Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - XERIUM TECHNOLOGIES INC | xrm-ex322_20161231xq4.htm |

| EX-32.1 - EXHIBIT 32.1 - XERIUM TECHNOLOGIES INC | xrm-ex321_20161231xq4.htm |

| EX-31.2 - EXHIBIT 31.2 - XERIUM TECHNOLOGIES INC | xrm-ex312_20161231xq4.htm |

| EX-31.1 - EXHIBIT 31.1 - XERIUM TECHNOLOGIES INC | xrm-ex311_20161231xq4.htm |

| EX-23.1 - EXHIBIT 23.1 - XERIUM TECHNOLOGIES INC | a12312016xeriumconsent.htm |

| EX-21.1 - EXHIBIT 21.1 - XERIUM TECHNOLOGIES INC | exhibit211_xeriumsubsidiar.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2016

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to

Commission File Number 001-32498

Xerium Technologies, Inc.

(Exact name of registrant as specified in its charter)

DELAWARE | 42-1558674 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

14101 Capital Boulevard

Youngsville, North Carolina 27596

(Address of principal executive offices)

(919) 526-1400

Registrant’s telephone number (including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, $0.001 par value per share | New York Stock Exchange | |

Preferred Stock Purchase Rights | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No X

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes X No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | Accelerated filer | X | ||||||

Non-accelerated filer | (Do not check if a smaller reporting company) | Smaller reporting company | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No X

The aggregate market value of the voting common stock held by non-affiliates of the registrant on June 30, 2016, the last business day in the second fiscal quarter, was approximately $63,778,812. There were 16,010,059 shares of the registrant’s common stock, $0.001 par value per share, outstanding as of June 30, 2016.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes X No

DOCUMENTS INCORPORATED BY REFERENCE

Proxy Statement for the 2017 Annual Meeting of Shareholders which will be filed pursuant to Regulation 14A, is incorporated by reference in Part III to the extent described therein.

TABLE OF CONTENTS

PAGE | ||

PART I. | ||

ITEM 1. | Business | 4 |

ITEM 1A. | Risk Factors | 11 |

ITEM 1B. | Unresolved Staff Comments | 26 |

ITEM 2. | Properties | 26 |

ITEM 3. | Legal Proceedings | 26 |

ITEM 4. | Mine Safety Disclosures | 27 |

PART II. | ||

ITEM 5. | Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 27 |

ITEM 6. | Selected Financial Data | 29 |

ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 30 |

ITEM 7A. | Quantitative and Qualitative Disclosures About Market Risk | 41 |

ITEM 8. | Financial Statements and Supplementary Data | 43 |

ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 43 |

ITEM 9A. | Controls and Procedures | 43 |

ITEM 9B. | Other Information | 46 |

PART III. | ||

ITEM 10. | Directors, Executive Officers and Corporate Governance | 46 |

ITEM 11. | Executive Compensation | 46 |

ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 46 |

ITEM 13. | Certain Relationships and Related Transactions, and Director Independence | 46 |

ITEM 14. | Principal Accounting Fees and Services | 46 |

PART IV. | ||

ITEM 15. | Exhibits, Financial Statement Schedules | 47 |

SIGNATURES | 48 | |

2

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to the safe harbor created by that Act. These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. In some cases, forward-looking statements can be identified by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue” or the negative of these terms or other comparable terminology. Undue reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties, and other factors that are, in some cases, beyond our control and that could materially affect actual results, levels of activity, performance, or achievements. Factors that could materially affect our actual results, levels of activity, performance or achievements include the following items:

• | rate and magnitude of decline in graphical grade paper production; |

• | fluctuations in interest rates and currency exchange rates; |

• | over-capacity of certain grades of paper, leading to distressed profit situations at our customers; |

• | execution risk related to our expansion projects; |

• | local economic conditions in the areas around the world where we conduct business; |

• | quality issues with new products that could lead to higher warranty and quality costs; |

• | structural shifts in the demand for paper; |

• | the effectiveness of our strategies and plans; |

• | sudden increase or decrease in production capacity; |

• | trend toward extended life in forming fabrics, leading to reduced market share; |

• | our development and marketing of new technologies and our ability to compete against new technologies developed by competitors; |

• | variations in demand for our products, including our new products; |

• | fluctuations in the price of our component supply costs and energy costs; |

• | our ability to generate substantial operating cash flow to fund growth and unexpected cash needs; |

• | occurrences of terrorist attacks or an armed conflict involving the United States or any other country in which we conduct business, or any other domestic or international calamity, including natural disasters; |

• | changes in the policies, laws, regulations and practices of the United States and any foreign country in which we operate or conduct business, including changes regarding taxes and the repatriation of earnings; and |

• | anti-takeover provisions in our charter documents. |

If any of these risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we project. Any forward-looking statement in this Annual Report on Form 10-K reflects our current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to our operations, results of operations, growth strategy, and liquidity. We assume no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events, or otherwise, except as required by law.

All references in this Annual Report to “Xerium”, “the Company”, “we”, “our” and “us” means Xerium Technologies, Inc. and its subsidiaries.

3

PART I

ITEM 1. | BUSINESS |

General

Xerium Technologies, Inc. (the "Company") is a leading, global provider of industrial consumable products and services including machine clothing, roll coverings, roll repair and mechanical services. These goods and services are used in the production of paper, paperboard, building products and nonwoven materials. Its operations are strategically located in the major paper-making regions of the world, including North America, Europe, Latin America and Asia-Pacific. We market our products through the following industry-recognized brands:

Brand | Product Category | Geographic Region | ||

Huyck Wangner | Machine Clothing | Worldwide, other than North America | ||

Weavexx | Machine Clothing | North America | ||

Stowe Woodward | Roll Covers & Spreader Rolls | Worldwide | ||

Mount Hope | Spreader Rolls | Worldwide | ||

Robec | Spreader Rolls | Europe | ||

IRGA | Spreader Rolls | Southern Europe and Indonesia | ||

Xibe/Stowe | Roll Covers | China | ||

JJ Plank | Specialty Services & Embossing, | North America | ||

Watermark & Dandy Rolls | ||||

Spencer Johnston | Spreader Rolls | North America, Japan, Latin America | ||

We have an extensive global footprint of 28 manufacturing facilities in 13 countries, strategically located in the major paper-producing regions of North America, Europe, Latin America and Asia Pacific, and have approximately 2,950 employees worldwide. We market our products, primarily using our direct sales force, to the paper industry’s leading producers. In 2016, we generated net sales of $471.3 million.

Company Overview

Our machine clothing and roll cover products are primarily installed on pulp and paper-making machines and play key roles in the process by which raw materials are converted into finished paper. A fundamental characteristic of our products is that they are consumed in the paper production process and must be regularly replaced. This positions us to make recurring sales to our customers, and accordingly, the number of paper machines in operation throughout the world and the amount of paper, pulp and board produced globally each year are primary drivers of the demand for our products. In addition, our products are also installed in other industrial applications such as nonwoven and fiber cement machines.

