Attached files

| file | filename |

|---|---|

| 10-K - SPEEDEMISSIONS INC | s3217010k.htm |

| EX-32.2 - EXHIBIT 32.2 - SPEEDEMISSIONS INC | ex32_2.htm |

| EX-32.1 - EXHIBIT 32.1 - SPEEDEMISSIONS INC | ex32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - SPEEDEMISSIONS INC | ex31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - SPEEDEMISSIONS INC | ex31_1.htm |

| EX-23.1 - EXHIBIT 23.1 - SPEEDEMISSIONS INC | ex23_1.htm |

| EX-10.14 - EXHIBIT 10.14 - SPEEDEMISSIONS INC | ex10_14.htm |

| EX-10.13 - EXHIBIT 10.13 - SPEEDEMISSIONS INC | ex10_13.htm |

| EX-10.12 - EXHIBIT 10.12 - SPEEDEMISSIONS INC | ex10_12.htm |

Exhibit 10.15

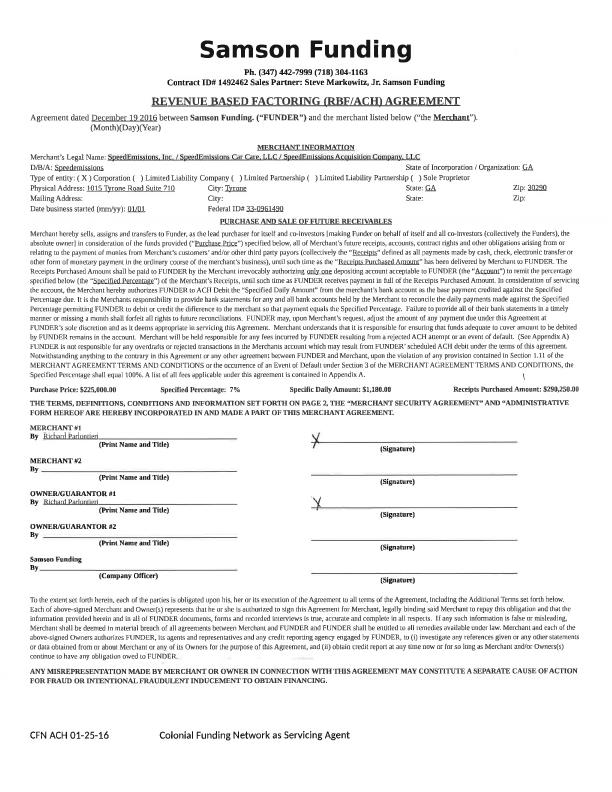

Samson Funding Ph. (347) 442-7999 (718) 304-1163 Contract ID# 1492462 Sales Partner: Steve Markowitz, Jr. Samson Funding REVENUE BASED FACTORING (RBF/ACH) AGREEMENT Agreement dated December 19 2016 between Samson Funding. ("FUNDER") and the merchant listed below ("the Merchant"). (Month)(Day)(Year) MERCHANT INFORMATION Merchant's Legal Name: SpeedEmissions _Inc.J SpeedEmissions Car Care. LLC I SpeedErnissions Acquisition Company. LLC D/B/A: Speedemissions State of Incorporation / Organization: CLA Type of entity: ( X ) Corporation ( ) Limited Liability Company ( ) Limited Partnership ( ) Limited Liability Partnership ( ) Sole Proprietor Physical Address: 1015 Tyrone Road Suite 710 City:yTrone State: GA Zip: 30290 Mailing Address: City: State: Zip: Date business started (rrun/yy): 01/01. Federal ID# 33-0961490 PURCHASE AND SALE OF FUTURE RECEIVABLES Merchant hereby sells, assigns and transfers to Funder, as the lead purchaser for itself and co-investors [making Funder on behalf of itself and all co-investors (collectively the Funders), the absolute owner] in consideration of the funds provided ("Purchase Price") specified below, all of Merchant's future receipts, accounts, contract rights and other obligations arising from or relating to the payment of monies from Merchant's customers' and/or other third party payors (collectively the "Receipts" defined as all payments made by cash, check, electronic transfer or other form of monetary payment in the ordinary course of the merchant's business), until such time as the "Receipts Purchased Amount" has been delivered by Merchant to FUNDER. The Receipts Purchased Amount shall be paid to FUNDER by the Merchant irrevocably authorizing only one depositing account acceptable to FUNDER (the "Account") to remit the percentage specified below (the "Specified Percentage") of the Merchant's Receipts, until such time as FUNDER receives payment in full of the Receipts Purchased Amount. In consideration of servicing the account, the Merchant hereby authorizes FUNDER to ACH Debit the "Specified Daily Amount" from the merchant's bank account as the base payment credited against the Specified Percentage due. It is the Merchants responsibility to provide bank statements for any and all bank accounts held by the Merchant to reconcile the daily payments made against the Specified Percentage permitting FUNDER to debit or credit the difference to the merchant so that payment equals the Specified Percentage. Failure to provide all of their bank statements in a timely manner or missing a month shall forfeit all rights to future reconciliations. FUNDER may, upon Merchant's request, adjust the amount of any payment due under this Agreement at FUNDER's sole discretion and as it deems appropriate in servicing this Agreement. Merchant understands that it is responsible for ensuring that funds adequate to cover amount to be debited by FUNDER remains in the account. Merchant will be held responsible for any fees incurred by FUNDER resulting from a rejected ACH attempt or an event of default. (See Appendix A) FUNDER is not responsible for any overdrafts or rejected transactions in the Merchants account which may result from FUNDER' scheduled ACH debit under the terms of this agreement. Notwithstanding anything to the contrary in this Agreement or any other agreement between FUNDER and Merchant, upon the violation of any provision contained in Section 1.11 of the MERCHANT AGREEMENT TERMS AND CONDITIONS or the occurrence of an Event of Default under Section 3 of the MERCHANT AGREEMENT TERMS AND CONDITIONS, the Specified Percentage shall equal 100%. A list of all fees applicable under this agreement is contained in Appendix A. Purchase Price: $225,000.00 Specified Percentage: 7% Specific Daily Amount: $1,180.00 Receipts Purchased Amount: $290,250.00 THE TERMS, DEFINITIONS, CONDITIONS AND INFORMATION SET FORTH ON PAGE 2, THE "MERCHANT SECURITY AGREEMENT" AND "ADMINISTRATIVE FORM HEREOF ARE HEREBY INCORPORATED IN AND MADE A PART OF THIS MERCHANT AGREEMENT. MERCHANT #1 By Richard Parlontieri (Print Name and Title) MERCHANT #2 By (Print Name and Title) OWNER/GUARANTOR #1 By Richard Eariontiet (Print Name and Title) OWNER/GUARANTOR #2 By (Print Name and Tide) Samson Funding By (Company Officer) (Signature) (Signature) (Signature) (Signature) (Signature) To the extent set forth herein, each of the parties is obligated upon his, her or its execution of the Agreement to all terms of the Agreement, including the Additional Terms set forth below. Each of above-signed Merchant and Owner(s) represents that he or she is authorized to sign this Agreement for Merchant, legally binding said Merchant to repay this obligation and that the information provided herein and in all of FUNDER documents, forms and recorded interviews is true, accurate and complete in all respects. If any such information is false or misleading, Merchant shall be deemed in material breach of all agreements between Merchant and FUNDER and FUNDER shall be entitled to all remedies available under law. Merchant and each of the above-signed Owners authorizes FUNDER, its agents and representatives and any credit reporting agency engaged by FUNDER, to (i) investigate any references given or any other statements or data obtained from or about Merchant or any of its Owners for the purpose of this Agreement, and (ii) obtain credit report at any time now or for so long as Merchant and/or Owners(s) continue to have any obligation owed to FUNDER. ANY MISREPRESENTATION MADE BY MERCHANT OR OWNER IN CONNECTION WITH THIS AGREEMENT MAY CONSTITUTE A SEPARATE CAUSE OF ACTION FOR FRAUD OR INTENTIONAL FRAUDULENT INDUCEMENT TO OBTAIN FINANCING. CFN ACH 01-25-16 Colonial Funding Network as Servicing Agent

