Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Federal Home Loan Bank of Pittsburgh | d379990d8k.htm |

Member

Audio/Web Conference

May 2, 2017 ` Exhibit 99.1 |

| Statements contained in these slides, including statements describing the objectives, projections, estimates, or predictions of the future of the Bank, may be “forward-looking statements.” These statements may use forward-looking terms, such as “anticipates,” “believes,” “could,” “estimates,” “may,” “should,” “will,” or their negatives or other variations on these terms. The Federal Home Loan Bank of Pittsburgh (the Bank) cautions that, by their nature, forward-looking statements involve risk or uncertainty and that actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, the following: economic and market conditions, including, but not limited to, real estate, credit and mortgage markets; volatility of market prices, rates, and indices related to financial instruments; political, legislative, regulatory, litigation, or judicial events or actions; changes in assumptions used in the quarterly Other-Than-Temporary Impairment (OTTI) process; risks related to mortgage-backed securities; changes in the assumptions used in the allowance for credit losses; changes in the Bank’s capital structure; changes in the Bank’s capital requirements; membership changes; changes in the demand by Bank members for Bank advances; an increase in advances’ prepayments; competitive forces, including the availability of other sources of funding for Bank members; changes in investor demand for consolidated obligations and/or the terms of interest rate exchange agreements and similar agreements; changes in the FHLBank System’s debt rating or the Bank’s rating; the ability of the Bank to introduce new products and services to meet market demand and to manage successfully the risks associated with new products and services; the ability of each of the other FHLBanks to repay the principal and interest on consolidated obligations for which it is the primary obligor and with respect to which the Bank has joint and several liability; applicable Bank policy requirements for retained earnings and the ratio of the market value of equity to par value of capital stock; the Bank’s ability to maintain adequate capital levels (including meeting applicable regulatory capital requirements); business and capital plan adjustments and amendments; technology risks; and timing and volume of market activity. We do not undertake to update any forward-looking information. Some of the data set forth herein is unaudited. Cautionary Statement Regarding Forward- Looking Information 2 |

Over/ 2017 2016 (Under) Net interest income 108.3 $ 81.4 $ 26.9 $ Provision for credit losses - 0.2 (0.2) Realized gains from sales of AFS securities - 12.7 (12.7) All other income (loss) 12.7 (11.8) 24.5 Other expenses 24.5 19.3 5.2 Income before assessment 96.5 62.8 33.7 Affordable Housing Program (AHP) assessment 9.7 6.3 3.4 Net income 86.8 $ 56.5 $ 30.3 $ Net interest margin (bps) 46 36 10 Three months ended March 31, Financial Highlights – Statement of Income (in millions) 3 |

Financial

Highlights – Selected Balance Sheet

2017 2016 Amount Average: Total assets 96,917 $ 93,842 $ 3,075 $ 3 % Advances 73,994 70,117 3,877 6 Total investments 18,171 19,191 (1,020) (5) March 31, Dec 31, 2017 2016 Amount Spot: Advances 70,317 $ 76,809 $ (6,492) $ (8) % Capital stock 3,523 3,755 (232) (6) Retained earnings 1,031 986 45 5 Percent Over/(Under) Over/(Under) Percent Three months ended March 31, (in millions) (in millions) 4 |

