Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WashingtonFirst Bankshares, Inc. | a8-kannualmeetingpresentat.htm |

NASDAQ: WFBI

Annual Shareholder Meeting

April 26, 2017

The Tower Club

Tysons Corner, Virginia

NASDAQ: WFBI

Disclaimer

1

WashingtonFirst Bankshares, Inc. and Subsidiary (the “Company”) make forward-

looking statements in this presentation that are subject to risks and uncertainties.

These forward-looking statements include: statements of goals, intentions,

earnings expectations, and other expectations; estimates of risks and of future costs

and benefits; assessments of probable loan losses; assessments of market risks; and

statements of the ability to achieve financial and other goals. These forward-

looking statements are subject to significant uncertainties because they are based

upon or are affected by: management’s estimates and projections of future interest

rates, market behavior, and other economic conditions; future laws and

regulations; and a variety of other matters which, by their nature, are subject to

significant uncertainties. Because of these uncertainties, the Company’s actual

future results may differ materially from those indicated. In addition, the

Company’s past results of operations do not necessarily indicate its future results.

Please also see the discussion of “RISK FACTORS” in the Company’s 10-K dated

March 15, 2016 which is available online at www.sec.gov.

For further information on the company please contact:

Matthew R. Johnson

Executive Vice President / Chief Financial Officer

(703) 840-2422

mjohnson@wfbi.com

NASDAQ: WFBI

2016 Year in Review

2

*Source: SNL Financial; based on deposits. Includes announced acquisition of Cardinal Financial Corp by United Bankshares

Opened two branches:

Historic Old Town Alexandria, Virginia

Potomac, Maryland

Surpassed $2.0 billion in total assets as of December 31, 2016

Maintained superior asset quality: improved NPAs from 0.86% to

0.43%, as of December 31, 2016

Added to the Russell 2000® index

Declared an increased cash dividend to $0.07 on November 22, 2016

(paid January 3, 2017)

Attained excellent market position as the 4th largest bank

headquartered in the Washington, DC metro area*

NASDAQ: WFBI

DC Area Community Banks – Total Assets(1)

Rank Company Location Total Assets ($000)

1 United Bankshares Inc. Charleston, WV $ 14,508,892

2 Eagle Bancorp Inc. Bethesda, MD $ 6,890,097

3 Sandy Spring Bancorp Inc. Olney, MD $ 5,091,383

4 Cardinal Financial Corp. Mclean, VA $ 4,210,514

5 Burke & Herbert Bank & Trust Company Alexandria, VA $ 2,958,790

6 WashingtonFirst Bankshares Inc. Reston, VA $ 2,002,911

7 Old Line Bancshares, Inc. Bowie, MD $ 1,716,690

8 Premier Financial Bancorp Inc. Huntington, WV $ 1,498,120

9 Access National Corp. Reston, VA $ 1,430,708

10 Middleburg Financial Corp. Middleburg, VA $ 1,335,002

11 Community Financial Corp. Waldorf, MD $ 1,334,257

12 Revere Bank Laurel, MD $ 1,327,309

13 Southern National Bncp of VA Mclean, VA $ 1,142,443

14 John Marshall Bank Reston, VA $ 1,075,166

15 FVCBankcorp, Inc. Fairfax, VA $ 909,305

16 Eagle Finacial Services, Inc Berryville, VA $ 668,421

17 Fauquier Bankshares Inc. Warrenton, VA $ 623,877

18 MainStreet Bancshares Inc. Fairfax, VA $ 575,711

Source: SNL Financial

1 As of 12/31/16; Banks within either the Washington-Arlington-Alexandria MSA or operating a branch in the District of Columbia with total assets

between $500MM and $15B

*Peers defined as banks in MD, VA and DC with total assets between $1 billion and $5 billion

