Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2016

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM _______ TO ___________

COMMISSION FILE NO. 000-52103

HIGHPOWER INTERNATIONAL, INC.

(Exact Name of Registrant As Specified In Its Charter)

| Delaware | 20-4062622 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

|

Building A1, 68 Xinxia Street, Pinghu, Longgang, Shenzhen, Guangdong People’s Republic of China |

518111 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (86) 755-89686292

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Title of | Name of each exchange | |

| Each Class | on which registered | |

| Common Stock, $0.0001 par value | Nasdaq Stock Market LLC | |

| (Nasdaq Global Market) |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

The aggregate market value of the registrant's issued and outstanding shares of common stock held by non-affiliates of the registrant as of June 30, 2016 (based on $1.92 per share, the price at which the registrant’s common stock was last sold on June 30, 2016) was approximately $17.2 million.

There were 15,137,480 shares outstanding of the registrant’s common stock, par value $0.0001 per share, as of March 28, 2017. The registrant’s common stock is listed on the Nasdaq Global Market under the stock symbol “HPJ”.

Documents Incorporated by Reference: None.

TABLE OF CONTENTS

HIGHPOWER INTERNATIONAL, INC.

TABLE OF CONTENTS TO ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended December 31, 2016

| i |

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this Form 10-K, includes some statements that are not purely historical and that are “forward-looking statements.” Such forward-looking statements include, but are not limited to, statements regarding our company’s and our management’s expectations, hopes, beliefs, intentions or strategies regarding the future, including our financial condition and results of operations. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” and similar expressions, or the negatives of such terms, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Form 10-K are based on current expectations and beliefs concerning future developments and the potential effects on our company. There can be no assurance that future developments actually affecting us will be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including the following:

| · | A global economic downturn adversely affecting demand for our products; |

| · | Our reliance on our major customers for a large portion of our net sales; |

| · | Our reliance on our major suppliers for our principal raw material; |

| · | Our ability to develop and market new products; |

| · | Our ability to establish and maintain a strong brand; |

| · | Protection of our intellectual property rights; |

| · | The implementation of new projects; |

| · | Our ability to successfully manufacture and deliver our products in the time frame and amounts expected; |

| · | Exposure to product liability, safety, and defect claims; |

| · | Exposure to currency exchange risks during our product export; |

| · | Rising labor costs, volatile metal prices, and inflation; |

| · | Changes in the laws of the PRC that affect our operations; |

| · | Our ability to obtain and maintain all necessary government certifications and/or licenses to conduct our business; |

| · | Development of an active trading market for our securities; |

| · | The cost of complying with current and future governmental regulations and the impact of any changes in the regulations on our operations; and |

| · | The other factors referenced in this Form 10-K, including, without limitation, under the sections entitled “Risk Factors,” “Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business.” |

| ii |

These risks and uncertainties, along with others, are also described above under the heading “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and we cannot predict all such risk factors, nor can we assess the impact of all such risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

| iii |

| ITEM 1. | BUSINESS |

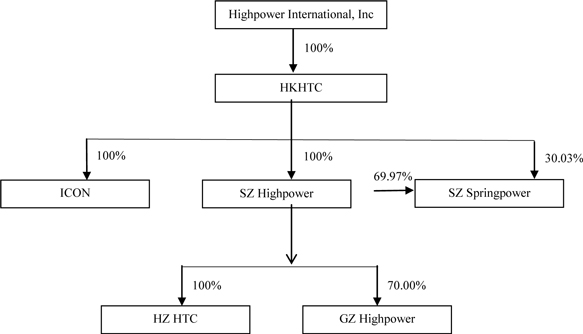

With respect to this discussion, the terms, “the Company” “Highpower” “we,” “us,” and “our” refer to Highpower International, Inc., and its 100%-owned subsidiary Hong Kong Highpower Technology Company Limited (“HKHTC”), HKHTC’s wholly-owned subsidiaries Shenzhen Highpower Technology Company Limited (“SZ Highpower”), and Icon Energy System Company Limited (“ICON”), SZ Highpower’s wholly owned subsidiary Huizhou Highpower Technology Company Limited (“HZ HTC”) and its 70%-owned subsidiary Ganzhou Highpower Technology Company Limited (“GZ Highpower”) and SZ Highpower’s and HKHTC’s jointly owned subsidiary, Springpower Technology (Shenzhen) Company Limited (“SZ Springpower”). Highpower and its subsidiaries are collectively referred to as the “Company”, unless the context indicates otherwise.

Corporate Information

Rapid advancements in electronic technology have expanded the number of battery-powered devices in recent years. As these devices have come to feature more sophisticated functions, more compact sizes and lighter weights, the sources of power that operate these products have been required to deliver increasingly higher levels of energy. This has stimulated consumer demand for higher-energy batteries capable of delivering longer service between recharges or battery replacement. In contrast to non-rechargeable batteries, after a rechargeable battery is discharged, it can be recharged and reused. Rechargeable batteries generally can be used in many non-rechargeable battery applications, as well as high energy drain applications such as electric toys, power tools, portable computers and other electronics, medical devices, and many other consumer products. High energy density and long achievable cycle life are important characteristics of rechargeable battery technologies. Energy density refers to the total electrical energy per unit volume stored in a battery. High energy density batteries generally are longer lasting power sources providing longer operating time and necessitating fewer battery recharges. Greater energy density will permit the use of batteries of a given weight or volume for a longer time period. Long cycle life is a preferred feature of a rechargeable battery because it allows the user to charge and recharge many times before noticing a difference in performance. Long achievable cycle life, particularly in combination with high energy density, is desirable for applications requiring frequent battery recharges.

To adapt to this demand, SZ Highpower was founded to manufacture, market and research Ni-MH batteries. SZ Highpower’s predecessor was founded in Guangzhou in 2001, and moved to Shenzhen in 2002.

Highpower was incorporated in the state of Delaware on January 3, 2006 and was originally organized as a “blank check” shell company to investigate and acquire a target company or business seeking the perceived advantages of being a publicly held corporation. On November 2, 2007, we closed a share exchange transaction, pursuant to which we (i) became the 100% parent of HKHTC and its wholly-owned subsidiary, SZ Highpower, (ii) assumed the operations of HKHTC and its subsidiary and (iii) changed our name to Hong Kong Highpower Technology, Inc. We subsequently changed our name to Highpower International, Inc. in October 2010.

HKHTC was incorporated in Hong Kong in 2003 under the Companies Ordinance of Hong Kong.