Paper-making machines utilize different processes and have different requirements depending on the design of the machine, the raw materials used, the type of paper being made and the preferences of individual production managers. We employ our broad portfolio of patented and proprietary product and manufacturing technologies, as well as our extensive industry experience, to provide our customers with tailored solutions designed to optimize the performance of their equipment and significantly reduce the costs of their operations. We systematically track and report the impact of these customized solutions to our customers through our ValueResults™ program which quantifies the optimization process on their machines.

Our machine clothing products are highly engineered synthetic textile belts that transport and filter paper as it is processed in a paper-making machine. Machine clothing plays a significant role in the forming, pressing and drying stages of paper production. Our machine clothing segment represented 61% of our net sales for the year ended December 31, 2016, 63% in 2015 and 64% in 2014.

Roll cover products cover the rolls on a paper-making machine, which are the large steel cylinders over which machine clothing is mounted and between which the paper travels as it is processed. Our roll covers provide a surface with the mechanical properties necessary to process the paper in a cost-effective manner that delivers the sheet qualities desired by the paper producer. We currently use several hundred chemical compounds in our roll cover manufacturing process. Our roll cover segment represented 39% of our net sales for the year ended December 31, 2016, 37% in 2015 and 36% in 2014.

Our products are in constant contact with the paper during the manufacturing process. As a result, our products have a significant effect on paper quality and the ability of a paper producer to differentiate its products, two factors that we believe

4

are increasingly important to paper producers. In addition, while machine clothing and roll covers represent only approximately 3%, on average, of a typical paper producer’s production costs, they can help a paper producer improve productivity and reduce overall costs. Our machine clothing and roll covers facilitate the paper producers' use of less expensive raw materials (including recycled fiber), their ability to run paper-making machines faster and with fewer interruptions and their ability to decrease the amount of energy required in the expensive drying portion of the paper-making process. We have found that, in certain cases, our products and services provide paper producers with cost savings that substantially offset the costs of such products and services.

We estimate that there are approximately 7,995 paper-making machines worldwide, all of which require a regular supply of machine clothing and roll covers. Machine clothing and roll covers must be replaced regularly to sustain high quality paper output and operate efficiently. Roll covers also require regular refurbishment, a service that we provide to our customers. Paper producers typically replace machine clothing multiple times per year, replace roll covers every two to five years and refurbish roll covers several times between each replacement.

We have a reputation for technological innovation in the paper-making industry. In our machine clothing segment, in recent years we have focused our research and development efforts on higher value-added, technologically advanced products, such as forming fabrics and press felts, which offer paper producers greater potential for differentiating their products through quality improvements and increasing their operating efficiency. Historically, we have pioneered a number of technologies that have become industry standards, including in our machine clothing business, synthetic forming fabrics (which replaced bronze wire technology), double-layer forming fabrics, laminated press felts and, most recently, triple-layer forming fabrics.

In our roll covers segment, we have introduced a number of innovations to our roll cover and spreader roll products in recent years, including (1) SMART™ Technology, the first continuous pressure sensing paper machine roll that enables the papermaker to maximize performance by knowing the pressure of the paper machine while the machine is running; (2) composite calendar roll covers that use nanoparticle technology to improve roll cover durability and paper gloss; (3) covers that use an improved polyurethane to increase abrasion and moisture resistance as well as responsiveness and stability; and (4) uniquely designed and proprietary grooving patterns that improve machine performance and reduce energy consumption.

Our portfolio of patented and proprietary product and manufacturing technologies differentiates our product offerings from others in the market and allows us to deliver high value products and services to our customers. As of December 31, 2016, we had approximately 444 issued patents and over 67 pending patent applications. Our patents and patent applications cover approximately 62 different inventions. We currently license certain of our patents and technologies to some of our competitors, which we believe helps further demonstrate our technological leadership in the industry. We believe that the technological sophistication of the products needed in our business and the capital-intensive nature of our business present significant challenges to any potential new competitors in our field.

We organized our business in 1999 in connection with the acquisition of the paper technology group of Invensys plc. We completed our initial public offering on May 19, 2005.

Recent Developments

New Technology

In December 2016, the Company introduced TransForm, a new generation of forming fabrics designed specifically for paperboard and packaging machines that lowers energy consumption and extends fabric life, among other considerable benefits. The TransForm technology is applicable for machines producing: paperboard, containerboard, fluting/corrugating, linerboard, kraft bag, liquid packaging board, food and beverage containers, bleach board, white top paperboard, boxboard, and other related subgrades. We believe that Transform helps our customers reduce energy consumption by more than 15 percent while extending fabric life between 15 and 25 percent.

Asian Expansion

In the fourth quarter of 2016, we surpassed 1,000 shipments of press felt from our new state-of-the-art machine clothing plant located in Kunshan, China. As a result of our new Kunshan facility, we are now routinely producing press felt solutions locally for customers in China and the Asia-Pacific region. Our Kunshan plant is located in the heart of the Yangtze River paper-making region in China, at the center of the largest papermaking region in the world. Prior to building the Kunshan plant, we served the Asia region as an exporter of products made in Europe. With the Kunshan facility, we have significantly increased our competitive position and is now closely partnering with customers in China and the rest of Asia. Xerium has a multi-year plan to continue expanding the scope of machine clothing production in Kunshan. We are underway right now with an expansion to make forming fabrics in Kunshan.

5

Global Trends in Paper Demand

The Company's markets have gone through a tough business cycle. Demand for the Company’s products are tied to our customer’s production rates and our product’s useful lives. While the majority of the Company’s end markets are growing, certain graphical grade paper production market segments have been in decline. Non-declining markets make up greater than 75% of the Company’s business model. Production of these grades of paper and board (tissue, paper towels, napkins, cardboard, consumer packaging, consumer durable packaging, e-commerce packaging) is steady and/or increasing globally. Declining grades of paper production are newsprint globally, and printing/writing papers in mature economies with full access to wireless/digital media. These market corrections have been very strong in the last few years and many paper machines dedicated to graphical paper production have been closed. At the same time, new machines have been installed to make the growing grades of paper and board. Both of these trends are continuing. In order to optimize outcomes in this changing environment, the Company has been implementing a repositioning program to re-map its plant locations, people, products, equipment tooling, and machine services offered to more naturally align with growing markets both geographically and by type of paper machine serviced.

