Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K | ||

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 28, 2017 | ||||

Commission file number 1-11609 | ||||

TOYS “R” US, INC.

(Exact name of registrant as specified in its charter) | ||||

Delaware | 22-3260693 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification Number) | |

One Geoffrey Way Wayne, New Jersey | 07470 | |

(Address of principal executive offices) | (Zip code) | |

(973) 617-3500 | ||||

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) or 12(g) of the Act: | ||||

None | ||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes x No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No ¨

(Note: As a voluntary filer not subject to the filing requirements of Section 13(a) or 15(d) of the Exchange Act, the registrant has filed all reports pursuant to Section 13(a) or 15(d) of the Exchange Act during the preceding 12 months as if the registrant were subject to such filing requirements.)

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one)

Large accelerated filer | ¨ | Accelerated filer | ¨ | ||

Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |

Emerging growth company | ¨ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of March 17, 2017, there were 49,353,943 outstanding shares of common stock, $0.001 par value per share, of Toys “R” Us, Inc., none of which were publicly traded.

DOCUMENTS INCORPORATED BY REFERENCE

None

Forward-Looking Statements

This Annual Report on Form 10-K, the other reports and documents that we have filed or may in the future file with the Securities and Exchange Commission and other publicly released materials and statements, both oral and written, that we have made or may make in the future, may contain “forward looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such disclosures are intended to be covered by the safe harbors created thereby. These forward looking statements reflect our current views with respect to, among other things, our operations and financial performance. All statements herein or therein that are not historical facts, including statements about our beliefs or expectations, are forward-looking statements. We generally identify these statements by words or phrases, such as “anticipate,” “estimate,” “plan,” “project,” “expect,” “believe,” “intend,” “foresee,” “forecast,” “will,” “may,” “outlook” or the negative version of these words or other similar words or phrases. These statements discuss, among other things, our strategy, our “Strategic Pillars,” store openings, integration and remodeling, the development, implementation and integration of our e-commerce business, future financial or operational performance, projected sales for certain periods, same store sales from one period to another, cost savings, results of store closings and restructurings, outcome or impact of pending or threatened litigation, domestic or international developments, amount and allocation of future capital expenditures, growth initiatives, inventory levels, cost of goods, selection and type of merchandise, marketing positions, implementation of safety standards, access to trade credit, future financings, refinancings and debt repayments, estimates regarding future effective tax rates, future interest payments, and other goals and targets and statements of the assumptions underlying or relating to any such statements.

These statements are subject to risks, uncertainties and other factors, including, among others, the seasonality of our business, competition in the retail industry, changes in our product distribution mix and distribution channels, general economic factors in the United States and other countries in which we conduct our business, consumer spending patterns, birth rates, our ability to implement our strategy including implementing initiatives for season, our ability to recognize cost savings, implementation and operation of our new e-commerce platform, marketing strategies, the availability of adequate financing, ability to repatriate cash from our foreign operations, ability to distribute cash from our operating subsidiaries to their parent entities, access to trade credit, changes in consumer preferences, changes in employment legislation, our dependence on key vendors for our merchandise, political and other developments associated with our international operations, costs of goods that we sell, labor costs, transportation costs, domestic and international events affecting the delivery of toys and other products to our stores, product safety issues including product recalls, the existence of adverse litigation, changes in laws including tax that impact our business, our substantial level of indebtedness and related debt-service obligations, restrictions imposed by covenants in our debt agreements and other risks, uncertainties and factors set forth under Item 1A entitled “RISK FACTORS” of this Annual Report on Form 10-K and in our other reports and documents filed with the Securities and Exchange Commission. In addition, we earn a disproportionate part of our annual operating earnings in the fourth quarter as a result of seasonal buying patterns and these buying patterns are difficult to forecast with certainty. These factors should not be construed as exhaustive, and should be read in conjunction with the other cautionary statements that are included in this report. We believe that all forward-looking statements are based on reasonable assumptions when made; however, we caution that it is impossible to predict actual results or outcomes or the effects of risks, uncertainties or other factors on anticipated results or outcomes and that, accordingly, one should not place undue reliance on these statements. Forward-looking statements speak only as of the date they were made, and we undertake no obligation to update these statements in light of subsequent events or developments unless required by the Securities and Exchange Commission’s rules and regulations. Actual results and outcomes may differ materially from anticipated results or outcomes discussed in any forward-looking statement.

INDEX

PAGE | ||

PART I. | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV. | ||

Item 15. | ||

Item 16. | ||

PART I

ITEM 1. | BUSINESS |

As used herein, the “Company,” “we,” “us,” or “our” means Toys “R” Us, Inc., and its consolidated subsidiaries, except as expressly indicated or unless the context otherwise requires. Our fiscal year ends on the Saturday nearest to January 31 of each calendar year. This Annual Report on Form 10-K focuses on our last three fiscal years ended as follows: fiscal 2016 ended January 28, 2017; fiscal 2015 ended January 30, 2016; and fiscal 2014 ended January 31, 2015. References to 2016, 2015 and 2014 are to our fiscal years unless otherwise specified.

Overview

We are relentlessly striving to be the best toy and baby products retail company for the world! Our purpose is to put huge smiles on the faces of children of all ages by being the world’s greatest toy store and to make it easier for parents to make the best possible choices as they care for their babies.

We are the leading global specialty retailer of toys and baby products as measured by Net sales. We believe our Toys “R” Us and Babies “R” Us brands are recognized as the toy and baby authority. We sell a variety of products in the baby, core toy, entertainment, learning and seasonal categories through our omnichannel offerings that leverage the synergies between our brick-and-mortar stores and e-commerce.

As of January 28, 2017, we operated 1,691 stores and licensed an additional 257 stores, which are located in 38 countries and jurisdictions around the world. We operate our stores under the Toys “R” Us and Babies “R” Us banners and also have smaller format Toys “R” Us Outlet stores (“Outlet”) and Toys “R” Us Express stores (“Express”). Our omnichannel presence includes our Toysrus.com and Babiesrus.com sites, as well as other e-commerce sites in our international markets. For fiscal 2016, we generated Net sales of $11,540 million, resulting in Net loss attributable to Toys “R” Us, Inc. of $36 million and Adjusted EBITDA of $792 million. For the definition of Adjusted EBITDA, an explanation of why we present it and a description of the limitations of this non-GAAP measure, as well as a reconciliation to Net loss attributable to Toys “R” Us, Inc., refer to Item 6 entitled “SELECTED FINANCIAL DATA” of this Annual Report on Form 10-K.

Our History

Our Company was founded in Washington D.C. in 1948 when Charles Lazarus opened a baby furniture store, Children’s Bargain Town. The Toys “R” Us name made its debut in 1957. In 1978, we completed an initial public offering of our common stock. When Charles Lazarus retired as our Chief Executive Officer (“CEO”) in 1994, we operated or licensed over 1,000 stores in 17 countries and jurisdictions. In 1996, we established the Babies “R” Us brand, further solidifying our reputation as a leading retail destination for children of all ages and their families.

On July 21, 2005, we were acquired by an investment group led by entities advised by or affiliated with Bain Capital Private Equity, L.P., Kohlberg Kravis Roberts & Co. L.P., and Vornado Realty Trust. We refer to this collective ownership group as our “Sponsors.” Upon the completion of this acquisition, we became a private company.

Leadership and Strategy

Since joining the Company in 2015, David A. Brandon, CEO and Chairman of the Board, has further strengthened our senior leadership team with a number of key hires across a broad range of disciplines, including communications, information technology, legal, marketing and operations. These hires, along with existing management, provide us with a fresh perspective on the business and bring with them a wealth of relevant experience and knowledge in leading key areas of our business.