HKHTC formed HZ Highpower and SZ Springpower in 2008. HZ Highpower was dissolved in 2015. On October 8, 2013, SZ Springpower further increased its registered capital to $15,000,000. SZ Highpower holds 69.97% of the equity interest of SZ Springpower, and HKHTC holds the remaining 30.03%.

In 2011, HKHTC formed another wholly-owned subsidiary, Icon Energy System Company Limited, a company organized under the laws of the PRC.

In 2012, SZ Highpower formed a wholly-owned subsidiary HZ HTC. In March 2015, HZ HTC increased its paid-in capital to RMB60,000,000 ($9,496,526).

In 2010, SZ Highpower formed a subsidiary GZ Highpower. On May 15, 2013, GZ Highpower increased its paid-in capital from RMB15,000,000 ($2,381,293) to RMB30,000,000 ($4,807,847). On November 13, 2014, GZ Highpower increased its paid-in capital from RMB30,000,000 ($4,898,119) to RMB40,000,000 ($6,530,825) and the additional capital of RMB10,000,000 was contributed by SZ Highpower. As of December 31, 2016, SZ Highpower holds 70% of the equity interest of GZ Highpower.

| 1 |

All other operating subsidiaries are incorporated in the People’s Republic of China (“PRC”) and are listed below:

| Subsidiary | Principal Activities | |

| SZ Highpower | Manufacturing, marketing and research of Ni-MH batteries | |

| SZ Springpower | Manufacturing, marketing and research of lithium batteries | |

| GZ Highpower | Processing, marketing and research of battery materials | |

| ICON | Design and production of advanced battery packs and systems | |

| HZ HTC | Manufacturing, marketing and research of lithium batteries |

| 2 |

Below is organizational flow chart of the Company:

Our Strategy

Our goal is to become a global leader in the development and manufacture of rechargeable battery products. We believe the following strategies are the critical to achieve this goal:

Continue to pursue cost-effective opportunities

Our operating model, coupled with our modern manufacturing processes, has resulted in a low cost structure, and an ability to respond rapidly to customer demands. We intend to achieve greater cost-effectiveness by expanding production capacity, increasing productivity and efficiency and seeking to lower the unit cost of products through the use of advanced technologies.

Continue to invest in Research and Development (“R&D”)

In order to maintain our difference, we will continue to strengthen the investment in R&D. We have also established a good cooperative relationship with universities, such as Central South University and Tsinghua University.

Continue to focus on brand customers

We intend to expand our existing lines of lithium batteries for use in other applications, such as energy storage systems and electric vehicle (“EV”). We are committed to bringing quality products and services to brand customers in the world and the top of segment markets to ensure the customer brand value continuously grows.

Products

Ni-MH batteries

Our Ni-MH rechargeable batteries are versatile solutions for many diverse applications due to their long life, environmentally friendly materials, high power and energy, low cost and safe applications. Developed to meet the requirement for increasingly higher levels of energy demanded by today’s electronic products, our Ni-MH rechargeable batteries offer increased capacity and higher energy density to expect a longer running time between charges as well as the performance of cycle life exceeds 2000 cycles for high end products. We produce AA, AAA, 9V, C, D, SC (Normal & RTU version) sized batteries in blister packing as well as chargers and battery packs.

| 3 |

Lithium-ion batteries

Similar to Ni-MH batteries, we established lithium-ion batteries production lines to meet market needs. We produce Lithium-ion cylindrical, Lithium-ion polymer rechargeable batteries and power source solutions.

Recycling and New Materials

We also recycle scrap battery materials and sell the recycled materials to customers. In recent years, China’s government has been stimulating the adoption of EVs to reduce carbon emission and air pollution. This was essentially created by a combination of our own desire to be environmentally friendly and our customers need for an option for the batteries that we produce for them. We have seen huge opportunity to cooperate with EVs manufacturers to reuse or recycle the used batteries in the EVs.

Sales and Marketing

We have a broad sales network of approximately 90 sales and marketing staff in China and have one branch office in Hong Kong. Our sales staff in each of our offices targets key customers by arranging in-person sales presentations and providing after-sales services. Our sales staff works closely with our customers so that we can better address their needs and improve the quality and features of our products. We offer different price incentives to encourage large-volume and long-term customers.

Sales from our customers are based primarily on purchase orders we receive from time to time rather than firm, long-term purchase commitments. Uncertain economic conditions and our general lack of long-term purchase commitments with our customers make it difficult for us to predict revenue accurately over the longer term. Even in those cases where customers are contractually obligated to purchase products from us, we may elect not to enforce our contractual rights immediately because of the long-term nature of our customer relationships and for other business reasons, and instead may negotiate accommodations with customers regarding particular situations.

We mainly engage in marketing activities such as attending industry-specific conferences and exhibitions to promote our products and brand name. We believe these activities help in promoting our products and brand name among key industry participants.

During the years ended December 31, 2016 and 2015, approximately 22.9% and 27.1% of our net sales were from our five largest customers, respectively. The percentages of net sales disclosed for each of our major customers includes sales to groups of customers under common control or that could be deemed affiliates of such major customers. During the years ended December 31, 2016 and 2015, no customer accounted for 10% or more of net sales.

Competition

We face competition from many other battery manufacturers, some of which have significantly greater name recognition and financial, technical, manufacturing, personnel and other resources than we have. We compete against other Ni-MH and lithium-ion battery producers, as well as manufacturers of other rechargeable and non-rechargeable batteries. The main types of rechargeable batteries currently on the market include: lead-acid; Ni-Cad; Ni-MH; liquid lithium-ion and lithium-ion polymer. Competition is typically based on design, quality, stability, and performance. The technology behind Ni-MH and lithium rechargeable batteries has consistently improved over time and we continue to enhance our products to meet the competitive threats from its competitors.

Supply of Raw Materials

The cost of the raw materials used in our rechargeable batteries is a key factor in the pricing of our products. We purchase materials in volume, which allows us to negotiate better pricing with our suppliers. Our purchasing department locates eligible suppliers of raw materials, striving to use only those suppliers who have previously demonstrated quality control and reliability.

| 4 |

For Ni-MH, we purchase raw materials, consisted primarily of metal materials including nickel oxide, nickel foam, metal hydride alloy and other battery components, such as membranes, from suppliers located in China and Japan. For lithium batteries, we purchase raw materials consisting primarily of LiCoO2, graphite and electrolyte. We believe that the raw materials and components used in manufacturing rechargeable batteries are available from enough sources to be able to satisfy our manufacturing needs; however, some of our materials relating to nickel and cobalt are available from a limited number of suppliers. No supplier accounted for over 10% of our total purchase amount during the years ended December 31, 2016 and 2015. Presently, our relationships with suppliers are generally good and we expect that our suppliers will be able to meet the anticipated demand for our products in the future.