MERCHANT AGREEMENT TERMS AND CONDITION I. TERMS OF ENROLLMENT IN PROGRAM 1.1 Merchant Deposit Agreement. Merchant shall execute an agreement (the "Merchant Deposit Agreement") acceptable to FUNDER, with a Bank acceptable to FUNDER, to obtain electronic fund transfer services. Merchant shall provide FUNDER and/or it's authorized agent with all of the information, authorizations necessary for verifying Merchant's receivables, receipts and deposits into the account. Merchant shall authorize FUNDER and/or it's agent to deduct the amounts owed to FUNDER for the Receipts as specified herein from settlement amounts which would otherwise be due to Merchant by permitting FUNDER to withdraw the specific daily amount credited against the specified percentages by ACH debit of the Merchant account. The authorization shall be irrevocable without the written consent of FUNDER. 1.2 Term of Agreement, This Agreement shall have an indefinite term that shall last either until all the Merchant's obligations to FUNDER are fully satisfied. This shall include but not be limited to any renewals, outstanding fees or costs. 1.3Enturgatrd1 uses.FUNDER reserves the right to rescind the offer to make any purchase payments hereunder, in its sole discretion. 1.4 Financial Condition Merchant and Guarantor(s) authorize FUNDER and its agents to investigate their financial responsibility and history, and will provide to FUNDER any bank or financial statements, tax returns, etc., as FUNDER deems necessary prior to or at any time after execution of this Agreement. A photocopy of this authorization will be deemed as acceptable for release of financial information. FUNDER is authorized to update such information and financial profiles from time to time as it deems appropriate. 1.5 Transactional History. Merchant authorizes their bank to provide FUNDER with Merchant's banking or processing history to determine qualification or continuation in this program. 1.6 Indemnification Merchant and Guarantor(s) jointly and severally indemnify and hold harmless Processor/Bank, its officers, directors and shareholders against all losses, damages, claims, liabilities and expenses (including reasonable attorney's fees) incurred by Processor resulting from (a) claims asserted by FUNDER for monies owed to FUNDER from Merchant and (b) actions taken by Processor in reliance upon information or instructions provided by FUNDER. 1.7 No Liability. In no event will FUNDER(or any of the Funders) be liable for any claims asserted by Merchant under any legal theory for lost profits, lost revenues, lost business opportunities, exemplary, punitive, special, incidental, indirect or consequential damages, each of which is waived by Merchant and Guarantor(s). 1.8 Reliance m Section 1.1, 1.7, 1.8 and 2.5 of this Agreement are agreed to for the benefit of Merchant, FUNDER and Processor, and notwithstanding the fact that Processor is not a party of this Agreement, Processor may rely upon their terms and raise them as a defense in any action. 1.9 Sale of Receipts. Merchant and FUNDER agree that the Purchase Price under this Agreement is in exchange for the Purchased Amount and that such Purchase Price is not intended to be, nor shall it be construed as a loan from FUNDER to Merchant. Merchant agrees that the Purchase Price is in exchange for the sale of future Receipts pursuant to this Agreement equals the fair market value of such Receipts. FUNDER has purchased and shall own all the Receipts described in this Agreement up to the full Purchased Amount as the Receipts are created. Payments made to FUNDER in respect to the full amount of the Receipts shall be conditioned upon Merchant's sale of products and services and the payment therefore by Merchant's customers in the manner provided in Section 1.1. In no event shall the aggregate of all amounts be deemed as interest hereunder and charged or collected hereunder exceed the highest rate permissible at law. In the event that a court determines that FUNDER has charged or received interest hereunder in excess of the highest applicable rate, the rate in effect hereunder shall automatically be reduced to the maximum rate permitted by applicable law and FUNDER shall promptly refund to Merchant any interest received by FUNDER in excess of the maximum lawful rate, it being intended that Merchant not pay or contract to pay, and that FUNDER not receive or contract to receive, directly or indirectly in any manner whatsoever, interest in excess of that which may be paid by Merchant under applicable law. 1.10 Power of Attorney Merchant irrevocably appoints FUNDER as its agent and attorney-in-fact with full authority to take any action or execute any instrument or document to settle all obligations due to FUNDER from Processor/Bank, or in the case of a violation by Merchant of Section 1.12 or the occurrence of an Event of Default under Section 4 hereof, from Merchant, under this Agreement, including without limitation (i) to obtain and adjust insurance; (ii) to collect monies due or to become due under or in respect of any of the Collateral; (iii) to receive, endorse and collect any checks, notes, drafts, instruments, documents or chattel paper in connection with clause (i) or clause (ii) above; (iv) to sign Merchant's name on any invoice, bill of lading, or assignment directing customers or account debtors to make payment directly to FUNDER; and (v) to file any claims or take any action or institute any proceeding which FUNDER may deem necessary for the collection of any of the unpaid Purchased Amount from the Collateral, or otherwise to enforce its rights with respect to payment of the Purchased Amount. 1.11 Protections Against Default, The following Protections 1 through 7 may be invoked by FUNDER, immediately and without notice to Merchant in the event (a) Merchant changes its arrangements with Processor/Bank in any way that is adverse to FUNDER; (b) Merchant changes the deposit account through which the Receipts are settled., or permits any event to occur that could cause diversion of any of Merchant's transactions to another account; (c) Merchant interrupts the operation of this business (other than adverse weather, natural disasters or acts of God) transfers, moves, sells, disposes, transfers or otherwise conveys its business or assets without (i) the express prior written consent of FUNDER, and (ii) the written agreement of any purchaser or transferee to the assumption of all of Merchant's obligations under this Agreement pursuant to documentation satisfactory to FUNDER; or (d) Merchant takes any action, fails to take any action, or offers any incentive —economic or otherwise—the result of which will be to induce any customer or customers to pay for Merchant's services with any means other than checks that are settled through Processor. These protections are in addition to any other remedies available to FUNDER at law, in equity or otherwise pursuant to this Agreement. Protection 1. The full uncollected Purchase Amount plus all fees due under this Agreement and the attached Security Agreement become due and payable in full immediately Protection 2. FUNDER may enforce the provisions of the Personal Guarantee of Performance against the Guarantor. Protection 3. Merchant shall, upon execution of this Agreement, deliver to FUNDER an executed confession of judgment in favor of FUNDER in the amount of the Purchase Amount stated in the Agreement. Upon breach of any provision in this paragraph 1.11, FUNDER may enter that confession of judgment as a judgment with the Clerk of the Court and execute thereon. Protection 4. FUNDER may enforce its security interest in the Collateral identified in Article III hereof. Protection 5. The entire Purchase Amount shall become immediately refundable to FUNDER from Merchant. Protection 6. FUNDER may proceed to protect and enforce its rights and remedies by lawsuit. In any such lawsuit, in which FUNDER shall recover judgment against Merchant, Merchant shall be liable for all of FUNDER's costs of lawsuit, including but not limited to all reasonable attorneys' fees and court costs. Protection 7. Merchant shall, upon execution of this Agreement, deliver to FUNDER an executed assignment of lease of Merchant's premises in favor of FUNDER. Upon breach of any provision in this paragraph 1.12, FUNDER may exercise its rights under such assignment of lease. Protection 8. FUNDER may debit Merchant's depository accounts wherever situated by means of ACH debit or facsimile signature on a computer- generated check drawn on Merchant's bank account or otherwise. 1.12 Protection of Information. Merchant and each person signing this Agreement on behalf of Merchant and/or as Owner, in respect of himself or herself personally, authorizes FUNDER to disclose information concerning Merchant's and each Owner's credit standing (including credit bureau reports that FUNDER obtains) and business conduct only to agents, affiliates, subsidiaries, and credit reporting bureaus. Merchant and each Owner hereby waives to the maximum extent permitted by law any claim for damages against FUNDER or any of its affiliates and the Funders relating to any (i) investigation undertaken by or on behalf of FUNDER as permitted by this Agreement or (ii) disclosure of information as permitted by this Agreement. 1.13 Confidentiality. Merchant understands and agrees that the terms and conditions of the products and services offered by FUNDER, including this Agreement and any other FUNDER documentations (collectively, "Confidential Information") are proprietary and confidential information of FUNDER. Accordingly unless disclosure is required by law or court order, Merchant shall not disclose Confidential Information of FUNDER to any person other than an attorney, accountant, financial advisor or employee of Merchant who needs to know such information for the purpose of advising Merchant ("Advisor"), provided such Advisor uses such information solely for the purpose of advising Merchant and first agrees in writing to be bound by the terms of this Section 1.13. 1.14 Publicity. Merchant and each Owner only authorizes FUNDER to use its, his or her name in a listing of clients and in advertising and marketing materials with their express written consent. 1.15 D/B/A's, Merchant hereby acknowledges and agrees that FUNDER may be using "doing business as" or "d/b/a" names in connection with various matters relating to the transaction between FUNDER and Merchant, including the filing of UCC-1 financing statements and other notices or filings. II. REPRESENTATIONS, WARRANTIES AND COVENANTS Merchant represents, warrants and CFN ACH 01-25-16 Colonial Funding Network as Servicing Agent

