Attached files

| file | filename |

|---|---|

| EX-10.1 - PROSPER MARKETPLACE, INC | i17103_ex10-1.htm |

| 8-K/A - PROSPER MARKETPLACE, INC | e17103_prosper-8ka.htm |

Exhibit 10.2

Execution Version

CONFIDENTIAL TREATMENT

[***] indicates that text has been omitted which is the subject of a confidential treatment request.

This text has been separately filed with the SEC.

WEBBANK

and

PROSPER MARKETPLACE, INC.

MARKETING AGREEMENT

Dated as of July 1, 2016

SCHEDULES AND EXHIBITS

| SCHEDULE 1 | Definitions | |

| SCHEDULE 6 | The Marketing Fee | |

| SCHEDULE 7(b)(4) | Litigation | |

| SCHEDULE 40 | Minimum Obligations | |

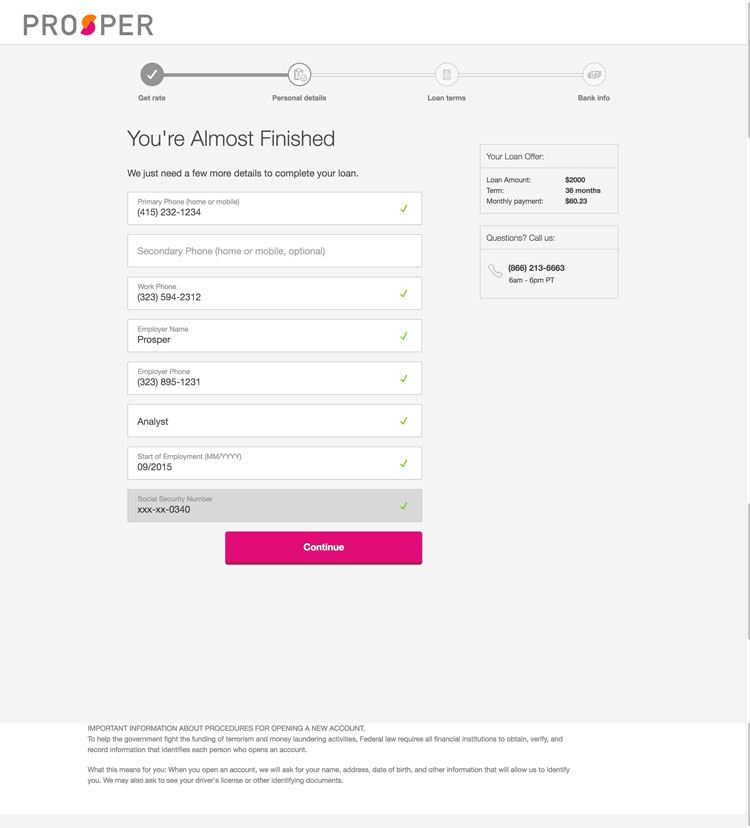

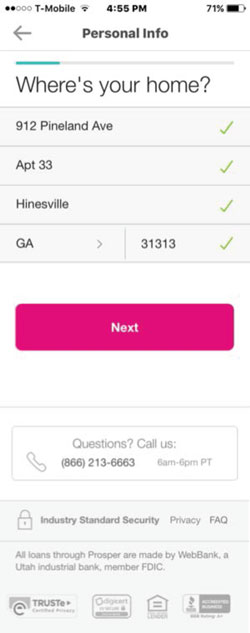

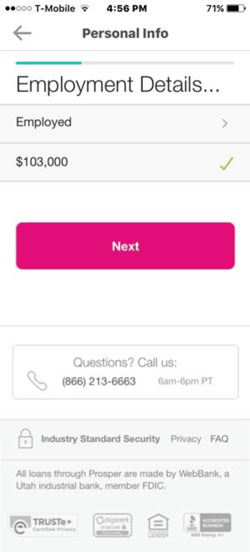

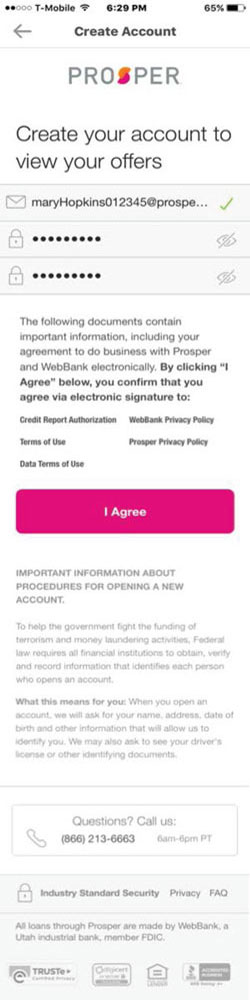

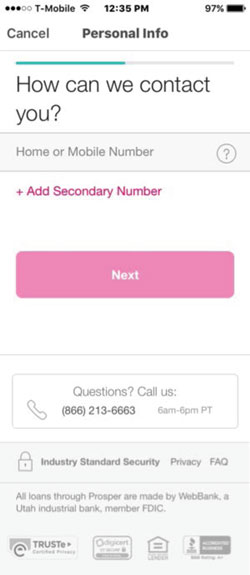

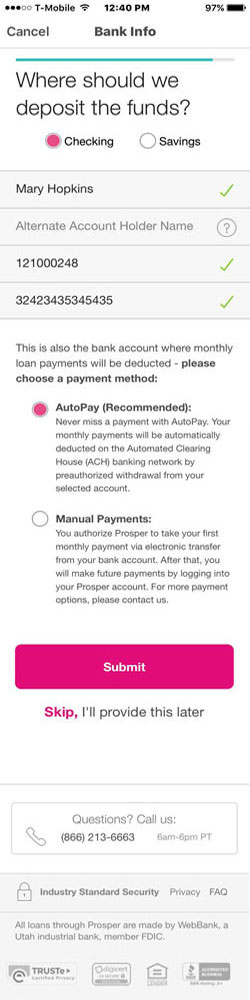

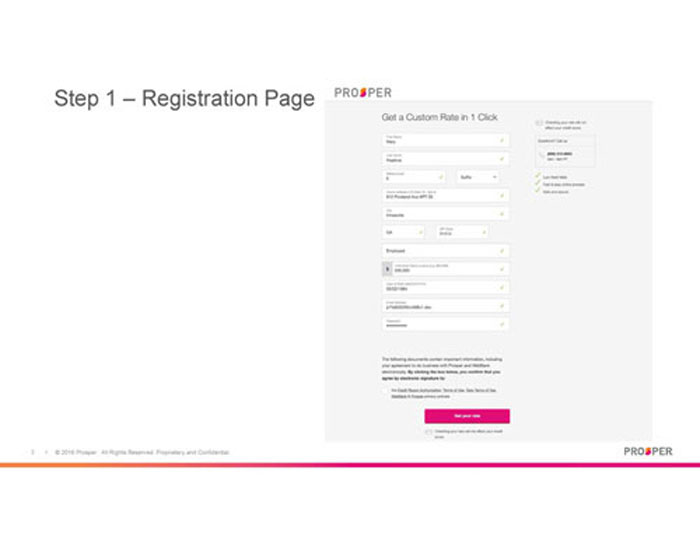

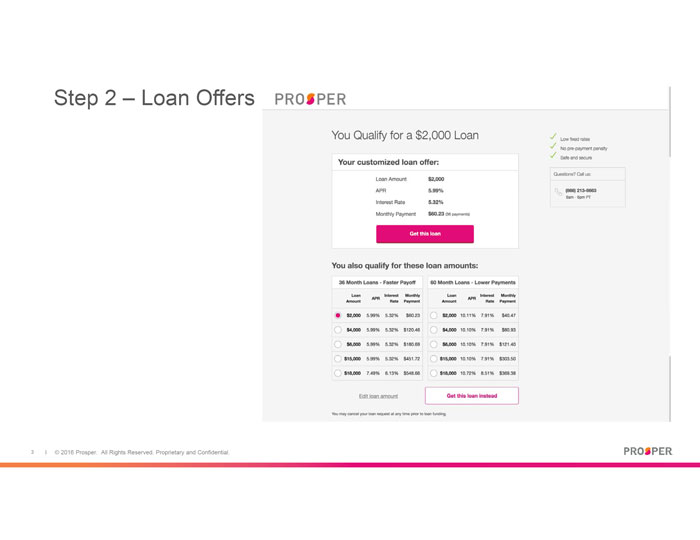

| EXHIBIT A | The Program Website | |

| EXHIBIT B | Credit Policy | |

| EXHIBIT C | Form of Application | |

| EXHIBIT D | Loan Documentation | |

| EXHIBIT E | Sample Funding Statement | |

| EXHIBIT F | Insurance Requirements | |

| EXHIBIT G | Program Compliance Manual | |

| EXHIBIT H | Third-Party Service Contractors | |

| EXHIBIT I | Bank Secrecy Act Policy |

This MARKETING AGREEMENT (this “Agreement”), dated as of July 1, 2016, is made by and between WEBBANK, a Utah-chartered industrial bank having its principal location in Salt Lake City, Utah (“Bank”), and PROSPER MARKETPLACE, INC., a Delaware corporation, having its principal location in San Francisco, California (“Company”).