Business Strategy

• | Correct footprint in order to deliver market competitive lead-times and cost structures, and outfit equipment to pursue new growth business - in the last four years, we closed and relocated equipment from declining market areas and into growing areas. Specifically, the Company closed 8 manufacturing locations as the source of new capacity, retooled and relocated that equipment to 9 other locations, and has 1 additional new plant under construction. That new plant will also receive equipment from the other locations. |

Closed/Provide Equipment to Others | Installed Equipment/Repositioned for Growth |

1. Argentina MC plant | 1. Canada MC plant |

2. Brazil MC plant | 2. Austria MC plant |

3. Charlotte, NC rolls plant | 3. Brazil MC plant |

4. Canada MC plant | 4. Chile rolls plant (new, underway) |

5. France rolls plant | 5. China MC plant (new) |

6. Germany rolls plant | 6. China rolls plant |

7. Middletown, VA rolls plant | 7. Griffin, GA rolls plant |

8. Spain MC plant | 8. Neenah, WI rolls plant |

9. Ruston, LA rolls plant | |

10. Turkey rolls plant (new) | |

• | Renovate products & services to leadership levels in order to secure New Business Wins on targeted machines - 90 new products in the last four years, several core mechanical service offerings were added into certain roll repair centers, patent portfolio expanded to 444 total patents with 67 pending applications. Company has added new sales personnel and is marketing to new market segments including: pulp, tissue, fiber cement, non-paper industries, paper and tissue converting, Turkey and Middle East markets, China and Asian markets, Mexico and Central American markets, Chile and South American markets. |

• | Create a unified, low-cost business model with one set of value-added processes - eliminate redundancy between regions and amongst product groups, supplement and top-grade team in certain areas, unify ERP and business systems, connect data streams into cohesive value-added processes using Industrial Internet of Things (IIoT) methodologies, and implement Lean Six Sigma in every plant globally. |

• | Pay down debt and deleverage the Company - after the majority of repositioning activities have been accomplished to install a go-forward business model, use excess free cash flow to pay down debt over a multi-year period in order to deleverage the company. |

Products

We operate through two principal business segments, machine clothing and roll covers. Our machine clothing segment products include various types of industrial textiles used on paper-making machines and other industrial applications. Through our roll covers segment, we manufacture various types of roll covers, refurbish previously installed roll covers, provide

6

mechanical services for the internal mechanisms of rolls used on paper-making machines and manufacture spreader rolls. For additional financial information about our machine clothing and roll covers segments, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 12 "Business Segment Information" to the accompanying audited consolidated financial statements.

Machine Clothing Products

Our machine clothing segment products are large, highly engineered synthetic textile belts that transport paper as it is processed in a paper-making machine from paper stock into finished paper. Machine clothing products must be tailored to each machine because all paper-making machines have different physical configurations and operating parameters. Machine clothing generally ranges in size from approximately 7 feet to over 30 feet wide and 24 feet to more than 460 feet long and operates on paper-making machines that run at speeds up to 7,500 feet per minute.

We manufacture three general types of machine clothing products used on paper-making machines—forming fabrics, press felts and dryer fabrics—each of which is located in a different section of a paper machine. Forming fabrics and press felts are typically replaced multiple times a year, but replacement frequency varies significantly by the grade of paper being produced, the manner in which the paper-making machine is operated and the quality of raw materials used in the paper stock. Dryer fabrics are replaced less frequently, with replacement typically taking place approximately once per year.

Forming fabrics. Forming fabrics are used at the beginning of paper-making machines, where highly diluted paper stock is deposited on the forming fabric while the fabric is traveling at a very high speed. Forming fabrics allow water to drain from the paper stock, creating an initial wet sheet. Forming fabrics must be sufficiently porous to allow water to drain evenly and quickly, yet tight enough to retain and align the fiber and other materials that form the sheet of paper. They must also be strong enough to withstand high mechanical stresses. Forming fabrics are custom-manufactured in single, double and triple layer designs in a variety of meshes to suit particular machines and paper grades. Customers are increasingly demanding the higher-priced triple layer designs that remove more moisture and produce higher quality paper. In 2016, forming fabrics accounted for approximately 34% of net sales in our machine clothing segment.

Press felts. Press felts are used to carry the paper sheet through a series of press rolls that mechanically press water from the sheet under high pressure. Press felts are designed to maximize water removal, which reduces the amount of water that must be removed during the expensive energy-intensive drying section of the production process. Press felts must maximize water removal while maintaining the orientation of the fibers and the consistency of the thickness of the paper, without removing chemicals or fillers from the paper.

Press felts differ from forming fabrics and dryer fabrics due to the addition of several layers of staple fiber that are needled into the fabric base. The staple fiber provides a smooth surface to meet the wet sheet of paper and creates a wicking effect to remove water from the paper sheet as it is pressed under high pressure between press rolls. Press felts are manufactured in a variety of designs, including lightweight single layer felts, multi-layer laminated endless felts and seamed felts that allow for reduced installation times. In 2016, press felts accounted for approximately 47% of net sales in our machine clothing segment.

Dryer fabrics. Dryer fabrics are used to transport the paper sheet through the drying section of paper-making machines, where high temperatures from large, steam-heated dryer cylinders evaporate the remaining moisture from the paper sheet. Dryer fabrics, which are less technically advanced than forming fabrics or press felts, are woven from heat-resistant yarns with a coarser mesh than forming fabrics. In 2016, dryer fabrics accounted for approximately 5% of net sales in our machine clothing segment.

Industrials and Other. We manufacture other fabrics used in other industrial applications, such as pulp, non-woven textiles, fiber cement, tannery sludge de-watering and textiles manufacturing. In 2016, net sales for such industrial applications accounted for 14% of net sales in our machine clothing segment.

New Machine Clothing Products. The major goal of research and development is to create customer value and solutions by combining latest technologies with excellent quality and unique product characteristics. This commitment will improve our competitive position and ensures a continuously optimized product portfolio. In recent years, we have focused our research and development efforts on higher performance, value-added, sustainable product solutions throughout our entire machine clothing offering. Our efforts have resulted in several innovative and revolutionary new forming fabric and press felt product solutions, which prove their performance benefits globally every day.

7

Roll Covers and Services

In our roll covers segment (or "rolls segment"), the majority of our sales are generated through the replacement and refurbishment of roll covers and spreader rolls, the manufacturing of new spreader rolls and general mechanical maintenance and repair services for the internal mechanisms of rolls.

Roll covers. We manufacture, refurbish and replace covers of all types of roll applications used in paper-making machines, such as press section rolls including suction rolls, lump breaker rolls, coater rolls, sizing rolls, calendar rolls and all purpose conveying rolls. There can be up to 200 such rolls in a typical paper-making machine. These metal rolls, which can be up to 39 feet long, 6 feet in diameter and weigh 500 to 140,000 pounds, are covered with an exterior layer of rubber, polyurethane, composite or ceramic, each of which is designed for use in a particular phase of the paper-making process. Roll covers operate in temperatures up to 400 degrees Fahrenheit, under pressures up to 12,000 pounds per square inch and at speeds up to 10,000 feet per minute. Roll covers are typically replaced every two to five years.