Manufacturing

The manufacturing of rechargeable batteries requires coordinated use of machinery and raw materials at various stages of production. We have a large-scale active production base of 58,480 square meters in Shenzhen and 126,605 square meters facility in Huizhou, a dedicated design, sales and marketing team, and approximately 3,500 company-trained employees. In 2014, we completed construction of our materials recycling factory in Ganzhou, Jiangxi Province, PRC and we began initial production in the factory in the first quarter of 2014. We use automated machinery which enables us to enhance uniformity and precision during the manufacturing process. We intend to further improve our automated production lines and strive to continue investing in manufacturing infrastructures to further increase our manufacturing capacity, which help us control the unit cost of products.

Research and Development

To enhance our product quality, reduce cost, and keep pace with technological advances and evolving market trends, we have established an advanced research and development center. Our research and development center is not only focused on enhancing our Ni-MH and Lithium-based technologies by developing new products and improving the performance of our current products, but also seeks to develop alternative technologies. Our research institute is currently staffed with over 300 research and development technicians who overlook our basic research center, product development center, process engineering center, material analysis and performance testing labs. These teams work together to research new material and techniques, develop new products and push to mass production.

For the years ended December 31, 2016 and 2015, we expended $9,243,750 and $7,631,181, respectively, in research and development.

Intellectual Property

We rely on a combination of patent and trade secret protection and other unpatented proprietary information to protect our intellectual property rights and to maintain and enhance our competitiveness in the battery industry. We regularly files patent applications to protect our research, development and design, and are currently pursuing lots of patent applications in China. Over time, we have accumulated a lot of patents in China. We also have a U.S. patent for safety technology on rechargeable batteries.

We also rely on unpatented technologies to protect the proprietary nature of our product and manufacturing processes. We require that our management team and key employees enter into confidentiality agreements that require the employees to assign the rights to any inventions developed by them during the course of their employment with us. The confidentiality agreements include noncompetition and non-solicitation provisions that remain effective during the course of employment and for periods following termination of employment, which vary depending on position and location of the employees.

Seasonality

The first quarter of each fiscal year tends to be our slow season due to the Chinese New Year holidays. Our factories and operations usually shut down for 2 weeks during this time, resulting in lower sales during the first quarter.

Employees

As of December 31, 2016, we had approximately 3,500 employees, all of whom were employed full-time. There are no collective bargaining contracts covering any of our employees. We have not experienced any work stoppages and consider our relations with employees to be good.

| 5 |

| ITEM 1A. | RISK FACTORS |

Any investment in our common stock involves a high degree of risk. Potential investors should carefully consider the material risks described below and all of the information contained in this Form 10-K before deciding whether to purchase any of our securities. Our business, financial condition or results of operations could be materially adversely affected by these risks if any of them actually occur. The trading price of our shares of common stock listed on the NASDAQ Global Market could decline due to any of these risks, and an investor may lose all or part of his investment. Some of these factors have affected our financial condition and operating results in the past or are currently affecting us. This report also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced described below and elsewhere in this Form 10-K.

RISKS RELATED TO OUR OPERATIONS

Our business depends in large part on the growth in demand for portable electronic devices.

Many of our battery products are used to power various portable electronic devices. Therefore, the demand for our batteries is substantially tied to the market demand for portable electronic devices. A growth in the demand for portable electronic devices will be essential to the expansion of our business. Our results of operations may be adversely affected by decreases in the general level of economic activity. Decreases in consumer spending that may result from the current global economic downturn may weaken demand for items that use our battery products. A decrease in the demand for portable electronic devices would likely have a material adverse effect on our results of operations. We are unable to predict the duration and severity of the current disruption in financial markets and the global adverse economic conditions and the effect such events might have on our business.

Our success depends on the success of manufacturers of the end applications that use our battery products.

Because our products are designed to be used in other products, our success depends on whether end application manufacturers will incorporate our batteries in their products. Although we strive to produce high quality battery products, there is no guarantee that end application manufacturers will accept our products. Our failure to gain acceptance of our products from these manufacturers could result in a material adverse effect on our results of operations.

Additionally, even if a manufacturer decides to use our batteries, the manufacturer may not be able to market and sell its products successfully. The manufacturer’s inability to market and sell its products successfully could materially and adversely affect our business and prospects because this manufacturer may not order new products from us. Therefore, our business, financial condition, results of operations and future success would be materially and adversely affected.

We are and will continue to be subject to declining average selling prices of consumer electronic devices, which may harm our results of operations.

Portable consumer electronic devices, such as cellular phones, laptop computers and tablets are subject to rapid declines in average selling prices due to rapidly evolving technologies, industry standards and consumer preferences. Therefore, electronic device manufacturers expect suppliers, such as our company, to cut their costs and lower the price of their products to lessen the negative impact on the electronic device manufacturer’s own profit margins. As a result, we have previously reduced the price of some of our battery products and expect to continue to face market-driven downward pricing pressures in the future. Our results of operations will suffer if we are unable to offset any declines in the average selling prices of our products by developing new or enhanced products with higher selling prices or gross profit margins, increasing our sales volumes or reducing our production costs.

| 6 |

Our success is highly dependent on continually developing new and advanced products, technologies, and processes and failure to do so may cause us to lose our competitiveness in the battery industry and may cause our profits to decline.

To remain competitive in the battery industry, it is important to continually develop new and advanced products, technologies, and processes. There is no assurance that competitors’ new products, technologies, and processes will not render our existing products obsolete or non-competitive. Alternately, changes in legislative, regulatory or industry requirements or in competitive technologies may render certain of our products obsolete or less attractive. Our competitiveness in the battery market therefore relies upon our ability to enhance our current products, introduce new products, and develop and implement new technologies and processes. We predominately manufacture and market Ni-MH batteries, Li-ion and Li-polymer batteries. Our ability to adapt to evolving industry standards and anticipate future standards will be a significant factor in maintaining and improving our competitive position and our prospects for growth. To achieve this goal, we have invested and plan to continue investing significant financial resources in research and development. Research and development, however, is inherently uncertain, and we might encounter practical difficulties in commercializing our research results. The research and development of new products and technologies is costly and time consuming, and there are no assurances that our research and development of new products will either be successful or completed within anticipated timeframes, if at all. Accordingly, our significant investment in research and development may not bear fruit. On the other hand, our competitors may improve their technologies or even achieve technological breakthroughs that would render our products obsolete or less marketable. Our failure to technologically evolve and/or develop new or enhanced products may cause us to lose competitiveness in the battery market and may cause our profits to decline.