Our Company has outlined the following key strategic growth initiatives, which we refer to as our “Strategic Pillars:”

• | Make Talent and Culture a Competitive Advantage. Create a culture of high performance, responsiveness and agility. |

• | Grow and Build the Toys “R” Us and Babies “R” Us Brands Throughout the World. Invest in our existing stores and e-commerce platforms and continue to grow our brands globally. |

• | Create a World Class Experience for Our Customers - Innovate and Lead. Develop empowered teams that strive for flawless execution in every aspect of the in-store and omnichannel experience. |

• | Create a Strong Financial Foundation. Continue to drive cost savings while we transition to our growth phase. |

1

Our Strengths

Strong Brand Equity

Our brand names are highly recognized in North America, Europe and Asia, and our expertise in the toy and baby products retail space, substantial scale and geographic footprint and strong vendor relationships account for our market-leading position and distinguish us from the competition. We believe we offer our customers the most comprehensive year-round selection of merchandise in the retail toy and baby categories through our “R” Us branded brick-and-mortar stores and e-commerce business. We seek to further differentiate ourselves from our competitors in several key areas, including our omnichannel presence, broad product assortment, private label and exclusively licensed product offerings and expert service which enables us to command a reputation as the shopping destination for toys and baby products.

Customer Experience

Every day we strive to improve the customer experience in our stores and online. This enables us to bring joy into the lives of our customers by being the toy and baby authority and definitive destination for kid fun, gift-giving solutions and parenting services. Compared with multi-line mass merchandisers, we believe we are able to provide more knowledgeable service to our customers through our highly trained sales force. We train our store team members to deepen their product knowledge and enhance their targeted selling skills in order to improve customer service.

To better leverage our physical presence, we are improving the shopping experience by bringing our stores to life. We have added feature shops in our stores that highlight several of our beacon brands, hot trends and featured movie properties, with larger than life graphic displays. Additionally, we are making our toy stores more interactive to engage kids and families. We are inviting customers to in-store events that offer free build-and-take toys, collect-and-trade days and toy demonstrations. Our Geoffrey’s Birthday Club was re-launched with in-store birthday celebrations for families to enjoy story time and meet Geoffrey himself. During the 2016 holidays, Babies “R” Us stores held a “Baby’s First Christmas” event and we offered professional Santa photo packages in select U.S. Toys “R” Us stores.

To improve shop-ability, our feature shops at the front of our toy stores are designed to help customers easily find what they’re looking for - a “Here’s What’s Hot Shop” with the hottest and trending toys in one convenient location and our “Gift Express” shop featuring grab-and-go gifts for $30 or less. Select U.S. stores are equipped with navigation, including digital store-specific maps to help customers pinpoint the location of the items they are looking for by using their smartphone on a navigational sign at the entrance to our stores. In addition, some of our Babies “R” Us store employees are equipped with tablets to help customers choose the perfect item from our webstore and order right on the spot. We are continuing to invest in our store appearance as part of our “Clean and Bright” initiative and enhance the customer experience by maintaining stronger in-stock positions in our stores and online for the hottest toys at competitive prices.

For the added convenience of our customers, we offer a layaway program and provide a home delivery service. Our “Price Match Guarantee” program matches competitors’ in-store and selected online retailer pricing on identical items.

2

E-Commerce and Omnichannel

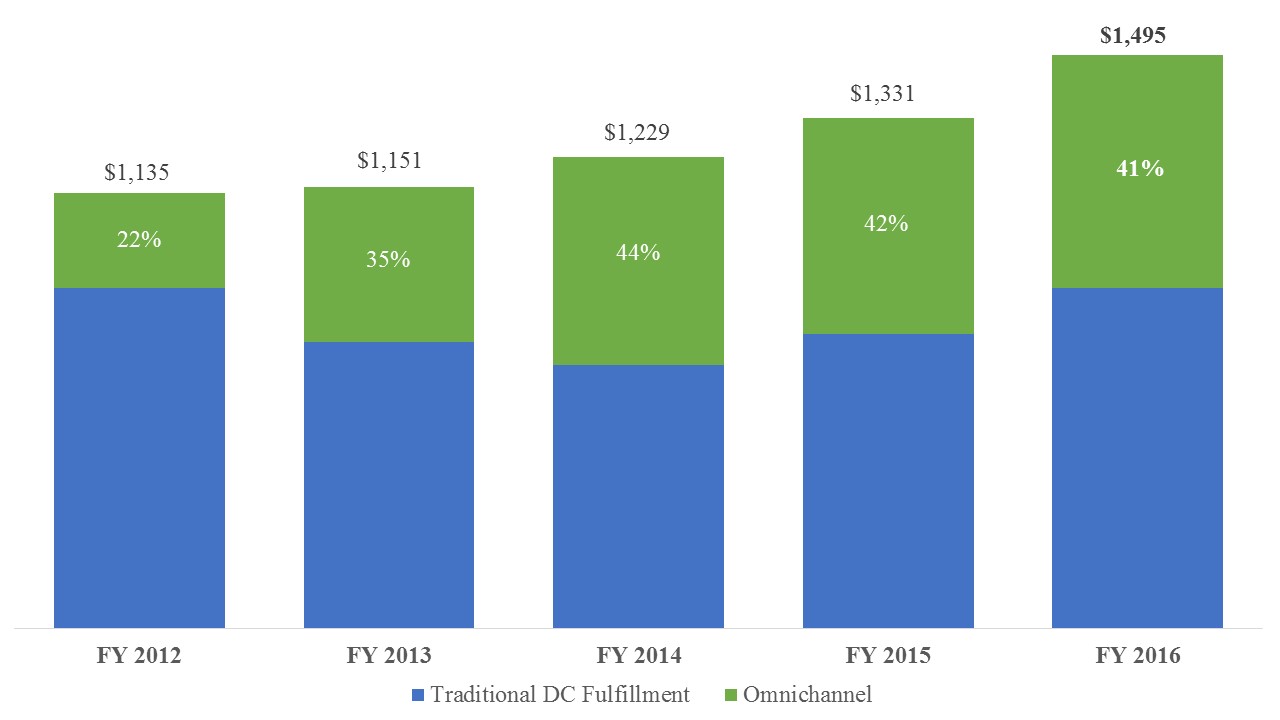

Over the past several years, we have driven growth in our e-commerce business, particularly within our omnichannel programs. For fiscal 2016, our consolidated e-commerce business generated net sales of $1,495 million, 41% of which was contributed by our omnichannel programs. The chart below shows our e-commerce net sales growth with the percentage of omnichannel fulfillment for the past five fiscal years:

($ In millions)

Our omnichannel capabilities through which we integrate our e-commerce and brick-and-mortar stores include the following:

• | Buy Online, Pick Up In Store. Available within all stores in the United States, United Kingdom, Canada and Germany. Offers customers the ability to browse and shop online and pick up their purchases in-store in as little as one hour. |

• | Ship to Store. Allows customers in the United States to purchase items online that may not be currently available in their local store, and have their order delivered to the local store of their choice, free of shipping charges. |

• | Ship from Store. Leverages inventory from our U.S. stores to improve the speed with which customers receive their online orders, as well as provide an additional option to fulfill these orders. This feature is also available in several of our international markets. |

• | Pay In Store. Provides customers the flexibility to shop online and pay for their items in any store across the United States. |

We are currently working towards the launch of our new Domestic e-commerce platform later in 2017 to transform and modernize our digital space. We aim to significantly improve the customer experience online and better integrate our omnichannel presence. We believe that this will provide us the flexibility needed to grow and allow us to respond to changing customer dynamics in an ever competitive marketplace. Over the past year, we have made improvements to our omnichannel fulfillment capacity, particularly through Ship from Store and improved staffing and training programs at our distribution centers, to meet peak demand during the holidays. In addition, our low everyday free shipping purchase minimum in the U.S. at Toysrus.com and Babiesrus.com is competitive in the marketplace.

