Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KNOLL INC | a8-kxq22017investorpresent.htm |

© 2017 Knoll Inc.

Knoll, Inc.

Second Quarter 2017 Investor Presentation

Andrew Cogan, President & CEO

Craig Spray, SVP & CFO

2 © 2017 Knoll Inc.

Forward-Looking Statements/Non-GAAP Measures

This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements regarding Knoll, Inc.’s

expected future financial position, results of operations, cash flows, business strategy, budgets, projected costs, capital

expenditures, products, competitive positions, growth opportunities, plans and objectives of management for future operations,

as well as statements that include words such as "anticipate," "if," "believe," "plan," "goals," "estimate," "expect," "intend,"

"may," "could," "should," "will," and other similar expressions are forward-looking statements. This includes, without limitation,

our statements and expectations regarding any current or future recovery in our industry, our expectations with respect to our

diversification strategy, our future performance in relation to our industry (BIFMA), and our expectations with respect to

leverage. Such forward-looking statements are inherently uncertain, and readers must recognize that actual results may differ

materially from the expectations of Knoll management. Knoll does not undertake a duty to update such forward-looking

statements. Factors that may cause actual results to differ materially from those in the forward-looking statements include

corporate spending and service-sector employment, price competition, acceptance of Knoll’s new products, the pricing and

availability of raw materials and components, foreign exchange rates, transportation costs, demand for high quality, well

designed furniture solutions, changes in the competitive marketplace, changes in trends in the market for furniture and

coverings, the financial strength and stability of our suppliers, customers and dealers, access to capital, our success in

designing and implementing our new enterprise resource planning system, our ability to successfully integrate acquired

businesses, and other risks identified in Knoll’s Annual Report on Form 10-K and other filings with the Securities and Exchange

Commission, as well as other cautionary statements that are made from time-to-time in Knoll’s public communications. Many

of these factors are outside of Knoll’s control.

This presentation also includes certain non-GAAP financial measures. A “non-GAAP financial measure” is a numerical

measure of a company’s financial performance that excludes or includes amounts so as to be different than the most directly

comparable measure calculated and presented in accordance with U.S. generally accepted accounting principles (“GAAP”).

We present Non-GAAP measures because we consider them to be important supplemental measures of our performance and

believe them to be useful to display ongoing results from operations distinct from items that are infrequent or not indicative of

our operating performance. We have provided reconciliations of these non-GAAP financial measures to the most directly

comparable GAAP measure in the presentation below.

These non-GAAP measures are not indicators of our financial performance under GAAP and should not be considered as an

alternative to the applicable GAAP measure. These non-GAAP measures have limitations as analytical tools, and you should

not consider them in isolation or as a substitute for analysis of our results as reported under GAAP. Our presentation of these

non-GAAP measures should not be construed as an inference that our future results will be unaffected by unusual or infrequent

items.

3 © 2017 Knoll Inc.

Knoll is an expanding constellation of design-driven

brands and people, working together with our clients

to create inspired modern interiors

Knoll is:

Knoll Office

KnollStudio

KnollTextiles

KnollExtra

DatesWeiser

Spinneybeck | FilzFelt

Edelman Leather

HOLLY HUNT

Vladimir Kagan

4 © 2017 Knoll Inc.

For 79 years, Knoll has stood for modern design

60s 60s

90s 90s

60s

00s 00s

10s 10s 10s

Design, leadership, quality and

innovation in both the contract

and residential markets

5 © 2017 Knoll Inc.

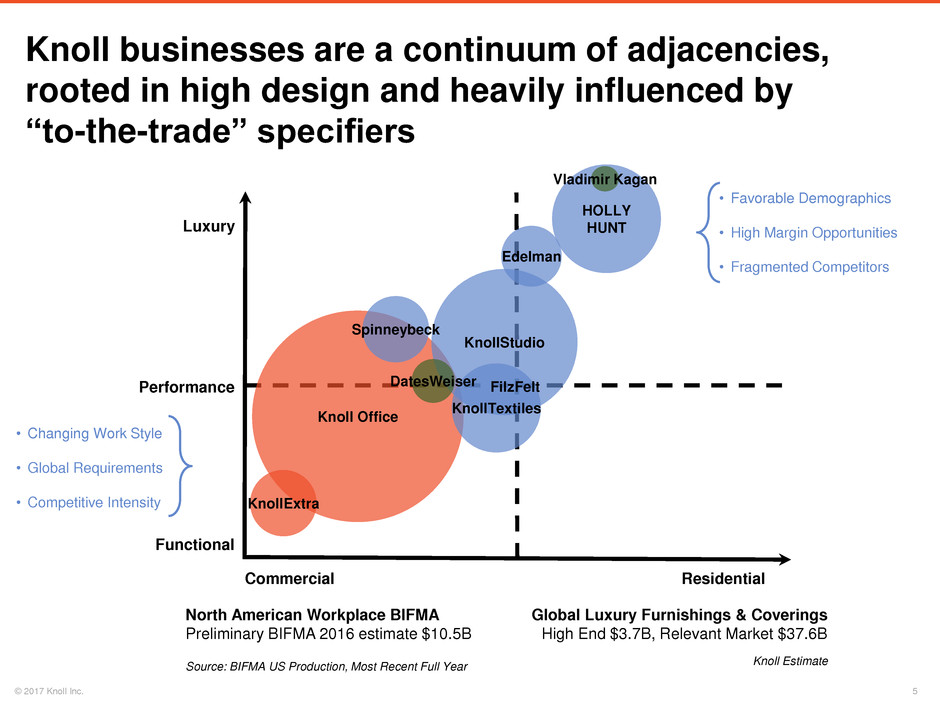

Knoll businesses are a continuum of adjacencies,

rooted in high design and heavily influenced by

“to-the-trade” specifiers

Global Luxury Furnishings & Coverings

High End $3.7B, Relevant Market $37.6B

Knoll Estimate

North American Workplace BIFMA

Preliminary BIFMA 2016 estimate $10.5B

Source: BIFMA US Production, Most Recent Full Year

• Changing Work Style

• Global Requirements

• Competitive Intensity

• Favorable Demographics

• High Margin Opportunities

• Fragmented Competitors

Luxury

Functional

Performance

Commercial Residential

Knoll Office

KnollStudio

Spinneybeck

KnollTextiles

KnollExtra

Edelman

FilzFelt

HOLLY

HUNT

Vladimir Kagan

DatesWeiser

6 © 2017 Knoll Inc.

