Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HERITAGE OAKS BANCORP | a17-9889_18k.htm |

Exhibit 99.1

Special Shareholders Meeting March 27, 2017

2 Forward Looking Statements Certain statements contained in this Presentation, including, without limitation, statements containing the words “believes”, “anticipates”, “intends”, “expects”, and words of similar impact, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, the following: the expected cost savings, synergies and other financial benefits from the pending transaction with Pacific Premier Bancorp might not be realized within the expected time frames or at all; conditions to the closing of the pending transaction with Pacific Premier Bancorp may not be satisfied; the Company’s shareholders may fail to approve the consummation of the pending transaction with Pacific Premier Bancorp and the shareholders of Pacific Premier Bancorp may not approve the issuance of Pacific Premier Bancorp common stock in connection with the pending transaction with Pacific Premier Bancorp and other risks described in our annual report on Form 10-K that is on file with the Securities and Exchange Commission. (Please see the Company’s Risk Factors identified in the Company’s most recent Form 10-K filed on March 3, 2017). The Company disclaims any obligation to update any such factors or to publicly announce the results of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

Deal highlights & New branch footprint Market extension into California’s Central Coast HEOP assets of $2.0 billion which increases PPBI’s pro forma assets to approximately $6.0 billion HEOP’s relationship banking model complements PPBI’s strong growth strategy Loan/deposit ratio of 82.2% for HEOP and 103.1% for PPBI as of 12/31/16 HEOP’s high quality core deposit franchise is additive to PPBI’s funding base Non-interest bearing deposits of 34.1% Cost of deposits of 0.22% in Q4 2016 PPBI Branch HEOP Branch HEOP Loan Production Office Pro Forma Branch Footprint Rationale and Highlights Transaction announced 12/13/2016. Tangible book value and earnings multiple is based on 9/30/16 public filings for 11/14/16 and 12/13/16 and 12/31/2016 for 3/24/17. 3 Company Snapshot - Heritage Oaks Bancorp ( as of 12/31/2016) Exchange/Ticker NASDAQ: HEOP Company Headquarters Paso Robles, CA Year Established 1983 Balance Sheet Total Assets ($MM) $2,025 Grpss Loans, Excluding HFS ($MM) $1,385 Total Deposits ($MM) $1,684 Loan / Deposit Ratio 82.2% Performance Return on Average Assets (Q4 2016) 0.90% Net Interest Margin (Q4 2016) 3.71% Non-Performing Assets / Total Assets 0.34% Non-Performing Loans / Gross Loans 0.49% Loan Loss Reserves / Gross Loans 1.24% Stock Price Tangible Book Value Multiple (2) Annual Earnings Multiple (2) 11/14/2016 8.86 163% 18x 12/13/2016 (1) 11.54 212% 24x 3/24/2017 11.54 214% 24x

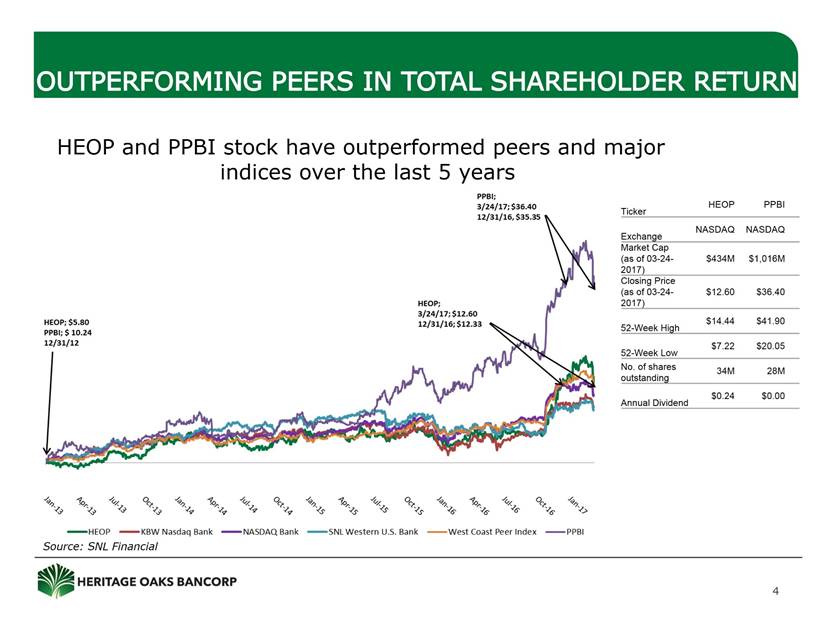

Outperforming Peers in Total Shareholder Return Source: SNL Financial Ticker HEOP PPBI Exchange NASDAQ NASDAQ Market Cap (as of 03-09-2017) $467M $1,098M Closing Price (as of 03-09-2017) $13.56 $39.33 52-Week High $14.44 $41.90 52-Week Low $7.22 $20.05 No. of shares outstanding $34M $28M Annual Dividend $0.24 $0.00 HEOP and PPBI stock have outperformed peers and major indices over the last 5 years (as of end of day Friday 3/24) 4 HEOP KBW Nasdaq Bank NASDAQ Bank SNL Western U.S. Bank West Coast Peer Index PPBI HEOP; $5.80 PPBI; $ 10.24 12/31/12 PPBI; 3/9/17; 39.35 12/31/16, $35.35 HEOP; 3/9/17; $13.56 12/31/16; $12.33 +134.3% +88.8% +105.1% +82.1% +110.9% +284.3%

PPBI was ranked the fifth best performing community bank in the U.S. with total assets between $1 billion and $10 billion, by S&P Global, the second consecutive year the bank was ranked in the top 10(1); Tax free nature of merger consideration to HEOP shareholders; Limited compelling acquisition opportunities of other financial institutions; Compared with recent bank mergers, compelling valuation multiples; Leverage operating efficiencies to compete with larger institutions; Larger branch network; Access to wider product offerings to HEOP’s customer base; Higher lending limits afforded to HEOP’s customer base; and More career growth opportunities for HEOP’s employees as a result of being part of a larger organization. 5 HEOP’s Compelling reasons for merger (1) S&P Global Market Intelligence

PPBI received regulatory approval for acquisition of HEOP on 3/21/2017; Transaction close expected late Q1 or early Q2 2017; Pacific Premier and Heritage Oaks teams have been working together to ensure a smooth close; Both banks operate on the same core system which should allow for easier system conversion and onboarding of employees; Strengthens Heritage Oaks’ position by combining with PPBI to form one of the leading commercial banks in California with $6 billion in total assets on a pro forma basis; Extends branch footprint from San Diego to Paso Robles; Deal is immediately accretive to PPBI tangible book value and earnings per share; Each HEOP share to convert into .3471 PPBI shares upon deal close; Transaction allows opportunity to deploy Heritage Oaks’ excess liquidity into higher yielding assets with a more geographically diverse loan mix and type; and Broad market presence provides for greater opportunities for future fill in acquisitions. Thank you for your continued confidence! 6 Transaction update and details/results