In addition, in order to compete effectively in the battery industry, we must be able to launch new products to meet our customers’ demands in a timely manner. However, we cannot provide assurance that we will be able to install and certify any equipment needed to produce new products in a timely manner, or that the transitioning of our manufacturing facility and resources to full production under any new product programs will not impact production rates or other operational efficiency measures at our manufacturing facility. In addition, new product introductions and applications are risky, and may suffer from a lack of market acceptance, delay in related product development and failure of new products to operate properly. Any failure by us successfully to launch new products, or a failure by our customers to accept such products, could adversely affect our operating results.

Our current business strategy depends on the growth in demand for EV and acceptance by customers of our products related to the EV market.

In anticipation of an expected increase in the demand for high-power EV we have invested in research and development of new products and also acquired an equity ownership in Huizhou Yipeng Energy Technology Co. Ltd. (“Yipeng”), an EV power battery system solutions provider specializing in the plug-in hybrid electric vehicle (“PHEV”) and E-bus market in China. However, the markets we have targeted may not achieve the level of growth we expect. If this market fails to achieve our expected level of growth or our products for the EV market are not widely accepted, our operating results may be adversely affected.

We have historically depended on a limited number of customers for a significant portion of our revenues and this dependence is likely to continue.

We have historically depended on a limited number of customers for a significant portion of our net sales. We anticipate that a limited number of customers will continue to contribute to a significant portion of our net sales in the future. Maintaining the relationships with these significant customers is vital to the expansion and success of our business, as the loss of a major customer could expose us to risk of substantial losses. Our sales and revenue could decline and our results of operations could be materially adversely affected if one or more of these significant customers stops or reduces its purchasing of our products, or if we fail to expand our customer base for our products.

Significant order cancellations, reductions or delays by our customers could materially adversely affect our business.

Our sales are typically made pursuant to individual purchase orders, and we generally do not have long-term supply arrangements with our customers, but instead work with our customers to develop nonbinding forecasts of future requirements. Based on these forecasts, we make commitments regarding the level of business that we will seek and accept, the timing of production schedules and the levels and utilization of personnel and other resources. A variety of conditions, both specific to each customer and generally affecting each customer’s industry, may cause customers to cancel, reduce or delay orders that were either previously made or anticipated. Generally, customers may cancel, reduce or delay purchase orders and commitments without penalty, except for payment for services rendered or products competed and, in certain circumstances, payment for materials purchased and charges associated with such cancellation, reduction or delay. Significant or numerous order cancellations, reductions or delays by our customers could have a material adverse effect on our business, financial condition or results of operations.

| 7 |

Substantial defaults by our customers on accounts receivable or the loss of significant customers could have a material adverse effect on our business.

A substantial portion of our working capital consists of accounts receivable from customers. If customers responsible for a significant amount of accounts receivable were to become insolvent or otherwise unable to pay for products and services, or to make payments in a timely manner, our business, results of operations or financial condition could be materially adversely affected. An economic or industry downturn could materially adversely affect the servicing of these accounts receivable, which could result in longer payment cycles, increased collection costs and defaults in excess of management’s expectations. A significant deterioration in our ability to collect on accounts receivable could also impact the cost or availability of financing available to us.

A change in our product mix may cause our results of operations to differ substantially from the anticipated results in any particular period.

Our overall profitability may not meet expectations if our products, customers or geographic mix are substantially different than anticipated. Our profit margins vary among our battery and new materials products, our customers and the geographic markets in which we sell our products. Consequently, if our mix of any of these is substantially different from what is anticipated in any particular period, our profitability could be lower than anticipated.

Certain disruptions in supply of and changes in the competitive environment for raw materials integral to our products may adversely affect our profitability.

We use a broad range of materials and supplies, including metals, chemicals and other electronic components in our products. A significant disruption in the supply of these materials could decrease production and shipping levels, materially increase our operating costs and materially adversely affect our profit margins. Shortages of materials or interruptions in transportation systems, labor strikes, work stoppages, war, acts of terrorism or other interruptions to or difficulties in the employment of labor or transportation in the markets in which we purchase materials, components and supplies for the production of our products, in each case may adversely affect our ability to maintain production of our products and sustain profitability. If we were to experience a significant or prolonged shortage of critical components from any of our suppliers and could not procure the components from other sources, we would be unable to meet our production schedules for some of our key products and to ship such products to our customers in timely fashion, which would adversely affect our sales, margins and customer relations.

Our industry is subject to supply shortages and any delay or inability to obtain product components may have a material adverse effect on our business.

Our industry is subject to supply shortages, which could limit the amount of supply available of certain required battery components. Any delay or inability to obtain supplies may have a material adverse effect on our business. During prior periods, there have been shortages of components in the battery industry and the availability of raw materials has been limited by some of our suppliers. We cannot assure investors that any future shortages or allocations would not have such an effect on our business. A future shortage can be caused by and result from many situations and circumstances that are out of our control, and such shortage could limit the amount of supply available of certain required materials and increase prices adversely affecting our profitability.

Our future operating results may be affected by fluctuations in costs of raw materials, such as nickel.

Our principal raw material is nickel, which is available from a limited number of suppliers in China. The prices our raw materials used to make our batteries increase and decrease due to factors beyond our control, including general economic conditions, domestic and worldwide demand, labor costs or problems, competition, import duties, tariffs, energy costs, currency exchange rates and those other factors described under “Certain disruptions in supply of and changes in the competitive environment for raw materials integral to our products may adversely affect our profitability.” In an environment of increasing prices for our raw materials, competitive conditions may impact how much of the price increases we can pass on to our customers and to the extent we are unable to pass on future price increases in our raw materials to our customers, our financial results could be adversely affected.

| 8 |

Our operations would be materially adversely affected if third-party carriers were unable to transport our products on a timely basis.

All of our products are shipped through third party carriers. If a strike or other event prevented or disrupted these carriers from transporting our products, other carriers may be unavailable or may not have the capacity to deliver our products to our customers. If adequate third party sources to ship our products are unavailable at any time, our business would be materially adversely affected.

We may not be able to increase our manufacturing output in order to maintain our competitiveness in the battery industry.