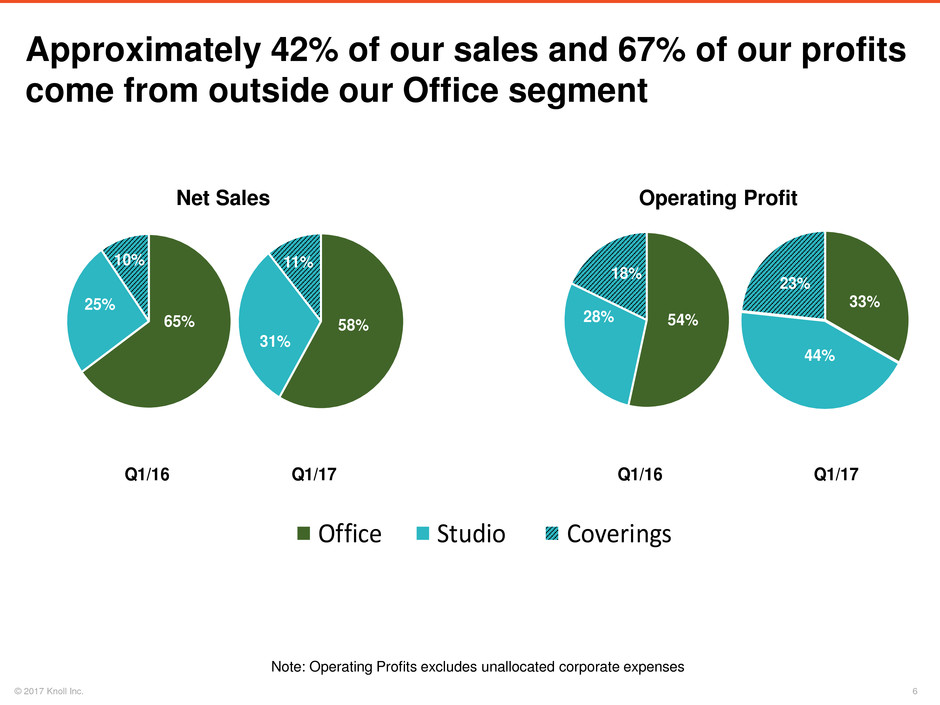

Q1/16 Q1/17 Q1/16 Q1/17

54%28%

18%

65%

25%

10%

58%

31%

11%

33%

44%

23%

31%Office Studio Coverings

Approximately 42% of our sales and 67% of our profits

come from outside our Office segment

Net Sales Operating Profit

Note: Operating Profits excludes unallocated corporate expenses

7 © 2017 Knoll Inc.

› Maximize office segment

profitability and growth

› Target underpenetrated and

emerging ancillary categories

and markets for growth

› Expand reach into residential

and decorator channels

around the world

› Build a responsive and

efficient customer centric

service and technology

infrastructure across our

businesses

Four strategic imperatives drive our growth

8 © 2017 Knoll Inc.

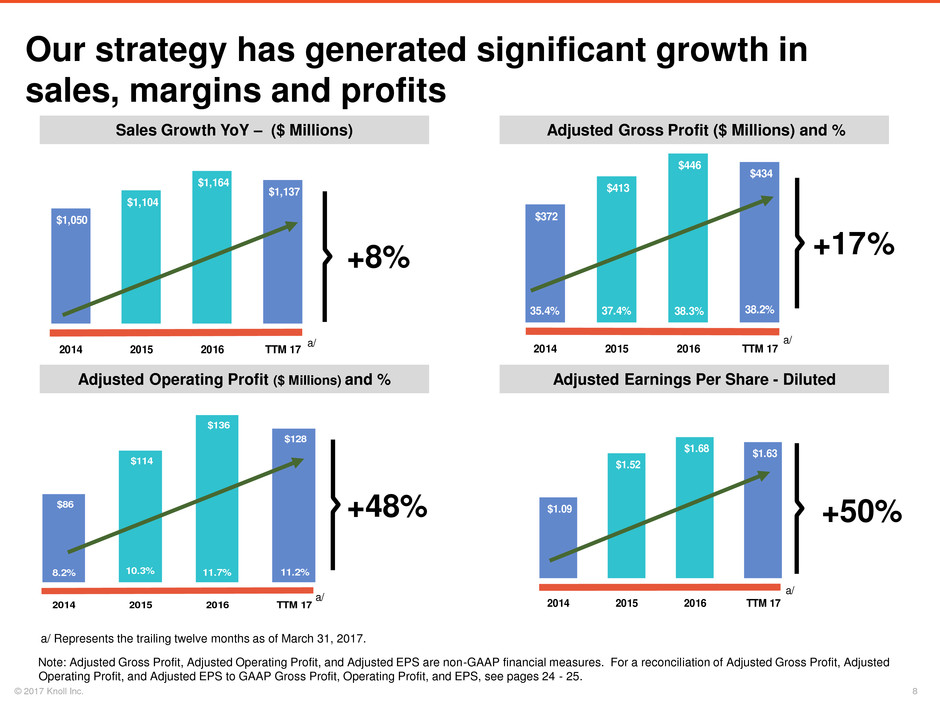

$1.09

$1.52

$1.68 $1.63

2014 2015 2016 TTM 17

$86

$114

$136

$128

8.2% 10.3% 11.7% 11.2%

2014 2015 2016 TTM 17

$372

$413

$446

$434

35.4% 37.4% 38.3% 38.2%

2014 2015 2016 TTM 17

$1,050

$1,104

$1,164

$1,137

2014 2015 2016 TTM 17

Our strategy has generated significant growth in

sales, margins and profits

Adjusted Gross Profit ($ Millions) and %

Adjusted Operating Profit ($ Millions) and % Adjusted Earnings Per Share - Diluted

Sales Growth YoY – ($ Millions)

+8% +17 %

+48% +50%

Note: Adjusted Gross Profit, Adjusted Operating Profit, and Adjusted EPS are non-GAAP financial measures. For a reconciliation of Adjusted Gross Profit, Adjusted

Operating Profit, and Adjusted EPS to GAAP Gross Profit, Operating Profit, and EPS, see pages 24 - 25.

a/

a/

a/

a/

a/ Represents the trailing twelve months as of March 31, 2017.

9 © 2017 Knoll Inc.

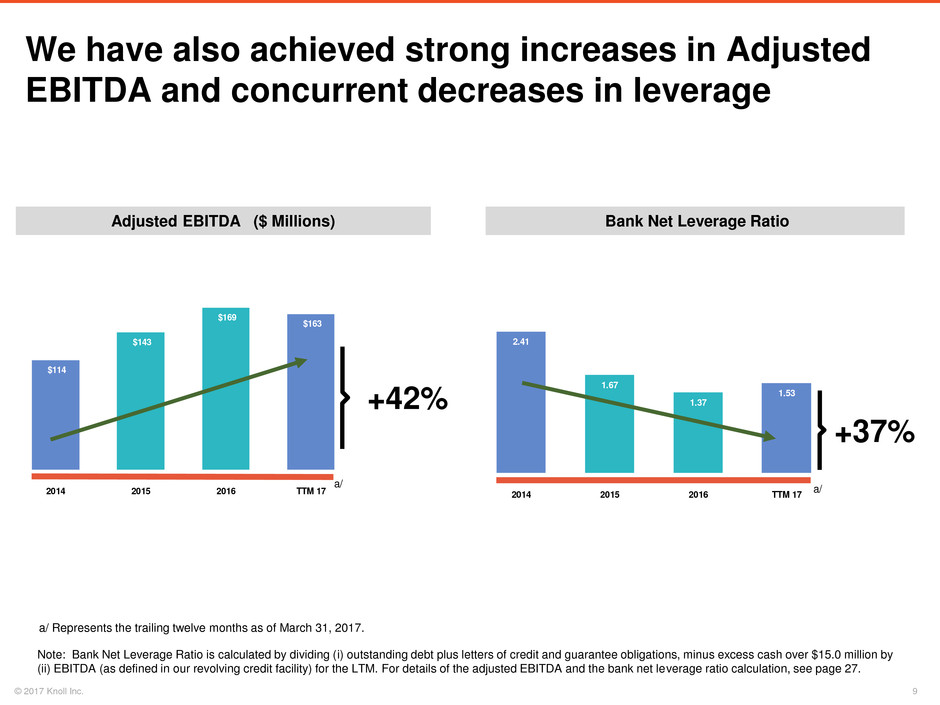

$114

$143

$169

$163

2014 2015 2016 TTM 17

2.41

1.67

1.37

1.53

2014 2015 2016 TTM 17

We have also achieved strong increases in Adjusted

EBITDA and concurrent decreases in leverage

Bank Net Leverage Ratio Adjusted EBITDA ($ Millions)

+42%

+37%

Note: Bank Net Leverage Ratio is calculated by dividing (i) outstanding debt plus letters of credit and guarantee obligations, minus excess cash over $15.0 million by

(ii) EBITDA (as defined in our revolving credit facility) for the LTM. For details of the adjusted EBITDA and the bank net leverage ratio calculation, see page 27.

a/

a/

a/ Represents the trailing twelve months as of March 31, 2017.

