Commercialise Compound or Product). |

| 1.60 | “Person” - any individual, partnership, joint venture, limited liability company, corporation, firm, trust, association, unincorporated organization, Competent Authority or any other entity not specifically listed herein. |

| 1.61 | “Phase III Clinical Trial” - a human clinical trial of Compound or Product for an indication on a sufficient number of subjects that is designed to establish that Compound or Product is safe and efficacious for its intended use, and to determine warnings, precautions and adverse reactions that are associated with Compound or Product in the dosage range to be prescribed, and to support Regulatory Approval to market such Compound or Product in patients having the indication being studied, as more fully defined in 21 C.F.R. §312.21(c) or its successor regulation, or the equivalent in any foreign country. |

| 1.62 | “Product(s)” - any pharmaceutical product in which the Compound is an active pharmaceutical ingredient, alone or in combination with one or more other active pharmaceutical ingredients, in any and all forms, presentations, dosages and formulations. |

| 1.63 | “Quarter” - a period of three (3) consecutive months ending on 31 March, 30 June, 30 September or 31 December and “Quarterly” shall be construed accordingly. |

| 1.64 | “Reasonable Best Efforts” - means commercially reasonable efforts and resources as commonly used by a similar size pharmaceutical company to Develop and Commercialise a product Controlled by such a company or to which it has exclusive rights, which product is at a similar stage in its development or product life and is of |

Page 12 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| similar market potential taking into account efficacy, safety, approved and/or anticipated labelling, the competitiveness of alternative products sold by Third Parties in the marketplace, the patent and other proprietary position of the product, the likelihood of regulatory approval given the regulatory structure involved, the profitability of the product including the royalties payable to licensors of patent or other intellectual property rights, and other relevant factors, including technical, legal, scientific and/or medical factors. Reasonable Best Efforts shall be determined on a country-by-country and indication-by-indication basis for a particular Product, and it is anticipated that the level of effort will change over time, reflecting changes in the status of the Product and the country(s) involved. |

| 1.65 | “Regulatory Approval” - all approvals (including, without limitation, where applicable, orphan drug designation, Product and/or establishment licenses, registrations or authorizations of any Regulatory Authority) necessary for the Development, manufacture, use or Commercialisation of Product in the applicable jurisdiction, including any label expansions of any of the above. |

| 1.66 | “Regulatory Authority” - any national, supranational, regional, state or local regulatory agency, department, bureau, commission, council or other governmental entity in any jurisdiction involved in the granting of regulatory marketing authorisation, including the EMA and the FDA. |

| 1.67 | “South American Major Markets” – Argentina, Brazil, Chile and Venezuela. |

| 1.68 | “Specifications” – shall mean the Compound specifications set out in Schedule F. |

| 1.69 | “Stock Purchase Agreement” - the agreement entered into by the Parties simultaneously with this Agreement under which Lundbeck receives Ovid shares. |

| 1.70 | “Strategic Acquisition” - with regard to a Party, any consolidation with or merger into, or acquisition of all of the stock or assets of, a Person having a portfolio of two (2) or more pharmaceutical products in clinical development or under Commercialisation. |

| 1.71 | “Sub-licensee” – a Third Party to whom Ovid has granted a sublicense under the Licensed IP. |

| 1.72 | “[*]” – with respect to the [*], (a) the [*] for such [*], and/or (b) the [*] and [*] of the [*]. Provided, however, if [*] but [*], this will not be [*]. |

| 1.73 | “Territory” - all countries in the world. |

| 1.74 | “Third Party” - a party other than either of the Parties or any of their respective Affiliates. |

| 1.75 | “Third Party License” - any license or other agreement between a Third Party and Ovid or its Affiliate, pursuant to which Ovid or its Affiliate, as applicable, is granted a license to Patent Rights or Know How Controlled by a Third Party, where such license is required for the Development or Commercialisation of Compound or Products due to infringement by the Licensed IP of Third Party rights. |

| 1.76 | “United States” or “U.S.” - the United States of America, including its territories and possessions. |

