Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - THT Heat Transfer Technology, Inc. | exhibit32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - THT Heat Transfer Technology, Inc. | exhibit32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - THT Heat Transfer Technology, Inc. | exhibit31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - THT Heat Transfer Technology, Inc. | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2016

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _____________

Commission File No. 001-34812

THT HEAT TRANSFER TECHNOLOGY,

INC.

(Exact name of registrant as specified in its

charter)

| Nevada | 20-5463509 |

| (State or other jurisdiction of incorporation or | (I.R.S. Employer Identification No.) |

| organization) |

THT Industrial Park

No. 5 Nanhuan Road, Tiexi

District

Siping, Jilin Province 136000

People’s

Republic of China

(Address of principal executive offices)

86-434-3265241

(Registrant’s telephone

number, including area code)

Securities registered pursuant to Section 12(b) of the Act:None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes

[X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes

[X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer [ ] | Accelerated Filer [ ] |

| Non-Accelerated Filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether registrant is a shell company

(as defined in Rule 12b-2 of the Act).

Yes [

] No [X]

As of June 30, 2016 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the shares of the registrant’s common stock held by non-affiliates (based upon the closing sale price of such shares as reported on the OTC Markets) was approximately $3.08 million. Shares of the registrant’s common stock held by each executive officer and director and each by each person who owns 10% or more of the outstanding common stock have been excluded from the calculation in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

There were a total of 20,453,500 shares of the registrant’s common stock outstanding as of April 12, 2017.

DOCUMENTS INCORPORATED BY REFERENCE

None.

THT HEAT TRANSFER TECHNOLOGY, INC.

| Annual Report on Form 10-K |

| Year Ended December 31, 2016 |

TABLE OF CONTENTS

INTRODUCTORY NOTE

Special Note Regarding Forward Looking Statements

In addition to historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, including those identified in Item 1A “Risk Factors” herein, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements.

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation, except as required by law, to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

-

“THT,” “Company,” “we,” “us,” or “our” are to the combined business of THT Heat Transfer Technology, Inc., a Nevada corporation, and its consolidated subsidiaries: Megaway, Star Wealth, Siping Juyuan and Beijing Juyuan;

-

“Megaway” are to Megaway International Holdings Limited, a BVI company;

-

“Star Wealth” are to Star Wealth International Holdings Limited, a Hong Kong company;

-

“Siping Juyuan” are to Siping City Juyuan Hanyang Plate Heat Exchanger Co. Ltd., a PRC company;

-

“Beijing Juyuan” are to Beijing Juyuan Hanyang Heat Exchange Equipment Co., Ltd., a PRC company;

-

“BVI” are to the British Virgin Islands;

-

“Hong Kong” are to the Hong Kong Special Administrative Region of the People’s Republic of China;

-

“PRC” and “China” are to the People’s Republic of China;

-

“SEC” are to the Securities and Exchange Commission;

-

“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

-

“Securities Act” re to the Securities Act of 1933, as amended;

-

“Renminbi” and “RMB” are to the legal currency of China; and

-

“U.S. dollars,” “dollars” and “$” are to the legal currency of the United States.

1

PART I

ITEM 1. BUSINESS.

Overview of Our Business

We are a leading total solution provider in the heat exchange industry. Our major products are plate heat exchangers, heat exchanger units, air-cooled heat exchangers and shell-and-tube heat exchangers. Unlike most other heat exchanger manufacturers in China, we not only provide heat exchange products, but also provide total solutions to our customers. As a total solutions provider, we analyze the working condition of our customers, provide optimized designs based on analysis and simulation, offer high quality heat exchange products, and continuously assist our customers in improving the heat exchange process.

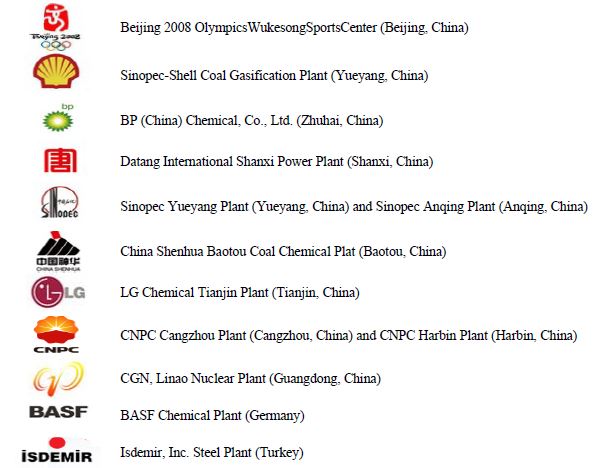

Over the past ten years, we have successfully completed over 3,000 projects in more than 15 industries, including metallurgy, heat and power, petrochemical, food and beverage, pharmaceutical and shipbuilding. We have provided heat exchange solutions to Fortune 500 companies, including Shell, BP, BASF, LG, Sinopec and China Shenhua. We have also provided heat exchange products for important Chinese and international projects such as the Beijing 2008 Olympics Wukesong Sports Center, Guangdong Lin’ao nuclear plant and BASF Chemical plant in Germany.

Our operations are headquartered in Siping, Jilin Province, PRC. Our primary Chinese operating subsidiaries are Siping Juyuan and Beijing Juyuan.

Our Corporate History

Background and History of BTHC VIII, Inc.

We were organized on August 7, 2006 as a Delaware corporation under the name BTHC VIII, Inc. to effect the reincorporation of BTHC VIII, LLC, a Texas limited liability company, mandated by the plan of reorganization discussed below. In accordance with the confirmed plan of reorganization, our business plan was to identify a privately-held operating company desiring to become a publicly held company by merging with us through a reverse merger or other acquisition transaction.

In September 1999, Ballantrae Healthcare LLC and affiliated limited liability companies, including BTHC VIII, LLC, were organized for the purpose of operating nursing homes throughout the United States. On March 28, 2003, they filed a petition for reorganization under Chapter 11 of the United States Bankruptcy Code. On November 29, 2004, the United States Bankruptcy Court in the Northern District of Texas, Dallas Division approved the First Amended Joint Plan of Reorganization. On August 16, 2006, pursuant to the plan of reorganization, BTHC VIII, LLC was merged into our Company.

We were subject to the jurisdiction of the bankruptcy court until we consummated the exchange transaction described below with Sino-America Ventures, Inc., a Delaware corporation, in February 2009. Because we consummated our merger with a qualifying entity in a timely manner, we filed a certificate of compliance with the bankruptcy court asserting that the requirements of the plan of reorganization had been satisfied, which resulted in an order granting the discharge. Thereafter, the post discharge injunction provisions (set forth in the plan of reorganization) and the confirmation order became effective.

Exchange Transaction with Sino-America Ventures, Inc.

On February 12, 2009, we entered into a share exchange agreement with Sino- America Ventures, Inc. and its sole stockholder, Mr. Gerard Pascale, pursuant to which Mr. Pascale transferred 100% of the issued and outstanding shares of the capital stock of Sino-America Ventures, Inc. to us in exchange for 5,404,800 newly issued shares of our common stock that constituted approximately 90% of our issued and outstanding capital stock on a fully-diluted basis as of, and immediately after, the consummation of such exchange. As a result of this transaction, Mr. Pascale became our controlling stockholder and Sino- America Ventures, Inc. became our subsidiary. Sino- America Ventures, Inc. was organized on February 10, 2009 to identify a privately-held operating company desiring to become a publicly held company by combination through a reverse merger or acquisition transaction, and was dissolved on May 22, 2009.