Roll cover replacement is performed at the manufacturing facility of the supplier, such as Xerium, which necessitates removing the roll from the paper-making machine, transporting it to the supplier’s site and using a spare roll in the interim. In general, each roll on a paper-making machine is unique due to its dimensions, specific design and cover material, and generally not interchangeable with other rolls. Because of their large size, paper producers generally maintain only one spare roll for each position on a paper-making machine. It is important that the roll cover replacement be completed quickly, because damage or a malfunction of the spare roll could render the paper-making machine inoperable.

Due to the large size and weight of a roll, transportation to and from a supplier’s site can be costly and is occasionally subject to regulations on road use that restrict available routes and times of travel, and that may require safety escorts. Round-trip transcontinental travel can take several weeks and intercontinental travel is rare. We offer an extensive network of manufacturing facilities worldwide, often in close proximity to our customers, which we believe is a significant competitive advantage.

Roll covers accounted for approximately 55% of our total net sales in our roll covers segment in 2016.

Services. Roll covers are typically refurbished several times over the two to five years they are in service before needing to be replaced. Refurbishment typically includes the regrinding of the roll cover to standard specifications and inspecting the bearings and other mechanical components of the roll. As with roll cover replacement, refurbishment is performed at the supplier’s manufacturing facility. Similar to the paper producer’s selection of a roll cover supplier, the selection of a refurbishment provider is influenced by the time and expense of transporting a roll cover.

We offer a wide range of mechanical maintenance and repair services for the internal mechanisms of rolls. Paper producers are increasingly finding it economical to have the company that refurbishes or replaces a roll cover also perform work on the internal roll mechanisms at the same time, which avoids having multiple suppliers and incurring additional time and transportation charges. We have begun performing such services to meet the demands of our customers and gain a competitive advantage. As of December 31, 2016, we provide major mechanical services at ten locations around the world. Roll cover refurbishment services and mechanical services accounted for approximately 25% of our total net sales in our roll covers segment in 2016.

Spreader rolls. We manufacture and repair spreader rolls, which are small-diameter curved rolls used throughout a paper-making machine to stretch, smooth and remove wrinkles from the paper and machine clothing. There are approximately five to seven spreader rolls in a typical paper-making machine. Spreader rolls and related services accounted for approximately 18% of our total net sales in our roll covers segment in 2016.

New Roll Products. We have introduced a number of innovations to our roll cover and spreader roll products in recent years, including composite calendar roll covers that use nanoparticle technology to improve roll cover durability and paper gloss, as well as covers that use an improved polyurethane to increase abrasion and moisture resistance as well as responsiveness and stability. We are evaluating new products, which will use different materials and utilize different sales channels and provide enhancements to our existing product line. The acquisition of Spencer Johnston in May of 2016 broadened the Company's capabilities with respect to spreader rolls, dandy rolls, and tissue embossing rolls. Sales generated by these new and other roll products account for approximately 2% of our total net sales in our roll covers segment in 2016.

Customers

We supply leading paper producers worldwide. Our top ten customers accounted for 26.6% of net sales in 2016 and individually, no customer accounted for more than 6% of 2016 net sales. In 2016, we generated 39% of our net sales in North America, 32% in Europe, 10% in Latin America and 19% in Asia-Pacific. See Note 12 "Business Segment Information" to the accompanying audited consolidated financial statements for geographic information related to net sales and long-lived assets.

8

Due to competitive market forces, we offer our customers payment terms similar to those offered by our competitors. Also, agreements with certain customers require us to maintain modest amounts of finished machine clothing inventory to assure those customers of supply continuity. We do not maintain finished rolls inventories.

Competition

Our largest competitors are the two leading manufacturers of paper-making machines and one independent machine clothing producer. In addition, we also face competition from smaller regional suppliers.

We compete primarily based on the value, price and production lead times of our products. Competition with respect to both machine clothing and roll covers, particularly as it relates to our technologically advanced forming fabrics, press felts and roll covers, is based primarily on the value that the products deliver to the paper producer through the ability of such products to reduce production costs and improve paper quality. Also, because our customers operate continuously, we aim to offer competitive delivery schedules from customer order to placement in their machines.

Competition in the machine clothing and roll covers market is also based on a supplier’s ability to deliver engineering and technical services. Many paper producers have been reducing their in-house engineering and technical staff and increasingly expect their suppliers to provide such services. While smaller suppliers often lack the resources necessary to invest in and provide this level of engineering and technical service, we have made investments in order to provide the following services to the paper producers: specialist advice and resident engineers, installation support, on-call “trouble-shooting” and performance monitoring and analysis of paper-making machines.

In the roll covers market, competition is also based on a supplier’s proximity to the paper producer’s facilities, which affects the transportation time and expense associated with refurbishing or replacing a roll cover, and on the supplier’s ability to provide mechanical services to a roll’s internal mechanisms while the roll cover is being refurbished or replaced. We offer an extensive network of facilities throughout the world and provide mechanical services at the majority of our locations.

Research and Development

Our continuing ability to deliver value depends on developing product innovations. As we create new and improved products, we are often able to obtain patent protection for our innovations, which is indicative of our technical capabilities and creativity. Although we do not consider any single patent to be material to our business, we believe that, in the aggregate, our patents and other intellectual property provide us with a competitive advantage. At December 31, 2016, we have approximately 444 domestic and foreign patents outstanding and approximately 67 pending patent applications. Our patents and patent applications cover approximately 62 different inventions. Some of our competitors license our technology in exchange for royalty payments, although such licensing does not represent a material amount of our business. Research and development expenses totaled $7.1 million in 2016, $7.4 million in 2015 and $7.9 million 2014, and were approximately 1.5%, 1.6% and 1.5% of our net sales in 2016, 2015 and 2014, respectively.

Production

Machine Clothing Production Process

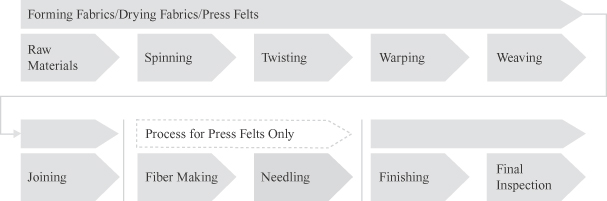

The following diagram represents the machine clothing production process.

The machine clothing production process begins with the spinning of synthetic fiber threads to produce yarn, which is then twisted in preparation for the manufacturing of machine clothing. Yarn, which companies sometimes purchase as a raw material, is then wound on large spools prior to installation on the loom. The yarn is drawn through needles in preparation for weaving.

9

With the yarn prepared for weaving, a weave pattern can be installed in the loom controller. The nature of the weave pattern is critical to how the machine clothing performs in the paper-making process. The yarn is then woven to the desired length.

Technological advancements have resulted in weaving becoming an almost entirely automated process. Following weaving of a forming or dryer fabric, the two ends are permanently joined to form a continuous loop of machine clothing. Although significant automation has occurred in the joining process, it remains the most labor intensive element of the machine clothing production process.