4

Total Asset Size

NASDAQ: WFBI

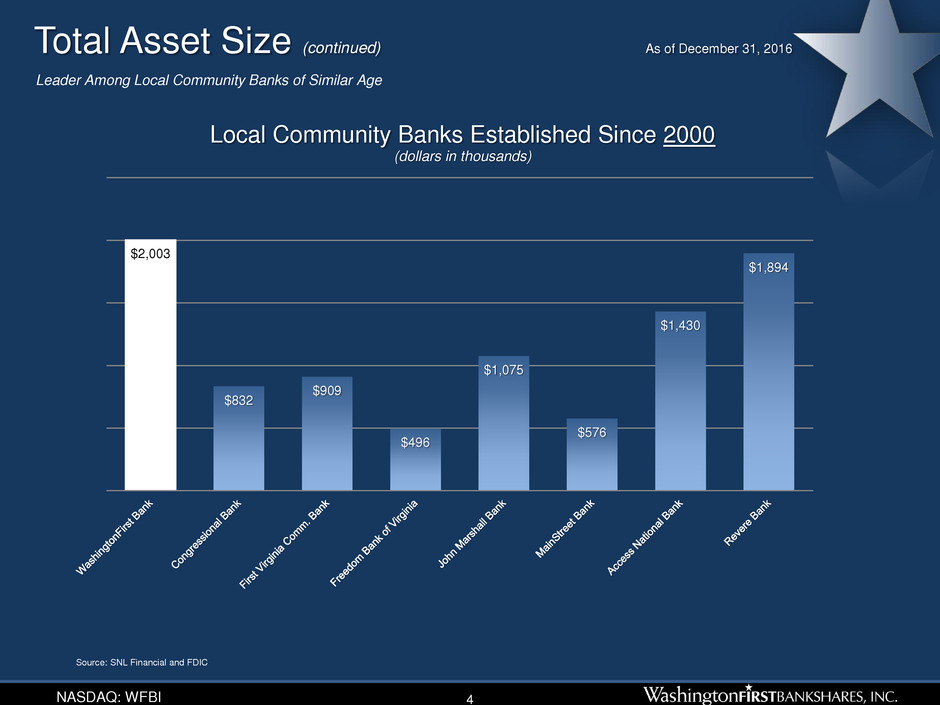

Leader Among Local Community Banks of Similar Age

Total Asset Size (continued) As of December 31, 2016

Source: SNL Financial and FDIC

4

$2,003

$832

$909

$496

$1,075

$576

$1,430

$1,894

Local Community Banks Established Since 2000

(dollars in thousands)

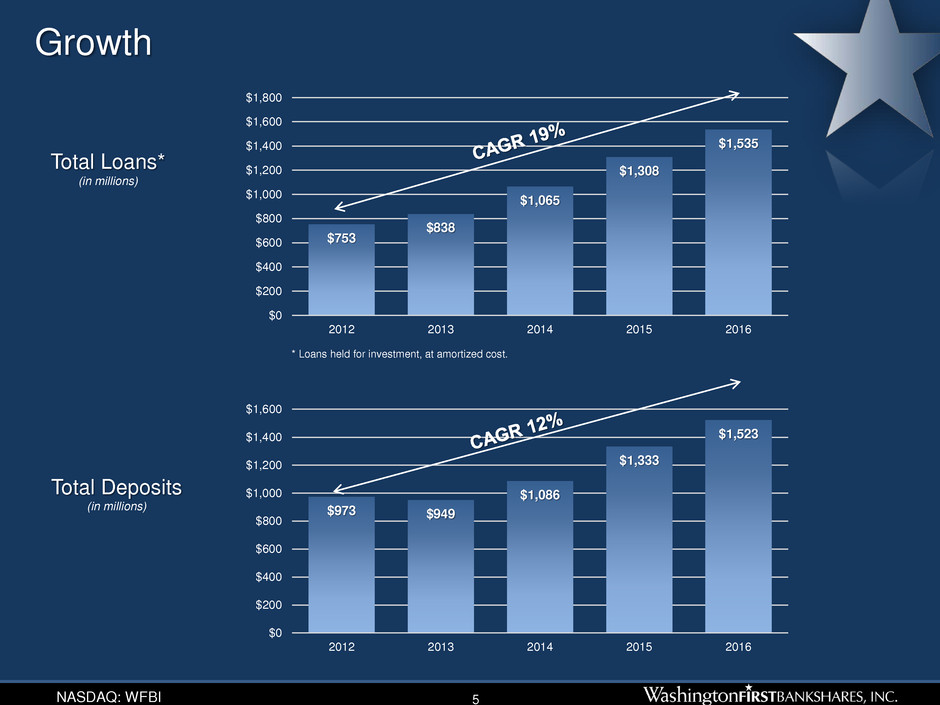

NASDAQ: WFBI 5

Growth

Total Deposits

(in millions)

Total Loans*

(in millions)

* Loans held for investment, at amortized cost.