We believe that our ability to provide cost-effective products represents a significant competitive advantage over our competitors. In order to continue providing such cost-effective products, we must maximize the efficiency of our production processes and increase our manufacturing output to a level that will enable us to reduce the unit production cost of our products. Our ability to increase our manufacturing output is subject to certain significant limitations, including:

| · | Our ability raise capital to acquire additional raw materials and expand our manufacturing facilities; |

| · | Delays and cost overruns, due to increases in raw material prices and problems with equipment vendors; |

| · | Delays or denial of required approvals and certifications by relevant government authorities; |

| · | Diversion of significant management attention and other resources; and |

| · | Failure to execute our expansion plan effectively. |

If we are not able to increase our manufacturing output and reduce our unit production costs, we may be unable to maintain our competitive position in the battery industry. Moreover, even if expand our manufacturing output, we may not be able to generate sufficient customer demand for our products to support our increased production output.

The market for our products and services is very competitive and, if we cannot effectively compete, our business will be adversely affected.

The market for our products and services is very competitive and subject to rapid technological change. Many of our competitors are larger and have significantly greater assets, name recognition and financial, personnel and other resources than we have. As a result, our competitors may be in a stronger position to respond quickly to potential acquisitions and other market opportunities, new or emerging technologies and changes in customer requirements. We cannot assure that we will be able to maintain or increase our market share against the emergence of these or other sources of competition. Failure to maintain and enhance our competitive position could materially adversely affect our business and prospects.

Our business may be adversely affected by a global economic downturn, in addition to the continuing uncertainties in the financial markets.

The global economy experienced a pronounced economic downturn in previous years. Global financial markets have and may in the future experience disruptions, including severely diminished liquidity and credit availability, declines in consumer confidence, declines in economic growth, increases in unemployment rates, and uncertainty about economic stability. There is no assurance that there will not be deterioration in the global economy in the future, the global financial markets and consumer confidence. If economic conditions deteriorate, our business and results of operations could be materially and adversely affected.

Additionally, sales of consumer items such as portable electronic devices, have slowed in previous years and there have been adverse changes in employment levels, job growth, consumer confidence and interest rates. During 2016, China, which represented 58.4% of our net sales for the year ended December 31, 2016, experienced a pronounced deceleration in its economic growth. Our future results of operations may experience substantial fluctuations from period to period as a consequence of these factors, and such conditions and other factors affecting consumer spending may affect the timing of orders. Thus, any economic downturns generally would have a material adverse effect on our business, cash flows, financial condition and results of operations.

| 9 |

Moreover, the inability of our customers and suppliers to access capital efficiently, or at all, may have other adverse effects on our financial condition. For example, financial difficulties experienced by our customers or suppliers could result in product delays; increase accounts receivable defaults; and increase our inventory exposure. The inability of our customers to borrow money to fund purchases of our products reduces the demand for our products and services and may adversely affect our results from operations and cash flow. These risks may increase if our customers and suppliers do not adequately manage their business or do not properly disclose their financial condition to us.

Although we believe we have adequate liquidity and capital resources to fund our operations internally, in light of current market conditions, our inability to access the capital markets on favorable terms, or at all, may adversely affect our financial performance. The inability to obtain adequate financing from debt or capital sources could force us to self-fund strategic initiatives or even forego certain opportunities, which in turn could potentially harm our performance.

Maintaining and expanding our manufacturing operations requires significant capital expenditures, and our inability or failure to maintain and expand our operations would have a material adverse impact on our market share and ability to generate revenue.

We had capital expenditures of approximately $8.5 million and $11.3 million in the years ended December 31, 2016 and 2015, respectively. We may incur significant additional capital expenditures as a result of our expansion of our operations into our new production factory, as well as unanticipated events, regulatory changes and other events that impact our business. If we are unable or fail to adequately maintain our manufacturing capacity or quality control processes or adequately expand our production capabilities, we could lose customers and there could be a material adverse impact on our market share and our ability to generate revenue.

Warranty claims, product liability claims and product recalls could harm our business, results of operations and financial condition.

Our business inherently exposes us to potential warranty and product liability claims, in the event that our products fail to perform as expected or such failure of our products results, or is alleged to result, in bodily injury or property damage (or both). Such claims may arise despite our quality controls, proper testing and instruction for use of our products, either due to a defect during manufacturing or due to the individual’s improper use of the product. In addition, if any of our designed products are or are alleged to be defective, then we may be required to participate in a recall of them.

Existing PRC laws and regulations do not require us to maintain third party liability insurance to cover product liability claims. Although we have obtained products liability insurance, if a warranty or product liability claim is brought against us, regardless of merit or eventual outcome, or a recall of one of our products is required, such claim or recall may result in damage to our reputation, breach of contracts with our customers, decreased demand for our products, costly litigation, additional product recalls, loss of revenue, and the inability to commercialize some products. Additionally, our insurance policy imposes a ceiling for maximum coverage and high deductibles and we may be unable to obtain sufficient amounts from our policy to cover a product liability claim. We may not be able to obtain any insurance coverage for certain types of product liability claims, as our policy excludes coverage of certain types of claims. In such cases, we may still incur substantial costs related to a product liability claim, which could adversely affect our results of operations.

Manufacturing or use of our battery products may cause accidents, which could result in significant production interruption, delay or claims for substantial damages.

Our batteries, especially lithium batteries, can pose certain safety risks, including the risk of fire. While we implement stringent safety procedures at all stages of battery production that minimize such risks, accidents may still occur. Any accident, regardless of where it occurs, may result in significant production interruption, delays or claims for substantial damages caused by personal injuries or property damages.

| 10 |

Our labor costs have increased and are likely to continue to increase as a result of changes in Chinese labor laws.

We expect to experience an increase in our cost of labor due to recent changes in Chinese labor laws which are likely to increase costs further and impose restrictions on our relationship with our employees. In June 2007, the National People’s Congress of the PRC enacted new labor law legislation called the Labor Contract Law and more strictly enforced existing labor laws. The law, which became effective on January 1, 2008, amended and formalized workers’ rights concerning overtime hours, pensions, layoffs, employment contracts and the role of trade unions. As a result of the law, we have had to increase the salaries of our employees, provide additional benefits to our employees, and revise certain other of our labor practices. The increase in labor costs has increased our operating costs, which we have not always been able to pass on to our customers. In addition, under the law, employees who either have worked for us for 10 years or more or who have had two consecutive fixed-term contracts must be given an “open-ended employment contract” that, in effect, constitutes a lifetime, permanent contract, which is terminable only in the event the employee materially breaches our rules and regulations or is in serious dereliction of his or her duties. Such non-cancelable employment contracts have substantially increased our employment-related risks and limit our ability to downsize our workforce in the event of an economic downturn. No assurance can be given that we will not in the future be subject to labor strikes or that we will not have to make other payments to resolve future labor issues caused by the new laws. Furthermore, there can be no assurance that labor laws in the PRC will not change further or that their interpretation and implementation will vary, which may have a negative effect upon our business and results of operations.