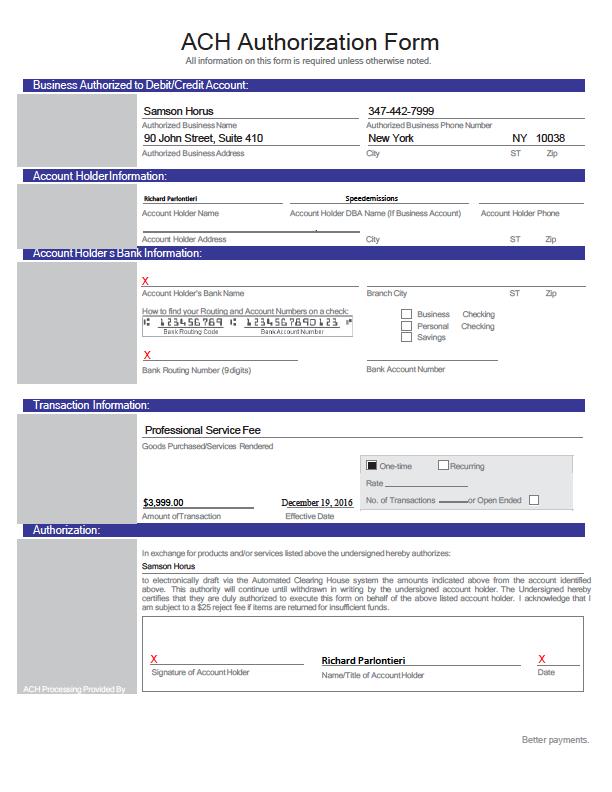

ACH Authorization Form All information on this form is required unless otherwise noted. Business Authorized to Debit/Credit Account: Samson Horns Authorized Business Name 90 John Street, Suite 410 Authorized Business Address Account Holder Information: Richard Parlontieri 347-442-7999 Authorized Business Phone Number New York NY 10038 lfit" ST Zip Speedemissions • Account Holder Name Account Holder DBA Name (If Business Account) Account Holder Phone Account Holder Address Account Holder s Bank Information: X Account Holder's Bank Name How to find your Routing and Account Numbers on a check: is 1 23456789 1: L 2345678901.23 ir Bank Routing Code Bunk Account Number X Bank Routing Number (9 digits) Transaction Information: Professional Service Fee City ST Zip Branch City ST Zip ❑ Business Checking ❑ Personal Checking 111 Savings Bank Account Number Goods Purchased/Services Rendered One-time Rate $3,999.00 December 19, 2016 No. of Transactions or Open Ended Authorization: ACH Processing Provided By Amount ofTransaction Effective Date In exchange for products and/or services listed above the undersigned hereby authorizes: Samson Horus to electronically draft via the Automated Clearing House system the amounts indicated above from the account identified above. This authority will continue until withdrawn in writing by the undersigned account holder. The Undersigned hereby certifies that they are duly authorized to execute this form on behalf of the above listed account holder. I acknowledge that I am subject to a $25 reject fee if items are returned for insufficient funds. Signature of Account Holder Name/Title of Account Holder Better payments.