$753

$838

$1,065

$1,308

$1,535

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

2012 2013 2014 2015 2016

$973 $949

$1,086

$1,333

$1,523

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

2012 2013 2014 2015 2016

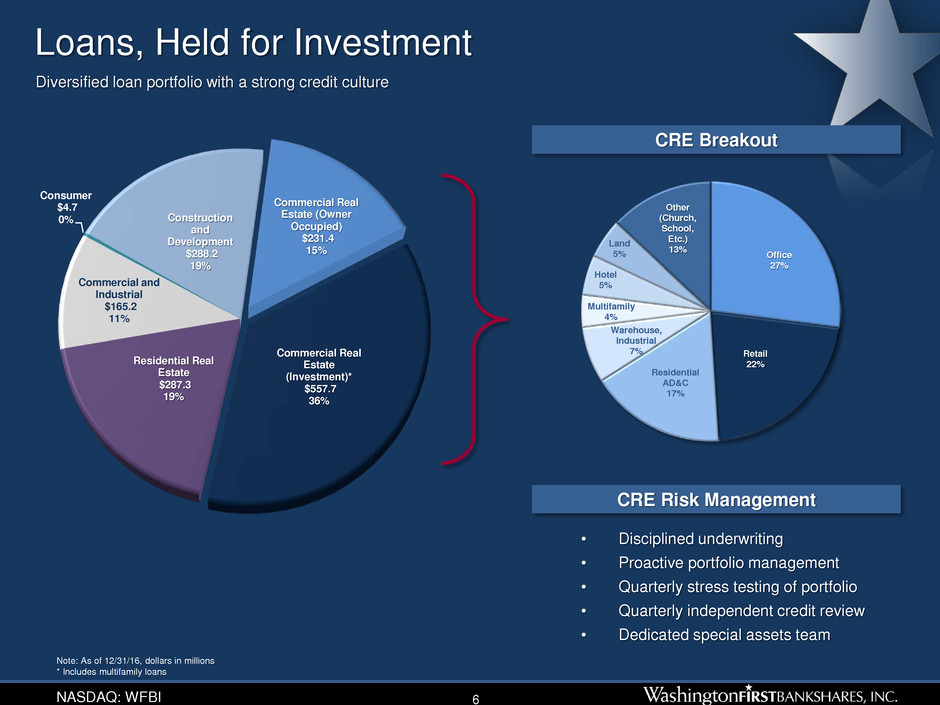

NASDAQ: WFBI 6

Office

27%

Retail

22%

Residential

AD&C

17%

Warehouse,

Industrial

7%

Multifamily

4%

Hotel

5%

Land

5%

Other

(Church,

School,

Etc.)

13%

Loans, Held for Investment

Construction

and

Development

$288.2

19%

Commercial Real

Estate (Owner

Occupied)

$231.4

15%

Commercial Real

Estate

(Investment)*

$557.7

36%

Residential Real

Estate

$287.3

19%

Commercial and

Industrial

$165.2

11%

Consumer

$4.7

0%

CRE Breakout

Diversified loan portfolio with a strong credit culture

Note: As of 12/31/16, dollars in millions

* Includes multifamily loans

• Disciplined underwriting

• Proactive portfolio management

• Quarterly stress testing of portfolio

• Quarterly independent credit review

• Dedicated special assets team

CRE Risk Management

NASDAQ: WFBI 7

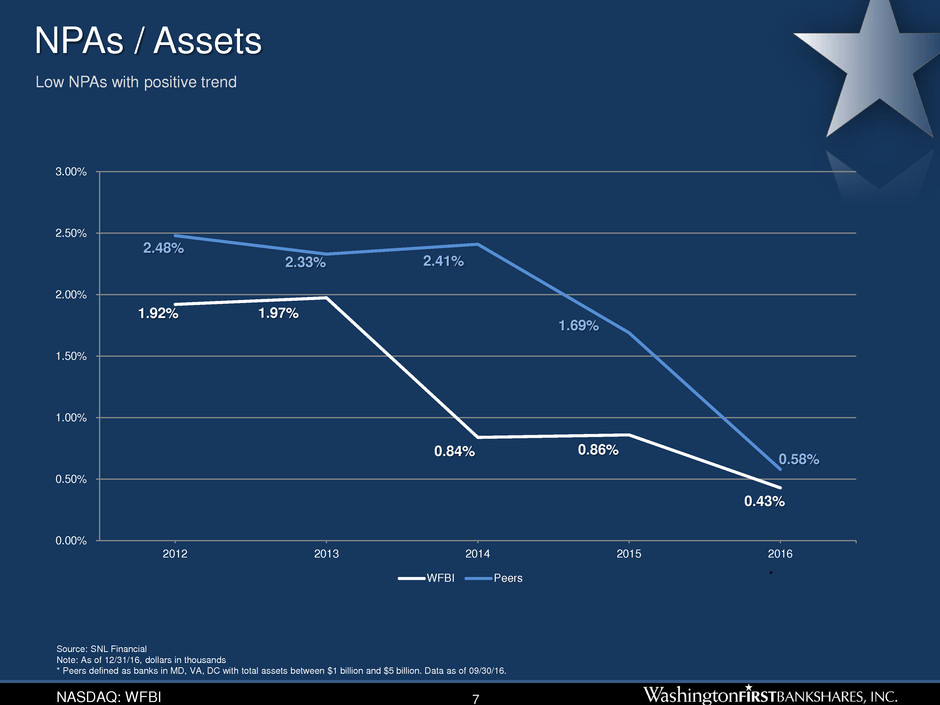

Source: SNL Financial

Note: As of 12/31/16, dollars in thousands

* Peers defined as banks in MD, VA, DC with total assets between $1 billion and $5 billion. Data as of 09/30/16.

