Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - US BANCORP \DE\ | d312622dex991.htm |

| 8-K - 8-K - US BANCORP \DE\ | d312622d8k.htm |

U.S. Bancorp 1Q17 Earnings Conference Call April 19, 2017 Exhibit 99.2

Forward-looking Statements and Additional Information The following information appears in accordance with the Private Securities Litigation Reform Act of 1995: Today’s presentation contains forward-looking statements about U.S. Bancorp. Statements that are not historical or current facts, including statements about beliefs and expectations, are forward-looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date hereof. These forward-looking statements cover, among other things, anticipated future revenue and expenses and the future plans and prospects of U.S. Bancorp. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. A reversal or slowing of the current economic recovery or another severe contraction could adversely affect U.S. Bancorp’s revenues and the values of its assets and liabilities. Global financial markets could experience a recurrence of significant turbulence, which could reduce the availability of funding to certain financial institutions and lead to a tightening of credit, a reduction of business activity, and increased market volatility. Stress in the commercial real estate markets, as well as a downturn in the residential real estate markets could cause credit losses and deterioration in asset values. In addition, changes to statutes, regulations, or regulatory policies or practices could affect U.S. Bancorp in substantial and unpredictable ways. U.S. Bancorp’s results could also be adversely affected by deterioration in general business and economic conditions; changes in interest rates; deterioration in the credit quality of its loan portfolios or in the value of the collateral securing those loans; deterioration in the value of securities held in its investment securities portfolio; legal and regulatory developments; litigation; increased competition from both banks and non-banks; changes in customer behavior and preferences; breaches in data security; effects of mergers and acquisitions and related integration; effects of critical accounting policies and judgments; and management’s ability to effectively manage credit risk, market risk, operational risk, compliance risk, strategic risk, interest rate risk, liquidity risk and reputational risk. For discussion of these and other risks that may cause actual results to differ from expectations, refer to U.S. Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2016, on file with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Corporate Risk Profile” contained in Exhibit 13, and all subsequent filings with the Securities and Exchange Commission under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934. However, factors other than these also could adversely affect U.S. Bancorp’s results, and the reader should not consider these factors to be a complete set of all potential risks or uncertainties. Forward-looking statements speak only as of the date hereof, and U.S. Bancorp undertakes no obligation to update them in light of new information or future events. This presentation includes non-GAAP financial measures to describe U.S. Bancorp’s performance. The calculations of these measures are provided in the Appendix. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

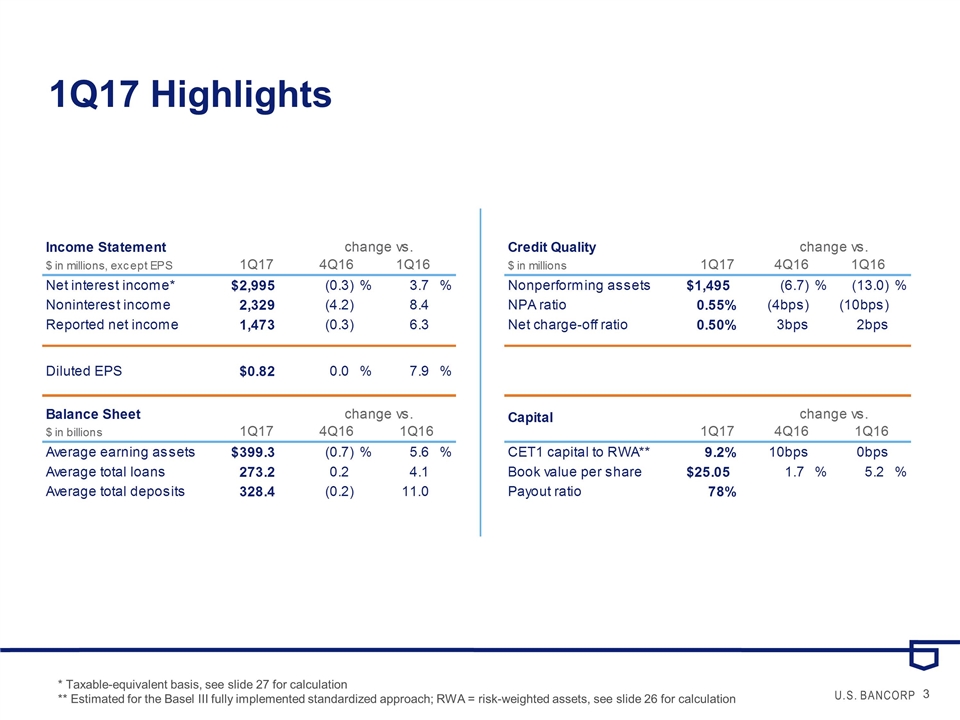

1Q17 Highlights * Taxable-equivalent basis, see slide 27 for calculation ** Estimated for the Basel III fully implemented standardized approach; RWA = risk-weighted assets, see slide 26 for calculation 1Q17 Highlights Income Statement change vs. Credit Quality change vs. $ in millions, except EPS 1Q17 4Q16 1Q16 $ in millions 1Q17 4Q16 1Q16 Net interest income* $2,995 -0.3 % 3.7 % Nonperforming assets $1,495 -6.7 % -13 % Noninterest income 2329 -4.2 8.4 NPA ratio 5.4999999999999997E-3 (4bps) (10bps) Reported net income 1473 -0.3 6.3 Net charge-off ratio 5.0000000000000001E-3 3bps 2bps Diluted EPS $0.82 0 % 7.9 % Balance Sheet change vs. Capital change vs. $ in billions 1Q17 4Q16 1Q16 1Q17 4Q16 1Q16 Average earning assets $399.3 -0.7 % 5.6 % CET1 capital to RWA** 9.2% 10bps 0bps Average total loans 273.2 0.2 4.0999999999999996 Book value per share $25.05 1.7 % 5.2 % Average total deposits 328.4 -0.2 11 Payout ratio 0.78 1Q17 Highlights Income Statement change vs. Credit Quality change vs. $ in millions, except EPS 1Q17 4Q16 1Q16 $ in millions 1Q17 4Q16 1Q16 Net interest income* $2,995 -0.3 % 3.7 % Nonperforming assets $1,495 -6.7 % -13 % Noninterest income 2329 -4.2 8.4 NPA ratio 5.4999999999999997E-3 (4bps) (10bps) Reported net income 1473 -0.3 6.3 Net charge-off ratio 5.0000000000000001E-3 3bps 2bps Diluted EPS $0.82 0 % 7.9 % Balance Sheet change vs. Capital change vs. $ in billions 1Q17 4Q16 1Q16 1Q17 4Q16 1Q16 Average earning assets $399.3 -0.7 % 5.6 % CET1 capital to RWA** 9.2% 10bps 0bps Average total loans 273.2 0.2 4.0999999999999996 Book value per share $25.05 1.7 % 5.2 % Average total deposits 328.4 -0.2 11 Payout ratio 0.78

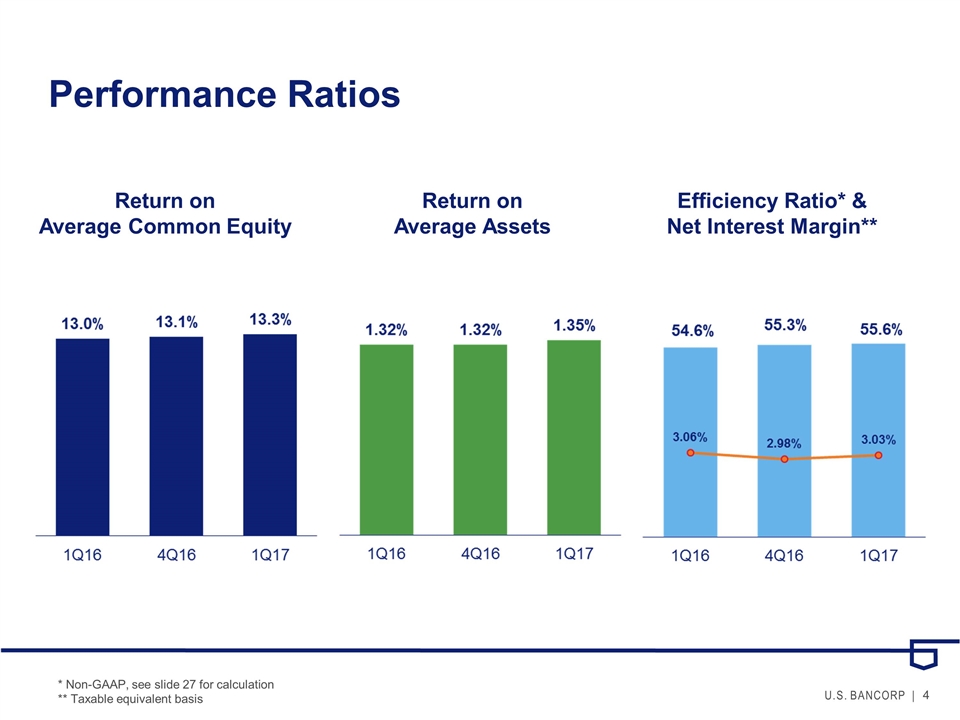

Performance Ratios Return on Average Common Equity Efficiency Ratio* & Net Interest Margin** * Non-GAAP, see slide 27 for calculation ** Taxable equivalent basis Return on Average Assets