Page 13 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| 1.77 | “USD” - the legal tender of the U.S. |

| 1.78 | “U.S. GAAP” - United States generally accepted accounting principles. |

| 1.79 | “Valid Claim” - with respect to any country, a claim of an issued and unexpired patent in such country which has not been revoked, held unenforceable, unpatentable or invalid by an administrative agency, court or other governmental agency of a competent jurisdiction in a final and non-appealable decision (or such decision is unappealed within the time allowed for appeal), and which has not been admitted to be invalid or unenforceable through reissue, disclaimer or otherwise. |

| 1.80 | “VAT” - the tax imposed by Council Directive 2006/112/EC of the European Community and any national legislation implementing that directive together with legislation supplemental thereto and in particular, in relation to the United Kingdom, the tax imposed by the Value Added Tax Act of 1994 or other tax of a similar nature imposed elsewhere instead of or in addition to value added tax. |

| 1.81 | Each of the following definitions is set forth in the section of the Agreement indicated below, all of which are highlighted in brackets and in capital first letters “…”: |

| Defined Term |

Section | |

| Affected Party |

17.1 | |

| CEO(s) |

19.2 | |

| Defaulting Party |

14.2 | |

| Development Milestone Amount |

4.2 | |

| Development Milestone Event |

4.2 | |

| Development Plan |

5.5 | |

| Development Report |

5.4 | |

| Disbursing Party |

4.31 | |

| Disclosing Party |

10.1 | |

| Dispute |

19.2 | |

| DMF Preparation Fee |

4.21 | |

| Effective Date |

Preamble | |

| Exercise Notice |

2.4 | |

| Financial Arbitrator |

4.29 | |

| Financial Report |

4.24 | |

| Fully Burdened Cost |

Schedule E | |

| Indemnitee |

12.4 | |

| Infringement |

8.4 | |

| Initial Price |

5.12 | |

| Initial Royalty Term |

4.18 | |

| Joint IP |

7.3 | |

| License |

2.1 | |

| Lundbeck |

Preamble | |

| Lundbeck Non-exclusive Patent Rights and Know How |

7.2.2 | |

| Manufacturing Re-establishment Costs |

4.23 | |

| Manufacturing Royalty Term |

4.18 | |

| Negotiation Period |

2.4 | |

| Non-Affected Party |

17.1 | |

| Ovid |

Preamble | |

| Ovid’s Negotiation Notice |

2.4 | |

| Paragraph IV Notice |

8.9 |

Page 14 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| Defined Term |

Section | |

| Parties |

Preamble | |

| Party |

Preamble | |

| Receiving Party |

10.1 | |

| Regulatory Milestone Amount |

4.5 | |

| Regulatory Milestone Event |

4.5 | |

| Right of First Negotiation |

2.4 | |

| Initial Royalty Term |

4.18 | |

| Sales Milestone Amount |

4.9 | |

| Sales Milestone Event |

4.9 | |

| Selling Party |

1.49 | |

| Supply Agreement |

5.10 | |

| System Maintenance Fee |

4.22 | |

| Term |

14.1 | |

| Terminating Party |

14.2 | |

| Third Party Claim |

12.1 | |

| Withholding Taxes |

4.31 |

| 1.82 | In this Agreement: |

| 1.82.1 | unless the context otherwise requires, all references to a particular Section, paragraph or Schedule shall be a reference to that Section, paragraph or Schedule in or to this Agreement as it may be amended from time to time; |

| 1.82.2 | the table of contents and headings are inserted for convenience only and shall not affect the interpretation of any provision of this Agreement; |

| 1.82.3 | unless the contrary intention appears, words importing the masculine gender shall include the feminine and vice versa and words in the singular include the plural and vice versa; |

| 1.82.4 | reference to the words “include” or “including” are to be construed without the limitation to the generality of the preceding words; and |

| 1.82.5 | reference to any statute or regulation includes any modification or reenactment of that statute or regulation. |

| 2. | LICENSE GRANT AND RETENTION OF RIGHTS |

License Grant

| 2.1 | Subject to the terms and conditions of this Agreement, Lundbeck hereby grants to Ovid an exclusive (even as to Lundbeck), royalty-bearing, perpetual, sub-licensable (through multiple tiers) licence under the Licensed IP to research, have researched, Develop, have Developed, use, have used, make and have made (subject to Section 5.10), Commercialise and have Commercialised Compound and/or Product in the Field in the Territory (the “License”). |

Retained Rights

| 2.2 | Lundbeck retains the right for itself to (a) manufacture Compound under this Agreement and the Supply Agreement in accordance with the terms herein and |

Page 15 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| therein, (b) perform non-commercial research activities related to Compound and manufacture Compound in relation to such research activities and (c) exploit Licensed IP outside the Field. Lundbeck’s Retained Rights and any activities carried out in relation to Lundbeck’s Retained Rights are subject to Section 9. Lundbeck may designate Third Parties to exercise its rights under this Section 2.2; provided that the designation is made in writing and the Third Party permit Lundbeck to comply with its obligations under Section 9. Further, neither Lundbeck nor its Affiliates or any Third Parties, are entitled to file any patents relating to Compound in the exercise of Lundbeck’s Retained Rights, which will prevent Ovid from researching, Developing, manufacturing and/or Commercialising Compound and/or Product without a license or other rights from Lundbeck, its Affiliates or any Third Party. |

| 2.3 | As of the Effective Date and to the Knowledge of Lundbeck, the License granted in Section 2.1 is subject only to the rights granted to Third Parties under the agreements sets forth on Schedule C and no other rights have been granted to Third Parties. Further, the rights granted to Third Parties do not include any rights to Commercialise Compounds or Products. Lundbeck covenants that no agreements set forth on Schedule C shall be amended, modified or altered, in any way, that may adversely affect Ovid without Ovid’s prior written consent. |