*

Low NPAs with positive trend

1.92% 1.97%

0.84% 0.86%

0.43%

2.48%

2.33% 2.41%

1.69%

0.58%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

2012 2013 2014 2015 2016

WFBI Peers

NPAs / Assets

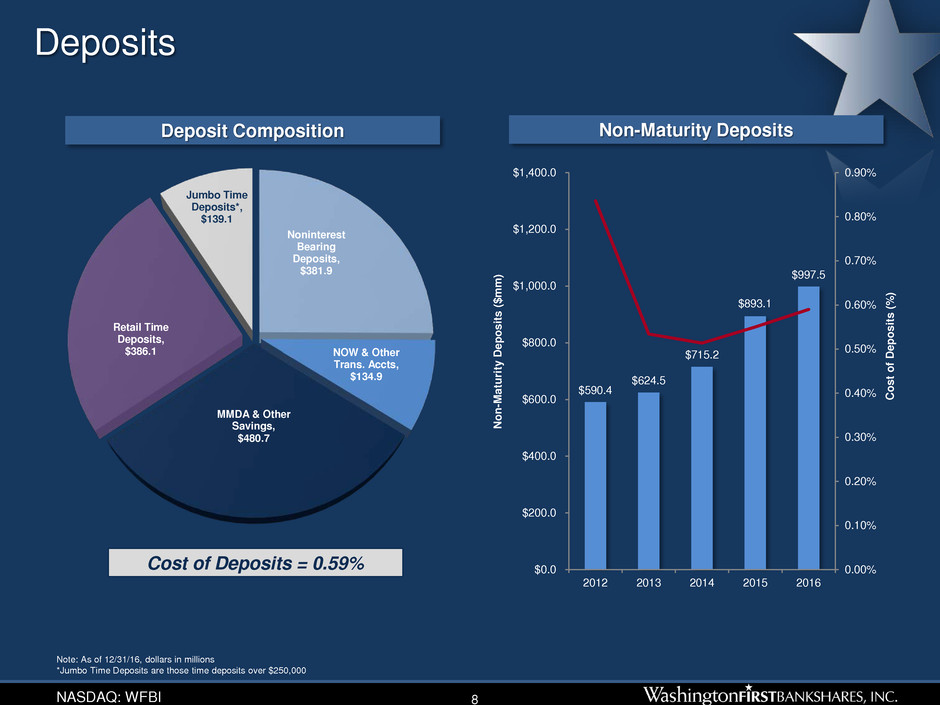

NASDAQ: WFBI 8

Cost of Deposits = 0.59%

Note: As of 12/31/16, dollars in millions

*Jumbo Time Deposits are those time deposits over $250,000

Noninterest

Bearing

Deposits,

$381.9

NOW & Other

Trans. Accts,

$134.9

MMDA & Other

Savings,

$480.7

Retail Time

Deposits,

$386.1

Jumbo Time

Deposits*,

$139.1

Deposit Composition Non-Maturity Deposits

$590.4

$624.5

$715.2

$893.1

$997.5

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

0.60%

0.70%

0.80%

0.90%

$0.0

$200.0

$400.0

$600.0

$800.0

$1,000.0

$1,200.0

$1,400.0

2012 2013 2014 2015 2016

C

os

t

of

D

ep

os

it

s

(%

)

N

on

-M

at

ur

it

y

D

ep

os

it

s

($

m

m

)

Deposits

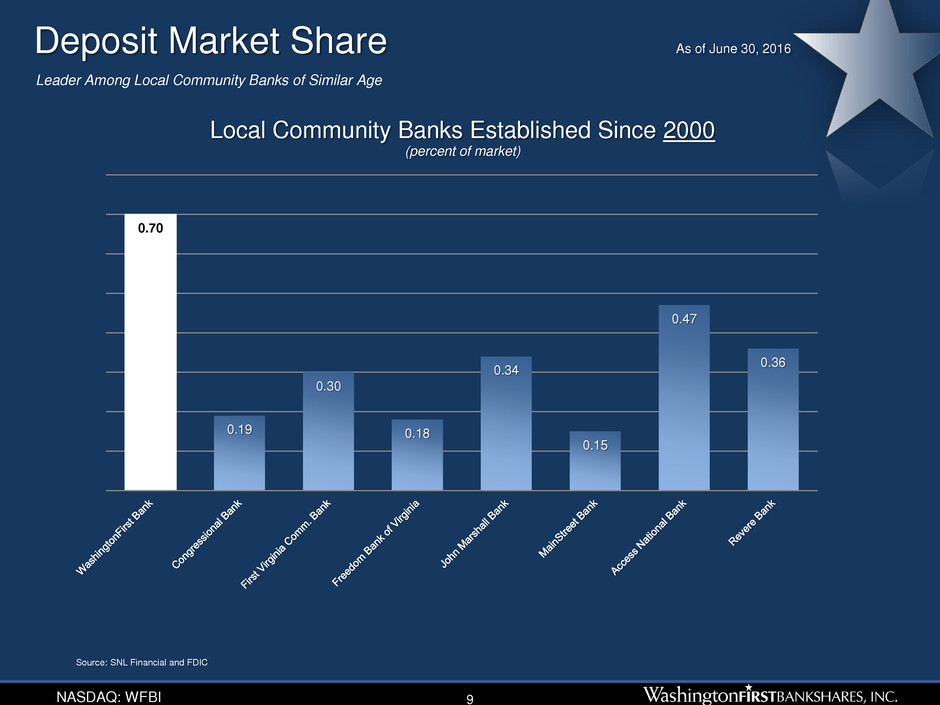

NASDAQ: WFBI

Leader Among Local Community Banks of Similar Age

Deposit Market Share As of June 30, 2016

9

0.70

0.19

0.30

0.18

0.34

0.15

0.47

0.36

Local Community Banks Established Since 2000

(percent of market)

