Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - INVESTORS TITLE CO | itic_20161231xex-32.htm |

| EX-31.2 - EXHIBIT 31.2 - INVESTORS TITLE CO | itic_20161231xex-312.htm |

| EX-31.1 - EXHIBIT 31.1 - INVESTORS TITLE CO | itic_20161231xex-311.htm |

| EX-23 - EXHIBIT 23 - INVESTORS TITLE CO | itic_20161231xex23.htm |

| EX-21 - EXHIBIT 21 - INVESTORS TITLE CO | itic_20161231xex-21.htm |

| EX-10.13 - EXHIBIT 10.13 - INVESTORS TITLE CO | itic_20161231xex1013.htm |

| EX-10.12 - EXHIBIT 10.12 - INVESTORS TITLE CO | itic_20161231xex1012.htm |

| EX-10.11 - EXHIBIT 10.11 - INVESTORS TITLE CO | itic_20161231xex1011.htm |

| EX-2.1 - EXHIBIT 2.1 - INVESTORS TITLE CO | itic_20161231xex21.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

for the fiscal year ended December 31, 2016

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

for the transition period from __to __

Commission file number 0-11774

INVESTORS TITLE COMPANY

(Exact name of registrant as specified in its charter)

North Carolina | 56-1110199 |

(State or other jurisdiction of | (I.R.S. Employer |

incorporation or organization) | Identification No.) |

121 North Columbia Street

Chapel Hill, North Carolina 27514

(919) 968-2200

(Address and telephone number of principal executive office)

Securities registered pursuant to section 12(b) of the Act: | Name of each exchange on which registered: |

Common Stock, no par value | The NASDAQ Stock Market LLC |

Rights to Purchase Series A Junior Participating Preferred Stock | The NASDAQ Stock Market LLC |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [X] Non-accelerated filer [ ] (Do not check if a smaller reporting company) Smaller reporting company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of the shares held by non-affiliates of the registrant as of June 30, 2016 was $134,766,844 based on the closing price on the NASDAQ Stock Market LLC.

As of February 14, 2017, there were 1,884,584 common shares of the registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Investors Title Company’s definitive proxy statement for the Annual Meeting of Shareholders to be held May 17, 2017 are incorporated by reference in Part III hereof.

SAFE HARBOR FOR FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, as well as information included in future filings by the Company with the Securities and Exchange Commission (“SEC”) and information contained in written material, press releases and oral statements issued by or on behalf of the Company, contains, or may contain, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, that reflect management’s current outlook for future periods. These statements may be identified by the use of words such as “plan,” “expect,” “aim,” “believe,” “project,” “anticipate,” “intend,” “estimate,” “should,” “could,” “would” and other expressions that indicate future events and trends. All statements that address expectations or projections about the future, including statements about the Company’s strategy for growth, product and service development, market share position, claims, expenditures, financial results and cash requirements, are forward-looking statements. Without limitation, projected developments in mortgage interest rates and the overall economic environment set forth in “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Business Trends and Recent Conditions” constitute forward-looking statements. Forward-looking statements are based on certain assumptions and expectations of future events that are subject to a number of risks and uncertainties. For a description of factors that may cause actual results to differ materially from such forward-looking statements, see Item 1A, “Risk Factors” of this Annual Report on Form 10-K.

Actual future results and trends may differ materially from historical results or those projected in any such forward-looking statements depending on a variety of factors, including, but not limited to, the following:

• | the level of real estate transactions, the level of mortgage origination volumes (including refinancing) and changes to the insurance requirements of the participants in the secondary mortgage market, and the effect of these factors on the demand for title insurance; |

• | changes in general economic, business, and political conditions, including the performance of the financial and real estate markets; |

• | the possible inadequacy of provisions for claims to cover actual claim losses; |

• | the incidence of fraud-related losses; |

• | unanticipated adverse changes in securities markets, including interest rates, could result in material losses to the Company’s investments; |

• | significant competition that the Company’s operating subsidiaries face, including the Company’s ability to develop and offer products and services that meet changing industry standards in a timely and cost-effective manner and expansion into new geographic locations; |

• | the Company’s reliance upon the North Carolina and Texas markets for a significant portion of its premiums, comprising approximately 35.5% and 20.5% of premiums written, respectively; |

• | compliance with government regulation, including pricing regulation, and significant changes to applicable regulations or in their application by regulators; |

• | the impact of governmental oversight of compliance by service providers, including title insurance agents, with federal consumer financial laws; |

• | possible downgrades from a rating agency, which could result in a loss of underwriting business; |

• | the inability of the Company to manage, develop and implement technological advancements and prevent system interruptions or unauthorized system intrusions; |

• | statutory requirements applicable to the Company’s insurance subsidiaries that require them to maintain minimum levels of capital, surplus and reserves and that restrict the amount of dividends they may pay to the Company without prior regulatory approval; |

• | the desirability to maintain capital above statutory minimum requirements for competitive, marketing and other reasons; |

• | heightened regulatory scrutiny and investigations of the title insurance industry; |

• | the Company’s dependence on key management and marketing personnel, the loss of whom could have a material adverse effect on the Company’s business; |

• | difficulty managing growth, whether organic or through acquisitions; |

• | reform of government-sponsored entities that could adversely impact the Company; |

• | policies and procedures for the mitigation of risks that may be insufficient to prevent losses; |

• | the shareholder rights plan could discourage transactions involving actual or potential changes of control; and |

• | other risks detailed elsewhere in this document and in the Company’s other filings with the SEC. |

These and other risks and uncertainties may be described from time to time in the Company’s other reports and filings with the SEC. The Company is not under any obligation (and expressly disclaims any such obligation) and does not undertake to update or alter any forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made. You should consider the possibility that actual results may differ materially from our forward-looking statements.

2

INVESTORS TITLE COMPANY AND SUBSIDIARIES

TABLE OF CONTENTS

3

PART I

ITEM 1. BUSINESS

GENERAL

Investors Title Company (the “Company”) is a holding company that operates through its subsidiaries and was incorporated in the state of North Carolina in 1973. The Company became operational in 1976, when it acquired Investors Title Insurance Company (“ITIC”), which had itself been operating since 1972, as a wholly owned subsidiary under a plan of exchange of shares of common stock. In 1983, the Company acquired National Investors Title Insurance Company (“NITIC”), formerly Northeast Investors Title Insurance Company, which had itself been operating since 1973, as a wholly owned subsidiary under a plan of exchange of shares of common stock. The Company’s executive offices are located at 121 North Columbia Street, Chapel Hill, North Carolina 27514 and its telephone number is (919) 968-2200. The Company maintains a website at www.invtitle.com.

OVERVIEW OF THE BUSINESS

The Company’s primary business activity, and its only reportable operating segment, is the issuance of residential and commercial title insurance through ITIC and NITIC. Additionally, the Company provides tax-deferred real property exchange services through its subsidiaries, Investors Title Exchange Corporation (“ITEC”) and Investors Title Accommodation Corporation (“ITAC”); investment management and trust services to individuals, trusts and other entities through its subsidiary Investors Trust Company (“Investors Trust”); and management services to title insurance agencies through its subsidiary, Investors Title Management Services (“ITMS”). See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 12 of Notes to Consolidated Financial Statements in this Annual Report on Form 10-K for additional information related to the revenues, income and assets attributable to the Company’s primary operating segment.