2

Acquisition of Megaway

On June 30, 2009, we completed a reverse acquisition transaction with Megaway, whereby we acquired all of the issued and outstanding capital stock of Megaway in exchange for 14,800,000 shares of our common stock, which, after giving effect to the cancellation of 4,805,387 shares of our common stock by Mr. Gerald Pascale in connection with the reverse acquisition, constituted 92.5% of our issued and outstanding capital stock on a fully-diluted basis as of and immediately after the consummation of the reverse acquisition. Megaway thereby became our wholly owned subsidiary and Wisetop International Holdings Limited, or Wisetop, the sole shareholder of Megaway, became our controlling stockholder. For accounting purposes, the share exchange transaction was treated as a reverse acquisition with Megaway as the acquirer and the Company as the acquired party.

As a result of the reverse acquisition of Megaway, our business became the business of Megaway and its subsidiaries, Star Wealth, Siping Juyuan and Beijing Juyuan.

Megaway was incorporated in the BVI on April 8, 2009. Megaway is a holding company that has no operations or assets other than its ownership of all of the capital stock of Star Wealth. Star Wealth was incorporated in Hong Kongon March 25, 2009. Star Wealth is also a holding company that has no operations or assets other than its ownership of all of the equity interests of Siping Juyuan, which was acquired by Star Wealth on June 8, 2009. Siping City Juyuan Heat Exchange Equipment Co., Ltd., the predecessor of Siping Juyuan, was first incorporated in China in December 1998. In May 2006, it was divided into three individual enterprises, including Siping Juyuan. Siping Juyuan carried on the primary business of Siping City Juyuan Heat Exchange Equipment Co., Ltd., while the other two enterprises gradually ceased operations. Mr. Guohong Zhao, our Chairman, Chief Executive Officer and President, is the founder of Siping City Juyuan Heat Exchange Equipment Co., Ltd.. All of our manufacturing operations are conducted through Siping Juyuan. Siping Juyuan owns 75% of the equity interests of Beijing Juyuan, which is solely engaged in the sales of Siping Juyuan’s products, and carries no production activities. The other 25% is owned by Hanyang International GmbH, a German company.

Reincorporation

On November 24, 2009, we effected a reincorporation from Delaware to Nevada by merging with THT Heat Transfer Technology, Inc., a corporation that we established in the State of Nevada solely to effect the reincorporation. As a result of the reincorporation, our domicile was changed from Delaware to Nevada and our name was changed from BTHC VIII, Inc. to THT Heat Transfer Technology, Inc.

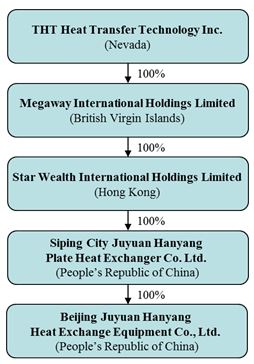

Our Corporate Structure

The following chart reflects our current corporate organizational structure:

3

Our Industry

A heat exchanger is a device built for efficient heat transfer from one medium to another. It is widely used in various industries including metallurgy, heat and power, petrochemical, food and beverage, pharmaceutical and shipbuilding.

A heat exchanger is a device built for efficient heat transfer from one medium to another. It is widely used in various industries including metallurgy, heat and power, petrochemical, food and beverage, pharmaceutical and shipbuilding.

According to “China Heat Exchanger Industry Report” issued by Zero Power Intelligence Co., Ltd., an independent market research firm in China, the world heat exchanger market has grown significantly in the past several years. The global sales value of heat exchangers grew from $29.7 billion in 2005 to $38.6 billion in 2008, representing a growth of 30%, and is expected to grow to $56.5 billion in 2015, representing a growth of 46.37% in the six-year period from 2009 to 2015. According to the report, China has become the second largest market and one of the fastest growing markets for heat exchangers. The sales value of heat exchangers in China grew from $3.2 billion in 2005 to $5.4 billion in 2008, representing a growth of 70%, and is expected to grow to $ 16.3 billion in 2016, representing a growth of 202% in the eight-year period from 2009 to 2016.

-

Economic Growth in China. According to the National Bureau of Statistics of the PRC, China’s GDP grew 6.7% in 2016, one of the fastest rates in the world. Because heat exchangers are widely used in various industries, including metallurgy, heat and power, petrochemical, food and beverage, pharmaceutical and shipbuilding, the heat exchanger market benefits from the general growth of the economy.

-

Expanding Energy Needs. A fast growing economy requires more energy. To keep pace with rising energy demands, additional power plants are being constructed. Heat exchangers are widely used in the closed circulation systems of thermal power plants, nuclear reactor heat exchange systems and regular water cooling systems of nuclear power plants. The Chinese government plans to spend a total of $66 billion in nuclear power plant construction. By 2020, 23 million kilowatt level nuclear power plants will be constructed. In 2010, construction began on six new nuclear power plants in the provinces of Zhejiang, Shandong, Guangdong and Hainan.

-

Environmental Protection. New environmental rules and regulations have helped reduce emissions and energy consumption. Both the Chinese and foreign governments encourage investments in order to reduce energy consumption and emissions. In many applications, industry buyers tend to use heat exchangers instead of simple cooling systems after giving consideration to their efficiency and energy savings. The investment in energy savings and emissions reduction in China was approximately159.78 billion during the twelfth five-year plan. According to the World Nuclear Organization, as of March 2014, China had 7 operating nuclear reactors and 37 reactors in the construction or planning phases.

4

- Rapid Urbanization. Heat exchangers are an important part of district heating systems (i.e., systems for distributing heat generated in a centralized location for residential and commercial heating requirements such as space and water heating). Such systems are required in the cities of northern China, an area which is experiencing a rapid pace of urbanization. As well, Heating, Ventilation and Air Conditioning systems, or HVAC, which are essential for buildings, require installation of heat exchangers. In 2009, the HVAC market in China was $6.0 billion and is expected to grow at a compound annual growth rate of 250% by 2016.

Our Competitive Strengths

We believe that the following strengths enable us to compete effectively in and to capitalize on growth in the heat exchange industry in China:

-

Leading market position. Our leading sales position will help develop our brand and brand awareness throughout China and assist us in acquiring an even larger market share in the future.

-

Comprehensive solution provider. Unlike most other heat exchanger manufacturers in China, we not only provide heat exchange products, but also provide comprehensive solutions to our customers. As a total solution provider, we analyze the working condition of our customers, provide optimized design based on analysis and simulation, offer high quality heat exchange products and continuously assist our customers in improving their heat exchange processes.

-

Broad product range. We provide the broadest range of heat exchanger products in China, surpassed only by Alfa Laval, the global market leader for heat exchanger products. Our products include plate heat exchangers, shell and tube heat exchangers, heat exchange units, air-cooled heat exchangers, welded plate heat exchangers and plate- and-shell heat exchangers. Our broad product variety provides our customers with one-stop purchasing convenience.

-

Solid track record. Over the past ten years, we have successfully completed over 3,000 projects in more than 15 industries, including metallurgy, heat and power, petrochemical, food and beverage, pharmaceutical and shipbuilding. We have provided heat exchange solutions to Fortune 500 companies including Shell, BP, BASF, LG, Sinopec, and China Shenhua as well as for high profile projects in both the PRC and other countries. Noteworthy projects include the Wukesong Sports Center for the 2008 Olympics in Beijing, the Guangdong Linao nuclear plant and the BASF Chemical plant in Germany. Our strong track record and our demonstrated ability to develop and deliver high quality solutions provides our Company with a strong brand and reputation in the industry.