Source: SNL Financial and FDIC

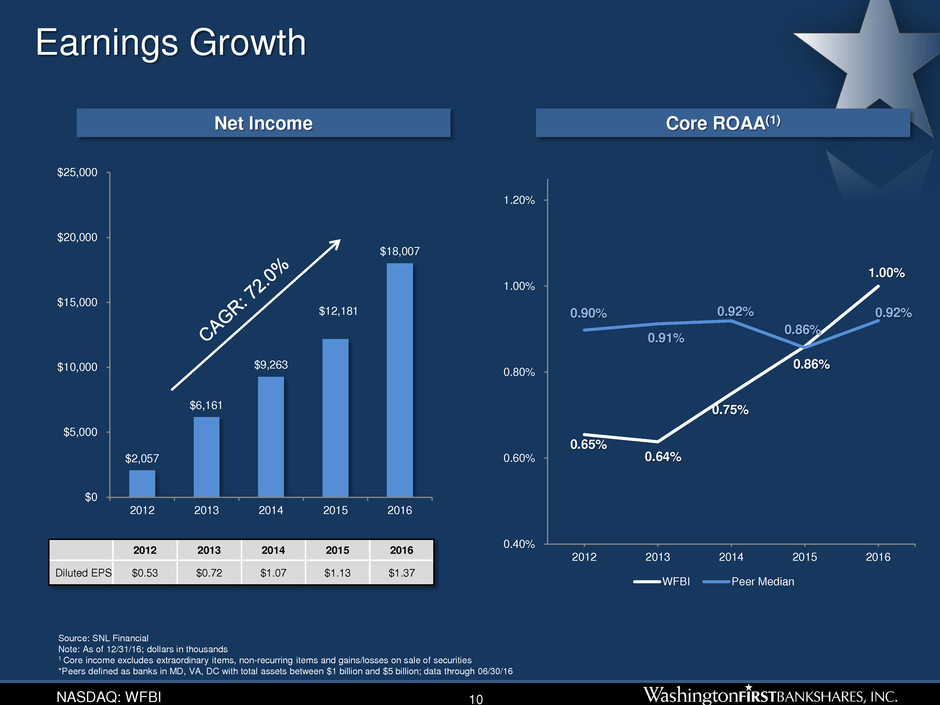

NASDAQ: WFBI 10

$2,057

$6,161

$9,263

$12,181

$18,007

$0

$5,000

$10,000

$15,000

$20,000

$25,000

2012 2013 2014 2015 2016

Earnings Growth

Core ROAA(1)

2012 2013 2014 2015 2016

Diluted EPS $0.53 $0.72 $1.07 $1.13 $1.37

Source: SNL Financial

Note: As of 12/31/16; dollars in thousands

1 Core income excludes extraordinary items, non-recurring items and gains/losses on sale of securities

*Peers defined as banks in MD, VA, DC with total assets between $1 billion and $5 billion; data through 06/30/16