Internationally, we have an online presence in 19 countries and jurisdictions, which includes Australia, Austria, Belgium, Canada, China, France, Germany, Hong Kong, Japan, Malaysia, Netherlands, Poland, Portugal, Singapore, Spain, Switzerland, Taiwan, Thailand and the United Kingdom, as well as in several of our licensed markets.

3

International Store Portfolio Expansion

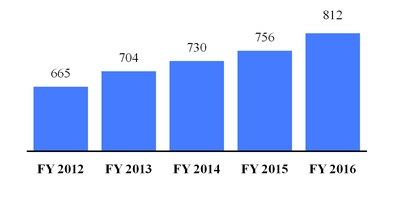

We believe that we have the potential to continue to grow the number of stores internationally, particularly those in the emerging markets which are seeing overall GDP growth. Our first licensed store in China opened in 2006 through our partnership with Fung Retailing. In fiscal 2011, the Company acquired a 70% ownership interest in Toys (Labuan) Holding Limited (“Asia JV”) from Fung Retailing, which included locations in Brunei, China, Hong Kong, Malaysia, Singapore, Taiwan and Thailand, consisting of 90 operating stores. Since the acquisition of Asia JV, we have more than doubled our store count and now operate 226 Toys “R” Us retail stores as of January 28, 2017. Our International segment operating store portfolio has grown by 22% since fiscal 2012:

Our licensed store base has also continued to expand as we identify opportunities in markets where we do not already have a physical store presence. As of January 28, 2017, we licensed 257 stores in 19 countries and jurisdictions, generating $18 million in licensing revenue.

Customer Loyalty Programs and Marketing

Domestically, we provide several programs that benefit customers throughout the year including:

Rewards “R” Us. With 19 million current active members, we believe this loyalty program results in an improved customer shopping experience and more frequent visits to our stores and online sites. In fiscal 2016, our valued loyalty members contributed approximately two-thirds of our Domestic Net sales and benefited from the program’s rewards and promotions. Members earn $5 for every $125 spent, with “R” Us credit cardholders earning double the rewards for every $1 spent. Through this program we offer a variety of exclusive one-time and ongoing benefits, deals and promotions to our customers, and allow them to earn and redeem points at our stores and online. This includes Bonus Points days, Black Friday previews, credit card promotions and eligibility to our Endless Earnings and Geoffrey’s Birthday Club programs.

Babies “R” Us Registry. Our baby business offers a broad range of baby products and delivers a high level of customer service and product knowledge to our customers. We provide a baby product assortment that draws new and repeat customers to our Baby Registry Program, with over 23 million registrants since inception. Our Baby Registry program is important to building our baby business. Establishing first contact with new parents enables us to develop long-lasting customer relationships as their children grow and they transition to our full portfolio of products. We have made several enhancements to our Baby Registry program to improve the shopping experience for expectant and new parents including:

• | A Registry mobile app that allows customers to manage their baby registry anytime, from anywhere. |

• | The Endless Earnings program where domestically, expectant parents receive 5% rewards on the first $300 in purchases and 10% on every purchase thereafter with no limits, encouraging parents to use their registry as their ultimate shopping list that pays them back. |

• | Innovative programs, classes and expert services for expectant and new parents, which include monthly in store events and exclusive offers for registrants. |

Much like our Rewards “R” Us program in the U.S., we have over 12 million active members in similar loyalty programs around the world. In addition, we offer the following to our customers:

• | Wish List. Allows parents and kids to create a tailored list of desired toys that gift-givers can utilize to make their purchases. |

• | Geoffrey’s Birthday Club. Parents receive exciting offers to help prepare for their child’s birthday and kids are invited to our stores to receive special gifts and meet Geoffrey the Giraffe. |

• | “R” Us Credit Card. We offer co-branded and private label credit cards which allows customers to finance purchases at our stores, online and at other businesses, and receive loyalty benefits, deals and promotions in exchange. |

4

We believe that we have achieved our leading market position largely as a result of, building highly recognized brand names, year-round breadth of product offerings, knowledgeable employees and strong loyalty programs. We use a variety of broad-based and targeted marketing and advertising strategies to reach consumers and to try to connect with our customers on a personal level. These strategies include targeted advertisements and mass marketing programs such as e-mail marketing, digital and social media, direct mail, national television and radio spots, catalogs inserts in national and local newspapers, direct mailings to loyalty program members and in-store marketing. We continue to transition a significant portion of our marketing reach in an effort to optimize our digital versus traditional media mix. Our most significant single piece of advertising in the U.S. is “The Great Big Toys “R” Us Book of Awesome” promotional catalog release, which is distributed through direct mail, newspapers and our stores in advance of the holiday selling season.

Inventory Management

We continue to focus on enhancing the customer experience by improving our in-stock position to ensure we have the hot products that customers are looking for, while at the same time maintaining healthy inventory levels. Additionally, our product life cycle management process continues to help reduce clearance margin risk by instituting greater discipline around product exit dates.

Vendor Relationships

We view our well-established vendor relationships as a core strength of the organization and continue to build these partnerships in the hopes of growing together. We provide our vendors with a year-round platform to showcase their brands and test their new products in our stores. In return, we obtain greater access to products in demand, exclusive products and support for advertising and marketing efforts to drive category leadership and differentiation. We additionally have strategic partnerships with American Girl® and Claire’s which are featured as branded shops within select Toys “R” Us stores.

Our Stores

As of January 28, 2017, we operated and licensed retail stores worldwide in the following formats:

Store Type | Store Count | Typical Square Footage | |||

Operated: | |||||

Traditional Toy (1) | 932 | 20,000 - 50,000 | |||

Side-By-Side (“SBS”) (2) | 420 | 30,000 - 70,000 | |||

Baby (3) | 237 | 30,000 - 55,000 | |||

Long-Term Express | 64 | 3,000 - 7,000 | |||

Outlet | 38 | 3,000 - 5,000 | |||

Total Operated Stores | 1,691 | ||||

Licensed (4) | 257 | Various | |||

(1) | Devote on average 5,000 square feet to boutique areas for baby products. |

(2) | Devote 20,000 to 40,000 square feet to traditional toy products and 10,000 to 30,000 square feet to baby products. |

(3) | Devote 3,000 square feet to traditional toy products and includes our Babies “R” Us flagship store in Union Square, New York City. |

(4) | “R” Us branded retail stores. Licensing revenue did not have a material impact on Net sales. |

Globally, our store portfolio includes smaller format Express stores located in malls and shopping centers. During the 2016 holiday season, we operated 126 Express stores, of which 103 were still open as of January 28, 2017. Of the 103 Express stores that remained open, 64 have been included in our overall store count as they each have a cumulative lease term of at least two years (“Long-Term Express”). The remaining 39 Express stores are considered temporary stores (“Temporary Express”). These locations typically range in size from 3,000 to 7,000 square feet each, have a cumulative lease term of less than two years and are not included in our overall store count.

Additionally, we operated 38 Outlets within our Domestic segment, 12 of which opened in fiscal 2016. These permanent stores are located in high traffic shopping and lifestyle centers, have traditional toy product assortments as well as unique discount items and typically have lease terms of at least five years.