WHEREAS, Company is in the business of providing certain services necessary for the origination of consumer installment loans;

WHEREAS, Bank is in the business of originating various types of consumer loans, including installment loans;

WHEREAS, Bank and Company have entered into a Second Amended and Restated Loan Account Program Agreement, dated as of January 25, 2013, pursuant to which Bank has retained Company to identify consumers who qualify for the Bank’s consumer installment loans, to market such loan program and to provide an online interface and certain other operational services in support of such loan program (as amended from time to time, the “Existing Program Agreement”); and

WHEREAS, effective as of the date hereof, the Parties desire to amend and restate the terms of the Existing Program Agreement on the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the foregoing and the terms, conditions and mutual covenants and agreements herein contained, and for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Bank and Company mutually agree as follows:

| 1. | Definitions; Effectiveness. |

| (a) | The terms used in this Agreement shall be defined as set forth in Schedule 1, and the rules of construction set forth in Schedule 1 shall apply to this Agreement. |

| (b) | This Agreement shall be effective as of August 1, 2016 (the “Effective Date”) and, as of the Effective Date, shall supersede and replace the Existing Program Agreement. This Agreement shall apply to all Loans originated by Bank during the term of this Agreement, beginning on the Effective Date. Loans originated on or after the Effective Date shall not be subject to the Existing Program Agreement. |

| (c) | All Loans originated by Bank prior to the Effective Date shall be governed by the terms of the Existing Program Agreement as in effect at the time that such Loans were originated, and shall not be subject to the terms of this Agreement. |

| (d) | This Agreement shall not operate so as to render invalid or improper any action heretofore taken under the Existing Program Agreement. |

| 2. | Program Marketing and Services. |

| (a) | Bank hereby retains Company to serve as Bank’s marketing and operations vendor for the Program. As such, Company shall perform the following services for Bank and the Program: |

| -1- |

| (1) | Company shall promote and otherwise market the Program and the Loans at Company’s own cost. In performing such promotion and other marketing services, (A) Company may devote such monetary and other resources as it deems appropriate in its sole discretion; and (B) Company may use any form of media, provided that Company shall discontinue the use of any specific form of media or media channel if reasonably directed to do so by Bank. Company’s promotion and marketing efforts shall not be required to produce any minimum number of Loans or other benefits to the Program during the Term of this Agreement or any year, month, or other period under this Agreement. Company may refer to Bank and the Program in promotional and marketing materials, including marketing scripts, upon the condition that any references to Bank and/or the Program in any such materials (and any changes in such materials) must receive the prior written approval of Bank; provided, however, that Bank’s prior written approval shall not be required with respect to investor-oriented communications by Company to its existing customers unless such communications also contain any information (i) directed towards, or about, Borrowers or Applicants, or (ii) describing or otherwise about the application process, in which case Bank’s prior written approval of such communications shall be required. Bank may require a change in such materials upon written notice provided to Company to the extent that such change is required by Applicable Laws, or to the extent that Bank determines such change is necessitated by safety and soundness concerns. Company shall ensure that all promotional and marketing materials for the Program shall be accurate and not misleading in all material respects. Company shall ensure that all promotional and marketing materials and strategies for the Program comply with Applicable Laws. |

| (2) | Company shall host and maintain the Program Website and provide customer support, regulatory compliance, administrative, and other operational services to support Bank’s origination of Loans and the Program generally. Company shall provide such services for the Program in a manner consistent with Company’s obligations specified in this Agreement and as the Parties may mutually agree in writing from time to time. |

| (b) | Bank acknowledges and agrees that (i) pursuant to Section 12 of this Agreement, Company is licensing to Bank valuable Proprietary Material of Company for use in the marketing and operation of the Program, which includes but is not limited to use of the Program Website; (ii) because the value of such Proprietary Material may be affected by Bank’s lending activities under the Program, Company requires Bank to perform and Bank hereby agrees to perform Bank’s lending activities under the Program with due regard to Company’s interests in such Proprietary Material and in close coordination with Company as specified hereafter in this Agreement; and (iii) the compensation to be paid by Bank to Company under this Agreement is in consideration of Company’s licensing of such Proprietary Material to Bank as well as Company’s marketing and operational services to Bank and the Program under this Agreement. |

| 3. | Extension of Credit. Company acknowledges that its approval of an Application on Bank’s behalf creates a creditor-borrower relationship between Bank and Borrower which involves, among other things, the disbursement of Loan Proceeds. Nothing in this Agreement shall obligate Bank to extend credit to an Applicant or disburse Loan Proceeds if Bank determines, in its sole discretion, that doing so would be an unsafe or unsound banking practice or that such extension of credit would be in violation of the Credit Policy. Bank shall use reasonable commercial efforts to provide Company prior notice of a decision not to extend credit to an Applicant or disburse Loan Proceeds in reliance on the preceding sentence and, in all instances where Bank does not provide such prior notice, Bank shall provide Company prompt notice after making a decision not to extend credit to an Applicant or disburse Loan Proceeds in reliance on the preceding sentence. |

| -2- |

| 4. | Consumer Documents and Credit Policy. The following documents, terms and procedures (“Consumer Finance Materials”) have been approved by Bank and will be used by Bank initially with respect to the Loans are attached to this Agreement: (i) the Program Website (screen shots of each page of the Program Website) as Exhibit A; (ii) Credit Policy as Exhibit B; (iii) form of Application, including disclosures required by Applicable Laws, as Exhibit C; and (iv) form of Loan Agreement, privacy policy and privacy notices, and all other Applicant and Borrower communications as Exhibit D. The Consumer Finance Materials shall not be changed without the prior written consent of both Parties, which consent shall not be unreasonably withheld or delayed; provided, however, that Bank may change the Consumer Finance Materials upon written notice provided to Company but without Company’s prior written consent, to the extent that such change is required by Applicable Laws or necessitated by safety and soundness concerns, and Bank may change the Credit Policy in order to ensure that Loan pricing is consistent with prudent management of the expected return and loss exposure. The Parties acknowledge that each Loan Agreement and all other documents referring to the creditor for the Program shall identify Bank as the creditor for the Loans. Company shall ensure that the Consumer Finance Materials comply with Applicable Laws. |

| 5. | Loan Processing, Origination, and Servicing. |

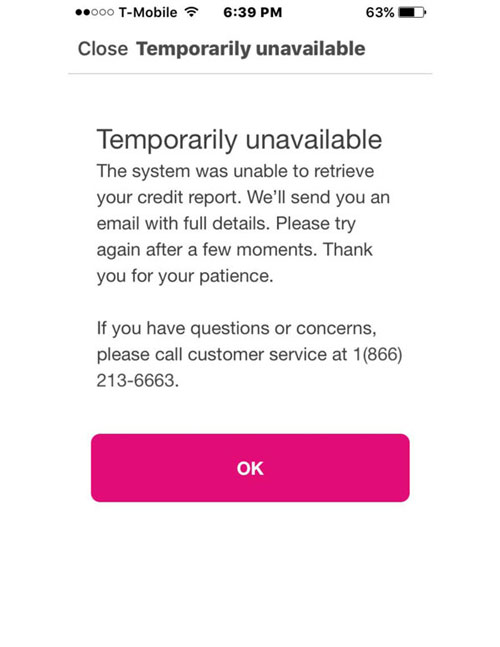

| (a) | On behalf of Bank, Company shall process Applications received from Applicants via the Program Website and other authorized channels (including retrieving credit reports) to determine whether the Applicant meets the eligibility criteria set forth in Bank’s Credit Policy and Bank’s “Know Your Customer” and anti-money laundering criteria (collectively, the “Bank Secrecy Act Policy”), which is attached hereto as Exhibit I, and which may be updated by Bank from time to time and such updates shall be effective upon notice to Company as set forth herein. Company shall respond to all inquiries from Applicants regarding the application process. |

| (b) | Company shall forward to Bank mutually agreed information including name, address, social security number, date of birth, and credit attributes regarding Applicants who meet the eligibility criteria set forth in the Credit Policy. Company shall have no discretion to override Bank’s Credit Policy with respect to any Applications. |

| (c) | Subject to the terms of this Agreement, Bank shall establish Loans with respect to Applicants who meet the eligibility criteria set forth in the Credit Policy. |

| (d) | Pursuant to procedures mutually agreed to by the Parties for the Program, Company shall deliver the Bank’s adverse action notices (in a form approved by Bank) to Applicants on who do not meet Bank’s Credit Policy criteria or are otherwise denied by Bank. |

| (e) | On behalf of Bank, Company shall deliver the Bank’s Program privacy notices (in a form approved by Bank) and Loan Agreements to Borrowers. |