-

Professional sales team. We have a sales team with 135 experienced sales people, which we believe is among the largest in the Chinese market. Our sales people are organized into four groups by industry: metallurgy, heat and power, petrochemical and shipbuilding. Each group specializes in serving customers in their specific industry. We believe this specialization allows our sales people to be more focused and equipped with superior industry knowledge and experience.

Our Growth Strategies

We are committed to enhancing our sales, profitability and cash flows through the following strategies:

- Increasing production and processing capacity. To fulfill future sales growth and enhance our capacity during peak periods, we expanded our production facility. Our workshop has a floor area of 7,356 square meters and our production line of plate heat exchangers, with a designed capacity of 200,000 square meters annually, was implemented in the workshop in October 2009.

5

-

Expanding sales network. We will further expand our sales network by establishing new sales offices in China. We are also strengthening our international marketing efforts.

-

Continually developing new products. We will continue to develop new products to broaden our product range so as to meet increased customer demands and seize larger market share. New products under development include box type units and building units use for heating company, residential or commercial blocks and most power plants. These new products will help us reach a larger number of customers in the central heating or district heating industries.

Our Products

Our products and heat exchange solutions are sold to customers in the chemical, metallurgical and shipbuilding industries and our products are also used with HVAC and district heating systems. Our products include plate heat exchangers, heat exchanger units, air-cooled heat exchangers, shell-and-tube heat exchangers, welded plate heat exchangers and plate-and-shell heat exchangers.

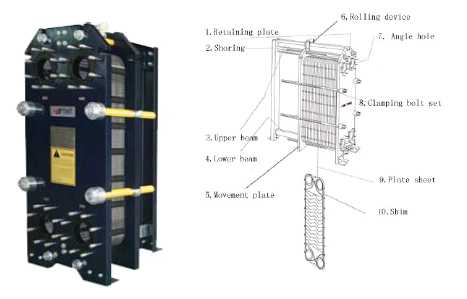

Plate Heat Exchangers

A plate heat exchanger is a type of heat exchanger that uses metal plates to transfer heat between two fluids. This type of heat exchanger has a major advantage over a conventional shell and tube heat exchangers since the fluids are exposed to a much larger surface area because the fluids spread out over the plates. This spreading of fluids over the plates facilitates the transfer of heat and greatly increases the speed of the temperature change.

The plate heat exchanger consists of a coiled pipe containing one fluid that passes through a chamber containing another fluid. The walls of the pipe are usually made of metal or another substance with a high thermal conductivity to facilitate the interchange. The outer casing of the larger chamber is made of a plastic or coated with thermal insulation to discourage heat from escaping from the exchanger.

Plate heat exchangers are used in a variety of applications including iron, steel and aluminum manufacturing, chemical manufacturing, electric and nuclear power generation, central building air-conditioning, pharmaceutical production, and the food and beverage industry. Plate heat exchanger sales accounted for approximately 40% of our sales revenue in 2016.

Heat Exchanger Units

A heat exchanger unit is a whole set of district heating control equipment. A heat exchanger unit integrates the following components: plate heat exchangers, circulating pump, water supplement pump, thermometer, manometer, sensors, conduits, valves and industrial controls, water supplement system, pressure stabilization system, frequency conversion flux control system, heat measurement and network communication control system. Combining these components on-site at our manufacturing facilities, we utilize our proprietary technologies to customize heat exchanger units to our client’s specifications.

6

Our heat exchanger units are most widely used in thermal power plants and residential heating systems, which require integration of control and monitoring systems for several distinct spaces. Sales of heat exchanger units accounted for approximately 44% of our sales revenue in 2016.

Air-cooled Heat Exchanger

An air-cooled heat exchanger is a pressure vessel which cools a circulating fluid within finned tubes by forcing ambient air over the exterior of the tubes. A common example of an air cooler is a car’s radiator. Air-cooled heat exchangers are beneficial because they increase plant efficiency and are a “green” solution as compared to cooling towers and shell and tube heat exchangers since they do not require an auxiliary water supply (therefore, no water is lost due to drift or evaporation, and no water treatment chemicals are required).

Air-cooled heat exchangers are used in various industries where cooling liquids are too costly to obtain or are not readily available .We did not have any sales of air-cooled heat exchangers in 2016.

Shell-and-tube Heat Exchanger

A shell-and-tube heat exchanger is a type of heat exchanger that consists of a large pressure vessel, or a shell, containing a bundle of tubes. One fluid runs through the tubes, and another fluid flows over the tubes, through the shell, to transfer heat between the two fluids. Heat is transferred from one fluid to the other through the tube walls, either from tube side to shell side or vice versa. The fluids can be either liquids or gases on either the shell or the tube side.

7

Shell-and-tube heat exchangers are generally used in the same industries as plate heat exchangers, and are most commonly used with extremely high-pressure liquids. Shell-and-tube heat exchanger sales accounted for approximately 2% of our sales revenue in 2016.

Welded Plate Heat Exchanger

A welded plate heat exchanger is used for heat exchange between high-pressure fluids or where a more compact product is required. Instead of a pipe passing through a chamber, there are instead two alternating chambers, usually thin in depth, separated at their largest surface by a corrugated metal plate. The heat transfer plates are connected by welding. Compared with other plate heat exchangers, welded plate heat exchangers can work under situations where the liquid pressure is higher. However, since the heat transfer plates are welded, such units are less convenient to maintain and clean as compared with other types of plate heat exchangers that are connected by gaskets.

Welded plate heat exchangers are utilized in many of the same industries as other plate heat exchangers and shell-and-tube heat exchangers. We did not have any sales of welded plate heat exchangers in 2016.

Plate-and-Shell Heat Exchanger

A plate-and-shell heat exchanger is a hybrid type of heat exchanger that combines aspects of the plate heat exchanger and shell-and-tube heat exchanger. Plate-and-shell heat exchangers consist of a shell with heat transfer plates inside of the shell instead of tubes.

8

Advantages of a plate-and-shell heat exchanger include its high heat transfer efficiency (more than double that of a shell-and-tube heat exchanger), compact structure and light weight. Shell-and-plate heat exchangers are also resistant to high pressure and high temperatures and are commonly used to meet the requirements of large-scale equipment used in oil refining, the chemical industry, fertilizer production and metallurgy. We did not have any sales of plate-and-shell heat exchangers in 2016.

Other heat exchange products accounted for 12% of our sales revenue in 2016.

New Products under Development

Our research and development department is constantly working on new products for our customers and enhancements to our existing products. Currently, our research and development team is working on box type units and building units used in heating industry.

Manufacturing

Manufacturing Facilities

Our manufacturing facilities are based in Siping City, Jilin Province, China and Tianjin City. The total floor area of our Siping facility is approximately 17,482 square meters. The production portion of the facility is approximately 11,275 square meters. Our research and development center is approximately 1,164 square meters and our executive office building, garage, and dormitory are approximately 5,043 square meters. We currently have two production lines for plate heat exchangers with an annual capacity of 500,000 square meters and one welding workshop with an annual capacity of 3,000 tons. The plate heat exchanger production line produces all heat transfer plates used in our plate heat exchangers, heat exchange units, air-cooled heat exchangers, welded plate heat exchangers and plate-and-shell heat exchangers. This production line also assembles heat transfer plates into plate heat exchangers. The welding work shop assembles shell and tube heat exchangers, heat exchanger units, air-cooled heat exchangers, welded plate heat exchangers and plate-and-shell heat exchangers, which require intensive welding operations. The facility is located on a 36,530 square meter plot of land for which we own the land use right.