Right of First Negotiation

| 2.4 | Ovid hereby grants Lundbeck a right of first negotiation, [*] to enter into an agreement to Develop and/or Commercialise Compound and/or Product in [*] (the “Right of First Negotiation”). If Ovid intends to enter into a Partnership to Develop and/or Commercialise Compound and/or Product in [*], Ovid shall notify Lundbeck in writing of Ovid’s intention, including a brief description of the intended Partnership and the [*] (“Ovid’s Negotiation Notice”). Lundbeck shall have [*] following the date of Ovid’s Negotiation Notice to notify Ovid in writing that Lundbeck wishes to exercise its Right of First Negotiation (the “Exercise Notice”). If Ovid’s Negotiation Notice pertains to [*], then the Exercise Notice shall specify [*] Lundbeck wishes to exercise its Right of First Negotiation. If Lundbeck delivers the Exercise Notice within such [*] period, then the Parties shall engage in exclusive good faith negotiations for a period of up to [*] to enter into definitive agreements for the proposed agreement (the “Negotiation Period”). |

| 2.5 | Ovid is not entitled to negotiate with Third Parties regarding a Partnership subject to the Right of First Negotiation prior to delivery of Ovid’s Negotiation Notice. |

| 2.6 | If Lundbeck does not deliver the Exercise Notice within the required [*] period, or if the Parties are unable to enter into definitive agreements for the proposed Partnership before the expiration of the Negotiation Period, then Ovid shall have the right to enter into a Partnership with a Third Party for [*] that was the subject of Ovid’s Negotiation Notice; provided, that [*]. |

| 2.7 | If Ovid has not entered into a definitive agreement with a Third Party for the Partnership proposed by Ovid’s Negotiation Notice within [*] after the date of Ovid’s Negotiation Notice, then Lundbeck’s Right of First Negotiation shall reset solely with respect to the rights set forth in Ovid’s Negotiation Notice. |

| 2.8 | If the proposed partnership is solely a Co-Promotion Partnership then Lundbeck shall deliver the Exercise Notice within [*] following Ovid’s Negotiation Notice and the Negotiation Period shall be [*]. |

Page 16 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| 3. | DOCUMENTS; TECHNOLOGY TRANSFER |

| 3.1 | Lundbeck hereby agrees to provide to Ovid, as soon as reasonably practicable following the Effective Date, a list of (a) all material Documents forming part of the Lundbeck Current Know How that are in the Control and possession of Lundbeck or otherwise reasonably available to Lundbeck at such time, excluding Compound Manufacturing Information, and (b) any other material Documents relating to Compound and/or Products, including copies of submissions to and correspondence with Regulatory Authorities and data relating to Compound formulations. At the request of Ovid, and at no additional expense to Ovid, Lundbeck shall by 1 May 2015 provide to Ovid electronic copies of any of the Documents on such list; provided, however, that solely the types of Documents listed in Schedule G, shall be supplied to Ovid under this Agreement. |

| 3.2 | From time to time during the Term, and at no additional cost to Ovid, Lundbeck shall provide to Ovid access to any other material Documents relating to Lundbeck Current Know How and Lundbeck Future Know How, solely relating to Compound and /or Product, reasonably requested by Ovid and necessary for Ovid’s Development and Commercialisation of Compound and/or Product; provided, however, that solely the types of Documents listed in Schedule G, shall be supplied to Ovid under this Agreement. |

| 3.3 | Subject to Sections 5.10 and 5.11, Ovid shall have the right to request that Lundbeck commences a manufacturing technology transfer to Ovid or Third Party of any manufacturing technology Controlled by Lundbeck that is reasonably necessary for the Development and Commercialisation of Compound and/or Product. Ovid shall reimburse Lundbeck all out of pocket costs and reasonable, internal cost related to such technology transfer. |

| 3.4 | The Parties acknowledge the significant contribution and experience of Lundbeck and Lundbeck employees to the research and Development of Compound prior to the Effective Date and that these contributions and experience may be valuable to Ovid. Accordingly, Ovid is entitled to meet with employees of Lundbeck who hold significant experience or expertise in the Development or manufacture of Compound [*]. The Venue for the meetings shall be Lundbeck’s premises in Valby, Copenhagen or via electronic media. Ovid shall provide reasonable notice to Lundbeck requesting such a meeting and Lundbeck’s approval of date and agenda of meeting shall not be unreasonably withheld. Each Party shall bear their own cost in relation to such meetings. |

| 4. | FINANCIAL PROVISIONS |

Share Transfer

| 4.1 | No later than ten (10) days following the Effective Date Ovid shall transfer to Lundbeck shares representing [*] of Ovid’s common stock in accordance with the terms and conditions set forth in the Stock Purchase Agreement. |