covenants that as of this date and during the term of this Agreement: 2.1 Financial Condition and Financial Information Its bank and financial statements, copies of which have been furnished to FUNDER, and future statements which will be furnished hereafter at the discretion of FUNDER, fairly represent the financial condition of Merchant at such dates, and since those dates there has been no material adverse changes, financial or otherwise, in such condition, operation or ownership of Merchant. Merchant has a continuing, affirmative obligation to advise FUNDER of any material adverse change in its financial condition, operation or ownership. FUNDER may request statements at any time during the performance of this Agreement and the Merchant shall provide them to FUNDER within S business days. Merchant's failure to do so is a material breach of this Agreement. 2.2 Governmental Approvals, Merchant is in compliance and shall comply with all laws and has valid permits, authorizations and licenses to own, operate and lease its properties and to conduct the business in which it is presently engaged. 2.3 Authorization. Merchant, and the person(s) signing this Agreement on behalf of Merchant, have full power and authority to incur and perform the obligations under this Agreement, all of which have been duly authorized. 2.4 Insurance. Merchant will maintain business- interruption insurance naming FUNDER as loss payee and additional insured in amounts and against risks as are satisfactory to FUNDER and shall provide FUNDER proof of such insurance upon request. 2.5 Intentionally omitted 2.6 Change of Name or Location Merchant will not conduct Merchant's businesses under any name other than as disclosed to the Processor and FUNDER or change any of its places of business. 2.7 Daily Batch Out. Merchant will batch out receipts with the Processor on a daily basis. 2.8 Estoppel Certificate. Merchant will at any time, and from time to time, upon at least one (1) day's prior notice from FUNDER to Merchant, execute, acknowledge and deliver to FUNDER and/or to any other person, person firm or corporation specified by FUNDER, a statement certifying that this Agreement is unmodified and in full force and effect (or, if there have been modifications, that the same is in full force and effect as modified and stating the modifications) and stating the dates which the Purchased Amount or any portion thereof has been repaid. 2.9 No Bankruptcy or Insolvency. As of the date of this Agreement, Merchant represents that it is not insolvent and does not contemplate and has not filed any petition for bankruptcy protection under Title 11 of the United States Code and there has been no involuntary petition brought or pending against Merchant. Merchant further warrants that it does not anticipate filing any such bankruptcy petition and it does not anticipate that an involuntary petition will be filed against it. In the event that the Merchant files for bankruptcy protection or is placed under an involuntary filing Protections 2 and 3 are immediately invoked. 2.10 Additional Financing. Merchant shall not enter into any arrangement, agreement or commitment for any additional financing, whether in the form of a purchase of receivables or a loan to the business with any party other than FUNDER without their written permission. 2.11 Unencumbered Receipts. Merchant has good, complete and marketable title to all Receipts, free and clear of any and all liabilities, liens, claims, changes, restrictions, conditions, options, rights, mortgages, security interests, equities, pledges and encumbrances of any kind or nature whatsoever or any other rights or interests that may be inconsistent with the transactions contemplated with, or adverse to the interests of FUNDER. 2.12 Businessftupiar„ Merchant is a valid business in good standing under the laws of the jurisdictions in which it is organized and/or operates, and Merchant is entering into this Agreement for business purposes and not as a consumer for personal, family or household purposes. 2.13 Default Under Other Contracts, Merchant's execution of and/or performance under this Agreement will not cause or create an event of default by Merchant under any contract with another person or entity. III. EVENTS OF DEFAULT AND REMEDIES 3.1 Events of Default. The occurrence of any of the following events shall constitute an "Event of Default" hereunder: (a) Merchant shall violate any term or covenant in this Agreement; (b) Any representation or warranty by Merchant in this Agreement shall prove to have been incorrect, false or misleading in any material respect when made; (c) Merchant shall admit in writing its inability to pay its debts, or shall make a general assignment for the benefit of creditors; or any proceeding shall be instituted by or against Merchant seeking to adjudicate it a bankrupt or insolvent, or seeking reorganization, arrangement, adjustment, or composition of it or its debts; (d) the sending of notice of termination by Guarantor; (e) Merchant shall transport, move, interrupt, suspend, dissolve or terminate its business; (f) Merchant shall transfer or sell all or substantially all of its assets; (h) Merchant shall make or send notice of any intended bulk sale or transfer by Merchant; (i) Merchant shall use multiple depository accounts without the prior written consent of FUNDER; (j) Merchant shall change its depositing account without the prior written consent of FUNDER; (k) Merchant shall perform any act that reduces the value of any Collateral granted under this Agreement; or (1) Merchant shall default under any of the terms, covenants and conditions of any other agreement with FUNDER. 3.2 Remedies. In case any Event of Default occurs and is not waived pursuant to Section 4.4.1 hereof, FUNDER on its own and on behalf of the Funders may proceed to protect and enforce its rights or remedies by suit in equity or by action at law, or both, whether for the specific performance of any covenant, agreement or other provision contained herein, or to enforce the discharge of Merchant's obligations hereunder (including the Personal Guarantee) or any other legal or equitable right or remedy. All rights, powers and remedies of FUNDER in connection with this Agreement may be exercised at any time by FUNDER after the occurrence of an Event of Default, are cumulative and not exclusive, and shall be in addition to any other rights, powers or remedies provided by law or equity. 3.3 Costs. Merchant shall pay to FUNDER all reasonable costs associated with (a) a breach by Merchant of the Covenants in this Agreement and the enforcement thereof, and (b) the enforcement of FUNDER's remedies set forth in Section 4.2 above, including but not limited to court costs and attorneys' fees. 3.4 Required Notifications Merchant is required to give FUNDER written notice within 24 hours of any filing under Title 11 of the United States Code. Merchant is required to give FUNDER seven days' written notice prior to the closing of any sale of all or substantially all of the Merchant's assets or stock. IV. MISCELLANEOUS 4.1 Modifications: Agreements. No modification, amendment, waiver or consent of any provision of this Agreement shall be effective unless the same shall be in writing and signed by FUNDER. 4.2 Assignment. Merchant acknowledges and understands that FUNDER is acting on its own behalf and as the administrator and lead investor for a group of independent participants a list of which can be provided to Merchant after funding and upon written notice to FUNDER. FUNDER may assign, transfer or sell its rights to receive the Purchased Amount or delegate its duties hereunder, either in whole or in Part. 4.3 Notices. All notices, requests, consent, demands and other communications hereunder shall be delivered by certified mail, return receipt requested, to the respective parties to this Agreement at the addresses set forth in this Agreement and shall become effective only upon receipt. 4.4 Waiver Remedies No failure on the part of FUNDER to exercise, and no delay in exercising, any right under this Agreement shall operate as a waiver thereof, nor shall any single or partial exercise of any right under this Agreement preclude any other or further exercise thereof or the exercise of any other right. The remedies provided hereunder are cumulative and not exclusive of any remedies provided by law or equity. 4.5 Binding Effect: Governing Law. Venue and Jurisdiction. This Agreement shall be binding upon and inure to the benefit of Merchant, FUNDER (and it's Participants) and their respective successors and assigns, FUNDER's Participants shall be third party beneficiaries of all such agreements. except that Merchant shall not have the right to assign its rights hereunder or any interest herein without the prior written consent of FUNDER which consent may be withheld in FUNDER's sole discretion. FUNDER reserves the rights to assign this Agreement with or without prior written notice to Merchant. This Agreement shall be governed by and construed in accordance with the laws of the State of New York, without regards to any applicable principals of conflicts of law. Any suit, action or proceeding arising hereunder, or the interpretation, performance or breach hereof, shall, if FUNDER so elects, be instituted in any court sitting in New York, (the "Acceptable Forums"). Merchant agrees that the Acceptable Forums are convenient to it, and submits to the jurisdiction of the Acceptable Forums and waives any and all objections to jurisdiction or venue. Should such proceeding be initiated in any other forum, Merchant waives any right to oppose any motion or application made by FUNDER to transfer such proceeding to an Acceptable Forum. 4.6 Survival of Representation. etc. All representations, warranties and covenants herein shall survive the execution and delivery of this Agreement and shall continue in full force until all obligations under this Agreement shall have been satisfied in full and this Agreement shall have terminated. 4.7 Severability. In case any of the provisions in this Agreement is found to be invalid, illegal or unenforceable in any respect, the validity, legality and enforceability of any other provision contained herein shall not in any way be affected or impaired. 4.8 Entire Agreement. Any provision hereof prohibited by law shall be ineffective only to the extent of such prohibition without invalidating the remaining provisions hereof. This Agreement and Security Agreement hereto embody the entire agreement between Merchant and FUNDER and supersede all prior agreements and understandings relating to the subject matter hereof. 4.9 JURY TRIAL WAIVER, THE PARTIES HERETO WAIVE TRIAL BY JURY IN ANY COURT IN ANY SUIT, ACTION OR PROCEEDING ON ANY MATTER ARISING IN CONNECTION WITH OR IN ANY WAY RELATED TO THE TRANSACTIONS OF WHICH THIS AGREEMENT IS A PART OR THE ENFORCEMENT HEREOF. THE CFN ACH 01-25-16 Colonial Funding Network as Servicing Agent