5

Our extensive experience in retail site selection has resulted in a portfolio of stores that includes attractive locations in many of our chosen markets. Markets for new stores and formats are selected on the basis of proximity to other “R” Us branded stores, demographic factors, population growth potential, competitive environment, availability of real estate and cost. Once a potential market is identified, we select a suitable location based upon several criteria, including size of the property, access to major commercial thoroughfares, proximity of other strong anchor stores, visibility and parking capacity.

Our Business Segments

Our business has two reportable segments: Toys “R” Us – Domestic (“Domestic”) and Toys “R” Us – International (“International”). Refer to Note 11 to our Consolidated Financial Statements entitled “SEGMENTS” for our segments’ financial results. The following is a brief description of our segments:

• | Domestic — Our Domestic segment sells a variety of products through 879 stores that operate in 49 states in the United States, Puerto Rico and Guam and through e-commerce. As of January 28, 2017, our Domestic stores consisted of 358 traditional toy stores, 223 baby stores, 212 SBS stores, 48 Long-Term Express stores and 38 Outlets, as well as Temporary Express locations. Domestic Net sales were $7,131 million for fiscal 2016, which accounted for 62% of our consolidated Net sales. |

• | International — Our International segment sells a variety of products through 812 operated and 257 licensed stores in 37 countries and jurisdictions and through e-commerce. As of January 28, 2017, our International stores consisted of 574 traditional toy stores, 208 SBS stores, 16 Long-Term Express stores and 14 baby stores, as well as Temporary Express locations. International Net sales were $4,409 million for fiscal 2016, which accounted for 38% of our consolidated Net sales. |

Product Selection and Merchandise

Our product offerings are focused on serving the needs of parents, grandparents and other gift-givers interested in purchasing merchandise in our primary product categories:

• | Baby — focused on serving newborns and children up to four years of age by offering a broad array of products, such as baby gear, consumables, infant care products, apparel, furniture, bedding and room décor; many of these items are available in toy and baby stores; |

• | Core Toy — boys and girls toys, such as action figures, dolls and doll accessories, drones, role play toys and vehicles; |

• | Entertainment — video game software, systems and accessories, tablets, portable electronics and other related products; |

• | Learning — educational electronics and developmental toys, such as our Imaginarium products in the United States and World of Imagination products at our International locations, construction toys, games, creative activities and pre-school merchandise which includes learning products, activities and toys; and |

• | Seasonal — toys and other products geared toward holidays (including Christmas, Hanukkah, Three Kings, Chinese New Year, Carnival, Easter, Children’s Day, Golden Week and Halloween) and summer activities, as well as bikes, sports toys, play sets and other outdoor products. |

We offer a wide selection of popular national toy and baby brands including many products that are exclusively offered at, or launched at, our stores. Over the past few years, we have worked with key vendors to obtain exclusive products and expand our private label brands enabling us to earn higher margins and offer products that our customers will not find elsewhere. We offer a broad selection of private label merchandise under names such as BABIES “R” US, IMAGINARIUM, KOALA BABY, AVIGO, FAST LANE, YOU & ME, JUST LIKE HOME, BRUIN, STATS, JOURNEY GIRLS, ANIMAL PLANET, TRUE HEROES, SIZZLIN’ COOL, EDU-SCIENCE, PAVILION, DREAM DAZZLERS and TOTALLY ME! in our stores. We believe these private label brands provide a platform on which we can expand our product offerings in the future and will further differentiate our products and allow us to enhance profitability. Our private label penetration rate was 12% of Net sales in fiscal 2016. We utilize our sourcing office in China to work with our vendors and differentiate our product offerings.

Safety Focus

We believe that we have put in place product safety standards that meet or exceed United States federally mandated and/or global regulatory requirements in the countries in which we operate. In addition, through our dedicated safety website, safety boards in stores, social media and e-mail communications and partnerships with safety organizations including the Consumer Products Safety Commission, we provide resources for customers, parents and others to help ensure they have the most up-to-date information on product safety and recalls.

6

Corporate Philanthropy and Community Service

We are proud to have a long tradition at Toys “R” Us of supporting numerous children’s charities. Over the past three decades, the Company has given more than $100 million in product donations to children’s charities. In addition, the Toys “R” Us Children’s Fund Inc., a public charity affiliated with the Company, has donated more than $130 million in grants to children’s charities that keep children safe and help them in times of need. We actively support charities such as the Marine Toys for Tots Foundation, Make-A-Wish America, Special Olympics, St. Jude Children’s Research Hospital and Save the Children, among others. We encourage our employees to become active in charitable endeavors by matching contributions they make to qualified charities of their choice, and through Volunteer Match, a program that helps them identify charities to assist in their communities. We also manage the Geoffrey Fund, Inc., a non-profit organization that provides assistance to employees affected by natural and personal disasters. The Geoffrey Fund relies on donations from employees to carry out its mission.

Market and Competition

In the domestic market, we compete with mass merchandisers, such as Walmart, Target and Kmart; consumer electronics retailers, such as Best Buy and GameStop; Internet and catalog businesses, such as Amazon.com; national and regional specialty, department and discount store chains; as well as local retailers in the geographic areas we serve. Our baby registry competes with baby registries of mass merchandisers, other specialty retail formats, such as buybuy BABY, and regional retailers. In the International toy and electronics markets, we compete with mass merchandisers, discounters and specialty retailers. The domestic and international mass merchandisers and discounters aggressively price items in the traditional toy and electronic product categories with larger dedicated selling space during the holiday season in order to build traffic for other store departments.

We believe the principal competitive factors in the toy, including video game products, and baby products markets are product variety, price, quality, availability, advertising and promotion, convenience or store location, shipping offers, safety and customer support and service. We believe we are able to effectively compete by providing a broader range of merchandise, strong in-stock positions, convenient locations, knowledgeable customer service and competitive pricing and shipping offers.

Seasonality

Our global business is highly seasonal with sales and earnings highest in the fourth quarter due to the fourth quarter holiday selling season. During fiscals 2016, 2015 and 2014, 40%, 41% and 40%, respectively, of our total Net sales were generated in the fourth quarter. We typically incur net losses in each of the first three quarters of the year, with a substantial portion of our operating earnings generated in the fourth quarter. We seek to continuously improve our ability to manage the numerous demands of a highly seasonal business, from the areas of product sourcing and distribution, to the challenges of delivering high sales volumes and excellent customer service during peak business periods. For more than 65 years, we have developed substantial experience and expertise in managing the increased demand during the holiday season which we believe favorably differentiates us from our competition.

License Agreements

We have license agreements with unaffiliated third party operators located outside the United States. The agreements are largely structured with royalty income paid as a percentage of sales for the use of our trademarks, trade name and branding. Licensing revenue was $18 million for fiscal 2016 and $17 million for fiscals 2015 and 2014, respectively. While this business format remains a small piece of our overall International business operations, we continue to look for opportunities for market expansion. Our preferred approach is to open stores in our Company-operated format, but we may choose partnerships or licensed arrangements where we believe it is appropriate due to business climate and risks.