Press felts are woven in a continuous loop and undergo a process that is not necessary for forming and dryer fabrics. An additional layer of fibers is added to the outside surface with the use of an advanced needling machine, such that a very smooth felt surface is created.

All machine clothing then undergoes heat setting and chemical treating. Heat setting tightens the machine clothing giving it the necessary mechanical properties for the paper-making process. Finally, the machine clothing is meticulously inspected prior to being shipped to the customer.

The machine clothing production process is capital intensive and requires a variety of equipment, including warping equipment, weaving looms, heat set equipment, joining equipment, needle looms and finishing machines.

Roll Cover Production Process

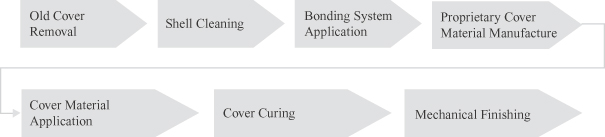

The following diagram represents the roll covering production process.

The covering on the rolls used in the paper-making process wear over time and must be periodically replaced for the roll to function properly. Rolls are removed from the paper-making machine and delivered to one of our facilities for re-covering. During this time, a spare roll is placed in the paper machine to enable continuous operations.

The roll covering process begins with the removal of the old cover. A lathe and belt grinder are used to remove the old cover, exposing the roll shell. The shell is cleaned with a pressure washer and blasted with solid particles to increase the shell’s surface area for bonding of the new cover. Following the blasting process, the shell is ready to be re-covered.

The shell is then coated with proprietary bonding agents that affix the new roll cover to the shell. Each type of cover material is applied with a different process. Rubber and composite covers are extruded in a slow spinning lathe. Polyurethane covers are typically cast on the core using a mold, and ceramic covering is expelled onto the shell at high pressure.

Following application of the core material, the cover undergoes a curing process. Rubber covers are cured for 12 to 28 hours in vulcanizers under high temperature and pressure, whereas polyurethane and composite materials are cured in a hot air oven. After curing, the roll cover is ground with belts and grinding stones. Depending on the type of roll, a proprietary pattern of holes and grooves is then drilled into the cover to aid in water removal. Finally, the roll is balanced for proper spinning motion and meticulously checked for quality before being returned to the customer.

The roll cover production process is capital intensive and requires a variety of equipment, including lathes, belt grinders, polyurethane casting molds (for polyurethane roll covers), extruders, mix stations, vulcanizers, ovens and balancing equipment.

Raw Materials

The primary raw materials used in our machine clothing production are synthetic yarns and fibers. The primary raw materials used in our roll cover products are synthetic and natural rubber, monomers, epoxy resins and polyurethane. A number of suppliers provide the materials used in our product lines, so availability has not posed a significant concern. Since both the machine clothing and primary roll cover materials are based on petroleum and natural gas derivatives, their prices are subject to changes in supply/demand and the price of petroleum and natural gas and their derivatives. The global average price for petroleum bottomed out one year ago and has almost doubled to $53/barrel since then. The U.S. Energy Information

10

Administration’s latest forecast is for pricing to remain at this level throughout 2017. We have recently seen the impact of this rise in energy prices, coupled with supply/demand issues of certain raw materials, causing an increase in certain synthetic yarn materials, as well as synthetic rubber. It is expected that these increases will abate as we head towards Q3 2017. Natural Rubber prices tend to be influenced directly by the weather in the Asian crop regions and by demand in China. This winter has been especially difficult in Asia with long-lasting rains, causing a temporary price increase in Natural Rubber. Pricing is expected to rescind towards mid-year. Xerium mitigates these impacts by placing blanket orders ahead of the winter while prices are lower.

Environmental

Our operations and facilities are subject to a number of national, state and local laws and regulations protecting the environment and human health in the United States and foreign countries that govern, among other things, the handling, storage and disposal of hazardous materials, discharges of pollutants into the air and water and workplace safety. Because of our operations, the history of industrial uses at some of our facilities, the operations of predecessor owners or operators of some of the businesses, and the use and release of hazardous substances at these sites, the liability provisions of environmental laws may affect us.

We believe that any liability in excess of amounts provided in Note 9 "Commitments and Contingencies" to the accompanying audited consolidated financial statements which may result from the resolution of such matters will not have a material adverse effect on our financial condition, liquidity or cash flow.

Employees

As of December 31, 2016 we had approximately 2,950 employees worldwide, of which approximately 67% were manufacturing employees. As of December 31, 2016, 2,010, or 68%, of our employees are members of labor unions, trade unions, employee associations or workers councils. We believe that we have good relations with our employees and the various groups that represent our employees.

Our Corporate Information

We are subject to the information requirements of the Securities Exchange Act of 1934 (the “Exchange Act”). Therefore, we file periodic reports, proxy statements and other information with the SEC. Such reports, proxy statements and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, DC 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site at https://www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically.

We maintain a website at www.xerium.com to provide information to the general public and our shareholders on our products and services, along with general information on Xerium. We make our periodic and current reports available, free of charge, on our website as soon as reasonably practicable after these reports are filed with, or furnished to, the SEC. Our corporate code of business conduct and ethics, our corporate governance guidelines, and the charters of each of the Audit, Compensation and Nominating and Corporate Governance Committees of our Board of Directors are also made available, free of charge, on our website. Our corporate code of business conduct and ethics, which includes our code of ethics, and related waivers (if any) are posted on our website and we intend to post on our website and (if required) file on Form 8-K all disclosures required by applicable law or the rules of the SEC concerning any amendment to, or waiver from, our code of ethics. Copies of these documents may be obtained, free of charge, by writing Investor Relations, Xerium Technologies, Inc., 14101 Capital Boulevard, Youngsville, NC 27596, or telephoning us at 919-526-1444.

ITEM 1A. | RISK FACTORS |

Our business, results of operations and financial condition, and an investment in our securities, are subject to various risks. Investors should carefully consider the risks described below in conjunction with the other information in this Form 10-K, including our Consolidated Financial Statements and related notes. If any of the following risks or other risks which have not been identified or which we may believe are immaterial or unlikely, actually occur, our business, financial condition and results of operations could be harmed. This could cause the value of our securities to decline and holders could lose part or all of their investment. This section does not describe all risks applicable to us, our business or industry, and it is intended only as a summary of certain material factors.

11

Risks Relating to Our Business and the Industry

Our current and anticipated restructuring actions aimed at shifting our cost structure from high-cost to low-cost markets and realigning our operations with market demand in the paper industry has required and may require significant expenditures in the future and may not be successful.

Beginning in 2012 and continuing through the present, we have announced and taken various operational restructuring measures in response to changed market conditions in the paper industry triggered by the structural realignment in the demand for the various grades of paper. For example, we have announced the termination of sales agency relationships in Europe, workforce reductions in Germany, the closure of four rolls facilities in Middletown, Virginia, Meyzieu, France, Charlotte, North Carolina and Heidenheim, Germany and the closure of four machine clothing facilities in Warwick, Quebec, Canada, Berazategui, Argentina, Zizurkil, Spain and Joao Pessoa, Brazil. We anticipate pursuing additional cost reduction programs in the future.