Development Milestone

| 4.2 | Upon Successful Completion of the first Phase III Clinical Trial for Product (the “Development Milestone Event”), Ovid shall pay to Lundbeck Ten Million Dollars (USD 10,000,000) (the “Development Milestone Amount”). |

Page 17 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| 4.3 | Payment of the Development Milestone Amount is due [*] after [*]. The Development Milestone Amount shall only be payable once no matter how many times the Development Milestone Event occurs and no more than Ten Million Dollars (USD 10,000,000) shall be payable under Sections 4.2 and 4.4. |

| 4.4 | The Parties agree that if [*], then Ovid shall pay to Lundbeck the Development Milestone Amount within [*]. |

Regulatory Milestones

| 4.5 | Ovid shall make each of the milestone payments set forth below (each, a “Regulatory Milestone Amount”) upon the first occurrence of the corresponding regulatory milestone event after the Effective Date with respect to Product (each, a “Regulatory Milestone Event”): |

| Event |

Amount | |

| [*] |

[*] |

| 4.6 | Each of the above Regulatory Milestone Amounts shall only be payable once no matter how many times each Regulatory Milestone Event occurs and no more than [*] shall be payable under Section 4.5. |

| 4.7 | For clarity, Ovid shall pay to Lundbeck each Regulatory Milestone Amount the first time that the corresponding Regulatory Milestone Event occurs even if multiple Regulatory Milestone Events occur during the same Calendar Year. |

| 4.8 | Ovid shall report the occurrence of each Regulatory Milestone Event to Lundbeck no later than [*] after its occurrence. Lundbeck is then entitled to issue an invoice payable by Ovid within [*] after receipt of said invoice. Notwithstanding the foregoing, payment of the Regulatory Milestone Amount for the first Regulatory Milestone Event [*] is due no later than [*] after such Regulatory Milestone Event has occurred. |

Sales Milestones

| 4.9 | Ovid shall make each of the milestone payments set forth below (each, a “Sales Milestone Amount”) upon the first occurrence of the corresponding sales milestone event (each, a “Sales Milestone Event”): |

| Event |

Amount | |

| First time aggregate Net Sales of all Products in the Territory in a Calendar Year exceed [*] |

[*] | |

| First time aggregate Net Sales of all Products in the Territory in a Calendar Year exceed [*] |

[*] | |

| First time aggregate Net Sales of all Products in the Territory in a Calendar Year exceed [*] |

[*] | |

| First time aggregate Net Sales of all Products in the Territory in a Calendar Year exceed [*] |

[*] | |

| 4.10 | Each of the above Sales Milestone Amounts shall only be payable once no matter how many times each Sales Milestone Event occurs and no more than [*] shall be payable under Section 4.9. |

Page 18 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| 4.11 | For clarity, Ovid shall pay to Lundbeck each Sales Milestone Amount the first time that the corresponding Sales Milestone Event occurs even if multiple Sales Milestone Events occur during the same Calendar Year, so that multiple sales milestones may be owed in any Calendar Year. |

| 4.12 | Ovid shall report the occurrence of each Sales Milestone Event to Lundbeck in the Financial Report. Lundbeck is then entitled to issue an invoice payable by Ovid within [*] after receipt of said invoice. |

Royalties outside Asian Major Markets

| 4.13 | For all countries in the Territory, except for the Asian Major Markets, Ovid shall pay to Lundbeck the following tiered royalties based on accumulated Net Sales for all Products in in a Calendar Year as set forth below: |

| Annual Net Sales |

Royalty Percentage | |

| The portion of Net Sales for all Products in a Calendar Year up to and including USD [*] |

[*]% | |

| The portion of Net Sales for all Products in a Calendar Year including or exceeding [*] but less than or equal to [*] |

[*]% | |

| The portion of Net Sales for all Products in a Calendar Year including or exceeding [*] |