We cannot guarantee the protection of our intellectual property rights and if infringement of our intellectual property rights occurs, including counterfeiting of our products, our reputation and business may be adversely affected.

To protect the reputation of our products, we have sought to file or register intellectual property, as appropriate, in the PRC where we have our primary business presence. As of December 31, 2016, we have registered two trademarks as used on our battery products, one in English and the other in its Chinese equivalent. Our products are currently sold under these trademarks in the PRC, and we plan to expand our products to other international markets. There is no assurance that there will not be any infringement of our brand name or other registered trademarks or counterfeiting of our products in the future, in China or elsewhere. Should any such infringement and/or counterfeiting occur, our reputation and business may be adversely affected. We may also incur significant expenses and substantial amounts of time and effort to enforce our trademark rights in the future. Such diversion of our resources may adversely affect our existing business and future expansion plans.

We believe that obtaining patents and enforcing other proprietary protections for our technologies and products have been and will continue to be very important in enabling us to compete effectively. However, there can be no assurance that our pending patent applications will issue, or that we will be able to obtain any new patents, in China or elsewhere, or that our or our licensors’ patents and proprietary rights will not be challenged or circumvented, or that these patents will provide us with any meaningful competitive advantages. Furthermore, there can be no assurance that others will not independently develop similar products or will not design around any patents that have been or may be issued to us or our licensors. Failure to obtain patents in certain foreign countries may materially adversely affect our ability to compete effectively in those international markets. If a sufficiently broad patent were to be issued from a competing application in China or elsewhere, it could have a material adverse effect upon our intellectual property position in that particular market.

In addition, our rights to use the licensed proprietary technologies of our licensors depends on the timely and complete payment for such rights pursuant to license agreements between the parties; failure to adhere to the terms of these agreements could result in the loss of such rights and could materially and adversely affect our business.

If our products are alleged to or found to conflict with patents that have been or may be granted to competitors or others, our reputation and business may be adversely affected.

Rapid technological developments in the battery industry and the competitive nature of the battery products market make the patent position of battery manufacturers subject to numerous uncertainties related to complex legal and factual issues. Consequently, although we either own or hold licenses to certain patents in the PRC, and are currently processing several additional patent applications in the PRC, it is possible that no patents will issue from any pending applications or that claims allowed in any existing or future patents issued or licensed to us will be challenged, invalidated, or circumvented, or that any rights granted there under will not provide us adequate protection. As a result, we may be required to participate in interference or infringement proceedings to determine the priority of certain inventions or may be required to commence litigation to protect our rights, which could result in substantial costs. Further, other parties could bring legal actions against us claiming damages and seeking to enjoin manufacturing and marketing of our products for allegedly conflicting with patents held by them. Any such litigation could result in substantial cost to us and diversion of effort by our management and technical personnel. If any such actions are successful, in addition to any potential liability for damages, we could be required to obtain a license in order to continue to manufacture or market the affected products. There can be no assurance that we would prevail in any such action or that any license required under any such patent would be made available on acceptable terms, if at all. Failure to obtain needed patents, licenses or proprietary information held by others may have a material adverse effect on our business. In addition, if we were to become involved in such litigation, it could consume a substantial portion of our time and resources. Also, with respect to licensed technology, there can be no assurance that the licensor of the technology will have the resources, financial or otherwise, or desire to defend against any challenges to the rights of such licensor to its patents.

| 11 |

We rely on trade secret protections through confidentiality agreements with our employees, customers and other parties; the breach of such agreements could adversely affect our business and results of operations.

We rely on trade secrets, which we seek to protect, in part, through confidentiality and non-disclosure agreements with our employees, customers and other parties. There can be no assurance that these agreements will not be breached, that we would have adequate remedies for any such breach or that our trade secrets will not otherwise become known to or independently developed by competitors. To the extent that consultants, key employees or other third parties apply technological information independently developed by them or by others to our proposed projects, disputes may arise as to the proprietary rights to such information that may not be resolved in our favor. We may be involved from time to time in litigation to determine the enforceability, scope and validity of our proprietary rights. Any such litigation could result in substantial cost and diversion of effort by our management and technical personnel.

The failure to manage growth effectively could have an adverse effect on our employee efficiency, product quality, working capital levels, and results of operations.

Any significant growth in the market for our products or our entry into new markets may require expansion of our employee base for managerial, operational, financial, and other purposes. During any growth, we may face problems related to our operational and financial systems and controls, including quality control and delivery and service capacities. We would also need to continue to expand, train and manage our employee base. Continued future growth will impose significant added responsibilities upon the members of management to identify, recruit, maintain, integrate, and motivate new employees.

Aside from increased difficulties in the management of human resources, we may also encounter working capital issues, as we will need increased liquidity to finance the purchase of raw materials and supplies, development of new products, and the hiring of additional employees. For effective growth management, we will be required to continue improving our operations, management, and financial systems and control. Our failure to manage growth effectively may lead to operational and financial inefficiencies that will have a negative effect on our profitability. We cannot assure investors that we will be able to timely and effectively meet that demand and maintain the quality standards required by our existing and potential customers.

We are dependent on certain key personnel and loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations.

Our success is, to a certain extent, attributable to the management, sales and marketing, and operational and technical expertise of certain key personnel. Each of the named executive officers performs key functions in the operation of our business. The loss of a significant number of these employees could have a material adverse effect upon our business, financial condition, and results of operations.

We are dependent on a technically trained workforce and an inability to retain or effectively recruit such employees could have a material adverse effect on our business, financial condition and results of operations.

We must attract, recruit and retain a sizeable workforce of technically competent employees to develop and manufacture our products and provide service support. Our ability to implement effectively our business strategy will depend upon, among other factors, the successful recruitment and retention of additional highly skilled and experienced engineering and other technical and marketing personnel. There is significant competition for technologically qualified personnel in our business and we may not be successful in recruiting or retaining sufficient qualified personnel consistent with our operational needs.

| 12 |

Adverse capital and credit market conditions may significantly affect our ability to meet liquidity needs, access to capital and cost of capital.