7

Geographic Distribution of Domestic Stores

The following table sets forth the location of our Domestic stores as of January 28, 2017:

Location | Number of Stores | ||

Alabama | 9 | ||

Alaska | 1 | ||

Arizona | 17 | ||

Arkansas | 5 | ||

California | 113 | ||

Colorado | 10 | ||

Connecticut | 14 | ||

Delaware | 3 | ||

Florida | 60 | ||

Georgia | 28 | ||

Hawaii | 5 | ||

Idaho | 2 | ||

Illinois | 38 | ||

Indiana | 19 | ||

Iowa | 7 | ||

Kansas | 6 | ||

Kentucky | 10 | ||

Louisiana | 9 | ||

Maine | 3 | ||

Maryland | 17 | ||

Massachusetts | 23 | ||

Michigan | 32 | ||

Minnesota | 8 | ||

Mississippi | 6 | ||

Missouri | 15 | ||

Montana | 1 | ||

Nebraska | 3 | ||

Nevada | 10 | ||

New Hampshire | 7 | ||

New Jersey | 45 | ||

New Mexico | 3 | ||

New York | 60 | ||

North Carolina | 22 | ||

North Dakota | 1 | ||

Ohio | 37 | ||

Oklahoma | 7 | ||

Oregon | 10 | ||

Pennsylvania | 45 | ||

Rhode Island | 2 | ||

South Carolina | 9 | ||

South Dakota | 2 | ||

Tennessee | 16 | ||

Texas | 66 | ||

Utah | 7 | ||

Vermont | 1 | ||

Virginia | 27 | ||

Washington | 16 | ||

West Virginia | 4 | ||

Wisconsin | 12 | ||

Guam | 1 | ||

Puerto Rico | 5 | ||

Total | 879 | ||

8

Geographic Distribution of International Stores

The following table sets forth the location of our International operated stores as of January 28, 2017:

Location | Number of Stores Operated | ||

Australia | 38 | ||

Austria | 15 | ||

Brunei | 1 | ||

Canada | 82 | ||

China | 131 | ||

France | 47 | ||

Germany | 67 | ||

Hong Kong | 15 | ||

Japan | 163 | ||

Malaysia | 36 | ||

Poland | 15 | ||

Portugal | 10 | ||

Singapore | 9 | ||

Spain | 49 | ||

Switzerland | 10 | ||

Taiwan | 22 | ||

Thailand | 12 | ||

United Kingdom | 90 | ||

Total | 812 | ||

The following table sets forth the location of our International licensed stores as of January 28, 2017:

Location | Number of Stores Licensed | ||

Bahrain | 1 | ||

Denmark | 16 | ||

Egypt | 3 | ||

Finland | 7 | ||

Iceland | 3 | ||

Israel | 27 | ||

Kuwait | 2 | ||

Macau | 2 | ||

Namibia | 1 | ||

Norway | 16 | ||

Oman | 1 | ||

Philippines | 32 | ||

Qatar | 1 | ||

Saudi Arabia | 14 | ||

South Africa | 61 | ||

South Korea | 39 | ||

Sweden | 22 | ||

United Arab Emirates | 8 | ||

Zambia | 1 | ||

Total | 257 | ||

Employees

As of January 28, 2017, we employed 64,000 full-time and part-time individuals worldwide, with 36,000 domestically and 28,000 internationally. These numbers do not include the individuals employed by licensees of our stores. Due to the

9

seasonality of our business, we employed 107,000 full-time and part-time employees worldwide during the 2016 holiday season.

Distribution

We operate 18 distribution centers including 8 that support our Domestic operations and 10 that support our International operations (excluding licensed operations). These distribution centers employ warehouse management systems and material handling equipment that help to manage overall inventory levels and distribution costs. In fiscal 2015, we opened a state-of-the-art distribution center in France which integrates our three previous fulfillment centers and serves as the headquarters office for Toys “R” Us, France. We believe that this facility creates greater operational efficiencies for our business, while allowing us to better serve our customers through our growing omnichannel capabilities in Europe.

We have agreements with third party logistics providers JB Hunt Transport, Inc. and Performance Team Freight Systems, Inc. to manage all services related to the delivery of inventory from our distribution centers to our U.S. stores. We believe the flexibility afforded by our warehouse/distribution system and the utilization of third party providers to distribute merchandise provides us with operating efficiencies and the ability to maintain a superior in-stock inventory position at our stores.

We also have an agreement with DHL Supply Chain (formerly Exel, Inc.), a leading North American contract logistics provider, who provides additional warehousing and fulfillment services for our e-commerce operations in the United States. We utilize various third party providers who furnish similar services in our international markets.

We continuously seek to improve our global supply chain management, optimize our inventory assortment and upgrade our automated replenishment system to improve inventory turnover. In line with this strategy, we have a service entity in Rotterdam, Netherlands referred to as the European Import Center (“EIC”) in order to improve supply chain management in the European markets in which we operate. The EIC manages a portion of the purchasing of inventory from third party vendors located in Asia on behalf of our wholly-owned subsidiaries within Europe.

Our Vendors

We procure our merchandise from a wide variety of domestic and international vendors. In fiscal 2016, we had 3,600 active vendor relationships. For fiscal 2016, our top 20 vendors worldwide, based on our purchase volume in U.S. Dollar (“USD”), represented 43% of the total products we purchased.

Financial Information About Our Segments

Financial information about our segments and our operations in different geographical areas for the last three fiscal years is set forth in Note 11 to the Consolidated Financial Statements entitled “SEGMENTS.”

Trademarks and Licensing

“TOYS “R” US®,” “BABIES “R” US®,” “GEOFFREY®,” “KOALA BABY®,” “IMAGINARIUM®,” “YOU & ME®,” “FAST LANE®,” “AVIGO®,” “JOURNEY GIRLS®,” “DREAM DAZZLERS®,” the reverse “R” monogram logo and the Geoffrey character logo, as well as variations of our family of “R” Us marks, among others either have been registered, or have trademark applications pending, with the United States Patent and Trademark Office and with the trademark registries of many other countries. These trademarks are material to our business operations. We believe that our rights to these properties are adequately protected. In addition, we own the United States trademarks (along with certain trademark rights in other countries) associated with eToys.com and KB Toys.

Available Information

Our investor relations website is Toysrusinc.com. On this website under “INVESTORS, FINANCIAL REPORTS,” we make available, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, as well as amendments to those reports as soon as reasonably practicable after we electronically file with the Securities and Exchange Commission (“SEC”).

We are not incorporating by reference in this Annual Report on Form 10-K any information from our websites. The public may read and copy any materials the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site, www.sec.gov, that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

10

ITEM 1A. | RISK FACTORS |

Investors should carefully consider the risks described below together with all of the other information in this Annual Report on Form 10-K. The risks and uncertainties described below are not the only ones that we face. Additional risks and uncertainties not presently known to us, or that we currently believe to be less significant than the following risk factors, may also adversely affect our business and operations. If any of the following risks actually occur, our business, financial condition, cash flows or results of operations could be materially adversely affected.

Risks Relating to Our Business

Our business is highly seasonal, and our financial performance depends significantly on the results of the fourth quarter of each fiscal year and, as a result, our operating results could be materially adversely affected if we achieve less than satisfactory sales prior to or during the holiday season.

Our business is highly seasonal. During fiscals 2016, 2015 and 2014, 40%, 41% and 40%, respectively, of our total Net sales were generated in the fourth quarter. We typically incur net losses in each of the first three quarters of the year, with a substantial portion of our operating earnings generated in the fourth quarter. As a result, we depend significantly upon the fourth quarter holiday selling season. If we achieve less than satisfactory sales, operating earnings or cash flows from operating activities during the fourth quarter, we may not be able to compensate sufficiently for the lower sales, operating earnings or cash flows from operating activities during the first three quarters of the fiscal year. Our results in any given period may be affected by dates on which important holidays fall and the shopping patterns relating to those holidays. Additionally, the concentrated nature of our seasonal sales means that our operating results could be materially adversely affected if we achieve less than satisfactory sales prior to or during the holiday season, including as a result of natural disasters, labor strikes, work stoppages, terrorist acts or disruptive global political events, prior to or during the holiday season, as described below.