Net Income

0.65%

0.64%

0.75%

0.86%

1.00%

0.90%

0.91%

0.92%

0.86%

0.92%

0.40%

0.60%

0.80%

1.00%

1.20%

2012 2013 2014 2015 2016

WFBI Peer Median

NASDAQ: WFBI 11

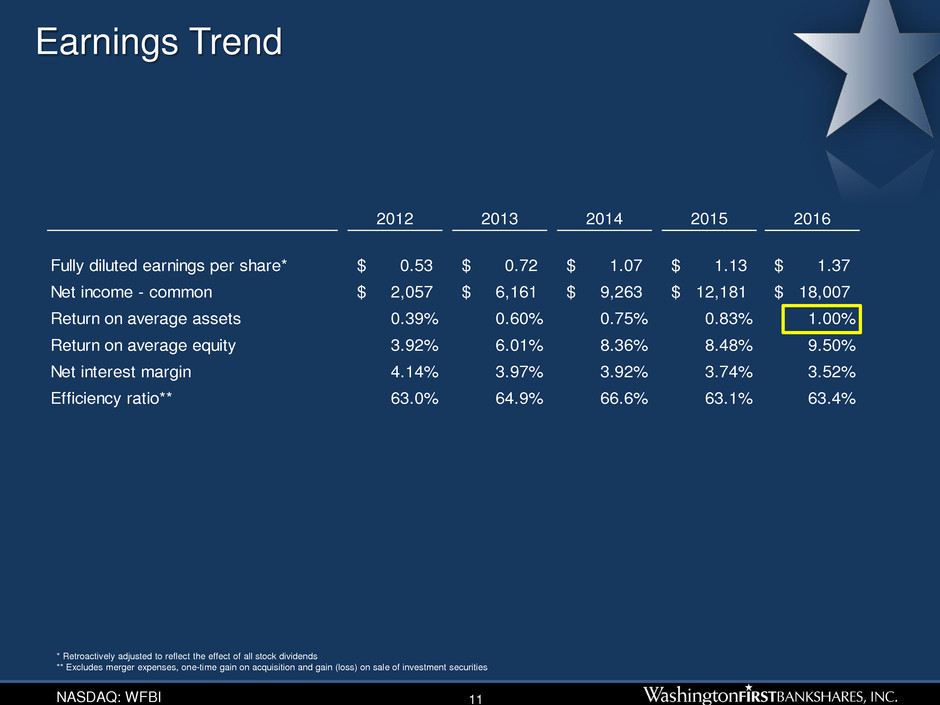

Earnings Trend

2012 2013 2014 2015 2016

Fully diluted earnings per share* 0.53$ 0.72$ 1.07$ 1.13$ 1.37$

Net income - common 2,057$ 6,161$ 9,263$ 12,181$ 18,007$

Return on average assets 0.39% 0.60% 0.75% 0.83% 1.00%

Return on average equity 3.92% 6.01% 8.36% 8.48% 9.50%

Net interest margin 4.14% 3.97% 3.92% 3.74% 3.52%

Efficiency ratio** 63.0% 64.9% 66.6% 63.1% 63.4%

* Retroactively adjusted to reflect the effect of all stock dividends

** Excludes merger expenses, one-time gain on acquisition and gain (loss) on sale of investment securities

NASDAQ: WFBI

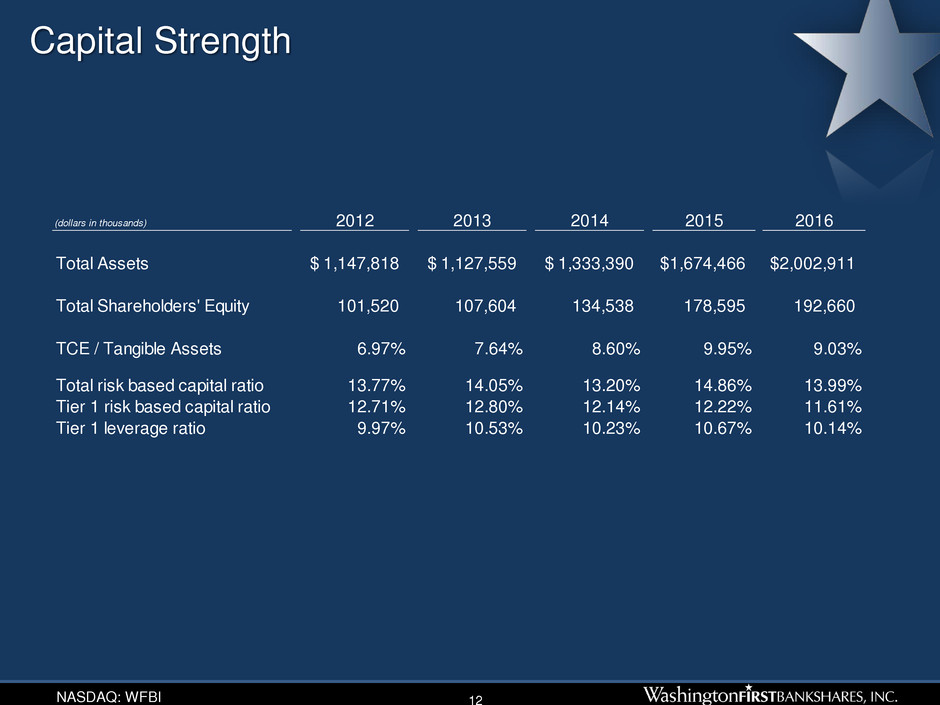

Capital Strength

(dollars in thousands) 2012 2013 2014 2015 2016

Total Assets 1,147,818$ 1,127,559$ 1,333,390$ $1,674,466 $2,002,911

Total Shareholders' Equity 101,520 107,604 134,538 178,595 192,660

TCE / Tangible Assets 6.97% 7.64% 8.60% 9.95% 9.03%

Total risk based capital ratio 13.77% 14.05% 13.20% 14.86% 13.99%