The capacity and utilization of our production lines are set forth below:

| Production Line | Current Capacity | 2016 Utilization | 2015 Utilization |

| Plate heat exchanger production line (square meters) | 300,000 | 70% | 70% |

| Welding workshop (tons) | 3,000 | 90% | 90% |

| Plate heat exchanger production line (square meters) | 200,000 | 45% | 45% |

In real operation, the hours our production lines run vary considerably from time to time over the year. This is mainly because our products are customized rather than standard products, and our sales orders are commonly project-based and placed unevenly over the year. In addition, the market demand from the heat industry tends to demonstrate strong seasonality and the period from July to October each year is commonly the peak season, when the residential heating system for northern China is implemented. Under our current utilization rate, our production lines have been running at full capacity during the peak periods.

9

To fulfill future sales growth and to enhance our capacity during peak periods, we further expanded our production facility. Our new workshop, which began operations in October 2009, has a floor area of 7,356 square meters and a new production line for plate heat exchangers with a designed capacity of 200,000 square meters. With the new workshop, we have been able to further streamline our production lines and have more space available for assembly and welding. In the new plate heat exchanger production line, we installed a 6,000 ton press machine to produce smaller size heat transfer plates while the old plate heat exchanger production line with a 22,000 ton press machine will be used to produce larger sized heat transfer plates. With the new workshop and the new production line, we believe both our production capacity and efficiency will be significantly improved.

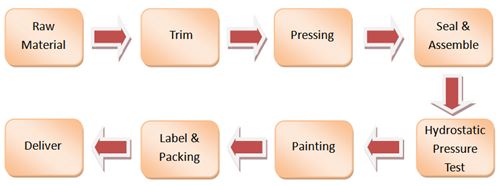

Manufacturing Processes

The following diagram illustrates the production process for our plate heat exchangers.

Production Process forPlate Heat Exchanger Manufacturing

The manufacturing process for the plate heat exchanger begins with the removal of edges from steel plates that we acquire as a raw material. Once the edges are removed, we cut the steel plate down to the desired size. The next step is the pressing of the steel plate to the desired shape and form. After the pressing is complete, we seal and combine the heat transfer plates together. The final step is to conduct a hydrostatic pressure test, which tests our product for leakage and also tests the strength of the product to ensure conformity to customer specifications.

The following diagram illustrates the production process for ourshell-and-tube heat exchangers.

Production Process of Shell-and-Tube Heat Exchanger Manufacturing

The manufacturing process for the shell-and-tube heat exchanger begins with the welding and combination of the shell and heat exchange tube. The next step is to conduct a hydrostatic pressure test, which tests our product for leakage and also tests the strength of the product to ensure conformity to customer specifications.

The production process for our heat exchange units, air-cooled heat exchangers, welded plate heat exchangers and plate and shell heat exchangers is similar to that of our plate heat exchanger production process, except that additional processes are added to arrive at the finished product. With the heat exchange units, additional components are added in the welding workshop, including a circulating pump, water supplement pump, thermometer, manometer, various sensors, conduits and valves. In the case of the air-cooled heat exchanger, additional fans and blowers are added to the plate heat exchanger in the welding workshop. With the welded plate heat exchanger, the heat transfer plates are welded rather than connected by gaskets. Finally, in the case of the plate and shell heat exchanger, the heat transfer plates replace tubes inside the shell vessel.

10

Raw Materials

We purchase raw materials for each project and the procurement is subject to different solutions designed to customer specifications, including the material type, material volume and accessories. Our raw materials are mainly metal plates made of stainless steel, carbon steel, titanium steel, nickel steel and other steel base alloys. Different steel plates are used to produce heat exchangers used in different environments or for use with different fluids. For heat exchangers used in environments containing corrosive air or liquids, such as on a ship or in alumina smelting, or used to exchange heat from highly-corrosive fluids, such as acid and alkali chemicals, corrosion resistant steel plates made from such metals as titanium steel, nickel steel, steel base alloy (such as 254SMO) and Hastelloy alloy are used as raw materials. For heat exchangers used in a regular environment or with regular fluids, stainless steel plates and carbon steel plates are used as raw materials. We also purchase heat transfer tubes from third party vendors to produce shell-and-tube heat exchangers and plate-and-shell heat exchangers.

Suppliers

The raw materials that we use to produce our products are widely available in the market. Since our products are mostly customized rather than standard products, we usually make purchases based on orders received, frequently in small quantities. Accordingly, we purchase from trading companies so that we are able to place orders in small quantities and request quick deliveries. Most of these trading companies are distributors of large global steel or alloy manufacturers such as Nippon Yakin Co., Ltd., TISCO, Haynes International, Inc., BAOTI, and Nippon Steel Corporation.

The following table sets forth our top ten suppliers in 2016:

Supplier |

Raw Materials |

Amount (in thousands of U.S. Dollars) |

| Shenyang Oriental Kunlun Stainless Steel Industrial Co., Ltd. | White Steel Plate | 4,064,446 |

| Tangshan Longteng Steel Co., Ltd. | Round bar steel | 2,155,534 |

| Siping Jinye Steel Trade Co., Ltd. | Round bar steel | 1,201,237 |

| Xi’an Lianyi Rubber Products Co., Ltd. | Rubber Mat. Spacer | 1,061,892 |

| Hebei Xuanlong Steel Rolling Co., Ltd. | Round bar steel | 1,044,031 |

| Siping Xinguangju Auto Control Equipment Co., Ltd. | PLC | 1,028,163 |

| Nanfang Zhongjin Huanjing Co., Ltd. | Pump | 930,359 |

| Jiangmen Special Stainless Steel Materiasls Co., Ltd. | White Steel Plate | 780,640 |

| Qinhuangdao Zhanqin Machine Co., Ltd. | Pump | 776,274 |

| Tianjin Jiang Chang Stainless Steel Co., Ltd. | White Steel Plate | 759,408 |

The following table sets forth our top ten suppliers in 2015:

Supplier |

Raw Materials |

Amount (in thousands of U.S. Dollars) |

| Shenyang Oriental Kunlun Stainless Steel Industrial Co., Ltd. | White Steel Plate | 2,712,198 |

| Tianjin Jiang Chang Stainless Steel Co., Ltd. | White Steel Plate | 2,398,010 |

| Liaoning Xingye Import and Export LLC. | Titanium Plate | 1,689,090 |

| Jiangmen Special Stainless Steel Materiasls Co., Ltd. | White Steel Plate | 1,087,910 |

| Xi’an Lianyi Rubber Products Co., Ltd. | RubberMat.Spacer | 845,160 |

| Tianjing Taigang Daming Metalwork Co., Ltd. | Titanium Plate | 639,661 |

11

| Dashiqiao Petrochemical Machinery Forging Factory | Forging | 627,242 |

| Shenyang Tong Feng Da Material Co., Ltd. | Carbon Steel Pate | 626,964 |

| Shenyang Jixing Jingye Steel Co., Ltd. | Carbon Steel Pate | 503,075 |

| Langfang Shengong Forging Product Co., Ltd. | Forging | 490,266 |

We pay the entire purchase price for the raw materials upon delivery. For materials purchased domestically, we pay 100% on receipt. For imported materials, we are usually required to make 30% deposit upon making an order with the balance due upon receipt.

Customers

Our customers are widely dispersed throughout various industries, including metallurgy, heat and power, petrochemical, food and beverage, pharmaceutical and shipbuilding. Our products have been well received by Fortune 500 companies in large projects worldwide. The following table identifies some of our customers and the projects in which our products have been used.*

*All marks are trademarks or registered trademarks of their respective owners. The display of trademarks herein does not imply that a license of any kind has been granted.