Our industry is highly competitive and competitive conditions may materially adversely affect our revenues and overall profitability.

The retail industry is highly and increasingly competitive and our results of operations are sensitive to, and may be materially adversely affected by competitive pricing, promotional pressures, competitor credit programs, additional competitor store openings, growth of e-commerce competitors and other factors. As a specialty retailer that primarily focuses on toys and baby products, we compete with discount and mass merchandisers, such as Walmart and Target, as well as Internet and catalog businesses, such as Amazon.com, national and regional chains and department stores and local retailers in the markets we serve. We also compete with national and local discount stores, consumer electronics retailers, supermarkets and warehouse clubs. Competition is principally based on product variety, price, quality, availability, advertising and promotion, convenience or store location, safety and customer support and service. We believe that some of our competitors in the toy and baby products markets, as well as in the other markets in which we compete, have a larger market share than our market share. In addition, some of our competitors have greater financial resources, lower merchandise acquisition costs and lower operating expenses than we do.

Much of the merchandise we sell is also available from various retailers at competitive prices. Discount and mass merchandisers use aggressive pricing policies and enlarged toy-selling areas during the holiday season to increase sales and build traffic for other store departments. Our business is vulnerable to shifts in demand and pricing, as well as consumer preferences.

We are vulnerable to competitive pressures from e-commerce activity in the market, both as they impact our own e-commerce business and our stores. The Internet provides greater price transparency of our merchandise that is widely available to customers. Our “Price Match Guarantee” may lead to reduced margins as a result of intense price competition, especially during the holiday selling season. In addition, sales of video games have been impacted by a shift to sales in channels other than traditional retail stores, including direct online distribution to customers through download, subscription or cloud play, which eliminates the need for a retailer. Furthermore, competitors’ subscription models for diapers, formula, and other consumables may eliminate the need for customers to visit our stores or e-commerce websites. We believe that this e-commerce activity has adversely affected our sales and profitability, and any increase in the proportion of our customers’ purchases via the Internet could materially adversely affect our sales and profitability from physical stores.

The baby registry market is highly competitive, based on convenience, quality and selection of merchandise offerings and functionality. Our baby registry primarily competes with the baby registries of mass merchandisers, Internet retailers and other specialty format and regional retailers. Some of our competitors have been aggressively advertising and marketing their baby registries through national television, magazine and Internet campaigns. These trends present consumers with more choices for their baby registry needs, and as a result, increase competition for our baby registry.

11

If we fail to compete successfully, we could face lower sales and may decide or be compelled to offer greater discounts to our customers, which could result in decreased profitability.

Our sales may be adversely affected by changes in economic factors and changes in consumer spending patterns.

Many economic and other factors outside our control, including consumer confidence, consumer spending levels, employment levels, consumer debt levels, individual income tax and sales tax rates, inflation and deflation, as well as the availability of consumer credit, affect consumer spending habits. A significant deterioration in the global financial markets and economic environment, recessions or an uncertain economic outlook adversely affects consumer spending habits and results in lower levels of economic activity. The domestic and international political situation, including the economic health of various political jurisdictions, also affects economic conditions and consumer confidence. In addition, changing economic and regulatory conditions and increasing consumer credit delinquencies may cause banks to re-evaluate their lending practices and terms which could have an adverse effect on our credit card program and consequently, an adverse effect on our sales. Any of these events and factors could cause consumers to curtail spending and could have a negative impact on our financial performance and position in future fiscal periods.

Our operations have significant liquidity and capital requirements and depend on the availability of adequate financing on reasonable terms. If our lenders are unable to fund borrowings under their credit commitments or we are unable to borrow, it could have a significant negative effect on our business.

We have significant liquidity and capital requirements. Among other things, the seasonality of our businesses requires us to purchase merchandise well in advance of the fourth quarter holiday selling season. We depend on our ability to generate cash flows from operating activities, as well as on borrowings under our revolving credit facilities and our credit lines, to finance the carrying costs of this inventory and to pay for capital expenditures and operating expenses. As of January 28, 2017, we had total outstanding borrowings of $465 million under our revolving credit facilities and credit lines. As of January 28, 2017, we had unused availability under committed lines of credit of $905 million. For fiscal 2016, peak borrowings under all of our revolving credit facilities and credit lines were $1,331 million, as we purchased merchandise for the fourth quarter holiday selling season. If our lenders are unable to fund borrowings under their credit commitments or we are unable to borrow, it could have a significant negative effect on our business. In addition, any adverse change to our credit ratings or our business could negatively impact our ability to refinance our debt on satisfactory terms and could have the effect of increasing our financing costs. While we believe we currently have adequate sources of funds to provide for our ongoing operations and capital requirements for at least the next 12 months, any inability on our part to have future access to financing, when needed, would have a negative effect on our business.

A loss of, or reduction in, trade credit from our vendors could reduce our liquidity, increase our working capital needs and/or limit our ability to purchase products.

Trade credit from our vendors is an important source of financing for the purchase of the inventory we sell in our stores. Accordingly, the loss of, or reduction in, trade credit could have a significant adverse impact on our inventory levels and operating cash flow and negatively impact our liquidity. Our vendors may seek credit insurance to protect against non-payment of amounts due to them. If credit insurance is not available to vendors at reasonable terms or at all, vendors may demand accelerated payment of amounts due to them or require advance payments or letters of credit before goods are shipped to us. A negative change in our credit ratings or our vendors’ perception of our creditworthiness, including due to pending debt maturities, may impact their willingness to provide trade credit to us. Any adverse changes in our trade credit for these or other reasons could increase our costs of financing our inventory or negatively impact our ability to deliver products to our customers, which could in turn negatively affect our financial performance.

We may not retain or attract customers if we fail to successfully implement our strategic initiatives, which could result in lower sales and a failure to realize the benefit of the expenditures incurred for these initiatives.

We continue to implement a series of customer-oriented strategic programs designed to differentiate and strengthen our core merchandise content and service levels and to expand and enhance our merchandise offerings. As part of our omnichannel strategy to integrate our e-commerce and brick-and-mortar businesses, we aim to satisfy our customers’ evolving shopping preferences by utilizing fulfillment channels such as “In-Store Pick Up,” “Ship from Store” and “Ship to Store.” In an effort to optimize our e-commerce operations and improve the customer experience online, we are currently developing an e-commerce platform which will allow us to manage certain aspects of our e-commerce operations internally rather than through a third-party provider.

We continue to evaluate the effectiveness of our marketing and advertising programs for our “R” Us stores and e-commerce business. The success of these and other initiatives will depend on various factors, including the implementation of our strategy, the appeal of our store and website formats, our ability to offer new products to customers, our financial condition, our ability to respond to changing consumer preferences and competitive and economic conditions. We continuously endeavor to

12

minimize our operating expenses, without adversely affecting the customer experience or the profitability of the business. If we fail to implement successfully some or all of our strategic initiatives, we may be unable to retain or attract customers, which could result in lower sales and a failure to realize the benefit of the expenditures incurred for these initiatives.

If we cannot increase profitability within existing stores or open new stores, our performance may be materially adversely affected.

