Attached files

| file | filename |

|---|---|

| 8-K - 8-K - XERIUM TECHNOLOGIES INC | sidoti8k.htm |

Investor Presentation

March 2017

2

Forward Looking Statements and Non-GAAP Reconciliations

These slides and any remarks about Xerium’s future expectations, plans and prospects are forward-looking statements within

the meaning of the federal securities laws. Forward-looking statements involve risks, uncertainties and other factors, including

those discussed in our earnings press release dated March 1, 2017 and in our filings with the SEC, which could cause our actual

results to differ materially from the results expressed or implied by our statements. Any forward-looking statements which we

make in this presentation or in our remarks, represent our views only as of the date made. We disclaim any duty to update any

such forward-looking statements.

These slides also include and we plan to discuss supplementary non-GAAP financial measures such as:

Adjusted EBITDA

Free cash flow

Net debt

Certain sales figures excluding currency effects

We use these numbers internally to assess financial performance, and therefore, we believe they will assist you in better

understanding our company. See our most recent earnings release, the end of this presentation and our annual report on Form

10-K for reconciliations of the non-GAAP numbers to their comparable GAAP numbers. Our use of these non-GAAP measures

in this presentation is subject to those additional disclosures, which we urge you to read.

3

Harold Bevis

• President, CEO, Director of Xerium Technologies (NYSE: XRM) since 2012

• Director of Commercial Vehicle Group (NASDAQ: CVGI) since 2014

• 31 years of experience; 15th year as a CEO, President, Director

• Experienced at repositioning – 3 corporate turnarounds (one underway!), 11 acquisitions,

3 divestitures, 11 new business/new plant startups, 24 plant expansions, 26 plant closures

• Experienced at growth and cost optimization - launched 150+ new products, companies

received 500+ new patents, 26 industry awards. Lean Six Sigma - Green Belt

• Own 533k shares of Xerium stock, recently purchased stock at $6.05/share

Management in Attendance Today

4

Conveyor Belts,

Machine Clothing

Roll Service,

Recovering

Optimization

Analytics

Part Repair,

Service

Customer

End Products

Cardboard, Consumer Packaging

Copy Paper, Magazines

Tissue, Paper Towels

Nonwoven fabrics, diapers

Siding, Roofing

Xerium Provides Consumable Parts & Services for its

Customer’s Manufacturing Process

Products & Services

5

Xerium at a Glance

2016 Sales $471 million

2016 EBITDA $95 million

20% of Sales

2016 Free Cash Flow $23 million

~3,000 Employees

Direct Sales

• Customers in 63 Countries

• ~70% sales outside U.S.

• 11 Primary Currencies

Continuous Innovation

• 3 R&D Centers

• 450+ Patents

Powerful Data Analytics

• Industrial Internet of Things (IIoT)

“Digital to Win”

28 Plants in 13 Countries

Lean Six Sigma culture

6

North

America

9 Plants

Europe

9 Plants

Latin

America

5 Plants*

Asia-Pacific

5 Plants

* New Rolls plant under construction in Concepción, Chile

Where We Are Located

Machine Clothing Roll Covers and Mechanical Services Xerium Global Headquarters

10 Factories

18 Repair Centers

13 Countries

~3,000 Employees

Customers in 63 Countries

7

Core value proposition: improve our

customer’s machine operating performance

through innovative and reliable clothing and

roll cover solutions

Attach the Company to naturally growing

segments of the market

Deploy the Company’s successful recurring

revenue model into new markets

Revenue Growth

Strategic

Objective

1

Pursuit of this strategic objective requires

high-quality capacity to be in the right

geographies and equipped with winning

technical designs

Key 2017 actions – globally rolling out a new

containerboard machine (~50% of the

world’s machines) product line called

TransFormTM , expanding China operations,

expanding capacity for new products

8

Emerging Country Growth

China/Asia

Chile/Latin America

Turkey/Middle East

Have a Strategic Goal to Align With Stable,

Growing Segments of the Market

2013 2016

Clothing 72%

79%

% of Revenue from Steady,

Growing Market Segments

End Product Growth

Consumer packaging

Tissue

eCommerce boxes

Tissue converting

Paper towels, napkins

Shipping containers

Folding cartons

9

8 Plants Closed, Equipment Retooled,

And Relocated

Xerium is

Repositioning…

10 Plants Renovated, Equipment Repurposed,

And Repositioned For Growth

Argentina

Brazil

Canada

Spain

Charlotte, NC

France

Germany

Middletown, VA

Canada

Austria

Brazil

China (new)

Chile (new, underway)

China

Griffin, GA

Neenah, WI

Ruston, LA

Turkey (new)