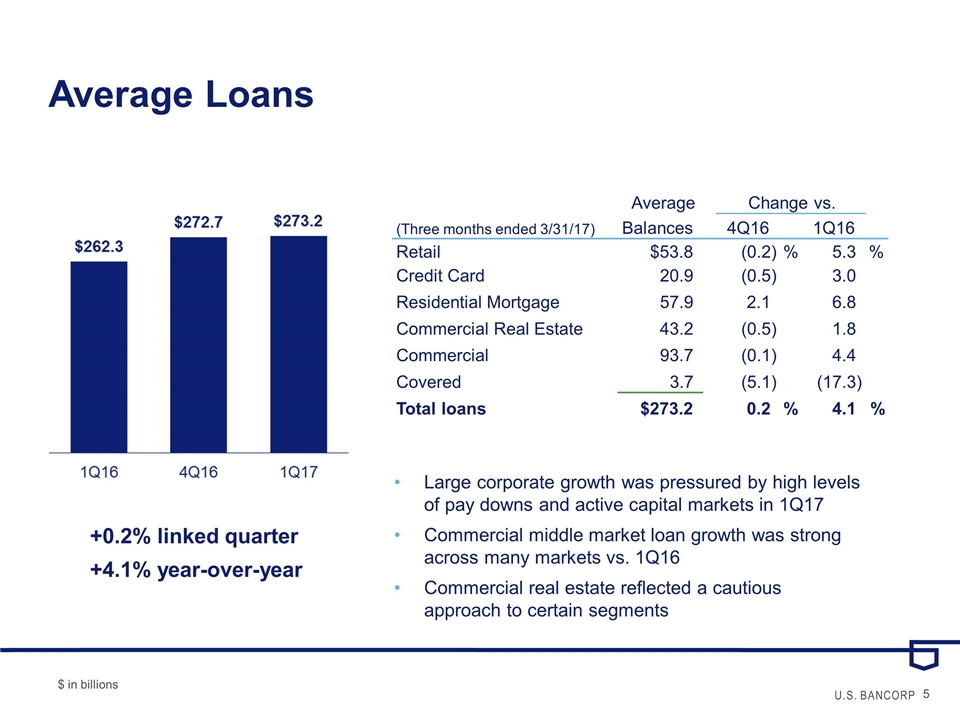

Average Loans +0.2% linked quarter +4.1% year-over-year Large corporate growth was pressured by high levels of pay downs and active capital markets in 1Q17 Commercial middle market loan growth was strong across many markets vs. 1Q16 Commercial real estate reflected a cautious approach to certain segments $ in billions Average (Three months ended 3/31/17) Balances 4Q16 1Q16 Retail $53.8 (0.2) % 5.3 % Credit Card 20.9 (0.5) 3.0 Residential Mortgage 57.9 2.1 6.8 Commercial Real Estate 43.2 (0.5) 1.8 Commercial 93.7 (0.1) 4.4 Covered 3.7 (5.1) (17.3) Total loans $273.2 0.2 % 4.1 % Change vs.

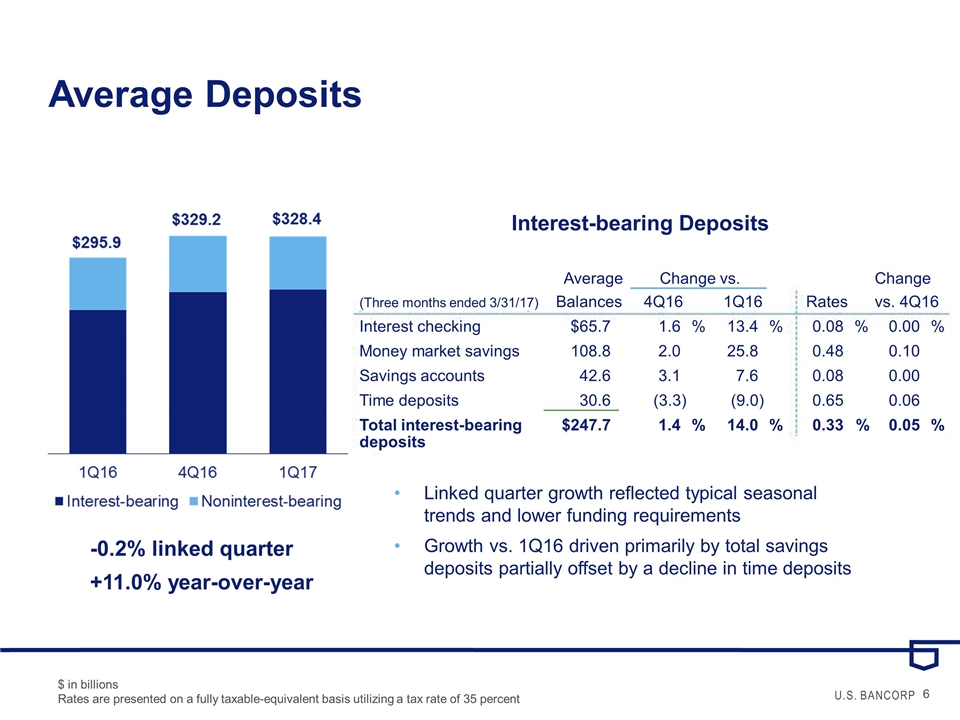

Average Deposits -0.2% linked quarter +11.0% year-over-year Interest-bearing Deposits $ in billions Rates are presented on a fully taxable-equivalent basis utilizing a tax rate of 35 percent Linked quarter growth reflected typical seasonal trends and lower funding requirements Growth vs. 1Q16 driven primarily by total savings deposits partially offset by a decline in time deposits Average Change (Three months ended 3/31/17) Balances 4Q16 1Q16 Rates vs. 4Q16 Interest checking $65.7 1.6 % 13.4 % 0.08 % 0.00 % Money market savings 108.8 2.0 25.8 0.48 0.10 Savings accounts 42.6 3.1 7.6 0.08 0.00 Time deposits 30.6 (3.3) (9.0) 0.65 0.06 Total interest-bearing $247.7 1.4 % 14.0 % 0.33 % 0.05 % deposits Change vs.

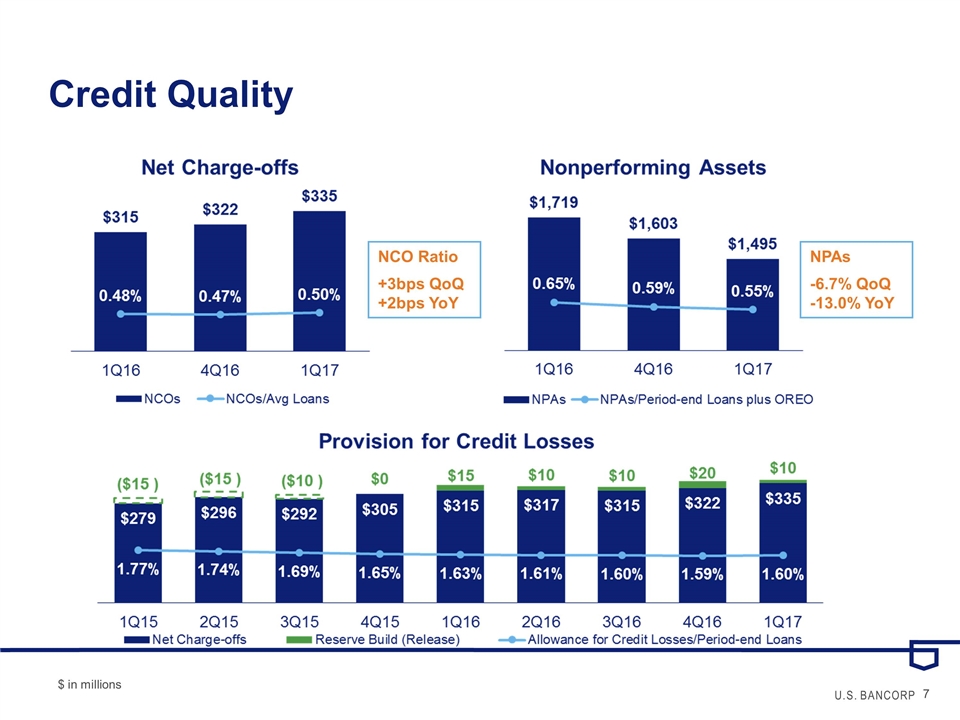

Credit Quality NCO Ratio +3bps QoQ +2bps YoY NPAs -6.7% QoQ -13.0% YoY $ in millions