10 © 2017 Knoll Inc.

Note: Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation of Adjusted EBITDA to GAAP EBITDA, see pages 26.

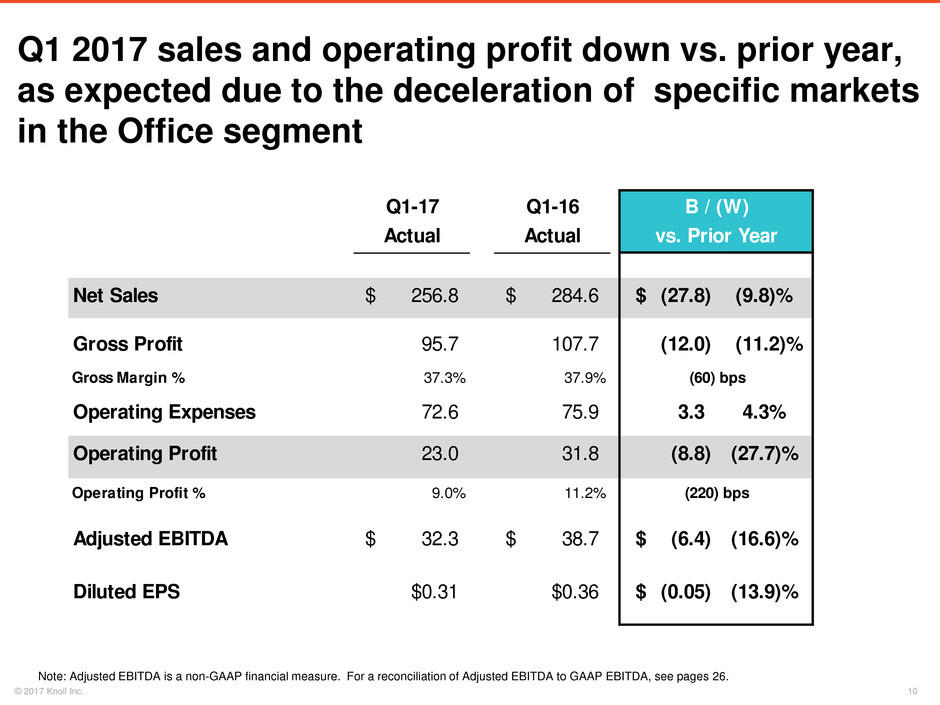

Q1 2017 sales and operating profit down vs. prior year,

as expected due to the deceleration of specific markets

in the Office segment

Q1

Q1-17 Q1-16

Actual Actual

Net Sales 256.8$ 284.6$ (27.8)$ (9.8)%

Gross Profit 95.7 107.7 (12.0) (11.2)%

Gross Margin % 37.3% 37.9%

Operating Expenses 72.6 75.9 3.3 4.3%

Operating Profit 23.0 31.8 (8.8) (27.7)%

Op rating Profit % 9.0% 11.2%

Adjusted EBITDA 32.3$ 38.7$ (6.4)$ (16.6)%

Diluted EPS $0.31 $0.36 (0.05)$ (13.9)%

(220) bps

B / (W)

vs. Prior Year

(60) bps

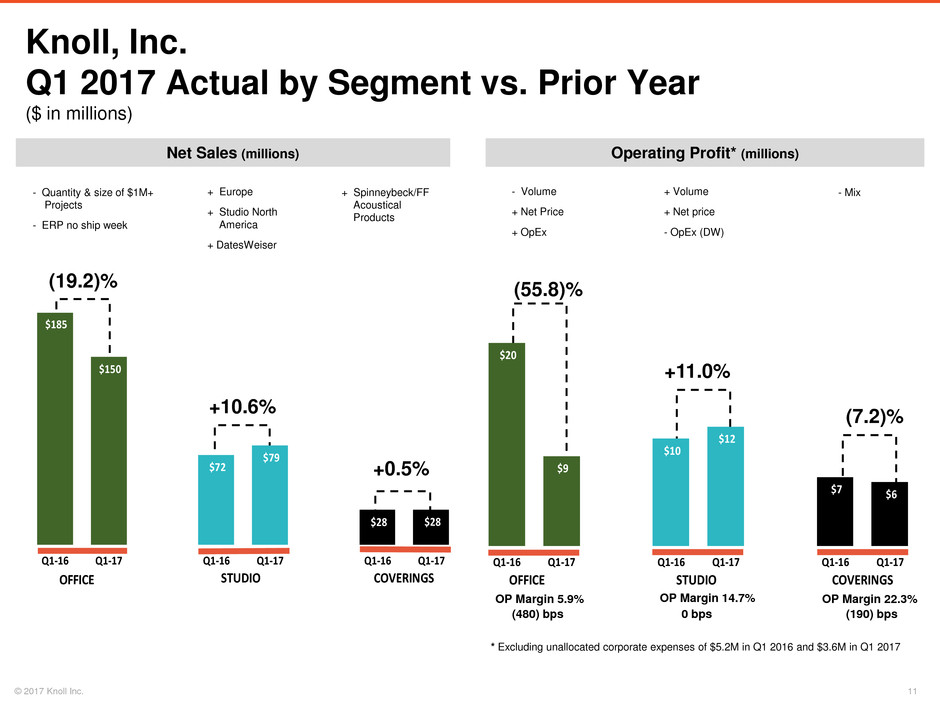

11 © 2017 Knoll Inc.

(19.2)% (55.8)%

Net Sales (millions) Operating Profit* (millions)

- Quantity & size of $1M+

Projects

- ERP no ship week

+ Europe

+ Studio North

America

+ DatesWeiser

+ Spinneybeck/FF

Acoustical

Products

- Volume

+ Net Price

+ OpEx

+ Volume

+ Net price

- OpEx (DW)

- Mix

OP Margin 5.9% OP Margin 14.7% OP Margin 22.3%

(480) bps 0 bps (190) bps

+10.6%

+11.0%

(7.2)%

* Excluding unallocated corporate expenses of $5.2M in Q1 2016 and $3.6M in Q1 2017

+0.5%

$185

$150

$72

$79

$28 $28

Q1-16 Q1-17 Q1-16 Q1-17 Q1-16 Q1-17

OFFICE STUDIO COVERINGS

Knoll, Inc.

Q1 2017 Actual by Segment vs. Prior Year

($ in millions)

$20

$9

$10

$12

$7 $6

- 6 Q1-17 Q1-16 Q1-17 Q -16 Q1-17

OFFICE STUDIO COVERINGS

12 © 2017 Knoll Inc.