In connection with these cost reduction measures and with any future plant closures or workforce reductions, delays or failures in the transition of production from a closed facility to our other facilities or the rate of absorption of job assignments by the remaining workforce could also adversely affect our financial performance. We may not recoup the costs of programs we have already initiated, or other programs we may in the future decide to engage in, the costs of which may be significant. In addition, our profitability may decline if our restructuring efforts do not sufficiently reduce our future costs while at the same time positioning us to maintain or increase our sales and gross margins.

We have targeted expansion projects where we have identified opportunities for business growth. Our various expansion projects are subject to execution risk and uncertainties that could adversely impact our business, results of operations and financial condition.

In connection with our efforts to realign our manufacturing footprint by either expanding in line with growth opportunities or by closing facilities in high cost regions and transferring production to lower cost regions, we are in the midst of, or have completed, significant expansions of several of our existing facilities. The completion and ramp up of these projects is dependent upon a number of factors, many of which may be beyond our control. For example, we may experience significant delays in completing these projects because we may not be able to acquire appropriate permits. For example, we may encounter unanticipated complications with the installation and implementation of the complex systems and equipment that would impair our ability to begin production within the time frame estimated for the projects. We also may be unable to attract a sufficient number of skilled workers to meet the needs of the new or expanded facilities.

In addition, the cost to implement our strategic projects ultimately may prove to be greater than originally anticipated. We have spent significant capital and managerial resources on these new facilities and expansions. Furthermore, our assessment of the projected benefits associated with the construction of these new facilities is subject to a number of estimates and assumptions, which in turn are subject to significant economic, competitive and other uncertainties that are beyond our control. If we incur unanticipated costs in connection with this project, are not able to complete these new facilities in a timely manner or at all, or otherwise unable to achieve the anticipated benefits from this project, our business, results of operations and financial position could be materially adversely affected.

New developments and trends in the paper industry could adversely affect our net sales and profitability.

Because demand for our products has been driven primarily by the volume of paper produced on a worldwide basis, trends that affect the production level of the paper industry, such as declining demand for newsprint and printing and writing paper due to increased adoption of digital media, will impact our business and financial results.

We have experienced, and we believe our industry in general has experienced significant declines in sales to the graphical and newsprint industry. We expect such declines to continue for the foreseeable future, and unless we are successful in increasing our sales to industries other than the graphical and newsprint industry, such declines may adversely affect our net sales and profitability.

The profitability of paper producers has historically been highly cyclical due to wide swings in the price of paper, driven to a high degree by the oversupply of paper during periods when paper producers have more aggregate capacity than the market requires. In response to significant changes in the sector and other technological shifts affecting paper consumption, paper producers have continually sought to improve the balance between the supply of and demand for paper. As part of these efforts, they have permanently shut down many paper-making machines or entire manufacturing facilities. Should papermakers continue to experience low levels of profitability, we would expect that further consolidation among papermakers, reducing the

12

number of paper producers, and shutdowns of paper-making machines or facilities could occur, particularly in Europe and North America, until there is a better balance between supply and demand for paper and the profit levels of paper producers improve.

Global paper production growth in developing markets such as Asia and South America could be moderated by the level of industry consolidation and paper machine shutdown activity that appears to be an underlying trend in developed markets. We have observed a trend that paper producers are focusing on cost reduction strategies and, as a result, are extending the life of roll covers and machine clothing products through additional maintenance cycles before replacing them. New developments and trends in the paper industry, either globally or in a particular region, could cause our paper manufacturing customers to reduce production, cease operations or declare bankruptcy, each of which would adversely affect our net sales and profitability.

Price competition in our industry could adversely affect our gross margins and net sales.

Historically, we and our competitors have been able to sell machine clothing and roll cover products and services at favorable prices that reflect the value they deliver to customers. This favorable pricing has been particularly derived from our more technologically advanced products, such as forming fabrics, press felts and advanced roll covers. In the event that competition increases due to global economic conditions or continued over capacity in the paper manufacturing industry, we may be required to price our products, in some cases, at levels insufficient to realize our historical gross margins. Such pricing pressure from our competitors might require price decreases or make us unable to affect planned price increases and, thereby, adversely affect our profitability.

Balancing production levels at our manufacturing facilities could negatively affect our production, customer order time, product quality, labor relations or gross margin.

As part of our efforts to reduce our costs, we have attempted to reduce or eliminate excess manufacturing capacity through closure of certain of our manufacturing plants and consolidation of our production. As a result, however, from time to time, our ability to meet customer demand for our products may rely on our ability to operate our remaining manufacturing facilities at or near capacity on an uninterrupted basis. Our manufacturing facilities are dependent on critical equipment, and operating such equipment at or near capacity for extended periods may result in increased equipment failures or other reliability problems, which may result in production shutdowns or periods of reduced production. Such disruptions could have an adverse effect on our operations and financial results. In addition, insufficient manufacturing capacity or other delays may cause our customer order times to increase and our product quality to decrease, which may increase warranty costs and negatively affect customer demand for our products and customer relations generally. Operating our facilities at or near capacity may also negatively affect relations with our employees, which could result in higher employee turnover, labor disputes and disruptions in our operations. On the other hand, if we anticipate or experience a significant decrease in demand for our products, we may choose to temporarily decrease production or idle manufacturing facilities and employees. While decreasing production may mitigate some of the risks of operating at or near capacity discussed above, a significant drop off in production to meet lower demand, including idling facilities or employees, may negatively impact our gross margin.

Fluctuations in currency exchange rates could adversely affect our net sales, profitability and compliance with our debt covenants.

Our foreign operations expose us to fluctuations in currency exchange rates and currency devaluations. We report our financial results in U.S. Dollars, but a substantial portion of our sales and expenses are denominated in Euros and other currencies. As a result, changes in the relative values of U.S. Dollars, Euros and other currencies will affect our levels of net sales and profitability. Currency fluctuations, as they pertain to the Euro, generally have a greater effect on the level of our net sales due to the amount of business we conduct in Euros. An increase in the U.S. Dollar against the Euro generally results in a decrease to net sales and net income. Increases in the U.S. Dollar against other currencies, such as the Brazilian Real, would not impact consolidated net sales as much, as a significant portion of sales in that country is denominated in or indexed to U.S. Dollars, but generally would increase net income as local currency costs would be translated into lower U.S. Dollar expenses for financial reporting purposes. We would expect a similar but opposite effect in a period in which the value of the U.S. Dollar decreases against these currencies. Although in certain circumstances we may attempt to hedge our cash exposure to fluctuations in currency exchange rates, our hedging strategies may not be effective.

Our industry is competitive and our future success will depend on our ability to effectively develop, market and supply competitive products.