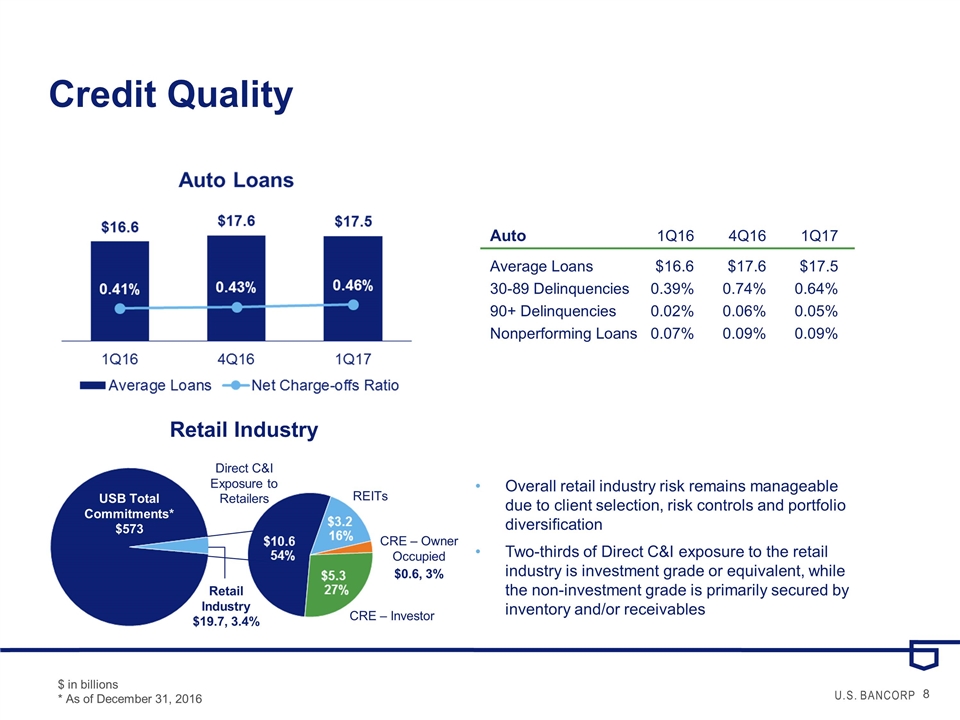

Credit Quality Auto 1Q16 4Q16 1Q17 Average Loans $16.6$17.6 $17.5 30-89 Delinquencies0.39% 0.74% 0.64% 90+ Delinquencies0.02% 0.06% 0.05% Nonperforming Loans0.07%0.09% 0.09% $ in billions * As of December 31, 2016 CRE – Owner Occupied USB Total Commitments* $573 $0.6, 3% Retail Industry $19.7, 3.4% Direct C&I Exposure to Retailers REITs CRE – Investor Retail Industry Overall retail industry risk remains manageable due to client selection, risk controls and portfolio diversification Two-thirds of Direct C&I exposure to the retail industry is investment grade or equivalent, while the non-investment grade is primarily secured by inventory and/or receivables

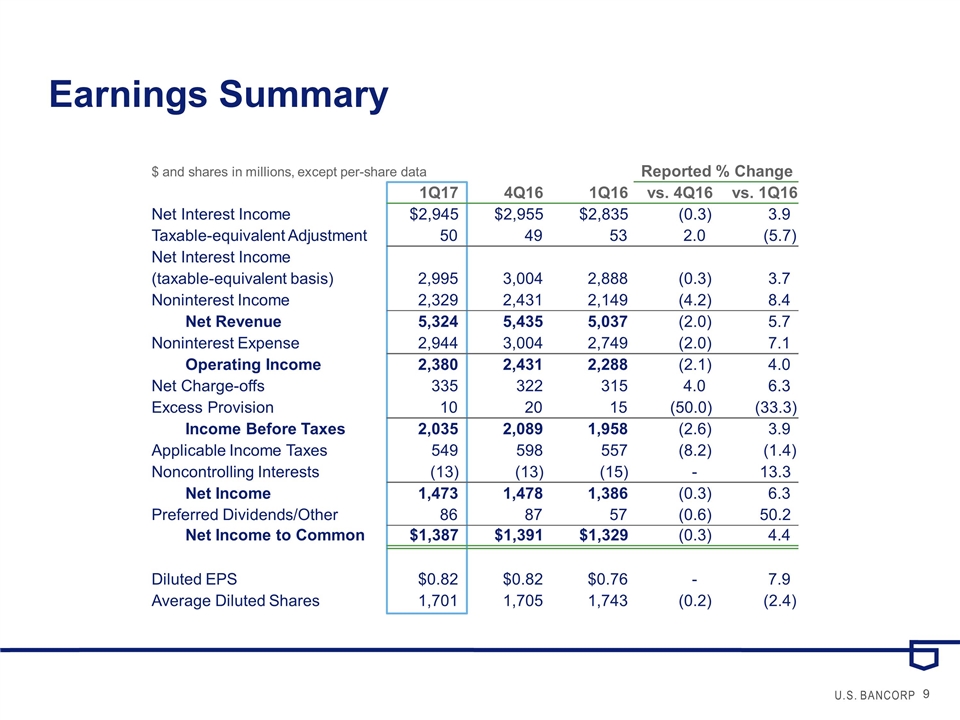

Earnings Summary $ and shares in millions, except per-share data 1Q17 4Q16 1Q16 vs. 4Q16 vs. 1Q16 Net Interest Income $2,945 $2,955 $2,835 (0.3) 3.9 Taxable-equivalent Adjustment 50 49 53 2.0 (5.7) Net Interest Income (taxable-equivalent basis) 2,995 3,004 2,888 (0.3) 3.7 Noninterest Income 2,329 2,431 2,149 (4.2) 8.4 Net Revenue 5,324 5,435 5,037 (2.0) 5.7 Noninterest Expense 2,944 3,004 2,749 (2.0) 7.1 Operating Income 2,380 2,431 2,288 (2.1) 4.0 Net Charge-offs 335 322 315 4.0 6.3 Excess Provision 10 20 15 (50.0) (33.3) Income Before Taxes 2,035 2,089 1,958 (2.6) 3.9 Applicable Income Taxes 549 598 557 (8.2) (1.4) Noncontrolling Interests (13) (13) (15) - 13.3 Net Income 1,473 1,478 1,386 (0.3) 6.3 Preferred Dividends/Other 86 87 57 (0.6) 50.2 Net Income to Common $1,387 $1,391 $1,329 (0.3) 4.4 Diluted EPS $0.82 $0.82 $0.76 - 7.9 Average Diluted Shares 1,701 1,705 1,743 (0.2) (2.4) Reported % Change

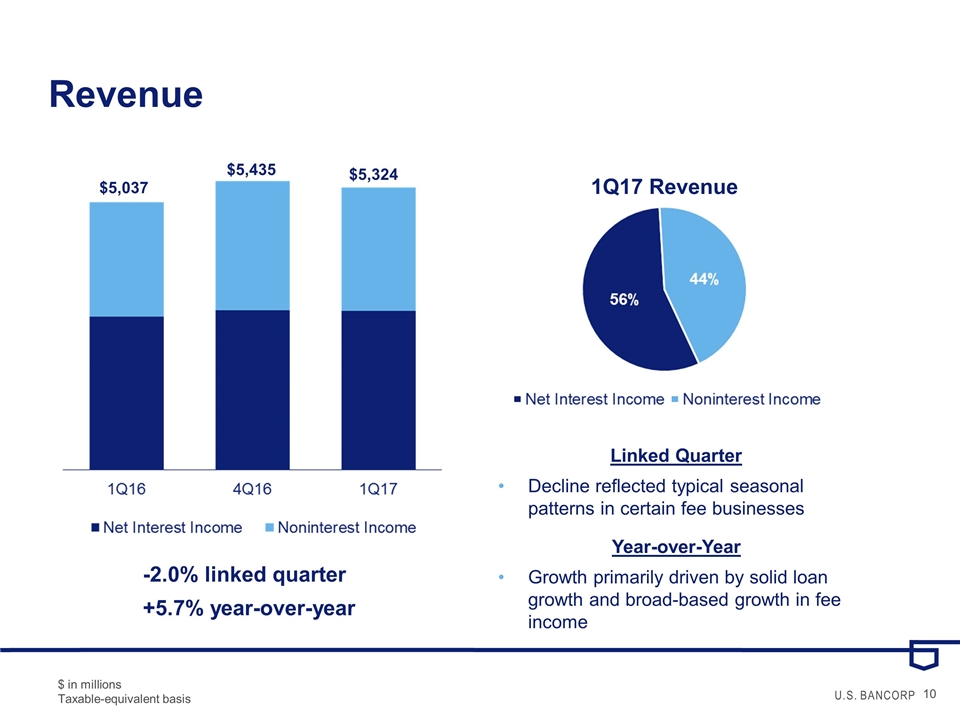

Revenue $5,324 $5,435 $5,037 Linked Quarter Decline reflected typical seasonal patterns in certain fee businesses Year-over-Year Growth primarily driven by solid loan growth and broad-based growth in fee income $ in millions Taxable-equivalent basis -2.0% linked quarter +5.7% year-over-year 1Q17 Revenue

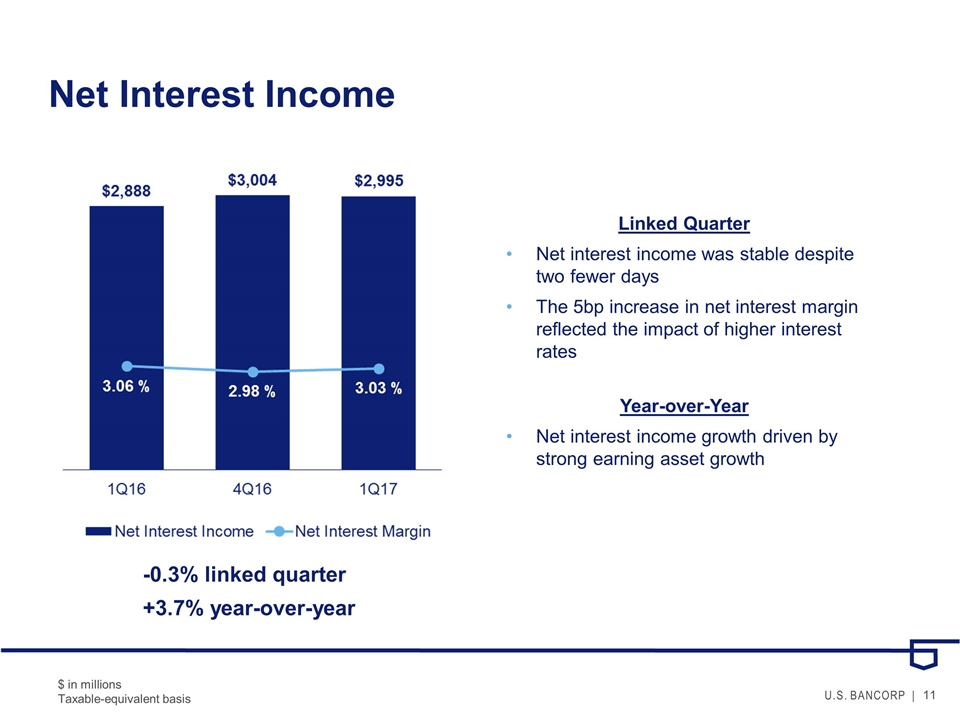

Net Interest Income Linked Quarter Net interest income was stable despite two fewer days The 5bp increase in net interest margin reflected the impact of higher interest rates Year-over-Year Net interest income growth driven by strong earning asset growth $ in millions Taxable-equivalent basis -0.3% linked quarter +3.7% year-over-year