0

50

100

150

200

250

300

350

400

2013 2014 2015 2016 2017

Th

ou

sa

nd

s

25

30

35

40

45

50

55

60

2013 2014 2015 2016 TTM Q1

2017

M

ill

io

ns 30

40

50

60

70

80

2013 2014 2015 2016 2017

40

45

50

55

60

3 2014 2015 2016 2017

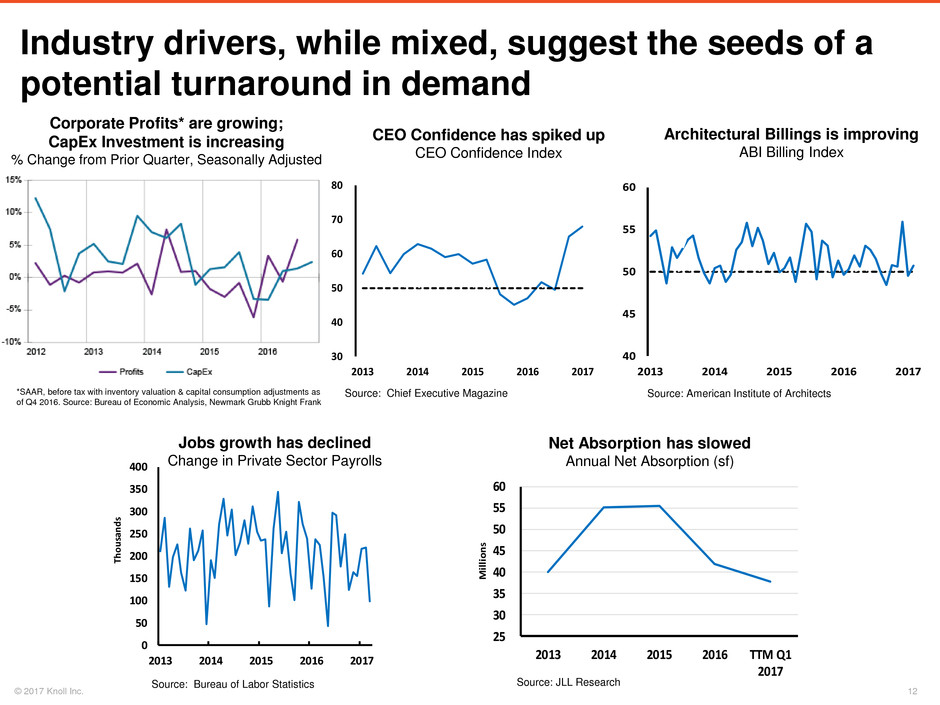

Industry drivers, while mixed, suggest the seeds of a

potential turnaround in demand

Source: Chief Executive Magazine

Corporate Profits* are growing;

CapEx Investment is increasing

% Change from Prior Quarter, Seasonally Adjusted

CEO Confidence has spiked up

CEO Confidence Index

Architectural Billings is improving

ABI Billing Index

Source: American Institute of Architects

Net Absorption has slowed

Annual Net Absorption (sf)

Source: JLL Research Source: Bureau of Labor Statistics

Jobs growth has declined

Change in Private Sector Payrolls

*SAAR, before tax with inventory valuation & capital consumption adjustments as

of Q4 2016. Source: Bureau of Economic Analysis, Newmark Grubb Knight Frank

13 © 2017 Knoll Inc.

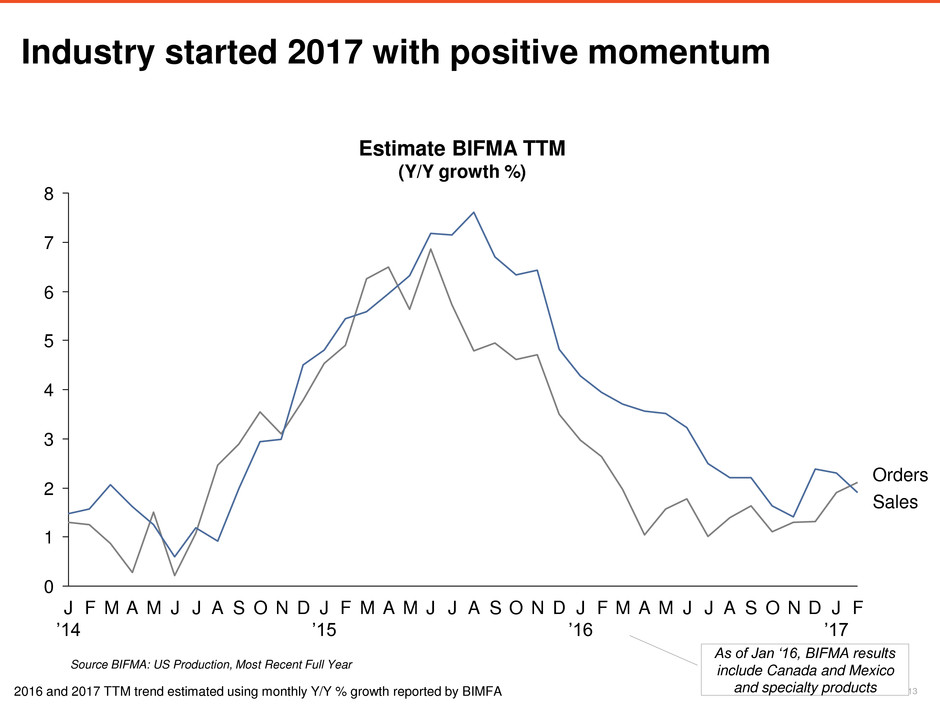

Industry started 2017 with positive momentum

0

1

2

3

4

5

6

7

8

J

’17

Sales

Orders

D N O S A J J M A M F J

’16

D N O S A J J M A M F J

’15

D N O S A J J M A M F J

’14

F

Estimate BIFMA TTM

(Y/Y growth %)

As of Jan ‘16, BIFMA results

include Canada and Mexico

and specialty products 2016 a d 2017 TTM trend estimated using monthly Y/Y % growth reported by BIMFA

Source BIFMA: US Production, Most Recent Full Year

14 © 2017 Knoll Inc.

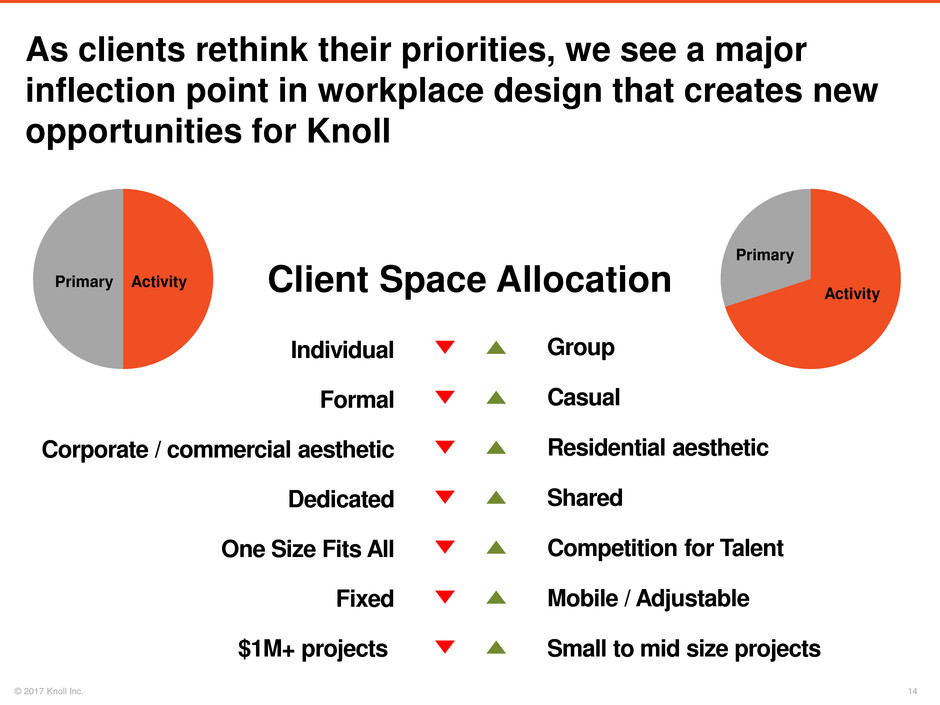

As clients rethink their priorities, we see a major

inflection point in workplace design that creates new

opportunities for Knoll

Individual

Formal

Fixed

Dedicated

One Size Fits All

Group

Casual

Mobile / Adjustable

Shared

Competition for Talent

Residential aesthetic Corporate / commercial aesthetic

Small to mid size projects $1M+ projects

Client Space Allocation Primary Activity

Primary

Activity

15 © 2017 Knoll Inc.