The following table sets forth our top ten customers in 2016:

12

Customer |

Main Products |

Amount (in thousands of U.S. Dollars) (without VAT) |

% of Sales Revenue |

| Liaoning Huiming International Trade Co., Ltd. | Plate Heat Units | 1,710,814.42 | 4% |

| Jinlin Tongda Heat Transfer System Integration, Ltd | Plate Heat Exchanger | 1,309,520.42 | 3% |

| Hulunbeier Northeasten Fufeng Biotechnology Co., Ltd. | Plate Heat Exchanger | 1,273,853.60 | 3% |

| Jiuquan Chunguang New Energy Heating Co., Ltd | Plate Heat Units | 1,249,948.26 | 3% |

| Shanxi Hongtu Construction Engineering Co., Ltd. - the Tenth Branch | Plate Heat Exchanger | 1,222,286.00 | 3% |

| Bayanzhuoer Yangguang Energy Co., Ltd. | Plate Heat Units | 1,129,035.36 | 2% |

| Xingrun Construction Engineering Co., Ltd. | Plate Heat Units | 1,020,690.64 | 2% |

| Taiyuan Heating Company | Plate Heat Exchanger | 840,004.85 | 2% |

| Tebian Electric Apparatus Stock Co. Ltd. - Energy and Power Branch | Plate Heat Units | 824,721.39 | 2% |

| Chengde thermoelectric engineering installation Co., Ltd. | Plate Heat Units | 758,061.78 | 2% |

The following table sets forth our top ten customers in 2015:

Customer |

Main Products |

Amount (in thousands of U.S. Dollars) (without VAT) |

% of Sales Revenue |

| Huaxia Hanhua Chemical equipment Co., Ltd. | Plate Heat Exchanger | 2,367,181 | 5% |

| Qingdao Thermoelectric Engineering Co., Ltd. | Heat Exchanger Unit | 1,627,708 | 4% |

| Tongfang Ted Inter Science &Technology (Beijing)Co., Ltd. | Plate Heat Exchanger | 1,576,746 | 3% |

| Guazhou Heating Power Co., Ltd. | Heat Exchanger Unit | 1,205,749 | 3% |

| Youyu Xincheng Heating Power Co., Ltd. | Heat Exchanger Unit | 1,142,951 | 2% |

| Taiyuan Heating Company | Plate Heat Exchanger | 1,098,716 | 2% |

| Heihe Thermal Power Plant | Plate-and-Shell Heat Exchanger | 1,000,484 | 2% |

| Ningxia Electric Heating Power Co., Ltd. | Heat Exchanger Unit | 983,768 | 2% |

| Jinan Thermoelectric Engineering Co., Ltd. | Heat Exchanger Unit | 895,722 | 2% |

| Longji Taihe Industrial(Baoding) Co., Ltd. | Heat Exchanger Unit | 879,788 | 2% |

Sales and Marketing

As of December 31, 2016, our sales force consisted of 135 experienced sales people organized into four groups based on industry: metallurgy, heat and power, petrochemical and shipbuilding. Each group specializes in serving our customers in their specific industry. We believe this specialization allows our sales people to be more focused and equipped with superior industry knowledge and experience.

The following table sets forth the location of our sales offices:

13

| Region | Number of Offices | Location |

| Northern China | 4 | Harbin, Shenyang, Baotou, Beijing |

| Eastern China | 2 | Qingdao, Shanghai |

| Central China | 3 | Wuhan, Zhengzhou,Hangzhou |

| Western China | 4 | Xi’an, Taiyuan, Chengdu, Urumqi |

Each sales office makes direct sales and provides after-sales services to the customers in its area. Our sales offices in Qingdao, Wuhan, Xi’an, Zhengzhou, Taiyuan, Chengdu, Harbin, Shenyang, Urumqi and Baotou are focused on sales to the heating and power industry while our Shanghai and Hangzhou sales offices are focused on sales to the shipbuilding industry.

Competition

The heat exchanger market in China is very fragmented and competitive. There are over 1,500heat exchanger manufacturers in China, most of which are relatively small in size. As a leading heat exchanger manufacturer in China, we mainly face competition from the leading domestic players including SmartHeat, Shanghai Accessen and Lanzhou Lanshi, as well as the leading international players including Alfa Laval and Aluminium Plant & Vessel Company Limited, or APV, each of whom has a presence in China. The following is a brief summary and analysis of our major competitors:

-

Alfa Laval is the largest plate heat exchanger manufacturer in the world. Alfa Laval has the broadest range of products covering application in almost all applicable industries. Since it also produces other industrial products like separators, Alfa Laval is also able to provide customers with integrated solutions of heat exchangers and other industrial products.Alfa Laval is especially strong in providing shell-and-tube heat exchangerproducts to the food and beverage and pharmaceutical industries. Alfa Laval is our key competitor in almost all industries. As compared to Alfa Laval, we are able to provide products of similar quality at a lower price.

-

APV is one of the most established plate heat exchanger manufacturers in the world. Founded by Dr. Richard Seligman, who made the first plate heat exchanger in 1910, APV was acquired by SPX, a multi-national company listed on the New York Stock Exchange, in 2008. APV is especially strong in providing solutions and products for the power industry.As compared to APV, we have a broader range of products and larger production capacity and sales volume in China.

-

SmartHeat, Inc. is a Chinese manufacturer of heat exchangers. Its production facility is located in Shenyang, Northeast China. SmartHeat manufactures and sells plate heat exchangers, heat exchanger units and heat meters.Itused to be the original equipment manufacturer service provider of Sondex, the Denmark manufacturer of plate heat exchangers, who is an especially strong competitor in the oil and gas industry. SmartHeat is more experienced than us in producing heat exchanger units but does not produce shell-and-tube heat exchangers. As compared to SmartHeat, we believe that we have stronger research and development capabilities,a wider range of products and that we have a more established track record in the industry.

-

Shanghai Accessen is a Chinese manufacturer of heat exchangers with its production facility in Shanghai. It started to produce and sell plate heat exchangers and heat exchanger units under its own brand in 2002 but does not produce shell-and-tube heat exchangers. As compared to Accessen, we believe that we have stronger research and development capabilities andwider range of products. We also believe that we have a more established track record in the industry and that we are much larger than Accessen in terms of production capacity and sales volume.

-

Lanzhou Lanshi is a Chinese manufacturer of heat exchangers with its production facility in Lanzhou, Northwest China. It manufactures and sells plate heat exchangers and heat exchanger units. Lanzhou Lanshi caters to the alumina production market. As compared to Lanshi, we believe that we have stronger research and development capabilities and a broader range of products. We are also much larger than Lanshi in terms of production capacity and sales volume.

14

Intellectual Property

We sell all our products under trademarks of “巨元” and “THT.” “巨元” has been registered with the State Trademark Bureau of PRC and has a valid term of ten years expiring August 20, 2020. “THT” has been registered with the State Trademark Bureau of PRC since July 14, 2009 and has a valid term of ten years expiring July 13, 2019.