Title Insurance

Through its two wholly owned title underwriting subsidiaries, ITIC and NITIC, the Company underwrites title insurance for owners and mortgagees as a primary insurer. ITIC and NITIC offer primary title insurance coverage to owners and mortgagees of real estate and assume reinsurance of title insurance risks from other title insurance companies. The commitments and policies are predominantly issued using standard forms approved by the American Land Title Association (“ALTA”).

Title insurance protects against losses resulting from title defects affecting real property. Upon a real estate closing, the seller of real property executes a deed to the new owner, and typically, the property is encumbered with a new mortgage. When real property is conveyed from one party to another, occasionally there is an undisclosed defect in the title or a mistake or omission in a prior deed or mortgage that may give a third party a legal claim against such property or result in the invalidity or unenforceability of the insured mortgage. If a claim is made against the title to real property, title insurance provides indemnification against covered defects.

Numerous types of defects could jeopardize the property owner’s or mortgagee’s interest in the property for which a title policy may provide coverage. Such risks include title being vested in an individual or entity other than the insured, lack of a right of access to the property, invalidity or unenforceability of the insured mortgage, or other defects, liens, or encumbrances that make the property unmarketable. The policy may provide coverage for defects arising from prior unsatisfied mortgages, judgments, tax liens or confirmed assessments, or encumbrances against the property arising through easements, restrictions or other existing covenants. Title insurance may also protect against deeds or mortgages that were forged or improperly acknowledged or delivered, that were executed by spouses without the other spouse’s signature or that were conveyed by minors or other persons who lack legal capacity.

Title Insurance Policies. The Company issues title insurance policies based on a search of public records. The title search documents the current status of title to the property. There are two basic types of title insurance policies – one for the mortgage lender and one for the real property owner. A lender often requires property owners to purchase title insurance to protect the priority of its mortgage loan, but the lender’s title insurance policy does not protect the property owner. The property owner has to purchase a separate owner’s title insurance policy to protect its investment.

Insured Risk on Policies in Force. Generally, the amount of the insured risk under a title insurance policy is equal to the purchase price, the loan amount or the fair market value of the insured property. If a claim is made against an insured property’s title, the insurer can choose to pay the cost of eliminating the covered title defects or to defend the insured party against covered title defects affecting the property. In the alternative, the insurer may opt to pay the policy limits to the insured or, if the loss is less than policy limits, the amount of the insured’s actual loss due to such title defects, at which time the insurer’s duty to defend the claim and all other obligations of the insurer with respect to the claim are satisfied.

4

At any given time, the insurer’s actual risk of monetary loss under outstanding policies is only a portion of the aggregate insured risk, or total face amount, of all policies in force. The lower risk results primarily from the reissuance of title insurance policies for the same property by other underwriters over time when such property is subsequently conveyed or refinanced. The coverage on a lender’s title insurance policy is reduced and eventually terminated as the mortgage loan it secures is paid. An owner’s policy is effective as long as the insured has an ownership interest in the property or has liability under warranties of title. Due to the variability of these factors, the aggregate contingent liability of a title underwriter on outstanding policies of the Company and its subsidiaries cannot be determined with precision.

Losses and Reserves. While most other forms of insurance provide for the assumption of risk of loss arising from unforeseen events, title insurance is based upon a process of loss avoidance. Title insurance generally serves to protect the policyholder from the risk of loss from events that predate the issuance of the policy. Losses on policies typically occur when a title defect is not discovered during the examination and settlement process or upon the occurrence of certain hidden risks which cannot be determined from an accurate search of public land records. The maximum amount of liability under a title insurance policy is generally the face amount of the policy plus the cost of defending the insured’s title against an adverse claim, if agreed to by the insurer prior to payment of loss under the policy, and any inflation protection clause associated with the policy. The reserve for claim losses is established from known claims, as well as estimated losses incurred but not yet reported to the Company based upon historical experience and other factors.

Title claims can often be complex, vary greatly in dollar amounts, are affected by economic and market conditions and may involve uncertainties as to ultimate exposure. Therefore, reserve estimates are subject to variability. For a more complete description of the Company’s reserve for claims, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report on Form 10-K.

Title Insurance Underwriting Operations. ITIC and NITIC issue title insurance through the Company’s home and branch offices and through a network of agents. Issuing agents are typically real estate attorneys, independent agents or subsidiaries of community and regional mortgage lending institutions, depending on local customs and regulations and the Company’s marketing strategy in a particular territory. The Company’s title insurance subsidiaries determine the terms and conditions upon which they will insure title to real property according to the Company’s underwriting standards, policies and procedures. Title insurance premiums written reflect a one-time premium payment, with no recurring premiums.

Generally, premiums for title insurance are recorded and recognized as revenue at the closing of the related transaction, when the earnings process is considered complete. When the policy is issued directly through a home or branch office, the premiums collected are retained by the Company. When the policy is issued through a title insurance agent, the agent retains a majority of the premium as a commission and remits the net amount to the Company. Title insurance commissions earned by the Company’s agents are recognized as expenses concurrently with premium recognition. The percentage of the premium retained by agents varies by region and is sometimes regulated by the states where the property is located.

For a description of the level of net premiums written by direct and agency operations, refer to “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report on Form 10-K.

Geographic Operations. ITIC was incorporated in North Carolina in 1972, and is licensed to write title insurance in 44 states and the District of Columbia. ITIC currently writes title insurance as a primary insurer in 21 states and the District of Columbia, primarily in the eastern half of the United States, and as a reinsurer for NITIC and third party title insurance companies.

NITIC was incorporated in South Carolina in 1973, and is licensed to write title insurance in 20 states and the District of Columbia. In November 2014, NITIC redomesticated to Texas. NITIC currently writes title insurance as a primary insurer in Texas and New York, and as a reinsurer for ITIC.

Premiums from title insurance written on properties located in North Carolina and Texas represent the largest source of revenue for the title insurance segment. In North Carolina, ITIC primarily issues title insurance commitments and policies through branch offices. In Texas and other states, title policies are primarily issued through issuing agents. For a description of the level of net premiums written geographically for significant states, refer to “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report on Form 10-K.

Each state license authorizing ITIC or NITIC to write title insurance must be renewed annually. These licenses are necessary for the companies to operate as a title insurer in each state in which they write premiums.

Ratings. The Company’s title insurance subsidiaries are regularly assigned ratings by independent agencies designed to indicate their financial condition and/or their claims paying ability. The rating agencies determine ratings primarily by analyzing financial data.

5

Reinsurance. The Company assumes and cedes reinsurance with other insurance companies in the normal course of business. Reinsurance is a contractual arrangement whereby one insurer assumes some or all of the risk exposure written by another insurer. Ceded reinsurance is comprised of excess of loss treaties, which outline the conditions in which the reinsurance company will pay claims and protect the ceding insurer against losses over certain agreed amounts.

In the ordinary course of business, ITIC and NITIC reinsure certain risks with other title insurers to limit their risk exposure and to comply with state insurance regulations. They also assume reinsurance for certain risks of other title insurers for which they receive additional income in the form of reinsurance premiums. For each of the last three years, revenues from reinsurance activities accounted for less than 1% of total premium volume.

Exchange Services, Investment Management and Trust Services, and Management Services

The Company’s other lines of business include services offered by wholly owned subsidiaries ITEC, ITAC, Investors Trust, and ITMS.