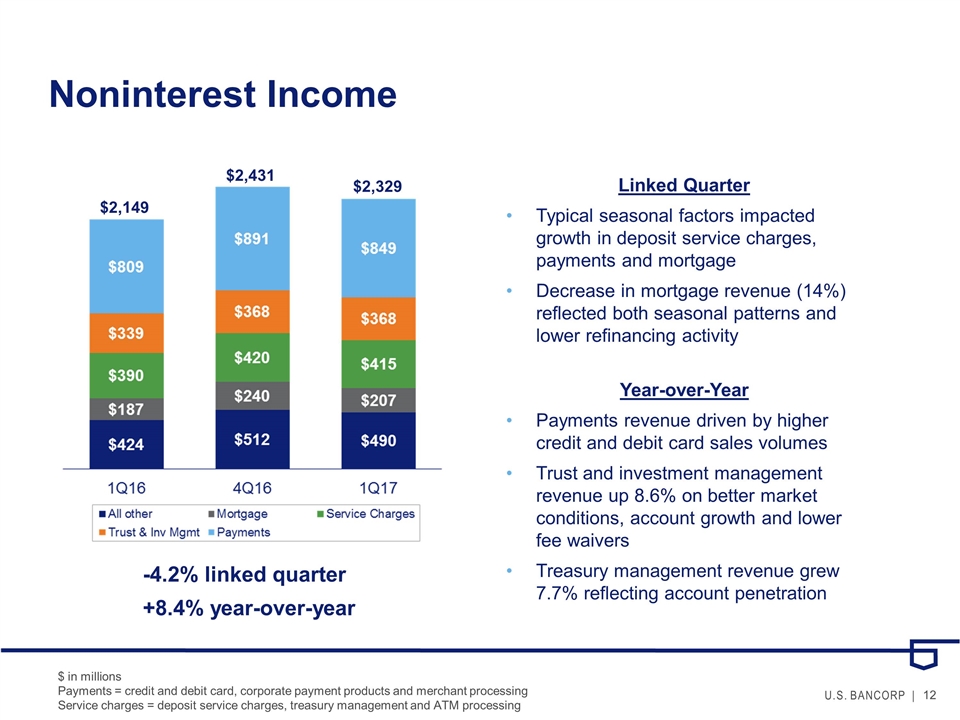

Noninterest Income $ in millions Payments = credit and debit card, corporate payment products and merchant processing Service charges = deposit service charges, treasury management and ATM processing $2,149 $2,431 $2,329 Linked Quarter Typical seasonal factors impacted growth in deposit service charges, payments and mortgage Decrease in mortgage revenue (14%) reflected both seasonal patterns and lower refinancing activity Year-over-Year Payments revenue driven by higher credit and debit card sales volumes Trust and investment management revenue up 8.6% on better market conditions, account growth and lower fee waivers Treasury management revenue grew 7.7% reflecting account penetration -4.2% linked quarter +8.4% year-over-year

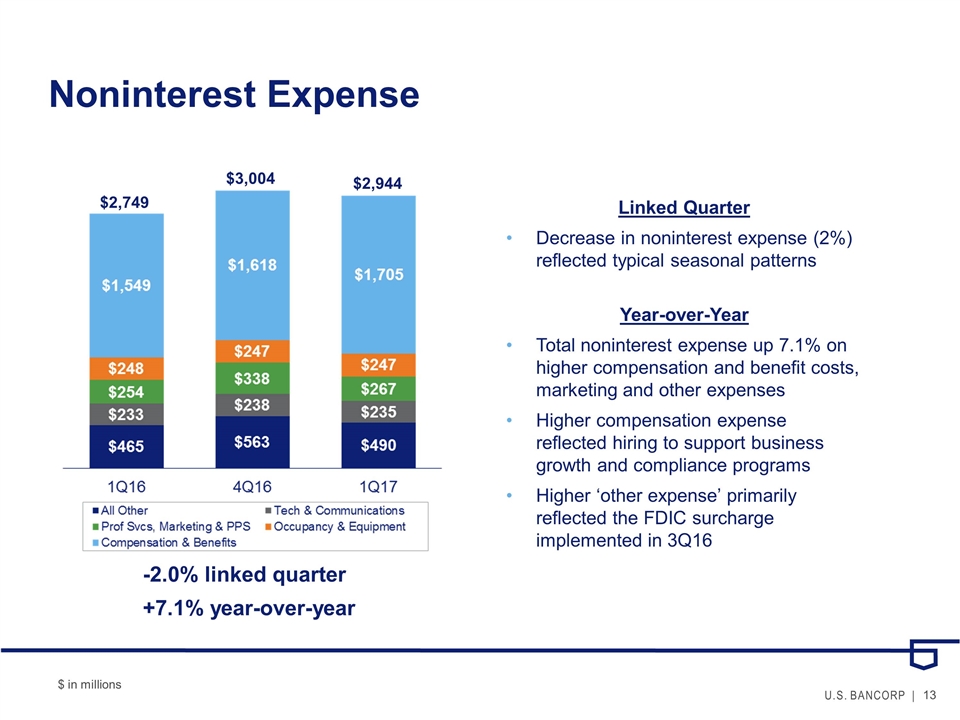

Noninterest Expense $2,749 $3,004 $2,944 Linked Quarter Decrease in noninterest expense (2%) reflected typical seasonal patterns Year-over-Year Total noninterest expense up 7.1% on higher compensation and benefit costs, marketing and other expenses Higher compensation expense reflected hiring to support business growth and compliance programs Higher ‘other expense’ primarily reflected the FDIC surcharge implemented in 3Q16 $ in millions -2.0% linked quarter +7.1% year-over-year

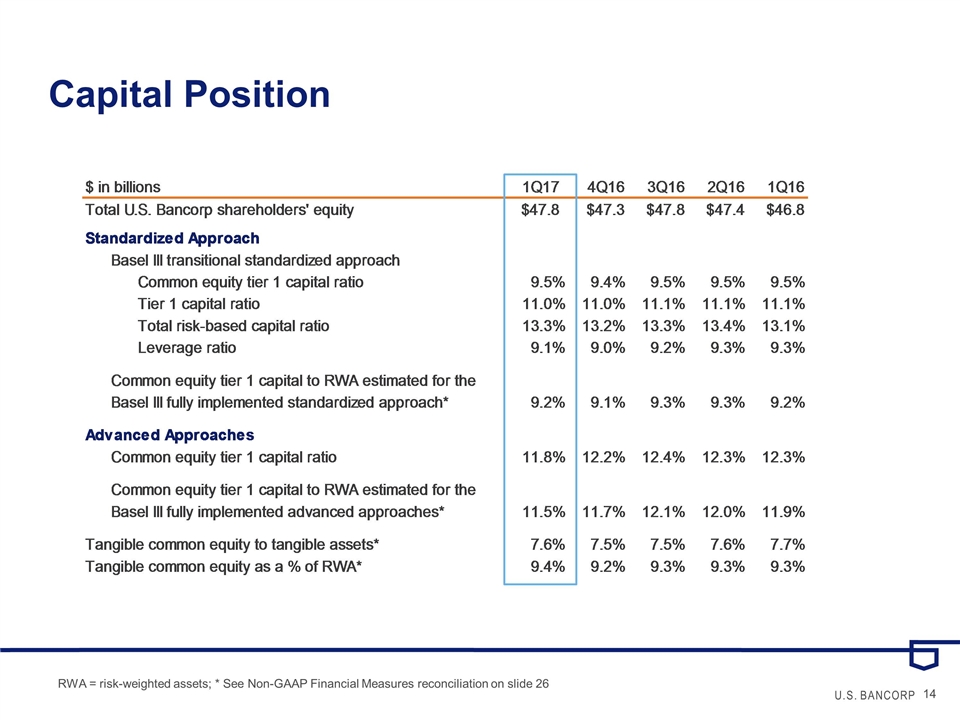

Capital Position RWA = risk-weighted assets; * See Non-GAAP Financial Measures reconciliation on slide 26 $ in billions 1Q17 4Q16 3Q16 2Q16 1Q16 Total U.S. Bancorp shareholders' equity $47.8 $47.3 $47.8 $47.4 $46.8 Standardized Approach Basel III transitional standardized approach Common equity tier 1 capital ratio 9.5% 9.4% 9.5% 9.5% 9.5% Tier 1 capital ratio 0.11 0.11 0.111 0.111 0.111 Total risk-based capital ratio 0.13300000000000001 0.13200000000000001 0.13300000000000001 0.13400000000000001 0.13100000000000001 Leverage ratio 9.0999999999999998 0.09 9.2% 9.3% 9.3% Common equity tier 1 capital to RWA estimated for the Basel III fully implemented standardized approach* 9.2% 9.0999999999999998 9.3% 9.3% 9.2% Advanced Approaches Common equity tier 1 capital ratio 0.11799999999999999 0.122 0.124 0.123 0.123 Common equity tier 1 capital to RWA estimated for the Basel III fully implemented advanced approaches* 0.115 0.11700000000000001 0.121 0.12 0.11899999999999999 Tangible common equity to tangible assets* 7.6% 7.5% 7.5% 7.6% 7.7% Tangible common equity as a % of RWA* 9.4% 9.2% 9.3% 9.3% 9.3%