Tier 1 risk based capital ratio 12.71% 12.80% 12.14% 12.22% 11.61%

Tier 1 leverage ratio 9.97% 10.53% 10.23% 10.67% 10.14%

12

NASDAQ: WFBI

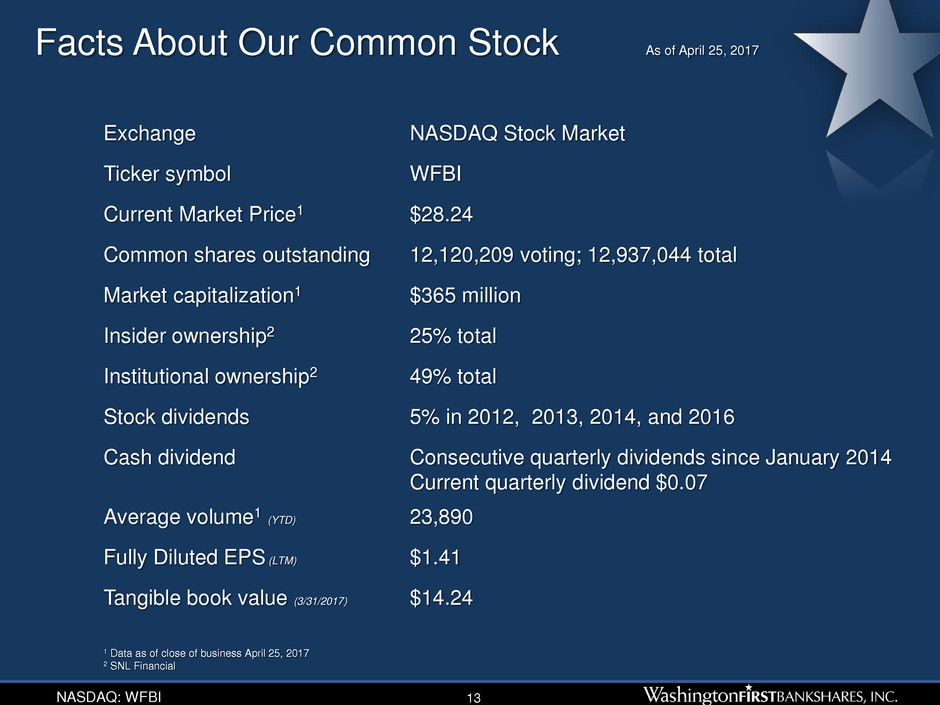

Facts About Our Common Stock As of April 25, 2017

Exchange NASDAQ Stock Market

Ticker symbol WFBI

Current Market Price1 $28.24

Common shares outstanding 12,120,209 voting; 12,937,044 total

Market capitalization1 $365 million

Insider ownership2 25% total

Institutional ownership2 49% total

Stock dividends 5% in 2012, 2013, 2014, and 2016

Cash dividend Consecutive quarterly dividends since January 2014

Current quarterly dividend $0.07

Average volume1 (YTD) 23,890

Fully Diluted EPS (LTM) $1.41

Tangible book value (3/31/2017) $14.24

1 Data as of close of business April 25, 2017

2 SNL Financial

13

NASDAQ: WFBI

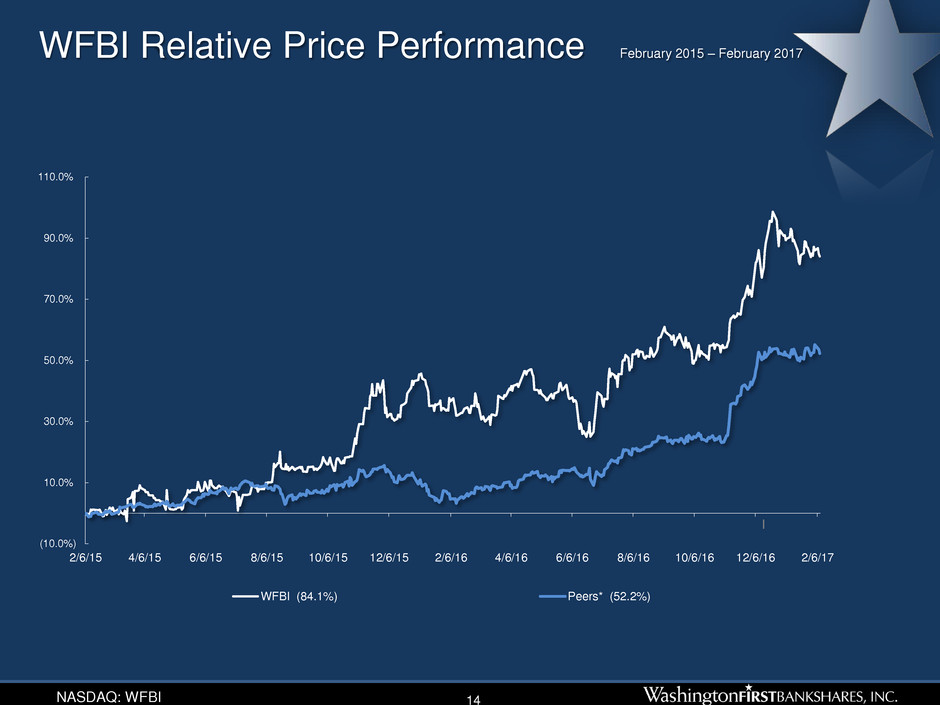

WFBI Relative Price Performance February 2015 – February 2017

14

(10.0%)

10.0%

30.0%

50.0%

70.0%

90.0%

110.0%

2/6/15 4/6/15 6/6/15 8/6/15 10/6/15 12/6/15 2/6/16 4/6/16 6/6/16 8/6/16 10/6/16 12/6/16 2/6/17

WFBI (84.1%) Peers* (52.2%)