The paper-making consumables industry is highly competitive. Some of our competitors are larger than us, have greater financial and other resources and are well-established suppliers to the markets we serve. For example, while we have recently expanded our business in China, we face substantial competition from manufacturers already operating there that are more

13

established and familiar with the Chinese marketplace. In addition, some of our competitors also manufacture paper-making machines and have the ability to initially package sales of their machine clothing and roll cover products with the sale of their machines and/or to tie the warranties on their machines to the use of their machine clothing and roll cover products. Due to various factors such as price or product innovation by our competitors, our products may not be able to compete successfully with the products of our competitors, which could result in a loss of customers and, as a result, decreased net sales and profitability.

Because we have substantial operations outside the United States, we are subject to the economic and political conditions of foreign nations.

We have 28 manufacturing facilities in 13 foreign countries. In 2016, we sold products in approximately 62 countries other than the United States, which represented approximately 69.5% of our net sales. Operating in foreign countries presents challenges unique to each country such as in hiring employees, our relations with various parties, including suppliers and governmental agencies, and in production.

Furthermore, we may decide to do business in countries where we have not previously done business. In such countries, we face the additional uncertainty of entering a new market and its social customs, laws and practices. Should these challenges be realized, our operating results could be adversely impacted and our business or production may be delayed.

Our foreign operations are subject to a number of risks and uncertainties, including risks that:

• | foreign governments may impose limitations on our ability to repatriate funds; |

• | foreign governments may impose withholding or other taxes on remittances and other payments to us, or the amount of any such taxes may increase; |

• | an outbreak or escalation of any insurrection or armed conflict may occur; |

• | foreign governments may impose or increase investment barriers or other restrictions affecting our business; or |

• | changes in and interpretations of tax policies of foreign governments may adversely affect our foreign subsidiaries. |

The occurrence of any of these conditions could disrupt our business in particular countries or regions of the world, or prevent us from conducting business in particular countries or regions, which could adversely affect our net sales and profitability. In addition, we rely on dividends and other payments or distributions from our subsidiaries to meet our debt obligations. If foreign governments impose limitations on our ability to repatriate funds or impose or increase taxes on remittances or other payments to us, the amount of dividends and other distributions we receive from our subsidiaries could be reduced, which could reduce the amount of cash available to us to meet our debt obligations.

Energy price increases may negatively impact our results of operations.

Certain of the components that we use in our manufacturing activities are petroleum-based. In addition, we, along with our suppliers and customers, rely on various energy sources (including oil) in our transportation activities. While significant uncertainty currently exists about the future levels of energy prices, significant increases are possible. Increased energy prices could cause an increase to our raw material costs and transportation costs. In addition, increased transportation costs of certain of our suppliers could be passed along to us. We may not be able to increase our prices enough to offset these increased costs. In addition, any increase in our prices may reduce our future customer orders and profitability.

We must continue to innovate and improve our products.

We compete primarily based on the value our products delivered to our customers. Our value proposition is based on a combination of price and the technology and performance of our products, including the ability of our products to help reduce our customers’ production costs and increase the quality of the paper they produce. Our ability to retain our customers and increase our business depends on our ability to continually develop new, technologically superior products that support our value proposition. We cannot assure that our investments in technological development will be sufficient, that we will be able to create and market new products, that such new products will be accepted by our customers or that we will be successful in competing against new technologies developed by competitors. In addition, either we or our competitors could develop new technologies that increase the useful life of machine clothing or roll covers, which could reduce the frequency with which our customers would need to replace their machine clothing and refurbish or replace their roll covers, and consequently lead to fewer sales.

14

We believe that market recognition of the extended life of our roll cover products and the trend towards new paper-making machine designs which have fewer rolls will continue to negatively impact the demand for our roll cover products.

We have seen a trend that paper producers are placing an increasingly strong emphasis on maintenance cost reduction and, as a result, are extending the life of roll covers through additional maintenance cycles before replacing them. Market recognition of the extended life of our roll cover products negatively impacts the demand for these products. In addition, we have seen a trend towards new paper-making machine designs which have fewer rolls, also negatively impacting the demand for our roll cover products. If we are not able to offset these negative impacts on the demand for our roll cover products with growth from new roll cover products, the sale of roll cover products in regions which we believe have high growth potential such as China, or from other sources, the volume of our roll cover sales will be adversely affected.

The loss of major customers or the shut down of a mill or mills by one of our customers could have a material adverse effect on our net sales and profitability.

Our top ten customers generated 26.6% of our net sales during 2016. The loss of major customers, financial difficulties faced by our customers or a substantial decrease in such customers’ purchases from us, for instance through the closure of mills, could have a material adverse effect on our net sales and profitability. Because we do not generally have binding long-term purchasing agreements with our customers, there can be no assurance that our existing customers will continue to purchase products from us.

We may fail to adequately protect our proprietary technology, which would allow competitors or others to take advantage of our research and development efforts.

We rely upon trade secrets, proprietary know-how, and continuing technological innovation to develop new products and remain competitive. If our competitors learn of our proprietary technology, they may use this information to produce products that are equivalent or superior to our products, which could reduce the net sales of our products. Our employees, consultants, and corporate collaborators may breach their obligations not to reveal our confidential information, and any remedies available to us may be insufficient to compensate our damages. Even in the absence of such breaches, our trade secrets and proprietary know-how may otherwise become known to our competitors, or be independently discovered by our competitors, which could adversely affect our competitive position.

Our success and ability to compete in the future may depend upon obtaining sufficient patent protection for proprietary technology.

Our patent applications may not result in issued patents, and even if they result in issued patents, the patents may not have claims of the scope we seek. Even in the event that these patents are not issued, the applications may become publicly available and proprietary information disclosed in the applications will become available to others. In addition, any issued patents may be challenged, invalidated or declared unenforceable. The term of any issued patent in the United States is 20 years from its filing date, and if our applications are pending for a long time period, we may have a correspondingly shorter term for any patent that may be issued. Our present and future patents may provide only limited protection for our technology and may not be sufficient to provide competitive advantages to us. For example, competitors could be successful in challenging any issued patents or, alternatively, could develop similar or more advantageous technologies on their own or design around our patents. Also, patent protection in certain foreign countries may not be available or may be limited in scope and any patents obtained may not be as readily enforceable as in the United States, making it difficult for us to effectively protect our intellectual property from misuse or infringement by other companies in these countries. Our inability to obtain and enforce our intellectual property rights in some countries may harm our business. In addition, given the costs of obtaining patent protection, we may choose not to protect certain innovations that later turn out to be important.

We may be liable for product defects or other claims relating to our products.