| (f) | Company shall hold and maintain, as custodian for Bank, all documents of Bank pertaining to Loans. Company shall periodically provide to Bank copies of records required to be maintained under the Bank Secrecy Act Policy and such other documents regarding Loans as requested by Bank, at intervals mutually agreed to by the Parties or as required by Bank to comply with Applicable Laws or requests of a Regulatory Authority. |

| -3- |

| (g) | Pursuant to Section 16, as Bank reasonably requires and upon reasonable advance written notice to Company, Bank will periodically audit Company for compliance with the terms of this Section 5 and the Agreement as a whole, including compliance with the standards set forth herein for Loan origination. |

| (h) | Bank shall pay to Company the Marketing Fee, in consideration for Company’s marketing and other activities for the Program. The Marketing Fee for a Loan shall be paid by Bank to Company on the day that a Loan is funded as provided in Section 6(b). Bank shall transfer by wire transfer, or initiate a transfer by ACH or other mutually acceptable means, to an account designated by Company by no later than 4:00 PM Mountain Time the aggregate Marketing Fee set forth on the Funding Statement. |

| (i) | Company will take all actions necessary to effect and maintain Bank’s ownership interest in the Loans, until such Loans may be sold or transferred by Bank. |

| (j) | Company shall not create or suffer to exist (by operation of law or otherwise) any lien, encumbrance or security interest upon or with respect to any of the Loans, until such Loans may be sold or transferred by Bank. Company shall immediately notify Bank of the existence of any such lien, encumbrance or security interest and shall defend the right, title and interest in, to and under the Loans against all claims of third parties. |

| (k) | Company shall service and administer the Loans for as long as Bank owns the Loans; provided, that if a Loan is serviced by Company for Bank pursuant to the Servicing Agreement, then Company shall no longer be obligated to service such Loan under this Agreement. Such servicing shall include statementing (to the extent necessary), payment processing, collections, customer service, refunds and adjustments, customer disputes, and providing such other services as are ordinary and customary in the servicing of installment loans. |

| (1) | Company shall service the Loans owned by Bank using that degree of care, skill, prudence and attention that is (i) deemed commercially reasonable in the unsecured consumer loan servicing industry and (ii) no less than the degree of care, skill, prudence and attention that it uses in relation to its servicing and administration of unsecured consumer loans and related participations for the account of its Affiliates or its or their other customers, clients, assigns and transferees, exercising reasonable business judgment and with a view to the timely recovery of all payments of principal and interest or, in the case of a delinquent Loans, reasonable attempts to maximize the receipt of principal and interest on the Loan, without regard to (A) any relationship, including as facilitator (or, if Company engages in the business of lending, as lender) on any other debt, that Company or a Subcontractor, as the case may be, or any Affiliate thereof, may have with the related Borrower or (B) the right of Company or a Subcontractor, as the case may be, or any Affiliate thereof, to receive compensation or reimbursement of costs hereunder generally or with respect to any particular transaction, and, in all cases in accordance with the terms of this Agreement, the accepted servicing practices agreed in writing between Company and Bank, and Applicable Laws. |

| -4- |

| (2) | All materials, documents, communication forms and templates, policies, and procedures relating to the relationship with the Borrower and that are used by Company to service the Loans owned by Bank (“Servicing Materials”) shall be subject to the review and approval of Bank. The Servicing Materials may be changed by Company, subject to the review and approval of Bank; provided, however, that Bank may change the Servicing Materials upon written notice provided to Company but without Company’s prior written consent, to the extent that Bank determines that such change is required by Applicable Laws or necessitated by safety and soundness concerns; provided, further, that Bank shall, to the extent reasonably practicable and permissible under Applicable Laws and safety and soundness concerns, provide at least thirty (30) days’ prior written notice of such change. Company shall ensure that all Servicing Materials shall comply with Applicable Laws. With respect to the materials, documents, communications forms and templates, policies, and procedures relating to the relationship with the Borrower and that are used by Company to service Loans that are not owned by Bank, Bank may review and supervise such matters, and may require changes to such matters if required by Applicable Laws or necessitated by safety and soundness concerns; provided, that Bank shall, to the extent reasonably practicable and permissible under Applicable Laws and safety and soundness concerns, provide at least thirty (30) days’ prior written notice of such change. |

| (3) | Upon request of Bank, Company shall deliver to Bank or to a custodian designated by Bank a copy of each Loan File via a secure method agreed by the Parties. Company shall provide Loan Files for new loans on a daily basis (excluding weekends and bank holidays), and reconciliation files to update Loan Files on a regular basis as agreed by the Parties. |

| (4) | As consideration for Company’s servicing the Loans subject to this Agreement, Bank shall be responsible for paying Company the Servicing Fee for each Loan subject to this Agreement. Payment of the Servicing Fee shall be effected solely through the determination of the Holding Period Interest Charge under the Asset Sale Agreement. |

| (l) | In consideration of the Marketing Fee, Company shall perform the obligations described in this Section 5 and deliver any customer communications to Applicants and Borrowers as necessary to carry on the Program, all at Company’s own cost and in accordance with Applicable Laws. |

| 6. | Funding Loans. |

| (a) | In order to support the administration of the Program on behalf of Bank, Company shall provide a Funding Statement to Bank by e-mail or as otherwise mutually agreed by the Parties by 1:00 PM Mountain Time on each Funding Date. Each Funding Statement shall (i) identify those Applicants whose Applications have been reviewed by Company on the Bank’s behalf who satisfy the requirements of Bank’s Credit Policy for the Program, and (ii) provide the requested Funding Amount to be disbursed by Bank on such Funding Date, including instructions for the disbursement of Loan Proceeds to each Borrower and/or such Borrower’s designee, and (iii) provide the aggregate Marketing Fee with respect to the Loans requested for funding by Bank. Bank’s funding of any Applicant is at all times subject to Bank’s approval as set forth in Section 3. The Funding Statement shall be in the form of Exhibit E. |

| -5- |

| (b) | Subject to timely receipt of the Funding Statement, and receipt from Company of instructions for the disbursement of Loan Proceeds to each Borrower, Bank shall initiate the disbursement of Loan Proceeds to Borrowers and/or Borrower’s designees in accordance with the procedures determined by the Parties, by no later than 4:00 PM Mountain Time on each Funding Date. |

| (c) | To the extent that the aggregate principal balance of Loans held by Bank (or its Affiliates) would exceed the Program Threshold Amount following the funding of any Loan, Bank may elect not to fund such Loan. Company may request an increase in the Program Threshold Amount at any time by providing written notice to Bank, specifying the increased Program Threshold Amount requested and accompanied by information supporting Company’s conclusion that the proposed increased Program Threshold Amount is reasonably necessary to support the expected growth in Program volume. Bank shall approve or reject any such request within ten (10) Business Days, and shall use reasonable best efforts to provide its approval or rejection more quickly. |

| (d) | In addition to any other rights or remedies available to Bank under this Agreement or by law, Bank shall have the right to suspend payments of the Funding Amounts during the period commencing with the occurrence of any monetary default by Company or PFL, as applicable, under the Program Documents and ending when such condition has been cured, subject to the following: |

(1) if the monetary default is not material, Bank shall notify Company of such default, and Bank shall not suspend payments of Funding Amounts unless Company or PFL, as applicable, fails to cure such default within two (2) Business Days of receipt of such notice from Bank; and

(2) if the monetary default is material, Bank may suspend payments of the Funding Amounts without giving Company or PFL, as applicable, an opportunity to cure. For purposes of the foregoing, the failure by Company or PFL, as applicable, to purchase any Assets under the Asset Sale Agreement, or Company’s or PFL’s breach of its indemnification obligations under the Program Documents, or Company’s or PFL’s failure to timely deposit money as required by Section (c) of Schedule 2 to the Asset Sale Agreement, or PFL’s failure to timely deposit loan collections as required by Section 3.03 of the Servicing Agreement, shall be deemed a material default of the Program Documents.