In 1988, the Company established ITEC to provide services in connection with tax-deferred exchanges of like-kind property pursuant to Section 1031 of the Internal Revenue Code. ITEC acts as a qualified intermediary in tax-deferred exchanges of property held for productive use in a trade or business or for investment, and its income is derived from fees for handling exchange transactions and interest earned on client deposits held by the Company. ITAC provides services as an exchange accommodation titleholder for accomplishing reverse exchanges when taxpayers decide to acquire replacement property before selling the relinquished property. The services provided by the Company’s exchange division, ITEC and ITAC, are pursuant to provisions in the Internal Revenue Code. From time to time, these laws are subject to review and changes, which may negatively affect the demand for tax-deferred exchanges in general, and consequently, the revenues and profitability of the Company’s exchange division.

Investors Trust provides investment management and trust services to individuals, companies, banks and trusts.

ITMS offers various consulting and management services to provide clients with the technical expertise to start and successfully operate a title insurance agency.

None of these other lines of business is currently a reportable segment for which separate financial information is presented; instead, they are collectively included and reported in the category “All Other” in the segment information of the Company’s financial statements.

CYCLICALITY AND SEASONALITY

Real estate activity, home sales and mortgage lending are cyclical in nature. Title insurance premiums are closely related to the level of real estate activity and the average price of real estate sales. The availability of funds to finance purchases directly affects real estate sales. Other factors include mortgage interest rates, consumer confidence, economic conditions, supply and demand and family income levels. The Company’s premiums in future periods are likely to fluctuate due to these and other factors which are beyond management’s control.

Historically, the title insurance business tends to be seasonal as well as cyclical. Because home sales are typically strongest in periods of favorable weather, the first calendar quarter tends to have the lowest activity levels, while the spring and summer quarters tend to be more active. Refinance activity is generally less seasonal, but is subject to interest rate fluctuations.

MARKETING

The Company markets its title insurance services to a broad range of customers in the residential and commercial market sectors of the real estate industry. Issuing agents are typically real estate attorneys, independent agents or subsidiaries of community and regional mortgage lending institutions, depending on local customs and regulations and the Company’s marketing strategy in a particular territory.

ITIC and NITIC strive to provide superior service to their customers and consider this an important factor in attracting and retaining customers. Branch and corporate personnel strive to develop new business and agency relationships to increase market share while ITIC’s Commercial Services Division focuses on services provided to commercial clients.

REGULATION

Any material change in the Company’s regulatory environment may have an adverse effect on its business.

6

Title Insurance

The Company is an insurance holding company and therefore it is subject to regulation in the states in which its insurance subsidiaries do business. These regulations, among other things, require insurance holding companies to register and file certain reports, and require prior regulatory approval of the payment of extraordinary dividends and other intercompany distributions or transfers.

Title insurance companies are extensively regulated under applicable state laws. All states have requirements for admission to do business as an insurance company, including minimum levels of capital, surplus and reserves. State regulatory authorities monitor the stability and service of insurance companies and possess broad powers with respect to the licensing of title insurers and agents, approving rate schedules and policy forms, financial reporting and accounting practices, reserve requirements, investments and dividend restrictions, approving related party transactions, as well as examining and auditing title insurers. At December 31, 2016, both ITIC and NITIC met the statutory premium reserve requirements and the minimum capital and surplus requirements of the states where they are licensed. A substantial portion of the assets of the Company’s title insurance subsidiaries consists of their portfolios of investment securities. Both of these subsidiaries are required by various state laws to maintain assets of a defined minimum quality and amount.

The Company’s insurance subsidiaries are subject to examination at any time by the insurance regulators in the states where they are licensed as well as required examinations every five years. These and other governmental authorities have the power to enforce state and federal laws to which the title insurance subsidiaries are subject. These governmental authorities include, but are not limited to, the Consumer Financial Protection Bureau (“CFPB”), which enforces the Real Estate Settlement Procedures Act (“RESPA”), the primary federal regulatory guidance governing the real estate settlement industry. The CFPB has the authority to identify and address, through regulation, unfair, deceptive and abusive practices in the mortgage industry and certain other settlement service industries.

On August 15, 2016, the CFPB proposed various amendments to federal mortgage disclosure requirements under RESPA and the Truth in Lending Act that are implemented in Regulation Z. The proposed amendments would reinforce the CFPB’s informal guidance on various issues and include clarifications and technical amendments. The CFPB also proposed changes that would create tolerances for the total of payments; adjust a partial exemption that mainly affects housing finance agencies and nonprofits; provide a uniform rule regarding application of the integrated mortgage disclosure requirements to cooperative units; and provide guidance on sharing the disclosures with various parties involved in the mortgage origination process. The comment period on the proposed rule changes closed October 18, 2016. The proposed rules, if adopted, should not have a material impact on the Company.

In recent years, the CFPB, Office of the Comptroller of Currency and the Federal Reserve have issued memorandums to banks that communicated those agencies’ heightened focus on vetting third party providers. Such increased regulatory involvement may affect the Company's agents and approved providers. Further proposals to change regulations governing insurance holding companies and the title insurance industry are often introduced in Congress, in state legislatures and before various insurance regulatory agencies. Although the Company regularly monitors such proposals, the likelihood and timing of passage of any such regulation, and the possible effects of any such regulation on the Company and its subsidiaries, cannot be determined at this time.

Exchange Services, Investment Management and Trust Services, and Management Services

Investors Trust is regulated by the North Carolina Commissioner of Banks.

COMPETITION

The title insurance industry is highly competitive. The four largest title insurance companies typically maintain greater than 85% of the market for title insurance in the United States, with smaller regional companies holding the balance of the market. The number and size of competing companies varies in the respective geographic areas in which the Company conducts business. Key competitive factors in the title insurance industry are the financial strength and size of the insurer, timeliness and quality of service, price and expertise in certain transactions. Title insurance underwriters also compete for agents based upon service and commission levels. Some title insurers currently have greater financial resources, larger distribution networks and more extensive computerized databases of property records and related information than the Company. In addition, there are numerous industry-related regulations and statutes that set out conditions and requirements to conduct business. Changes to or the removal of such regulations and statutes could result in additional competition from alternative title insurance products or new entrants into the industry that could materially affect the Company’s business operations and financial condition.

7

CUSTOMER, LENDER AND AGENT CONCENTRATION

The Company is not dependent upon any single title insurance customer or a few customers, and the loss of any single customer would not have a material adverse effect on the Company.

Based on information from Mortgage Daily, published on April 4, 2016, in 2015’s Largest Mortgage Lenders by Bankrate.com, there were 10 lending institutions in the United States that accounted for approximately 43% of all mortgage originations in the United States in 2015. These lending institutions benefit from title insurance policies that are purchased by borrowers on the lending institutions’ behalf as a condition to the making of a loan. Refusal by major market lenders to accept our product offerings could have a material adverse effect on the Company.

In 2016, 2015 and 2014, the Company had one agent that accounted for 5.4%, 10.3% and 23.6% of net premiums written, respectively.