The capital and credit markets have previously experienced extreme volatility and disruption, including, among other things, extreme volatility in securities prices, severely diminished liquidity and credit availability, ratings downgrades of certain investments and declining valuations of others. Governments have taken unprecedented actions intended to address extreme market conditions that have included severely restricted credit and declines in real estate values. In some cases, the markets have exerted downward pressure on availability of liquidity and credit capacity for certain issuers. While historically these conditions have not impaired our ability to utilize our current credit facilities and finance our operations, there can be no assurance that there will not be deterioration in financial markets and confidence in major economies such that our ability to access credit markets and finance our operations, might be impaired. Without sufficient liquidity, we may be forced to curtail our operations. Adverse market conditions may limit our ability to replace, in a timely manner, maturing liabilities and access the capital necessary to operate and grow our business. As such, we may be forced to delay raising capital or bear an unattractive cost of capital which could decrease our profitability and significantly reduce our financial flexibility. The tightening of credit in financial markets could adversely affect the ability of our customers to obtain financing for purchases of our products and could result in a decrease in or cancellation of orders for our products. Our results of operations, financial condition, cash flows and capital position could be materially adversely affected by disruptions in the financial markets.

We have been relying on bank facilities to finance our expansion of new plants, which increased our debt asset ratio. We may not have sufficient cash to meet our payment obligations.

The Company leverages from various Chinese banks to fund its business operations and our expansion to meet the demand from the fast growing lithium battery market in mobile and portable consumer devices, vehicles of various sizes, and energy storage systems. As of December 31, 2016, the Company’s debt asset ratio was 72.3%. The management of the Company has taken and will take a number of actions and will continue to address our high debt level situation in order to restore the Company to a sound financial position with an appropriate business strategy going forward. These actions can include market more higher-margined lithium battery products and systems; control cost in operating expenses, and improve management efficiency; and introduce strategic investment. If we are not successful in implementing these actions, we may not have sufficient cash to meet our payment obligations.

Our quarterly results may fluctuate because of many factors and, as a result, investors should not rely on quarterly operating results as indicative of future results.

Fluctuations in operating results or the failure of operating results to meet the expectations of public market analysts and investors may negatively impact the value of our securities. Quarterly operating results may fluctuate in the future due to a variety of factors that could affect revenues or expenses in any particular quarter. Fluctuations in quarterly operating results could cause the value of our securities to decline. Investors should not rely on quarter-to-quarter comparisons of results of operations as an indication of future performance. As a result of the factors listed below, it is possible that in the future periods results of operations may be below the expectations of public market analysts and investors. This could cause the market price of our securities to decline. Factors that may affect our quarterly results include:

| · | Vulnerability of our business to a general economic downturn in China; |

| · | Fluctuation and unpredictability of costs related to the raw materials used to manufacture our products; |

| · | Seasonality of our business; |

| · | Changes in the laws of the PRC that affect our operations; |

| · | Competition from our competitors; and |

| · | Our ability to obtain necessary government certifications and/or licenses to conduct our business. |

| 13 |

Our stock price may be negatively affected if we become subject to the recent scrutiny, criticism and negative publicity involving U.S. listed Chinese companies.

U.S. public companies that have substantially all of their operations in China, particularly companies like us which have completed share exchanges or reverse merger transactions, have been the subject of intense scrutiny, criticism and negative publicity by investors, financial commentators and regulatory agencies, such as the SEC. Much of the scrutiny, criticism and negative publicity has centered around financial and accounting irregularities and mistakes, a lack of effective internal controls over financial accounting, inadequate corporate governance policies or a lack of adherence thereto and, in many cases, allegations of fraud. As a result of the scrutiny, criticism and negative publicity, the publicly traded stock of many U.S.-listed Chinese companies has sharply decreased in value and, in some cases, has become virtually worthless. Many of these companies subject to shareholder lawsuits and SEC enforcement actions, conducted internal and external investigations into the allegations. If we become the subject of any unfavorable allegations, whether such allegations are proven to be true or untrue, we will have to expend significant resources to investigate such allegations and/or defend our company. This situation will be costly and time consuming and distract our management from growing our company. If such allegations are not proven to be groundless, our company and business operations will be severely negatively affected and your investment in our stock could be rendered worthless.

We have outstanding warrants and options, and future sales of the shares obtained upon exercise of these options or warrants could adversely affect the market price of our common stock.

As of December 31, 2016, we had outstanding options exercisable for an aggregate of 381,392 shares of common stock at a weighted average exercise price of $2.76 per share and warrants exercisable for an aggregate of 740,001 shares of common stock at a weighted average exercise price of $5.43 per share. We have registered the issuance of all the shares issuable upon exercise of the options and 540,001 of the shares underlying warrant, and they will be freely tradable by the exercising party upon issuance. The holders may sell these shares in the public markets from time to time, without limitations on the timing, amount or method of sale. As our stock price rises, the holders may exercise their warrants and options and sell a large number of shares. This could cause the market price of our common stock to decline.

RISKS RELATED TO DOING BUSINESS IN CHINA

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property, and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Substantially all of our assets are located in the PRC and substantially all of our revenues are derived from our operations in China, and changes in the political and economic policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and accordingly on the results of our operations and financial condition.

Our business operations may be adversely affected by the current and future political environment in the PRC. The Chinese government exerts substantial influence and control over the manner in which we must conduct our business activities. Our ability to operate in China may be adversely affected by changes in Chinese laws and regulations, including those relating to taxation, import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters. Under the current government leadership, the government of the PRC has been pursuing economic reform policies that encourage private economic activities and greater economic decentralization. There is no assurance, however, that the government of the PRC will continue to pursue these policies, or that it will not significantly alter these policies from time to time without advance notice.

Our operations are subject to PRC laws and regulations that are sometimes vague and uncertain. Any changes in such PRC laws and regulations, or the interpretations thereof, may have a material and adverse effect on our business.

The PRC’s legal system is a civil law system based on written statutes. Unlike the common law system prevalent in the United States, decided legal cases have little value as precedent in China. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to, governmental approvals required for conducting business and investments, laws and regulations governing the battery industry, national security-related laws and regulations and export/import laws and regulations, as well as commercial, antitrust, patent, product liability, environmental laws and regulations, consumer protection, and financial and business taxation laws and regulations.

| 14 |

The Chinese government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively.