| Notwithstanding Bank’s suspension rights under this Section, Bank may also exercise any right to terminate this Agreement as permitted herein. |

| 7. | Representations and Warranties. |

| (a) | Bank hereby represents and warrants, as of the date hereof and as of the Effective Date, or covenants, as applicable, to Company that: |

| (1) | Bank is an FDIC-insured Utah-chartered industrial bank, duly organized, validly existing under the laws of the State of Utah and has full corporate power and authority to execute, deliver, and perform its obligations under this Agreement; the execution, delivery and performance of this Agreement have been duly authorized, and are not in conflict with and do not violate the terms of the charter or bylaws of Bank and will not result in a material breach of or constitute a default under, or require any consent under, any indenture, loan or agreement to which Bank is a party; |

| -6- |

| (2) | All approvals, authorizations, licenses, registrations, consents, and other actions by, notices to, and filings with, any Person that may be required in connection with the execution, delivery, and performance of this Agreement by Bank, have been obtained (other than those required to be made to or received from Borrowers and Applicants); |

| (3) | This Agreement constitutes a legal, valid, and binding obligation of Bank, enforceable against Bank in accordance with its terms, except (i) as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, receivership, conservatorship or other similar laws now or hereafter in effect, including the rights and obligations of receivers and conservators under 12 U.S.C. §§ 1821 (d) and (e), which may affect the enforcement of creditors’ rights in general, and (ii) as such enforceability may be limited by general principles of equity (whether considered in a suit at law or in equity); |

| (4) | There are no proceedings or investigations (other than those previously disclosed to Company by Bank in writing) pending or, to the best knowledge of Bank, threatened against Bank (i) asserting the invalidity of this Agreement, (ii) seeking to prevent the consummation of any of the transactions contemplated by Bank pursuant to this Agreement, (iii) seeking any determination or ruling that, in the reasonable judgment of Bank, would materially and adversely affect the performance by Bank of its obligations under this Agreement, (iv) seeking any determination or ruling that would materially and adversely affect the validity or enforceability of this Agreement or (v) would have a materially adverse financial effect on Bank or its operations if resolved adversely to it; |

| (5) | Bank is not Insolvent; |

| (6) | The execution, delivery and performance of this Agreement by Bank comply with Utah and federal banking laws specifically applicable to Bank’s operations; provided that Bank makes no representation or warranty regarding compliance with Utah or federal banking laws relating to consumer protection, consumer lending, usury, loan collections, anti-money laundering, data security or privacy as they apply to the operation of the Program; |

| (7) | To the extent Bank receives non-public personally identifiable information from the Company or the Borrower, Bank will comply with all Applicable Laws related to the protection and retention of such information; and |

| (8) | The Proprietary Materials Bank licenses to Company pursuant to Section 12, and their use as contemplated by this Agreement, do not violate or infringe upon, or constitute an infringement or misappropriation of, any U.S. patent, copyright or U.S. trademark, service mark, trade name or trade secret of any person or entity and Bank has the right to grant the licenses set forth in Section 12 below. |

| (b) | Company hereby represents and warrants, as of the date hereof and as of the Effective Date, or covenants, as applicable, to Bank that: |

| -7- |

| (1) | Company is a corporation, duly organized and validly existing in good standing under the laws of the State of Delaware, and has full power and authority to execute, deliver, and perform its obligations under this Agreement; the execution, delivery, and performance of this Agreement have been duly authorized, and are not in conflict with and do not violate the terms of the articles or bylaws of Company and will not result in a material breach of or constitute a default under or require any consent under any indenture, loan, or agreement to which Company is a party; |

| (2) | All approvals, authorizations, consents, and other actions by, notices to, and filings with any Person required to be obtained for the execution, delivery, and performance of this Agreement by Company, have been obtained; |

| (3) | This Agreement constitutes a legal, valid, and binding obligation of Company, enforceable against Company in accordance with its terms, except (i) as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, or other similar laws now or hereafter in effect, which may affect the enforcement of creditors’ rights in general, and (ii) as such enforceability may be limited by general principles of equity (whether considered in a suit at law or in equity); |

| (4) | There are no proceedings or investigations pending or, to the best knowledge of Company, threatened against Company (i) asserting the invalidity of this Agreement, (ii) seeking to prevent the consummation of any of the transactions contemplated by Company pursuant to this Agreement, (iii) seeking any determination or ruling that, in the reasonable judgment of Company, would materially and adversely affect the performance by Company of its obligations under this Agreement, (iv) seeking any determination or ruling that would materially and adversely affect the validity or enforceability of this Agreement, or (v) except as set forth on Schedule 7(b)(4), that would have a materially adverse financial effect on Company or its operations if resolved adversely to it; |

| (5) | Company is not Insolvent; |

| (6) | The execution, delivery and performance of this Agreement by Company, the Consumer Finance Materials, the Servicing Materials, and the promotional and marketing materials and strategies shall all comply with Applicable Laws; |

| (7) | The Proprietary Materials Company licenses to Bank pursuant to Section 12, and their use as contemplated by this Agreement, do not violate or infringe upon, or constitute an infringement or misappropriation of, any U.S. patent, copyright or U.S. trademark, service mark, trade name or trade secret of any person or entity and Company has the right to grant the license set forth in Section 12 below; and |

| (8) | Company shall comply with Title V of the Gramm-Leach-Bliley Act and the implementing regulations of the FDIC, including but not limited to applicable limits on the use, disclosure, storage, safeguarding and destruction of Applicant information, and shall maintain commercially reasonable data security and disaster recovery protections that at the least are consistent with industry standards for the consumer lending industry. |

| -8- |

| (c) | Company hereby represents and warrants to Bank as of each Funding Date that: |

| (1) | For each Loan and each disbursement of Loan Proceeds: (i) to the best of Company’s knowledge, all information in the related Application is true and correct, provided, however, that Company’s representation and warranty in this regard shall be subject to the following limitations, unless otherwise set forth in the Credit Policy: (A) Company does not verify the self-reported income, employment and occupation or other information provided by Applicants in listings, (B) each Applicant’s debt-to-income ratio is determined by Company from a combination of the Applicant’s self-reported income and information from the Applicant’s credit report and not otherwise verified by Company, (C) credit data that appears in Applications is taken directly from a credit report obtained on the Applicant from a credit reporting agency, without any review or verification by Company, (D) Company does not verify any statements by Applicants as to how Loan Proceeds are to be used and does not confirm after loan disbursement how Loan Proceeds were used, and (E) Applicants’ home ownership status is not verified by Company but is derived from the Applicant’s credit report, in that if the credit report reflects an active mortgage loan the Applicant is presumed to be a homeowner; (ii) the Loan is fully enforceable and all required disclosures to Borrowers have been delivered in compliance with Applicable Laws; (iii) the Loan Agreement and all other Loan documents are genuine and legally binding and enforceable, complete and accurate, conform to the requirements of the Program, were prepared in conformity with the Program Compliance Manual, and represent the entire agreement between Bank and Company (on the one hand) and Borrower (on the other hand); (iv) to the knowledge of the Company, the Applicant has legal capacity to enter into, execute and deliver the Loan Agreement; (v) the terms, covenants and conditions of the Loan have not been waived, altered, impaired, modified or amended in any respect; (vi) all necessary approvals required to be obtained by Company have been obtained; (vii) principal payments of, and interest payments on, the Loan are payable to Bank and its successors and assigns in legal tender of the United States, and are made by the applicable Borrower and not by Company or any of its affiliates; (viii) the Loan does not contain any provision pursuant to which monthly payments are paid by any source other than the Borrower or that may constitute a “buydown” provision, and the Loan is not a graduated payment consumer loan, and does not have a shared appreciation or contingent interest feature; (ix) the Loan is denominated in dollars, and the billing address of the related Borrower and the bank account used for payments (via ACH or other mutually approved method of transfer) on the Loan are each located in the United States; (x) Company has fulfilled all of its obligations with respect to the origination of the Loan pursuant to Bank’s Program; (xi) Company has not advanced funds, or induced, solicited or knowingly received any advance of funds from a party other than the applicable Borrower, directly or indirectly, for the payment of any amount required by the Loan; (xii) any automated data processing systems used by or on behalf of Company in connection with Loan origination comply with Applicable Laws; and (xiii) nothing exists as to the Company or its business that would prohibit the sale of the Loans or Participations by Bank; |

| (2) | Each Borrower listed on a Funding Statement is eligible for a Loan under Bank’s Credit Policy; each Borrower has submitted an Application; and each Loan satisfies the requirements of Bank’s Credit Policy; |

| -9- |

| (3) | The origination of the Loan will, assuming performance by Bank of its obligations under this Agreement, comply with all Applicable Laws; |

| (4) | Company has not pledged, assigned, sold, granted a security interest in or otherwise conveyed any of the Loans nor authorized the filing of, and is not aware of, any financing statements against the Company or Bank that include a description of collateral covering any portion of the Loans (except for Loans that have been sold by Bank under the Program Documents); the Loan Agreement or other record that constitutes or evidences a Loan does not and shall not have any marks or notations indicating that it has been pledged, assigned or otherwise conveyed to any Person (except for Loans that have been sold by Bank under the Program Documents); |

| (5) | Assuming performance by Bank of its obligations under this Agreement, all right, title and interest to each Loan shall, upon origination of such Loan, be vested in Bank, free of any interest of Company except as provided in the Program Documents, and Bank shall be the sole legal and beneficial owner of such Loan, and have the right to assign, sell and transfer such Loan, free and clear of any lien or encumbrance in connection with a securitization or otherwise; |

| (6) | The Loan constitutes a “payment intangible” within the meaning of Article 9 of the Uniform Commercial Code; |

| (7) | The Loan is not subject to the laws of any jurisdiction under which the sale, transfer, assignment, setting over, conveyance or pledge of such Loan would be unlawful, void, or voidable; Company has not entered into any agreement with the Borrower that prohibits, restricts or conditions the assignment of such Loan; |