INVESTMENT POLICIES

The Company and its subsidiaries derive a substantial portion of their income from investments in municipal government securities and investment grade corporate bonds and equity securities. The Company’s debt and equity securities are classified as available for sale and carried at fair market value. The Company’s investment policy is designed to maintain a high quality portfolio and maximize income. Some state laws impose restrictions upon the types and amounts of investments that can be made by the Company’s insurance subsidiaries. The Company’s investment portfolio is managed internally and via an affiliated entity. The securities in the Company’s portfolio are subject to economic conditions and normal market risks. Equity securities at December 31, 2016 and 2015 consisted of investments in various industry groups. The Company’s investment portfolio did not include any significant investments in banks, trust or insurance companies at December 31, 2016 or 2015. Short-term investments, which consist primarily of money market instruments and certificates of deposit which have an original maturity of one year or less, are carried at cost, which approximates fair value due to the short duration to maturity. In addition, at December 31, 2016 and 2015, the Company held investments that are accounted for using the equity method (see Note 1 of the Notes to the Consolidated Financial Statements in this Annual Report on Form 10-K.)

See Note 3 of the Notes to the Consolidated Financial Statements in this Annual Report on Form 10-K for the major categories of investments, scheduled maturities, fair values of investment securities and earnings by category.

ENVIRONMENTAL MATTERS

The title insurance policies ITIC and NITIC currently issue exclude any liability for environmental risks and contamination unless a notice of violation relating to an environmental protection law, ordinance or regulation is recorded prior to the date of such policy or the Company issues a specific policy endorsement providing coverage for environmental liens recorded prior to the date of such policy. The Company has not experienced and does not anticipate that it or its subsidiaries will incur any significant expenses related to environmental claims.

In connection with tax-deferred exchanges of like-kind property, ITAC may temporarily hold title to property pursuant to an accommodation titleholder agreement. In order for ITAC to enter into such arrangements, each person or entity for which title is being held must first (i) execute an indemnification agreement under which it agrees to indemnify ITAC for any environmental or other claims which may arise as a result of the arrangement, and (ii) provide due diligence materials regarding any known environmental issues, in the form of an environmental questionnaire and/or applicable environmental engineering studies, if indicated for review by ITAC, as applicable.

EMPLOYEES

The Company and its subsidiaries had 307 full-time employees and 13 part-time employees as of December 31, 2016. None of the employees are covered by any collective bargaining agreements. Management considers its relationship with its employees to be favorable.

8

ADDITIONAL INFORMATION

The Company’s internet address is www.invtitle.com. The contents of the Company’s website are not and shall not be deemed to be a part of this document or any other Securities and Exchange Commission (“SEC”) filing. The Company makes available free of charge through its internet website its annual reports on Form 10-K, its quarterly reports on Form 10-Q, its current reports on Form 8-K, and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC, and also makes available the Section 16 reports on Forms 3, 4 and 5 of its insiders no later than the end of the business day following such filings. The information is free of charge and may be reviewed and downloaded from the website at any time. The public may read any material it has filed with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The “Investor Relations” section of the Company’s website also includes its code of business conduct and ethics and the charters of the Audit, Compensation and Nominating Committees of its Board of Directors.

EXECUTIVE OFFICERS OF THE COMPANY

Following is information regarding the executive officers of the Company as of February 24, 2017. Each officer is appointed at the annual meeting of the Board of Directors to serve until the next annual meeting of the Board or until his or her respective successor has been elected and qualified.

Name | Age | Position with Registrant | ||

J. Allen Fine | 82 | Chief Executive Officer and Chairman of the Board | ||

James A. Fine, Jr. | 54 | President, Treasurer, Chief Financial Officer, Chief Accounting Officer and Director | ||

W. Morris Fine | 50 | Executive Vice President, Secretary and Director | ||

J. Allen Fine has been Chief Executive Officer and Chairman of the Board of the Company since its incorporation in 1973. He also served as President of the Company until May 1997. He is the father of James A. Fine, Jr. and W. Morris Fine.

James A. Fine, Jr. was named Vice President of the Company in 1987. In 1997, he was named President and Treasurer and appointed as a Director of the Company. In 2002, he was appointed as Chief Financial Officer and Chief Accounting Officer. He is the son of J. Allen Fine and the brother of W. Morris Fine.

W. Morris Fine was named Vice President of the Company in 1992. In 1993, he was named Treasurer of the Company and served in that capacity until 1997. In 1997, he was named Executive Vice President and Secretary of the Company. In 1999, he was appointed as a Director of the Company. He is the son of J. Allen Fine and the brother of James A. Fine, Jr.

ITEM 1A. RISK FACTORS

The risk factors listed in this section and other factors noted herein could cause actual results to differ materially from those contained in any forward-looking statements or could result in a significant or material adverse effect on the Company’s results of operations.

Adverse changes in real estate activity may negatively impact the Company’s results of operations and financial condition.

The demand for the Company’s title insurance and other real estate transaction products and services varies from year to year and is dependent upon, among other factors, the volume of residential and commercial real estate transactions and mortgage financing transactions. The volume of these transactions has historically been influenced by factors such as the state of the overall economy, the average price level of real estate sales and the availability and pricing of mortgage financing. During periods of economic uncertainty, or when the availability of mortgage credit is limited or when mortgage interest rates are increasing, real estate activity typically declines. The cyclical nature of the Company’s business has caused volatility in revenue and profitability in the past and could do so in the future.

Demand for title insurance also depends in part upon the requirement by mortgage lenders and other participants in the secondary mortgage market that title insurance policies be obtained on residential and commercial real property.

9

The Company may experience material losses resulting from fraud, defalcation or misconduct.

Underwriting agents and approved settlement providers perform a significant portion of the work necessary to issue the Company’s title insurance policies. These agents and providers operate with a substantial degree of independence from the Company, and while they are subject to certain contractual limitations designed to mitigate the Company’s risk, there is no guarantee that these limitations will eliminate all associated risks. As a result, the Company’s use of title agents and approved providers could result in claims on the Company’s policies and other expenses due to fraud and negligence. Fraud, defalcation, errors and other misconduct by the Company’s agents, approved attorneys and employees are risks inherent in the Company’s business. Agents and approved attorneys typically handle large sums of money in trusts pursuant to the closing of real estate transactions. Misappropriation of funds by any of these parties could result in title claims, some of which could have a material negative impact on the Company’s results of operations and financial condition.

The Company relies upon the North Carolina and Texas markets for a significant portion of its premiums. Changes in the economic or regulatory environments in North Carolina or Texas could have an adverse impact on the Company.

North Carolina and Texas are the largest sources of premium revenue for the Company’s title insurance subsidiaries. In 2016, North Carolina and Texas represented 35.5% and 20.5% of total premiums written by the Company, respectively. A decrease in the level of real estate activity in either North Carolina and/or Texas, whether driven by weak economic conditions, changes in regulatory environments or other factors that influence demand, could have a negative impact on the Company’s financial results.

Adverse deviation of actual claims experience from expected claims experience will result in lower net earnings.

The Company’s net income is affected by the extent to which its actual claims experience differs from the assumptions used in establishing the reserve for claims. The reserve for claims is established based on actuarial estimates of future payments for reported claims, as well as claims which have been incurred but not yet reported. In addition, management considers factors such as the Company’s historical claims experience, case reserve estimates on reported claims, large claims and other relevant factors in determining loss provision rates and the aggregate recorded expected liability for claims.

Due to the nature of the underlying risks and the high degree of uncertainty associated with the estimation of the reserve for claims, the Company cannot determine precisely the amounts which it will ultimately pay to settle its claims. Factors contributing to the complexity in establishing reserves can include varying loss potentials, timing, unfavorable market or economic conditions and the legal environment. The timing of claims is difficult to estimate as payments may not occur until well into the future. Higher levels of defaults and foreclosures upon insured properties are more prevalent in times of unfavorable economic conditions and can lead to an increase in title insurance claims. The Company may also incur higher than normal claim payment experience or large losses. To the extent that actual claims experience is greater than estimated, the Company could be required to increase the reserve.