Machine Clothing Plants Rolls Plants Machine Clothing Plants Rolls Plants

…Into Growth

Markets

10

This New Plant Was the Main Reason for Above-Trend

Capital Investment 2013 – 2016

Average depreciation was historically $35 million per year (2003-2012)

Average capital spending was historically $27 million per year (2003-

2012)

Invested a cumulative $35 million above these traditional levels during

2013 – 2016

Capital spending required to build new machine clothing plant in China

was $35 million cumulative during 2013-2016, or the entire amount of

the overage

Centerpiece of 2013 – 2016 Repositioning Investment Plan

Xerium’s First-Ever Machine Clothing Plant in China

Having a machine clothing

plant located in the largest

and fastest growing market in

the world for the Company’s

products is a game-changer

for Xerium

11

Xerium Asia Press Felt Sales Growth

Permanently corrected lead time and delivered cost

competitiveness for press felts for Asian market

Plant is focused on growing markets & segments

Plant launched ground-up with Lean Six Sigma

Plant in full ramp-up mode, adding forming fabric

production in 2017

New credibility in region, game-changing

commitment from “Voice of the Customer”

2012 2016

600

to

n

s

+47%

New China Machine Clothing Plant a Success, Ramping Up

12

Expanded press felt business

(underway)

Expanded forming fabric

business (underway)

Expanded local market

customer base (underway)

Expanded roll service in

Southern China mills (2018)

Sales Pathways Now Open Region Number of Paperboard,

Tissue, Pulp & Paper

Machines*

Asia-Pacific 4,604

China 2,749

EMEA 1,906

North America 835

Latin America 650

Global Total 7,995

Source: Fisher International.

*Machines that produce >30 tons per day as of February 23, 2017.

**Modeled based on historical tissue machine growth + GDP or population growth for developed, and developing countries.

Improved Presence in China is Opening Up Many Opportunities

Paperboard

Paper Tissue

Nonwovens Building Products

o 34% of the world’s

machines in China

o Many new machines

forecasted

o 1,040 new tissue

machines worldwide by

2025 alone**

Kunshan Machine Clothing & Asia HQ

Xi’An Roll Plant

Changzhou Roll Plant

Dongguan Roll Plant (2018)

13

Xerium’s most profitable and

advanced product line

A major break-though in

competitiveness for Xerium & will

help sales growth in the region

First 20 orders have been received

with elite customers including

Nine Dragons and Asia Symbol

First shipment within weeks

Next production phase is also

already underway

Xerium’s 2nd Machine Clothing Operation in China is Starting Up Now

Forming Fabric Production Has Begun

14

Startups Outpacing Closures

March 10, 2017 YTD - new machine startups

outpacing old machine closures by ~ 2:1

o Start-ups = 45 machines

o Closures = 24 machines

Significant market correction occurred during

2013 – 2015, and the machine closure pace

declined significantly in 2016

Graphical market decline will continue

(~20% of the market), but closure pace and

impact will be less

Growth of GDP grades (~80% of the market)

is continuing and is overcoming the declining

grades

Base Business Stabilizing

Global Machines Shut Down

2013 2014 2015 2016

#

o

f

M

a

c

h

in

e

s

38%

improvement

170 173 167

104

Source: Fisher International, machines that

produce >30 tons per day

2017

323 New Machines

Announced for 2017

239

54

22

8

Asia

EMEA

LA

NA

Source: Fisher International

15

2016 Orders were above prior year, 2017

orders are above 2016 orders YTD

Sales slightly down due to end of year

timing, some production ramp-up issues

Backlog up, repositioning program is

working – new products and new

capacity in the right spots

Sales Are Stabilizing

Constant Currency

$477m $474m

2015 2016

(1)%

$115m $114m

(1)% Q4 Q4

16

2014 2015 2016 2017

$15m

$34m

$45m

Target

Repositioning Initiatives in Ramp-Up Phase, $94 million of New Wins & Climbing

China press felt plant (underway)

Shoe press belt ramp-up (underway)

TransFormTM forming fabrics (underway)

Spencer Johnston acquisition full-year

effect (underway)

Production increases for new products

(now)

China forming fabric plant (now)

Chile rolls & service plant (Q4)

New Business Wins Increasing

17

2017 backlog continues to increase YTD

90 new products launched since 2013, very

successful value propositions

Synergies between machine clothing, roll

technology, analytics. Delivering unique

customer value.

New capacity in targeted regions, enabling

growth volume.

Spencer Johnston integration fully underway

Order Levels Strong, Backlogs Steadily Improving

Year End

2015

Year End

2016

Clothing

Rolls

Clothing

Rolls

+5%

18

Lean Six Sigma

Lead in quality, delivery, cost

Achieve > 99% delivered quality

Offset inflation, price, mix

Operational Excellence

Strategic

Objective

Leading Financial Outcomes

38-40% gross margin

19-21% EBITDA

21-23% working capital

2

19

Reduce Leverage

Strategic

Objective

3

Generate free cash flow

Pay down debt and reduce leverage over the next 3-5 years

Target leverage reduction from 5.1x (pro-forma including Spencer Johnston) to <3x

Annual debt reduction, timing around interest payments

Improvement and de-risking of EBITDA driven by stronger commercial program &

repositioning actions

20

2016 was a good start with free cash flow

generation

Headed towards long term goal

Free Cash Flow

Goal

Range

$100m

$23m

2016

21

Q3

2016

$523m

Q4

2016

$512m

Net Debt Reduction Underway

Committed to paying down $100

million of debt

Continue to reposition & de-risk the

Company commercially &

financially

Benefit from 2013-2015 equipment

modernization and maintain

modest capex spending levels

22

Chile Rolls & Services Plant

Key 2017 Projects

Q4

China Forming Fabric Plant

Starting Now

Increase Production

for New Products

Starting Now

23

Expect Market Environment to

Continue to Improve

Non-declining grades now 79% of

sales, was 72% three years ago

New wins and business growth are

now outpacing graphical paper

business declines

Expect new machine startups to

outpace old machine closures

Expect Brazil macro-economic

environment to continue its

gradual improvement, and our

business alongside it

Outlook for 2017

Expect Business Growth

to Continue to Increase

Repositioned people, capacity,

products go-forward

opportunities much more robust

Foundational China machine

clothing plant in place & ramping

up – press felts and forming

fabrics

Additional new business growth

projects ramping up this year

Backlog has continued to grow,

good backlog headed into Q2

Generate Free Cash Flow

and Pay Down Debt

2017 capex investment will be

similar to 2016. Benefiting from

newly refurbished, repositioned

machines, will result in a sustained

modest level of spending

After 2 years of unfavorable

currency environment, expect

stability

24

65%

18%

17%

Institutional Insiders Retail

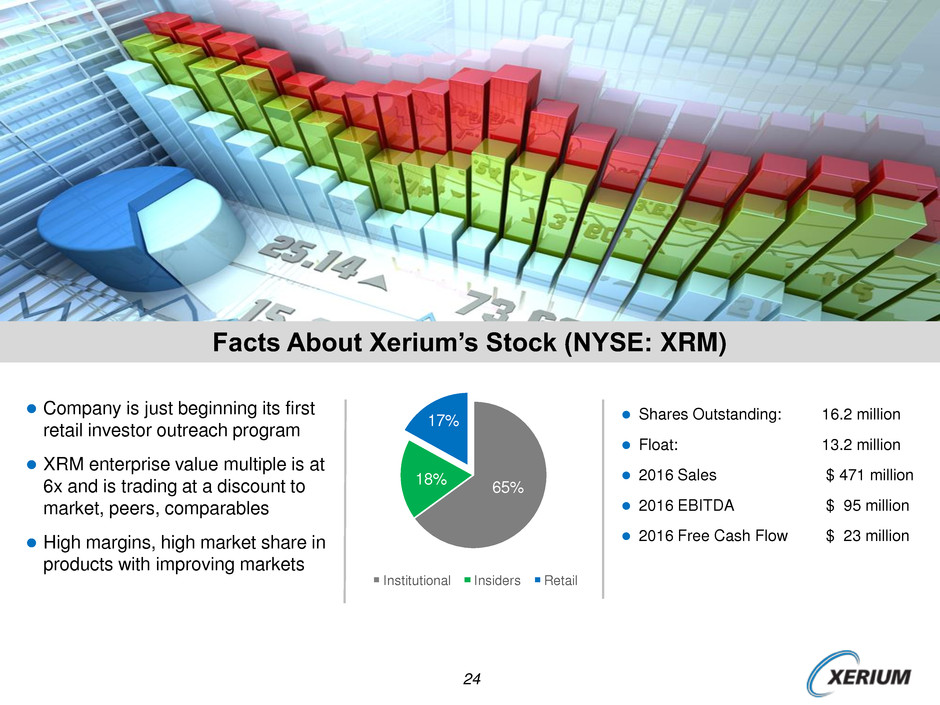

Facts About Xerium’s Stock (NYSE: XRM)

Company is just beginning its first

retail investor outreach program

XRM enterprise value multiple is at

6x and is trading at a discount to

market, peers, comparables

High margins, high market share in

products with improving markets

Shares Outstanding: 16.2 million

Float: 13.2 million

2016 Sales $ 471 million

2016 EBITDA $ 95 million

2016 Free Cash Flow $ 23 million

25

Investment Highlights

Passing through a tough business

cycle of machine closures and

strong dollar effects, and

consensus among industry peers

that the market future looks better.

Implemented a large repositioning

program, go-forward sales

opportunities brighter and more robust.

Committed to deleveraging and a multi-

year goal of paying down $100 million

of debt.

26

2017 Update

Q1 has been a good start to the year

Orders, sales, production, costs, margins, EBITDA, customers, prices, cash,

capex on track

Excellent backlog of good-mix business headed into Q2

Continue to have FX headwind

Next round of strategic programs coming on line right now

27

Supplemental

Information

28

% Change

% Excluding

2016 2015 Change Currency Impacts

Total 113$ 115$ (2)% (1)%

Machine Clothing 69$ 71$ (3)% (3)%

Rolls & Services 44$ 44$ (1)% 0%

% Change

% Excluding

2016 2015 Change Currency Impacts

Total 471$ 477$ (1)% (1)%

Machine Clothing 286$ 300$ (5)% (5)%

Rolls & Services 185$ 177$ 4% 6%

Q4

Full Year

Sales by Segment

- %

Note:

All numbers rounded to the nearest million

29

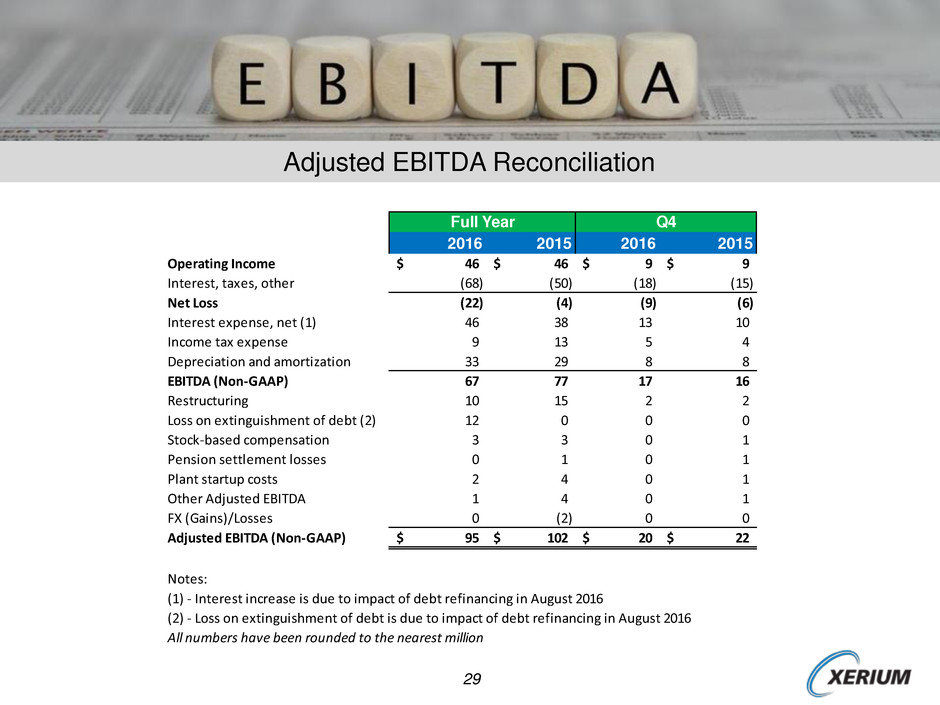

Adjusted EBITDA Reconciliation

2016 2015 2016 2015

Operating Income 46$ 46$ 9$ 9$

Interest, taxes, other (68) (50) (18) (15)

Net Loss (22) (4) (9) (6)

Interest expense, net (1) 46 38 13 10

Income tax expense 9 13 5 4

Depreciation and amortization 33 29 8 8

EBITDA (Non-GAAP) 67 77 17 16

Restructuring 10 15 2 2

Loss on extinguishment of debt (2) 12 0 0 0

Stock-based compensation 3 3 0 1

Pension settlement losses 0 1 0 1

Plant startup costs 2 4 0 1

Other Adjusted EBITDA 1 4 0 1

FX (Gains)/Losses 0 (2) 0 0

Adjusted EBITDA (Non-GAAP) 95$ 102$ 20$ 22$

Notes:

(1) - Interest increase is due to impact of debt refinancing in August 2016

(2) - Loss on extinguishment of debt is due to impact of debt refinancing in August 2016

All numbers have been rounded to the nearest million

Full Year Q4

30

Thank You!