[*]% | |

Royalties in Asian Major Markets

| 4.14 | If Ovid Commercialises a Product in any of the Asian Major Markets with a Partner other than Lundbeck, Ovid shall pay to Lundbeck (a) [*] of that portion of royalties (any share of Net Sales, supply price less Fully Burdened Cost of goods) or on Net Sales of Products in the Asian Major Markets payable by the Partner to Ovid or its Affiliates, and (b) [*] of other payments payable by the Partner to Ovid or its Affiliates attributable to the Development or Commercialisation of Compound and/or Product in any of the Major Asian Markets. For purposes of this Section 4.14, “other payments” shall include milestone payments, lump sums, any up-front payment, etc., but shall not include royalties under Section 4.14(a). |

| 4.15 | Ovid shall be entitled to set off from any amounts payable under Section 4.14 up to [*] of its actual and reasonable out-of-pocket costs incurred in order to conduct Development activities for Compound and/or Products in any Asian Major Market. Ovid’s right to set off under this Section 4.15 shall only apply to the extent that the costs in question have not been reimbursed or paid by the Partner or by any other Third Party. |

| 4.16 | Ovid is obliged to disclose to Lundbeck all material financial terms and other relevant terms, in any agreement subject to Section 4.14 to the extent necessary for Lundbeck to ensure compliance with this Agreement. |

| 4.17 | If Ovid chooses to Develop and/or Commercialise Product in any of the Asian Major Markets without a Partner, the royalties and milestones in Section 4.5, 4.9 and 4.13 as well as the off-set in 4.15 shall apply. |

Page 19 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

Royalty Term

| 4.18 | Ovid’s obligation to pay royalties under Section 4.13 and to make payments under Section 4.14 shall commence upon the First Commercial Sale, country-by-country, of such Product and shall expire on a country-by-country and Product-by-Product basis on the expiration of the last Valid Claim of the Licensed IP (other than the Joint IP) or ten (10) years after First Commercial Sale of a Product, whichever is period is the longest (the “Initial Royalty Term”). After expiry of the Initial Royalty Term if, and for as long as, Lundbeck manufactures Compound for Ovid, Ovid shall in addition to Fully Burdened Cost of such manufactured Compound, pay to Lundbeck a royalty percentage of [*] of Annual Net Sales of the Product manufactured by Lundbeck (the “Manufacturing Royalty Term”). |

Royalties in Case of Generic Product Competition

| 4.19 | If at any time Generic Product Competition exists in a given country with respect to a Product, then the royalty rate with respect to sales of such Product in such country shall be reduced (prior to giving effect to any reductions set forth in Sections 4.15 and 4.20) to [*]. For clarity, if Generic Product Competition ceases to exist then the royalty rates shall no longer be reduced. |

Royalties in Case of Third Party Licenses

| 4.20 | Subject to 8.5, Ovid shall pay all documented amounts due under Third Party Licenses; provided, that Ovid shall be entitled to a credit against the royalties otherwise due to Lundbeck under Sections 4.13 and 4.14 by an amount equal to [*] of the total royalties paid by Ovid or its Affiliate to a Third Party with respect to such Product under any Third Party Licenses. Notwithstanding the foregoing, such credit shall not cause the royalty rate payable to Lundbeck, after giving effect to any other reductions contemplated by this Section 4, to be reduced to less than [*] of the amounts that would otherwise be payable by Ovid to Lundbeck under this Section 4; provided, further, that Ovid shall have the right to carry forward for application against royalties payable with respect to such Product in future periods any uncredited amount, until such time when the foregoing limitation would not apply. |

DMF Preparation Fee

| 4.21 | Ovid will pay to Lundbeck a lump sum payment of [*] for the preparation of the DMF and preparation for pre-approval inspection (the “DMF Preparation Fee”). Upon initiation of a Phase III Clinical Trial, Lundbeck is entitled to issue an invoice for the DMF Preparation Fee payable by Ovid within [*] after receipt of said invoice. Should the preparation of the DMF require significant additional work (e.g., a DMF re-write), then Ovid will pay to Lundbeck the cost of this additional work at a FTE rate of [*] up until further [*]. The DMF Preparation Fee cannot exceed [*]. |

System Maintenance Fee

| 4.22 | Ovid will pay to Lundbeck [*] per Calendar Year for maintenance of systems necessary for analysis and release of Compound (the “System Maintenance Fee”). Ovid’s obligation to pay the System Maintenance Fee shall commence upon Regulatory Approval of the first Product and shall terminate in the event that Lundbeck is no longer supplying Ovid with Compound under Section 5 or the Supply Agreement. The first and last System Maintenance Fee shall be pro-rated based on (i) the remaining |