The Company’s insurance subsidiaries are subject to complex government regulations. Changes in regulations may have an adverse effect on the Company’s results of operations.

The Company’s title insurance subsidiaries are subject to extensive regulations that are intended to protect policyholders and consumers.

The Company’s title insurance subsidiaries are subject to regulations by the CFPB, created by the Dodd-Frank Act. The CFPB has extensive regulatory and enforcement authority over real estate and mortgage markets, including RESPA, the primary federal regulatory guidance governing the real estate settlement industry. The manner and extent to which the CFPB will implement new regulations is not fully known; however, any new regulations implemented could result in changes to internal processes through changes to systems and forms. Additionally, the CFPB has issued extensive regulations for the integration of mortgage disclosures which became effective on October 3, 2015. These new regulations impacted the way in which mortgage market participants create, process and deliver disclosures to consumers; however, implementation did not have a material impact on the Company’s financial position or results of operations.

10

In addition to federal regulation, title insurance subsidiaries are subject to state regulations. The nature and extent of state regulations, which vary from state to state, typically involve, among other matters, licensing and renewal requirements and trade and marketing practices, including, but not limited to the following:

• | licensing of insurers and agents; |

• | capital and surplus requirements; |

• | approval, regulation or establishment of premium rates for insurance; |

• | limitations on types and amounts of investments; |

• | limitations on the size of risks that may be insured by a single company; |

• | filing of annual and other reports with respect to financial condition; |

• | the amount of dividends and other payments made by insurance subsidiaries; |

• | establishing reserves; |

• | accounting and financing practices; |

• | deposits of securities for the benefit of policyholders; |

• | trade and marketing practices; |

• | regulation of reinsurance; |

• | approval of policy forms; and |

• | use of personal information. |

Insurance holding companies are subject to periodic examinations and the regulation of acquisitions, intercompany transactions and changes in control, among others, by state regulators.

The Company and its subsidiaries are also subject to certain federal regulations established by the Office of the Comptroller of Currency, the Federal Reserve and various other governmental agencies.

The Company’s other businesses also operate within state and federal guidelines. Any changes in the regulatory environment could restrict its existing or future operations and could possibly make it more burdensome and costly to conduct them.

New regulations, or differing interpretations of existing laws, could change business processes, products and services and have a negative impact on the Company’s results of operations and financial condition.

Competition affects the Company’s results of operations.

The title insurance industry is highly competitive with only a few insurers comprising a large percentage of the market. Key competitive factors are quality of service, price within regulatory parameters, expertise, timeliness and the financial strength and size of the insurer. Title insurance underwriters compete for premiums by choosing various distribution channels which may include company-owned operations, independent agents and agency relationships with real estate attorneys, subsidiaries of community and regional lending institutions, realtors, builders and other settlement service providers. Title insurance underwriters compete for agents on the basis of service, technology and commission levels. Some title insurers currently have greater financial resources, larger distribution networks and more extensive computerized databases of property records and information than the Company. The number and size of competing companies varies in the different geographic areas in which the Company operates, and any reductions to current regulatory barriers within any of the different geographic areas could increase the number of competitors entering into the title insurance market. Competition among the major providers of title insurance or the acceptance of alternative products to traditional title products by the regulatory authorities and the marketplace could adversely affect the Company’s operations and financial condition.

Deterioration in financial markets may cause a decline in the performance of the Company’s investments and could have a material adverse impact on net income.

The Company derives a substantial portion of its income from its investment portfolio. The Company’s investment policy is designed to comply with regulatory requirements and to balance the competing objectives of asset quality and investment returns. The Company’s investment portfolio is subject to risk from changes in general economic conditions, interest rates, liquidity, credit markets, and other external factors. The risk of loss is increased during periods of economic uncertainty and tight credit markets as these factors could limit the ability of some issuers to repay their debt obligations. If the carrying value of the Company’s investments exceeds the fair value, and the decline in fair value is deemed to be other-than-temporary, the Company will be required to write down the value of its investments, which could have a material negative impact on the Company’s results of operations and financial condition.

11

A downgrade from a rating agency could result in a loss of underwriting business.

The competitive positions of title insurance companies rely partly on ratings published by independent rating services. Government sponsored entities and lending institutions utilize these ratings, among other items, to evaluate a title insurer’s strength and stability. The Company’s title insurance subsidiaries are currently rated by A.M. Best Company, Kroll Bond Agency and Demotech, Inc. The ratings issued by independent rating agencies are not credit ratings, but represent the opinion of the individual rating agency in regards to the title insurance subsidiaries’ financial strength, operating performance, and ability to meet policyholder obligations. These insurer ratings are subject to periodic review and there can be no assurance that the Company’s insurance subsidiaries will maintain their current respective ratings. A significant downgrade in the ratings of either of the Company’s insurance subsidiaries could negatively impact the ability to compete for new business, retain existing business and maintain the necessary licenses to operate as title insurance companies in various states.

Unauthorized access to the Company’s systems, or other system interruptions, and unauthorized data disclosures may harm the Company’s reputation, disrupt the Company’s operations, or result in monetary losses.

The Company utilizes electronic systems to deliver products and services. These electronic systems are used to receive, process, store, and transmit data. Non-public information may include, but is not limited to, names, addresses, social security numbers, and banking information. In addition, the Company utilizes electronic systems to receive and transfer money. While the Company takes normal precautions to minimize the risk of unauthorized access to and disclosure of non-public information, this risk cannot be entirely eliminated. Events beyond the control of the Company, including unauthorized system intrusions, fraud, telecommunication failures or natural disasters could disrupt operations both internally and externally, increase the possibility of an unauthorized release of proprietary and/or non-public information, and increase the possibility of defalcation of corporate or client funds. Furthermore, certain laws to which the Company or its subsidiaries are subject and certain contracts to which they are party, particularly contracts with financial institutions, require notification to various parties, consumers and customers in the event that confidential or personal information may have been or was accessed by unauthorized third parties. Such an event could potentially result in a breach of contract, and any required notifications could result in, among other things, the loss of customers, negative publicity, distraction of management, fines, suits for breach of contract, regulatory inquiries or involvement and a decline in sales. To counter these risks, the Company invests significant resources in maintaining the security of our network and adapting to evolving security threats. The Company further mitigates the financial risk associated with unauthorized disclosure of non-public information by maintaining cyber liability insurance coverage.

Title insurance rate regulation could have an adverse impact on the Company’s results of operations.

Rates for title insurance vary by state and are subject to extensive regulation. Statutes generally provide that rates must not be excessive, inadequate or unfairly discriminatory. The process of implementing a rate change in most states involves pre-approval by the applicable state insurance regulator. This regulation could impact the Company’s ability to adjust prices in the face of rapidly changing market conditions, which could adversely affect results of operations.

The Company may encounter difficulties managing system or technological changes, which could adversely affect its financial and operating results.

Technological changes in the title insurance industry are driven primarily by evolution in technology, competitive factors, and regulatory changes. These changes have resulted in faster information delivery and efficient, highly automated production processes. The inability of the Company to manage, develop or successfully implement new systems or technological changes could negatively impact profitability.