We own fifteen patents, all of which are for utility models. The term of the patents, as stipulated by the PRC Patent Law, is ten years starting from the authorization date. The following table lists our patents, their registration and certificate numbers and their authorization dates:

Patents |

Registration No. |

Certificate No. |

Authorization Date |

| Shell and tube helix baffle plate heat exchanger | ZL201020107719.2 | 1565896 | 2010-10-20 |

| High efficiency wide flow channel disassemble plate heat exchanger | ZL200920093790.7 | 1512219 | 2010-08-18 |

| Special high efficiency detachable type heat exchanger heat transfer plate | ZL200920094384.2 | 1565896 | 2010-05-12 |

| A kind of plate heat exchanger use in air conditioning industry | ZL200920094383.8 | 1411275 | 2010-05-12 |

| Variable section flow channel plate heat exchanger | ZL200720093847.4 | 1109105 | 2008-10-08 |

| Wide flow channel disassemble plate heat exchanger | ZL200520127760.5 | 876165 | 2007-03-07 |

| Wide flow channel welded plate heat exchanger | ZL200520127762.4 | 842256 | 2006-11-29 |

| Large-scale closed cooling water circulator | ZL200520127763.9 | CN 2842348Y | 2006-11-29 |

| Block type heat exchanger | ZL200520127761X | 842022 | 2006-11-29 |

| Powder heat exchanger | ZL20120579425.X | 1817117 | 2010-10-28 |

| Semi-welded plate heat exchanger | ZL201120167533.0 | 2055400 | 2011-12-28 |

| O-ring composite sealing gasket with U type protective use in plate heat exchanger | ZL201120459019.4 | 2298122 | 2012-07-11 |

| Plate heat exchangers with double sealed washer | ZL201120444804.2 | 2276392 | 2012-07-04 |

| Plate and shell heat exchanger with countercurrent circular plate | ZL201220225259.2 | 2557243 | 2012-12-05 |

| Main pump lube oil cooler | ZL201220225258.8 | 2555906 | 2012-05-18 |

| Efficient detachable wide channel plate heat exchanger | ZL200910067086.9 | 1124253 | 2013-1-23 |

| Hybrid heat heater for heating network | ZL201220679204.9 | 2925929 | 2013-5-29 |

| Vertical floating-head heat exchanger | ZL201320105056.4 | 3099993 | 2013-8-14 |

| Double seal high-pressure plate heat exchanger | ZL201320297235.2 | 3341805 | 2013-12-25 |

Regulation

Because our primary operating subsidiaries are located in China, we are subject to China’s national and local laws, including those outlined below. We believe that we are in material compliance with all registrations and requirements for the issuance and maintenance of all licenses required by the governing bodies, and that all license fees and filings are current.

We do not face any significant government regulation in connection with the production of our products. We do not require any special government permits to produce our products other than those permits that are required of all corporations in China.

15

Environmental Matters

Our manufacturing facilities are subject to various pollution control regulations with respect to noise and air pollution and the disposal of waste and hazardous materials. We also are subject to periodic inspections by local environmental protection authorities. Our operating subsidiaries have received certifications from the relevant PRC government agencies indicating that their business operations are in material compliance with the relevant PRC environmental laws and regulations. We are not currently subject to any pending actions alleging any violations of applicable PRC environmental laws.

Occupational Health and Safety

The Standing Committee of the National People’s Congress promulgated the PRC Safe Production Law on June 29, 2002, which sets out the legal framework to achieve and ensure safety in the production and operation activities of enterprises. Under the Safe Production Law, enterprises are required to establish internal safety systems and regulations, set up internal organization or appoint responsible personnel for safety affairs, to provide necessary safe working conditions and to strictly follow the State or industrial standards in relation to safe production. Enterprises which do not satisfy the facilities and conditions required under the laws and the State or industrial standards are not allowed to start or continue their production or operation activities. Enterprises are also required to set up obvious safety caution signals on those production or operation sites, facilities or equipment where there is a material potential risk for safety and shall further provide protective uniforms and personal care products to the field employees for their personal protection.

The PRC Law on the Prevention and Treatment of Occupational Diseases, which was promulgated on October 27, 2001 and became effective on May 1, 2002, requires that work environment and conditions established or provided by employers meet the occupational health standards and requirements of the State, and that employers shall further adopt and implement measures to assure employees’ access to occupational health protection. The employers are also required to participate in social insurance for work-related injury in accordance with the law and declare to and be supervised by the relevant health authorities if the employers are engaged in those harmful projects listed in the Occupational Diseases Catalogue.

We have not experienced any incident of injury or death due to violation of health and safety regulations. We have adopted a set of safety and occupational health protection procedures and standards, based on the specifications and guidelines set out under the PRC laws and regulations.

Regulations on Protection of Intellectual Property Rights

China has adopted legislation governing protection of intellectual property rights, including copyrights, trademarks and patents. China is a signatory to the main international conventions governing protection of intellectual property rights and became a member of the Agreement on the Trade Related Aspects of Intellectual Property Rights upon its accession to the World Trade Organization in December 2001.

The PRC Patent Law, adopted in 1984 and revised in 1992, 2000 and 2008, respectively, and the Implementing Rules of the PRC Patent Law, promulgated by the State Council in 2001 and revised in 2002 and 2010 respectively, govern and protect the proprietary rights to registered patents. The State Intellectual Property Office, or SIPO, handles patent registration and grants a term of twenty years to inventions and a term of ten years to utility models and designs. The protection to patent rights may be terminated before expiry of the term granted as a result of the failure of the registrant to pay the annual registration fee accordingly. Patent license agreements and transfer agreements must be filed with the SIPO for record.

Land Use Rights

All urban land in China is owned by the State. Pursuant to Interim Regulations of the People’s Republic of China Concerning the Assignment and Transfer of the Right to the Use of the State-owned Land in the Urban Areas, which became effective on May 19, 1990, individuals and companies are permitted to acquire rights to use urban land or land use rights for specific purposes, including residential, industrial and commercial purposes. The land use rights are granted for a period of 70 years for residential purposes, 50 years for industrial purposes and 40 years for commercial purposes. These periods may be renewed at the expiration of the initial and any subsequent terms. Upon approval by both the land administrative authorities and city planning authorities, industrial parcel uses may be converted to other uses, and the duration and other clauses in the land use right granting agreement will be revised to match the new use. Granted land use rights are transferable and may be used as security for borrowings and other obligations. We have received the necessary land use right certificates for the properties described under Item 2 “Properties.”

16

Foreign Currency Exchange

The majority of our sales revenue and expenses are denominated in RMB. Under the PRC foreign currency exchange regulations applicable to us, RMB is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Currently, our PRC operating subsidiaries may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, employee salaries (even if employees are based outside of China), and payment for equipment purchases outside of China, without the approval of the State Administration of Foreign Exchange of the People’s Republic of China, or SAFE, by complying with certain procedural requirements. Conversion of RMB for capital account items, such as direct investment, loan, security investment and repatriation of investment, however, is still subject to the approval of SAFE. In particular, if our PRC operating subsidiaries borrow foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance the subsidiaries by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the Ministry of Commerce, or MOFCOM, or their respective local branches. These limitations could affect our PRC operating subsidiaries’ ability to obtain foreign exchange through debt or equity financing. In the event of a liquidation of our PRC subsidiaries, SAFE approval is required before the remaining proceeds can be expatriated from China.

Taxation

On March 16, 2007, the National People's Congress of China passed a new Enterprise Income Tax Law, or EIT Law, and on November 28, 2007, the State Council of China passed its implementing rules, which took effect on January 1, 2008. Before the implementation of the EIT Law, foreign invested enterprises, or FIEs, established in the PRC, unless granted preferential tax treatments by the PRC government, were generally subject to an earned income tax, or EIT, rate of 33.0%, which included a 30.0% state income tax and a 3.0% local income tax. The EIT Law and its implementing rules impose a unified EIT of 25.0% on all domestic-invested enterprises and FIEs, unless they qualify under certain limited exceptions. Despite these changes, the EIT Law gives FIEs established before March 16, 2007, or Old FIEs, a five-year grandfather period during which they can continue to enjoy their existing preferential tax treatments. During this five-year grandfather period, the Old FIEs which enjoyed tax rates lower than 25% under the original EIT law will be subject to gradually increased EIT rates over a 5-year period until their tax rate reaches 25%. In addition, the Old FIEs that are eligible for other preferential tax treatments by the PRC government under the original EIT law are allowed to continue enjoying their preference until these preferential treatment periods expire.