Appendix

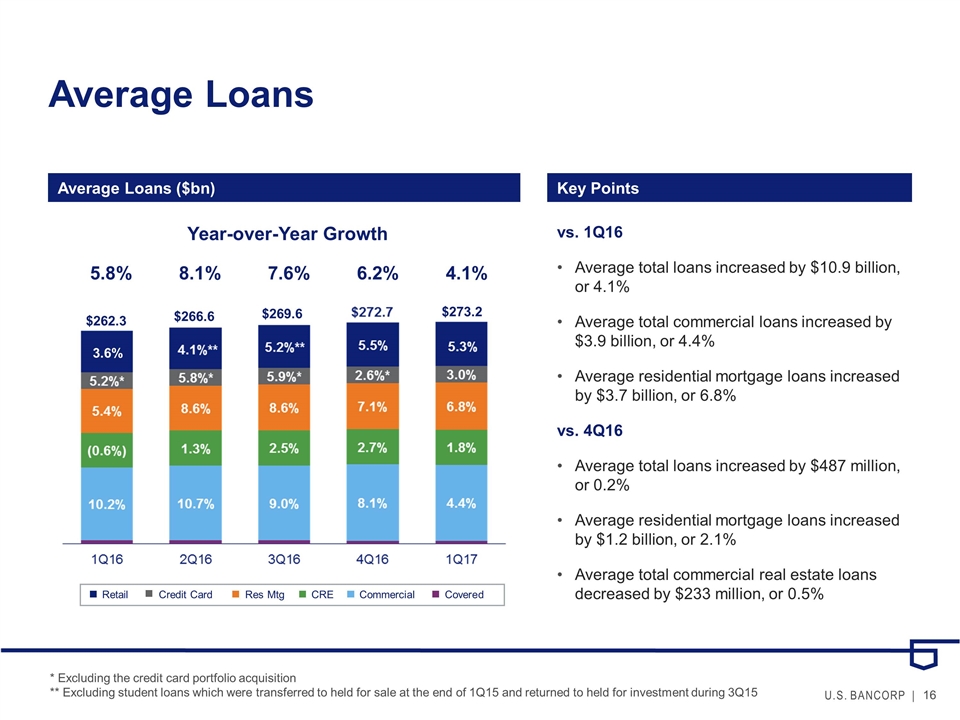

Average Loans Key Points vs. 1Q16 Average total loans increased by $10.9 billion, or 4.1% Average total commercial loans increased by $3.9 billion, or 4.4% Average residential mortgage loans increased by $3.7 billion, or 6.8% vs. 4Q16 Average total loans increased by $487 million, or 0.2% Average residential mortgage loans increased by $1.2 billion, or 2.1% Average total commercial real estate loans decreased by $233 million, or 0.5% Year-over-Year Growth 5.8% 8.1% 7.6% 6.2% 4.1% Covered Commercial CRE Res Mtg Retail Credit Card $269.6 $262.3 $266.6 * Excluding the credit card portfolio acquisition ** Excluding student loans which were transferred to held for sale at the end of 1Q15 and returned to held for investment during 3Q15 3.6% $273.2 Average Loans ($bn)

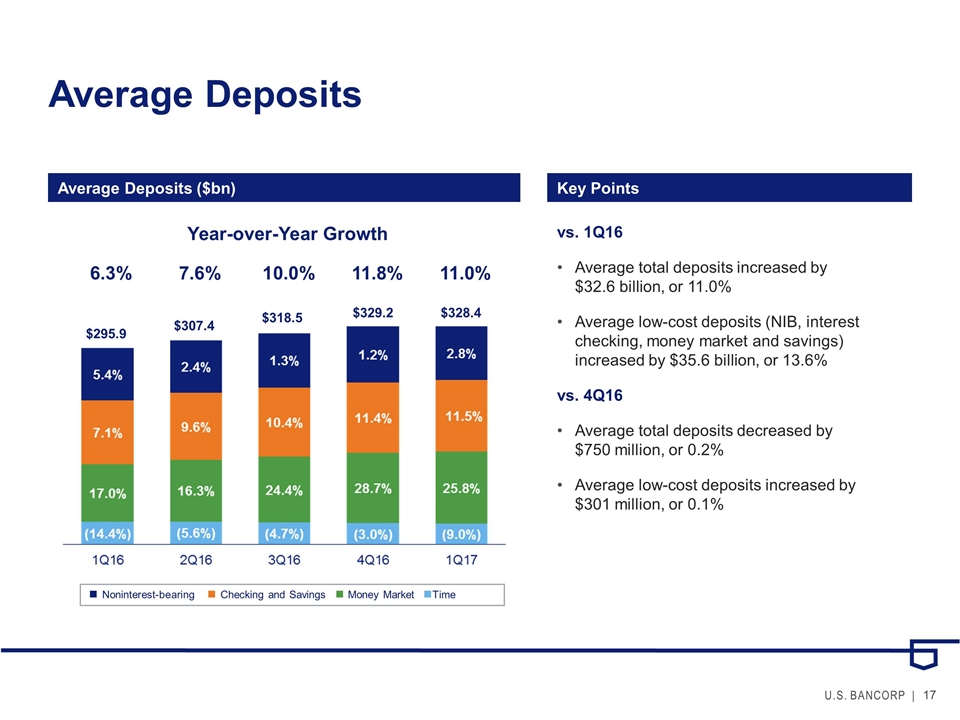

Average Deposits Key Points vs. 1Q16 Average total deposits increased by $32.6 billion, or 11.0% Average low-cost deposits (NIB, interest checking, money market and savings) increased by $35.6 billion, or 13.6% vs. 4Q16 Average total deposits decreased by $750 million, or 0.2% Average low-cost deposits increased by $301 million, or 0.1% Year-over-Year Growth 6.3% 7.6% 10.0% 11.8% 11.0% Time Money Market Checking and Savings Noninterest-bearing $318.5 $295.9 $307.4 $329.2 Average Deposits ($bn) $328.4

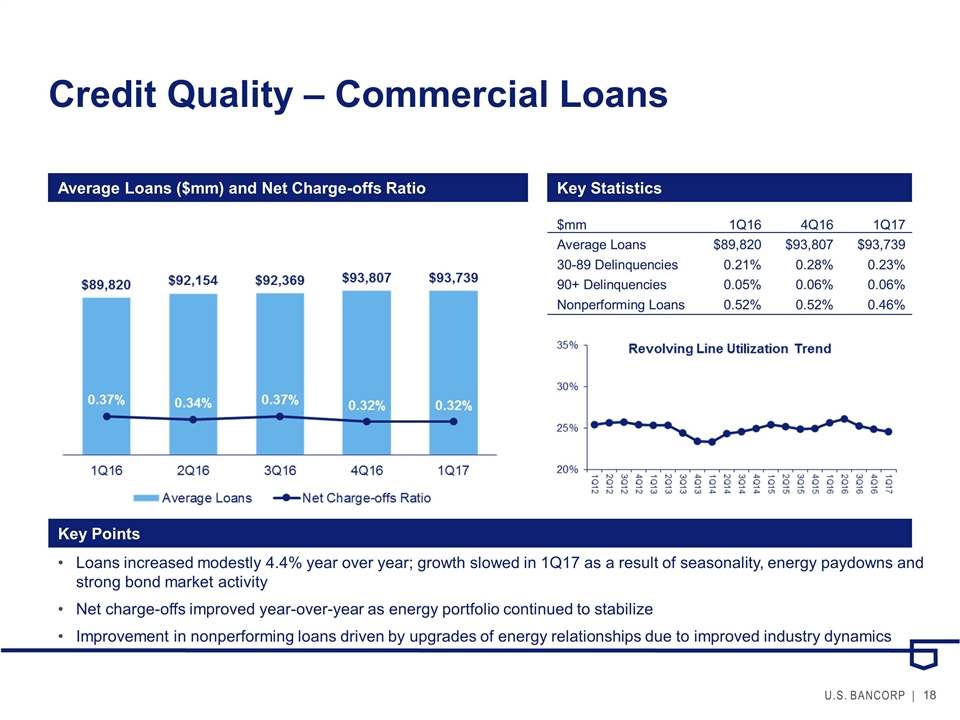

Credit Quality – Commercial Loans Average Loans ($mm) and Net Charge-offs Ratio Key Statistics Key Points Loans increased modestly 4.4% year over year; growth slowed in 1Q17 as a result of seasonality, energy paydowns and strong bond market activity Net charge-offs improved year-over-year as energy portfolio continued to stabilize Improvement in nonperforming loans driven by upgrades of energy relationships due to improved industry dynamics $mm1Q164Q161Q17 Average Loans$89,820$93,807$93,739 30-89 Delinquencies0.21%0.28%0.23% 90+ Delinquencies0.05%0.06%0.06% Nonperforming Loans0.52%0.52%0.46%