| (8) | All information provided by Company to Bank in connection with a Loan or Borrower Account is true and correct (other than information provided by a Borrower to Company, which is true and correct to the best of Company’s knowledge); |

| (9) | Each Loan is readily identifiable by the loan identification number ascribed thereto and no other outstanding Loan has the same loan identification number; and |

| (10) | The information on each Funding Statement provided by Company is true and correct in all respects. |

| (d) | The representations and warranties of Bank and Company contained in Sections 7(a) and (b), except those representations and warranties contained in subsections 7(a)(4) and 7(b)(4), are made continuously throughout the term of this Agreement. In the event that any investigation or proceeding of the nature described in subsections 7(a)(4) and 7(b)(4) is instituted or threatened against either Party, such Party shall promptly notify the other Party of the pending or threatened investigation or proceeding (unless prohibited from doing so by Applicable Laws or the direction of a Regulatory Authority). |

| -10- |

| 8. | Other Relationships with Borrowers. |

| (a) | Separate from the obligation to market Loans offered by Bank, and subject to the Program privacy policy and Applicable Laws, Company shall have the right, at its own expense, to solicit Applicants and/or Borrowers with offerings of other goods and services from Company and parties other than Bank, provided, however, that in the event that Company uses Bank’s name and/or Proprietary Materials in connection with such offerings, Company shall obtain Bank’s prior approval for such use. |

| (b) | Except as necessary to carry out its rights and responsibilities under the Program Documents, Bank shall not use Applicant and/or Borrower information and shall not provide or disclose any Applicant and/or Borrower information to any Person, except to the extent required to do so under Applicable Laws or legal process. |

| (c) | Notwithstanding subsection 8(b), (i) Bank may make solicitations for goods and services to the public, which may include one or more Applicants or Borrowers; provided that Bank does not (A) target such solicitations to specific Applicants and/or Borrowers, (B) use or permit a third party to use any list of Applicants and/or Borrowers in connection with such solicitations or (C) refer to or otherwise use the name of Company; (ii) Bank may make solicitations to Applicants or Borrowers for goods and services that are not competitive with the Loans; provided that Bank does not refer to or otherwise use the name of Company; and (iii) Bank shall not be obligated to redact the names of Applicants and/or Borrowers from marketing lists acquired from third parties (e.g., subscription lists) that Bank uses for solicitations. |

| (d) | The terms of this Section 8 shall survive the expiration or earlier termination of this Agreement. |

| 9. | Indemnification. |

| (a) | Company agrees to defend, indemnify, and hold harmless Bank and its Affiliates, and the officers, directors, employees, representatives, shareholders, agents and attorneys of such entities (the “Indemnified Parties”) from and against any and all claims, actions, liability, judgments, damages, costs and expenses, including reasonable attorneys’ fees (“Losses”) to the extent arising from Bank’s participation in the Program as contemplated by this Agreement (including Losses arising from a violation of Applicable Laws or a breach by Company or its agents or representatives of any of Company’s representations, warranties, obligations or undertakings under this Agreement), unless such Loss results from (i) the gross negligence or willful misconduct of Bank, or (ii) Bank’s failure to timely transfer the Funding Amount to the extent required under Section 6(b), provided that Company and PFL are not in breach of any of their respective obligations under the Program Documents, including, but not limited to, PFL’s obligations with respect to the purchase of Loans under the Asset Sale Agreement or Company’s obligations with respect to the purchase of Loans under the Stand By Purchase Agreement, or (iii) Excluded Servicing Losses. |

| (b) | To the extent permitted by Applicable Laws, any Indemnified Party seeking indemnification hereunder shall promptly notify Company, in writing, of any notice of the assertion by any third party of any claim or of the commencement by any third party of any legal or regulatory proceeding, arbitration or action, or if the Indemnified Party determines the existence of any such claim or the commencement by any third party of any such legal or regulatory proceeding, arbitration or action, whether or not the same shall have been asserted or initiated, in any case with respect to which Company is or may be obligated to provide indemnification (an “Indemnifiable Claim”), specifying in reasonable detail the nature of the Loss and, if known, the amount or an estimate of the amount of the Loss; provided, that failure to promptly give such notice shall only limit the liability of Company to the extent of the actual prejudice, if any, suffered by Company as a result of such failure. The Indemnified Party shall provide to Company as promptly as practicable thereafter information and documentation reasonably requested by Company to defend against the Indemnifiable Claim. |

| -11- |

| (c) | Company shall have ten (10) days after receipt of any notification of an Indemnifiable Claim (a “Claim Notice”) to notify the Indemnified Party of Company’s election to assume the defense of the Indemnifiable Claim and, through counsel of its own choosing, and at its own expense, to commence the settlement or defense thereof, and the Indemnified Party shall cooperate with Company in connection therewith if such cooperation is so requested and the request is reasonable; provided that Company shall hold the Indemnified Party harmless from all its reasonable out-of-pocket expenses, including reasonable attorneys’ fees, incurred in connection with the Indemnified Party’s cooperation; provided, further, that if the Indemnifiable Claim relates to a matter before a Regulatory Authority, the Indemnified Party may elect, upon notice to Company, to assume the defense of the Indemnifiable Claim at the cost of and with the cooperation of Company. If the Company assumes responsibility for the settlement or defense of any such claim, (i) Company shall permit the Indemnified Party to participate at the Indemnified Party’s expense in such settlement or defense through counsel chosen by the Indemnified Party; provided that, in the event that both Company and the Indemnified Party are defendants in the proceeding and the Indemnified Party shall have reasonably determined and notified Company that representation of both parties by the same counsel would be inappropriate due to the actual or potential differing interests between them, then the fees and expenses of one such counsel for all Indemnified Parties in the aggregate shall be borne by Company; and (ii) Company shall not settle any Indemnifiable Claim without the Indemnified Party’s consent. |

| (d) | If the Company does not notify the Indemnified Party within ten (10) days after receipt of the Claim Notice that it elects to undertake the defense of the Indemnifiable Claim described therein, or if Company fails to contest vigorously any such Indemnifiable Claim, or if the Indemnified Party elects to control the defense of an Indemnifiable Claim as permitted by Section 9(c), then, in each case, the Indemnified Party shall have the right, upon notice to the Company, to contest, settle or compromise the Indemnifiable Claim in the exercise of its reasonable discretion; provided that the Indemnified Party shall notify Company prior thereto of any compromise or settlement of any such Indemnifiable Claim. No action taken by the Indemnified Party pursuant to this paragraph (d) shall deprive the Indemnified Party of its rights to indemnification pursuant to this Section 9. |

| (e) | All amounts due under this Section 9 shall be payable not later than ten (10) days after written demand therefor. |

| (f) | The terms of this Section 9 shall survive the expiration or earlier termination of this Agreement. |

| -12- |

| 10. | Term and Termination. |

| (a) | This Agreement shall have an initial term beginning on the Effective Date and ending three (3) years thereafter (the “Initial Term”) and shall renew automatically for one (1) successive term of one (1) year (the “Renewal Term,” collectively, the Initial Term and Renewal Term shall be referred to as the “Term”), unless either Party provides notice of non-renewal to the other Party at least ninety (90) days prior to the end of the Initial Term or this Agreement is earlier terminated in accordance with the provisions hereof. |

| (b) | This Agreement shall terminate immediately upon the expiration or earlier termination of the Asset Sale Agreement, the Stand By Purchase Agreement, or the Servicing Agreement. |

| (c) | Bank shall have a right to terminate this Agreement immediately upon written notice to Company if: |

| (1) | based upon the opinion of counsel, Bank’s continued participation in the Program would be in violation of Applicable Law or has been prohibited pursuant to an order or other action, including any letter or directive of any kind, by a Regulatory Authority; |

| (2) | a Regulatory Authority with jurisdiction over Bank has provided, formally or informally, concerns about the Program and Bank determines, in its sole discretion, and based upon the opinion of counsel, that its rights and remedies under this Agreement are not sufficient to protect Bank fully against the potential consequences of such concerns; |

| (3) | a fine or penalty has been assessed against Bank by a Regulatory Authority of Bank, or a material fine or penalty has been assessed by any other Regulatory Authority, in connection with the Program, including as a result of a consent order or stipulated judgment; |

| (4) | (i) Company defaults on its obligation to make a payment to Bank as provided in Section 2 of the Stand By Purchase Agreement or Section 3.03 of the Servicing Agreement and fails to cure such default within one (1) Business Day of receiving notice of such default from Bank; (ii) Company defaults on its obligation to make a payment to Bank as provided in Section 2 of the Stand By Purchase Agreement or Section 3.03 of the Servicing Agreement more than once in any three (3) month period; or (iii) Company fails to maintain the Required Balance in the Collateral Account as required by Section 31 of the Stand By Purchase Agreement; or |

| (5) | there is a Change of Control of Company. Company shall provide written notice to Bank of any expected or anticipated Change of Control of Company not later than thirty (30) days prior to the effective date of such Change of Control. |