Our performance is dependent on maintaining and increasing sales in existing stores and the ability to successfully open profitable new stores. Increases in sales in existing stores are dependent on factors such as competition, merchandise selection, store operations (including maintaining and remodeling these stores) and other factors discussed in these Risk Factors. The success of any store depends in substantial part on its location. There can be no assurance that current locations will continue to be attractive as demographic patterns change. Neighborhood or economic conditions where stores are located could decline in the future, potentially resulting in reduced sales in these locations.

Our ability to successfully relocate or open new stores and expand into additional market areas depends in part on the following factors, which are in part beyond our control:

• | the availability of sufficient funds for the expansion; |

• | the availability of attractive store locations and the ability to accurately assess the demographic or retail environment and customer demand at a given location; |

• | the ability to negotiate favorable lease terms and obtain the necessary permits and zoning approvals; |

• | the absence of occupancy delays; |

• | the ability to construct, furnish and supply a store in a timely and cost effective manner; |

• | the ability to hire and train new personnel, especially store managers, in a cost effective manner; and |

• | general economic conditions. |

Delays or failures in successfully opening new stores, or achieving lower than expected sales in existing or new stores, could materially adversely affect our profitability. In addition, we may not be able to anticipate all of the challenges imposed by the expansion of our operations and, as a result, may not meet our targets for opening new stores or relocating stores or expanding profitably.

Some of our new stores may be located in areas where we have little or no meaningful experience. Those markets may have different market conditions, consumer preferences and discretionary spending patterns than our existing markets, which may cause our new stores to be less successful than stores in our existing markets. Other new stores may be located in areas where we have existing stores. Although we have experience in these markets, increasing the number of locations may result in unanticipated over-saturation of markets and temporarily or permanently divert customers and sales from our existing stores, thereby adversely affecting our overall financial performance.

The success and expansion of our e-commerce business depends on our ability to successfully transition to an internally developed Domestic e-commerce platform and to provide quality service to our customers and if we are not able to provide such services, our operating results may be materially adversely affected.

We are currently in the process of developing a new internal e-commerce platform for our Domestic website, which we now expect to launch in fiscal 2017. We may be faced with significant unforeseen transition challenges including additional implementation delays, cost overruns, technology interruptions and disruption of our distribution channels which could adversely affect our e-commerce platform. Any inability to successfully transition to, operate or maintain our internal platform or unforeseen transition operation challenges or disruptions may materially impact our sales, results of operations and financial condition and may materially adversely affect our ability to achieve future sales and profitability growth.

Additionally, our Internet operations are subject to a number of risks and uncertainties which are in part beyond our control, including the following:

• | failure of our Internet service providers to perform their services properly and in a timely and efficient manner; |

• | changes in consumer willingness to purchase goods via the Internet; |

• | increases in software filters that may inhibit our ability to market our products through e-mail messages to our customers and increases in consumer privacy concerns relating to the Internet; |

• | changes in applicable federal and state regulation, such as the Federal Trade Commission Act, the Children’s Online Privacy Act, the Fair Credit Reporting Act and the Gramm-Leach-Bliley Act and similar types of international laws; |

• | breaches of Internet security including our new internal e-commerce platform; |

13

• | failures in our Internet infrastructure or the failure of systems or third parties, such as telephone or electric power service, resulting in website downtime or other problems; |

• | failure by us to process online customer orders properly and on time, which may negatively impact future online and in-store purchases by such customers; |

• | failure by our service provider to provide warehousing and fulfillment services, which may negatively impact future online and in-store purchases by customers; and |

• | failure to keep up with changes in technology. |

As technology continues to advance, customers are increasingly using a variety of devices, such as computers, tablets and smartphones to shop online with us and our competitors. We continue to enhance our customers’ shopping experience on each of these devices as well as incorporate social media as another means of communicating with our customers. If we fail to provide attractive, user-friendly online shopping platforms or fail to continually meet the evolving expectations of customers with developments in online merchandising technology and competitor offerings, we could be at a competitive disadvantage and our business and results of operations may be materially adversely affected.

Our sales may be adversely affected if we fail to respond to changes in consumer preferences in a timely manner.

Our financial performance depends on our ability to identify, originate and define product trends, as well as to anticipate, gauge and react to changing consumer preferences in a timely manner. Our products must appeal to a broad range of consumers whose preferences cannot be predicted with certainty and are subject to change. Our business fluctuates according to changes in consumer preferences dictated in part by fashion trends, perceived value and season. These fluctuations affect the merchandise in stock since purchase orders are written well in advance of the holiday season and, at times, before fashion trends and high-demand brands are evidenced by consumer purchases. If we overestimate the market for our products, we may be faced with significant excess inventories, which could result in increased expenses and reduced margins associated with having to liquidate obsolete inventory at lower prices or write it off. Conversely, if we underestimate the market for our products, we will miss opportunities for increased sales and profits, which would place us at a competitive disadvantage.

Sales of video games and video game systems are adversely affected by changing trends in the interactive entertainment industry including the rise in popularity of browser, mobile, tablet and social games distributed through alternative channels.

Sales of video games and video game systems, which have accounted for 4%, 4% and 6% of our annual Net sales for fiscals 2016, 2015 and 2014, respectively, have been impacted by trends in the interactive entertainment industry. Video games are now played on a wide variety of products, including mobile phones, tablets, social networking websites and other devices. The popularity of such non-traditional gaming has increased greatly and this popularity is expected to continue to grow. Browser, mobile, tablet and social gaming is accessed through hardware other than the consoles and traditional hand-held video game devices we sell and its games are available through websites or proprietary app stores via direct online distribution at a fraction of the cost of console games. While we continue to develop and implement various strategies to incorporate these new trends into our offerings, including selling third party tablets and other devices, we can provide no assurances that these strategies will be successful or contribute to profitability. Similarly, a continued rise in the popularity of mobile and tablet gaming could negatively impact sales and profitability of traditional toys.

The decrease of birth rates in countries where we operate could negatively affect our business.

Most of our end-customers are newborns and children and, as a result, our revenues are dependent on the birth rates in countries where we operate. In recent years, many countries’ birth rates have dropped or stagnated as their population ages, and education and income levels increase. A continued and significant decline in the number of newborns and children in these countries could have a material adverse effect on our operating results.

Potential changes to trade laws, regulations and policies, related to or restricting global trade, may negatively affect our business.

The result of the November 2016 presidential election in the United States has introduced the potential of a tax reform package which may include tariffs and regulations affecting trade between the United States and other countries. We source a significant portion of our merchandise from manufacturers located outside the United States, primarily in Asia. Major developments in tax policy or trade relations, such as the disallowance of tax deductions for imported merchandise or the imposition of tariffs on imported products, could have a material adverse effect on our business, results of operations and liquidity.

14

We depend on key vendors to supply the merchandise that we sell to our customers and our vendors’ failure to supply quality merchandise in a timely manner may damage our reputation and brands and harm our business.

Our performance depends, in part, on our ability to purchase our merchandise in sufficient quantities at competitive prices. We purchase our merchandise from numerous international and domestic manufacturers and importers. We have no contractual assurances of continued supply, pricing or access to new products, and any vendor could change the terms under which they sell to us or discontinue selling to us at any time. We may not be able to purchase desired merchandise in sufficient quantities on terms acceptable to us in the future. Better than expected sales demand may also lead to customer backorders and lower in-stock positions of our merchandise.

In fiscal 2016, we had 3,600 active vendor relationships through which we procure the merchandise that we offer to our customers. For fiscal 2016, our top 20 vendors worldwide, based on our purchase volume in USD, represented 43% of the total products we purchased. An inability to purchase suitable merchandise on acceptable terms or the loss of one or more key vendors could have a negative effect on our business and operating results and could cause us to miss products that we feel are important to our assortment. We may not be able to develop relationships with new vendors, and products from alternative sources, if any, may be of a lesser quality and/or more expensive than those from existing vendors.