In addition to the changes to the current tax structure, under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a resident enterprise and will normally be subject to an EIT of 25% on its global income. The implementing rules define the term “de facto management bodies” as “an establishment that exercises, in substance, overall management and control over the production, business, personnel, accounting, etc., of a Chinese enterprise.” If the PRC tax authorities subsequently determine that we should be classified as a resident enterprise, then our organization’s global income will be subject to PRC income tax of 25%. For detailed discussion of PRC tax issues related to resident enterprise status, see Item 1A “Risk Factors—Risks Related to Doing Business in China—Under the Enterprise Income Tax Law, we may be classified as a ‘resident enterprise’ of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.”

In addition, the EIT Law and its implementing rules generally provide that an income tax rate of 10% will normally be applicable to dividends payable to investors that are “non-resident enterprises,” or non-resident investors, which (i) do not have an establishment or place of business in the PRC or (ii) have an establishment or place of business in the PRC, but the relevant income is not effectively connected with the establishment or place of business to the extent such dividends are derived from sources within the PRC. The State Council of the PRC or a tax treaty between China and the jurisdictions in which the non-PRC investors reside may reduce such income tax. Under the Arrangement between the Mainland and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income, effective as of January 1, 2007, such dividend withholding tax rate is reduced to 5% if a Hong Kong resident enterprise owns over 25% of the PRC company distributing the dividends. As Star Wealth is a Hong Kong company and owns 100% of Siping Juyuan, under the aforesaid arrangement, any dividends that Siping Juyuan pays Star Wealth may be subject to a withholding tax at the rate of 5%. However, if Star Wealth is not considered to be the “beneficial owner” of such dividends under the Notice Regarding Interpretation and Recognition of Beneficial Owners under Tax Treaties, or Notice 601, promulgated by the State Administration of Taxation on October 27, 2009, such dividends would be subject to the withholding tax rate of 10%. The withholding tax rate of 5% or 10% applicable to Star Wealth will have a significant impact on the amount of dividends to be received by the Company and ultimately by stockholders.

17

Pursuant to the Provisional Regulation of China on Value Added Tax and its implementing rules, all entities and individuals that are engaged in the sale of goods, the provision of repairs and replacement services and the importation of goods in China are generally required to pay value added tax, or VAT, at a rate of 17.0% of the gross sales proceeds received, less any deductible VAT already paid or borne by the taxpayer. Further, when exporting goods, the exporter is entitled to some or all of the refund of VAT that it has already paid or borne.

Dividend Distributions

All of our sales are earned by our PRC subsidiaries. However, PRC regulations restrict the ability of our PRC subsidiaries to make dividends and other payments to its offshore parent company. PRC legal restrictions permit payments of dividends by our PRC subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiaries are also required under PRC laws and regulations to allocate at least 10% of their annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of our registered capital. Allocations to these statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances, or cash dividends.

Circular 37

On July 4, 2014, SAFE issued the Notice on Relevant Issues Relating to Domestic Residents’ Investment and Financing and Round-Trip Investment through Special Purpose Vehicles, or Circular 37. Circular 37 repeals and replaces the Notice on Relevant Issues Concerning Foreign Exchange Administration for Domestic Residents to Engage in Overseas Financing and Round Trip Investment via Overseas Special Purpose Vehicles, or Circular 75. Circular 37 regulates the foreign exchange matters in relation to the use of a special purpose vehicle, or SPV, by PRC residents to seek offshore equity financing and conduct “round trip investment” in China. Under Circular 37, a SPV refers to an offshore entity established or controlled, directly or indirectly, by PRC residents or PRC entities for the purpose of investing or obtaining financing, utilizing assets or interests legally held by such domestic residents. Circular 37 requires that, before establishing or controlling a SPV, PRC residents and PRC entities are required to complete foreign exchange registration with the local offices of SAFE for their overseas investments. Circular 37 further requires amendment to the registration in the event of any significant changes to the SPV. Failure to fulfill the required registration may result in being prohibited from making profit distributions to the offshore parent and from carrying out subsequent cross-border foreign exchange activities.

As we stated under Item 1A “Risk factors—Risks Related to Doing Business in China—Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident stockholders to personal liability, limit our ability to acquire PRC companies or to inject capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute profits to us or otherwise materially adversely affect us,” we have asked our stockholders, who are PRC residents as defined in Circular 75, to register with the relevant branch of SAFE, as then required, in connection with their equity interests in us and our acquisitions of equity interests in our PRC subsidiaries. Circular 37 shall apply to any subsequent amendments made by our stockholders after the effective date of Circular 37. However, we cannot predict how Circular 37 will affect our business operations or future strategies. For example, our present and prospective PRC subsidiaries’ ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 37 by our PRC resident beneficial holders.

Mergers and Acquisitions

On August 8, 2006, six PRC regulatory agencies promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, or the M&A Rule, which became effective on September 8, 2006. According to the M&A Rule, a “Round-trip Investment” is defined as having taken place when a PRC business that is owned by PRC individual(s) is sold to a non-PRC entity that is established or controlled, directly or indirectly, by those same PRC individual(s). Under the M&A Rule, any Round-trip Investment must be approved by MOFCOM and any indirect arrangement or series of arrangements which achieves the same end result without the approval of MOFCOM is a violation of PRC law.

On June 30, 2009, Mr. Guohong Zhao, our Chairman and CEO and a founder of Siping Juyuan, entered into an option agreement with Ms. Jinghua Zhao, the sole shareholder of Wisetop, pursuant to which Mr. Guohong Zhao was granted an option, exercisable after 180 days, to acquire all of the equity interests of Wisetop owned by Ms. Jinghua Zhao at an exercise price of $3,246,160. This initial expiration date of the option was June 30, 2011, however, on May 16, 2011, the parties extended the expiration date to June 30, 2012. On November 29, 2011, Mr. Zhao exercised his option.

18

Also on June 30, 2009, Wisetop entered into separate option agreements with the other original founders of Siping Juyuan, pursuant to which such founders were granted options, exercisable after 90 days, to purchase an aggregate of 10,240,786 shares of our common stock owned by Wisetop at a total exercise price of $7,291,440. The founders exercised their options on December 17, 2010. On December 17, 2010, the founders exercised their options and the shares were transferred to the founders. Wisetop owned 4,559,214 after the option exercise.

After Mr. Guohong Zhao and the founders (collectively referred to herein as the PRC Individuals) exercised their options, they became our controlling stockholders. Their acquisition of our equity interest, or the Acquisition, is required to be registered with the competent administration of industry and commerce authorities, or AIC, in Beijing. The PRC Individuals are required to make filings with the Beijing SAFE, to register the Company and its non-PRC subsidiaries to qualify them as SPVs, pursuant to Circular 75 and Circular 106.