| (d) | A Party shall have a right to terminate this Agreement immediately upon written notice to the other Party in any of the following circumstances: |

| (1) | any representation or warranty made by the other Party in this Agreement shall be incorrect in any material respect and shall not have been corrected within thirty (30) Business Days after written notice thereof has been given to such other Party; |

| -13- |

| (2) | the other Party shall default in the performance of any obligation or undertaking under this Agreement and such default shall continue for thirty (30) Business Days after written notice thereof has been given to such other Party; |

| (3) | the other Party shall commence a voluntary case or other proceeding seeking liquidation, reorganization, or other relief with respect to itself or its debts under any bankruptcy, insolvency, receivership, conservatorship or other similar law now or hereafter in effect or seeking the appointment of a trustee, receiver, liquidator, conservator, custodian, or other similar official of it or any substantial part of its property, or shall consent to any such relief or to the appointment of a trustee, receiver, liquidator, conservator, custodian, or other similar official or to any involuntary case or other proceeding commenced against it, or shall make a general assignment for the benefit of creditors, or shall fail generally to pay its debts as they become due, or shall take any corporate action to authorize any of the foregoing; |

| (4) | an involuntary case or other proceeding, whether pursuant to banking regulations or otherwise, shall be commenced against the other Party seeking liquidation, reorganization, or other relief with respect to it or its debts under any bankruptcy, insolvency, receivership, conservatorship or other similar law now or hereafter in effect or seeking the appointment of a trustee, receiver, liquidator, conservator, custodian, or other similar official of it or any substantial part of its property; or an order for relief shall be entered against either Party under the federal bankruptcy laws as now or hereafter in effect; or |

| (5) | there is a material adverse change in the financial condition of the other Party. |

| (e) | Bank shall not be obligated to approve Applications or establish new Loans after termination of this Agreement; provided, that Bank may originate Loans to Applicants to whom Bank has assumed a legally binding duty to fund a loan prior to termination, unless this Agreement is terminated pursuant to subsection 10(c) or 10(h) or by Bank pursuant to subsection 10(d). |

| (f) | The termination of this Agreement either in part or in whole shall not discharge any Party from any obligation incurred prior to such termination. |

| (g) | Company’s failure to obtain the approval of Bank as required by Sections 2(a)(1), 4 or 30, and Company’s failure to provide any notice required by Section 32, shall each constitute a material breach of this Agreement. |

| (h) | Bank may terminate this Agreement immediately upon written notice to Company if Bank incurs any Loss that would have been subject to indemnification under Section 9(a) but for the application of Applicable Laws that limit or restrict Bank’s ability to seek such indemnification. |

| -14- |

| (i) | Company may terminate this Agreement immediately upon written notice to Bank if Bank defaults on its obligation to disburse Loan Proceeds to Borrowers as provided in Section 6(b) of this Agreement and such failure is not cured by Bank within two (2) days after Company provides notice of such default to Bank, provided, that Company may not exercise a right of termination if the disbursement is not completed or is reversed due to matters beyond Bank’s control, or if Company has not complied with its obligation (including the obligation to deliver the Funding Statement), or if there are errors in the Funding Statement. |

| (j) | The terms of this Section 10 shall survive the expiration or earlier termination of this Agreement. |

| 11. | Confidentiality. |

| (a) | Each Party agrees that Confidential Information of the other Party shall be used by such Party solely in the performance of its obligations and exercise of its rights pursuant to the Program Documents. Except as required by Applicable Laws or legal process, neither Party (the “Restricted Party”) shall disclose Confidential Information of the other Party to third parties; provided, however, that the Restricted Party may disclose Confidential Information of the other Party (i) to the Restricted Party’s Affiliates, agents, representatives or subcontractors for the sole purpose of fulfilling the Restricted Party’s obligations under this Agreement (as long as the Restricted Party exercises reasonable efforts to prohibit any further disclosure by its Affiliates, agents, representatives or subcontractors), provided that in all events, the Restricted Party shall be responsible for any breach of the confidentiality obligations hereunder by any of its Affiliates, agents (other than Company as agent for Bank), representatives or subcontractors, (ii) to the Restricted Party’s auditors, accountants and other professional advisors (provided such receiving party is subject to confidentiality obligations at least as stringent as those set forth herein and the Restricted Party shall be responsible for any breach of confidentiality obligations by such receiving party), or to a Regulatory Authority or (iii) to any other third party as mutually agreed by the Parties. |

| (b) | A Party’s Confidential Information shall not include information that: |

| (1) | is generally available to the public; |

| (2) | has become publicly known, without fault on the part of the Party who now seeks to disclose such information (the “Disclosing Party”), subsequent to the Disclosing Party acquiring the information; |

| (3) | was otherwise known by, or available to, the Disclosing Party prior to entering into this Agreement; or |

| (4) | becomes available to the Disclosing Party on a non-confidential basis from a Person, other than a Party to this Agreement, who is not known by the Disclosing Party after reasonable inquiry to be bound by a confidentiality agreement with the non-Disclosing Party or otherwise prohibited from transmitting the information to the Disclosing Party. |

| (c) | Upon written request or upon the termination of this Agreement, each Party shall, within thirty (30) days, return to the other Party all Confidential Information of the other Party in its possession that is in written form, including by way of example, but not limited to, reports, plans, and manuals; provided, however, that either Party may maintain in its possession all such Confidential Information of the other Party required to be maintained under Applicable Laws relating to the retention of records for the period of time required thereunder or stored on such Party’s network as part of standard back-up procedures (provided that such information shall remain subject to the confidentiality provisions of this Section 11). |

| -15- |

| (d) | In the event that a Restricted Party is requested or required (by oral questions, interrogatories, requests for information or documents, subpoena, civil investigative demand or similar process) to disclose any Confidential Information of the other Party, the Restricted Party shall provide the other Party with prompt notice of such request(s) so that the other Party may seek an appropriate protective order or other appropriate remedy and/or waive the Restricted Party’s compliance with the provisions of this Agreement. In the event that the other Party does not seek such a protective order or other remedy, or such protective order or other remedy is not obtained, or the other Party grants a waiver hereunder, the Restricted Party may furnish that portion (and only that portion) of the Confidential Information of the other Party which the Restricted Party is legally compelled to disclose and shall exercise such efforts to obtain reasonable assurance that confidential treatment shall be accorded any Confidential Information of the other Party so furnished as the Restricted Party would exercise in assuring the confidentiality of any of its own Confidential Information. |

| (e) | Company shall obtain Bank’s pre-approval of any identification of Bank by name or any description of the Program or the terms of the Program Documents in any publicly filed or widely disseminated documents. |

| (f) | The terms of this Section 11 shall survive the expiration or earlier termination of this Agreement. |

| 12. | Proprietary Material. |

| (a) | Each Party (“Licensing Party”) hereby provides the other Party (“Licensee”) with a non-exclusive right and license to use and reproduce the Licensing Party’s name, logo, registered or other trademarks and service marks (collectively, “Marks”) on the Applications, Loan Agreements, and other Consumer Finance Materials (including the Program Website), Program marketing materials, and any other publicly distributed or available Program materials, and to otherwise use the Marks and such copyrights, patents, and other intellectual property as the Licensing Party may designate or otherwise make available from time to time in the Licensing Party’s sole discretion (collectively with the Marks, “Proprietary Material”) for the purposes of or otherwise in connection with the fulfillment of Licensee’s obligations under this Agreement; provided, however, that (i) the Licensee shall at all times comply with any and all written instructions provided by the Licensing Party from time to time regarding the use of the Licensing Party’s Proprietary Material, and (ii) each Licensee acknowledges that, except for the license specifically provided in this Agreement, it shall acquire no interest in the Licensing Party’s Proprietary Material. Upon termination of this Agreement, each such license will terminate, and the Licensee shall cease using the Licensing Party’s Proprietary Material. Neither Party may use the other Party’s Marks in any press release without the prior written consent of the other Party. |

| -16- |

| (b) | Bank hereby acknowledges and agrees that, as between Bank and Company (i) as of the Effective Date, Company is the sole and exclusive owner of all pre-existing Marks, copyrights, patents, other intellectual property rights, software, other technology, and other tangible and intangible property used on or in connection with the Program Website, and its Company run predecessors; and (ii) Company shall be the sole and exclusive owner of any and all modifications to such tangible and intangible property during the Term of this Agreement, including but not limited to any and all trademark, service mark, copyright, patent, and other intellectual property rights in and to such modifications, except as the Parties may otherwise agree in writing. For avoidance of doubt, Company shall not obtain any rights in Bank’s Marks (other than the license described in subsection 12(a)) by virtue of incorporation of Bank’s Marks into the Program Website. |

| 13. | Relationship of Parties. The Parties agree that in performing their respective responsibilities pursuant to this Agreement, they are in the position of independent contractors. This Agreement is not intended to create, nor does it create and shall not be construed to create, a relationship of partner or joint venturer or any association for profit between Bank and Company. |