Our principal operating subsidiaries, SZ Highpower, SZ Springpower and ICON are considered foreign invested enterprises under PRC laws, and as a result are required to comply with PRC laws and regulations, including laws and regulations specifically governing the activities and conduct of foreign invested enterprises. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our businesses. If the relevant authorities find us in violation of PRC laws or regulations, they would have broad discretion in dealing with such a violation, including, without limitation:

| · | Levying fines; |

| · | Revoking our business license, other licenses or authorities; |

| · | Requiring that we restructure our ownership or operations; and |

| · | Requiring that we discontinue any portion or all of our business. |

The disclosures in our reports and other filings with the SEC and our other public pronouncements are not subject to the scrutiny of any regulatory bodies in the PRC. Accordingly, our public disclosure should be reviewed in light of the fact that no governmental agency that is located in China where substantially all of our operations and business are located have conducted any due diligence on our operations or reviewed or cleared any of our disclosures.

We are regulated by the SEC and our reports and other filings with the SEC are subject to SEC review in accordance with the rules and regulations promulgated by the SEC under the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Unlike public reporting companies whose operations are located primarily in the United States, however, substantially all of our operations are located in China. Since substantially all of our operations and business take place in China, it may be more difficult for the Staff of the SEC to overcome the geographic and cultural obstacles that are present when reviewing our disclosures. These same obstacles are not present for similar companies whose operations or business take place entirely or primarily in the United States. Furthermore, our SEC reports and other disclosures and public pronouncements are not subject to the review or scrutiny of any PRC regulatory authority. For example, the disclosure in our SEC reports and other filings are not subject to the review of China Securities Regulatory Commission, a PRC regulator that is tasked with oversight of the capital markets in China. Accordingly, you should review our SEC reports, filings and our other public pronouncements with the understanding that no local regulator has done any due diligence on our company and with the understanding that none of our SEC reports, other filings or any of our other public pronouncements has been reviewed or otherwise been scrutinized by any local regulator.

Our auditors, like other independent registered public accounting firms operating in China and to the extent their audit clients have operations in China, is not permitted to be subject to full inspection by the Public Company Accounting Oversight Board and, as such, you may be deprived of the benefits of such inspection.

Our independent registered public accounting firm that issued the audit reports included in our annual reports filed with the SEC, as auditors of companies that are traded publicly in the United States and registered with the US Public Company Accounting Oversight Board (United States), or PCAOB, are required by the laws of the United States to undergo regular inspections by the PCAOB to assess their compliance with the laws of the United States and professional standards.

However, our operations are solely located in the PRC, a jurisdiction where PCAOB is currently unable to conduct inspections without the approval of the PRC authorities. Our independent registered public accounting firm, like others operating in China (and Hong Kong, to the extent their audit clients have operations in China), is currently not subject to inspection conducted by the PCAOB. Inspections of other firms that the PCAOB has conducted outside China have identified deficiencies in those firms’ audit procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. The inability of the PCAOB to conduct full inspections of auditors operating in China makes it more difficult to evaluate our auditors’ audit procedures or quality control procedures. As a result, investors may be deprived of the benefits of PCAOB inspections.

| 15 |

The scope of our business license in China is limited, and we may not expand or continue our business without government approval and renewal, respectively.

Our principal operating subsidiaries, SZ Highpower and ICON, are wholly foreign-owned enterprises, commonly known as WFOEs. A WFOE can only conduct business within its approved business scope, which appears on the business license since its inception. Our license permits us to design, manufacture, sell and market battery products throughout the PRC. Any amendment to the scope of our business requires further application and government approval. Prior to expanding our business and engaging in activities that are not covered by our current business licenses, we are required to apply and receive approval from the relevant PRC government authorities. In order for us to expand business beyond the scope of our license, we will be required to enter into a negotiation with the authorities for the approval to expand the scope of our business. PRC authorities, which have discretion over business licenses, may reject our request to expand the scope of our business licenses to include our planned areas of expansion. We will be prohibited from engaging in any activities that the PRC authorities do not approve in our expanded business licenses. Companies that operate outside the scope of their licenses can be subjected to fines, disgorgement of income and ordered to cease operations. Our business and results of operations may be materially and adversely affected if we are unable to obtain the necessary government approval for expanded business licenses that cover any areas in which we wish to expand.

We are subject to a variety of environmental laws and regulations related to our manufacturing operations. Our failure to comply with environmental laws and regulations may have a material adverse effect on our business and results of operations.

We are subject to various environmental laws and regulations in China that require us to obtain environmental permits for our battery manufacturing operations. Although we do not currently exceed the approved annual output limits under the new permit, we cannot guarantee that this will continue to be the case. Additionally, our current permit does not cover one of our existing premises at our manufacturing facility. If we fail to comply with the provisions of our permit, we could be subject to fines, criminal charges or other sanctions by regulators, including the suspension or termination of our manufacturing operations.

To the extent we ship our products outside of the PRC, or to the extent our products are used in products sold outside of the PRC, they may be affected by the following: The transportation of non-rechargeable and rechargeable lithium batteries is regulated by the International Civil Aviation Organization (ICAO), and corresponding International Air Transport Association (IATA), Pipeline & Hazardous Materials Safety Administration (PHMSA), Dangerous Goods Regulations and the International Maritime Dangerous Goods Code (IMDG), and in the PRC by General Administration of Civil Aviation of China and Maritime Safety Administration of People’s Republic of China. These regulations are based on the United Nations (UN) Recommendations on the Transport of Dangerous Goods Model Regulations and the UN Manual of Tests and Criteria. We currently ship our products pursuant to ICAO, IATA and PHMSA hazardous goods regulations. New regulations that pertain to all lithium battery manufacturers went into effect in 2003 and 2004, and additional regulations went into effect on October 1, 2009. The regulations require companies to meet certain testing, packaging, labeling and shipping specifications for safety reasons. We comply with all current PRC and international regulations for the shipment of our products, and will comply with any new regulations that are imposed. We have established our own testing facilities to ensure that we comply with these regulations. If we were unable to comply with the new regulations, however, or if regulations are introduced that limit our ability to transport products to customers in a cost-effective manner, this could have a material adverse effect on our business, financial condition and results of operations.

We cannot assure that at all times we will be in compliance with environmental laws and regulations or our environmental permits or that we will not be required to expend significant funds to comply with, or discharge liabilities arising under, environmental laws, regulations and permits. Additionally, these regulations may change in a manner that could have a material adverse effect on our business, results of operations and financial condition. We have made and will continue to make capital and other expenditures to comply with environmental requirements.

| 16 |

Furthermore, our failure to comply with applicable environmental laws and regulations worldwide could harm our business and results of operations. The manufacturing, assembling and testing of our products require the use of hazardous materials that are subject to a broad array of environmental, health and safety laws and regulations. Our failure to comply with any of these applicable laws or regulations could result in: