Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - UCP, Inc. | exhibit231201610-k.htm |

| EX-32.2 - EXHIBIT 32.2 - UCP, Inc. | exhibit322201610-k.htm |

| EX-32.1 - EXHIBIT 32.1 - UCP, Inc. | exhibit321201610-k.htm |

| EX-31.2 - EXHIBIT 31.2 - UCP, Inc. | exhibit312201610-k.htm |

| EX-31.1 - EXHIBIT 31.1 - UCP, Inc. | exhibit311201610-k.htm |

| EX-21.1 - EXHIBIT 21.1 - UCP, Inc. | exhibit211201610-k.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 10-K

SANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED December 31, 2016

OR

£TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 001-36001

UCP, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Delaware (State or other jurisdiction of incorporation) | 90-0978085 (IRS Employer Identification No.) |

99 Almaden Boulevard, Suite 400, San Jose, CA 95113

(Address of principal executive offices, including zip code)

(408) 207-9499

Registrant’s telephone number, including area code

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange On Which Registered |

Class A Common Stock, Par Value $0.01 | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act.

Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

Large accelerated filer Yes ¨ | Accelerated filer ý | Non-accelerated filer ¨ | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12-b of the Act). Yes ¨ No ý

At June 30, 2016, the aggregate market value of shares of the registrant’s Class A common stock held by non-affiliates of the registrant (based upon the closing sale price of such shares on the New York Stock Exchange on June 30, 2016) was $59.8 million, which excludes shares of Class A common stock held in treasury and shares held by executive officers, directors, and stockholders whose ownership exceeds 10% of the registrant’s Class A common stock outstanding at June 30, 2016. This calculation does not reflect a determination that such persons are deemed to be affiliates for any other purposes.

On March 1, 2017, the registrant had 7,958,314 shares of Class A common stock, $0.01 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Definitive Proxy Statement for our 2017 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K. We expect to file our Proxy Statement within 120 days after December 31, 2016.

1

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

Page No. | ||

PART I | ||

PART II | ||

PART III | ||

PART IV | ||

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We have made forward-looking statements in this Annual Report on Form 10-K that are subject to risks, uncertainties and assumptions. All statements other than statements of historical fact included in this report are forward-looking statements. You can identify forward-looking statements by the fact that they do not relate strictly to historical facts. These statements may include words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue,” the negative of these terms and other comparable terminology. These forward-looking statements may include projections of our future financial or operating performance, our anticipated growth strategies, anticipated trends in our business and other future events or circumstances. These statements are only predictions based on our current expectations and projections about future events.

Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods which may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

• | economic changes either nationally or in the markets in which we operate, including declines in employment, volatility of mortgage interest rates, consumer sentiment and inflation; |

• | downturns in the homebuilding industry, either nationally or in the markets in which we operate; |

• | continued volatility and uncertainty in the credit markets and broader financial markets; |

• | our business operations; |

• | changes in our business and investment strategy; |

• | availability of land to acquire and our ability to acquire such land on favorable terms or at all; |

• | availability, terms and deployment of capital, including our ability to access debt financing on reasonable terms; |

• | disruptions in the availability of mortgage financing or increases in the number of foreclosures in our markets; |

• | shortages of or increased prices for labor, land or raw materials used in housing construction; |

• | delays or restrictions in land development or home construction resulting from adverse weather and geological conditions or other events outside our control; |

• | reduced consumer demand; |

• | the cost and availability of insurance and surety bonds; |

• | changes in, or the failure or inability to comply with, governmental laws and regulations; |

• | the timing of receipt of regulatory approvals and the opening of communities; |

• | the degree and nature of our competition; |

• | our leverage and debt service obligations; |

• | our future operating expenses, which may increase disproportionately to our revenue; |

• | our ability to achieve operational efficiencies with future revenue growth; |

• | our relationship, and actual and potential conflicts of interest, with PICO; and |

• | availability of qualified personnel and our ability to retain our key personnel. |

You are cautioned not to place undue reliance on forward-looking statements. While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance, and our actual results could differ materially from those expressed in any forward-looking statement. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes, except as required by law. For a further discussion of these and other factors, see Item 1A, "Risk Factors" in this Annual Report on Form 10-K. In light of these risks and uncertainties, the forward-looking events discussed in this report might not occur.

3

PART I

ITEM 1. BUSINESS

As used in this Annual Report on Form 10-K, unless the context otherwise requires or indicates, references to “the Company,” “we,” “us,” “our” and “UCP” refer (1) prior to the July 23, 2013 completion of the initial public offering of Class A common stock, par value $0.01 per share (“Class A common stock”) of UCP, Inc. (the “IPO”) and related transactions, to UCP, LLC and its consolidated subsidiaries and (2) after our IPO and related transactions, to UCP, Inc. and its consolidated subsidiaries including UCP, LLC.

OUR COMPANY

The Company is a homebuilder and land developer with expertise in residential land acquisition, development and entitlement, as well as home design, construction and sales. We operate in the states of California, Washington, North Carolina, South Carolina and Tennessee. We design, construct and sell high quality single-family homes through Benchmark Communities, LLC (“Benchmark Communities”), our wholly owned homebuilding subsidiary. Prior to completion of our IPO, we operated as a wholly owned subsidiary of PICO Holdings, Inc. ("PICO"), a NASDAQ-listed, diversified holding company. Subsequent to our IPO, PICO holds a majority of the voting power of UCP, Inc. and of the economic interests of UCP, LLC, the subsidiary through which we operate our business under the name UCP.

Company’s History

The Company’s operations began in 2004 and principally focused on acquiring land, and entitling and developing it for residential construction, and selling residential lots to third-party homebuilders. | Company’s assets were acquired by PICO in January 2008, which allowed the Company to accelerate the development of its business and gain access to a capital partner capable of funding its growth. | Formed Benchmark Communities, LLC, its wholly-owned homebuilding subsidiary, to design, construct and sell high quality single-family homes. | The Company completed its IPO on July 23, 2013 and purchased a 42.3% economic interest in UCP, LLC with the net proceeds. | Completed the acquisition of the assets and liabilities of Citizens Homes, Inc. ("Citizens Acquisition") on April 10, 2014 to expand its operations for the purchase of real estate and the construction and marketing of residential homes in the Southeast. | Construction management services acquired as part of the Citizens Acquisition was sold in the fourth quarter of 2015. | Benchmark Communities reached a milestone of 2,000 new home deliveries since its parent company, UCP, went public in 2013, with over 1,000 occurring since the beginning of 2015. | ||||||

OUR BUSINESS STRATEGY

We actively source, evaluate and acquire land for residential real estate development and homebuilding. For each of our real estate assets, we periodically analyze ways to maximize value by either (i) building single-family homes and marketing them for sale under our Benchmark Communities brand or (ii) completing entitlement work and horizontal infrastructure development and selling lots to third-party homebuilders. We perform this analysis using a disciplined analytical process, which we believe is a differentiating component of our business strategy.

We believe that our sizable inventory of well-located land provides us with a significant opportunity to develop communities and design, construct and sell homes under our Benchmark Communities brand. While we expect to opportunistically sell select residential lots to third-party homebuilders when we believe it will maximize our returns or lower our risk, we expect that homebuilding and home sales will constitute our primary means of generating revenue growth for the foreseeable future.

4

When acquiring real estate assets, we focus on seeking maximum long-term risk-adjusted returns. Our underwriting and operating philosophies emphasize capital preservation, risk identification and mitigation, and risk-adjusted returns.

We seek to mitigate our exposure to market downturns and capitalize on market upturns through the following key strategies:

• | identifying and regularly reviewing the risks associated with our assets and business, including market, entitlement and environmental risks, and structuring transactions designed to reduce the impact of those risks; |

• | maintaining high quality in our construction activities; |

• | maintaining a strong balance sheet, using a prudent amount of leverage; |

• | leveraging our purchasing power and controlling costs; |

• | attracting highly experienced professionals and encouraging them to maintain a deep understanding and ownership of their respective disciplines; |

• | maintaining a strong corporate culture that is based on our core values including integrity, honesty, transparency, innovation, quality and excellence; and |

• | maintaining rigorous supervision over our operations. |

SEGMENTS AND GEOGRAPHIC MARKETS

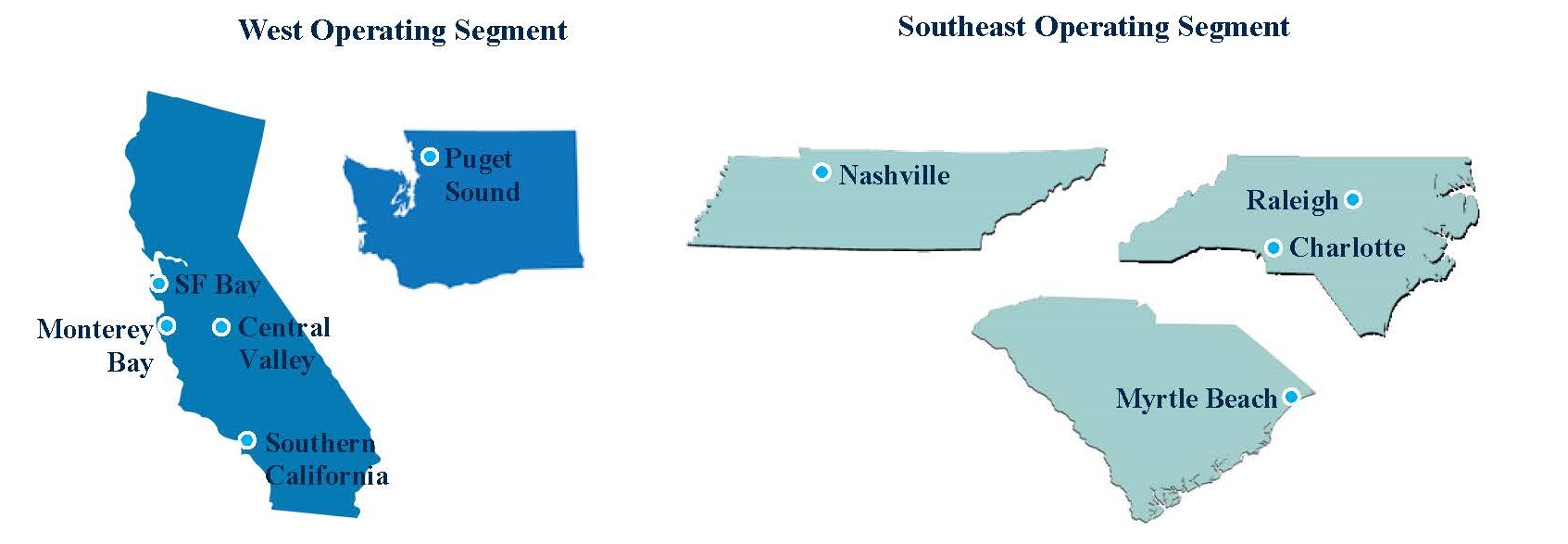

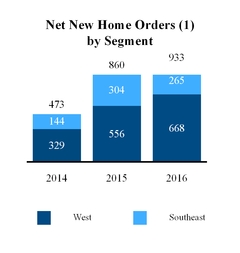

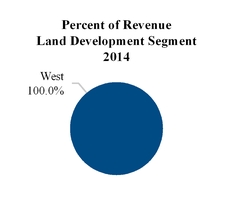

The Company has segmented its operating activities into two geographical regions and currently has homebuilding reportable segments and land development reportable segments in the West and Southeast.

In California, we primarily operate in the Central Valley area (Fresno and Madera counties), the Monterey Bay area (Monterey County), the South San Francisco Bay area (Santa Clara and San Benito counties) and in Southern California (Los Angeles, Ventura and Kern counties). In Washington State, we operate in the Puget Sound area (King, Snohomish, Thurston and Kitsap counties). In North Carolina, we operate in the Charlotte and Raleigh areas (Mecklenburg, Iredell, Union, Chatham counties). In South Carolina, we operate in the Myrtle Beach area (Horry County). In Tennessee, we operate in the Nashville area (Davidson, Rutherford, Wilson and Sumner counties).

We believe that these markets have attractive residential real estate investment characteristics, such as favorable long-term population demographics, consumer demand for single-family housing that often exceeds available supply, large and growing employment bases, and the ability to generate above-average investment returns. We continue to experience significant homebuilding and land development opportunities in our current markets and are evaluating potential expansion opportunities in other markets that we believe have attractive long-term investment characteristics.

For a more detailed description of and financial information about our segments, see Note 12, "Segment Information" to our consolidated financial statements included elsewhere in this Annual Report on Form 10-K.

5

HOMEBUILDING OPERATIONS

We build homes through our wholly owned homebuilding subsidiary, Benchmark Communities, LLC. Benchmark Communities operates under the principle that “Everything Matters!” This principle underlies all phases of our new home sale and construction process including planning, design, construction, marketing, sales and the customer experience. We are diversified by product offering, which we believe reduces our exposure to any particular market or customer segment. We decide to target specific and identifiable buyer segments by project and geographic market, in part dictated by each particular asset, its location, topography and competitive market positioning, and the amenities of the surrounding area and the community in which it is located.

We believe our customers look for distinctive new homes; accordingly, we design homes in thoughtful and creative ways to create homes that we expect buyers will find highly desirable. We seek to accomplish this by collecting and analyzing information about the characteristics of our target buyer segments and incorporating our analysis into new home designs. We source information about our target buyer segments from our experience selling new homes and through market research that enables us to identify design preferences that we believe will appeal to our customers. We target diverse buyer segments, including first-time buyers, first-time move-up buyers, second-time move-up buyers and active-adult buyers. Most of our communities target multiple buyer segments, enabling us to seek increased sales pace and reduce our dependence on any single buyer segment.

We contract with third party architects, engineers and interior designers to assist our experienced internal product development personnel in designing homes that are intended to reflect our target customers’ tastes and preferences. In addition to identifying desirable design and amenities, this process includes a rigorous value engineering strategy that allows us to seek efficiencies in the construction process.

Customer Experience

We seek to make the home buying experience friendly, effective and efficient. Our integrated quality assurance and customer care functions assign the same personnel at each community the responsibility for monitoring quality control and managing the customer experience. As a standard practice, we seek to communicate with each homeowner multiple times during their first two years of ownership in an effort to ensure satisfaction with their new home. Additionally, we monitor the effectiveness of our customer experience efforts with third-party surveys that measure our home buyers’ perception of the quality of our homes and the responsiveness of our customer service. Our customer experience program seeks to optimize customer care in terms of availability, response time and effectiveness, and we believe that it reduces our exposure to future liability claims. We believe that our continuing commitment to quality and the customer experience provides a compelling value proposition for prospective home buyers and reduces our exposure to long-term construction defect claims.

Homebuilding, Marketing and Sales Process

We realize homebuilding is a local business. As a result, we focus on the unique characteristics of each market and submarket. Each of our markets is managed locally by a division president who has a deep understanding of the local market, including our competition. Additionally, our division presidents maintain a broad network of relationships with land sellers, land developers, subcontractors and realtors.

In order to balance construction capacity with consumer demand, we release homes for sale in small phases, usually four to eight homes. We use sales prices as the lever to maintain equilibrium between capacity and demand. In markets where demand is outpacing construction capacity we have been able to raise prices and improve gross margins. From time to time we may identify, specific communities where demand has lagged construction capacity. In these cases, we have used incentives in order to increase demand.

We utilize a construction methodology that allows us to standardize the time of new home starts in order to reduce labor and material costs and the administrative inefficiencies in the construction process. Our even flow method provides visibility to our material suppliers, vendors and subcontractors, helping them balance their labor and material needs consistently over time, which we believe results in higher-quality craftsmanship and lower production costs. Our even flow method provides us with enhanced visibility, oversight and control of our production process, staffing and cash flow requirements. As a result, we believe that we are able to more effectively manage our working capital and borrowing needs.

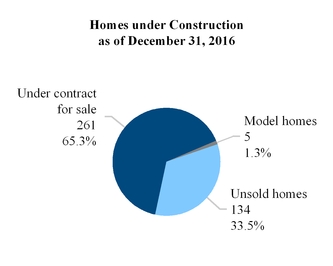

Generally, we seek to pre-sell homes before we commence construction. This allows customers to choose certain structural and finish options and often offers us higher profitability as compared to homes that are constructed prior to identifying a buyer. Pre-sold homes often result in superior customer satisfaction and higher gross margins. During periods of strong demand, we have been successful in pre-selling a majority of our homes before construction begins. Given our even flow method, when there is an

6

opportunity to start construction of a home that is not yet sold we will do so in order to have homes available for customers who would like to move into a new home quickly. Homes that are under construction or completed that are not yet sold are attractive to customers who are renting, who are relocating, and who have had or are having a major change in their lives such as marriage, birth of a child or divorce. Homes that are unsold and under construction or completed allow us to compete more aggressively with the resale market where time from contract to close is usually 45 to 60 days.

We routinely monitor and actively manage our even flow production process to align our inventory with prevailing and expected future home absorption trends. In the even our inventory begins to build faster than homes are sold, we will typically reduce or halt the start of any additional unsold homes in order to bring our supply in balance with consumer demand. This allows us to more efficiently manage our inventory and asset levels as well as our capital needs with the objective of improving our overall return metrics.

Our sales and marketing process uses extensive advertising and promotional strategies, including Benchmark Communities’ website, community marketing brochures, and the use of billboards and other roadside signage. Brokerage operations are conducted through our wholly owned subsidiaries in each state, as follows: (1) BMC Realty Advisors, Inc. in California and Washington; (2) Builders BMC, Inc. in North Carolina; (3) BMCH Tennessee, LLC in Tennessee; and (4) Benchmark Communities, LLC in South Carolina.

We typically staff two sales professionals at each of our communities. Our in-house sales teams have offices in their respective model home complex and are responsible for selling homes, interfacing with customers between the time a sales contract is executed and the home sale closes, and coordinating with our escrow management department. Our sales professionals work with potential buyers to determine their unique needs and then by demonstrating the functionality and livability of our homes with floor plans, price information, development and construction timetables, tours of model homes and the selection of amenities. Our sales professionals are internally trained, generally have prior experience selling new homes in their respective markets and are licensed by applicable real estate oversight agencies.

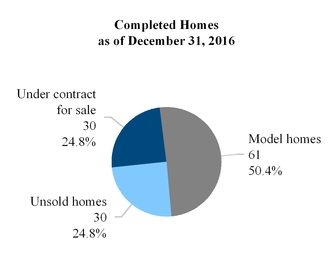

Model homes are one of our primary sales tools. Depending on the amount of time we expect it will take to complete sales at a community and the number of different homes we are offering, we typically build between two and four model homes. Our marketing staff uses interior designers, architects and color consultants to create model homes designed to appeal to our targeted buyer segments. Our models typically include features that are included in the base price of the particular home model, and options and upgrades that a home buyer may elect to purchase. We often use an on-site design center that offers our customers the opportunity to purchase various options and upgrades and provides additional revenue opportunities for us.

Home Buyer Financing

The majority of our home buyers finance a significant portion of the purchase price of their home with long-term mortgage financing. We assist prospective purchasers in obtaining mortgage financing by providing referrals to one of our preferred lenders. Our preferred lenders have a track record of offering our customers competitive rates and terms, a desire to enhance our customer's experience and the ability to perform on an agreed schedule in order to meet our expectations and those of our customers. Through our lender referral process we seek to reduce the challenges our customers encounter when trying to obtain mortgage financing for our homes.

Quality Control and Customer Service

We pay particular attention to the product design process and carefully consider quality and choice of materials in order to attempt to eliminate building deficiencies. The quality and workmanship of the subcontractors we employ are monitored and we make regular internal and third party inspections and evaluations of our subcontractors to seek to ensure that our standards are met.

We have quality control and customer service staff who seek to provide a positive experience for each home buyer throughout the pre-sale, sale, building, closing and post-closing periods. These employees are responsible for providing after sales customer service. Our quality and service initiatives include taking home buyers on a comprehensive tour of their home prior to closing and using customer survey results to improve our standards of quality and customer satisfaction.

Warranty Program

We provide a “fit and finish” warranty on our home sales that covers workmanship and materials consistent with local market custom (two years in the West homebuilding segment and one year in the Southeast homebuilding segment). As is customary in the homebuilding industry, our trade partners who build our homes are contractually obligated to provide warranty repairs inside the fit and finish warranty period, including structural and water intrusion repairs up the to the period designated by the relevant state statute.

7

Along with our homeowners receiving warranty information, they also receive important home maintenance guidelines in an effort to help them enjoy and prolong the durability of their home. Customers who actively and correctly maintain their home not only protect the value of their home, but minimize the longer-term risk to the Company that is normally associated with homes that are not properly maintained.

The limited warranty covering construction defects is transferable to subsequent buyers not under direct contract with us and requires that home buyers agree to the conditions, restrictions and procedures set forth in the warranty. We accrue estimated warranty costs based upon our estimates of the expense we expect to incur for work under warranty.

Raw Materials

When constructing homes, we use various materials and components. It has typically taken us four to six months to construct a home, during which time we are subject to price fluctuations in raw materials.

LAND DEVELOPMENT OPERATIONS

As a homebuilder and land developer, we are positioned to either build new homes on our lots or to sell our lots to third-party homebuilders. While our current business plan emphasizes building new homes, we proactively monitor market conditions and our operations allow us to opportunistically sell a portion of our lots to third-party homebuilders if we believe that will maximize our returns or lower our risk. We believe that our ability and willingness to opportunistically build on or sell our lots to third-party homebuilders afford us the following important advantages:

• | exploit periods of cyclical expansion by building on our lots; |

• | manage our operating margins and reduce operating income volatility by opportunistically selling lots as operating performance and market conditions dictate; and |

• | manage operating risk in periods where we anticipate cyclical contraction by reducing our land supply through lot sales. |

We benefit from the long-standing relationships our executive management team has with key land owners, brokers and lenders, as well as development and real estate companies in our markets. These relationships have provided us with opportunities to evaluate and privately negotiate acquisitions outside of a broader marketing process. In addition, we believe that our financial position and positive reputation in our markets provide land sellers and brokers confidence that we will consummate transactions in a highly professional, efficient and transparent manner. Our ability to regularly do so in turn strengthens these relationships for future opportunities. We believe our relationships with land owners and brokers will continue to provide opportunities to source land acquisitions prior to a full marketing process, helping us to maintain a significant pipeline of opportunities on favorable terms and prices.

The land development process in our markets can be very complex and often requires highly-experienced individuals that can respond to numerous unforeseen challenges with a high degree of competency and integrity. We actively seek land acquisition opportunities where others might seek to avoid complexities, as we believe we can add significant value through our expertise in entitlements, re-entitlements, horizontal land planning and development.

Acquisition Process

Our ability to identify, evaluate and acquire land in desirable locations and on favorable terms is critical to our success. We evaluate land opportunities based on risk-adjusted returns and employ a rigorous due diligence process to identify risks, which we then seek to mitigate.

We leverage our relationships with land owners, brokers, developers and financial institutions, and our history of purchasing land, to seek the “first look” at land acquisition opportunities or to evaluate opportunities before they are broadly marketed. We use a variety of transaction structures, including purchase and option contracts, to maximize our risk-adjusted return, with particular emphasis on reducing our risk, conserving our capital while accommodating the particular needs of each seller.

We combine our entitlement, land development and homebuilding expertise to increase the flexibility of our business, seek enhanced margins, control our lot deliveries and maximize returns. Additionally, we believe that the integration of the entitlement,

8

development and homebuilding process allows us to deliver communities that achieve a high level of customer satisfaction. Our entitlement expertise allows us to add value through the zoning and land planning process. Our land development entitlement expertise allows us to consider a broader range of land acquisition opportunities from which to seek superior risk-adjusted returns.

We selectively evaluate expansion opportunities in our existing markets as well as new markets that we believe have attractive long-term investment characteristics. These characteristics include, among others, demand for single-family housing that exceeds available supply, well regarded educational systems and institutions, high educational attainment levels, desirable transportation infrastructure, proximity to major trade corridors, positive employment trends, diverse employment bases and high barriers to the development of residential real estate, such as geographic or political factors.

OUR FINANCING STRATEGY

We intend to use debt and equity as part of our ongoing financing strategy, coupled with redeployment of cash flows from continuing operations. We intend to employ prudent levels of leverage to finance the acquisition and development of our lots and construction of our homes. We attempt to match the duration of our real estate assets with the duration of the capital that finances each asset.

Our indebtedness is primarily comprised of our 8.5% Senior Notes due 2017 (the "2017 Notes") and project-level secured acquisition, development and constructions loans. Substantially all of our project debt is guaranteed by UCP, LLC and UCP, Inc. Our board of directors considers a number of factors when evaluating our level of indebtedness and when making decisions regarding the incurrence of new indebtedness, including the purchase price of assets to be acquired with debt financing, the estimated market value of our assets, the expected asset's duration and the ability of particular assets, and our Company as a whole, to generate cash flow to cover the expected debt service. Though we intend to remain prudently capitalized, our charter does not contain a limitation on the amount of debt we may incur and our board of directors may change our target debt levels within the covenants and restrictions currently in place with our lenders at any time without the approval of our stockholders.

We intend to finance future acquisitions and developments with the most advantageous source of capital available to us at the time of the transaction, which may include a combination of common and preferred equity, secured and unsecured corporate-level debt, property-level debt and mortgage financing and other public, private or bank debt.

For a more detailed description of and financial information about our indebtedness, see Note 8, "Notes Payable and Senior Notes, Net" to our consolidated financial statements included elsewhere in this Annual Report on Form 10-K.

REGULATION AND ENVIRONMENTAL MATTERS

We are subject to various local, state, and federal statutes, ordinances, rules, and regulations concerning zoning, building design, construction, and similar matters, including local regulations which impose restrictive zoning and density requirements in order to limit the number of homes that can be built within the boundaries of a particular locality. In addition, we are subject to registration and filing requirements in connection with the construction, advertisement, and sale of our communities in certain states and localities in which we operate. We may also be subject to periodic delays or may be precluded entirely from developing communities due to building moratoriums that could be implemented in the future in the states in which we operate. Generally, such moratoriums relate to insufficient water or sewerage facilities or inadequate road capacity.

In addition, some state and local governments in markets where we operate have approved, and others may approve, slow-growth, or no-growth initiatives that could negatively affect the availability of land and building opportunities within those areas. Approval of these initiatives could adversely affect our ability to build and sell homes in the affected markets and/or could require the satisfaction of additional administrative and regulatory requirements, which could result in slowing the progress or increasing the costs of our homebuilding operations in these markets. Any such delays or costs could have a negative effect on our future revenues and earnings.

We are also subject to a variety of local, state, and federal laws and regulations concerning protection of health and the environment. The particular environmental laws which apply to any given community vary according to the community site, the site’s environmental conditions, and the present and former uses of the site. These environmental laws may result in delays, may cause us to incur substantial compliance, remediation, and/or other costs; and prohibit or severely restrict development and homebuilding activity.

9

Despite our past ability to obtain necessary permits and approvals for our communities, we anticipate that increasingly stringent requirements will be imposed on developers and homebuilders in the future. Although we cannot predict the effect of these requirements, they could result in time-consuming and expensive compliance programs and in substantial expenditures, which could cause delays and increase our cost of operations. In addition, our ability to obtain or renew permits or approvals and the continued effectiveness of permits already granted or approvals already obtained is dependent upon many factors, some of which are beyond our control, such as changes in policies, rules, and regulations and their interpretation and application.

SEASONALITY

The homebuilding industry generally exhibits seasonality. We have historically experienced, and in the future expect to continue to experience, variability in our operating results and capital needs on a quarterly basis. Although we enter into home sales contracts throughout the year, a significant portion of our sales activity takes place during the spring and summer, with the corresponding closings taking place during the fall and winter. Additionally, our capital needs are typically greater during the spring and summer when we are building homes for delivery later in the year. Accordingly, our revenue may fluctuate significantly on a quarterly basis, and we must maintain sufficient liquidity to meet short-term operating requirements. As a result of seasonal variation, our quarterly results of operations and financial position at the end of a particular quarter are not necessarily representative of the results we expect at year-end.

COMPETITION

The homebuilding and land development industry is highly competitive. We compete with numerous large national and regional homebuilding companies and with smaller local homebuilders and land developers for, among other things, home buyers, financing, desirable land parcels, raw materials and skilled management and labor resources. We also compete with sales of existing homes and, to a lesser extent, with the rental housing market. Our homes compete on the basis of design, quality, price, location and our reputation. In addition to home sales, we sell lots to third-party homebuilders. We compete for land buyers with other land owners. Our land holdings compete on the basis of quality, market positioning, location and price.

The homebuilding and land development industry has historically been subject to significant volatility. We may be at a competitive disadvantage with regard to certain of our national competitors whose operations are more geographically diversified than ours, as these competitors may be better able to withstand any future regional downturn in the housing market.

We compete directly with a number of national homebuilders who are larger than we are and may have greater financial and operational resources than we do. This may give our competitors an advantage in marketing their products, securing materials and labor at lower prices, purchasing land and allowing their homes to be delivered to customers more quickly and at more favorable prices. This competition could reduce our market share and limit our ability to expand our business.

EMPLOYEES

As of December 31, 2016, we had 203 employees consisting of 59 executive, management or administrative personnel, 96 construction personnel and 48 sales and marketing personnel. Although none of our employees are covered by collective bargaining agreements, certain of the subcontractors engaged by us are represented by labor unions or are subject to collective bargaining arrangements. We believe that we have good relations with our employees and subcontractors.

10

EXECUTIVE OFFICERS

The executive officers of UCP, Inc. are:

Name | Age | Position | ||

Dustin L. Bogue | 42 | President, Chief Executive Officer and Director | ||

James M. Pirrello | 58 | Chief Financial Officer, Chief Accounting Officer and Treasurer | ||

Dustin L. Bogue. Mr. Bogue has served as our President since 2008. Since our IPO in July of 2013, he has served as our President and Chief Executive Officer and as a member our board of directors. Mr. Bogue was involved with the formation of our predecessor, Union Community Partners, LLC in 2004 as the President and Managing Member until 2008. Mr. Bogue was instrumental in Union Community Partners, LLC’s acquisition and entitlement of several communities in Northern California. In 2008, Union Community Partners, LLC was acquired by PICO and its name was changed to UCP, LLC. Mr. Bogue was instrumental in creating our subsidiary, Benchmark Communities in 2010, with the goal of creating designing and delivering outstanding homes in communities with exceptional value and sustainability. Since Union Community Partners, LLC’s inception in 2004, Mr. Bogue has been principally responsible for developing the strategic direction of our Company and our operations. Prior to joining our Company, Mr. Bogue was the Vice President of Development and Sales at Landcastle Real Estate from 2001 to 2004. From 1999 to 2001, Mr. Bogue worked for Wellington Corporation of Northern California, a subsidiary of Triple Five National Development Company. At Wellington, Mr. Bogue was the Director of Land Acquisitions and Development, managing Wellington’s California real estate portfolio, including acquisition, disposition and development. Additionally, at Wellington, Mr. Bogue was actively involved in creating two technology start-ups; Bridgewater Ventures, an early-stage venture capital company, and Cenatek, Inc., a solid-state storage device company where Mr. Bogue served as an executive vice president.

James M. Pirrello. Mr. Pirrello serves as our Chief Financial Officer, Chief Accounting Officer and Treasurer; he has served in these roles since January 2016. Mr. Pirrello has over 30 years of homebuilding experience in both senior financial and senior operational roles, including chief operating officer, chief financial officer, and division president. Mr. Pirrello most recently served as President and Founder of American New Homes Group. Over his career he has held senior financial positions at numerous homebuilder and real estate development firms including BCB Homes, Builder Acquisition Corp., First Homebuilders of Florida, The Longford Group, and The Fortress Group and NVR. During his career, he has negotiated numerous debt and equity capital market financings, and over 20 merger and acquisition transactions. Mr. Pirrello earned MBAs, from both Columbia University and the University of California, Berkeley, along with an undergraduate degree in accounting from Juniata College.

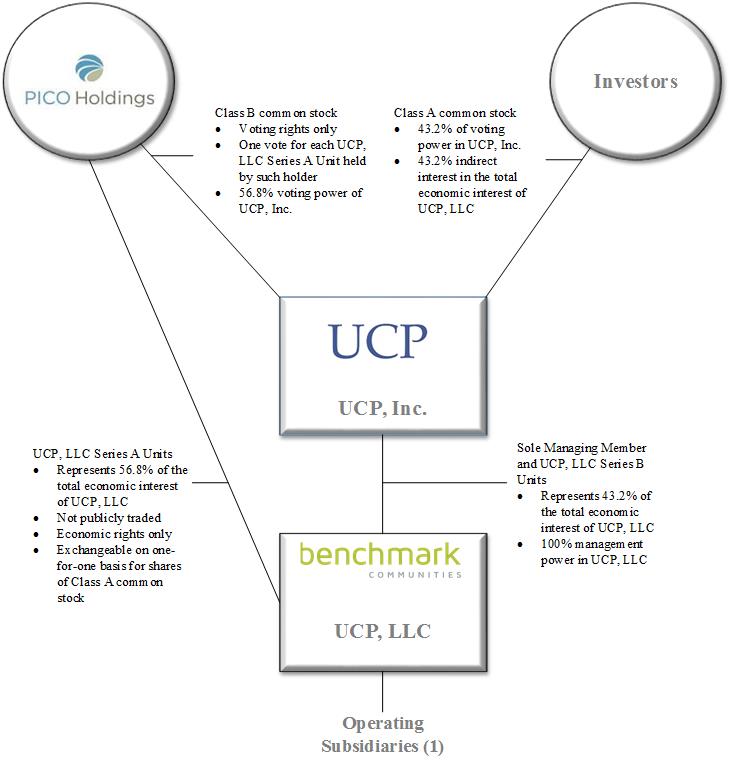

OUR STRUCTURE

The amended and restated certificate of incorporation of UCP, Inc. authorizes two classes of common stock: Class A common stock and Class B common stock, par value $0.01 per share (“Class B common stock”). Shares of Class A common stock represent 100% of the economic rights of the holders of all classes of UCP, Inc.'s common stock. Shares of Class B common stock, which are held exclusively by PICO, are not entitled to any dividends paid by, or rights upon liquidation of, UCP, Inc. PICO holds 100 shares of Class B common stock of UCP, Inc., providing PICO with no economic rights but entitling PICO, without regard to the number of shares of Class B common stock held by PICO, to one vote on matters presented to stockholders of UCP, Inc. for each UCP, LLC Series A Unit (as defined below) held by PICO. Holders of the Company’s Class A common stock and Class B common stock will vote together as a single class on all matters presented to the Company’s stockholders for their vote or approval, except as otherwise required by applicable law. As of December 31, 2016, PICO held 10,593,000 UCP, LLC Series A Units and 100 shares of Class B common stock, which provided PICO with 56.8% of the aggregate voting power of UCP, Inc.'s outstanding Class A common stock and Class B common stock, which equals PICO’s economic interest in the Company. PICO effectively has control over the outcome of votes on all matters requiring approval by the Company’s stockholders. As described in more detail below, each Series A Unit of UCP, LLC can be exchanged for one share of Class A common stock.

The Company's charter provides that its board of directors has the authority, without action by the stockholders, to designate and issue up to 50,000,000 shares of preferred stock in one or more classes or series and to fix for each class or series the powers, rights, preferences and privileges of each series of preferred stock, including dividend rights, conversion rights, voting rights, terms of redemption, liquidation preferences and the number of shares constituting any class or series, which may be greater than the rights of the holders of the Class A common stock or Class B common stock.

11

As of December 31, 2016, UCP, Inc. held a 43.2% interest in UCP, LLC, through its ownership of UCP, LLC Series B Units (as defined below), and PICO held the remaining 56.8% interest in UCP, LLC through its ownership of UCP, LLC Series A Units. UCP, Inc. is a holding company, and its sole material asset is its equity interest in UCP, LLC.

In connection with the IPO, UCP, LLC's Amended and Restated Limited Liability Company Operating Agreement (the "Operating Agreement") was amended and restated to, among other things, designate UCP, Inc. as the sole managing member of UCP, LLC and establish a new series of units (“UCP, LLC Series B Units”), which are held solely by UCP, Inc., and reclassify PICO's units into 10,593,000 UCP, LLC Series A Units (the “UCP, LLC Series A Units”), which are held solely by PICO (and its permitted transferees). UCP, Inc. purchased 7,750,000 UCP, LLC Series B Units through its investment in UCP, LLC with the net proceeds from the IPO. The UCP, LLC Series B Units rank on parity with the UCP, LLC Series A Units as to distribution rights and rights upon liquidation, winding up or dissolution. Subsequent to the IPO and related transactions, as the sole managing member of UCP, LLC, UCP, Inc. operates and controls all of the business and affairs and consolidates the financial results of UCP, LLC and its subsidiaries.

Tax Distribution

Pursuant to the Operating Agreement, UCP, Inc. has the right to determine when distributions (other than tax distributions) will be made to the members of UCP, LLC and the amount of any such distributions. If UCP, Inc. authorizes a distribution, such distribution generally will be made to the members of UCP, LLC pro rata in accordance with their respective percentage interests. During the years ended December 31, 2016 and December 31, 2015, UCP, LLC made distributions of $4.8 million and $1.0 million, respectively, to PICO toward its tax liability as required by the Operating Agreement and a pro rata distribution of $3.7 million and $0.7 million, respectively, to UCP, Inc. There were no other distributions by UCP, LLC for the year ended December 31, 2016.

The holders of limited liability company interests in UCP, LLC, including UCP, Inc., generally have to include for purposes of calculating their U.S. federal, state and local income taxes their allocable share of any taxable income of UCP, LLC. In general, taxable income of UCP, LLC will be allocated to PICO and UCP, Inc. on a pro rata basis in accordance with their respective percentage interests. However, as a result of certain taxable “built-in gains” in the assets of UCP, LLC that existed at the time of the IPO which, by statute, must be allocated solely to PICO, UCP, Inc. is expected at times to be allocated a disproportionately smaller amount of net taxable income and PICO is expected to be allocated a disproportionately larger amount of net taxable income. UCP, LLC is obligated, subject to available cash, applicable law and contractual restrictions (including limitations imposed by any financing agreements), to make cash distributions, which we refer to as “tax distributions,” based on certain assumptions (including a combined federal, state and local tax rate of 41% (or such other rate determined by UCP, Inc. to be the highest marginal effective rate of federal, state and local income tax applicable to corporations doing business in California or such other jurisdiction in which UCP, LLC is doing business)), to its members (including UCP, Inc.). Generally, these tax distributions will be pro rata in accordance with the respective percentage interests of PICO and UCP, Inc. and will be in an amount sufficient to allow PICO and UCP, Inc. to pay taxes on their allocable shares of the taxable income of UCP, LLC. If, however, there is insufficient cash to make pro rata tax distributions to PICO and UCP, Inc. in an amount that would allow PICO and UCP, Inc. to pay taxes on their allocable shares of the taxable income of UCP, LLC, PICO and UCP, Inc. would receive distributions in proportion to their respective tax liabilities based upon their allocable shares of UCP, LLC’s taxable income. It is expected in that case that PICO would receive a larger proportional distribution than UCP, Inc. would receive and, in some cases (for instance if all of the taxable income is allocable to PICO), UCP, Inc. could receive no tax distributions. In any case in which UCP, Inc. received a smaller proportional distribution than PICO, UCP, LLC would have an obligation to make future distributions to UCP, Inc. to eliminate the difference as soon as funds become available and UCP, LLC would be required to pay interest to UCP, Inc. at a prevailing market rate on such difference.

As a result of the potential differences in the amount of net taxable income allocable to UCP, Inc. and to PICO described above, it is expected that UCP, Inc. will receive tax distributions significantly in excess of UCP, Inc.’s tax liabilities and obligations to make payments under the tax receivable agreement (as described below). To the extent, as currently expected, UCP, Inc. does not distribute such cash balances as dividends on its Class A common stock and instead, for example, holds such cash balances or lends them to UCP, LLC, PICO would benefit from any value attributable to such accumulated cash balances as a result of its ownership of our Class A common stock following an exchange of its UCP, LLC Series A Units (including any exchange upon an acquisition of UCP, Inc.).

On June 6, 2016, our Board of Directors authorized the repurchase of up to $5.0 million of the Company’s Class A common stock between June 7, 2016 and June 1, 2018 (the “Stock Repurchase Program”). As part of the Company's Stock Repurchase Program, the Company used $1.2 million of cash received through these tax distributions to repurchase stock. See Note 2, "Summary of Significant Accounting Policies--Stock Repurchase Program" and Note 10, “Equity--Stock Repurchase Program” to the consolidated financial statements included elsewhere in this Annual Report on Form 10-K for additional information regarding the Stock Repurchase Program.

12

The diagram below depicts our organizational structure as of December 31, 2016:

(1) | We carry out our business generally through a number of operating subsidiaries and project-specific subsidiaries that are directly or indirectly wholly owned by UCP, LLC. Benchmark Communities, LLC, a Delaware limited liability company, is our wholly owned general contractor subsidiary in all states except North Carolina. Benchmark Builders North Carolina, LLC, a Delaware limited liability company, is our wholly owned general contractor subsidiary in North Carolina. BMC Realty Advisors, Inc., a California corporation, is our wholly-owned subsidiary through which we conduct real estate brokerage activities relating to our business in California and Washington. Builders BMC, Inc., a Delaware corporation, is our wholly-owned subsidiary through which we conduct real estate brokerage activities relating to our business in North Carolina. BMCH Tennessee, LLC, a Delaware limited liability company, is our wholly-owned subsidiary through which we conduct real estate brokerage activities relating to our business in Tennessee. Benchmark Communities, LLC, a Delaware limited liability company, is our wholly-owned subsidiary through which we conduct real estate brokerage activities relating to our business in South Carolina. |

13

Exchange Agreement

In connection with the IPO, UCP, Inc. entered into an Exchange Agreement dated July 23, 2013 by and among UCP, Inc., UCP, LLC and PICO (the "Exchange Agreement"), pursuant to which PICO (and its permitted transferees) have the right to cause UCP, Inc. to exchange PICO's UCP, LLC Series A Units for shares of UCP, Inc. Class A common stock on a one-for-one basis, subject to equitable adjustments for stock splits, stock dividends, stock repurchases and reclassifications. As of December 31, 2016, giving effect to the Class A common stock that the Company would issue if PICO were to elect to exchange all of its UCP, LLC Series A Units for shares of Class A common stock, the Company would have 18,635,834 shares of Class A common stock outstanding. Any UCP, LLC Series A Units being exchanged will be reclassified as UCP, LLC Series B Units in connection with such exchange.

Exchanges by PICO of its UCP, LLC Series A Units for shares of UCP, Inc. Class A common stock are expected to result, with respect to UCP, Inc., in increases in the tax basis of the assets of UCP, LLC that otherwise would not have been available. These increases in tax basis may reduce the amount of tax that UCP, Inc. would otherwise be required to pay in the future. These increases in tax basis may also decrease gains (or increase losses) on future dispositions of certain assets to the extent tax basis is allocated to those assets.

Tax Receivable Agreement

UCP, Inc., UCP, LLC and PICO are party to a Tax Receivable Agreement dated July 23, 2013 (the "TRA"). When PICO sells or exchanges its UCP, LLC Series A Units for shares of the Company’s Class A common stock, such a sale or exchange by PICO would result in an adjustment to the tax basis of the assets owned by UCP, LLC at the time of an exchange. An increase in tax basis is expected to increase the Company's depreciation and amortization income tax deductions and create other tax benefits and therefore may reduce the amount of income tax that the Company would otherwise be required to pay in the future. Under the TRA, the Company generally is required to pay to PICO 85% of the applicable cash savings in U.S. federal and state income tax that the Company actually realizes (or is deemed to realize in certain circumstances) as a result of sales or exchanges of the UCP, LLC Series A Units held by PICO for shares of Class A common stock, leaving the Company with 15% of the benefits of the tax savings. Cash savings in income tax will be computed by comparing the Company’s actual income tax liability to the amount of income taxes that the Company would have been required to pay had there been no increase in the tax basis of the tangible and intangible assets of UCP, LLC as a result of the exchanges. If the Company would not have reported taxable income in a given year had there been no increase in the tax basis of assets as a result of the exchanges, no payment under the TRA for that taxable year is required because no tax savings will have been realized.

As of December 31, 2016, PICO has not exchanged any of its UCP, LLC Series A Units. Estimating the amount of future payments to be made under the TRA cannot be done reliably at this time because any increase in tax basis, as well as the amount and timing of any payments, will vary depending on a number of factors, including:

• | the timing of any exchanges of UCP, LLC Series A Units for shares of the Company’s Class A common stock by PICO, as the increase in any tax deductions will vary depending on the allocation of fair market value to the assets of UCP, LLC at the time of any such exchanges, and this value allocation may fluctuate over time; |

• | the price of the Company’s Class A common stock at the time of any exchanges of UCP, LLC Series A Units for shares of the Company’s Class A common stock (since the increase in the Company’s share of the basis in the assets of UCP, LLC, as well as the corresponding increase in any tax deductions, will be related to the price of the Company’s Class A common stock at the time of any such exchanges); |

• | the tax rates in effect at the time the Company uses the increased amortization and depreciation deductions or realize other tax benefits; and |

• | the amount, character and timing of the Company’s taxable income. |

The effects of the TRA on the Company’s consolidated balance sheet if PICO elects to exchange all or a portion of its UCP, LLC Series A Units for the Company’s Class A common stock are expected to be as follows:

• | an increase in deferred tax assets for the estimated income tax effects of the increase in the tax basis of the assets owned by UCP, LLC based on enacted federal, state and local income tax rates at the date of the relevant transaction. To the extent the Company believes that it is more likely than not that the Company will not realize the full tax benefit represented by the deferred tax asset, the Company will reduce the deferred tax asset with a valuation allowance; |

• | the Company may record 85% of the applicable cash tax savings in U.S. federal and state income taxes resulting from the increase in the tax basis of the UCP, LLC Series A Units and certain other tax benefits related to entering into the TRA, including tax benefits attributable to payments under the TRA as an increase in a payable due to PICO; and |

14

• | an increase to additional paid-in capital equal to the difference between the increase in deferred tax assets and the increase in the liability due to PICO. |

The Company has the right to terminate the TRA at any time. In addition, the TRA will terminate early if the Company breaches obligations under the TRA or upon certain mergers, asset sales, other forms of business combinations or other changes of control. In either case, the Company’s payment obligations under the TRA would be accelerated and would become due and payable based on certain assumptions, including that (a) all the UCP, LLC Series A Units are deemed exchanged for their fair value, (b) the Company would have sufficient taxable income to fully utilize the deductions arising from the increased tax deductions and tax basis and (c) the subsidiaries of UCP, LLC will sell certain non-amortizable assets (and realize certain related tax benefits) no later than a specified date. In each of these instances, the Company would be required to make an immediate payment to PICO equal to the present value of the anticipated future tax benefits (discounted over the applicable amortization and depreciation periods for the assets the tax bases of which are stepped up (which could be as long as fifteen years in respect of intangibles and goodwill) at a discount rate equal to the 30-day London Interbank Offered Rate ("LIBOR") plus 100 basis points). The benefits would be payable even though, in certain circumstances, no UCP, LLC Series A Units are actually exchanged at the time of the accelerated payment under the TRA, thereby resulting in no corresponding tax basis step up at the time of such accelerated payment under the TRA.

Investor Rights Agreement and Transition Services Agreement

Pursuant to an Investor Rights Agreement dated July 23, 2013 (the "Investor Rights Agreement"), PICO has the right to nominate two individuals for election to UCP, Inc.'s board of directors for as long as PICO owns 25% or more of the combined voting power of UCP, Inc.'s outstanding Class A and Class B common stock and one individual for as long as it owns at least 10% (in each case, excluding shares of any of UCP, Inc.'s common stock that are subject to issuance upon the exercise or exchange of rights of conversion or any options, warrants or other rights to acquire shares). However, the Investor Rights Agreement does not entitle PICO to nominate individuals for election to UCP, Inc.'s board of directors if their election would result in PICO nominees comprising more than two of UCP, Inc.'s directors (for as long as PICO owns 25% or more of the combined voting power of UCP, Inc.'s outstanding Class A and Class B common stock) or one of UCP, Inc.'s directors (for as long as PICO owns at least 10% of the combined voting power of UCP, Inc.'s outstanding Class A and Class B common stock).

UCP also entered into a Transition Services Agreement ("TSA"), dated July 23, 2013 with PICO, pursuant to which PICO provided UCP, Inc. with certain accounting, human resources and information technology services. This agreement was completed on July 31, 2015, and PICO no longer provides such services to UCP, Inc.

CORPORATE INFORMATION

Our principal executive offices are located at 99 Almaden Boulevard, Suite 400, San Jose, California 95113. Our telephone number is (408) 207-9499. Our website is located at www.unioncommunityllc.com. Our homebuilding subsidiary, Benchmark Communities, also maintains an Internet website at www.benchmarkcommunities.com. The information that is found on or accessible through our websites is not incorporated into, and does not form a part of this Annual Report on Form 10-K or any other report or document that we file with or furnish to the Securities and Exchange Commission (the "SEC"). We have included our website addresses in this Annual Report on Form 10-K as an inactive textual reference and do not intend it to be an active link to our websites.

We make available on our website, free of charge, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934, as amended (the "Exchange Act") as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. We also make our Code of Business Conduct and Ethics for our directors, officers and employees available on our website on the Corporate Governance page under the Investor Relations section of our website.

This Annual Report on Form 10-K and other reports filed with the SEC can be read or copied at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC; the website address is www.sec.gov.

15

ITEM 1A. RISK FACTORS

Set forth below are the risks that we believe are material to our investors. You should carefully consider the following risks and the other matters in this Annual Report on Form 10-K in evaluating our business and prospects. The occurrence of any of the following risks could materially adversely impact our financial condition, results of operations, cash flow, liquidity, the market price of our Class A common stock and our ability to achieve our objectives, which in turn could cause our stockholders to lose all or part of their investment. Some statements in this report, including statements in the following risk factors constitute forward-looking statements. Please refer to the section entitled “Special Note about Forward-Looking Statements” elsewhere in this Annual Report on Form 10-K.

RISKS RELATED TO OUR BUSINESS

Our long-term growth depends, in part, upon our ability to successfully identify and acquire desirable land parcels for residential buildout, which may be limited due to a variety of factors.

Our future growth depends, in part, upon our ability to successfully identify and acquire attractive land parcels in geographic areas in which we operate for development of single-family homes at reasonable prices, either by ourselves, through Benchmark Communities, or by our third-party homebuilder customers. Our ability to acquire land parcels for new single-family homes may be adversely affected by changes in the general availability of land parcels, the willingness of land sellers to sell land parcels at reasonable prices, competition for available land parcels, availability of financing to acquire land parcels, zoning and other market conditions. If the supply of land parcels appropriate for development of single-family homes is limited because of these factors, or for any other reason, our ability to grow could be significantly limited, and our revenue and gross margin could decline. To the extent that we are unable to purchase land parcels or enter into new contracts or options for the purchase of land parcels at reasonable prices, our revenue and results of operations could be negatively impacted.

Our industry is cyclical and adverse changes in general and local economic conditions could reduce the demand for homes and, as a result, could have a material adverse effect on us.

The residential homebuilding industry is cyclical and is highly sensitive to changes in general economic conditions, such as levels of employment, consumer sentiment and income, availability and cost of financing for acquisitions, construction and mortgages, interest rate levels, inflation and demand for housing. The health of the residential homebuilding industry may also be significantly affected by “shadow inventory” levels during recessionary and recovery periods.

“Shadow inventory” refers to the number of homes with mortgages that are in some form of distress but that have not yet been listed for sale. Shadow inventory can occur when lenders put properties that have been foreclosed or forfeited to lenders or available for short sale (i.e. potentially available for sale for an amount that is less than the unpaid principal balance on a related mortgage loan) on the market gradually, rather than all at once, or delay the foreclosure process. A significant shadow inventory in our markets could, were it to be released, adversely impact home and land prices and demand for our homes and land, which would have a material adverse effect on our business, prospects, liquidity, financial condition and results of operations. In addition, an important segment of our end-purchaser and customer base consists of first-time and second-time “move-up” buyers, the latter often purchase homes subject to contingencies related to the sale of their existing homes. The difficulties facing these buyers in selling their homes during recessionary periods may adversely affect our sales. Moreover, during such periods, we may need to reduce our sales prices and offer greater incentives to buyers to compete for sales, and that may result in reduced gross margins.

Our long-term growth depends, in part, upon our ability to acquire undeveloped land suitable for residential homebuilding at reasonable prices.

The availability of partially finished developed lots and undeveloped land for purchase at reasonable prices depends on a number of factors outside our control, including land availability in general, competition with other homebuilders and land buyers, inflation in land prices, zoning, allowable housing density, the ability to obtain building permits and other regulatory requirements. Should suitable lots or land become less available, the number of homes we may be able to build and sell could be reduced, and the cost of land could be increased, perhaps substantially, which could adversely impact us. As competition for suitable land increases, the cost of acquiring partially finished developed lots and undeveloped lots and the cost of developing owned land could rise and the availability of suitable land at acceptable prices may decline, which could adversely impact us. The availability of suitable land assets could also affect the success of our land acquisition strategy, which may impact our ability to increase the number of actively selling communities, grow our revenue and gross margins, and achieve or maintain profitability. Additionally, developing undeveloped land

16

is capital intensive and time consuming. It is possible that we may develop land based upon forecasts and assumptions that prove to be inaccurate, resulting in projects that are not economically viable.

Because of the seasonal nature of our business our quarterly operating results fluctuate.

We generally experience seasonal fluctuations in our quarterly operating results and capital requirements that can have a material impact on our results and our consolidated financial statements. We typically experience the highest new home order activity in spring and summer, although this activity is also highly dependent on the number of active selling communities, the timing of new community openings and other market factors. Since it typically takes four to six months to construct a new home, we deliver more homes in the second half of the year as spring and summer home orders convert to home deliveries. Because of this seasonality, home starts, construction costs and related cash outflows have historically been highest in the second and third quarters, and the majority of cash receipts from home deliveries occur during the second half of the year. We expect this seasonal pattern to continue over the long‑term, although it may be affected by volatility in the homebuilding industry. In a recovering housing market, we expect the traditional seasonality and its impact on our results of operations would become more pronounced. This seasonality requires us to finance our construction activities significantly in advance of the receipt of sales proceeds. Accordingly, there is a risk that we will invest significant amounts of capital in the acquisition and development of land and construction of homes that we do not sell at anticipated pricing levels or within anticipated time frames. If, due to market conditions, construction delays or other causes we do not complete home sales at anticipated pricing levels or within anticipated time frames, our liquidity, financial condition and results of operations would be adversely affected.

If the market value of our land inventory decreases, our results of operations could be adversely affected by impairments and write-downs.

The market value of our land and housing inventories depends on market conditions. We acquire land for expansion into new markets and for replacement of land inventory and expansion within our current markets. There is a risk that the value of the land owned by us may decline after purchase. The valuation of property is inherently subjective and based on the individual characteristics of each property. We may have acquired options on or bought and developed land at a cost we will not be able to recover fully or on which we cannot build and sell homes profitably. In addition, our deposits for lots controlled under purchase, option or similar contracts may be put at risk.

Factors such as changes in regulatory requirements and applicable laws (including in relation to building regulations, taxation and planning), political conditions, the condition of financial markets, both local and national economic conditions, the financial condition of customers, potentially adverse tax consequences, and interest and inflation rate fluctuations subject land valuations to uncertainty. Moreover, our valuations are made on the basis of assumptions, including assumptions relating to economic conditions and demographics that may prove to be inaccurate. If housing demand fails to meet our expectations when we acquired our inventory, our profitability may be adversely affected and we may not be able to recover our costs when we sell homes that we build or land that we own.

We regularly review the value of our land holdings and continue to review our holdings on a periodic basis. Material write-downs and impairments in the value of our inventory may be required, and we may in the future sell land or homes at a loss, which could adversely affect our results of operations and financial condition. See Note 2, “Summary of Significant Accounting Policies” and Note 9, "Fair Value Disclosures" to the consolidated financial statements for further discussion on impairment and estimated fair values of real estate inventories included elsewhere in this report.

The homebuilding industry is highly competitive, and if our competitors are more successful or offer better value to our customers our business could decline.

We operate in a very competitive environment which is characterized by competition from a number of other homebuilders and land developers in each of the markets in which we operate. Additionally, there are relatively low barriers to entry into our business and new competitors arise from time to time. We compete with numerous large national and regional homebuilding companies and with smaller local homebuilders and land developers for, among other things, home buyers, desirable land parcels, financing, raw materials and skilled management and labor resources. Our competitors may develop land and construct housing units that are superior or substantially similar to our products, which could make our products less attractive to consumers.

We may be at a competitive disadvantage with regard to certain of our large national and regional homebuilding competitors whose operations are more geographically diversified than ours, as these competitors may be better able to withstand any future regional downturn in the housing market. Many of these competitors have longer operating histories and greater financial and operational resources than we do. Additionally, many of these competitors also have longstanding relationships with subcontractors

17

and suppliers in the markets in which we operate. This may give our competitors an advantage in marketing their products, securing materials and labor at lower prices and allowing their homes to be delivered to customers more quickly and at more favorable prices. This competition could reduce our market share and limit our ability to expand our business.

Increased competition could hurt our business, as it could prevent us from acquiring attractive land parcels on which to build homes or make such acquisitions more expensive, adversely affect our market share and cause us to increase our selling incentives and reduce our prices. An oversupply of homes available for sale or discounting of home prices could adversely affect pricing for homes in the markets in which we operate. Oversupply and price discounting can be exacerbated by supply from the resale, or “previously owned,” home market, with which we also compete. Oversupply and price discounting have periodically adversely affected certain markets, and it is possible that our markets will be adversely affected by these factors in the future. If we are unable to compete effectively in our markets, our business could decline disproportionately to our competitors, and our results of operations and financial condition could be adversely affected.

If home buyers are not able to obtain suitable mortgage financing, due to more stringent lending standards, rising interest rates, changes in regulation, reduced investor demand for mortgage loans and mortgage backed securities, changes in the relationship between Fannie Mae and Freddie Mac and the federal government or other reasons, our results of operations may decline.

A majority of home buyers finance their home purchases through lenders that provide mortgage financing. The availability of mortgage financing may be constrained, due in part to lower mortgage valuations on properties, various regulatory changes and lower risk appetite by lenders, with many lenders requiring increased levels of financial qualification, lending at lower multiples of income and requiring larger down payments. First-time home buyers are generally more affected by the availability of mortgage financing than other potential home buyers. These buyers are a key source of demand for new homes. A limited availability of home mortgage financing may adversely affect the volume of our home and land sales and the sales prices we achieve.

Additionally, housing demand is adversely affected by reduced availability of mortgage financing and factors that increase the upfront or monthly cost of financing a home, such as increases in interest rates, insurance premiums or limitations on mortgage interest deductibility. Any decrease in the willingness and ability of lenders to make home mortgage loans, the tightening of lending standards and the reduction in the types of financing products available, will make it more difficult for home buyers to obtain acceptable financing. Any substantial increase in mortgage interest rates or unavailability of mortgage financing may adversely affect the ability of prospective first-time and move-up home buyers to obtain financing for our homes, as well as adversely affect the ability of prospective move-up home buyers to sell their current homes. The housing industry is benefiting from the current low interest rate environment, which has allowed many home buyers to obtain mortgage financing with relatively low interest rates as compared to long-term historical averages. While the timing of any increase in interest rates is uncertain, it is widely expected that interest rates will increase over time, and any such increase will make mortgage financing more expensive and adversely affect the ability of home buyers to purchase our homes. The recent disruptions in the credit markets and the curtailed availability of mortgage financing has adversely affected, and is expected to continue to adversely affect, our business, prospects, liquidity, financial condition, results of operations and cash flows as compared to prior periods.

Beginning in 2008, the mortgage lending industry has experienced significant instability, beginning with increased defaults on sub-prime loans and other non-conforming loans and compounded by expectations of increasing interest payment requirements and further defaults. This in turn resulted in a decline in the market value of many mortgage loans and related securities. Lenders, regulators and others questioned the adequacy of lending standards and other credit requirements for several loan products and programs. Credit requirements have tightened, and investor demand for mortgage loans and mortgage-backed securities has declined. The deterioration in credit quality during the economic downturn caused almost all lenders to stop offering sub-prime mortgages and most other loan products that were not eligible for sale to Fannie Mae or Freddie Mac or loans that did not meet Federal Housing Administration and Veterans Administration requirements. Fewer loan products, tighter loan qualifications and a reduced willingness of lenders to make loans may continue to make it more difficult for certain buyers to finance the purchase of our homes.

These factors may reduce the pool of qualified home buyers and make it more difficult to sell to first-time and move-up buyers who have historically made up a substantial part of our homebuilding customers.