NASDAQ: WFBI 15

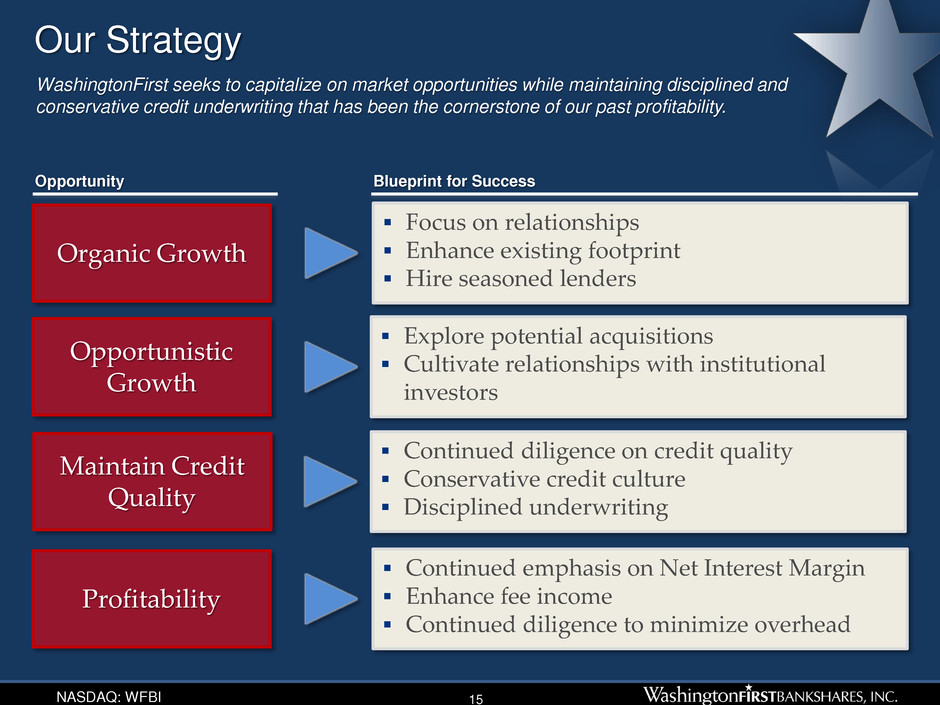

Our Strategy

WashingtonFirst seeks to capitalize on market opportunities while maintaining disciplined and

conservative credit underwriting that has been the cornerstone of our past profitability.

Opportunity

Organic Growth

Focus on relationships

Enhance existing footprint

Hire seasoned lenders

Blueprint for Success

Profitability

Continued emphasis on Net Interest Margin

Enhance fee income

Continued diligence to minimize overhead

Opportunistic

Growth

Explore potential acquisitions

Cultivate relationships with institutional

investors

Maintain Credit

Quality

Continued diligence on credit quality

Conservative credit culture

Disciplined underwriting

NASDAQ: WFBI

Looking Ahead – 2017

Expand bank branch network into new markets in the greater

DC metro area

Hire additional lenders

Continue to maximize on our earnings

Net earnings of $4.4 million for the first quarter

NPAs remain low at 0.37%

Continue to provide superior service quality

16

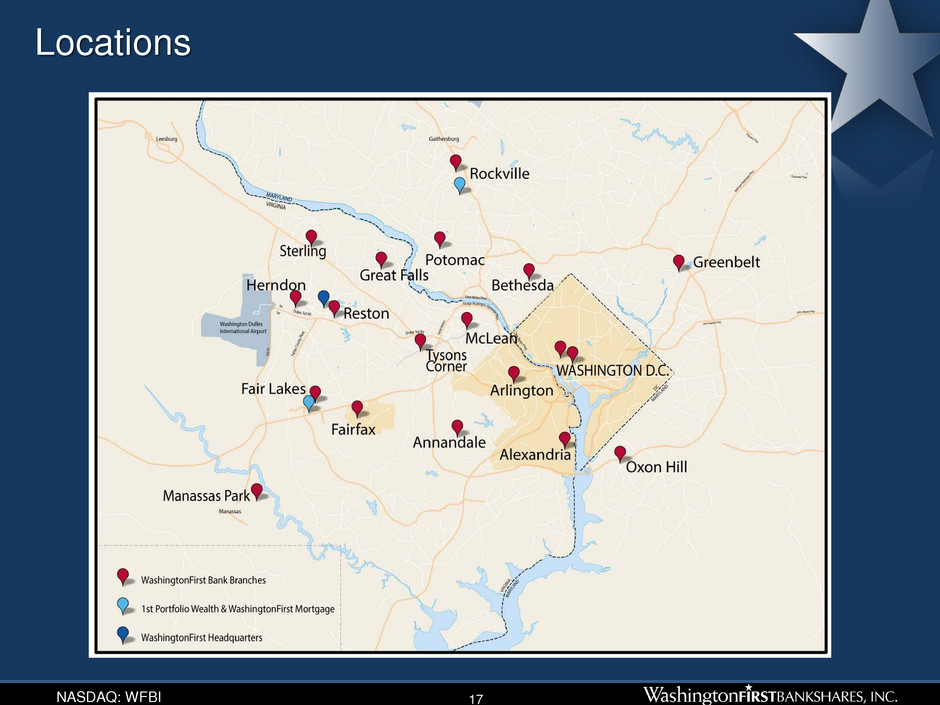

NASDAQ: WFBI 17

Locations

NASDAQ: WFBI

Recognition

18

Sandler O’Neill Class of 2016 Bank & Thrift Sm-All Star

Added to Russell 2000® Index in 2016

Top 10 Most Profitable Banks in DC metro area

#3 Total Asset Growth among banks in DC metro area

Top 10 Commercial Lender in DC metro area

Top 15 Home Mortgage Lender in DC metro area

Bauer Financial 5 Star Rating

NASDAQ: WFBI

WFYF Golf Invitational

19

NASDAQ: WFBI

NASDAQ: WFBI

www.wfbi.com

Thank You