| 14. | Expenses. |

| (a) | Except as set forth herein, each Party shall bear the costs and expenses of performing its obligations under this Agreement. |

| (b) | Company shall reimburse Bank for all third party fees incurred by Bank in connection with the performance of the Program Documents. Bank shall provide Company with notice of third party fees to be incurred by Bank in connection with performance of the Program Documents as soon as practicable after Bank becomes aware of such fees. |

| (c) | Company shall pay all costs of any credit reports it obtains on Applicants or Borrowers and any adverse action notices it delivers to Applicants or Borrowers in accordance with Company’s Application processing responsibilities under this Agreement. |

| (d) | Each Party shall be responsible for payment of any federal, state, or local taxes or assessments associated with the performance of its obligations under this Agreement and for compliance with all filing, registration and other requirements with regard thereto. |

| (e) | Company shall be responsible for (i) all of Bank’s out-of-pocket legal fees directly related to the Program, including Bank’s attorneys’ fees and expenses in connection with the preparation, negotiation, execution, and delivery of the Program Documents; any amendment, modification, administration, collection and enforcement of the Program Documents; any modification of the Consumer Finance Materials or other documents or disclosures related to the Program; or any dispute or litigation arising out of or related to the Program; and (ii) all of Bank’s out-of-pocket costs and expenses for any other third-party professional services related to the Program, including the services of any third-party compliance specialists in connection with Bank’s preparation of policies and procedures and Bank’s review of the Program. To the extent that such fees are expected to exceed [***], Bank will provide oral or email notification to the extent reasonably practicable. Bank shall invoice Company for such fees. Company shall pay such invoice within thirty (30) days of receipt of such invoice. |

| (f) | Company shall reimburse Bank for all reasonable costs associated with Bank’s assignment to Company of Loans pursuant to Section 10. |

| -17- |

| 15. | Examination. Each Party agrees to submit to any examination that may be required by a Regulatory Authority having jurisdiction over the other Party, during regular business hours and upon reasonable prior notice, and to otherwise provide reasonable cooperation to the other Party in responding to such Regulatory Authority’s inquiries and requests related to the Program. |

| 16. | Inspection; Reports. Each Party, upon reasonable prior notice from the other Party, agrees to submit to an inspection of its books, records, accounts, and facilities relevant to the Program, from time to time, during regular business hours subject to the duty of confidentiality each Party owes to its customers and banking secrecy and confidentiality requirements otherwise applicable to each Party under Applicable Laws. All expenses of inspection shall be borne by the Party conducting the inspection. Notwithstanding the obligation of each Party to bear its own expenses of inspection, Company shall reimburse Bank for reasonable out of pocket expenses incurred by Bank in the performance of periodic on site reviews of Company’s financial condition, operations and internal controls. Company shall store all documentation and electronic data related to its performance under this Agreement and shall make such documentation and data available during any inspection by Bank or its designee. With such reasonable frequency and in such reasonable manner as requested by Bank, Company shall report to Bank regarding the performance of its obligations and the Program. |

| 17. | Governing Law; Waiver of Jury Trial. This Agreement shall be interpreted and construed in accordance with the laws of the State of Utah, without giving effect to the rules, policies, or principles thereof with respect to conflicts of laws. THE PARTIES HEREBY EXPRESSLY WAIVE ANY RIGHT TO TRIAL BY JURY OF ANY CLAIM, DEMAND, ACTION OR CAUSE OF ACTION ARISING HEREUNDER. The terms of this Section 17 shall survive the expiration or earlier termination of this Agreement. |

| 18. | Severability. Any provision of this Agreement which is deemed invalid, illegal or unenforceable in any jurisdiction, shall, as to that jurisdiction, be ineffective to the extent of such invalidity, illegality or unenforceability, without affecting in any way the remaining portions hereof in such jurisdiction or rendering such provision or any other provision of this Agreement invalid, illegal, or unenforceable in any other jurisdiction. |

| 19. | Assignment. This Agreement and the rights and obligations created under it shall be binding upon and inure solely to the benefit of the Parties and their respective successors, and permitted assigns. Neither Party shall be entitled to assign or transfer any interest under this Agreement (including by operation of law) without the prior written consent of the other Party, which shall not be unreasonable withheld or delayed. No assignment made in conformity with this Section 19 shall relieve a Party of its obligations under this Agreement. |

| 20. | Third Party Beneficiaries. Nothing contained herein shall be construed as creating a third-party beneficiary relationship between either Party and any other Person. |

| 21. | Notices. All notices and other communications that are required or may be given in connection with this Agreement shall be in writing and shall be deemed received (a) on the day delivered, if delivered by hand; (b) on the day transmitted, if transmitted by e-mail during business hours; or (c) one (1) business days after the date of deposit with a nationally recognized overnight courier for delivery at the following address, or such other address as either Party shall specify in a notice to the other: |

| -18- |

| To Bank: | WebBank | |

| Attn: Senior Vice President – Strategic Partners | ||

| 215 S. State Street, Suite 1000 | ||

| Salt Lake City, UT 84111 | ||

| Tel. (801) 456-8398 | ||

| Email: strategicpartnerships@webbank.com | ||

| With a copy to: | ||

| WebBank | ||

| Attn: Chief Compliance Officer | ||

| 215 S. State Street, Suite 1000 | ||

| Salt Lake City, UT 84111 | ||

| Tel. (801) 456-8363 | ||

| Email: complianceofficer@webbank.com | ||

| To Company: | Prosper Marketplace, Inc. | |

| 221 Main Street, Suite 300 | ||

| San Francisco, CA 94105 | ||

| Attn: Sachin Adarkar | ||

| E-mail Addresses: sadarkar@propser.com and legalnotices@prosper.com | ||

| Telephone: (415) 593-5433 |

| 22. | Amendment and Waiver. This Agreement may be amended only by a written instrument signed by each of the Parties. The failure of a Party to require the performance of any term of this Agreement or the waiver by a Party of any default under this Agreement shall not prevent a subsequent enforcement of such term and shall not be deemed a waiver of any subsequent breach. All waivers must be in writing and signed by the Party against whom the waiver is to be enforced. |

| 23. | Entire Agreement. The Program Documents, including this Agreement and its schedules and exhibits (all of which schedules and exhibits are hereby incorporated into this Agreement), constitute the entire agreement between the Parties with respect to the subject matter hereof, and supersede any prior or contemporaneous negotiations or oral or written agreements with regard to the same subject matter. |

| 24. | Counterparts. This Agreement may be executed and delivered by the Parties in any number of counterparts, and by different parties on separate counterparts, each of which counterpart shall be deemed to be an original and all of which counterparts, taken together, shall constitute but one and the same instrument. |

| 25. | Interpretation. The Parties acknowledge that each Party and its counsel have reviewed and revised this Agreement and that the normal rule of construction to the effect that any ambiguities are to be resolved against the drafting party shall not be employed in the interpretation of this Agreement or any amendments thereto, and the same shall be construed neither for nor against either Party, but shall be given a reasonable interpretation in accordance with the plain meaning of its terms and the intent of the Parties. |

| -19- |

| 26. | Agreement Subject to Applicable Laws. If (a) either Party has been advised by legal counsel of a change in Applicable Laws or any judicial decision of a court having jurisdiction over such Party or any interpretation of a Regulatory Authority that, in the view of such legal counsel, would have a materially adverse effect on the rights or obligations of such Party under this Agreement or the financial condition of such Party, (b) either Party receives a request of any Regulatory Authority having jurisdiction over such Party, including any letter or directive of any kind from any such Regulatory Authority, that prohibits or restricts such Party from carrying out its obligations under this Agreement, or (c) either Party has been advised by legal counsel that there is a material risk that such Party’s or the other Party’s continued performance under this Agreement would violate Applicable Laws, then the Parties shall meet and consider in good faith any modifications, changes or additions to the Program or the Program Documents that may be necessary to eliminate such result. Notwithstanding any other provision of the Program Documents, including Section 10 hereof, if the Parties are unable to reach agreement regarding such modifications, changes or additions to the Program or the Program Documents within [***] after the Parties initially meet, either Party may terminate this Agreement upon [***] prior written notice to the other Party. A Party may suspend performance of its obligations under this Agreement, or require the other Party to suspend its performance of its obligations under this Agreement, upon providing the other Party advance written notice, if any event described in subsections 26(a), (b) or (c) above occurs. |