Page 20 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| portion of the Calendar Year during which Regulatory Approval of the first Product was granted or (ii) the portion of the Calendar Year during which Lundbeck is supplying Ovid with Compound. Upon Regulatory Approval of the first Product, Lundbeck is entitled to issue an invoice for the first System Maintenance Fee payable by Ovid within [*] after receipt of said invoice. Thereafter, Ovid shall pay the System Maintenance Fee for each Calendar Year on [*]. |

Manufacturing Re-establishment Costs

| 4.23 | The Parties acknowledge that Lundbeck’s time and expertise is needed to manufacture Compound to permit Ovid to Develop Product; therefore, Ovid will pay to Lundbeck all reasonable, documented costs for re-establishment of the Compound manufacturing to the extent such re-establishment is required to supply Compound to Ovid under Section 5 and the Supply Agreement (the “Manufacturing Re-establishment Costs”). For clarity, the Manufacturing Re-establishment Costs shall not include costs attributable to the manufacturing of products, compounds or active pharmaceutical ingredients other than Compound. Lundbeck is entitled to issue an invoice for the Manufacturing Reestablishment Costs payable by Ovid within [*] after receipt of said invoice. Lundbeck shall, at the request of Ovid, permit an internationally recognized independent accountant selected by Ovid to have access during ordinary business hours upon reasonable notice, to such books and records as may be necessary to determine the basis of any Manufacturing Re-establishment Costs. Ovid shall be responsible for expenses for the independent certified public accountant, except that Lundbeck shall reimburse Ovid in full thereof if the independent accountant determines that Ovid overpaid Manufacturing Re-establishment Costs by [*] or more over the period being audited, in which case documented and reasonable audit fees for such examination shall be paid by Lundbeck. |

Timing of Payments; Financial Report

| 4.24 | Except as otherwise stipulated, Ovid shall make payments due to Lundbeck under Section 4 at Quarterly intervals. Within [*] of the end of each Quarter, Ovid shall provide Lundbeck with a report summarising the Net Sales of each Product (including the various elements of the Net Sales calculation) during the relevant Quarter, the currency conversion rate, if applicable, the taxes withheld, if any, and the total royalties and other payments due under Sections 4.9, 4.13 and 4.14 (the “Financial Report”). As part of the Financial Report summarising Net Sales of each Product delivered at the end of the fourth (4th) Quarter of each Calendar Year, Ovid shall include a report showing the total Net Sales of each Product for the Calendar Year in question and the royalties payable thereon calculated in accordance with Section 4. Concurrent with the delivery of each Financial Report, Ovid shall make the payments due to Lundbeck for the Calendar Quarter covered by such Financial Report. |

| 4.25 | Net Sales and amounts due hereunder shall be expressed in USD and the Parties shall make all payments in USD, except where otherwise specifically stipulated. Whenever for the purpose of calculating royalties conversion from any foreign currency shall be required, such conversion shall be made as follows: when calculating the Net Sales, the amount of such sales in foreign currencies shall be converted into USD using the rate of exchange for such currencies at the time published by the European Central Bank in Frankfurt (e.g., on Reuters Screen <ECB37>), on the last day of the relevant Quarter in accordance with Ovid’s then current standard practices. |

Page 21 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| 4.26 | All payments made to Lundbeck under this Agreement shall be made by wire transfer to the account of Lundbeck [*] or any other bank account that may be notified by Lundbeck to Ovid from time to time. All payments made to Ovid under this Agreement shall be made by wire transfer to a bank account designated by Ovid in writing ten (10) days before the payment is due. Ovid may not, without the prior written consent of Lundbeck, make any payments to Lundbeck from a jurisdiction outside the U.S. |

| 4.27 | If a Party fails to make any payment on the due date for payment and the payment is not in dispute between the Parties, without prejudice to any other right or remedy available to a Party, then such Party shall be entitled to charge the other Party interest (both before and after judgement) on the amount owed and unpaid at the annual rate of London Interbank Offered Rate (LIBOR) or Euro Interbank Offered Rate (EURIBOR) plus [*], calculated on a daily basis until payment in full is made. |