As we stated under Item 1A “Risk factors—Risks Related to Doing Business in China—Our business and financial performance may be materially adversely affected if the PRC regulatory authorities determine that our acquisition of Siping Juyuan constitutes a Round-trip Investment without MOFCOM approval,” the PRC regulatory authorities may take the view that the Acquisition and the reverse acquisition of Megaway are part of an overall series of arrangements which constitute a Round-trip Investment because at the end of these transactions the PRC Individuals became the majority owners and effective controlling parties of a foreign entity that acquired ownership of our Chinese subsidiaries. The PRC regulatory authorities may also take the view that the registration of the Acquisition with the relevant AIC in Beijing and the filings with the Beijing SAFE may not be evidence that the Acquisition has been properly approved because the relevant parties did not fully disclose to the AIC, SAFE or MOFCOM the overall restructuring arrangements, the existence of the reverse acquisition of Megaway and its link with the Acquisition. If the PRC regulatory authorities take the view that the Acquisition constitutes a Round-trip Investment without MOFCOM approval, they could invalidate our acquisition and ownership of our Chinese subsidiaries. We believe that if this takes place, we may be able to find a way to re-establish control of our Chinese subsidiaries’ business operations through a series of contractual arrangements rather than an outright purchase of our Chinese subsidiaries, but we cannot assure you that such contractual arrangements will be protected by PRC law or that we can receive as complete or effective economic benefit and overall control of our Chinese subsidiaries’ business than if the Company had direct ownership of our Chinese subsidiaries. In addition, we cannot assure you that such contractual arrangements can be successfully effected under PRC law.

Employees

As of December 31, 2016, we employed a total of 576 full-time employees. The following table sets forth the number of employees by function:

| Function | Number of Employees |

| Senior Management | 7 |

| Solution design | 9 |

| Sales | 11 |

| Marketing | 124 |

| Procurement | 8 |

| Production | 295 |

| Quality Control | 20 |

| R&D | 59 |

| HR &Administration | 34 |

| Finance | 7 |

| Internal Audit and Control | 2 |

| TOTAL | 576 |

As required by applicable PRC law, we have entered into employment contracts with most of our officers, managers and employees. We are working towards entering employment contracts with those employees who do not currently have employment contracts with us. We believe that we maintain a satisfactory working relationship with our employees, and we have not experienced any significant disputes or any difficulty in recruiting staff for our operations.

Our employees in China participate in a state pension scheme organized by PRC municipal and provincial governments. We are currently required to contribute to the scheme at a rate of 30.6% to 31.2% of an employee’s average monthly salary.

19

In addition, we are required by PRC law to cover employees in China with various types of social insurance, and we believe that we are in material compliance with the relevant PRC laws.

Insurance

We maintain property insurance for our premises located at Siping, China where our main production facilities are located. The aggregate maximum amount covered by our insurance policy is up to RMB 25.39 million (approximately $3.72 million). We also maintain property insurance for our automobiles. We do not maintain business interruption, product liability insurance or key-man life insurance. We believe our insurance coverage is customary and standard of companies of comparable size in comparable industries in China. However, we cannot ensure that our existing insurance policies are sufficient to insulate us from all loses and liabilities that we may incur.

ITEM 1A. RISK FACTORS.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

RISKS RELATED TO OUR BUSINESS

We face risks related to general domestic and global economic conditions and our revenue will decrease if the industries in which our customers operate experience a protracted slowdown.

The uncertainty arising out of domestic and global economic conditions, including the recent disruption in credit markets, poses a risk to the PRC economy and may impact our ability to manage normal relationships with our customers, suppliers and creditors. If the current situation deteriorates significantly, our business could be materially negatively impacted, as demand for our products and services may decrease from a slow-down in the general economy, or supplier or customer disruptions may result from tighter credit markets.

In addition, because our products mainly serve as key components in projects operated by our customers who are mostly in the chemical, metallurgical, shipbuilding, HVAC and district heating industries, we are subject to the general changes in economic conditions affecting those industry segments of the economy. If the industry segments in which our customers operate do not grow or if there is a contraction in those industries, demand for our products will decrease. Demand for our products is typically affected by a number of overarching economic factors, including, but not limited to, interest rates, the availability and magnitude of private and governmental investment in infrastructure projects and the health of the overall global economy. If there is a decline in economic activity in China and the other markets in which we operate or a protracted slowdown in industries on which we rely for our sales, demand for our products and our revenue will likewise decrease.

Our industry is very competitive in China.

The domestic market for heat exchange products is fragmented and highly competitive. We compete with over 1,500 small-sized, local Chinese heat exchanger manufacturers. The number of these companies varies from time to time. While we may have greater resources than our smaller competitors, it is possible that these competitors have better access in certain local markets to customers and prospects and lower production and raw material costs. Some of our products compete on the basis of price and are sold in fragmented markets with low barriers to entry, allowing less expensive domestic producers to gain market share and reduce our margins.

Foreign competition is intense and could have a material adverse effect on our financial condition and results of operations.

In addition to domestic competition, we face intense competition from foreign competitors. The intensity of foreign competition is affected significantly by fluctuations in the value of the U.S. dollar against Chinese currency and by the level of import duties imposed by the Chinese government on certain products. Our major international competitors are Alfa Laval and APV. Many of our competitors have more resources and greater brand recognition than we enjoy. While our resources may not be as great as our larger competitors, we believe our product quality and direct sales offices and distribution network are superior in China. If our competitors are able to gain greater market share or improve their sales efforts, our sales may decrease, we may be forced to lower our prices, or our marketing costs may increase, all of which could negatively impact our financial results.

20

A significant amount of our sales revenue are derived from our largest customers and any reduction in revenue from any of these customers would reduce our sales revenue and net income.

Approximately 36% of our sales revenue in 2016 came from our top ten customers, with our largest customer, Liaoning Huiming International Trade Co., Ltd., accounting for approximately 4% of our sales revenue in 2016. If we cease to do business at or above current levels with the top customers or with any other large customers who contribute significantly to our sales revenue, and we are unable to generate additional or substitute sales revenue, our net income would decline considerably.

Any decrease in the availability, or increase in the cost, of raw materials could materially affect our earnings.

Our operations depend heavily on the availability of various raw materials. The raw materials for our operations are mainly metal plates made of stainless steel, carbon steel, titanium steel, nickel steel and other steel based alloy. The availability of raw materials may decrease and their prices may fluctuate greatly. We have long-term relationships with several suppliers; however, if our suppliers are unable or unwilling to provide us with raw materials on terms favorable to us, we may be unable to produce certain products. This could result in a decrease in profit and damage to our reputation in our industry. In the event our raw material and energy costs increase, we may not be able to pass these higher costs on to our customers in full or at all. Any increase in the prices for raw materials or energy resources could materially increase our costs and therefore lower our earnings. Additionally, certain of our supply contracts are for fixed prices. Although we currently benefit from favorable pricing in some of these supply contracts, if market prices for these raw materials decline, we may not be able to take advantage of decreasing market prices, and our profit margins may suffer.

Our rapid expansion could significantly strain our resources, management and operational infrastructure which could impair our ability to meet increased demand for our products and hurt our business results.

To accommodate our anticipated growth, we will need to expend capital resources and dedicate personnel to implement and upgrade our accounting, operational and internal management systems and enhance our record keeping and contract tracking system. Such measures will require us to dedicate additional financial resources and personnel to optimize our operational infrastructure and to recruit more personnel to train and manage our growing employee base. If we cannot successfully implement these measures efficiently and cost-effectively, we will be unable to satisfy the demand for our products, which will impair our revenue growth and hurt our overall financial performance.

Our business is capital intensive and our growth strategy may require additional capital which may not be available on favorable terms or at all.

We believe that our current cash and cash flow from operations will be sufficient to meet our present and reasonably anticipated capital and capital expenditure needs given the current state of our production line for the marketing of the products. We may, however, require additional cash resources due to changed business conditions, implementation of our strategy to expand our manufacturing capacity or other investments or acquisitions we may decide to pursue. If our own financial resources are insufficient to satisfy our capital requirements, we may seek to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity securities could result in dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financial covenants that would restrict our operations. Financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, could limit our ability to expand our business operations and could harm our overall business prospects.

We depend heavily on key personnel, and turnover of key employees and senior management could harm our business.