Financial institution failures could adversely affect the Company.

The Company has substantial deposits with financial institutions, including fiduciary deposits that are owned by third parties. There is no guarantee the Company, whether through the Federal Deposit Insurance Corporation or otherwise, would recover the funds it has deposited should one or more of the financial institutions at which the Company maintains deposits fail.

12

The Company may encounter difficulties managing growth, which could adversely affect its results.

The Company’s future growth plans involve expansion into new geographic locations and further penetration into established markets through new or existing agents, or through acquisitions. Such growth may subject the Company to associated risks, such as the diversion of management’s attention. Furthermore, growth through acquisitions may subject the Company to additional risks, such as incurring unanticipated liabilities from an acquired business, not being able to integrate an acquired entity, retain its employees or customers or realize synergies. The occurrence of any of these risks may deprive the Company of some or all of the anticipated value of an acquisition or other growth initiatives, resulting in lower returns on investment and negative effects on the Company’s results of operations. These risks could be particularly significant if the Company incurs significant costs in pursuing an acquisition or other initiatives.

The Company depends on its ability to attract and retain key personnel and agents, and its inability to do so could adversely affect its business.

Competition for skilled and experienced personnel in the Company’s industry is high, and the success of the Company is substantially dependent on its ability to attract and retain such personnel. The Company may have difficulty hiring and retaining the necessary marketing and management personnel to support future growth plans. Also, the Company’s results of operations and financial condition could be adversely affected if it is unsuccessful in attracting and retaining new agents.

Regulatory investigations of the title insurance industry by governmental entities could adversely impact the Company’s results of operations.

The title insurance industry is subject to scrutiny by both federal and state regulators focusing on violations of state insurance codes, RESPA and similar state and federal laws, among others. The Company’s insurance subsidiaries routinely receive inquiries from regulators involving market conduct. Future inquiries could lead to fines for violations, settlements with regulating authorities that could result in fines or requirements to pay claims and the potential for further regulation, all of which could adversely affect the Company’s results of operations and financial condition.

Mortgage lending is highly concentrated and changes in relationships with lenders or reform of government-sponsored entities could adversely affect the Company.

In 2015, the 10 largest mortgage lenders accounted for slightly less than half of all mortgage originations in the United States. Refusal by major market lenders to accept our product offerings could have a material adverse effect on the Company. Furthermore, government-sponsored entities, Federal National Mortgage Association (“Fannie Mae”) and Federal Home Loan Mortgage Corporation (“Freddie Mac”), often require the purchase of title insurance for home loans they securitize. The federal government has had discussions about the possible reform of Fannie Mae and Freddie Mac. Changes to these entities could impact the entire mortgage loan process and as a result, could impact the demand for title insurance. The timing and results of reform are currently unknown; however, changes to these entities could adversely impact the Company and its results of operations.

Policies and procedures for the mitigation of risk may not be sufficient.

The Company has policies and procedures in place to help identify, analyze, and measure the risks associated with the issuance of title insurance policies, investment risks, interest rate risks and legal risks, among others. Because a significant degree of judgment is involved with the establishment of policies and processes as well as the measurement of risks, it is possible not all risks have been identified or anticipated. Misidentified or unanticipated risks could adversely impact the Company and its results of operations.

The Company relies on distributions from its insurance subsidiaries.

The Company is an insurance holding company and it has no substantial operations of its own. Its principal assets are investments in its operating subsidiaries, primarily its insurance subsidiaries. The Company’s ability to pay dividends and meet its obligations is dependent, among other factors, on the ability of its subsidiaries to pay dividends or repay intercompany loans. The Company’s insurance subsidiaries are subject to regulations that limit the amount of dividends, loans or advances they may make to the Company. The restriction on these amounts is based on the amount of the insurance subsidiaries’ unassigned surplus and net income, with certain adjustments. Additionally, these subsidiaries are required to maintain minimum amounts of capital, surplus and reserves. As of December 31, 2016, approximately $88,323,000 of consolidated stockholders’ equity represented the net assets of the Company’s subsidiaries that cannot be transferred in the form of dividends, loans or advances to the Company. In general, dividends in excess of prescribed limits are deemed “extraordinary” and require prior approval by the appropriate regulatory body. These dividend restrictions could limit the Company’s ability to pay dividends to its shareholders or fund growth opportunities.

13

Certain provisions of the Company’s shareholder rights plan may deter or discourage a takeover of the Company.

The Company has adopted a shareholder rights plan. The rights set forth in the plan are not intended to prevent a takeover of the Company, and we believe the rights would be beneficial to the Company and its shareholders in the event of negotiations with a potential acquirer. However, the shareholder rights plan could discourage transactions involving actual or potential changes of control, including transactions that may involve payment of a premium over prevailing market prices to the Company’s common shareholders.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None

ITEM 2. PROPERTIES

The Company owns two adjacent office buildings and property located on the corner of North Columbia and West Rosemary streets in Chapel Hill, North Carolina, which serve as the Company’s corporate headquarters. The main building contains approximately 23,000 square feet and has on-site parking facilities. The Company’s subsidiaries, principally ITIC and NITIC, lease office space in 37 locations throughout North Carolina, South Carolina, Texas and Nebraska. The Company believes that each of the office facilities occupied by the Company and its subsidiaries are in good condition, adequately insured and sufficient for its present operations.

ITEM 3. LEGAL PROCEEDINGS

The Company and its subsidiaries are involved in legal proceedings that are incidental to their business. In the Company’s opinion, based on the present status of these proceedings, any potential liability of the Company or its subsidiaries with respect to these legal proceedings, will not, in the aggregate, be material to the Company’s consolidated financial condition or operations.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable

14

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock Data and Dividends

The Common Stock of the Company is traded under the symbol “ITIC” on the NASDAQ Stock Market LLC. The number of record holders of common stock at December 31, 2016 was 286. The number of record holders is based upon the actual number of holders registered on the books of the Company at such date and does not include holders of shares in “street name” or persons, partnerships, associations, corporations or other entities identified in security position listings maintained by securities depositories. The following table shows, for the periods indicated, the high and low sales prices of the Company’s Common Stock as reported on the NASDAQ Global Market, and cash dividends declared.

2016 | 2015 | ||||||||||||||||||||||

High | Low | Dividend Paid | High | Low | Dividend Paid | ||||||||||||||||||

First Quarter | $ | 99.89 | $ | 76.35 | $ | 0.16 | $ | 81.75 | $ | 66.55 | $ | 0.08 | |||||||||||

Second Quarter | $ | 106.80 | $ | 82.13 | $ | 0.16 | $ | 77.75 | $ | 69.51 | $ | 0.08 | |||||||||||

Third Quarter | $ | 102.70 | $ | 88.70 | $ | 0.20 | $ | 72.50 | $ | 67.25 | $ | 0.08 | |||||||||||

Fourth Quarter | $ | 174.10 | $ | 93.78 | $ | 0.20 | $ | 102.41 | $ | 71.00 | $ | 0.16 | |||||||||||

The Company’s current dividend policy anticipates the payment of quarterly dividends in the future. The declaration and payment of dividends will be at the discretion of the Board of Directors and will be dependent upon the Company’s future earnings, financial condition and capital requirements. The Company’s ability to pay dividends is also subject to certain regulatory restrictions on the payment of dividends by its insurance subsidiaries as described in the “Liquidity and Capital Resources” section of “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and Note 2 to the Consolidated Financial Statements included in Item 8 of this Form 10-K.