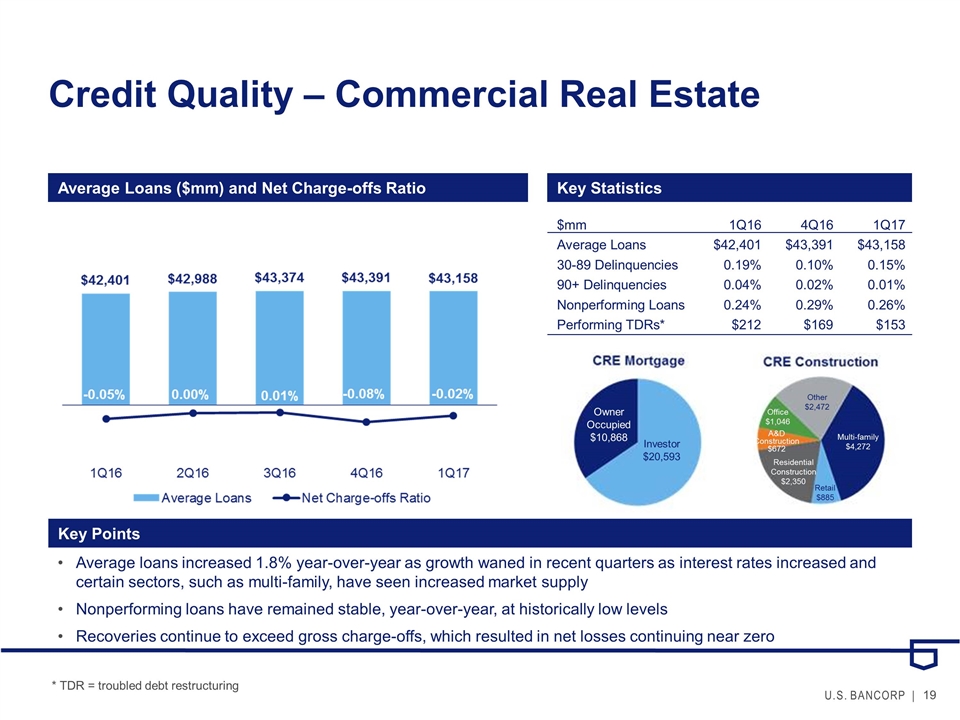

A&D Construction $672 Credit Quality – Commercial Real Estate Average Loans ($mm) and Net Charge-offs Ratio Key Statistics Key Points Average loans increased 1.8% year-over-year as growth waned in recent quarters as interest rates increased and certain sectors, such as multi-family, have seen increased market supply Nonperforming loans have remained stable, year-over-year, at historically low levels Recoveries continue to exceed gross charge-offs, which resulted in net losses continuing near zero $mm1Q164Q161Q17 Average Loans$42,401$43,391$43,158 30-89 Delinquencies0.19%0.10%0.15% 90+ Delinquencies0.04%0.02%0.01% Nonperforming Loans0.24%0.29%0.26% Performing TDRs*$212$169$153 Investor $20,593 Owner Occupied $10,868 Multi-family $4,272 Retail $885 Residential Construction $2,350 Office $1,046 Other $2,472 * TDR = troubled debt restructuring

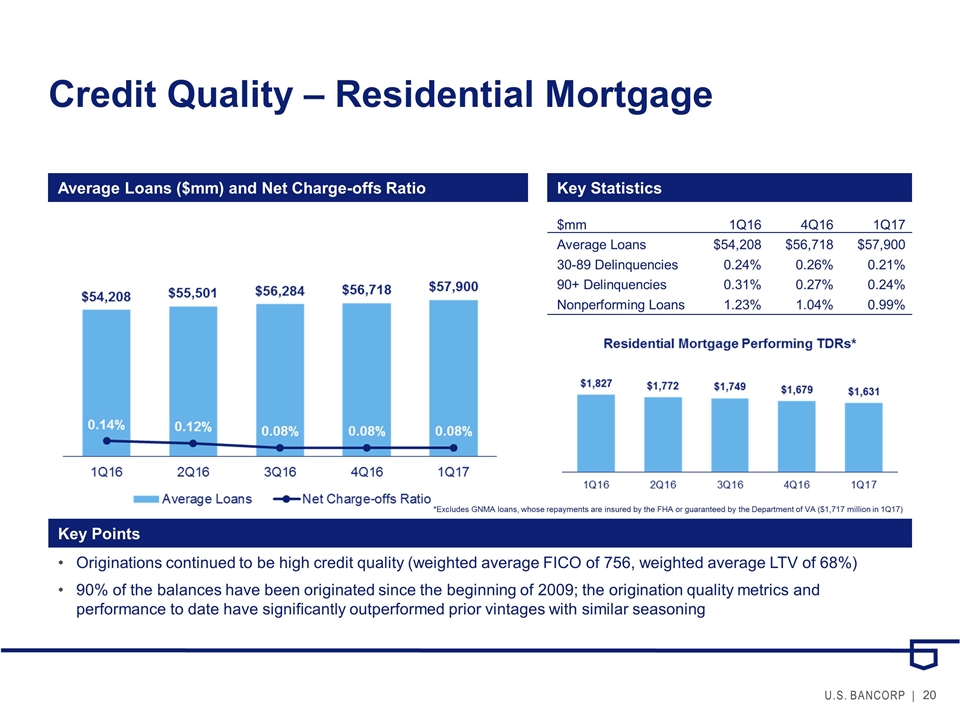

Credit Quality – Residential Mortgage Average Loans ($mm) and Net Charge-offs Ratio Key Statistics Key Points Originations continued to be high credit quality (weighted average FICO of 756, weighted average LTV of 68%) 90% of the balances have been originated since the beginning of 2009; the origination quality metrics and performance to date have significantly outperformed prior vintages with similar seasoning $mm1Q164Q161Q17 Average Loans$54,208$56,718$57,900 30-89 Delinquencies0.24%0.26%0.21% 90+ Delinquencies0.31%0.27%0.24% Nonperforming Loans1.23%1.04%0.99% *Excludes GNMA loans, whose repayments are insured by the FHA or guaranteed by the Department of VA ($1,717 million in 1Q17)

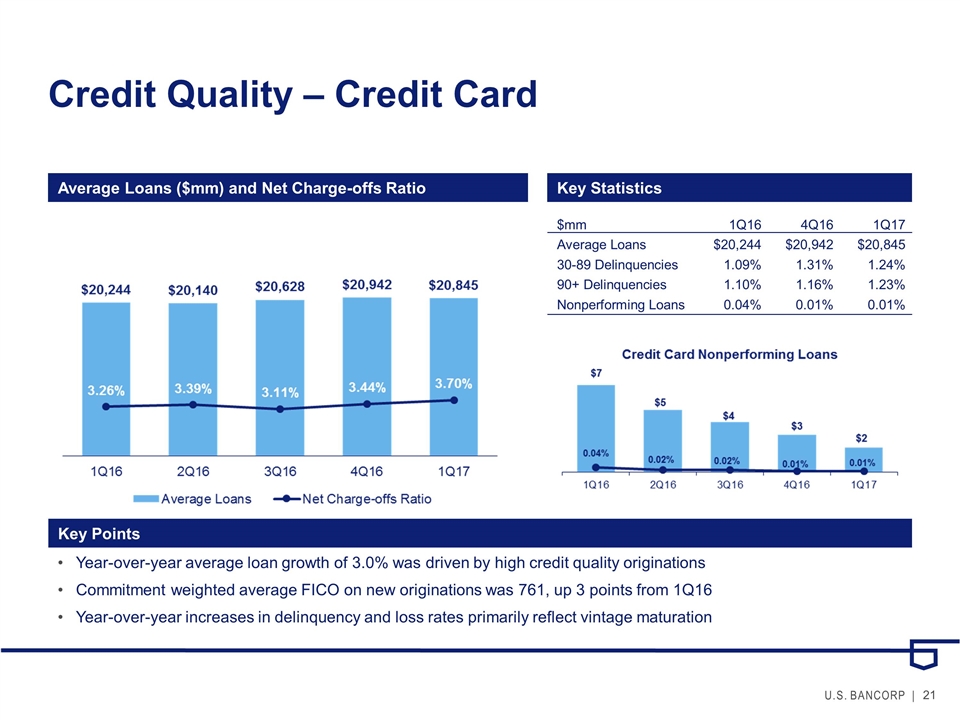

Credit Quality – Credit Card Average Loans ($mm) and Net Charge-offs Ratio Key Statistics Key Points Year-over-year average loan growth of 3.0% was driven by high credit quality originations Commitment weighted average FICO on new originations was 761, up 3 points from 1Q16 Year-over-year increases in delinquency and loss rates primarily reflect vintage maturation $mm1Q164Q161Q17 Average Loans$20,244$20,942$20,845 30-89 Delinquencies1.09%1.31%1.24% 90+ Delinquencies1.10%1.16%1.23% Nonperforming Loans0.04%0.01%0.01%