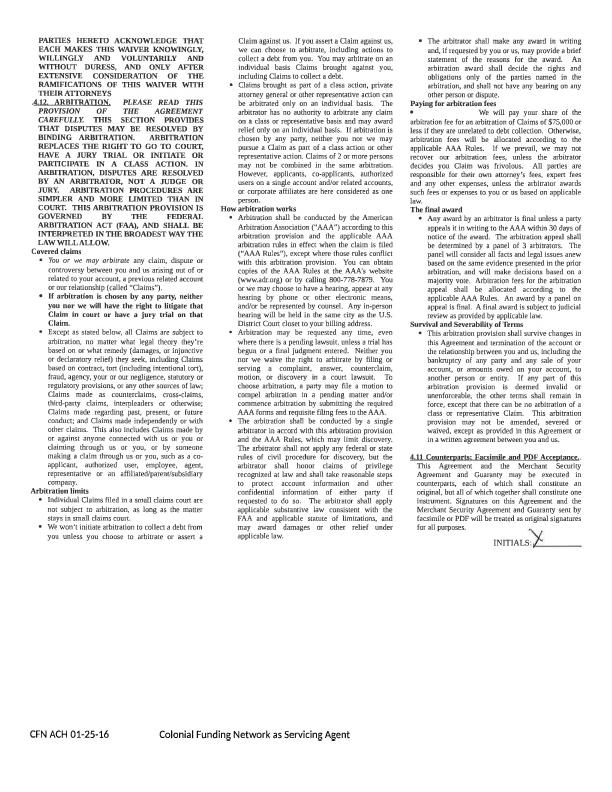

PARTIES HERETO ACKNOWLEDGE THAT EACH MAKES THIS WAIVER KNOWINGLY, WILLINGLY AND VOLUNTARILY AND WITHOUT DURESS, AND ONLY AFTER EXTENSIVE CONSIDERATION OF THE RAMIFICATIONS OF THIS WAIVER WITH THEIR ATTORNEYS .4.12. ARBITRATION. PLEASE READ THIS PROVISION OF THE AGREEMENT CAREFULLY. THIS SECTION PROVIDES THAT DISPUTES MAY BE RESOLVED BY BINDING ARBITRATION. ARBITRATION REPLACES THE RIGHT TO GO TO COURT, HAVE A JURY TRIAL OR INITIATE OR PARTICIPATE IN A CLASS ACTION. IN ARBITRATION, DISPUTES ARE RESOLVED BY AN ARBITRATOR, NOT A JUDGE OR JURY. ARBITRATION PROCEDURES ARE SIMPLER AND MORE LIMITED THAN IN COURT. THIS ARBITRATION PROVISION IS GOVERNED BY THE FEDERAL ARBITRATION ACT (FAA), AND SHALL BE INTERPRETED IN THE BROADEST WAY THE LAW WILL ALLOW. Covered claims • You or we may arbitrate any claim, dispute or controversy between you and us arising out of or related to your account, a previous related account or our relationship (called "Claims"). • If arbitration is chosen by any party, neither you nor we will have the right to litigate that Claim in court or have a jury trial on that Claim. • Except as stated below, all Claims are subject to arbitration, no matter what legal theory they're based on or what remedy (damages, or injunctive or declaratory relief) they seek, including Claims based on contract, tort (including intentional tort), fraud, agency, your or our negligence, statutory or regulatory provisions, or any other sources of law; Claims made as counterclaims, cross-claims, third-party claims, interpleaders or otherwise; Claims made regarding past, present, or future conduct; and Claims made independently or with other claims. This also includes Claims made by or against anyone connected with us or you or claiming through us or you, or by someone making a claim through us or you, such as a co- applicant, authorized user, employee, agent, representative or an affiliated/parent/subsidiary company. Arbitration limits • Individual Claims filed in a small claims court are not subject to arbitration, as long as the matter stays in small claims court. • We won't initiate arbitration to collect a debt from you unless you choose to arbitrate or assert a Claim against us. If you assert a Claim against us, we can choose to arbitrate, including actions to collect a debt from you. You may arbitrate on an individual basis Claims brought against you, including Claims to collect a debt. • Claims brought as part of a class action, private attorney general or other representative action can be arbitrated only on an individual basis. The arbitrator has no authority to arbitrate any claim on a class or representative basis and may award relief only on an individual basis. If arbitration is chosen by any party, neither you nor we may pursue a Claim as part of a class action or other representative action. Claims of 2 or more persons may not be combined in the same arbitration. However, applicants, co-applicants, authorized users on a single account and/or related accounts, or corporate affiliates are here considered as one person. How arbitration works • Arbitration shall be conducted by the American Arbitration Association ("AAA") according to this arbitration provision and the applicable AAA arbitration rules in effect when the claim is filed ("AAA Rules"), except where those rules conflict with this arbitration provision. You can obtain copies of the AAA Rules at the AAA's website (www.adr.org) or by calling 800-778-7879. You or we may choose to have a hearing, appear at any hearing by phone or other electronic means, and/or be represented by counsel. Any in-person hearing will be held in the same city as the U.S. District Court closet to your billing address. • Arbitration may be requested any time, even where there is a pending lawsuit, unless a trial has begun or a final judgment entered. Neither you nor we waive the right to arbitrate by filing or serving a complaint, answer, counterclaim, motion, or discovery in a court lawsuit. To choose arbitration, a party may file a motion to compel arbitration in a pending matter and/or commence arbitration by submitting the required AAA forms and requisite filing fees to the AAA. • The arbitration shall be conducted by a single arbitrator in accord with this arbitration provision and the AAA Rules, which may limit discovery. The arbitrator shall not apply any federal or state rules of civil procedure for discovery, but the arbitrator shall honor claims of privilege recognized at law and shall take reasonable steps to protect account information and other confidential information of either party if requested to do so. The arbitrator shall apply applicable substantive law consistent with the FAA and applicable statute of limitations, and may award damages or other relief under applicable law. • The arbitrator shall make any award in writing and, if requested by you or us, may provide a brief statement of the reasons for the award. An arbitration award shall decide the rights and obligations only of the parties named in the arbitration, and shall not have any bearing on any other person or dispute. Paying for arbitration fees • We will pay your share of the arbitration fee for an arbitration of Claims of $75,000 or less if they are unrelated to debt collection. Otherwise, arbitration fees will be allocated according to the applicable AAA Rules. If we prevail, we may not recover our arbitration fees, unless the arbitrator decides you Claim was frivolous. All parties are responsible for their own attorney's fees, expert fees and any other expenses, unless the arbitrator awards such fees or expenses to you or us based on applicable law. The final award • Any award by an arbitrator is final unless a party appeals it in writing to the AAA within 30 days of notice of the award. The arbitration appeal shall be determined by a panel of 3 arbitrators. The panel will consider all facts and legal issues anew based on the same evidence presented in the prior arbitration, and will make decisions based on a majority vote. Arbitration fees for the arbitration appeal shall be allocated according to the applicable AAA Rules. An award by a panel on appeal is final. A final award is subject to judicial review as provided by applicable law. Survival and Severability of Terms • This arbitration provision shall survive changes in this Agreement and termination of the account or the relationship between you and us, including the bankruptcy of any party and any sale of your account, or amounts owed on your account, to another person or entity. If any part of this arbitration provision is deemed invalid or unenforceable, the other terms shall remain in force, except that there can be no arbitration of a class or representative Claim. This arbitration provision may not be amended, severed or waived, except as provided in this Agreement or in a written agreement between you and us. 4.11 Counterparts: Facsimile and PDF Acceptance.. This Agreement and the Merchant Security Agreement and Guaranty may be executed in counterparts, each of which shall constitute an original, but all of which together shall constitute one instrument. Signatures on this Agreement and the Merchant Security Agreement and Guaranty sent by facsimile or PDF will be treated as original signatures for all purposes. INITIAL S: CFN ACH 01-25-16 Colonial Funding Network as Servicing Agent