For the quarter ended December 31, 2016, the Company did not purchase any shares of the Company’s common stock pursuant to the Company’s ongoing purchase program that was initially announced on June 5, 2000. On November 9, 2015, the Board of Directors of the Company approved the purchase of an additional 163,335 shares pursuant to the Company’s repurchase plan, such that there was authority remaining under the plan to purchase up to an aggregate of 500,000 shares of the Company’s common stock pursuant to the plan immediately after this approval. During the year ended December 31, 2016, the Company purchased a total of 66,803 shares of the Company’s common stock at an average per share price of $93.10 under the Company’s repurchase plan. As of December 31, 2016, there was authority remaining under the plan to purchase up to an aggregate of 429,777 shares of the Company’s common stock. Unless terminated earlier by resolution of the Board of Directors, the plan will expire when all shares authorized for purchase under the plan (as such number may be amended by the Board from time to time) have been purchased. The Company anticipates making further purchases under this plan from time to time in the future, depending on such factors as the prevailing market price of the Company’s common stock, the Company’s available cash and then existing alternative uses for such cash.

15

Common Stock Performance Graph

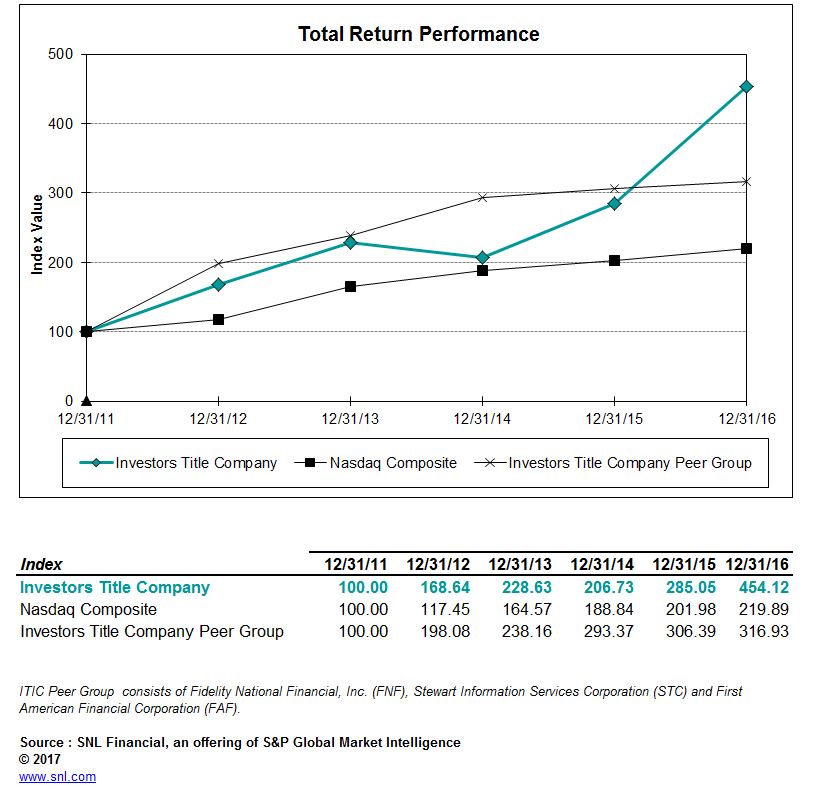

Presented below is a line graph comparing the yearly percentage change in the cumulative total return on the Company’s common stock to the cumulative return of the NASDAQ Composite Index and a peer group consisting of certain companies in the title insurance industry (SIC Code 6361) for the period commencing December 31, 2011 and ending December 31, 2016. The graph assumes that $100 was invested in the Company’s common stock, the NASDAQ Composite Index and the peer group on December 31, 2011 and that all dividends were reinvested on a quarterly basis. Returns for the companies included in the peer group have been weighted on the basis of the total market capitalization for each company.

The performance graph above and the related information shall not be deemed “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Exchange Act, as amended, except to the extent that the Company specifically incorporates it by reference into such filing.

16

ITEM 6. SELECTED FINANCIAL DATA

(amounts in thousands except per share data)

For the Year | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||

Net premiums written | $ | 122,095 | $ | 112,476 | $ | 109,964 | $ | 113,886 | $ | 102,331 | |||||||||

Investment income | 4,684 | 4,531 | 4,260 | 3,895 | 3,980 | ||||||||||||||

Revenues | 138,492 | 127,200 | 123,119 | 126,251 | 115,079 | ||||||||||||||

Net income attributable to the Company | 19,523 | 12,534 | 9,649 | 14,708 | 11,102 | ||||||||||||||

Per Share Data | |||||||||||||||||||

Basic earnings per common share | $ | 10.23 | $ | 6.32 | $ | 4.75 | $ | 7.15 | $ | 5.33 | |||||||||

Weighted average shares outstanding – Basic | 1,908 | 1,984 | 2,032 | 2,056 | 2,082 | ||||||||||||||

Diluted earnings per common share | $ | 10.19 | $ | 6.30 | $ | 4.74 | $ | 7.08 | $ | 5.24 | |||||||||

Weighted average shares outstanding – Diluted | 1,915 | 1,990 | 2,038 | 2,077 | 2,117 | ||||||||||||||

Cash dividends per share | $ | 0.72 | $ | 0.40 | $ | 0.32 | $ | 0.32 | $ | 0.29 | |||||||||

At Year-End | |||||||||||||||||||

Assets | $ | 228,938 | $ | 211,522 | $ | 198,039 | $ | 188,306 | $ | 171,918 | |||||||||

Investments | 160,854 | 160,552 | 159,411 | 142,764 | 130,779 | ||||||||||||||

Stockholders’ equity attributable to the Company | 155,045 | 142,670 | 137,564 | 128,062 | 114,639 | ||||||||||||||

Book value/share attributable to the Company | 82.28 | 73.17 | 67.99 | 62.86 | 56.10 | ||||||||||||||

Performance Ratios | |||||||||||||||||||

Net income attributable to the Company to: | |||||||||||||||||||

Average stockholders’ equity attributable to the Company | 13.12 | % | 8.95 | % | 7.27 | % | 12.12 | % | 10.04 | % | |||||||||

Total revenues | 14.10 | % | 9.85 | % | 7.84 | % | 11.65 | % | 9.65 | % | |||||||||

17

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the Consolidated Financial Statements and the related notes in this report. Forward-looking statements are based on certain assumptions and expectations of future events that are subject to a number of risks and uncertainties. Actual results may vary.

Overview

Investors Title Company (the “Company”) is a holding company that engages primarily in issuing title insurance through two subsidiaries, Investors Title Insurance Company (“ITIC”) and National Investors Title Insurance Company (“NITIC”). Total revenues from the title segment accounted for 95.3% of the Company’s revenues in 2016. Through ITIC and NITIC, the Company underwrites land title insurance for owners and mortgagees as a primary insurer. Title insurance protects against loss or damage resulting from title defects that affect real property.

Title insurance policies for mortgage lenders and real estate owners are the two basic types of title insurance policies. A lender often requires the property owner to purchase a lender’s title insurance policy to protect its position as a holder of a mortgage loan, but the lender’s title insurance policy does not protect the property owner. The property owner has to purchase a separate owner’s title insurance policy to protect its investment. When real property is conveyed from one party to another, occasionally there is an undisclosed defect in the title or a mistake or omission in a prior deed, will or mortgage that may give a third party a legal claim against such property. If a covered claim is made against real property, title insurance provides indemnification against insured defects.