For Knoll, solving ancillary is critical for maintaining

our position as a market leader and fueling growth

±90% ±10%

2015 Knoll Dealers

workplace

Estimated share of wallet1

* ±50% combined share of wallet based on major project review and reported Dealer value

±13% ±1.5%

2016 Industry ~$10.5B3

Estimated Market share2

workplace

2 ±7% combined market share, Knoll Estimate

3 Preliminary BIFMA 2016 estimate

Workstations

(Primary Spaces)

Ancillary

(Activity)

Workstations

(Primary Spaces)

Ancillary

(Activity)

1 ±50% combined share of wallet based on major project

review and reported Dealer value

16 © 2017 Knoll Inc.

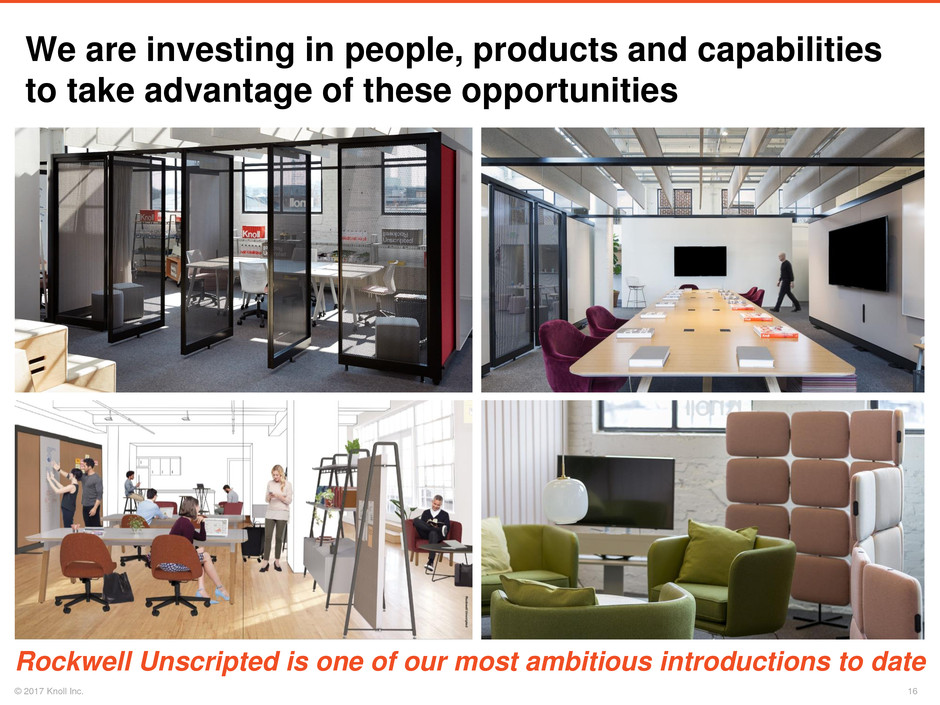

We are investing in people, products and capabilities

to take advantage of these opportunities

Rockwell Unscripted is one of our most ambitious introductions to date

17 © 2017 Knoll Inc.

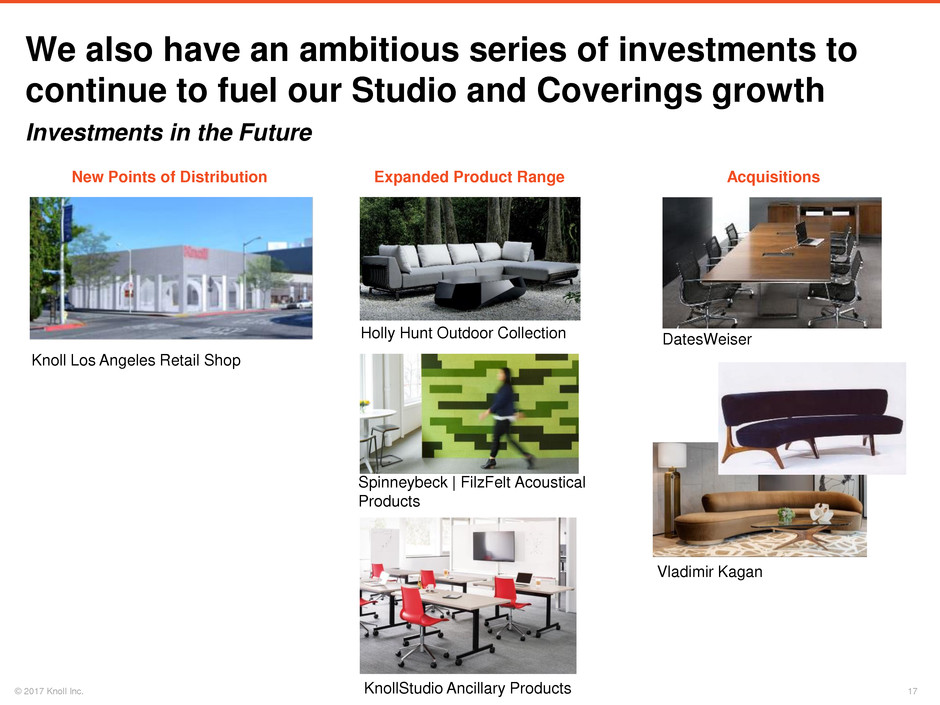

We also have an ambitious series of investments to

continue to fuel our Studio and Coverings growth

Investments in the Future

New Points of Distribution

Knoll Los Angeles Retail Shop

Expanded Product Range

Holly Hunt Outdoor Collection

Spinneybeck | FilzFelt Acoustical

Products

KnollStudio Ancillary Products

DatesWeiser

Acquisitions

Vladimir Kagan

18 © 2017 Knoll Inc.

