Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Spark Energy, Inc. | a321certificationbytheceoa.htm |

| EX-31.2 - EXHIBIT 31.2 - Spark Energy, Inc. | a312certificationbycfo-q42.htm |

| EX-31.1 - EXHIBIT 31.1 - Spark Energy, Inc. | a311certificationbyceo-q42.htm |

| EX-23.1 - EXHIBIT 23.1 - Spark Energy, Inc. | a231consentofkpmg-q42016.htm |

| EX-21.1 - EXHIBIT 21.1 - Spark Energy, Inc. | a211listofsubsidiariesofsp.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 |

FORM 10-K | ||||

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016.

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-36559

Spark Energy, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 46-5453215 | |||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

12140 Wickchester Ln, Suite 100 | (713) 600-2600 | |||

Houston, Texas 77079 | ||||

(Address and zip code of principal executive offices) | (Registrant’s telephone number, including area code) | |||

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of exchange on which registered | |||

Class A common stock, par value $0.01 per share | The NASDAQ Global Select Market | |||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer x

Non-accelerated filer o (Do not check if a smaller reporting company) Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

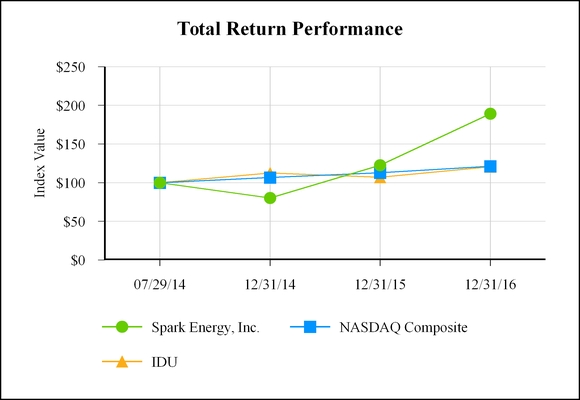

The aggregate market value of common stock held by non-affiliates of the registrant on June 30, 2016, the last business day of the registrant's most recently completed second fiscal quarter, based on the closing price on that date of $33.05, was $195.0 million. The registrant, solely for the purpose of this required presentation, had deemed its Board of Directors and Executive Officers to be affiliates, and deducted their stockholdings in determining the aggregate market value.

There were 6,496,559 shares of Class A common stock and 10,742,563 shares of Class B common stock outstanding as of February 28, 2017.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement in connection with the 2017 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

Table of Contents

Page | ||||

PART I | ||||

Items 1 & 2. | Business and Properties | |||

Item 1A. | Risk Factors | |||

Item 1B. | Unresolved Staff Comments | |||

Item 3. | Legal Proceedings | |||

Item 4. | Mine Safety Disclosures | |||

PART II | ||||

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |||

Stock Performance Graph | ||||

Item 6. | Selected Financial Data | |||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||

Overview | ||||

Drivers of Our Business | ||||

Factors Affecting Comparability of Historical Financial Results | ||||

How We Evaluate Our Operations | ||||

Combined and Consolidated Results of Operations | ||||

Operating Segment Results | ||||

Liquidity and Capital Resources | ||||

Cash Flows | ||||

Summary of Contractual Obligations | ||||

Off-Balance Sheet Arrangements | ||||

Related Party Transactions | ||||

Critical Accounting Policies and Estimates | ||||

Contingencies | ||||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |||

Item 8. | Financial Statements and Supplementary Data | |||

Index to Consolidated Financial Statements | ||||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |||

Item 9A. | Controls and Procedures | |||

Item 9B. | Other Information | |||

PART III | ||||

Item 10. | Directors, Executive Officers and Corporate Governance | |||

Item 11. | Executive Compensation | |||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |||

Item 14. | Principal Accounting Fees and Services | |||

PART IV | ||||

Item 15. | Exhibits, Financial Statement Schedules | |||

Item 16. | Form 10-K Summary | |||

SIGNATURES | ||||

EXHIBIT INDEX | ||||

Glossary

CFTC. The Commodity Futures Trading Commission.

CPUC. California Public Utility Commission.

ERCOT. The Electric Reliability Council of Texas, the independent system operator and the regional coordinator of various electricity systems within Texas.

ESCO. Energy service company.

FCC. Federal Communications Commission.

FERC. The Federal Energy Regulatory Commission, a regulatory body that regulates, among other things, the transmission and wholesale sale of electricity and the transportation of natural gas by interstate pipelines in the United States.

FTC. Federal Trade Commission.

ISO. An independent system operator. An ISO manages and controls transmission infrastructure in a particular region.

MMBtu. One million British Thermal Units, a standard unit of heating equivalent measure for natural gas. A unit of heat equal to 1,000,000 Btus, or 1 MMBtu, is the thermal equivalent of approximately 1,000 cubic feet of natural gas.

MWh. One megawatt hour, a unit of electricity equal to 1,000 kilowatt hours (kWh), or the amount of energy equal to one megawatt of constant power expended for one hour of time.

Non-POR Market. A non-purchase of accounts receivable market.

NYPSC. Public Service Commission of the State of New York.

POR Market. A purchase of accounts receivable market.

RCE. A residential customer equivalent, refers to a natural gas customer with a standard consumption of 100 MMBtus per year or an electricity customer with a standard consumption of 10 MWhs per year.

REP. A retail electricity provider.

RTO. A regional transmission organization. A RTO, similar to an ISO, is a third party entity that manages transmission infrastructure in a particular region.

TCPA. Telephone Consumer Protection Act of 1991.

Cautionary Note Regarding Forward Looking Statements

This report contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. These statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) can be identified by the use of forward-looking terminology including “may,” “should,” “likely,” “will,” “believe,” “expect,” “anticipate,” “estimate,” “continue,” “plan,” “intend,” “projects,” or other similar words. All statements, other than statements of historical fact included in this report, regarding strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans, objectives and beliefs of management are forward-looking statements. Forward-looking statements appear in a number of places in this report and may include statements about business strategy and prospects for growth, customer acquisition costs, ability to pay cash dividends, cash flow generation and liquidity, availability of terms of capital, competition and government regulation and general economic conditions. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we cannot give any assurance that such expectations will prove correct.

The forward-looking statements in this report are subject to risks and uncertainties. Important factors that could cause actual results to materially differ from those projected in the forward-looking statements include, but are not limited to:

• | changes in commodity prices, |

• | extreme and unpredictable weather conditions, |

• | the sufficiency of risk management and hedging policies, |

• | customer concentration, |

• | federal, state and local regulation, including the industry's ability to prevail on its challenge to the New York Public Service Commission's order enacting new regulations that sought to impose significant new restrictions on retail energy providers operating in New York, |

• | key license retention, |

• | increased regulatory scrutiny and compliance costs, |

• | our ability to borrow funds and access credit markets, |

• | restrictions in our debt agreements and collateral requirements, |

• | credit risk with respect to suppliers and customers, |

• | level of indebtedness, |

• | changes in costs to acquire customers, |

• | actual customer attrition rates, |

• | actual bad debt expense in non-POR markets, |

• | accuracy of billing systems, |

• | ability to successfully navigate entry into new markets, |

• | whether our majority shareholder or its affiliates offers us acquisition opportunities on terms that are commercially acceptable to us, |

• | ability to successfully and efficiently integrate acquisitions into our operations, |

• | competition, and |

• | the “Risk Factors” in this report, and in our quarterly reports, other public filings and press releases. |

You should review the Risk Factors in Item 1A of Part I and other factors noted throughout this report that could cause our actual results to differ materially from those contained in any forward-looking statement. All forward-looking statements speak only as of the date of this report. Unless required by law, we disclaim any obligation to publicly update or revise these statements whether as a result of new information, future events or otherwise. It is not possible for us to predict all risks, nor can we assess the impact of all factors on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

5

PART I.

Items 1 & 2. Business and Properties

General

We are a growing independent retail energy services company first founded in 1999 that provides residential and commercial customers in competitive markets across the United States with an alternative choice for their natural gas and electricity. We purchase our natural gas and electricity supply from a variety of wholesale providers and bill our customers monthly for the delivery of natural gas and electricity based on their consumption at either a fixed or variable price. Natural gas and electricity are then distributed to our customers by local regulated utility companies through their existing infrastructure.

We were formed as a Delaware corporation in April 2014 to act as a holding company for the retail natural gas business and asset optimization activities and the retail electricity business of our predecessor, Spark Energy Ventures, LLC. On August 1, 2014, we completed an initial public offering ("IPO") of 3,000,000 shares of our Class A common stock. References to us and our business prior to August 1, 2014 refer to the combined business of our operating subsidiaries before completion of our corporate reorganization in connection with our IPO. See Note 1 "Formation and Organization" to the audited combined and consolidated financial statements for a description of our corporate reorganization in connection with our IPO.

Our business consists of two operating segments:

• | Retail Natural Gas Segment. We purchase natural gas supply through physical and financial transactions with market counterparts and supply natural gas to residential and commercial consumers pursuant to fixed-price and variable-price contracts. For the years ended December 31, 2016, 2015 and 2014, approximately 24%, 36% and 45%, respectively, of our retail revenues were derived from the sale of natural gas. We also identify wholesale natural gas arbitrage opportunities in conjunction with our retail procurement and hedging activities, which we refer to as asset optimization. |

• | Retail Electricity Segment. We purchase electricity supply through physical and financial transactions with market counterparts and independent system operators ("ISOs") and supply electricity to residential and commercial consumers pursuant to fixed-price and variable-price contracts. For the years ended December 31, 2016, 2015 and 2014, approximately 76%, 64% and 55%, respectively, of our retail revenue were derived from the sale of electricity. |

See Note 14 "Segment Reporting" to the Company’s audited combined and consolidated financial statements in this report for financial information relating to our operating segments.

Recent Developments

See “Management's Discussion and Analysis of Financial Condition and Results of Operations—Recent Developments” for a discussion of recent developments affecting our business and operations.

Relationship with our Founder and Majority Shareholder

We leverage our relationship with affiliates of our founder, chairman and majority shareholder, W. Keith Maxwell III (our "Founder"), to execute on our growth strategy that includes sourcing of acquisitions, financing support, and operating cost efficiencies.

Our Founder formed National Gas & Electric, LLC (“NG&E”) in 2015 for the purpose of purchasing retail energy companies and retail customer books that could ultimately be resold to the Company. On August 23, 2016, we and Spark HoldCo completed the purchase of all of the outstanding membership interests in the Major Energy Companies from NG&E. Please see “Management’s Discussion and Analysis of Financial Condition and Results of

6

Operations—Drivers of Our Business—Acquisitions—Acquisition of the Major Energy Companies" for a more detailed discussion.

We may also engage in additional transactions with NG&E in the future. We currently expect that we would fund any future transactions with NG&E with some combination of cash, subordinated debt, or the issuance of Class A common stock or Class B common stock to NG&E. However, actual consideration paid for the assets will depend, among other things, on our capital structure and liquidity at the time of any transaction.

This relationship affords us access to opportunities that might not otherwise be available to us due to our size and availability of capital. Given our Founder's significant economic interest in us, we believe that he is incentivized to offer us opportunities to grow through this drop-down structure. However, our Founder and his affiliates are under no obligation to offer us acquisition opportunities, and we are under no obligation to buy assets from them. Additionally, as we grow and our access to capital and opportunities improves, we may rely less upon NG&E as a source of acquisitions and seek to enter into more transactions directly with third parties. Any acquisition activity involving NG&E or any other affiliate of our Founder will be subject to negotiation and approval by a special committee of the Board of Directors consisting solely of independent directors.

We entered into a Master Service Agreement (the “Master Service Agreement”) effective January 1, 2016 with Retailco Services, LLC ("Retailco Services"), which is a wholly owned subsidiary of W. Keith Maxwell III. The Master Service Agreement is for a one-year term and renews automatically for successive one-year terms unless the Master Service Agreement is terminated by either party. On January 1, 2017, the Master Service Agreement renewed automatically pursuant to its terms for a one year period ending on December 31, 2017.

Pursuant to the Master Service Agreement, Retailco Services provides us with operational support services such as: enrollment and renewal transaction services; customer billing and transaction services; electronic payment processing services; customer services and information technology infrastructure and application support services. As a result of this relationship, the Company realized per customer savings relative to its cost structure prior to the Master Services Agreement and a more stable operating cost model, and will position itself to effectively realize additional economies of scale over time. See “—Master Service Agreement with Retailco Services, LLC” for a more detailed summary of the terms and conditions of the Master Service Agreement.

On December 27, 2016, we entered into a $25.0 million subordinated debt facility (the "Subordinated Facility") with Retailco, LLC ("Retailco"), which is wholly owned by our Founder. Please see “Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Subordinated Debt Facility” for a description of the Subordinated Facility.

See “Risk Factors—Our future growth is dependent on successful execution of the growth strategy” and “—The provision of operational support services under the Master Service Agreement by our affiliate, Retailco Services, LLC, subjects us to a variety of risks” for a discussion of certain risks attributable to the drop down strategy and the related party transactions in which we are involved.

Our Operations

As of December 31, 2016, we operated in 90 utility service territories across 18 states and the District of Columbia and had approximately 774,000 RCEs. An RCE, or residential customer equivalent, is an industry standard measure of natural gas or electricity usage with each RCE representing annual consumption of 100 MMBtu of natural gas or 10 MWh of electricity. We serve natural gas customers in fifteen states (Arizona, California, Colorado, Connecticut, Florida, Illinois, Indiana, Maryland, Massachusetts, Michigan, Nevada, New Jersey, New York, Ohio and Pennsylvania) and electricity customers in eleven states (Connecticut, Illinois, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Ohio, Pennsylvania and Texas) and the District of Columbia using eight brands (Spark Energy, CenStar Energy, Electricity Maine, ENH Power, Major Energy, Oasis Energy, Provider Power Mass, and Respond Power).

7

Customer Contracts and Product Offerings

Fixed and variable price contracts

We offer a variety of fixed-price and variable-price service options to our natural gas and electricity customers. Under our fixed-price service options, our customers purchase natural gas and electricity at a fixed price over the life of the customer contract, which provides our customers with protection against increases in natural gas and electricity prices. Our fixed-price contracts typically have a term of one to two years for residential customers and up to three years for commercial customers and most provide for an early termination fee in the event that the customer terminates service prior to the expiration of the contract term. Our variable-price service options carry a month-to-month term and are priced based on our forecasts of underlying commodity prices and other market factors, including the competitive landscape in the market and the regulatory environment. In a typical market, we offer fixed-price electricity plans for 6, 12 and 24 months and fixed-price natural gas plans from 12 to 24 months, which may come with or without a monthly service fee and/or a termination fee. We also offer variable price natural gas and electricity plans that offer an introductory fixed price that is generally applied for a certain number of billing cycles, typically two billing cycles in our current markets, then switches to a variable price based on market conditions. Our variable plans may or may not provide for a termination fee, depending on the market and customer type.

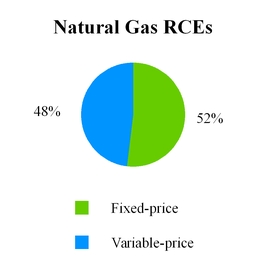

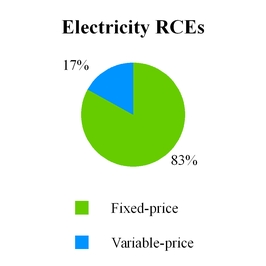

As of December 31, 2016, approximately 52% of our natural gas RCEs were fixed-price, and the remaining 48% of our natural gas RCEs were variable-price. As of December 31, 2016, approximately 83% of our electricity RCEs were fixed-price, and the remaining 17% of our electricity RCEs were variable-price.

Green products and renewable energy credits

We offer renewable and carbon neutral (“green”) products in certain markets. Green energy products are a growing market opportunity and typically provide increased unit margins as a result of improved customer satisfaction and less competition. Renewable electricity products allow customers to choose electricity sourced from wind, solar, hydroelectric and biofuel sources, through the purchase of renewable energy credits (“RECs”). Carbon neutral gas products give customers the option to reduce or eliminate the carbon footprint associated with their energy usage through the purchase of carbon offset credits. These products typically provide for fixed or variable prices and generally follow the terms of our other products with the added benefit of carbon reduction and reduced environmental impact. We currently offer renewable electricity in all of our electricity markets and carbon neutral natural gas in several of our gas markets.

In addition to the RECs we purchase to satisfy our voluntary requirements under the terms of our green contracts with our customers, we must also purchase a specified amount of RECs based on the amount of electricity we sell

8

in a state in a year pursuant to individual state renewable portfolio standards. We forecast the price for the required RECs at the end of each month and incorporate this cost component into our customer pricing models.

Product Development Process

We identify market opportunities by developing price curves in each of the markets we serve and comparing the market prices and the price the local regulated utility is offering. We then determine if there is an opportunity in a particular market based on our ability to create an attractive customer value proposition that is also able to enhance our profitability. The attractiveness of a product from a consumer’s standpoint is based on a variety of factors, including overall pricing, price stability, contract term, sources of generation and environmental impact and whether or not the contract provides for termination and other fees. Product pricing is also based on a several other factors, including the cost to acquire customers in the market, the competitive landscape and supply issues that may affect pricing.

Customer Acquisition and Retention

Our customer acquisition strategy consists of significant customer growth obtained through opportunistic acquisitions complemented by traditional organic customer acquisition. We make decisions on how best to deploy capital on customer acquisition based on a variety of factors, including cost to acquire customers, availability of opportunities and our view of attractive commodity pricing in particular regions. For example, we may seek to make an acquisition of a large number of customers in a particular group of markets even though the initial acquisition cost may be higher because long-term margins are higher. Historically, a significant component of our customer acquisition strategy was the relationship and growth strategy structure with NG&E. See “—Relationship with our Founder and Majority Shareholder” for a discussion of this relationship. As we grow and our access to capital and opportunities improves, we may rely less upon NG&E as a source of acquisitions and seek to enter into more transactions directly with third parties. Since 2015, of our four largest acquisitions, two have been through NG&E and two have been directly from third parties.

Acquisition of new customers and sales channels

Our customer growth strategy includes acquiring customers through acquisitions as well as organically. We acquire both portfolios of customers as well as retail energy companies.

Once a product has been created for a particular market, we then develop a marketing campaign using a combination of sales channels, with an emphasis on door-to-door and web-based marketing. We identify and acquire customers through a variety of additional sales channels, including our inbound customer care call center, online marketing, email, direct mail, brokers and direct sales. We typically employ multiple vendors under short-term contracts and have not entered into any exclusive marketing arrangements with sales vendors. Our marketing team continuously evaluates the effectiveness of each customer acquisition channel and makes adjustments in order to achieve targeted growth and customer acquisition costs. We attempt to maintain a disciplined approach to recovery of our customer acquisition costs within defined periods.

During the year ended December 31, 2016, our RCE acquisitions were generated from the following sales channels:

Acquisitions | 61 | % |

Door to Door | 14 | % |

Indirect Sales Brokers | 12 | % |

Web Based | 5 | % |

Outbound | 5 | % |

Call Center | 2 | % |

Other | 1 | % |

9

Retaining customers and maximizing customer lifetime value

Our management and marketing teams devote significant attention to customer retention. We have developed a disciplined renewal communication process, which is designed to effectively reach our customers prior to the end of the contract term, and employ a team dedicated to managing this renewal communications process. Customers are contacted in each utility prior to the expiration of the customer's contract. Spark may elect to contact the customer through additional channels such as outbound telephone calls and electronic mail communication. We encourage retention and promote renewals by means of each of these contact methods.

We also apply a proprietary evaluation and segmentation process to optimize value both to us and the customer. We analyze historical usage, attrition rates and consumer behaviors to specifically tailor competitive products that aim to maximize the total expected return from energy sales to a specific customer, which we refer to as customer lifetime value.

Asset Optimization

Part of our business includes asset optimization activities in which we identify opportunities in the natural gas wholesale marketplace in conjunction with our retail procurement and hedging activities. Many of the competitive pipeline choice programs in which we participate require us and other retail energy suppliers to take assignment of and manage natural gas transportation and storage assets upstream of their respective city-gate delivery points. With respect to our allocated storage assets, we are also obligated to buy and inject gas in the summer season (April through October) and sell and withdraw gas during the winter season (November through March). These purchase and injection obligations in our allocated storage assets require us to take a seasonal long position in natural gas. Our asset optimization group determines whether market conditions justify hedging these long positions through additional derivative transactions.

Our asset optimization group utilizes these allocated transportation and storage assets for retail customer usage and to effect transactions in the wholesale market based on market conditions and opportunities. Our asset optimization group also contracts with third parties for transportation and storage capacity in the wholesale market. We are responsible for reservation and demand charges attributable to both our allocated and third-party contracted transportation and storage assets. Our asset optimization group utilizes these allocated and third-party transportation and storage assets in a variety of ways to either improve profitability or optimize supply-side counterparty credit lines.

We frequently enter into spot market transactions in which we purchase and sell natural gas at the same point or we purchase natural gas at one point or pool and ship it using our pipeline reservations for sale at another point or pool, in each case if we are able to capture a margin. We view these spot market transactions as low risk because we enter into the buy and sell transactions simultaneously on a back-to-back basis. We will also act as an intermediary for market participants who need assistance with short-term procurement requirements. Consumers and suppliers will contact us with a need for a certain quantity of natural gas to be bought or sold at a specific location. We are able to use our contacts in the wholesale market to source the requested supply, and we will capture a margin in these transactions.

The asset optimization group historically entered into long-term transportation and storage transactions. Our risk policies are now such that this business is limited to back-to-back purchase and sale transactions, or open positions subject to our aggregate net open position limits, which are not held for a period longer than two months. Furthermore, all additional capacity procured outside of a utility allocation of retail assets must be approved by our risk committee. Hedges on our firm transportation obligations are limited to two years or less and hedging of interruptible capacity is prohibited.

We also enter into back-to-back wholesale transactions to optimize our credit lines with third-party energy suppliers. With each of our third-party energy suppliers, we have certain contracted credit lines, within which we are able to purchase energy supply from these counterparties. If we desire to purchase supply beyond these credit

10

limits, we are required to post collateral, in the form of either cash or letters of credit. As we begin to approach the limits of our credit line with one supplier, we may purchase energy supply from another supplier and sell that supply to the original counterparty in order to reduce our net buy position with that counterparty and open up additional credit to procure supply in the future. Our sales of gas pursuant to these activities also enable us to optimize our credit lines with third-party energy suppliers by decreasing our net buy position with those suppliers.

Commodity Supply

We hedge and procure our energy requirements from various wholesale energy markets, including both physical and financial markets, through short and long term contracts. Our in-house energy supply team is responsible for managing our commodity positions (including energy procurement, capacity, transmission, renewable energy, and resource adequacy requirements) within risk tolerances defined by our risk management policies. We procure our natural gas and electricity requirements at various trading hubs, city gates and load zones. When we procure commodities at trading hubs, we are responsible for delivery to the applicable local regulated utility for distribution.

We periodically adjust our portfolio of purchase/sale contracts in the wholesale natural gas market based upon continual analysis of our forecasted load requirements. Natural gas is then delivered to the local regulated utility city-gate or other specified delivery points where the local regulated utility takes control of the natural gas and delivers it to individual customers’ locations. Additionally, we hedge our natural gas price exposure with financial products. During the year ended December 31, 2016, we transacted physical and financial settlement of natural gas with approximately 97 wholesale counterparties.

In most markets, we typically hedge our electricity exposure with financial products and then purchase the physical power directly from the ISO for delivery. From time to time, we use a combination of physical and financial products to hedge our electricity exposure before buying physical electricity in the day-ahead and real-time market from the ISO. During the year ended December 31, 2016, we transacted physical and financial settlement of electricity with approximately 15 suppliers.

We are assessed monthly for ancillary charges such as reserves and capacity in the electricity sector by the ISOs. For example, the ISOs will charge all retail electricity providers for monthly reserves that the ISO determines are necessary to protect the integrity of the grid. We attempt to estimate such amounts, but they are difficult to estimate because they are charged in arrears by the ISOs and are subject to fluctuations based on weather and other market conditions. Many of the utilities we serve also allocate natural gas transportation and storage assets to us as a part of their competitive choice program. We are required to fill our allocated storage capacity with natural gas, which creates commodity supply and price risk. Sometimes we cannot hedge the volumes associated with these assets because they are too small compared to the much larger bulk transaction volumes required for trades in the wholesale market or it is not economically feasible to do so.

Risk Management

Our management team operates under a set of corporate risk policies and procedures relating to the purchase and sale of electricity and natural gas, general risk management and credit and collections functions. Our in-house energy supply team is responsible for managing our commodity positions (including energy procurement, capacity, transmission, renewable energy, and resource adequacy requirements) within risk tolerances defined by our risk management policies. We attempt to increase the predictability of cash flows by following our various hedging strategies.

The risk committee has control and authority over all of our risk management activities. The risk committee establishes and oversees the execution of our credit risk management policy and our commodity risk policy. The risk management policies are reviewed at least annually and the risk committee typically meets quarterly to assure that we have followed its policies. The risk committee also seeks to ensure the application of our risk management policies to new products that we may offer. The risk committee is comprised of our Chief Executive Officer, our Chief Financial Officer and our Risk Manager who meet on a regular basis to review the status of the risk

11

management activities and positions. We employ a Risk Manager who reports directly to our Chief Financial Officer and whose compensation is unrelated to trading activity. Commodity positions are typically reviewed and updated daily based on information from our customer databases and pricing information sources. The risk policy sets volumetric limits on intra-day and end of day long and short positions in natural gas and electricity. With respect to specific hedges, we have established and approved a formal delegation of authority specifying each trader's authorized volumetric limits based on instrument type, lead time (time to trade flow), fixed price volume, index price volume and tenor (trade flow) for individual transactions. The Risk Manager reports to the risk committee any hedging transactions that exceed these delegated transaction limits.

Commodity Price and Volumetric Risk

Because our contracts require that we deliver full natural gas or electricity requirements to many of our customers and because our customers’ usage can be impacted by factors such as weather, we may periodically purchase more or less commodity than our aggregate customer volumetric needs. In buying or selling excess volumes, we may be exposed to commodity price volatility. In order to address the potential volumetric variability of our monthly deliveries for fixed-price customers, we implement various hedging strategies to attempt to mitigate our exposure.

Our commodity risk management strategy is designed to hedge substantially all of our forecasted volumes on our fixed-price customer contracts, as well as a portion of the near-term volumes on our variable-price customer contracts. We use both physical and financial products to hedge our fixed-price exposure. The efficacy of our risk management program may be adversely impacted by unanticipated events and costs that we are not able to effectively hedge, including abnormal customer attrition and consumption, certain variable costs associated with electricity grid reliability, pricing differences in the local markets for local delivery of commodities, unanticipated events that impact supply and demand, such as extreme weather, and abrupt changes in the markets for, or availability or cost of, financial instruments that help to hedge commodity price.

Customer demand is also impacted by weather. We use utility-provided historical and/or forward projected customer volumes as a basis for our forecasted volumes and mitigate the risk of seasonal volume fluctuation for some customers by purchasing excess fixed-price hedges within our volumetric tolerances. Should seasonal demand exceed our weather-normalized projections, we may experience a negative impact on financial results.

In addition to our forward price risk management approach described above, we may take further measures to reduce price risk and optimize our returns by: (i) maximizing the use of storage in our daily balancing market areas in order to give us the flexibility to offset volumetric variability arising from changes in winter demand; (ii) entering into daily swing contracts in our daily balancing markets over the winter months to enable us to increase or decrease daily volumes if demand increases or decreases; and (iii) purchasing out-of-the-money call options for contract periods with the highest seasonal volumetric risk to protect against steeply rising prices if our customer demands exceed our forecast. Being geographically diversified in our delivery areas also permits us, from time to time, to employ assets not being used in one area to other areas, thereby mitigating potential increased costs for natural gas that we otherwise may have had to acquire at higher prices to meet increased demand.

We utilize NYMEX-settled financial instruments to offset price risk associated with volume commitments under fixed-price contracts. The valuation for these financial instruments is calculated daily based on the NYMEX Exchange published Closing Price, and they are settled using the Exchange’s published Settlement Price at their Maturity.

Basis Risk

We are exposed to basis risk in our operations when the commodities we hedge are sold at different delivery points from the exposure we are seeking to hedge. For example, if we hedge our natural gas commodity price with Chicago basis but physical supply must be delivered to the individual delivery points of specific utility systems around the Chicago metropolitan area, we are exposed to basis risk between the Chicago basis and the individual utility system delivery points. These differences can be significant from time to time, particularly during extreme,

12

unforecasted cold weather conditions. Similarly, in certain of our electricity markets, customers pay the load zone price for electricity, so if we purchase supply to be delivered at a hub, we may have basis risk between the hub and the load zone electricity prices due to local congestion that is not reflected in the hub price. We attempt to hedge basis risk where possible, but hedging instruments are sometimes not economically feasible or available in the smaller quantities that we require.

Customer Credit Risk

Our credit risk management policies are designed to limit customer credit exposure. Credit risk is managed through participation in purchase of receivables ("POR") programs in utility service territories where such programs are available. In these markets, we monitor the credit ratings of the local regulated utilities and the parent companies of the utilities that purchase our customer accounts receivable. We also periodically review payment history and financial information for the local regulated utilities to ensure that we identify and respond to any deteriorating trends. In non-POR markets, we assess the creditworthiness of new applicants, monitor customer payment activities and administer an active collections program. Using risk models, past credit experience and different levels of exposure in each of the markets, we monitor our aging, bad debt forecasts and actual bad debt expenses and continually adjust as necessary.

In many of the utility services territories where we conduct business, POR programs have been established, whereby the local regulated utility purchases our receivables, and then becomes responsible for billing the customer and collecting payment from the customer. This service results in substantially all of our credit risk being linked to the applicable utility and not to our end-use customer in these territories. For the year ended December 31, 2016, approximately 67% of our retail revenues were derived from territories in which substantially all of our credit risk was directly linked to local regulated utility companies, all of which had investment grade ratings as of such date. During the same period, we paid these local regulated utilities a weighted average discount of approximately 1.3% of total revenues for customer credit risk. In certain of the POR markets in which we operate, the utilities limit their collections exposure by retaining the ability to transfer a delinquent account back to us for collection when collections are past due for a specified period. If our collection efforts are unsuccessful, we return the account to the local regulated utility for termination of service. Under these service programs, we are exposed to credit risk related to payment for services rendered during the time between when the customer is transferred to us by the local regulated utility and the time we return the customer to the utility for termination of service, which is generally one to two billing periods. We may also realize a loss on fixed-price customers in this scenario due to the fact that we will have already fully hedged the customer’s expected commodity usage for the life of the contract.

In non-POR markets (and in POR markets where we may choose to direct bill our customers), we manage commercial customer credit risk through a formal credit review and manage residential customer credit risk through a variety of procedures, which may include credit score screening, deposits and disconnection for non-payment. We also maintain an allowance for doubtful accounts, which represents our estimate of potential credit losses associated with accounts receivable from customers within non-POR markets.

We assess the adequacy of the allowance for doubtful accounts through review of the aging of customer accounts receivable and general economic conditions in the markets that we serve. Our bad debt expense for the year ended December 31, 2016 was $1.3 million, or 0.2% of retail revenues. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Drivers of our Business—Customer Credit Risk” for a more detailed discussion of our bad debt expense during the year ended December 31, 2016.

We have limited exposure to high concentrations of sales volumes to individual customers. For the year ended December 31, 2016, our largest customer accounted for less than 1% of total retail energy sales volume.

Counterparty Credit Risk in Wholesale Market

We do not independently produce natural gas and electricity and depend upon third parties for our supply, which exposes us to wholesale counterparty credit risk in our retail and asset optimization activities. If the counterparties

13

to our supply contracts are unable to perform their obligations, we may suffer losses, including as a result of being unable to secure replacement supplies of natural gas or electricity on a timely and cost-effective basis or at all. At December 31, 2016, approximately 96% of our total exposure of $14.6 million was either with an investment grade customer or otherwise secured with collateral or a guarantee.

Operational Risk

As with all companies, the Company is at risk from cyber-attacks (breaches, unauthorized access, misuse, computer viruses, or other malicious code or other events) that could materially adversely affect our business, or otherwise cause interruptions or malfunctions in our operations.

We mitigate these risks through multiple layers of security controls including policy, hardware, and software security solutions. We also have engaged third parties to assist with both external and internal vulnerability scans and continue to enhance awareness with employee education and accountability. As of December 31, 2016, we have not experienced any material loss related to cyber-attacks or other information security breaches.

Master Service Agreement with Retailco Services, LLC for Operational Support Services

We entered into a Master Service Agreement effective January 1, 2016 with Retailco Services, a wholly owned subsidiary of W. Keith Maxwell III, and NuDevco Retail, LLC ("NuDevco Retail"), an affiliate of our Founder. The Master Service Agreement is for a one-year term and renews automatically for successive one-year terms unless the Master Service Agreement is terminated by either party. On January 1, 2017, the Master Service Agreement renewed automatically pursuant to its terms for a one year period ending on December 31, 2017.

Retailco Services provides operational support services to us such as: enrollment and renewal transaction services; customer billing and transaction services; electronic payment processing services; customer services and information technology infrastructure and application support services under the Master Service Agreement (collectively, the "Services").

Spark HoldCo pays Retailco Services a monthly fee consisting of a monthly fixed fee plus a variable fee per customer per month depending on market complexity. We meet with Retailco Services quarterly to discuss fees and Service Levels (as defined below) based on changes in assumptions; to date, we have not adjusted fees or the Service Levels. The Master Service Agreement provides that Retailco Services perform the Services in accordance with specified service levels (the “Service Levels”), and in the event Retailco Services fails to meet the Service Levels, Spark HoldCo receives a credit against invoices or a cash payment (the “Penalty Payment”). The amount of the Penalty Payment was initially limited to $0.1 million monthly, but adjusts annually based upon the amount of fees charged by Retailco Services for Services over the prior year. Furthermore, in the event that the Service Levels are not satisfied and Spark HoldCo suffers damages in excess of $0.5 million as a result of such failure, Retailco Services will make a payment (the “Damage Payment”) to Spark HoldCo for the amount of the damages (less the amount of any Penalty Payments also due). The Master Service Agreement provides that in no event may the Penalty Payments and Damage Payments exceed $2.5 million in any twelve-month period. For the year ended December 31, 2016, Penalty Payments and Damage Payments totaled $0.1 million and $1.4 million, respectively.

In connection with the Master Service Agreement, certain of Spark HoldCo’s employees who previously provided services similar to those to be provided under the Master Service Agreement have become employees of Retailco Services, and certain contracts, assets, and intellectual property have been assigned to Retailco Services. In addition, in order to facilitate the Services, Spark HoldCo has granted Retailco Services a non-transferable, non-exclusive, royalty-free, revocable and non-sub-licensable license to use certain of its intellectual property.

Either Spark HoldCo or Retailco Services is permitted to terminate the Master Service Agreement: (a) upon 30 days prior written notice for convenience and without cause; (b) upon a material breach and written notice to the breaching party when the breach has not been cured 30 days after such notice; (c) upon written notice if Retailco Services is unable for any reason to resume performance of the services within 60 days following the occurrence of

14

an event of force majeure; and (d) upon certain events of insolvency, assignment for the benefit of creditors, cessation of business, or filings of petitions for bankruptcy or insolvency proceedings by the other party. In the event the Master Service Agreement is terminated for any reason, Retailco Services will provide certain transition services to Spark HoldCo following the termination, not to exceed six months at the then-current fees.

Retailco Services and Spark HoldCo have agreed to indemnify each other from: (a) willful misconduct or negligence of the other; (b) bodily injury or death of any person or damage to real and/or tangible personal property caused by the acts or omission of the other; (c) any breach of any representation, warranty, covenant or other obligation of the other party under the Master Service Agreement, and (d) other standard matters. Subject to certain exceptions (including indemnification obligations, the obligations to pay fees and the Damage Payments and Penalty Payments), each parties’ liability is limited to $2.5 million of direct damages.

NuDevco Retail has entered into the Master Service Agreement for the limited purpose of guarantying payments that Retailco Services may be required to make under the Master Service Agreement up to a maximum of $2.0 million.

Competition

The markets in which we operate are highly competitive. In markets that are open to competitive choice of retail energy suppliers, our primary competition comes from the incumbent utility and other independent retail energy companies. In the electricity sector, these competitors include larger, well-capitalized energy retailers such as Direct Energy, Inc., FirstEnergy Solutions, Inc., Just Energy Group, Inc. and NRG Energy, Inc. We also compete with small local retail energy providers in the electricity sector that are focused exclusively on certain markets. Each market has a different group of local retail energy providers. With respect to natural gas, our national competitors are primarily Direct Energy and Constellation Energy. Our national competitors generally have diversified energy platforms with multiple marketing approaches and broad geographic coverage similar to us. Competition in each market is based primarily on product offering, price and customer service. The number of competitors in our markets varies. In well-established markets in the Northeast and Texas we have hundreds of competitors, while in others, the competition is limited to several participants.

The competitive landscape differs in each utility service area and within each targeted customer segment. Over the last several years, a number of utilities have spun off their retail marketing arms as part of the opening of retail competition in these markets. Markets that offer POR programs are generally more competitive than those markets in which retail energy providers bear customer credit risk. Market participants are significantly shielded from bad debt expense, thereby allowing easier entry into the POR markets. In these markets, we face additional competition as barriers to entry are less onerous.

Our ability to compete by increasing our market share depends on our ability to convince customers to switch to our products and services, and our ability to offer products at attractive prices. Many local regulated utilities and their affiliates may possess the advantages of name recognition, long operating histories, long-standing relationships with their customers and access to financial and other resources, which could pose a competitive challenge to us. As a result of these advantages, many customers of these local regulated utilities may decide to stay with their longtime energy provider if they have been satisfied with their service in the past. In addition, competitors may choose to offer more attractive short-term pricing to increase their market share.

Seasonality of our Business

Our overall operating results fluctuate substantially on a seasonal basis depending on: (i) the geographic mix of our customer base; (ii) the relative concentration of our commodity mix; (iii) weather conditions, which directly influence the demand for natural gas and electricity and affect the prices of energy commodities; and (iv) variability in market prices for natural gas and electricity. These factors can have material short-term impacts on monthly and quarterly operating results, which may be misleading when considered outside of the context of our annual operating cycle.

15

Our accounts payable and accounts receivable are impacted by seasonality due to the timing differences between when we pay our suppliers for accounts payable versus when we collect from our customers on accounts receivable. We typically pay our suppliers for purchases of natural gas on a monthly basis and electricity on a weekly basis. However, it takes approximately two months from the time we deliver the electricity or natural gas to our customers before we collect from our customers on accounts receivable attributable to those supplies. This timing difference could affect our cash flows, especially during peak cycles in the winter and summer months.

Natural gas accounted for approximately 24% of our retail revenues for the year ended December 31, 2016, which exposes us to a high degree of seasonality in our cash flows and income earned throughout the year as a result of the high concentration of heating load in the winter months. We utilize a considerable amount of cash from operations and borrowing capacity to fund working capital, which includes inventory purchases from April through October each year. We sell our natural gas inventory during the months of November through March of each year. We expect that the significant seasonality impacts to our cash flows and income will continue in future periods.

Regulatory Environment

We operate in the highly regulated natural gas and electricity retail sales industry in all of our respective jurisdictions. We must comply with the legislation and regulations in these jurisdictions in order to maintain our licensed status and to continue our operations, and to obtain the necessary licenses in jurisdictions in which we plan to compete. Licensing requirements vary by state, but generally involve regular, standardized reporting in order to maintain a license in good standing with the state commission responsible for regulating retail electricity and gas suppliers. There is potential for changes to state legislation and regulatory measures addressing licensing requirements that may impact our business model in the applicable jurisdiction. In addition, as further discussed below, our marketing activities and customer enrollment procedures are subject to rules and regulations at the state and federal level, and failure to comply with requirements imposed by federal and state regulatory authorities could impact our licensing in a particular market.

As of October 2015, the state of Connecticut no longer allows retail energy providers to offer variable rate plans even after the customer rolls off of a fixed rate plan. As a result of this change, we now offer customers who end their fixed terms with another fixed term of no less than four billing cycles. This regulatory change did not have a significant impact on our results of operations, and we expect that we can continue to manage the renewals in these markets to maintain profitability. Other states are currently examining the effectiveness of implementing such a restriction.

On February 23, 2016, the New York State Public Service Commission ("NYPSC") issued an order ("Resetting Order") resetting retail energy markets that, among other things, would have limited the types of competitive products that energy service companies ("ESCOs"), such as us, could offer in New York. The Resetting Order stated that all new customer enrollments or expiring agreements for mass market (residential and certain small commercial) customers must enroll or re-enroll in a contract that offers either: (i) a guarantee that the customer will pay no more than what the customer would pay as a full service utility customer, or (ii) an electricity product that is at least 30% derived from specific renewable sources either in the State of New York or in adjacent market areas. On July 22, 2016, most of the Resetting Order, including the provisions previously noted, was vacated by a New York state court. However, an appeal by certain ESCOs is ongoing as to whether the NYPSC has jurisdiction over ESCO pricing of products. The NYPSC cross appealed the decision as well. Currently, the NYPSC and ESCOs are engaged in certain evidentiary proceedings that are addressing, among other things, whether the NYPSC has sufficient cause to implement another similar Resetting Order. ESCOs are actively participating in these evidentiary proceedings and are vigorously contesting any efforts to restrict the industry given the anti-competitive effect of these efforts on the retail markets in New York.

We are evaluating the potential impact of the NYPSC's Resetting Order on our New York operations while preparing to operate in compliance with any new requirements that may come as a result of the evidentiary proceedings. Given the uncertainty of the outcome of these matters and the final requirements that may be

16

implemented, we are unable to predict at this time whether it will have a significant long-term impact on our operations in New York.

The NYPSC has also increased its scrutiny of individual ESCOs in 2016 and 2017. Many ESCOs, including one of the Company's subsidiaries, are the subject of a variety of investigative proceedings regarding their marketing efforts in New York. The Company's subsidiary is the subject of an investigative order by the NYPSC concerning a limited number of slamming allegations and late processing of customer refunds. The Company has responded to the order confirming that it has the requisite third party verifications in response to the allegations of slamming and that it has taken remediative measures to address the late refunds. While investigations of this nature have become common and are often resolved in a manner that allows the ESCO to continue operating in New York, there can be no assurance that the NYPSC will not take more severe action on individual ESCOs, including the Company's subsidiaries.

Our marketing efforts to consumers, including but not limited to telemarketing, door-to-door sales, direct mail and online marketing, are subject to consumer protection regulation including state deceptive trade practices acts, Federal Trade Commission ("FTC") marketing standards, and state utility commission rules governing customer solicitations and enrollments, among others. By way of example, telemarketing activity is subject to federal and state do-not-call regulation and certain enrollment standards promulgated by state regulators. Door-to-door sales are governed by the FTC’s “Cooling Off” Rule as well as state-specific regulation in many jurisdictions. In markets in which we conduct customer credit checks, these checks are subject to the requirements of the Fair Credit Reporting Act. Violations of the rules and regulations governing our marketing and sales activity could impact our license to operate in a particular market, result in suspension or otherwise limit our ability to conduct marketing activity in certain markets, and potentially lead to private actions against us. Moreover, there is potential for changes to legislation and regulatory measures applicable to our marketing measures that may impact our business models.

Recent interpretations of the Telephone Consumer Protection Act of 1991 (the "TCPA") by the Federal Communications Commission ("FCC") have introduced confusion regarding what constitutes an “autodialer” for purposes of determining compliance under the TCPA. Also, additional restrictions have been placed on wireless telephone numbers making compliance with the TCPA more costly. See “Risk Factors—Risks Associated with Violations of the Telephone Consumer Protection Act.”

As compliance with the TCPA gets more costly and as door-to-door marketing becomes increasingly risky both from a regulatory compliance perspective and from the risk of such activities drawing class action litigation claims, we and our peers who rely on these sales channels will find it more difficult than in the past to engage in direct marketing efforts. In response to these risks, the Company is experimenting with new technologies such as ringless messaging and door-to-door sales using tablets, both of which expand opportunities to market directly to customers.

Our participation in natural gas and electricity wholesale markets to procure supply for our retail customers and hedge pricing risk is subject to regulation by the Commodity Futures Trading Commission, including regulation pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act. In order to sell electricity, capacity and ancillary services in the wholesale electricity markets, we are required to have market-based rate authorization, also known as “MBR Authorization”, from the Federal Energy Regulatory Commission ("FERC"). We are required to make status update filings to FERC to disclose any affiliate relationships and quarterly filings to FERC regarding volumes of wholesale electricity sales in order to maintain our MBR Authorization.

The transportation and sale for resale of natural gas in interstate commerce are regulated by agencies of the U.S. federal government, primarily FERC under the Natural Gas Act of 1938, the Natural Gas Policy Act of 1978 and regulations issued under those statutes. FERC regulates interstate natural gas transportation rates and service conditions, which affects our ability to procure natural gas supply for our retail customers and hedge pricing risk. Since 1985, FERC has endeavored to make natural gas transportation more accessible to natural gas buyers and sellers on an open and non-discriminatory basis. FERC’s orders do not attempt to directly regulate natural gas retail sales. As a shipper of natural gas on interstate pipelines, we are subject to those interstate pipelines tariff requirements and FERC regulations and policies applicable to shippers.

17

Changes in law and to FERC policies and regulations may adversely affect the availability and reliability of firm and/or interruptible transportation service on interstate pipelines, and we cannot predict what future action FERC will take. We do not believe, however, that any regulatory changes will affect us in a way that materially differs from the way they will affect other natural gas marketers and local regulated utilities with which we compete.

On December 26, 2007, FERC issued Order 704, a final rule on the annual natural gas transaction reporting requirements, as amended by subsequent orders on rehearing. Under Order 704, wholesale buyers and sellers of more than 2.2 million MMBtus of physical natural gas in the previous calendar year, including natural gas gatherers and marketers, are required to report, on May 1 of each year, aggregate volumes of natural gas purchased or sold at wholesale in the prior calendar year to the extent such transactions utilize, contribute to, or may contribute to the formation of price indices. It is the responsibility of the reporting entity to determine which individual transactions should be reported based on the guidance of Order 704. Order 704 also requires market participants to indicate whether they report prices to any index publishers, and if so, whether their reporting complies with FERC’s policy statement on price reporting. As a wholesale buyer and seller of natural gas, we are subject to the reporting requirements of Order 704.

Employees

We employed 143 people as of December 31, 2016. This number does not include employees of Retailco Services who provide services to us under the Master Service Agreement as described under “—Master Service Agreement with Retailco Services, LLC for Operational Support Services.”

We are not a party to any collective bargaining agreements and have not experienced any strikes or work stoppages. We consider our relations with our employees to be satisfactory. We also utilize the services of independent contractors and vendors to perform various services.

Facilities

Our corporate headquarters is located in Houston, Texas. We believe that our facilities are adequate for our current operations. We share our corporate headquarters with certain of our affiliates. NuDevco Midstream Development, LLC, an indirect subsidiary of TxEx Energy Investments, LLC, is the lessee under the lease agreement covering these facilities. NuDevco Midstream Development, LLC pays the entire lease payment on behalf of the affiliates of TxEx Energy Investments, LLC, and we reimburse NuDevco Midstream Development, LLC for our share of the leased space.

18

Available Information

Our principal executive offices are located at 12140 Wickchester Ln., Suite 100, Houston, Texas 77079, and our telephone number is (713) 600-2600. Our website is located at www.sparkenergy.com. We make available our periodic reports and other information filed with or furnished to the Securities and Exchange Commission (the “SEC”), free of charge through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Any materials that we have filed with the SEC may be read and copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington D.C. 20549, or accessed by calling the SEC at 1-800-SEC-0330 or visiting the SEC’s website at www.sec.gov.