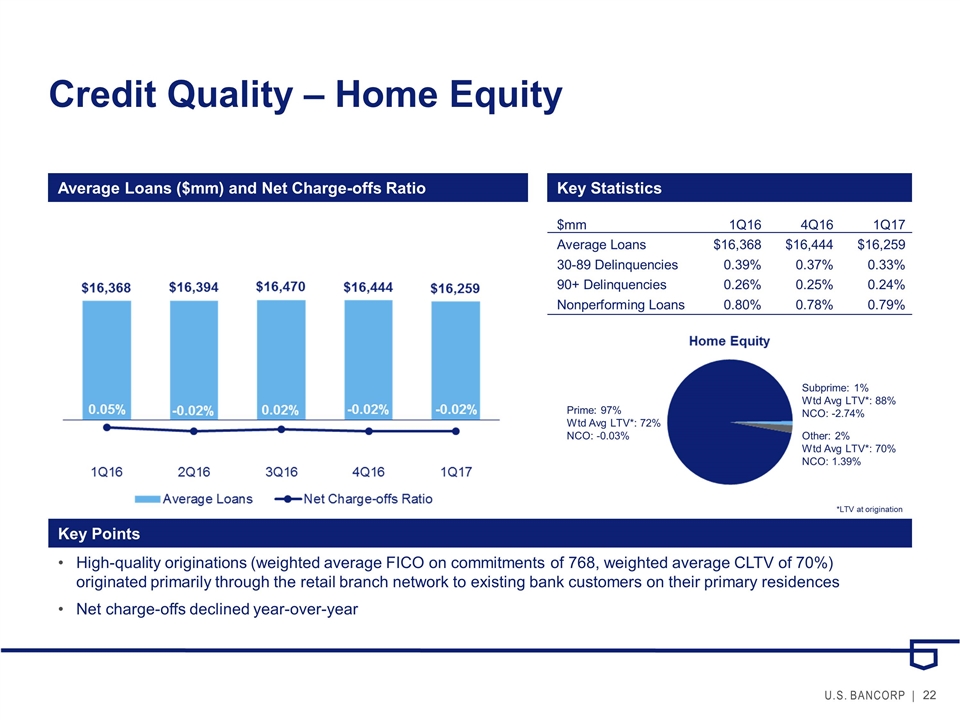

Credit Quality – Home Equity Average Loans ($mm) and Net Charge-offs Ratio Key Statistics Key Points High-quality originations (weighted average FICO on commitments of 768, weighted average CLTV of 70%) originated primarily through the retail branch network to existing bank customers on their primary residences Net charge-offs declined year-over-year $mm1Q164Q161Q17 Average Loans$16,368$16,444$16,259 30-89 Delinquencies0.39%0.37%0.33% 90+ Delinquencies0.26%0.25%0.24% Nonperforming Loans0.80%0.78%0.79% Subprime: 1% Wtd Avg LTV*: 88% NCO: -2.74% Prime: 97% Wtd Avg LTV*: 72% NCO: -0.03% Other: 2% Wtd Avg LTV*: 70% NCO: 1.39% *LTV at origination

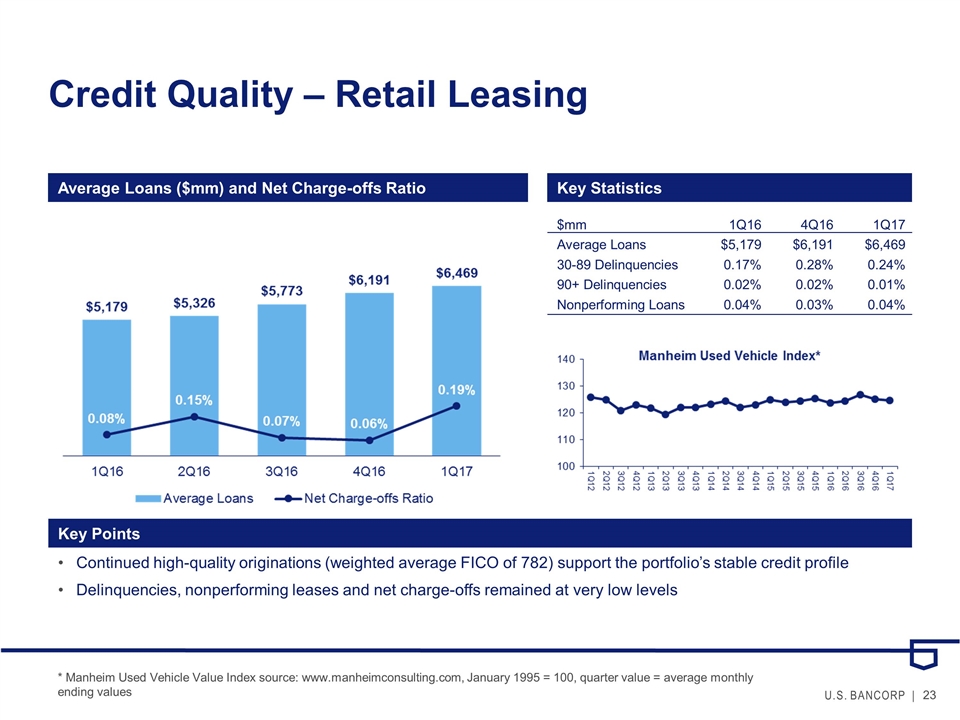

Credit Quality – Retail Leasing Average Loans ($mm) and Net Charge-offs Ratio Key Statistics Key Points Continued high-quality originations (weighted average FICO of 782) support the portfolio’s stable credit profile Delinquencies, nonperforming leases and net charge-offs remained at very low levels $mm1Q164Q161Q17 Average Loans$5,179$6,191$6,469 30-89 Delinquencies0.17%0.28%0.24% 90+ Delinquencies0.02%0.02%0.01% Nonperforming Loans0.04%0.03%0.04% * Manheim Used Vehicle Value Index source: www.manheimconsulting.com, January 1995 = 100, quarter value = average monthly ending values

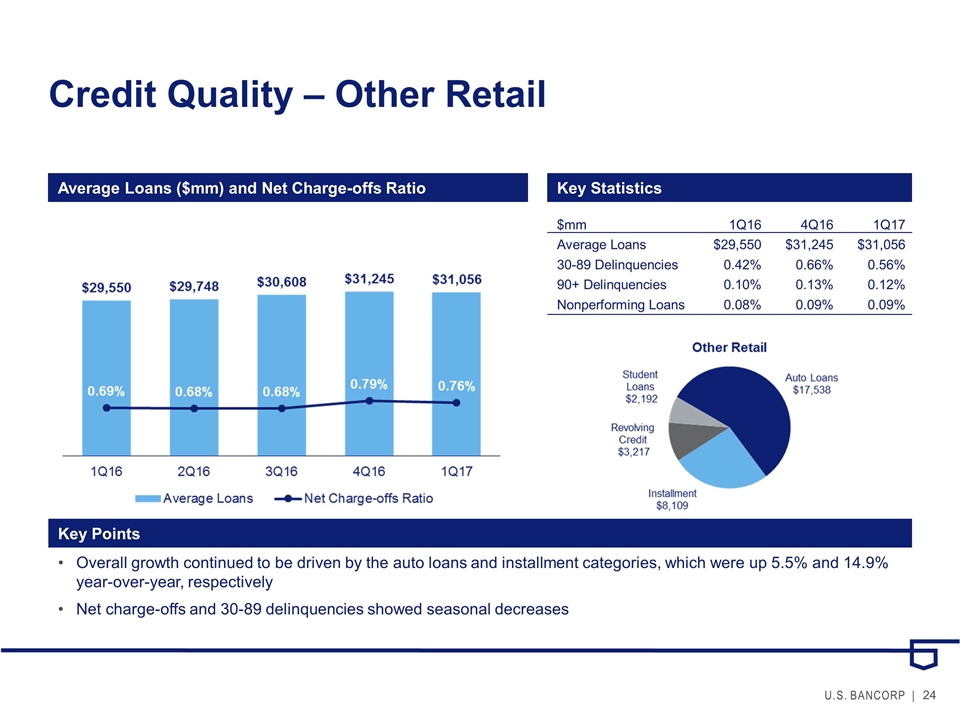

Credit Quality – Other Retail Average Loans ($mm) and Net Charge-offs Ratio Key Statistics Key Points Overall growth continued to be driven by the auto loans and installment categories, which were up 5.5% and 14.9% year-over-year, respectively Net charge-offs and 30-89 delinquencies showed seasonal decreases $mm1Q164Q161Q17 Average Loans$29,550$31,245$31,056 30-89 Delinquencies0.42%0.66%0.56% 90+ Delinquencies0.10%0.13%0.12% Nonperforming Loans0.08%0.09%0.09%

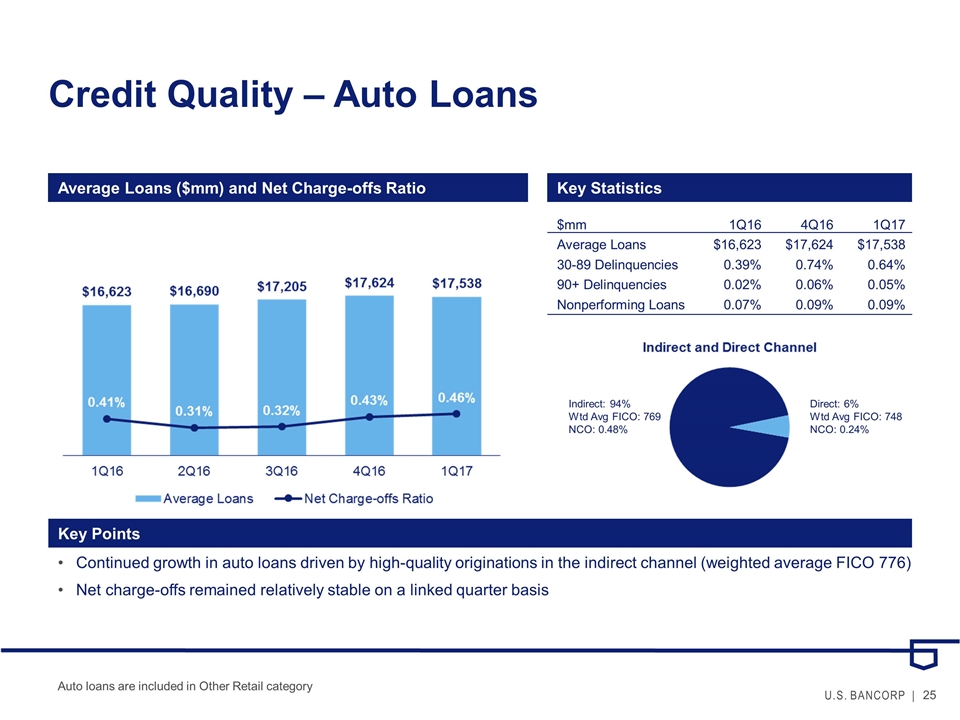

Credit Quality – Auto Loans Average Loans ($mm) and Net Charge-offs Ratio Key Statistics Key Points Continued growth in auto loans driven by high-quality originations in the indirect channel (weighted average FICO 776) Net charge-offs remained relatively stable on a linked quarter basis $mm1Q164Q161Q17 Average Loans$16,623$17,624$17,538 30-89 Delinquencies0.39%0.74%0.64% 90+ Delinquencies0.02%0.06%0.05% Nonperforming Loans0.07%0.09%0.09% Direct: 6% Wtd Avg FICO: 748 NCO: 0.24% Indirect: 94% Wtd Avg FICO: 769 NCO: 0.48% Auto loans are included in Other Retail category