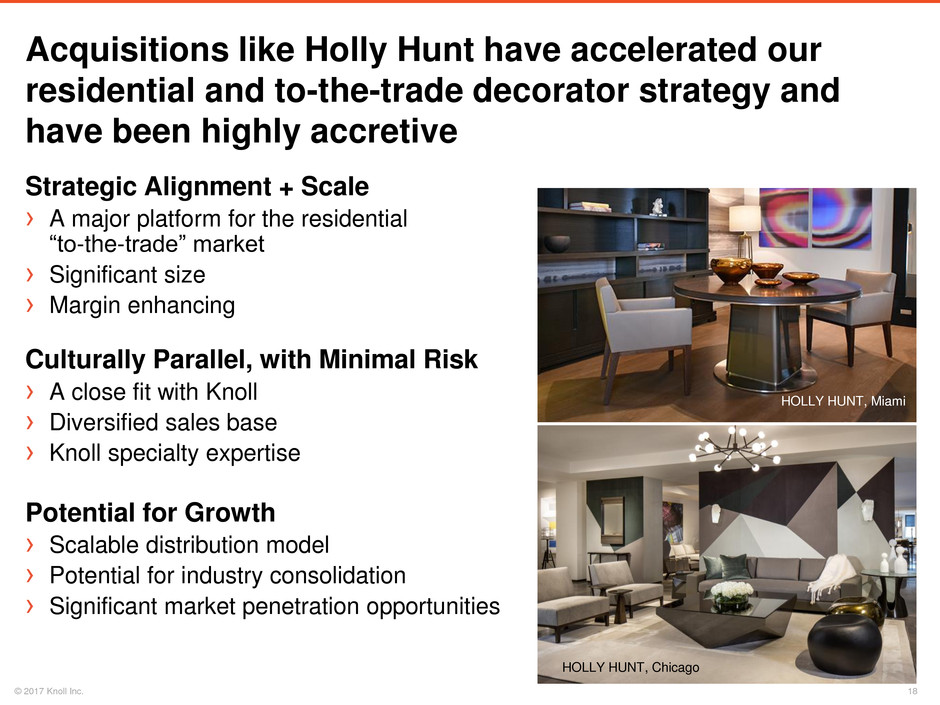

Acquisitions like Holly Hunt have accelerated our

residential and to-the-trade decorator strategy and

have been highly accretive

Strategic Alignment + Scale

› A major platform for the residential

“to-the-trade” market

› Significant size

› Margin enhancing

Culturally Parallel, with Minimal Risk

› A close fit with Knoll

› Diversified sales base

› Knoll specialty expertise

Potential for Growth

› Scalable distribution model

› Potential for industry consolidation

› Significant market penetration opportunities

HOLLY HUNT, Chicago

HOLLY HUNT, Miami

19 © 2017 Knoll Inc.

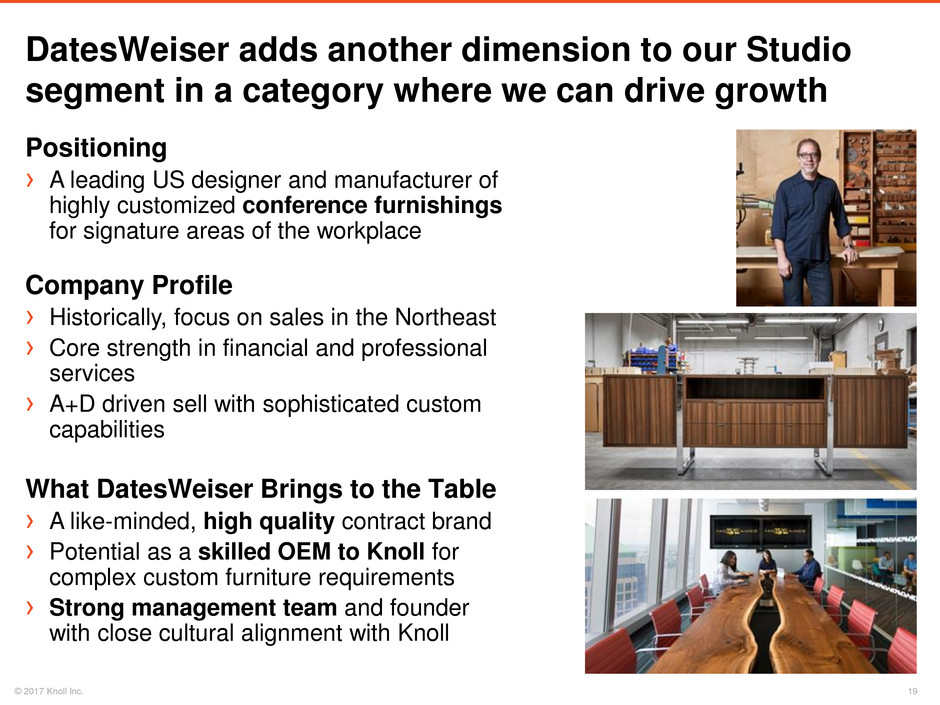

DatesWeiser adds another dimension to our Studio

segment in a category where we can drive growth

Positioning

› A leading US designer and manufacturer of

highly customized conference furnishings

for signature areas of the workplace

Company Profile

› Historically, focus on sales in the Northeast

› Core strength in financial and professional

services

› A+D driven sell with sophisticated custom

capabilities

What DatesWeiser Brings to the Table

› A like-minded, high quality contract brand

› Potential as a skilled OEM to Knoll for

complex custom furniture requirements

› Strong management team and founder

with close cultural alignment with Knoll

20 © 2017 Knoll Inc.

“Less is More” Bringing Lean to Knoll

We are implementing a culture of continuous improvement

Lean across Knoll

› Driving out waste and inefficiency

› Engaging our manufacturing associates

› Process and productivity improvement

Waste and Landfill

Recycled Content

Safety Incident Rate

Lean Initiatives

21 © 2017 Knoll Inc.

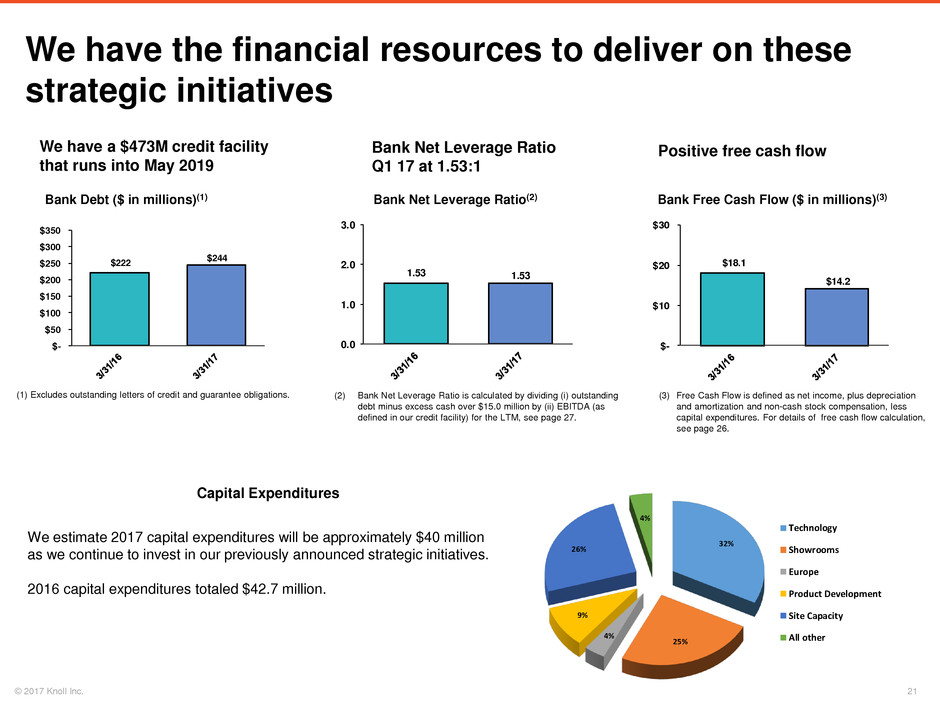

$18.1

$14.2

$-

$10

$20

$30

1.53 1.53

0.0

1.0

2.0

3.0

$222

$244

$-

$50

$100

$150

$200

$250

$300

$350

We have the financial resources to deliver on these

strategic initiatives

We have a $473M credit facility

that runs into May 2019

Bank Net Leverage Ratio

Q1 17 at 1.53:1

Positive free cash flow

(1) Excludes outstanding letters of credit and guarantee obligations. (2) Bank Net Leverage Ratio is calculated by dividing (i) outstanding

debt minus excess cash over $15.0 million by (ii) EBITDA (as

defined in our credit facility) for the LTM, see page 27.