19

Item 1A. Risk Factors

You should carefully consider the risks described below together with the other information contained in this report on Form 10-K. Our business, financial condition, cash flows, ability to pay dividends on our Class A common stock and results of operations could be adversely impacted due to any of these risks.

Risks Related to Our Business

We are subject to commodity price risk.

Our financial results are largely dependent on the prices at which we can acquire the commodities we resell. The prevailing market prices for natural gas and electricity have historically, and may continue to, fluctuate substantially over relatively short periods of time, potentially adversely impacting our results of operations, financial condition, cash flows and our ability to pay dividends to the holders of our Class A common stock. Changes in market prices for natural gas and electricity may result from many factors that are outside of our control, including the following:

— | weather conditions; |

— | seasonality; |

— | demand for energy commodities and general economic conditions; |

— | disruption of natural gas or electricity transmission or transportation infrastructure or other constraints or inefficiencies; |

— | reduction or unavailability of generating capacity, including temporary outages, mothballing, or retirements; |

— | the level of prices and availability of natural gas and competing energy sources, including the impact of changes in environmental regulations impacting suppliers; |

— | the creditworthiness or bankruptcy or other financial distress of market participants; |

— | changes in market liquidity; |

— | natural disasters, wars, embargoes, acts of terrorism and other catastrophic events; |

— | federal, state, foreign and other governmental regulation and legislation; and |

— | demand side management, conservation, alternative or renewable energy sources. |

Additionally, significant changes in the pricing methods in the wholesale markets in which we operate could affect our commodity prices. Regulatory policies concerning how markets are structured, how compensation is provided for service, and the kinds of different services that can or must be offered, may change and could have significant impacts on our costs of doing business. For example, the Electric Reliability Council of Texas ("ERCOT") has recently considered supplementing the existing energy and ancillary service markets with a mandate to purchase installed capacity, which could have the effect of increasing our supply costs. Similarly, ERCOT adopted a new reserve imbalance market that will increase prices in certain circumstances. Changes to the prices we pay to acquire commodities and that we are not able to pass along to our customers could materially adversely affect our operations, which could negatively impact our financial results and our ability to pay dividends to the holders of our Class A common stock.

Our financial results may be adversely impacted by weather conditions.

Weather conditions directly influence the demand for and availability of natural gas and electricity and affect the prices of energy commodities. Generally, on most utility systems, demand for natural gas peaks in the winter and demand for electricity peaks in the summer. Typically, when winters are warmer or summers are cooler, demand for energy is lower than expected, resulting in less natural gas and electricity consumption than forecasted. When demand is below anticipated levels due to weather patterns, we may be forced to sell excess supply at prices below our acquisition cost, which could result in reduced margins or even losses.

Conversely, when winters are colder or summers are warmer, consumption may outpace the volumes of natural gas and electricity against which we have hedged, and we may be unable to meet increased demand with storage or

20

swing supply. In these circumstances, we may experience reduced margins or even losses if we are required to purchase additional supply at higher prices. Our failure to accurately anticipate demand due to fluctuations in weather or to effectively manage our supply in response to a fluctuating commodity price environment could negatively impact our financial results and our ability to pay dividends to the holders of our Class A common stock.

Our risk management policies and hedging procedures may not mitigate risk as planned, and we may fail to fully or effectively hedge our commodity supply and price risk exposure against changes in consumption volumes or market rates.

To provide energy to our customers, we purchase the relevant commodity in the wholesale energy markets, which are often highly volatile. Our commodity risk management strategy is designed to hedge substantially all of our forecasted volumes on our fixed-price customer contracts, as well as a portion of the near-term volumes on our variable-price customer contracts. We use both physical and financial products to hedge our fixed-price exposure. The efficacy of our risk management program may be adversely impacted by unanticipated events and costs that we are not able to effectively hedge, including abnormal customer attrition and consumption, certain variable costs associated with electricity grid reliability, pricing differences in the local markets for local delivery of commodities, unanticipated events that impact supply and demand, such as extreme weather, and abrupt changes in the markets for, or availability or cost of, financial instruments that help to hedge commodity price.

We are exposed to basis risk in our operations when the commodities we hedge are sold at different delivery points from the exposure we are seeking to hedge. For example, if we hedge our natural gas commodity price with Chicago basis but physical supply must be delivered to the individual delivery points of specific utility systems around the Chicago metropolitan area, we are exposed to basis risk between the Chicago basis and the individual utility system delivery points. These differences can be significant from time to time, particularly during extreme, unforecasted cold weather conditions. Similarly, in certain of our electricity markets, customers pay the load zone price for electricity, so if we purchase supply to be delivered at a hub, we may have basis risk between the hub and the load zone electricity prices due to local congestion that is not reflected in the hub price. We attempt to hedge basis risk where possible, but hedging instruments are sometimes not economically feasible or available in the smaller quantities that we require.

In addition, we incur costs monthly for ancillary charges such as reserves and capacity in the electricity sector by ISOs. For example, the ISOs will charge all retail electricity providers for monthly reserves that the ISO determines are necessary to protect the integrity of the grid. We attempt to estimate such amounts but they are difficult to estimate because they are charged in arrears by the ISOs and are subject to fluctuations based on weather and other market conditions. We may be unable to fully pass the higher cost of ancillary reserves and reliability services through to our customers, and increases in the cost of these ancillary reserves and reliability services could negatively impact our results of operations.

Additionally, assumptions that we use in establishing our hedges may reduce the effectiveness of our hedging instruments. Considerations that may affect our hedging policies include, but are not limited to, human error, assumptions about customer attrition, the relationship of prices at different trading or delivery points, assumptions about future weather, and our load forecasting models.

Many of the natural gas utilities we serve allocate a share of transportation and storage capacity to us as a part of their competitive market operations. We are required to fill our allocated storage capacity with natural gas, which creates commodity supply and price risk. Sometimes we cannot hedge the volumes associated with these assets because they are too small compared to the much larger bulk transaction volumes required for trades in the wholesale market or it is not economically feasible to do so. In some regulatory programs or under some contracts, this capacity may be subject to recall by the utilities, which could have the effect of us being required to access the spot market to cover such recall.

In general, if we are unable to effectively manage our risk management policies and hedging procedures, our financial results and our ability to pay dividends to the holders of our Class A could be adversely affected.

21

We depend on consistent regulation within a particular utility territory (or state), as well as at the federal level, to permit us to operate in restructured, competitive segments of the natural gas and electricity industries. If competitive restructuring of the natural gas and electricity utility industries is altered, reversed, discontinued or delayed, our business prospects and financial results could be materially adversely affected.

We operate in the highly regulated natural gas and electricity retail sales industry. Regulations may be revised or reinterpreted or new laws and regulations may be adopted or become applicable to us or our operations. Such changes may have a detrimental impact on our business.

In certain restructured energy markets, state legislatures, governmental agencies and/or other interested parties have made proposals to fully or partially re-regulate these markets, which would interfere with our ability to do business. If competitive restructuring of natural gas or electricity markets is altered, reversed, discontinued or delayed, our financial results and our ability to pay dividends to the holders of our Class A common stock could be adversely affected.