(in

millions) March 31,

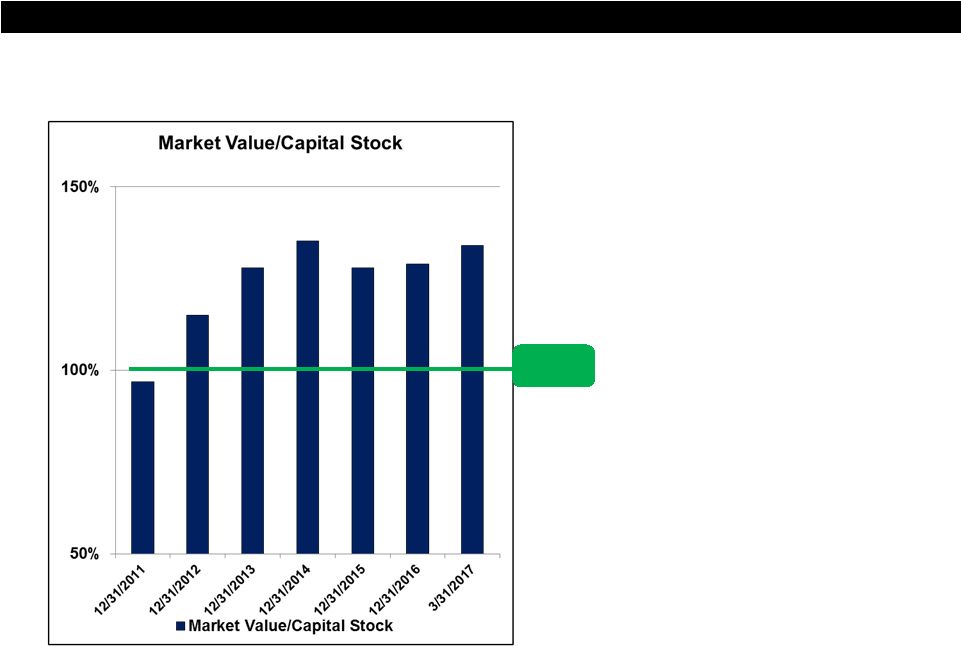

Dec 31, 2017 2016 Permanent capital 4,560 $ 4,747 $ Excess permanent capital over RBC requirement 3,558 $ 3,839 $ Regulatory capital ratio (4% minimum) 4.8% 4.7% Leverage ratio (5% minimum) 7.2% 7.0% Market value/capital stock (MV/CS) 134.1% 128.9% Capital Requirements 5 |

Membership Update Kris Williams |

| First

Quarter Highlights •

Great quarter for the co-op

• Highest average advances – maintains mission focus • Recent performance reflects – Demand for liquidity – FHLBank’s financial stability 7 |

Shareholder Cash Dividend + “Community Dividend” Customer Product & Service Usage Value of Membership Membership Value Proposition • Stable Stock Value • Financial Return • Community Dividend • Vibrant Bank • Access to Liquidity • Products and Services That Help Your Business 8 |

Stable

Stock Value PAR

• FHLBank stock always trades at par – our goal at all times is to maintain a market value above par • The decline in the market value from a high in 2014 was primarily due to advance growth • When market value is above par and a new advance is executed, the purchase of capital stock at par reduces the total market value of the FHLBank 9 |

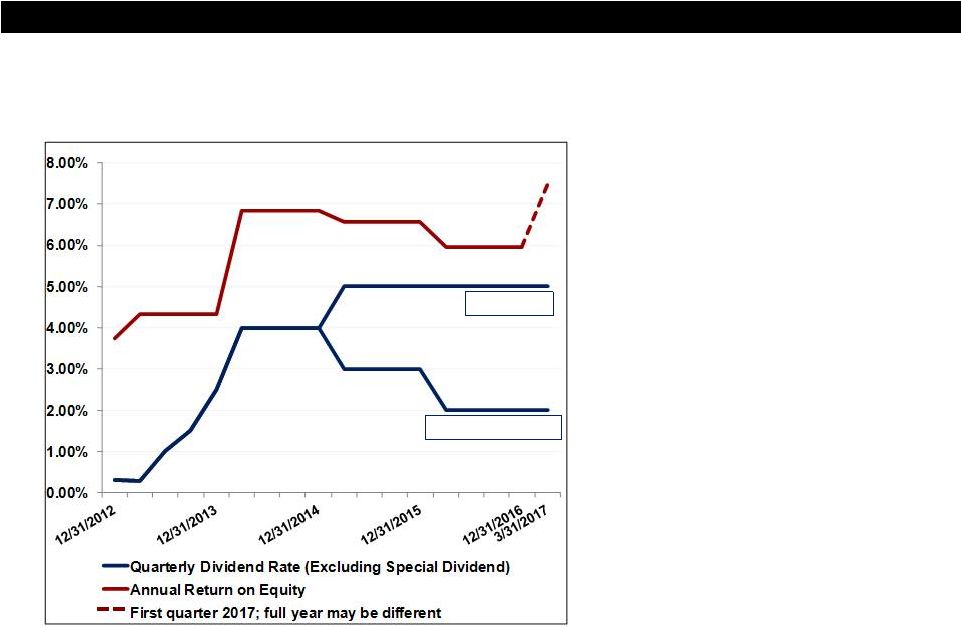

Financial Return • Return on equity improved significantly over the past four years • 2017, 2016 and 2015 results were generated from member activity, whereas 2014 benefited from litigation gains • A reliable dividend is important to membership value • We will continue to pay a differentiated dividend payment based on activity versus membership Membership Activity 10 |

| “Community Dividends”

• Funds awarded through Community Investment products in 2016: – Affordable Housing Program funding round -- $23 million – First Front Door -- $8 million – Banking On Business -- $5 million – Community Lending Program -- $1 billion revolving pool • Business advantages for members: – new relationships, CRA requirements, cost-of-funds advances, corporate citizenship • Community needs served: – housing, development, jobs, dreams • Impact on people and communities: – dignity, security, progress, hope 11 |