| 27. | Force Majeure. If any Party is unable to carry out the whole or any part of its obligations under this Agreement by reason of a Force Majeure Event, then the performance of the obligations under this Agreement of such Party as they are affected by such cause shall be excused during the continuance of the inability so caused, except that should such inability not be remedied within thirty (30) days after the date of such cause, the Party not so affected may at any time after the expiration of such thirty (30) day period, during the continuance of such inability, terminate this Agreement on giving written notice to the other Party and without payment of a termination fee or other penalty. To the extent that the Party not affected by a Force Majeure Event is unable to carry out the whole or any part of its obligations under this Agreement because a prerequisite obligation of the Party so affected has not been performed, the Party not affected by a Force Majeure Event also is excused from such performance during such period. A “Force Majeure Event” as used in this Agreement shall mean an unanticipated event that is not reasonably within the control of the affected Party or its subcontractors (including, but not limited to, acts of God, acts of governmental authorities, strikes, war, riot and any other causes of such nature), and which by exercise of reasonable due diligence, such affected Party or its subcontractors could not reasonably have been expected to avoid, overcome or obtain, or cause to be obtained, a commercially reasonable substitute therefore. No Party shall be relieved of its obligations hereunder if its failure of performance is due to removable or remediable causes which such Party fails to remove or remedy using commercially reasonable efforts within a reasonable time period. Either Party rendered unable to fulfill any of its obligations under this Agreement by reason of a Force Majeure Event shall give prompt notice of such fact to the other Party, followed by written confirmation of notice, and shall exercise due diligence to remove such inability with all reasonable dispatch. |

| 28. | Jurisdiction; Venue. The Parties consent to the personal jurisdiction and venue of the federal and state courts in Salt Lake City, Utah for any court action or proceeding. The terms of this Section 28 shall survive the expiration or earlier termination of this Agreement. |

| 29. | Insurance. Company agrees to maintain insurance coverage on the terms and conditions specified in Exhibit F at all times during the term of this Agreement and to notify Bank promptly of any cancellation or lapse of any such insurance coverage. |

| -20- |

| 30. | Compliance with Applicable Laws; Program Compliance Manual. Company shall comply with Applicable Laws, the Bank Secrecy Act Policy and the Program Compliance Manual in its performance of the Program pursuant to this Agreement, including Loan solicitation, Application processing and preparation of Loan Agreements and other Loan documents. The Program Compliance Manual shall not be changed without the prior written consent of both Parties, which consent shall not be unreasonably withheld or delayed; provided, however, that Bank may change the Program Compliance Manual upon written notice provided to Company but without Company’s prior written consent, to the extent that such change is required by Applicable Laws, or to the extent that Bank determines such change is necessitated by safety and soundness concerns. A copy of the Program Compliance Manual is attached hereto as Exhibit G. Without limiting the foregoing, Company shall: |

| (a) | apply to all Applicants customer identification procedures that comply with Section 326 of the USA PATRIOT Act of 2001 (“Patriot Act”) and the implementing regulations applicable to Bank (31 C.F.R. § 1020.220); |

| (b) | retain for five (5) years after a Loan is repaid or terminated, and deliver to Bank upon request: (i) the Applicant’s name, address, social security number, and date of birth obtained pursuant to such customer identification procedures; (ii) a description of the methods and the results of any measures undertaken to verify the identity of the Applicant; and (iii) a description of the resolution of any substantive discrepancy discovered when verifying the identifying information obtained; |

| (c) | screen all Applicants against the Office of Foreign Assets Control list of Specially Designated Nationals and Blocked Persons, and reject any Applicant whose name appears on such list and notify Bank thereof; |

| (d) | monitor, identify and report to Bank any suspicious activity that meets the thresholds for submitting a Suspicious Activity Report under the Bank Secrecy Act and the implementing regulations applicable to Bank (31 C.F.R. § 1020.320); |

| (e) | implement an anti-money laundering program to assist Bank in its compliance with Section 352 of the Patriot Act and the implementing regulations applicable to Bank (31 C.F.R. § 1020.210); |

| (f) | in addition to the information retained pursuant to subsection (b) above, retain the account number identifying a Borrower’s Loan for at least one (1) year after the Loan is repaid or terminated; |

| (g) | upon receipt of a government information request forwarded by Bank to Company, (i) compare the names, addresses, and social security numbers on such government list provided by Bank with the names, addresses, and social security numbers of Borrowers for all Loans purchased from Bank within the prior twelve (12) months, and (ii) within one (1) week of receipt of such an information request, deliver to Bank a certification of completion of such a records search, which shall indicate whether Company located a name, address, or social security number match and, if so, provide for any such match: the name of the Borrower, the account number identifying the Borrower’s Loan, and the Borrower’s social security number, date of birth, address, or other similar identifying information provided by the Borrower, to assist Bank in its compliance with Section 314(a) of the Patriot Act and the implementing regulations applicable to Bank (31 C.F.R. § 1010.520); |

| (h) | provide to Bank electronic copies of the information retained pursuant to subsections (b) and (g) above as mutually agreed to by the Parties, immediately upon request; |

| -21- |

| (i) | (i) maintain policies and procedures in a form approved by Bank (“Red Flags Policy”) to (1) detect relevant red flags that may arise in the performance of Company’s obligations, (2) take appropriate steps to address such red flags and to prevent and mitigate the effect of identity theft, (3) report to Bank on such policies and procedures on a regular basis, and (4) otherwise assist Bank in complying with the provisions of § 605A of the Fair Credit Reporting Act, 15 U.S.C. § 1681c-1, and applicable implementing regulations; (ii) identify a program administrator responsible for the Red Flags Policy; (iii) conduct annual training regarding the Red Flags Policy; and (iv) provide a written report regarding the Red Flags Policy no less frequently than annually, by the date designated by the Bank, which report shall (1) address material matters related to the program, (2) evaluate issues such as the effectiveness of the Red Flags Policy in addressing the risk of identity theft in connection with the opening of covered accounts and with respect to existing covered accounts, (3) identify service provider arrangements, (4) identify significant incidents involving identity theft and management’s response, and (5) provide recommendations for material changes to the Red Flags Policy; |

| (j) | develop and implement a compliance management system (“CMS”) to provide an internal control process for the business functions and processes directed towards Applicants and Borrowers, the elements of which CMS shall include (i) an overall policy statement governing the CMS, (ii) specific procedures for approvals of additions or changes to the CMS, including a description of items subject to the CMS, a process for internal review and approval by Company and its legal counsel, and a process for internal review and approval by Bank and its legal counsel, and (iii) documentation of Company’s testing process, including testing/review of Company’s website and user acceptance testing (UAT); the scope of the CMS shall include, at a minimum, the Consumer Finance Materials, all policy changes, new products, advertisements, press releases, and the website(s) used in connection with the Program; |

| (k) | maintain a compliance training program for its officers, directors, employees, and agents that is acceptable to Bank; as part of the program, Company shall, subject in each case to the approval of Bank, (i) identify applicable Company officers, directors, employees, and agents and assign appropriate training courses to each and (ii) determine a schedule of each training course and when each applicable officer, director, employee, and agent shall take each such course; Company shall provide reports to Bank regarding the compliance training program on a quarterly basis or, if requested by Bank, more frequently; |

| (l) | designate a dedicated compliance officer for purposes of the Program, acceptable to Bank, who shall oversee reviews of Company’s compliance with laws and regulations that may be applicable, including, to the extent applicable, the Fair Credit Reporting Act, the Equal Credit Opportunity Act, the Fair Debt Collection Practices Act, the Truth-in-Lending Act and Regulation Z, the Federal Trade Commission (FTC) Act, the Consumer Financial Protection Act, and laws prohibiting unfair, deceptive, or abusive acts or practices; and, in the event of the termination of the employment of the compliance officer, promptly employ a replacement compliance officer acceptable to Bank; |

| -22- |

| (m) | cooperate with and bear the expenses of a compliance audit of the Program on an annual basis (including the model governance of Company’s proprietary credit model(s)), and such other audits as may be requested by Bank from time to time in its reasonable discretion, in each case to be conducted by a third-party audit firm that is selected by and reports to Bank; the scope of each audit shall be determined by Bank (considering in good faith input received by Company); Bank shall receive all draft and final reports of the audit firm and shall be included in any meetings or correspondence related to the audit; the auditor shall deliver the final audit report to Bank, and Bank shall provide a copy of the report to Company; Company may not share a copy of the report with any third party without the advance written consent of Bank; |

| (n) | provide to Bank, on an annual basis in writing, a report by the compliance officer of the results of all audits and reviews of the Program, and significant issues to be addressed (if any), as well as Company’s resolutions of such issues (if applicable); and |

| Company will provide to Bank a certification letter, each quarter, that it is complying with its obligations under this section. Bank will comply with any reporting requirements of the Utah Department of Financial Institutions or the FDIC applicable to Bank’s performance of this Agreement. The terms of subsections (b), (f) and (g) of this section 30 shall survive the expiration or earlier termination of this Agreement. |

| 31. | Prohibition on Tie-In Fees. Company shall not directly or indirectly impose or collect any fees, charges or remuneration relating to the processing or approval of an Application, the establishment of a Loan, or the disbursement of Loan Proceeds, unless such fee, charge or remuneration is set forth in the Consumer Finance Materials or approved by Bank. |

| 32. | Notice of Consumer Complaints and Regulatory Inquiries. |