Our products could be defective, fail to perform as designed or otherwise cause harm to our customers, their equipment or their products. If any of our products are defective, we may be required to recall the products and/or repair or replace them, which could result in substantial expenses and affect our profitability. Any problems with the performance of our products could harm our reputation, which could result in a loss of sales to customers and/or potential customers. In addition, if our customers believe that they have suffered harm caused by our products, they could bring claims against us that could result in significant liability. A failure of our products could cause substantial damage to a paper-making machine. Any claims brought against us by customers may result in:

• | diversion of management’s time and attention; |

• | expenditure of large amounts of cash on legal fees, expenses, and payment of damages; |

• | decreased demand for our products and services; and |

15

• | injury to our reputation. |

Our insurance may not sufficiently cover a large judgment against us or a large settlement payment, and is subject to customary deductibles, limits and exclusions.

Cybersecurity incidents could disrupt business operations, result in the loss of critical and confidential information, and adversely impact our reputation and results of operations.

Global cybersecurity threats can range from uncoordinated individual attempts to gain unauthorized access to our information technology ("IT") systems to sophisticated and targeted measures known as advanced persistent threats. While we employ comprehensive measures to prevent, detect, address and mitigate these threats (including access controls, data encryption, vulnerability assessments, continuous monitoring of our IT networks and systems and maintenance of backup and protective systems), cybersecurity incidents, depending on their nature and scope, could potentially result in the misappropriation, destruction, corruption or unavailability of critical data and confidential or proprietary information (our own or that of third parties) and the disruption of business operations. The potential consequences of a material cybersecurity incident include reputational damage; litigation with third parties; diminution in the value of our investment in research, development and engineering, and increased cybersecurity protection and remediation costs, which in turn could adversely affect our competitiveness and results of operations.

We may be adversely affected if we fail to attract and retain key personnel.

Our future success depends on the continued contributions of our key senior management personnel, including members of our senior sales staff and research and development team. The loss of services of any one or more of our key personnel might significantly delay or prevent the achievement of our business objectives and could cause us to incur additional costs to recruit replacements. Each member of our executive management team may terminate his or her employment at any time. We do not maintain “key person” life insurance with respect to any of our executives.

We could incur substantial costs as a result of violations of or liabilities under laws protecting the environment and human health.

Our operations and facilities are subject to a number of national, state and local laws and regulations protecting the environment and human health in the United States and foreign countries that govern, among other things, the handling, storage and disposal of hazardous materials, discharges of pollutants into the air and water and workplace safety. The U.S. Federal Comprehensive Environmental Response, Compensation and Liability Act, as amended, provides for responses to, and, in some instances, joint and several liability for releases of hazardous substances into the environment. Environmental laws also hold current owners or operators of land or businesses liable for their own and for previous owners’ or operators’ releases of hazardous or toxic substances, materials or wastes, pollutants or contaminants, including petroleum and petroleum products. Because of our operations, the history of industrial uses at some of our facilities, the operations of predecessor owners or operators of some of the businesses and the use and release of hazardous substances at these sites, the liability provisions of environmental laws may affect us. Many of our facilities have experienced some level of regulatory scrutiny in the past and are or may be subject to further regulatory inspections, future requests for investigation or liability for regulated materials management practices.

We cannot assure that we have been or will be at all times in complete compliance with all laws and regulations applicable to us which are designed to protect the environment and human health. We could incur substantial costs, including clean-up costs, fines and sanctions and third party property damage or personal injury claims, as a result of violations of or liabilities under environmental laws, relevant common law or the environmental permits required for our operations or under workplace safety laws. While we believe that the current level of reserves is adequate, the adequacy of these reserves may change in the future due to new developments in particular matters.

Adverse labor relations could harm our operations and reduce our profitability.

We are subject to risk of work stoppages and other labor relations matters because a significant portion of our workforce is unionized. As of December 31, 2016, we had approximately 2,950 employees worldwide, approximately 13% of whom were subject to protection of various North American collective bargaining agreements and approximately 55% of whom were subject to job protection as members of European or South American trade unions, employee associations or workers’ councils. As of December 31, 2016, approximately 11% of the employees subject to North American collective bargaining agreements (or approximately 1.4% of our total employees) were covered by an agreement that is set to expire prior to December 31, 2017. We cannot be certain that we will be able to renew the collective bargaining agreement set to expire this year, or enter into a new collective bargaining agreement that does not adversely affect our operating results or that we will be without production interruptions, including labor stoppages. In addition, all of our European and South American employees subject to job

16

protection as members of trade unions, employee associations or workers’ councils are subject to arrangements that typically result in higher negotiated or mandated salary increases on either an annual or biannual basis. We cannot be certain that the terms of employment applicable to such employees will not change in the future in a manner which could adversely affect our operating results. We cannot be certain that we will not experience disruptions in our operations as a result of labor disputes or experience other labor relations issues. If we are unable to maintain good relations with our employees, our ability to produce our products and provide services to our customers could be reduced and/or our production costs could increase, either of which could disrupt our business and reduce our net sales and profitability.

We may be subject to assessment of income taxes for which we have not accrued any liability.

We accrue for certain known and reasonably anticipated income tax obligations after assessing the likely outcome. In the event that actual results differ from these accruals or if we become subject to a tax obligation for which we have made no accrual, we may need to make adjustments, which could materially impact our financial condition and results of operations. For example, taxing authorities may disagree with our tax accounting methodologies and may subject us to inquiries regarding such taxes, which potentially could result in additional income tax assessments against us. In accordance with accounting rules, we do not accrue for potential income tax obligations if we deem a particular tax position, based solely on its technical merits, is more likely than not to be sustained upon examination. In making our determination, we assume that the taxing authorities will have access to all relevant facts and information.

Risks Relating to Our Capital Structure

Our level of indebtedness could adversely affect our ability to raise additional capital to fund our operations, limit our ability to plan for and react to changes in the economy, our industry or our business and prevent us from meeting our debt obligations.

We are significantly leveraged. As of December 31, 2016, our total indebtedness was approximately $524.5 million. Our substantial degree of leverage could have important consequences to us, including the following:

• | it may limit our ability to obtain additional debt or equity financing for working capital, capital expenditures, product development, debt service requirements, acquisitions or general corporate or other purposes; |

• | a substantial portion of our cash flows from operations will be dedicated to the payment of principal and interest on our indebtedness and will not be available for other purposes, including our operations, capital expenditures and other business opportunities; |

• | certain of our borrowings, including borrowings under our ABL Facility (defined in "Management Discussion & Analysis of Financial Conditions & Results of Operations & Credit Facility and Notes"), are at variable rates of interest, exposing us to the risk of increased interest rates; |

• | if we seek to refinance our debt or require additional refinancing in the future, we may be unable to do so on attractive terms or at all; |

• | it may limit our flexibility in planning for, or our ability to adjust to, changes in our business or the industry in which we operate, and place us at a competitive disadvantage compared to our competitors that have less debt; and |

• | we may be vulnerable to a downturn in general economic conditions or in our business, or we may be unable to carry out capital spending that is important to our growth. |

Despite current indebtedness levels, we may still be able to incur substantially more debt. This could further exacerbate the risks associated with our substantial leverage.