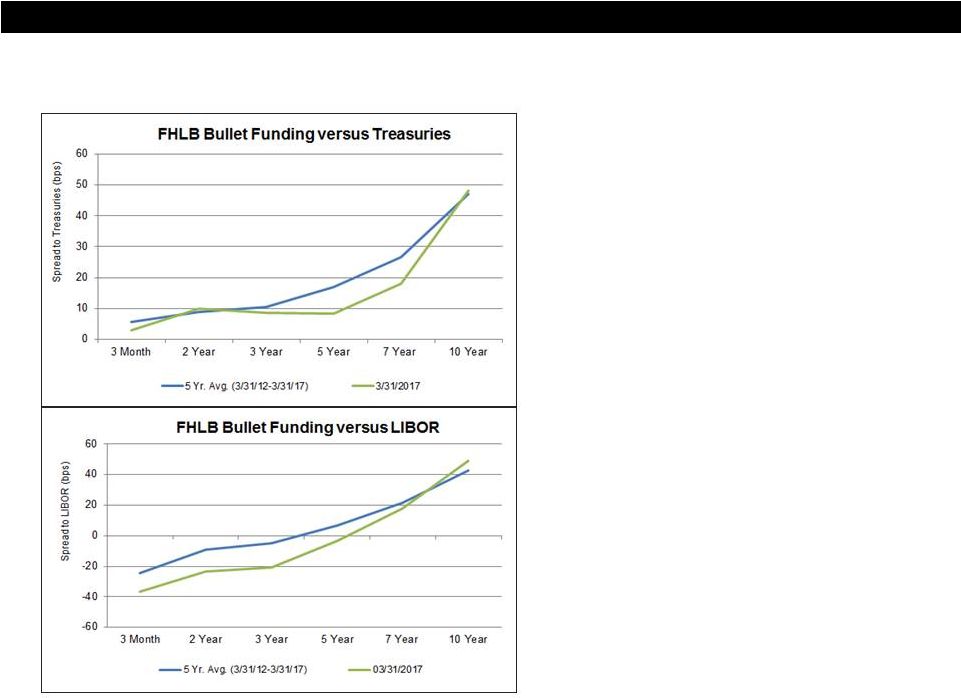

Access

to Liquidity •

Attractive advance pricing

depends on the FHLBank’s

ability to raise attractively priced

funding in the capital markets

• Current FHLBank funding spreads versus Treasuries are attractive in maturities three years and out when compared to the 5-year average of spreads – An excellent time to term out advances! • FHLBank floating-rate funding is currently pricing quite well relative to LIBOR due to increased demand from Money Market Funds 12 |

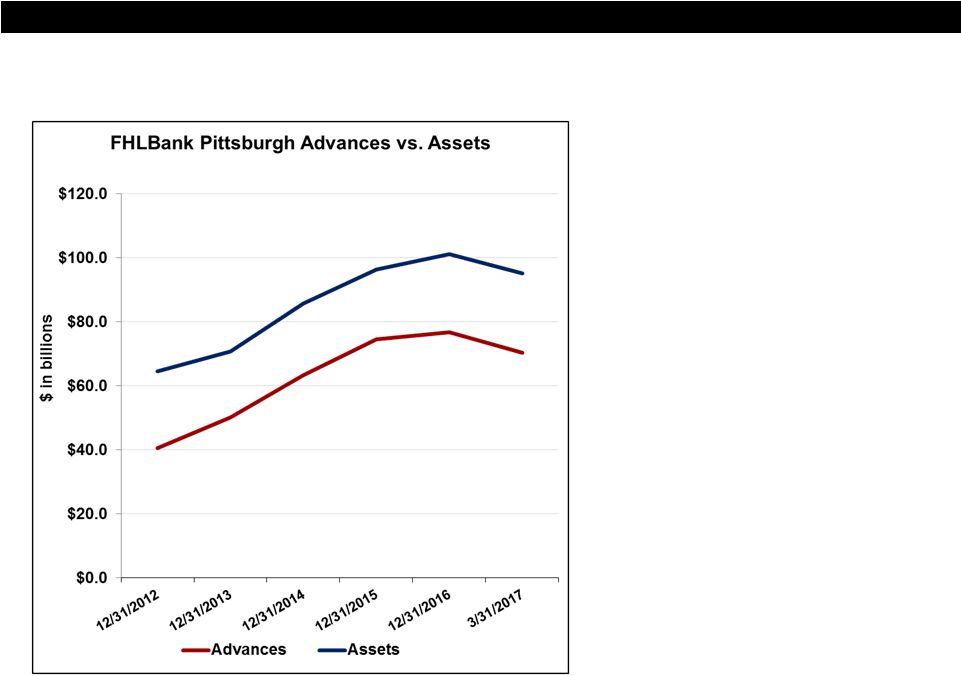

Vibrant

Bank •

FHLBank vibrancy is driven

by member activity with the

Bank • Advances have seen significant growth in the last four years • Advances declined from year end; however, it is not uncommon for the Bank to experience variances in the overall portfolio driven by member needs • The Mortgage Partnership Finance ® (MPF ® ) Program continues to grow year over year • Letters of Credit had highest number of users "Mortgage Partnership Finance” and "MPF" are registered trademarks of the Federal Home Loan Bank of Chicago

13 |

Products

and Services Advances and

Bank Services Letters of Credit Mortgage Partnership Finance ® (MPF ® ) Program Participation Community Investment Product Offerings Maximum Membership Value The value of your membership increases the more you use FHLBank products and services.

14 |

Member

Audio/Web Conference

May 2, 2017 |