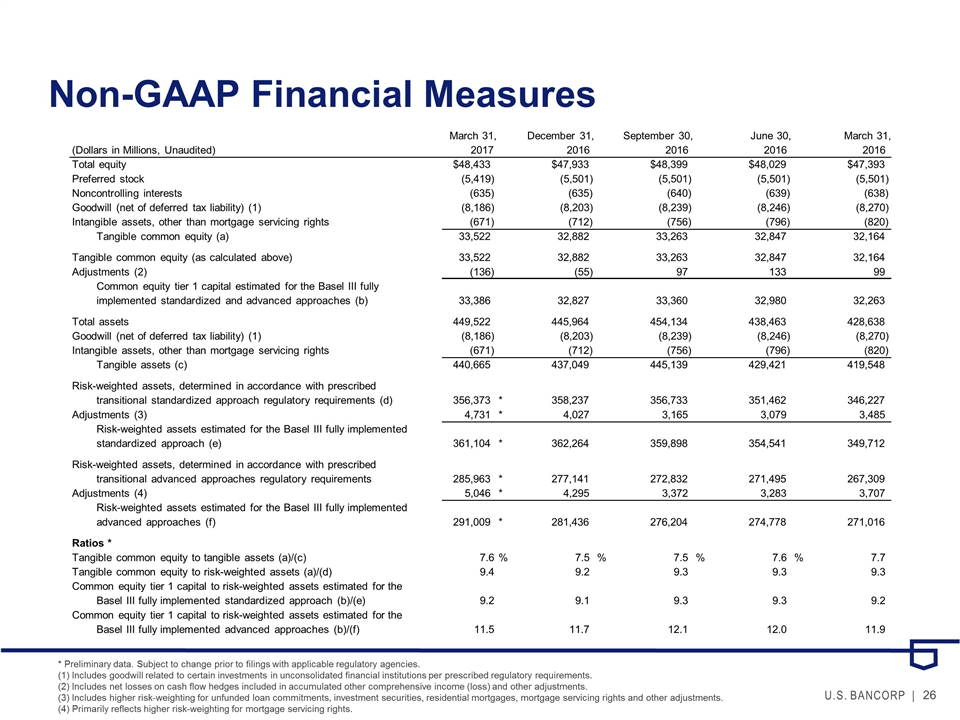

Non-GAAP Financial Measures * Preliminary data. Subject to change prior to filings with applicable regulatory agencies. (1) Includes goodwill related to certain investments in unconsolidated financial institutions per prescribed regulatory requirements. (2) Includes net losses on cash flow hedges included in accumulated other comprehensive income (loss) and other adjustments. (3) Includes higher risk-weighting for unfunded loan commitments, investment securities, residential mortgages, mortgage servicing rights and other adjustments. (4) Primarily reflects higher risk-weighting for mortgage servicing rights. March 31, December 31, September 30, June 30, March 31, (Dollars in Millions, Unaudited) 2017 2016 2016 2016 2016 Total equity $48,433 $47,933 $48,399 $48,029 $47,393 Preferred stock (5,419) (5,501) (5,501) (5,501) (5,501) Noncontrolling interests (635) (635) (640) (639) (638) Goodwill (net of deferred tax liability) (1) (8,186) (8,203) (8,239) (8,246) (8,270) Intangible assets, other than mortgage servicing rights (671) (712) (756) (796) (820) Tangible common equity (a) 33,522 32,882 33,263 32,847 32,164 Tangible common equity (as calculated above) 33,522 32,882 33,263 32,847 32,164 Adjustments (2) (136) (55) 97 133 99 Common equity tier 1 capital estimated for the Basel III fully implemented standardized and advanced approaches (b) 33,386 32,827 33,360 32,980 32,263 Total assets 449,522 445,964 454,134 438,463 428,638 Goodwill (net of deferred tax liability) (1) (8,186) (8,203) (8,239) (8,246) (8,270) Intangible assets, other than mortgage servicing rights (671) (712) (756) (796) (820) Tangible assets (c) 440,665 437,049 445,139 429,421 419,548 Risk-weighted assets, determined in accordance with prescribed transitional standardized approach regulatory requirements (d) 356,373 * 358,237 356,733 351,462 346,227 Adjustments (3) 4,731 * 4,027 3,165 3,079 3,485 Risk-weighted assets estimated for the Basel III fully implemented standardized approach (e) 361,104 * 362,264 359,898 354,541 349,712 Risk-weighted assets, determined in accordance with prescribed transitional advanced approaches regulatory requirements 285,963 * 277,141 272,832 271,495 267,309 Adjustments (4) 5,046 * 4,295 3,372 3,283 3,707 Risk-weighted assets estimated for the Basel III fully implemented advanced approaches (f) 291,009 * 281,436 276,204 274,778 271,016 Ratios * Tangible common equity to tangible assets (a)/(c) 7.6 % 7.5 % 7.5 % 7.6 % 7.7 Tangible common equity to risk-weighted assets (a)/(d) 9.4 9.2 9.3 9.3 9.3 Common equity tier 1 capital to risk-weighted assets estimated for the Basel III fully implemented standardized approach (b)/(e) 9.2 9.1 9.3 9.3 9.2 Common equity tier 1 capital to risk-weighted assets estimated for the Basel III fully implemented advanced approaches (b)/(f) 11.5 11.7 12.1 12.0 11.9

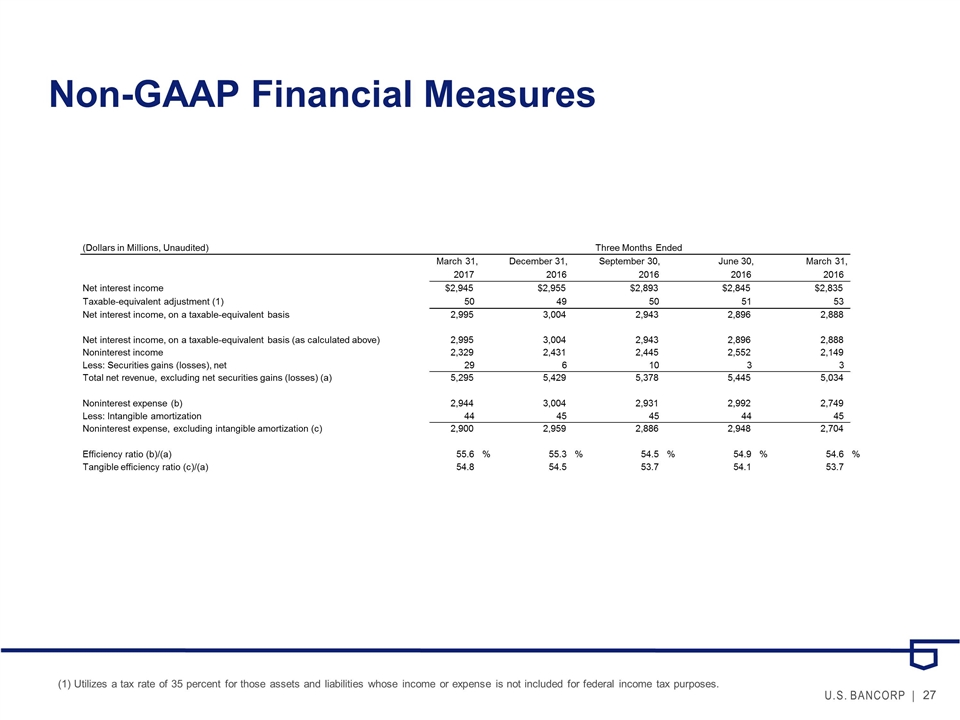

Non-GAAP Financial Measures (1) Utilizes a tax rate of 35 percent for those assets and liabilities whose income or expense is not included for federal income tax purposes. (Dollars in Millions, Unaudited) March 31, December 31, September 30, June 30, March 31, 2017 2016 2016 2016 2016 Net interest income $2,945 $2,955 $2,893 $2,845 $2,835 Taxable-equivalent adjustment (1) 50 49 50 51 53 Net interest income, on a taxable-equivalent basis 2,995 3,004 2,943 2,896 2,888 Net interest income, on a taxable-equivalent basis (as calculated above) 2,995 3,004 2,943 2,896 2,888 Noninterest income 2,329 2,431 2,445 2,552 2,149 Less: Securities gains (losses), net 29 6 10 3 3 Total net revenue, excluding net securities gains (losses) (a) 5,295 5,429 5,378 5,445 5,034 Noninterest expense (b) 2,944 3,004 2,931 2,992 2,749 Less: Intangible amortization 44 45 45 44 45 Noninterest expense, excluding intangible amortization (c) 2,900 2,959 2,886 2,948 2,704 Efficiency ratio (b)/(a) 55.6 % 55.3 % 54.5 % 54.9 % 54.6 % Tangible efficiency ratio (c)/(a) 54.8 54.5 53.7 54.1 53.7 Three Months Ended

U.S. Bancorp 1Q17 Earnings Conference Call April 19, 2017