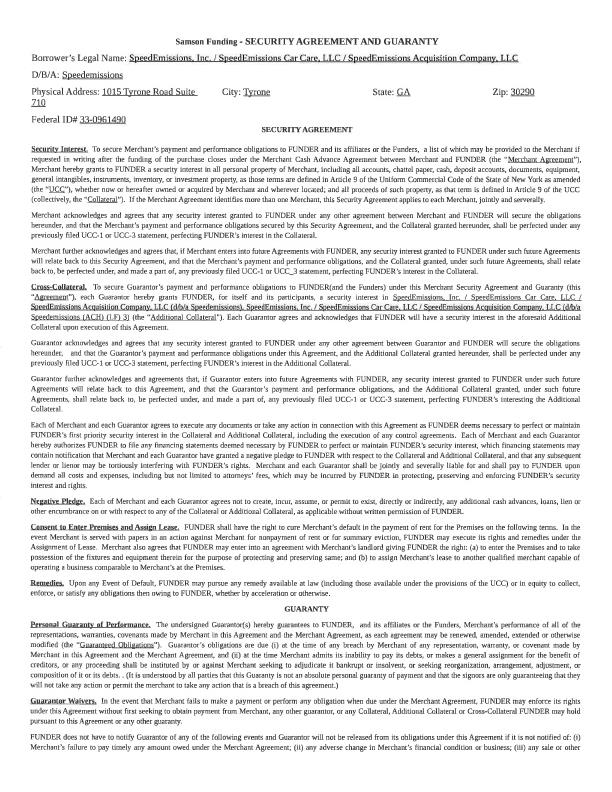

Samson Funding - SECURITY AGREEMENT AND GUARANTY Borrower's Legal Name: SpeedEmissions. Inc. / SpeedEmissions Car Care. LLC / SpeedEmissions Acquisition Company. LLC D/B/A: Speedemissions Physical Address: 1015 Tyrone Road Suite City: Tyrone State: Zip: 30290 710 Federal ID# 33-0961490 SECURITY AGREEMENT Security Interest. To secure Merchant's payment and performance obligations to FUNDER and its affiliates or the Funders, a list of which may be provided to the Merchant if requested in writing after the funding of the purchase closes under the Merchant Cash Advance Agreement between Merchant and FUNDER (the "Merchant Agreement"), Merchant hereby grants to FUNDER a security interest in all personal property of Merchant, including all accounts, chattel paper, cash, deposit accounts, documents, equipment, general intangibles, instruments, inventory, or investment property, as those terms are defined in Article 9 of the Uniform Commercial Code of the State of New York as amended (the "UCC"), whether now or hereafter owned or acquired by Merchant and wherever located; and all proceeds of such property, as that term is defined in Article 9 of the UCC (collectively, the "Collateral"). If the Merchant Agreement identifies more than one Merchant, this Security Agreement applies to each Merchant, jointly and serverally. Merchant acknowledges and agrees that any security interest granted to FUNDER under any other agreement between Merchant and FUNDER will secure the obligations hereunder, and that the Merchant's payment and performance obligations secured by this Security Agreement, and the Collateral granted hereunder, shall be perfected under any previously filed UCC-1 or UCC-3 statement, perfecting FUNDER's interest in the Collateral. Merchant further acknowledges and agrees that, if Merchant enters into future Agreements with FUNDER, any security interest granted to FUNDER under such future Agreements will relate back to this Security Agreement, and that the Merchant's payment and performance obligations, and the Collateral granted, under such future Agreements, shall relate back to, be perfected under, and made a part of, any previously filed UCC-1 or UCC_3 statement, perfecting FUNDER's interest in the Collateral. Cross-Collateral. To secure Guarantor's payment and performance obligations to FUNDER(and the Funders) under this Merchant Security Agreement and Guaranty (this "Agreement"), each Guarantor hereby grants FUNDER, for itself and its participants, a security interest in SpeedEmissions. Inc. / SpeedEmissions Car Care. LLC / SpeedEmissions Accuisitlon Company. LLC fd/b/a Speedemissions} SpeedEmissions Inc I SpeedEmissions Car Cate LLC I SpeedEmissions Acquisition Company LLC (d/Lila mi inn A LF (the "Additional Collateral"). Each Guarantor agrees and acknowledges that FUNDER will have a security interest in the aforesaid Additional Collateral upon execution of this Agreement. Guarantor acknowledges and agrees that any security interest granted to FUNDER under any other agreement between Guarantor and FUNDER will secure the obligations hereunder, and that the Guarantor's payment and performance obligations under this Agreement, and the Additional Collateral granted hereunder, shall be perfected under any previously filed UCC-1 or UCC-3 statement, perfecting FUNDER's interest in the Additional Collateral. Guarantor further acknowledges and agreements that, if Guarantor enters into future Agreements with FUNDER, any security interest granted to FUNDER under such future Agreements will relate back to this Agreement, and that the Guarantor's payment and performance obligations, and the Additional Collateral granted, under such future Agreements, shall relate back to, be perfected under, and made a part of, any previously filed UCC-1 or UCC-3 statement, perfecting FUNDER's interesting the Additional Collateral. Each of Merchant and each Guarantor agrees to execute any documents or take any action in connection with this Agreement as FUNDER deems necessary to perfect or maintain FUNDER's first priority security interest in the Collateral and Additional Collateral, including the execution of any control agreements. Each of Merchant and each Guarantor hereby authorizes FUNDER to file any financing statements deemed necessary by FUNDER to perfect or maintain FUNDER's security interest, which financing statements may contain notification that Merchant and each Guarantor have granted a negative pledge to FUNDER with respect to the Collateral and Additional Collateral, and that any subsequent lender or lienor may be tortiously interfering with FUNDER's rights. Merchant and each Guarantor shall be jointly and severally liable for and shall pay to FUNDER upon demand all costs and expenses, including but not limited to attorneys' fees, which may be incurred by FUNDER in protecting, preserving and enforcing FUNDER's security interest and rights. Negative Pledge Each of Merchant and each Guarantor agrees not to create, incur, assume, or permit to exist, directly or indirectly, any additional cash advances, loans, lien or other encumbrance on or with respect to any of the Collateral or Additional Collateral, as applicable without written permission of FUNDER. Consent to Enter Premises and Assign Lease. FUNDER shall have the right to cure Merchant's default in the payment of rent for the Premises on the following terms. In the event Merchant is served with papers in an action against Merchant for nonpayment of rent or for summary eviction, FUNDER may execute its rights and remedies under the Assignment of Lease. Merchant also agrees that FUNDER may enter into an agreement with Merchant's landlord giving FUNDER the right: (a) to enter the Premises and to take possession of the fixtures and equipment therein for the purpose of protecting and preserving same; and (b) to assign Merchant's lease to another qualified merchant capable of operating a business comparable to Merchant's at the Premises. Remedies Upon any Event of Default, FUNDER may pursue any remedy available at law (including those available under the provisions of the UCC) or in equity to collect, enforce, or satisfy any obligations then owing to FUNDER, whether by acceleration or otherwise. GUARANTY Personal Guaranty of Performance. The undersigned Guarantor(s) hereby guarantees to FUNDER, and its affiliates or the Funders, Merchant's performance of all of the representations, warranties, covenants made by Merchant in this Agreement and the Merchant Agreement, as each agreement may be renewed, amended, extended or otherwise modified (the "Guaranteed Obligations"). Guarantor's obligations are due (i) at the time of any breach by Merchant of any representation, warranty, or covenant made by Merchant in this Agreement and the Merchant Agreement, and (ii) at the time Merchant admits its inability to pay its debts, or makes a general assignment for the benefit of creditors, or any proceeding shall be instituted by or against Merchant seeking to adjudicate it bankrupt or insolvent, or seeking reorganization, arrangement, adjustment, or composition of it or its debts.. (It is understood by all parties that this Guaranty is not an absolute personal guaranty of payment and that the signors are only guaranteeing that they will not take any action or permit the merchant to take any action that is a breach of this agreement.) Guarantor Waivers. In the event that Merchant fails to make a payment or perform any obligation when due under the Merchant Agreement, FUNDER may enforce its rights under this Agreement without first seeking to obtain payment from Merchant, any other guarantor, or any Collateral, Additional Collateral or Cross-Collateral FUNDER may hold pursuant to this Agreement or any other guaranty. FUNDER does not have to notify Guarantor of any of the following events and Guarantor will not be released from its obligations under this Agreement if it is not notified of: (i) Merchant's failure to pay timely any amount owed under the Merchant Agreement; (ii) any adverse change in Merchant's financial condition or business; (iii) any sale or other