(3) Free Cash Flow is defined as net income, plus depreciation

and amortization and non-cash stock compensation, less

capital expenditures. For details of free cash flow calculation,

see page 26.

Bank Debt ($ in millions)(1) Bank Net Leverage Ratio(2) Bank Free Cash Flow ($ in millions)(3)

Capital Expenditures

We estimate 2017 capital expenditures will be approximately $40 million

as we continue to invest in our previously announced strategic initiatives.

2016 capital expenditures totaled $42.7 million.

32%

25%

4%

9%

26%

4%

Technology

Showrooms

Europe

Product Development

Site Capacity

All other

22 © 2017 Knoll Inc.

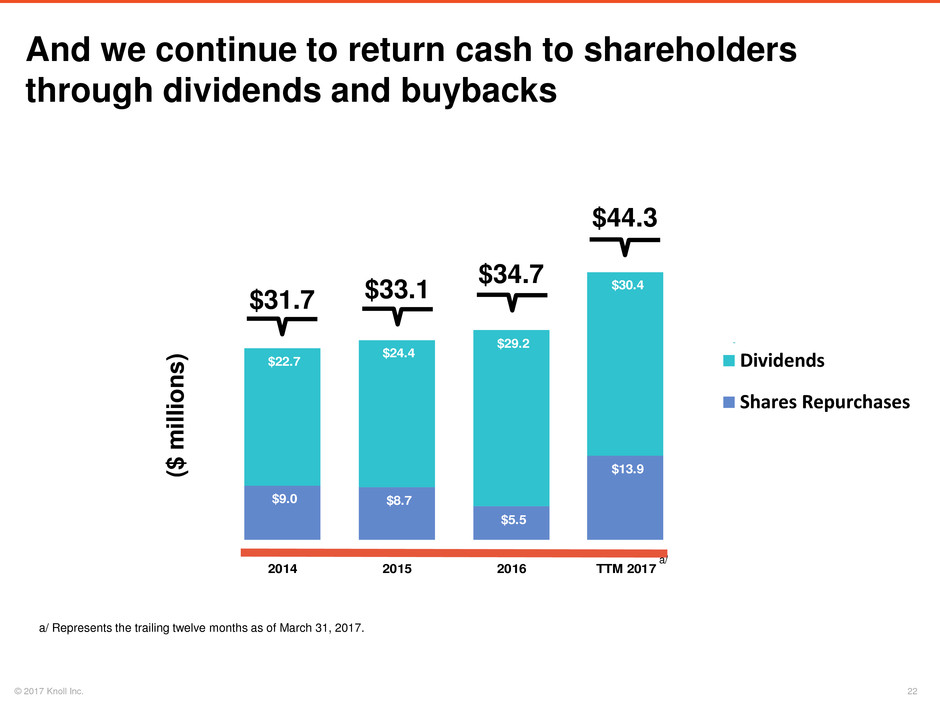

$9.0 $8.7

$5.5

$13.9

$22.7

$24.4

$29.2

$30.4

2014 2015 2016 TTM 2017

($ mil

li

o

ns)

Dividends

Shares Repurchases

$31.7 $33.1

$34.7

$44.3

And we continue to return cash to shareholders

through dividends and buybacks

a/

a/ Represents the trailing twelve months as of March 31, 2017.

23 © 2017 Knoll Inc.

Thank you for your interest as we

continue to build out our singular

brand and platform

knoll.com

24 © 2017 Knoll Inc.

2014 2015 2016 TTM 2017

Operating Profit ($mm) 76.8$ 101.0$ 136.3$ 127.5$

Add back (deduct):

Intangible asset impairment charge - 10.7 - -

Pension settlement and OPEB curtailment 6.5 - - -

Restructuring charges 1.5 0.9 - -

Seating product discontinuation - 0.9 - -

Acquisition expenses 0.7 - - -

Remeasurement of FilzFelt Earn-out liability 0.5 - - -

Adjusted Operating Profit 86.0$ 113.5$ 136.3$ 127.5$

Net Sales ($mm) 1,050.3$ 1,104.4$ 1,164.3$ 1,136.5$

Adjusted Operating Profit % 8.2% 10.3% 11.7% 11.2%

Years Ended December 31,

Reconciliation of Non-GAAP Results

2014 2015 2016 TTM 2017

Knoll Inc.

Gross Profit 371.7$ 412.1$ 445.9$ 433.9$

Add back:

Seating product discontinuation charge - 0.9 - -

Adjusted Gross Profit 371.7$ 413.0$ 445.9$ 433.9$

Net Sales 1,050.3$ 1,104.4$ 1,164.3$ 1,136.5$

Adjusted Gro s Profit % 35.4% 37.4% 38.3% 38.2%

($ in millions)

Years Ended December 31,

a/

a/

a/ Represents the trailing twelve months as of March 31, 2017.

25 © 2017 Knoll Inc.

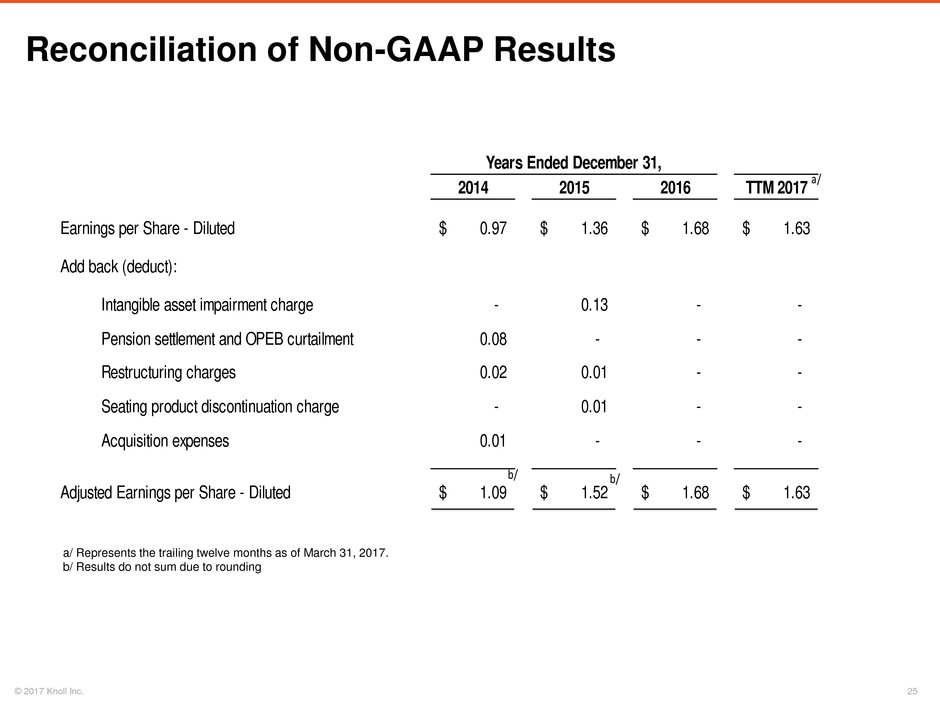

Reconciliation of Non-GAAP Results

a/ Represents the trailing twelve months as of March 31, 2017.

b/ Results do not sum due to rounding

2014 2015 2016 TTM 2017

Earnings per Share - Diluted 0.97$ 1.36$ 1.68$ 1.63$

Add back (deduct):

Intangible asset impairment charge - 0.13 - -

Pension settlement and OPEB curtailment 0.08 - - -

Restructuring charges 0.02 0.01 - -

Seating product discontinuation charge - 0.01 - -

Acquisition expenses 0.01 - - -

Adjusted Earnings per Share - Diluted 1.09$ 1.52$ 1.68$ 1.63$

Years Ended December 31,

a/

b/ b/

26 © 2017 Knoll Inc.