In addition, our vendors are subject to various risks, including raw material costs, inflation, labor disputes, union organizing activities, financial liquidity, product merchantability, inclement weather, natural disasters and general economic and political conditions that could limit our vendors’ ability to provide us with quality merchandise on a timely basis and at prices and payment terms that are commercially acceptable. For these or other reasons, one or more of our vendors might not adhere to our quality control standards, and we might not identify the deficiency before merchandise ships to our stores or customers. In addition, our vendors may have difficulty adjusting to our changing demands and growing business. Our vendors’ failure to manufacture or import quality merchandise in a timely and effective manner could damage our reputation and brands, and could lead to an increase in customer litigation against us and an increase in our routine and non-routine litigation costs. Further, any merchandise that does not meet our quality standards could become subject to a recall, which could damage our brand reputation and harm our business.

If our vendors fail to provide promotional support consistent with past levels, our sales, earnings and cash flow could be materially adversely affected.

Our vendors typically provide us with promotional support for the sale of their products in our stores and on our websites, including allowances for volume-related purchases. As part of this support, we receive allowances, payments and credits from the vendors which reduce our cost of goods sold, support the promotion and merchandising of the products we sell and drive sales at our stores and on our websites. We cannot provide assurance that vendors will continue to provide this support consistent with past levels. If our vendors fail to do so, our sales, earnings and cash flow could be materially adversely affected.

Our business operations could be disrupted if we are unable to protect the integrity and security of our customers’ information, or if our information technology systems, including our new internal e-commerce platform, fail to perform adequately.

A compromise of our security systems (or a design flaw in our system environment) could result in unauthorized access to certain personal information about our employees or customers (including credit card and gift registry information) which could materially adversely affect our reputation with our customers and others, and thus affect our sales and profitability. Other sophisticated retailers have recently suffered serious security breaches. A serious breach could negatively impact our operations, and could result in litigation against us or the imposition of penalties. In addition, a security breach could require that we expend significant additional resources related to our information security systems. Such risks may be difficult to adequately insure against or insurance may be costly.

We depend largely upon our information technology systems in the conduct of all aspects of our operations. If our information technology systems, including our new internal e-commerce platform, fail to perform as anticipated, or should we experience any delays or difficulties in transitioning to these or other new systems, or integrating these systems with our current systems, we could experience difficulties in virtually any area of our operations, including but not limited to replenishing inventories or in delivering our products to store locations and customers. Any of these or other systems-related problems could, in turn, materially adversely affect our sales and profitability.

We have substantial obligations under long-term leases that could materially adversely affect our financial condition and prevent us from fulfilling our obligations.

As of January 28, 2017, we leased 1,383 of our properties from third-parties pursuant to long-term space and ground leases. Total rent expense, net of sublease income, was $524 million, $546 million and $601 million for fiscals 2016, 2015 and 2014, respectively, and is expected to be approximately $495 million for fiscal 2017. Many of our leases provide for scheduled

15

increases in rent. The substantial obligations under our leases could further exacerbate the risks described below under “Our substantial indebtedness could adversely affect our ability to raise additional capital to fund our operations or refinance our maturing debt, limit our ability to react to changes in the economy or our industries, expose us to interest rate risk to the extent of our variable rate debt and prevent us from meeting our obligations under our various debt instruments.”

If we are unable to renew or replace our current store leases or if we are unable to enter into leases for additional stores on favorable terms, or if one or more of our current leases are terminated prior to expiration of their stated term and we cannot find suitable alternate locations, our growth and profitability could be negatively impacted.

We currently have ground leasehold interests in 14% and long-term space leasehold interests in 65% of our domestic and international store locations. Most of our current leases provide for our unilateral option to renew for several additional periods at specific rental rates. Our ability to re-negotiate favorable terms on an expiring lease or to negotiate favorable terms for a suitable alternate location or for additional store locations could depend on conditions in the real estate market, competition for desirable properties and our relationships with current and prospective landlords or may depend on other factors that are not within our control. Any or all of these factors and conditions could negatively impact our growth and profitability.

Our business, financial condition and results of operations are subject to risks arising from the international scope of our operations which could negatively impact our financial condition and results of operations.

We conduct a significant portion of our business outside the United States. For fiscals 2016, 2015 and 2014, 38%, 38% and 39% of our Net sales, respectively, were generated outside the United States. In addition, as of January 28, 2017 and January 30, 2016, 33% and 32% of our long-lived assets, respectively, were located outside of the United States. Weakened global economic conditions, particularly the weakened and unstable environment in parts of Europe and Asia, could continue to affect us through lower sales as a result of reduced demand and the effects of foreign currency translation. All of our foreign operations are subject to risks inherent in conducting business abroad, including the challenges of different economic conditions in each of the countries, possible nationalization or expropriation, price and currency exchange controls, fluctuations in the relative values of currencies as described below, limited protection of intellectual property in certain jurisdictions, political instability and restrictive governmental actions.

The products we sell are sourced from a variety of international suppliers, with China being a significant source. Additionally, a growing portion of our stores are located in China and as a consequence, our financial results are expected to become increasingly affected by our results in China, and our business is increasingly exposed to risks there. Political or financial instability, trade restrictions, labor unrest, transport capacity and costs, port security or other events that could slow port activities and affect foreign trade are beyond our control and could disrupt our supply of merchandise and/or materially adversely affect our results of operations. In addition, changes in the costs of procuring raw materials used in our merchandise or the costs related to our supply chain, including labor, fuel, tariffs, and currency exchange rates could have a material adverse effect on gross margin, expenses and results of operations.

In addition, any significant or prolonged deterioration in US - China relations could adversely affect our China business. Certain risks and uncertainties of doing business in China are solely within the control of the Chinese government, and Chinese law regulates the scope of our foreign investments and business conducted within China. There are also uncertainties regarding the interpretation and application of laws and regulations and the enforceability of intellectual property and contract rights in China.

Our business is subject to fluctuations in foreign currency exchange rates and such fluctuations may have a material adverse effect on our business, financial condition and results of operations.

Exchange rate fluctuations may affect the translated value of our earnings and cash flow associated with our international operations, as well as the translation of net asset or liability positions that are denominated in foreign currencies. In countries outside of the United States where we operate stores, we generate revenues and incur operating expenses and selling, general and administrative expenses denominated in local currencies. In many countries where we do not operate stores, our licensees pay royalties in USD. However, as the royalties are calculated based on local currency sales, our revenues are still impacted by fluctuations in exchange rates. In fiscal years 2016, 2015 and 2014, 38%, 38% and 39% of our Net sales, respectively, were transacted in a currency other than the USD, the majority of which were denominated in yen, Euros, Canadian dollars and pounds. In fiscal 2016, our reported operating earnings would have decreased or increased $32 million if all foreign currencies uniformly weakened or strengthened by an incremental 10% relative to the USD.

We enter into foreign exchange agreements from time to time with financial institutions to reduce our exposure to fluctuations in currency exchange rates referred to as hedging activities. However, these hedging activities may not eliminate foreign currency risk entirely and involve costs and risks of their own. Although we hedge some exposures to changes in foreign currency exchange rates arising in the ordinary course of business, foreign currency fluctuations may have a material adverse effect on our business, financial condition and results of operations.

16

Because of our extensive international operations, we could be adversely affected by violations of the United States Foreign Corrupt Practices Act and similar worldwide anti-bribery laws.