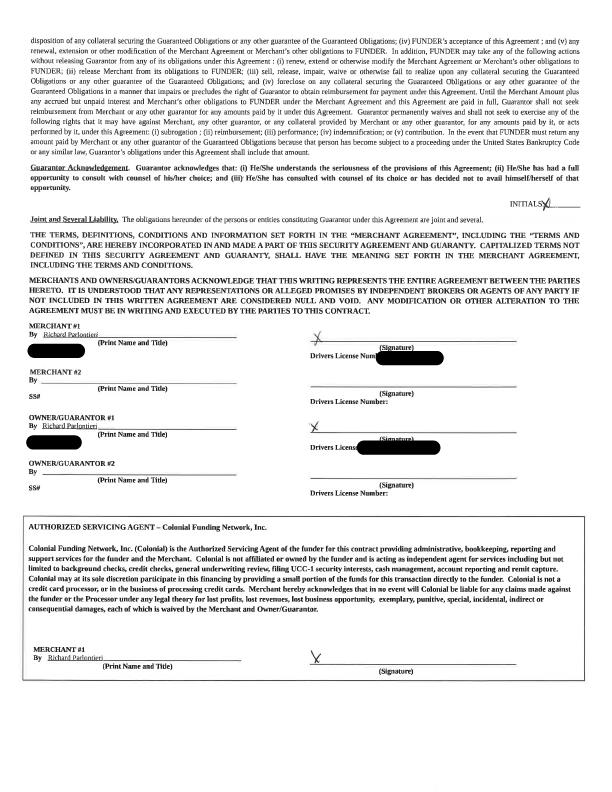

disposition of any collateral securing the Guaranteed Obligations or any other guarantee of the Guaranteed Obligations; (iv) FUNDER's acceptance of this Agreement ; and (v) any renewal, extension or other modification of the Merchant Agreement or Merchant's other obligations to FUNDER. In addition, FUNDER may take any of the following actions without releasing Guarantor from any of its obligations under this Agreement : (i) renew, extend or otherwise modify the Merchant Agreement or Merchant's other obligations to FUNDER; (ii) release Merchant from its obligations to FUNDER; (iii) sell, release, impair, waive or otherwise fail to realize upon any collateral securing the Guaranteed Obligations or any other guarantee of the Guaranteed Obligations; and (iv) foreclose on any collateral securing the Guaranteed Obligations or any other guarantee of the Guaranteed Obligations in a manner that impairs or precludes the right of Guarantor to obtain reimbursement for payment under this Agreement. Until the Merchant Amount plus any accrued but unpaid interest and Merchant's other obligations to FUNDER under the Merchant Agreement and this Agreement are paid in full, Guarantor shall not seek reimbursement from Merchant or any other guarantor for any amounts paid by it under this Agreement. Guarantor permanently waives and shall not seek to exercise any of the following rights that it may have against Merchant, any other guarantor, or any collateral provided by Merchant or any other guarantor, for any amounts paid by it, or acts performed by it, under this Agreement: (i) subrogation ; (ii) reimbursement; (ill) performance; (iv) indemnification; or (v) contribution. In the event that FUNDER must return any amount paid by Merchant or any other guarantor of the Guaranteed Obligations because that person has become subject to a proceeding under the United States Bankruptcy Code or any similar law, Guarantor's obligations under this Agreement shall include that amount. Guarantor A c_luimal I • • ment. Guarantor acknowledges that: (i) He/She understands the seriousness of the provisions of this Agreement; (ii) He/She has had a full opportunity to consult with counsel of his/her choice; and 04 He/She has consulted with counsel of its choice or has decided not to avail himself/herself of that opportunity. INITIAL S Joint and Several Liability. The obligations hereunder of the persons or entities constituting Guarantor under this Agreement are joint and several. THE TERMS, DEFINITIONS, CONDITIONS AND INFORMATION SET FORTH IN THE "MERCHANT AGREEMENT", INCLUDING THE "TERMS AND CONDITIONS", ARE HEREBY INCORPORATED IN AND MADE A PART OF THIS SECURITY AGREEMENT AND GUARANTY. CAPITALIZED TERMS NOT DEFINED IN THIS SECURITY AGREEMENT AND GUARANTY, SHALL HAVE THE MEANING SET FORTH IN THE MERCHANT AGREEEMNT, INCLUDING THE TERMS AND CONDITIONS. MERCHANTS AND OWNERS/GUARANTORS ACKNOWLEDGE THAT THIS WRITING REPRESENTS THE ENTIRE AGREEMENT BETWEEN THE PARTIES HERETO. IT IS UNDERSTOOD THAT ANY REPRESENTATIONS OR ALLEGED PROMISES BY INDEPENDENT BROKERS OR AGENTS OF ANY PARTY IF NOT INCLUDED IN THIS WRITTEN AGREEMENT ARE CONSIDERED NULL AND VOID. ANY MODIFICATION OR OTHER ALTERATION TO THE AGREEMENT MUST BE IN WRITING AND EXECUTED BY THE PARTIES TO THIS CONTRACT. MERCHANT #1 By Richard Parlontieri (Print Name and Title) SS# ###-##-#### MERCHANT #2 By (Print Name and Title) SS# OWNER/GUARANTOR #1 By Richard Parlontieri (Print Name and Title) SS# ###-##-#### OWNER/GUARANTOR #2 By (Print Name and Title) SS# AUTHORIZED SERVICING AGENT — Colonial Funding Network, Inc. (Signature) Drivers License Number: 018466983-GA (Signature) Drivers License Number: (Signature) Drivers License Number: 018466983-GA (Signature) Drivers License Number: Colonial Funding Network, Inc. (Colonial) is the Authorized Servicing Agent of the funder for this contract providing administrative, bookkeeping, reporting and support services for the funder and the Merchant. Colonial is not affiliated or owned by the hinder and is acting as independent agent for services including but not limited to background checks, credit checks, general underwriting review, filing UCC-1 security interests, cash management, account reporting and remit capture. Colonial may at its sole discretion participate in this financing by providing a small portion of the funds for this transaction directly to the funder. Colonial is not a credit card processor, or in the business of processing credit cards. Merchant hereby acknowledges that in no event will Colonial be liable for any claims made against the hinder or the Processor under any legal theory for lost profits, lost revenues, lost business opportunity, exemplary, punitive, special, incidental, indirect or consequential damages, each of which is waived by the Merchant and Owner/Guarantor. MERCHANT #1 By Richard Parlontieri (Print Name and Title) (Signature)