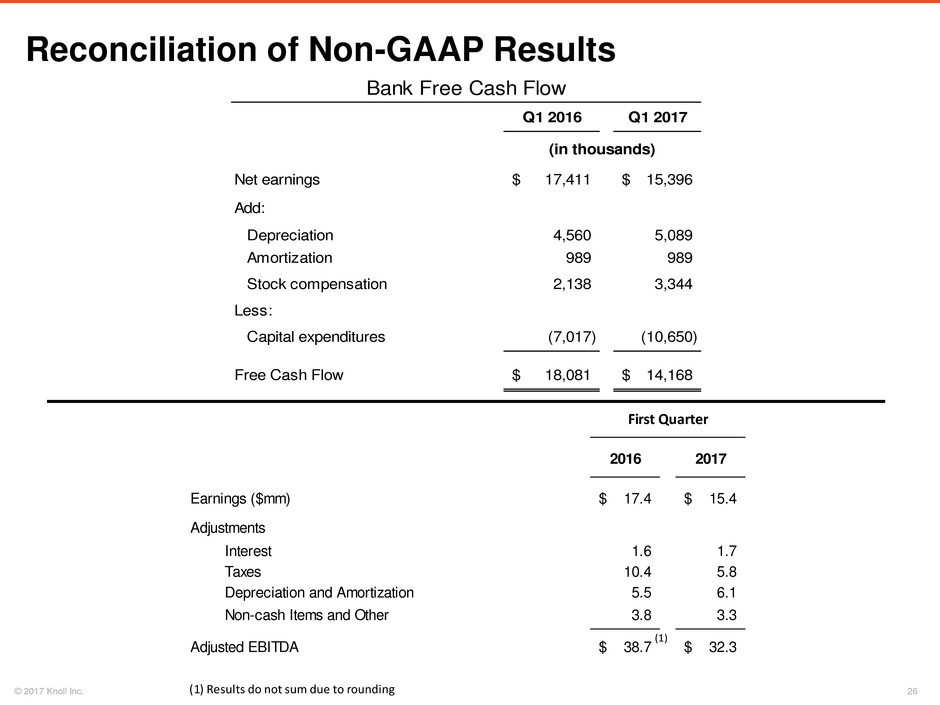

2016 2017

Earnings ($mm) 17.4$ 15.4$

Adjustments

Interest 1.6 1.7

Taxes 10.4 5.8

Depreciation and Amortization 5.5 6.1

Non-cash Items and Other 3.8 3.3

Adjusted EBITDA 38.7$ 32.3$

(1) Results do not sum due to rounding

First Quarter

(1)

Q1 2016 Q1 2017

Net earnings 17,411$ 15,396$

Add:

Depreciation 4,560 5,089

Amortization 989 989

Stock compensation 2,138 3,344

Less:

Capital expenditures (7,017) (10,650)

Free Cash Flow 18,081$ 14,168$

(in thousands)

Bank Free Cash Flow

Reconciliation of Non-GAAP Results

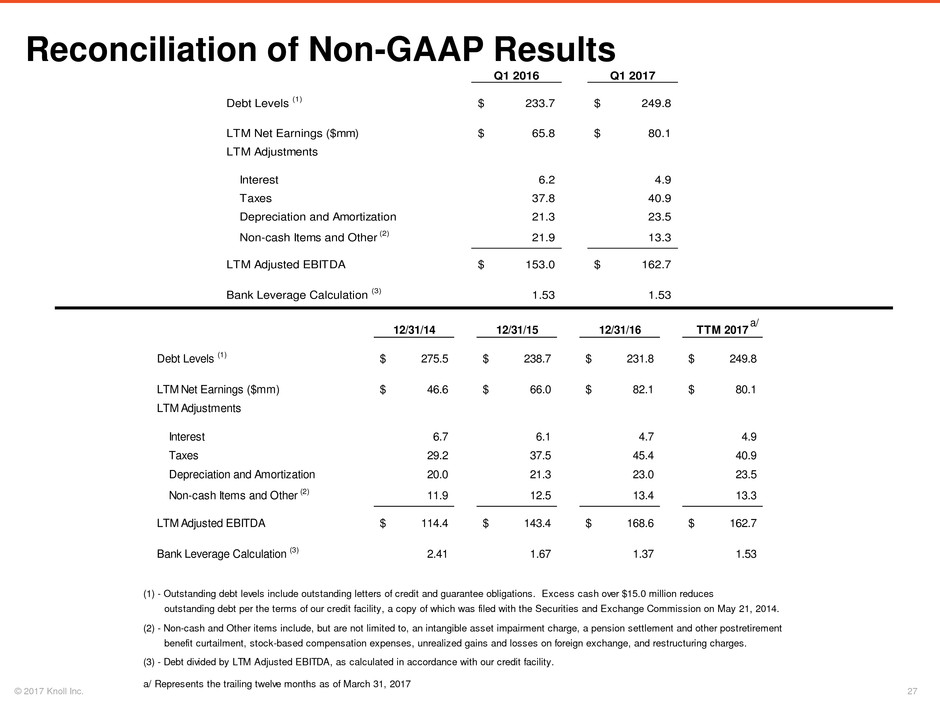

27 © 2017 Knoll Inc.

12/31/14 12/31/15 12/31/16 TTM 2017

Debt Levels (1) 275.5$ 238.7$ 231.8$ 249.8$

LTM Net Earnings ($mm) 46.6$ 66.0$ 82.1$ 80.1$

LTM Adjustments

Interest 6.7 6.1 4.7 4.9

Taxes 29.2 37.5 45.4 40.9

Depreciation and Amortization 20.0 21.3 23.0 23.5

Non-cash Items and Other (2) 11.9 12.5 13.4 13.3

LTM Adjusted EBITDA 114.4$ 143.4$ 168.6$ 162.7$

Bank Leverage Calculation (3) 2.41 1.67 1.37 1.53

(1) - Outstanding debt levels include outstanding letters of credit and guarantee obligations. Excess cash over $15.0 million reduces

outstanding debt per the terms of our credit facility, a copy of which was filed with the Securities and Exchange Commission on May 21, 2014.

(2) - Non-cash and Other items include, but are not limited to, an intangible asset impairment charge, a pension settlement and other postretirement

benefit curtailment, stock-based compensation expenses, unrealized gains and losses on foreign exchange, and restructuring charges.

(3) - Debt divided by LTM Adjusted EBITDA, as calculated in accordance with our credit facility.

a/ Represents the trailing twelve months as of March 31, 2017

Q1 2016 Q1 2017

Debt Levels

(1)

233.7$ 24 .8$

LTM Net Earnings ($mm) 65.8$ 80.1$

LTM Adjustments

Interest 6.2 4.9

Taxes 37.8 40.9

Depreciation and Amortization 21.3 23.5

Non-cash Items and Other

(2)

21.9 13.3

LTM Adjusted EBITDA 153.0$ 162.7$

Bank Leverage Calculation

(3)

1.53 1.53

Reconciliation of Non-GAAP Results

a/

28 © 2017 Knoll Inc.