Audits

| 4.28 | Ovid and its Affiliates shall keep and shall require its Sub-licensees to keep, full, true and accurate records and books of account containing all particulars that may be necessary for the purpose of calculating all royalties and other amounts payable to Lundbeck under Sections 4.9, 4.13, 4.14, 4.15 and 4.19 for a minimum period of [*]. Upon timely request by Lundbeck, Lundbeck shall have the right to instruct an independent, internationally recognised, accounting firm to perform an audit, conducted so far as appropriate in accordance with U.S. GAAP, for the period or periods requested by Lundbeck on the following basis: |

| 4.28.1 | such firm of accountants shall be given access to and shall be permitted to examine such books and records upon [*] notice to Ovid, and at all reasonable times on Business Days and for no longer than [*], for the purpose of certifying to Lundbeck whether the Net Sales and other sums calculated and reported by Ovid or its Affiliates during any Calendar Year were calculated correctly in accordance with this Agreement (and if such certification cannot be given specifying the reasons why which will enable the Parties to recalculate the relevant sums). Ovid shall during these [*] and to a reasonable extent after these [*] make available personnel to answer queries on all books and records required for the purpose of that certification; |

| 4.28.2 | prior to any such examination taking place, such firm of accountants shall undertake to Ovid that they shall keep all information and data contained in such books and records strictly confidential and shall not disclose such information or copies of such books and records to any Third Party or Lundbeck, but shall only use the same for the purpose of the reviews and/or calculations which they need to perform in order to issue the certificate to Lundbeck which this Section 4.28 envisages; |

| 4.28.3 | any such access examination and certification shall occur no more frequently than [*] and will not go back over records more than [*] old; and |

| 4.28.4 | if the certification is in disagreement with the Net Sales and other sums calculated by Ovid, Ovid shall notify Lundbeck within [*] whether or not Ovid agrees with the certification. If Ovid notifies its agreement with the certification within the [*] period or fails to give any notification within that period, the sums included in the certification shall be used for purposes |

Page 22 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| of calculating any monies owed. The cost of the audit shall be the responsibility of Lundbeck unless the recalculation shows that Ovid’s previous figures supplied to Lundbeck are inaccurate by more than [*], in which case the reasonable and documented cost of the audit shall be the responsibility of Ovid. |

| 4.29 | If within [*] after Lundbeck receives notice from Ovid of its disagreement with the certification Ovid and Lundbeck have not resolved the disagreement, either Party may refer the items in dispute to a partner of at least ten (10) years qualified experience at an independent, internationally recognised, public accounting firm agreed by the Parties in writing for attempted resolution (the “Financial Arbitrator”). The Financial Arbitrator appointed shall act on the following basis: |

| 4.29.1 | the Financial Arbitrator shall act as an arbitrator to the extent that both Parties agree that the Financial Arbitrator is capable and qualified of settling the matter; |

| 4.29.2 | the Financial Arbitrator’s terms of reference shall be to determine the matters in dispute within [*] of his appointment; |

| 4.29.3 | the Parties shall each provide the Financial Arbitrator with all information relating to the items in dispute which the Financial Arbitrator reasonably requires and such person shall be entitled (to the extent he considers appropriate) to base his determination on such information; |

| 4.29.4 | the decision of the Financial Arbitrator is final and binding on the Parties. |

| 4.29.5 | the Financial Arbitrator’s costs shall be paid by Ovid and Lundbeck as the Financial Arbitrator may determine, taking into consideration the extent to which each Party has succeeded in its claim; and |

| 4.29.6 | should a Party reasonably object to the use of a Financial Arbitrator in relation to solving a dispute, the matter will be solved according to Section 19. Such objection could be based on the fact that a dispute will demand legal interpretation rather than financial capabilities. An objection must be raised prior to the decision of the Financial Arbitrator or within [*] after appointment of the Financial Arbitrator, which ever time comes first. |

Taxes

| 4.30 | The parties do not expect any VAT to be payable under this Agreement, however all payments to Lundbeck under this Agreement are expressed to be exclusive of value added tax howsoever arising and Ovid shall pay to Lundbeck in addition to those payments all value added tax for which Lundbeck is liable to account to any Competent Authority in relation to any supply made or deemed to be made for value added tax purposes to this Agreement on receipt of a tax invoice or invoices from Lundbeck. Without limiting the foregoing, it is expected that any goods or services purchased or sold under this Agreement shall have a zero rating (for tax purposes) under Applicable Law. |

| 4.31 | Each Party will be responsible for any and all income or other taxes owed by it and required by Applicable Law to be withheld or deducted from any of the payments made by or on behalf of the other Party (“Disbursing Party”) to it hereunder (“Withholding Taxes”) and the Disbursing Party may deduct from any amounts that the Disbursing |