The Company issues title insurance policies through its home and branch offices and through a network of agents. Issuing agents are typically real estate attorneys, independent agents or subsidiaries of community and regional mortgage lending institutions, depending on local customs and regulations and the Company’s marketing strategy in a particular territory. The ability to attract and retain issuing agents is a key determinant of the Company’s growth in title insurance premiums written.

Revenues for this segment primarily result from purchases of new and existing residential and commercial real estate, refinance activity and certain other types of mortgage lending such as home equity lines of credit.

Title insurance premiums vary from state to state and are subject to extensive regulation. Statutes generally provide that rates must not be excessive, inadequate or unfairly discriminatory. The process of implementing a rate change in most states involves pre-approval by the applicable state insurance regulator.

Volume is a factor in the Company’s profitability due to fixed operating costs which are incurred by the Company regardless of title insurance premium volume. The resulting operating leverage tends to amplify the impact of changes in volume on the Company’s profitability. The Company’s profitability also depends, in part, upon its ability to manage its investment portfolio to maximize investment returns and minimize risks such as interest rate changes, defaults and impairments of assets.

The Company’s volume of title insurance premiums is affected by the overall level of residential and commercial real estate activity, which includes sales, mortgage financing and mortgage refinancing. Real estate activity, home sales and mortgage lending are cyclical in nature. In turn, real estate activity is affected by a number of factors, including the availability of mortgage credit, the cost of real estate, consumer confidence, employment and family income levels and general United States economic conditions. Interest rate volatility is also an important factor in the level of residential and commercial real estate activity.

The Company’s title insurance premiums in future periods are likely to fluctuate due to these and other factors which are beyond management’s control.

Services other than title insurance provided by operating divisions of the Company are not reported separately and are reported collectively in a category called “All Other.” These other services include those offered by the Company and by its wholly owned subsidiaries, Investors Title Exchange Corporation (“ITEC”), Investors Title Accommodation Corporation (“ITAC”), Investors Trust Company (“Investors Trust”) and Investors Title Management Services, Inc. (“ITMS”).

18

The Company’s exchange services division, consisting of the operations of ITEC and ITAC, provides customer services in connection with tax-deferred real property exchanges. ITEC serves as a qualified intermediary in like-kind exchanges of real or personal property under Section 1031 of the Internal Revenue Code of 1986, as amended. In its role as qualified intermediary, ITEC coordinates the exchange aspects of the real estate transaction, and its duties include drafting standard exchange documents, holding the exchange funds between the sale of the old property and the purchase of the new property, and accepting the formal identification of the replacement property within the required identification period. ITAC serves as exchange accommodation titleholder in reverse exchanges. An exchange accommodation offers a vehicle for accommodating a reverse exchange when the taxpayer must acquire replacement property before selling the relinquished property.

The Company’s trust services division, Investors Trust, provides investment management and trust services to individuals, companies, banks and trusts.

ITMS offers various consulting services to provide clients with the technical expertise to start and successfully operate a title insurance agency.

Business Trends and Recent Conditions

The housing market is heavily influenced by overall economic conditions and government policies. Initiatives undertaken by various governmental agencies could ease barriers to home ownership and help instill consumer confidence. Regulatory changes and reform of government-sponsored entities could impact lending standards or the processes and procedures used by the Company. The current real estate environment, including interest rates and general economic activity, typically influence the demand for real estate. Any of these factors would likely impact the Company's results of operations.

Current Initiatives

In efforts to provide transparency, the Federal Open Market Committee (“FOMC”) of the Federal Reserve issues disclosures on a periodic basis that include projections of the federal funds rate and expected actions. At the December 2015 meeting, the FOMC voted to raise the federal funds rate for the first time since December 2008 to a target range between 0.25% and 0.50%. The FOMC voted at the December 2016 meeting to increase interest rates to a target range between 0.50% and 0.75%. Any future adjustments to the rate are expected to be based on realized and expected economic developments to achieve maximum employment and 2.0% inflation. The FOMC anticipates future economic conditions to evolve in ways that will warrant gradual increases, and that for some time, the federal funds rate is expected to be below long range levels.

On October 20, 2014, the Federal Housing Finance Agency ("FHFA"), which regulates the Federal National Mortgage Association (“Fannie Mae”) and the Federal Home Loan Mortgage Corporation (“Freddie Mac”), announced that Fannie Mae and Freddie Mac were negotiating guidelines with mortgage lenders that resulted in less strict lending requirements and lower barriers to mortgage loans for borrowers who are seeking access to home loans. The FHFA noted in its announcement that it intended to clarify the rules that allow Fannie Mae and Freddie Mac to require mortgage lenders to repurchase troubled loans. The FHFA also sought to increase the supply of credit available, particularly to creditworthy lower and middle-income families, by collaborating with mortgage lenders to provide guidelines for mortgage loans with down payments as low as 3.0%. In December 2014, both Fannie Mae and Freddie Mac officially approved 97.0% loan-to-value products (3.0% down payment mortgages). The Fannie Mae program is targeted to first-time home buyers and became available to lenders in December 2014. The Freddie Mac program became available to lenders on March 23, 2015 and is available to both first-time home buyers and other qualified borrowers with limited down payment savings.

In an effort to expand home ownership for lower-income buyers, the Federal Housing Authority (“FHA”) announced in January 2015 that it would cut its rates on mortgage insurance premiums. Mortgage insurance premium rates for 30-year FHA insured mortgages with less than a 5.0% down payment decreased from 1.35% to 0.85%. Mortgage insurance premium rates for 30-year FHA insured mortgages with more than a 5.0% down payment decreased from 1.30% to 0.80%. The new rates took effect on January 26, 2015 and will not apply to borrowers with existing mortgages, unless refinanced, or to 15-year mortgages.

Regulation and Reform

In 2008, the federal government took control of Fannie Mae and Freddie Mac in an effort to keep these government-sponsored entities from failing. The primary functions of Fannie Mae and Freddie Mac are to provide liquidity to the nation's mortgage finance system by purchasing mortgages on the secondary market, pooling them and selling them as mortgage-backed securities. In order to securitize, Fannie Mae and Freddie Mac typically require the purchase of title insurance for loans they acquire. Since the federal takeover, there have been various discussions and proposals regarding their reform. Changes to these entities could impact the entire mortgage loan process and, as a result, could affect the demand for title insurance. The timing and results of reform are currently unknown; however, any changes to these entities could affect the Company and its results of operations.

19

On August 15, 2016, the Consumer Financial Protection Bureau (“CFPB”) proposed various amendments to federal mortgage disclosure requirements under the Real Estate Settlement Procedures Act and the Truth in Lending Act that are implemented in Regulation Z. The proposed amendments would reinforce the CFPB’s informal guidance on various issues and include clarifications and technical amendments. The CFPB also proposed changes that would create tolerances for the total of payments; adjust a partial exemption that mainly affects housing finance agencies and nonprofits; provide a uniform rule regarding application of the integrated mortgage disclosure requirements to cooperative units; and provide guidance on sharing the disclosures with various parties involved in the mortgage origination process. The comment period on the proposed rule changes closed October 18, 2016. The proposed rules, if adopted, are not expected to have a material impact on the Company.