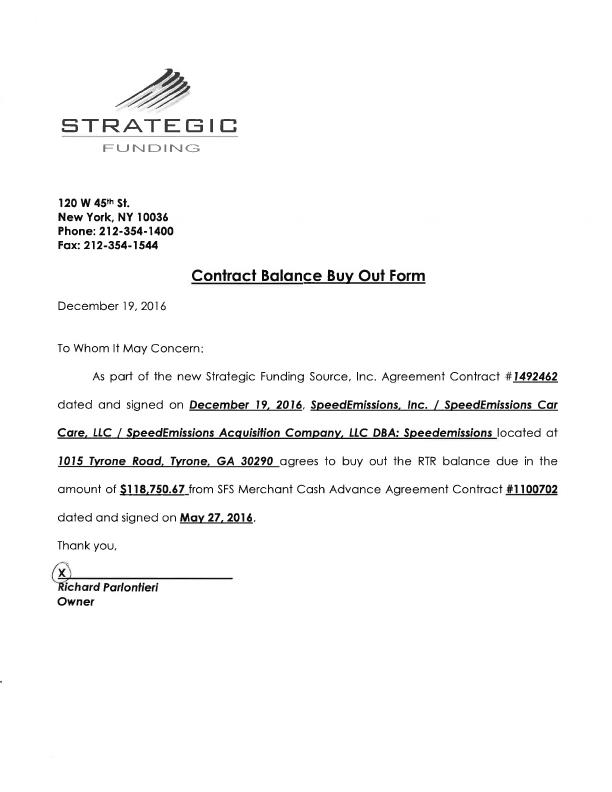

STRATEGIC FUNDIN 120 W 45th St. New York, NY 10036 Phone: 212-354-1400 Fax: 212-354-1544 December 19, 2016 G Contract Balance Buy Out Form To Whom It May Concern: As part of the new Strategic Funding Source, Inc. Agreement Contract #1492462 dated and signed on December 19, 2016, SpeedEmissions, Inc. I SpeedEmissions Car Care, LLC SpeedEmissions Acquisition Company, LLC DBA: Speedemissions located at 1015 Tyrone Road. Tyrone. GA 30290 agrees to buy out the RTR balance due in the amount of $118,750.67 from SFS Merchant Cash Advance Agreement Contract #1100702 dated and signed on May 27, 2016. Thank you, (x) Richard Parlontieri Owner Ir"%c lp

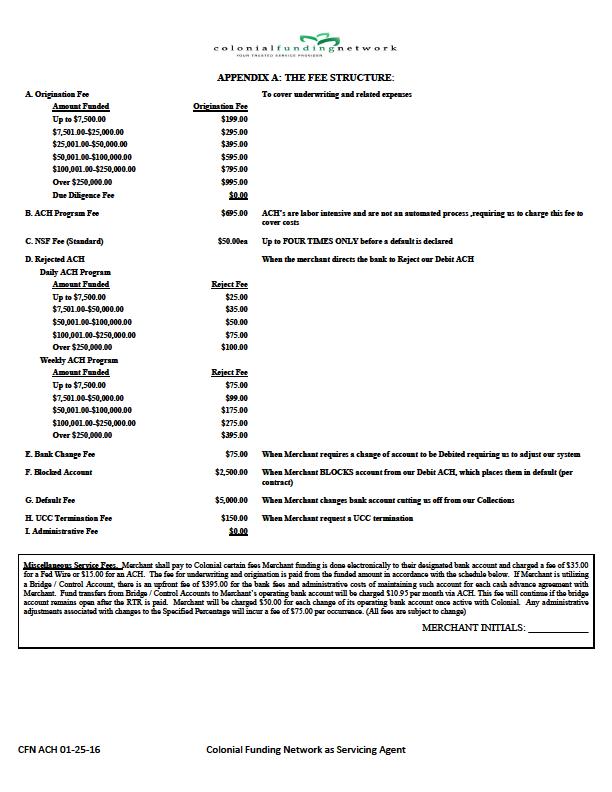

colortialfundingnetwork YOUR TRUSTED SERVICE PROVIDER APPENDIX A: THE FEE STRUCTURE: A. Origination Fee Amount Funded Origination Fee Up to $7,500.00 $199.00 $7,501.00-$25,000.00 $295.00 $25,001.00-$50,000.00 $395.00 $50,001.00-$100,000.00 $595.00 $100,001.00-$250,000.00 $795.00 Over $250,000.00 $995.00 Due Diligence Fee $0.00 B. ACH Program Fee $695.00 C. NSF Fee (Standard) $50.00ea D. Rejected ACH Daily ACH Program Amount Funded Reject Fee Up to $7,500.00 $25.00 $7,501.00-$50,000.00 $35.00 $50,001.00-$100,000.00 $50.00 $100,001.00-$250,000.00 $75.00 Over $250,000.00 $100.00 Weekly ACH Program Amount Funded Reject Fee Up to $7,500.00 $75.00 $7,501.00-$50,000.00 $99.00 $50,001.00-$100,000.00 $175.00 $100,001.00-$250,000.00 $275.00 Over $250,000.00 $395.00 E. Bank Change Fee $75.00 F. Blocked Account $2,500.00 G. Default Fee $5,000.00 H. UCC Termination Fee $150.00 I. Administrative Fee $0.00 To cover underwriting and related expenses ACH's are labor intensive and are not an automated process ,requiring us to charge this fee to cover costs Up to FOUR TIMES ONLY before a default is declared When the merchant directs the bank to Reject our Debit ACH When Merchant requires a change of account to be Debited requiring us to adjust our system When Merchant BLOCKS account from our Debit ACH, which places them in default (per contract) When Merchant changes bank account cutting us off from our Collections When Merchant request a UCC termination Miscellaneous Service Fees. Merchant shall pay to Colonial certain fees Merchant funding is done electronically to their designated bank account and charged a fee of $35.00 for a Fed Wire or $15.00 for an ACH. The fee for underwriting and origination is paid from the funded amount in accordance with the schedule below. If Merchant is utilizing a Bridge / Control Account, there is an upfront fee of $395.00 for the bank fees and administrative costs of maintaining such account for each cash advance agreement with Merchant. Fund transfers from Bridge / Control Accounts to Merchant's operating bank account will be charged $10.95 per month via ACH. This fee will continue if the bridge account remains open after the RTR is paid. Merchant will be charged $50.00 for each change of its operating bank account once active with Colonial. Any administrative adjustments associated with changes to the Specified Percentage will incur a fee of $75.00 per occurrence. (All fees are subject to change) MERCHANT INITIALS: CFN ACH 01-25-16 Colonial Funding Network as Servicing Agent