Page 23 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| Party is required to pay hereunder an amount equal to such Withholding Taxes. Any amounts withheld shall be deemed as paid by the Disbursing Party to the other Party for all purposes under this Agreement. Each Party will provide the other Party with (a) reasonable advance notice of tax withholding obligations to which it reasonably believes that it is subject, and (b) any reasonable information available to it that is necessary to determine the Withholding Taxes. The Disbursing Party will pay such Withholding Taxes to the proper taxing authority for the other Party’s account and evidence of such payment will be secured and sent by the Disbursing Party to the other Party within one (1) month of such payment. The Parties will do all such lawful acts and things and sign all such lawful deeds and documents as either Party may reasonably request from the other Party to enable each Party or its Affiliates to (i) take advantage of any applicable legal provision or any treaty provisions with the object of paying the sums due to such Party hereunder with the lowest legal amount of Withholding Taxes, and (ii) comply with its tax withholding obligations. |

| 4.32 | The Parties shall reasonably co-operate to minimise any deduction or withholding in relation to any payments pursuant to this Agreement. |

| 5. | DEVELOPMENT |

Diligence

| 5.1 | Ovid shall use Reasonable Best Efforts to Develop Product at its own cost and risk. |

| 5.2 | Ovid shall ensure that Development activities are carried out in accordance with Applicable Law. |

Records

| 5.3 | Ovid shall keep or cause to be kept detailed written records and reports of the progress of Development activities in sufficient detail and in good scientific manner appropriate for all purposes, including obtaining and maintaining Regulatory Approval and making patent filings. These written records and reports shall properly reflect all the material work done and the material results achieved in carrying out Development activities. |

Development Reports; Development Plans

| 5.4 | Ovid shall, once yearly, until the First Commercial Sale in the United States of a Product, provide to Lundbeck a written report describing Development activities undertaken by Ovid or on its behalf during the preceding Calendar Year with regards to Compound and/or Products, including submissions sent to Regulatory Authorities regarding the Products and the results of any pre-clinical trials or Clinical Studies (the “Development Report”). Such report shall be submitted within thirty (30) days of the end of each Calendar Year and shall be considered the Confidential Information of Ovid. |

| 5.5 | Ovid shall, once yearly until the First Commercial Sale in the United States of a Product, provide to Lundbeck a written plan describing the efforts that Ovid plans to use in the following Calendar Year with regards to Development of Compound and/or Products (the “Development Plan”). Such plan shall be submitted within thirty (30) days of the end of each Calendar Year and shall be considered the Confidential Information of Ovid. The first Development Plan shall be submitted to Lundbeck one hundred and twenty days (120) after the Effective Date. |

Page 24 of 54

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted and filed separately with the Securities and Exchange Commission pursuant to Rule 406 of the Securities Act of 1933, as amended.

| 5.6 | Ovid shall furthermore provide Lundbeck with reasonable supplementary information relating to Development of Compound and/or Product requested by Lundbeck solely to the extent necessary for Lundbeck to determine Ovid’s compliance with this Agreement. |

Regulatory Filings

| 5.7 | Ovid shall use Reasonable Best Efforts for the preparation, submission, prosecution and maintenance of all filings and applications with Regulatory Authorities required to obtain all necessary Regulatory Approvals to Develop or Commercialise Products and shall maintain all Regulatory Approvals that have been granted. Ovid shall as soon as practicably possible inform Lundbeck in writing of each MAA or NDA filing made or Regulatory Approval obtained by Ovid, its Affiliate, Sub-licensee or Partner in relation to Product. Lundbeck shall be responsible for the preparation, submission, prosecution and maintenance of the DMF; provided, that Lundbeck shall discuss with Ovid the general and specific strategy for material steps to be taken with regard to the preparation, submission, prosecution and maintenance of the DMF; provided, further, that Lundbeck shall incorporate in good faith Ovid’s reasonable comments to the DMF before submission to the appropriate Regulatory Authorities. |

| 5.8 | Lundbeck shall use Reasonable Best Efforts to transfer Lundbeck’s IND for Compound to Ovid at Ovid’s cost within six (6) months of the Effective Date and Ovid shall collaborate with Lundbeck regarding the transfer. |

| 5.9 | Until the Current Compound Inventory is depleted or for as long as Lundbeck manufactures Compound (whichever is longer), Lundbeck shall have the responsibility to provide data, information and other documentation related to its manufacture of Compound as is necessary to prepare its DMF. Ovid will be solely responsible for the preparation of all other regulatory documentation required to obtain Regulatory Approval for Products throughout the Territory. Ovid shall be entitled to cross-reference Lundbeck’s DMF for the Compound in regulatory filings for Products. |

Supply of Compound

| 5.10 | Until the Current Compound Inventory is depleted, Ovid shall purchase its entire requirement of Compound for the Development and Commercialisation of Products from Lundbeck, and Lundbeck shall deliver Compound to Ovid. The Parties will within ninety (90) days after the Effective Date enter into a supply agreement relating to the supply of Compound from the Current Compound Inventory on commercially reasonable terms that are materially consistent with the terms set forth in this Section 5 (the “Supply Agreement”). Such negotiations will be conducted in good faith. |